Abstract

The Supplemental Nutrition Assistance Program (SNAP) in the United States is a key element of the nation’s safety net. Yet, 12.5 million US children live in households that experience food insecurity, despite national spending of $65 billion on SNAP alone.

In analyses integrating data from the 36 Organisation for Economic Co-operation and Development (OECD) countries, we found that child poverty and food insecurity are much higher in the United States than in most of the other OECD countries. The United States has higher total social spending than other OECD countries, but a lower rate of spending on children and families. This international comparison suggests that potentially effective solutions implemented in other countries might help further alleviate US childhood poverty and food insecurity.

Broadly, we recommend increasing investments in families with children, particularly low-income families. Our specific recommendations include increasing SNAP benefits, establishing additional benefits to support low-income families with young children, and implementing a universal child allowance. Achieving substantial reductions in child poverty and food insecurity will require overcoming many challenges, including the current US political climate, a national history of underinvestment in social programs, a lack of political will, and a culture of structural racism.

Living in poverty is detrimental to children’s growth, health, and development.1–3 Yet, in the United States, children are more likely to live in poverty than the general population.4 To improve outcomes for poor households, the United States has implemented social safety net programs,5 such as the Supplemental Nutrition Assistance Program (SNAP); the Earned Income Tax Credit (EITC); the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); and Temporary Assistance for Needy Families6 (see Table 1 for overview). Even with these programs in place, however, many low-income families still struggle to meet their basic needs. Thus, persistent food insecurity in the United States demands a new, rights-based approach to protect vulnerable children and their families.19 The primary motivation for this article was to assess how other Organisation for Economic Co-operation and Development (OECD) nations approach child food insecurity and poverty, to understand whether the US approach, which relies heavily on SNAP, is as effective as it could be in achieving these ends.

TABLE 1—

Review of Selected Social Safety Net Programs in the United States as of June 2019

| Name and Abbreviation | Description | US Total Expenditure | Maximum and Average per Family |

| Earned Income Tax Credit (EITC) | Provides tax rebates to individuals and families, contingent upon employment. Benefits increase with higher income until a threshold is met, then benefits are phased out.7 | $63 billion8 | Max: $5716 for 2-child household8; Average: $2488 for 2-child household8 |

| Temporary Assistance for Needy Families (TANF) | Provides grants for states to administer funds to low-income families that can be used to help with expenses related to housing, childcare, medical care, etc.9 | $15.4 billion10 | Varies widely by state; in 2012, the median state (ND) offered a max of $427/mo to single parent of 2 children9 |

| Supplemental Nutrition Assistance Program (SNAP) | Provides cash assistance to low-income individuals and families to spend on eligible food items at participating retail stores. | $65 billion11 | Max: $511/mo (3-person household); Average: $125/mo11 |

| Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) | Provides supplemental foods and nutrition education to low-income pregnant, postpartum, and breastfeeding women as well as infants and children (up to age 5) who are at nutritional risk.11 | $5.3 billion11 | Max: Depends on age of children and breastfeeding status; Average: $40.83/mo11 |

| Child and Dependent Care Tax Credit (CDCC or CDCTC) | A tax credit to offset a portion of the cost of qualifying child care expenses of working parents with children younger than 13 years or other dependents. There is no income cap for eligibility, but higher credits are given to lower-income families. It is estimated that only 13% of families with children claim the credit, and the majority have annual income greater than > $75 000.12 | $3.59 billion12 (2015) | Max: $1050 for one child or dependent or $2100 for 2; Average: $56512 |

| Child Tax Credit (CTC) | Nonrefundable tax credit for families with children younger than 17 years. | $54.2 billion13 (2013) | Max: $2000 per child; Average: $2420 per family14 |

| Federal rental assistance | Rental assistance, including Housing Choice Vouchers (Section 8) and public housing, provides low-income, people with disabilities, elderly, and veterans with options to rent units in the private market.13 | $43.9 billion15 | Variable depending on program; for Section 8, families spend 30% of their income on rent and Section 8 covers the rest15 |

| Medicaid | Provides free or low-cost health care for low-income adults and children and people living with disabilities. | $462.8 billion (total)$89.7 billion (children only; 2014)16 | Average annual coverage cost: $5736 (adults), $2577 (children)17 |

| Children’s Health Insurance Program (CHIP) | Provides low-cost health care to eligible children in families whose income is too high to qualify for Medicaid. | $17.5 billion (federal and state shares; 2017)18 | Variable |

Note. US expenditure on programs represents costs in 2018, unless otherwise noted.

POVERTY, FOOD INSECURITY, AND SNAP

More than 1 in 6 children aged 17 years and younger (17.5%) in the United States lived in poverty in 2017, and this percentage was higher among African American children (29%) and Hispanic children (25%).20 Children from poorer households have worse health and development outcomes,21–26 and these differences often increase with age27,28 and continue into adolescence and adulthood.29–33 Living in poverty is a significant risk factor for food insecurity,34 though many families with incomes above the poverty line also experience food insecurity.35 In the United States, an estimated 15 million households (11.8%) experienced food insecurity at some time during the 2018 fiscal year, despite national spending of $96.1 billion on domestic food assistance overall.11 Food insecurity is higher than average in households with children36 and in households headed by non-Hispanic Black or Hispanic individuals.36

In the United States, there are no broadly available cash transfers designated specifically for families with children, but there is federal spending targeted for families with children through indirect mechanisms.37 To specifically address food security, the US Department of Agriculture administers 15 food and nutrition assistance programs, the largest of which is SNAP, with annual spending of $65 billion.11 The poverty-reducing benefits from SNAP are so large that in the absence of SNAP benefits, the child poverty rate in the United States would be 40% higher than it currently is, and the percentage of children living in deep poverty would be nearly 100% higher.38 Nearly half (44%) of all SNAP participants are children, and 31% of US children aged 4 years and younger participate in SNAP.39 Although SNAP participation is associated with lower odds of food insecurity, more than half of households receiving SNAP benefits are still food insecure.40–42 Persistent food insecurity may be a consequence of the most vulnerable households self-selecting into SNAP or that SNAP benefits are not actually sufficient to allow households to prepare healthy meals43 or to lift households out of food insecurity.44

SNAP participation has been linked with many positive outcomes beyond improved food security, including effects on dietary diversity,45,46 self-reported health,47 and fewer emergency department visits related to pregnancy,48 asthma,49 and high blood pressure,50 along with reductions in health care spending.51–55 The EITC has demonstrated benefits for families such as an increase in employment as well as the reduction of families living in poverty56 and on child and maternal health.57–61 Similarly, WIC has shown positive effects for infant birth weight, low birth weight babies and child length-for-age,62 and food security.63

