Abstract

This study uses publicly available Marketplace health plan data from 2016 and 2017 to examine whether premium growth in monopoly markets with a declining number of insurers differs from that in markets having a stable number of insurers.

In 2017, nearly half of insurers exited the Affordable Care Act (ACA) Marketplace, expanding single-insurer or monopoly markets. Concurrently, benchmark Silver plan premiums increased approximately 25%, compared with 7.2% in the previous year. The expectation of more insurer exits in 2018 has raised questions regarding the extent to which changes in insurer count are associated with premium growth.

Methods

Using data publicly available on the Healthcare.gov website (https://www.healthcare.gov/) for market characteristics and premiums and plan enrollment for 38 states, we identified insurers selling a qualified nongroup health plan in each of the 2602 counties in 2016 and 2017. Unique insurers sharing a parent company or group affiliation were combined. Plan enrollment data were based on the 2016 ACA Marketplace health plan selections by county from the Centers for Medicare & Medicaid Services. For premiums, we used the second-lowest Silver plan monthly premium—which helps determine federal subsidies to low- and middle-income enrollees—for a 27-year-old individual. Our use of publicly available data was exempted from institutional review board approval by the University of Pennsylvania Institutional Review Board.

We categorized counties in 2017 by whether they had experienced an increasing or decreasing number of insurers, and using generalized linear regression, we tested whether the premium growth for markets with a declining number of insurers differed from that in markets with a stable number of insurers. This analysis was stratified by the number of insurers in the market in 2017 and weighted by the number of county enrollees. We also estimated the correlation between county-level premium increase and the number of insurers in the 2017 market using an enrollee-weighted generalized linear model.

Results

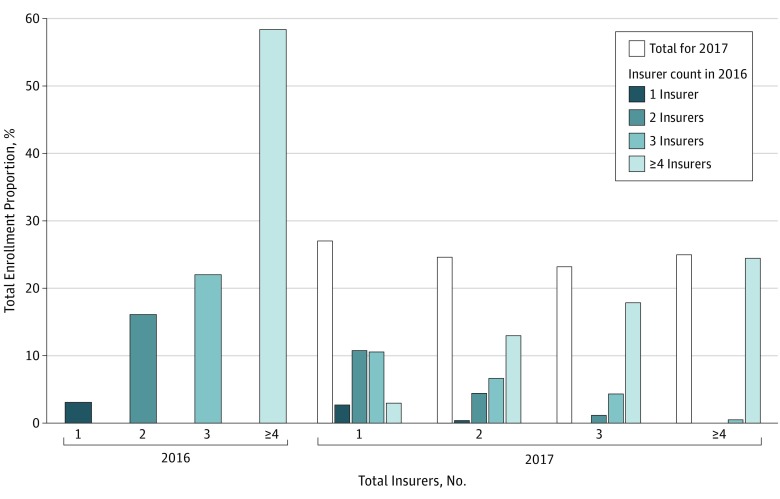

From 2016 to 2017, the percentage of enrollees facing a monopoly market rose from 3% to 27% (Figure 1). While 81% of consumers experienced a reduction in the number of insurers offering plans, only 4% of consumers, across 79 counties, experienced an increase in total insurers.

Figure 1. Distribution of Total Insurer Count by Enrollment in 2016 and 2017.

Height of each bar in 2016 and height of the open bars in 2017 represent the percentage of total enrollment in counties for the total insurer count indicated. Colored bars in 2017 represent distribution of the total insurer count by enrollment in 2016. For example, among counties with 1 insurer in 2017, 10% of counties had 1 insurer, 40% had 2 insurers, 39% had 3 insurers, and 11% had at least 4 insurers in 2016. This distribution is weighted by the county-level plan enrollment in 2016.

