Abstract

Introduction:

We described the population of daily smokers purchasing cigarettes on Indian reservations (IRs), estimated the rates of cigarette purchasing on IRs for diverse populations of daily smokers in the U.S., and assessed the trends in the period from 2010–11 to 2014–15.

Methods:

We used the 2010–11 and 2014–15 Tobacco Use Supplement to the Current Population Survey data for adult daily smokers as well as additional information, e.g., state excise tax on tobacco (n = 33,871).

Results:

Daily smokers who purchased cigarettes on IRs were primarily 45+ years old, non-Hispanic (NH) White, resided in a state with an IR, paid less than $4.50 per pack, and purchased cigarettes in the state of their residency. The majority of purchases on IRs were made in New York (28%), Oklahoma (14%), Washington (10%), Arizona (9%), and Florida (6%). The rate of purchasing cigarettes on IRs decreased from 4% in 2010–11 to 3% in 2014–15 (p =0.012). The rates were higher for females than males (OR = 1.23, CI = 1.09:1.40) and heavy than non-heavy smokers (OR = 1.35, CI =1.17:1.55). Higher state excise tax on tobacco, on average, was associated with purchasing cigarettes on IRs.

Conclusions:

The rate of purchasing cigarettes on IRs is relatively low and has decreased in recent years. However, the rates differ across sociodemographic factors of daily smokers, including the state of residency and purchase. Purchasing cigarettes on IRs at lower prices can affect smokers’ intentions to quit and can reduce federal and state efforts toward a tobacco-free nation.

Keywords: Complex sampling, National survey, Racial/ethnic health disparities, Smoking behaviors

1. Introduction

Historically, commercial tobacco has been a source of income for American Indian/Alaska Native (AIAN) tribes (Kwok, 2014). Because AIAN tribes have semi-sovereignty and are outside the jurisdiction of the states in which they are located, the states cannot regulate tobacco sales on tribal lands (DeCicca et al., 2015). However, the states do have the authority to collect taxes on tribal tobacco sales to non-tribal members (DeLong et al., 2016; DeCicca et al., 2015). To resolve tax issues, some states and AIAN tribes have negotiated inter-governmental agreements, so-called “tribal compacts”, outlining tax collection mechanisms such as revenue allocation formulas (DeLong et al., 2016). Nonetheless, because states have taken different approaches toward taxing tribal tobacco sales, and AIAN tribes have negotiated different terms, there is considerable heterogeneity across the states, e.g., some states do not collect any taxes, while some states collect the state excise tax on tobacco (DeCicca et al., 2015). Specifically, among 34 states with federally recognized AIAN areas in 2015, only 20 states had tribal compacts or codified laws addressing the issue of tax enforcement of tobacco sales on tribal lands (DeLong et al., 2016).

Increases in cigarette prices and taxes on tobacco are among the most effective means of reducing tobacco use (Chaloupka et al., 2011; Hill et al., 2014). On the other hand, tobacco sales have been a source of income for AIAN tribes. Thus, increased cigarette prices and decreased tobacco sales lead to lost revenue and increased financial burden for AIAN tribes (Kwok, 2014). For this reason, AIAN tribes, and primarily Indian reservations (IRs), often sell lower-priced cigarettes to non-tribal members (DeCicca et al., 2015; National Research Council, 2015; Stehr, 2005; Wang et al., 2017). Specifically, the majority of reported cigarette purchases made on IRs were made by non-Hispanic (NH) White smokers (Golden et al., 2016; Wang et al., 2017) rather than NH AIAN smokers.

Availability of cheaper cigarettes in IRs for tribal members does not fully eliminate disparities in cigarette purchasing prices for NH AIAN and other racial/ethnic groups. While NH AIAN and NH White smokers purchase cigarettes, on average, at a lower price relative to other smokers, NH AIAN smokers pay about 38 cents more per pack than NH White smokers (Golden et al., 2016). Moreover, only about 30% of NH AIAN smokers who last purchased their cigarettes made these purchases on IRs (Golden et al., 2016). This low rate indicates that the majority of NH AIAN smokers do not take advantage of low-priced cigarettes sold in IRs and buy cigarettes elsewhere (Golden et al., 2016).

Previous studies estimated that purchasing cigarettes on IRs is associated with average price savings of $1.54 per pack when compared to purchasing cigarettes off IRs (Golden et al., 2016). In addition, among non-AIAN smokers, the 2010–11 prevalence of purchasing cigarettes in IRs was estimated at 4% (Wang et al., 2017). However, the populations of smokers who take advantage of low-priced cigarettes sold in IRs have not been fully described in the literature. To fill this gap in current knowledge we (1) described the population of daily smokers purchasing cigarettes in IRs in terms of smokers’ sociodemographic characteristics and cigarette purchase attributes, (2) estimated the rate of cigarette purchasing in IRs among diverse populations of daily smokers in the U.S., as well as the rate trajectory in the period from 2010–11 to 2014–15, and (3) identified the key characteristics of daily smokers associated with purchasing cigarettes in IRs.

