1. Introduction

Adult obesity is a growing problem. In 1962, obesity prevalence among Americans aged 20 to 74 years was 13.4 percent; by 2006, obesity prevalence nearly tripled to 35.1 percent (Flegal, Carroll, Ogden, and Curtin, 2010). The rising prevalence of obesity is not limited to a particular socioeconomic group and is not unique to the United States.

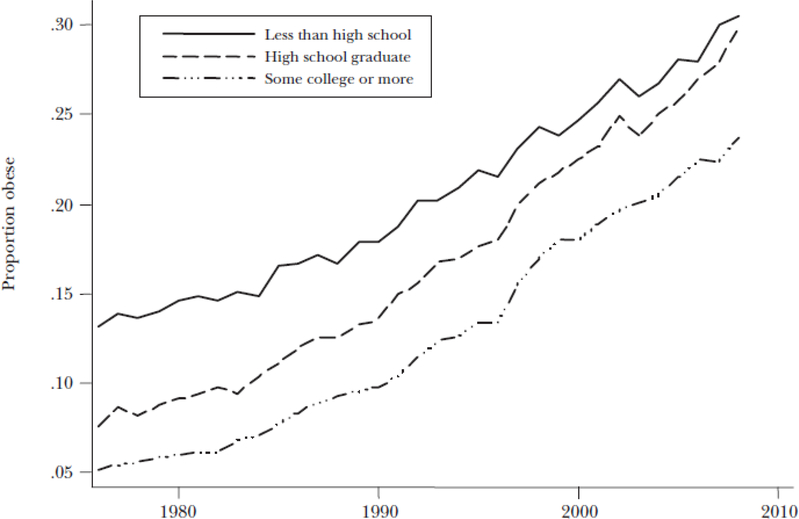

Figure 1 shows rising obesity across all education groups in the United States. Obesity is usually measured by the body mass index (or BMI), which is defined as weight measured in kilograms divided by height measured in meters squared. For someone who is six feet tall, one point on the body mass index represents about 7.5 pounds. In epidemiological studies of body weight, it is a standard to label adults with a body mass index between 25 and 30 as “overweight” and adults above 30 as “obese.” Body mass index should not be regarded as a medical diagnosis. Many people who would be counted as obese on the basis of body mass index are physically fit when measured in other ways, like percentage of body fat. Nevertheless, body mass index is widely used as a measure of population obesity because it is easy to measure in surveys and it correlates reasonably well with other measures of obesity. As Figure 1 shows, while the less educated are more likely to be obese, the body mass index has been rising in every education group.

Figure 1: Obesity for Adult Americans by Education Groups.

Source: Authors calculations based on data from the National Health Interview Surveys.

Note: Obese is defined here as a body mass index over 30.

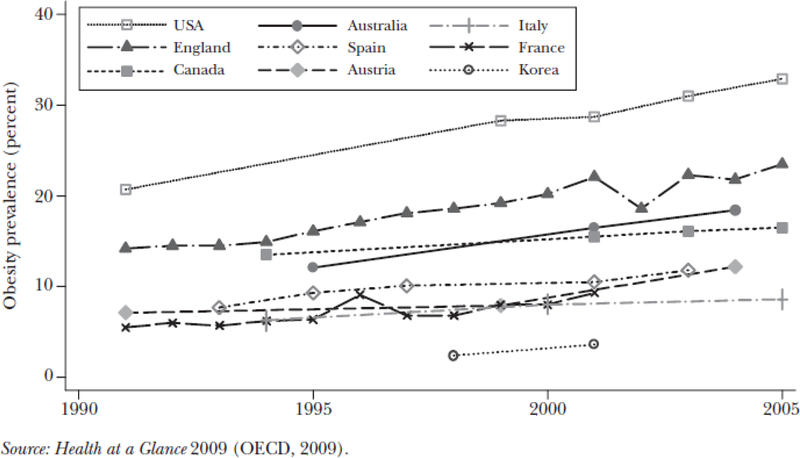

The United States is not alone in its body weight rise; other countries have also seen rising obesity rates. Figure 2 shows obesity prevalence for select countries where comparable obesity data is available over time. Clearly, the proportion of individuals who are obese varies substantially across countries: for example, Austria has approximately 12 percent of its adult population with a body mass index above 30, while the United States has approximately 33 percent of its adult population with a body mass index above 30, the highest among high-income countries in the world (OECD, 2009). Even in Austria, though, obesity rates have more than doubled since 1980. Similarly, obesity rates have risen in every European country, in Australia and in Canada, and in Korea.

Figure 2:

Obesity Rates in Selected Countries

Should this widespread obesity epidemic be a cause for alarm? From a personal health perspective, the answer is an emphatic “yes.” Obesity has been linked to increased incidence of several chronic diseases and to lower life expectancy. But when it comes to justifications of public policy for reducing obesity, the analysis becomes more complex. A common starting point in such discussions is the assertion that those who are obese impose higher health costs on the rest of the population—a statement which is then taken to justify public policy interventions. But the question of who pays for obesity is an empirical one, and it involves analysis of how obese people fare in labor markets and health insurance markets. We will argue that the existing literature on these topics suggests that obese people on average do bear the costs and benefits of their eating and exercise habits. We begin by estimating the lifetime costs of obesity. We then discuss the extent to which private health insurance pools together obese and thin, whether health insurance causes obesity, and whether being fat might actually cause positive externalities for those who are not obese. If public policy to reduce obesity is not justified on the grounds of external costs imposed on others, then the remaining potential justification would need to be on the basis of helping people to address problems of ignorance or self-control that lead to obesity. In the conclusion, we offer a few thoughts about some complexities of such a justification.