POVERTY RELIEF IN HIGH-INCOME COUNTRIES

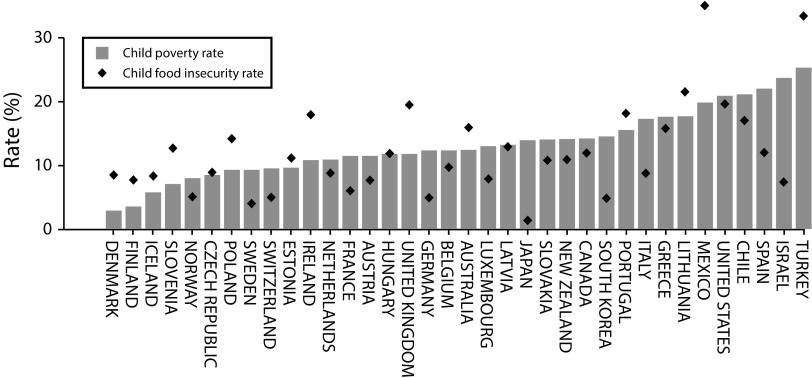

The United States is not alone in struggling with childhood poverty and food insecurity. There are several countries where more than 15% of families with children live in poverty (e.g., the United States, Italy, Greece, Spain, Israel, Chile, and Turkey) among the 36 high-income countries defined as being members of the OECD; notable national exceptions include Denmark and Finland, where 5% or fewer children live in poverty4 (Figure 1).

FIGURE 1—

Child Poverty Rate and Food Insecurity Rate in Organization for Economic Cooperation and Development (OECD) Countries

Note. Authors’ analysis of data on social spending from the Social Expenditure Database of the OECD. Child poverty data represent country estimates from 2014 to 2016, and food security data represent estimates from 2014 to 2015. For full source information and variable definitions, see Appendix A, available as a supplement to the online version of this article at http://www.ajph.org.

In fact, because of the extent of children living in poverty worldwide, members of the United Nations Member States prioritized ending poverty as the first of 17 Sustainable Development Goals, which together provide a framework to promote peace and prosperity for all nations.64 All high-income countries invest in some sort of social safety net to support children and families living in poverty.5,11 In most cases across OECD countries, government spending on families is not targeted to low-income families but rather to all families with children.65 Social safety net programs are hypothesized to improve outcomes via the family investment model (i.e., having more money to spend on inputs66,67 or more time to spend with children68) and the family stress model (i.e., decreased maternal depression because of increased household resources).69 Studies examining data from multiple higher-income countries suggest that those countries with better social policies (e.g., a long history of investment in social safety net programs) have flatter economic gradients in literacy among those aged 15 years.70

Overall, provision of social benefits reduces child poverty rates: on average in OECD nations, an approximate 1% increase in per-capita social expenditure is associated with a 1% reduction in the child poverty rate.4 This association is not sustained, however, for the lowest-income families, for whom much greater changes in economic conditions are required to lift them out of poverty. Studies suggest that many nuances of detail in terms of how benefits and transfers are structured are important for making substantial changes in child poverty rates.

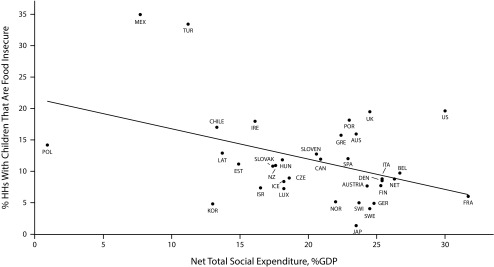

In our analyses, we reviewed OECD data on child poverty and social spending and mapped that against global estimates of OECD nations’ food insecurity rates among households with children. Our key findings were that higher rates of total social spending (including both public and private social expenditures) across OECD nations were associated with lower rates of food insecurity among households with children (Figure 2). The United States is a clear outlier, outspending all nations except France, yet having childhood food insecurity rates higher than every country except Mexico, Turkey, and Lithuania. This association suggests that the investments the United States makes in social spending are not affecting childhood food insecurity in the way that other nations’ investments are.

FIGURE 2—

Net Total Social Expenditure as Percentage of Gross Domestic Product and Percentage of Food-Insecure Households With Children

Note. Authors’ analysis of data on social spending from the Social Expenditure Database of the OECD. AUS = Australia; BEL = Belgium; CAN = Canada; CZE = Czech Republic; DEN = Denmark; EST = Estonia; FIN = Finland; FRA = France; GER = Germany; GRE = Greece; HHs = households; HUN = Hungary; ICE = Iceland; IRE = Ireland; ISR = Israel; ITA = Italy; JAP = Japan; KOR = South Korea; LAT = Latvia; LIT = Lithuania; LUX = Luxembourg; MEX = Mexico; NET = Netherlands; NZ = New Zealand; NOR = Norway; POL = Poland; POR = Portugal; SLOVAK = Slovakia; SLOVEN = Slovenia; SPA = Spain; SWE = Sweden; SWI = Switzerland; TUR = Turkey; UK = United Kingdom. Social expenditure data represent country estimates from 2015 to 2016, and food security data represent estimates from 2014 to 2015. For full source information and variable definitions, see Appendix A, available as a supplement to the online version of this article at http://www.ajph.org.

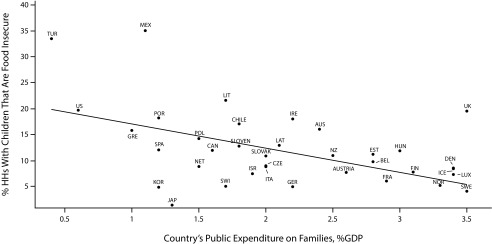

One reason that the United States could appear to have high social expenditures while also reporting high food insecurity is that total social spending is very different from family-specific spending. We find a clear association between greater public expenditure on families and a lower prevalence of food insecurity among households with children (Figure 3), highlighting that the United States spends only 0.6% of its gross domestic product (GDP) specifically on families. In contrast, several countries such as Korea, Japan, and Germany spend 1% to 2% of GDP on families, and all have a prevalence of food insecurity among families of less than 10%. Among the several countries that spend the largest portion of GDP on family-related services (e.g., Sweden, Norway, and Finland spend 3%–3.5%), food insecurity rates in households with children are 5% to 10%.

FIGURE 3—

Public Expenditure on Families as a Percentage of Gross Domestic Product and Households With Children That Are Food Insecure

Note. Authors’ analysis of data on social spending from the Social Expenditure Database of the OECD. AUS = Australia; BEL = Belgium; CAN = Canada; CZE = Czech Republic; DEN = Denmark; EST = Estonia; FIN = Finland; FRA = France; GER = Germany; GRE = Greece; HHs = households; HUN = Hungary; ICE = Iceland; IRE = Ireland; ISR = Israel; ITA = Italy; JAP = Japan; KOR = South Korea; LAT = Latvia; LIT = Lithuania; LUX = Luxembourg; MEX = Mexico; NET = Netherlands; NZ = New Zealand; NOR = Norway; POL = Poland; POR = Portugal; SLOVAK = Slovakia; SLOVEN = Slovenia; SPA = Spain; SWE = Sweden; SWI = Switzerland; TUR = Turkey; UK = United Kingdom. Data on public expenditure on families represent country estimates from 2015 to 2016, and food security data represent estimates from 2014 to 2015. For full source information and variable definitions, see Appendix A, available as a supplement to the online version of this article at http://www.ajph.org.

