Significance

Contributing to cooperation is costly, while its rewards are often available to all members of a social group. Therefore, cooperation is vulnerable to exploitation by individuals that do not contribute but nevertheless share the benefits. So why contribute to cooperation? This dilemma can be resolved if individuals modulate their ‟investment” into cooperation dependent on whether benefits go to relatives or nonrelatives, which maximizes the return on investment to their genes. To evaluate this idea, we derived a model for cooperative investment and tested its predictions using a social microbe that cooperatively builds a stalk to facilitate spore dispersal. We find that cooperative investment into stalk closely matches predictions, with strains strategically adjusting investment according to their relatedness to their group.

Keywords: cooperation, conflict, game theory, cheating, kin selection

Abstract

Contributing to cooperation is typically costly, while its rewards are often available to all members of a social group. So why should individuals be willing to pay these costs, especially if they could cheat by exploiting the investments of others? Kin selection theory broadly predicts that individuals should invest more into cooperation if their relatedness to group members is high (assuming they can discriminate kin from nonkin). To better understand how relatedness affects cooperation, we derived the ‟Collective Investment” game, which provides quantitative predictions for patterns of strategic investment depending on the level of relatedness. We then tested these predictions by experimentally manipulating relatedness (genotype frequencies) in mixed cooperative aggregations of the social amoeba Dictyostelium discoideum, which builds a stalk to facilitate spore dispersal. Measurements of stalk investment by natural strains correspond to the predicted patterns of relatedness-dependent strategic investment, wherein investment by a strain increases with its relatedness to the group. Furthermore, if overall group relatedness is relatively low (i.e., no strain is at high frequency in a group) strains face a scenario akin to the “Prisoner’s Dilemma” and suffer from insufficient collective investment. We find that strains employ relatedness-dependent segregation to avoid these pernicious conditions. These findings demonstrate that simple organisms like D. discoideum are not restricted to being ‟cheaters” or ‟cooperators” but instead measure their relatedness to their group and strategically modulate their investment into cooperation accordingly. Consequently, all individuals will sometimes appear to cooperate and sometimes cheat due to the dynamics of strategic investing.

Cooperation is widespread in nature (1–3), often being manifested as individuals investing in the production of public goods that benefit all members of a group (4–6). However, these goods are vulnerable to exploitation by “cheaters” (or “free riders”) that reap the benefits of cooperation without commensurate investment (7, 8). Because such behavior has the potential to undermine the evolutionary stability of cooperation through public good production, successful cooperation is typically thought to require mechanisms of cheater avoidance or control (1, 9–11). This logic implies a simple evolutionary scenario where there is competition between alternative “cooperator” and cheater strategies. However, it is logical to assume that such discrete strategies would lose out to individuals that can strategically modify their contribution to public goods. This is because strategic investment could allow individuals to balance the costs and benefits of “investing” while realizing potential opportunities to exploit the investments made by others (12, 13). Because these costs and benefits can vary across social settings, individuals face a strategic dilemma over how much to invest, with the realized success of a strategy depending not only on the level of cooperative investments made by the individual but also on that made by others in the group.

Kin selection theory provides an appealing framework for understanding how evolution shapes investment in cooperation. In this framework, the competing “individuals” are different genetic variants (14–16), with strategies evolving to maximize “inclusive fitness” (17, 18). The inclusive fitness accounting considers the total impact of a behavior on the success of the causal genes in terms of the direct costs to the actor and indirect benefits to relatives (i.e., others carrying that same genetic variant). For cooperation through production of public goods, where all benefits go to the entire group, relatedness to the group should be a critical determinant of inclusive fitness because it governs the share of rewards that go to the individual, and hence determines the expected net return on investment. Consequently, we would logically expect that individuals should optimize their inclusive fitness by facultatively modulating their willingness to invest into public goods as a function of their relatedness to the members of the group (4, 19–21).

A number of theoretical studies have analyzed facultative cooperative strategies, where individuals modulate their behavior in response to social context (such as the behaviors shown by rivals) (22, 23). While most of these studies have focused on discrete alternative strategies (cooperate or cheat) (12, 22), there is also a growing literature that considers continuously variable strategic cooperative behavior in response to social contexts, including relatedness (4, 23). However, experimental tests of theoretical predictions often either rely on simpler models that do not include such potential complexity (24–28) or do not evaluate whether the observed facultative patterns are strategic (i.e., match adaptive quantitative predictions from evolutionary models) (29–34). For example, the opportunistic pathogen Pseudomonas aeruginosa facultatively produces iron-scavenging siderophores, which represent a cooperative public good (35–37). Cells produce quorum-sensing molecules that allow them to modulate their production of siderophores. There is evidence that investment into siderophore production is flexible (35, 36) and varies between broad-scale differences of “high” versus “low” relatedness (37). However, it is unclear as to whether the level of production can be varied quantitatively as a strategic response to fine-grained variation in relatedness.

To understand how selection shapes patterns of investment into public goods in response to variation in relatedness, we first developed a dynamic game-theoretical framework that views competing genetic variants as players who can modulate their contributions to public goods based on their relatedness to their group. The resulting “Collective Investment” game offers an intuitive economic logic for why and how organisms should modulate their contributions to public goods and provides a set of simple and unambiguous predictions that can be tested empirically. To directly test these predictions, we next examined the consequences of experimental manipulation of social group composition in the social amoeba Dictyostelium discoideum for patterns of individual and collective investment in cooperation. These studies revealed a remarkable agreement between patterns of individual and collective investment with fine-scale model predictions, where patterns of cooperation are explained by savvy investment strategies that maximize the fitness return on investment.

Results and Discussion

The Collective Investment Game.

When individuals engage in social interactions, their success typically depends on both their own behavior and the behavior of their social partner(s). Under these conditions, game theory provides a powerful framework for identifying how individuals should behave to maximize their expected social success across encounters (16, 38–40). Game-theoretical models predict that individuals will display the evolutionarily stable strategy (ESS), which cannot be invaded by any competing strategy (16, 39). In most economic and biological scenarios that involve cooperation, we might logically expect that individuals could do better by playing dynamic strategies in which they change their behavior quantitatively across different social contexts (3, 13). While games with fixed alternative strategies (e.g., the Prisoner’s Dilemma) have been widely used as the basis for analyses of strategic modulation of cooperative behavior (4, 23), they do not yield any quantitative predictions about continuously variable behavior. Instead, models that consider cooperation via public goods (4, 23, 41, 42), typically based on the inclusive fitness framework (20, 43, 44), have proven more informative. We extent this work by developing a model based on an equivalent “direct fitness” accounting, where different genetic variants are the players in a dynamic game, to provide an intuitive logic for the costs and benefits of investing in public goods. The game is described with two players but logically extends to include more.

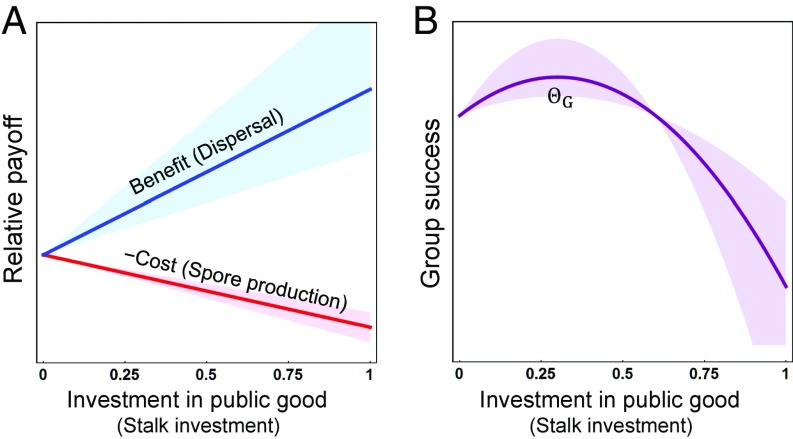

The Collective Investment game is based on a scenario in which the payoff to a player is determined by two opposing factors: the costs suffered from investing in the public good and the resulting benefits from public good availability (Fig. 1A). From the perspective of the group, this antagonistic relationship between costs and benefits results in a scenario where group success is maximized at some intermediate level of collective investment whenever public good production is favored by natural selection (Fig. 1B). Examples of this sort of scenario, where overall success is maximized at an intermediate level of investment, are well-documented, ranging from economics to biology (23, 45–47). However, the level of collective investment that maximizes group success (denoted in the model) will typically differ from the level of personal investment that maximizes individual fitness (10). This is because individuals suffer the cost of investment, yet their payoffs are divided among the collective. Therefore, we expect individuals to implement selfish strategies that maximize their return on investment in terms of fitness, which must balance their personal costs with the return they receive through their influence on collective success (7, 13). The relative magnitude of the costs and benefits together define the strength of selection (denoted Γ in the model), which reflects the rate at which group success declines as investment deviates from the level that maximizes group success (i.e., deviates from ).