2. Lifetime Costs of Obesity

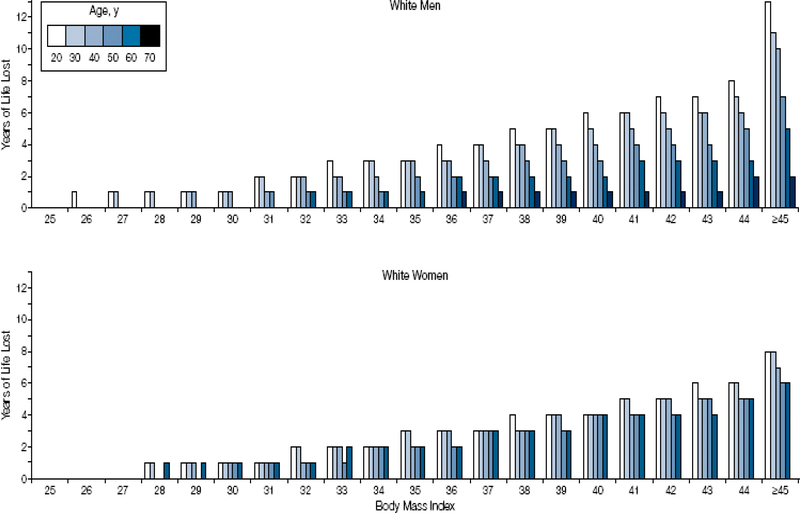

Obesity is linked to increased risk of several chronic diseases including diabetes and heart disease, as well as to reduced life expectancy. This essay is not the place to review the literature on obesity and health; instead, we highlight findings from a prominent study by Fontaine, Redden, Wang, Westfall, and Allison (2003), who use data from the National Health and Nutrition Examination Surveys and life tables to estimate the association between life expectancy and obesity across the lifespan and by race and sex. These authors calculate life tables based on observed mortality rates in a nationally representative cross section of thin and obese people. Although the analysis does not establish a causal relationship, the results are nonetheless interesting and suggest that the effects of obesity might be quite heterogeneous across population groups. Figure 3, reproduced from their article, shows the main results. The x-axis plots people at different body mass index levels, ranging from 24 (considered normal weight); through 25–30 (considered overweight); to 30 through 45 and above (considered obese). The y-axis plots the expected years of life lost relative to someone with a body mass index of 24. At each level of body mass index, the graph shows the years of life lost for people in different age groups, ranging from 20 years old (the lightest color bars) to 70 years old (the darkest bars).

Figure 3: Years of Life Lost Due to Obesity among White Men and Women.

Source: Figure 1 from “Years of Life Lost Due to Obesity.” JAMA, vol. 289, no. 2 (Fontaine, Redden, Wang, Westfall, and Allison, 2003). Reproduced with permission.

Note: The x-axis plots people at different body mass index levels, ranging from 24 (considered normal weight); through 25–30 (considered overweight); to 30 through 45 and above (considered obese). The y-axis plots the expected years of life lost relative to someone with a body mass index of 24. At each level of body mass index, the graph shows the years of life lost for people in different age groups, ranging from 20 years old (the lightest color bars) to 70 years old (the darkest bars).

The results show a remarkable heterogeneity in the effects of overweight and obesity on life expectancy. The effects of obesity on life expectancy typically diminish with age, although this effect probably arises in part because those who are obese and older were probably also more likely to be obese when they were younger but were the ones who survived longer. In addition, there are fewer years of life to lose when you are already past 70. Another intriguing finding is that being moderately overweight, with a body mass index in the range of 25–29, has only a modest effect on mortality, and has no effect at all on mortality for the oldest groups. The gradient of body mass index to life expectancy is less steep for women than for men: overweight women experience only modest declines in life expectancy and only at younger ages. What is perhaps the most surprising finding from this study, not shown in Figure 3, is that overweight and moderately obese blacks, both men and women, experience longer life spans than blacks with a body mass index of 24. It is not known why the body mass index–life expectancy gradient tilts so differently for blacks.1

Of course, this potential heterogeneity in the effects of obesity on health in itself has implications for what kinds of public policy interventions might make the most sense. But here, we want to emphasize that if obesity causes bad health, it follows plausibly that obesity also leads to higher health expenditures in any given year. Many studies amply demonstrate that, in many different insurance coverage settings, obese people do indeed spend more on health care than thin people (for example, Bertakis and Azari, 2005; Burton, Chen, Schultz, and Edington, 1999; Raebel, Malone, Conner, Xu, Porter, and Lanty, 2004; Sturm, 2002; Finkelstein, Fiebelkorn, and Wang 2003). The difference in expenditure grows with age and is greater for women than for men (Bhattacharya and Bundorf, 2009). However, for purposes of thinking about social costs of obesity, differences in annual health expenditures need to be interpreted with care. For example, if the obese spend more per year on health care, but live shorter lives, it is quite possible that over a lifetime, obese individuals will spend less on health care. Taking a lifetime perspective on healthcare spending also helps to clarify who is paying these costs. For example, a 50 year-old who becomes obese might pay for his or her higher medical care expenses before retirement in the form of higher out-of-pocket medical costs, higher premiums for health insurance, or reduced wages. However, after the individual makes the transition to Medicare, most of the medical costs of obesity will be borne by taxpayers.

Few prior studies estimate the lifetime costs of obesity in the United States (for two exceptions, see Allison, Zannolli, and Narayan, 1999; Finkelstein, Trogdon, Brown, Allaire, Dellea, and Kamal-Bahl, 2008), and the available studies typically do not use panel data to estimate how the gradient between obesity and medical care costs changes with age. The exception is a study by Lakdawalla, Goldman, and Shang (2005), who base their estimates on the RAND Future Elderly Model (FEM), a micro simulation model of disease and health care spending for people over 65 years old. The parameter estimates that undergird the FEM are derived from the nationally representative and longitudinal Medicare Current Beneficiary Survey (MCBS). Since that publication, Dana Goldman and his colleagues have extended the model, using data from the Health and Retirement Survey, to people over 51 years old (Goldman, Zheng, Girosi, Michaud, Olshansky, Cutler, and Rowe, 2009). Here, we apply the extended version of the FEM to estimate the lifetime costs of obesity.

The FEM has two components. The first is a series of health and functional status transition equations and a mortality equation to model the health of the 50-plus population over their lifetimes. Health is described by the presence of certain chronic conditions including heart disease, diabetes, hypertension, cancer, stroke, emphysema, and bronchitis. Functional status is measured by limitations in activities of daily living (ADLs), instrumental activities of daily living (IADLs), and nursing home residency. ADLs include activities such as eating, bathing, dressing, and getting in and out of a chair and walking. IADLs include activities such as using the phone, managing money, and taking medicines. In the Future Elderly Model, future disease acquisition or health is related to baseline diagnosis of chronic conditions; functional status; demographics including age, gender, race, and education; and risk factors such as smoking and obesity. Similarly, obesity status is modeled as a function of baseline obesity status, health, functional status, and demographics. All health conditions, functional states, and risk factors were modeled with first-order Markov processes that controlled for baseline unobserved factors and a battery of baseline health variables.2 The second component of the FEM models healthcare costs of the elderly as a function of current health, functional status, risk factors, and demographics. These estimates are based on pooled weighted least squares regressions. For more details on the FEM, see Goldman, Zheng, Girosi, Michaud, Olshansky, Cutler, and Rowe (2009).