2. Methods

2.1. Data and measures

We used the 2010–11 and 2014–15 Tobacco Use Supplement to the Current Population Survey (TUS-CPS), a national survey of tobacco use in the U.S. (US Department of Commerce, Census Bureau, 2016). The overall cohort (n = 33,871) consisted of the 2010–11 (n =18,991) and 2014–15 (n =14,880) cohorts. The cohort consisted of adults (18+ years old) who self-identified as daily cigarette smokers at the time of the assessment, reported buying their own cigarettes, and provided information regarding their last cigarette purchase. The interviews were done either in-person (46.5%) or by phone (53.5%). Sociodemographic characteristics of daily smokers are depicted in Table 1.

Table 1.

Sociodemographic Characteristics of Daily Smokers in the U.S. in 2010–11 and 2014–15.

| Characteristics | Sample Count |

Percent (%) Based on Population Counts |

|---|---|---|

|

| ||

| Age | ||

| 18–24 | 2,490 | 12.0 |

| 25–44 | 12,990 | 38.4 |

| 45+ | 18,391 | 49.6 |

| Sex | ||

| Male | 16,651 | 53.5 |

| Female | 17,220 | 46.5 |

| Race/Ethnicity | ||

| Non-Hispanic (NH) White | 26,859 | 75.6 |

| NH Black/African American | 3,234 | 11.3 |

| NH American Indian/Alaska Native | 561 | 1.0 |

| NH Asian, NH Hawaiian/Pacific Islander | 686 | 2.3 |

| NH Multiracial | 625 | 1.8 |

| Hispanic | 1,906 | 7.9 |

| Marital Status | ||

| Married (spouse present or absent) | 13,720 | 38.9 |

| Widowed, divorced, or separated | 10,922 | 29.7 |

| Never married | 9,229 | 31.4 |

| Education | ||

| Less than High school | 5,635 | 17.5 |

| High school (or equivalent) | 14,130 | 41.3 |

| Some college or a Bachelor’s Degree | 13,312 | 39.0 |

| Graduate degree or equivalent | 794 | 2.2 |

| Employment Status | ||

| Employed (at work or absent) | 19,747 | 59.1 |

| Unemployed | 2,989 | 9.9 |

| Not in labor force | 11,135 | 31.0 |

| Region of Residency | ||

| Northeast | 5,745 | 16.3 |

| Midwest | 9,072 | 26.0 |

| South | 12,525 | 41.6 |

| West | 6,529 | 16.2 |

| Metropolitan Area of Residency | ||

| Metropolitan area | 24,310 | 79.2 |

| Non-metropolitan area | 9,561 | 20.8 |

| Total (Population Count is 22,873,620) | 33,871 | 100.0 |

In addition to the sociodemographic characteristics depicted in Table 1, the survey mode (phone, in-person), and the period (2010–11, 2014–15), we considered the following measures:

2.1.1. Heavy smoking status

Heavy smokers (40.8%) were defined as smoking 20 or more cigarettes per day (on average) and non-heavy smokers (59.2%) as smokers who smoke less than 20 cigarettes per day (on average).

2.1.2. Price per pack measure

Price was categorized as $0.00−$4.49 (29.7%), $4.50−$5.99 (39.7%), and $6.00−$20.99 (30.6%). Prices reported for the last purchased pack or carton were converted to the (average) price per pack; price per pack of $21 or higher was treated as an outlier and was not included in the definition.

2.1.3. Indicator of residing in a state with an IR

Residing in a state with an IR (77.0%) and residing in a state with no IR (23.0%) was defined using multiple external sources of federally and state recognized IRs and AIAN tribes (National Conference of State Legislatures, List of Federal and State Recognized Tribes, 2018). Arkansas, District of Columbia, Hawaii, Illinois, Kentucky, Missouri, New Hampshire, Ohio, Pennsylvania, Tennessee, and West Virginia were identified as states with no IRs; the other states were identified as states with an IR.

2.1.4. Indicator of purchasing cigarettes in the state of residency

Purchasing cigarettes in the state of residency (97.8%) and purchasing cigarettes in another state (2.2%) was also measured. The indicator was defined using responses to the survey item, “Did you buy your last pack (carton) of cigarettes in your state of residency or some other state?”