Fig. 1.

The costs and benefits of cooperation through production of public goods. (A) The benefit (relative payoff) from public good production is an increasing function of the resources invested into the public good (blue line). Because investment is costly it results in a decreasing payoff through other components (red line). In the case of the D. discoideum system, the benefits of stalk investment come through spore dispersal and come at a cost in terms of reduced spore production. (B) The costs and benefits of investment in the public good result in a quadratic relationship between total investment and overall group success (). Groups have their highest success at some intermediate level of investment () that balances costs and benefits. In both A and B, investment in public good is given as the proportion of the total budget available, with 0 being no investment and 1 corresponding to investment of all available budget into the public good. In the case of the D. discoideum system, this represents the proportion of cells that a strain invests into stalk production. For illustration, the optimal level of investment () resulting from the relative costs and benefits is 0.3. To capture different strengths of selection on investment (Γ; see Eq. 5), the bold lines were plotted for a strength of selection where Γ = 2, with the shaded region indicating the range from Γ = 1 to 4.

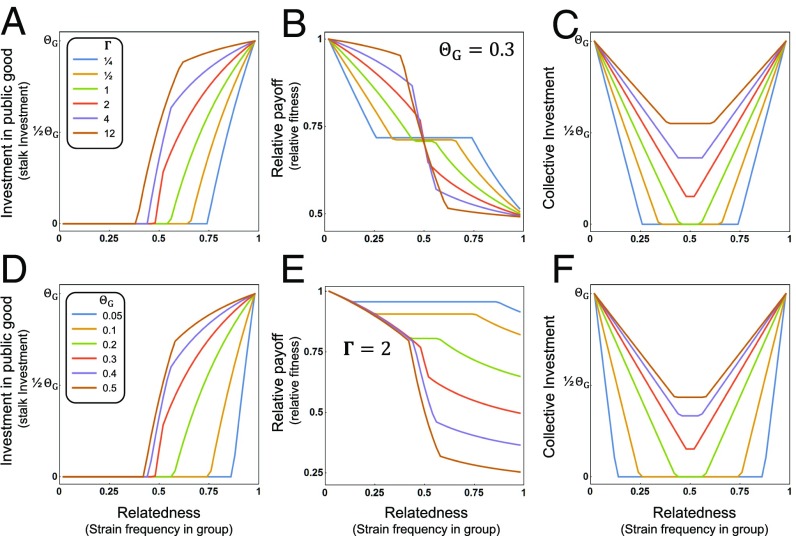

To implement our direct fitness accounting, we consider a player to represent some proportion of the group, which is equivalent to the frequency of that genetic variant within the group (and therefore can vary between 0 and 1) and represents their “whole-group relatedness” (20, 21) (in economic terms, this might be described as a player’s “stake” in the group). This measure of relatedness is relevant because, as the benefits of public goods are accessible to all group members, the whole group is the beneficiary of investment made by an individual, and hence whole-group relatedness accounts for direct fitness return from investing in public goods. Despite differing from the more typical “kinship” coefficient of inclusive fitness models, the two approaches produce exactly equivalent results (20, 21, 43). To identify the strategy that maximizes expected individual fitness, which represents the ESS for the game, we solved the Collective Investment game across the full range of relatedness over a broad array of relative costs and benefits of investment in public goods. These analyses revealed a general qualitative prediction for patterns of investment under the ESS: Individuals should modulate their investment into public goods as a continuous function of their relatedness to the group. By evaluating the patterns predicted by the model across an enormous range of values for the optimal level of collective investment (i.e., the value that maximizes group success, ) and the strength of selection on investment (Γ), it is clear that the qualitative results are robust across a wide array of conditions (Fig. 2 A and D; see also SI Appendix, Fig. S1 A, D, G, and J). When there is a relatively large asymmetry in the degree to which players are related to the group, each player should behave differently. The player with higher relatedness to the group has the incentive to invest because their interests are more closely aligned with those of the group (and hence investing maximizes their fitness; see SI Appendix, Fig. S2), while the player(s) that is less related to the group does best by withholding investment (or underinvesting) and exploiting the investment of their partner(s) (SI Appendix, Fig. S2). Consequently, under these conditions, the player with the lower relatedness will have higher relative fitness than the player with higher relatedness because of this exploitative behavior (Fig. 2 B and E; see also SI Appendix, Fig. S1 B, E, H, and K). In contrast, when the players have similar levels of relatedness to the group, neither is expected to be willing to invest heavily, leading to a pattern of underinvestment in the public good (Fig. 2 C and F; see also SI Appendix, Fig. S1 C, F, I, and L).

Fig. 2.

Examples of the predictions of the Collective Investment game (and specific application to the D. discoideum system). Predictions are plotted as a function of a focal player’s relatedness to the group (i.e., a strain’s frequency in the group). For A–C the optimal investment () was fixed at 0.3 and the strength of selection (Γ) was varied, while for D–F the strength of selection was fixed at 2 and the optimum was varied. (A and D) Predicted Investment in the public good (stalk investment) as a function of relatedness (frequency). (B and E) Predicted relative payoff (fitness) () as a function of relatedness (frequency). (C and F) Predicted collective investment for a pair of players as a function of the relatedness (frequency) of the focal player to the group (see SI Appendix, Fig. S1 for illustrations across other parameter values).

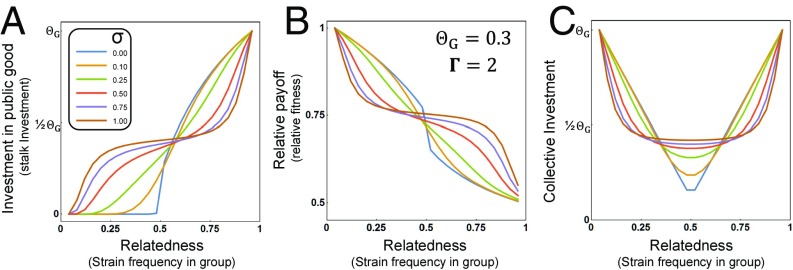

Because organisms in nature presumably rely on some cue(s) to measure their level of relatedness to the group (which would represent a mechanism of kin discrimination), we also evaluated how the patterns would be affected if individuals make errors when measuring relatedness (with the patterns in Fig. 2 and SI Appendix, Fig. S1 illustrating the scenario of no measurement error). We included measurement error in the model by integrating over a Gaussian distribution centered on the true relatedness (allowing us to vary the degree of error by modulating the SD of the error distribution; SI Appendix, Fig. S3). We further assumed that measurement error depends on group complexity and so is high at intermediate levels of relatedness (where group composition is the most complex) and low when one player has very high relatedness to the group. This extension of the model provides us with a robust and clear set of predictions for what to expect in nature (see Fig. 3 for an example and SI Appendix, Fig. S4 for illustrations across parameter space). Together, the Collective Investment game reveals that although the exact patterns will depend on the relative costs and benefits of public good production (which will determine the optimal level of investment and the relative strength of selection on investment patterns) and the degree of error in measurement of relatedness, the qualitative patterns of individual investment, relative fitness, and collective investment are consistent across parameter space (see also SI Appendix, Fig. S2B for an illustration of absolute fitness).

Fig. 3.

Illustration of the predictions of the Collective Investment game for the case where players make errors when measuring their relatedness. This corresponds to the scenario where players have imperfect information about their relatedness and are estimating their relatedness from some cues. The structure of the figure matches that of Fig. 2. In A–C the optimal level of investment () is 0.3 and the strength of selection (Γ) is 2. Lines within A–C correspond to different values of error (σ) in measurement of relatedness (frequency in the group) (see SI Appendix, Fig. S4 for illustrations across other parameter values).

Individual and Collective Investment in D. discoideum.

To test whether organisms are able to deploy the relatedness-dependent (and hence frequency-dependent) strategies predicted by the Collective Investment game, we measured patterns of investment into a public good in the social amoeba D. discoideum. Free-living D. discoideum amoebae initiate a social cycle in response to starvation (48, 49). Thousands of amoebae aggregate to form a multicellular fruiting body with a supporting stalk composed of dead cells that holds aloft a sporehead. The stalk structure is thought to have evolved to aid spore dispersal, and it has been shown experimentally that an intact fruiting body does indeed increase dispersal (although dispersal is not eliminated by stalk removal) (50). Stalk-cell differentiation has typically been viewed as altruistic self-sacrifice for the benefit of the cells in the sporehead (49, 51–53). However, this perspective ignores the implications of collective investment on the group’s success: If a genotype only produced altruists then there would be no spores to reap the benefits of stalk investment, and likewise if a genotype only produced spores then they would be unable to reap group benefits of producing a stalk (Fig. 1A). Consequently, there must be some intermediate level of stalk investment that is favored by natural selection that balances these costs and benefits (Fig. 1B). Indeed, laboratory measurements reveal that typically 25–35% of cells are allocated to the stalk-cell fate (54, 55).

