Abstract

Background

Earlier studies have found significant associations between sociodemographic factors and enrolment in the National Health Insurance Scheme (NHIS) in Ghana. These studies were mainly household surveys in relatively rural areas with high incidence of poverty. To expand the scope of existing evidence, this paper examines policy design factors associated with enrolment and dropout of the scheme in an urban poor district using routine secondary data.

Methods

This study is a cross-sectional quantitative analysis of 2014–2016 NHIS enrolment data of the Ashiedu Keteke district office. Descriptive and multivariate logistic regression analyses were performed to examine sociodemographic factors associated with NHIS enrolment and dropout.

Results

A total of 215,724 individuals enrolled in the NHIS over the period under study, of which 98,232 (46%) were new members. About 41% of existing members in 2014 dropped out of the NHIS in 2015 and 53% of those in 2015 dropped out in 2016. The indigents (core poor) are significantly more likely to enrol and to drop out of the NHIS. However, the males, informal sector employees, social security and national insurance trust (SSNIT) contributors, and the aged (70+ years) are significantly less likely to enrol in the NHIS but more likely to retain coverage.

Conclusions

A considerable number of members are dropping out of the NHIS. The indigents in particular, are increasingly enrolling in and dropping out of the NHIS whilst the males, informal sector employees, SSNIT contributors and the aged are not enrolling as expected but increasingly retaining coverage. Policy reforms to ensuring continued growth towards realization of universal health coverage should take these factors into consideration.

Electronic supplementary material

The online version of this article (10.1186/s13561-019-0241-y) contains supplementary material, which is available to authorized users.

Keywords: Enrolment, Dropout, National Health Insurance, Urban district, Ghana

Background

Increasingly, social health insurance (SHI) is becoming a preferred health financing mechanism for protecting the poor against catastrophic healthcare expenditure in low- and middle-income countries (LMICs) [1, 2]. SHI is also seen as a promising means for addressing equity in healthcare and achieving overarching goal of universal health coverage (UHC) through pooling of resources and risks [3–5]. Evidence abounds that SHI enhances resource mobilization and access to healthcare for the poor and vulnerable populations [5–8]. However, Wipf and Garand [9] posits that without sufficiently high participation, voluntary health insurance schemes are likely to suffer from adverse selection and higher claims and administrative expenses, which may threaten their sustainability in the long run.

In 2003, Ghana introduced National Health Insurance Scheme (NHIS) to reduce out-of-pocket payments at the point of healthcare use [10–12]. The scheme is operational in 166 districts across the country, and has a population coverage of 10.8 million (36%) and over 4000 network of healthcare providers as of December 2018 [13]. It is financed by 2.5% levy on selected goods and services, two and a half percentage points of workers’ contributions to the Social Security and National Insurance Trust (SSNIT), contributions from employees in the informal sector of the economy, approved funds by parliament, resources accrued to the National Health Insurance Fund (NHIF) from investments, and support from donor partners [12].

As a pro-poor policy, groups considered vulnerable and too poor are exempted from paying premium to the scheme. These groups include persons below the age of 18 years, the elderly aged 70 years or older, SSNIT pensioners, pregnant women, indigent (or core poor), and beneficiaries of the Livelihood Empowerment Against Poverty (LEAP) programme [12, 14]. The LEAP programme was introduced in the year 2008 to reduce poverty through conditional cash transfer, and has covered over 74,000 households in 99 districts across the country as of November, 2013 [15, 16]. The National Health Insurance Authority (NHIA) which is the regulator of health insurance schemes in the country and an implementer of the NHIS, enrols LEAP beneficiaries in the scheme separately from the indigents. This is done in collaboration with the Ministry of Gender, Children and Social Protection (MoGCSP). The NHIA determines an expansion of coverage, partly through the inclusion of the poor and vulnerable population groups that are exempted [17–19]. Yet, despite the relatively low contributions and large groups of the population exempted from paying premium (close to 70% of the members), more than half of the population remains uninsured.

Literature show that enrolment and retention in SHI schemes are significantly associated with demand- and supply-side factors [20–23]. At the individual level, demand-side factors that are positively associated with enrolment include income, education, and age [19, 20, 24, 25]. Others are sex, marital status, chronic episode, and trust in the scheme management [20, 22, 25–27]. The supply-side factors are knowledge and understanding of the health insurance scheme, perception of quality of healthcare, and trust in the management of the scheme [20]. Factors that are positively associated with retention of coverage include education, household size, and trust in the scheme management [20, 28]. Other motivating factors for retention of coverage are knowledge and understanding of the scheme, healthcare quality, and receipt of benefits in the previous year [20]. However, inappropriate benefits package, cultural beliefs, affordability of premiums, distance to healthcare facility, area of residence and legal and policy frameworks to support SHI schemes are some of the barriers to enrolment [8, 14, 20, 26, 28–30]. Interaction of some of these demand and supply-side factors also influence enrolment and retention of coverage in social health insurance [14, 20, 26].

A number of studies have investigated factors influencing enrolment and dropout in SHI in LMICs using surveys and systematic reviews [14, 19–21, 28, 29]. This study adds to the existing evidence by examining sociodemographic determinants of health insurance enrolment in an urban poor district of Ghana. The study uses quantitative method to analyse routine secondary enrolment data of Ghana’s NHIS. It provides evidence to guide development of interventions to increase enrolment and sustain growth towards realization of UHC in the NHIS and other SHI schemes in LMICs.

