Abstract

Background:

Human-capital based lifetime productivity estimates are frequently used in cost-of-illness (COI) analyses and, less commonly, in cost-effectiveness analyses (CEAs). Previous US estimates assumed that labor productivity and real earnings both grow by 1% per year.

Objectives:

This study presents estimates of annual and lifetime productivity for 2016 using data from the American Community Survey, the American Time Use Survey, and the Current Population Survey, and with varying assumptions about real earnings growth.

Methods:

The sum of market productivity (gross annual personal labor earnings adjusted for employer-paid benefits) and the imputed value of non-market time spent in household, caring, and volunteer services was estimated. The present value of lifetime productivity at various ages was calculated for synthetic cohorts using annual productivity estimates, life tables, discount rates, and assumptions about future earnings growth rates.

Results:

Mean annual productivity was $57,324 for US adults in 2016, including $36,935 in market and $20,389 in non-market productivity. Lifetime productivity at birth, using a 3% discount rate, is roughly $1.5 million if earnings grow by 1% per year and $1.2 million if future earnings growth averages 0.5% per year.

Conclusions:

Inclusion of avoidable productivity losses in societal-perspective CEAs of health interventions is recommended in new US cost-effectiveness guidelines. However, estimates vary depending on whether analysts choose to estimate total productivity or just market productivity, and on assumptions made about growth in future productivity and earnings.

Keywords: Productivity, cost-of-illness, lifetime, USA

JEL CLASSIFICATION CODES: I11, I15, I19

Introduction

Estimates of productivity costs associated with morbidity, disability, and premature mortality, also referred to as indirect costs, are included in the majority of cost-of-illness (COI) analyses1–3. Productivity costs are important components of the preventable burden of chronic diseases and risk factors, such as smoking or obesity4,5. For example, estimated annual costs of cardiovascular disease in the US during 2012–2013 included $189.7 billion in direct medical costs and $126.4 billion in lost productivity resulting from premature mortality6. Including lost productivity from both premature mortality and disability, the economic burden of occupational injury and illness in the US in 2007 was estimated to be $250 billion, with $67 billion in direct medical costs and $183 billion in indirect costs7.

Productivity costs are included in some cost-effectiveness analyses (CEAs) from the societal perspective8. However, because of heterogeneous methods for estimating productivity losses9,10, findings of CEAs that are restricted to estimates of direct costs may be more comparable11. Until recently, CEA guidance documents did not recommend their inclusion. The First US Panel on Cost-effectiveness in Health and Medicine in 1996 recommended against inclusion of productivity costs in reference-case CEAs on the grounds that there could be double-counting of health effects between quality adjusted life-years (QALYs) and productivity costs, an argument that was subsequently challenged on the basis of evidence that that was not a serious issue12,13. In 2016, the Second US Panel on Cost-effectiveness in Health and Medicine (Second Panel) recommended that reference-case CEAs undertaken from the societal perspective use lifetime productivity estimates to value the benefit of avoided premature deaths14,15. Specifically, the panel recommended the use of human capital methods that include both market and non-market productivity as originally developed by US economists in the 1960s16–18. A few countries, notably the Netherlands, Canada, and Germany, have endorsed the friction cost method, which includes short-term market productivity losses19,20. The strengths and limitations of the human capital and friction cost methods have been extensively discussed in the literature, including two recently published review articles21,22. Potential modifications to the standard human capital approach, as discussed in both of those articles, are beyond the scope of the present study.

The most recent published lifetime market and non-market productivity estimates for the US are from a 2009 study by Grosse et al.23. That study, like previous US studies using the human capital approach, projected productivity in future years by assuming that current age–gender specific annual productivity or earnings would increase by 1% per year, in line with long-term growth in labor productivity, with the assumption that real earnings grow at the same rate as average labor productivity18,24–27. The change in the value of total employer compensation using the Employment Cost Index (ECI) for the total compensation of all civilian workers, adjusted for inflation, is a measure of real earnings growth. From 1981–2004, the annual change in the constant-dollar ECI averaged 1%23. However, from 2004–2016, the average annual growth in real employee compensation fell to 0.3–0.5% per year,1 even though labor productivity grew at ~1% per year during that period.2

Methods

In accordance with previous US studies, we use the gross human capital approach to estimate annual and lifetime productivity by age and sex, including both market productivity (earnings) and non-market productivity (mostly household services).

Since 2006, the US Census Bureau’s American Community Survey (ACS) has covered the US resident population (50 states plus the District of Columbia) of persons living in private households, institutionalized group quarters, and non-institutionalized group quarters.3 Using the 2016 ACS, we calculated the annual wages and salaries and self-employment income for persons aged 16 years and over by age and gender. At each age, the economic value of market productivity is set to the sum of gross employee compensation and self-employment income earned at that age in the population, divided by the size of the non-institutionalized population in that age group. ACS reports self-employment income separately from wage and salary income for individuals who report both types of income; many of those individuals own small businesses and draw both a salary and profit from the business, with the business profit reported as self-employment income.

Gross employee compensation is equal to wage and salary income multiplied by one plus average employer-paid benefits provided to all employees as a percentage of wages and salaries calculated using data from the Bureau of Economic Analysis (BEA). The BEA provides estimates of the total benefit cost (medical insurance, retirement benefits, and legally required benefits, such as Federal Insurance Contributions Act tax and unemployment) paid by civilian employers and the total wages and salaries paid to civilian employees in separate tables.4 The ratio of total benefits (annual value for 2016 in row 1 in BEA, Table 7.8) to total wages and salaries (average of 2016 quarterly values in row 1 of BEA, Table 2.2.B) was 23.4%. We multiplied mean money earnings from the ACS by a ratio of 1.234 to adjust for total employer compensation.

