Abstract

Differences in consumption patterns are usually treated as a matter of preferences. In this article, the authors examine consumption from a structural perspective and argue that black households face unique constraints restricting their ability to acquire important goods and services. Using data from the Consumer Expenditure Surveys, the authors examine racial differences in total spending and in spending on major categories of goods and services (food, transportation, utilities, housing, health care, and entertainment). The authors also capture heterogeneous effects of racial stratification across class by modeling racial consumption gaps across household income levels. The results show that black households tend to have lower levels of total spending than their white counterparts and that these disparities tend to persist across income levels. Overall, these analyses indicate that racial disparities in consumption exist independently of other economic disparities and may be a key unexamined factor in the reproduction of racial inequality.

Keywords: consumption, disparities, inequality, structure, household, markets

Consumption is a central component of household finances and plays an important role in processes of social stratification. In sociology, studies of consumption usually focus on cultural rather than economic aspects (Schor 2005; Zukin 2004). The relationship between consumption and stratification is conceptualized as indirect, driven by consumption’s role in signaling tastes and social position (Bourdieu 1984; DiMaggio 1987; Peterson and Kern 1996). In this context, consumption differences are implicitly treated as the result of socially patterned individual preferences. The focus tends to be on cultural goods (e.g., music), while practical day-to-day expenditures (e.g., rent) remain relatively ignored. Evidence indicates, however, that access to these more practical goods and services varies significantly across social groups (Powell et al. 2007; Schuetz, Kolko and Meltzer 2012; Small and McDermott 2006). Because such disparities arise in the process of spending one’s resources, they are missed by research that focuses on earnings or wealth accumulation alone. Yet disparities in consumption can result in substantial inequalities in well-being and in the intergenerational transmission of social advantage (Citro and Michael 1995; Meyer and Sullivan 2012).

In this article, we propose that consumer markets are subject to various and often nominally race-neutral mechanisms that constrain blacks’ access to goods and services relative to whites. We focus on three key mechanisms: (1) access to credit, (2) retail and service desertification, and (3) consumer discrimination. These mechanisms, we argue, result in lower overall consumption levels for blacks relative to whites. These mechanisms, however, do not affect all households equally. Instead, we propose that they interact with social class to produce complex patterns of racial disparities in access to goods and services. We argue that higher class position allows black households to minimize the impact of stratification mechanisms tied to credit access but does little to mitigate the impact of retail desertification and consumer discrimination. By doing so, we contribute to a growing literature on the persisting but heterogeneous impact of racial stratification across social class (Landry and Marsh 2011; Thomas and Moye 2015).

To examine consumption-based stratification processes, we use household spending data from the 2013 and 2014 Consumer Expenditure Surveys (CE). Our goal is to provide a comprehensive empirical overview of racial differences in spending for those goods and services on which households spend the most. Because direct measures of the proposed mechanisms are not available in the CE, our analytical strategy relies on testing observable implications from the proposed argument. We specify these through hypotheses developed in conversation with racial stratification scholarship. Our hypotheses address expected racial differences in overall spending levels, as well as differences across specific categories of household spending. All hypotheses consider differences in expected racial spending gaps across income groups. We test these hypotheses empirically using hierarchical linear regression models. Overall, our results suggest important racial disparities in access to goods and services, such that blacks and whites in similar socioeconomic positions obtain significantly different material returns from similar economic resources.

APPROACHES TO RACE AND CONSUMPTION

Markets are often conceptualized as a neutral coordination mechanism in which rewards are determined by the supply of and demand for participants’ endowments, rather than any social status they may hold (Weber 1978:636–38). Sociological work on markets, however, indicates that social statuses play an important role in structuring economic relationships. Research on labor markets, for instance, shows that markets tend to reproduce prevalent forms of categorical inequality (Moss and Tilly 2001; Pager and Shepherd 2008; Stainback and Tomaskovic-Devey 2012). As Fourcade and Healy (2013) suggest consumer markets also operate in ways that likely reproduce categorical inequality. Empirical work on racial differences in consumption, however, has focused on narrow categories of goods and service and proposed individual-level explanations only. Drawing on the Veblenian concept of conspicuous consumption (Veblen 1899), scholars have argued that black consumers devote a greater portion of their resources to visible, status-increasing goods (Charles, Hurst and Roussanov 2009; Ivanic, Overbeck and Nunes 2011). This conspicuous consumption is variously presented as a rational strategy for managing racially motivated microaggressions (Lamont and Molnar 2001; Lee 2000) or as a problematic form of spending leading to lower investments in productive assets (Moav and Neeman 2010; Rayo and Becker 2006).

Here, we propose a new approach to understanding racial differences in consumption. Rather than focusing on individual motivations, we propose that racial differences in consumption are caused in large part by broader structural factors and often reflect differences in access to goods and services. Unlike previous studies, we extend our investigation of racial differences in consumption to types of spending that are more centrally related to individuals’ material well-being, and we consider the interaction of race and income in producing complex patterns of inequality.

The Racial Spending Gap: Credit, Desertification, and Discrimination

Racial disparities in income and wealth in the United States entail lower consumption levels for blacks compared with whites. Income and wealth, however, are not the only determinants of the ability to consume. Drawing on racial stratification research, we identify three factors that constrain blacks’ overall ability to consume relative to whites, net of income and wealth differences.

The first is access to credit. Access to credit plays a key role in the ability to acquire high-cost goods, make long-term investments, and increasingly, sustain day-to-day consumption (Barba and Pivetti 2009; Barr 2012; Prasad 2012). Access to credit, however, is not equal across racial groups. Credit card applicants from predominantly black neighborhoods, for instance, are more likely to have credit requests denied than similarly qualified applicants from majority-white neighborhoods (Cohen-Cole 2011). Similar trends exist for mortgage lending (Williams, Nesiba and McConnell 2005) and auto loans (Charles, Hurst and Stephens 2008; Cohen 2012). Black borrowers are more likely to be targets of predatory lending (Ghent, Hernández-Murillo, and Owyang 2011) and more likely to be steered toward disadvantageous and costly bankruptcy provisions when they default (Braucher, Cohen and Lawless 2012). These credit constraints suggest that compared with whites, blacks’ spending on costly goods and services that require financing will likely be lower. Because access to credit is especially important to low- and middle-income households, we expect credit-related racial gaps in spending to be especially large for these income groups.

Retail and service desertification is another factor that likely affects household spending. Retail deserts are geographic areas with low densities of retail and service providers (Schuetz et al. 2012). Retail deserts have been found for grocery stores, banks, health care providers, gas stations, pharmacies, and clothing outlets, among others (Kwate et al. 2013; Meltzer and Schuetz 2012; Myers et al. 2011; Small and McDermott 2006). Studies of grocery stores have found that low-income and segregated majority-black neighborhoods are at particularly high risk for desertification (Avery et al. 1997; Moore and Diez Roux 2006).

Historically, retail desertification has been a result of capital disinvestment following the urban riots of the 1960s and 1970s (Boustan 2010; Collins and Smith 2007) and the relocation of retail infrastructure to shopping centers near majority-white suburbs (Cohen 2003). These developments changed the institutional dynamics of retail and service markets in majority-black areas. Insurance premiums for commercial property in segregated neighborhoods sky-rocketed, becoming unaffordable for many business owners (Lee 2002). Capital availability plummeted as financial institutions were unwilling to extend loans to underinsured businesses. Obtaining insurance and capital remains a problem for businesses operating in segregated neighborhoods today (Blanchflower, Levine, and Zimmerman 2003; Chatterji and Seamans 2011), leading to chronic liquidity constraints and high rates of business failure (Fairlie and Robb 2007; Kollinger and Minniti 2006). The overall result for segregated neighborhoods—lower retail density and higher business turnover—limits access to quality goods and services. Because residential segregation by race persists across the income distribution (Lichter, Parisi, and Taquino 2015; Sharkey 2014), we expect segregation-driven spending gaps to exist for all income groups.

A final factor potentially leading to racial spending gaps is consumer discrimination: the biased treatment of nonwhite customers in retail and service settings, such as being denied service or steered toward lower quality alternatives (Harris, Henderson, and Williams 2005). Evidence of consumer discrimination is greater in the service sector but also exists in housing, health care, and the automobile retail industry (Ayres and Siegelman 1995; Bridges 2011; Rothwell 2011). Consumer discrimination can often take forms that are not directly obvious to customers. Shop owners, for example, may petition municipal authorities to change public transportation routes to restrict the flow of low-income black commuters to their establishments (Austin 1997). Because it restricts black consumers’ access to certain consumption opportunities, consumer discrimination should lead to lower spending for black households. This effect is likely larger for higher income blacks, who are more likely than their low-income counterparts to shop in majority-white areas and to face discrimination as a result (Feagin and Sikes 1995).

Together, restricted access to credit, retail desertification, and consumer discrimination suggest that black households at all income levels should have lower spending levels than white households:

Hypothesis 1: Low-, middle-, and high-income black households have lower expenditures than similar-income white households.

Broad Categories of Goods and Services

Beyond their overall impact on consumption levels, restricted access to credit, retail desertification, and consumer discrimination also likely have different spending effects for different goods or services. In this section, we identify three broad, ideal-typical categories of goods and services and clarify expected racial disparities in spending patterns for each.