Methods

Study design and setting

The design is a cross-sectional study of NHIS enrolment data for the period, 2014–2016. The selection of this period for the study was driven by reliability of the data. Membership data for the last quarter of 2016; however, was not available at the time of this study. The Ashiedu Keteke district in Ghana was used for the study because of its cosmopolitan nature. The district is the central business district of the Accra Metropolis and the smallest among the six sub-metropolitan districts (Additional file 1). However, it has one of the largest slums (Sodom and Gomorrah) in the city capital [31], which serves as dwelling place for migrants from the northern ecological zone of the country.

In the 2010 Population and Housing Census (PHC), the district had a population of 117,525 and an estimated daily commuter population of 200,000 [17, 32]. A district population of 62,360 (53%) were females; 32,410 (28%) were in the age bracket of 0–14 years; 80,362 (68%) were between 15 and 64 years; and 4753 (4%) were 65 years or older [32]. The district is also characterised by low socioeconomic status with majority of the inhabitants engaged in petty trading, fishing and fish-mongering. In 2013, about 104 individuals were beneficiaries of the LEAP programme in the district with a monthly cash transfer benefit of GHS24.00 (USD4.57) [33]. The district has one specialized hospital (Children’s hospital), a polyclinic, and a number of public and private clinics, and community pharmacies.

Study population

Enrolment data of members of the Ashiedu Keteke district NHIA office was used for the study. The data covered a period of 3 years from 2014 to 2016 and were generated by the NHIA’s biometric system of registration. This system was introduced in the year 2014 to address challenges such as duplication, difficulty in generating reports, among others, associated with the previous non-biometric system. The biometric enrolment data obtained comprised characteristics including age, sex, and member category. Other characteristics were member number, year of entry, and enrolment type (new or renewal).

Data collection and analysis

Data for the study were obtained from the district NHIA office using pre-designed template. Descriptive analysis was performed to determine the proportion of members by enrolment status, age, sex, and member category. Two multivariate logistic regression analyses were also conducted to determine associations between member characteristics and enrolment status. In the first multivariate analysis, the outcome variable (enrolment status) was assigned a discrete value of ‘1’ if an individual is enrolled as a new member and ‘0’ if an individual is enrolled as a renewed member. In the second analysis, the outcome variable was assigned a value of ‘1’ if an individual enrolled in 2014 as a new member but dropped out in 2015 and ‘0’ if an individual enrolled in 2014 as a new member and renewed membership in 2015. The explanatory variables were age, sex, and member category defined as being a person below the age of 18 years, indigent, informal sector employee (18–69 yrs), LEAP beneficiary, aged (70 + yrs), pregnant woman, SSNIT contributor and pensioner.

In both analyses, a person below the age of 18 years was used as a reference category for comparison to determine the odds of other member categories enrolling in the scheme. The reason is that persons below the age of 18 years are more susceptible to diseases, and are at the highest risk of poor health and death [34]. Thus, they are more likely to enrol and retain coverage in the NHIS by their parents. After testing for collinearity using Pearson’s R test, age was eliminated from the final model because it strongly correlated with member category, r = 0.62. The selection of member category over age for inclusion in the final model was informed by the nature of the enrolment data. Bootstrapping analytical technique was also applied to test the predictive power or consistency of the two regression models. This analytical method tests the accuracy of regression models by running its performance on subsets of the dataset over a number of times (replications) [35, 36]. Thus, it indicates how the predictive power or accuracy of a regression model is bounded. In this study, the performance of the two regression models were tested 1000 times through three subsets of the data: training, testing and validation [35, 36]. Stata version 13 and Microsoft excel 2016 was used to perform the analyses, and a conservative threshold of p < 0.05 was set to determine statistical significance.

Results

Nature of the enrolment data

Table 1 shows distribution of members by age, sex, and category over the same period. A total enrolment of 215,724 was recorded, of which 98,232 (46%) were new enrolments (not in table); 117,419 (54%) active members were in the age group of 18–69 years; 127,729 (59%) were females; and 81,549 (38%) belonged to the informal sector of the economy (not in table).

Table 1.

Enrolment by age, sex, and member category from 2014 to 2016

| Variable | 2014 | 2015 | 2016 (Jan.–Sept.) | |||

|---|---|---|---|---|---|---|

| New (%) | Renewal (%) | New (%) | Renewal (%) | New (%) | Renewal (%) | |

| Age | ||||||

| < 18 | 17,145 (43.4) | 13,194 (38.8) | 18,273 (43.6) | 17,746 (40.6) | 6794 (40.5) | 16,040 (40.3) |

| 18–69 | 21,587 (54.6) | 18,690 (55.0) | 23,029 (54.9) | 23,291 (53.4) | 9705 (57.9) | 21,117 (53.0) |

| 70+ | 800 (2.0) | 2124 (6.2) | 633 (1.5) | 2619 (6.0) | 266 (1.6) | 2670 (6.7) |

| Sex | ||||||

| Female | 24,022 (60.8) | 19,729 (58.0) | 24,545 (58.5) | 25,383 (58.1) | 9783(58.4) | 24,267 (60.9) |

| Male | 15,510 (39.2) | 14,280 (42.0) | 17,390 (41.5) | 18,273 (41.9) | 6982 (41.6) | 15,560 (39.1) |

| Member category | ||||||

| Child under 5 yrs | 6307 (16.0) | 2539 (7.5) | 8365 (19.9) | 5352 (12.3) | 4207 (25.0) | 5539 (13.9) |

