Abstract

The Earned Income Tax Credit (EITC) is the largest US poverty-alleviation program, yet few studies examine its effects on the health of recipients’ children. We employed quasiexperimental techniques to test the hypothesis that EITC refund receipt is associated with short-term improvements in child health. The data set included children in families surveyed in the Third National Health and Nutrition Examination Survey (n = 7,444). We employed a difference-in-differences approach, exploiting the seasonal nature of EITC refund receipt. We compared children of EITC-eligible families interviewed immediately after refund receipt (February to April) with those interviewed during other months (May to January), differencing out seasonal variation among non-EITC-eligible families. We examined outcomes that were likely to be affected immediately after refund receipt, including general health, nutrition, metabolic and inflammatory biomarkers, and test scores. There were improvements in physician-reported overall health after refund receipt but no changes in infection, serum metabolic or inflammatory markers, or test scores, and there were contradictory findings for food insufficiency. In summary, EITC refunds are not strongly associated with most short-term health outcomes among recipients’ children, although numerous previous studies have demonstrated impacts on longer-term outcomes. This highlights the importance of examining the effects of public policies on beneficiaries and their children using varying study designs.

Keywords: child health, difference-in-differences, Earned Income Tax Credit, poverty alleviation

Poverty during childhood has been associated with poorer health in adulthood (1). Proposed mechanisms include lower income, which may affect food access and worsen nutritional outcomes; increased chronic psychosocial stress, which may adversely affect mental health and development (2); and increased rates of infection and inflammation due to differences in exposure or immune response (Web Figure 1, available at https://academic.oup.com/aje) (3–5). Differences in health-care access may contribute in the United States, where insurance coverage is closely linked to employment and socioeconomic status (6). Interventions to address poverty during childhood may therefore improve life-course health trajectories. Randomized controlled trials of cash transfers in international settings have shown improved child health (7, 8). Yet such trials of US poverty-alleviation programs are limited due to the logistical hurdles of randomizing and following sufficient numbers of subjects. One randomized controlled trial of a cash transfer program in New York examined a limited number of health outcomes, finding increased receipt of medical care (9).

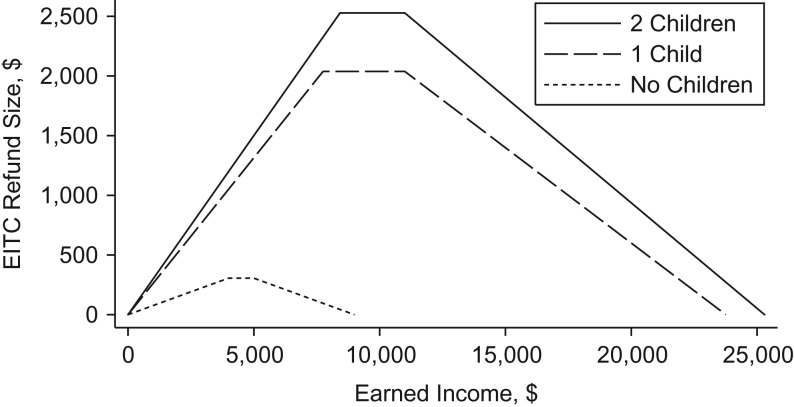

Another category of interventions that address the socioeconomic determinants of health during childhood are social policies such as the Earned Income Tax Credit (EITC). The EITC is the largest US poverty-alleviation program, with over 27 million beneficiaries receiving almost $67 billion (US dollars) in 2015 (10). It is a federal program that provides tax refunds to low-income families contingent upon employment, with refund size calculated using income, number of children, and marital status (Figure 1) (11–13). The EITC improves economic outcomes (14, 15), although the evidence for health has been mixed. Among adults, studies have shown reduced smoking and improved food security but increased obesity and worsened metabolic markers (16–19). Among children, studies have shown improved birth weight and behavioral problems (20–22) but more very low birth weight and no effect on obesity (23, 24). Qualitative work suggests that the EITC refund is spent differently from typical employment income, perhaps because it is distributed as a lump sum (25). Thus, there may be differential effects for a given outcome depending on the mechanism of action. For example, due to uncertainty in the timing of the refund, stress levels may be higher in the months immediately surrounding EITC refund receipt, although the eventual income boost may improve material resources. For child health in particular, effects may not be uniformly positive because the refund is dependent upon parental employment, which may adversely affect parental attention. Systematic reviews have found insufficient evidence on the effects of such financial interventions on child and adult health (26, 27), suggesting the need for additional studies.

Figure 1.

Earned Income Tax Credit (EITC) refund size according to income (US dollars) and number of children, 1994. Authors’ depiction based on administrative data (13).

In the present study, we examined the association of receipt of the EITC refund with child health outcomes that potentially mediate the relationship between childhood poverty and adult health, including objective metabolic and inflammatory markers. We employed a quasiexperimental difference-in-differences (DID) approach using a diverse, nationally representative sample. We took advantage of the seasonal nature of EITC refund receipt as well as variation in EITC refund size due to program expansions that were unassociated with unobserved individual confounders (13). To our knowledge, this study is the first to employ a seasonal DID strategy to estimate the EITC’s short-term impacts on child health, adding to the literature on the effects of poverty-alleviation programs on child outcomes.

METHODS

Data set

This study was conducted using the Third National Health and Nutrition Examination Survey (NHANES III, 1988–1994), a cross-sectional, nationally representative study. NHANES III includes a variable representing month of interview, which is essential to the analytical strategy described below. We included children under age 18 years (n = 13,944). Our approach relies on the availability of year-round data, so we restricted the sample to individuals residing in the South and West Census regions; those in the Northeast and Midwest were not interviewed during the winter months. We included children whose responses could be linked to parental information on sociodemographic determinants of EITC eligibility (n = 7,444).

