Loan covenants, stock exchange listing rules, and shareholder activism can redirect capital toward better seafood practices

Abstract

Can finance contribute to seafood sustainability? This is an increasingly relevant question given the projected growth of seafood markets and the magnitude of social and environmental challenges associated with seafood production. As more capital enters the seafood industry, it becomes crucial that investments steer the sector toward improved sustainability, as opposed to fueling unsustainable working conditions and overexploitation of resources. Using a mixed-methods approach, we map where different financial mechanisms are most salient along a seafood firm’s development trajectory and identify three leverage points that can redirect capital toward more sustainable practices: loan covenants, stock exchange listing rules, and shareholder activism. We argue that seafood sustainability requirements need to be integrated into traditional financial services and propose key research avenues for academic, policy, and practice communities. While our study focuses on the role of finance in seafood sustainability, the insights developed are also of high relevance to other extractive industries.

INTRODUCTION

Seafood is increasingly regarded as an important component of the global food portfolio to meet the nutritional demands of a growing population within environmental limits (1). Since the 1960s, aquaculture has been the world’s fastest growing food production system, rates of fish consumption have been increasing twice as rapidly as population growth, and fish has become one of the most traded food commodities (1, 2). However, today’s seafood production suffers from a number of sustainability challenges, including overexploitation of resources (3); habitat destruction (4); illegal, unreported, and unregulated (IUU) fishing (5); limited transparency (6); overuse of antibiotics (7); and forced labor (8). How to ensure that seafood is both environmentally and socially sustainable has therefore become a key concern for industry, academics, and the general public alike (9, 10).

To date, three major pathways have been pursued to advance the sustainability of seafood production: through improved governance, including rights-based management and ecosystem approach to fisheries [e.g., (11, 12)]; via market-based mechanisms, such as certification schemes [e.g., (13, 14)]; or by engaging with large corporate actors to promote stewardship initiatives from the industry itself [e.g., (15, 16)]. However, a number of recent initiatives indicate a nascent awakening to the role of finance in influencing the development of the seafood industry and its practices (17–19).

Financial institutions such as banks, pension funds, insurance companies, private equity firms, and other investors play an important role in shaping the global economy, which, in turn, is a major driver of ecological change worldwide (20). Examples from the agrifood business show that the relations between financiers and firms can be critical for understanding corporate behavior as well as farmers’ decision making (21, 22). How this may play out for fisheries and aquaculture, on the other hand, has received limited attention from the academic community.

Studies have warned that shifting responsibility for environmental outcomes into the incentivizing control of investment finance might be detrimental (23) and lead to adverse effects on small-scale fisheries through privatization and ocean grabbing (24). On the other hand, if the financial sector was to better recognize how ecological risks translate into financial risks, opportunities for mainstreaming sustainability into seafood-related financial decisions could emerge (25). Until now, most of the literature on seafood and finance has focused on the role of subsidies (26) and the potential for impact investment (27). Pioneering work has examined links between illegal fisheries and the insurance sector (28), proposed a framework for financing fisheries reform (17), or assessed the risk exposure of publicly listed companies to seafood production (19), but more effort is needed to reach a comprehensive understanding of how the financial sector intersects with the seafood industry and where leverage points for sustainability may lie. By leverage points, we refer to mechanisms in the financial system where a relatively small shift in practices has the capacity to lead to fundamental changes in the system as a whole, and its effect on the social-ecological environment (29). This paper uses a mixed-methods approach to identify leverage points for sustainability in the seafood-finance nexus and to discuss the possible role of the financial sector in seafood stewardship.

A brief introduction to finance

For readers unfamiliar with the topic, we start with an overview of the main financing types available to firms (Table 1). Companies have different options to finance their investments, and various factors affect the decision making, such as taxes, the business cycle, economic structure, and institutions (30). The way in which a firm is financed also affects its value and growth opportunities.

Table 1. Main financing mechanisms and their potential to influence a firm’s strategy.

See section S1 for a glossary of all financial terms used throughout the paper.

| Type of financing | Financing mechanism | Description | Potential to impact firm strategy | |

| Internal | Retained earnings | Profits generated by a company that are not distributed as dividends. |

None, as it is the firm itself deciding about the use of proceeds. | |

| External | Informal finance | A broad range of instruments, most importantly trade credit and leasing, as well as financing from friends and relatives. |

No institutional mechanism in place. Little potential with trade credit and leasing as this is usually tied to particular assets being prefinanced. |

|

| Venture capital | A form of financing provided to startup companies and small businesses deemed to have high growth potential. |

Depends on the ambition of the investors and where they perceive the enhanced value of the company to lie. Venture capitalists usually aim at selling their stake relatively quickly. |

||

| Debt | Loan | A direct lending for particular projects or to the organization. It may be via preapproved credit line that can be drawn on demand. Loans are flexible and can be unsecured or secured by a borrower’s assets, as well as long term or short term (often used for immediate expenses, such as acquisitions). |

Mainly upon the closure of the contract. Covenants (i.e., conditions associated to the loan) can be written into the contract and are then subject to monitoring and enforcement. Supervisors of lenders may also require they assess nonfinancial risks of loans and the loan portfolio. |

|

| Bond | A type of loan tradable on the market. It is accessible for large organizations and comes with requirements regarding disclosure of financial information. Usually organized by a group (“syndicate”) of financial institutions who try to place the bond issue with investors. |

Mainly upon origination of the bond issue. Additional requirements can be written into covenants and subject to monitoring throughout. “Green” bonds use the principal amount or the proceeds to specifically further environmental objectives. Stock exchanges may require the disclosure of information from companies being listed. |

||

| Equity | A stock market instrument (although it can also be placed privately) linked to the process of raising capital through the sale of shares in a company. It provides a claim on part of the profits (dividend) as well as voting rights. |

