Abstract

Introduction

Previous research has reported switching from traditional Medicare (TM) to Medicare Advantage (MA) plans increased from 2006 to 2011 at the aggregate level, and switching from MA plans to TM also increased. However, little is known about switching behavior among individuals with specific chronic diseases.

Objective

To examine disease-specific switching patterns between TM and MA to understand the impact on MA plans.

Methods

Using the 2006 to 2012 Medicare Current Beneficiary Survey, we examined disease-specific switching rates between TM and MA and disease-specific ratios of mean baseline total Medicare expenditures of beneficiaries remaining in the same plan (stayers) vs those switching to another plan (switchers), respectively. We focused on beneficiaries with 1 or more of 10 incident diagnoses.

Results

Beneficiaries with a new diagnosis of Alzheimer disease and related dementias, hypertension, and psychiatric disorders had relatively high rates of switching into MA plans and low rates of switching out of MA plans. Among those with new diagnoses of psychiatric disorders and diabetes, more costly beneficiaries (those with higher costs) switched into MA plans. For cancer, more costly beneficiaries remained in MA plans.

Conclusion

Together, these results suggest that MA plans may have not only higher caseloads but also a more costly case mix of beneficiaries with certain diseases than historically was the case. Our findings can help inform MA plans to understand their beneficiaries’ disease burden and prepare for provision of relevant services.

Keywords: disease burden, Medicare Advantage, plan switching, traditional Medicare

INTRODUCTION

For several decades, policymakers have promoted managed care as one way to improve the quality of health care while also containing costs. Because this approach creates incentives to encourage preventive care and better care coordination, it could be especially helpful in caring for Medicare beneficiaries, 68.4% of whom had 2 or more chronic conditions and 36.4% had 4 or more chronic conditions in 2010.1 Since 1983, the Centers for Medicare and Medicaid Services has encouraged Medicare beneficiaries to enroll in Medicare managed care plans, known as Medicare Advantage (MA) plans, as an alternative to Medicare fee-for-service, known as traditional Medicare (TM).2 Hence, identifying switching patterns for beneficiaries between TM and MA to predict their future caseload is of particular interest to MA plans for whom capitation requires that they bear the full risk of costs for their enrolled population.

Because MA plans have different coverage and benefit levels compared with TM, we may expect selection into MA plans from beneficiaries attracted to the array of services not available through TM. MA plans must provide the same services covered by TM, and the actuarial value of the total benefits package must be at least equivalent to TM’s benefits.3 However, MA plans have the flexibility to vary benefit designs. For a particular service, cost-sharing in MA plans could be greater or less than cost-sharing in TM. Moreover, MA plans could restrict physician networks or offer additional services. Therefore, MA plans typically offer more generous benefits and lower cost-sharing than TM in general, whereas MA plans tend to have limited physician networks and require higher cost-sharing for costly services.4 Because MA plans are paid on a capitated basis, these flexible benefit designs are one method of avoiding high-cost beneficiaries.5,6

Previous research reported that the likelihood that MA plans avoid sick or high-cost beneficiaries in TM was drastically decreased mainly because of changes in regulatory policies that took place in 2004. Several studies have found increased switching from TM to MA plans among beneficiaries in poorer health.7–10 These studies also found that differences in baseline total Medicare expenditures between beneficiaries remaining in TM and those switching into MA narrowed substantially.7–9 Furthermore, enrollment in MA plans has grown from 5.3 million in 2004 to 19.0 million in 2017, reaching a historic high of MA’s penetration of almost 33% of the Medicare population.11 Together, these data suggest that MA plans have larger caseloads with patients who have greater medical need than previously.

