Abstract

Rising economic insecurity in recent decades has focused attention on the importance of social welfare programs in managing household financial stability. Some governments are more effective than others in managing this outcome, and informal social institutions help explain why. Social capital is expected to shape economic security through multiple mechanisms, but whether the effect is to magnify or mitigate volatility is an open question. Part of the answer has to do with how social capital interacts with policy implementation, and whether it conditions the effectiveness of government spending. Evidence from the U.S. states from 1986 to 2010 fails to support a benevolent social capital thesis—not only is social capital associated with greater economic insecurity, there is no evidence that it improves social welfare effectiveness. However, greater spending on some social programs can mitigate the adverse impact of social capital on economic security.

Keywords: social capital, social welfare policy, economic insecurity, public policy, political economy

How governments respond to household financial hardship with public policy is an increasingly important question in an era of rising economic insecurity (Hacker et al. 2014). Income volatility and uncertainty of income streams are linked to severe adverse effects on individual well-being (Corman et al. 2012; Prause, Dooley, and Huh 2009). Personal economic insecurity and economic context also shape individual support for social policies (Compton and Lipsmeyer In press; Gingrich and Ansell 2012; Hacker, Rehm, and Schlesinger 2013; Margalit 2013) and voting behavior (Mughan and Lacy 2002). Economic insecurity has important political and material implications for individuals’ lives, and some governments are more successful than others in its management.

Over the past century, addressing economic insecurity has become a fundamental role of government in developed democracies (Esping-Andersen 1990), including the U.S. states (Weir, Orloff, and Skocpol 1988). Social welfare policies were designed to dampen the impact of economic shocks on household finances and well-being by investing in social insurance and temporary assistance to families, smoothing income across time or space. Yet political, bureaucratic, and economic factors shape how effectively public policies translate government expenditures into outcomes. Dollar for dollar, social policy expenditures can vary in their impact on macroeconomic outcomes, and part of this variation may be explained by social context. Informal institutions of cooperation are theorized to improve democratic governance and the effectiveness of public administration (Boix and Posner 1998; Putnam 1993; 2000). It is often argued that this social capital perpetuates a propensity for coordination within communities that shapes the implementation of social policy, but whether this “capital” benefits or impedes the goals of public policy remains a question.

In this article, I bring together theories of social policy and social capital to advance a more contextualized explanation of social policy and economic insecurity. With the U.S. states from 1986 to 2010 as a sample, programmatic government expenditures and a panel measure of social capital are used to test these expectations. Results from the analysis here reject the expectation of social capital as a benevolent force for improved bureaucratic functioning. Rather, these results support an argument for a “dark side” of social capital, with these social contexts reducing the effectiveness of social spending. Social welfare spending in the U.S. goes further–it has a larger impact on economic security– where there is less social capital.

Economic Impacts of Social Spending

Reducing absolute deprivation and poverty are fundamental objectives of social policy. Although spending on welfare programs is shown to reduce poverty rates cross-nationally, the effects depend on how and to whom benefits are targeted (Kim 2001; Korpi and Palme 1998; Moller et al. 2003; Rovny 2014; Scruggs and Allan 2006). This finding holds within the U.S. context (Brady 2009; Rodgers and Payne 2007; Rodgers, Payne, and Chervachidze 2006; Smeeding 2005). Social spending is also valued for its contribution to income equality both in a comparative perspective and in the United States (Hayes and Vidal 2015; Kenworthy and Pontusson 2005), though the effectiveness of these expenditures depend on institutional design (e.g., Korpi and Palme 1998; Lieberman 1998, etc.). Research has underscored how social spending can manage economic outcomes such as poverty and inequality, and these impacts are a function of program generosity and the specificity of their targeting. Economic insecurity as an outcome of social policy, however, has received far less attention in political science.

Adopting the definition of economic insecurity offered by Hacker et al. (2014) as “the degree to which individuals are protected against hardship-causing economic losses,” public expenditures on social welfare programs are key to securing post-tax post-transfer incomes. Net incomes should be less volatile over time where governments put greater effort toward insurance against financial losses from events such as unemployment, retirement, disability, or health—to replace lost wages or personal income with benefits during qualifying life events. Spending on need-based income maintenance programs can also stabilize incomes. However, the effectiveness of social transfer spending, or any policy implementation, is not independent of social norms, expectations, or behaviors. In the following sections, I introduce social capital as a contextual factor that conditions social policy implementation.

Social Capital and Social Welfare

Social capital is significantly linked to many normatively desirable political and economic outcomes.1 There is growing evidence that it matters, but it is not clear how it matters for politics or public policy. Social capital is typically operationalized to include a combination of (1) networks of civic engagement and social interaction, including volunteering; (2) strong adherence to social norms; and (3) generalized trust. Including trust, however, obfuscates the mechanisms through which social capital effects outcomes for two reasons. First, structural components are directly observable through behavior and activities in society. Trust is only indirectly observed, requiring additional theoretical assumptions to connect it to political or economic outcomes. Second, indicators of trust and social networks relate differently with outcomes such as economic growth and investment (Beugelsdijk and Van Schaik 2005a; 2005b; Knack and Keefer 1997), corruption (Paldam and Bjørnskov 2004), better governance (Knack 2002), or life satisfaction (Bjørnskov 2006). This suggests that attitudes like trust and the network components of social capital are distinct theoretical and empirical phenomena, each serving different functions in society (Coleman 1988; Foley and Edwards 1999; van Deth et al. 2016). Therefore, I adopt the definition of social capital offered by Ostrom (1990) as the socially devised rules that determine who is involved in decision making, what options are restricted, how preferences are aggregated, what information is necessary, and how payoffs will be distributed. These informal institutions define the environment in which public policy is designed and implemented by shaping coordination among society members.

The importance of social capital for public policy, or politics more generally, is multidimensional. In summarizing a long tradition of theory in sociology, Portes (1998) identifies the three “resources” of social capital as (1) a source of family support, (2) a source of benefits through extra-familial networks, and (3) a source of social control and increased “rule following.” It is also described as a lubricant of social interaction that reduces transaction costs in coordination or the “glue” that generates excess cooperation (Paldam 2000). On the one hand, this implies an excess propensity for coordination to solve public or collective action problems, to serve a common good. Beyond a direct exchange of material support and information between individuals, these “resources” shape coordination in communities and public organizations, potentially benefiting institutional performance (Boix and Posner 1998; Ostrom 1994; Putnam 1993; 2000). As Putnam (1993, 164) has argued, “the performance of all social institutions, from international credit markets to regional governments to bus queues, depends on how these [coordination] problems are resolved.”

On the other hand, this “glue” could bond some groups more strongly than others, generating motivation and propensity for exclusive, defensive, or outright malevolent civic or social activities (Putzel 1997). A “dark side” of social capital emerges if associational involvement serves exclusionary goals (over-involvement, reproducing social inequality, conformist biases, etc.) or if interactions reinforce uncivil norms (incivility, distrust, old-boys networks, protection of vested interests, closed shops, antisocial attitudes, corruption, etc., for example, van Deth et al. 2016). Indeed, social capital that is maldistributed across groups in society can be exploited by the more advantaged, thereby circumscribing any “benefit” to historically privileged groups (Hero 2003b; Lin 2002; O’Brien 2012; Portes 1998). These outcomes put social capital’s influence on aggregate outcomes such as economic insecurity in a different light.

In the following, I discuss three mechanisms through which social capital can shape economic security, directly or by interacting with public policy implementation: (1) information, (2) direct assistance, and (3) organizational effects. Although a range of civic, economic, or political benefits are often attributed to these mechanisms, theory leads to ambiguous expectations. Social capital might instead cut against economic security and social policy effectiveness.

Informational Effects

First, social capital is argued to reduce information asymmetries in labor markets to directly affect economic outcomes. Unemployment, underemployment, or job change are all important correlates of personal income loss from one year to the next (Hacker et al. 2014; Ziliak, Hardy, and Bollinger 2011). Social networks transfer information about jobs, employers, and potential employees even if they are not deliberately established or maintained for this reason.

The extension of networks beyond familial connections to include infrequent interactions with acquaintances is more likely to provide novel information or new job opportunities (Granovetter 1983; 1995; Mouw 2003). Information about professional expectations and norms of behavior is also communicated through social interactions (Portes 1998). Through social interactions, people can learn about job opportunities, obtain personal references, and also learn the appropriate cultural cues to improve chances of long-term employment success (Schneider 2006). Beyond facilitating job-finding, social capital is shown to promote self-employment and entrepreneurship (Kwon, Heflin, and Ruef 2013), which offer additional opportunities for employment to promote income security. Indeed, evidence suggests that social capital is associated with positive job market outcomes; it helps people find better jobs (Matthews, Pendakur, and Young 2009; Mouw 2003). “Who you know” matters in finding a job, and social capital has the potential to increase who and what you know (Lin 2002).

