Abstract

Background

Discontinuous Medicaid insurance erodes access to care, increases administrative costs, and exposes enrollees to substantial out-of-pocket spending.

Objective

To assess the impact of Medicaid expansion under the Affordable Care Act on continuity of Medicaid coverage among those enrolled prior to expansion.

Design

Using a difference-in-differences framework, we compared Colorado, a state that expanded Medicaid, to Utah, a nonexpansion state, before and after Medicaid expansion implementation.

Participants

Adults ages 18–62 who were enrolled in Medicaid coverage in Colorado and Utah prior to expansion, from the Utah and Colorado All Payer Claims Databases, 2013–2015.

Main Measures

The primary outcomes were the duration of Medicaid enrollment and rates of disrupted coverage.

Key Results

Following Medicaid expansion, enrollees in Colorado gained an additional 2 months of coverage over two years of follow-up and were 16 percentage points less likely to experience a coverage disruption in a given year relative to enrollees in Utah.

Conclusions

Increasing Medicaid eligibility levels under the Affordable Care Act appears to be an effective strategy to reduce churning in the Medicaid program, with important implications for other states that are considering Medicaid expansion.

Electronic supplementary material

The online version of this article (10.1007/s11606-019-05101-8) contains supplementary material, which is available to authorized users.

KEY WORDS: access to care, Medicaid, continuity of care, health policy, health insurance, vulnerable populations

INTRODUCTION

Churning, or frequent gaps or transitions in health insurance coverage, has detrimental effects on access to care for enrollees in the Medicaid program.1 Churning encompasses both losing and changing coverage. While long-term uninsurance poses major barriers to accessing care, transitions between different types of health insurance and short gaps in coverage can also negatively impact enrollees. Switching coverage can erode continuity due to changes in provider networks and/or covered services between plans.2, 3 Even short gaps in insurance coverage can be harmful by compromising access to effective medical services and prescription drugs.4 Studies have demonstrated that those with unstable coverage are more likely to be diagnosed with late-stage cancer, less likely to receive key preventive services, and have markedly increased use of hospital care.5–7 Spells of uninsurance may also have negative effects on personal finances due to high out-of-pocket costs for health care.8

Churning is a long-standing concern for Medicaid programs aiming to deliver continuous care to enrollees while maintaining the program’s eligibility requirements.9 Income fluctuations, changes in family circumstances, and data inconsistencies can trigger coverage disruptions among Medicaid beneficiaries that incur administrative expenses and may result in care delivered in higher-cost settings.10–12 Low retention in Medicaid also impedes quality measurement efforts as the eligibility criteria for performance indicators often require continuous insurance throughout a calendar year.13

The Affordable Care Act (ACA) provided states with an option to extend Medicaid coverage to adults with incomes below 138% of the federal poverty level (FPL). Medicaid expansion holds the potential to reduce churning among Medicaid enrollees by increasing the income-based eligibility levels within which enrollees’ incomes can fluctuate and eliminating the need for a category of eligibility beyond income. Prior research has documented that Medicaid expansions have led to substantial gains in coverage and declines in uninsurance, but this work has largely relied on point-in-time surveys that do not capture the dynamic nature of health insurance.14 To date, little is known about the impact of the ACA’s Medicaid expansion on the stability of coverage in the Medicaid program.

Studies forecasted high rates of discontinuous coverage under the ACA despite coverage expansions.15, 16 A 2014 study estimated that states that expanded their Medicaid programs to ACA levels would face churning rates similar to the pre-expansion period.17 Few studies have evaluated continuity of insurance coverage after expansion. Sommers et al. conducted a three-state survey and found that 12% of Medicaid enrollees (and 25% of low-income adults overall) reported a coverage disruption in 2015, substantially lower than prior forecasts.18 Vistnes and Cohen found a decline in the length of uninsured spells using Medical Expenditure Panel Survey (MEPS) data, with greater declines reported among respondents residing in Medicaid expansion states.19 However, survey-based analyses may suffer from errors related to recall or confusion over insurance type.20

In this study, we assess the impact of Medicaid expansion on coverage continuity for low-income adults enrolled in Medicaid prior to expansion. We use a difference-in-differences approach and Medicaid data from Colorado and Utah. Colorado opted to expand its Medicaid program, and Utah, a bordering state, did not. We compare Medicaid enrollment duration and the rate of coverage disruptions across states before and after expansion in Colorado.

