Abstract

We examine the impact of Children’s Health Insurance Program (CHIP) eligibility expansions 1999 to 2012 on child and joint parent/child insurance coverage. We use changes in state CHIP income eligibility levels and data from the Current Population Survey Annual Social and Economic Supplement to create child/parent dyads. We use logistic regression to estimate marginal effects of eligibility expansions on coverage in families with incomes below 300% federal poverty level (FPL) and, in turn, 150% to 300% FPL. The latter is the income range most expansions targeted. We find CHIP expansions increased public coverage among children in families 150% to 300% FPL by 2.5 percentage points (pp). We find increased joint parent/child coverage of 2.3 pp (P = .055) but only in states where the public eligibility levels for parent and child are within 50 pp. In these states, the CHIP expansion increased the probability that both parent/child are publicly insured (2.5 pp) among insured dyads, but where the eligibility levels are further apart (51-150 pp; >150 pp), CHIP expansions increase the probability of mixed coverage—one public, one private—by 0.9 to 1.5 pp. Overall, families made decisions regarding coverage that put the child first but parents took advantage of joint parent/child coverage when eligibility levels were close. Joint public parent/child coverage can have positive care-seeking effects as well as reduced financial burdens for low-income families.

Keywords: family insurance, CHIP expansions, eligibility

Introduction

The role of the Children’s Health Insurance Program (CHIP) after the passage of the Affordable Care Act (ACA) was initially unclear. While CHIP was successful in reducing uninsured children, covering 8.9 million in 2016, over half of the children remaining uninsured are likely eligible for public insurance coverage through Medicaid or CHIP.1,2 States have historically had flexibility in CHIP program design, particularly regarding income eligibility levels and premiums. This flexibility led to upper limit eligibility levels ranging from 160% to 400% of the federal poverty level (FPL) across states in 2012,3 precisely the income group targeted for tax credits to support Marketplace coverage. Thus, some considered CHIP to be unnecessary. Nonetheless, CHIP funding was renewed in 2018 in the face of policy instability affecting marketplace options for low-income families without employer-sponsored insurance.

Older studies clearly show that Medicaid and CHIP expansions result in gains in public health insurance coverage, declines in uninsurance, and gains in access to medical and dental care and, yet, mixed evidence on their effect on child health.4 More recent work emphasizes that for every access, use, and cost measure studied, CHIP enrollees are better off than uninsured children and experience similar access to privately insured children; the financial burdens of families with CHIP-enrolled children are also substantially lower than those for families of privately insured children.5,6 CHIP also helps meet children’s specific needs, as CHIP enrollees are more likely to have specialty visit, mental health visits, and access to prescription drugs than uninsured children.7 Finally, expansions of children’s public insurance have been found to increase financial stability and family material well-being in the short-run and long-run, decrease mortality and rates of chronic conditions among children, and lead to greater educational attainment and less reliance on government support later in life.8

A key feature of CHIP has been states’ ability to experiment with program design, resulting in variation in income eligibility levels, use of premiums, and a range of other policy designs across states. While the ACA required states to maintain 2010 levels of effort for CHIP, financing for CHIP was scheduled to end following fiscal year 2017. In January 2018, Congress passed a 6-year extension.9 As the nation considers adjustments to the ACA and CHIP and as states continue to engage in expanding Medicaid, it is important to consider what types of CHIP programs have been most successful for families as a whole.

Prior Studies

Nearly all earlier studies indicate that expansions of public health insurance for children increase insurance coverage among Medicaid- and CHIP-eligible children, but the magnitudes of estimates vary.3,10-19 In a systematic review, the estimated reduction in uninsurance among children in 26 studies ranged from no effect to a reduction of 23 percentage points (pp) and the estimated increase in public coverage ranged from 0 to 24.3 pp.3 One explanation for this variation is the difference in estimated “crowd out” of private insurance as children move into public coverage, with estimated declines in private coverage ranging from 5 to 10.2 pp.3 The most recent study of CHIP expansions after the program’s 2009 reauthorization found an additional 1.1 pp reduction in uninsured children and called for a better understanding of the wide variation in effects seen across states.16

We focus on the 1999 to 2012 period to study incremental effects of CHIP expansions during the years following initial program implementation. During this period, states were expanding eligibility levels while making administrative and programmatic improvements known to increase enrollment to meet program goals and their use of their federal allotments.20 Enrollment in CHIP tripled with the initial implementation between 1999 and 2003 and then increased annually at a slower pace by 35% from 2003 to 2013.21 Our key contribution to the literature is our analysis of not only child insurance but also joint parent/child coverage by creating parent/child dyads. While earlier studies suggest an effect of parental expansions on child insurance, none have considered the effect of CHIP expansions on joint parent/child coverage. Such joint coverage may influence utilization and care-seeking behavior of children.15,22-24 For example, children with parents in public programs are significantly less likely to drop out of Medicaid/CHIP, children’s receipt of recommended health care services is associated with their parent’s access to a usual source of care, and Medicaid-covered children with parents also covered by Medicaid are more likely to receive preventive care than their Medicaid-covered peers with uninsured parents.25-33

The nature of the family dyad also matters for coverage. Children in single-parent families are more likely to have child-only, rather than family, coverage, and children in single female–headed families are less likely to have private insurance and more likely to be uninsured or Medicaid insured.34,35 Children eligible but not enrolled in Medicaid are more likely to come from single-parent families, while children with married parents have greater access to employer-sponsored insurance and higher incomes.36,37 We control for marital status as well as other family characteristics known to affect insurance coverage.

Conceptual Model

We proceed from an economic framework that assumes families make interdependent health insurance coverage decisions for each family member, taking into account costs, the value they place on the coverage option inclusive of any potential “stigma” associated with public program enrollment, and the probability that family members will need health care in the coming year.38 This follows from Arrow’s theoretical model, which asserts that parents will maximize the expected utility of health insurance and other consumption for each family member, given their public and private options for coverage, family budget constraints, expected out-of-pocket costs for each option, and health status.39 The model predicts that higher costs will lower demand for coverage, and if public and private coverage are viewed as substitutes, the costs of each type will affect the take-up of the other type and the probability of uninsurance.40-46 Estimates of the marginal employee premiums for family versus individual coverage are highly variable, but an earlier study estimates that for more than half of all workers, they are almost $900 per year, and for the top quartile of all workers, they exceed $2170 per year.47 We hypothesize that, consistent with prior studies, CHIP expansions increase the probability that children are insured.