The first category includes goods and services with large initial up-front costs, which cannot be acquired in small increments (e.g., appliances, vehicles, and housing). To acquire these, households must either have sufficient liquid assets or access to credit. Because blacks have lower savings and lower access to credit on average than whites, they are likely not able to acquire high-cost goods at the same rate. Constrained access to credit, however, does not affect all households equally. Because high-income households are more likely to have disposable assets or income, they experience fewer liquidity problems than low-income households. We therefore expect the racial gap in spending for high up-front cost goods to be largest for low-income households and to shrink for households higher up the income distribution.

The second category includes frequent, day-today purchases, such as groceries. Shopping for these goods entails important time commitments, known as fixity constraints (Schwanen, Kwan, and Ren 2008). To minimize these time commitments, households tend to rely on nearby retail establishments for these types of purchases (Doherty 2006; Millward and Spinney 2011). Because of retail desertification, black households are faced with a choice between relying on lower quality local resources or longer traveling time to shop in a different neighborhood. Longer trips are not an insurmountable barrier, but the time costs they entail mean that the average black family will sometimes choose a nearby (but lower quality) retail alternative. Because white families are not faced with that same alternative, we expect this to lead to significant racial differences in spending. This also entails that the black-white gap in spending for high-frequency goods should increase with income, as higher income blacks living in segregated neighborhoods or suburbs will occasionally forgo the more expensive premium goods (e.g., organic produce) that their earnings otherwise allow them to purchase (Lacy 2007; Richardson et al. 2012).

The final category consists of goods and services provided through contracts, such as rented housing, insurance, and utilities. Unlike arm’s-length transactions, contract-based transactions are subject to ancillary fees that are unrelated to the quality or quantity of the purchase. These fees, usually justified as a risk management strategy, tend to impose higher financial burdens on already disadvantaged consumers (Fourcade and Healy 2013). Providers can request deposits from clients with low credit scores, without stable employment, or with criminal records (Jacobs and Crepet 2007; Oyama 2009). Penalties for late payments, contract termination, and service relocation can also be imposed. These risk-pricing practices likely have a disproportionate impact on black consumers. Blacks are, for example, more likely to experience involuntary job loss (Strully 2009; Wilson and McBrier 2005), increasing their odds of skipping payments or of having to relocate to a new job and break an existing contract (Phinney 2013). We therefore expect blacks to spend more than whites for contract-based goods and services. Because the factors leading to higher costs are not specific to income groups, we expect spending differences for contractual goods to hold across the income distribution.

The Major Household Expenditure Types

The categories of goods and services proposed—high-cost, high-frequency, and contract-based—are ideal-types. Specific expenditures fall under more than a single category. In this section, we draw on these ideal-types to formulate hypotheses on racial disparities in spending for specific goods and services, focusing on the six largest categories of household expenditures (see Table 1).

Table 1.

Dependent Variables.

| Variable | Hypothesis | Percentage of Total | Description |

|---|---|---|---|

| Total spending | 1 | 100.0 | Total household spending on food, housing, utilities, furniture, appliances, childcare, clothes, personal care, transportation, health care, health insurance, entertainment, education, reading material, personal insurance, pensions, alcohol, tobacco, and other miscellaneous expenditures |

| Groceries | 2 | 12.5 | Food prepared and consumed at home |

| Owned housing | 3A | 14.1 | Mortgage principal and interest, homeowner’s insurance, property taxes, management fees, maintenance fees, service or repair charges paid by homeowner |

| Rented housing | 3B | 8.6 | Rent, renter’s insurance, management fees, maintenance fees, service or repair charges paid by renter |

| Utilities | 4 | 9.6 | Natural gas, electricity, heating fuels, telephone, water, and sewage costs for owned or rented properties |

| Transportation | 5 | 14.1 | Gasoline, diesel fuel, and motor oil, costs for new or used vehicle purchase, vehicle finance charges, maintenance and repairs, insurance, lease charges, cash down, termination fees for leased vehicle, driver’s license cost, rental costs, vehicle inspection fees, parking and tolls, Global Positioning System fees, towing charges, membership fees for automobile service clubs |

| Health care | 6 | 8.7 | Medical and laboratory services (physicians, dentists, and eye care providers), hospitalization, convalescent care, prescription drugs, eyewear, hearing aids, convalescent medical equipment (e.g., wheelchair), general medical supplies, and health insurance premiums |

| Entertainment | 7 | 4.5 | Fees and admission for health clubs, country clubs, swimming pools, tennis clubs, social clubs, and other civic, service, or fraternal organizations; televisions, radios, and sound equipment; pets, toys, and playground equipment; miscellaneous recreational equipment (e.g., musical instruments, boating equipment, photography equipment) |

Groceries.

Groceries are a high-frequency purchase, which entails that households’ food spending is relatively constrained by the availability of nearby food retail. Retail density for grocery stores varies significantly with neighborhood composition; indeed, food deserts are one of the best documented cases of retail desertification (Walker, Keane, and Burke 2010). Food deserts are associated with both low-income and majority-black neighborhoods (Block and Kouba 2006; Powell et al. 2007; Richardson et al. 2012). Because food deserts affect low-income neighborhoods and majority-black neighborhoods in similar ways, low-income white and black households are expected to face similar constraints in access to food retail. Accordingly, racial differences in food spending should be smallest at the lower end of the income distribution. The association between food desertification and residential segregation net of neighborhood income level, however, should lead to larger racial differences in grocery spending for higher-income households.

Hypothesis 2: Black households have lower food expenditures than white households; the gap is smallest for low-income households and widens for middle- and high-income households.

Housing.

Rates of homeownership have historically been lower for blacks than for whites (Fischer 2013; Hirschl and Rank 2010), in part because of unequal access to credit and mortgage financing (Chomsisengphet and Pennington-Cross 2006; Freund 2007; Rugh and Massey 2010). Research on housing costs suggests that blacks spend more than whites for equal (or sometimes lower) quality housing. Studies of racial steering, for example, have found that black homeowners pay a monetary premium at the time of purchase (Bayer et al. 2013) even though they acquire homes of significantly lower value (Galster and Godfrey 2005; Krivo and Kaufman 2004; Roscigno, Karafin, and Tester 2009). Difficulties obtaining mortgage financing for blacks have been associated with higher interest rates and monthly mortgage payments, especially in the lead-up to the recent foreclosure crisis (Rugh, Albright, and Massey 2015). We therefore expect to see greater spending on owned housing for blacks compared with whites. We expect this difference to shrink as income increases, reflecting lower liquidity constraints (and therefore better mortgage terms) for higher-income black families.

Hypothesis 3A: Low-income black homeowners have higher owned housing expenditures than white homeowners; this difference shrinks as income increases.

Rented housing is a contractual good for which various penalties can be imposed (Thacher 2008). Rented housing is also subject to consumer discrimination in the form of refusal of service (Hogan and Berry 2011; Massey and Lundy 2001; Ondrich, Stricker, and Yinger 1999), which limits the range of black renters’ housing options. Both of these processes should lead black households to pay higher overall prices on average for lower quality units. As for contractual goods more generally, this difference is expected to persist across the income distribution.

Hypothesis 3B: Low-, middle-, and high-income black households have higher rented housing expenditures than white households.

Utilities.

Electricity, water, heating, and home phone services are usually provided on a contractual basis, usually within a geographic area dominated by a small number of suppliers. As such, utilities are particularly susceptible to the type of contractual fees and penalties that we argue disproportionately affect black consumers in all income groups. Utilities can be subject to fees for start of service, contract termination, and relocation. Utility companies can also impose penalties or request deposits for various reasons, including making a late payment, being unemployed, or having poor credit. Utility expenditures are also unique in that they are inversely correlated to housing stock quality, which tends to be lower for blacks (Friedman and Rosenbaum 2004). These factors taken together imply that black households will pay higher prices for utilities, net of actual differences in usage.

Hypothesis 4: Low-, middle-, and high-income black households have higher utility expenditures than white households.

Transportation.

Personal vehicles are high-cost goods. Their purchase therefore depends on access to liquid assets and credit, which are both lower for blacks on average. Blacks are also more likely to experience price markups when purchasing vehicles, which exacerbates the issue (Ayres and Siegelman 1995; Morton, Zettelmeyer, and Silva-Risso 2003). We expect low-income black households to be less likely to own vehicles than low-income white households, leading to lower average transportation spending. As for high-cost goods more generally, this gap should narrow and transportation spending should equalize as income increases.

Hypothesis 5: Low-income black households have lower transportation expenditures than white households; the gap shrinks as income increases.

Health Care.

Research has shown important racial disparities in access to health care, even when income and health insurance coverage are taken into account (Smedley, Stith, and Nelson 2009; White, Haas, and Williams 2012). Residents of segregated neighborhoods, for instance, are less likely to have access to primary care providers (Gaskin et al. 2009) and to other health-related services and products (Morrison et al. 2000; Smith et al. 2007). Prescription drug use is lower for blacks (Gaskin et al. 2006), partly because of differential prescription of certain drugs by physicians (Roberts 2011; Tamayo-Sarver et al. 2003). Instances of racial discrimination in health settings also contribute to mistrust of care providers among black patients and to a lesser degree of willingness to seek health services (Dovidio et al. 2008; Roberts 2011). We therefore expect lower health care–related spending for blacks compared with whites at all income levels.

Hypothesis 6: Low-, middle-, and high-income black households have lower health care expenditures than white households.

Entertainment.

