Abstract

Objective

To determine the effect of state‐level dependent coverage expansion (DCE) with and without other state health reforms on exit from dependent coverage for adolescents and young adults (AYA).

Data Sources

Administrative longitudinal data for 131,542 privately insured AYA in Massachusetts (DCE with other reforms) versus Maine and New Hampshire (DCE without other reforms) across three periods: prereform (1/00–12/06), poststate reform (1/07–9/10), and postfederal reform (10/10–12/12).

Study Design

A difference‐in‐differences estimator was used to determine the rate of exit from dependent coverage, age at exit from dependent coverage, and re‐uptake of dependent coverage among AYA in states with comprehensive reforms versus DCE only.

Principal Findings

Implementation of DCE with other reforms was significantly associated with a 23 percent reduction in exit from dependent coverage among AYA compared to the reduction observed for DCE alone. Additionally, comprehensive reforms were associated with over two additional years of dependent coverage for the average AYA and a 33 percent increase in the odds of regaining dependent coverage after a prior loss.

Conclusions

Findings suggest that an individual mandate and other reforms may enhance the effect of DCE in preventing loss of coverage among AYA.

Keywords: Health reform, adolescents and young adults, insurance coverage, dependent coverage

Adolescents and young adults (AYA) traditionally have higher rates of uninsurance than other age groups(Callahan and Cooper 2005; Majerol, Newkirk, and Garfield 2015), due in large part to lower rates of employment, reduced access to employer‐sponsored insurance (ESI) coverage, and lower individual incomes (U.S. Congress Joint Economic Committee Majority Staff 2010; Garfield and Young 2015; Majerol, Newkirk, and Garfield 2015). Dependent coverage expansion (DCE) policies on the state and federal level have been enacted to target the high rates of uninsurance and unique barriers to obtaining coverage among this group (Monheit et al. 2011; Monheit, Cantor, and DeLia 2015). Several states, including Massachusetts, New Hampshire, and Maine, adopted state DCE policies in 2007 that extended dependent coverage up to age 26, with the Massachusetts policy accompanied by other health reforms that were later incorporated into the Affordable Care Act (ACA), including an individual mandate, a Medicaid expansion, creation of a health insurance exchange with subsidies, and prohibition of pre‐existing condition exclusions. In 2010, the ACA implemented a federal DCE, which extended these policies nationally and mitigated some of the state‐specific restrictions, including variability due to Employee Retirement Income Security Act (ERISA) exemptions for self‐insured employers and differences in eligibility requirements, coverage riders, and administrative barriers. Several repeated cross‐sectional studies have found that state and federal DCE policies were associated with increased coverage for AYA (Cantor et al. 2012; Sommers and Kronick 2012; Sommers et al. 2013), but the magnitude of the impact of DCE policies in the context of other federal reforms is unclear.

State and federal health reforms may modify the effects of a DCE by altering the coverage options and incentives for coverage for AYA—for instance, Medicaid expansion, creation of health insurance exchanges with subsidies, and prohibition of pre‐existing condition exclusions may all facilitate new sources of insurance for AYA who have previously had dependent coverage. An individual mandate, which went into effect nationally in 2014 (nearly 4 years after the federal DCE), may drive AYA to maintain or re‐establish dependent coverage to meet the coverage requirement and avoid the associated penalty. Adding a young adult dependent to an existing family plan at no additional cost through a DCE creates a stronger price effect than purchasing individual coverage through an exchange, even with a subsidy. Moreover, ESI may have greater benefits or lower cost‐sharing than exchange plans, making the true price difference even greater and dependent coverage a more attractive option for many AYA.

Despite the movement to eliminate or downscale the ACA, particularly policies such as the mandate and subsidized exchange plans, the DCE has remained popular and is likely to remain at the state and federal level. Understanding how the effect of the DCE may vary with and without other health reforms is important in informing this ongoing policy debate. As differential state‐level policy change serves as a natural experiment that may help predict effects of federal reforms, we sought to examine the effect of state‐level DCE with and without other health reforms on AYA insurance coverage. We hypothesized that a DCE would have a greater impact on AYA dependent coverage retention in a state with other reforms (specifically an individual mandate) than in states with a DCE only. Using health plan enrollment data for AYA and their families from three states, we constructed a large, longitudinal cohort to examine the additional impact of other health reforms on the effect of a DCE on exit from dependent coverage among AYA.

Study Data and Methods

Data Source and Population

This retrospective cohort study was conducted using enrollment and claims data from Harvard Pilgrim Health Care (HPHC), a large not‐for‐profit health plan with over 1 million members in commercial plans concentrated in Massachusetts, New Hampshire, and Maine. The study cohort included all HPHC members who were enrolled continuously as a dependent for at least 1 year between the ages of 16 and 18, from January 2000 to December 2012 (N = 131,542 individuals).

The HPHC Institutional Review Board approved the study.

Measures

Enrollment was tracked from entry into the study until members’ 26th birthday, disenrollment from HPHC coverage, or end of the study period (whichever occurred first). Disenrollment was defined as a lapse in HPHC coverage >2 months. As we hypothesized that the rates of exit from dependent coverage would not be constant across chronological age, we assessed insurance coverage for each chronological year of age (representing 512,790 person‐years of insurance coverage).

For each enrollment period, dependent status was determined using information on member type; “Child,” “Step‐Child,” “Other Dependent,” and “Student” member types were considered to be dependents. Disenrollment dates for AYA dependents were compared against the disenrollment date for the family contract to which they belonged to determine whether the AYA disenrolled with their family (i.e., loss of family coverage) or disenrolled independent of their family (i.e., exit from dependent coverage, primary outcome of interest). In some instances, AYA disenrolled from dependent coverage and obtained HPHC coverage as a subscriber; if their family plan continued, we still treated this as an exit from dependent coverage.