Ownership of the share in the firm allows shareholder to speak up during annual general meetings and advocate particular causes or organize petitions among shareholders that can be voted. The higher the share, the more influence. Stock exchanges may require the disclosure of information from companies being listed. |

||

Firm investment can be financed internally from retained earnings, which result from the surplus of revenues over costs in a particular time period. The net earnings are reinvested into the firm and control is kept in the company, but the growth opportunities are limited to the size of annual earnings. If the firm wants to expand, the owner will have to seek external financing, which entails separating ownership and control (31). In doing this, the owner sells claims to future proceeds of the firm or issues promises to repay in the future. Informal external financing modes include funds from family and friends, trade credit (i.e., when a customer purchases goods or services on account and pays the supplier at a later date), as well as leasing of machinery and equipment. This type of finance grants some controlling rights to outsiders but is generally limited to the direct social and commercial network of the firm owner. External financing can also come from venture capitalists, banks, or capital markets. Venture capitalists usually invest in emerging firms deemed to have high growth potential with the aim of selling their stake within a couple of years. Banks offer loans of specific size and duration, and in capital markets, firms can opt for the issuing of equity or debt. The former is the sale of stock in the corporation and happens for the first time via an initial public offering (IPO) of shares on the stock market. Any subsequent issuances of shares are seasoned equity offerings (SEOs). Shares give their owners the right to a claim on the net profit of a firm (through the payment of dividends), as well as the possibility to vote on some decisions at the shareholder meetings (e.g., related to mergers and takeovers, change of directors, remuneration, and overall strategy). In the case of debt, there is a temporary obligation (typically between 5 and 20 years) during which the firm pays interest on the debt and returns the principal (i.e., the original amount of funds provided) along a predetermined schedule. All types of financing are subject to risk for investors, especially default risk, which occurs when the borrower does not pay back interest or the sum granted. In capital markets, the financial claims on the firm are tradable. This allows a large number of investors but presents them with the additional risk of market fluctuations.

Because different types of financing have different costs and benefits and because preferences among companies vary, there is no single way in which firms finance their assets. The pecking order theory holds that managers choose the least expensive capital first (e.g., internally generated funds) and then move to more costly options when the cheaper ones are no longer available (32). While loans and bonds are relatively affordable, the issuance of shares is more expensive for the company and often represents the last source tapped into. Different types of financing are not mutually exclusive, though, and firms often rely on diverse financing modes (30). On average, internal finance makes up 60% of all firm financing. Within external finance, bank finance accounts for 50%, followed by trade credit and equity finance at around 15%. Leasing and funding from government institutions (excluding subsidies or tax advantages) are about 5% each (30).

Not all financing mechanisms offer opportunities for external parties to influence firm strategy and policies (Table 1). Internal financing, for instance, provides no route to influence. Our paper therefore focuses on external financing to identify leverage points for sustainability in the financial sector. Despite their importance for the fishing industry, a deliberate choice was made to exclude subsidies from the scope of this study because they are linked to government policy, not the financial sector, and have been extensively studied [e.g., (26)].

Methodological approach

While the previous section presented an overview of general firm capitalization mechanisms, how these are deployed across seafood firm development stages is not readily available in any reference material. To provide an empirically grounded investigation of how the financial sector interacts with the seafood industry, we therefore carried out a content analysis of two of the most widely recognized independent media outlets specialized in seafood—Fishing News International (FNI) and Undercurrent News (UCN). This formed the basis for a synthetic analysis using the Weberian notion of “ideal types” to classify firms according to their scale of operations and their ownership structure (publicly listed or privately owned). The use of ideal types is a well-established method within qualitative sociology to scrutinize, classify, and define social reality (33). Ideal types do not refer to perfect observable things but rather to idea-constructs that help emphasize certain common attributes and can be said to best exemplify the phenomenon in focus (33). This approach allowed us to validate the generic description of external financing mechanisms within a seafood context. It also served as a useful heuristic for mapping where different financial mechanisms are most salient along a seafood firm’s development trajectory and where sustainability leverage points may lie.

When quantitative data were not accessible, as for debt, we relied on qualitative examples identified during the content analysis to illustrate the mechanisms and highlight how sustainability could be taken into consideration. In the case of shareholding, however, data were readily available. We thus conducted descriptive statistics to unpack the shareholding pattern of 160 listed seafood companies and contribute to a discussion on the scope for sustainability leverage via equity (34). Together, the use of content analysis, qualitative examples, and shareholder analysis formed the basis for identifying leverage points for sustainability in the seafood-finance nexus and for discussing the possible role of the financial sector in seafood stewardship.

RESULTS AND DISCUSSION

Mechanisms for financing seafood firm growth

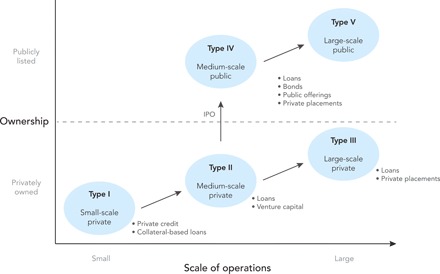

A comprehensive summary of all financial mechanisms featured in the seafood media literature is found in table S1. On the basis of these data, we classified seafood firms into five ideal types, which differ qualitatively in their relative access to, and use of, capitalization mechanisms as a company moves from a small-scale private business to a large publicly listed corporate entity (Fig. 1).

Fig. 1. Ideal types of seafood firms.

Conceptual diagram using the Weberian notion of ideal types to classify firms on the basis of their scale of operations and ownership structure. The five ideal types differ qualitatively in their relative access to and use of capitalization mechanisms, as a company moves from a small-scale private business to a large publicly listed corporate entity. Large-scale private companies (Type III) can also go through an IPO and become publicly listed (Type V). See section S1 for a glossary of financial terms.

Type I refers to small (often family-run) seafood businesses whose access to finance is generally confined to collateral-based loans from a bank or private credit from trading partners—a prevalent dynamic in many small-scale tropical fisheries (35). Only when a firm has a record of earning revenues and making profits, and thus the ability to make a credible promise to pay interest, are corporate loans a feasible option for conventional financiers. A firm would then fall into what we classify as Type II, corresponding to medium-scale private seafood companies. Loan issuance and venture capital are key mechanisms by which Type II firms capitalize their businesses. Like any other firm that wishes to expand, a growing seafood business will eventually face the decision to remain privately owned (Type III) or become publicly listed (Types IV and V). The seafood industry differs from other sectors in that private ownership is very common even among the largest businesses in the sector. Of the world’s 100 largest seafood companies, 53% are privately held (36), in which case access to investment capital is secured largely through bank loans and private placements (i.e., sales of stocks, bonds, or securities directly to an individual or small of group of investors, rather than as part of a public offering). Some seafood firms nonetheless choose to grow by issuing shares of stock through an IPO, thus opening up the ownership of the company to the public (Type IV). At this point, the full range of financing mechanisms, composed of various types of debt and equity (see examples in table S1), becomes available. A few firms will grow into large public corporations (Type V), with complex ownership structure and subsidiaries distributed across many countries. The range of financing mechanisms accessible to these firms does not differ substantially from the smaller publicly listed companies. However, the scale of capital available to, and required by, this type of seafood company distinguishes them from smaller operations, as does the potential impact on ecosystems stemming from their operations [see, e.g., (15)].