Multicellular aggregations can also be composed of multiple strains (i.e., can be chimeric), providing the opportunity for conflict over stalk investment (49, 56). Conflict arises because the different strains within an aggregation each contribute to the costs for building the stalk, while all members of the aggregation benefit equally. Thus, stalk investment in D. discoideum fits the scenario modeled by the Collective Investment game. In our direct fitness accounting, different strains are the relevant fitness-maximizing strategists, with the proportion of cells killed by the strain to build the stalk representing their investment into the public good, and their relative frequency within the aggregation determining their relatedness to the group (Fig. 1). Furthermore, D. discoideum provides an ideal model social system to experimentally test the predictions made by the Collective Investment game because group composition can be manipulated and corresponding patterns of investment can be measured quantitatively (49). Specifically, the ESS of the Collective Investment game predicts that D. discoideum strains should show relatedness-dependent patterns of investment, meaning that their investment should change as a function of their frequency in a group. When a strain is at low frequency in the aggregation they would be predicted to invest little or nothing into the stalk (hence produce mostly spores), while a strain that is at a high frequency in an aggregation should invest at a level that is close to their clonal investment (Fig. 2 A and D). This pattern of investment results in a return on investment, and hence relative fitness, that is highest when a strain is at low frequency in an aggregation and hence has low relatedness (because it exploits its partner as a free rider) and is lowest when it is at high frequency and hence has high relatedness (because it pays the cost of being exploited). Consequently, the expected relative fitness of the lower-frequency player is always higher than that of the higher-frequency player (Fig. 2 B and E).

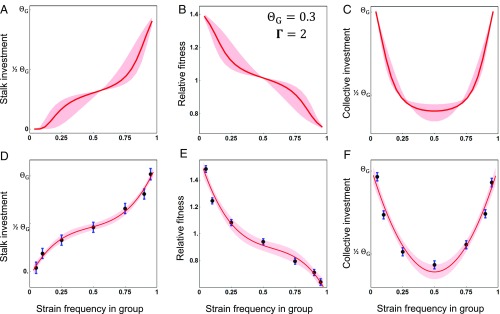

To test these predictions, we measured the behavior of cooccurring natural D. discoideum strains in clonal and chimeric development. We examined the fit to theoretical predictions using data from 10 naturally cooccurring strains, which represent the spectrum of genetic diversity within a natural population (57), interacting in 34 different chimeric pairings. To vary levels of relatedness we combined pairs of strains across a range of frequencies (at least five different frequencies per replicate, for a total of 944 chimeric combinations). On average, strains show patterns of frequency-dependent investment in the stalk in pairwise mixes that match the qualitative predictions of the ESS in the Collective Investment game (compare Fig. 4A with Fig. 4D; see also expected values in Figs. 2 A and D and 3A). Strains invest little into the stalk when their relative frequency in a group is low and much more when their relative frequency is high [χ2(3) = 181.5, P < 10−38; see also SI Appendix, Fig. S5 A and B for high-resolution illustrations of patterns from two pairings]. Overall, the pattern very closely corresponds to the quantitative predictions of the model (Fig. 4 A and D). Strains approach zero investment when they are at a very low frequency in a group, whereas their investment is close to the optimal level of investment (assumed to be about 30% of their cells into stalk) when their frequency in a group approaches 100%. This pattern of investment leads to the pattern of frequency-dependent relative fitness predicted by the Collective Investment game (Figs. 2 B and E and 3B) in which strains have a high relative fitness when they are at a low frequency in a group and low relative fitness when they are at high frequency [χ2(3) = 348, P < 10−75; compare the illustration of expected values in Fig. 4B with the experimental results in Fig. 4E and see also SI Appendix, Fig. S5 C and D]. Importantly, these results imply that all strains will appear to behave as cheaters when at low frequency in groups and as cooperators when at high frequency.

Fig. 4.

Patterns of stalk investment, relative fitness, and collective investment as a function of strain frequencies in chimeric aggregations. A–C illustrate expected patterns under parameter values that resemble the empirical results [using the same equations (Eqs. 11–13) to calculate model expectations as those used for empirical estimation], with the bold line corresponding to the case where = 0.3, Γ = 2, and σ = 0.50, with the shading spanning a range of error in measurement of frequency (relatedness) (σ = 0.25 to σ = 0.75). D–F show empirical results from the set of 34 chimeric pairs (n = 944 total chimeric mixes), with the points representing the means and the bars their SEs, estimated from a mixed model (following the model structure in Materials and Methods, but with frequency as a categorical factor). (D) Individual stalk investment by a focal strain as a function of its frequency in a chimeric aggregation. (E) Relative fitness for a focal strain as a function of its frequency in a chimeric aggregation. (F) Collective investment by chimeras as a function of the frequency of a randomly assigned focal strain to the chimeric aggregation. In D and E the bold curve represents the best-fit estimate from the cubic regression model (here fitted to the estimated means). For F, the curve represents the best-fit estimated from a quadratic regression model (fitted to the estimated means). For all three figures (D–F) the shaded region indicates a one SE interval on either side of the best-fit line. Individual (A and D) and collective (C and F) investment values were rescaled by subtracting from the raw measures, under the assumption that (therefore, the value labeled as corresponds to a value of 0.3 in the figure).

The predictions of the Collective Investment game can also be viewed from the perspective of the aggregate behavior of the strains in terms of total collective investment. Experimental measurements of total collective investment as a function of the relative frequencies of strains shows the predicted pattern of relative investment in stalk across frequencies in a group (Figs. 2 C and F and 3C), where investment is lowest when strains are at the same frequency and increases exponentially as the difference in their frequencies increases (i.e., as frequency of the focal strain approaches zero or one) [χ2(2) = 144.3, P < 10−32; compare the illustration of expected patterns in Fig. 4C with empirical results in Fig. 4F and see also SI Appendix, Fig. S5 E and F].

The Prisoner’s Dilemma and How to Avoid It.

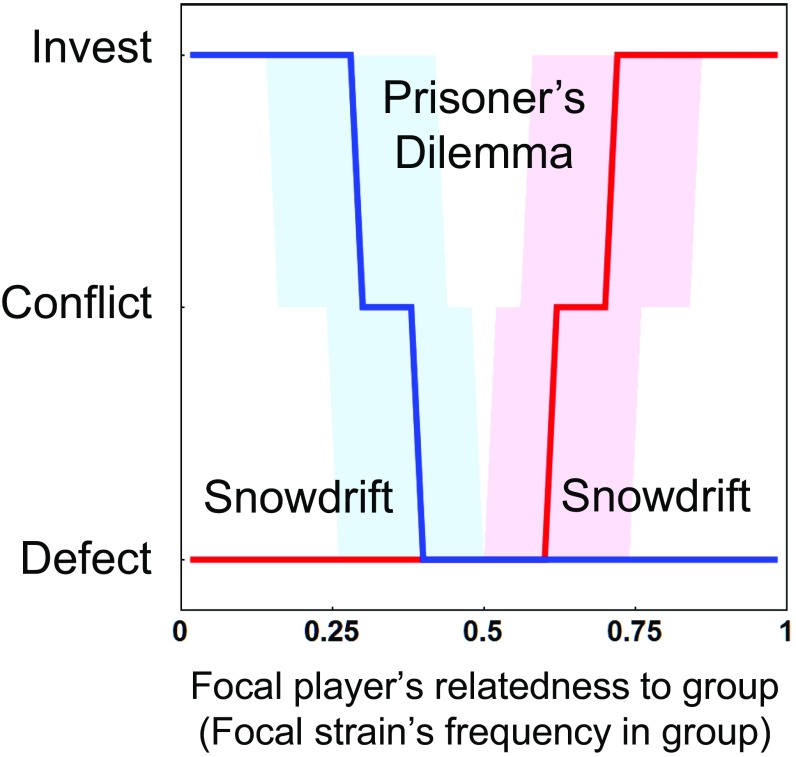

Although the ESS is characterized by continuously variable relatedness-dependent (or frequency-dependent) behavior (Fig. 2), to achieve a more intuitive understanding we can link the payoff structure at any particular group composition to canonical games. To do so, at a given group composition we can compare the relative payoffs to a player that defects by making no contribution and the relative payoffs to a player that cooperates by making a contribution (Materials and Methods). We consider a scenario to be akin to the Prisoner’s Dilemma when defection is the best strategy for both players, regardless of the opponent’s strategy. In the Snowdrift game, we expect players to adopt opposite roles, with one cooperating and the other defecting. Therefore, we consider two different scenarios to be akin to the Snowdrift game. The first scenario follows the structure of the classic symmetrical game, where players are better off defecting against a cooperator and cooperating against a defector. The second scenario occurs when there is an asymmetry between players that dictates their roles in the Snowdrift game, with one player doing best by cooperating while the other does best by defecting.