Black consumers’ entertainment and leisure expenditures are likely influenced by both consumer discrimination and retail desertification. Black consumers report racial discrimination in a wide range of entertainment venues, especially those located in more affluent and racially mixed areas (Feagin 1991; Harris et al. 2005). As a result, black consumers are probably more likely to avoid such venues or to favor home entertainment. Few studies examine retail desertification for entertainment venues, but segregated majority-black areas likely also have lower densities of entertainment outlets. Retail desertification and consumer discrimination suggest that blacks have lower entertainment spending that whites, and that this gap increases with income.

Hypothesis 7: Low-, middle-, and high-income black households have lower entertainment expenditures than white households; this gap increases with income.

DATA

We use data from the 2013 and 2014 Consumer Expenditure Surveys (CE), the most complete nationally representative U.S. expenditure survey. The CE uses detailed questionnaires administered in respondents’ homes by trained U.S. Census Bureau personnel, and provides quarterly data on major household expenditures for which transaction records are available or which respondents are expected to be able to recall over extended periods of time. The CE is administered on a rotating panel basis and samples approximately 7,000 households each quarter. These households are then reinterviewed every three months over a full calendar year, for a total of four interviews.

Although expenditure data in the CE are collected quarterly, background information for each household is collected in the first interview only and is then carried forward. Financial data are collected in the first interview, carried forward in the second and third interviews, and updated in the last interview (for additional details, see National Research Council 2013). Some data (e.g., on financial assets) are collected only in the last interview. We use household characteristics from the last available interview, include only black and white households, pool the quarterly data from March 2013 to March 2015, and use data only from respondents who completed their final interviews. Our final analytic sample includes 26,654 quarterly observations in 9,558 households.

Dependent Variables

Our dependent variables measure total quarterly out-of-pocket spending and quarterly out-of-pocket spending for six categories of goods and services. All amounts include applicable taxes. All dollar values (including income and wealth measures described in the next section) were adjusted for inflation using the Consumer Price Index. Because dependent variables measure quarterly spending, we use the monthly Consumer Price Index averaged over each quarter. All reported dollar values therefore represent constant 2015 first-quarter dollars. For our health care spending measures, a small number of households reported greater reimbursements than expenditures, resulting in negative values; because our models use log transformations, we bottom-code health expenditures at zero. Detailed definitions for all dependent variables are provided in Table 1.

Independent Variable

We use a binary indicator for non-Hispanic black households, with non-Hispanic white households as the reference category. Because race and ethnicity are individual-level variables, we create a household-level variable in the following way:

For single-headed households, we use the race or ethnicity of the respondent.

For married or cohabiting households, we use the race or ethnicity of both partners when they report the same race or ethnicity.

For interracial households (less than 4 percent of our sample), we use the race of the household’s primary earner.

We interact this race variable with a three-category income-level variable. Households are assigned to the low-, middle-, or high-income category on the basis of their tertile in the overall (after-tax) income distribution. The low-income category includes all households with incomes below $29,840, the middle category includes all households with income between $29,841 and $69,456, and the top category includes all households with incomes over $69,456.

Control Variables

We use four categories of controls: family structure, socioeconomic status, housing, and geography. Family structure affects household spending in several ways. Larger households spend more, especially when the number of children in the household is large. Marital composition of the household affects how spending decisions are made (Treas and de Ruijter 2008) and can make certain spending needs (e.g., childcare for single parents) more pressing. Because family structure varies significantly by race (McLanahan and Percheski 2008), we include controls for family type—a categorical variable indicating whether the household is composed of husband and wife (or cohabiting partners) only, husband and wife and children, a single parent with children, a single person, or other—for the total number of adults and of children under age 16 in the household, for whether anyone over age 64 resides in the household, and for the primary respondent’s age and its square.

Because socioeconomic status correlates with race and purchasing power, we control for (logged) total after-tax and after-transfer income over 12 months using employment earnings and income from the following: Social Security; government programs; dividends, trusts, and estates; rental units and roomers or boarders; interest on bonds and deposits; private pensions and annuities; and scholarships and fellowships. We also include a categorical control for the occupation of the households’ primary earner (manager or professional; administrative support, technical, or sales personnel; service worker; operator, assembler, or laborer; precision production, craft, and repair worker; or not employed at the time); a categorical control for educational attainment of the households’ primary earner (no high school diploma, completed high school, some college, has a bachelor’s degree, or has a graduate or professional degree); and the number of earners in the household.

We also include several wealth and housing controls. Wealth is an important determinant of household spending. It represents a potential source of liquid funds for larger purchases and can help households maintain their consumption levels when faced with an economic shock. Because black families have lower levels of wealth on average than white families, we include a control for overall (log) household financial wealth. We measure financial wealth as the sum of all household assets held in checking, savings, and money market accounts; certificates of deposit; financial instruments (such as stocks, bonds, mutual funds, annuities, trusts, royalties, and other financial assets); retirement accounts (such as individual retirement accounts and 401[k] plans); and the surrender value of whole-life and other insurance policies that can be cashed or borrowed against prior to death. Housing arrangements affect spending (e.g., larger home have higher utility costs) and purchasing power (e.g., homeownership provides tax benefits and facilitates access to credit instruments). Because black families are less likely to own their homes (Flippen 2010), we include a categorical control for housing type (whether households own their home with mortgage, own without mortgage, rent, or have a different arrangement [e.g., reside in student housing]). We also control for total number of rooms (including bathrooms) in the respondent’s home or apartment.

Finally, we include geographic controls to account for regional variation in prices. Price levels and accessibility of goods and services vary with the size of the urban agglomeration in which the household is located (Richardson et al. 2012). Prices also vary between rural and urban areas (Kaufman 1999). We control for whether households reside in a rural or urban area, for the size of their city or town (a categorical variable indicating whether households reside in an agglomeration with more than 4 million people, 1.2 million to 4 million people, 0.33 million to 1.19 million people, 125,000 to 329,000 people, or fewer than 125,000 people), and for their U.S. region of residence (Northeast, South, Midwest, or West). Because regional and agglomeration size differences in price levels are not linear (e.g., large cities in the South have different price levels than large cities in the Northeast), we include interactions between region and city size. Descriptive statistics are presented in Table 2.

Table 2.

Descriptive Statistics for White and Black Households, 2013 to 2015.

| White |

Black |

|||

|---|---|---|---|---|

| Variable | M | SD | M | SD |

| Income level | ||||

| Low | 0.296 | 0.505 | ||

| Middle | 0.322 | 0.328 | ||

| Top | 0.382 | 0.167 | ||

| Demographics | ||||

| Married | 0.274 | 0.094 | ||

| Married with children | 0.235 | 0.134 | ||

| Single parent | 0.037 | 0.132 | ||

| Single | 0.332 | 0.412 | ||

| Other household | 0.123 | 0.227 | ||

| Number of adults | 1.881 | 0.922 | 1.769 | 0.986 |

| Number of children | 0.425 | 0.905 | 0.523 | 0.970 |

| >64 years old | 0.323 | 0.246 | ||

| Age (years) | 53.73 | 17.24 | 50.475 | 16.20 |

| Socioeconomics | ||||

| Income | 72,606 | 70,359 | 41,390 | 42,395 |

| Number of earners | 1.21 | 1.008 | 1.002 | 0.914 |

| No high school | 0.001 | 0.002 | ||

| High school | 0.323 | 0.478 | ||

| Some college | 0.301 | 0.315 | ||

| Bachelor’s degree | 0.221 | 0.122 | ||

| Graduate degree | 0.155 | 0.082 | ||

| Management, professional | 0.325 | 0.192 | ||

| Administrative support, sales | 0.169 | 0.166 | ||

| Service | 0.108 | 0.185 | ||

| Operator, assembler | 0.107 | 0.104 | ||

| Precision production and craft | 0.012 | 0.008 | ||

| Not employed | 0.279 | 0.345 | ||

| Housing and wealth | ||||

| Assets (median) | 801.79 | 0 | ||

| Assets (mean) | 148,951 | 627,912 | 15,594 | 79,760 |

| Own (with mortgage) | 0.425 | 0.287 | ||

| Own (no mortgage) | 0.324 | 0.183 | ||

| Rent | 0.241 | 0.511 | ||

| Other | 0.010 | 0.019 | ||

| Number of rooms and bathrooms | 7.971 | 2.735 | 6.91 | 2.438 |

| Geography | ||||

| Urban | 0.923 | 0.989 | ||

| ≥4 million | 0.301 | 0.383 | ||

| 1.2 million to 4 million | 0.244 | 0.236 | ||

| 0.33 million to 1.19 million | 0.058 | 0.098 | ||

| 125,000 to 329,000 | 0.266 | 0.169 | ||

| <125,000 | 0.131 | 0.113 | ||

| Northeast | 0.189 | 0.157 | ||

| Midwest | 0.264 | 0.149 | ||

| South | 0.343 | 0.62 | ||

| West | 0.205 | 0.073 | ||

| n | 22,747 | 3,907 | ||

METHODS

To estimate racial differences in quarterly household spending, we use hierarchical linear models with random intercepts at the household level. Formally, the model can be represented as

where i indexes household-quarters, j indexes households, y measures total dollar amount spent for a given category of expenditures, Racej and Incomej are both categorical variables measured at the household level, x is a vector of household-level controls including a set of dichotomous variables for year, μj. are random intercepts at the household level, and εij are random errors. Reported R2 values are calculated as the proportional reduction in prediction error variance relative to the null model (Rabe-Hesketh and Skrondal 2012).