Critical to the observable association between social capital and economic security is whether these norms and institutions incentivize within- or between-group information sharing. Distinctions are drawn between “bridging” and “bonding” social capital (e.g., Putnam 2000). Institutions fostering coordination across structural divisions (bridging) can diversify and expand networks, providing more interactions with acquaintances and people outside of one’s immediate family or neighborhood, which can benefit job searches (Granovetter 1983; Putnam 2000; Woolcock 2001). Within-group (bonding) coordination will be limited in capacity by the (human or financial capital) resources available within that group, or it may be more exploited for defensive and exclusionary goals.

Direct Assistance Effects

The second mechanism through which social capital shapes economic insecurity is by fostering direct assistance between community members, either interpersonally or by promoting charitable and public organization activity. Social capital institutions that generate and reinforce a common identity can provide individuals with the capital necessary to “get by” and cope in times of need, especially among poorer communities (de Souza Briggs 1998; O’Brien 2012; Warr 2006). First, because social capital can make information about the community and other individuals available (Bowles and Gintis 2002; Jottier and Heyndels 2012), the magnitude of risks and need for assistance can be better communicated. Awareness of problems and mobilization to help in times of need are both facilitated by interaction, networks, and possibly also by social norms. Beyond the effect on job searches, people can use social networks to help with child care, transportation, health care, and emotional/mentoring support, which are services that can make it easier to obtain and maintain employment (Schneider 2006).

Furthermore, by strengthening social ties and norms of cooperation and reciprocity, social capital may facilitate informal risk sharing. In Putnam’s (1993) examination of community governance, he argues that social capital facilitates voluntary rotating credit associations as a form of informal risk-pooling, that is, insurance. Not only is information on community members’ behavior less costly to obtain (Bowles and Gintis 2002; Jottier and Heyndels 2012), but societal norms can also increase the costs of defection and incentivize rule compliance (Boix and Posner 1998; Portes 1998). More formally, rule compliance and reciprocity encourage risk sharing by limiting the problem of moral hazard with the threat of social stigma, reputation, and pressure (Barr 2001). But risk pooling need not take such a formal structure as a credit association. The effect of social capital could be seen, for example, in employers’ increased awareness and sensitivity to the threat and consequences of layoffs. When facing an economic downturn, firms with access to greater social capital can elect not to fire or lay off workers but, instead, reduce wages or hours among all workers, thereby pooling risk (Bowles and Gintis 2002). This kind of risk-sharing arrangement is observed in the plywood industry in the South Eastern United States (Craig et al. 1995).

It is important to note, however, that although social capital may increase some interpersonal assistance, these effects can be limited in their impact on the community as a whole. Across-group social capital can draw on a broader pool of capital resources, potentially increasing the impact of coordination on social and economic outcomes. Research shows that economically disadvantaged communities are characterized by more bonding networks, while in more advantaged communities, the two forms of capital are more likely to overlap (Warr 2006). This suggests that low-income and minority community members benefit from bonding capital providing direct assistance in times of need, while higher-income community members have greater access to the job-finding and assistance benefits of bridging social capital. Furthermore, in less advantaged communities, mutual assistance may actually constrain household financial resources, if family or individual expectations of reciprocity grow excessive, thereby becoming a burden. Poor families might reduce household savings and invest more in nonsharable durable goods in an effort to avoid kinship obligations (di Falco and Bulte 2011). By reducing liquid assets, such investment behaviors can limit households’ ability to buffer unexpected income shocks.

In addition to direct informal security-improving assistance, more organized community efforts are also affected. Social capital is associated with higher levels of charitable giving or support for redistribution (Brooks 2005; Wiepking and Maas 2009; Yamamura 2012). Charitable organizations seeking to provide assistance can benefit from information, greater interest and participation, and charitable donations. For example, organizations such as the United Way make it a priority to help families manage financial risks. In fact, promoting income stability is one of the United Way’s three primary objectives, along with the promotion of education and health. They do this by helping families locate affordable housing, find and maintain employment, and develop spending and savings plans, and they connect families to sources of direct income support and help with the application process. This is closely related to the third and final mechanism through which social capital can shape macroeconomic security.

Organizational Effects

The third mechanism through which social capital can shape economic security is by improving bureaucratic effectiveness (Putnam 1993). Bureaucrats, clients, and stakeholders in social programs rely on coordination for program implementation and service delivery (Boix and Posner 1998; Tavits 2006). Not only could policy and program design be more effective where technocrats, policy makers, network partners, and clientele communicate and coordinate in the initial planning stages, but the implementation of policies is affected by social capital within bureaucratic organizations (Boix and Posner 1998; Schneider 2006). Research in public management has shown that social capital can, in some circumstances, effect better organizational outcomes (Andrews 2011; Compton and Meier 2016; Meier, Favero, and Compton 2016; Sorenson and Rogan 2014). Social welfare programs are particularly susceptible to social capital’s influence because administration of their benefits requires community outreach and coordination across both government agencies and nonprofit nongovernmental organizations (e.g., the United Way). The efforts of public employees to contact and coordinate with clientele, social service organizations, community organizations, provider coalitions, and advocacy coalitions are made more effective by this community context (Kay and Johnston 2007; Schneider 2006).

To put this into more substantive terms, in a context of greater social capital, public employees may be more likely to pick up the phone or walk down the hall to coordinate with employees working in other programs, or have easier access to information about complementary services provided by other organizations. Cooperative norms can generate and spread more sophisticated information about all available sources of public assistance, which public employees (and other organizational partners) can use to better serve clientele. Having better and more frequent connections with community organizations can reduce obstacles in identifying and enrolling eligible clientele for public programs. Administration of benefits and clientele recruitment should be more effective. The same program budget could have a larger impact in the context of greater social capital. However, although individuals might coordinate more readily in the context of social capital, the intention of this civic mobilization may not serve the public good.

Groups in society with both private financial resources and access to social capital might coordinate to shape social policy design or implementation with the goal of excluding or limiting access to lower income and more vulnerable households. Because social capital is not distributed uniformly across all groups in a community (Lin 2000), any effects on public policy outcomes depend on the interests or goals of the groups with stronger norms of coordination. For example, Compton and Meier (2016) and Hawes and Rocha (2011) find that social capital is associated with disparities in public service outcomes for diverse groups, in the context of education. If social capital serves some more than others, or if it provides some groups with the resources to exploit policy or institutions (both formal and informal) for their exclusive benefit, the aggregate effect of a unidimensional measure of social capital on aggregate economic insecurity is theoretically ambiguous.

Social Capital as a Substitute for the State

Beyond conditioning the bureaucratic organization of public programs, it could be argued that social capital influences the design or generosity of social welfare institutions. On the one hand, social capital might increase social solidarity, altruism, and a willingness to contribute to the needs of others, which could rather increase political demand for public social welfare efforts (Scheepers, Grotenhuis, and Gelissen 2002). On the other hand, it might “crowd out” demand for public social welfare efforts through government institutions (Bird 1999). However, evidence exists that the effect on citizens’ willingness to pay for social services is driven by trust rather than the networking and participation components of social capital (Bjørnskov and Sønderskov 2012).

Counter to these expectations, welfare state institutions could themselves influence the creation and maintenance of social capital, by reducing the need for community organization to address common needs (Rothstein 2001). There is suggestive evidence, however, that this effect is only significant in reducing trustworthiness, and not the behavioral and structural components of social capital considered here (van Oorschot and Arts 2005). Lastly, it is possible that welfare state institutions encourage the development of social capital by reducing stigma associated with benefit receipt (Kaariainen and Lehtonen 2006). In sum, there is little empirical consensus on the direction or significance of influence between social capital and generosity of social welfare institutions (Gelissen, van Oorschot, and Finsveen 2012; van Oorschot and Arts 2005). This mixed evidence is explained in part by the varied definitions used across these studies, which has contributed to a general confusion in the literature on social capital (Bjørnskov and Sønderskov 2012). These works also consider different aspects of the welfare state or social insurance institutions, leaving unclear which programs are more or less related to social capital.

A Theory of Social Capital as a Constraint

In bringing together the literatures on social policy and social capital, I have identified a series of mechanisms through which these two factors could affect macroeconomic outcomes such as economic insecurity. Because spending on social security and assistance programs should have a direct impact on household post-tax post-transfer incomes, these categories of public spending should reduce net income volatility. However, because policy implementation requires interaction with community members and stakeholders, the effectiveness of social welfare spending depends on social context.