METHODS

Study Sample and Setting

On January 1, 2014, Colorado expanded its Medicaid program to childless adults with incomes under 138% FPL. Utah did not expand its Medicaid program under the ACA. Our study sample consisted of a closed cohort of 18–62 year-olds enrolled in Medicaid as of January 2013. We focused this analysis on coverage outcomes among previously enrolled beneficiaries for three primary reasons. First, focusing on this population allowed us to assess the impact of expansion on those categorically eligible for Medicaid prior to the ACA. Second, examining continuity of coverage for the same population before and after expansion ensures our results are not driven by the changing characteristics of Medicaid enrollees post-expansion. Third, 75.6% of the Colorado Medicaid enrollees in 2014–2015 were enrolled in the program in 2013, indicating that persons with categorical eligibility prior to expansion continued to represent a substantial fraction of enrollees post-expansion.

The population contained 99,772 enrollees in Utah and 254,370 enrollees in Colorado who qualified for Medicaid coverage according to pre-expansion eligibility criteria. Enrollees who lost coverage in a given year but subsequently reenrolled the following year could reenter the cohort. Prior to 2014 in Utah, pregnant women with incomes below 133% FPL and parents with incomes below 44% FPL were eligible for Medicaid. In Colorado, pregnant women with incomes below 185% FPL and parents with incomes below 105% FPL were eligible for Medicaid.21 Both states covered those with disability-based Supplemental Security Income (SSI). Utah and Colorado both covered a limited number of childless adults through waivers. Utah provided primary care benefits for some childless adults with incomes up to 95% FPL under a Primary Care Network waiver, a population that comprised 5.9% of the 2013 Medicaid population.22 Colorado covered 10,000 childless adults with incomes below 10% FPL, comprising 1.2% of the 2013 Medicaid population.23 Such differences in eligibility do not in themselves pose a threat to the validity of a difference-in-differences framework as estimations of cross-state differences account for each state’s baseline outcome measures.

Data

We used Medicaid claims included in all payer claims databases (APCDs) from Colorado and Utah. The Colorado APCD contains complete Medicaid fee-for-service and managed care claims, and the Utah APCD contains complete Medicaid fee-for-service claims and 90% of Medicaid managed care claims. The datasets are described in more detail in online Appendix A1. Our analyses used each state’s eligibility files from 2013 to 2015 which record health insurance enrollment data.

Variables

We analyzed two main outcome measures of continuity of Medicaid coverage. First, we examined the impact of Medicaid expansion on the total number of months of Medicaid coverage per calendar year. Second, we examined the impact of expansion on the probability of experiencing a disruption in coverage in a given year. These two outcomes offer complementary information about continuity of Medicaid coverage under the ACA, capturing both those who cycle in and out Medicaid and those who experience longer spells without Medicaid coverage. These measures are also consistent with outcomes examined in prior research on Medicaid churning.18 A disruption in coverage was defined as either disenrollment from Medicaid coverage (with no reenrollment) prior to the end of the year, or a gap in Medicaid coverage greater than 1 month (31 days) followed by reentry into Medicaid. In online Appendix A3, we varied the length of the gap to 90 and 120 days, which did not substantively change our findings. In online Appendix A7, we tracked insurance transitions from Medicaid to commercial coverage using a unique person identifier provided in the APCDs.

One of the central assumptions of a difference-in-differences study design is that in the absence of the policy change, trends in the outcome variables would be similar across treatment and control groups. Because we were limited to 1 year of pre-period data, we assessed this assumption by plotting quarterly continuous enrollment rates in Colorado and Utah during 2013. Medicaid enrollees in both states had similar trends in continuity of Medicaid coverage prior to expansion (p = 0.923). These results are presented in online Appendix A4.