| Child aged 5-17 yrs | 9617 (24.3) | 10,425 (30.7) | 9105 (21.7) | 12,353 (28.3) | 2607 (15.6) | 10,839 (27.2) |

| Indigent | 1334 (3.4) | 404 (1.2) | 1468 (3.5) | 451 (1.0) | 33 (0.2) | 92 (0.2) |

| Informal sector employee | 14,815 (37.5) | 12,653 (37.2) | 15,972 (38.0) | 16,572 (38.0) | 6454 (38.5) | 15,083 (37.9) |

| LEAP beneficiary | 26 (0.1) | 37 (0.1) | 32 (0.1) | 52 (0.1) | 60 (0.4) | 48 (0.1) |

| Aged (≥70 yrs) | 756 (1.9) | 2153 (6.3) | 586 (1.4) | 2534 (5.8) | 240 (1.4) | 2492 (6.3) |

| Pregnant woman | 5256 (13.3) | 1171 (3.4) | 5031 (12.0) | 1211 (2.8) | 2761 (16.5) | 1793 (4.5) |

| SSNIT contributor | 1393 (3.5) | 4479 (13.2) | 1364 (3.3) | 4975 (11.4) | 395 (2.3) | 3802 (9.5) |

| SSNIT pensioner | 28 (0.1) | 148 (0.4) | 12 (0.1) | 156 (0.4) | 8 (0.1) | 139 (0.3) |

| Total | 39,532 (53.8) | 34,009 (46.2) | 41,935 (49.0) | 43,656 (51.0) | 16,765 (29.6) | 39,827 (70.4) |

LEAP Livelihood Empowerment Against Poverty, SSNIT Social Security and National Insurance Trust

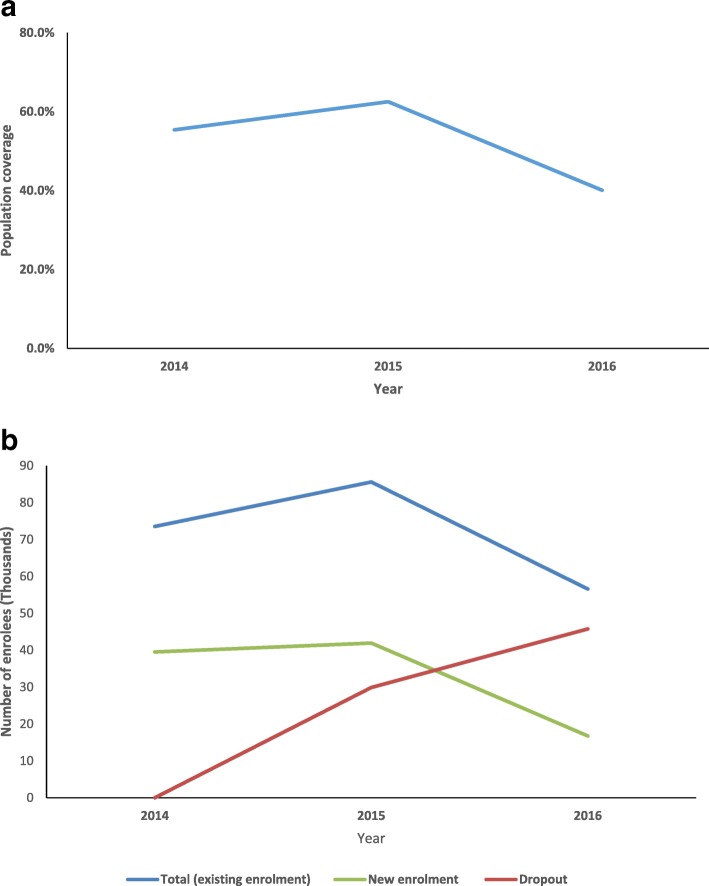

Over the study period, population coverage of the scheme increased from 55% to 63% between 2014 and 2015 and declined to 40% in September 2016 (Fig. 1a). Trends in enrolment also show that total enrolment (existing enrolment) and new enrolment assumed a downward trajectory after the base year (2014) (Fig. 1b). Existing enrolment increased by 16% from 73,541 members in 2014 to 85,591 members in 2015, and then declined by 34% to 56,592 members in September 2016. Likewise, new enrolment increased by 6% from 39,532 members in 2014 to 41,935 members in 2015, and then declined by 60% to 16,764 members in September 2016. These downward trends resulted in an increase in dropouts by 41% (29,885) between 2014 and 2015 and 53% (45,764) between 2015 and September 2016.

Fig. 1.

a Trend in population coverage, 2014–2016. b Trends in enrolment types, 2014–2016

Relationship between member characteristics and NHIS enrolment

Several individual and policy-related characteristics were associated with enrolment in the NHIS. In the pooled data, results of the multivariate analysis showed that being an indigent (OR = 2.48, 95% CI: 2.25–2.73) was significantly associated with high enrolment in the NHIS compared to persons below the age of 18 years (Table 2). Similarly, by combining individual and policy-related characteristics, being a male SSNIT pensioner (OR = 4.00, 95% CI: 1.94–8.24), male informal sector employee (OR = 2.49, 95% CI: 2.39–2.58), male SSNIT contributor (OR = 2.02, 95% CI: 1.85–2.19), male aged 70 years or older (OR = 1.61, 95% CI: 1.43–1.80) or male indigent (OR = 1.43, 95% CI: 1.22–1.66) was significantly associated with high enrolment in the scheme relative to a male below the age of 18 years.

Table 2.