EXAMPLES OF ALTERNATIVE SAFETY NET APPROACHES

Thus, the approaches some other countries have taken to invest in social programs and prevent poverty and food insecurity have been more effective at reducing childhood poverty and food insecurity than the approaches of the United States have been (see Table A, available as a supplement to the online version of this article at http://www.ajph.org, for examples from selected countries). Models from other OECD countries suggest that efforts focused on how to reduce child poverty and improve food security may lead to solutions that more generally invest in children and families. We now consider some of the most relevant evidence-based approaches being tested or implemented in nations around the world to limit childhood poverty and food insecurity.

Universal Income

Universal basic income is defined as a transfer that provides enough of a cash benefit to live on without other earnings, does not fade out as earnings rise, and is available to a large proportion of the population rather than being targeted at specific households.71 The benefits of the universal basic income are that there is no stigma associated with receiving the transfer because everyone is getting it, and the complexity of administration is reduced because it is universal. The cost is high, however, and at $3 trillion per year would be 2 times the equivalent safety net expenditure in the United States, for example, to achieve a recommended cash payout of $12 000 per person, calculated as being sufficient to live on without other earnings.71 While the universal basic income approach is being pilot tested or discussed by thought leaders and policymakers in several countries, including Switzerland, Finland, the Netherlands, Canada, France, and the United States, some evidence suggests that if basic income replaced other safety-net programs, low-income households currently receiving benefits could be worse off, and in some cases, poverty rates could rise.72

There are only a few examples where a universal income approach has been attempted, but not to the level of providing sufficient income to live on without other earnings. For example, since 1982, the Alaska Permanent Fund Dividend has provided all Alaska residents a dividend of $800 to $2000 per year, contingent only upon proving residency and not having a felony charge conviction or being incarcerated the year before applying.73 One evaluation of the Permanent Fund Dividend found that the program did not change overall employment but increased part-time work in some sectors.74 In another example, in North Carolina, the Eastern Cherokee Native American Tribe provided all adult tribal members with $4000 per person per year with profits from a new casino and found benefits to children’s educational attainment and socio-emotional development.75

Targeted Programs

In targeted programs, which are also popular worldwide, the recipient must belong to the broadly defined eligibility category, but no other conditions are required to receive the transfer. Eligibility categories can be income-based (e.g., living below an established poverty line), geographically based (e.g., living in a defined region), or demographically based (e.g., belonging to a defined group such as indigenous peoples or being an orphan). In Finland, a current transfer program available to unemployed individuals resulted in improvements in well-being, but not in employment76; effects on food insecurity have not been assessed.

Several countries also have minimum income assistance for individuals or families who are below a certain threshold. For example, in France, unemployed or low-income individuals can receive Active Solidarity Income (Revenu de Solidarité Active) benefits if they do not meet the minimum-wage annual income.77 This program aims to guarantee “sufficient means of subsistence,” and encourage continuation of or return to employment. Many other countries, including Germany,77 Japan,78 and South Korea,79 similarly have programs to help individuals or families to meet basic costs of living. The United States has a version of a targeted assistance program in Temporary Assistance for Needy Families but has reduced investment in the program over the past decades.80

In our analysis of the 36 OECD countries, the United States was in a group of countries (also including Mexico, Spain, Greece, and Israel) that would achieve their lowest child poverty rates by targeting family benefits or the sum of family and housing benefits toward poor children. These countries have either low mean family transfers with a low proportion of children receiving them, or they have a take-up rate of family benefits that is much lower for poor than for wealthier families.4

Cash Transfer Programs

Unlike basic income programs or targeted programs, conditional cash transfer (CCT) programs are tied to compliance with a set of predetermined actions or behaviors, the “conditions” of the transfer (e.g., mandatory school attendance or preventive health care appointments).81 Programs that enforce conditionalities can be complex and more costly than basic income transfers because of the required monitoring and compliance, and they require functioning health care and school systems.82 A recent review showed positive effects of CCT programs on some child outcomes, including birth weight and illness or morbidity,83 and mixed effects on child height and weight84 and developmental outcomes.85 In spite of the positive effects of CCTs for child outcomes, evidence from Mexico and Colombia shows that higher cumulative cash transfers are associated with increased body mass index and incidence of overweight, obesity, and hypertension in adults.86,87

CCTs have generally shown greater effects than programs with unconditional cash transfer,85 with the largest effects for programs that were explicitly conditional, had a clear system for monitoring compliance, and had penalties for noncompliance.88 Thus, cash transfer programs appear to be most effective when the receipt of cash is linked with a specific intervention that can maximize the potential impact of the transfer.89 A consistent theme across effective CCT programs is that the cash itself is most effective for improving health and child development when it is provided in a context in which the recipients’ basic needs for essentials like health care services are met, such as within a CCT program rather than an unconditional cash transfer.85

Programs to Promote Work and Earnings

One of the reasons so many children in the United States live in poverty is that earnings in the United States have stagnated over the past several decades, particularly for men and for low-skilled workers.90 Between 1980 and 2014, average pretax income remained fixed at about $16 000 a year for the bottom 50% of the population, whereas it grew by 40% among adults between the median and the 90th percentile, and even more for those at the top of the distribution.91 There are many explanations for these trends in inequality and wage stagnation, including technological change, globalization, a fall in the value of the minimum wage, declines in worker mobility, weakening of unions, and civil society in general.71,92 Many countries have invested in programs to promote better wages, and a National Academies of Sciences, Engineering, and Medicine report proposes raising the US minimum wage from $7.25 to $10.25, with potential for slight variation depending on each state’s existing minimum wage.38 Other nations’ approaches involve increasing minimum wages to be a living wage, which was tested in the Dominican Republic where an apparel factory began a living wage intervention including a 350% wage increase and significant workplace improvements. For adult participants, this experiment showed improved self-rated health,93 reduced depressive symptoms,94 and greater consumption of protein, dairy, soda, and juice95; children’s outcomes were not measured.

REDUCING CHILD POVERTY AND FOOD INSECURITY

Our recommendations for the United States focus specifically on programs and policies that could more directly pull children and families out of poverty and food insecurity. First we discuss our core recommendation, which is increasing investments in 2 existing programs, SNAP and the EITC, and then we follow with additional policy ideas drawn from global examples.