We also hypothesize that CHIP expansions could have multiple effects on the probability of public or private parental coverage and that on net, they increase the probability of both the parent and the child being insured. The mechanism can be either a positive effect on the family’s budget or increased awareness of an existing state-specific program for which the parent was previously eligible but not enrolled. With regard to private parental coverage, as a CHIP expansion lowers the cost of coverage for children, this allows the parent to enroll in private insurance as an individual rather than in the more expensive family coverage. As noted above, the marginal costs of insuring a child privately is high and can impose a significant burden on lower income families. Theoretically, however, there is the possibility of the opposite effect if, in the absence of CHIP eligibility, parents elect private family coverage only out of concern for a child’s coverage. Such parents may drop their own coverage once the child is publicly insured. If this effect dominates, a CHIP expansion could actually result in a decline in private parental coverage. With regard to public parental coverage, CHIP expansions targeting children are sometimes accompanied by state or nonprofit-funded outreach programs to increase awareness and enroll eligible children. Such outreach targeting children for CHIP could increase awareness of, or receptivity to, a state-specific program for which the parent was previously eligible but not enrolled.

To test these hypotheses, we estimate models on the probability that (1) a child is public or privately insured versus uninsured; (2) both parent and child within a family are insured; and (3) when both are insured, parent-child insurance is jointly public, jointly private, or mixed. To estimate models on joint coverage, we create parent-child dyads by matching each child with either their single-parent or, in 2-parent families, a randomly selected parent.39 Throughout our article, we are using an “intent to treat” analysis, including every family with children potentially eligible for a state expansion (those with family incomes at or below 300% FPL; 150% to 300% FPL) over our study period. Hence, with this sample, we include some families who might not actually be “treated” in a given expansion year and comparison families in states not expanding in a state/year who may have already been “treated.” While this “attenuates” our effect measure, intent to treat analysis implies a higher likelihood of type II error and, hence, is a more conservative estimate. Therefore, we acknowledge results that are weakly significant (P < .10). The analytic approach allows us to analyze all states’ expansions (some were multiple) over this period to report the “average” effect of expansions across states as in earlier studies,15 and to capture effects of expansions on some children already eligible but not enrolled.

Methods

Data

We use data from the Current Population Survey (CPS) Annual Social and Economic Supplement for each state and year 2000 to 2013 to identify children (≤18 years old) in families with income ≤300% FPL; only 2 states expanded beyond this level over the period. We also test for effects on families in the 150% to 300% FPL range since most of our study states’ expansions targeted this range. Control groups are children in these same income ranges but in state-years without a CHIP expansion. We define household income as any income a person receives that can be used to purchase food, clothing or shelter, including both earned and unearned income.* We supplement the CPS data with Medical Expenditure Panel Survey–Insurance Component data on private premiums by state, year, and firm size; Area Resource File data on area characteristics; and data on state CHIP expansion policies.

Ethical Approval and Informed Consent

This study was exempt from institutional review board approval due to the use of only de-identified secondary data in the analysis.

Analysis

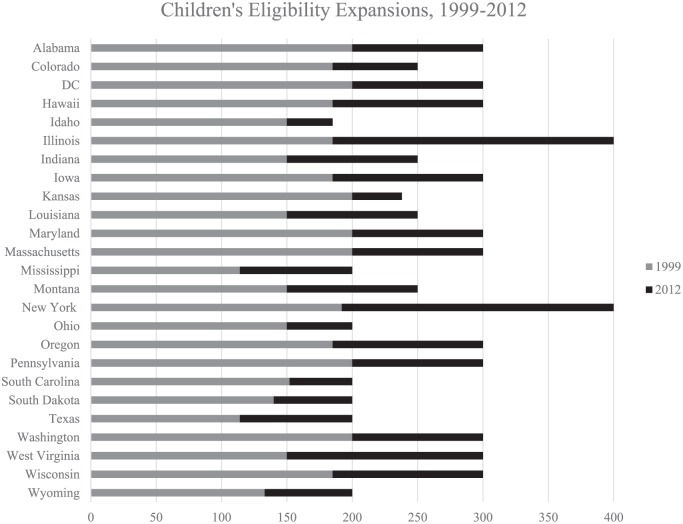

We use a quasi-experimental design exploiting variation in states’ CHIP expansion policies 1999 to 2012 (Appendix Table A1) to estimate marginal effects. We limit the analysis to expansions increasing child eligibility ≥25 pp of the FPL in order to reflect expansions that resulted from eligibility policy changes rather than changes in income disregard. Over our study period, 24 states and the District of Columbia expanded eligibility once or more with 11 expansions reaching 200% FPL, 19 expansions reaching 201% to 300% FPL, and 2 expansions above 300% FPL (Figure 1). All models include 16 control states without CHIP expansions or premium policy changes during our study period. Details of the changes in study states’ CHIP expansions are included in the notes to each results table. The mean change in eligibility in our expanding states was 90 pp FPL. We use logistic regression models on unweighted data and include state and year fixed effects to account for time-invariant unobserved characteristics of states and secular trends that may be correlated with insurance coverage levels for children and parents.48 The model is depicted by the following equation:

Figure 1.

Expansions of children’s eligibility for public insurance >25% federal poverty level, 1999 to 2012.

Source: Authors’ analysis of state eligibility policies. (see Appendix Table A1).

Gray bars denote the states’ eligibility thresholds for 1999. Black bars denote the percentage point change of eligibility expansions 1999 to 2012. Together the gray and black bars denote 2012 eligibility levels. States expansions less than 25 percentage points of the federal poverty level were excluded. All eligibility levels are reported as percent of the federal poverty level.

