Abstract

Objectives. To estimate changes in sugar-sweetened beverage (SSB) and water consumption 3 years after an SSB tax in Berkeley, California, relative to unexposed comparison neighborhoods.

Methods. Data came from repeated annual cross-sectional beverage frequency questionnaires from 2014 to 2017 in demographically diverse Berkeley (n = 1513) and comparison (San Francisco and Oakland; n = 3712) neighborhoods. Pretax consumption (2014) was compared with a weighted average of 3 years of posttax consumption.

Results. At baseline, SSBs were consumed 1.25 times per day (95% confidence interval [CI] = 1.00, 1.50) in Berkeley and 1.27 times per day (95% CI = 1.13, 1.42) in comparison city neighborhoods. When we adjusted for covariates, consumption in Berkeley declined by 0.55 times per day (95% CI = −0.75, −0.35) for SSBs and increased by 1.02 times per day (95% CI = 0.54, 1.50) for water. Changes in consumption in Berkeley were significantly different from those in the comparison group, which saw no significant changes.

Conclusions. Reductions in SSB consumption were sustained in demographically diverse Berkeley neighborhoods over the first 3 years of an SSB tax, relative to comparison cities. These persistent, longer-term reductions in SSB consumption suggest that SSB taxes are an effective policy option for jurisdictions focused on improving public health.

Sugar-sweetened beverage (SSB) consumption, a major contributor to obesity, cardiometabolic disease, and dental caries, carries significant health care costs.1,2 Consumption of SSBs has declined but remains high in the United States (50% of adults and 61% of children consume SSBs daily3), particularly among low-income and racial/ethnic minority populations, who bear a disproportionate burden of diet-related disease.4

Consumption of SSBs fell in the short-term after SSB excise taxes were introduced into US cities. Consumption in demographically diverse neighborhoods in Berkeley, California, declined by 21%5 4 months after Berkeley levied a $0.01-per-ounce excise tax on distributors of nonmilk, nonalcoholic beverages containing caloric sweeteners (≥ 2 calories/oz). Consumption of SSBs fell by 26% in Philadelphia, Pennsylvania, 2 months after its beverage excise tax.6

Determining longer-term SSB consumption changes is critical for determining the health effects of an SSB tax. Here, we estimated SSB consumption changes in demographically diverse neighborhoods in Berkeley and in neighboring cities 3 years after Berkeley’s tax.

METHODS

Using a repeated cross-sectional design, we measured SSB consumption annually through beverage frequency questionnaires (BFQs) administered in demographically diverse neighborhoods in Berkeley, Oakland, and San Francisco, California.

We chose Oakland and San Francisco as comparators given shared exogenous but difficult-to-measure factors (e.g., culture, media, and retail environments) with Berkeley that might affect SSB consumption. In Berkeley and San Francisco, we used 2010 Census data to identify 2 large neighborhoods with the highest combined proportion of African American and Hispanic residents. We selected 2 Oakland neighborhoods to match the distribution of African American and Hispanic residents in the Berkeley and San Francisco neighborhoods.

We assessed baseline consumption in April through July 2014, before SSB taxes were proposed on the Berkeley and San Francisco November ballots. Only Berkeley’s tax passed in 2014. During the 3 posttax years, we collected data between April and October. In 2016, Oakland and San Francisco surveys occurred 1 to 3 months before their SSB-tax ballot measures passed. Oakland implemented its tax in July 2017 and San Francisco in January 2018; thus, some 2017 surveys occurred 1 to 3 months after Oakland’s tax took effect.

The BFQs were based on the previously validated 15-item Beverage Questionnaire,7 asking “How many times per day, week, or month do you drink . . . ?” each of regular (not diet) soda, energy drinks, sports drinks, fruit drinks, presweetened coffee or tea, and unsweetened water. We converted responses to daily frequencies (times per day). We determined total SSB consumption by summing frequencies for regular soda; energy, sports, and fruit drinks; and presweetened coffee or tea.