The exact nature of payoffs depend on the model parameters, but in general, when the players’ differ widely in their relatedness to the group, we find that the pattern of joint payoffs are akin to the Snowdrift game and when they have similar levels of relatedness to the group it is akin to the Prisoner’s Dilemma (12, 23) (Fig. 5). Under the Snowdrift game, one player adopts the role as the cooperator and the other as the defector, which results in relatively high fitness for the group. By adopting different roles, the defector receives a higher payoff than the cooperator, but the cooperator is willing to adopt that role because it is better off cooperating than defecting when its opponent defects (23). In the context of the Collective Investment game, it is the asymmetry in relatedness to the group that drives the players to adopt the two roles (Fig. 5), with the player that is more related to the group acting as the cooperator while its opponent is able to defect (Figs. 2 A and D and 3A), leading to a higher relative payoff to the defector (Figs. 2 B and E and 3B). In contrast, under the Prisoner’s Dilemma conditions (Fig. 5), both players do best by defecting, which leads to low collective investment (Figs. 2 C and F and 3C). These game scenarios help explain the pattern of collective investment in stalk that we observe in the D. discoideum system (Fig. 4F): Under the Snowdrift game conditions we see collective investment approach the level seen in clonal development (which presumably evolved to maximize group fitness), whereas under the Prisoner’s Dilemma conditions we see underinvestment.

Fig. 5.

Payoff structure of the Collective Investment game and relationship to classic games. Payoffs are characterized in terms of whether defection or investment is favored, or whether the best strategy depends on the investment by the opponent (labeled as Conflict). The best strategy for the focal player is shown in red and that of their opponent in blue. When both players do best by defecting the overall payoff structure is akin to the Prisoner’s Dilemma, and we see low levels of total investment (Fig. 2). When one player does best by investing while its opponent does best by defecting the overall payoff structure is akin to an asymmetric Snowdrift game, where the difference in relatedness determines which player takes the role as the cooperator (with the player with higher relatedness making the investment in cooperation). Bridging these two regions is a zone of conflict. The bold lines correspond to a level of investment of , with the shaded region spanning the range from to . The shaded region illustrates that the zones corresponding to the different games will depend on how much an individual invests when cooperating.

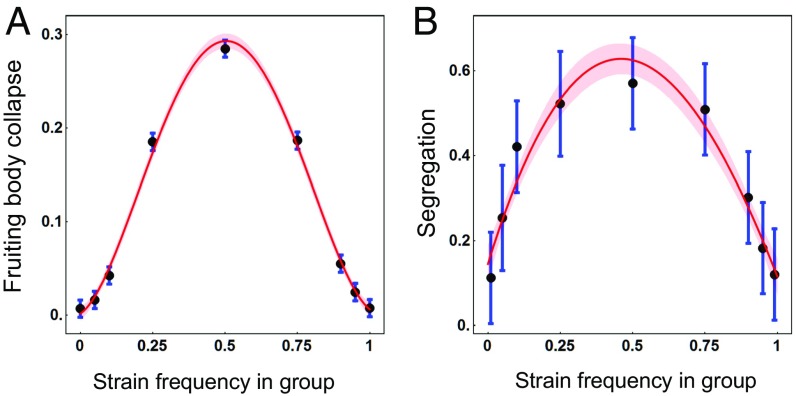

We expect the predicted collective underinvestment under the Prisoner’s Dilemma conditions to be detrimental compared with the higher investment under Snowdrift conditions. We tested this by measuring the proportion of fruiting bodies that collapsed due to inadequate investment in the stalk. Fruiting bodies made by chimeric mixtures (using all pairwise 50:50 mixes of 10 natural strains) were found to have spontaneously collapsed more often than those made by clonal groups [12% versus 1.1%, F(1,52.3) = 10.4, P = 0.002]. Furthermore, we expect the stability of fruiting bodies to reflect the overall level of collective investment in stalk, which should be manifested as an inverse relationship between the level of collective investment (Fig. 4F) and the probability of fruiting-body collapse. We tested this prediction using data from four pairs of strains measured at seven frequencies and find the expected negative correlation between collective investment for a given pair and probability of their fruiting bodies collapsing (r = −0.94, P = 0.0009). This relationship between investment and fruiting-body stability underlies a strongly frequency- (and hence relatedness-) dependent risk of fruiting-body collapse, with risk of collapse peaking when is there is no asymmetry in the frequency of the strains (i.e., both strains at a frequency of 0.5) and declining exponentially as the difference in frequencies increases (i.e., on either size of a frequency of 0.5) [χ2(4) = 403, P < 10−86; Fig. 6A and SI Appendix, Figs. S6 and S7]. If we use fruiting-body stability (which is simply 1 minus the probability of fruiting-body collapse) as a proxy for the dispersal success of a group [] and the estimates for individual stalk investment (Fig. 4D) to estimate fitness through spores (as simply 1 minus the proportion of cells invested in stalk; see Eq. 1), we can generate an approximate pattern of individual fitness (Eq. 3). Despite the fact that our laboratory-based measure of fruiting-body stability provides only a rough approximation for group fitness through dispersal, we find that the pattern of individual fitness closely matches the pattern expected under the Collective Investment game (SI Appendix, Fig. S2 C and D). The resulting fitness pattern illustrates that individuals will have the lowest possible fitness when at intermediate frequencies and, while individuals always do best at very low frequency in a group, individual fitness increases toward both frequency extremes.

Fig. 6.

Empirical measures of fruiting-body stability and segregation behavior. (A) The proportion of fruiting bodies that spontaneously collapsed as a function of the frequency of the focal strain in each mix (estimated from six chimeric pairings; n = 324). (B) The relative degree of segregation as a function of the frequency of the designated focal strain. Measurements are from three different chimeric pairings across the nine frequencies (n = 692 total sporeheads, with an average of 25.6 sporeheads measured for each pair at each frequency). In A and B, the points represent the means and the bars their SEs, estimated from a mixed model (following the model structure in Materials and Methods, but with frequency as a categorical factor). For A, the curve gives the best-fit cubic relationship while for B the curve gives the best-fit quadratic relationship (with the shaded region indicating a one SE range on either side of the curve).

The finding that individuals suffer a much larger cost from conflict when trapped in the Prisoner’s Dilemma-like conditions at intermediate levels of relatedness (Figs. 5 and 6A) raises the question of why strains would engage in cooperative fruiting-body formation under these conditions. Indeed, widespread (imperfect) strain segregation is a known mechanism in D. discoideum for avoiding chimerism when strains are mixed at equal frequencies and developed on a natural soil substrate (58, 59), with two rapidly evolving genes being thought to be principally responsible (57, 58). Although the mechanism by which these genes regulate segregation remains to be fully elucidated, there is evidence to suggest that a critical mass of self–self interactions is required for the coordinated directional motility that is necessary to form independent cooperating groups (60). We might, therefore, expect strains to only show segregation when faced with Prisoner’s Dilemma-like conditions (i.e., low asymmetry in relatedness), while remaining in aggregations when in Snowdrift-like conditions of high asymmetry in levels of relatedness. Indeed, as predicted, we find that segregation is highest when there is little asymmetry in frequencies (relatedness) and declines exponentially as the difference in frequencies increases [χ2(2) = 19, P < 10−4; Fig. 6B]. The frequency-dependent nature of segregation suggests that it may not have evolved as a mechanism of “cheater avoidance,” as has previously been suggested (57–59), but rather as a mechanism for reshaping group composition to generate asymmetry in relative frequencies (resulting in a scenario where there will typically be a strain with high relatedness to the group), thereby avoiding the pernicious Prisoner’s Dilemma-like conditions and entering into the more favorable Snowdrift-like conditions.

The Logic of Collective Investment.

The Collective Investment game and the supporting empirical data from the D. discoideum system have broad implications for our understanding of cooperative behavior. From the perspective of kin selection theory, an individual’s relatedness to the group governs whether the personal cost of contributing to public goods is outweighed by the benefit. Consequently, if individuals can measure their relatedness to groupmates, we would expect to see them invest in a way that maximizes inclusive fitness in terms of the balance between the benefit to kin in relation to the costs to self (following Hamilton’s rule in the context of the ESS, which means that the optimal strategy depends on the behavior of opponents). Applying this logic to the D. discoideum system, an individual cell should modulate its “willingness” to differentiate into a stalk cell based on its measurement of relatedness to other members of its aggregation, with the actual level of investment being determined by the benefits of producing a stalk relative to the cost of diminished spore production. From an economics perspective, we can view players as investors in some collective venture who are out to maximize return on investment, with relatedness representing their level of stake or “ownership” in the venture. When a player has a low relatedness to the group, their personal investment can have little effect on the overall performance of the venture (regardless of how much they invest), so they are better off withholding their investment. In contrast, when a player has high relatedness to the group their investment can have a large impact on the performance of the venture. Therefore, they should be willing to invest more heavily. In the context of the D. discoideum system, this perspective logically implies that a strain at a low frequency in an aggregation cannot affect the performance of the fruiting body regardless of how much it invests into stalk, and hence that strain should withhold their investment. Finally, we can view the scenario from the perspective of a dynamic game, with individuals as players out to maximize their payoff. From this perspective, a player contributes to the public good because they directly benefit from their own contribution and the optimal strategy is determined by the benefit they receive in relation to the cost paid (Fig. 1A). Players with low representation in the group do not contribute much to the public good because their contribution is diluted by the group, so they receive back only a small fraction of what they invest. In contrast, a player with high representation in the group should invest more because they receive back most of the benefit, and consequently they are mostly helping themselves through production of the public good. In the context of the D. discoideum system, this perspective implies that a strain with a high frequency in an aggregation should contribute heavily to stalk production because most of the benefit goes to their own spores, and lower investment would only hurt them. The result is that a strain with a lower frequency, which would see little return on its contribution, can be exploitative since it is in the best interests of a common strain to build a stalk to its own benefit.