An important influence on economic security comes from the norms and rules shaping coordination within society– that is, social capital. Following extant theory of social capital as a benevolent influence, these informal institutions should be associated with greater economic insecurity. By shaping norms and information in labor markets, by facilitating direct assistance between people or by community nongovernmental charitable organizations, and by advantageously interacting with social policy implementation, social capital should promote greater economic security. If this explanation were supported, there should be less economic insecurity where social capital is greater.

Hypothesis 1a (H1a): Economic insecurity will be less in the context of greater social capital.

However, as discussed earlier, there is a rival theory of social capital’s influence on aggregate economic outcomes. If these informal institutions fail to bridge exchange across groups to serve vulnerable households, if they are exploited for private or malevolent purposes by privileged groups, or if they constrain households in saving for unexpected income shocks, social capital will be associated with greater economic insecurity.

Hypothesis 1b (H1b): Economic insecurity will be greater in the context of greater social capital.

Social capital can further shape the experience of economic insecurity by interacting with public policy implementation. This implies that the effectiveness of social spending is not independent of social capital context, and that there exists an interaction between societal context and government efforts to provide social security. This introduces my second set of hypotheses, that the effectiveness of social spending in mitigating economic insecurity is conditional on social capital.

One interpretation of social capital anticipates a productive influence on public service provision, with these impacts most evident in social welfare programs (Schneider 2006). This expectation of social capital as a benevolent force in public policy implementation would be supported if both programmatic spending and social capital promoted economic insecurity, and if the influence of one benefited the effect of the other—in other words, if the two worked better together. This generates the next hypothesis.

Hypothesis 2a (H2a): Social capital reduces aggregate economic insecurity, and the effect of social spending is greater in the context of greater social capital.

Alternatively, a “dark side” theory would be supported if social capital adversely affected economic insecurity. If the dark side manifests both directly by increasing economic insecurity and by adversely shaping policy implementation, the effect of programmatic spending would be lessened where social capital is greater. This provides my next hypothesis.

Hypothesis 2b (H2b): Social capital increases aggregate economic insecurity, and the effect of social spending is weaker in the context of greater social capital.

However, greater investment in social program capacity might provide the resources necessary to overcome this “dark side” influence, making the effect of social capital less where spending is greater. With this expectation, spending on social welfare can counterbalance social capital, providing my last hypothesis.

Hypothesis 2c (H2c): Social capital increases aggregate economic insecurity, and this effect is weaker in the context of greater social spending.

Either Hypothesis 2b or 2c would support “darker” inferences about the association between social capital and economic security, with the critical difference being the capacity of social policy programs to overcome this effect (H2c) or not (H2b). Drawing on extant research has produced contradictory expectations, driven by different interpretations or arguments about social capital and its relationship with economic outcomes and public policy implementation. By testing these rival expectations (i.e., hypotheses in opposing directions), I aim to bring clarity to a literature that is, to date, ambiguous in answering these questions. In the following sections, I introduce my research design and measurement of these concepts, before examining the evidence for these expectations.

Economic Insecurity in the U.S. States

To test these theoretical expectations, I turn to the U.S. states from 1987 to 2010. With this comparative study of subnational governments, the influence of local social context on economic outcomes can be isolated because many formal policy institutions are uniform across the sample. Also, a reliance on cross-sectional empirical analyses has led to ambiguous findings on social capital more generally (Keele 2005). In this study, using cross-sectional time-series data allows for dynamic inferences. In doing so, I continue the study of a panel measure of social capital that has become increasingly common in this literature (Hawes, Rocha, and Meier 2013), allowing valid comparison and cumulation of findings on social capital, policy, and politics. Adapting the above theoretical expectations to the United States, however, requires recognition of the unique political background in the American states.

State-level governments in the United States have sufficient autonomy over government spending and tax policies to substantially influence local economic conditions (e.g., Prillaman and Meier 2014). Playing an important role in economic outcomes, social welfare policies in the United States are administered by local, state, and federal programs. Policies providing income support; pensions (Social Security); unemployment insurance (UI); disability support; Veterans’ assistance; public health care for low-income households, children, and the elderly; and so on, are each administered by different networks of public agencies, nonprofit organizations, and public-private collaborations. The design, generosity, eligibility requirements, and administrative procedures of many of these programs vary substantially across state governments. Being decentralized to different degrees, these programs, even if federally regulated and funded, are subject to local social and political influences.

Understanding the influence of local influences is important because the politics of social welfare policy and administration in the U.S. states are indelibly entwined with moral values, race, and institutional devolution (Barrilleaux and Bernick 2003; Hero 2003a; Kim and Fording 2010; Lieberman 1998; Soss, Fording, and Schram 2008; Soss et al. 2001). The origins of social policy in the United States trace back to the post–Civil War era, when military pensions were extended to include a cross-section of veterans and their surviving spouses (Skocpol 1992). Ever since, the evolution of social policy design, administration, and popular support in the United States has been expanded and structured to privilege “deserving” groups (Barrilleaux and Bernick 2003; Skocpol 1995), effectively disadvantaging nonwhite minorities and historically marginalized groups (Lieberman and Lapinski 2001; Soss, Fording, and Schram 2008; Soss et al. 2001). In this specific ideological and institutional context, social capital resources are likely to mobilize information, direct assistance, or organizational effects for the benefit of groups seen as more deserving or less at fault for their economic hardship. In interacting with social policy implementation, then, social capital’s mitigation or magnification of government spending in affecting economic security might differ across program types, which target different recipient groups. Also, because authority in designing and administering social programs is decentralized to different degrees across programs (or devolved, see Kim and Fording 2010), some programs may be more or less sensitive to local social influences. Medicaid, standard UI, or in-kind assistance to families and children (WIC, TANF, etc.), for example, are highly decentralized in comparison with Medicare, assistance to veterans, or Social Security benefits. To shed light on these characteristics, it is important to disaggregate social welfare spending by program, which I explain in the Social Welfare Measures section below.

An Empirical Model of Economic Insecurity

The advantage of testing hypotheses with panel data is the opportunity to model a dynamic process, because macroeconomic outcomes such as economic insecurity are likely determined by both short- and long-term processes. This process is characterized as a function (equation 1) of a lagged dependent variable term , a vector of independent variables , and an error term , that is,

where j = 1…, N and t = 1,…,T.

Estimating a model of economic insecurity across space and time, however, invites biased inferences from autocorrelation and unit heterogeneity. By construction, the inclusion of a lagged dependent variable in such a model violates the strict exogeneity assumption necessary for unbiased estimation by standard estimators. To address these concerns, results reported here are obtained using the Arellano-Bond linear dynamic panel estimator (Arellano and Bond 1991).2 All results reported in Tables 1 and 2 below are estimated by this method.3 Now, I turn to a discussion of measurement.

Table 1.

GMM Models of Economic Insecurity, 1986–2010.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| ESIt–1 | 0.69*** | 0.68*** | 0.69*** | 0.71*** | 0.69*** | 0.72*** |

| (0.021) | (0.022) | (0.022) | (0.021) | (0.021) | (0.021) | |

| Social Capitalt–1 | 0.31*** | 0.28*** | 0.32*** | 0.35*** | 0.30*** | 0.32*** |

| (0.057) | (0.057) | (0.057) | (0.056) | (0.057) | (0.056) | |

| All Welfare p.c.t–1 | −0.51*** | |||||

| (0.118) | ||||||

| Income Maintenancet–1 | −0.95 | −1.93*** | ||||

| (0.622) | (0.579) | |||||

| Unemployment Insurancet–1 | 1.49** | 1.02 | ||||

| (0.662) | (0.661) | |||||

| Public Medical Care p.c.t–1 | −1.10*** | −1.18*** | ||||

| (0.215) | (0.200) | |||||

| Total Government Spending p.c.t–1 | 0.99*** | |||||

| (0.218) | ||||||

| Union Strengtht–1 | −0.06*** | −0.06*** | −0.05*** | −0.06*** | −0.06*** | −0.06*** |

| (0.020) | (0.020) | (0.020) | (0.020) | (0.020) | (0.020) | |

| Government Liberalismt–1 | −0.09 | −0.16 | −0.16 | −0.19 | −0.11 | −0.23 |

| (0.140) | (0.141) | (0.140) | (0.142) | (0.140) | (0.141) | |

| Individual Income Tax p.c.t–1 | 0.60 | 0.61 | 0.62* | 0.75** | 0.63* | 0.58 |

| (0.372) | (0.372) | (0.375) | (0.374) | (0.372) | (0.375) | |

| Corporate Income Tax p.c.t–1 | 2.66** | 2.85*** | 2.81*** | 2.01* | 2.56** | 2.28** |