At each age, the economic value of non-market productivity is the sum of the product of non-market work hours by age and the average hourly wage rate paid to personal and service occupation workers by age. American Time Use Survey (ATUS) 2016 data were used to estimate weekly hours of non-market work performed by the non-institutionalized population. Non-market work was set to the time spent in the following categories: performing household activities, caring and helping people, consumer purchases, volunteer activities, secondary childcare,5 and, beginning in 2011, other secondary eldercare.6 Caring and helping people was captured as time spent in primary activities other than household services in which someone monitored children under the age of 12 years as a secondary activity. Also included in non-market work is the time spent traveling for non-market work activities.7 Since time use data are not available in the ATUS for persons under age 15 or for those living in institutions, non-market productivity for those persons was set to zero.8

To value the average weekly hours of non-market work, we estimated the average hourly earnings of “personal care and service occupation workers” by gender and age as found in the Current Population Survey (CPS). The average hourly wages in 2016 were $11.66 for males and $11.00 for females. To the hourly service wage, we added private industry employers’ average hourly benefit costs as a percentage of their part-time service occupation workers’ total hourly earnings, as reported in the BLS Employer Cost of Employee Compensation survey.9 Employer costs for insurance, retirement, and savings, and legally required benefits as a percentage of total money hourly service occupation earnings averaged 17.87% of hourly earnings in 2016.

The present value of remaining individual lifetime productivity at age X (e.g. 0 for birth) is estimated by summing expected annual productivity in future years weighted by population lifetable survival probabilities and applying a discount rate. Mean labor productivity at each future age is projected as the mean productivity, at that age in 2016, exponentiated using the assumed annual growth rate of real earnings (inclusive of benefits) applied to the difference in ages. Mean productivity at each age is multiplied by the probability of survival to that specific age. The present value of lifetime productivity at age X is calculated by applying an annual discount rate to the difference in years between future ages and age X.

Reflecting the observed slowdown in growth in real earnings during 2004–2016, we provide estimates under two assumptions of future annual real earnings growth: 0.5% and 1%.

Risk-of-survival productivity values were discounted to present values using two primary estimates of the real or inflation-free discount rates 3% and 7%. Unofficial US guidance recommends use of a 3% real discount rate for reference case CEAs14. The US Office of Management and Budget calls for both 3% and 7% discount rates in regulatory impact analyses29. Results for real discount rates from 0–10%, including single-age estimates from 0–99 years, are posted as Online Supplementary Tables.