2.1.5. State excise tax on tobacco (in the state where the cigarettes were purchased)

State excise tax was recorded for each subject using his/her state of purchase in addition to information on state excise tax amount. 2010 tax amount was used for 2010–11 purchases, and 2014 tax amount was used for 2014–15 purchases (Centers for Disease Control and Prevention, 2018). In 2010, the average state excise tax was $1.36 (SE =$0.86), ranging from $0.07 in South Carolina to $3.46 in Rhode Island, and in 2014, the average state excise tax was $3.04 (SE =$1.04), ranging from $0.17 in Missouri to $4.35 in New York (Centers for Disease Control and Prevention, 2018) In our cohort, the average state excise tax on tobacco was $1.25 (SE =$0.01) for 2010–11 and $1.43 (SE = $0.01) for 2014–15 cigarette purchases.

2.1.6. Indicator of purchasing cigarettes on an IR (yes, no; primary measure)

If a respondent reported purchasing cigarettes in his/her state of residency or some other state (including DC), then he/she was asked, “Did you buy your last pack (carton) of cigarettes from an IR?” If the respondent indicated buying cigarettes some other way (e.g., on the internet), then he/she was asked to clarify how/where the purchase was made, including whether it was made in an IR.

2.2. Statistical analysis

All statistical analyses incorporated Balanced Repeated Replications for variance estimation (Wolter, 2007) and TUS-CPS survey weights as is described elsewhere (Ha and Soulakova, 2017, 2018). Thus, all percentages reported in this paper (including all rates reported in Section 2.1 except for the survey mode) are based on the population counts. Table 1 depicts the total population counts for analyses corresponding to the entire cohort of daily smokers. Table 2 depicts the total population count for analyses corresponding to daily smokers who (last) purchased cigarettes on IRs. Because there were only 15 NH Asian and NH Hawaiian/Pacific Islander respondents who indicated purchasing cigarettes in IRs, we considered these two racial/ethnic groups jointly in all analyses. The significance level was fixed at the 5% level for each test. If an association with a measure containing three or more levels was significant, we performed multiple comparisons using Bonferroni adjustments. Computing was performed using SAS/STAT 9.4 software (SAS Institute Inc, 2014).

Table 2.

Cigarette Purchases Made in IRs: Characteristics of Daily Smokers and Purchase Attributes.

| Characteristics | Sample Count |

Percent (%) Based on Population Counts |

|---|---|---|

|

| ||

| Age (p < 0.001) | ||

| 18–24 | 57 | 7.9 |

| 25–44 | 378 | 29.0 |

| 45+ | 932 | 63.1 |

| Sex (not significant) | ||

| Male | 632 | 49.2 |

| Female | 735 | 50.8 |

| Race/Ethnicity (p < 0.001) | ||

| Non-Hispanic (NH) White | 990 | 76.1 |

| NH Black/African American | 60 | 5.3 |

| NH American Indian/Alaska Native | 174 | 7.2 |

| NH Asian, NH Hawaiian/Pacific Islander | 15 | 1.3 |

| NH Multiracial | 39 | 2.5 |

| Hispanic | 89 | 7.5 |

| Marital Status (p < 0.001) | ||

| Married (spouse present or absent) | 588 | 42.6 |

| Widowed, divorced, or separated | 493 | 32.7 |

| Never married | 286 | 24.8 |

| Education (p < 0.001) | ||

| Less than High school | 253 | 18.0 |

| High school (or equivalent) | 547 | 41.2 |

| Some college or a Bachelor’s Degree | 538 | 39.0 |

| Graduate degree or equivalent | 29 | 1.8 |

| Employment Status (p < 0.001) | ||

| Employed (at work or absent) | 706 | 54.2 |

| Unemployed | 120 | 9.4 |

| Not in labor force | 541 | 36.4 |

| Region of Residency (p < 0.001) | ||

| Northeast | 241 | 27.7 |

| Midwest | 311 | 12.8 |

| South | 318 | 26.0 |

| West | 497 | 33.5 |

| Metropolitan Area of Residency (p < 0.001) | ||

| Metropolitan area | 824 | 70.5 |

| Non-metropolitan area | 543 | 29.5 |

| Total (Population Count is 850,961) | 1367 | 100.0 |

To describe the population of daily smokers purchasing cigarettes in IRs, we considered a cohort of 1367 (3.7%) daily smokers who reported making their last cigarette purchase in an IR. To test for the overall differences in the rates for diverse populations (e.g., daily smokers who are 18–24, 25–44 and 45+ years old), we used Rao-Scott chi-square tests (Rao and Scott, 1981). We also used these tests to assess the significance of associations between purchasing cigarettes in IRs and the other categorical measures, i.e., sociodemographic characteristics, heavy smoking, price per pack, residing in a state with an IR, purchasing cigarettes in the state of residency, survey mode (phone, inperson), and period (2010–11, 2014–15). We used t-tests for survey data for the additional analysis of state excise tax on tobacco (Lohr, 1999).