Covariates included age, sex, the Elixhauser comorbidity index, and prior use of health services measured by the number of ED visits, inpatient stays, and outpatient visits in the 2013 baseline year.24 We assessed whether the magnitude of the impact of Medicaid expansion varied by the health status of Medicaid enrollees using the Elixhauser. Because the claims data have limited information on race/ethnicity and income, we included area-level characteristics from the 2013 American Community Survey. These variables were matched at the ZIP Code level in Colorado and the level of the Small Health Area in Utah, a geographic measure computed by the Utah Department of Statistics to reduce the risk of person identification in rural areas of the state.25 Area-level covariates included the proportion of the geographic area that identified as White, Black, Hispanic, and Asian, unemployment, uninsured and poverty rates, median household income, educational attainment, and the proportion of residents in urban versus rural areas. Neither APCD included information on reason for Medicaid eligibility.

Analysis

We estimated a multivariate linear regression model for the continuous outcome of total number of months of Medicaid coverage per year. For the binary outcome of Medicaid coverage disruptions, we used linear probability models for ease of interpretation, as is common in difference-in-differences analyses.26 Each regression included an indicator variable for state, corresponding to whether enrollees resided in Colorado or Utah, an indicator variable for pre-policy (2013) versus post-policy years (2014–2015), and an interaction term between the state indicator and post variables. The coefficient for this interaction corresponds to the mean difference in continuity of Medicaid coverage between Colorado and Utah before and after expansion. Models adjusted for health status, utilization, age, sex, and area-level demographics, though our results were similar with and without multivariate adjustment.

In our primary models, we estimated standard errors using Huber–White robust standard errors clustered at the state level and obtained p values from t distributions with one degree of freedom.27 This approach clusters at the highest level of aggregation (the state) following work by Pepper.28 However, in models with few clusters, this approach may underestimate the variance. In online Appendix A5, we analyze an alternative model aggregated to the area level with standard errors clustered at the ZIP code tabulation area, which did not substantially change our findings.

While our primary analyses focused on a broad definition of Medicaid coverage loss for any reason, we examined transition rates from Medicaid to commercial coverage as a supplementary analysis in online Appendix A7. We do not include these results as part of our main findings as the composition of the commercial market included in the APCDs changed over time.

RESULTS

Table 1 reports the characteristics of Medicaid beneficiaries ages 18–62 enrolled in January 2013 in Colorado and Utah. Medicaid enrollees in Colorado were more likely to be female and were younger than Medicaid enrollees in Utah. Medicaid enrollees in Colorado also lived in more ethnically diverse communities and had lower use of outpatient care in the baseline period compared to Utah Medicaid enrollees. 38.6% of the Medicaid sample in Utah and 33.6% of the Medicaid sample in Colorado had an existing comorbid condition diagnosed during the baseline year.

Table 1.

Characteristics of Medicaid Beneficiaries in Colorado and Utah Enrolled as of January 2013