We use the FEM to predict lifetime outcomes under two scenarios. In scenario 1, we assume that all individuals are normal weight at their baseline age when they first enter the HRS sample. In scenario 2 we assume that all individuals are obese at their baseline age. For each scenario we estimate life expectancy and lifetime medical care costs. The difference in outcomes between scenario 1 and 2, reflects the marginal lifetime costs of becoming obese at a particular age.

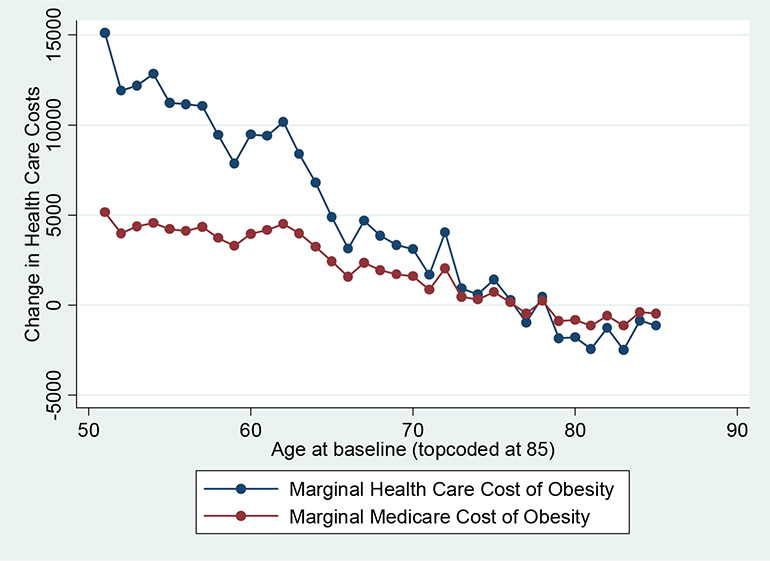

This data suggests that obesity is a persistent condition. Of those individuals who are not obese at age 51, only a few percent become obese later in life. Conversely, for those who are obese at age 51, roughly three-quarters remain obese even several decades later. Figure 4 shows the effect of obesity on lifetime medical care costs, accounting for the reduction in life expectancy due to obesity. Obesity increases the lifetime medical care costs for 50 year-olds by about $15,000, while 65 year-olds only experience a $5,000 increase in medical care costs. Those over age 75 experience no increase in medical care costs and in fact experience modest medical care cost savings of about $1,000. Medicare pays for most of the increased medical care costs due to obesity for persons above 65 years of age. In addition, Medicare also pays for a significant fraction of lifetime medical care costs of obesity for the near elderly. For example, Medicare pays for one-third of the medical care costs for 50 year-olds and about half of the costs for 60 year-olds.

Figure 4:

Marginal Effect of Becoming Obese at Baseline on Lifetime Health Care and Medicare Costs

Thus, obesity is associated with both reduced life expectancy and increased healthcare expenditures. The former is a largely private cost borne by the obese individual, while the latter might in principle be borne by others in the obese person’s health insurance pool (we will have more to say about this in subsequent sections). Suppose that these are the only two important costs associated with being obese. How important are the healthcare costs in the context of the costs of foregone life? We provide a back-of-the-envelope answer to this question. Following Murphy and Topel (2006), we assume that the value of a statistical life-year is a reasonable measure of the value of life and take this value to be $200,000. Multiplying the value of a statistical life-year by the associated reduction in life-years gives an estimate of the value of reduced life expectancy associated with obesity. We compare this estimate with the lifetime healthcare costs associated with obesity.

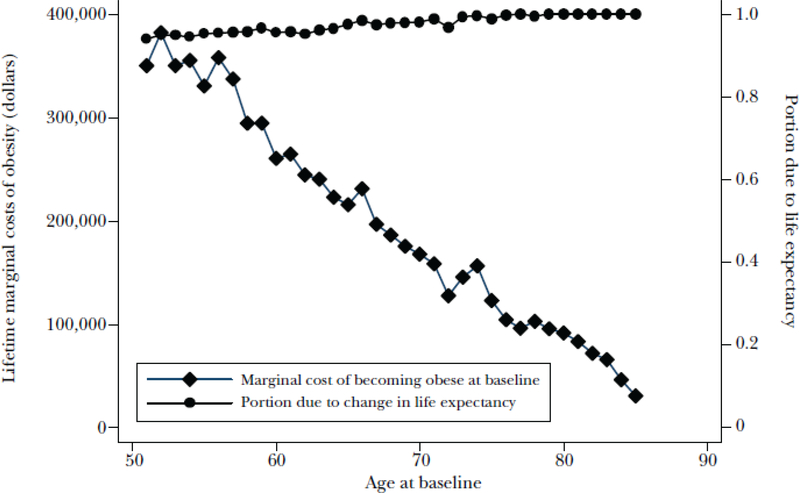

Figure 5 plots the total marginal cost of becoming obese—including both the dollar value of the life and healthcare costs of obesity—as a person ages. This declines with age largely because the loss in years of life declines with age. Figure 5 also plots the fraction of the total marginal cost that is due to the reduction in life. The results show that obesity is a costly disease and can cost several hundred thousand dollars over a lifetime. The vast bulk of the total marginal costs (over 95 percent) are due to the reduction in life. For example, for 50 year-olds, obesity reduces life expectancy by 1.65 years valued at $330,000 and increases lifetime medical care spending by about $15,000. Similarly, for 65 year-olds, obesity reduces life expectancy by 1.05 years valued at $210,000 and increases lifetime medical care spending by about $5,000. In this sense, from a lifetime perspective, the data reveal that costs of obesity are primarily a personal problem. However, as we have seen, obesity does substantially raise health expenditures and so could impose (pending further analysis) important costs on others in the society, even if these are a small fraction of the total costs of obesity.

Figure 5: Marginal Cost of Becoming Obese at Baseline and Portion Due to Change in Life Expectancy.