Mergers and acquisitions constitute another key mechanism for large seafood corporations to grow and expand. Traditionally, the seafood sector has been more fragmented than other food industries due to the existence of many niche markets (37). In recent years, however, the diversification of large companies into new species, across different geographies, and throughout the value chain, has led to an increased global consolidation in the seafood business (24, 37). Industry experts suggest that the impetus behind this trend arises from multiple drivers, including an increasing crossover between wild-capture and aquaculture companies, a race to acquire fishing quotas and farming licenses as these continue to consolidate in the hands of fewer players, and the need for upstream integration from processors and distributors (37). Consolidation also offers a way to mitigate risks and protect against the volatility of the sector. Consequently, and combined with the projected growth in seafood markets, interest in seafood investments is increasing.

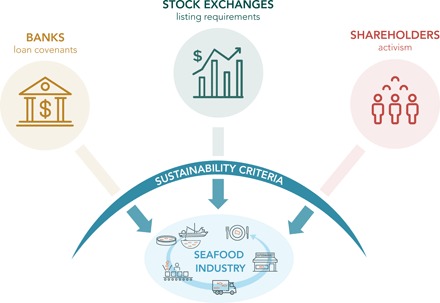

It is not until seafood firms have reached a certain size and corporate structure (Types II to V) that intensive interaction with the financial sector emerges (Fig. 1). The remainder of this paper therefore focuses on financial leverage points for influencing the sustainability of industrial-scale fisheries. We are aware that, in doing so, we exclude two forms of external finance often associated with small-scale fisheries, namely, development finance and impact investment. These finance mechanisms play an important role in achieving desirable social and environmental change (27), yet they represent only a small portion of the financial capital supporting the seafood industry (38). Below, we explore three leverage points for sustainability in traditional financial services (Fig. 2) and discuss how they could serve to redirect mainstream investments toward more sustainable practices.

Fig. 2. Leverage points in the financial sector for seafood sustainability.

By integrating sustainability criteria into their investment decisions, loan covenants, stock exchange listing rules, and shareholder activism have great potential for incentivizing seafood companies toward better practices. Sustainability criteria should focus on, e.g., the absence of forced labor and IUU fishing activities, the status of fish populations and ecosystems, as well as transparency and traceability throughout the value chain.

Banks and loan covenants

Regardless of the ownership structure of a firm (i.e., private or public), bank loans dominate external financing in the world’s major economies and are usually more important than stocks and bonds (30). Creditor banks are essential to the operations of seafood companies because they provide finance for all types of business activities, ranging from the construction of new processing facilities and vessels to the acquisition of other companies and refinancing (i.e., replacement of an existing debt obligation with another one under different terms). A comprehensive analysis of loans in the seafood industry, however, is limited by the lack of publicly available data, making it difficult to estimate in a systematic way how much is being loaned, from whom, and for what. Instead, it is often the trade media literature that offers glimpses into the world of creditors and their role in the seafood business (Box 1).

Box 1. The power of banks.

The case of how Pescanova, the largest fishing company in the European Union, became Nueva Pescanova illustrates the influence that creditor banks can have on a firm’s trajectory. Pescanova was forced into bankruptcy in 2013 after it became apparent that they had undisclosed debt and that the company was not financially stable (56). For the purpose of this paper, the point of interest is how the debt restructuring process in the wake of the bankruptcy filings resulted in Nueva Pescanova being almost entirely owned by the former Pescanova’s creditor banks. First, the procedure saw Pescanova turn into a holding company of a new entity named Nueva Pescanova, to which all of its fishing assets were transferred. In November 2015, Nueva Pescanova’s creditor banks used debt-for-equity swaps to collectively gain 71% of the company’s shares. A debt-for-equity swap is a restructuring process by which creditors trade the debt owed to them into equity in the company. Through these swaps, the syndicate of banks exchanged €667 million of Pescanova’s €725 million debt into equity, leaving the roughly 9000 preexisting shareholders of Pescanova with 20% equity share in the company. The owner banks, then, provided more capital for the operations of the company (including investments in its fishing fleet) through new loan issuance. In an additional debt-for-equity swap in 2017, the banks gained further shareholder influence while reducing the stake of Pescanova in Nueva Pescanova from 20% to 1.7% (57). This example highlights not only the importance of loan capital in the financial viability of a company but also the power bestowed upon creditors through the process. If they were willing to, banks could therefore considerably influence the sustainability of seafood companies.

Overall, the literature on bank lending and environmental sustainability remains limited [but see (39, 40)]. Yet banks hold great potential for promoting sustainability given their ability to engage in detailed monitoring of a company and to tailor loan terms. A loan covenant is an agreement between the lender and the borrower, stipulating the terms associated with the loan. It forbids the borrower from undertaking certain actions or, in contrast, requires the fulfillment of certain conditions, thereby making covenants a relevant mechanism through which banks can incentivize companies to implement sustainability measures. In May 2019, for example, the agriculture giant Louis Dreyfus Company agreed with its lenders a $750 million loan for which the interest rate is linked to the company’s sustainability performance, as measured by a reduction in its carbon dioxide emissions, electricity consumption, water usage, and solid waste sent to landfill. If the sustainability rating goes up, the interest goes down, and vice versa. Unlike blue bonds or green loans that are earmarked to finance a specific project, sustainability-linked covenants can be used for general corporate purposes. Hence, they represent a promising avenue for bank lending in the seafood industry to incorporate sustainability criteria and, ultimately, reward companies with better practices.

These criteria could draw on the recent Principles for Investment in Sustainable Wild-Caught Fisheries (www.fisheriesprinciples.org). Modeled after the Equator Principles (41) and launched in March 2018, they represent a voluntary framework designed to provide guidance to financial institutions and ensure that investments in wild-caught fisheries advance environmental sustainability and social responsibility. The nine principles “apply globally to all debt and equity investment products deployed to finance a project or a company, and where the project or company has or is expected to have an impact on wild-caught fisheries and their associated ecosystems and communities” (18). Investors are targeted as adopters of the Principles and other non-investor stakeholders as endorsers. As of early 2019, adopters consisted of impact investment funds and companies focused on sustainable solutions, but no mainstream bank had yet signed on to the initiative. Should the latter happen, and the Principles be tailored to adequately address the challenges of the aquaculture sector as well, they could provide an opportunity for the seafood investment community to introduce sustainability covenants in bank loans and promote this type of financial incentive across the industry.

Stock exchanges as gatekeepers

To open its ownership to the public, a firm has to go through an IPO to get listed on a stock exchange. Companies do so to access capital, gain exposure to broader markets, and enhance their brand reputation (42). As part of the IPO process, the firm submits a prospectus, a legal document highlighting its intentions and any risk or liability it sees in the future. This creates a unique opportunity to scrutinize the company and take sustainability into consideration, as illustrated by the IPO of China Tuna Industry Group.