We additionally assessed age at exit from dependent coverage (i.e., time from age 16 to dependent coverage exit) and whether AYA who lost dependent coverage subsequently re‐enrolled as a dependent in their original family contract (i.e., regained dependent coverage).

Adolescents and young adults age, sex, and state of residence were obtained from enrollment files. We linked the AYA's 5‐digit zip code to 2000 Census data to create a binary measure of neighborhood poverty in which a zip code was defined as low‐income if >20 percent of residents were below the federal poverty level (Krieger 1992; US Bureau of the Census 1995). To identify AYA with chronic conditions, we used the Pediatric Medical Complexity Algorithm (PMCA; Simon et al. 2014). This algorithm uses ICD‐9 codes from claims data to classify youth as having a complex chronic condition (a significant chronic condition in more than one body system, e.g., diabetes and depression, or a single condition that is progressive or malignant, e.g., cystic fibrosis), a noncomplex chronic condition (a lifelong condition involving only one body system that is not progressive or malignant, e.g., asthma), or no chronic condition.

We created time‐varying covariates related to characteristics of the insurance contract. First, we categorized the provider network of the AYA's health plan as either a more restricted provider network (e.g., a Health Maintenance Organization [HMO] plan or a tiered network plan) or a less restricted network (e.g., a Preferred Provider Organization [PPO] or Point of Service [POS] plan). We also assessed the plan's annual individual deductible (categorized as high if ≥$1,000, low if <$1,000, or none) and whether their coverage came from an employer‐sponsored plan versus another source (e.g., nongroup market, state health insurance exchange). Finally, from the plan contract type, we determined whether the AYA's family plan included other dependents in addition to the AYA (including other children or the subscriber's spouse), in which case dropping or adding the AYA would likely be cost‐neutral to the family premium.

Analytic Approach

We employed a pre‐ to postcomparison design with three periods: Prereform (January 2000–December 2006), Poststate reform (January 2007–September 2010), and Postfederal reform (October 2010–December 2012). AYA in Massachusetts (DCE with individual mandate/other reforms) were compared to AYA in Maine and New Hampshire (DCE without individual mandate/other reforms) to estimate the joint effect of implementing an individual mandate and other reforms with DCE, compared to DCE alone.

Our primary outcome of interest, exit from dependent coverage, was estimated using generalized estimating equations (GEE) with a binomial distribution; robust standard errors were clustered at the person level to account for serial autocorrelation over time. A difference‐in‐differences (D‐in‐D) estimator was used to determine annualized probability of exit from dependent coverage in each of the three time periods, comparing AYA insured in Massachusetts (MA, state‐dependent coverage expansion with an individual mandate/other reforms) to those insured in Maine and New Hampshire (ME/NH, state‐dependent coverage expansions without an individual mandate/other reforms), additionally adjusting for age, sex, chronic condition status, neighborhood poverty, contract type, provider network, coverage source, and deductible amount.

Multivariable Cox proportional hazard regression was used to model age at exit from dependent coverage (based on time from age 16 to age at dependent coverage exit). Multivariable logistic regression was used to model the odds of regaining dependent coverage among those who had previously lost dependent coverage and whose families maintained coverage. We additionally utilized a triple‐difference, or difference‐in‐difference‐in‐differences (D‐in‐D‐in‐D), estimator to investigate the potential for effect heterogeneity of reform effects across individual and plan characteristics. Specifically, we evaluated the possibility of interactions between the D‐in‐D estimator and each covariate to estimate the magnitude of policy effects for each level of the covariates (e.g., if the policy effect was greater for males vs. females).

Results

The study sample was 50.8 percent male, 28.3 percent had at least one chronic condition, 5.2 percent lived in a high‐poverty neighborhood, and 87.6 percent of the sample resided in Massachusetts (Table 1). On average, 28.9 percent of AYA who were enrolled as dependents exited their dependent coverage (while their family remained insured) during the prereform period (51.9 percent were ≤19 years old when they exited coverage, Table 1), dropping to 16.1 percent in the poststate reform period (33.7 percent were ≤19 years), and further to 9.8 percent in the postfederal reform period (24.2 percent were ≤19 years; p < .01). The median age at exit from dependent coverage was 19.8 years in the prereform period, increasing to 21.8 years and 23.0 years across the poststate and federal reforms, respectively (p < .001, Table 1). Nearly a quarter (23.5 percent) of AYA who lost their dependent coverage subsequently regained this coverage, increasingly so across the three reform periods (16.0 percent prereform, 24.5 percent poststate, 41.0 percent postfederal; p < .01).

Table 1.