Source: Authors’ calculations based on the Health and Retirement Study and the Future Elderly Model.

3. External Costs of Obesity—An Economic Framework

Even though most of the costs of obesity arise from its effects on personal health, such as the reduction in life expectancy, the increases in healthcare expenditures due to obesity are not trivial. However, not all of these increased healthcare costs are social costs: some are borne privately, some publicly. While there are many potential mechanisms by which obesity can impose public costs, we will focus here on pooled health insurance. The economics literature has the most to say about the public costs of obesity in this context, and it is also a good way to illustrate the economic issues involved in a concrete way that can be extended to other applications.

There are at least two different forms of moral hazard associated with insurance coverage. The first, on which we will focus in this article, is a potential distortion in people’s body weight choices after joining an insurance pool. A second source of moral hazard associated with insurance is caused by the change in demand for health care induced by the reduction in the out-of-pocket price of health care. The social loss due to this moral hazard increases with the elasticity of demand for health care. The empirical question for this form of moral hazard is: Do the obese have a more elastic demand curve for health care than the thin? To a first order of approximation, it seems to us that the obese and thin have similarly sloped demand elasticities for health care. If there is any difference, it is likely that the obese will have a less elastic demand curve, and hence lower moral hazard, since they have a higher propensity to use inpatient services. (The RAND health insurance experiment found lower demand elasticities in the demand for inpatient services than in the demand for outpatient care.)

We turn back now to the first source of moral hazard. Two things need to be true for this type of moral hazard to arise: 1) the health insurance contract must actually pool risk across the obese and thin (that is, premiums should not depend on body weight); and 2) the transfer from thin to obese induced by the health insurance pool must cause individuals to change behavior. For example, some individuals might eat more or exercise less due to the transfer arising through pooled health insurance from thin to obese, while others might drop insurance coverage in response to rising insurance premiums due to increasing obesity in the insurance pool.

Of course, if health insurance premiums are risk-adjusted to reflect expected costs related to obesity, then these costs would be internalized and not be passed on to others. In this case, insurance does not distort body weight choices, or more generally incentives for self protection, as premiums adjust to reflect the expected costs for body weight choices and other health risks (Ehrlich and Becker, 1972; Bhattacharya and Sood, 2006). In pooled insurance, where premiums do not adjust with body weight, the incentives to invest in reducing body weight are reduced. In this case, high medical expenditures by one member of the pool are paid for in part by every member of the pool. Employer-provided health insurance is typically pooled insurance. Public insurance programs like Medicare or Medicaid are other examples of pooled insurance.

The second condition is perhaps less obvious. Suppose that the pooled health insurance coverage does not lead to a change in behavior. In this case, a pooled insurance contract is a lump sum transfer from what thin people in the pool pay to what obese people in the pool receive. However, standard welfare economics suggests that this lump sum transfer has no social cost, unless it induces a change in behavior.

Now suppose that the incentives of pooled insurance matter and that the transfer from thin to obese causes some people to gain weight or change behavior in other contexts.3 In this situation, there is a classic social welfare loss from obesity, where the welfare loss comes in the form of pool members eating more and exercising less than they ought relative to the social optimum. There is arguably, a more equitable distribution of income since the (higher-income) thin still transfer money to (lower-income) obese through pooled insurance, but an efficiency cost must be paid.

The extent to which each of these conditions holds in the real world is an empirical matter, and it turns out the answer is not obvious in either case. In the next two sections, we will discuss the available empirical evidence for these two propositions.

4. Does Health Insurance Pool the Thin and Obese?

In the United States, private health insurance is sold to consumers through two distinct mechanisms. The less common type of insurance contract, which covered about 25 million people in 2008, is sold directly to consumers. In general, the premiums charged to consumers in this market increase with expected medical expenditures, although not proportionally, perhaps due to state price regulations that limit pricing based on risks (Pauly and Herring, 2007). Thus, the magnitude of the obesity externality due to this segment of the market is likely to be limited, as there is only limited risk pooling across people with heterogeneous health risk and the size of the market is relatively small.

The most common type of insurance contract, which covered about 180 million Americans in 2008, covers consumers through their employers as part of the employment package. Employee premium contributions are rarely risk-adjusted for obesity or any other observable risk factor except family size (Keenan, Buntin, McGuire, and Newhouse, 2001). This is partly because of the administrative burden involved and partly because of legal provisions—specifically, the Health Insurance Portability and Accountability Act of 1996 prohibits employers from varying employee contributions based of health-related factors (GAO, 2003). Thus, employees at a given firm who sign up for the same health plan offered by their employer are, at least potentially, pooled with regard to their health risk.

However, one market mechanism could undo this potential pooling—namely, wage setting. The higher expected medical expenditures of obese workers could, in principle, be passed on to them in the form of lower wages in firms where there is coverage through employer-sponsored health insurance. If the wages of obese workers at firms that provide health insurance are lower than those of similar but thinner workers by enough to offset expected medical expenditure differences between the two, then the pooling of health risk is strictly nominal.

Such an outcome could happen. It is well-established that obese workers earn less than their thinner colleagues, even after adjustments are made for many important correlates of worker productivity (Cawley, 2004). The traditional explanation for this fact in the labor economics literature is employer-driven discrimination against the obese, but this sort of discrimination will be reinforced among firms that offer health insurance to their workers if they have a financial reason to discriminate (because obese employees cost more to insure than normal weight employees). Even if employers do not consciously discriminate in wage setting against their obese employees, the market imposes severe pressure on firms that provide employer-sponsored insurance and gives the same wages to their obese and thin employees. If wages do not adjust based on body weight, firms in a competitive industry who provide health insurance could make greater profits by hiring only thin workers.

A recent study by Bhattacharya and Bundorf (2009) investigates the relationship between obesity, wages, and insurance, and finds several pieces of evidence supporting the likelihood that any subsidy the obese receive through pooled health insurance is offset by wage differentials. They analyzed data from the National Longitudinal Survey of Youth (NLSY), a nationally representative sample of 12,686 people aged 14–22 years in 1979 who were followed annually until 1994 and biennially since. They confirm the common finding that obese workers earn less than thinner workers, but they also find that this relationship holds only in jobs that provide health insurance! This wage gap between obese and thin in employers who provide health insurance survives regression analysis that controls for observed differences between obese and thin workers, including age, race, gender, years of schooling, job tenure, industry and occupation dummies, scholarly aptitude test scores, marital status, and employer size.