RESULTS

Race and Total Spending

Black households spend less on average than white households: unweighted mean quarterly spending for black households in our sample was $8,387 compared with $13,713 for white households. Spending differences within income categories are also large. Low-income blacks spent $5,223 on average compared with $7,058 for low-income whites, middle-income blacks spent $9,113 (vs. $11,106 for whites), and top-income blacks spent $16,527 (vs. $21,075 for whites).

Table 3 provides estimates from nested models of total expenditures. Model 1 provides baseline estimates of racial differences in spending and confirms that the descriptive differences are statistically significant at conventional levels. The black-white gap in spending for low-income households is provided by the Black coefficient. The Middle Income × Black and Top Income × Black coefficients show how the black-white gap in these income categories differs relative to the black-white gaps for low-income households. Coefficients can be interpreted as the approximate percentage point differences in dollar amounts spent for blacks relative to whites. For example, the −0.211 coefficient for black households in the first model indicates that total quarterly spending for low-income black households is approximately 0.81 times (e−0.211) that of low-income white households. Middle-income blacks also spend less than middle-income whites (approximately 0.84 or e[−0211 + 0.045] times the amount spent by whites). The nonsignificant coefficient for Middle Income × Black and Top Income × Black indicates that the estimated racial gap for those households is statistically similar to the gap for low-income households (i.e., the ratios of black to white household spending in the middle-income and the high-income categories are not statistically distinguishable from 0.81).

Table 3.

Nested Hierarchical Linear Models for Total Expenditures, 2013 to 2015.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Black | −0.211*** | −0.239*** | −0.173*** | −0.133*** | −0.140*** |

| (0.021) | (0.020) | (0.019) | (0.018) | (0.018) | |

| middle Income × Black | 0.045 | 0.075* | 0.026 | 0.023 | 0.018 |

| (0.032) | (0.030) | (0.028) | (0.027) | (0.026) | |

| Top Income × Black | −0.004 | 0.045 | 0.013 | 0.031 | 0.029 |

| (0.039) | (0.037) | (0.034) | (0.032) | (0.032) | |

| Middle income | 0.551*** | 0.436*** | 0.174*** | 0.150*** | 0.146*** |

| (0.014) | (0.014) | (0.015) | (0.015) | (0.014) | |

| Top income | 1.182*** | 0.965*** | 0.462*** | 0.372*** | 0.346*** |

| (0.013) | (0.015) | (0.020) | (0.020) | (0.019) | |

| Married with children | −0.024 | −0.020 | −0.023 | −0.030* | |

| (0.017) | (0.016) | (0.015) | (0.015) | ||

| Single parent | −0.133*** | −0.106*** | −0.089*** | −0.106*** | |

| (0.024) | (0.022) | (0.021) | (0.021) | ||

| Single | −0.226*** | −0.217*** | −0.211*** | −0.228*** | |

| (0.015) | (0.014) | (0.013) | (0.013) | ||

| Other household | −0.127*** | −0.094*** | −0.073*** | −0.086*** | |

| (0.016) | (0.015) | (0.015) | (0.015) | ||

| Number of adults | 0.057*** | 0.054*** | 0.042*** | 0.037*** | |

| (0.008) | (0.008) | (0.008) | (0.008) | ||

| Number of children | 0.049*** | 0.049*** | 0.034*** | 0.037*** | |

| (0.006) | (0.006) | (0.006) | (0.006) | ||

| >64 years old | 0.032* | 0.036* | 0.029* | 0.029* | |

| (0.016) | (0.015) | (0.014) | (0.014) | ||

| Age | 0.013*** | 0.011*** | 0.007*** | 0.006*** | |

| (0.002) | (0.002) | (0.002) | (0.001) | ||

| Age squared | −0.000*** | −0.000*** | −0.000*** | −0.000*** | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Income (log) | 0.152*** | 0.133*** | 0.125*** | ||

| (0.007) | (0.006) | (0.006) | |||

| Number of earners | 0.013 | 0.009 | 0.013 | ||

| (0.007) | (0.007) | (0.007) | |||

| High school | 0.165 | 0.107 | 0.070 | ||

| (0.163) | (0.154) | (0.151) | |||

| Some college | 0.280 | 0.191 | 0.149 | ||

| (0.163) | (0.154) | (0.151) | |||

| Bachelor’s degree | 0.402* | 0.294 | 0.237 | ||

| (0.163) | (0.154) | (0.151) | |||

| Graduate degree | 0.486** | 0.367* | 0.307* | ||

| (0.164) | (0.155) | (0.151) | |||

| Administrative support, sales | −0.060*** | −0.053*** | −0.050*** | ||

| (0.010) | (0.010) | (0.010) | |||

| Service | −0.057*** | −0.042*** | −0.040*** | ||

| (0.011) | (0.011) | (0.011) | |||

| Operator, assembler | −0.057*** | −0.044*** | −0.031* | ||

| (0.012) | (0.012) | (0.012) | |||

| Precision production and craft | 0.074* | 0.078* | 0.080* | ||

| (0.034) | (0.033) | (0.033) | |||

| Not employed | −0.161*** | −0.140*** | −0.142*** | ||

| (0.015) | (0.015) | (0.015) | |||

| Assets (log) | 0.018*** | 0.018*** | |||

| (0.001) | (0.001) | ||||

| Number of rooms | 0.038*** | 0.041*** | |||

| (0.002) | (0.002) | ||||

| Own (no mortgage) | −0.126*** | −0.118*** | |||

| (0.011) | (0.011) | ||||

| Rent | −0.034** | −0.049*** | |||

| (0.012) | (0.012) | ||||

| Other | −0.369*** | −0.376*** | |||

| (0.028) | (0.028) | ||||

| Urban | −0.005 | ||||

| (0.022) | |||||

| 1.2 million to 4 million | −0.170*** | ||||

| (0.038) | |||||

| 0.33 million to 1.19 million | −0.187*** | ||||

| (0.044) | |||||

| 125,000 to 329,000 | −0.169*** | ||||

| (0.024) | |||||

| <125,000 | −0.183** | ||||

| (0.069) | |||||

| Midwest | −0.050* | ||||

| (0.021) | |||||

| South | −0.094*** | ||||

| (0.019) | |||||

| West | −0.011 | ||||

| (0.020) | |||||

| 2014 | 0.028*** | 0.030*** | 0.032*** | 0.033*** | 0.034*** |

| (0.006) | (0.006) | (0.006) | (0.005) | (0.005) | |

| 2015 | 0.013 | 0.018 | 0.021 | 0.025* | 0.026* |

| (0.012) | (0.012) | (0.012) | (0.012) | (0.012) | |

| var(μj) | 0.196 | 0.175 | 0.142 | 0.123 | 0.116 |

| (0.003) | (0.003) | (0.003) | (0.002) | (0.002) | |

| var(εij) | 0.099 | 0.099 | 0.099 | 0.099 | 0.099 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| R2 | 0.464 | 0.503 | 0.562 | 0.598 | 0.610 |

| BIC | 31,220 | 30,433 | 29,020 | 27,927 | 27,715 |

| n | 26,654 | 26,654 | 26,654 | 26,654 | 26,654 |

Note. Standard errors are in parentheses.

Population × Region interactions are included but not shown.

p < .05.

p < .01.

p < .001.

Model 2 introduces controls for family structure. As expected, larger families have higher average consumption levels. The racial gap in spending, however, remains negative and significant at all income levels, even when demographic differences are taken into account. Model 3 introduces socioeconomic controls. Higher income, higher education, and higher occupational status are all positively associated with total spending, providing strong evidence that greater consumption levels are an important benefit of high social and economic status. The relative racial gap in household spending in model 3 is smaller than in previous models for all income categories. This suggests that socioeconomic status accounts for a significant part of the observed spending differences between black and white households. Racial gaps estimated in model 3, however, remain significant and negative.

Model 4 introduces wealth- and housing-related controls. Greater wealth is associated with greater total spending. Homeowners with mortgages spend more than both nonhomeowners and homeowners without mortgages. Residents of larger housing units spend more than residents of smaller ones. The overall racial gap in spending, however, is not accounted for by racial differences in wealth, homeownership, or housing unit size. Finally, model 5 introduces geographic controls. Interactions between region and agglomeration size are included in the model but are not shown in the table. We find that geographic differences in household location do not account for racial differences in spending.

These results are consistent with hypothesis 1: black households at all income levels have lower consumption levels than white households, even when core socioeconomic and demographic differences are taken into account. Predicted values from the full model (model 5) indicate that black households spend between $1,232 (for bottom earners) and $1,402 (for top earners) less than white households each quarter.