Sample Demographic Characteristics and Dependent Coverage

| Individual Level Characteristics | Total (%) | Dependent Coverage | |

|---|---|---|---|

| Median Age (years) at Exit | % Exiting ≤19 years† | ||

| Total N (%) | 131,542 | 20.5 | 44.1% |

| Time Invariant Characteristics | |||

| State of residence | ** | ** | |

| Massachusetts | 87.6% | 20.7 | 42.4% |

| Maine/New Hampshire | 12.4% | 19.3 | 61.5% |

| Sex | ** | ** | |

| Male | 50.8% | 20.1 | 48.3% |

| Female | 49.2% | 21.1 | 39.5% |

| Chronic condition status | ** | ** | |

| Complex chronic | 7.9% | 20.2 | 47.9% |

| Noncomplex chronic | 20.4% | 20.1 | 48.1% |

| No conditions | 71.7% | 20.6 | 42.7% |

| Neighborhood poverty | ** | ** | |

| >20% in poverty | 5.2% | 19.5 | 55.4% |

| ≤20% in poverty | 93.5% | 20.6 | 43.2% |

| Unknown | 1.3% | 20.0 | 48.9% |

| Time Variant Characteristics (measured at outcome/censoring) | |||

| Reform period | ** | ** | |

| Prereform | 34.9% | 19.8 | 51.9% |

| Poststate reform | 19.9% | 21.8 | 33.7% |

| Postfederal reform | 45.2% | 23.0 | 24.2% |

| Family contract type | ** | ||

| Multiple children/dependents | 98.2% | 20.5 | 43.7% |

| Single child/dependent | 1.8% | 19.4 | 60.1% |

| Provider network | * | ** | |

| HMO/Tiered network plan | 77.9% | 20.6 | 43.4% |

| PPO/POS plan | 22.1% | 20.3 | 46.7% |

| Coverage source | ** | ** | |

| Employer sponsored | 92.9% | 20.4 | 44.7% |

| Other | 7.1% | 21.8 | 33.1% |

| Deductible‡ | ** | ** | |

| None | 71.3% | 20.6 | 42.7% |

| Low | 13.9% | 21.2 | 42.4% |

| High | 12.4% | 20.8 | 42.2% |

| Unknown | 2.4% | 19.1 | 81.4% |

Data are from Harvard Pilgrim Health Care enrollment files during 2000–2012.

**p < .001; *p < .05.

†Percent (unadjusted) of youth who exited dependent insurance coverage at or prior to turning 19 among all youth who lost dependent coverage (while their family remained insured).

‡High‐deductible plans were defined as those with an annual deductible of $1,000 or more per individual.

Overall, implementation of DCE on the state level resulted in a 66 percent decrease in the annualized odds of exiting dependent coverage for HPHC‐insured youth in MA (Adjusted Odds Ratio (AOR): 0.34, 95%CI: 0.33–0.35) and a 55 percent decrease for those in ME/NH (AOR: 0.45, 95%CI: 0.41–0.49), with youth exposed to DCE with an individual mandate/other reforms experiencing a significantly greater (23 percent) relative reduction in the odds of exiting dependent coverage than youth exposed to a DCE only (D‐in‐D AOR: 0.77, 95%CI: 0.71–0.84, Table 2). While federal DCE resulted in a larger relative reduction in the odds of exiting dependent coverage compared to both prereform and state reform period (in MA vs. prereform AOR: 0.10, 95%CI: 0.09–0.10; vs. state reform AOR: 0.28, 95%CI: 0.27–0.30), the joint effect of federal DCE and other reforms was not statistically different from the joint effect of state DCE and other reforms (D‐in‐D AOR: 0.95, 95%CI: 0.83–1.09). Examination of prereform trends for exiting dependent coverage did not identify divergence between Massachusetts and Maine/New Hampshire (data not shown).

Table 2.

Exit from Dependent Coverage before and after State and Federal Health Care Reform among Adolescents and Young Adults (Difference‐in‐Differences Results)

| Outcome | Age‐Adjusted %/Medians | Multivariate Adjusted Effects (95% CI) | ||||

|---|---|---|---|---|---|---|

| State | Prereform | State Reform | Federal Reform | State (vs. Pre) Reform Effect | Federal (vs. Pre) Reform Effect | Federal (vs. State) Reform Effect |

| Exit from dependent coverage† | Adjusted Odds Ratios | |||||

| Massachusetts | 29.1% | 11.0% | 2.9% | 0.34** | 0.10** | 0.28** |

| (0.33–0.35) | (0.09–0.10) | (0.27–0.30) | ||||

| Maine/New Hampshire | 27.2% | 12.2% | 3.5% | 0.45** | 0.13** | 0.30** |

| (0.41–0.49) | (0.12–0.15) | (0.26–0.34) | ||||

| Difference (MA vs. ME/NH) | +1.8% | −1.3% | −0.7% | 0.77** | 0.73** | 0.95 |

| (0.71–0.84) | (0.65–0.83) | (0.83–1.09) | ||||

| Age at dependent coverage exit (in years)‡ | Adjusted Hazard Ratio | |||||

| Massachusetts | 19.9 | 22.1 | 23.3 | 0.41** | 0.13** | 0.32** |

| (0.40–0.42) | (0.13–0.14) | (0.31–0.33) | ||||

| Maine/New Hampshire | 19.2 | 19.4 | 19.9 | 0.50** | 0.18** | 0.36** |

| (0.47–0.54) | (0.16–0.20) | (0. 32–0.40) | ||||

| Difference (MA vs. ME/NH) | +0.7 | +2.6 | +3.3 | 0.82** | 0.73** | 0.89 |

| (0.76–0.89) | (0.65–0.82) | (0.79–1.01) | ||||

| Regained dependent coverage after prior loss§ | Adjusted Odds Ratio | |||||

| Massachusetts | 13.0% | 24.4% | 50.4% | 2.35** | 8.69** | 3.70** |

| (2.21–2.51) | (8.01–9.44) | (3.39–4.03) | ||||

| Maine/New Hampshire | 9.6% | 18.9% | 30.6% | 2.81** | 6.58** | 2.34** |

| (2.31–3.42) | (5.14–8.41) | (1.81–3.01) | ||||

| Difference (MA vs. ME/NH) | +3.3% | +5.5% | +19.8% | 0.84 | 1.32* | 1.58** |

| (0.68–1.03) | (1.03–1.70) | (1.21–2.06) | ||||

Notes. State reform effect describes the (1) adjusted odds ratio for exit from dependent coverage (AOR <1.0 indicates reduced exit from dependent coverage); (2) adjusted hazard ratio for time to dependent coverage exit (AHR <1.0 indicates lower risk of dependent coverage exit over time); or (3) adjusted odds ratio for regaining dependent coverage (AOR >1.0 indicates greater odds of regained coverage) among young adults with a state‐dependent coverage expansion and state individual mandate compared to a state‐dependent coverage expansion only (with respect to prereform differences).