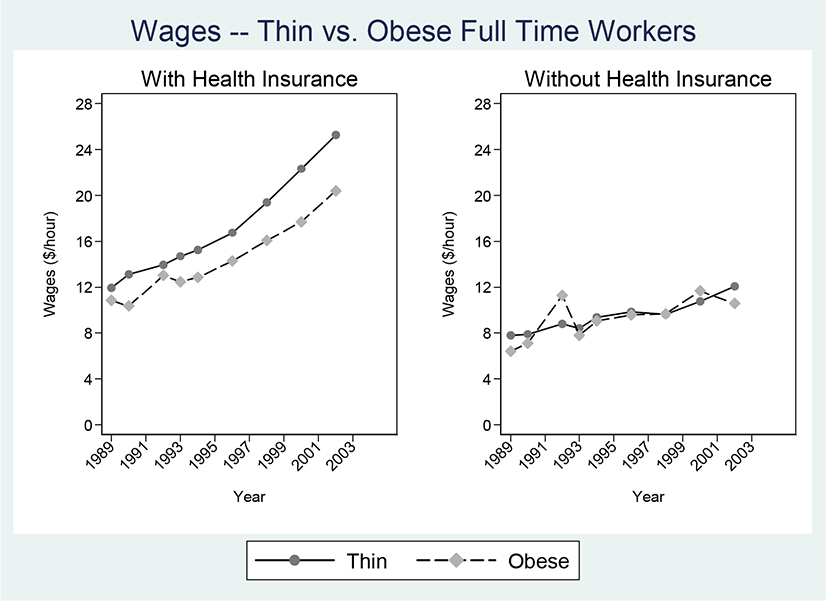

In addition, Bhattacharya and Bundorf (2009) find a close link between the size of the obesity wage gap and the difference in expected medical expenditures between obese and thin. In fact, the obesity wage gap at jobs that provide health insurance exceeds the expected medical expenditure difference between obese and thin people. The left panel of Figure 6, which restricts the data sample to fulltime workers under the age of 50, shows that the wage gap between obese and thin workers at jobs providing insurance grows as the population ages. Similarly, the gap in expected medical expenditures between the obese and the thin increases with age. Also, the obesity wage gap is greater for female workers than for male workers, which corresponds to the fact that the difference in expected medical expenditures between obese and others is greater for females than males in this age group.

Figure 6: Wages – Thin vs. Obese Full Time Workers.

Source: Authors’ calculations based on data from the National Longitudinal Survey of Youth (NLSY).

Note: The difference in wages between obese and thin workers with health insurance (panel A) is statistically significant at the 5 percent level.

One possible additional explanation for this finding is that productivity differences between obese and thin workers in high-end jobs (such as those with insurance) is greater than the difference in low-end jobs in ways that are difficult for economists to observe but have nothing to do with the higher healthcare costs of obese workers. While such productivity differences may exist, we do not believe they explain the fact that thin workers earn more than obese workers only in jobs that provide health insurance and not in other jobs. If such productivity differences were the explanation, we should observe that thin workers earn more than obese workers in jobs that offer other benefits that high-end jobs tend to offer (such as dental insurance, maternity leave, retirement benefits, profit-sharing, vocational training, and child care). In the same National Longitudinal Survey of Youth data that we describe above, we find that the difference in wages between thin and obese workers does not depend upon whether their jobs offer any of those other benefits. Only health insurance provision seems to induce a wedge between the wages earned by obese and thin workers.

The upshot of these arguments is that there is no real pooling between the obese and thin in employer-provided health plans.

5. Does Health Insurance Make You Fat?

Although it is a substantial empirical challenge to find out whether health insurance makes you fat, we cannot avoid this question if we want to measure the social loss due to obesity. Public health insurance programs like Medicare for the elderly and Medicaid for the poor provide low-cost health insurance and hence shield people from the true medical care costs of obesity. This subsidy for the costs of obesity might cause a substantial welfare loss if it induces people to gain weight. Thus, estimating the effects of insurance on body weight is critical to measuring the size of the welfare loss induced by obesity through public health insurance.

We start by making a distinction between two types of changes in the generosity of health insurance coverage: 1) the move from no formal insurance coverage to some coverage, which we call the extensive margin; and 2) the move from less generous coverage to more generous coverage, which we call the intensive margin. We make this distinction because the analytic methods for measuring the effect of these two types of changes on body weight are different. The intensive margin case turns out to be simpler to answer because there is a randomized trial that provides evidence on how more generous insurance coverage changes health status. There is no randomized intervention aimed at the extensive margin case, and the literature has produced conflicting answers.

In the intensive margin case, the relevant randomized intervention is the famous RAND Health Insurance Experiment. This study is the only large-scale randomized health insurance intervention ever conducted. It enrolled roughly 2,000 nonelderly families from six areas around the country in the late 1970s and early 1980s. As described in Newhouse (1996), each family was assigned a different level of insurance coverage on a random basis. The purpose of the study was to determine the effects of patient cost-sharing on medical care utilization and health. The participants were assigned to different fee-for-service plans that varied along several dimensions. The dimension that concerns us here is that the plans differed on the basis of the coinsurance rate: that is, the fraction of billed charges paid by patients). The plans were characterized by four different coinsurance percentages: 0 percent, often referred to as “free care,” 25 percent, 50 percent, and 95 percent.4 The coverage was comprehensive in the sense that it included nearly all types of medical care. If health insurance induces obesity along the intensive margin, then we should expect people assigned to the free care plan to gain more weight than people assigned to the plans that require more cost sharing.

In all the plans, people gained weight over the years of the experiment. However, there is no evidence of statistically significant differences between the plans in the probability of obesity or body mass index, either at entry or at exit.5 In addition, we found no evidence of differences across the plans in changes in these measures. The study also found no statistically significant difference in body mass index at exit between enrollees in the free plan and enrollees in the other plans (Newhouse, 1996, p. 198). Apparently, health insurance does not make you fat, at least along the intensive margin. One caveat is that the incentives to gain weight might have been mitigated as those enrolled in generous plans would have lost the generous coverage at the end of their five years in the experiment.