Increased Investment in SNAP and EITC

A recent National Academies of Sciences, Engineering, and Medicine report focused on poverty reduction among US children suggested that increases to SNAP benefits could help to alleviate child poverty and improve outcomes for children. In this same report, the authors specifically recommended options that included increasing SNAP benefits by 20% to 30%, expanding benefits for children aged 12 years or older to be $360 per adolescent per year (given that adolescents have equivalent consumption amounts as adults), and adding a Summer Electronic Benefit Transfer to Children of $180 more per child, pre-K through 12th grade, to support families during the months that school meals are not available.38 To meet the report’s goal of reducing child poverty by at least 50%, the SNAP increases would not be implemented in isolation but along with an expansion of the EITC, Child Care Tax Credit, and housing vouchers. Our analyses suggest that increasing these programs’ benefits for low-income families with children would be likely to help the United States move out of its outlier status in terms of the relationship between social investments and childhood food insecurity. Given the complexities of the food environment, the current political environment, the sheer numbers of families who are food insecure, and SNAP’s current role within the US safety net, we conclude that restricting SNAP benefits or constraining them in any way risks immediate and detrimental effects for low-income and food-insecure households.96

Additional Targeting of Benefits for Families

In the United States, the single greatest transfer of funds to families with children is incorporated through the tax system. For example, families with children filing taxes are eligible for the Child Tax Credit. The bulk of these tax benefits are provided to families with incomes that exceed the poverty rate, and the total cost of these investments in recent years has exceeded the costs of most individual programs for the poor. For example, in 2015, the United States spent more on the child tax exemption and the Child Tax Credit, than on any single transfer targeted specifically to low-income households with children, including EITC, SNAP, or TANF.97 We do not advocate reducing the US investment in any families with children—given that much US social investment is focused on older adults98—but evidence suggests that more effectively and equitably targeting investment to lower-income families is critical for reducing poverty and improving economic well-being for those struggling financially.

Universal Child Allowance

A universal child allowance would provide a stable source of cash income to families with young children.99 One proposal by child development researchers and policymakers in the United States would provide $250 to $300 per month per child according to the age of the child, with more going to children aged 5 years and younger.97 This type of program is estimated to reduce child poverty by about 40% and deep poverty by 50% in the United States, and would cost $66 to $105 billion annually.97

Other OECD countries that have implemented versions of the child benefit include Austria, Canada, Denmark, Finland, France, Germany, Ireland, Luxembourg, the Netherlands, Norway, Sweden, and the United Kingdom.100,101 What the universal child benefit plans have in common is that they are accessible to all families, regardless of whether parents work or what their income may be, and they generally are provided as cash distributions on a regular schedule, rather than as credits or exemptions provided through the tax system.97 Several rigorous studies are currently under way to test various models of a child allowance approach (e.g., Duncan and Noble102) in the United States sponsored by the National Institutes of Health and several foundations; there is no evidence to date about the effectiveness of a child allowance in the US context.

CHALLENGES TO ADOPTING GLOBAL MODELS

While other nations more successfully invest public resources to minimize child poverty and food insecurity than the United States does currently, a number of social challenges, described next, present potential barriers to adopting these global models in the US context.

Prevailing Viewpoints

In the United States, a highly prevalent viewpoint is that social assistance provides a disincentive for the population to engage in the workforce, in spite of evidence to the contrary.103 In the World Values Survey, when respondents were asked to rank themselves from 1 (“Incomes should be made more equal.”) to 10 (“We need larger income differences as incentives for individual effort.”), the mean score in the United States was 5.58 (SD = 2.55)104; in contrast, the score was 4.08 (SD = 2.22) in Germany and 4.88 (SD = 2.53) in Sweden. Similarly, in response to the request to rank from 1 (“Government should take more responsibility to ensure that everyone is provided for.”), to 10 (“People should take more responsibility to provide for themselves.”), the United States scored 6.2 (SD = 2.88), higher than Sweden (mean = 5.52; SD = 2.47), Japan (mean = 3.72; SD = 2.33), and Germany (mean = 4.75; SD = 2.47).

Lack of Political Will

In contrast with other countries, the United States also focuses much more intensely on making sure that welfare recipients are working, with recent legislative and executive branch efforts to enhance SNAP work requirements offering a case in point.105,106 Changes in the distribution of welfare benefits in recent decades may reflect cultural beliefs about which low-income groups are “deserving” of benefits.107 Furthermore, US policy experts recognize that programs targeted more broadly in the population, like Social Security and Medicare, receive greater public and political support, making them stronger and more stable than programs exclusively targeted to the poor.108 While European nations commonly adopt the Precautionary Principle (i.e., in the presence of unknown or uncertain levels of risk, policymakers should err on the side of protecting the public from possible harm) in their approach to addressing health and social challenges, the United States more readily adopts programs to fix problems that already exist.109

Larger Social Issues

A complex web of issues challenges any of the solutions we propose here. For example, the current US political climate, a history of underinvestment in social programs, a lack of political will, and a culture of structural racism have all hindered progress toward protecting vulnerable children and families. Furthermore, broad issues such as incarceration, financial inclusion, female empowerment (especially that of single, low-income mothers), physical and mental health, and lack of political involvement by the working class or vulnerable groups, are all crucially important. Thus, none of the suggested approaches to improving outcomes for vulnerable children and their families can happen without attention to these larger issues.

CONCLUSIONS

The United States consistently spends less on children than other countries do, in spite of the great returns that these investments provide, particularly for the most disadvantaged populations. Currently in the United States, with or without SNAP, many low-income families still struggle to meet their basic needs.110,111 While SNAP offers many critical benefits to US households, such as improved food security, health, and developmental and educational outcomes, and lower health care costs, it has not been enough to prevent food insecurity. While we spend our budget dollars paying for the consequences (e.g., health care costs) of poverty and food insecurity, other nations have developed systems that invest in children and families so that they do not incur these harms or costs.

Our analyses show that child food insecurity and poverty are much lower in many OECD countries and that the United States is an outlier, with higher social spending and higher rates of childhood food insecurity than nearly all other high-income nations. This international comparison highlights ways that other potentially effective solutions implemented in other countries might help further alleviate US childhood poverty and food insecurity. After we considered a variety of potential approaches, our recommendations include increasing SNAP and EITC benefits, establishing additional benefits to support low-income families with young children, and implementing a universal child allowance. More broadly, we recommend following the examples of other high-income countries and increasing US investments in families with children, particularly low-income families, including SNAP as well as support for tax credits, housing, and education.

While SNAP has received a great deal of attention in the public health community in recent years, especially with debates about whether the program should do more to improve participants’ nutrition outcomes, our analysis highlights SNAP’s currently outsized role of alleviating poverty in the US social safety net. We conclude that interventions to ensure that SNAP optimizes nutrition are needed, but that additional financial supports for low-income families with children are needed even more critically. People working to protect US children’s health should unite to ensure that our children are provided with similar opportunities to develop optimally as children growing up in other high-income nations. Once families have access to additional financial support, we can ensure our federal food programs support our nation’s nutrition goals. Overcoming the current US political climate, a history of underinvestment in social programs, a lack of political will, and a culture of structural racism will help to facilitate the achievement of substantial reductions in child poverty and food insecurity. In a nation as wealthy as ours, bold actions are necessary to reduce the existing high rates of poverty and food insecurity among households with children.

ACKNOWLEDGMENTS

We gratefully acknowledge Leah Jennings for her research assistance and the anonymous reviewers for their critical insights about the manuscript.

CONFLICTS OF INTEREST

The authors have no conflicts of interest to disclose.

HUMAN PARTICIPANT PROTECTION

No human participants were involved in the making of this article, and institutional review board approval is not applicable.

Footnotes

See also the AJPH Supplemental Nutrition Assistance Program section, pp. 1631–1677.