Results

Overview of annual and lifetime productivity estimates

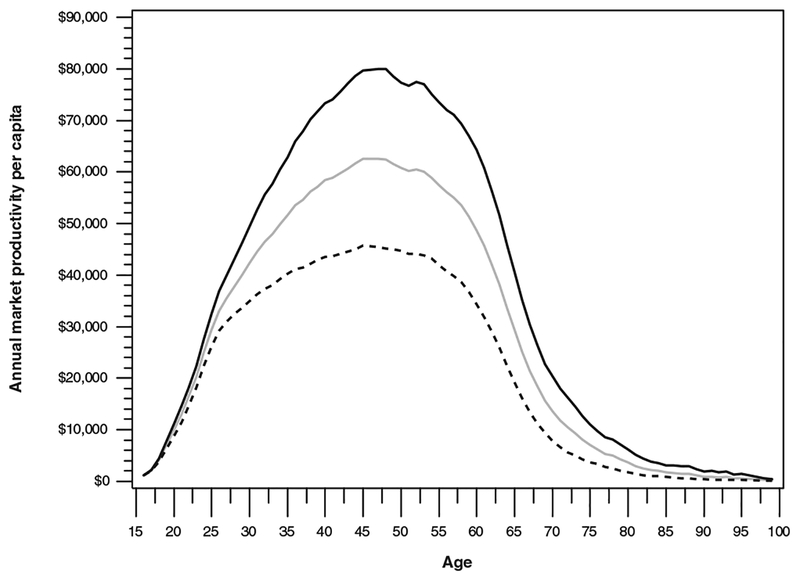

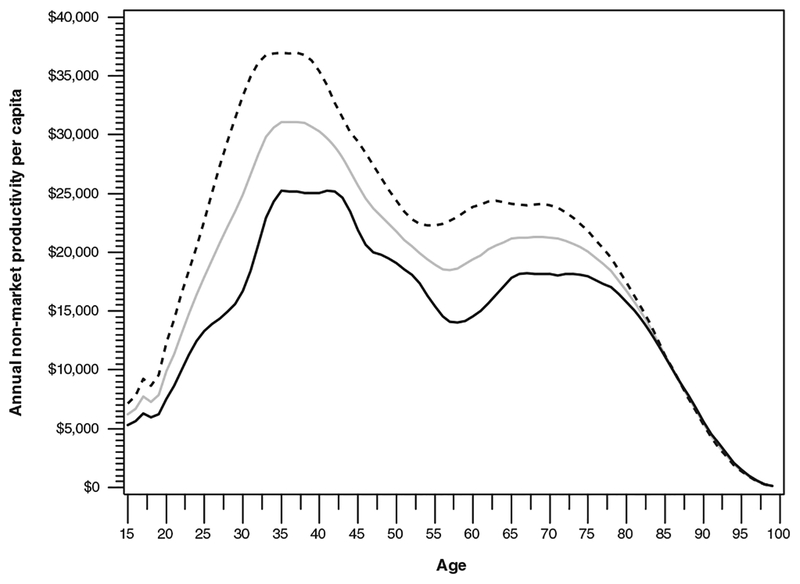

The 2016 US resident population market, non-market, and total productivity annual mean values, by gender and age, are shown in Table 1. Male and female market productivity values diverge starting at childbearing years, due to both greater absence from the labor force while bearing and raising children and slower earnings growth with increasing age for females (Figure 1). Although average annual earnings draw closer in absolute dollar values at older ages, in relative terms there is no convergence. Non-market work productivity rises to a peak during child-raising years, and subsequently diminishes as children leave home (Figure 2). There is a bump in non-market productivity during retirement years, followed by a decline with advancing age. Females consistently outperform males in non-market productivity, which more than offsets their lower earnings until age 31. After age 31, higher male earnings more than offset lower non-market productivity.

Table 1.

Annual productivity during 2016, by age and gender, 2016 US dollars

| 15 to 24 | 25 to 34 | 35 to 44 | 45 to 54 | 55 to 64 | 65 to 74 | 75 to 99 | All | |

|---|---|---|---|---|---|---|---|---|

| Males | ||||||||

| Market productivity | $11,030 | $47,082 | $71,532 | $78,114 | $63,785 | $25,170 | $5,711 | $47,185 |

| Non-market productivity | $7,931 | $17,377 | $24,932 | $19,118 | $15,049 | $18,105 | $12,916 | $16,614 |

| Total productivity | $18,961 | $64,459 | $96,464 | $97,232 | $78,834 | $43,275 | $18,627 | $63,798 |

| Females | ||||||||

| Market productivity | $8,968 | $33,672 | $42,839 | $44,646 | $34,458 | $10,553 | $1,500 | $27,237 |

| Non-market productivity | $12,468 | $31,242 | $34,840 | $25,208 | $23,443 | $23,763 | $12,797 | $23,961 |

| Total productivity | $21,435 | $64,914 | $77,679 | $69,853 | $57,901 | $34,315 | $14,297 | $51,199 |

| All | ||||||||

| Market productivity | $10,026 | $40,433 | $57,109 | $61,151 | $48,593 | $17,384 | $3,173 | $36,935 |

| Non-market productivity | $10,140 | $24,253 | $29,914 | $22,203 | $19,396 | $21,120 | $12,844 | $20,389 |

| Total productivity | $20,166 | $64,686 | $87,023 | $83,354 | $67,990 | $38,504 | $16,017 | $57,324 |

Figure 1.

Resident population market productivity annual mean values by gender and age, 2016 US dollars.

Legend.  Both sexes

Both sexes  Males

Males  Females

Females

Figure 2.

Resident population non-market productivity annual mean values by gender and age, 2016 US dollars.

Legend.  Both sexes

Both sexes  Males

Males  Females

Females

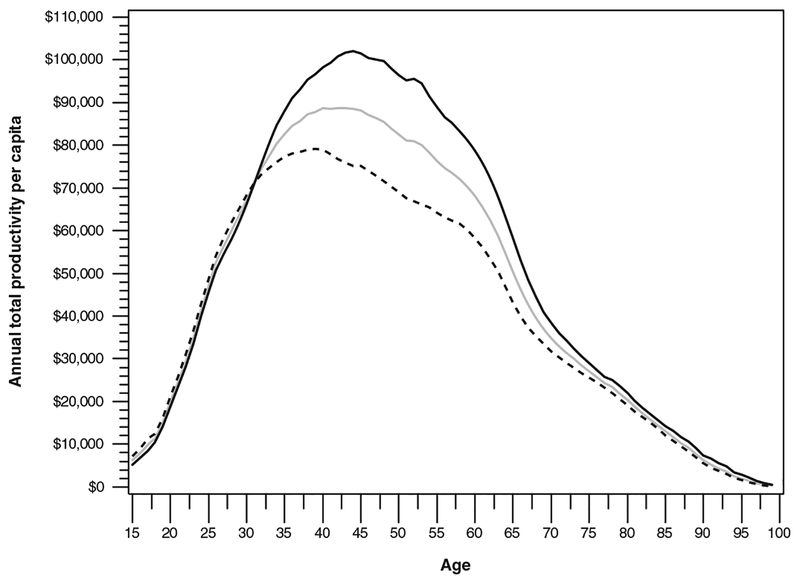

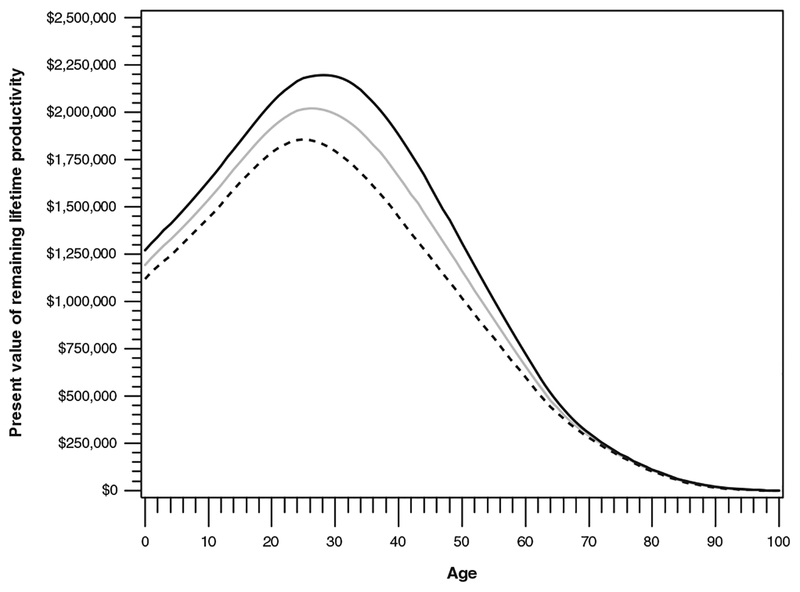

In Table 2 and Figures 3 and 4, we show estimates of the lifetime present value of individual productivity at birth and selected ages from 16–90 years, using a 3% discount rate and either 1% or 0.5% future productivity growth. Table 2 also reports results using a 7% discount rate.