To test for associations while controlling for other factors, we fitted a survey multiple logistic regression model for the logit of probability of purchasing cigarettes in an IR. The initial model contained all sociodemographic characteristics depicted in Table 1: heavy smoking, price per pack, residing in a state with an IR, purchasing cigarettes in the state of residency, survey mode (phone, in-person), and period (2010–11, 2014–15). Because the price per pack and state excise tax on tobacco (when both are continuous) were highly positively correlated, the latter measure was not included in the initial model. Price per pack was not significant after controlling for the other factors and was not included in the final model; the other factors remained in the final model.

3. Results

3.1. Describing the population of daily smokers purchasing cigarettes in IRs

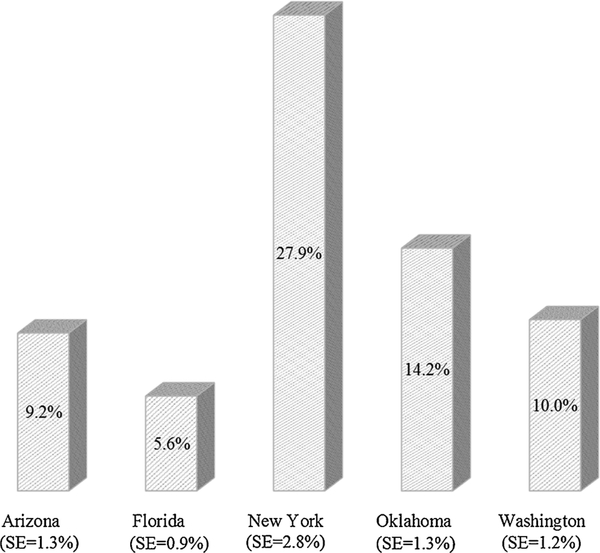

The sociodemographic characteristics of daily smokers who last purchased cigarettes on IRs are depicted in Table 2. The majority of daily smokers who purchased cigarettes on IRs were non-heavy smokers (53.8%, p= 0.012), resided in a state with an IR (99.1%, p < 0.001), and purchased cigarettes in the state of their residency (96.1%, p < 0.001); only 79 smokers purchased cigarettes in a state other than the state of their residency. Fig. 1, depicts the U.S. states that each accounted for the majority of purchases made in IRs; each state accounted for more than 5% of all purchases on IRs. Alabama, California, Idaho, Iowa, Kansas, Minnesota, Nevada, New Mexico, Texas, and Wisconsin each accounted for more than 1% but less than 5% of purchases in IRs. The other states accounted for less than 1% of purchases. In addition, the majority of daily smokers who purchased cigarettes on IRs paid a lower price per pack (p < 0.001): $0.00−$4.49 (60.1%), $4.50−$6.00 (25.8%), and $6.00−$20.99 (14.1%).

Fig. 1.

Percentage and Standard Error (SE) for the States Accounting for the Majority of Last Cigarette Purchases Made by Daily Smokers on IRs.

3.2. Rate of cigarette purchasing in IRs among diverse populations of daily smokers in the U.S. and rate trends in the period from 2010–11 to 2014–15

The overall rate of purchasing cigarettes on reservations was 3.7% (SE = 0.2%); the rate was 4.1% (SE =0.2%) in 2010–11 and 3.3% (SE = 0.2%) in 2014–15. The difference between the two rates was significant (two-tailed p= 0.012), indicating that the rate of purchasing cigarettes in IRs has decreased from 2010–11 to 2014–15.

Table 3 presents the rates of purchasing cigarettes in reservations for measures with three or more categories. In addition, the rate of purchasing cigarettes on IRs was significantly higher for women (4.1%) than men (3.4%, p =0.003), heavy (4.2%) than non-heavy daily smokers (3.4%, p < 0.001), daily smokers residing in a non-metropolitan area (5.3%) than those residing in a metropolitan area (3.3%, p < 0.001), daily smokers residing in a state with an IR (4.8%) than those residing in a state without IRs (0.1%, p < 0.001), and daily smokers who purchased cigarettes in a state other than their state of residency (6.6%) than those who purchased in their state of residency (3.7%, p < 0.001). The rates were similar for smokers who were interviewed by phone and those who were interviewed in-person.

Table 3.