Conversely, more recent evidence suggests that switching out of MA plans among sick or high-cost beneficiaries in MA plans increased. Several studies have shown that a high proportion of MA beneficiaries with chronic conditions or those in need of costly services dropped out of MA plans and switched back to TM.5,12–14 Qualitative studies have found that high cost and limited access to specialty care were the most important considerations among MA beneficiaries switching to TM.15,16 These findings suggest that the need for medical care among patients enrolled in MA plans may be greater than is evident from examining enrollment patterns. They also raise concern that we may see poorer health outcomes among older adults; MA plans typically provide better care coordination and thus tend to perform better for beneficiaries with chronic conditions.17

The extant literature offers limited evidence toward understanding switching patterns between TM and MA. First, little is known about whether beneficiaries with specific diagnoses are more likely to switch between TM and MA. Because MA plans can design disease-specific benefits, switching patterns between TM and MA could vary by disease. Several studies have examined switching behaviors between TM and MA, with results reported by age, dual eligibility, or county-level MA penetration rate,14,18 but not by disease. Second, most of the previous studies have examined either switching into MA plans or switching out of MA plans.7–9,12–14,18 However, findings from the studies are unlikely to be comparable to each other because they have focused on different populations in different settings. Thus, little is known about a comprehensive picture for switching patterns between TM and MA and implications for disease burden on MA plans.

In this study, we examined the switching patterns between TM and MA among beneficiaries with highly prevalent chronic diseases. Specifically, we examined disease-specific switching rates between TM and MA and disease-specific ratios of mean baseline total Medicare expenditures for beneficiaries remaining in the same plan (stayers) and those switching to another plan (switchers), respectively. We focused on beneficiaries with newly diagnosed diseases because incidence may lead beneficiaries to reassess their insurance coverage.

METHODS

Data

We used rolling 3-year panel data from the Medicare Current Beneficiary Survey (MCBS) between 2006 and 2012. The MCBS is particularly well suited for studying switching patterns between TM and MA. First, the MCBS provides a nationally representative sample of the Medicare population with a 4-year follow-up. We can therefore identify a panel on the basis of disease incidence and track enrollment in TM and MA over time. Second, the MCBS provides data on Medicare expenditures for both TM and MA beneficiaries. Although Medicare claims data offer complete information from Medicare expenditures for all TM beneficiaries in the sample, the claims data for MA beneficiaries are not publicly available. However, the MCBS obtains information on Medicare expenditures for all MA beneficiaries through survey. This allows us to compare Medicare expenditures across disease categories among TM and MA beneficiaries.

Study Population

Our study population included beneficiaries with 3 years of continuous Medicare enrollment (both Medicare Parts A and B benefits) and any of the following diseases and conditions newly diagnosed in year 2: Psychiatric disorders, asthma/chronic obstructive pulmonary disease (COPD), cancer, osteoporosis/arthritis, Alzheimer disease and related dementia (ADRD), hardening of arteries, heart attack, diabetes, hypertension, and stroke. Disease incidence was identified through responses to the following question: Has a doctor ever told you that you had [this specific disease] since last interview? The MCBS collects information on about 20 diseases for each respondent. Among these diseases, we chose the 10 above-mentioned diseases/conditions because they are commonly observed among elderly adults and documented to be among the most important drivers of high medical costs. Using data from years 1 and 2, we determined whether a disease was newly diagnosed in year 2. We included all Medicare beneficiaries as a reference group to compare switching patterns of beneficiaries with each of the newly diagnosed diseases.

For each disease cohort, we excluded beneficiaries dually eligible for Medicare and Medicaid as well as beneficiaries eligible for Medicare because of disability or end-stage renal disease because of differing rules determining plan switching and reimbursement for these groups. We also excluded beneficiaries who switched between TM and MA during midyear of years 2 and 3 because of difficulties in identifying which plan they were in when they were diagnosed and in comparing annual expenditures of midyear switchers. Finally, we excluded those who were enrolled in different plans in years 1 and 2 because their plan switching might be attributable to factors other than disease incidence.

We created 4 mutually exclusive groups: 1) TM stayers (continuously enrolled in TM during years 2 and 3); 2) TM-to-MA switchers (continuously enrolled in TM during year 2, switched to MA during year 3); 3) MA stayers (continuously enrolled in MA during years 2 and 3); and 4) MA-to-TM switchers (continuously enrolled in MA during year 2, switched to TM during year 3).

Outcome Measures

We had 2 outcome measures. The first outcome was the switching rate between TM and MA between years 2 and 3. The switching rate was calculated by dividing the number of beneficiaries who switched in year 3 by the number of beneficiaries in the plan in year 2. The second outcome was the ratio of mean total Medicare expenditures in year 2 of stayers to switchers. Total expenditures for TM beneficiaries were calculated by summing Part A and B expenditures reported in claims, and total expenditures for MA beneficiaries were summed across the self-reported expenditures from the beneficiary or proxy survey responses. All expenditures were adjusted to 2012 US dollars using the Consumer Price Index for All Urban Consumers. Sample weights provided by the MCBS were used to produce nationally representative results.