Within each neighborhood, questionnaires were administered as anonymous, 3- to 10-minute surveys in English or Spanish near the highest foot-traffic intersection. Trained data collectors invited passersby to complete a survey; 20% of those approached (n = 2435) in Berkeley and 22% (n = 5141) in comparison neighborhoods agreed (Figure A, available as a supplement to the online version of this article at http://www.ajph.org). Of these, 79% were eligible (lived in the city in which the survey was conducted, spoke English or Spanish, were aged 18 years or older, and could demonstrate understanding of questions [e.g., proficient English or Spanish skills]).

The primary outcome was the difference in SSB consumption before versus the first 3 years after tax in Berkeley relative to that in the comparison cities. For each beverage, generalized linear models with a log link function and a γ distribution (accounting for the nonnegative and right-skewed nature of count data) modeled mean frequency of daily consumption, adjusting for age, gender, race/ethnicity, language, education, neighborhood, survey month, and ambient temperature.8 We included an indicator term for Berkeley and interaction terms between Berkeley and categorical year to adjust for time-invariant unmeasured confounders unique to Berkeley, and we calculated robust standard errors to correct for heteroskedasticity. We computed pre–post changes and 95% confidence intervals (CIs) in consumption frequency within and between groups by using NLCOM commands in Stata (version MP-15, StataCorp LP, College Station, TX; Table A, available as a supplement to the online version of this article at http://www.ajph.org).

Berkeley’s SSB tax was levied on distributors, who were expected to pass costs onto retailers who, in turn, were expected to raise shelf prices. In 2015, 3 months after implementation, roughly half of the full tax rate had been “passed through” or reflected in observed shelf prices.9 Therefore, consumption in 2015, measured when pass-through was incomplete, was given only half the weight compared with data from 2016 and 2017, when the tax was more fully passed-through in Berkeley.10 In robustness checks, we estimated unweighted and pre–post (2014 vs 2017) models, as well as a doubly robust modified-inverse probability weighted model6 and models with multiple imputation for missing outcome or covariate data (12%).

RESULTS

The primary analytic sample included 1513 participants from Berkeley (91% of eligible) and 3712 from the comparison cities (87% of eligible) who completed a BFQ. Berkeley participants were older, more likely to be White, and more highly educated (Table B, available as a supplement to the online version of this article at http://www.ajph.org) than comparison participants. Posttax participants were older than those pretax for both groups and, within Berkeley, more likely to be White and more highly educated.