Exposure

The primary exposure was a binary variable representing whether the child’s family was eligible for the EITC. We imputed EITC refund size using the Taxsim package (28) for Stata (StataCorp LLC, College Station, Texas), based on Internal Revenue Service tax tables; inputs included the parent’s marital status, age, number of dependent children, tax year, and household income before taxes. We calculated number of dependent children by subtracting 2 from the household size if the parent was cohabiting/married and subtracting 1 if the parent was single. While NHANES does not provide the year in which each participant was surveyed, it provides a range for each survey phase (Phase I: 1988–1991; Phase II: 1991–1994). Similarly, household pretax income is represented by 27 income categories (e.g., $1,000–1,999). For each participant, we calculated EITC refund size using the maximum and minimum of each income category in the maximum and minimum of each survey year range. We then averaged these 4 EITC values to arrive at the final imputed refund size. Because of the measurement error in calculating refund size, and because moderate to large income refunds are more likely to affect health, we defined an EITC-eligible household as one that received ≥$500 in EITC benefits. The maximum refund size during this time period was roughly $1,000—about 5%–10% of an eligible household’s income.

Health outcomes

We selected outcomes based on whether they were likely to be affected in the short term after EITC refund receipt. Because some components were obtained by NHANES only for children of certain ages, sample sizes differed for some outcomes. Outcomes captured various mechanistic pathways hypothesized in prior work, including nutrition, inflammation/infection, and psychosocial stress (Web Figure 1), as well as general health.

General health included variables on self-reported (or parent-reported) overall health and physician-reported overall health, as well as lead, an adverse environmental exposure which was included as a “negative control” because it is unlikely to be affected immediately after refund receipt.

Nutritional outcomes included 3 measures of food insufficiency: whether the family had enough food in the past month; whether this was because of insufficient money (for those who responded negatively); and the number of days the family had no food in the past month (zero for those who reported enough food). We examined dietary quality using the Healthy Eating Index (range, 0–100), with higher scores indicating healthier eating (29). Daily calorie intake was assessed by dietary recall. Serum markers of nutrition included hemoglobin, iron, high-density lipoprotein cholesterol, triglycerides, and glycated hemoglobin.

Measures of inflammation or infection included physician-assessed evidence of active infection and presence of infection in the past 4 weeks. Serum immune and inflammatory markers included white blood cell count, C-reactive protein, and ferritin.

The psychosocial pathway was assessed using the reading and mathematics subsets of the revised Wide Range Achievement Test, for which NHANES provides age-adjusted scores (30).

Covariates

Covariates included child sex, age, and race; head of household sex, age, marital status, number of dependents, and educational attainment; and region of residence. We also adjusted for NHANES survey phase to account for secular trends (Phase I: 1988–1991; Phase II: 1991–1994), because NHANES III does not provide data on the exact year of interview. Given sparsity, we collapsed the 27 NHANES income ranges into 5 categories.

Data analysis

We first calculated descriptive sample characteristics separately according to interview season and EITC eligibility. We then estimated EITC effects using DID analysis, a quasiexperimental technique suited to examining the effects of policy changes while accounting for secular trends (31). We took advantage of the fact that 90% of EITC beneficiaries receive their refunds in February to April (32). Also, NHANES interviews in the South and West take place throughout the year and are unlikely to be associated with refund status or other individual characteristics. This creates a natural experiment, in that EITC-eligible participants interviewed during February to April are interviewed soon after refund receipt, while EITC-eligible participants interviewed during May to January have more distant exposure to this income boost. Thus, we compared EITC-eligible individuals interviewed during February to April with those interviewed in May to January. To factor out possible secular changes, DID analysis “differences out” the seasonal differences observed for non-EITC-eligible individuals interviewed during February to April and those interviewed in May to January. The underlying assumption is that the seasonal differences in these outcomes are similar between EITC-eligible and non-EITC-eligible individuals. Importantly, this allows us to estimate short-term impacts that are unconfounded by unobservable individual or family characteristics that would bias a typical observational study of the association between EITC receipt and health (Web Figure 1). This technique has been used in other studies examining the effects of the EITC on adult health (18). Additional details are described in Web Appendix 1, including several standard analyses to test DID assumptions.

Alternative specifications

We conducted alternative modeling strategies to test the robustness of results. First, instead of imputing EITC refund size by averaging the 4 EITC amounts calculated from maximum and minimum income values for the maximum and minimum survey phase years, we instead calculated a single EITC refund amount for the average of each income category in the average phase year. To be concise, we refer to these imputation methods as “maximum/minimum” and “mean.” Second, instead of using $500 as the cutoff for EITC eligibility, we examined the population eligible for $1,000 or more in EITC refunds (given that larger refunds might lead to larger effects) and those eligible for an EITC refund of any amount (to test the hypothesis that even small refunds result in health effects). Third, we additionally controlled for household income, marital status, and number of dependents, even though this might reduce variation in our exposure because these potential confounders also determine EITC refund size. Fourth, we restricted the control group to noneligible individuals who were likely to be more comparable to the eligible group. To do so, we excluded individuals unlikely to receive the EITC (i.e., those with earned income of $0 or at least $50,000; n = 929). Finally, we conducted the primary analysis stratified by NHANES survey phase (1988–1991 versus 1991–1994), to account for the fact that a recession occurred in the United States during the first survey wave, which may have led to heterogeneity in effect estimates over time.