REFERENCES

- 1.Cree RA, Bitsko RH, Robinson LR et al. Health care, family, and community factors associated with mental, behavioral, and developmental disorders and poverty among children aged 2–8 years—United States, 2016. MMWR Morb Mortal Wkly Rep. 2018;67(50):1377–1383. doi: 10.15585/mmwr.mm6750a1. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Jensen SKG, Berens AE, Nelson CA., 3rd Effects of poverty on interacting biological systems underlying child development. Lancet Child Adolesc Health. 2017;1(3):225–239. doi: 10.1016/S2352-4642(17)30024-X. [DOI] [PubMed] [Google Scholar]

- 3.Sattler K, Gershoff E. Thresholds of resilience and within- and cross-domain academic achievement among children in poverty. Early Child Res Q. 2019;46:87–96. doi: 10.1016/j.ecresq.2018.04.003. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Organization for Economic Cooperation and Development. Poor children in rich countries why we need policy action. 2018. Available at: http://www.oecd.org/social/family/Poor-children-in-rich-countries-Policy-brief-2018.pdf. Accessed September 26, 2019.

- 5.Devereux S, Sabates-Wheeler R. Transformative social protection. IDS Working Paper 232. Institute of Development Studies. 2004. Available at: https://www.ids.ac.uk/publications/transformative-social-protection. Accessed September 26, 2019.

- 6.Hoynes HW, Schanzenbach DW. Safety net investments in children. Brookings Papers on Economic Activity, Spring 2018. Available at: https://www.brookings.edu/wp-content/uploads/2018/03/HoynesSchanzenbach_Text.pdf. Accessed September 26, 2019.

- 7.Internal Revenue Service. About EITC. March 11, 2019. Available at: https://www.eitc.irs.gov/eitc-central/about-eitc/about-eitc. Accessed August 14, 2019.

- 8.Internal Revenue Service. EITC fast facts. December 20, 2018. Available at: https://www.eitc.irs.gov/partner-toolkit/basic-marketing-communication-materials/eitc-fast-facts/eitc-fast-facts. Accessed August 14, 2019.

- 9.Falk G. Temporary Assistance for Needy Families (TANF): eligibility and benefit amounts in state TANF cash assistance programs. Congressional Research Service. July 2014. Available at: https://fas.org/sgp/crs/misc/R43634.pdf. Accessed August 14, 2019.

- 10.Department of Health and Human Services. HHS FY 2018 budget in brief - ACF - mandatory. May 23, 2017. Available at: https://www.hhs.gov/about/budget/fy2018/budget-in-brief/acf/mandatory/index.html#tanf. Accessed August 14, 2019.

- 11.Oliveira V. The food assistance landscape: FY 2018 annual report. US Department of Agriculture, Economic Research Service. Available at: https://www.ers.usda.gov/webdocs/publications/92896/eib-207.pdf?v=8949.8. Accessed September 26, 2019.

- 12.Crandall-Hollick MN. Child and dependent care tax benefits: how they work and who receives them. Congressional Research Service. March 2018. Available at: https://fas.org/sgp/crs/misc/R44993.pdf. Accessed August 14, 2019.

- 13.Urban Institute Tax Policy Center. Child-related benefits in the federal income tax. January 27. 2014. Available at: https://www.taxpolicycenter.org/publications/child-related-benefits-federal-income-tax/full. Accessed August 19, 2019.

- 14.Urban Institute Tax Policy Center. Tax Policy Center briefing book: key elements of the US tax system. 2016. Available at: https://www.taxpolicycenter.org/briefing-book. Accessed August 19, 2019.

- 15.Center on Budget Policies and Priorities. Federal rental assistance fact sheets. May 2019. Available at: https://www.cbpp.org/research/housing/federal-rental-assistance-fact-sheets#US. Accessed August 14, 2019.

- 16.Henry J. Kaiser Family Foundation. Medicaid spending by enrollment group. 2019. Available at: https://www.kff.org/medicaid/state-indicator/medicaid-spending-by-enrollment-group/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D. Accessed August 16, 2019.

- 17.Henry J. Kaiser Family Foundation. Medicaid spending per enrollee (full or partial benefit) 2019. Available at: https://www.kff.org/medicaid/state-indicator/medicaid-spending-per-enrollee/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D. Accessed August 16, 2019.

- 18.Medicaid and CHIP Payment and Access Commission. EXHIBIT 33: CHIP spending by state. 2019. Available at: https://www.macpac.gov/publication/chip-spending-by-state. Accessed August 19, 2019.

- 19.Chilton M, Rose D. A rights-based approach to food insecurity in the United States. Am J Public Health. 2009;99(7):1203–1211. doi: 10.2105/AJPH.2007.130229. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Fontenot K, Semega J, Kollar M. Income and poverty in the United States: 2017. US Census Bureau. 2018. Available at: https://www.census.gov/library/publications/2018/demo/p60-263.html. Accessed September 26, 2019.

- 21.Chen E, Martin AD, Matthews KA. Socioeconomic status and health: do gradients differ within childhood and adolescence? Soc Sci Med. 2006;62(9):2161–2170. doi: 10.1016/j.socscimed.2005.08.054. [DOI] [PubMed] [Google Scholar]

- 22.Bradley RH, Corwyn RF. Socioeconomic status and child development. Annu Rev Psychol. 2002;53(1):371–399. doi: 10.1146/annurev.psych.53.100901.135233. [DOI] [PubMed] [Google Scholar]

- 23.Evans GW, Kim P. Childhood poverty and health: cumulative risk exposure and stress dysregulation. Psychol Sci. 2007;18(11):953–957. doi: 10.1111/j.1467-9280.2007.02008.x. [DOI] [PubMed] [Google Scholar]

- 24.Shonkoff JP, Boyce WT, McEwen BS. Neuroscience, molecular biology, and the childhood roots of health disparities: building a new framework for health promotion and disease prevention. JAMA. 2009;301(21):2252–2259. doi: 10.1001/jama.2009.754. [DOI] [PubMed] [Google Scholar]

- 25.Victorino CC, Gauthier AH. The social determinants of child health: variations across health outcomes—a population-based cross-sectional analysis. BMC Pediatr. 2009;9(1):53. doi: 10.1186/1471-2431-9-53. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Larson K, Halfon N. Family income gradients in the health and health care access of US children. Matern Child Health J. 2010;14(3):332–342. doi: 10.1007/s10995-009-0477-y. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Case A, Lubotsky D, Paxson C. Economic status and health in childhood: the origins of the gradient. Am Econ Rev. 2002;92(5):1308–1334. doi: 10.1257/000282802762024520. [DOI] [PubMed] [Google Scholar]

- 28.Currie J, Stabile M, Manivong P, Roos L. Child health and young adult outcomes. NBER Working Paper No. W14482. 2008. Available at: http://ssrn.com/abstract=1301930. Accessed September 26, 2019.