Although these different perspectives suggest different logical explanations for why and how individuals should invest in public goods, they are ultimately interchangeable since all are based on the same underlying framework. All suggest that organisms should adopt dynamic strategies in which they modulate their contribution to cooperation through public goods in relation to their relatedness to the group. Furthermore, it suggests that approaches where organisms are simply classified as cooperators and cheaters (11, 12, 61) will often fail to capture the true nature of cooperative behavior in many systems. Indeed, the same individual or genotype could be expected to be cooperative or exploitative depending on their relatedness to the group. This scenario is clearly realized in the D. discoideum system. Although strains have typically been viewed as cooperators and cheaters (49, 62–64), the striking fit of the observed investment behavior by natural strains to the predictions of the Collective Investment game (Fig. 4) provides strong evidence they cooperate through the implementation of a dynamic frequency-dependent strategy. As a result, all strains can appear as cheaters when they are at a relatively low frequency in a group and as cooperators when they are at a relatively high frequency. Our finding that even simple organisms like a social amoeba can implement the sorts of savvy relatedness-dependent investment suggests that these dynamic adaptive strategies may be common in nature.

Materials and Methods

The Collective Investment Game.

The Collective Investment game is a two-player game in which each individual makes an investment into a public good and receives a payoff as a function of their own investment and the collective investment of the pair. The structure of the game is related to economic games of public goods (4, 7) but differs in that the return on investment is a function of a player’s relatedness to the group. The game is described with reference to the D. discoideum system but the basic structure is easily adapted for other systems. The players are different genotypes (strains) but in principle can represent any evolutionarily relevant fitness-maximizing agent. Within an aggregation (which represents the group or collective) strains may have varying relative frequencies or proportions (). The frequency of a strain in a group is equivalent to whole-group relatedness since it represents the average relatedness of a randomly selected cell to the entire group (self-included) (20, 21). We present the model results and insights with regard to relatedness in keeping with theory but discuss the results in the context of frequencies of strains within a group to provide a clear link to the experimental methods.

Strains invest a proportion of their cells into stalk () and the rest () into spores (with the level of investment potentially depending on their proportion, ). Therefore, their level of investment represents the proportion of their entire “budget” of cells that are allocated toward stalk production (hence 0 ≥ ≤ 1). Investment into stalk is costly because it reduces the total number of spores a strain can produce and hence the “payoff” (component of fitness) to a strain through spores declines (at a rate of ) as a function of their investment in stalk (Fig. 1A):

| [1] |

The payoff is scaled to a value of 1 when no cells are invested into stalk.

Strains presumably invest in building a stalk to facilitate dispersal of spores (49, 50, 56). While the cost of investing into the stalk is paid by the individual strain from their total budget of cells, the benefit (payoff) gained from dispersal depends on the architecture of the fruiting body, and hence on collective investment into the stalk (which is simply the weighted average of the stalk allocation of the two players, ). We model the performance of the fruiting body for spore dispersal as an increasing function of collective investment:

| [2] |

where gives the rate at which the payoff through dispersal increases as a function of investment into stalk (Fig. 1A). As with the payoff through spores (Eq. 1), the payoff through dispersal is scaled to a value of 1 when no investment is made. For both payoff functions (Eqs. 1 and 2) the qualitative results do not depend on this scaling, so the baseline value of 1 is used in both cases for simplicity. Similar cost/benefit relationships underlie a wide array of models that consider tradeoffs, such as models for the evolution of life histories (e.g., models of clutch size and parental investment). For example, models for the evolution of parental investment assume increasing investment per offspring is costly because it reduces fecundity but beneficial because it increases offspring survival. Although, like many of these models, we assume a linear relationship between investment and costs/benefits, the qualitative results are robust across an array of relationships (so long as costs and benefits both increase with investment).

The overall success of a strain is determined by its payoff through spores weighted by the overall performance of the fruiting body. This is consistent with evolutionary theory, such as models that consider trade-offs between components of fitness or episodes of selection, and is necessary to properly account for the influence of multiple factors affecting fitness. For example, to calculate total parental fitness in models for the evolution of parental investment, it is necessary to multiply an individual’s fecundity (number of offspring produced) by the expected survival of the progeny they produce (since the product represents the number of surviving offspring). In terms of the D. discoideum system, the expected success of each spore depends on its expected dispersal, and hence fitness of a strain is the product of spore number and spore dispersal:

| [3] |

The overall success of a group is simply the average fitness of its members (Eq. 3), , which is equivalent to the expected payoff for the group through spores weighted by the payoff through dispersal, (where the group payoff through spores is the weighted average of the spore production by group members, ). The trade-off between spore production and spore dispersal reflected in the payoffs (Eqs. 1 and 2; see Fig. 1A) results in a quadratic relationship between collective investment and group success (Fig. 1B). From this relationship, we can derive the level of collective investment () that maximizes group success (), which represents the most efficient (welfare optimal) allocation of cells to stalk and spores that is possible given the costs and benefits of stalk investment:

| [4] |

where the condition ensures that investment is nonnegative. Therefore, the optimal level of investment into stalk (in terms of group success) is determined by the relative importance of payoffs through spores versus through dispersal. Consequently, under any conditions where the benefits of dispersal outweigh the cost to spore production, the collective will have highest overall success at some intermediate level of investment into stalk. Because aggregations of D. discoideum invest into stalk while also producing spores, the pattern of payoffs in nature must result in such an intermediate optimum. The strength of selection on fruiting-body architecture () is given by the rate at which group success declines as the level of investment deviates from the group optimum:

| [5] |

The value of represents the curvature of the relationship between collective investment and group success (i.e., it is the quadratic coefficient for the parabolic relationship between collective investment and group success; see Fig. 1B).

While Eq. 4 represents the optimal investment into stalk for a group, individual players (strains) within a group should invest in a way that maximizes their expected individual fitness (Eq. 3). The optimal level of investment for a given player (a strain) is a function of their relatedness to (i.e., frequency in) their group:

| [6] |

Logically, the optimal level of individual investment corresponds to the value that maximizes group success (Eq. 4) when a strain is clonal (). At all other frequencies, the optimal level of investment will be lower than the value that maximizes group success (since 0 ≥ ≤ 1 and 0 > < 1). The level of investment given by Eq. 6 represent the ESS for a strain, but because the optimal level of investment by each strain depends on the level of investment by other strains, the actual level of investment will depend on the joint resolution of that interdependence. As a result of this interdependence, the constraints on the range of investment values (0 ≥ ≤ 1), and the constraints on the range of frequencies (0 ≥ ≤ 1), we use numerical solutions from Eq. 6 to illustrate the patterns of the ESS under different conditions (discussed below).

To understand the properties of the ESS consider the case where other strains make no investment, such that the ESS is simply (or zero when the term is negative). This level of investment represents the most economically “efficient” strategy for a strain. Under these conditions, when the optimal strategy is to make a nonzero stalk investment, the two terms in parentheses must be greater than zero, with the first term () representing the reciprocal of the cost of investing and the second term () the reciprocal of the benefit of investing. Thus, at the optimal payoff , which is a form of Hamilton’s rule (19, 65), the kin selection benefits () must outweigh the costs (). The third term in parentheses () reflects the dispersal benefit to the focal strain arising from investment into stalk made by other strains, with the numerator () representing the total investment made by others. The ESS deviates from the most efficient strategy because any investment made by other strains increases the value of the focal strain’s spores, and hence increases the cost of making their own investment. This term can be viewed from an economic perspective as an “opportunity cost,” where a strain has the opportunity to gain from the dispersal benefit provided by the investment made by others and loses that opportunity when those spores are killed to invest into stalk. The kin selection consequences of this opportunity cost can be seen by examining the conditions where the ESS level of investment is nonzero, which correspond to . Consequently, if we view these conditions as a form of Hamilton’s rule, we can see that the dispersal benefit to kin from investing has to overcome both the direct cost from making an investment and the additional cost arising from the missed opportunity to exploit investments made by others.