In this equation, insurance for the ith child or child/parent dyad in the jth state and year t is a function of residing in a state with an expansion in year t (EXPAND). We control for a vector of individual characteristics (Xijt) that includes family income as percent FPL; family size; infant in household; parent’s age, gender, race/ethnicity, health status, disabled status, education, marital status, citizenship, child’s age, gender, race/ethnicity, health status, and citizenship, firm size category of worker in family; full-time/part-time work status of worker; and spouse work status. We also control for a vector of county characteristics (β3Xict) including urban/rural area; county unemployment rate; per capita income, state fixed effects (γSTATEj), and year fixed effects (θYEARt). These models provide difference-in-difference estimates by comparing the intended treatment group of children and parent-child dyads in state-years with CHIP expansions to comparable children and parent-child dyads in state-years without CHIP expansions. The models are based on pooled, cross-sectional data, allowing for heterogeneity of the year of implementation of study states’ CHIP expansions.49

To further test the effects of states’ expansions on the constellation of parent/child coverage, we estimate models where each state’s CHIP expansion is classified by its proximity to the eligibility level for covering parents in the year that the CHIP expansion occurred. In all models, we omit states with concurrent child and parent expansions from dyad analyses to isolate the effect of a CHIP expansion on the dependent variable. We report on parental expansions during this time period in a separate article.46

We test for pre-expansion trends in expanding versus non-expanding states and find no significant differences in the trends for child and parent coverage for the majority of our study states (Appendix Table A2). We use Stata version 14.2 to estimate coefficients, marginal effects, and robust standard errors.50 Standard errors are clustered at the state level to account for potential serial correlation. Finally, we allow for a possible lag in the effect of state expansions and avoid confounding from expansions implemented mid-year by omitting all of a state’s observations from the year of expansion. A full list of control variables is included in table notes.

Results

Descriptive

Unadjusted data for children and parent-child dyads indicate clear shifts between the public and private insurance sectors that differ for parents and children from 1999 to 2012 (Table 1). Overall, the percent of uninsured children in our sample declines from 15.6% to 11.2% in the expansion states. In expansion states, the increase in public insurance from 23.8% to 44.4% in 1999 to 2012 is offset by a decline in private coverage of 16 pp. The percentage of uninsured children in control states only declines from 15.9% to 13.0% over this same period. While the percent of children in expansion states with coverage increases, the likelihood of both parent and child being covered declines. Data on joint parent-child coverage indicate that families with discordant insurance status are more likely to insure the child first; by 2012, only 1.3% of dyads have the parent insured and child uninsured in the expansion states, and this holds for 1.4% of dyads in control states. In contrast, the percent with only the child insured more than doubles (9.8% to 21.1%) in 1999 to 2012 in expansion states as well as control states (11% to 23%). Among dyads where both parent and child were covered, the percent with private coverage decreases while the percent with both public and mixed coverage increases from 1999 to 2012 in both the expansion and control states.

Table 1.

Insurance Coverage Among Children, Parents, and Children-Parent Dyads <300% FPL, 1999 to 2012a.

| Expansion States |

Control States |

|||||||

|---|---|---|---|---|---|---|---|---|

| 1999 |

2012 |

1999 |

2012 |

|||||

| Mean | SE | Mean | SE | Mean | SE | Mean | SE | |

| Child insurance status | ||||||||

| Private | 0.605 | 0.006 | 0.445 | 0.005 | 0.614 | 0.007 | 0.442 | 0.006 |

| Public | 0.238 | 0.005 | 0.444 | 0.005 | 0.228 | 0.007 | 0.429 | 0.006 |

| Uninsured | 0.156 | 0.004 | 0.112 | 0.003 | 0.159 | 0.005 | 0.130 | 0.004 |

| Insurance status of the parent-child dyad | ||||||||

| Both insured | 0.738 | 0.006 | 0.671 | 0.005 | 0.733 | 0.007 | 0.639 | 0.006 |

| Parent only insured | 0.025 | 0.002 | 0.013 | 0.001 | 0.024 | 0.002 | 0.014 | 0.002 |

| Child only insured | 0.098 | 0.004 | 0.211 | 0.004 | 0.110 | 0.005 | 0.231 | 0.005 |

| Both uninsured | 0.140 | 0.004 | 0.105 | 0.003 | 0.134 | 0.005 | 0.117 | 0.004 |

| Type of insurance among insured dyads | ||||||||

| Both private | 0.777 | 0.006 | 0.611 | 0.006 | 0.793 | 0.008 | 0.631 | 0.008 |

| Both public | 0.192 | 0.006 | 0.295 | 0.006 | 0.161 | 0.007 | 0.286 | 0.007 |

| One public/one private | 0.031 | 0.003 | 0.094 | 0.004 | 0.046 | 0.004 | 0.083 | 0.004 |

Abbreviations: FPL, federal poverty level; SE, standard error.

Sample includes children in families with income up to 300% FPL.

Multivariate

In Table 2, we present the marginal effects for states’ expansions of 25 pp FPL or more for families <300% and 150% to 300% FPL. The results suggest an increase in children publicly insured among families <300% FPL equal to 2.4 pp (P < .05) and a similar increase of 2.5 pp (P < .05) among those 150% to 300% FPL. Results for both groups provide weak evidence of a decline in the likelihood of being uninsured at P ≤ .10. We found no overall effects on the probability that both parent and child were covered. When both child and parent were insured, CHIP expansions to families in the 150% to 300% FPL income range decreased (2.3 pp) the likelihood that parent/child were both privately insured and increased the probability there was one public and one private insured (2.0 pp). This effect was also seen for all families <300% FPL, but the magnitude was smaller (1.2 pp).

Table 2.

Effects of Eligibility Expansions for Children, Families <300% FPL and 150% to 300% FPLa.

| Children in Families With Income up to 300% FPL |

Children in Families With Income 150% to 300% FPL |

|||||||

|---|---|---|---|---|---|---|---|---|

| n | Marginal Effect | Standard Error | P | n | Marginal Effect | Standard Error | P | |

| Child multinomial models | ||||||||

| Private | 346 345 | −0.009 | 0.007 | .253 | 169 677 | −0.012 | 0.009 | .162 |

| Public | 0.024 | 0.012 | .049 | 0.025 | 0.011 | .022 | ||

| Uninsured | −0.015 | 0.009 | .104 | −0.012 | 0.007 | .084 | ||

| Multinomial dyad model | ||||||||

| Both insured | 303 610 | 0.004 | 0.010 | .700 | 149 949 | 0.009 | 0.009 | .338 |

| Parent only insured | −0.001 | 0.001 | .613 | −0.002 | 0.002 | .367 | ||

| Child only insured | 0.002 | 0.006 | .802 | −0.004 | 0.007 | .545 | ||

| Both uninsured | −0.005 | 0.009 | .581 | −0.003 | 0.006 | .629 | ||

| Both insured multinomial model | ||||||||

| Both private | 212 690 | −0.013 | 0.009 | .138 | 121 306 | −0.023 | 0.008 | .006 |

| Both public | 0.002 | 0.009 | .862 | 0.003 | 0.005 | .535 | ||

| One public/one private | 0.012 | 0.004 | .009 | 0.020 | 0.005 | <.001 | ||

Abbreviation: FPL, federal poverty level.