While the RAND data allow us to examine the responsiveness of body weight to a change in the generosity of coverage, the fact that everyone in the experiment had health insurance coverage leaves open the possibility of an effect along the extensive margin. In other words, the responsiveness of body weight to any insurance relative to none may be greater than the responsiveness to changes in the generosity of that coverage. No randomized intervention has ever been conducted about the extensive margin, and due to both ethical and feasibility reasons, none is ever likely to be conducted. However, two recent papers attempt to address what we are calling the extensive margin: Markowitz and Kelly (2009) and Bhattacharya, Bundorf, Pace, and Sood (forthcoming). Both studies rely on instrumental variables methods and observational data. In particular, both papers rely on differences between states and within states over time (the preferred specification includes state fixed effects) with respect to the proportion of workers that are employed at large firms and with respect to the generosity of the Medicaid program. The basic idea is that states that expanded Medicaid programs tended to have fewer uninsured individuals over time. If these generous states also have more obesity over time, then we have again suggestive evidence that health insurance expansions lead to obesity. Similarly, states that see an increase in the proportion of workers at large firms will have fewer uninsured individuals over time, because large firms are more likely to provide their workers health insurance. If those states also have higher obesity rates, then we again have suggestive evidence that health insurance expansions along the extensive margin lead to obesity.

While both papers rely on the same instruments, the papers differ on the econometric estimator that the authors use to analyze the data. Markowitz and Kelly (2009) use a two-stage least squares estimator, which is susceptible to problems caused by weak instruments (as is certainly possible here). They conclude that health insurance expansions along the extensive margin do not cause obesity. In Bhattacharya, Bundorf, Pace, and Sood (2010), we use a maximum likelihood estimator that is not sensitive to the use of weak instruments but requires that certain unverifiable assumptions about the distribution of unobserved determinants hold true. We conclude that extensive health insurance expansions do indeed cause obesity. For instance, we find that moving from a lack of insurance to Medicaid increases body mass index in the long run by over 2 points, which is equivalent to about 14.7 pounds for someone who is 6 feet tall. Personal pride in authorship aside, we believe the literature on this point is still undecided.

The story we have told here has its twists and turns, but it is easy to summarize. For employer-sponsored health insurance, obesity induces little externality because lower wages for obese workers likely undoes any nominal risk pooling. Public insurance does shield participants from the true costs of obesity. However, the evidence on the extent to which this obesity subsidy influences obesity is mixed. Thus, expansions in public coverage to the previously uninsured do induce transfer income to the obese, but the literature is not settled about whether this transfer induces substantial social welfare loss. Finally, increases in the generosity of benefits offered by public insurance increase the size of transfers to the obese but are unlikely to induce any substantial change in obesity and associated welfare loss.

6. The Complexity of Making Social Welfare Judgments about Obesity

Obesity is a serious health problem that is worthy of concern by those who are obese or at risk of becoming obese. This lesson is especially true for the case of someone who has developed one of the chronic diseases associated with being obese, such as diabetes.

In this paper, we have emphasized that the classic Pigovian case for intervention— that social welfare can be improved if those who impose externalities on others are required to internalize the social costs—does not apply especially well to obesity. In employer-provided health insurance pools, being obese causes limited externality harm because obese individuals likely pay the costs of their body weight through reduced wages. In public health insurance, there is an implicit transfer from thin people to obese people, but this transfer is progressive and seems unlikely to induce substantial social loss.

Thus, we believe that the public policy arguments in support of government interventions that seek to reduce the extent of obesity must be non-Pigouvian. For example, behavioral economists have pointed out that many people lack self control over their dietary and exercise habits. Even with the best intentions, when the time comes to skip dessert or to take the jog, many people skip the jog and take the dessert. Models of hyperbolic discounting predict such lapses in self control, and some have argued that these lapses justify taxes to help people overcome them (Laibson, 1994, 1997; Gruber and Köszegi, 2001). Others argue that in models of myopic behavior, social welfare calculation requires some degree of paternalism to justify sin taxes (Bhattacharya and Lakdawalla, 2004). This paper is not the place to attempt an analysis of public policy that is based on the notion that many people are not choosing what they “really” want to choose so that public policy should give them incentives or default options that will push them toward their “true” choice. But any such policy raises important and difficult issues about social welfare measurement that are far from settled (Bernheim and Rangel, 2005).

We conclude by emphasizing that obesity is a complex social problem, interlinked with a variety of issues, including healthcare research and development, prices for food and exercise, agricultural price supports, Social Security, peer effects, and even the level of crowding in airplane seats. Before being too quick to make social welfare judgments or policy recommendations about reducing obesity, whether on Pigouvian or non-Pigouvian grounds, these types of complexities and some potentially surprising interactions need to be considered.

Here are some examples. Bhattacharya and Packalen (2008) find that biomedical researchers have responded to the increased prevalence of obesity by focusing their research efforts on the diseases associated with obesity. They find that both for profit and nonprofit institutions involved in biomedical research (medical schools, for example) respond in this way. Private markets reward this responsiveness with profits for pharmaceutical firms, and the National Institute of Health rewards this responsiveness with grant funding to universities and medical schools. Of course, any benefits from induced research on heart attacks and diabetes will not accrue solely to obese individuals. Many nonobese individuals suffer from these diseases, and they will benefit when scientists make breakthroughs in treating those diseases. This induced innovation effect represents a positive externality from the obese to the thin (as argued in greater detail in Bhattacharya and Packalen, 2008). However, it may be that increases in the prevalence of obesity and of older people in the population have diverted research and development resources that would have gone to diseases that have a greater effect on thinner people and younger people, which is another complicating factor for a complete analysis.

Another way in which the obese “subsidize” the thin is, presumably, by dying earlier and not claiming as much in Social Security benefits. The literature on underlying causes of obesity discusses potential causes like agricultural price supports, and addressing this cause might affect efficiency by reducing price distortions in agriculture and affect equity through transfers away from the agricultural sector. A related concern is that changes in food prices can have unintended negative consequences on the health of others. For example, raising the price of ground beef as a way to discourage eating in fast-food restaurants could lead to increased anemia rates among poor children in the United States. It is not particularly surprising that anemia and the price of ground beef rise together, since beef, often consumed at fast-food restaurants, is a primary source of iron for poor children (Lakdawalla, Philipson, and Bhattacharya, 2005). Some have also argued that obesity can be viewed as an infectious disease that spreads through social networks. Christakis and Fowler (2007) analyze longitudinal data on subjects enrolled in the Framingham Heart Study. The data contain over 30 years of information on body weight and social networks of subjects. They find that a person’s chance of becoming obese increases substantially if he or she has a friend or family member who becomes obese. However, evidence on obesity peer effects among adolescents is mixed and depends on the methods used and assumptions made to account for the endogenous formation of peer groups (Cohen-Cole and Flecther, 2008; Trogden, Nonnemaker, and Paris, 2008).