Multivariate logistic regression model estimates for NHIS enrolment

| Variable | 2014 | 2015 | 2016 | Pooled (2014–2016 |

|---|---|---|---|---|

| OR (95% CI) | OR (95% CI) | OR (95% CI) | OR (95% CI) | |

| Member category | ||||

| Persons below 18 yrs | 1.00 | |||

| Indigent | 1.99 (1.72–2.32)*** | 2.17 (1.89–2.49)*** | 0.65 (0.38–1.09) | 2.48 (2.25–2.73)*** |

| Informal sector employee (18–69 yrs) | 0.59 (0.56–0.61)*** | 0.56 (0.54–0.58)*** | 0.50 (0.48–0.53)*** | 0.57 (0.56–0.58)*** |

| LEAP beneficiary | 0.52 (0.29–0.92)** | 0.49 (0.29–0.87)** | 1.59 (1.02–2.49)** | 0.72 (0.53–0.97)** |

| Aged (≥70 yrs) | 0.21 (0.19–0.24)*** | 0.14 (0.13–0.16)*** | 0.14 (0.12–0.17)*** | 0.17 (0.16–0.19)*** |

| SSNIT contributor | 0.15 (0.14–0.17)*** | 0.16 (0.14–0.18)*** | 0.13 (0.11–0.16)*** | 0.16 (0.15–0.17)*** |

| SSNIT pensioner | 0.07 (0.03–0.15)*** | 0.01 (0.00–0.08)*** | 0.05 (0.01–0.19)*** | 0.04 (0.02–0.08)*** |

| Sex | ||||

| Female | 1.00 | |||

| Male | 0.69 (0.66–0.72)*** | 0.68 (0.66–0.71)*** | 0.69 (0.65–0.72)*** | 0.69 (0.68–0.71)*** |

| Member category and sex interaction | ||||

| Male Indigent | 1.27 (1.00–1.59)** | 1.73 (1.39–2.17)*** | 1.17 (0.52–2.61) | 1.43 (1.22–1.66)*** |

| Male Informal sector employee (18–69 yrs) | 2.09 (1.96–2.23)*** | 2.53 (2.39–2.69)*** | 3.39 (3.14–3.67)*** | 2.49 (2.39–2.58)*** |

| Male LEAP beneficiary | 0.39 (0.09–1.59) | 1.04 (0.42–2.62) | 3.36 (1.49–8.93)** | 1.38 (0.81–2.36) |

| Male Aged (≥70 yrs) | 1.22 (1.02–1.46)** | 2.09 (1.74–2.52)*** | 1.84 (1.39–2.43)*** | 1.61 (1.43–1.80)*** |

| Male SSNIT contributor | 1.88 (1.64–2.14)*** | 2.01 (1.76–2.29)*** | 2.22 (1.78–2.76)*** | 2.02 (1.85–2.19)*** |

| Male SSNIT pensioner | 2.82 (1.12–7.06)** | 10.65 (1.34–84.58)** | 4.05 (0.79–20.76)* | 4.00 (1.94–8.24)*** |

| _cons | 1.76 | 1.40 (1.37–1.44)*** | 0.61 90.59_0.63)*** | 1.21 (1.19–1.23)*** |

| Number of obs | 73,541 | 85,591 | 56,592 | 215,724 |

| LR chi2 (16) | 4714.72 | 5483.40 | 3116.40 | 13,154.54 |

| Prob > chi2 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Log likelihood | −48,409.791 | −56,568.159 | −32,829.792 | − 142,090.29 |

| Pseudo R2 | 0.0464 | 0.0462 | 0.0453 | 0.0442 |

OR odds ratio; *p < 0.05; **p < 0.01; ***p < 0.001; LEAP Livelihood Empowerment Against Poverty, SSNIT Social Security and National Insurance Trust

However, being a male (OR = 0.69, 95% CI: 0.68–0.71), informal sector employee (OR = 0.57, 95% CI: 0.56–0.58), aged (OR = 0.17, 95% CI: 0.16–0.19), SSNIT contributor (OR = 0.16, 95% CI: 0.15–0.17), SSNIT pensioner (OR = 0.04, 95% CI: 0.02–0.08) or LEAP beneficiary (OR = 0.72, 95% CI: 0.53–0.97) was significantly associated with low enrolment in the NHIS. Similar trends were also observed in each study period. Results of the bootstrapping model to test the predictive power of the logistic regression model shows a narrower 95% CI (0.344–0.348) of the Area under ROC Curve (AUC), indicating high accuracy of the model in predicting enrolment in the NHIS (Additional file 2).

Relationship between member characteristics and NHIS dropout

Results of the logistic regression shows that being an indigent (OR = 2.27, 95% CI: 1.68–3.07) was significantly associated with dropping out of the NHIS (Table 3). Likewise, an interaction between individual and policy-related characteristics shows that being a male informal sector employee (OR = 2.47, 95% CI: 2.17–2.79); male aged (OR = 2.10, 95% CI:1.47–2.64); or male SSNIT contributor (OR = 1.97, 95% CI: 1.47–2.64) was significantly associated with dropping out of the scheme. However, being a male (OR = 0.61, 95% CI: 0.56–0.66); informal sector employee (OR = 0.77, 95% CI: 0.71–0.83); SSNIT contributor (OR = 0.55, 95% CI: 0.44–0.69) or aged 70 years or older (OR = 0.33, 95% CI: 0.27–0.39) was significantly associated with retention of membership in the scheme. A test of predictive power or performance of the model using bootstrapping method (resampling) shows a narrower bias 95% CI (0.33–0.34), suggesting accurate estimates of the predictors (Additional file 3).