Table 2.

Present value of lifetime productivity by age, 2016 US dollars.

| Male | Female | All | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Age | Market | Non-market | Total productivity | Market | Non-market | Total productivity | Market | Non-market | Total productivity |

| 1% annual productivity growth, 3% discount rate | |||||||||

| 0 | $1,145,374 | $419,801 | $1,565,175 | $722,718 | $650,361 | $1,373,079 | $934,583 | $534,086 | $1,468,669 |

| 16 | $1,582,111 | $574,484 | $2,156,595 | $996,428 | $889,397 | $1,885,825 | $1,289,764 | $730,749 | $2,020,513 |

| 18 | $1,643,861 | $585,917 | $2,229,778 | $1,033,468 | $907,886 | $1,941,353 | $1,339,095 | $745,791 | $2,084,886 |

| 21 | $1,723,913 | $602,533 | $2,326,446 | $1,077,539 | $932,161 | $2,009,700 | $1,400,883 | $766,452 | $2,167,334 |

| 30 | $1,774,850 | $601,765 | $2,376,614 | $1,053,136 | $892,769 | $1,945,906 | $1,412,400 | $747,703 | $2,160,103 |

| 40 | $1,509,926 | $489,068 | $1,998,994 | $853,168 | $690,851 | $1,544,018 | $1,178,047 | $591,210 | $1,769,257 |

| 50 | $1,014,389 | $356,124 | $1,370,514 | $554,062 | $515,592 | $1,069,654 | $779,774 | $437,548 | $1,217,322 |

| 60 | $469,661 | $277,388 | $747,049 | $225,823 | $394,430 | $620,254 | $342,843 | $338,250 | $681,093 |

| 70 | $121,324 | $189,460 | $310,784 | $43,032 | $243,956 | $286,988 | $79,260 | $218,703 | $297,963 |

| 80 | $27,914 | $83,694 | $111,609 | $7,768 | $95,218 | $102,987 | $16,320 | $90,330 | $106,651 |

| 90 | $6,377 | $13,520 | $19,897 | $1,203 | $13,676 | $14,878 | $2,939 | $13,626 | $16,565 |

| 0.5% annual productivity growth, 3% discount rate | |||||||||

| 0 | $927,253 | $340,824 | $1,268,077 | $589,628 | $530,050 | $1,119,677 | $758,954 | $434,543 | $1,193,498 |

| 16 | $1,386,668 | $504,273 | $1,890,942 | $880,117 | $783,878 | $1,663,995 | $1,133,948 | $642,904 | $1,776,852 |

| 18 | $1,454,754 | $517,964 | $1,972,719 | $921,556 | $806,100 | $1,727,657 | $1,188,666 | $660,924 | $1,849,590 |

| 21 | $1,545,809 | $538,333 | $2,084,142 | $973,229 | $836,635 | $1,809,865 | $1,259,795 | $686,561 | $1,946,356 |

| 30 | $1,638,493 | $550,965 | $2,189,458 | $976,203 | $818,991 | $1,795,194 | $1,306,000 | $685,308 | $1,991,308 |

| 40 | $1,425,827 | $454,004 | $1,879,831 | $807,501 | $639,949 | $1,447,450 | $1,113,445 | $548,098 | $1,661,543 |

| 50 | $974,933 | $333,331 | $1,308,265 | $533,991 | $482,490 | $1,016,481 | $750,242 | $409,475 | $1,159,717 |

| 60 | $457,493 | $263,911 | $721,405 | $220,632 | $375,914 | $596,547 | $334,317 | $322,147 | $656,464 |

| 70 | $118,670 | $183,626 | $302,296 | $42,145 | $236,508 | $278,653 | $77,566 | $211,998 | $289,564 |

| 80 | $27,443 | $82,315 | $109,758 | $7,641 | $93,596 | $101,236 | $16,051 | $88,809 | $104,860 |

| 90 | $6,315 | $13,427 | $19,742 | $1,189 | $13,576 | $14,765 | $2,908 | $13,529 | $16,437 |

| 1% annual productivity growth, 7% discount rate | |||||||||

| 0 | $248,773 | $98,002 | $346,775 | $166,246 | $155,970 | $322,216 | $207,769 | $126,581 | $334,350 |

| 16 | $632,176 | $243,441 | $875,617 | $421,672 | $388,052 | $809,724 | $527,495 | $314,814 | $842,308 |

| 18 | $706,770 | $260,610 | $967,380 | $469,988 | $417,190 | $887,178 | $588,988 | $337,957 | $926,945 |

| 21 | $816,743 | $288,566 | $1,105,309 | $538,357 | $462,446 | $1,000,803 | $678,107 | $374,605 | $1,052,712 |