Specific Expenditures

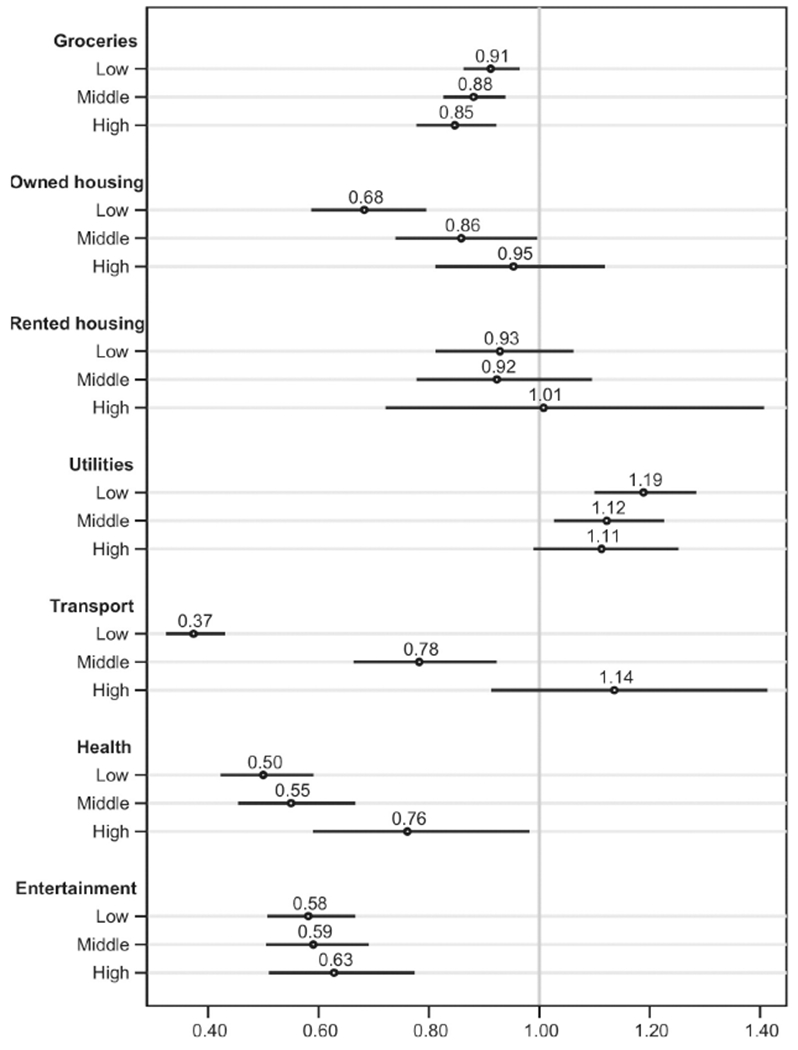

We now turn to hypotheses 2 through 7 by examining racial differences in spending for the six largest household expenditure categories: housing, utilities, groceries, transportation, health care, and entertainment. Together, these expenditures represent between 80 percent (for low-income black households) and 65 percent (for high-income white households) of total household spending. To facilitate interpretation, results are presented in Figure 1 in the form of predicted ratios of black to white spending at each income level for each dependent variable. Predicted ratios are computed from full models that include all control variables. Coefficient estimates for all models are provided as an online appendix (Table A1).

Figure 1.

Predicted ratio of black to white quarterly spending, by income level.

Predicted black-white ratios for spending on groceries provide support for hypothesis 2. Predicted spending from the full model shows that the racial gap in food spending is smallest for low-income households. Predicted spending ratios also show that the estimated racial gap increases for households with greater incomes.

Estimates of racial differences in owned housing expenditures and outlays provide no support for hypothesis 3A. Contrary to expectations, estimated spending ratios show that low- and middle-income black homeowners spend less on owned housing than white homeowners on average. No racial gap is found among high-income households. In light of earlier research, these findings are surprising. One potential explanation is that our statistical model does not adequately capture differences in housing quality. Differences in housing value and quality between black and white homeowners at low- and middle-income levels could be so large that black homeowners end up spending significantly less on mortgages and property taxes relative to white homeowners, even when their already documented higher spending relative to quality is taken into account. In the absence of detailed measures of housing quality, however, this interpretation cannot be tested directly.

For renters, estimates provide no evidence of higher spending for blacks relative to whites. The estimates provide no support for hypothesis 3B. Predicted gaps where obtained from an analytic sample restricted to renters and indicate that at all income levels, black and white renters spend similar amounts on rented housing. These estimates, however, should not be interpreted as straightforward evidence of equal access to rental housing for blacks and whites. It could be the case, for instance, that black renters pay amounts similar to white renters, but for much lower quality apartments. Because our data do not capture variation in the quality of rental housing stock, we cannot test this directly.

Predicted black-white differences in utility expenditures provide support for hypothesis 4. Because utility expenditures are contract-based, we proposed that various ancillary fees and penalties would lead to higher spending for blacks at all income levels. Our estimates reveal substantial differences in utility spending between blacks and whites. Among low-income households, blacks spend about 120 percent the amount spent by whites every quarter. The gap for middle-income households is smaller but significant, with blacks spending approximately 112 percent the amount spent by whites. For top earners, we find a gap of a similar magnitude, but the estimate is not statistically significant (p = 0.08). The magnitude of the coefficient and the size of its standard error suggest, however, that this may be due to uncertainty in the estimate rather than actual parity for top-income households.

Predicted black-white differences in transportation expenditures support hypothesis 5. Low-income blacks spend much less than low-income whites on private transportation. The gap is smaller for middle-income households but remains significant. The estimate for top-income households is relatively uncertain, suggesting either parity or higher spending for black households. These patterns are consistent with the proposed liquidity-constraint mechanism. Supplemental analyses (not shown) indicate that black households spend greater amounts than white households on used vehicles (despite the lower total), which supports the argument that lower access to liquidity leads black households to rely on cheaper, lower quality alternatives.

Predicted black-white spending ratios for health-related spending provide support for hypothesis 6. Estimates indicate large gaps in out-of-pocket health spending (including health insurance) between blacks and whites at all income levels. Predicted values from the model indicate that blacks only spend between approximately half (for low- and middle-income households) and two-thirds (for high-income households) the amount spent by whites on health care every quarter. Given blacks’ poorer average health status and greater need for medical care (Williams et al. 2010), these differences in health care spending are particularly striking.

Predicted spending on entertainment for blacks and whites provides support for hypothesis 7. Our results show that on average black households at all income levels spend significantly less than similar white households on entertainment (approximately half of what white households spend for all income groups). These spending patterns are consistent with the proposed consumer discrimination and retail desertification mechanisms.

CONCLUSION

Racial inequalities in access to consumption in the United States remain relatively unexplored. In this article, we argue that blacks experience significant constraints in their ability to acquire certain goods and services relative to whites, net of differences in income and wealth. Retail desertification in racially segregated neighborhoods, restricted access to affordable credit for blacks, and consumer racial discrimination, we argue, result in lower overall spending for blacks at all income levels, even when other primary determinants of household spending are taken into account.

Drawing on racial stratification research, we expected black households to spend less than whites on certain types of goods and services (those requiring significant liquidity and those for which customers tend to rely on local providers) and to spend more on others (those provided on a contractual basis whereby fees and penalties can be imposed on consumers). We also expected that for each type of good, racial gaps would vary across income groups. For goods and services purchased on credit, we expected the gap to shrink with income. For goods and services purchased frequently and locally, we expected the gap to increase with income. For contractual goods and services, we expected a relatively constant gap across income groups. These general expectations allowed us to derive formal hypotheses describing expected patterns of racial differences in spending.

To test these hypotheses, we used 2013 and 2014 data from the CE. We estimated models of racial differences in spending for total household spending, as well as spending on the largest categories of household expenditures (groceries, housing, utilities, transportation, health care, and entertainment). Our findings indicate sizable racial gaps in consumption, with black households consuming considerably less than comparable white households on average. Although a portion of this gap was explained by racial differences in economic status and demographic characteristics, controlling for the main determinants of household spending did not eliminate racial gaps in consumption. At a theoretical level, this entails that racial inequalities in access to goods and services are greater than disparities in income or wealth alone suggest.

We then turned to differences in expenditures for specific goods and services. Our findings were broadly consistent with the proposed hypotheses. For purchases requiring significant amounts of money to be paid up front (e.g., vehicles), we found that low-income blacks spent much less than low-income whites. In most cases, this gap shrank or disappeared for higher income households. Racial gaps in spending for frequently purchased goods and services (e.g., groceries) and for nonessential spending (e.g. entertainment) tended to be smallest for low-income households and to increase with income, which we interpret as reflecting white households’ greater access to higher-end consumer markets. Goods obtained through long-term contracts were an important exception to the overall trend of lower black spending. For these goods (i.e., for utilities but, surprisingly, not for housing), we found that blacks spent more than whites, a trend we attribute to providers’ color-blind but racially biased risk-pricing strategies.

Our analyses suggest important avenues for future research. For example, the role of retail desertification in generating racial consumption disparities could be estimated more directly by using neighborhood-level data on retail density. Analyses of major metropolitan areas have already shown lower concentrations of goods and services providers in majority black neighborhoods (Small and McDermott 2006). Linking retail density data with consumption data could provide scholars with a better understanding of the mechanisms driving consumption deficits. The role of access to credit in generating racial disparities in consumption should also be explored more directly. Prior to the foreclosure crisis, blacks were more likely than whites to rely on subprime lenders for their mortgage needs (Rugh and Massey 2010). Similar predatory markets for smaller consumer loans, known as fringe banking, have developed over the past few decades and disproportionately cater to black consumers (Barr 2012; Caskey 1994). Understanding fringe banking institutions’ impact on black households’ spending would significantly improve our understanding of the mechanisms driving racial consumption disparities.