Based on models with robust standard errors clustered at the state level.

Expansion states: AL, CO, DC, HI, ID, IL, IN, IA, KS, LA, MA, MD, MS, MT, NY, OH, OR, PA, SC, SD, TX, WA, WI, WV, WY.

Non-expansion states: AR, AZ, CT, DE, FL, GA, ME, MI, MN, MO, NC, NJ, NM, NV, OK, VT.

CO, IL, IN, and MA are excluded from dyad analysis due to concurring parental expansions.

Models include controls for the supply/availability of child/parent private or public insurance: parent worker status; firm size category of worker in family; full-time/part-time work status of worker; spouse work status and market factors including urban/rural area; county unemployment rate; per capita income; and state/year indicators of CHIP expansions 1999 to 2012. Models include controls for demand-side factors: family income as percent FPL; family size; infant in household; parent’s age, gender, race/ethnicity, health status, disabled status, education, marital status, citizenship, child’s age, gender, race/ethnicity, health status, and citizenship.

CHIP Program Expansions and Parent Eligibility

When children become eligible for public health insurance, their parents are often not eligible, and hence, joint coverage may not be affected. However, we hypothesize above that if expansions are tied to outreach and enrollment efforts, parents might learn of public coverage options already available to them, and that this outreach effect might be stronger when expansions target income groups with preexisting parental coverage programs. We test the effects of states’ CHIP expansions on joint coverage of parent and child by classifying states on the proximity of their eligibility levels in the year of the CHIP expansion. In Table 3, we present results for CHIP expansions in states where the % FPL eligibility levels for parent and post-expansion eligibility levels for child are (1) within 50 or fewer pp; (2) within 51 to150 pp; and (3) >150 pp in the year of the CHIP expansion. Effects on children’s insurance are seen in the 51% to 150% FPL and >150% FPL categories. For the latter, the CHIP expansion is associated with a decline in uninsured of 2.2 pp and a weakly significant increase in publicly insured of 2.7 pp (P < .10).

Table 3.

Effects of Eligibility Expansions for Children by Proximity to Parent Income Eligibility Levela.

| Proximity of Child Eligibility Level to Parent Eligibility Level |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| 0 to 50 Percentage Points (N = 12 343) |

51 to 150 Percentage Points (N = 47 081) |

>150 Percentage Points (N = 77 123) |

|||||||

| Marginal Effect | Standard Error | P | Marginal Effect | Standard Error | P | Marginal Effect | Standard Error | P | |

| Child multinomial logit model (n = 346 345) | |||||||||

| Private | −0.006 | 0.010 | .586 | −0.013 | 0.008 | .102 | −0.004 | 0.010 | .677 |

| Public | 0.017 | 0.014 | .235 | 0.024 | 0.011 | .023 | 0.027 | 0.015 | .073 |

| Uninsured | −0.011 | 0.009 | .207 | −0.012 | 0.009 | .184 | −0.022 | 0.010 | .025 |

| Dyad multinomial logit model (n = 346 345) | |||||||||

| Both insured | 0.023 | 0.012 | .055 | 0.007 | 0.011 | .525 | 0.018 | 0.012 | .136 |

| Parent only insured | −0.003 | 0.003 | .306 | −0.002 | 0.001 | .223 | −0.003 | 0.002 | .214 |

| Child only insured | −0.014 | 0.006 | .037 | 0.003 | 0.010 | .763 | 0.006 | 0.008 | .482 |

| Both uninsured | −0.007 | 0.008 | .425 | −0.008 | 0.008 | .320 | −0.020 | 0.009 | .027 |

| Both insured multinomial logit model (n = 245 347) | |||||||||

| Both private | −0.025 | 0.010 | .011 | −0.022 | 0.009 | .018 | −0.026 | 0.011 | .021 |

| Both public | 0.025 | 0.012 | .042 | 0.008 | 0.010 | .430 | 0.018 | 0.012 | .138 |

| One public/one private | 0.000 | 0.009 | .979 | 0.015 | 0.006 | .011 | 0.009 | 0.005 | .051 |

Based on models with robust standard errors clustered at the state level.

Expansion states: AL, CO, DC, HI, ID, IL, IN, IA, KS, LA, MA, MD, MS, MT, NY, OH, OR, PA, SC, SD, TX, WA, WI, WV, WY.

Non-expansion states: AR, AZ, CT, DE, FL, GA, ME, MI, MN, MO, NC, NJ, NM, NV, OK, VT.

Models include controls for the supply/availability of child/parent private or public insurance: parent worker status; firm size category of worker in family; full-time/part-time work status of worker; spouse work status and market factors including urban/rural area; county unemployment rate; per capita income; and state/year indicators of CHIP expansions 1999 to 2012. Models include controls for demand-side factors: family income as percent FPL; family size; infant in household; parent’s age, gender, race/ethnicity, health status, disabled status, education, marital status, citizenship, child’s age, gender, race/ethnicity, health status, and citizenship.

This analysis is the first to indicate some evidence of an increase in joint parent-child coverage of 2.3 pp (P = .055) from CHIP expansions. This result was only seen in states where their eligibility levels are within 50 pp; there is a corresponding reduction in child only insured of 1.4 pp in these states. In all 3 categories of states’ parent/child eligibility levels, CHIP expansions are associated with “crowd out”—declines in parent/child joint private coverage in dyads where both are insured. The magnitude of this effect varies only slightly across the state groups (2.2-2.6 pp). In states where the eligibility levels are close (<50 pp different), there is an increase in the probability that both the parent and child are publicly insured of 2.5 pp as joint private coverage declines. In the other 2 state groups, coverage for parent and child becomes mixed—one public, one private—as families move out of joint private coverage. The magnitude of the increase in mixed coverage ranges from 0.9 pp in the states where the eligibility levels differ by >150% FPL to 1.5 pp in states where the eligibility levels for parent and child are within 51% to 150% FPL.