| 30 | $1,027,390 | $339,878 | $1,367,267 | $626,906 | $513,287 | $1,140,194 | $826,729 | $426,548 | $1,253,276 |

| 40 | $1,014,572 | $300,611 | $1,315,183 | $581,279 | $417,720 | $998,999 | $795,958 | $359,765 | $1,155,722 |

| 50 | $766,891 | $226,883 | $993,774 | $426,425 | $327,015 | $753,440 | $593,589 | $277,936 | $871,525 |

| 60 | $390,053 | $195,134 | $585,187 | $191,410 | $281,209 | $472,619 | $286,799 | $239,868 | $526,667 |

| 70 | $103,560 | $151,255 | $254,815 | $37,059 | $195,227 | $232,286 | $67,891 | $174,821 | $242,712 |

| 80 | $24,669 | $74,087 | $98,756 | $6,886 | $83,952 | $90,838 | $14,459 | $79,759 | $94,218 |

| 90 | $5,928 | $12,843 | $18,771 | $1,107 | $12,947 | $14,054 | $2,721 | $12,914 | $15,635 |

| 0.5% annual productivity growth, 7% discount rate | |||||||||

| 0 | $206,988 | $82,819 | $289,807 | $139,302 | $132,172 | $271,474 | $173,374 | $107,138 | $280,511 |

| 16 | $569,461 | $222,224 | $791,685 | $382,530 | $355,358 | $737,888 | $476,546 | $287,896 | $764,442 |

| 18 | $642,662 | $239,166 | $881,828 | $430,296 | $384,322 | $814,619 | $537,075 | $310,832 | $847,907 |

| 21 | $751,582 | $267,061 | $1,018,643 | $498,611 | $429,861 | $928,472 | $625,657 | $347,577 | $973,234 |

| 30 | $966,771 | $320,289 | $1,287,060 | $591,779 | $485,022 | $1,076,800 | $778,930 | $402,595 | $1,181,525 |

| 40 | $969,705 | $285,687 | $1,255,393 | $556,284 | $396,193 | $952,476 | $761,151 | $341,493 | $1,102,643 |

| 50 | $742,300 | $215,855 | $958,155 | $413,502 | $310,801 | $724,303 | $574,960 | $264,256 | $839,216 |

| 60 | $381,652 | $187,306 | $568,959 | $187,711 | $270,400 | $458,111 | $280,847 | $230,489 | $511,336 |

| 70 | $101,630 | $147,234 | $248,863 | $36,405 | $190,103 | $226,508 | $66,651 | $170,206 | $236,857 |

| 80 | $24,302 | $72,987 | $97,289 | $6,786 | $82,667 | $89,453 | $14,248 | $78,552 | $92,800 |

| 90 | $5,874 | $12,761 | $18,635 | $1,095 | $12,859 | $13,954 | $2,695 | $12,828 | $15,523 |

Figure 3.

Lifetime present value of individual productivity at birth and selected ages from 16–90 years using a 3% discount rate and 1% future productivity growth, 2016 US dollars.

Legend.  Both sexes

Both sexes  Males

Males  Females

Females

Figure 4.

Lifetime present value of individual productivity at birth and selected ages from 16–90 years using a 3% discount rate and 0.5% future productivity growth, 2016 US dollars.

Legend.  Both sexes

Both sexes  Males

Males  Females

Females

Variation in future productivity growth, age, gender, and discount rate

Assuming 1% annual growth in employee compensation and a 3% discount rate, the present value of lifetime total productivity at birth, including market and non-market productivity, is ~ $1.5 million. Assuming 0.5% annual growth in future real gross earnings and a 3% discount rate, the present value of productivity at birth is ~ $1.2 million. Present value estimates calculated using a 7% discount rate are lower, roughly $0.3 million at birth, regardless of the rate of future earnings growth.

The differential in present value of total productivity diminishes with age. At age 30, the present values using a 3% discount rate with 1% and 0.5% future earnings growth are $2.2 million and $2.0 million, respectively, and, at age 50, both estimates are rounded to $1.2 million. Using a 7% discount rate, the present value of total productivity is $1.2 million at age 30 and ~ $850,000 at age 50 for both 1% and 0.5% earnings growth rates.

Using a 3% discount rate, the present value of lifetime market productivity at birth in 2016 was roughly $0.9 million assuming 1% future earnings growth, and $0.8 million assuming 0.5% growth in future years. At age 30, the present values of earnings in 2016 are $1.4 million and $1.3 million. Present value estimates calculated using a 7% discount rate are much lower, roughly $0.2 million at birth and $0.8 million at age 30.

Gender-specific lifetime productivity estimates are higher for males than females, especially when restricted to market productivity. At birth, the present values of market productivity, assuming 1% future earnings growth and a 3% discount rate, are $1.1 million for males and $0.7 million for females. The corresponding estimates for total productivity in 2016 are $1.6 million and $1.4 million, which reflect the larger expected value of non-market productivity for females.

Discussion

Relevancy of estimates

This study presents methodologically consistent estimates of market and non-market labor productivity by age and gender for the US resident population during 2016 on the basis of public use microdata from the ATUS, the CPS, and the ACS. Such estimates are essential to inform CEAs that follow the guidance of the Second Panel14. Unlike previously published estimates23,25,27, market productivity estimates incorporated self-employment income as well as earnings of employed workers. The ACS has a much larger sample size than the ATUS, allowing for the direct calculation of estimates of annual market productivity. Other methodological improvements include more comprehensive estimates of non-market time. Non-market productivity time averaged 4.5 hours per day in the present study, which compares with a mean of 3.1 hours per day in the study by Grosse et al.23. The increase was due primarily to the inclusion of time spent in secondary childcare, such as watching children while primarily engaged in leisure activities, such as watching television (Supplementary Appendix). We believe that this inclusion is justified because, if the caregiver were sick or disabled, another adult would need to take his or her place.