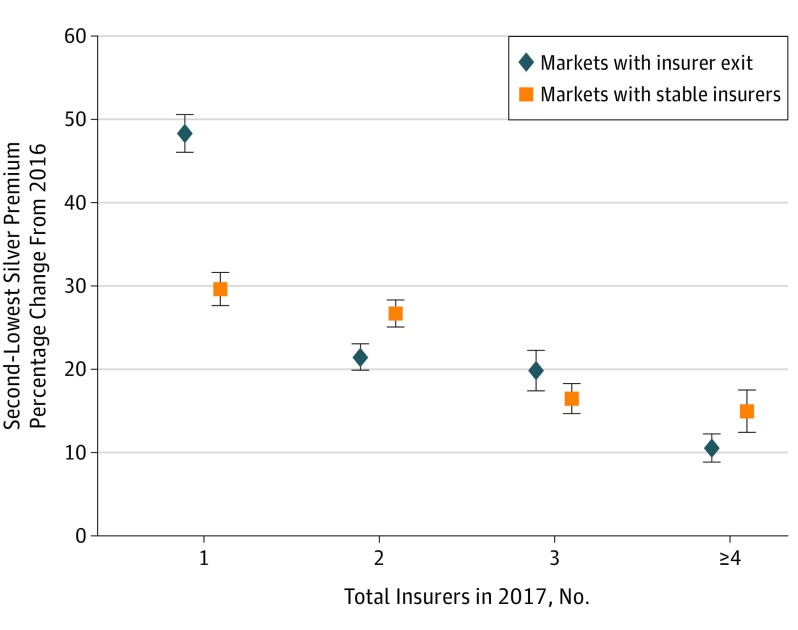

Premiums increased from $263 to $383, a weighted average of 48% (95% CI, 46%-51%; P < .001, 2-sided), in markets that became new monopoly markets in 2017 (Figure 2). In single-insurer markets that remained monopolies, premiums increased from $297 to $380, a weighted average of 30% (95% CI, 28%-32%; P < .001, 2-sided). Unlike in monopoly markets, there was no significant difference in premium growth between the markets that experienced a loss of insurers and those that did not experience any change (17% [95% CI, 16%-18%] vs 19% [95% CI, 18%-21%]; P = .05). Overall, premium growth was negatively associated with the number of insurers in the market (slope, −8.5; P < .001).

Figure 2. Mean Percentage Change in Second-Lowest Silver Plan Premium Segmented by Total Insurer Count in 2017 and by Changes in Insurer Participation.

Data are restricted to the 2534 counties that experienced a decrease or no change in total insurer count from 2016 to 2017. Each data marker represents a set of counties with the same or fewer insurers in 2017 vs 2016. Error bars indicate 95% CIs.

Discussion

A monopoly insurer may be able to set premiums without substantial consequences because under the current ACA subsidy structure, prices are capped for subsidy-eligible consumers and the premium increases are fully offset by federal subsidies. This impact is most pronounced for the 20% of individual market enrollees who do not qualify for subsidies. When there are multiple insurers, however, our data support a conjecture that the ACA market structure encourages insurers to compete for consumers on premium price and value.

Although we identified significant premium increases in new monopoly markets, the reasons for these changes require further study. Many drivers of recent premium hikes are independent of market competition, including the end of the temporary risk corridor and reinsurance programs and underenrollment of young, healthy individuals. Insurers also had initially underpriced plans partly by underestimating health care utilization of new enrollees, and remaining insurers may have increased premiums to cover sicker risk pools if exiting insurers had previously enrolled unexpectedly expensive beneficiaries. Additional factors, including physician consolidation, insurer consolidation and profitability, and growing uncertainty around cost-sharing subsidies, may also influence insurer decision making around premium setting and market participation. Understanding how market structure and rules influence premium setting in monopoly markets is critical to the stability of insurance markets and likely any alternative reforms introduced by the current administration.

References

- 1.Garthwaite C, Graves JA. Success and failure in the insurance exchanges. N Engl J Med. 2017;376(10):907-910. [DOI] [PubMed] [Google Scholar]

- 2.Office of the Assistant Secretary for Planning and Evaluation Health plan choice and premiums in the 2017 health insurance marketplace. https://aspe.hhs.gov/pdf-report/health-plan-choice-and-premiums-2017-health-insurance-marketplace.

- 3.Centers for Medicare & Medicaid Services Health insurance marketplaces 2017 open enrollment period: January enrollment report. https://www.cms.gov/newsroom/mediareleasedatabase/fact-sheets/2017-fact-sheet-items/2017-01-10.html. Published January 10, 2017. Accessed March 4, 2017.

- 4.Cox C, Levitt L, Claxton G, Ma R, Duddy-Tenbrunsel R Kaiser Family Foundation. Analysis of 2015 premium changes in the Affordable Care Act’s health insurance marketplaces. http://kff.org/health-reform/issue-brief/analysis-of-2015-premium-changes-in-the-affordable-care-acts-health-insurance-marketplaces/. Published January 6, 2015. Accessed March 4, 2017.

- 5.Levitt L, Cox C, Claxton G Kaiser Family Foundation. How ACA marketplace premiums measure up to expectations. http://kff.org/health-reform/perspective/how-aca-marketplace-premiums-measure-up-to-expectations/. Published August 1, 2016. Accessed February 24, 2017.