Limitations

This study is limited by the CPS measure of insurance, which applies a single insurance coverage type to an entire year and is based on interviewees’ reports of prior year coverage. Thus, we are unable to observe within-year changes in coverage, and responses may be inaccurate due to recollection bias. It is likely that coverage is overestimated. Second, although policy changes and Medicaid eligibility determinations occur at specific points in time, we are limited to annual income data. This can lead to misestimating point-in-time income and, thus, establishing eligibility for an expansion. Additionally, although Medicaid counts the income of both parents, we cannot link parents across households and must assume that parents do not identify the income of non-household parents when applying. As in other studies of this type, we proxy availability of employer-sponsored insurance coverage for families using parents’ work status and, if working, firm size. Finally, our study period and sample of states provides 41 clusters, which limits our power to detect significant effects in models including clustered standard errors.

Discussion

Our study time period (1999-2012) reflects years when federal funds were redistributed across the states and the Children’s Health Insurance Program Reauthorization Act (CHIPRA) revised the program’s funding structure. During this period, states used program design options, including eligibility expansions, to revise their originally implemented CHIP programs in order to use their federal grant allotments. We find that states’ CHIP eligibility expansions during this period explain a 1.5 pp decrease in the likelihood that children in families between 150% and 300% FPL were uninsured. The overall decline in the likelihood of a child being uninsured was 3 pp across all states for children in families with incomes below 300% FPL. There was a corresponding increase in public insurance of 2.5 pp for children in this income range. Our average state effects are only somewhat smaller than the 2.9% increase in public insurance found post CHIPRA.16

When looking at children’s coverage only, our models do not find statistically significant evidence of “crowd-out” as a result of CHIP expansions. Earlier studies discuss the crowd out issue within the context of low-income families’ lacking access to private insurance14,51; our controls for work status and size of firm help address that issue. We note that while some of the expansions during this period targeted higher income families more likely to have access to private coverage, the majority of states that expanded were extending eligibility to relatively low-income children.

A new finding on “crowd-out” is seen in our results on joint parent/child coverage where we consider the proximity of eligibility for public insurance. Across all groups, there is evidence that the CHIP expansion leads to crowd-out of private insurance for those insured parent/child dyads. Our estimated effects ranged from 2.2 pp to 2.6 pp reductions. Where the parent/child eligibility levels are close, the CHIP expansion is associated with increased probability that parent/child are both publicly insured and where eligibility levels are further apart, their coverage becomes mixed—one public, one private.

Earlier work indicated states’ parental Medicaid expansions increased the likelihood that both parent and child are insured.46 Whereas children were previously eligible for public coverage when their parents gained eligibility through expansions, able-bodied parents of children who gain eligibility through CHIP expansions are generally not eligible for public coverage. Our study finds CHIP expansions in states where parent and child eligibility levels are within 50 pp increased the probability that parents and children were both insured, driven by a reduction in the likelihood that only the child was insured. This finding suggests that child eligibility expansions may increase public health insurance coverage among their previously eligible but not enrolled parents. Taken together, these findings add to the growing literature on the effects of public insurance on improving financial stability and material well-being of families.8

As federal funding for CHIP was expiring, states began to exhaust existing federal funds and to take action to alert families as they faced hard choices regarding children’s coverage.52 Congress extended CHIP funding for 6 years and required states to maintain 2010 levels of effort for CHIP for children with family incomes up to 300% FPL through 2023 but reduced the ACA “enhanced” CHIP FMAP (Federal Medical Assistance Percentages). The reduced FMAP may induce states to cut back on CHIP costs by imposing premiums or using other means of curtailing the program as more state tax revenues are needed and states face other budgetary needs. Coupled with increased premiums in the individual markets and the lack of Medicaid expansion in some states, families continue to face complicated decisions regarding parent/child insurance. Child coverage through the marketplaces will generally be more costly than CHIP, and marketplace plans are not required to cover the same breadth of services for children as CHIP. Parents may see these plans as lower quality or of lower value. Additionally, the so-called “family glitch” means that some parents without affordable Employees’ State Insurance offers cannot obtain subsides for family premiums and would face large, perhaps insurmountable, additional costs for child coverage in the absence of CHIP.47

In summary, families have historically made decisions regarding child and parent coverage that put the child first, but families were responsive to the availability of child and joint parent/child coverage under states’ Medicaid and CHIP eligibility policies. In states that expanded CHIP eligibility for children in the period before the ACA, children’s eligibility levels increased children’s coverage and in states with similar parental and child eligibility levels, increased the likelihood that both parents and children were covered. In these states, insured families tended to move from both private to both public insurance coverage. While this raises the issue of crowd-out, it is also consistent with reduced financial burdens for these lower income families. Consistent public coverage within a family could also lead to parents and children sharing the same coverage plan, which could positively affect utilization and care-seeking behavior of children as parents are better prepared to navigate the public health care system. It is an opportune time for the nation to review the success of the federal subsidization of CHIP programs, state flexibility in program design, and evaluation of states’ efforts to maintain the high levels of insurance coverage as the number of uninsured children actually increased in 2017 for the first time in a decade.53

Appendix A

Table A1.

Classification of State Policies by Year of Expansion and Upper Eligibility Levels.