Federal reform effect describes the (1) AOR for exit from dependent coverage; (2) AHR for time to dependent coverage exit; or (3) AOR for regaining dependent coverage among young adults with a federal‐dependent coverage expansion and state individual mandate compared to a federal‐dependent coverage expansion only (with respect to prereform differences and poststate reform differences).

Multivariate adjusted models additionally controlled for state and reform period main effects, age, gender, chronic condition status, neighborhood poverty, contract type, provider network, coverage source, and deductible.

Data are from Harvard Pilgrim Health Care enrollment files during 2000–2012.

**p ≤ .001; *p ≤ .05.

†Percent (age‐adjusted) of young adults who exited from dependent insurance coverage in a given period.

‡Median age at dependent coverage exit in a given period.

§Percent (age‐adjusted) of young adults who regained dependent coverage after a coverage loss in a given period.

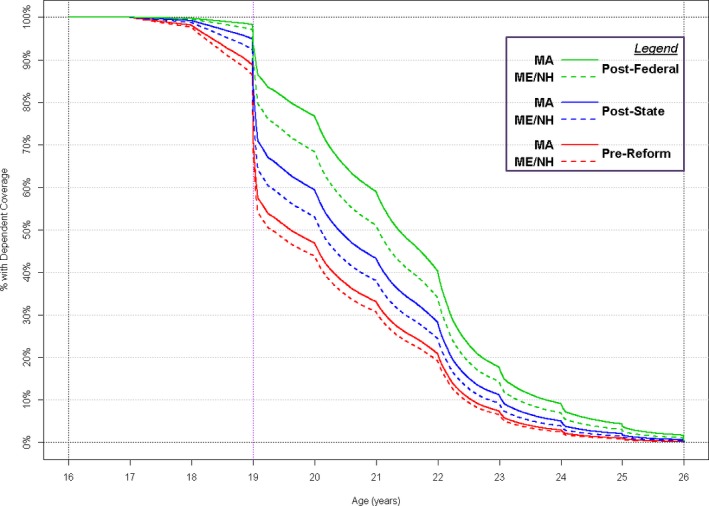

The presence of other health reforms was associated with older age at exit from dependent coverage (Adjusted Hazard Ratio (AHR) <1.0 indicates slower rate of dependent coverage exit, thus older age at exit; see Figure 1). D‐in‐D analyses revealed that poststate reform AYA in MA maintained dependent coverage through older ages compared to their counterparts in ME/NH (state reform D‐in‐D AHR: 0.82, 95%CI: 0.76–0.89, Table 2), as did AYA postfederal reform (D‐in‐D AHR: 0.73, 95%CI: 0.65–0.82).

Figure 1.

- Legend: Fully adjusted multivariate Cox proportional hazard models were used to generate “survivorship” curves that identify the predicted age at dependent coverage exit for adolescents and young adults (AYA) in Massachusetts (MA) compared to Maine/New Hampshire (ME/NH) across the three reform periods. For example, among those covered as dependents at age 16, 19.1 percent of AYA in ME/NH in the prereform period were still covered as dependents at age 22 compared to 20.8 percent in MA; however, in the postfederal reform period, 34.0 percent of AYA in ME/NH were still covered by age 22 compared to 40.2 percent in MA. Data are from Harvard Pilgrim Health Care enrollment files during 2000–2012.

The odds of regaining dependent coverage after a prior exit significantly increased both poststate and postfederal reforms; AYA in MA versus those in ME/NH had significantly greater odds of regaining dependent coverage in the postfederal reform period compared to the poststate reform period (D‐in‐D AOR: 1.58, 95%CI: 1.21–2.06).

Investigation into potential reform effect heterogeneity revealed that older AYA, AYA with chronic conditions, AYA in poorer neighborhoods, and AYA in families with more generous coverage (i.e., no deductible) saw greater benefits postreform (i.e., larger reduction in the odds of exiting dependent coverage and longer time covered as a dependent, Table 3) than their respective counterparts. Older AYA were more likely to regain dependent coverage post state reform than their younger counterparts (AOR: 2.48, 95%CI: 1.59–3.87); regaining dependent coverage was less likely post state reform for AYA whose family plan had any versus no deductible (AOR: 0.27, 95%CI: 0.14–0.52) and postfederal reform for AYA whose family contract did not include any other dependents after the AYA lost coverage versus contracts that did include other dependents (AOR: 0.28, 95%CI: 0.09–0.86).

Table 3.