Selected Characteristics Significantly Associated with Purchasing Cigarettes in Indian Reservations.

| Characteristics | Purchasing Cigarettes in IRs (%) |

p-Value Adjusted for Multiplicity |

|---|---|---|

|

| ||

| Age (p < 0.001) | ||

| 18–24 | 2.4 | 0.001 |

| 25–44 | 2.8 | < 0.001 |

| 45+ | 4.7 | reference |

| Race/Ethnicity (p < 0.001) | ||

| Non-Hispanic (NH) White | 3.7 | reference |

| NH Black/African American | 1.7 | < 0.001 |

| NH American Indian/Alaskan Native | 25.9 | < 0.001 |

| NH Asian, NH Hawaiian/Pacific Islander | 2.1 | not significant |

| NH Multiracial | 5.3 | not significant |

| Hispanic | 3.5 | not significant |

| Marital Status (p < 0.001) | ||

| Married (spouse present/ absent) | 4.1 | reference |

| Widowed, divorced, or separated | 4.1 | NS |

| Never Married | 2.9 | 0.001 |

| Employment Status (p =0.001) | ||

| Employed (at work or absent) | 3.4 | < 0.001 |

| Unemployed | 3.6 | not significant |

| Not in Labor Force | 4.4 | reference |

| Region of Residency (p < 0.001) | ||

| Northeast | 6.3 | not significant |

| Midwest | 1.8 | < 0.001 |

| South | 2.3 | < 0.001 |

| West | 7.7 | reference |

| Price per Pack (p < 0.001) | ||

| $0.00 − $4.49 | 7.5 | reference |

| $4.50 − $6.00 | 2.4 | < 0.001 |

| $6.00 − $20.99 | 1.7 | < 0.001 |

Additional analysis of state excise tax on tobacco indicated that in 2010–11 the average state excise tax was $1.71 (SE = $0.05) for purchases made on IRs and $1.23 (SE <$0.01) for purchases made off IRs; the mean difference was significant (t =9.6, df = 160, p < 0.001). Similarly, in 2014–15 the average state excise tax was $2.52 (SE= $0.11) for purchases made on IRs and $1.39 (SE =$0.01) for purchases made off IRs; the mean difference was significant (t =10.2, df =160, p < 0.001). Thus, purchasing cigarettes on IRs was consistently associated with a higher average state excise tax on tobacco.

3.3. Key characteristics of daily smokers associated with purchasing cigarettes in IRs

The model for the logit of the probability of purchasing cigarettes in an IR (likelihood ratio =1,028,196, df = 24, p < 0.001) indicated significance of age (p < 0.001), sex (p =0.001), race/ethnicity (p < 0.001), region of residency (p < 0.001), metropolitan area of residency (p < 0.001), heavy smoking (p < 0.001), residing in a state with an IR (p < 0.001), purchasing cigarettes in the state of residency (p < 0.001), and time period (p =0.021). Marital status, highest level of education, employment record, and the survey mode were not significant.

Table 4 presents results based on the model for all significant measures with three or more categories. For binary measures, the results were as follows. The odds of purchasing cigarettes on IRs were significantly higher for women than men (OR =1.23, CI = 1.09:1.40) and heavy smokers than non-heavy smokers (OR =1.35, CI = 1.17:1.55). The odds were lower for smokers residing in a metropolitan area than non-metropolitan area (OR =0.50, CI = 0.36:0.67), smokers residing in a state with no IRs than in a state with an IR (OR =0.03, CI = 0.01:0.06), and smokers who purchased cigarettes in the state of their residency than those who purchased cigarettes in another state (OR =0.63, CI = 0.41:0.97). The odds of purchasing on an IR were significantly higher in 2010–11 relative to 2014–15 (OR = 1.25, CI = 1.03:1.51).

Table 4.

Results of the Survey Multiple Logistic Regression Model.