| (1.051) | (1.064) | (1.072) | (1.048) | (1.047) | (1.048) | |

| Energy Pricet–1 | 0.08*** | 0.10*** | 0.06*** | 0.06*** | 0.09*** | 0.06*** |

| (0.012) | (0.013) | (0.011) | (0.012) | (0.012) | (0.011) | |

| Poverty Ratet | 0.03* | 0.03** | 0.03** | 0.03** | 0.03** | 0.03** |

| (0.014) | (0.014) | (0.014) | (0.014) | (0.014) | (0.014) | |

| Post Reformt | −0.27*** | −0.30*** | −0.30*** | −0.24*** | −0.27*** | −0.28*** |

| (0.085) | (0.087) | (0.087) | (0.086) | (0.086) | (0.086) | |

| Devolvedt | −0.23 | −0.20 | −0.24 | −0.32 | −0.22 | −0.21 |

| (0.212) | (0.212) | (0.214) | (0.213) | (0.212) | (0.214) | |

| Unemploymentt–1 | −0.04 | −0.13*** | −0.07*** | −0.15*** | −0.08*** | −0.11*** |

| (0.028) | (0.038) | (0.025) | (0.038) | (0.024) | (0.023) | |

| Δ Unemploymentt | 0.13*** | 0.07** | 0.11*** | 0.11*** | 0.09*** | 0.12*** |

| (0.027) | (0.029) | (0.028) | (0.028) | (0.028) | (0.028) | |

| Total Government Spending, logt | −0.25 | 0.18 | −0.95*** | −1.66*** | 0.19 | −2.74*** |

| (0.415) | (0.422) | (0.343) | (0.305) | (0.415) | (0.394) | |

| GSP Growtht | −1.72** | −1.57* | −2.24*** | −2.54*** | −1.49* | −3.03*** |

| (0.823) | (0.821) | (0.813) | (0.812) | (0.824) | (0.818) | |

| Real GSP, logt | 3.67*** | 3.17*** | 4.00*** | 4.34*** | 3.30*** | 4.65*** |

| (0.524) | (0.532) | (0.513) | (0.502) | (0.532) | (0.506) | |

| Diversityt | −0.65 | −0.62 | 0.13 | 0.12 | −0.70 | 1.24 |

| (0.817) | (0.811) | (0.803) | (0.804) | (0.812) | (0.839) | |

| Constant | −82.42*** | −76.19*** | −80.67*** | −78.51*** | −80.00*** | −72.31*** |

| (10.053) | (10.155) | (10.102) | (10.236) | (10.066) | (10.259) | |

| N | 1,104 | 1,104 | 1,104 | 1,104 | 1,104 | 1,104 |

Note. Dependent variable is Economic Insecurity Index, the percentage of state population with a net household income loss of at least 25% relative to the previous year. Coefficients obtained using the Arellano-Bond generalized method of moments estimator. All social spending variables (all transfers, income maintenance, unemployment insurance, medical care, and total government expenditure) are real government spending per capita in each category, in thousands of 2007 USD. Per capita Income and Corporate Income Tax receipts, Energy Price, Log Total Government Spending, and logged GSP are also inflation adjusted and measured in 2007 USD. Sample includes all 48 contiguous U.S. states from 1986 to 2010. GMM = generalized method of moments; ESI = Economic Insecurity Index; p.c. = per capita; GSP = gross state product.

*p < .10. **p < .05. ***p < .01 for a two tailed hypothesis test.

Table 2.

Interactive GMM Models of Economic Insecurity, 1986–2010.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| ESIt–1 | 0.69*** | 0.68*** | 0.69*** | 0.71*** | 0.69*** | 0.72*** |

| (0.021) | (0.022) | (0.022) | (0.021) | (0.021) | (0.021) | |

| Social Capitalt–1 | 0.51*** | 0.56*** | 0.56*** | 0.36*** | 0.40*** | 0.80*** |

| (0.138) | (0.120) | (0.119) | (0.065) | (0.101) | (0.215) | |

| All Welfare p.c.t–1 | −0.49*** | |||||

| (0.118) | ||||||

| Welfare × Social Capitalt–1 | −0.05 | |||||

| (0.036) | ||||||

| Income Maintenancet–1 | −1.24** | −2.00*** | ||||

| (0.629) | (0.579) | |||||

| Income Maintenance × Social Capitalt–1 | −1.33** | −0.65** | ||||

| (0.537) | (0.280) | |||||

| Unemployment Insurancet–1 | 1.42** | 1.16 | ||||

| (0.720) | (0.725) | |||||

| Unemployment Insurance × Social Capitalt–1 | 0.63 | −0.18 | ||||

| (0.426) | (0.388) | |||||

| Public Medical Care p.c.t–1 | −1.12*** | −1.15*** | ||||

| (0.217) | (0.202) | |||||

| Public Medical Care × Social Capitalt–1 | 0.12 | −0.08 | ||||

| (0.114) | (0.063) | |||||

| Total Government Spending p.c.t–1 | 1.05*** | |||||

| (0.219) | ||||||

| Total Spending × Social Capitalt–1 | −0.17** | |||||

| (0.073) | ||||||

| Union Strengtht–1 | −0.05*** | −0.06*** | −0.05** | −0.06*** | −0.06*** | −0.05*** |

| (0.020) | (0.020) | (0.020) | (0.020) | (0.020) | (0.020) | |

| Government Liberalismt–1 | −0.07 | −0.10 | −0.11 | −0.19 | −0.09 | −0.20 |

| (0.141) | (0.142) | (0.142) | (0.142) | (0.141) | (0.142) | |

| Individual Income Tax p.c.t–1 | 0.63* | 0.62* | 0.65* | 0.76** | 0.66* | 0.64* |

| (0.373) | (0.372) | (0.374) | (0.374) | (0.373) | (0.376) | |

| Corporate Income Tax p.c.t–1 | 2.75*** | 3.14*** | 3.02*** | 2.01* | 2.64** | 2.34** |

| (1.054) | (1.067) | (1.075) | (1.049) | (1.049) | (1.050) | |

| Energy Pricet–1 | 0.07*** | 0.09*** | 0.06*** | 0.07*** | 0.09*** | 0.05*** |

| (0.012) | (0.013) | (0.011) | (0.012) | (0.012) | (0.011) | |

| Poverty Ratet | 0.03** | 0.04*** | 0.03** | 0.03* | 0.03** | 0.03** |

| (0.014) | (0.014) | (0.014) | (0.014) | (0.014) | (0.014) | |

| Post Reformt | −0.25*** | −0.27*** | −0.27*** | −0.24*** | −0.26*** | −0.26*** |

| (0.086) | (0.088) | (0.088) | (0.086) | (0.087) | (0.087) | |

| Devolvedt | −0.30 | −0.34 | −0.35 | −0.31 | −0.28 | −0.28 |

| (0.217) | (0.219) | (0.218) | (0.213) | (0.218) | (0.216) | |

| Unemploymentt | −0.04 | −0.12*** | −0.07*** | −0.16*** | −0.08*** | −0.10*** |

| (0.028) | (0.039) | (0.025) | (0.038) | (0.024) | (0.023) | |

| Δ Unemploymentt | 0.13*** | 0.08*** | 0.11*** | 0.11*** | 0.09*** | 0.12*** |

| (0.028) | (0.029) | (0.028) | (0.029) | (0.028) | (0.028) | |

| Total Government Spending logt | −0.30 | 0.28 | −0.93*** | −1.68*** | 0.15 | −2.76*** |

| (0.416) | (0.430) | (0.342) | (0.307) | (0.416) | (0.395) | |

| GSP Growtht | −1.72** | −1.37* | −2.20*** | −2.58*** | −1.50* | −2.97*** |

| (0.824) | (0.828) | (0.812) | (0.817) | (0.824) | (0.820) | |

| Real GSP, logt | 3.63*** | 3.11*** | 3.96*** | 4.35*** | 3.26*** | 4.52*** |

| (0.525) | (0.535) | (0.513) | (0.503) | (0.533) | (0.509) | |

| Diversityt | −0.18 | −0.09 | 0.73 | 0.15 | −0.30 | 1.61* |

| (0.874) | (0.872) | (0.842) | (0.807) | (0.873) | (0.856) | |

| Constant | −80.76*** | −76.42*** | −80.17*** | −78.45*** | −78.71*** | −69.14*** |

| (10.117) | (10.260) | (10.096) | (10.240) | (10.122) | (10.368) | |

| N | 1,104 | 1,104 | 1,104 | 1,104 | 1,104 | 1,104 |

Note. Dependent variable is Economic Insecurity Index, the percentage of state population with a net household income loss of at least 25% relative to the previous year. Coefficients obtained using the Arellano-Bond generalized method of moments estimator. All social spending variables (all transfers, income maintenance, unemployment insurance, medical care, and total government expenditure) are real government spending per capita in each category, in thousands of 2007 USD. Per capita Income and Corporate Income Tax receipts, Energy Price, Log Total Government Spending, and logged GSP are also inflation adjusted and measured in 2007 USD. Sample includes all 48 contiguous U.S. states from 1986 to 2010. GMM = generalized method of moments; ESI = Economic Insecurity Index; p.c. = per capita; GSP = gross state product.