China Tuna operated through its subsidiary Dalian Ocean Fishing and was a major supplier of tuna to Japan. In 2014, the company launched a $100 million to $200 million IPO to the Hong Kong Stock Exchange to expand their South Pacific fishing operations (43). In the draft IPO prospectus, as part of their risk analysis, the firm indicated that vessels under the Chinese flags had year on year exceeded the catch limits allocated to China but that noncompliance penalties were either non-existent or not upheld. In particular, it mentioned that because the Chinese Government had not set any quotas with respect to individual fishing companies or vessels, there was no risk of them being held responsible (see actual extracts from the prospectus in section S2). Following the submission of the IPO prospectus, Greenpeace filed a complaint with the Hong Kong Stock Exchange, highlighting that China Tuna used outdated stock status for their assessment and that the environmental and sustainability risks had been overlooked. It also reached out to China’s Bureau of Fisheries, which strongly condemned the company’s actions as “gravely misleading investors and the international community,” and to Deutsche Bank—the sole sponsor of the IPO—which declined to comment (and thereafter suffered reputational damages) (44). This led the Hong Kong Stock Exchange to suspend the draft IPO before China Tuna eventually withdrew its application a few months later.

In this case, it remains unclear whether the issue would have been flagged and the IPO cancelled, if not for the complaint from Greenpeace. Stock exchanges are able to act as regulatory bodies via their listing rules, both during the IPO and on a continuing basis for listed companies. However, unlike requirements for financial and governance information, which are mandatory and have well-established international reporting and auditing standards, sustainability disclosure is still largely voluntary (45). According to the Sustainable Stock Exchanges Initiative database (www.sseinitiative.org/data), only 2 of the world’s 10 largest stock exchanges require some environmental and social reporting as a listing rule. Even then, one of the two is a “comply-or-explain” system, whereby firms have the option not to disclose sustainability records as long as they justify their decision. Still, there is growing evidence that sustainability issues are gaining traction among investors, government regulators, and the stock exchanges themselves (46). Similar to how financial disclosure progressively became the norm throughout the 1970s, today’s voluntary sustainability reporting and best practices may be tomorrow’s standard in compliance regulations (45).

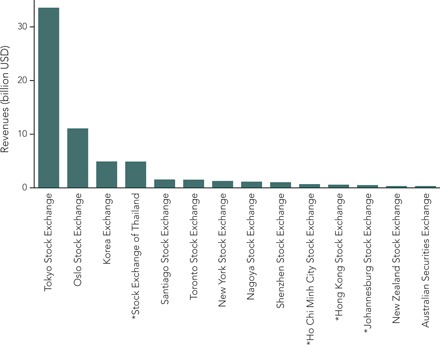

Within the seafood industry, stock exchanges seem particularly well placed to promote greater transparency and influence sustainability. A review of the world’s 100 largest seafood companies (36) indicates that the publicly listed ones are highly consolidated into a handful of stock exchanges (Fig. 3). The Tokyo Stock Exchange alone concentrates 53% of the combined revenue of listed seafood companies, while the largest four (Tokyo, Oslo, Korea, and Thailand) together account for 86%. Only one of them, the Stock Exchange of Thailand, currently requires environmental and social reporting as a listing rule. If more stringent sustainability requirements were to form part of the mandated information needed for the IPO process and ongoing listing, stock exchanges would constitute powerful gatekeepers to ensure that seafood sustainability criteria are incorporated into the practices of publicly listed firms.

Fig. 3. Seafood revenues in stock exchanges.

Cumulative revenues of the world’s 45 largest publicly listed seafood companies by stock exchange. The Tokyo Stock Exchange concentrates 53% of total revenues, while the largest four together account for 86%. The asterisks indicate stock exchanges that have social and environmental reporting as a listing rule, according to the Sustainable Stock Exchanges Initiative database (www.sseinitiative.org/data).

Shareholder ownership

Once a company gets listed, the percentage of stock ownership determines the share of voting rights and the extent to which any one investor can affect corporate decisions. The required stake to have effective control differs across firms, but shareholding of at least 5% is generally assumed to entail substantial influence (47). There are two main mechanisms for large shareholders to influence a firm’s governance. The first one, known as “voice,” includes voting and direct engagement with management (e.g., private letters, meetings, and public shareholder proposals). The second one, known as “exit,” consists of selling the shares (or threatening to do so), which signals discontent and may push down the stock price (47). Recent studies have documented the role of large financial actors in the global network of corporate ownership (48) and pointed out the increasing level of activism among investors (49). Institutional shareholders of listed seafood companies could therefore offer leverage to enhance sustainability.

Our analysis of more than 3000 shareholders of 160 seafood firms, however, shows a remarkable modularity in the network of investors and companies (Fig. 4A). The absence of key nodes indicates that most seafood companies have a unique cohort of large shareholders and that no single investor holds substantial stocks in many companies, thus indicating limited leverage potential. Notably, the pattern remains similar for parent shareholders (fig. S1). Looking at the nature of the owners further reveals that the proportion accounted for by financial institutions decreases as the ownership share increases, whereas the percentage of individuals and nonfinancial corporations rises (Fig. 4B and table S2). On the other hand, the cumulative investment of shareholders across all seafood companies shows that financial institutions are by far the largest investors in terms of market capitalization (Fig. 4C and data file S1). This illustrates a conventional risk spreading strategy whereby financial investors buy small ownership stakes in a multitude of companies. The distinct types of shareholders also underscore geographical differences, with more than half of all individuals and 87% of nonfinancial corporations based in Asia, while financial institutions are primarily European (42%) and North American (27%) (table S2). Overall, we observe a home bias where the predominant shareholders’ region matches the company’s headquarters location (fig. S2). Whether these geographical patterns entail differences in how the financial sector can be engaged for increasing sustainability is an important question that remains to be explored.

Fig. 4. Shareholder ownership.

(A) Network of publicly listed seafood companies and their shareholders for different share values representing relative thresholds of potential influence over corporate operations and governance. Network density (overall level of connectivity of the network measured as the proportion of actual connections relative to the total number possible) is very low in all three cases. The network for all ownership shares (i.e., >0%) has too many nodes and links to be visualized in a clear way. Explore interactive versions of the networks at https://jbjouffray.github.io/SeafoodFinance/networks. (B) Proportion of all shareholders accounted for by financial institutions, individuals, and nonfinancial corporations for different share values. See table S2 for proportions split by regions and additional shareholder types. (C) Cumulative market capitalization across all seafood companies by shareholder types.