| Measure | Adjusted p-Value |

Odds Ratio |

95% Simultaneous Confidence Interval |

|---|---|---|---|

|

| |||

| Age (p < 0.001) | |||

| 18–24 | 0.010 | 0.52 | 0.30:0.88 |

| 25–44 | < 0.001 | 0.60 | 0.49:0.73 |

| 45+ | Reference level | ||

| Race/Ethnicity (p < 0.001) | |||

| Non-Hispanic (NH) White | Reference level | ||

| NH Black/African American | < 0.001 | 0.56 | 0.38:0.83 |

| NH American Indian/Alaskan Native | < 0.001 | 7.67 | 4.75:12.40 |

| NH Asian and NH Hawaiian/Pacific Islander | 0.012 | 0.48 | 0.23:1.01 |

| NH Multiracial | Not significant | 1.47 | 0.85:2.53 |

| Hispanic | Not significant | 0.77 | 0.54:1.10 |

| Region of Residency (p < 0.001) | |||

| West | Reference level | ||

| Northeast | Not significant | 1.25 | 0.84:1.85 |

| Midwest | < 0.001 | 0.26 | 0.20:0.35 |

| South | < 0.001 | 0.32 | 0.25:0.41 |

4. Discussion

4.1. Key findings

The study indicated that the population of daily smokers who purchased cigarettes in IRs was primarily 45+ years old, NH White, employed, resided in a state with an IR, resided in a metropolitan area, and made the cigarette purchase in the state of their residency. New York, Oklahoma, Washington, Arizona, and Florida each accounted for the largest percentages of these purchases, and the state rate varied from 27.9% for New York to 5.6% for Florida. Ten other states (Alabama, California, Idaho, Iowa, Kansas, Minnesota, Nevada, New Mexico, Texas, and Wisconsin) each accounted for more than 1% but less than 5% of these purchases. The other states accounted for none (10 states and District of Columbia, including states with no IRs) and less than 1% (25 states) of these purchases. In addition, the majority of daily smokers who purchased cigarettes on IRs paid less than $4.50 per pack, which was considerably lower than $5.86− the average price per pack in the U.S. in 2010 (Bandi et al., 2013).

The study also estimated the rates of cigarette purchasing in IRs for diverse populations of daily smokers in the U.S. and evaluated whether the rate differences were significant. Results of analyses adjusting and non-adjusting for other factors were consistent. Specifically, the rates of purchasing cigarettes on IRs were significantly higher for daily smokers who were 45+ years old relative to those who were 18–44 years old, female than male, NH AIAN relative to NH White, NH White relative to NH Black/African American, residing in a non-metropolitan than those residing in a metropolitan area, residing in western than those residing in midwestern and southern regions, residing in a state with an IR than those residing in a state with no IRs, and who purchased cigarettes in a state other than the state of their residency than who purchased cigarettes in the state of their residency. Purchasing cigarettes on IRs was associated with higher average state excise tax on tobacco in both 2010–11 and 2014–15 periods. The overall rate of purchasing cigarettes in IRs has significantly decreased in the period from 2010–11 to 2014–15.

The results are consistent with prior research findings. The higher rate of purchasing cigarettes in IRs observed for 45+-year-old smokers could be explained, in part, using life-cycle theories of consumption and savings (Hubbard et al., 1994). Specifically, increased saving behavior due to the imminent loss of middle-age wages and end-of-life-cycle expenses in the elderly could trigger saving-related behaviors (Hubbard et al., 1994). The majority of daily smokers purchasing cigarettes in IRs are NH Whites, and among NH AIAN daily smokers less than 30% (in our study about 26%) purchased cigarettes in IRs. These findings are consistent with prior studies (Golden et al., 2016; Wang et al., 2017). The relatively low rate of purchasing cigarettes on IRs among NH AIAN daily smokers could be due to several reasons, e.g., the majority of the NH AIAN population (about 79%, including AIAN multi-racial groups) do not live in AIAN areas (Norris et al., 2012) and therefore choose to purchase cigarettes elsewhere.

4.2. Study implications

While among daily smokers the rate of purchasing cigarettes on IRs is relatively low and has decreased in recent years, these purchases accounted for a large number of last cigarette purchases. We estimate that there were about 12,470,993 last cigarette purchases made by daily smokers in the period from 2010 to 201, and about 509,012 of these purchases were made on IRs. Similarly, there were about 10,402,626 last cigarette purchases made by daily smokers in the period from 2014 to 2015, and about 341,949 of these purchases were made on IRs.

While tobacco sales result in financial gains for IRs, tobacco sales at reduced prices diminish tobacco use cessation efforts (Hodge et al., 2004; Samuel et al., 2012). For example, availability of cheaper cigarettes could affect smokers’ motivation to quit and thus promote smoking behaviors and delay smoking cessation. This is critical for heavy smokers, who are at higher risks for smoking-attributable diseases in comparison to non-heavy smokers. Given that relationships between state and tribal governments and policies regarding taxation from tobacco sales on IRs vary drastically by state (Bandi et al., 2013), it is important to aid and encourage the AIAN tribes to promote tobacco-free lifestyles on reservations with the ultimate goal of promoting personal health and well-being.

4.3. Study limitations and future research

This study used data for U.S. adult daily smokers, and thus the findings may not hold for the other populations, e.g., youth and occasional smokers. This study also considered a limited number of factors when assessing significant associations with cigarette purchasing in IRs. Other factors not considered in this study (e.g., purchasing other tobacco products) could have had important individual effects. An additional analysis exploring the cigarette purchasing behaviors among NH AIAN smokers living on and off IRs would be of interest. This investigation would help identify whether residing in IRs is associated with significantly lower cigarette purchasing prices among NH AIAN smokers and thus allow for the estimation of average cost savings.