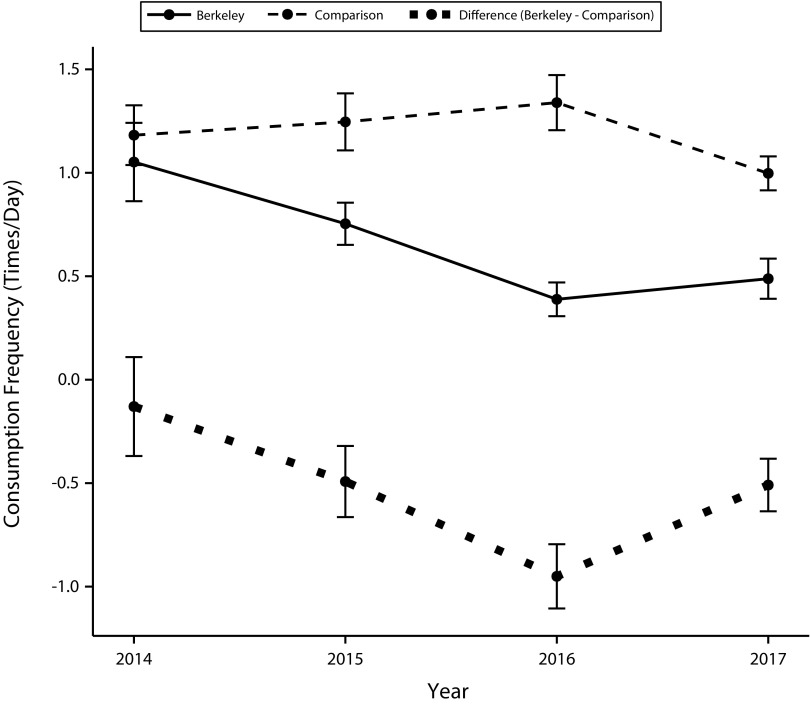

Adjusted SSB consumption, similar at baseline in the 2 groups, diverged after the tax (Figure 1). The initial reduction in Berkeley from 2014 to 2015 (–0.30 times per day [95% CI = −0.51, −0.08]) was amplified in 2016 and 2017 (2016: −0.66 times per day [95% CI = −0.87, −0.46]; 2017: −0.56 times per day [95% CI = −0.78, −0.35]). In the fully adjusted model, SSB consumption in Berkeley decreased by 0.55 (95% CI = 0.35, 0.75) times per day from 2014 to the weighted average of 2015 to 2017 (52.3% reduction), with significant declines in all categories of SSBs except energy drinks (Table C, available as a supplement to the online version of this article at http://www.ajph.org); water consumption increased by 1.02 (95% CI = 0.54, 1.50) times per day (29.3% increase). There were no significant consumption changes in the comparison group.

FIGURE 1—

Adjusted Within-Group Frequencies and Between-Group Differences in Sugar-Sweetened Beverage Consumption: Berkeley, Oakland, and San Francisco, CA, 2014–2017

In the weighted model adjusted for all covariates, SSB consumption decreased 0.55 (95% CI = 0.30, 0.81) times per day more in Berkeley than in the comparison (a relative decline of 52.5%), with significant declines in regular soda, sports drinks, and sweetened teas and coffees (Table C). Water consumption increased 0.85 (95% CI = 0.29, 1.42) times per day (25.1%) more in Berkeley than in the comparison (Figure B, available as a supplement to the online version of this article at http://www.ajph.org).

All between-group results were robust to sensitivity analyses (Table A and Figure C, available as supplements to the online version of this article at http//www.ajph.org).

DISCUSSION

We observed sustained changes in SSB consumption after an SSB tax in the United States. Similar to our findings, studies in Mexico (the only other geography documenting longer-term trends in posttax consumption) revealed increased effects over time, with a 5.5% decrease in the volume of taxed beverage purchases in the first year and 9.7% decrease in the second year after the tax.11

Our results reflect consumption changes in demographically diverse neighborhoods, whose residents are more likely to consume SSBs. In the second year of Mexico’s tax, the volume of taxed beverage purchases declined more in low- than in high-SES households (14.3% vs 5.6%), providing some empirical evidence that low-income populations, who bear a disproportionate burden of cardiometabolic diseases, may be more responsive to taxes.11 If similar patterns manifest in other jurisdictions in the United States, taxes could reduce health disparities.

This study has several limitations, including a convenience sample that may limit generalizability and unmeasured confounding, a concern in all nonexperimental designs. Results from Berkeley, a small and highly educated city, may not translate to other geographic areas. Self-reported BFQ data are subject to bias; however, BFQs have been validated, and change estimates are less susceptible to bias than point estimates of consumption.12 In 2017, Oakland surveys occurred 1 to 3 months after tax implementation, and both Oakland and San Francisco had SSB tax ballot measures in 2016, which might lead to conservative estimates of relative declines in Berkeley.

PUBLIC HEALTH IMPLICATIONS

The persistent declines in SSB consumption we demonstrate in Berkeley, 3 years into an SSB tax, could significantly reduce obesity, cardiovascular disease, and associated health care costs, particularly among populations with high initial SSB consumption.

ACKNOWLEDGMENTS

Research reported in this publication was supported by the National Institute of Diabetes and Digestive and Kidney Diseases of the National Institutes of Health under awards R01DK116852 and K01DK113068, and by the California Endowment under award 000533.