*p < .10. **p < .05. ***p < .01 for a two tailed hypothesis test.

Economic Insecurity Index (ESI)

Offering a new measure of economic insecurity, Hacker et al. (2014) generated estimates of aggregate income volatility using Current Population Survey (CPS) panel responses from the 1980s through 2010, for each of the 48 contiguous U.S. states. This ESI represents the percentage of state households experiencing a post-tax post-transfer income loss of at least 25% in the previous 12 months. Net household income loss is estimated by summing all household changes in income, out-of-pocket medical spending, and the absence of a sufficient household safety-net to buffer the loss. Those households with sufficient liquid savings to compensate and buffer against negative income shocks are not included in this percentage. Also, those individuals entering into retirement are not included in the insecure population. This measure is scaled to range from 0 to 100, and varies between 10.25 (Minnesota in 1997) and 24.54 (Mississippi in 2010) within this sample with an unweighted mean of 17.12.4

Social Capital

Because the conceptualization of social capital employed here is limited to the associational and civic network participation components (the behavioral aspects), the measure estimated by Hawes, Rocha, and Meier (2013) is a valid operationalization. This panel measure incorporates the three components of social capital that closely relate to the theoretical concept: community organizational life, engagement in public affairs, and community volunteerism.5

A possibility to consider could be the potential impact of economic insecurity on social capital or on social spending. Increased household financial volatility could plausibly encourage or discourage civic or voluntary participation, and could shape social policy institutions in the long run. Although the GMM estimator used here exploits within-sample instruments to produce consistent estimates in the case of simultaneous equations, I also lag all measures of social capital and social policy by one year to ensure exogeneity (Greene 2012). Furthermore, a Granger causality test indicates Granger-causation of social capital and all social policies, respectively, on economic insecurity, but does not indicate the reverse (Geweke 1982; Lopez and Weber 2017).6 Empirically, there is no evidence for a significant feedback effect of economic insecurity on social capital or social welfare in this panel.

Social Welfare Measures

To represent the social welfare states of the United States, I examine four categories of social spending. First, all social transfers paid per capita (p.c.) in thousands of real dollars is the sum of all direct transfers paid to individuals in a state through any government program (federal, state, or local), including any payment of retirement or disability insurance, medical benefits, income maintenance benefits, UI, veterans benefits, and education and training assistance. I then extract three components from this aggregate measure to include as separate independent variables: Unemployment Insurance claims payments; Public Medical Care expenditures including Medicaid, Medicare, and all other public assistance for medical care; and the cash value of all Income Maintenance programs, including in-kind or cash transfers.7 Each of these three subcategories are mutually exclusive, and their sum constitutes only a portion of the all social transfers total. These three categories are selected for closer inspection for two reasons. First, they are the public programs most closely associated with insurance against income volatility. Second, these are also generally more decentralized programs than other social transfer programs, which include retirement and disability insurance, veterans benefits, education and training assistance, or federal relief from natural disasters, among others. Spending and administration of three categories should, thus, be most significantly linked to macroeconomic insecurity and should be most susceptible to local influence than more centralized programs. All spending variables are measured in thousands of real 2007 dollars per capita. Each of these programs should have a direct impact on economic insecurity by providing a safety net against the financial strain introduced by unemployment or other financial shocks to those with insufficient income or wealth to buffer the impact.

Additional Factors in Insecurity

Economic insecurity is driven by multiple factors in addition to social capital and state social welfare expenditures. My model of insecurity, therefore, includes additional controls. First, both the unemployment rate and the change in unemployment in a state are included to account for the potential financial difficulties imposed by unanticipated job loss. Next, the poverty rate is included with the expectation that a population of lower income households will be more susceptible to negative income shocks without sufficient savings to buffer the loss. To further account for factors with a direct effect on aggregate post-tax post-transfer incomes, measures of both per capita real individual income tax receipts and real per capita corporate income tax receipts are included.8

State economic conditions are further accounted for by including a measure of gross state product growth (GSP Growth) and energy price in real dollars per million Btu.9 States of larger size might be more or less subject to income volatility, so the natural log of real gross state product (Real GSP) and the natural log of real total government spending are included to account for state government size. More liberal and conservative governments may differ in in their administration or policy making for social welfare, so a measure of government liberalism is included (Berry et al. 2010). Because labor unions offer stronger advocacy for some policies related to labor or economic security, or institutions to assist their implementation, I include a measure of labor union strength (Hirsch, MacPherson, and Vroman 2001). Also, I include a dichotomous indicator equal to one for the post-welfare reform era (post-1996), Post Reform, and an indicator for the eight states that pursued the most second-order devolution of administration in the post-reform era, Devolved (Kim and Fording 2010).10 Last, an index of racial diversity is included as a proxy measure of heterogeneity within a stateBecause the dependent variable represents the aggregate of individual household financial circumstances relative to the previous 12 months, the measures of social capital, social spending, union strength, government liberalism, and the unemployment rate are lagged by one year. These measures should only influence economic insecurity to the extent that they precede the incidence of loss, and may themselves be influenced by the experience of insecurity. Thus, to respect the causal order and to address the concern of endogeneity, these measures are lagged.

Results

Results from a linear dynamic model of economic insecurity are reported in Table 1. In Model 1 of this table, the only measure of social policy included is the sum of all social welfare spending, per capita in real terms. Moving across the models in this table, three categories of social welfare spending are modeled together in Model 2, and independently in Models 3 through 5. The last column in this table includes the total of all government spending. A few findings stand out, which are supported across each model specification.

First, beginning with the first column of Table 1, the estimated effect of all combined social spending is negative. Unsurprisingly, states investing more resources in social programs subsequently experience less economic insecurity. However, in column 2, social spending is disaggregated in the regression model and results suggest not all social spending is effective in promoting net income stability. Income maintenance and public health care reduce economic insecurity, but UI spending is associated with increased income volatility. In comparison with income maintenance or public health spending, which directly or indirectly promote investment in human capital to prevent income loss, UI is paid only after the experience of a loss in wages.

To put these results in more substantive terms, consider the overall impact of social spending categories on insecurity as estimated in Model 2 of Table 1. Because a lagged dependent variable is included in these models, calculating the overall long-term effect of a variable requires an additional step.11 One hundred inflation-adjusted dollars per capita spent on income maintenance benefits is estimated to reduce economic insecurity by a total of 3 points in the long run, though this long-run effect is not significant at the 95% confidence level for a two-tailed hypothesis test. The estimated long-run effects of an equivalent amount spent on public medical care benefits are 4.7 and −3.4 points, respectively, each of which are significant. More concretely, in 2006, Maine spent about the national average on need-based food or cash benefits, approximately $470, per capita. If spending on these income maintenance programs were doubled, this model estimates that economic insecurity would be decreased by an additional 1.5 points, ceteris paribus. Similarly, if the average UI expenditure ($60, about what Idaho spent) or public healthcare spending ($210, about what Missouri spent) were doubled in 2006, economic insecurity would be increased by 0.3 and decreased by −7.2 points, respectively. Considering that the economic insecurity measure has an in-sample range of about 10% to 24.5%, a difference of even 1 point constitutes a substantial impact in real terms. These results offer clear evidence that spending on health care and need-based transfers reduces aggregate economic insecurity, but some programs are more effective than others in this aim.

Considering now the relationship between social capital and economic insecurity, the first set of hypotheses are tested in Table 1. The results from this table offer clear support for H1b, the expectation that social capital is associated with greater insecurity. Social capital coefficients are significant and consistently positive across each model. A one standard deviation increase in social capital is estimated to produce an immediate (short-run) increase in economic insecurity between 0.28 and 0.35 points, depending on the specification in Table 1. The total long-run effect estimates range from 0.83 and 1.12 points. This is evidence in favor of the “dark side” theory of social capital, that economic insecurity is greater in the context of greater voluntary and civic participation.

The models in Table 1 also support conventional expectations about the effects of included control variables. Stronger union representation and more liberal state governments are associated with reduced insecurity, though the effect of government liberalism is not significant. Individual taxes have no significant or substantive effect, but greater per capita corporate income tax receipts are significantly associated with income volatility. Poverty, increasing unemployment, and the real size of a state economy are all positively and significantly associated with greater insecurity.