- 29.Keating DP, Hertzman C, editors. Developmental Health and the Wealth of Nations: Social, Biological, and Educational Dynamics. New York, NY: The Guilford Press; 2000. [Google Scholar]

- 30.Ringbäck Weitoft GR, Hjern A, Batljan I, Vinnerljung B. Health and social outcomes among children in low-income families and families receiving social assistance—a Swedish national cohort study. Soc Sci Med. 2008;66(1):14–30. doi: 10.1016/j.socscimed.2007.07.031. [DOI] [PubMed] [Google Scholar]

- 31.Siegler V, Al-Hamad A, Blane D. Social inequalities in fatal childhood accidents and assaults: England and Wales, 2001–2003. Health Stat Q. 2010;48(1):3–35. doi: 10.1057/hsq.2010.19. [DOI] [PubMed] [Google Scholar]

- 32.van Oort FV, van der Ende J, Wadsworth ME, Verhulst FC, Achenbach TM. Cross-national comparison of the link between socioeconomic status and emotional and behavioral problems in youths. Soc Psychiatry Psychiatr Epidemiol. 2011;46(2):167–172. doi: 10.1007/s00127-010-0191-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33.Najman JM, Hayatbakhsh MR, Heron MA, Bor W, O’Callaghan MJ, Williams GM. The impact of episodic and chronic poverty on child cognitive development. J Pediatr. 2009;154(2):284–289. doi: 10.1016/j.jpeds.2008.08.052. [DOI] [PubMed] [Google Scholar]

- 34.Anderson SA. Core indicators of nutritional state for difficult-to-sample populations. J Nutr. 1990;120(suppl 11):1559–1600. doi: 10.1093/jn/120.suppl_11.1555. [DOI] [PubMed] [Google Scholar]

- 35.Wight V, Kaushal N, Waldfogel J, Garfinkel I. Understanding the link between poverty and food insecurity among children: does the definition of poverty matter? J Child Poverty. 2014;20(1):1–20. doi: 10.1080/10796126.2014.891973. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 36.Coleman-Jensen A, Rabbitt MP, Gregory CA, Singh A. Household food security in the United States in 2017. US Department of Agriculture, Economic Research Service. 2018. Available at: https://www.ers.usda.gov/publications/pub-details/?pubid=90022. Accessed September 26, 2019.

- 37.Isaacs JB, Lou C, Hahn H, Hong A, Quakenbush C, Steuerle CE. Kids’ share: report on federal expenditure on children through 2017 and future projections. Urban Institute. 2018. Available at: https://www.urban.org/sites/default/files/publication/98725/kids_share_2018_0.pdf. Accessed September 26, 2019.

- 38.National Academies of Sciences, Engineering, and Medicine. A Roadmap to Reducing Child Poverty. Washington, DC: The National Academies Press; 2019. [PubMed] [Google Scholar]

- 39.Farson Gray K, Lauffer S. Characteristics of Supplemental Nutrition Assistance Program households: fiscal year 2015. Alexandria, VA: US Department of Agriculture, Food and Nutrition Service; 2016.

- 40.Nord M, Golla AM. Does SNAP decrease food insecurity? Untangling the self-selection effect. Washington, DC: US Department of Agriculture; 2009.

- 41.Nord M. How much does the Supplemental Nutrition Assistance Program alleviate food insecurity? Evidence from recent programme leavers. Public Health Nutr. 2012;15(5):811–817. doi: 10.1017/S1368980011002709. [DOI] [PubMed] [Google Scholar]

- 42.Mabli J, Worthington J. Supplemental Nutrition Assistance Program participation and child food security. Pediatrics. 2014;133(4):610–619. doi: 10.1542/peds.2013-2823. [DOI] [PubMed] [Google Scholar]

- 43.Caswell JA, Yaktine AL. Supplemental Nutrition Assistance Program: Examining the Evidence to Define Benefit Adequacy. National Academies of Sciences, Engineering and Medicine; 2013. Available at: https://www.nap.edu/catalog/13485/supplemental-nutrition-assistance-program-examining-the-evidence-to-define-benefit. Accessed September 26, 2019. [PubMed] [Google Scholar]

- 44.Seligman HK, Berkowitz SA. Aligning programs and policies to support food security and public health goals in the United States. Annu Rev Public Health. 2019;40(1):319–337. doi: 10.1146/annurev-publhealth-040218-044132. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 45.Gordon AR, Briefel RR, Collins AM, Rowe GM, Klerman JA. Delivering summer Electronic Benefit Transfers for children through the Supplemental Nutrition Assistance Program or the Special Supplemental Nutrition Program for Women, Infants, and Children: benefit use and impacts on food security and foods consumed. J Acad Nutr Diet. 2017;117(3):367–375.e2. doi: 10.1016/j.jand.2016.11.002. [DOI] [PubMed] [Google Scholar]

- 46.Leung CW, Blumenthal SJ, Hoffnagle EE et al. Associations of food stamp participation with dietary quality and obesity in children. Pediatrics. 2013;131(3):463–472. doi: 10.1542/peds.2012-0889. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 47.Gregory CA, Deb P. Does SNAP improve your health? Food Policy. 2015;50:11–19. [Google Scholar]

- 48.Arteaga I, Heflin C, Hodges L. SNAP benefits and pregnancy-related emergency room visits. Popul Res Policy Rev. 2018;37(6):1031–1052. [Google Scholar]

- 49.Heflin C, Arteaga I, Hodges L, Ndashiyme JF, Rabbitt MP. SNAP benefits and childhood asthma. Soc Sci Med. 2019;220:203–211. doi: 10.1016/j.socscimed.2018.11.001. [DOI] [PubMed] [Google Scholar]

- 50.Ojinnaka CO, Heflin C. Supplemental Nutrition Assistance Program size and timing and hypertension-related emergency department claims among Medicaid enrollees. J Am Soc Hypertens. 2018;12(11):e27–e34. doi: 10.1016/j.jash.2018.10.001. [DOI] [PubMed] [Google Scholar]

- 51.Berkowitz SA, Seligman HK, Rigdon J, Meigs JB, Basu S. Supplemental Nutrition Assistance Program (SNAP) participation and health care expenditures among low-income adults. JAMA Intern Med. 2017;177(11):1642–1649. doi: 10.1001/jamainternmed.2017.4841. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 52.Basu S, Berkowitz SA, Seligman H. The monthly cycle of hypoglycemia: an observational claims-based study of emergency room visits, hospital admissions, and costs in a commercially insured population. Med Care. 2017;55(7):639–645. doi: 10.1097/MLR.0000000000000728. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 53.Christian P, Mullany LC, Hurley KM, Katz J, Black RE. Nutrition and maternal, neonatal, and child health [erratum in Semin Perinatol. 2015;39(6):505] Semin Perinatol. 2015;39(5):361–372. doi: 10.1053/j.semperi.2015.06.009. [DOI] [PubMed] [Google Scholar]

- 54.Szanton SL, Samuel LJ, Cahill R et al. Food assistance is associated with decreased nursing home admissions for Maryland’s dually eligible older adults. BMC Geriatr. 2017;17(1):162. doi: 10.1186/s12877-017-0553-x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 55.Samuel LJ, Szanton SL, Cahill R et al. Does the Supplemental Nutrition Assistance Program affect hospital utilization among older adults? The case of Maryland. Popul Health Manag. 2018;21(2):88–95. doi: 10.1089/pop.2017.0055. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 56.Hoynes HW, Patel AJ. Effective policy for reducing inequality? The Earned Income Tax Credit and the distribution of income. J Hum Resources. 2018;53(4):859–890. [Google Scholar]

- 57.Simon D, McInerney M, Goodell S. The Earned Income Tax Credit, poverty, and health. Health Affairs. 2018. Available at: https://www.healthaffairs.org/do/10.1377/hpb20180817.769687/full. Accessed September 26, 2019.