Table 3.

Multivariate logistic regression model estimates for NHIS dropout

| Variable | Odds Ratio | (95% C.I) |

|---|---|---|

| Member category | ||

| Persons below 18 yrs | 1.00 | |

| Indigent | 2.27 | (1.68–3.07)*** |

| Informal sector employee (18–69 yrs) | 0.77 | (0.71–0.83)*** |

| Aged (≥70 yrs) | 0.33 | (0.27–0.39)*** |

| SSNIT contributor | 0.55 | (0.44–0.69)*** |

| Sex | ||

| Female | 1.00 | |

| Male | 0.61 | (0.56–0.66)*** |

| Member category and sex interaction | 1.00 | |

| Male indigent | 1.19 | (0.77–1.86) |

| Male informal sector employee (18–69 yrs) | 2.47 | (2.17–2.79)*** |

| Male Aged (≥70 yrs) | 2.09 | (1.47–2.96)*** |

| Male SSNIT contributor | 1.97 | (1.47–2.64)*** |

| _cons | 7.18 | (6.81–7.56)*** |

| Number of obs | 39,532 | |

| LR chi2 (14) | 433.28 | |

| Prob > chi2 | 0.0000 | |

| Log likelihood | −16,048.971 | |

| Pseudo R2 | 0.0133 | |

OR odds ratio; ***p < 0.001; SSNIT Social Security and National Insurance Trust

Discussion

This study examined individual characteristics and policy design features that influence NHIS enrolment and dropout in an urban poor district of Ghana. The findings show that the number of people taking up new membership in the NHIS are declining and existing members are increasingly dropping out of the scheme; consequently, population coverage has assumed a downward trend. Sociodemographic factors such as being a male, indigent, informal sector employee, social security contributor or pensioner, or an aged (70+ years) is associated with NHIS enrolment and dropout. However, there are no substantial variations in the sociodemographic factors associated with enrolment in each year of the study period.

The increasing dropout of the NHIS and the resultant decline in population coverage is due to both demand and supply-side factors. Demand-side factors including the inability of the National Health Insurance Authority (NHIA) to ensure continuous availability of materials to produce membership cards in the period under study (2014–2016) might have contributed to the downward trend in coverage. Anecdotal reports show that this situation created inconvenience for people to enrol in the NHIS because they had to queue for long hours at the district offices or registration centres. Clearly, those who were dissatisfied and could not wait for long hours to enrol would leave the offices or registration centres. Besides, reported cases of unauthorised out-of-pocket payment at the healthcare provider sites are plausible causes of the decreasing population coverage. Evidence show that these factors negatively affect enrolment in social health insurance programmes [14, 20, 29, 31, 37]. Although the NHIA has recently introduced an innovative electronic membership renewal system for members whose cards have expired to renew their membership through the use of mobile money, efforts are needed to deepen the public knowledge of the NHIS especially the benefit package. There is also the need for policy makers to address reported cases of illegal charges at the healthcare facilities. Our finding is consistent with similar studies on the NHIS [31, 38, 39].

Findings of the study also show that the indigents are significantly more likely to enrol and to drop out of the NHIS relative to persons below the age 18 years. The increased enrolment among the indigents is related to the fact that most of them are identified and enrolled in the scheme by donor partners such as the World Bank and other philanthropic organisations. The increased collaborative effort between the NHIA and Ministry of Gender, Children and Social Protection (MoGCSP) in recent years, to increase the number of poor and vulnerable groups in the NHIS might have also accounted for the remarkable enrolment of indigents in the scheme. The high dropout of enrolment by the indigents; however, suggests that the same efforts are not being made by the two institutions to ensuring continued retention of coverage for this subgroup after enrolling them in the scheme. Although, indigents are exempted from paying premium, the mandatory payment of a membership card processing fee of GHS5.00 (USD0.95) during renewals is a significant barrier as found in previous studies [14, 28]. This annual renewal processing fee is almost half of the national daily minimum wage of GHS10.65 (USD2.03) [40] but constitutes less than a percent of the annual minimum wage.

Our findings; however, show that the informal sector employees are less likely to enrol in the scheme but more likely to retain coverage. This may be attributed to the fact that majority of the them believe that they have low healthcare needs or are mostly healthy [14, 31]. Similarly, the SSNIT contributors are significantly less likely to enrol in the scheme but more likely to retain coverage. The plausible reason is that these are formal sector employees who receive consistent income; therefore, they can afford to pay out-of-pocket for healthcare or take up private health insurance [31]. These findings are consistent with earlier studies in Ghana [14, 29] but contradict a study in Kenya which found that individuals participating in National Social Security Fund, saving schemes, and community-based saving groups were significantly more likely to have public health insurance [41]. Persons aged 70 years or older are also less likely to enrol in the scheme but more likely to retain coverage, which corroborates an earlier study [42]. The plausible explanation is that this subpopulation has more healthcare needs [22, 43]; therefore, would take up health insurance to avoid unexpected catastrophic healthcare expenditure.

Moreover, the study reveals that males are significantly less likely to enrol in the NHIS relative to females but more likely to retain coverage, which corroborates previous studies [20, 26, 41]. However, interaction between individual and policy-related characteristics shows that male informal sector employees, male SSNIT contributors, male SSNIT pensioners and males aged 70 years or older are significantly more likely to enrol in the NHIS. This occurrence might be due to a combination of factors including adverse selection, especially of the aged and SSNIT pensioners, who usually have more healthcare needs but inadequate incomes [22]. Thus, they are most likely to seek financial protection under the scheme against their healthcare cost as emphasised earlier.