Finally, we suggest that consumption-based stratification processes should be examined for other racial and ethnic groups. Latino Americans, for instance, likely also face structural constraints on their consumption opportunities. Foreign-born and undocumented Latinos in particular experience legal barriers—the inability to obtain a driver’s license, to enroll in a postsecondary educational institution, or to obtain credit through formal financial institutions—that may limit their ability to consume compared with both whites and blacks. Important heterogeneities in socioeconomic status, nativity, ethnicity, and documentation among the Latino and Asian population, combined with state-level variation in documented and undocumented migrants’ economic rights, could allow further tests of the mechanisms we posit generate consumption deficits.

Acknowledgments

FUNDING

Mr. Charron-Chénier is supported by the Social Sciences and Humanities Research Council of Canada (SSHRC) and the Horowitz Foundation for Social Policy. Mr. Fink is supported by the National Institutes of Health and funding provided by a T-32 predoctoral grant. Dr. Keister is supported by a grant from the National Science Foundation.

Biographies

AUTHOR BIOGRAPHIES

Raphaël Charron-Chénier is a Ph.D. candidate in the Department of Sociology at Duke University. His research focuses on the role of consumer market institutions in the production of racial inequality. His current projects examine fringe financial services, racial disparities in health care costs, and racial disparities in access to retail and service providers.

Joshua J. Fink has an M.S. in Statistical Science and is a Ph.D. candidate in the Department of Sociology at Duke University. His research focuses on economic stratification, punishment inequality, and Bayesian statistics.

Lisa A. Keister is Gilhuly Family Professor of Sociology at Duke University. She conducts research on wealth ownership in the U.S., the one percent, the role of religion in economic decision making, immigration and its economic consequences, interfirm networks, and organizational startup and performance during China’s transition. She is author of numerous books and articles including Wealth in America (2000), Getting Rich (2005), and Faith and Money: How Religious Belief Contributes to Wealth and Poverty (2011).

Table A1.

Full HLM Models for Specific Expenditures, 2013-2015

| Groceries | Owned Housing | Rented Housing | Utilities | Transport | Health | Entertainment | |

|---|---|---|---|---|---|---|---|

| Black | −0.092** | −0.382*** | −0.074 | 0.173*** | −0.985*** | −0.694*** | −0.543*** |

| (0.029) | (0.078) | (0.068) | (0.040) | (0.073) | (0.086) | (0.070) | |

| Mid-income × Black | −0.035 | 0.229* | −0.006 | −0.058 | 0.740*** | 0.096 | 0.016 |

| (0.042) | (0.107) | (0.107) | (0.058) | (0.108) | (0.126) | (0.103) | |

| Top-income × Black | −0.074 | 0.334** | 0.082 | −0.066 | 1.113*** | 0.421** | 0.077 |

| (0.051) | (0.111) | (0.182) | (0.071) | (0.131) | (0.153) | (0.125) | |

| Mid-income | 0.076*** | 0.182*** | 0.355*** | 0.200*** | 0.454*** | 0.283*** | 0.388*** |

| (0.023) | (0.049) | (0.069) | (0.032) | (0.059) | (0.069) | (0.056) | |

| Top-income | 0.116*** | 0.368*** | 0.485*** | 0.198*** | 0.347*** | 0.334*** | 0.672*** |

| (0.031) | (0.066) | (0.101) | (0.043) | (0.080) | (0.093) | (0.076) | |

| Married w/children | 0.083*** | 0.093* | 0.020 | 0.076* | −0.046 | 0.187** | 0.080 |

| (0.024) | (0.040) | (0.099) | (0.031) | (0.055) | (0.070) | (0.058) | |

| Single parent | −0.118*** | 0.055 | −0.128 | 0.141** | −0.209** | −0.470*** | 0.014 |

| (0.034) | (0.074) | (0.104) | (0.045) | (0.081) | (0.100) | (0.083) | |

| Single | −0.373*** | 0.036 | −0.126 | −0.223*** | −0.681*** | −0.580*** | −0.257*** |

| (0.021) | (0.039) | (0.083) | (0.028) | (0.051) | (0.062) | (0.051) | |

| Other household | −0.022 | 0.014 | −0.096 | 0.071* | −0.112* | −0.173* | 0.021 |

| (0.024) | (0.042) | (0.086) | (0.031) | (0.055) | (0.069) | (0.057) | |

| # adults | 0.101*** | −0.068** | 0.016 | 0.065*** | 0.029 | 0.031 | −0.054 |

| (0.013) | (0.021) | (0.043) | (0.016) | (0.028) | (0.036) | (0.030) | |

| # children | 0.094*** | 0.047** | −0.016 | 0.074*** | −0.043* | 0.080** | 0.055* |

| (0.009) | (0.017) | (0.030) | (0.012) | (0.022) | (0.027) | (0.022) | |

| Over 64 | 0.035 | 0.017 | −0.174* | 0.038 | 0.151** | 0.866*** | 0.103 |

| (0.023) | (0.038) | (0.087) | (0.029) | (0.052) | (0.066) | (0.055) | |

| Age | 0.027*** | 0.010 | −0.000 | 0.048*** | 0.045*** | 0.066*** | 0.032*** |

| (0.002) | (0.006) | (0.007) | (0.003) | (0.006) | (0.007) | (0.006) | |

| Age (squared) | −0.000*** | −0.000*** | 0.000 | −0.000*** | −0.001*** | −0.000*** | −0.000*** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Income (log) | 0.063*** | 0.185*** | 0.105*** | 0.104*** | 0.240*** | 0.361*** | 0.181*** |

| (0.010) | (0.024) | (0.027) | (0.014) | (0.026) | (0.031) | (0.025) | |

| # earners | −0.014 | 0.003 | 0.037 | −0.007 | 0.027 | −0.028 | 0.018 |

| (0.012) | (0.017) | (0.041) | (0.013) | (0.023) | (0.032) | (0.027) | |

| High school | −0.416 | −0.496 | −0.094 | 1.040** | 2.161*** | 0.786 | 0.370 |

| (0.242) | (1.047) | (0.477) | (0.338) | (0.628) | (0.729) | (0.594) | |

| Some college | −0.389 | −0.355 | −0.052 | 0.993** | 2.464*** | 1.018 | 0.480 |

| (0.242) | (1.047) | (0.478) | (0.338) | (0.628) | (0.729) | (0.595) | |

| Bachelor’s | −0.343 | −0.212 | 0.098 | 1.013** | 2.410*** | 1.211 | 0.559 |

| (0.243) | (1.047) | (0.479) | (0.338) | (0.629) | (0.730) | (0.595) | |

| Graduate | −0.328 | −0.191 | 0.240 | 0.997** | 2.414*** | 1.200 | 0.587 |

| (0.243) | (1.047) | (0.483) | (0.339) | (0.629) | (0.731) | (0.596) | |

| Admin support, sales | −0.026 | −0.052* | −0.030 | 0.020 | 0.007 | −0.001 | −0.121** |

| (0.017) | (0.025) | (0.048) | (0.019) | (0.031) | (0.045) | (0.038) | |

| Service | 0.010 | −0.057* | −0.029 | −0.001 | 0.022 | −0.204*** | −0.116** |

| (0.019) | (0.028) | (0.053) | (0.021) | (0.035) | (0.050) | (0.042) | |

| Operator, assembler | 0.005 | −0.032 | −0.104 | −0.015 | −0.018 | −0.229*** | −0.109* |

| (0.021) | (0.030) | (0.062) | (0.023) | (0.038) | (0.055) | (0.046) | |

| Precision production | 0.095 | −0.147 | 0.132 | 0.158* | 0.405*** | −1.215*** | 0.222 |

| (0.055) | (0.098) | (0.136) | (0.065) | (0.111) | (0.151) | (0.127) | |

| Not employed | −0.036 | −0.166*** | −0.087 | −0.032 | −0.300*** | −0.009 | −0.044 |

| (0.025) | (0.038) | (0.077) | (0.029) | (0.049) | (0.068) | (0.057) | |

| Assets (log) | −0.002 | 0.009*** | 0.010 | 0.006** | 0.040*** | 0.053*** | 0.054*** |

| (0.001) | (0.003) | (0.005) | (0.002) | (0.003) | (0.004) | (0.003) | |

| # rooms | 0.014*** | 0.089*** | −0.007 | 0.050*** | 0.062*** | −0.007 | 0.068*** |

| (0.003) | (0.006) | (0.011) | (0.004) | (0.008) | (0.009) | (0.007) | |

| Own (no mortgage) | 0.023 | −0.021 | −0.045 | −0.005 | −0.094* | ||

| (0.017) | (0.023) | (0.042) | (0.051) | (0.042) | |||

| Rent | −0.088*** | −0.534*** | −0.583*** | −0.594*** | −0.276*** | ||

| (0.019) | (0.026) | (0.048) | (0.058) | (0.047) | |||

| Other | −0.189*** | −0.976*** | −0.711*** | −0.746*** | −0.920*** | ||

| (0.049) | (0.053) | (0.090) | (0.127) | (0.108) | |||

| Urban | −0.007 | 0.370*** | 0.138 | 0.072 | 0.246** | −0.294** | 0.020 |

| (0.035) | (0.069) | (0.136) | (0.049) | (0.091) | (0.105) | (0.086) | |

| 1.2 - 4 million | −0.280*** | −0.664*** | −1.206*** | −0.016 | 0.633*** | −0.079 | 0.255 |

| (0.060) | (0.123) | (0.196) | (0.084) | (0.156) | (0.181) | (0.148) | |

| 0.33 - 1.19 million | −0.213** | −0.473*** | 0.034 | −0.332*** | 0.735*** | 0.100 | −0.064 |