- 58.Hamad R, Rehkopf DH. Poverty, pregnancy, and birth outcomes: a study of the Earned Income Tax Credit. Paediatr Perinat Epidemiol. 2015;29(5):444–452. doi: 10.1111/ppe.12211. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 59.Hamad R, Rehkopf DH. Poverty and child development: a longitudinal study of the impact of the Earned Income Tax Credit. Am J Epidemiol. 2016;183(9):775–784. doi: 10.1093/aje/kwv317. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 60.Rehkopf DH, Strully KW, Dow WH. The short-term impacts of Earned Income Tax Credit disbursement on health. Int J Epidemiol. 2014;43(6):1884–1894. doi: 10.1093/ije/dyu172. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 61.Hoynes HW, Miller DL, Simon D. Income, the Earned Income Tax Credit, and infant health. Am Econ J Econ Policy. 2015;7(1):172–211. [Google Scholar]

- 62.Fox MK, Hamilton WL, Lin B. WIC Program. Washington, DC: US Department of Agriculture, Economic Research Service; 2004. Effects of food assistance and nutrition programs on nutrition and health. Literature review. Vol 3. [Google Scholar]

- 63.Metallinos-Katsaras E, Gorman KS, Wilde P, Kallio J. A longitudinal study of WIC participation on household food insecurity. Matern Child Health J. 2011;15(5):627–633. doi: 10.1007/s10995-010-0616-5. [DOI] [PubMed] [Google Scholar]

- 64.United Nations. Sustainable Development Goals. 2017. Available at: http://www.un.org/sustainabledevelopment/sustainable-development-goals. Accessed September 26, 2019.

- 65.Organization for Economic Cooperation and Development. Public spending is high in many OECD countries. 2019. Available at: http://www.oecd.org/social/soc/OECD2019-Social-Expenditure-Update.pdf. Accessed September 26, 2019.

- 66.Guo G, Harris KM. The mechanisms mediating the effects of poverty on children’s intellectual development. Demography. 2000;37(4):431–447. doi: 10.1353/dem.2000.0005. [DOI] [PubMed] [Google Scholar]

- 67.Yeung WJ, Linver MR, Brooks-Gunn J. How money matters for young children’s development: parental investment and family processes. Child Dev. 2002;73(6):1861–1879. doi: 10.1111/1467-8624.t01-1-00511. [DOI] [PubMed] [Google Scholar]

- 68.Del Boca D, Flinn C, Wiswall M. Household choices and child development. Rev Econ Stud. 2014;81(1):137–185. [Google Scholar]

- 69.Mistry RS, Biesanz JC, Taylor LC, Burchinal M, Cox MJ. Family income and its relation to preschool children’s adjustment for families in the NICHD study of early child care. Dev Psychol. 2004;40(5):727–745. doi: 10.1037/0012-1649.40.5.727. [DOI] [PubMed] [Google Scholar]

- 70.Siddiqi A, Kawachi I, Berkman L, Subramanian SV, Hertzman C. Variation of socioeconomic gradients in children’s developmental health across advanced capitalist societies: analysis of 22 OECD nations. Int J Health Serv. 2007;37(1):63–87. doi: 10.2190/JU86-457P-7656-W4W7. [DOI] [PubMed] [Google Scholar]

- 71.Hoynes HW, Rothstein J. Universal basic income in the US and advanced countries. 2018. Available at: https://gspp.berkeley.edu/assets/uploads/research/pdf/Hoynes-Rothstein-UBI-081518.pdf. Accessed September 26, 2019.

- 72.Organization for Economic Cooperation and Development. Basic income as a policy option: can it add up? 2017. Available at: https://www.oecd.org/els/emp/Basic-Income-Policy-Option-2017.pdf. Accessed September 26, 2019.

- 73.Alaska Department of Revenue. Permanent Fund Dividend Division. 2019. Available at: https://pfd.alaska.gov. Accessed July 24, 2019.

- 74.Jones D, Marinescu I. The labor market impacts of universal and permanent cash transfers: evidence from the Alaska Permanent Fund. NBER Working Paper No. 24312. Cambridge, MA: National Bureau of Economic Research; 2018. [Google Scholar]

- 75.Akee RKQ, Copeland W, Keeler G, Angold A, Costello EJ. Parents’ incomes and children’s outcomes: a quasi-experiment using transfer payments from casino profits. Am Econ J Appl Econ. 2010;2(1):86–115. doi: 10.1257/app.2.1.86. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 76.Kela Preliminary results of the basic income experiment: self-perceived wellbeing improved, during the first year no effects on employment. 2019. Available at https://www.epressi.com/tiedotteet/hallitus-ja-valtio/preliminary-results-of-the-basic-income-experiment-les-resultats-preliminaires-de-lexperience-du-revenu-de-basepredvariteljnye-rezuljtaty-eksperimentaljnoj-koncepcii-bezuslovnogovorlaufige-ergebnisse-des-experiments-zum-grundeinkommen.html. Accessed September 26, 2019.

- 77.Mutual Information System on Social Protection. Comparative tables. 2019. Available at: https://www.missoc.org/missoc-database/comparative-tables. Accessed September 26, 2019.

- 78.Hayashi M. Social protection in Japan: current state and challenges. In: Asher MG, Oum S, Parulian F, editors. Social Protection in East Asia—Current State and Challenges. ERIA Research Project Report 2009-9. Jakarta, Indonesia: Economic Research Institute for ASEAN and East Asia; 2010: 19–54. [Google Scholar]

- 79.The Government of the Republic of Korea. Welfare services guidelines. 2018. Available at: http://www.mohw.go.kr/eng/upload/content_data/2018/2018%20Welfare%20Services%20Guidelines.pdf. Accessed September 26, 2019.

- 80.Lynch KE. Trends in child care spending from the CCDF and TANF. 2016. Available at: https://fas.org/sgp/crs/misc/R44528.pdf. Accessed September 26, 2019.

- 81.Gaarder MM, Glassman A, Todd JE. Conditional cash transfers and health: unpacking the causal chain. J Dev Effect. 2010;2(1):6–50. [Google Scholar]

- 82.Bastagli F, Hagen-Zanker J, Harman L Cash transfers: what does the evidence say? A rigorous review of impacts and the role of design and implementation features. Overseas Development Institute. 2016. Available at: https://www.odi.org/sites/odi.org.uk/files/resource-documents/11316.pdf. Accessed September 26, 2019.