Estimates of lifetime market productivity alone may be relevant for economic evaluations of policies or interventions that avoid exposures that affect market productivity. For example, environmental health researchers have used estimates of the association of childhood exposures to contaminants, such as elemental lead, with cognitive ability and the association of cognitive ability with earnings to calculate the preventable economic burden of productivity losses due to childhood exposures to environmental contaminants, such as elemental lead environmental exposures30–32.

Accuracy of estimates

Accurate estimates of the indirect or productivity cost of disease or injury should be based on up-to-date estimates of the expected economic productivity of individuals in the general population. The slow growth in inflation-adjusted earnings in the US during the 2006–2016 period implies that use of productivity estimates that assumed 1% annual growth in the real value of labor time overstated market and non-market productivity losses during that period. For example, according to Grosse et al.23, average annual gross earnings for women aged 35–39 and 40–44 years were $33,464 and $35,870, respectively, in 2007 dollars. Projected forward, assuming 1% annual growth in earnings, the average earnings for women aged 35–44 years in 2016 would have been $37,915 in 2007 dollars, or $43,399 in 2016 US dollars using the gross domestic product price deflator. The observed average market productivity for women aged 35–44 years in 2016 was $42,899 (Table 1), which is 1.3% lower than projected.

Conversely, the more complete coverage of non-market productive activities in the present study is associated with larger age-specific estimates of annual non-market productivity than in Grosse et al.23. That is especially the case for women of childbearing age. For example, for women aged 35–44 years, average household productivity of $21,319 in 2007, corresponds to an inflation-adjusted estimate of $26,688 in 2016, assuming 1% annual productivity growth. In comparison, average non-market productivity for women in that age group in 2016 in the present study was $34,840, which is 31% higher.

Significance of estimates

The net effect on total annual productivity of these offsetting differences in market and non-market productivity varied by demographic group. Total productivity for women aged 35–44 years in 2016 ($77,679) was 11% higher than the inflation- and productivity growth-adjusted estimate from 2007. For men, on the other hand, total productivity in 2016 in real terms was close to projections from 2007 values, because increased estimates of non-market productivity almost exactly offset lower estimates of real earnings. For example, men aged 45–54 years had 2.1% lower market productivity and 40.1% higher non-market productivity relative to 2007 estimates adjusted for inflation and earnings growth, with 2016 total productivity higher by just 4.1%.

Lifetime total productivity estimates in 2016, calculated assuming 1% future annual earnings growth and a 3% discount rate, are similar to the estimates from 2007 data. In 2007, lifetime productivity at birth was estimated to be roughly $1,180,796, which adjusted for inflation and 1% annual earnings growth is $1,478,207. This value is virtually the same as the calculated value of $1,468,669 in 2016, reflecting an 18.5% increase in non-market productivity estimates, almost exactly offsetting a 9.1% decrease in estimated lifetime market productivity. The 9.1% decrease in lifetime market productivity for 2016 relative to the predicted value based on the 2007 estimate is due to the assumption of 1% annual productivity growth between 2007 and 2016. The 2007 lifetime market productivity at birth estimate, $820,892, adjusted for inflation to 2016 dollars, is $939,624. That is slightly larger than the 2016 estimate, $934,583, compared with a predicted value of $1,027,653 assuming real growth of 1% per year during that 9-year period.

The magnitude of future growth in real earnings, which is uncertain, affects human capital estimates of lifetime productivity. That is also true for non-market productivity, which is indexed to the real earnings of service workers. Lifetime productivity at birth in 2016 was 23% higher in estimates that assumed 1% annual earnings growth relative to those that incorporated 0.5% annual earnings growth (Table 2). The lack of growth in observed real per-person earnings between 2007 and 2016 implies that the assumption of 1% annual earnings growth might be optimistic. The gap between growth rates in real earnings and growth in labor productivity in the US since 2004 has multiple explanations. A widely reported long-term decline in the labor share in national income in high-income countries since the early 1980s has been attributed by experts to structural factors such as globalization and increased market concentration in many high-income countries33–35. Either temporary or structural distortions in labor markets can call into question the neoclassical basis for the standard human capital approach. It could be useful for researchers to document trends in estimates of growth in real earnings and labor productivity in other high-income countries, as well as country-specific estimates of changes over time in market concentration. On the other hand, the US Congressional Budget Office (CBO) has posited that the recent decline in the US labor share will reverse itself36 and optimistically projects that growth in both labor productivity and real earnings will increase in coming years; in 2017 CBO projected 1.1% annual growth in real earnings per worker over the coming decade, and in 2018 CBO raised the projected growth in real earnings to 1.5% per year37,38.

Debate over inclusion of productivity costs in economic evaluations

Although the inclusion of productivity costs in health-related economic evaluations has been debated for years, fewer than 10% of cost-effectiveness analyses include productivity costs21,39. However, with the new recommendation to include productivity costs in CEAs from the societal perspective, it is important to consider the implications of excluding productivity costs from pharmacoeconomic evaluations39. In a 2011 systematic review of cost analyses of treatments for depressive disorders, researchers found that productivity costs accounted for 60% on average of total costs40. Including productivity estimates could lead to certain interventions that would be considered too costly to implement, based on direct costs alone, being reclassified as cost-effective41.