We can also view the cost of investment into stalk in terms of its effect on the representation of a strain in the sporehead of their group (), which defines their within-group fitness. Their representation is determined by their investment in stalk relative to the overall investment made by the group: . The within-group fitness can be calculated as a strain’s representation in the sporehead relative to its frequency in the group: , making the relative (within-group) fitness of a strain ():

| [7] |

Therefore, relative fitness within a group is a direct function of the relative investment made by strains. The pattern of relative fitness within a group is similar to the pattern of relative absolute fitness (), which is simply .

The Nature of the Game.

To understand the properties of the ESS we can characterize the payoffs to players in relation to the payoff structures of the Prisoner’s Dilemma and Snowdrift games (23). This analysis allows us to relate the game’s properties to the intuitive framework of existing well-understood models. However, to achieve this goal we need to first address the fact that the investment game differs from the canonical games in three key aspects. First, the investment game differs in that expected payoffs vary as a function of relatedness, so there is no single payoff matrix but rather a relatedness-dependent payoff function. Therefore, we need to evaluate the properties of the game across levels of relatedness, which allows us to understand how the properties of the game change as a player’s relatedness to the group changes. Second, when the opposing players differ in their relatedness to the group, they will also differ in their expected payoffs. Therefore, we need to consider a separate payoff matrix for each player at each level of relatedness. Finally, because investment into public goods can vary quantitatively, the game does not have discrete strategies that correspond to fixed alternative strategies like cooperate or defect. There are several logical alternative ways to consider cooperation versus defection and the type of game that a scenario corresponds to necessarily depends on the level of investment being made by a cooperator. The higher the investment made by a cooperator the higher the rewards for defection, which changes the optimal response (Eq. 6). Therefore, we use a simple framework where we consider defection as the case where individuals make no contribution to the public goods and cooperation as the case where individuals make some nonzero contribution (the size of which we vary in our analysis of the game).

The game scenario depends on payoffs to a player in terms of their expected fitness (, Eq. 3) under four scenarios (stating the focal player’s strategy first): cooperate against a cooperator (CiCj), cooperate against a defector (CiDj), defect against a cooperator (DiCj), or defect against a defector (DiDj). Because we are primarily interested in how payoffs lead to “motivation” for a player to invest or defect, we consider “weak” forms of the games rather than the overall structure of the payoff matrices. That is, we consider whether a player’s fitness is increased or decreased by making a contribution to public goods when their opponent either cooperates (makes a contribution) or defects (withholds their contribution). Payoffs are classified as being Prisoner’s Dilemma-like when a player is better off defecting regardless of the strategy of their opponent (DiCj > CiCj and DiDj > CiDj) and Snowdrift-like when they are better off defecting against a cooperator and cooperating against a defector (DiCj > CiCj and CiDj > DiDj). If a player is better off cooperating regardless of the strategy of their opponent (CiCj > DiCj and CiDj > DiDj) we consider their strategy as selfish investment, meaning they are favored to cooperate because it is in their own selfish interests regardless of what their opponent does.

Both players can “agree” on the game being played or, because of the asymmetry in payoffs, they can disagree. When both agree that the game is Prisoner’s Dilemma or Snowdrift we classify the scenario as the agreed game. Disagreement over the game being played generally arises when one player views the scenario as favoring selfish investment, while the other sees the scenario as a Prisoner’s Dilemma. This scenario is analogous to the ESS for an asymmetrical Snowdrift game, with one player getting a payoff for cooperating with a defector and the other getting the payoff for defecting against a cooperator. In this case, the asymmetry in relatedness determines which player will take the role as cooperator and which as defector (with the higher-relatedness player being the cooperator). Hence, we describe this scenario as being like an asymmetrical Snowdrift game.

Imperfect Information.

The derivation of the Collective Investment game implicitly assumes that players (strains) have perfect information about their relatedness to the group and can therefore adjust their investment accordingly. In the context of D. discoideum, “information” is the output of any mechanism that provides feedback to cells that reflects their frequency in a group, and hence can potentially arise from many molecular mechanisms. Of course, if the players have no information about their relatedness we would not expect to see any relatedness-dependent changes in stalk investment, so any frequency-dependent change in behavior must correspond to some information (regardless of whether it is actively or passively acquired). Presumably any molecular mechanism or responses to information should have some degree of noise, resulting in random error in the measurement of relatedness. In the D. discoideum system, random noise could simply represent the variation from cell to cell in their measurement of their frequency, so the entire group of cells from a strain measures their frequency with some noise. The mean of their measurement could be accurate, but the individual cells would respond as if they were at a different frequency, making the response deviate from the perfect information case.

We modeled error using a Gaussian probability density function (PDF), where the mean of the PDF represents the true frequency (relatedness) of the strain and the SD the level of noisiness (SI Appendix, Fig. S2). We assume that measurement error depends on the complexity of group composition, so the magnitude of the error (i.e., the SD of the PDF) was weighted by (which has a maximum value of 1 when and declines to zero as either strain nears a frequency of 1). Logically, this implies that strains are much more able to measure their frequency (relatedness) when they are at extreme frequencies than when they are at intermediate frequencies in a group. For example, a strain would be better able to distinguish between a true frequency of 0.01 and 0.21 than it would be able to distinguish between 0.4 and 0.6. Analyses were integrated over all possible frequencies (from 0 to 1), with the probability that a strain behaves as if it has a particular frequency being given by the PDF weighted by the group complexity term. Because each player assesses their own frequency, analyses at a given frequency require integration over all possible pairwise frequencies.

Model Predictions.

To generate predictions for collective investment in D. discoideum, we varied the relative cost to spore production () and benefit from dispersal () from stalk investment to alter the strength of selection on fruiting-body architecture (Eq. 5). For most illustrations in the main text we restricted the parameters to values that result in an optimal level of clonal investment of 30% of cells to the stalk, which corresponds to the approximate pattern observed in naturally derived strains (54, 55). However, in Fig. 2 D–F we hold the strength of selection constant (at ) and vary the optimal level of clonal investment to illustrate the impact of different optima. We illustrate a much wider range of parameter space in SI Appendix, Fig. S1, varying both the strength of selection and the clonal investment optimum systematically across panels. Within the range of values that keep fitness nonnegative, the strength of selection on allocation of cells and the clonal investment optimum (which are both determined by the values of and ; see Eqs. 4 and 5) do not change the qualitative predictions of the model.

At each frequency (relatedness) we solved the ESS level of investment (Eq. 6) for the two players. Exact solutions were generated using the Solve function in Mathematica 10.0 (Wolfram Research, Inc.). Given the ESS level of investment, we calculated absolute and relative (within-group) fitness of each player and the level of collective investment. We also analyzed the game scenarios under each scenario to link these patterns to the logic of the Prisoner’s Dilemma and Snowdrift games. To link the model results to the experimental data we also calculated individual and collective investment following the methods used in the experimental work (where all measures are based on spore counts and representation in chimeric sporeheads, discussed below).

Measurement of Spore Allocation.

We followed well-established D. discoideum protocols (29, 48, 54), which are therefore only briefly outlined here. We used a set of 10 naturally cooccurring strains of D. discoideum from Little Butt’s Gap, NC (NC28.1, NC34.2, NC52.3, NC60.1, NC63.2, NC69.1, NC71.1, NC80.1, NC99.1, and NC105.1) that have previously been used in several studies of social interactions (29, 57, 66). All strains were grown on SM plates with Klebsiella aerogenes as a food source. Before aggregation, cells were harvested and washed of bacteria by repeated centrifugation in KK2 (16.1 mM KH2PO4 and 3.7 mM K2HPO4). To construct experimental chimeras we reciprocally mixed cells from a strain that was fluorescently labeled with 10 mM CellTracker Green CMFDA (5-chloromethylfluorescein diacetate) dye with an unlabeled partner treated with DMSO to control for any effect of labeling. Clonal sets of labeled and unlabeled cells were also created to provide a measure of any counting bias. Cell mixes were plated for development on 1.5% KK2 purified agar plates (surface area ∼21.3 cm2), at a density of 4.7 × 105 cells per cm2. Relative proportional representation of the focal strain in the sporehead was primarily determined by counting the percentage of fluorescent spores using flow cytometry. However, for some sets of replicates from two pairs (NC28.1+NC63.2 and NC34.2+NC105.1) measurements were done by microscopy (with spores washed into 5 mL spore buffer and imaged using a fluorescence imaging system). Despite the fact that two different methodologies were used to measure relative spore number, the patterns of relative representation in the sporehead were indistinguishable. Because of technical limitations associated with the labeling process, an average of 0.3% (SD = 0. 09%) of unlabeled spores are counted as being labeled and an average of 1.4% (SD = 0. 9%) of labeled spores are counted as being unlabeled (based on data from clonal populations of labeled and unlabeled). Therefore, to correct for any potential counting bias, the raw proportion of labeled () cells of strain i in a chimeric mix with an unlabeled strain j was corrected using the proportion of labeled cells measured from clonal sets of labeled () and unlabeled cells () (created using the same pools of cells as in the chimeric mixtures): . To count the total number of spores produced by a set of fruiting bodies from a given number of cells plated (107 cells per plate), we harvested the entire agar discs from the plates into 5 mL of spore buffer (20 mM EDTA and 0.05% Nonidet P-40) and counted spores using a hemocytometer.