The framework that we develop above is useful for thinking about the welfare consequence of obesity in this case as well. Does the formation of a friendship between a thin person and an obese person induce a transfer from the thin person to the obese person? If the friendship is voluntary, then the answer is presumably “no,” because friendship with the obese individual provides sufficient benefits to offset any negative obesity externality (which would exist if the obese friend induces the thin person to be obese). Consider now a family relationship, where the relationship is less likely voluntary, and suppose for the sake of argument that the obese family member does not convey sufficient benefits to thin family members to compensate for the fact that they induce their fellow family members to be obese. In this case, there is a net transfer from the thin family members to the obese ones, and this transfer induces a welfare loss. Surprisingly, Sacerdote (2007), on the basis of twin studies of transmission of obesity from parents to adoptees and biological children, finds that shared family environment plays only a small role in explaining the correlation between siblings in body weight. While we do not believe this literature is settled, our reading is that the current evidence does not establish that the obese cause, in any simple sense, their family members to also become obese. Thus, affiliations between thin and obese friends and family members are analytically similar to exchanges in the insurance market. Both a transfer and moral hazard are needed for the externality to induce a welfare loss.

On a similar note, another common suggestion is that obese individuals impose negative externalities on others in close quarters, such as in coach seats in commercial airplanes. A full accounting of this externality, which has not to our knowledge been examined in the literature, would consider the extent to which the social opprobrium of impinging on another person’s space is internalized by the obese person.

The extremely high costs of obesity make it an important subject for economists and other social scientists. But optimal population weight and how to achieve it is a complicated and controversial topic, filled with tradeoffs, and an area where uninformed tinkering with public policy can have unexpected and in some cases undesirable results.

Acknowledgment

The authors thank William Vogt, Darius Lakdawalla, Grant Miller, Dana Goldman, Kate Bundorf, Michael Grossman, Mikko Packalen, Alan Garber, Thomas MaCurdy, and many others for helpful comments about the research on which this article is based. We thank Yuhui Zheng for helping us with the FEM analysis presented in this paper. We thank the editors of the JEP for their patience and their exceedingly helpful comments. Bhattacharya and Sood thank the National Institute on Aging (R01-AG028236 and P30-AG024968) for funding for this project.

Footnotes

One possibility is that body mass index is a poorer indicator of fatness for blacks than whites. Another possibility is that a higher prevalence among blacks of other diseases unrelated to obesity reduces the life decreasing effects of obesity. Finally, it is possible that moderate levels of body fat have certain beneficial effects for blacks.

Both the health transition function estimates and health cost estimates in the Future Elderly Model rely on associations in nationally representative longitudinal data from the Medicare Current Beneficiary Survey and the Health and Retirement Study

For example, it is possible that obesity-related healthcare costs and transfers through pooled insurance from the thin to obese might induce some individuals to drop insurance coverage or might lead to increased taxes to finance public insurance coverage. Such consequences might impose welfare costs even in the absence of changes in body weight. However, there is no empirical research on this topic; we thus abstract from this issue and do not discuss it further in this paper.

In other empirical work (Bhattacharya, Bundorf, Pace, and Sood, forthcoming), we compared outcomes across individuals assigned to plans with different coinsurance rates, and we control (using regression adjustment) for any other randomly assigned differences between the plans. It should also be noted that to minimize participation bias, the RAND investigators offered a participation incentive. The participation incentive for a given family was defined as “the maximum loss risked by changing to the experimental plan from existing coverage,” and was intended to ensure that families were equally likely to participate independent of their prior health insurance status and the plan to which they were assigned

We limit our analysis to adults (age ≥ 21) and drop observations with missing data for key control variables (age, education, family income, race, gender, marital status, and self-reported health status).

Contributor Information

Jay Bhattacharya, Center for Primary Care and Outcomes Research, Stanford University School of Medicine, Stanford, California.; Research Fellow, National Bureau of Economic Research, Cambridge, Massachusetts.

Neeraj Sood, Schaeffer Center for Health Policy and Economics, School of Pharmacy, University of Southern California, Los Angeles, California.; Faculty Research Fellow, National Bureau of Economic Research, Cambridge, Massachusetts.

References

- Allison DB, Zannolli R, and Narayan KM 1999. “The Direct Health Care Costs of Obesity in the United States.” American Journal of Public Health, 89(8): 1194–99. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Arrow Kenneth J. 1963. “Uncertainty and the Welfare Economics of Medical Care.” American Economic Review, 50(5): 941–73. [Google Scholar]

- Bernheim Douglas, and Rangel Antonio. 2005. “Behavioral Public Economics: Welfare and Policy Analysis with Non-Standard Decision-Makers.” NBER Working Paper 11518. [Google Scholar]

- Bertakis Klea D., and Azari Rahman. 2005. “Obesity and the Use of Health Care Services.” Obesity Research, 13(2): 372–79. [DOI] [PubMed] [Google Scholar]

- Bhattacharya Jay, and Bundorf M. Kate. 2009. “The Incidence of the Healthcare Costs of Obesity. Journal of Health Economics, 28(3): 649–58. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bhattacharya Jay, Bundorf Kate, Pace Noemi, and Sood Neeraj. Forthcoming “Does Insurance Make You Fat?” In Economic Aspects of Obesity, University of Chicago Press, ed. Mocan Naci, Grossman Michael. (“Does Health Insurance Make You Fat?” NBER Working Paper 15163, 2009.) [Google Scholar]

- Bhattacharya Jay, and Lakdawalla Darius. 2004. “Time Inconsistency and Welfare.” NBER Working Paper 10345. [Google Scholar]

- Bhattacharya Jay, and Packalen Mikko. 2008. “Is Medicine an Ivory Tower? Induced Innovation, Technological Opportunity, and For-Profit vs. Non-Profit Innovation.” NBER Working Paper 13862. [Google Scholar]