I turn now to Table 2 to test the second set of hypotheses. The organization of this table is similar to Table 1, except that multiplicative interaction terms between each spending category and social capital are included to test H2a to H2c as conditional expectations. A cursory look at the coefficients in this table offers some evidence that each spending measure is significant and negative, again, with the exception of UI. The effects of social capital remain consistent and positive across these interactive models. Also, the estimated control variable coefficients remain consistent and as expected in this table. The inclusion of interaction terms complicates interpretation, so to evaluate the second set of hypotheses, I discuss graphical representations of these results for more valid inference (Brambor, Clark, and Golder 2006).

In Figures 1 to 3, levels of predicted economic insecurity are shown along the vertical axes. Each horizontal axis represents the full in-sample range of either the social capital measure or a social spending measure, as indicated. The two pairs of lines in each figure, either solid or dashed, represent 95% confidence intervals for predictions of economic insecurity under defined conditions based on a two-tailed hypothesis test. These scenarios are distinguished by holding either a spending level or social capital variable constant at its 10th or 90th sample percentile, as indicated in each legend.12 In these figures, statistical significance can be interpreted in two ways. First, the significance of the horizontal axis variable can be inferred if, for any value of the vertical axis, the confidence intervals for a single conditional scenario do not overlap. In other words, the axis variable is significant if the confidence interval for a conditional scenario increases or decreases with the horizontal axis so as to have no overlapping vertical axis values. Second, significance of the variable distinguishing each pair of lines is inferred if two separate sets of confidence intervals do not intersect. In other words, for any value of the horizontal axis, if the two sets of confidence intervals do not overlap, the variable labeled in the legend is interpreted as having a significant effect, at that specific value of the horizontal axis.

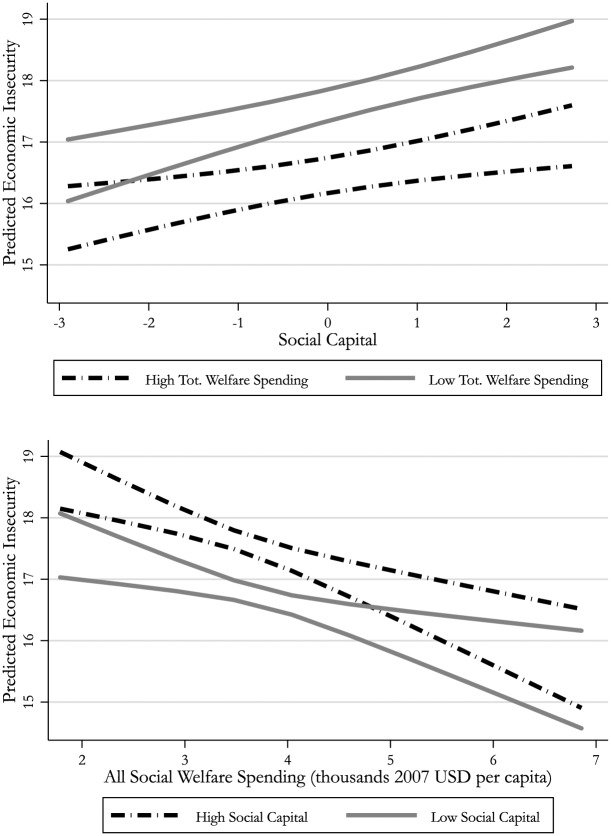

Figure 1.

Short-run effects of social capital and all social transfer payments.

Note. Each graph reports 95% confidence intervals for predicted economic insecurity as the percentage of state population with a net household income loss of at least 25% relative to the previous year. Marginal estimates are obtained using coefficients from Model 1 in Table 2 while holding all variables not labeled in the figure constant at their sample mean, including the lagged dependent variable term. “High” and “Low” values are defined by the 10th and 90th in-sample percentile, respectively, of the indicated variable.

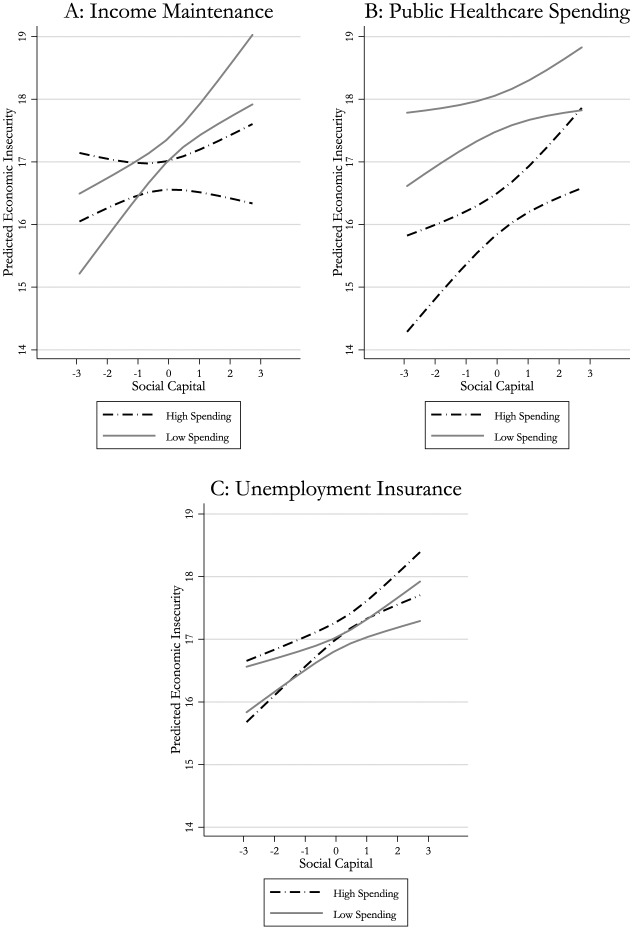

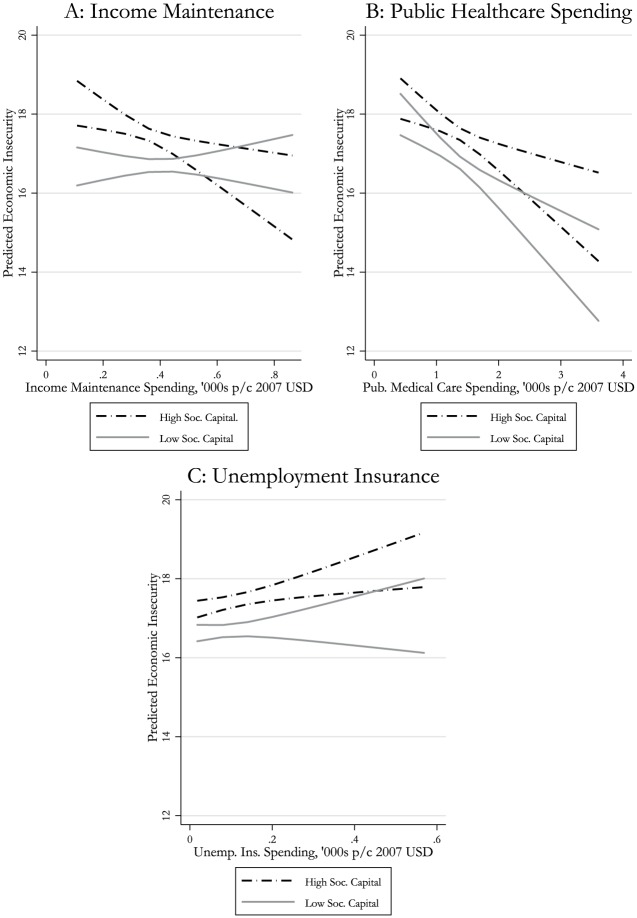

Figure 3.

Short-run effects of social capital.

Note. Each graph reports 95% confidence intervals for predicted economic insecurity as the percentage of state population with a net household income loss of at least 25% relative to the previous year. Marginal estimates are obtained using coefficients from Model 2 in Table 2 while holding other variables not specifically labeled in each subfigure constant at their sample mean, including the lagged dependent variable term. “High” and “Low” values are defined by the 10th and 90th in-sample percentiles, respectively, of each spending measure.

Looking first at the top half of Figure 1, which reflects the estimates from Model 1 in Table 2, it is evident that movement right along the horizontal axis representing an increase in social capital is associated with greater insecurity, and this effect is significant in both high- and low-spending scenarios. This graphical evidence reinforces the support from Table 1 in favor of Hypothesis 1b, that social capital is associated with greater economic insecurity. Now looking at the bottom half of Figure 2, evidence for the second set of hypotheses can be evaluated. First, the downward sloping lines show that increased total social spending is associated with less economic insecurity, in both the high and low social capital scenarios. At lower levels of spending, predicted insecurity in the high social capital scenario is significantly greater than that in the lower social capital scenario, meaning that social capital is associated with a significant increase in insecurity. However, at higher levels of spending, above roughly $5,000 per capita, this effect becomes insignificant as the confidence intervals across the two scenarios overlap. Putting these findings together, the evidence suggests that social spending works—it enhances aggregate economic security—and further, spending also mitigates the detrimental impact of social capital.