Accounting for multiple hypothesis testing

Because this study included 20 health outcomes and multiple modeling strategies, we accounted for multiple hypothesis testing in 2 ways. First, we conducted a standard Bonferroni correction (33); instead of considering P values of <0.05 to be statistically significant, we used a threshold of 0.0025 (i.e., 0.05/20). Bonferroni is likely overly conservative, however, because it assumes that outcomes are independent of one another (34). Consequently, we also calculated Romano-Wolf stepdown P values, which account for dependency between outcomes (35–37). A limitation of Romano-Wolf is that it cannot account for NHANES survey weighting, although weighted and unweighted models produced results of similar direction and effect size (results available upon request). We therefore present our original weighted results, Bonferroni-corrected results (based on weighted analyses), and Romano-Wolf-corrected results (based on unweighted analyses).

Ethical approval

This study involved public-use data without personal identifiers. No ethical approval was required.

RESULTS

Sample characteristics

EITC-eligible children were more likely to be black or Hispanic, with a female, unmarried, low-income, less-educated parent with more dependents (Table 1). Among EITC-eligible participants there were seasonal differences in several covariates, but these differences were not statistically significantly different from seasonal differences among noneligible individuals. The exception was race, suggesting that NHANES unintentionally interviewed individuals of different races at different times of the year; we adjusted for race and other sociodemographic characteristics in all subsequent models. These findings highlight the utility of a DID approach to “difference out” any seasonal trends.

Table 1.

Sample Sociodemographic Characteristics According to Eligibility for the Earned Income Tax Credit and the Interview Seasona, Third National Health and Nutrition Examination Survey, United States, 1988–1994

| Characteristic | Eligible | Not Eligible | ||||||

|---|---|---|---|---|---|---|---|---|

| February to April (n = 991) | May to January (n = 1,497) | February to April (n = 1,748) | May to January (n = 3,208) | |||||

| Mean (SD) | % | Mean (SD) | % | Mean (SD) | % | Mean (SD) | % | |

| Child female | 51.0 | 50.0 | 43.5 | 49.0 | ||||

| Child age, years | 7.9 (4.8) | 8.0 (4.9) | 8.7 (4.8) | 8.4 (4.9) | ||||

| Child race/ethnicity | ||||||||

| White | 28.5 | 40.4 | 57.9 | 73.5 | ||||

| Black | 15.0 | 33.2 | 8.5 | 15.3 | ||||

| Hispanic | 51.5 | 19.8 | 24.7 | 7.9 | ||||

| Other | 5.0 | 6.6 | 8.8 | 3.3 | ||||

| Parent female | 52.3 | 51.8 | 13.1 | 18.6 | ||||

| Parent age, years | 35.0 (9.2) | 34.2 (8.5) | 37.8 (7.9) | 37.5 (7.8) | ||||

| Parent married | 52.9 | 46.1 | 85.7 | 83.2 | ||||

| Parent education | ||||||||

| Less than high school | 58.5 | 45.6 | 17.6 | 16.8 | ||||

| High school | 33.2 | 36.6 | 33.2 | 34.6 | ||||

| More than high school | 8.3 | 17.9 | 49.2 | 48.6 | ||||

| No. of children | 3.3 (1.5) | 2.9 (1.6) | 2.8 (1.7) | 2.4 (1.3) | ||||

| Family income, $ | ||||||||

| 0–9,999 | 36.8 | 47.8 | 3.1 | 4.5 | ||||

| 10,000–14,999 | 44.5 | 40.5 | 3.1 | 3.2 | ||||

| 15,000–24,999 | 18.6 | 11.7 | 24.2 | 17.6 | ||||

| 25,000–39,999 | 0 | 0 | 22.3 | 29.5 | ||||

| ≥40,000 | 0 | 0 | 47.4 | 45.2 | ||||

| Survey Phase I | 35.5 | 43.0 | 52.3 | 55.0 | ||||

| South region of residence | 21.1 | 80.7 | 22.4 | 76.6 | ||||

Abbreviations: NHANES III, Third National Health and Nutrition Examination Survey; SD, standard deviation.

a Sample was drawn from NHANES III, conducted during 1988–1994. Characteristics were calculated using NHANES survey weights.

In general, health outcomes were worse among EITC-eligible children (Table 2), with worsened overall health, increased food insufficiency, and worsened test scores. We again noted seasonal differences that might be brought about by EITC receipt; we examined these using the DID analyses below.

Table 2.

Sample Health Characteristics According to Eligibility for the Earned Income Tax Credit and the Interview Seasona, Third National Health and Nutrition Examination Survey, United States, 1988–1994

| Health Characteristic | Eligible | Not Eligible | No. of Observations | ||||||

|---|---|---|---|---|---|---|---|---|---|

| February to April (n = 991) | May to January (n = 1,497) | February to April (n = 1,748) | May to January (n = 3,208) | ||||||

| Mean (SD) | % | Mean (SD) | % | Mean (SD) | % | Mean (SD) | % | ||

| General health | |||||||||

| Self-reported health excellent/very good | 54.9 | 57.8 | 76.5 | 81.6 | 7,444 | ||||

| Physician-reported health excellent/very good | 93.1 | 89.7 | 91.7 | 93.1 | 6,847 | ||||

| Lead, μg/dL | 3.21 (2.69) | 3.37 (2.45) | 2.22 (2.05) | 2.32 (1.97) | 5,230 | ||||

| Nutrition | |||||||||

| Enough food, past month | 76.7 | 84.9 | 95.5 | 97.7 | 7,444 | ||||

| No money for food | 16.5 | 11.5 | 2.8 | 1.6 | 7,441 | ||||

| No. of days with no food, past month | 0.94 (2.8) | 0.79 (2.8) | 0.16 (0.23) | 0.08 (0.78) | 7,436 | ||||

| Total calorie intake, kcal | 1,972 (971) | 1,764 (731) | 1,921 (934) | 1,892 (973) | 6,486 | ||||

| HEI score | 65.16 (12.51) | 64.07 (12.85) | 65.48 (12.21) | 64.95 (11.92) | 5,118 | ||||