The data utilized in the study did not contain specific information regarding taxes paid when making the cigarette purchases or whether the smokers had a tribal membership. Therefore, we cannot comment on whether tax-free or low-tax cigarettes have been sold in IRs to nontribal members; this topic was addressed elsewhere (Fix et al., 2014; National Research Council, 2015; Stehr, 2005; Wang et al., 2017; Xu et al., 2014). Also, the data did not have any information regarding the exact purpose of purchasing cigarettes on IRs (e.g., to self-smoke, to give as a present, to resell) or other factors that can aid identifying the purpose, e.g., the total amount of cigarettes purchased and frequency of purchasing cigarettes on IRs. Thus, we cannot comment on whether daily smokers purchased cigarettes for illegal resale (National Research Council, 2015). This is an important future research topic because the illicit tobacco market is not uniform across the states and is more prevalent in the states with high taxes, e.g., New York and Washington (National Research Council, 2015).

An additional limitation is that all data were self-reported, and the actual cigarette purchase attributes, as well as the other considered measures, could be subject to a response bias (Kreuter et al., 2008; Krosnick, 1991; Tourangeau et al., 2000). Prior reliability studies of the TUS-CPS demonstrated that the data are reliable (overall); however, inconsistent reporting may occur with respect to some measures (Bright and Soulakova, 2014; Soulakova et al., 2015a, b; Soulakova et al., 2012).

The study demonstrates that the rate of purchasing cigarettes on IRs by daily smokers has decreased from 4.1% in 2010–11 to 3.3% in 2014–15. Rates of purchasing cigarettes on IRs differ across daily smoker’s age, sex, race/ethnicity, region of residency, area of residency (metropolitan/non-metropolitan) and smoking habits. Among daily smokers, purchasing cigarettes on IRs is associated with lower cigarette purchase price and higher state excise tax on tobacco. Among purchases made by daily smokers on IRs in the period from 2010–11 to 2014–15, the majority of purchases were made by smokers who resided in a state with an IR and who purchased cigarettes in the state of their residency.

Acknowledgments

Role of funding source

Research reported in this publication was supported by the National Institute on Minority Health and Health Disparities of the National Institutes of Health under Award Number R01MD009718. The content is solely the responsibility of the authors and does not necessarily represent the official views of the National Institutes of Health (NIH). The NIH had no role in the study design, collection, analysis or interpretation of the data, writing the manuscript, or the decision to submit the paper for publication.

Footnotes

Conflict of interest

No conflict declared.

References

- Bandi P, Blecher E, Cokkinides V, Ross H, Jemal A, 2013. Cigarette affordability in the United States. Nicotine Tob. Res 15, 1484–1491. [DOI] [PubMed] [Google Scholar]

- Bright BC, Soulakova JN, 2014. Evidence of telescoping in regular smoking onset age. Nicotine Tob. Res 16, 717–724. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chaloupka FJ, Straif K, Leon ME, International Agency for Research on Cancer Working Group, 2011. Effectiveness of tax and price policies in tobacco control. Tob. Control 20, 235–238. [DOI] [PubMed] [Google Scholar]

- DeCicca P, Kenkel D, Liu F, 2015. Reservation prices: an economic analysis of cigarette purchases on Indian reservations. Natl. Tax J 68, 93–118. [Google Scholar]

- DeLong H, Chriqui J, Leider J, Chaloupka FJ, 2016. Common state mechanisms regulating tribal tobacco taxation and sales, the USA, 2015. Tob. Control 25, i32–37. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Fix BV, Hyland A, O’Connor RJ, Cummings KM, Fong GT, Chaloupka FJ, Licht AS, 2014. A novel approach to estimating the prevalence of untaxed cigarettes in the USA: findings from the 2009 and 2010. Int. Tobacco Control Surv. Tob. Control 23 (Suppl. 1), i61–66. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Golden SD, Kong AY, Ribisl KM, 2016. Racial and ethnic differences in what smokers report paying for their cigarettes. Nicotine Tob. Res 18, 1649–1655. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ha T, Soulakova JN, 2017. Statistical Analyses of Public Health Surveys Using SAS ® Survey Package. Retreived from. https://analytics.ncsu.edu/sesug/2017/ SESUG2017_Paper-189_Final_PDF.pdf.