| (0.070) | (0.137) | (0.260) | (0.098) | (0.183) | (0.212) | (0.173) | |

| 125,000 - 329,000 | −0.134*** | −0.592*** | −0.710*** | −0.060 | 0.587*** | 0.281* | 0.196* |

| (0.038) | (0.074) | (0.144) | (0.053) | (0.099) | (0.115) | (0.094) | |

| <125,000 | −0.211 | −0.386 | 0.146 | −0.014 | 1.232*** | 0.051 | −0.155 |

| (0.110) | (0.234) | (0.333) | (0.153) | (0.285) | (0.331) | (0.270) | |

| Midwest | −0.124*** | −0.305*** | 0.003 | −0.066 | 0.618*** | 0.392*** | 0.081 |

| (0.034) | (0.068) | (0.113) | (0.047) | (0.087) | (0.102) | (0.083) | |

| South | −0.091** | −0.518*** | −0.044 | −0.051 | 0.660*** | 0.225* | −0.155* |

| (0.030) | (0.062) | (0.100) | (0.042) | (0.079) | (0.092) | (0.075) | |

| West | 0.046 | −0.163* | 0.263** | −0.176*** | 0.309*** | −0.248* | 0.100 |

| (0.032) | (0.070) | (0.095) | (0.045) | (0.084) | (0.097) | (0.079) | |

| 2014 | 0.014 | 0.029* | 0.064* | 0.095*** | −0.034* | 0.308*** | 0.066** |

| (0.010) | (0.013) | (0.026) | (0.010) | (0.016) | (0.024) | (0.021) | |

| 2015 | 0.000 | −0.035 | 0.092 | 0.156*** | −0.110** | 0.263*** | 0.093* |

| (0.021) | (0.028) | (0.054) | (0.021) | (0.034) | (0.052) | (0.045) | |

| var(μj) | 0.261 | 1.004 | 1.080 | 0.664 | 2.399 | 2.866 | 1.827 |

| (0.006) | (0.020) | (0.038) | (0.012) | (0.040) | (0.055) | (0.036) | |

| var(εij) | 0.346 | 0.348 | 0.549 | 0.289 | 0.758 | 1.880 | 1.448 |

| (0.004) | (0.004) | (0.012) | (0.003) | (0.008) | (0.020) | (0.016) | |

| N (household-quarters) | 26654 | 18874 | 7489 | 26654 | 26654 | 26598 | 26654 |

Standard errors in parentheses

p<.001,

p<.01,

p<.05

Population × Region interactions included but not shown

REFERENCES

- Austin Regina. 1997. “Not Just for the Fun of It: Governmental Restraints on Black Leisure, Social Inequality, and the Privatization of Public Space.” Southern California Law Review 71:667–714. [Google Scholar]

- Avery Robert B., Bostic Raphael W., Calem Paul S., and Canner Glenn B.. 1997. “Changes in the Distribution of Banking Offices.” Federal Reserve Bulletin 83:707–25. [Google Scholar]

- Ayres Ian, and Siegelman Peter. 1995. “Race and Gender Discrimination in Bargaining for a New Car.” American Economic Review 85(3):304–21. [Google Scholar]

- Barba Aldo, and Pivetti Massimo. 2009. “Rising Household Debt: Its Causes and Macroeconomic Implications—A Long-period Analysis.” Cambridge Journal of Economics 33(1):113–37. [Google Scholar]

- Barr Michael S. 2012. No Slack: The Financial Lives of Low-income Americans. Washington, DC: Brookings Institution Press. [Google Scholar]

- Bayer Patrick, Casey Marcus, Ferreira Fernando, and McMillan Robert. 2013. “Estimating Racial Price Differentials in the Housing Market” Economic Research Initiatives at Duke (ERID) Working Paper 142. [Google Scholar]

- Blanchflower David G., Levine Phillip B., and Zimmerman David J.. 2003. “Discrimination in the Small-business Credit Market.” Review of Economics and Statistics 85(4):930–43. [Google Scholar]

- Block Daniel, and Kouba Joanne. 2006. “A Comparison of the Availability and Affordability of a Market Basket in Two Communities in the Chicago Area.” Public Health Nutrition 9(7):837–45. [DOI] [PubMed] [Google Scholar]

- Bourdieu Pierre. 1984. Distinction: A Social Critique of the Judgement of Taste. Cambridge, MA: Harvard University Press. [Google Scholar]

- Boustan Leah Platt. 2010. “Was Postwar Suburbanization ‘White Flight’? Evidence from the Black Migration.” Quarterly Journal of Economics 125(1):417–43. [Google Scholar]

- Braucher Jean, Cohen Dov, and Lawless Robert M.. 2012. “Race, Attorney Influence, and Bankruptcy Chapter Choice.” Journal of Empirical Legal Studies 9(3):393–429. [Google Scholar]

- Bridges Khiara M. 2011. Reproducing Race: An Ethnography of Pregnancy as a Site of Racialization. Berkeley: University of California Press. [Google Scholar]

- Caskey John P. 1994. Fringe Banking: Check-cashing Outlets, Pawnshops, and the Poor. New York: Russell Sage. [Google Scholar]

- Charles Kerwin Kofi, Hurst Erik, and Roussanov Nikolai. 2009. “Conspicuous Consumption and Race.” Quarterly Journal of Economics 124(2):425–67. [Google Scholar]

- Charles Kerwin Kofi, Hurst Erik, and Stephens Melvin. 2008. “Rates for Vehicle Loans: Race and Loan Source.” American Economic Review 98(2):315–20. [Google Scholar]

- Chatterji Aaron K., and Seamans Robert C.. 2011. “Entrepreneurial Finance, Credit Cards, and Race.” Journal of Financial Economics 106(1):182–95. [Google Scholar]

- Chomsisengphet Souphala, and Anthony Pennington-Cross. 2006. “The Evolution of Subprime Mortgage Markets.” Federal Reserve Bank of St. Louis Review 88:31–56. [Google Scholar]

- Citro Constance F., and Michael Robert T., eds. 1995. Measuring Poverty: A New Approach. Washington, DC: National Academy Press. [Google Scholar]

- Cohen-Cole Ethan. 2011. “Credit Card Redlining.” Review of Economics and Statistics 93(2):700–13. [Google Scholar]

- Cohen Lizabeth. 2003. A Consumers’ Republic: The Politics of Mass Consumption in Postwar America. New York: Random House. [Google Scholar]

- Cohen Mark A. 2012. “Imperfect Competition in Auto Lending: Subjective Markup, Racial Disparity, and Class Action Litigation.” Review of Law and Economics 8(1):21–58. [Google Scholar]

- Collins William J., and Smith Fred H.. 2007. “A Neighborhood-level View of Riots, Property Values, and Population Loss: Cleveland 1950–1980.” Explorations in Economic History 44(3):365–86. [Google Scholar]

- DiMaggio Paul. 1987. “Classification in Art.” American Sociological Review 52(4):440–55. [Google Scholar]

- Doherty Sean T. 2006. “Should We Abandon Activity Type Analysis? Redefining Activities by Their Salient Attributes.” Transportation 33(6):517–36. [Google Scholar]

- Dovidio John F., Penner Louis A., Albrecht Terrance L., Norton Wynne E., Gaertner Samuel L., and Shelton J. Nicole. 2008. “Disparities and Distrust: The Implications of Psychological Processes for Understanding Racial Disparities in Health and Health Care.” Social Science and Medicine 67(3):478–86. [DOI] [PubMed] [Google Scholar]

- Fairlie Robert W., and Robb Alicia M.. 2007. “Why Are Black-owned Businesses Less Successful Than White-owned Businesses? The Role of Families, Inheritances, and Business Human Capital.” Journal of Labor Economics 25(2):289–323. [Google Scholar]

- Feagin Joe R. 1991. “The Continuing Significance of Race: Antiblack Discrimination in Public Places.” American Sociological Review 56(1):101–16. [Google Scholar]

- Feagin Joe R., and Sikes Melvin P.. 1995. Living with Racism: The Black Middle-class Experience. Boston: Beacon. [Google Scholar]

- Fischer Mary J. 2013. “Black and White Homebuyer, Homeowner, and Household Segregation in the United States, 1990–2010.” Social Science Research 42(6):1726–36. [DOI] [PubMed] [Google Scholar]

- Flippen Chenoa A. 2010. “The Spatial Dynamics of Stratification: Metropolitan Context, Population Redistribution, and Black and Hispanic Home-ownership.” Demography 47(4):845–68. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Fourcade Marion, and Healy Kieran. 2013. “Classification Situations: Life-chances in the Neoliberal Era.” Accounting, Organizations and Society 38(8): 559–72. [Google Scholar]

- Freund David M. P. 2007. Colored Property: State Policy and White Racial Politics in Suburban America. Chicago: University of Chicago Press. [Google Scholar]

- Friedman Samantha, and Rosenbaum Emily. 2004. “Nativity Status and Racial/Ethnic Differences in Access to Quality Housing: Does Homeownership Bring Greater Parity?” Housing Policy Debate 15(4):865–901. [Google Scholar]

- Galster George, and Godfrey Erin. 2005. “By Words and Deeds: Racial Steering by Real Estate Agents in the U.S. in 2000.” Journal of the American Planning Association 71(3):251–68. [Google Scholar]