| Hemoglobin, g/dL | 13.03 (1.16) | 12.85 (1.18) | 13.12 (1.11) | 12.97 (1.11) | 5,074 | ||||

| Iron, μg/dL | 82.23 (34.72) | 78.65 (36.51) | 82 (33.05) | 79.65 (34.29) | 5,114 | ||||

| HDL cholesterol, mg/dL | 51.56 (10.59) | 51.19 (11.78) | 50.32 (10.82) | 49.89 (11.31) | 3,543 | ||||

| Triglycerides, mg/dL | 85.30 (52) | 86.65 (47.16) | 82.89 (43.61) | 84.61 (43.99) | 1,062 | ||||

| Glycated hemoglobin, % | 5.02 (0.3) | 5.02 (0.45) | 4.97 (0.37) | 5.02 (0.35) | 3,384 | ||||

| Inflammation/infection | |||||||||

| Infection, past 4 weeks | 40.6 | 46 | 42.8 | 47.2 | 6,820 | ||||

| Possible active infection | 5.9 | 10.4 | 5.5 | 5.5 | 6,839 | ||||

| White blood cell count, 1,000 cells/μL | 7.84 (2.32) | 7.78 (2.42) | 7.63 (2.22) | 7.73 (2.3) | 5,074 | ||||

| C-reactive protein, mg/dL | 0.25 (0.37) | 0.27 (0.33) | 0.27 (0.39) | 0.3 (0.42) | 3,006 | ||||

| Ferritin, ng/mL | 30.55 (18.32) | 39.17 (47.57) | 35.62 (24.63) | 36.27 (23.91) | 5,084 | ||||

| Test scores | |||||||||

| Math scoreb | 88.49 (15.84) | 86.79 (14.74) | 98.17 (18.08) | 94.44 (15.98) | 2,694 | ||||

| Reading scoreb | 83.93 (16.41) | 84.49 (16.04) | 95.33 (18.22) | 93.66 (16.11) | 2,616 | ||||

Abbreviations: HDL, high-density lipoprotein; HEI, Healthy Eating Index; NHANES III, Third National Health and Nutrition Examination Survey; SD, standard deviation.

a Sample was drawn from NHANES III, conducted during 1988–1994. Characteristics were calculated using NHANES survey weights.

b Scores were obtained using the Wide Range Achievement Test–Revised.

EITC association with child health

The “Model 1” columns of Table 3 present the results of the primary analysis, while subsequent columns present the results of alternative specifications (models 2–5). For general health, there were improvements in physician-reported overall health across multiple models that were statistically significant using the Romano-Wolf adjustment, but only one of these—using an eligibility cutoff of $0 (model 4)—maintained statistical significance when using Bonferroni correction (β = 0.12, 95% CI: 0.05, 0.20). There was no association with self-reported overall health or lead (negative control).

Table 3.

Short-Term Effects of the Earned Income Tax Credit on Child Health Outcomes, According to Model Specificationa, Third National Health and Nutrition Examination Survey, United States, 1988–1994

| Child Outcome | Model 1b | Model 2c | Model 3d | Model 4e | Model 5f | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| β | 95% CI | β | 95% CI | β | 95% CI | β | 95% CI | β | 95% CI | |

| General health | ||||||||||

| Self-reported health excellent/very good | 0.05 | −0.03, 0.13 | 0.04 | −0.04, 0.12 | −0.04 | −0.16, 0.08 | −0.03 | −0.11, 0.05 | 0.03 | −0.04, 0.09 |

| Physician-reported health excellent/very good | 0.06i | −0.001, 0.124 | 0.06g,h | 0.001, 0.119 | 0.06 | −0.03, 0.15 | 0.12g,i | 0.05, 0.20 | 0.06i | −0.01, 0.13 |

| Ln(Lead) (negative control) | −0.02 | −0.23, 0.19 | −0.01 | −0.20, 0.19 | −0.07 | −0.40, 0.26 | −0.10 | −0.25, 0.06 | 0.01 | −0.19, 0.21 |

| Nutrition | ||||||||||

| Enough food, past month | −0.04 | −0.10, 0.02 | −0.04 | −0.10, 0.01 | −0.01 | −0.15, 0.11 | −0.05g,h | −0.10, −0.01 | −0.06h | −0.115, 0.004 |

| No money for food | 0.02 | −0.04, 0.08 | 0.03h | −0.02, 0.08 | 0.04 | −0.09, 0.16 | 0.03h | −0.01, 0.07 | 0.03h | −0.03, 0.10 |

| No. of days with no food, past month z score | −0.01 | −0.20, 0.19 | 0.002 | −0.18, 0.18 | −0.08 | −0.52, 0.37 | 0.05h | −0.07, 0.18 | 0.04 | −0.15, 0.22 |

| Total calorie intake | 253g | 44, 461 | 200 | −9, 409 | 139 | −61, 339 | 19 | −157, 195 | 242g | 37, 448 |

| HEI score | 1.11 | −1.08, 3.31 | 1.47 | −0.55, 3.48 | −0.07 | −2.38, 2.25 | 0.40 | −1.65, 2.45 | 1.08 | −1.11, 3.28 |

| Hemoglobin | 0.02 | −0.18, 0.21 | 0.01 | −0.17, 0.19 | −0.003 | −0.36, 0.35 | −0.05 | −0.23, 0.13 | 0.03 | −0.17, 0.22 |

| Iron | 1.36 | −5.79, 8.51 | 1.31 | −6.01, 8.63 | 8.11 | −1.02, 17.25 | 6.74 | −0.03, 13.51 | 1.24 | −5.18, 7.67 |

| HDL cholesterol | 0.97 | −1.34, 3.28 | 0.73 | −1.47, 2.93 | 0.97 | −2.81, 4.75 | 1.72 | −0.22, 3.67 | 0.88 | −1.51, 3.27 |