| State | Year | % FPL Pre | % FPL Post | Control States | Excluded States |

|---|---|---|---|---|---|

| Alabama | 2010 | 200 | 300 | ||

| Alaska | — | — | — | — | Xa |

| Arizona | 200 | X | |||

| Arkansas | 200 | X | |||

| California | — | — | — | — | Xb |

| Colorado* | 2010 | 185-205 | 250 | ||

| Connecticut | 300 | X | |||

| Delaware | 200 | X | |||

| DC | 2007 | 200 | 300 | ||

| Florida | 200 | X | |||

| Georgia | 235 | X | |||

| Hawaii | 2006 | 200 | 300 | ||

| Idaho | 2004 | 150 | 185 | ||

| Illinois* | 2006 | 185-200 | 400** | ||

| Indiana* | 2000 | 150 | 200 | ||

| Indiana* | 2008 | 200 | 250 | ||

| Iowa | 2009 | 185-200 | 300 | ||

| Kansas | 2010 | 200 | 241 | ||

| Kentucky | — | — | — | Xc | |

| Louisiana | 2001 | 150 | 200 | ||

| Louisiana | 2008 | 200 | 250 | ||

| Maine | 200 | X | |||

| Maryland | 2001 | 200 | 300 | ||

| Massachusetts* | 2006 | 200 | 300 | ||

| Michigan | 200 | X | |||

| Minnesota | 280/275/275 | X | |||

| Mississippi | 2000 | 185/133/100 | 200 | ||

| Missouri | 300 | X | |||

| Montana | 2007 | 150 | 175 | ||

| Montana | 2009 | 175 | 250 | ||

| Nebraska | — | — | — | — | Xd |

| Nevada | 200 | X | |||

| New Hampshire | — | — | —- | — | Xc |

| New Jersey | 350 | X | |||

| New Mexico | 235 | X | |||

| New York | 2000 | 192 | 250 | ||

| New York | 2008 | 250 | 400 | ||

| North Carolina | 200 | X | |||

| North Dakota | — | — | — | — | Xd |

| Ohio | 2000 | 150 | 200 | ||

| Oklahoma | 185 | X | |||

| Oregon | 2009 | 185 | 300 | ||

| Pennsylvania | 2007 | 235 | 300 | ||

| Rhode Island | — | — | — | — | Xc |

| South Carolina | 2007 | 185/150/150 | 200 | ||

| South Dakota | 2000 | 140 | 200 | ||

| Tennessee | — | — | — | — | Xe |

| Texas | 2000 | 185/133/100 | 200 | ||

| Utah | — | — | — | — | Xc |

| Vermont | 300 | X | |||

| Virginia | — | — | — | — | Xc |

| Washington | 2000 | 200 | 250 | ||

| Washington | 2009 | 250 | 300 | ||

| West Virginia | 2000 | 150 | 200 | ||

| West Virginia | 2009 | 220 | 250 | ||

| West Virginia | 2011 | 250 | 300 | ||

| Wisconsin | 2008 | 185 | 300 | ||

| Wyoming | 2003 | 133 | 185 |

Abbreviation: FPL, federal poverty level.

Excluded from all dyad analyses due to co-occurring child and parent expansions.

Expanded to all uninsured children, regardless of income, top coded as 400% FPL in our dataset.

Excluded due to a decrease in eligibility.

Excluded due to an expansion only for infants.

Excluded due to premium changes independent of eligibility changes.

Excluded due to expansion of less than 25% FPL.

Excluded due to policy complexities surrounding TennCare.

Table A2.

Formal Test for Equality of Pre-Expansion Trendsa.

| Expansion State | Child Insured | Both Insured |

|---|---|---|

| Alabama | 0.004 (.039) | −0.003 (.244) |

| Colorado | 0.003 (.084) | NA |

| District of Columbia | 0.004 (.283) | 0.006 (.155) |

| Hawaii | 0.006 (.064) | 0.005 (.205) |

| Idaho | 0.010 (.051) | −0.004 (.500) |

| Illinois | −0.002 (.299) | NA |

| Indiana | No pre-trend | |

| Iowa | 0.004 (.043) | −0.002 (.477) |

| Kansas | −0.000 (.992) | −0.004 (.027) |

| Louisiana | 0.016 (.581) | −0.046 (.198) |

| Maryland | −0.024 (.538) | −0.016 (.745) |

| Massachusetts | −0.007 (.045) | NA |

| Mississippi | No pre-trend | |

| Montana | 0.002 (.574) | −0.004 (.288) |

| New York | No pre-trend | |

| Ohio | No pre-trend | |

| Oregon | 0.0001 (.945) | −0.006 (.011) |

| Pennsylvania | −0.004 (.071) | −0.005 (.029) |

| South Carolina | −0.001 (.854) | −0.001 (.709) |

| South Dakota | No pre-trend | |

| Texas | No pre-trend | |

| Washington | No pre-trend | |

| West Virginia | No pre-trend | |

| Wisconsin | −0.0003 (.874) | 0.001 (.671) |

| Wyoming | −0.020 (.016) | −0.031(.002) |

Estimates represent the interaction term between year trend and treatment state dummy; P values are in parenthesis.

CO, IL, IN, and MA are excluded due to their exclusion from all dyad analyses.

Sample includes children in families with income up to 300% federal poverty level.

Author Contributions: Drs. Adams, Johnston, Guy and Ketsche contributed to the conception, design, completion of the analysis and writing of the manuscript. Mr. Joski and Dr. Guy completed the file construction, analytic runs and econometric analysis.

Declaration of Conflicting Interests: The author(s) declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding: The author(s) disclosed receipt of the following financial support for the research, authorship and/or publication of this article: This work was supported by the Robert Wood Johnson Foundation (RWJF) Changes in Health Care Finance and Organization 9HCFO) initiative (ID: 71436 PI: Adams). The research described and preparation of this article was completed by the authors without the involvement of RWJF. The views expressed are those of the authors and should not be attributed to RWJF. The work was completed while Dr. Johnston was a doctoral candidate at Emory University.

ORCID iD: E. Kathleen Adams  https://orcid.org/0000-0002-4811-2752

https://orcid.org/0000-0002-4811-2752

See Medicaid Manual, Pub. 45, “General Financial Eligibility Requirements and Options,” p. 3812, “Treatment of Contributions from Relatives to Medicaid Applicants or Recipients.” From http://www.ncsl.org/documents/health/defincacamedicdprov.pdf.

References

- 1. Henry J. Kaiser Family Foundation. Extending federal funding for CHIP: what is at stake? https://www.kff.org/medicaid/fact-sheet/extending-federal-funding-for-chip-what-is-at-stake/. Accessed October 30, 2017.

- 2. Kenney GM, Haley JM, Pan CW, Lynch V, Buettgens M. Medicaid/CHIP participation rates rose among both children and parents in 2015. https://www.urban.org/research/publication/medicaidchip-participation-rates-rose-among-both-children-and-parents-2015. Published May 17, 2017. Accessed October 30, 2017.