These results suggest that equity currently holds limited potential for financial actors to affect seafood corporate governance and promote sustainability. The seafood industry is already characterized by a large number of privately owned companies with unknown shareholder structure and thus little leverage. Our findings indicate that, even for publicly listed companies, individuals and nonfinancial corporations are the most prevalent investors with shares large enough to be influential (Fig. 4B). While individuals can be instrumental in their own right, they are less susceptible to public pressure than institutional investors such as pension funds and sovereign wealth funds. The observed pattern of institutional shareholders injecting large amounts of capital into an industry but with little stake in any one company could thus be conceived of as a “financial commons dilemma,” where powerful financial investors lack the incentives to monitor individual firms—at least in the seafood sector (Fig. 4). This situation is unlikely to change as long as investors remain uninterested in or unaware of the social-ecological impacts of their investments.

Toward a social-ecologically literate financial sector

While some of the leverage points identified above hold promise for steering the seafood industry toward more sustainable practices, investments are ultimately meant to maximize profits in relation to risks. Any transformative potential is therefore unlikely to be realized unless financial institutions become (i) more aware of the social-ecological risks associated with seafood production, (ii) appreciative of how these are likely to translate into financial and reputational risks, and (iii) willing or compelled to transform their own practices toward improved sustainability accordingly.

Numerous sustainable finance initiatives have emerged in recent years, showing an increased attention to social and environmental issues. From the Equator Principles and the Sustainable Stock Exchange Initiative to the Principles for Responsible Investment and the growth of the green bond market, there are signs that finance is aware of its potential. However, these initiatives or instruments are mostly voluntary and represent only a tiny fraction of global financial flows. For instance, green bonds, let alone blue ones, amount to less than 0.6% of the total bond market (25). What is needed, instead, if sustainability concerns are to become mainstream, are new norms and regulations that can redirect the bulk of corporate finance toward improved sustainability (Fig. 2). Crucial to this process is the disclosure by seafood companies of their nonfinancial activities and performance. This requires integrated reporting of both financial and nonfinancial information to allow investors, financiers, and other stakeholders to better assess firm performance and risks. Overall, seafood companies should be screened to ensure that they do not violate human and labor rights (8), engage in IUU fishing (5), or operate under flags of noncompliance and tax haven jurisdictions (50). Drawing on the disclosure of what species of fish are caught, how much, when, and where, particular attention must be paid to the ecological status of fish populations as well as potential impacts on wider marine ecosystems (2). Financiers should also request traceability and transparency throughout the value chain (51), including catch documentation schemes and systematic disclosure of metrics such as biomass produced, amount of antibiotics used, and percentage of eco-certified products (7, 14).

Nonfinancial risks tend to be an important predictor of company and industry-specific financial risks (52). However, it requires improving the ability of financial actors to articulate, understand, and translate these data to market insights. In this respect, initiatives such as the Ocean Disclosure Project (www.oceandisclosureproject.org), Fish Tracker (www.fish-tracker.org), or the Principles for Investment in Sustainable Wild-Caught Fisheries (www.fisheriesprinciples.org) can help foster collaboration and provide guidance to financiers. The information also needs to be independently audited to ensure its validity and reliability. Where it is not yet the case, national and international regulation regarding financial reporting and accounting must therefore be expanded to also include nonfinancial information. Governments should enforce provision of this type of reporting by treating it on par with the requirements of financial accounting and reporting standards. Likewise, stock exchanges could promote the use of nonfinancial and industry-specific criteria by demanding that listed companies comply with the proposals and framework of the Sustainability Accounting Standards Board (www.sasb.org) or the Global Reporting Initiative (www.globalreporting.org). The Sustainable Stock Exchange Initiative provides a relevant platform to enable these reforms in combination with regulatory pressure from finance ministries. In case seafood companies stop complying, this could result in their demotion to a lower-tier exchange or even delisting. Many fishing and aquaculture companies may not have a listing on an exchange but will receive external finance via banks. Loan covenants can then specify the type of information to be provided to the bank and require that the company adhere to international norms and standards. Violation of covenants could trigger default clauses upon which the company has to pay a fine to the bank or even repay the loan and all financial obligations related to it, de facto ending the arrangement.

Pressure from civil society organizations and the general public will be important to promote awareness and stimulate regulatory responses. A number of approaches have emerged to sensitize the seafood sector to the importance of sustainability, from eco-certifications aimed at informing consumers’ choices, to lobbying by nongovernmental organizations (NGOs) on how the industry needs to improve (sometimes targeting specific companies with naming and shaming campaigns), and through the proliferation of private governance initiatives. Here, we argue that sustainability screening and industry-specific considerations must become the norm for investments in the seafood industry, in the same way as financial auditing currently is. Banks, stock exchanges, and shareholders alike could have incentives to do so because the company’s social and environmental performance will directly or indirectly feed back to the financier and may yield financial and reputational benefits (53).

Future research should aim at testing the reality of these incentives and exploring each of the leverage points in more depth. For bank loans, the focus must be on identifying keystone banks in the seafood industry and assessing their willingness to set up new norms of sustainability requirements for credit lending, similar to the exercise undertaken by Österblom et al. (16) regarding the world’s largest fishing and aquaculture firms. For stock exchanges, efforts should aim at reviewing the listing rules of the ones that concentrate seafood revenues (Fig. 3) and evaluating the possibility to implement more stringent sustainability disclosure requirements. For shareholders, an empirical assessment of the relationship between financial performance and social and environmental ratings should be conducted for both the seafood companies and their investors. See Gonenc and Scholtens (54) for a comparable analysis on fossil fuels firms. Beyond the mechanisms elaborated here lies a whole spectrum of research avenues to further investigate the relevance of finance as a leverage for sustainability. This includes a focus on proxy voting service providers as well as greater attention to the role of credit rating agencies and large accounting firms that assess and audit most of the financial transactions and thus could constitute powerful change agents.

CONCLUSION

In an epoch when considerable efforts and technologies are deployed to track fishing vessels in near real time (www.globalfishingwatch.org), following the money is no less important and deserves increased attention from both scholars and policymakers. Many lessons can be drawn from the literature on financialization in the agrifood sector, which describes the growing influence of finance at the expense of producers, consumers, and the environment (22). Accordingly, we do not advocate the emergence of new “green” investment tools but rather a radical and deliberate transformation of how seafood sustainability is integrated into traditional financial services—either at their own initiative or via regulation. This would also improve the effectiveness and efficiency of financial institutions with respect to the materiality of nonfinancial information. Given the projected demand for seafood and the magnitude of the challenges associated with its production, we regard our identification of leverage points in the financial sector as a crucial avenue to not only complement but also promote existing governmental, market-based, and corporate efforts toward increased sustainability.