Note. The content is solely the responsibility of the authors and does not necessarily represent the official views of the National Institutes of Health or the California Endowment.

CONFLICTS OF INTEREST

The authors report no conflict of interest regarding this work.

HUMAN PARTICIPANT PROTECTION

This work was considered exempt by the University of California Berkeley Committee for the Protection of Human Subjects.

REFERENCES

- 1.Johnson RK, Appel LJ, Brands M et al. Dietary sugars intake and cardiovascular health: a scientific statement from the American Heart Association. Circulation. 2009;120(11):1011–1020. doi: 10.1161/CIRCULATIONAHA.109.192627. [DOI] [PubMed] [Google Scholar]

- 2.Hu FB. Resolved: there is sufficient scientific evidence that decreasing sugar-sweetened beverage consumption will reduce the prevalence of obesity and obesity-related diseases. Obes Rev. 2013;14(8):606–619. doi: 10.1111/obr.12040. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Bleich SN, Vercammen KA, Koma JW, Li Z. Trends in beverage consumption among children and adults, 2003–2014. Obesity (Silver Spring) 2018;26(2):432–441. doi: 10.1002/oby.22056. [DOI] [PubMed] [Google Scholar]

- 4.Stringhini S, Dugravot A, Shipley M et al. Health behaviours, socioeconomic status, and mortality: further analyses of the British Whitehall II and the French GAZEL prospective cohorts. PLoS Med. 2011;8(2):e1000419. doi: 10.1371/journal.pmed.1000419. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Falbe J, Thompson HR, Becker CM, Rojas N, McCulloch CE, Madsen KA. Impact of the Berkeley excise tax on sugar-sweetened beverage consumption. Am J Public Health. 2016;106(10):1865–1871. doi: 10.2105/AJPH.2016.303362. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Zhong Y, Auchincloss AH, Lee BK, Kanter GP. The short-term impacts of the Philadelphia beverage tax on beverage consumption. Am J Prev Med. 2018;55(1):26–34. doi: 10.1016/j.amepre.2018.02.017. [DOI] [PubMed] [Google Scholar]

- 7.Hedrick VE, Savla J, Comber DL et al. Development of a brief questionnaire to assess habitual beverage intake (BEVQ-15): sugar-sweetened beverages and total beverage energy intake. J Acad Nutr Diet. 2012;112(6):840–849. doi: 10.1016/j.jand.2012.01.023. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.National Oceanic and Atmospheric Administration. Climate data online. National Centers for Environmental Information. Available at: https://www.ncdc.noaa.gov/cdo-web. Accessed July 24, 2018.

- 9.Falbe J, Rojas N, Grummon AH, Madsen KA. Higher retail prices of sugar-sweetened beverages 3 months after implementation of an excise tax in Berkeley, California. Am J Public Health. 2015;105(11):2194–2201. doi: 10.2105/AJPH.2015.302881. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Silver LD, Ng SW, Ryan-Ibarra S et al. Changes in prices, sales, consumer spending, and beverage consumption one year after a tax on sugar-sweetened beverages in Berkeley, California, US: a before-and-after study. PLoS Med. 2017;14(4):e1002283. doi: 10.1371/journal.pmed.1002283. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Colchero MA, Rivera-Dommarco J, Popkin BM, Ng SW. Mexico, evidence of sustained consumer response two years after implementing a sugar-sweetened beverage tax. Health Aff (Millwood) 2017;36(3):564–571. doi: 10.1377/hlthaff.2016.1231. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Hedrick VE, Comber DL, Ferguson KE et al. A rapid beverage intake questionnaire can detect changes in beverage intake. Eat Behav. 2013;14(1):90–94. doi: 10.1016/j.eatbeh.2012.10.011. [DOI] [PMC free article] [PubMed] [Google Scholar]