- 3. Howell EM, Kenney GM. The impact of the Medicaid/CHIP expansions on children: a synthesis of the evidence. Med Care Res Rev. 2012;69:372-396. doi: 10.1177/1077558712437245 [DOI] [PubMed] [Google Scholar]

- 4. Heberlein M. Performing Under Pressure: Annual Findings of a 50-State Survey of Eligibility, Enrollment, Renewal, and Cost-Sharing Policies in Medicaid and CHIP, 2011-2012. Menlo Park, CA: Henry J. Kaiser Family Foundation; 2012. [Google Scholar]

- 5. Harrington ME. The Children’s Health Insurance Program Reauthorization Act evaluation findings on children’s health insurance coverage in an evolving health care landscape. Acad Pediatr. 2015;15(3 suppl):S1-S6. doi: 10.1016/j.acap.2015.03.007 [DOI] [PubMed] [Google Scholar]

- 6. Johnston EM, Gates J, Kenney GM. Medicaid and CHIP for children: trends in coverage, affordability, and provider access. https://www.urban.org/research/publication/medicaid-and-chip-children-trends-coverage-affordability-and-provider-access. Published June 21, 2017. Accessed October 30, 2017.

- 7. Clemans-Cope L, Kenney G, Waidmann T, Huntress M, Anderson N. How well is CHIP addressing health care access and affordability for children? Acad Pediatr. 2015;15(3 suppl):S71-S77. doi: 10.1016/j.acap.2015.02.007 [DOI] [PubMed] [Google Scholar]

- 8. Wherry LR, Kenney GM, Sommers BD. The role of public health insurance in reducing child poverty. Acad Pediatr. 2016;16(3 suppl):S98-S104. doi: 10.1016/j.acap.2015.12.011 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9. Henry J. Kaiser Family Foundation. Summary of the 2018 CHIP Funding Extension. Menlo Park, CA: Henry J. Kaiser Family Foundation; 2018. http://files.kff.org/attachment/Fact-Sheet-Summary-of-the-2018-CHIP-Funding-Extension. Accessed June 12, 2018. [Google Scholar]

- 10. Bansak C, Raphael S. The effects of state policy design features on take-up and crowd-out rates for the state children’s health insurance program. J Policy Anal Manage. 2007;26:149-175. [DOI] [PubMed] [Google Scholar]

- 11. Blumberg LJ, Dubay L, Norton SA. Did the Medicaid expansions for children displace private insurance? An analysis using the SIPP. J Health Econ. 2000;19:33-60. [DOI] [PubMed] [Google Scholar]

- 12. Card D, Shore-Sheppard LD. Using discontinuous eligibility rules to identify the effects of the federal Medicaid expansions on low-income children. Rev Econ Stat. 2004;86:752-766. [Google Scholar]

- 13. Cutler DM, Gruber J. The effect of Medicaid expansions on public insurance, private insurance, and redistribution. Am Econ Rev. 1996;86:378-383. [PubMed] [Google Scholar]

- 14. De La Mata D. The effect of Medicaid eligibility on coverage, utilization, and children’s health. Health Econ. 2012;21:1061-1079. [DOI] [PubMed] [Google Scholar]

- 15. Dubay L, Kenney G. The impact of CHIP on children’s insurance coverage: an analysis using the National Survey of America’s Families. Health Serv Res. 2009;44:2040-2059. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16. Goldstein IM, Kostova D, Foltz JL, Kenney GM. The impact of recent CHIP eligibility expansions on children’s insurance coverage, 2008-12. Health Aff (Millwood). 2014;33:1861-1867. doi: 10.1377/hlthaff.2014.0208 [DOI] [PubMed] [Google Scholar]

- 17. Gresenz CR, Edgington SE, Laugesen M, Escarce JJ. Take-up of public insurance and crowd-out of private insurance under recent CHIP expansions to higher income children. Health Serv Res. 2012;47:1999-2011. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18. Gruber J, Simon K. Crowd-out 10 years later: have recent public insurance expansions crowded out private health insurance? J Health Econ. 2008;27:201-217. [DOI] [PubMed] [Google Scholar]

- 19. Ham JC, Shore-Sheppard L. The effect of Medicaid expansions for low-income children on Medicaid participation and private insurance coverage: evidence from the SIPP. J Public Econ. 2005;89:57-83. [Google Scholar]

- 20. Blavin F, Kenney GM, Huntress M. The effects of express lane eligibility on Medicaid and CHIP enrollment among children. Health Serv Res. 2014;49:1268-1289. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21. Smith V, Snyder L, Rudowitz R. CHIP enrollment snapshot: December 2013. http://kff.org/medicaid/issue-brief/chip-enrollment-snapshot-december-2013/. Published June 3, 2014. Accessed April 3, 2017.

- 22. Ku L, Broaddus M. The importance of family-based insurance expansions: new research findings about state health reforms. http://eric.ed.gov/?id=ED444766. Published September 5, 2000. Accessed May 17, 2015.

- 23. Lambrew JM. Health Insurance: A Family Affair. A National Profile and State by State Analysis of Uninsured Parents and Their Children. New York, NY: Commonwealth Fund; 2001. [Google Scholar]

- 24. Sommers BD. Insuring children or insuring families: do parental and sibling coverage lead to improved retention of children in Medicaid and CHIP? J Health Econ. 2006;25:1154-1169. [DOI] [PubMed] [Google Scholar]

- 25. Cheng T. Children’s access to four medical services: impact of welfare policies, social structural factors, and family resources. Child Youth Serv Rev. 2006;28:595-609. [Google Scholar]

- 26. Hanson KL. Is insurance for children enough? The link between parents’ and children’s health care use revisited. Inquiry. 1998:294-302. [PubMed] [Google Scholar]

- 27. Minkovitz CS, O’Campo PJ, Chen YH, Grason HA. Associations between maternal and child health status and patterns of medical care use. Ambul Pediatr. 2002;2:85-92. [DOI] [PubMed] [Google Scholar]

- 28. Newacheck PW. Characteristics of children with high and low usage of physician services. Med Care. 1992;30:30-42. [DOI] [PubMed] [Google Scholar]