- Bhattacharya Jayanta, and Sood Neeraj. 2006. “Health Insurance and the Obesity Externality” In Advances in Health Economics and Health Services Research, Vol. 17, The Economics of Obesity, pp. 281–321. Elsevier. [PubMed] [Google Scholar]

- Burton Wayne N., Chin-Yu Chen, Schultz Alyssa B., and Edington Dee W. 1999. “The Costs of Body Mass Index Levels in an Employed Population.” Statistical Bulletin, Metropolitan Life Insurance Company, 80(3): 8–14. [PubMed] [Google Scholar]

- Cawley John. 2004. “The Impact of Obesity on Wages.” Journal of Human Resources, 39(2): 451–74. [Google Scholar]

- Christakis Nicholas A., and Fowler James H. 2007. “The Spread of Obesity in a Large Social Network over 32 Years.” New England Journal of Medicine, 357(4): 370–79. [DOI] [PubMed] [Google Scholar]

- Cohen-Cole Ethan, and Flecther Jason M. 2008. “Is Obesity Contagious? Social Networks versus Environmental Factors in the Obesity Epidemic.” Journal of Health Economics, 27(5): 1382–87. [DOI] [PubMed] [Google Scholar]

- Ehrlich Isaac, and Becker Gary S. 1972. “Market Insurance, Self Insurance, and Self Protection.”Journal of Political Economy, 80(4): 623–48. [Google Scholar]

- Finkelstein Eric A, Fiebelkorn Ian C., and Wang Guijing. 2003. “National Medical Spending Attributable to Overweight and Obesity: How Much, and Who’s Paying?” Health Affairs, Web Exclusive, W3–219–W3–226. [DOI] [PubMed] [Google Scholar]

- Finkelstein Eric A., Trogdon Justin G., Brown Derek S., Allaire Benjamin T., Dellea Pam S., and Kamal-Bahl Sachin J. 2008. “The Lifetime Medical Cost Burden of Overweight and Obesity: Implications for Obesity Prevention.” Obesity, 16(8): 1843–48. [DOI] [PubMed] [Google Scholar]

- Flegal Katherine M., Carroll Margaret D.,Ogden Cynthia L., and Curtin Lester R. 2010. Prevalence and Trends in Obesity among US Adults, 1999–2008.” JAMA, 303(3): 235–41. [DOI] [PubMed] [Google Scholar]

- Fontaine Kevin R, Redden David T., Wang Chenxi, Westfall Andrew O., and Allison David B. 2003. “Years of Life Lost Due to Obesity.” JAMA, 289(2): 187–93. [DOI] [PubMed] [Google Scholar]

- Gruber Jonathan, and Köszegi Botond. 2001. “Is Addiction ‘Rational’? Theory and Evidence. Quarterly Journal of Economics, 116(4): 1261–1305. [Google Scholar]

- Goldman Dana P, Zheng Yuhui, Girosi Frederico, Michaud Pierre-Carl, Olshansky Jay, Cutler David, and Rowe John. 2009. “The Benefits of Risk Factor Prevention in Americans Aged 51 Years and Older.” American Journal of Public Health, 99(11): 2096–2101. [DOI] [PMC free article] [PubMed] [Google Scholar]

- GAO. 2003. “Private Health Insurance: Federal and State Requirements Affecting Coverage Offered by Small Businesses” Report to Congressional Requester. GAO-13–1133. U.S. Government General Accounting Office. [Google Scholar]

- Keenan Patricia Seliger, Buntin Melinda J. Beeuwkes, McGuire Thomas G., and Newhouse Joseph P. 2001. “The Prevalence of Formal Risk Adjustment in Health Plan Purchasing.” Inquiry,38(3): 245–59. [DOI] [PubMed] [Google Scholar]

- Laibson David. 1994. “Hyperbolic Discounting and Consumption.” Ph.D. thesis, Massachusetts Institute of Technology. [Google Scholar]

- Laibson David. 1997. “Golden Eggs and Hyperbolic Discounting.” Quarterly Journal of Economics, 112(2): 443–77. [Google Scholar]

- Lakdawalla Darius N., Goldman Dana P., Shang Baoping. 2005. “The Health and Cost Consequences of Obesity among the Future Elderly.”Health Affairs, 24(2): W5R30–41. [DOI] [PubMed] [Google Scholar]

- Lakdawalla Darius, Philipson Thomas, and Bhattacharya Jay. 2005. “Welfare-Enhancing Technological Change and the Growth of Obesity.” American Economics Review, 95(2): 253–57. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Markowitz Sara, and Kelly Inas Rashad. 2009. “Incentives in Obesity and Health Insurance.” Inquiry, 46(4): 418–32. [DOI] [PubMed] [Google Scholar]

- Murphy Kevin M., and Topel Robert H. 2006. “The Value of Health and Longevity.” Journal of Political Economy, 114(5): 871–904. [Google Scholar]

- Newhouse Joseph P. 1996. Free for All? Lessons from the RAND Health Insurance Experiment. Cambridge, MA: Harvard University Press. [Google Scholar]

- OECD. 2009. Health at a Glance 2009. Organisation for Economic Co-operation and Development. [Google Scholar]

- Pauly Mark V., and Herring Bradley. 2007. “Risk Pooling and Regulation: Policy and Reality in Today’s Individual Health Insurance Market.”Health Affairs, 26(3): 770–79. [DOI] [PubMed] [Google Scholar]

- Raebel Marsha A, Malone Daniel C., Conner Douglas A., Xu Stanley, Porter Julie A., and Lanty Frances A. 2004. “Health Services Use and Health Care Costs of Obese and Nonobese Individuals. Archives of Internal Medicine, 164(19): 2135–40. [DOI] [PubMed] [Google Scholar]

- Sacerdote Bruce. 2007. “How Large Are the Effects From Changes in Family Environment? A Study of Korean American Adoptees.” Quarterly Journal of Economics, 121(1): 119–58. [Google Scholar]

- Sturm Roland. 2002. “The Effects of Obesity, Smoking, and Drinking on Medical Problems and Costs.” Health Affairs, 21(2): 245–53. [DOI] [PubMed] [Google Scholar]

- Trogdon Justin G., Nonnemaker James, and Paris Joanne. 2008. “Peer Effects in Adolescent Overweight.” Journal of Health Economics, 27(5):1388–99. [DOI] [PubMed] [Google Scholar]