MATERIALS AND METHODS

Content analysis of seafood news literature

The content analysis proceeded in two steps and included all FNI monthly issues (2008–2014; n = 84) and UCN online articles (2012–2017; n = 29,865). The limited set of FNI issues constituted a comprehensive, yet small enough, sample to allow an exhaustive manual coding of all articles. On the basis of this review, a codebook with search terms was developed and subsequently applied to the independent set of articles in the UCN archives to narrow down the number of articles to be analyzed in detail. The content analysis was done using MAXQDA 12.3.3.

Codebook development entailed reading FNI articles and conducting exploratory coding of all topics related to the financial sector. Anything relevant to finance was marked to identify three elements: a financial entity (provider of capital), a seafood company (recipient), and a mechanism through which capital flowed from the financial provider to the recipient (fig. S3). A financial entity was defined as an institution that has, or assembles, funds for investment. A seafood company was defined as a company implicated in the seafood value chain, regardless of it being primarily involved in the capture, aquaculture, processing, or retailing sector. Through the exploratory coding, a set of preliminary search terms that were deemed necessary to capture all articles of interest was identified with a focus on financial mechanisms (table S3). Using either recipients or providers as key search terms would have limited the analysis to these specific companies or institutions, and made it impossible to discover any additional types of actors and mechanisms not covered by the FNI archives. Each identified search term was then assessed for relevance by conducting a systematic lexical search of the word within all FNI articles and measuring how many times the term appeared within or outside a coded segment. Words with low relevance, such as “stock” that can refer to financial stock (equity) but was mostly used in relation to fish stock, were not retained (table S3). In step two, the refined list of terms was applied to the entire UCN online archives, and a total of 1246 articles were retrieved using Python version 2.7.13 (table S4). Each article was read in its entirety to identify the type of financial mechanisms and, where available, the recipient and provider. A Jupyter notebook with the data extraction code as well as the list of all articles’ URLs are both available on request.

To summarize the detailed accounts uncovered by the content analysis, and to draw out generalizable insights, we relied on the Weberian notion of “ideal types” to classify firms on the basis of their scale of operations and their ownership structure (publicly listed or privately owned). Ideal types are models, each representing a class (group of objects) with particular characters that can be said to best exemplify the phenomenon in focus—in our case, the intersection of finance with the seafood industry. Using ideal types allows to extend examination beyond the uniqueness of individual cases and develop an understanding of what commonalities exist between cases (55).

Quantitative analysis of shareholder ownership

We conducted descriptive statistics of shareholder ownership in the seafood industry based on the publicly listed companies with seafood involvement identified by McCarron (19) (table S5 and data file S1). Shareholder information was retrieved from the FactSet Ownership Download Builder on 23 October 2017 (www.factset.com) using the “all shareholder” view to account for any unconsolidated or unlisted part of the company. We focused on market capitalization and the percentage of ownership, defined as the proportion of outstanding shares of the company held by any investor. The completeness of the data depended on company disclosure. We found information for 160 companies with a combined market capitalization of $520 billion, an average of 57% ownership disclosed, and 3250 unique shareholders consolidating into 2561 parent shareholders (e.g., 16 different BlackRock funds consolidating into “BlackRock Inc.”) (data file S1). More than 93% of all listed companies were engaged in processing/wholesale. Of those, 32, 25, and 10% were also involved in aquaculture, capture fisheries, or both, respectively. Only four companies were engaged only in capture, and seven were engaged only in aquaculture (data file S1).

Web searches for each shareholder name were conducted to classify unique shareholders into five broad categories: financial institutions (n = 1832; e.g., banks, insurances, pension funds, private equity firms, hedge funds, and mutual funds), individuals (n = 732; including family-owned trusts), nonfinancial corporations (n = 610; e.g., private and public companies, holding companies, and business associations), foundations/nonprofit (n = 18; e.g., foundations, endowments, and nonprofit organizations), and governments (n = 12, including sovereign wealth managers). Forty-six shareholders (mostly private companies) could not confidently be classified into one of these categories (data file S1). Analyses and network visualizations were performed using R version 3.3.2 with a focus on ownership values above 5 and 10%, representing identified thresholds of potential influence over corporate operations and governance (47). Statistical scripts and data are available on GitHub (https://github.com/JBjouffray/SeafoodFinance).

Supplementary Material

Acknowledgments

We thank R. Blasiak, B. Metz, K. Lankester, and numerous colleagues for insightful discussions and constructive feedback throughout the development of this study. We are grateful to the Fish Tracker Initiative and C. Li for providing shareholding data, as well as to three reviewers for valuable comments that helped improve the manuscript. Funding: The authors acknowledge support from the Erling-Persson Family Foundation through the Global Economic Dynamics and the Biosphere programme (GEDB) at the Royal Swedish Academy of Sciences. J.-B.J. was also funded by the Swedish Research Council Formas (project no. 2015-743). Author contributions: J.-B.J., B.C., and E.W. designed research, collected data, and analyzed data. All authors contributed to the preparation of the manuscript and were involved in the interpretation of the results. Competing interests: J.-B.J., B.C., and J.B. provide scientific support to companies in the seafood sector through the Seafood Business for Ocean Stewardship (SeaBOS) initiative (http://keystonedialogues.earth/). J.-B.J. was on the advisory committee of the Fish Tracker Initiative for the publication of their first report in 2017. The authors declare no other competing interests. Data and materials availability: Data needed to evaluate the conclusions in the paper are present in the paper, the Supplementary Materials, or athttps://github.com/JBjouffray/SeafoodFinance. Data on shareholder percent ownership are available upon request.

SUPPLEMENTARY MATERIALS

Supplementary material for this article is available at http://advances.sciencemag.org/cgi/content/full/5/10/eaax3324/DC1

Section S1. Glossary of all financial terms used throughout the paper

Section S2. Extracts from the application proof of China Tuna to the Hong Kong Stock Exchange

Fig. S1. Parent shareholder ownership network.

Fig. S2. Shareholder regions in relation to company headquarters.

Fig. S3. Codebook development framework.

Table S1. Summary of financial mechanisms and associated examples identified through the content analysis.

Table S2. Descriptive statistics of 3250 shareholders of 160 publicly listed seafood companies by shareholder types and regions.

Table S3. Development of search terms applied to UCN archives.

Table S4. Number of UCN articles retrieved by year.

Table S5. Selection process to identify publicly listed seafood companies.

Data file S1. Company and shareholder data (Excel file).

REFERENCES AND NOTES

- 1.Thilsted S. H., Thorne-Lyman A., Webb P., Bogard J. R., Subasinghe R., Phillips M. J., Allison E. H., Sustaining healthy diets: The role of capture fisheries and aquaculture for improving nutrition in the post-2015 era. Food Policy 61, 126–131 (2016). [Google Scholar]

- 2.FAO, The State of World Fisheries and Aquaculture 2018—Meeting the Sustainable Development (FAO, 2018).