Statistical Analysis

For each disease cohort, we estimated numbers of beneficiaries initially enrolled in TM and MA. We also estimated the proportion of beneficiaries in MA plans by disease. Then, we examined the disease-specific switching rates between TM and MA and the disease-specific ratios of mean total Medicare expenditures in year 2 of stayers to switchers among beneficiaries initially enrolled in TM and MA, respectively.

RESULTS

Share of Beneficiaries in Medicare Advantage Plans

In 2007 to 2011, a total of 22.6% of all Medicare beneficiaries enrolled in MA plans (Table 1). This proportion was variable by disease. Compared with all Medicare beneficiaries, beneficiaries with a new diagnosis of ADRD, heart attack, hardening of arteries, psychiatric disorders, cancer, and stroke had relatively lower enrollment rates in MA plans (ranging from 18.39% to 22.41% for cancer and ADRD, respectively). However, beneficiaries with newly diagnosed hypertension, osteoporosis/arthritis, asthma/COPD, and diabetes had relatively higher enrollment rates in MA plans (ranging from 22.91% to 24.80% for osteoporosis/arthritis and asthma/COPD, respectively).

Table 1.

Numbers of Medicare beneficiaries initially enrolled in traditional Medicare and Medicare Advantage, by type of disease

| Type of disease | No. initially enrolled in TM | No. initially enrolled in MA | Percentage of total no. of beneficiaries who initially enrolled in MA |

|---|---|---|---|

| All Medicare beneficiaries (N = 32,693) | 25,300 | 7393 | 22.61 |

| ADRD | 471 | 136 | 22.41 |

| Heart attack | 1074 | 288 | 21.15 |

| Hardening of arteries | 383 | 98 | 20.37 |

| Hypertension | 1191 | 354 | 22.91 |

| Osteoporosis/arthritis | 3299 | 969 | 22.70 |

| Psychiatric disorders | 416 | 110 | 20.91 |

| Cancer | 985 | 222 | 18.39 |

| Asthma/COPD | 558 | 184 | 24.80 |

| Stroke | 277 | 76 | 21.53 |

| Diabetes | 724 | 235 | 24.50 |

ADRD = Alzheimer disease and related dementia; COPD = chronic obstructive pulmonary disease; MA = Medicare Advantage; TM = traditional Medicare.

Switching Patterns

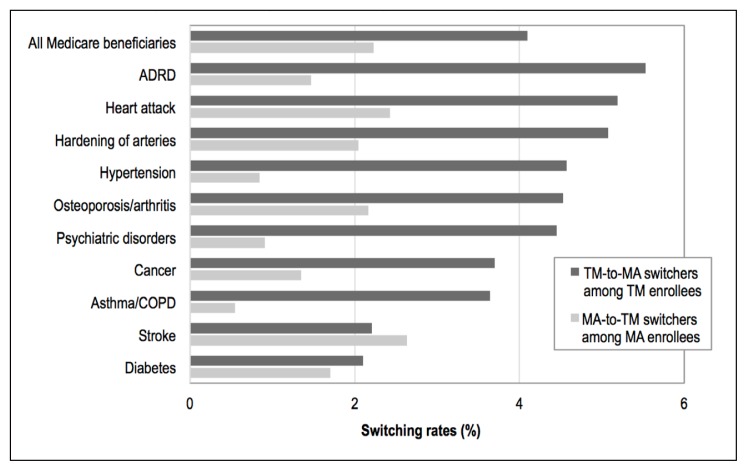

Among all Medicare beneficiaries, the rate of switching into MA plans was higher than the rate of switching out of MA plans (4.10% and 2.23%, respectively; Figure 1). This pattern held for almost all diseases. For stroke, however, the rate of switching into MA plans was slightly lower than the rate of switching out of MA plans (2.21% and 2.63%, respectively).

Figure 1.

Comparison of switching rates of Medicare beneficiaries with newly diagnosed diseases between traditional Medicare and Medicare Advantage, by type of disease.a

a The number of MA-to-TM switchers with a new diagnosis of stroke/brain hemorrhage was 0.