| Variable | Colorado | Utah |

|---|---|---|

| Sample size | 254,370 | 99,772 |

| Female, % | 67.4 | 64.8 |

| Age (years), % | ||

| 18–29 | 40.0 | 37.7 |

| 30–44 | 35.8 | 36.6 |

| 45–62 | 24.2 | 25.6 |

| ED Visits in 2013, % | ||

| 0 | 74.8 | 76.8 |

| 1 | 12.6 | 13.3 |

| 2 | 5.5 | 4.5 |

| 3+ | 7.1 | 5.4 |

| Hospitalizations in 2013, % | ||

| 0 | 90.4 | 93.8 |

| 1 | 7.6 | 5.7 |

| 2+ | 2.0 | 0.5 |

| Office Visits in 2013, % | ||

| 0 | 57.7 | 33.6 |

| 1–2 | 20.0 | 27.7 |

| 3–4 | 9.5 | 15.1 |

| 5+ | 12.8 | 23.5 |

| Elixhauser Comorbidity Index, % | ||

| 0 | 67.7 | 61.4 |

| 1 | 18.5 | 23.1 |

| 2 | 7.5 | 9.7 |

| 3+ | 6.3 | 5.8 |

| Area-level characteristics | ||

| White, % | 80.3 | 84.6 |

| Black, % | 5.3 | 1.3 |

| Asian, % | 2.4 | 2.1 |

| Hispanic/Latino, % | 18.5 | 17.2 |

| Unemployed, % | 6.5 | 5.4 |

| Uninsured, % | 17.9 | 17.3 |

| Income below the federal poverty level, % | 13.1 | 11.8 |

| Mean regional median household income | $51,881 | $56,008 |

| Graduated high school, % | 85.8 | 87.5 |

| Graduated college, % | 28.8 | 27.1 |

Area-level characteristics drawn from the 2013 American Community Survey at the level of the ZIP Code in Colorado and the level of the Small Health Area in Utah. p values were computed using chi-square tests for categorical variables and two-sample t tests for differences between proportions. All characteristics are significantly different across Colorado and Utah at the p < .001 level

Table 2 reports difference-in-differences estimates comparing continuity of Medicaid coverage in Utah and Colorado before and after Medicaid expansion. In the baseline 2013 year, Medicaid beneficiaries in Colorado were enrolled for an average of 10.5 months and 28.4% experienced a Medicaid coverage disruption. In Utah during the baseline year, average Medicaid enrollment was 9.5 months and 40.6% of Medicaid beneficiaries experienced a coverage disruption. After Medicaid expansion (2014–2015 vs. 2013), continuity of Medicaid coverage increased significantly among Colorado enrollees relative to their Utah counterparts, gaining an additional month of Medicaid coverage per year (p = 0.008) and experiencing a 15.9 percentage-point reduction in the likelihood of a Medicaid coverage disruption (p = 0.001). For both outcomes, these results did not vary significantly by the baseline presence of a comorbid condition.

Table 2.

Changes in Continuity of Medicaid Coverage in Colorado and Utah Before and After Medicaid Expansion, 2013-2015

| Variable | Colorado | Utah | Adjusted difference-in-differences | 95% confidence interval | ||||

|---|---|---|---|---|---|---|---|---|

| State | 2013 | 2014–2015 | Change | 2013 | 2014–2015 | Change | ||

| Number of months of Medicaid coverage per year | 10.5 | 11.2 | 0.7 | 9.5 | 9.2 | − 0.3 | 1.0 | (0.20, 1.8) |

| Probability of coverage disruption per year | 28.4% | 10.8% | − 17.6% | 40.6% | 38.1% | − 2.5% | − 15.9% | (− 26.3, − 5.5) |

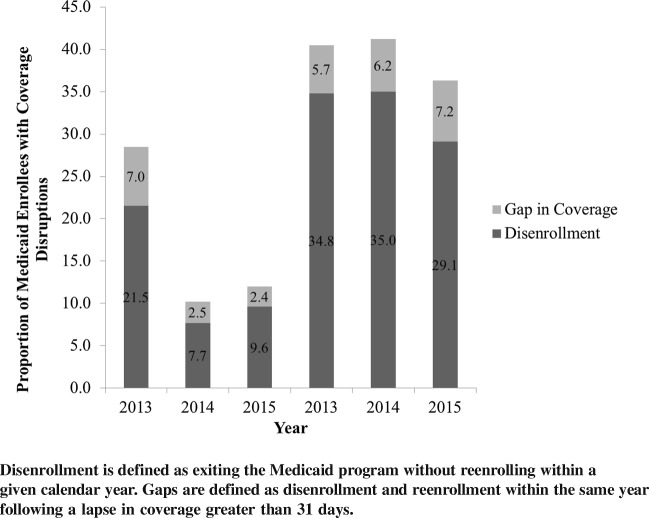

Figure 1 shows the proportion of enrollees who experienced a disruption in Medicaid coverage in Colorado and Utah by year. Rates of coverage disruptions are further broken down by whether enrollees disenrolled (with no reenrollment) or experienced a gap in coverage and subsequently reenrolled in Medicaid within the same calendar year. Enrollees in Colorado experienced a sharp decline in both disenrollment and gaps in coverage between 2013 and 2014, stabilizing in 2015. In contrast, disenrollment rates in Utah were relatively stable in 2014–2015, before declining moderately in 2015.