Conclusion

The economic impact of premature mortality and disability is often incorporated in analyses of economic burden of disease and is increasingly included in CEAs from the societal perspective. Such analyses require updated estimates of the present value of expected productivity over the remaining lifetime. Adjustment of historic estimates for changes in price levels is inadequate; updated estimates that reflect changed labor force attachment and age-earnings profiles as well as current estimates of non-market productivity and uncertainty in future earnings growth may be more informative. Although it has long been standard practice to assume that labor productivity and earnings will grow indefinitely at a constant rate of 1% per year, because of uncertainty in earnings growth a range of estimates may be more informative. This issue is particularly timely, since the Second Panel in 2016 recommended that reference-case analyses from the societal perspective include expected decrements to productivity that result from disease, disability, or death as preventable costs14.

Supplementary Material

Declaration of financial/other relationships

KVK is an employee of John Ward Economics, which provides expert analysis in modeling economic damages in tort claims such as personal injury and wrongful death. SDG and JP have no conflicts of interest to disclose. JME peer reviewers on this manuscript have no relevant financial or other relationships to disclose.

Supplemental data for this article is available online at https://doi.org/10.1080/13696998.2018.1542520.

This article was originally published with errors, which have now been corrected in the online version. Please see Correction http://dx.doi.org/10.1080/13696998.2019.1584497I

Declaration of funding

There is no funding to disclose.

Publisher's Disclaimer: Disclaimer

Publisher's Disclaimer: The findings and conclusions in this report are those of the authors and do not necessarily represent the official position of the Centers for Disease Control and Prevention.

Notes

Current dollar ECI is available at https://www.bls.gov/data/ under Pay and Benefits. Real growth adjusted using the Consumer Price Index for Urban Consumers was 0.3% per year, and adjusting using the gross domestic product deflator was 0.5% per year28.

Calculated from data available in the Total Economy Database™ https://www.conference-board.org/data/economydatabase/index.cfm?id=27762

Private households include houses, apartments, mobile homes, and rented rooms. Institutionalized group quarters include correctional facilities, nursing homes, and mental hospitals. Non-institutionalized group quarters include college dormitories, military barracks, group homes, missions, and shelters.

These data are reported by the BEA in their interactives tables: Table 2.2B. Wages and Salaries by Industry and Table 7.8. Supplements to Wages and Salaries by Type. The data are accessible beginning at https://www.bea.gov/iTable/index_nipa.cfm (October 23, 2017).

Secondary childcare is defined in the ATUS as the time one has a child under 13 years “in his or her care” while doing something else as a primary activity.

Eldercare is defined in the ATUS as the time providing persons aged 65 or older with help needed due to a condition related to aging, such as assisting with grooming, preparing meals, and providing transportation.

Examples can be found in the ATUS Activity Lexicon: https://www.bls.gov/tus/lexiconwex2016.pdf (October 23, 2017). Time-based activities are not allowed to overlap. For example, if the “main” activity of a person is cooking, but the “cooking” is performed as part of eldercare, eldercare during that time is set to zero.

If non-market work data were available for institutionalized persons, we would expect those hours to be low compared to those in the non-institutional population.

The information can be found at https://www.bls.gov/data under Pay and Benefits. Since we value non-market services by-the-hour, the benefit rate should also be measured by-the-hour. This method differs from accounting for market benefits as a percentage of total personal earnings using the BEA estimates, which are based on gross annual payroll costs.

References

- 1.Larg A, Moss JR. Cost-of-illness studies. Pharmacoeconomics 2011; 29:653–71 [DOI] [PubMed] [Google Scholar]

- 2.Finkelstein E, Corso P. Cost-of-illness analyses for policy making: a cautionary tale of use and misuse. Expert Rev Pharmacoecon Outcomes Res 2003;3:367–9 [DOI] [PubMed] [Google Scholar]

- 3.Onukwugha E, McRae J, Kravetz A, et al. Cost-of-illness studies: an updated review of current methods. Pharmacoeconomics 2016;34: 43–58 [DOI] [PubMed] [Google Scholar]

- 4.Wang G, Grosse SD, Schooley MW. Conducting research on the economics of hypertension to improve cardiovascular health. Am J Prev Med 2017;53:S115–S7 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Akobundu E, Ju J, Blatt L, et al. Cost-of-illness studies: a review of current methods. Pharmacoeconomics 2006;24:869–90 [DOI] [PubMed] [Google Scholar]

- 6.Benjamin EJ, Blaha MJ, Chiuve SE, et al. Heart disease and stroke statistics-2017 update: a report from the American Heart Association. Circulation 2017;135:e146–603 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Leigh JP. Economic burden of occupational injury and illness in the United States. Milbank Q 2011;89:728–72 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Xu J, Zhou F, Reed C, et al. Cost-effectiveness of seasonal inactivated influenza vaccination among pregnant women. Vaccine 2016;34:3149–55 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Zhang W, Bansback N, Anis AH. Measuring and valuing productivity loss due to poor health: a critical review. Soc Sci Med 2011;72: 185–92 [DOI] [PubMed] [Google Scholar]

- 10.Krol M, Brouwer W. How to estimate productivity costs in economic evaluations. Pharmacoeconomics 2014;32:335–44 [DOI] [PubMed] [Google Scholar]

- 11.Joensuu JT, Huoponen S, Aaltonen KJ, et al. The cost-effectiveness of biologics for the treatment of rheumatoid arthritis: a systematic review. PLoS One 2015;10:e0119683. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Meltzer D, Johannesson M. Inconsistencies in the “societal perspective” on costs of the Panel on Cost-Effectiveness in Health and Medicine. Med Decis Making 1999;19:371–7 [DOI] [PubMed] [Google Scholar]