Difference‐in‐Difference‐in‐Differences Results

| Multivariable Adjusted D‐in‐D‐in‐D (95% CI) | Exit from Dependent Coverage (Adjusted Odds Ratio) | Time to Dependent Coverage Exit (Adjusted Hazard Ratio) | Regained Dependent Coverage (Adjusted Odds Ratio) | |||

|---|---|---|---|---|---|---|

| State Reform Effect | Federal Reform Effect | State Reform Effect | Federal Reform Effect | State Reform Effect | Federal Reform Effect | |

| Age | 0.75*** | 1.08 | 0.79* | 1.11 | 2.48*** | 0.97 |

| ≥22 vs. ≤21 | (0.63–0.88) | (0.85–1.37) | (0.66–0.96) | (0.85–1.43) | (1.59–3.87) | (0.59–1.58) |

| Sex | 1.03 | 0.88 | 1.03 | 0.94 | 1.07 | 1.39 |

| Male vs. female | (0.86–1.22) | (0.69–1.13) | (0.88–1.20) | (0.74–1.18) | (0.71–1.61) | (0.85–2.28) |

| Chronic condition | 0.78* | 1.03 | 0.80* | 1.07 | 0.95 | 0.94 |

| Any condition vs. none | (0.64–0.95) | (0.78–1.37) | (0.68–0.95) | (0.83–1.38) | (0.61–1.48) | (0.55–1.60) |

| Neighborhood poverty | 0.41* | 0.25** | 0.41* | 0.44 | 5.26 | 1.36 |

| >20% poverty vs. ≤20% | (0.17–0.99) | (0.09–0.67) | (0.19–0.85) | (0.18–1.10) | (0.38–70.63) | (0.18–10.19) |

| Family contract type† | 0.88 | 0.85 | 0.80 | 0.88 | 0.75 | 0.28* |

| Single vs. multiple dependents | (0.54–1.44) | (0.43–1.69) | (0.53–1.23) | (0.49–1.57) | (0.34–1.68) | (0.09–0.86) |

| Provider network | 0.92 | 0.73 | 0.89 | 0.73* | 0.75 | 1.02 |

| PPO/POS vs. HMO/tiered | (0.69–1.23) | (0.53–1.01) | (0.69–1.15) | (0.54–0.99) | (0.39–1.43) | (0.54–1.91) |

| Deductible | 1.55*** | 1.78*** | 1.68*** | 1.76*** | 0.27*** | 0.60 |

| Any vs. none | (1.22–1.95) | (1.33–2.38) | (1.36–2.07) | (1.34–2.30) | (0.14–0.52) | (0.30–1.21) |

Notes. For each comparison, state reform effect describes the relative change in the (1) adjusted odds ratio for exit from dependent coverage (AOR <1.0 indicates reduced exit from dependent coverage); (2) adjusted hazard ratio for time to dependent coverage exit (AHR <1.0 indicates lower risk of dependent coverage exit over time); or (3) adjusted odds ratio for regaining dependent coverage (AOR >1.0 indicates greater odds of regained coverage) among young adults with a state‐dependent coverage expansion and state individual mandate compared to a state‐dependent coverage expansion only (with respect to prereform differences).

For each comparison, federal reform effect describes the relative change in the (1) AOR for exit from dependent coverage; (2) AHR for time to dependent coverage exit; or (3) AOR for regaining dependent coverage with a federal‐dependent coverage expansion and state individual mandate compared to a federal‐dependent coverage expansion only (with respect to prereform differences).

Models additionally controlled for state and reform period main effects and D‐in‐D estimator, age, gender, chronic condition status, neighborhood poverty, contract type, provider network, coverage source, and deductible.

Data are from Harvard Pilgrim Health Care enrollment files during 2000–2012.

***p ≤ .001; **p ≤ .01; *p ≤ .05.

†Defined by the total number of dependents covered by the contract (including the AYA) during the last enrollment span prior to first exit. In models for regaining dependent coverage, contract type was defined as the status of the family's contract immediately after the AYA first disenrolled and was classified as having no dependents (single) versus any other dependents (multiple).

Discussion

Our data suggest that implementation of an individual mandate and other health reforms along with a dependent coverage expansion is associated with a significant reduction in exit from dependent coverage for AYA, compared to implementation of dependent coverage expansion alone. Moreover, the joint effect of these policy levers is also associated with maintenance of dependent coverage until an older age and increased likelihood of regaining dependent coverage after an initial disenrollment. Our study also found greater use of dependent coverage after the federal‐dependent coverage expansion than after state‐dependent coverage expansions in both MA and ME/NH. Further increases in dependent coverage for AYA may have resulted from implementation of the federal individual mandate and other ACA policies after 2014, in addition to dependent coverage expansion.

Although many components of the ACA have been politically controversial and threatened with elimination in whole or in part (Singer 2016), the DCE has been largely well received (Hamel, Firth, and Brodie 2014) and is likely to remain intact. Our findings suggest that the impact of this popular policy may be substantially enhanced in conjunction with other reforms such as an individual mandate, which may induce AYA to take full advantage of the DCE. Without a mandate, some AYA may drop dependent coverage, especially those who are healthy (importantly, the combination of a DCE plus mandate may provide a mechanism for healthy AYA to remain in the risk pool) or those whose families would have lower premium costs without a dependent. However, with a mandate, retention of dependent coverage remains economically attractive for AYA who have access to a family plan (especially a family plan with lower cost‐sharing) rather than purchasing coverage on their own, as average monthly premiums per person in the individual market are $235.27, compared to $97.50 per enrollee for the average employer‐based plan.1 On the other hand, some low‐income AYA may choose to drop dependent coverage if less expensive coverage is available through a Medicaid expansion or subsidized exchange plan. Although we could not partition out the specific effects of each additional health reform policy that was implemented in MA, the effects of new coverage options from Medicaid or exchanges may be at least partially countervailing to DCE effects. Still, the net effect is that of greater retention of dependent coverage with DCE plus other health reforms. As policy makers continue to debate whether to keep or eliminate various health reform policies, it will be important to consider the impact of these policies independently and collectively.