| Ln(Triglycerides) | −0.07 | −0.25, 0.11 | −0.06 | −0.24, 0.12 | 0.16 | −0.18, 0.49 | −0.11 | −0.32, 0.10 | −0.09 | −0.26, 0.08 |

| Glycated hemoglobin | 0.09 | −0.002, 0.177 | 0.06 | −0.04, 0.16 | 0.07 | −0.09, 0.22 | 0.06 | −0.02, 0.13 | 0.10g | 0.02, 0.18 |

| Inflammation/infection | ||||||||||

| Infection, past 4 weeks | −0.01 | −0.09, 0.07 | −0.01 | −0.08, 0.07 | −0.06 | −0.18, 0.07 | 0.05 | −0.03, 0.12 | 0.003 | −0.07, 0.08 |

| Possible active infection | −0.04g | −0.07, −0.01 | −0.04g | −0.07, −0.08 | −0.06g | −0.12, −0.001 | −0.03 | −0.059, 0.003 | −0.03g | −0.06, −0.01 |

| White blood cell count | −0.05 | −0.48, 0.38 | −0.001 | −0.42, 0.42 | −0.28 | −0.86, 0.31 | 0.15 | −0.25, 0.54 | 0.011 | −0.40, 0.42 |

| Ln(C-reactive protein) | −0.04 | −0.11, 0.04 | −0.03 | −0.10, 0.04 | −0.15g | −0.25, −0.04 | −0.05 | −0.15, 0.06 | −0.03 | −0.10, 0.04 |

| Ln(Ferritin) | −0.11 | −0.23, 0.02 | −0.10 | −0.22, 0.02 | 0.05 | −0.12, 0.22 | −0.09 | −0.19, 0.01 | −0.09 | −0.22, 0.03 |

| Test scores | ||||||||||

| Math score | 0.34 | −3.81, 4.48 | −0.70 | −5.27, 3.86 | 0.95 | −4.09, 5.99 | −0.19 | −3.78, 3.41 | −0.38 | −4.56, 3.80 |

| Reading score | 0.05 | −4.07, 4.16 | −0.90 | −4.99, 3.20 | −0.43 | −9.22, 8.35 | −3.7g | −7.11, −0.31 | −0.68 | −4.58, 3.22 |

Abbreviations: EITC, Earned Income Tax Credit; HDL, high-density lipoprotein; HEI, Healthy Eating Index; Ln, natural logarithm; NHANES III, Third National Health and Nutrition Examination Survey.

a Sample includes children interviewed for NHANES III in the South and West census regions, for whom sociodemographic information was available on the parent (n = 7,444). Coefficients represent the interaction term between EITC eligibility and being interviewed for NHANES III during February to April.

b Model 1 used $500 EITC eligibility cutoff, used the maximum/minimum EITC imputation method, and adjusted for child’s sex, age, and race; parent’s sex, age, and education; survey phase; and census region.

c Model 2 used $500 EITC eligibility cutoff, used the mean EITC imputation method, and adjusted for the same covariates as in model 1.

d Model 3 used $1,000 EITC eligibility cutoff, used the maximum/minimum EITC imputation method, and adjusted for the same covariates as in model 1.

e Model 4 used any EITC eligibility cutoff, used the maximum/minimum EITC imputation method, and adjusted for same covariates as in model 1.

f Model 5 used $500 EITC eligibility cutoff, used the maximum/minimum EITC imputation method, and adjusted for the same covariates as in model 1; it additionally adjusted for household income, parent’s marital status, and number of children.

gP < 0.05 in original model.

hP < 0.05 in Romano-Wolf model. Analyses involve multivariable linear regressions.

iP < 0.0025 Bonferroni-corrected.

For nutrition, the EITC was associated with increased likelihood of having no money for food and more days without food when using an eligibility cutoff of $0 and the Romano-Wolf adjustment (model 4) and when we adjusted for additional covariates (model 5). While there were scattered results suggesting improvements in calorie intake and serum biomarkers of nutrition, none of these were robust to Bonferroni or Romano-Wolf corrections.

For infection outcomes, reduced likelihood of active infection was statistically significant at P < 0.05 (models 1–2, 4–5) but not robust to Bonferroni or Romano-Wolf corrections. C-reactive protein was reduced when using a $1,000 eligibility cutoff (model 3), and this was robust to Bonferroni correction (β = −0.15, 95% CI: −0.25, −0.04).

For the psychosocial pathway, there were no differences in math or reading scores.

Alternative specifications

When excluding individuals who had zero or at least $50,000 in household income (Web Table 1), there were improvements in Romano-Wolf-adjusted models for physician-reported overall health (models 6–7, 9) and increased likelihood of having no money for food (models 7, 9). Contrary to the primary models, there was a reduction in the number of days without food, although this association was statistically significant with Romano-Wolf adjustment only when using an EITC eligibility cutoff of $0 (model 9). Otherwise, there was no association with other health outcomes and no result robust to Bonferroni correction.

When stratifying the analysis by NHANES survey phase, EITC eligibility was again repeatedly associated with not enough food (models 4–5), no money for food (models 1–5), and improved physician-reported health (models 1–5) during the first survey phase (1998–1991) in Romano-Wolf-adjusted models; the findings for worsened food insufficiency were robust to Bonferroni correction as well. In the second survey phase, only the findings for food insufficiency in model 4 were statistically significant after Romano-Wolf and Bonferroni correction (results available upon request).

DISCUSSION

The present study estimated the short-term effects of the EITC on child health, using a quasiexperimental DID approach that took advantage of the seasonal nature of receipt of the EITC to strengthen causal inference. We were unable to rule out the null hypothesis that there is no effect of the EITC on most measures of child general health, nutrition, infection, or psychosocial pathways when adjusting for multiple hypothesis testing. For outcomes that were robust to Bonferroni correction and Romano-Wolf testing, results were mixed.