- 3.Pauly D., Zeller D., Catch reconstructions reveal that global marine fisheries catches are higher than reported and declining. Nat. Commun. 7, 10244 (2016). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Halpern B. S., Walbridge S., Selkoe K. A., Kappel C. V., Micheli F., D’Agrosa C., Bruno J. F., Casey K. S., Ebert C., Fox H. E., Fujita R., Heinemann D., Lenihan H. S., Madin E. M. P., Perry M. T., Selig E. R., Spalding M., Steneck R., Watson R., A global map of human impact on marine ecosystems. Science 319, 948–952 (2008). [DOI] [PubMed] [Google Scholar]

- 5.McCauley D. J., Woods P., Sullivan B., Bergman B., Jablonicky C., Roan A., Hirshfield M., Boerder K., Worm B., Ending hide and seek at sea. Science 351, 1148–1150 (2016). [DOI] [PubMed] [Google Scholar]

- 6.Miller D. D., Mariani S., Smoke, mirrors, and mislabeled cod: Poor transparency in the European seafood industry. Front. Ecol. Environ. 8, 517–521 (2010). [Google Scholar]

- 7.Henriksson P. J. G., Rico A., Troell M., Klinger D. H., Buschmann A. H., Saksida S., Chadag M. V., Zhang W., Unpacking factors influencing antimicrobial use in global aquaculture and their implication for management: A review from a systems perspective. Sustain. Sci. 13, 1105–1120 (2018). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Nakamura K., Bishop L., Ward T., Pramod G., Thomson D. C., Tungpuchayakul P., Srakaew S., Seeing slavery in seafood supply chains. Sci. Adv. 4, e1701833 (2018). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Smith M. D., Roheim C. A., Crowder L. B., Halpern B. S., Turnipseed M., Anderson J. L., Asche F., Bourillón L., Guttormsen A. G., Khan A., Liguori L. A., McNevin A., O’Connor M. I., Squires D., Tyedmers P., Brownstein C., Carden K., Klinger D. H., Sagarin R., Selkoe K. A., Sustainability and global seafood. Science 327, 784–786 (2010). [DOI] [PubMed] [Google Scholar]

- 10.Kittinger J. N., Teh L. C. L., Allison E. H., Bennett N. J., Crowder L. B., Finkbeiner E. M., Hicks C., Scarton C. G., Nakamura K., Ota Y., Young J., Alifano A., Apel A., Arbib A., Bishop L., Boyle M., Cisneros-Montemayor A. M., Hunter P., le Cornu E., Levine M., Jones R. S., Koehn J. Z., Marschke M., Mason J. G., Micheli F., McClenachan L., Opal C., Peacey J., Peckham S. H., Schemmel E., Solis-Rivera V., Swartz W., Wilhelm T. A., Committing to socially responsible seafood. Science 356, 912–913 (2017). [DOI] [PubMed] [Google Scholar]

- 11.Costello C., Ovando D., Clavelle T., Strauss C. K., Hilborn R., Melnychuk M. C., Branch T. A., Gaines S. D., Szuwalski C. S., Cabral R. B., Rader D. N., Leland A., Global fishery prospects under contrasting management regimes. Proc. Natl. Acad. Sci. U.S.A. 113, 5125–5129 (2016). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.S. M. Garcia, in Handbook of Marine Fisheries Conservation and Management (Oxford Univ. Press, 2010), pp. 87–98. [Google Scholar]

- 13.Jacquet J., Hocevar J., Lai S., Majluf P., Pelletier N., Pitcher T., Sala E., Sumaila R., Pauly D., Conserving wild fish in a sea of market-based efforts. Oryx 44, 45–56 (2010). [Google Scholar]

- 14.Gutiérrez N. L., Valencia S. R., Branch T. A., Agnew D. J., Baum J. K., Bianchi P. L., Cornejo-Donoso J., Costello C., Defeo O., Essington T. E., Hilborn R., Hoggarth D. D., Larsen A. E., Ninnes C., Sainsbury K., Selden R. L., Sistla S., Smith A. D., Stern-Pirlot A., Teck S. J., Thorson J. T., Williams N. E., Eco-label conveys reliable information on fish stock health to seafood consumers. PLOS ONE 7, e43765 (2012). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Österblom H., Jouffray J.-B., Folke C., Crona B., Troell M., Merrie A., Rockström J., Transnational corporations as “keystone actors” in marine ecosystems. PLOS ONE 10, e0127533 (2015). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.Österblom H., Jouffray J.-B., Folke C., Rockström J., Emergence of a global science–business initiative for ocean stewardship. Proc. Natl. Acad. Sci. U.S.A. 114, 9038–9043 (2017). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Environmental Defense Fund and Nicholas Institute for Environmental Policy Solutions at Duke University, Financing Fisheries Reform: Blended Capital Approaches in Support of Sustainable Wild-Capture Fisheries (Environmental Defense Fund, 2018); edf.org/blendedcapital.

- 18.Environmental Defense Fund, Rare/Meloy Fund, Encourage Capital, Principles for Investment in Sustainable Wild-Caught Fisheries (2018); fisheriesprinciples.org.

- 19.B. McCarron, Empty Nets—How Overfishing Risks Leaving Investors Stranded (Fish Tracker Initiative, 2017). [Google Scholar]

- 20.Galaz V., Gars J., Moberg F., Nykvist B., Repinski C., Why ecologists should care about financial markets. Trends Ecol. Evol. 30, 571–580 (2015). [DOI] [PubMed] [Google Scholar]

- 21.Isakson S. R., Food and finance: The financial transformation of agro-food supply chains. J. Peasant Stud. 41, 749–775 (2014). [Google Scholar]

- 22.Clapp J., Isakson S. R., Risky returns: The implications of financialization in the food system. Dev. Change 49, 437–460 (2018). [Google Scholar]

- 23.Sullivan S., Banking nature? The spectacular financialisation of environmental conservation. Antipode 45, 198–217 (2013). [Google Scholar]

- 24.Knott C., Neis B., Privatization, financialization and ocean grabbing in New Brunswick herring fisheries and salmon aquaculture. Mar. Policy 80, 10–18 (2017). [Google Scholar]

- 25.Scholtens B., Why finance should care about ecology. Trends Ecol. Evol. 32, 500–505 (2017). [DOI] [PubMed] [Google Scholar]

- 26.Sumaila U. R., Lam V., Le Manach F., Swartz W., Pauly D., Global fisheries subsidies: An updated estimate. Mar. Policy 69, 189–193 (2016). [Google Scholar]

- 27.Encourage Capital, Investing for Sustainable Global Fisheries (Encourage Capital, 2016); http://investinvibrantoceans.org/wp-content/uploads/documents/FULL-REPORT_FINAL_1-11-16.pdf.