In addition to reductions in the odds of and time to dependent coverage exit, DCE was associated with further coverage gains for AYA in the form of regained dependent coverage. Specifically, AYA were over twice as likely to regain their previously lost dependent coverage after state DCE was enacted, and this policy effect was significantly boosted after federal DCE was enacted—a finding that is unsurprising given that the ACA substantially expanded the reach of DCE by eliminating ERISA exemptions and administrative barriers (e.g., dependent coverage riders) and other differences in eligibility requirements at the state level. Notably, the federal DCE main effects were substantively larger than state DCE main effects for all outcomes in both MA and ME/NH, highlighting the advantages of maintaining this policy at the federal level (rather than state level) because of the expanded scope and eligibility afforded by the federal provision.

Importantly, the salutary effects of DCE do not extend to uninsured AYA, those who were previously publicly insured, or those whose parents do not have access to commercial insurance with an affordable dependent coverage option. Other ACA policies, such as health insurance exchanges (or marketplaces) and Medicaid expansions, have the potential to provide new coverage options for these AYA who may not have access to dependent coverage through their parents. Our D‐in‐D‐in‐D results suggested that even among AYA who do have the potential to benefit from DCE, differences exist, including less efficacious policy effects for AYA enrolled in plans with higher deductibles or plans for which there are added premium costs for keeping or adding them as a dependent. Examining longer term trends will be important for determining how full implementation of the ACA may affect health insurance coverage for all AYA (Berk and Fang 2016).

Although we did not evaluate how these policies affected health care use and costs for AYA in this study, evidence suggests that dependent coverage expansion provides substantial financial protection for AYA (Mulcahy et al. 2013; Busch, Golberstein, and Meara 2014; Chua and Sommers 2014; Chen, Vargas‐Bustamante, and Novak 2017) and is associated with positive gains in access to care and some health outcomes (Blum et al. 2012; Mulcahy et al. 2013; Sommers et al. 2013; Han et al. 2014; Akosa Antwi et al. 2015; Barbaresco, Courtemanche, and Qi 2015; Chen et al. 2015; Lipton and Decker 2015; Robbins et al. 2015). Moreover, given that AYA may be less likely to have stable employment or access to employer‐sponsored benefits (Sommers and Schwartz 2011) and losing/changing jobs is a primary reason why adults experience a gap in health insurance coverage (Collins, Davis, and Ho 2005), the DCE may lead to better continuity of coverage during a time when AYA are in flux. Continuity of coverage may reduce adverse effects of gaps in coverage on access to care (Cabana and Jee 2004; Olson, Tang, and Newacheck 2005; Callahan 2007; Callahan and Cooper 2007; DeVoe et al. 2008). Expanding dependent coverage may also lead to increased labor market flexibility, as AYA may no longer have to stay in suboptimal jobs to maintain coverage or choose school over employment if a potential job does not include benefits (Currie and Madrian 1999).

Despite the potential for expanded coverage and improved access to care, allowing AYA to maintain dependent coverage may have unintended negative consequences. Our study cannot determine the degree to which a DCE leads to substitution of dependent coverage for ESI in the AYA's own name, but this has been noted in other studies (Monheit et al. 2011). Although evidence is currently sparse, it is possible that AYA's ability to obtain insurance as a subscriber is associated with transitions to adult care or an indication of self‐management or self‐advocacy skills, which are particularly important for youth with special health care needs (Sawicki et al. 2011; Altman et al. 2014; Wood et al. 2014). AYA who shop for plans on the marketplace may be better poised to identify plans with benefits and cost‐sharing that best suits their needs as individuals.

Limitations

Several limitations should be considered when interpreting our findings. First, our data are from a single private health insurer, so we do not have the ability to determine whether individuals subsequently obtained coverage from another source after they disenrolled from an HPHC plan, or if they had insurance from another source, such as a college health plan. In this sample, 19.5 percent of AYA who lost dependent coverage subsequently regained coverage as a subscriber through HPHC, and this proportion was similar across each reform period; however, we are unable to assess how often this occurred with other health plans or how often AYA became uninsured postdisenrollment. Thus, our study can provide new evidence about the impact of the DCE and other health reform policies on exit from dependent coverage but not on uninsurance rates overall and substitution of dependent coverage for ESI or other types of coverage. Second, given that MA concurrently enacted several health reforms (e.g., an individual mandate, establishment of an exchange, Medicaid expansion, prohibition of pre‐existing condition exclusions) in addition to a dependent coverage expansion, our study cannot estimate the separate/independent contribution of a mandate and other health reform policies on the impact of a DCE. Third, the generalizability of this regional cohort of privately insured beneficiaries may be limited. Fourth, our estimates may be subject to some residual confounding; for example, plan generosity is likely correlated with family income, although we attempt to mitigate this by adjusting for neighborhood income. Finally, although we attempt to control for differences between states with the D‐in‐D design, it is possible that other time‐dependent factors could have differentially affected AYA coverage among the three states studied (e.g., local employment trends, insurance markets, local economy).

Conclusion

We find evidence to suggest that implementing an individual mandate along with other health care reform policies may prevent exit from dependent coverage for AYA to a greater extent than dependent coverage expansion policies alone. Our findings on the impact of the MA‐dependent coverage expansion combined with a mandate and other reform policies suggest that increasing maintenance of dependent coverage into young adulthood through the ACA individual mandate and other similar reform policies implemented in 2014 could continue to improve access and continuity of coverage for AYA. Future work is needed to determine how these shifts in source of coverage affect health care utilization and costs for all AYA, and whether additional policies may be needed to reduce or prevent disparities for this population.

Supporting information

Appendix SA1: Author Matrix.