The 10 strains were used to construct 34 different types of chimeric mixtures, with each strain used in at least four different pairings. Within each pairing, chimeras were created in which strains were mixed in seven different input frequency combinations (0.05, 0.10, 0.25, 0.50, 0.75, 0.90, and 0.95). For each pair of strains, the set of chimeric mixtures across different input frequencies were independently replicated at least twice (with an average of four replicates per pair) for a total of 944 chimeric mixtures composed from the 34 pairs across the various input frequencies. Two of these strain pairings (NC28.1+NC63.2 and NC34.2+NC105.1) were replicated a larger number of times (n = 18 and n = 15 replicates, respectively) to provide higher-resolution examples. Each experimental replicate therefore provides measurements of the relative representation of each strain in the sporehead and the total number of spores produced by the pair across different input frequencies. Every experimental replicate for a given pair also produced an estimate of the clonal spore production for both strains in the pair.

Estimation of Investment and Relative Fitness.

To provide for direct comparison between the model and the experimental data we calculated each parameter from the model following the same methods used to process the data. Four types of measurements were used to generate an estimate of stalk investment of a strain within a chimera (): the total number of spores produced by chimeric fruiting bodies composed from strains i and j (), the total number of spores produced by a strain when in clonal fruiting bodies (), the input proportion of a strain within a chimeric mix (), and the output proportion of a strain within chimeric sporeheads (). From these values we calculated the number of spores from a given strain within the chimeric sporeheads as . This measure of spore production was normalized against the clonal spore production of the strain to account for any inherent differences in numbers of spores produced by different strains [which reflect differences in spore size and fixed differences in allocation of cells to spores (29, 66)] to produce a measure of relative spore production: . The inverse of the relative allocation of cells to spores provides a measure of relative investment into stalk:

| [8] |

Therefore, an investment value () of 1 indicates that a strain allocates the same proportion of cells to spores when in a chimera as when clonal. Since we expect the allocation pattern of clones to correspond to the optimal pattern, a value of 1 indicates that cells in both clones and chimeras are allocating a proportion of their cells into stalk and into spores. In the case where strains allocate 100% of their cells to spores, the estimate of relative investment () is expected to simply be the ratio of the clonal level of allocation of cells to spores () to 1 (where 1 is the proportion allocated in a chimera). Thus, an investment value corresponding to is equivalent to a pattern of zero investment of cells into stalk. Therefore, when we present the patterns of investment we rescale the estimates that are based on relative spore production to a scale that reflects relative investment in stalk by simply subtracting a value of . As a result, when strains invest at the clonal level we get the expected investment value of , and when they allocate all cells to spores (i.e., show zero investment) we get a value of 0. When applying this method to the analysis of data from the natural strains we use an optimal investment value of 30% of cells into the stalk, which is supported by a variety of empirical measurements (54, 55). The investment for both strains within each chimeric combination within each experimental replicate were calculated separately.

To calculate relative collective investment for a group () we first calculated the number of spores we would expect in a chimera given the clonal spore production for the pair and their relative frequencies in the chimera: . Collective investment was calculated following Eq. 4 by dividing this clonal expectation by the observed number of spores produced by a chimera:

| [9] |

Collective investment for each chimeric combination was calculated for each experimental replicate using the measures of the component parameters for that replicate. As with the measure of individual investment (Eq. 8), the pattern of collective investment reflects the relative allocation of cells to spores by strains in a chimera compared with the pattern they shown when clonal (but measured for the entire group, rather than for the individual strains separately). Hence, the values of collective investment calculated using Eq. 9 have the same scaling as the measure for individual investment (Eq. 8). Therefore, we also subtracted a value of from all collective investment values, such that optimal investment (i.e., the clonal pattern) corresponds to the expected value of and the scenario where the collective produces only spores corresponds to a collective investment value of zero.

Relative fitness within a group follows the definition in the model and simply reflects the representation of a strain in the sporehead relative to its input frequency:

| [10] |

For simplicity, we compare the fitness of strains using the ratio of their relative fitness values (e.g., for strain i relative to j). Values of relative fitness were calculated for each individual replicate. To test for any potential bias caused by the experimental labeling and methods used to calculate relative fitness, we applied the calculation of relative fitness in Eq. 10 to clonal self-mixes of labeled and unlabeled cells across the same set of frequencies. We find no significant frequency-dependent pattern of relative fitness in these self-mixes (F1, 195 = 1.65, P = 0.2; see SI Appendix, Fig. S8).

Patterns of collective investment, individual investment, and relative fitness across frequencies were modeled using a mixed model implemented in SAS (SAS Institute) fitted by maximum likelihood. For collective investment, frequency was modeled as a quadratic fixed effect with experimental replicate as a random effect. For individual investment and relative fitness, frequency was modeled as a cubic fixed effect. For relative fitness, strain by block was included as a random grouping variable, while for investment strain was included as a grouping variable (owing to a lack of convergence for a model containing a block or replicate effect). Reduced versions of all models were also run without any fixed effects (i.e., with only the random effects). Significance was determined by calculating twice the difference in the negative log likelihoods of the two models (full model and reduced), which is approximately χ2 distributed with degrees of freedom determined by the difference in the number of parameters in the models.

Measurement and Analysis of the Cost of Chimerism.

To measure the risk of fruiting-body collapse we collected two sources of data. First, we created 50:50 chimeric and clonal mixes of 10 strain pairs (NC28.1, NC34.2, NC52.3, NC60.1, NC63.2, NC69.1, NC71.1, NC80.1, NC99.1, and NC105.1), with an average of 10.4 replicates per chimeric combination (total n = 469) and 13 replicates per clone (total n = 130) (which together represent data from 31,026 fruiting bodies). Differences between clonal and chimeric mixes were analyzed using a mixed model with aggregation type (clonal or chimeric) as a fixed effect and pair as a random effect. Model degrees of freedom were determined using the Kenward–Roger approximation, which corrects the denominator degrees of freedom for the fixed effect based on the structure of the random effect to avoid pseudoreplication. Second, we created chimeric mixes across a range of focal strain frequencies (0.05, 0.10, 0.25, 0.5, 0.75, 0.90, and 0.95) for six strain pairs (NC28.1+NC105.1, NC99.1+NC105.1, NC99.1+NC60.1, NC34.2.1+NC105.1, NC63.2.1+NC60.1, and NC34.2+NC60.1). Mixes were plated as a 10-μL droplet onto nonnutrient KK2 agar in a 24-well dish and allowed to develop into fruiting bodies. The number of fruiting bodies that had spontaneously collapsed was scored as a proportion of the total number of fruiting bodies in the well. Data were modeled using a mixed model implemented in SAS (SAS Institute) fitted by maximum likelihood with frequency modeled as a fixed quadratic effect and pair as a random grouping variable. Significance was determined by calculating twice the difference in the negative log likelihoods of the two models (discussed above).

Measurement and Analysis of Segregation.

To measure the degree of segregation between pairs of strains across different asymmetry in relatedness, we followed established protocols for measuring segregation for pairs at equal frequency and applied these methods to measurements across a range of pairwise frequencies (58, 67). Briefly, cells were labeled with CellTracker Green CMFDA (with DMSO used as a control for unlabeled cells) and strains were reciprocally mixed at a range of relative frequencies of the labeled strain (0.05, 0.10, 0.25, 0.5, 0.75, 0.90, and 0.95). Mixes were plated as a 10-μL droplet on ∼1.25 g of sharp horticultural sand (Keith Singleton) wetted with 250 μL of KK2 in a 24-well dish and allowed to develop to form fruiting bodies. Individual fruiting bodies were then harvested into spore buffer (KK2 with 20 mM EDTA and 0.05% Nonidet P-40), and the proportion of fluorescent to nonflourescent spores in each fruiting body measured by flow cytometery. We measured patterns of segregation using three different pairs of strains (NC28.1+NC63.2, NC105.1+NC34.2, and NC105.1+NC99.1), with at least 10 sporeheads measured for each pair at each frequency (for a total of 692 sporeheads overall).