EITC receipt was consistently associated with improved physician-reported overall health across multiple sensitivity tests, including varying the EITC imputation method and eligibility cutoffs. Physicians were 6% more likely to rate children from EITC-eligible households interviewed in the treatment months as being in excellent or very good health. Yet there was no change in self-reported health or most objective measures on exam or laboratory testing. Refund receipt may be associated with changes in physical or mental health that are more likely to be detected by health-care providers than parents or standard testing, although NHANES documentation does not indicate how the physician assessment was made.

Our study demonstrated contradictory findings related to nutrition and food insufficiency. In our primary models, there was an increase in the likelihood of having no money for food. Similarly, our primary models found increased number of days with no food, although this finding was reversed when excluding zero- and high-income groups, which are unlikely to be appropriate controls for EITC-eligible individuals, and when employing logistic rather than linear models (Web Table 2). For all of these, findings were statistically significant only in Romano-Wolf-adjusted (i.e., unweighted) models. This suggests that there may be seasonal differences in the types of individuals interviewed by NHANES that are accounted for with survey weights, such that these findings are unlikely to be due to the effects of the EITC itself. In analyses that employed survey weights, there were no statistically significant findings that were robust to Bonferroni correction, although numerous analyses demonstrated improvements in total calorie intake at a level of P < 0.05. Indeed, with increased income from the EITC, we might expect increased food purchases and consumption (38–40). A prior study examining the short-term effects of the EITC among adults found improved food security among recipients during the treatment months (18). Conversely, one possible explanation for worsened food insufficiency is a violation of the assumptions underlying the DID model. In other words, DID analyses assume that the temporal trends in the outcomes are similar across EITC-eligible and noneligible groups. However, it may be that EITC-eligible families with children are more likely to be food-insecure in February to April than in May to January relative to noneligible families, such that differencing out secular trends in the noneligible groups is not a sufficient adjustment for secular trends in EITC-eligible families. Prior work has shown that low-income individuals are more likely to struggle with the cost of utilities and subsequent food insecurity during cold months (41). Thus, we may be misattributing the worsened food insufficiency during February to April to the EITC, when in fact it is due to differential trends in this outcome by EITC eligibility. Alternatively, it may be that EITC refund receipt does in fact decrease the availability of food in the household; prior work has shown that families tend to use the lump-sum EITC refund to purchase big-ticket items and other household resources (25, 42). This may lead them to redirect typical monthly income towards these items, detracting from the ability to pay for daily needs. Finally, it may be that the linear model is not appropriate for this binary outcome, given that we find differing results using logistic models (Web Table 2); or it may be that the low probability of food insufficiency among noneligible households results in unstable estimates.

For infection and inflammation, findings were not robust to adjustment for multiple hypothesis testing. High levels of C-reactive protein, ferritin, and other inflammatory markers have been correlated with a variety of disease outcomes—particularly infection, autoimmune disease, and obesity—among children (43–46), as well as lower socioeconomic status (47). Ours is among the first studies to examine whether an intervention to alleviate poverty may reduce levels of these markers in children, although in this case we are unable to rule out the null hypothesis that there is no effect.

Among our alternative specifications, we varied the cutoff at which we considered individuals to be eligible for the EITC, including $0, $500, and $1,000. While we expected effect sizes to increase with higher cutoffs, given the larger exposure, we did not find this to be the case. Because we imputed EITC refund size based on NHANES income and year categories rather than exact values, there was imprecision in the EITC variable, so varying the cutoff may have been less impactful for subsequent analyses. Most statistically significant findings were present in models that used an eligibility cutoff of $0, perhaps because this increased the size of the treatment group and the power to detect small effects.

This study has several limitations. First, measurement error is likely for self-reported variables, such as income. Second, because participants did not specifically report on EITC refund receipt, we imputed a binary variable for eligibility based on income categories. This may result in misclassification and limits the granularity of detail on EITC refund size. To address this, we used 2 imputation methods, one of which is likely to overestimate EITC receipt while the other is likely to underestimate receipt (models 1–2). Because approximately 80% of individuals during the study period actually received EITC refunds for which they were eligible (48), our estimates are analogous to intent-to-treat estimates in a randomized controlled trial. Moreover, by using individual-level demographic variables to calculate EITC eligibility, this technique represents an improvement over prior studies that have used only educational attainment as a proxy for EITC receipt (49, 50). A third possible limitation is that DID analyses assume parallel secular trends among the treatment and control groups. While we find this to be true for all of the predictor variables except race (Table 1), we cannot empirically test this for the outcome variables. Finally, our analysis was conducted using data from 1988 to 1994, meaning that results are not necessarily generalizable to the present. For example, the study period coincides with the US recession of 1990–1991, so results may be most applicable to income interventions that occur during economic downturns. Most of our results—including improved physician-reported health and worsened food insufficiency—were stronger during the first survey phase; it is unclear whether this is driven by prerecessionary (1988–1989) or recessionary (1990–1991) trends, given that NHANES III does not provide the exact year in which participants were interviewed. Finally, our study does not examine the effects of state EITC programs, which were implemented more recently; future studies should examine this additional source of policy variation.

Social policies have been highlighted as key determinants of health disparities (51). This study adds to the literature on the possible effects of one policy—the EITC—on child health. While results suggest that the program may have positive impacts on overall health, we demonstrate mixed findings for food insufficiency and null results for the majority of health outcomes. Notably, we focus on short-term health, while prior studies have consistently documented positive effects on long-term outcomes (22, 52). Our results highlight the potential of poverty-alleviation programs to address the social determinants of health, and the importance of rigorously evaluating social programs using multiple methodologies to better understand the mechanisms of their effects.