One significant implication of our findings is that the high dropout rate of the NHIS, coupled with the large number of members exempted from paying premium to the scheme, has the potential to pose huge financial burden on the scheme, which could threaten its sustainability. For instance, this phenomenon could reduce risk pooling and financial risk protection for members of the scheme, particularly the poor and vulnerable, and eventually derail progress towards attainment of UHC. Policy makers need to enforce the mandatory enrolment provision in the law governing operations of the scheme. This can be done by making enrolment in the scheme a prerequisite for obtaining certain services such as driving licence and employment in both public and private institutions, as is the case for enrolment into secondary and tertiary educational institutions in the country after one obtains offer of admission.

Limitations

Some limitations of the study are worth mentioning. First, the administrative data lack important demand-side information on income level, education, household size, marital status, health status and length of enrolment, found in literature as factors associated with enrolment in health insurance schemes. The data also lack important supply-side factors including population-to-doctor ratio, availability of healthcare facilities, and distance to healthcare facility. Although, this situation limited the explanatory variables for determining why certain groups are more likely to enrol in the scheme, the multivariate logistic regression models show consistencies in their predictive powers when bootstrapping (resampling) was applied to test their performances in predicting the outcome. The findings of the study also show consistency with a number of similar studies in LMICs, indicating reliability of the study findings for informed policy decision-making.

Secondly, the study could not employ panel data analysis to account for heterogeneity and other unobservable effects in the insured data over the 3-year period because the data were unbalanced. Available data for the year 2016 were less than 1 year (January–September). Although, a Breusch-Pagan Lagrange Multiplier (LM) test showed variances across the members (insured), these variances were too small (close to zero) for a panel analysis. Again, lack of data for the last quarter of 2016 at the time of this study made it impossible to completely track the odds of new members in 2014 and 2015 dropping out of the scheme in 2016. Lastly, the use of enrolment data from one district office of the NHIA may limit generalization of the results to the national member population of the scheme. The NHIS member population of the study area represents only a percent of the national active member population. Thus, transferability of the results to other urban districts needs to take into account the low socioeconomic status in this study area and other related factors.

Conclusions

The study reveals that indigents are enrolling in the scheme more than renewing their membership whilst the males, informal sector employees, SSNIT contributors and the aged (70 years or older) are renewing their membership more than new members enrolling. Policy reforms seeking to achieve and sustain UHC should consider these factors especially using targeted advocacy and promotional health education to improve enrolment in the NHIS. Further research should investigate low enrolment in the NHIS among informal sector employees and the vulnerable groups so that appropriate intervention can be designed and implemented to sustain the scheme. The proposed research should take into account individual, NHIS, and healthcare provider related factors to give a comprehensive view of factors influencing enrolment in the NHIS.

Additional files

Map of Accra Metropolis showing Ashiedu Keteke district; adopted from https://www.hensongeodata.com/map/4/. (JPG 139 kb)

Bootstrap (resampling) model estimates for NHIS enrolment. (DOCX 133 kb)

Bootstrap (resampling) model estimates for NHIS dropout. (DOCX 133 kb)

Acknowledgements

We thank the Management of Ashiedu Keteke District office of the NHIA for providing the enrolment data for the study. Our gratitude also goes to the reviewers for their time and insightful comments.

Abbreviations

- AUC

Area under ROC Curve

- LEAP

Livelihood Empowerment against Poverty

- LM

Breusch-Pagan Lagrange Multiplier

- LMICs

Low-and Middle-Income Countries

- MoGCSP

Ministry of Gender, Children and Social Protection

- NHIA

National Health Insurance Authority

- NHIF

National Health Insurance Fund

- NHIS

National Health Insurance Scheme

- PHC

Population and Housing Census

- ROC

Receiver Operating Characteristic

- SHI

Social Health Insurance

- SSNIT

Social Security and National Insurance Trust

- UHC

Universal Health Coverage

Authors’ contributions

ENB conceived the study, analysed the data and prepared the manuscript. JN, GCA, PS, FT, PA and MA reviewed the manuscript and provided substantial intellectual contribution to shape it. All the authors read and approved the manuscript for submission and publication.

Funding

Not applicable.

Availability of data and materials

The datasets generated and/or analysed during the current study are not publicly available due to confidential information of the insured but are available from the corresponding author on reasonable request.

Competing interests

ENB is an employee of the NHIS but his affiliation did not in any way compromise the outcome of study. JN, GCA, PS, FT, PA and MA declare that they have no competing interests.

Footnotes

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Contributor Information

Eric Nsiah-Boateng, Email: ensiah-boateng@st.ug.edu.gh.

Justice Nonvignon, Email: jnonvignon@ug.edu.gh.

Genevieve Cecelia Aryeetey, Email: gcaryeetey@ug.edu.gh.

Paola Salari, Email: paola.salari@unibas.ch.

Fabrizio Tediosi, Email: fabrizio.tediosi@unibas.ch.

Patricia Akweongo, Email: pakweongo@ug.edu.gh.

Moses Aikins, Email: mksaikins@ug.edu.gh.