- 29. Newacheck PW, Budetti PP, Halfon N. Trends in activity-limiting chronic conditions among children. Am J Public Health. 1986;76:178-184. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30. DeVoe JE, Tillotson CJ, Wallace LS, Angier H, Carlson MJ, Gold R. Parent and child usual source of care and children’s receipt of health care services. Ann Fam Med. 2011;9:504-513. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31. Davidoff A, Kenney G, Dubay L, Yemane A. Patterns of Child-Parent Insurance Coverage: Implications for Expansion of Coverage. Assessing the New Federalism Brief. Policy Brief B-39. Washington, DC: Urban Institute; 2001. [Google Scholar]

- 32. DeVoe JE, Tillotson CJ, Wallace LS. Children’s receipt of health care services and family health insurance patterns. Ann Fam Med. 2009;7:406-413. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33. Guendelman S, Pearl M. Children’s ability to access and use health care. Health Aff (Millwood). 2004;23:235-244. [DOI] [PubMed] [Google Scholar]

- 34. Cunningham PJ, Hahn BA. The changing American family: implications for children’s health insurance coverage and the use of ambulatory care services. Future Child. 1994;4:24-42. doi: 10.2307/1602433 [DOI] [PubMed] [Google Scholar]

- 35. Weinick RM, Monheit AC. Children’s health insurance coverage and family structure, 1977-1996. Med Care Res Rev. 1999;56:55-73. doi: 10.1177/107755879905600104 [DOI] [PubMed] [Google Scholar]

- 36. Hudson JL, Selden TM. Children’s eligibility and coverage: recent trends and a look ahead. Health Aff (Millwood). 2007;26:w618-w629. doi: 10.1377/hlthaff.26.5.w618 [DOI] [PubMed] [Google Scholar]

- 37. Gorman BK, Braverman J. Family structure differences in health care utilization among US children. Soc Sci Med. 2008;67:1766-1775. doi: 10.1016/j.socscimed.2008.09.034 [DOI] [PubMed] [Google Scholar]

- 38. Ketsche P, Adams EK, Minyard K, Kellenberg R. The stigma of public programs: does a separate S-CHIP program reduce it? J Policy Anal Manage. 2007;26:775-789. [DOI] [PubMed] [Google Scholar]

- 39. Arrow KJ. Uncertainty and the welfare economics of medical care. Am Econ Rev. 1963;53:941-973. [Google Scholar]

- 40. Guy GP, Jr, Adams EK, Atherly A. Public and private health insurance premiums: how do they affect the health insurance status of low-income childless adults? Inquiry. 2012;49:52-64. doi: 10.5034/inquiryjrnl_49.01.04 [DOI] [PubMed] [Google Scholar]

- 41. Abdus S, Hudson J, Hill SC, Selden TM. Children’s health insurance program premiums adversely affect enrollment, especially among lower-income children. Health Aff (Millwood). 2014;33:1353-1360. doi: 10.1377/hlthaff.2014.0182 [DOI] [PubMed] [Google Scholar]

- 42. Atherly A, Dowd BE, Coulam RF, Guy G. The effect of HIFA waiver expansions on uninsurance rates in adult populations. Health Serv Res. 2012;47(3 pt 1):939-962. doi: 10.1111/j.1475-6773.2011.01376.x [DOI] [PMC free article] [PubMed] [Google Scholar]

- 43. Hadley J, Reschovsky JD, Cunningham P, Kenney G, Dubay L. Insurance premiums and insurance coverage of near-poor children. Inquiry. 2006-2007;43:362-377. [DOI] [PubMed] [Google Scholar]

- 44. Kenney G, Hadley J, Blavin F. Effects of public premiums on children’s health insurance coverage: Evidence from 1999 to 2003. Inquiry. 2006-2007;43:345-361. [DOI] [PubMed] [Google Scholar]

- 45. Marton J, Ketsche PG, Snyder A, Adams EK, Zhou M. Estimating premium sensitivity for children’s public health insurance coverage: selection but no death spiral. Health Serv Res. 2015;50:579-598. doi: 10.1111/1475-6773.12221 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 46. Guy GP, Jr, Johnston EM, Ketsche P, Joski P, Adams EK. The role of public and private insurance expansions and premiums for low-income parents: lessons from state experiences. Med Care. 2017;55:236-243. http://journals.lww.com/lww-medicalcare/Abstract/publishahead/The_Role_of_Public_and_Private_Insurance.98796.aspx. Accessed March 7, 2017. [DOI] [PubMed] [Google Scholar]

- 47. Selden TM, Dubay L, Miller GE, Vistnes J, Buettgens M, Kenney GM. Many families may face sharply higher costs if public health insurance for their children is rolled back. Health Aff (Millwood). 2015;34:697-706. [DOI] [PubMed] [Google Scholar]

- 48. Bertrand M, Duflo E, Mullainathan S. How Much Should We Trust Differences-in-Differences Estimates? Cambridge, MA: National Bureau of Economic Research; 2002. http://www.nber.org/papers/w8841. Accessed July 1, 2015. [Google Scholar]

- 49. Wen H, Hockenberry JM, Cummings JR. The effect of medical marijuana laws on adolescent and adult use of marijuana, alcohol, and other substances. J Health Econ. 2015;42:64-80. doi: 10.1016/j.jhealeco.2015.03.007 [DOI] [PubMed] [Google Scholar]

- 50. Karaca-Mandic P, Norton EC, Dowd B. Interaction terms in nonlinear models. Health Serv Res. 2012;47(1 pt 1):255-274. doi: 10.1111/j.1475-6773.2011.01314.x [DOI] [PMC free article] [PubMed] [Google Scholar]

- 51. McMorrow S, Kenney GM, Waidmann T, Anderson N. Access to private coverage for children enrolled in CHIP. Acad Pediatr. 2015;15(3 suppl):S50-S55. doi: 10.1016/j.acap.2015.02.005 [DOI] [PubMed] [Google Scholar]

- 52. Dubay L, Buettgens M, Kenney GM, Johnston EM. Not extending federal funding for CHIP jeopardizes coverage for children. https://www.urban.org/urban-wire/not-extending-federal-funding-chip-jeopardizes-coverage-children. Published October 3, 2017. Accessed October 30, 2017.

- 53. Alker J, Pham O. Nation’s progress on children’s health coverage reverses course. https://ccf.georgetown.edu/wp-content/uploads/2018/11/UninsuredKids2018_Final_asof1128743pm.pdf. Published November 2018. Accessed March 18, 2019.