Figure 1.

Rates of disenrollment and gaps among Medicaid enrollees in Colorado and Utah, 2013–2015. Disenrollment is defined as exiting the Medicaid program without reenrolling within a given calendar year. Gaps are defined as disenrollment and reenrollment within the same year following a lapse in coverage greater than 31 days. Figure 1 contains poor quality of text inside the artwork. Please do not re-use the file that we have rejected or attempt to increase its resolution and re-save. It is originally poor, therefore, increasing the resolution will not solve the quality problem. We suggest that you provide us the original format. We prefer replacement figures containing vector/editable objects rather than embedded images. Preferred file formats are eps, ai, tiff and pdf."Figures 1 please confirm if captured correctly.Original file provided in .tiff format as an attachment.The title of this figure is "Rates of disenrollment and gaps among Medicaid enrollees in Colorado and Utah, 2013-2015"The text "Disenrollment is defined as exiting the Medicaid program without reenrolling with a given calendar year. Gaps are defined as disenrollment and reenrollment within the same year following a lapse in coverage greater than 31 days" should be presented as a footnote to the figure, not in the title (similar to the footnote for Table 1). Please check Fig. 1 caption if captured correctly.The title of this figure is "Rates of disenrollment and gaps among Medicaid enrollees in Colorado and Utah, 2013-2015"The text "Disenrollment is defined as exiting the Medicaid program without reenrolling with a given calendar year. Gaps are defined as disenrollment and reenrollment within the same year following a lapse in coverage greater than 31 days" should be presented as a footnote to the figure, not in the title (similar to the footnote for Table 1).

DISCUSSION

In this two-state difference-in-difference analysis, we found that Medicaid expansion was associated with significant reductions in Medicaid insurance loss and coverage gaps among those enrolled in Medicaid pre-expansion. Following expansion, Medicaid enrollees in Colorado gained an additional 2 months of coverage over 2 years of follow-up and were 16 percentage points less likely to experience a coverage disruption in a given year compared to concurrent trends observed for enrollees in Utah, a bordering state that did not expand Medicaid.

We found that from 2013 to 2015, nearly 40% of Utah Medicaid enrollees lost coverage each year. This figure aligns with prior work; a national study examining data from 2000 to 2004 found that 43% of adults in Medicaid disenrolled within 12 months.9 In Colorado, the rate of Medicaid disenrollment in 2013 was 28%, indicating that prior to expansion, Colorado had higher Medicaid retention compared to Utah and the national average. The Medicaid disenrollment rate in Colorado after expansion is lower than prior work predicted. Sommers et al. estimated that less than half of low-income adults in Colorado would experience continuous eligibility for Medicaid or Marketplace coverage.17 Importantly, our measures of coverage continuity may differ from prior work because we assessed coverage for those eligible for Medicaid prior to expansion and used enrollment data from two specific states. Nonetheless, our difference-in-differences estimates suggest greater gains in coverage stability in Colorado among our study population than prior studies predicted would occur under the ACA.

To our knowledge, this study is the first to examine the impact of the ACA’s Medicaid expansion on coverage stability in Medicaid using administrative data. Evaluations of the law’s impact on Medicaid churning are limited. Graves et al. examined Medicaid retention in Massachusetts following the 2006 coverage expansions and reported decreases in coverage lapses lasting 4-20 months.29 Sommers et al. compared churning rates across three states that took different approaches to Medicaid expansion, finding no significant differences across expansion status.18 Again, these differences between our findings and other expansion evaluations could be partially explained by choices of data sources and study populations.

Medicaid expansion enabled enrollees with episodic Medicaid eligibility to maintain coverage in instances where they would have become ineligible if not for expansion. Under expansion in Colorado, pregnant women with incomes between 106 and 138% FPL were able to retain their Medicaid coverage after delivery. Prior to expansion, women who did not meet the more restrictive parental income thresholds (106% FPL in Colorado, 44% FPL in Utah) were at risk of losing coverage during the vulnerable postpartum period, a pattern that has been documented nationally among postpartum women enrolled in Medicaid.30 Similarly, parents with incomes below 138% FPL who would have lost parental eligibility status when their children turned 18 during the pre-expansion period also gained new opportunities to maintain Medicaid coverage. Low-income Americans are more likely to experience income volatility, often due to seasonable or shift-based employment, which can trigger loss of coverage.31 Even without a change in categorical eligibility, Medicaid expansion provided greater latitude to enrollees who experienced income fluctuations above pre-expansion income cutoffs, reducing the likelihood that beneficiaries experience a disruption in coverage.