References

- 1.Normand C, Weber A, Carrin G, Doetinchem O, Mathauer I, Scheil-Adlung X, et al. Social health insurance: a guidebook for planning. 2. Homburg: World Health; 2009. [Google Scholar]

- 2.Carrin G. Social health insurance in developing countries: a continuing challenge. Int Soc Secur Rev. 2002;55:1–13. doi: 10.1111/1468-246X.00124. [DOI] [Google Scholar]

- 3.Spaan E, Mathijssen J, Tromp N, Baltussen R. The impact of health insurance in Africa and Asia : a systematic review. Bull World Health Organ. 2015;90:1–12. doi: 10.2471/BLT.12.102301. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Fenny AP, Asante FA, Arhinful DK, Kusi A, Parmar D, Williams G. Who uses outpatient healthcare services under Ghana’s health protection scheme and why? BMC Health Serv Res. 2016;16:2–8. doi: 10.1186/s12913-016-1429-z. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Dalinjong PA, Laar AS. The national health insurance scheme: perceptions and experiences of health care providers and clients in two districts of Ghana. Heal Econ Rev. 2012;2:1–13. doi: 10.1186/2191-1991-2-1. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Ranson MK. Reduction of catastrophic health care expenditures by a community-based health insurance scheme in Gujarat, India: current experiences and challenges. Bull World Health Organ. 2002;80:613–621. [PMC free article] [PubMed] [Google Scholar]

- 7.Mathauer I, Musango L, Sibandze S, Mthethwa K, Carrin G. Is universal coverage via social health insurance financially feasible in Swaziland? S Afr Med J. 2011;101:179–183. doi: 10.7196/SAMJ.4281. [DOI] [PubMed] [Google Scholar]

- 8.Carrin G, Waelkens M-P, Criel B. Community-based health insurance in developing countries: a study of its contribution to the performance of health financing systems. Tropical Med Int Health. 2005;10:799–811. doi: 10.1111/j.1365-3156.2005.01455.x. [DOI] [PubMed] [Google Scholar]

- 9.Wipf J, Garand D. Performance indicators for microinsurance: a handbook for microinsurance practitioners. In: Opdebeeck B, Faber V, editors. Quality. 2. Sainte Zithe: ADA asbl; 2010. [Google Scholar]

- 10.Parliament of Ghana. National Health Insurance Act, 2003 (Act 650): Insur. Act, 650 Accra, Ghana; 2003. p. 1–39.

- 11.Parliament of Ghana. National Health Insurance Regulations, 2004 (LI 1809 ): Regulation, 1809 Accra, Ghana; 2004. p. 1–43.

- 12.Parliament of Ghana . National Health Insurance Act, 2012 (Act 852) Accra: Parliament of Ghana; 2012. pp. 1–55. [Google Scholar]

- 13.National Health Insurance Authority . Districts. 2019. [Google Scholar]

- 14.Agyepong IA, Nana D, Abankwah Y, Abroso A, Chun C, Nii J, et al. The “Universal” in UHC and Ghana’s National Health Insurance Scheme: policy and implementation challenges and dilemmas of a lower middle income country. BMC Health Serv Res. 2016;16:1–14. doi: 10.1186/s12913-016-1758-y. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Ministry of Local Government and Rural Development, Republic of Ghana. Report of the Commitee on district boundary disputes relating to the 2010 population and housing census. Accra: Minsitry of Local Governement and Rural Development; 2012.

- 16.Abbey CO, Odonkor E, Boateng D. A beneficiary assessment of Ghana’s cash transfer Programme (LEAP) in May 2014. Accra: African Dev. Progr; 2014. [Google Scholar]

- 17.Nsiah-Boateng E, Aikins M, Asenso-boadi F, Andoh-Adjei F-X. Value and service quality assessment of the National Health Insurance Scheme in Ghana : evidence from Ashiedu Keteke District. Value Heal Reg Issues. 2016;10:7–13. doi: 10.1016/j.vhri.2016.03.003. [DOI] [PubMed] [Google Scholar]

- 18.Witter S, Garshong B. Something old or something new? Social health insurance in Ghana. BMC Int Health Hum Rights. 2009;9:1–13. doi: 10.1186/1472-698X-9-20. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Gobah FK, Zhang L. The National Health Insurance Scheme in Ghana: prospects and challenges: a cross-sectional evidence. Global J Health Sci. 2011;3:90–101. doi: 10.5539/gjhs.v3n2p90. [DOI] [Google Scholar]

- 20.Dror DM, Hossain SAS, Majumdar A, Pérez Koehlmoos TL, John D, Panda PK. What factors affect voluntary uptake of community-based health insurance schemes in low- and middle-income countries? A systematic review and meta-analysis. PLoS One. 2016;11:1–31. doi: 10.1371/journal.pone.0160479. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Ayitey AB, Makarious A, Nketiah-Amponsah E. Determinants of insurance enrolment among Ghanaian adults: the case of the National Health Insurance Scheme (NHIS) Econ Manag Financ Mark. 2013;8:37–57. [Google Scholar]

- 22.Andersen R, Newman JF. Societal and individual determinants of medical care utilization in the United States. Milbank Q. 2005;83:1–28. doi: 10.1111/j.1468-0009.2005.00412.x. [DOI] [PubMed] [Google Scholar]

- 23.Adebayo EF, Uthman OA, Wiysonge CS, Stern EA, Lamont KT, Ataguba JE. A systematic review of factors that affect uptake of community-based health insurance in low-income and middle- income countries. BMC Health Serv Res. 2015;15:1–13. doi: 10.1186/s12913-015-1179-3. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.Sulzbach S, Garshong B, Owusu-Banahene G. Evaluating the effects of the National Health Insurance act in Ghana: baseline report. Bethesda: The Partners for Health Reformplus Project, Abt Associates Inc; 2005. [Google Scholar]