- Ha T, Soulakova JN, 2018. Importance of adjusting for multi-stage design when analyzing data from complex surveys. In: Yichuan Zhao, Chen Ding-Geng (Eds.), International Chinese Statistical Association Book Series in Statistics: Frontier of Biostatistics and Bioinformatics. Springer in press. [Google Scholar]

- Hill S, Amos A, Clifford D, Platt S, 2014. Impact of tobacco control interventions on socioeconomic inequalities in smoking: review of the evidence. Tob. Control 23, e89–97. [DOI] [PubMed] [Google Scholar]

- Hodge FS, Geishirt Cantrell BA, Struthers R, Casken J, 2004. American Indian internet cigarette sales: another avenue for selling tobacco products. Am. J. Public Health 94, 260–261. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hubbard RG, Skinner J, Zeldes SP, 1994. The importance of precautionary motives in explaining individual and aggregate saving. Carnegie-Rochester Conference Series on Public Policy 40, 59–125. [Google Scholar]

- Kreuter F, Presser S, Tourangeau R, 2008. Social desirability bias in CATI, IVR, and web surveys: the effects of mode and question sensitivity. Public Opin. Q 72, 847–865. [Google Scholar]

- Krosnick JA, 1991. Response strategies for coping with the cognitive demands of attitude measures in surveys. Appl. Cogn. Psychol 5, 213–236. [Google Scholar]

- Kwok DY, 2014. Taxation without compensation as a challenge for tribal sovereignty. Miss. Law J Retrieved from. https://ssrn.com/abstract=2597650. [Google Scholar]

- Lohr SL, 1999. Sampling: Design and Analysis, 2nd ed. Duxbury Press, N. Scituate, MA. [Google Scholar]

- National Conference of State Legislatures, 2016. List of federal and state-recognized tribes. National Conference of State Legislatures Retreived from. http://www.ncsl. org/research/state-tribal-institute/list-of-federal-and-state-recognized-tribes.aspx.

- National Research Council, 2015. Understanding the U.S. Illicit Tobacco Market: Characteristics, Policy Context, and Lessons from International Experiences. The National Academies Press, Washington, DC. 10.17226/19016. [DOI] [Google Scholar]

- Norris T, Vines PL, Hoeffel EM, 2012. American Indian and Alaska Native Population: 2010. 2010 Census Briefs. Retreived from. U.S. Census Bureau, Suitland, MD. https://www.census.gov/history/pdf/c2010br-10.pdf. [Google Scholar]

- Rao JNK, Scott AJ, 1981. The analysis of categorical data from complex sample surveys: chi-squared tests for goodness of fit and independence in two-way tables. J. Am. Stat. Assoc 76, 221. [Google Scholar]

- Samuel KA, Ribisl KM, Williams RS, 2012. Internet cigarette sales and native American sovereignty: political and public health contexts. J. Public Health Policy 33, 173–187. [DOI] [PubMed] [Google Scholar]

- Soulakova JN, Hartman AM, Benmei L, Willis GB, Augustine S, 2012. Reliability of adult self-reported smoking history: data from the tobacco use supplement to the current population survey 2002–2003 cohort. Nicotine Tob. Res 14, 952–960. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Soulakova JN, Bright BC, Crockett LJ, 2015a. Perception of time since smoking cessation: time in memory can elapse faster. J. Addict. Behav. Ther. Rehabil 4. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Soulakova JN, Huang H, Crockett LJ, 2015b. Racial/ethnic disparities in consistent reporting of smoking-related behaviors. J. Addict. Behav. Ther. Rehabil 4. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Stehr M, 2005. Cigarette tax avoidance and evasion. J. Health Econ 24, 277–297. [DOI] [PubMed] [Google Scholar]

- Tourangeau R, Rips LJ, Rasinski K, 2000. The Psychology of Survey Response. Cambridge University Press, Cambridge. [Google Scholar]

- US Department of Commerce, Census Bureau, 2016. National Cancer Institute and Food and Drug Administration Co-Sponsored Tobacco Use Supplement to the Current Population Survey. pp. 2014–2015. https://cancercontrol.cancer.gov/brp/tcrb/tuscps/.

- Wang X, Xu X, Tynam MA, Gerzoff RB, Caraballo RS, Promoff GR, 2017. Tax avoidance and evasion: cigarette purchases from Indian reservations among US adult smokers, 2010–2011. Public Health Rep. 132, 304–308. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Wolter KM, 2007. Introduction. Introduction to Variance Estimation. Statistics for Social and Behavioral Sciences. Springer, New York, NY, pp. 1–20. [Google Scholar]

- Xu X, Malarcher A, O’Halloran A, Kruger J, 2014. Does every US smoker bear the same cigarette tax? Addiction 109, 1741–1749. [DOI] [PMC free article] [PubMed] [Google Scholar]