A metric of the degree of segregation was calculated following ref. 57. Briefly, this measure is based on the SD of a strain’s proportional representation across sporeheads [] at a given input frequency. If there is no segregation, then we would expect all variation in the representation of a strain across fruiting bodies (composed from the same proportions of strains) to be due to random binomial sampling error, and hence should be very small given the number of spores counted. However, when there is segregation, we expect to see much more variation in the representation of a strain across fruiting bodies as strains preferentially aggregate with themselves. Because the maximum value of this SD depends on the relative frequencies of the strains, it is standardized to the maximum possible value, which is determined by the geometric mean of the average representation of the two strains across all sporeheads (), which is . This yields a standardized measure of segregation:

| [11] |

which goes from 0 (no segregation) to 1 (the maximum possible degree of segregation, which would necessarily correspond to all fruiting bodies being clonal, with the relative frequency of each type of clonal fruiting body depending on the relative frequencies of the strains). In the statistical analysis, segregation data were modeled using a quadratic model following the approach outlined above for fruiting-body collapse.

Supplementary Material

Acknowledgments

We thank Matthew Cobb and Christopher Knight for comments on earlier versions of this manuscript and two anonymous referees for comments that greatly improved the presentation of our work. This work was supported by Biotechnology and Biological Sciences Research Council (BBSRC) Grants BB/M01035X/1 and BB/M007146/1 (to J.B.W. and C.R.L.T.), Wellcome Trust Investigator Award WT095643AIA (to C.R.L.T.), a BBSRC studentship (P.G.M.), a Natural Environment Research Council studentship (L.J.B.), and the University of Bath Alumni Fund.

Footnotes

The authors declare no conflict of interest.

This article is a PNAS Direct Submission. K.R.F. is a guest editor invited by the Editorial Board.

This article contains supporting information online at www.pnas.org/lookup/suppl/doi:10.1073/pnas.1716087115/-/DCSupplemental.

References

- 1.West SA, Griffin AS, Gardner A. Evolutionary explanations for cooperation. Curr Biol. 2007;17:R661–R672. doi: 10.1016/j.cub.2007.06.004. [DOI] [PubMed] [Google Scholar]

- 2.Bourke AFG. Principles of Social Evolution. Oxford Univ Press; Oxford: 2011. [Google Scholar]

- 3.Hamilton WD. The genetical evolution of social behaviour. II. J Theor Biol. 1964;7:17–52. doi: 10.1016/0022-5193(64)90039-6. [DOI] [PubMed] [Google Scholar]

- 4.Frank SA. A general model of the public goods dilemma. J Evol Biol. 2010;23:1245–1250. doi: 10.1111/j.1420-9101.2010.01986.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Hardin G. The tragedy of the commons. Science. 1968;162:1243–1248. [PubMed] [Google Scholar]

- 6.Rankin DJ, Bargum K, Kokko H. The tragedy of the commons in evolutionary biology. Trends Ecol Evol. 2007;22:643–651. doi: 10.1016/j.tree.2007.07.009. [DOI] [PubMed] [Google Scholar]

- 7.Olson M. The Logic of Collective Action. Harvard Univ Press; Cambridge, MA: 1965. [Google Scholar]

- 8.Hamilton WD. The evolution of altruistic behavior. Am Nat. 1963;97:354–356. [Google Scholar]

- 9.Clutton-Brock TH, Parker GA. Punishment in animal societies. Nature. 1995;373:209–216. doi: 10.1038/373209a0. [DOI] [PubMed] [Google Scholar]

- 10.Frank SA. Perspective: Repression of competition and the evolution of cooperation. Evolution. 2003;57:693–705. doi: 10.1111/j.0014-3820.2003.tb00283.x. [DOI] [PubMed] [Google Scholar]

- 11.Travisano M, Velicer GJ. Strategies of microbial cheater control. Trends Microbiol. 2004;12:72–78. doi: 10.1016/j.tim.2003.12.009. [DOI] [PubMed] [Google Scholar]

- 12.Doebeli M, Hauert C, Killingback T. The evolutionary origin of cooperators and defectors. Science. 2004;306:859–862. doi: 10.1126/science.1101456. [DOI] [PubMed] [Google Scholar]

- 13.Ostrom E. Governing the Commons: The Evolution of Institutions for Collective Action. Cambridge Univ Press; Cambridge, UK: 1990. [Google Scholar]

- 14.Williams GC. Adaptation and Natural Selection: A Critique of Some Evolutionary Thought. Princeton Univ Press; Princeton: 1966. [Google Scholar]

- 15.Cosmides LM, Tooby J. Cytoplasmic inheritance and intragenomic conflict. J Theor Biol. 1981;89:83–129. doi: 10.1016/0022-5193(81)90181-8. [DOI] [PubMed] [Google Scholar]

- 16.Taylor PD, Wild G, Gardner A. Direct fitness or inclusive fitness: How shall we model kin selection? J Evol Biol. 2007;20:301–309. doi: 10.1111/j.1420-9101.2006.01196.x. [DOI] [PubMed] [Google Scholar]

- 17.Grafen A. Optimization of inclusive fitness. J Theor Biol. 2006;238:541–563. doi: 10.1016/j.jtbi.2005.06.009. [DOI] [PubMed] [Google Scholar]

- 18.West SA, Gardner A. Adaptation and inclusive fitness. Curr Biol. 2013;23:R577–R584. doi: 10.1016/j.cub.2013.05.031. [DOI] [PubMed] [Google Scholar]

- 19.Hamilton WD. The genetical evolution of social behaviour. I. J Theor Biol. 1964;7:1–16. doi: 10.1016/0022-5193(64)90038-4. [DOI] [PubMed] [Google Scholar]

- 20.Taylor PD, Frank SA. How to make a kin selection model. J Theor Biol. 1996;180:27–37. doi: 10.1006/jtbi.1996.0075. [DOI] [PubMed] [Google Scholar]

- 21.Pepper JW. Relatedness in trait group models of social evolution. J Theor Biol. 2000;206:355–368. doi: 10.1006/jtbi.2000.2132. [DOI] [PubMed] [Google Scholar]

- 22.Axelrod R, Hamilton WD. The evolution of cooperation. Science. 1981;211:1390–1396. doi: 10.1126/science.7466396. [DOI] [PubMed] [Google Scholar]

- 23.Doebeli M, Hauert C. Models of cooperation based on the Prisoner’s dilemma and the Snowdrift game. Ecol Lett. 2005;8:748–766. [Google Scholar]

- 24.Dugatkin LA, Reeve HK. Game Theory and Animal Behavior. Oxford Univ Press; Oxford: 1998. [Google Scholar]

- 25.Turner PE, Chao L. Prisoner’s dilemma in an RNA virus. Nature. 1999;398:441–443. doi: 10.1038/18913. [DOI] [PubMed] [Google Scholar]

- 26.Bshary R, Grutter AS, Willener AST, Leimar O. Pairs of cooperating cleaner fish provide better service quality than singletons. Nature. 2008;455:964–966. doi: 10.1038/nature07184. [DOI] [PubMed] [Google Scholar]

- 27.Gore J, Youk H, van Oudenaarden A. Snowdrift game dynamics and facultative cheating in yeast. Nature. 2009;459:253–256. doi: 10.1038/nature07921. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.Sinervo B, Lively CM. The rock-paper-scissors game and the evolution of alternative male strategies. Nature. 1996;380:240–243. [Google Scholar]

- 29.Buttery NJ, Rozen DE, Wolf JB, Thompson CRL. Quantification of social behavior in D. discoideum reveals complex fixed and facultative strategies. Curr Biol. 2009;19:1373–1377. doi: 10.1016/j.cub.2009.06.058. [DOI] [PubMed] [Google Scholar]

- 30.Parkinson K, Buttery NJ, Wolf JB, Thompson CRL. A simple mechanism for complex social behavior. PLoS Biol. 2011;9:e1001039. doi: 10.1371/journal.pbio.1001039. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.Xavier JB, Kim W, Foster KR. A molecular mechanism that stabilizes cooperative secretions in Pseudomonas aeruginosa. Mol Microbiol. 2011;79:166–179. doi: 10.1111/j.1365-2958.2010.07436.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32.Bruce JB, Cooper GA, Chabas H, West SA, Griffin AS. Cheating and resistance to cheating in natural populations of the bacterium Pseudomonas fluorescens. Evolution. 2017;71:2484–2495. doi: 10.1111/evo.13328. [DOI] [PubMed] [Google Scholar]

- 33.Pollak S, et al. Facultative cheating supports the coexistence of diverse quorum-sensing alleles. Proc Natl Acad Sci USA. 2016;113:2152–2157. doi: 10.1073/pnas.1520615113. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Manhes P, Velicer GJ. Experimental evolution of selfish policing in social bacteria. Proc Natl Acad Sci USA. 2011;108:8357–8362. doi: 10.1073/pnas.1014695108. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Diggle SP, Griffin AS, Campbell GS, West SA. Cooperation and conflict in quorum-sensing bacterial populations. Nature. 2007;450:411–414. doi: 10.1038/nature06279. [DOI] [PubMed] [Google Scholar]