We also hypothesize that changes to Colorado’s Medicaid outreach and renewal policies played a role in our findings. In 2014, Colorado began offering real-time eligibility determinations, allowing Medicaid beneficiaries to upload documents electronically and verify their incomes after they started receiving benefits, and developed a mobile app through which beneficiaries could update their enrollment information. Importantly, Colorado also implemented a policy that allowed applicants with fluctuating wages to annualize their incomes to determine Medicaid eligibility.32 Because updates to Colorado’s renewal system occurred contemporaneously with expansion, we are unable to disentangle the effects of changing administrative policies from the coverage expansion itself. However, these policies represent an important area of future research as they may help explain the divergence between coverage volatility predicted under expansion and disenrollment rates derived from administrative data.

This study has several limitations. First, we were limited in our ascertainment of differences between pre-period outcome trends in Colorado and Utah by one year of pre-policy data. While our assessment of quarterly continuous Medicaid coverage during the 2013 baseline year did not indicate significantly different trends in the two states prior to expansion, we cannot rule out bias introduced by time-varying differences in the outcomes.

Second, our study is limited to two states. This affects both generalizability to other states and statistical concerns due to just two-state clusters in our analysis. On the first issue, Utah and Colorado are large states with urban and rural regions that have similarities to many states still considering Medicaid expansion. Regarding the estimation of standard errors with two clusters, an alternative approach to clustering produced similar results (see online Appendix A6). Taken together with the magnitude of our effects and the sample sizes observed in each state, we believe it is highly unlikely our difference-in-differences estimates achieved statistical significance due to chance. Third, we lacked detailed demographic data, though we were able to include important area-level factors. Finally, the APCDs did not include information on reason for Medicaid eligibility; stratifying by categorical eligibility group would be an informative area of future work.

In conclusion, we found that Medicaid expansion was associated with improvements in the continuity of Medicaid coverage among those enrolled prior to expansion. Colorado’s reductions in Medicaid churning after expansion hold important lessons for other states faced with high Medicaid coverage instability. These findings also have implications related to access to care and administrative efficiency for other state Medicaid programs that are considering or actively implementing Medicaid expansion. One such state is Utah, where residents passed a Medicaid expansion ballot initiative in November of 2018 which has recently faced legislative challenges. These results provide important evidence that Medicaid expansion is an effective strategy not only to expand coverage to uninsured individuals but also to reduce coverage disruptions for those already enrolled in the Medicaid program.

Electronic supplementary material

(DOCX 57 kb)

Acknowledgments

Staff at the Center for Improving Value in Health Care and the Office of Health Care Statistics at the Utah Department of Health provided valuable data assistance. This work is funded by the Agency for Healthcare Research and Quality R36 Dissertation Award, Award Notice R36 HS025560-01 (Sarah Gordon). To date, this work has not been presented or shared elsewhere in any form.

Compliance with Ethical Standards

Conflict of Interest

The authors declare that they do not have a conflict of interest.

Footnotes

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

References

- 1.Hadley J. Sicker and poorer—the consequences of being uninsured: a review of the research on the relationship between health insurance, medical care use, health, work, and income. Med Care Res Rev. 2003;60:3S–75S. doi: 10.1177/1077558703254101. [DOI] [PubMed] [Google Scholar]

- 2.Lavarreda SA, Gatchell M, Ponce N, Brown ER, Chia YJ. Switching health insurance and its effects on access to physician services. Med Care. 2008;46(10):1055–1063. doi: 10.1097/MLR.0b013e318187d8db. [DOI] [PubMed] [Google Scholar]