Supplementary Material

ACKNOWLEDGMENTS

Author affiliations: Philip R. Lee Institute for Health Policy Studies, Department of Family and Community Medicine, University of California San Francisco, San Francisco, California (Rita Hamad); Department of Family and Community Medicine, University of California San Francisco, San Francisco, California (Daniel F. Collin); and Department of Medicine, School of Medicine, Stanford University, Palo Alto, California (David H. Rehkopf).

This work was supported by the National Heart, Lung, and Blood Institute (grant K08HL132106 to R.H.) and the National Institute on Aging (grant K01AG047280 to D.H.R.).

Conflict of interest: none declared.

Abbreviations

- DID

difference-in-differences

- EITC

Earned Income Tax Credit

- NHANES

National Health and Nutrition Examination Survey.

REFERENCES

- 1. Alderman H. No Small Matter: The Impact of Poverty, Shocks, and Human Capital Investments in Early Childhood Development. Washington, DC: World Bank Publications; 2011. [Google Scholar]

- 2. Epel ES, Lithgow GJ. Stress biology and aging mechanisms: toward understanding the deep connection between adaptation to stress and longevity. J Gerontol A Biol Sci Med Sci. 2014;69(suppl 1):S10–S16. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3. Corna LM. A life course perspective on socioeconomic inequalities in health: a critical review of conceptual frameworks. Adv Life Course Res. 2013;18(2):150–159. [DOI] [PubMed] [Google Scholar]

- 4. Heidt T, Sager HB, Courties G, et al. Chronic variable stress activates hematopoietic stem cells. Nat Med. 2014;20(7):754–758. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5. Ploubidis GB, Benova L, Grundy E, et al. Lifelong Socio Economic Position and biomarkers of later life health: testing the contribution of competing hypotheses. Soc Sci Med. 2014;119:258–265. [DOI] [PubMed] [Google Scholar]

- 6. Barnett JC, Berchick ER. Health Insurance Coverage in the United States: 2016. Current Population Reports Washington, DC: US Census Bureau; 2017. [Google Scholar]

- 7. Fernald LC, Gertler PJ, Neufeld LM. Role of cash in conditional cash transfer programmes for child health, growth, and development: an analysis of Mexico’s Oportunidades. Lancet. 2008;371(9615):828–837. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8. Guanais FC. The combined effects of the expansion of primary health care and conditional cash transfers on infant mortality in Brazil, 1998–2010. Am J Public Health. 2015;105(suppl 4):S593–S599. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9. Riccio J, Dechausay N, Greenberg D, et al. Toward reduced poverty across generations: early findings from New York City’s conditional cash transfer program. MDRC; 2010. https://www.mdrc.org/publication/toward-reduced-poverty-across-generations. Accessed August 31, 2018.

- 10. Hathaway J. Tax credits for working families: Earned Income Tax Credit. National Conference of State Legislatures; 2017. http://www.ncsl.org/research/labor-and-employment/earned-income-tax-credits-for-working-families.aspx. Accessed August 25, 2017.

- 11. Friedman P. The Earned Income tax Credit. Welfare Information Network. 2000;4(4):Issue Notes. [Google Scholar]

- 12. Nichols A, Rothstein J. The Earned Income Tax Credit (EITC). Cambridge, MA: National Bureau of Economic Research; 2015. [Google Scholar]

- 13. Committee on Ways and Means Green Book. Washington, DC: US House of Representatives; 2004. [Google Scholar]

- 14. Chetty R, Friedman JN, Saez E. Using differences in knowledge across neighborhoods to uncover the impacts of the EITC on earnings. Am Econ Rev. 2013;103(7):2683–2721. [Google Scholar]

- 15. Dahl M, DeLeire T, Schwabish J. Stepping stone or dead end? The effect of the EITC on earnings growth. Natl Tax J. 2009;62(2):329–346. [Google Scholar]

- 16. Averett S, Wang Y The effects of EITC payment expansion on maternal smoking. Bonn, Germany: Institute for the Study of Labor; 2012.

- 17. Cowan B, Tefft N. Education, maternal smoking, and the Earned Income Tax Credit. BE J Econ Anal Policy. 2012;12(1):1–39. [Google Scholar]

- 18. Rehkopf DH, Strully KW, Dow WH. The short-term impacts of Earned Income Tax Credit disbursement on health. Int J Epidemiol. 2014;43(6):1884–1894. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19. Schmeiser MD. Expanding wallets and waistlines: the impact of family income on the BMI of women and men eligible for the Earned Income Tax Credit. Health Econ. 2009;18(11):1277–1294. [DOI] [PubMed] [Google Scholar]

- 20. Hoynes HW, Miller DL, Simon D. Income, the Earned Income Tax Credit, and infant health. Am Econ J Econ Policy. 2015;7(1):172–211. [Google Scholar]

- 21. Hamad R, Rehkopf DH. Poverty, pregnancy, and birth outcomes: a study of the Earned Income Tax Credit. Paediatr Perinat Epidemiol. 2015;29(5):444–452. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22. Hamad R, Rehkopf DH. Poverty and child development: a longitudinal study of the impact of the Earned Income Tax Credit. Am J Epidemiol. 2016;183(9):775–784. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23. Bruckner TA, Rehkopf DH, Catalano RA. Income gains and very low-weight birth among low-income black mothers in California. Biodemography Soc Biol. 2013;59(2):141–156. [DOI] [PubMed] [Google Scholar]

- 24. Rehkopf DH, Strully KW, Dow WH The Effects of Anti-Poverty Tax Policy on Child and Adolescent BMI and Obesity. Working Paper. Washington, DC: Strong Foundations: The Economic Futures of Kids and Communities. Federal Reserve Bank of San Francisco; 2017.