- 28.Miller D. D., Sumaila U. R., Copeland D., Zeller D., Soyer B., Nikaki T., Leloudas G., Fjellberg S. T., Singleton R., Pauly D., Cutting a lifeline to maritime crime: Marine insurance and IUU fishing. Front. Ecol. Environ. 14, 357–362 (2016). [Google Scholar]

- 29.Abson D. J., Fischer J., Leventon J., Newig J., Schomerus T., Vilsmaier U., von Wehrden H., Abernethy P., Ives C. D., Jager N. W., Lang D. J., Leverage points for sustainability transformation. Ambio 46, 30–39 (2017). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.Beck T., Demirgüç-Kunt A., Maksimovic V., Financing patterns around the world: Are small firms different? J. Financ. Econ. 89, 467–487 (2008). [Google Scholar]

- 31.Jensen M. C., Meckling W. H., Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360 (1976). [Google Scholar]

- 32.Myers S. C., Majluf N. S., Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 13, 187–221 (1984). [Google Scholar]

- 33.Cahnman W. J., Ideal type theory: Max Weber’s concept and some of its derivations. Sociol. Q. 6, 268–280 (1965). [Google Scholar]

- 34.Galaz V., Crona B., Dauriach A., Scholtens B., Steffen W., Finance and the Earth system – Exploring the links between financial actors and non-linear changes in the climate system. Glob. Environ. Chang. 53, 296–302 (2018). [Google Scholar]

- 35.O’Neill E. D., Crona B., Assistance networks in seafood trade—A means to assess benefit distribution in small-scale fisheries. Mar. Policy 78, 196–205 (2017). [Google Scholar]

- 36.J. Smith, K. Mimizuka, N. Ramsden, World’s 100 Largest Seafood Companies (Undercurrent News, 2018). [Google Scholar]

- 37.T. Seaman, E. Tallaksen, N. Ramsden, Seafood’s Top Dealmakers (Undercurrent News, 2017). [Google Scholar]

- 38.Wabnitz C. C. C., Blasiak R., The rapidly changing world of ocean finance. Mar. Policy 107, 103526 (2019). [Google Scholar]

- 39.Coulson A. B., Monks V., Corporate environmental performance considerations within bank lending decisions. Eco Manag. Audit 6, 1–10 (1999). [Google Scholar]

- 40.Thompson P., Cowton C. J., Bringing the environment into bank lending: Implications for environmental reporting. Br. Account. Rev. 36, 197–218 (2004). [Google Scholar]

- 41.Scholtens B., Dam L., Banking on the equator. Are banks that adopted the equator principles different from non-adopters? World Dev. 35, 1307–1328 (2007). [Google Scholar]

- 42.R. Geddes, IPOs and Equity Offerings (Elsevier, 2005). [Google Scholar]

- 43.Undercurrent News, China Tuna reportedly postpones IPO (2014); www.undercurrentnews.com/2014/09/22/china-tuna-reportedly-postpones-ipo/.

- 44.Undercurrent News, Chinese tuna group shelves IPO plans after quota breach revelations (2014); www.undercurrentnews.com/2014/10/15/chinese-tuna-group-shelves-ipo-plans-after-quota-breach-revelations/.

- 45.B. Urdang, “An assessment of the environmental sustainability guidelines and requirements set by international stock exchanges,” thesis, University of the Witwatersrand, Johannesburg, South Africa (2017). [Google Scholar]

- 46.SSE, Sustainable Stock Exchange Initiative—2018 report on progress (2018).

- 47.Edmans A., Blockholders and corporate governance. Annu. Rev. Financ. Econ. 6, 23–50 (2014). [Google Scholar]

- 48.Fichtner J., Heemskerk E. M., Garcia-Bernardo J., Hidden power of the Big Three? Passive index funds, re-concentration of corporate ownership, and new financial risk. Bus. Polit. 19, 298–326 (2017). [Google Scholar]

- 49.J. G. Hill, R. S. Thomas, Research Handbook on Shareholder Power (Edward Elgar Publishing, 2015). [Google Scholar]

- 50.Galaz V., Crona B., Dauriach A., Jouffray J.-B., Österblom H., Fichtner J., Tax havens and global environmental degradation. Nat. Ecol. Evol. 2, 1352–1357 (2018). [DOI] [PubMed] [Google Scholar]

- 51.Gardner T. A., Benzie M., Börner J., Dawkins E., Fick S., Garrett R., Godar J., Grimard A., Lake S., Larsen R. K., Mardas N., Mc Dermott C. L., Meyfroidt P., Osbeck M., Persson M., Sembres T., Suavet C., Strassburg B., Trevisan A., West C., Wolvekamp P., Transparency and sustainability in global commodity supply chains. World Dev. 121, 163–177 (2019). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 52.Scholtens B., A note on the interaction between corporate social responsibility and financial performance. Ecol. Econ. 68, 46–55 (2008). [Google Scholar]

- 53.Sharfman M. P., Fernando C. S., Environmental risk management and the cost of capital. Strateg. Manag. J. 29, 569–592 (2008). [Google Scholar]

- 54.Gonenc H., Scholtens B., Environmental and financial performance of fossil fuel firms: A closer inspection of their interaction. Ecol. Econ. 132, 307–328 (2017). [Google Scholar]

- 55.A. Elliott, The Routledge Companion to Social Theory (Routledge, 2009). [Google Scholar]

- 56.T. Seaman, Pescanova: Six months of scandal at stricken giant (2013); www.undercurrentnews.com/2013/09/09/pescanova-six-months-of-scandal-at-stricken-seafood-giant/.

- 57.M. Mereghetti, Pescanova reduces its participation in Nueva Pescanova. Undercurr. News (2017).

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Supplementary material for this article is available at http://advances.sciencemag.org/cgi/content/full/5/10/eaax3324/DC1

Section S1. Glossary of all financial terms used throughout the paper

Section S2. Extracts from the application proof of China Tuna to the Hong Kong Stock Exchange

Fig. S1. Parent shareholder ownership network.

Fig. S2. Shareholder regions in relation to company headquarters.

Fig. S3. Codebook development framework.

Table S1. Summary of financial mechanisms and associated examples identified through the content analysis.

Table S2. Descriptive statistics of 3250 shareholders of 160 publicly listed seafood companies by shareholder types and regions.

Table S3. Development of search terms applied to UCN archives.

Table S4. Number of UCN articles retrieved by year.

Table S5. Selection process to identify publicly listed seafood companies.

Data file S1. Company and shareholder data (Excel file).