- 3.Gill JM, Mainous AG, Diamond JJ, Lenhard MJ. Impact of provider continuity on quality of care for persons with diabetes mellitus. Ann Fam Med. 2003;1(3):162–170. doi: 10.1370/afm.22. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Harman JS, Hall AG, Zhang J. Changes in health care use and costs after a break in Medicaid coverage among persons with depression. Psychiatr Serv. 2007;58(1):49–54. doi: 10.1176/ps.2007.58.1.49. [DOI] [PubMed] [Google Scholar]

- 5.Dawes AJ, Louie R, Nguyen DK, et al. The impact of continuous Medicaid enrollment on diagnosis, treatment, and survival in six surgical cancers. Health Serv Res. 2014;49(6):1787–1811. doi: 10.1111/1475-6773.12237. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Rogers MAM, Lee JM, Tipirneni R, Banerjee T, Kim C. Interruptions in private health insurance and outcomes in adults with type 1 diabetes: a longitudinal study. Health Aff. 2018;37(7):1024–1032. doi: 10.1377/hlthaff.2018.0204. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Gold R, DeVoe J, Shah A, Chauvie S. Insurance continuity and receipt of diabetes preventive care in a network of Federally Qualified Health Centers. Med Care. 2009;47(4):431–439. doi: 10.1097/MLR.0b013e318190ccac. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Duchon L, Schoen C, Doty MM, Davis K, Strumpf E, Bruegman S. Security matters: how instability in health insurance puts US workers at risk. Available at: http://www.academia.edu/download/38369626/duchon_securitymatters_512_pdf. Accessed 28 February 2019.

- 9.Sommers BD. Loss of health insurance among non-elderly adults in Medicaid. J Gen Intern Med. 2009;24(1):1–7. doi: 10.1007/s11606-008-0792-9. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Ku L, Ross DC. Staying covered: the importance of retaining health insurance for low-income families. Available at: https://www.commonwealthfund.org/publications/fund-reports/2002/dec/staying-covered-importance-retaining-health-insurance-low-income. Accessed 28 February 2019.

- 11.Bindman AB, Chattopadhyay A, Auerback GM. Interruptions in Medicaid coverage and risk for hospitalization for ambulatory care-sensitive conditions. Ann Intern Med. 2008;149(12):854–860. doi: 10.7326/0003-4819-149-12-200812160-00004. [DOI] [PubMed] [Google Scholar]

- 12.Harman JS, Manning WG, Lurie N, Christianson JB. Association between interruptions in Medicaid coverage and use of inpatient psychiatric services. Psychiatr Serv. 2003;54(7):999–1005. doi: 10.1176/appi.ps.54.7.999. [DOI] [PubMed] [Google Scholar]

- 13.National Quality Forum. Strengthening the core set of healthcare quality measures for adults enrolled in Medicaid. 2017. Available at: https://www.qualityforum.org/WorkArea/linkit.aspx?LinkIdentifier=id&ItemID=85815. Accessed 28 February 2019.

- 14.Mazurenko O, Balio CP, Agarwal R, Carroll AE, Menachemi N. The effects of Medicaid expansion under the ACA: a systematic review. Health Aff. 2018;37(6):944–950. doi: 10.1377/hlthaff.2017.1491. [DOI] [PubMed] [Google Scholar]

- 15.Sommers BD, Rosenbaum S. Issues in health reform: how changes in eligibility may move millions back and forth between Medicaid and insurance exchanges. Health Aff. 2011;30(2):228–236. doi: 10.1377/hlthaff.2010.1000. [DOI] [PubMed] [Google Scholar]

- 16.Shore-Sheppard LD. Income dynamics and the Affordable Care Act. Health Serv Res. 2014;49(S2):2041–2061. doi: 10.1111/1475-6773.12245. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Sommers BD, Graves JA, Swartz K, Rosenbaum S. Medicaid and Marketplace eligibility changes will occur often in all states; policy options can ease impact. Health Aff. 2014;33(4):700–707. doi: 10.1377/hlthaff.2013.1023. [DOI] [PubMed] [Google Scholar]