- 25. Romich JL, Weisner T. How families view and use the EITC: advance payment versus lump sum delivery. Natl Tax J. 2000;53(4; PART 2):1245–1266. [Google Scholar]

- 26. Lucas PJ, McIntosh K, Petticrew M, et al. Financial benefits for child health and well‐being in low income or socially disadvantaged families in developed world countries. Cochrane Database Syst Rev. 2008;(2):CD006358. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27. Pega F, Carter K, Blakely T, et al. In‐work tax credits for families and their impact on health status in adults. Cochrane Database Syst Rev. 2013(8):CD009963. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28. Feenberg D, Coutts E. An introduction to the TAXSIM model. J Policy Anal Manage. 1993;12(1):189–194. [Google Scholar]

- 29. Kennedy ET, Ohls J, Carlson S, et al. The Healthy Eating Index: design and applications. J Am Diet Assoc. 1995;95(10):1103–1108. [DOI] [PubMed] [Google Scholar]

- 30. Jastak S, Wilkinson GS. Wide Range Achievement Test Revised. Wilmington, DE: Jastak Associates; 1984. [Google Scholar]

- 31. Dimick JB, Ryan AM. Methods for evaluating changes in health care policy: the difference-in-differences approach. JAMA. 2014;312(22):2401–2402. [DOI] [PubMed] [Google Scholar]

- 32. LaLumia S. The EITC, tax refunds, and unemployment spells. Am Econ J Econ Policy. 2013;5(2):188–221. [Google Scholar]

- 33. Bland JM, Altman DG. Multiple significance tests: the Bonferroni method. BMJ. 1995;310(6973):170. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34. Bender R, Lange S. Adjusting for multiple testing—when and how? J Clin Epidemiol. 2001;54(4):343–349. [DOI] [PubMed] [Google Scholar]

- 35. Romano JP, Wolf M. Exact and approximate stepdown methods for multiple hypothesis testing. J Am Stat Assoc. 2005;100(469):94–108. [Google Scholar]

- 36. Romano JP, Wolf M. Efficient computation of adjusted P values for resampling-based stepdown multiple testing. Stat Probab Lett. 2016;113:38–40. [Google Scholar]

- 37. Clarke D. RWOLF: Stata module to calculate Romano-Wolf stepdown p-values for multiple hypothesis testing. Statistical Software Components Boston, Massachusetts: Boston College Department of Economics; 2018.

- 38. Hamad R, Fernald LC. Microcredit participation and nutrition outcomes among women in Peru. J Epidemiol Community Health. 2012;66(6):e1. [DOI] [PubMed] [Google Scholar]

- 39. Moseson H, Hamad R, Fernald L. Microcredit participation and child health: results from a cross-sectional study in Peru. J Epidemiol Community Health. 2014;68(12):1175–1181. [DOI] [PubMed] [Google Scholar]

- 40. Winship S, Jencks C How did the social policy changes of the 1990s affect material hardship among single mothers? Evidence from the CPS food security supplement. Working Paper RWP04-027. Cambridge, Massachusetts: Harvard University; 2004.

- 41. Bhattacharya J, DeLeire T, Haider S, et al. Heat or eat? Cold-weather shocks and nutrition in poor American families. Am J Public Health. 2003;93(7):1149–1154. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 42. Goodman-Bacon A, McGranahan L. How do EITC recipients spend their refunds? Econ Perspect. 2008;32(2). [Google Scholar]

- 43. Skinner AC, Steiner MJ, Henderson FW, et al. Multiple markers of inflammation and weight status: cross-sectional analyses throughout childhood. Pediatrics. 2010;125(4):e801–e809. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 44. Yanoff LB, Menzie CM, Denkinger B, et al. Inflammation and iron deficiency in the hypoferremia of obesity. Int J Obes (Lond). 2007;31(9):1412–1419. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 45. Pelkonen P, Swanljung K, Siimes MA. Ferritinemia as an indicator of systemic disease activity in children with systemic juvenile rheumatoid arthritis. Acta Paediatr Scand. 1986;75(1):64–68. [DOI] [PubMed] [Google Scholar]

- 46. Baynes R, Bezwoda W, Bothwell T, et al. The non-immune inflammatory response: serial changes in plasma iron, iron-binding capacity, lactoferrin, ferritin and C-reactive protein. Scand J Clin Lab Invest. 1986;46(7):695–704. [DOI] [PubMed] [Google Scholar]

- 47. Ranjit N, Diez-Roux AV, Shea S, et al. Socioeconomic position, race/ethnicity, and inflammation in the multi-ethnic study of atherosclerosis. Circulation. 2007;116(21):2383–2390. [DOI] [PubMed] [Google Scholar]

- 48. Hotz VJ, Scholz JK. The Earned Income Tax Credit In: Moffitt RA, ed. Means-Tested Transfer Programs in the United States. Chicago, IL: University of Chicago Press; 2003:141–197. [Google Scholar]

- 49. Evans WN, Garthwaite CL. Giving mom a break: the impact of higher EITC payments on maternal health. Am Econ J Econ Policy. 2014;6(2):258–290. [Google Scholar]

- 50. Markowitz S, Komro KA, Livingston MD, et al. Effects of state-level Earned Income Tax Credit laws in the US on maternal health behaviors and infant health outcomes. Soc Sci Med. 2017;194:67–75. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 51. Avendano M, Kawachi I. Why do Americans have shorter life expectancy and worse health than people in other high-income countries? Annu Rev Public Health. 2014;35:307–325. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 52. Dahl GB, Lochner L. The impact of family income on child achievement: evidence from the Earned Income Tax Credit. Am Econ Rev. 2012;102(5):1927–1956. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.