Figure 2.

Short-run effects of social transfers, by category.

Note. Each graph reports 95% confidence intervals for predicted economic insecurity as the percentage of state population with a net household income loss of at least 25% relative to the previous year. Marginal estimates are obtained using coefficients from Model 2 in Table 2 while holding other variables not specifically labeled in each subfigure constant at their sample mean, including the lagged dependent variable term. “High” and “Low” social capital values are defined by the 10th and 90th in-sample percentile, respectively.

To examine these effects more closely, in Figures 2 and 3 estimated conditional predictions from Model 2 in Table 2 are shown. These figures show the effect of social capital’s interaction with spending to differ across policy programs, though all suggest that social capital becomes insignificant at high levels of spending. First, in the leftmost figure, spending on income maintenance programs reduces insecurity, and also attenuates the difference between predicted insecurity in the high and low social capital scenarios. A similar pattern of effects is seen in health care spending. Lastly, in the rightmost figure, the predictions suggest that UI spending is only associated with greater insecurity in more social-capital-dense areas, and its effect is null where social capital is lower. But again, the effect of social capital becomes insignificant where spending is very high. One implication is drawn from all subfigures in Figure 2: greater social spending mitigates the detrimental effect of social capital, and this holds for all three spending categories.

Figure 3 represents the same model as Figure 2, but instead with social capital represented by the horizontal axis. Predictions shown in the leftmost figure reflecting the interaction between income maintenance and social capital suggest that social capital has an effect on economic insecurity only where spending is low. Put another way, greater spending on income maintenance appears to mitigate the effect of social capital. In the middle figure, representing the interaction between public health spending and social capital, the predictions suggest that social capital is associated with an increase in insecurity regardless of spending levels. Last, from the right most figure representing the interaction between UI spending and social capital, it appears that spending has almost no significant effect across the range of social capital (the confidence intervals on the two scenarios overlap almost the entire range).

To summarize these findings, social capital interacts with spending on social policy in a significant way to affect insecurity. Where governments spend more on income maintenance, the detrimental effect of social capital on economic insecurity is mitigated. This could suggest that greater spending counterbalances the influence of social capital, in support of Hypothesis 2c. Greater spending on public medical care has a strong and significant beneficial impact on economic security, with the effect of spending evidently greater if social capital is less. Somewhat differently, this suggests that health spending is not effective in overcoming the negative influence of social capital, which is support for Hypothesis 2b. Lastly, UI spending is positively associated with economic insecurity, but this effect is only significant in higher social capital areas, and the positive effect is not significant in lower social capital areas. This supports Hypothesis 2c, that the impact of social capital is less where programmatic spending is greater. Referring again to Figure 1, total social welfare spending fosters economic security, and this effect is greater in high social capital areas and this is not because social capital is advantaging program implementation.These results point to support for Hypothesis 2c: greater social welfare spending mitigates the detrimental impact of social capital on aggregate economic insecurity.

Findings and Conclusion

As should be expected, increased spending on social welfare programs has the effect of reducing macroeconomic income volatility. Where governments expend more resources on programs to assist or insure citizens from poverty or income shocks, households experience greater economic security, in aggregate. These results suggest that some programs have a larger dollar-for-dollar impact on security, with UI having least benefit and spending on health care having the largest impact on macroeconomic insecurity.

However, contrary to some expectations, economic insecurity is greater in the context of social capital. The anticipated benefits of informal cooperative institutions for the administration of public policy and community responsiveness as articulated by scholars including Putnam (2000) or Boix and Posner (1998) are not seen in these results. Instead, this evidence favors an explanation of social networks, interactions, and informal norms as potential sources of detrimental macroeconomic outcomes, supporting the arguments of critics such as Putzel (1997) and Hero (2003b). Evidence for an adverse interaction between social capital and welfare program implementation is less clear. When measured as the sum of all programmatic expenditures, social welfare spending evidently counterbalances this negative influence—total public spending on social programs mitigates the adverse effect of social capital. When programs are disaggregated, this effect is clearest in income maintenance programs.

Empirical support for Hypothesis 2c suggests that although social capital is either unavailable to vulnerable households or is coopted by groups with exclusionary goals, greater capacity within social welfare programs can mitigate this effect. A dark side of social capital is evident—it is adversely associated with economic insecurity—but some public programs overcome this influence. As measured by spendinglevels, social welfare programs can counterbalance the influence of social capital. This points to a important role for management of social policy programs to interact with communities to overcome potential divisions or disadvantages reflected in social capital institutions.

It is important to again note the unique political and historical context of social welfare programs in the U.S. states to understand the interaction between social capital and administration. Given scarcity of time and material resources, the community organization, direct assistance, or civic mobilization fostered by social capital may work in greater cooperation with some programs than others, depending on perceptions of their respective target populations. Some social insurance programs such as Social Security or Medicare address universal life risks faced by a broad cross-section of the American population, whereas need-based assistance programs for the poor or unemployment-based programs are more narrowly targeted. Barrilleaux and Bernick (2003) find political competition to be associated with an increase in state efforts to help the “deserving” poor and a decline in efforts to help the “undeserving” poor through social programs. Given the political environment surrounding welfare in the United States, efforts to manage or mitigate the impact of social capital on public administration may find it easier to counterbalance these influences in programs serving the broadest populations.

Overall, these results point to a “dark side” effect of social capital. If social capital does not connect households in need of support with the resources necessary to forestall economic vulnerability, it is unlikely to generate greater economic stability through the mechanisms elaborated on by scholars such as Schneider (2006). Diversity may be an important factor in explaining this finding. State politics often reinforce existing inequities along class or racial lines in the United States by maintaining historically determined social divisions and institutionalized biases (Hero 1998; Lieberman 1998). If social capital is constrained within disadvantaged groups or is concentrated among groups with sufficient private resources to buffer against insecurity, it will not be effectively utilized to improve aggregate economic security. Instead, it may reinforce existing divisions in society that disadvantage some groups in public policy outcomes, namely, minority and low-income groups.13

Finally, an important element of social capital theory involves the orientation of networks and norms, whether this capital is “bonding” or “bridging.” Either form could contribute to economic security by providing labor market information, or direct informal or nonstate assistance, or by interacting with public policy implementation. Theory suggests, however, that bonding capital is ill-equipped to serve low-income or economically vulnerable households, because within-group resources are limited. Also, bonding capital that is concentrated within more advantaged groups in society may be exploited to shape policy for their own exclusive benefit, which could have direct or indirect negative impacts on other groups. Unfortunately, the measure of social capital used here cannot distinguish between these two types. The findings from the analysis here can, however, be used to inform future theory building and research design. The observed negative relationship with economic insecurity might indicate that social capital within a community creates more bonds than bridges, and is thereby limited in capacity to provide resources for economic insecurity. Or, this negative association might indicate that social capital is used by advantaged groups to exclude more vulnerable groups from access to public resources. These explanations cannot be tested with the aggregated data here, but should be considered in future research.

A critical next step in this research agenda will also be to investigate the mechanisms driving this observed aggregate relationship. As discussed above, there are multiple channels through which social capital might interact with policy to affect macroeconomic security. With data available to date, it cannot be answered which of the posited mechanisms (information, direct assistance, or improved administrative efficiency) fails or succeeds in producing the expected effect. This is an important question to answer before inferences may be drawn about how the social capital context conditions welfare policy, because the analysis here shows that it does.

Supplemental Material

Supplemental material, SPPQ-15-0108_SI_codebook for Less Bang for Your Buck? How Social Capital Constrains the Effectiveness of Social Welfare Spending by Mallory E. Compton in State Politics & Policy Quarterly

Author Biography

Mallory E. Compton is a postdoctoral researcher at Utrecht University School of Governance. She studies public policy, governance success, and political economy with an emphasis on social welfare policies.

In a very general sense, Ostrom and Ahn (2008) identify social capital as enabling collective action and stability in community governance. Social capital is also associated with better performance quality of governance (Knack 2002; Putnam 2002), better political accountability (Jottier and Heyndels 2012), confidence in government institutions (Brehm and Rahn 1997), less public and private debt (Agarwal, Chomsisengphet, and Liu 2011; Coffé and Geys 2005), better public health outcomes (Perry et al. 2008; Rostila 2007), more developed financial sectors (Guiso, Sapienza, and Zingales 2004), and higher happiness levels (Putnam 2000). Putnam (1993) brought social capital into the mainstream of political science research with the argument that it fosters democratization, quality of government, and economic growth.