- 18.Sommers BD, Gourevitch R, Maylone B, Blendon RJ, Epstein AM. Insurance churning rates for low-income adults under health reform: lower than expected but still harmful for many. Health Aff. 2016;35(10):1816–1824. doi: 10.1377/hlthaff.2016.0455. [DOI] [PubMed] [Google Scholar]

- 19.Vistnes JP, Cohen JW. Duration of uninsured spells for nonelderly adults declined after 2014. Health Aff. 2018;37(6):951–955. doi: 10.1377/hlthaff.2017.1638. [DOI] [PubMed] [Google Scholar]

- 20.The United States Census Bureau. Validating self-reported health insurance coverage: preliminary results on CPS and ACS. Available at: https://www.census.gov/newsroom/blogs/research-matters/2016/05/validating-self-reported-health-insurance-coverage-preliminary-results-on-cps-and-acs.html. Accessed 28 February 2019.

- 21.Medicaid.gov. Monthly Medicaid & CHIP application, eligibility determination, and enrollment reports & data. Available at: https://www.medicaid.gov/medicaid/program-information/medicaid-and-chip-enrollment-data/monthly-reports/index.html. Accessed 28 February 2019.

- 22.Utah Department of Health. Primary Care Network waiver overview. Available at: http://www.health.utah.gov/pcn/whatis.html. Accessed 28 February 2019.

- 23.Courtot B, Coughlin TA. Cross-cutting issues: progress in implementing selected Medicaid provisions of the Affordable Care Act: a 10-state analysis. Available at https://www.urban.org/sites/default/files/publication/26211/412697-Progress-in-Implementing-Selected-Medicaid-Provisions-of-the-Affordable-Care-Act-A-Ten-State-Analysis.PDF. Accessed 28 February 2019.

- 24.Graves JA, Swartz K. Health care reform and the dynamics of insurance coverage — lessons from Massachusetts. N Engl J Med. 2012;367(13):1181–1184. doi: 10.1056/NEJMp1207217. [DOI] [PubMed] [Google Scholar]

- 25.Elixhauser A, Steiner C, Harris DR, Coffey RM. Comorbidity measures for use with administrative data. Med Care. 1998;36(1):8–27. doi: 10.1097/00005650-199801000-00004. [DOI] [PubMed] [Google Scholar]

- 26.Small Health Area ZIP Code Crosswalk provided by the Utah Department of Health. Updated June 2014.

- 27.Wherry LR, Miller S. Early coverage, access, utilization, and health effects associated with the Affordable Care Act Medicaid expansions: a quasi-experimental study. Ann Intern Med. 2016;164(12):795–803. doi: 10.7326/M15-2234. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.Pepper JV. Robust inferences from random clustered samples: an application using data from the panel study of income dynamics. Econ Lett. 2002;75(3):341–345. doi: 10.1016/S0165-1765(02)00010-1. [DOI] [Google Scholar]

- 29.Cameron AC, Miller DL. A practitioner’s guide to cluster-robust inference. J Hum Resour. 2015;50(2):317–372. doi: 10.3368/jhr.50.2.317. [DOI] [Google Scholar]

- 30.Daw JR, Hatfield LA, Swartz K, Sommers BD. Women in the United States experience high rates of coverage “churn” in months before and after childbirth. Health Aff. 2017;36(4):598–606. doi: 10.1377/hlthaff.2016.1241. [DOI] [PubMed] [Google Scholar]

- 31.HARDY BRADLEY, ZILIAK JAMES P. DECOMPOSING TRENDS IN INCOME VOLATILITY: THE “WILD RIDE” AT THE TOP AND BOTTOM. Economic Inquiry. 2013;52(1):459–476. doi: 10.1111/ecin.12044. [DOI] [Google Scholar]

- 32.Wishner J, Hill I, Marks J, Thornburgh S. Medicaid real-time eligibility determinations and automated renewals: lessons for Medi-Cal from Colorado and Washington. Available at: https://www.urban.org/sites/default/files/publication/98904/medicaid_real-time_eligibility_determinations_and_automated_renewals_2.pdf. Accessed 28 February 2019.

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

(DOCX 57 kb)