Acknowledgments

Joint Acknowledgment/Disclosure Statement: This work was generously supported by grants from the U.S. Department of Health and Human Services Agency for Healthcare Research and Quality and Centers for Medicare & Medicaid Services, CHIPRA Pediatric Quality Measures Program Centers of Excellence under grants U18 HS020513 and U18 HS025299 (principal investigator of both: Schuster), Agency for Healthcare Research and Quality (5T32HS00063‐21; PI: Finkelstein), National Institute of Child Health and Human Development K24HD060786 (PI: Finkelstein), and by the Thomas O. Pyle Fellowship in the Department of Population Medicine. The content is solely the responsibility of the authors and does not necessarily represent the official views of the Agency for Healthcare Research and Quality.

Dr. Wisk had full access to all of the data in the study and takes responsibility for the integrity of the data and the accuracy of the data analysis. The authors have no conflict of interests or financial relationships relevant to this article to disclose. Previous versions of this work have been presented at the annual meetings of the Pediatric Academic Societies (San Diego, CA, 2015), AcademyHealth (Minneapolis, MN, 2015), and American Public Health Association (Chicago, IL, 2015). We wish to acknowledge the contributions of Matthew Lakoma, MPH, and Kelly Horan, MPH.

Disclosures: None.

Disclaimer: None.

Note

According to the Henry J. Kaiser Family Foundation, the average monthly premium per person for plans purchased in the individual market in 2013 was $235.27 while the average monthly premium (employee contribution) per enrolled employee in 2013 was $97.50 (see kff.org/state‐category/health‐costs‐budgets/).

References

- Akosa Antwi, Y. , Moriya A. S., Simon K., and Sommers B. D.. 2015. “Changes in Emergency Department Use among Young Adults after the Patient Protection and Affordable Care Act's Dependent Coverage Provision.” Annals of Emergency Medicine 65 (6): 664–72 e2. [DOI] [PubMed] [Google Scholar]

- Altman, S. , O'Connor S., Anapolsky E., and Sexton L.. 2014. “Federal and State Benefits for Transition Age Youth.” Journal of Pediatric Rehabilitation Medicine 7 (1): 71–7. [DOI] [PubMed] [Google Scholar]

- Barbaresco, S. , Courtemanche C. J., and Qi Y.. 2015. “Impacts of the Affordable Care Act Dependent Coverage Provision on Health‐Related Outcomes of Young Adults.” Journal of Health Economics 40: 54–68. [DOI] [PubMed] [Google Scholar]

- Berk, M. L. , and Fang Z.. 2016. “Young Adult Insurance Coverage and Out‐of‐Pocket Spending: Long‐Term Patterns.” Health Affairs (Millwood) 35 (4): 734–8. [DOI] [PubMed] [Google Scholar]

- Blum, A. B. , Kleinman L. C., Starfield B., and Ross J. S.. 2012. “Impact of State Laws That Extend Eligibility for Parents’ Health Insurance Coverage to Young Adults.” Pediatrics 129 (3): 426–32. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Busch, S. H. , Golberstein E., and Meara E.. 2014. “ACA Dependent Coverage Provision Reduced High Out‐of‐Pocket Health Care Spending for Young Adults.” Health Affairs (Millwood) 33 (8): 1361–6. [DOI] [PubMed] [Google Scholar]

- Cabana, M. D. , and Jee S. H.. 2004. “Does Continuity of Care Improve Patient Outcomes?” Journal of Family Practice 53 (12): 974–80. [PubMed] [Google Scholar]

- Callahan, S. T. 2007. “Bridging the Gaps in Health Insurance Coverage for Young Adults.” Journal of Adolescent Health 41 (4): 321–2. [DOI] [PubMed] [Google Scholar]

- Callahan, S. T. , and Cooper W. O.. 2005. “Uninsurance and Health Care Access Among Young Adults in the United States.” Pediatrics 116 (1): 88–95. [DOI] [PubMed] [Google Scholar]

- Callahan, S. T. , and Cooper W. O.. 2007. “Continuity of Health Insurance Coverage among Young Adults with Disabilities.” Pediatrics 119 (6): 1175–80. [DOI] [PubMed] [Google Scholar]

- Cantor, J. C. , Monheit A. C., DeLia D., and Lloyd K.. 2012. “Early Impact of the Affordable Care Act on Health Insurance Coverage of Young Adults.” Health Services Research 47 (5): 1773–90. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chen, J. , Vargas‐Bustamante A., and Novak P.. 2017. “Reducing Young Adults’ Health Care Spending through the ACA Expansion of Dependent Coverage.” Health Services Research 52 (5): 1835–57. https://doi.org/10.1111/1475-6773.12555 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chen, J. , Vargas‐Bustamante A., Mortensen K., and Ortega A. N.. 2015. “Racial and Ethnic Disparities in Health Care Access and Utilization Under the Affordable Care Act.” Medical Care 54 (2): 140–6. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chua, K. P. , and Sommers B. D.. 2014. “Changes in Health and Medical Spending Among Young Adults under Health Reform.” Journal of the American Medical Association 311 (23): 2437–9. [DOI] [PubMed] [Google Scholar]

- Collins, S. R. , Davis K., and Ho A.. 2005. “A Shared Responsibility. US Employers and the Provision of Health Insurance to Employees.” Inquiry 42 (1): 6–15. [DOI] [PubMed] [Google Scholar]

- Currie, J. , and Madrian B. C.. 1999. “Health, Health Insurance and the Labor Market” In Handbook of Labor Economics, vol. 3C, edited by Ashenfelter O. and Card D., pp. 3309–415. Amsterdam: Elsevier Science. [Google Scholar]