- 25.Owusu-Sekyere E, Chiaraah A. Demand for health Insurance in Ghana: what factors influence enrollment? Am J Public Heal Res. 2014;2:27–35. doi: 10.12691/ajphr-2-1-6. [DOI] [Google Scholar]

- 26.Jehu-Appiah C, Aryeetey G, Spaan E, de Hoop T, Agyepong I, Baltussen R. Equity aspects of the National Health Insurance Scheme in Ghana: who is enrolling, who is not and why? Soc Sci Med. 2011;72:157–165. doi: 10.1016/j.socscimed.2010.10.025. [DOI] [PubMed] [Google Scholar]

- 27.Osei-Akoto I. Stay poor chronic poverty dev policy, Inst Dev Policy Manag Univ Manchester. Manchester: Chronic Poverty Research Centre (CPRC); 2003. Demand for voluntary health insurance by the poor in developing countries: evidence from rural Ghana; pp. 1–24. [Google Scholar]

- 28.Boateng D, Awunyor-Vitor D, Scheme N, Atim C, Grey S, Apoya P, et al. Health insurance in Ghana: evaluation of policy holders’ perceptions and factors influencing policy renewal in the Volta region. Int J Equity Health. 2013;12:1–10. doi: 10.1186/1475-9276-12-50. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.Fenny AP, Kusi A, Arhinful DK, Asante FA. Factors contributing to low uptake and renewal of health insurance: a qualitative study in Ghana. Glob Health Res Policy. 2016;1:1–10. doi: 10.1186/s41256-016-0018-3. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.National Development Planning Commission. 2008 citizens’ assessment of the national health insurance scheme: towards a sustainable health care financing arrangement that protects the poor. Accra: Minsitry of Local Governement and Rural Development; 2009.

- 31.Atinga RA, Abiiro GA, Kuganab-Lem RB. Factors influencing the decision to drop out of health insurance enrolment among urban slum dwellers in Ghana. Tropical Med Int Health. 2015;20:312–321. doi: 10.1111/tmi.12433. [DOI] [PubMed] [Google Scholar]

- 32.Ghana Statistical Service. Population by region , district , age groups and sex. In: The 2010 population and housing census. Accra; 2010. http://www.statsghana.gov.gh/docfiles/pop_by_region_district_age_groups_and_sex_2010.pdf. Accessed 28 Jun 2018.

- 33.Ghana News Agency. Ministry to increase coverage of LEAP: Ghana News Agency; 2013. http://www.ghananewsagency.org/print/65987. Accessed 29 Jan 2017

- 34.WHO . Fact sheets. 2018. Children: reducing mortality. [Google Scholar]

- 35.Skalská H, Freylich V. Web-bootstrap estimate of area under ROC curve. Austrian J Stat. 2006;35:325–330. [Google Scholar]

- 36.Garment V. 3 Ways to test the accuracy of your predictive models. Predict. Anal. Times. 2014. https://www.predictiveanalyticsworld.com/patimes/3-ways-test-accuracy-predictive-models/3295/. Accessed 25 May 2019.

- 37.Fadlallah R, El-Jardali F, Hemadi N, Morsi RZ, Abou C, Samra A, et al. Barriers and facilitators to implementation, uptake and sustainability of community- based health insurance schemes in low- and middle-income countries: a systematic review. Int J Equity Health. 2018;17:0–18. doi: 10.1186/s12939-018-0721-4. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 38.Seddoh A, Sataru F. Mundane? Demographic characteristics as predictors of enrolment onto the National Health Insurance Scheme in two districts of Ghana. BMC Health Serv Res. 2018;18:1–6. doi: 10.1186/s12913-018-3155-1. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Nsiah-Boateng E, Aikins M. Trends and characteristics of enrolment in the National Health Insurance Scheme in Ghana : a quantitative analysis of longitudinal data. Glob Health Res Policy. 2018;3:1–10. doi: 10.1186/s41256-018-0087-6. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 40.Nyavor G. Minimum wage goes up by 10%; now GHS10.65. Myjoyonline.com. 2018. https://www.myjoyonline.com/business/2018/July-27th/minimum-wage-goes-up-by-now-gh1065.php. Accessed 8 Apr 2018.

- 41.Kimani JK, Ettarh R, Kyobutungi C, Mberu B, Muindi K. Determinants for participation in a public health insurance program among residents of urban slums in Nairobi , Kenya : results from a cross- sectional survey. BMC Health Serv Res. 2012;12:66. doi: 10.1186/1472-6963-12-66. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 42.van der Wielen N, Falkingham J, Channon AA. Determinants of National Health Insurance enrolment in Ghana across the life course: are the results consistent between surveys? Int J Equity Health. 2018;17:1–14. doi: 10.1186/s12939-017-0710-z. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 43.The Henry J. Kaiser Family Foundation. Health care cost: key information on health care costs and their impact. Washington Dc; 2009. https://www.issuelab.org/resources/7286/7286.pdf. Accessed 31 May 2019

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Map of Accra Metropolis showing Ashiedu Keteke district; adopted from https://www.hensongeodata.com/map/4/. (JPG 139 kb)

Bootstrap (resampling) model estimates for NHIS enrolment. (DOCX 133 kb)

Bootstrap (resampling) model estimates for NHIS dropout. (DOCX 133 kb)

Data Availability Statement

The datasets generated and/or analysed during the current study are not publicly available due to confidential information of the insured but are available from the corresponding author on reasonable request.