- Gaskin Darrell J., Briesacher Becky A., Limcangco M Rhonda, and Brigantti Betsy L.. 2006. “Exploring Racial and Ethnic Disparities in Prescription Drug Spending and Use among Medicare Beneficiaries.” American Journal of Geriatric Pharmacotherapy 4(2):96–111. [DOI] [PubMed] [Google Scholar]

- Gaskin Darrell J., Price Adrian, Brandon Dwayne T., and LaVeist Thomas A.. 2009. “Segregation and Disparities in Health Services Use.” Medical Care Research and Review 66(5):578–89. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ghent Andra, Hernandez-Murillo Ruben, and Owyang Michael. 2011. “Race, Redlining, and Subprime Loan Pricing.” Federal Reserve Bank of St. Louis Working Paper No. 2011-033A (). [Google Scholar]

- Harris Anne-Marie G., Henderson Geraldine R., and Williams Jerome D.. 2005. “Courting Customers: Assessing Consumer Racial Profiling and Other Marketplace Discrimination.” Journal of Public Policy and Marketing 24(1):163–71. [Google Scholar]

- Hirschl Thomas A., and Rank Mark R.. 2010. “Homeownership across the American Life Course: Estimating the Racial Divide.” Race and Social Problems 2(3):125–36. [Google Scholar]

- Hogan Bernie, and Berry Brent. 2011. “Racial and Ethnic Biases in Rental Housing: An Audit Study of Online Apartment Listings.” City & Community 10(4):351–72. [Google Scholar]

- Ivanic Aarti S., Overbeck Jennifer R., and Nunes Joseph C.. 2011. “Status, Race, and Money: The Impact of Racial Hierarchy on Willingness to Pay.” Psychological Science 22(12):1557–66. [DOI] [PubMed] [Google Scholar]

- Jacobs James, and Crepet Tamara. 2007. “The Expanding Scope, Use, and Availability of Criminal Records.” New York University Journal of Legislation and Public Policy 11:177. [Google Scholar]

- Kaufman Phil R. 1999. “Rural Poor Have Less Access to Supermarkets, Large Grocery Stores.” Rural Development Perspectives 13(3):19–26. [Google Scholar]

- Kollinger Philipp, and Minniti Maria. 2006. “Not for Lack of Trying: American Entrepreneurship in Black and White.” Small Business Economics 27(1):59–79. [Google Scholar]

- Krivo Lauren Joy, and Kaufman Robert L.. 2004. “Housing and Wealth Inequality: Racial-ethnic Differences in Home Equity in the United States.” Demography 41(3):585–605. [DOI] [PubMed] [Google Scholar]

- Kwate Naa Oyo A., Ji Meng Loh Kellee White, and Saldana Nelson. 2013. “Retail Redlining in New York City: Racialized Access to Day-to-day Retail Resources.” Journal of Urban Health 90(4):632–52. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lacy Karyn R. 2007. Blue-chip Black: Race, Class, and Status in the New Black Middle Class. Berkeley: University of California Press. [Google Scholar]

- Lamont Michele, and Molnar Virag. 2001. “How Blacks Use Consumption to Shape Their Collective Identity.” Journal of Consumer Culture 1(1):31–45. [Google Scholar]

- Landry Bart, and Marsh Kris. 2011. “The Evolution of the New Black Middle Class.” Annual Review of Sociology 37:373–94. [Google Scholar]

- Lee Jennifer. 2000. “The Salience of Race in Everyday Life Black Customers’ Shopping Experiences in Black and White Neighborhoods.” Work and Occupations 27(3):353–76. [Google Scholar]

- Lee Jennifer. 2002. Civility in the City: Blacks, Jews, and Koreans in Urban America. Cambridge, MA: Harvard University Press. [Google Scholar]

- Lichter Daniel T., Parisi Domenico, and Taquino Michael C.. 2015. “Toward a New Macro-segregation? Decomposing Segregation within and between Metropolitan Cities and Suburbs.” American Sociological Review 80(4):843–73. [Google Scholar]

- Massey Douglas S., and Lundy Garvey. 2001. “Use of Black English and Racial Discrimination in Urban Housing Markets: New Methods and Findings.” Urban Affairs Review 36(4):452–69. [Google Scholar]

- McLanahan Sara, and Percheski Christine. 2008. “Family Structure and the Reproduction of Inequalities.” Annual Review of Sociology 34:257–76. [Google Scholar]

- Meltzer Rachel, and Schuetz Jenny. 2012. “Bodegas or Bagel Shops? Neighborhood Differences in Retail and Household Services.” Economic Development Quarterly 26(1):73–94. [Google Scholar]

- Meyer Bruce D., and Sullivan James X.. 2012. “Identifying the Disadvantaged: Official Poverty, Consumption Poverty, and the New Supplemental Poverty Measure.” Journal of Economic Perspectives 26(3):111–35. [Google Scholar]

- Millward Hugh, and Spinney Jamie. 2011. “Time Use, Travel Behavior, and the Rural-urban Continuum: Results from the Halifax STAR Project.” Journal of Transport Geography 19(1):51–58. [Google Scholar]

- Moav Omer, and Neeman Zvika. 2010. “Status and Poverty.” Journal of the European Economic Association 8(2–3):413–20. [Google Scholar]

- Moore Latetia V., and Diez Roux Ana V.. 2006. “Associations of Neighborhood Characteristics with the Location and Type of Food Stores.” American Journal of Public Health 96(2):325–31. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Morrison R. Sean, Wallenstein Sylvan, Natale Dana K., Senzel Richard S., and Huang Lo-Li. 2000. “‘We Don’t Carry That’—Failure of Pharmacies in Predominantly Nonwhite Neighborhoods to Stock Opioid Analgesics.” New England Journal of Medicine 342(14):1023–26. [DOI] [PubMed] [Google Scholar]

- Morton Fiona Scott, Zettelmeyer Florian, and Silva-Risso Jorge. 2003. “Consumer Information and Discrimination: Does the Internet Affect the Pricing of New Cars to Women and Minorities?” Quantitative Marketing and Economics 1(1):65–92. [Google Scholar]

- Moss Philip I., and Tilly Chris. 2001. Stories Employers Tell: Race, Skill, and Hiring in America. New York: Russell Sage. [Google Scholar]

- Myers Caitlin Knowles, Close Grace, Fox Laurice, Meyer John William, and Niemi Madeline. 2011. “Retail Redlining: Are Gasoline Prices Higher in Poor and Minority Neighborhoods?” Economic Inquiry 49(3):795–809. [Google Scholar]

- National Research Council. 2013. Measuring What We Spend: Toward a New Consumer Expenditure Survey. Washington, DC: National Academies Press. [Google Scholar]

- Ondrich Jan, Stricker Alex, and Yinger John. 1999. “Do Landlords Discriminate? The Incidence and Causes of Racial Discrimination in Rental Housing Markets.” Journal of Housing Economics 8(3):185–204. [Google Scholar]

- Oyama Rebecca. 2009. “Do Not (Re) Enter: The Rise of Criminal Background Tenant Screening as a Violation of the Fair Housing Act.” Michigan Journal of Race and Law 15:181–222. [Google Scholar]

- Pager Devah, and Shepherd Hana. 2008. “The Sociology of Discrimination: Racial Discrimination in Employment, Housing, Credit, and Consumer Markets.” Annual Review of Sociology 34:181–209. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Peterson Richard A., and Kern Roger M.. 1996. “Changing Highbrow Taste: From Snob to Omnivore.” American Sociological Review 61(5):900–907. [Google Scholar]

- Phinney Robin. 2013. “Exploring Residential Mobility among Low-income Families.” Social Service Review 87(4):780–815. [Google Scholar]

- Powell Lisa M., Slater Sandy, Mirtcheva Donka, Bao Yanjun, and Chaloupka Frank J.. 2007. “Food Store Availability and Neighborhood Characteristics in the United States.” Preventive Medicine 44(3):189–95. [DOI] [PubMed] [Google Scholar]

- Prasad Monica. 2012. The Land of Too Much: American Abundance and the Paradox of Poverty. Cambridge, MA: Harvard University Press. [Google Scholar]

- Rabe-Hesketh Sophia, and Skrondal Anders. 2012. Multilevel and Longitudinal Modeling Using Stata. College Station, TX: Stata Press. [Google Scholar]

- Rayo Luis, and Becker Gary S.. 2006. “Peer Comparisons and Consumer Debt.” University of Chicago Law Review 73:231–48. [Google Scholar]

- Richardson Andrea S., Boone-Heinonen Jane, Popkin Barry M., and Gordon-Larsen Penny. 2012. “Are Neighbourhood Food Resources Distributed Inequitably by Income and Race in the USA? Epidemiological Findings across the Urban Spectrum.” BMJ Open 2(2). [DOI] [PMC free article] [PubMed] [Google Scholar]

- Roberts Dorothy E. 2011. Fatal Invention: How Science, Politics, and Big Business Re-create Race in the Twenty-first Century. New York: New Press. [Google Scholar]

- Roscigno Vincent J., Karafin Diana L., and Tester Griff. 2009. “The Complexities and Processes of Racial Housing Discrimination.” Social Problems 56(1):49–69. [Google Scholar]

- Rothwell Jonathan T. 2011. “Racial Enclaves and Density Zoning: The Institutionalized Segregation of Racial Minorities in the United States.” American Law and Economics Review 13(1):290–358. [Google Scholar]