- DeVoe, J. E. , Graham A., Krois L., Smith J., and Fairbrother G. L.. 2008. “‘Mind the Gap’ in Children's Health Insurance Coverage: Does the Length of a Child's Coverage Gap Matter?” Ambulatory Pediatrics 8 (2): 129–34. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Garfield, R. , and Young K.. 2015. Adults Who Remained Uninsured at the End of 2014. Menlo Park, CA: The Henry J. Kaiser Family Foundation. [Google Scholar]

- Hamel, L. , Firth J., and Brodie M.. 2014. Kaiser Health Tracking Poll: March 2014. Menlo Park, CA: The Henry J. Kaiser Family Foundation. [Google Scholar]

- Han, X. , Yabroff K. R., Robbins A. S., Zheng Z., and Jemal A.. 2014. “Dependent Coverage and Use of Preventive Care under the Affordable Care Act.” New England Journal of Medicine 371 (24): 2341–2. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Krieger, N. 1992. “Overcoming the Absence of Socioeconomic Data in Medical Records: Validation and Application of a Census‐Based Methodology.” American Journal of Public Health 82 (5): 703–10. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lipton, B. J. , and Decker S. L.. 2015. “ACA Provisions Associated with Increase In Percentage of Young Adult Women Initiating and Completing the HPV Vaccine.” Health Affairs (Millwood) 34 (5): 757–64. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Majerol, M. , Newkirk V., and Garfield R.. 2015. “The Uninsured: A Primer – Key Facts about Health Insurance and the Uninsured in America” In The Kaiser Commission on Medicaid and the Uninsured, pp. 1–21. Menlo Park, CA: The Henry J. Kaiser Family Foundation. [Google Scholar]

- Monheit, A. C. , Cantor J. C., and DeLia D.. 2015. “Drawing Plausible Inferences about the Impact of State Dependent Coverage Expansions.” Health Services Research 50 (3): 631–6. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Monheit, A. C. , Cantor J. C., DeLia D., and Belloff D.. 2011. “How Have State Policies to Expand Dependent Coverage Affected the Health Insurance Status of Young Adults?” Health Services Research 46 (1 Pt 2): 251–67. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Mulcahy, A. , Harris K., Finegold K., Kellermann A., Edelman L., and Sommers B. D.. 2013. “Insurance Coverage of Emergency Care for Young Adults under Health Reform.” New England Journal of Medicine 368 (22): 2105–12. [DOI] [PubMed] [Google Scholar]

- Olson, L. M. , Tang S. F., and Newacheck P. W.. 2005. “Children in the United States with Discontinuous Health Insurance Coverage.” New England Journal of Medicine 353 (4): 382–91. [DOI] [PubMed] [Google Scholar]

- Robbins, A. S. , Han X., Ward E. M., Simard E. P., Zheng Z., and Jemal A.. 2015. “Association Between the Affordable Care Act Dependent Coverage Expansion and Cervical Cancer Stage and Treatment in Young Women.” Journal of the American Medical Association 314 (20): 2189–91. [DOI] [PubMed] [Google Scholar]

- Sawicki, G. S. , Lukens‐Bull K., Yin X., Demars N., Huang I. C., Livingood W., Reiss J., and Wood D.. 2011. “Measuring the Transition Readiness of Youth with Special Healthcare Needs: Validation of the TRAQ–Transition Readiness Assessment Questionnaire.” Journal of Pediatric Psychology 36 (2): 160–71. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Simon, T. D. , Cawthon M. L., Stanford S., Popalisky J., Lyons D., Woodcox P., Hood M., Chen A. Y., and Mangione‐Smith R.. 2014. “Pediatric Medical Complexity Algorithm: A new Method to Stratify Children by Medical Complexity.” Pediatrics 133 (6): e1647–54. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Singer, P. M. 2016. “The Future of Health Care Reform – Section 1332 Waivers and State‐Led Reform.” New England Journal of Medicine 376 (2): 108–11. [DOI] [PubMed] [Google Scholar]

- Sommers, B. D. , and Kronick R.. 2012. “The Affordable Care Act and Insurance Coverage for Young Adults.” Journal of the American Medical Association 307 (9): 913–4. [DOI] [PubMed] [Google Scholar]

- Sommers, B. D. , and Schwartz K.. 2011. “2.5 Million Young Adults Gain Health Insurance due to the Affordable Care Act” In ASPE Issue Brief. Office of the Assistant Secretary for Planning and Evaluation. Washington, DC: U.S. Department of Health and Human Services. [Google Scholar]

- Sommers, B. D. , Buchmueller T., Decker S. L., Carey C., and Kronick R.. 2013. “The Affordable Care Act Has Led to Significant Gains in Health Insurance and Access to Care for Young Adults.” Health Affairs (Millwood) 32 (1): 165–74. [DOI] [PubMed] [Google Scholar]

- US Bureau of the Census . 1995. “Poverty Areas” [accessed on June 24, 2014]. Available at http://www.census.gov/population/socdemo/statbriefs/povarea.html

- U.S. Congress Joint Economic Committee Majority Staff . 2010. “Understanding the Economy: Unemployment among Young Workers.”

- Wood, D. L. , Sawicki G. S., Miller M. D., Smotherman C., Lukens‐Bull K., Livingood W. C., Ferris M., and Kraemer D. F.. 2014. “The Transition Readiness Assessment Questionnaire (TRAQ): its Factor Structure, Reliability, and Validity.” Academic Pediatric 14 (4): 415–22. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Appendix SA1: Author Matrix.