- 13.Brouwer WB, Koopmanschap MA, Rutten FF. Productivity costs measurement through quality of life? A response to the recommendation of the Washington Panel. Health Econ 1997;6:253–9 [DOI] [PubMed] [Google Scholar]

- 14.Sanders GD, Neumann PJ, Basu A, et al. Recommendations for conduct, methodological practices, and reporting of cost-effectiveness analyses: second panel on cost-effectiveness in health and medicine. JAMA 2016;316:1093–103 [DOI] [PubMed] [Google Scholar]

- 15.Neumann PJ, Sanders GD, Russell LB, et al. Cost-effectiveness in health and medicine. 2nd ed. Oxford: Oxford University Press; 2016 [Google Scholar]

- 16.Weisbrod BA. The valuation of human capital. J Polit Economy 1961;69:425–36 [Google Scholar]

- 17.Rice DP. Estimating the cost of illness. Am J Public Health 1967;57: 424–40 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Grosse SD, Krueger KV. The income-based human capital valuation methods in public health economics used by forensic economics. J Forensic Econ 2011;22:43–57 [Google Scholar]

- 19.Nyman JA. Productivity costs revisited: toward a new US policy. Health Econ 2012;21:1387–401 [Google Scholar]

- 20.Birnbaum H. Friction-cost method as an alternative to the human-capital approach in calculating indirect costs. Pharmacoeconomics 2005;23:103–5 [DOI] [PubMed] [Google Scholar]

- 21.Pike J, Grosse SD. Friction cost estimates of productivity costs in cost-of-illness studies in comparison with human capital estimates: a review. Appl Health Econ Health Policy 2018 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.Targoutzidis A. Some adjustments to the human capital and the friction cost methods. Eur J Health Econ 2018 [DOI] [PubMed] [Google Scholar]

- 23.Grosse SD, Krueger KV, Mvundura M. Economic productivity by age and sex: 2007 estimates for the United States. Med Care 2009; 47:S94–S103 [DOI] [PubMed] [Google Scholar]

- 24.Hartunian NS, Smart CN, Thompson MS. The incidence and economic costs of cancer, motor vehicle injuries, coronary heart disease, and stroke: a comparative analysis. Am J Public Health 1980; 70:1249–60 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Grosse SD. Productivity loss tables In: Haddix AC, Teutsch SM, Corso PS, editors, Prevention effectiveness: a guide to decision analysis and economic evaluation. 2nd ed. New York: Oxford University Press; 2003. p. 245–257. [Google Scholar]

- 26.Max W, Rice DP, MacKenzie EJ. The lifetime cost of injury. Inquiry 1990;27:332–43 [PubMed] [Google Scholar]

- 27.Max WPD, Rice DP, Sung H-Y, et al. Valuing human life: estimating the present value of lifetime earnings, 2000. 2004 [Google Scholar]

- 28.Dunn A, Grosse SD, Zuvekas SH. Adjusting health expenditures for inflation: a review of measures for health services research in the United States. Health Serv Res 2018;53:175–96 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.US Office of Management and Budget. Circular A-4: Regulatory analysis. Washington, DC: US Office of Management and Budget; 2003 [Google Scholar]

- 30.Grosse SD, Matte TD, Schwartz J, et al. Economic gains resulting from the reduction in children’s exposure to lead in the United States. Environ Health Perspect 2002;110:563–9 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.Gould E. Childhood lead poisoning: conservative estimates of the social and economic benefits of lead hazard control. Environ Health Perspect 2009;117:1162–7 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32.Zhou Y, Nurmagambetov T, McCord M, et al. Economic valuation of selected illnesses in environmental public health tracking. J Public Health Manag Pract 2017;23(Suppl 5):S18–S27 [DOI] [PubMed] [Google Scholar]

- 33.International Labour Organization, Organisation for Economic Co-operation and Development. The Labour Share in G20 Economies. ILO, OECD; 2015. Available at: https://www.oecd.org/g20/topics/employment-and-social-policy/The-Labour-Share-in-G20-Economies.pdf [Google Scholar]

- 34.Elsby MW, Hobijn B, Şahin A. The decline of the US labor share. Brookings Pap Econ Act 2013;2013:1–63 [Google Scholar]

- 35.Dorn D, Katz LF, Patterson C, et al. Concentrating on the fall of the labor share. Am Econ Rev 2017;107:180–5 [Google Scholar]

- 36.Congressional Budget Office. How CBO projects income. Washington, D.C.: CBO; 2013 [Google Scholar]

- 37.Congressional Budget Office. The 2017 long-term budget outlook. Washington, D.C.: CBO; 2017 [Google Scholar]

- 38.Congressional Budget Office. The 2018 long-term budget outlook. Washington, D.C.: CBO; 2018 [Google Scholar]

- 39.Krol M, Papenburg J, Tan SS, et al. A noticeable difference? Productivity costs related to paid and unpaid work in economic evaluations on expensive drugs. Eur J Health Econ 2016;17:391–402 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 40.Krol M, Papenburg J, Koopmanschap M, et al. Do productivity costs matter? Pharmacoeconomics 2011;29:601–19 [DOI] [PubMed] [Google Scholar]

- 41.Van den Hout W. The value of productivity: human-capital versus friction-cost method. Ann Rheum Dis 2010;69:i89–i91 [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.