- 83.Bassani DG, Arora P, Wazny K, Gaffey MF, Lenters L, Bhutta ZA. Financial incentives and coverage of child health interventions: a systematic review and meta-analysis. BMC Public Health. 2013;13(suppl 3):S30. doi: 10.1186/1471-2458-13-S3-S30. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 84.Manley J, Gitter S, Slavchevska V. How effective are cash transfers at improving nutritional status? World Dev. 2013;48:133–155. [Google Scholar]

- 85.de Walque D, Fernald LCH, Gertler P, Hidrobo M. Cash transfers and child and adolescent development. In: Bundy DAP, Silva N, Horton S, Jamison DT, Patton GC, editors. Child and Adolescent Health and Development. 3rd ed. Washington, DC: World Bank; 2017. [PubMed] [Google Scholar]

- 86.Fernald LCH, Gertler PJ, Hou X. Cash component of conditional cash transfer program is associated with higher body mass index and blood pressure in adults. J Nutr. 2008;138(11):2250–2257. doi: 10.3945/jn.108.090506. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 87.Forde I, Chandola T, Garcia S, Marmot MG, Attanasio O. The impact of cash transfers to poor women in Colombia on BMI and obesity: prospective cohort study. Int J Obes (Lond). 2012;36(9):1209–1214. doi: 10.1038/ijo.2011.234. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 88.Baird S, Ferreira FHG, Özler B, Woolcock M. Conditional, unconditional and everything in between: a systematic review of the effects of cash transfer programmes on schooling outcomes. J Dev Effect. 2014;6(1):1–43. [Google Scholar]

- 89.Fernald LCH, Gertler PJ, Neufeld LM. 10-year effect of Oportunidades, Mexico’s conditional cash transfer programme, on child growth, cognition, language, and behaviour: a longitudinal follow-up study. Lancet. 2009;374(9706):1997–2005. doi: 10.1016/S0140-6736(09)61676-7. [DOI] [PubMed] [Google Scholar]

- 90.Autor DH. Skills, education, and the rise of earnings inequality among the “other 99 percent. Science. 2014;344(6186):843–851. doi: 10.1126/science.1251868. [DOI] [PubMed] [Google Scholar]

- 91.Piketty T, Saez E, Zucman G. Distributional national accounts: methods and estimates for the United States. Q J Econ. 2018;133(2):553–609. [Google Scholar]

- 92.Kochan TA, Riordan CA. Employment relations and growing income inequality: causes and potential options for its reversal. J Ind Relat. 2016;58(3):419–440. [Google Scholar]

- 93.Landefeld JC, Burmaster KB, Rehkopf DH et al. The association between a living wage and subjective social status and self-rated health: a quasi-experimental study in the Dominican Republic. Soc Sci Med. 2014;121:91–97. doi: 10.1016/j.socscimed.2014.09.051. [DOI] [PubMed] [Google Scholar]

- 94.Burmaster KB, Landefeld JC, Rehkopf DH et al. Impact of a private sector living wage intervention on depressive symptoms among apparel workers in the Dominican Republic: a quasi-experimental study. BMJ Open. 2015;5(8):e007336. doi: 10.1136/bmjopen-2014-007336. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 95.Rehkopf DH, Burmaster K, Landefeld JC et al. The impact of a private sector living wage intervention on consumption and cardiovascular disease risk factors in a middle income country. BMC Public Health. 2018;18(1):179. doi: 10.1186/s12889-018-5052-2. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 96.Seligman HK, Basu S. an unhealthy food system, what role should SNAP play? PLoS Med. 2018;15(10):e1002662. doi: 10.1371/journal.pmed.1002662. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 97.Shaefer HL, Collyer S, Duncan G et al. A universal child allowance: a plan to reduce poverty and income instability among children in the United States. RSF. 2018;4(2):22–42. doi: 10.7758/RSF.2018.4.2.02. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 98.Congressional Budget Office. The budget and economic outlook: 2019 to 2029. 2019. Available at: https://www.cbo.gov/system/files?file=2019-01/54918-Outlook.pdf. Accessed September 26, 2019.

- 99.Smeeding T, Thevenot C. Addressing child poverty: how does the United States compare with other nations? Acad Pediatr. 2016;16(3, suppl):S67–S75. doi: 10.1016/j.acap.2016.01.011. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 100.Matthews D. Sweden pays parents for having kids—and it reaps huge benefits. Why doesn’t the US? Vox. 2016. Available at: https://www.vox.com/2016/5/23/11440638/child-benefit-child-allowance. Accessed September 26, 2019.

- 101.Garfinkel I, Harris D, Waldfogel J, Wimer C. Doing more for our children: modeling a universal child allowance or more generous child tax credit. 2016. Available at: https://tcf.org/content/report/doing-more-for-our-children. Accessed September 26, 2019.

- 102.Duncan G, Noble K. Baby’s First Years. US National Library of Medicine. 2018. Available at: https://clinicaltrials.gov/ct2/show/NCT03593356. Accessed September 26, 2019.

- 103.Banerjee AV, Hanna R, Kreindler GE, Olken BA. Debunking the stereotype of lazy welfare recipient: evidence from cash transfer programs. World Bank Res Obs. 2017;32(2):155–184. [Google Scholar]

- 104.World Values Survey. 2019. Available at: http://www.worldvaluessurvey.org/WVSOnline.jsp. Accessed September 26, 2019.

- 105.US Department of Agriculture, Food and Nutrition Service. Supplemental Nutrition Assistance Program: requirements for able-bodied adults without dependents. 2018-28059. 84 FR 980. 2019. Available at: https://www.federalregister.gov/documents/2019/02/01/2018-28059/supplemental-nutrition-assistance-program-requirements-for-able-bodied-adults-without-dependents. Accessed September 26, 2019.

- 106. Agriculture and Nutrition Act of 2018, 115th Congress. HR 2, Pub L No. 115-334 (2018).

- 107.Moffitt RA. The deserving poor, the family, and the US welfare system. Demography. 2015;52(3):729–749. doi: 10.1007/s13524-015-0395-0. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 108.Kirp DL. Kids First: Five Big Ideas for Transforming Children’s Lives and America’s Future. New York, NY: Public Affairs; 2011. [Google Scholar]

- 109.Vogel D. Regulating Health, Safety, and Environmental Risks in Europe and the United States. Princeton, NJ: Princeton University Press; 2012. [Google Scholar]

- 110.Edin K, Boyd M, Mabli J SNAP food security in-depth interview study. Mathematica Policy Research Reports. March 2013. Available at: http://ideas.repec.org/p/mpr/mprres/cad6b24b82bd4318b8459c8ef2cd0ff7.html. Accessed September 26, 2019.

- 111.Gosliner W, Shah H. Participant voices: examining issue, program, and policy priorities of SNAP-Ed eligible adults in California. Renew Agric Food Syst. 2019. epub June 24, 2019:1–9. Available at: . Accessed September 26, 2019. [DOI]