All reported estimates are obtained using the xtabond command in Stata 14. This generalized method of moments (GMM) estimator offers a number of advantages over the common alternatives in modeling panel data, the most important of which is the use of lagged values of the dependent and independent variables and their first differences as instruments to produce consistent estimates for data containing unobserved panel effects (Arellano and Bond 1991; Baltagi 2008; Zhu 2012). More simply, this estimator transforms the model into a first differences model, which allow lagged values of to be used as valid instruments, as first shown by Anderson and Hsiao (1982), and altered by Arellano and Bond (1991) to include all preceding values of the dependent variable. The Arellano and Bond (1991) estimator allows more valid estimation of the parameter, which is fundamental to dynamic panel models, and is also suitable for panel data such as mine with relatively small T and large N.

Substantively similar results are obtained when estimated by feasible generalized least squares (GLS) with random effects or state-fixed-effects.

This variable is panel stationary according to the Hadri Lagrange multiplier stationarity test (Hadri 2000).

This measure first utilizes more than 20,000 responses to a biannual survey conducted by a private marketing research firm. Because these data are proprietary, the survey results are available for 29 state clusters. To supplement these data, Hawes, Rocha, and Meier (2013) include, among other measures, the number of nonprofit organizations per capita, voter turnout, and an index of charitable giving. Together with the private survey data, these indicators of social capital are factor analyzed to produce one social capital index covering each state. This measure is a three-year moving average to capture the “memory” and inertia of social capital, and is standardized to have a mean of zero and a standard deviation of one.

In the case of social capital, total social transfers, health care transfers, and income maintenance spending, feedback of economic insecurity is absent in every state in the panel. There is a subset of states for which a feedback effect is observed for unemployment spending, but substantive implications do not change when that subset of states is excluded from estimation. Robustness checks are reported in the online supplemental appendix.

Income maintenance benefits include payments made through the Supplemental Security Income (SSI) program, the Earned Income Tax Credit (EITC), Supplemental Nutrition Assistance Program (SNAP), and any other family assistance program (including AFDC and TANF, and WIC). All benefit transfer payment data are collected from the Annual State Personal Income and Employment data (series SA35) published by the Bureau of Economic Analysis at http://www.bea.gov/regional.

Individual and corporate tax data are published in the U.S. Census Bureau’s Annual Survey of State Government Tax Collections (STC), available at http://www.census.gov/programs-surveys/stc.html .

Btu = British Thermal Unit; Energy price data are published by the U.S. Energy Information Administration at http://www.eia.gov/finance/.

These states are California, Colorado, Maryland, Minnesota, New York, North Carolina, Ohio, and Wisconsin.

This total effect, , of a variable in a model including a lagged dependent variable parameter, , is equal to , with the immediate or short-run effect being equal to (De Boef and Keele 2008). Statistical significance calculated with Wald-type test of the expression.

These conditional predictions are made using the margins suite of commands in Stata 14. In each scenario, key independent variables are either held constant at their sample mean or vary as indicated in each figure. All control variables are similarly held constant at their sample means, and inferences do not change if values are allowed to vary as observed.

To explore this potential moderating effect, I include a measure of racial diversity in each empirical model reported here. This coefficient is consistently insignificant and small in magnitude. This result persists when diversity is interacted with social capital or spending. Despite the argument that social capital can be detrimental to societal well-being by fostering inequality and promoting exclusive benefits from public services along racial divisions (Hero 2003b; 2007), these aggregate results do not suggest that racial diversity significantly interacts with the social capital context in shaping economic insecurity through social policy. To more validly investigate this possibility, however, either micro-level data or macro-level outcome data disaggregated by race, ethnicity, or income level are required.

Declaration of Conflicting Interests: The author(s) declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding: The author(s) disclosed receipt of the following financial support for research, authorship, and/or publication of this article: This project received funding from the European Research Council (ERC) under the European Union’s Horizon 2020 research and innovation program (Grant Agreement No. 694266).

Supplemental Material: Supplementary material for this article is available online.

ORCID iD: Mallory E. Compton  https://orcid.org/0000-0002-5124-238X

https://orcid.org/0000-0002-5124-238X

References

- Agarwal Sumit, Chomsisengphet Souphala, Liu Chunlin. 2011. “Consumer Bankruptcy and Default: The Role of Individual Social Capital.” Journal of Economic Psychology 32 (4): 632–50. [Google Scholar]

- Anderson T. W., Hsiao Cheng. 1982. “Formulation and Estimation of Dynamic Models Using Panel Data.” Journal of Econometrics 18: 47–82. [Google Scholar]

- Andrews Rhys. 2011. “Exploring the Impact of Community and Organizational Social Capital on Government Performance: Evidence from England.” Political Research Quarterly 64 (4): 938–49. [Google Scholar]

- Arellano Manuel, Bond Stephen. 1991. “Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations.” Review of Economic Studies 58: 277–97. [Google Scholar]

- Baltagi Badi H. 2008. Econometric Analysis of Panel Data. Chichester: John Wiley. [Google Scholar]

- Barr Nicholas. 2001. The Welfare State as Piggy Bank: Information, Risk, Uncertainty and the Role of the State. Oxford: Oxford University Press. [Google Scholar]

- Barrilleaux Charles, Bernick Ethan. 2003. “Deservingness, Discretion, and the State Politics of Welfare Spending, 1990-96.” State Politics & Policy Quarterly 3 (1): 1–22. [Google Scholar]

- Berry William D., Fording Richard C., Ringquist Richard C., Hanson Russell L., Klarner Carl E. 2010. “Measuring Citizen and Government Ideology in the U.S. States: A Re-appraisal.” State Politics & Policy Quarterly 10 (2): 117–35. [Google Scholar]

- Beugelsdijk Sjoerd, Van Schaik Ton. 2005. a. “Differences in Social Capital between 54 Western European Regions.” Regional Studies 39 (8): 1053–64. [Google Scholar]

- Beugelsdijk Sjoerd, van Schaik Ton. 2005. b. “Social Capital and Growth in European Regions: An Empirical Test.” European Journal of Political Economy 21 (2): 301–24. [Google Scholar]

- Bird Edward. J. 1999. “Can Welfare Policy Make Use of Social Norms?” Rationality and Society 11 (3): 343–65. [Google Scholar]

- Bjørnskov Christian. 2006. “The Multiple Facets of Social Capital.” European Journal of Political Economy 22 (1): 22–40. [Google Scholar]

- Bjørnskov Christian, Sønderskov Kim Mannemar. 2012. “Is Social Capital a Good Concept?” Social Indicators Research 114 (3): 1225–42. [Google Scholar]

- Boix Carles, Posner Daniel N. 1998. “Social Capital: Explaining its Origins and Effects on Government Performance.” British Journal of Political Science 28 (4): 686–93. [Google Scholar]

- Bowles Samuel, Gintis Herbert. 2002. “Social Capital and Community Governance.” The Economic Journal 112 (483): F419–36. [Google Scholar]

- Brady David. 2009. Rich Democracies, Poor People: How Politics Explain Poverty: How Politics Explain Poverty. Oxford: Oxford University Press. [Google Scholar]

- Brambor Thomas, Clark William Roberts, Golder Matt. 2006. “Understanding Interaction Models: Improving Empirical Analyses.” Political Analysis 14 (1): 63–82. [Google Scholar]

- Brehm John, Rahn Wendy. 1997. “Individual-Level Evidence for the Causes and Consequences of Social Capital.” American Journal of Political Science 41 (3): 999–1023. [Google Scholar]

- Brooks Arthur C. 2005. “Does Social Capital Make You Generous?” Social Science Quarterly 86 (1): 1–15. [Google Scholar]

- Coffé Hilde, Geys Benny. 2005. “Institutional Performance and Social Capital: An Application to the Local Government Level.” Journal of Urban Affairs 27 (5): 485–501. [Google Scholar]

- Coleman James S. 1988. “Social Capital in the Creation of Human Capital.” American Journal of Sociology 94 (1988): S95–S120. [Google Scholar]

- Compton Mallory E., Lipsmeyer Christine S. In press. “Everybody Hurts Sometimes: How Economic Context and Insecurity Shape Policy Preferences.” The Journal of Politics. [Google Scholar]

- Compton Mallory E., Meier Kenneth J. 2016. “Managing Social Capital and Diversity for Performance in Public Organizations.” Public Administration 94 (3): 609–29. [Google Scholar]

- Corman Hope, Noonan Kelly, Reichman Nancy E., Schultz Jennifer. 2012. “Effects of Financial Insecurity on Social Interactions.” The Journal of Socio-Economics 41 (5): 574–83. [Google Scholar]