ADRD = Alzheimer disease and related dementia; COPD = chronic obstructive pulmonary disease; MA = Medicare Advantage; TM = traditional Medicare.

There was sizable variation in the rate of switching into MA plans by disease. Compared with all Medicare beneficiaries, beneficiaries with newly diagnosed ADRD, heart attack, hardening of arteries, hypertension, osteoporosis/arthritis, and psychiatric disorders had higher rates of switching into MA plans (ranging from 4.45% to 5.53% for psychiatric disorders and ADRD, respectively). However, the rate of switching into MA plans was relatively low among beneficiaries with newly diagnosed cancer, asthma/COPD, stroke, and diabetes (ranging from 2.10% to 3.70% for diabetes and cancer, respectively).

Although the rate of switching out of MA plans was also variable by disease, this variation was considerably smaller than the variation in the rate of switching into MA plans. Beneficiaries with newly diagnosed stroke and heart attack had relatively high rates of switching out of MA plans (2.63% and 2.43%, respectively), but these switching rates were not substantially higher than the rate of switching out of MA plans for all Medicare beneficiaries (2.23%). For beneficiaries with all other newly diagnosed diseases, however, the rate of switching out of MA plans was close to or lower than 2.0%. The lowest switching rates were observed among beneficiaries with newly diagnosed asthma/COPD, hypertension, and psychiatric disorders (0.54%, 0.85%, and 0.91%, respectively). Also, beneficiaries with newly diagnosed cancer, ADRD, and diabetes were also notable because they had relatively low rates of switching out of MA plans (1.35%, 1.47%, and 1.70%, respectively).

In sum, for newly diagnosed cases of ADRD, hypertension, and psychiatric disorders, beneficiaries were more likely to switch into MA plans and less likely to switch out of MA plans.

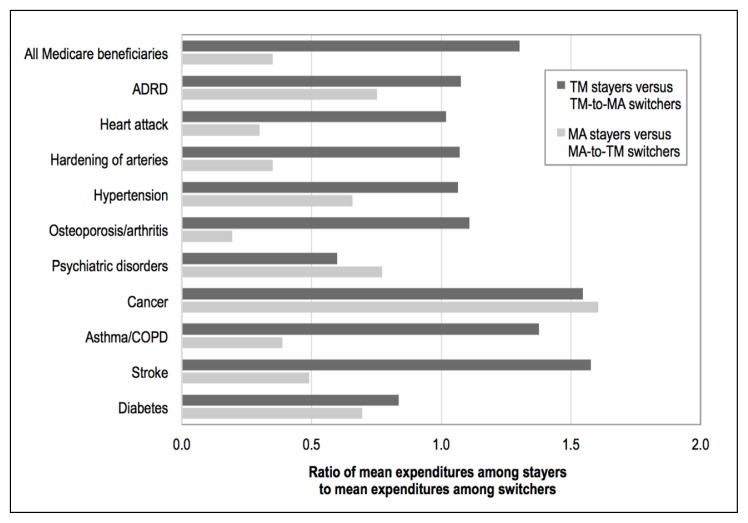

Expenditure Patterns

For all Medicare beneficiaries, on average, TM stayers cost 1.30 times that of the TM-to-MA switchers the year before switching, whereas MA stayers cost only 0.35 times that of MA-to-TM switchers (Figure 2). This pattern held across almost all diseases, with the exceptions of psychiatric disorders and cancer. For beneficiaries with newly diagnosed psychiatric disorderss, TM stayers cost less than TM-to-MA switchers (0.60 times). For beneficiaries with newly diagnosed cancer, MA stayers cost more than MA-to-TM switchers (1.60 times).

Figure 2.

Comparison of mean baseline year Medicare expenditures of Medicare beneficiaries with newly diagnosed diseases between plan “switchers” and “stayers,” by type of disease.a

a The number of MA-to-TM switchers with a new diagnosis of stroke/brain hemorrhage was 0.

ADRD = Alzheimer disease and related dementia; COPD = chronic obstructive pulmonary disease; MA = Medicare Advantage; TM = traditional Medicare.

The ratio of mean expenditures of TM stayers to TM-to-MA switchers was variable by disease. In particular, beneficiaries with newly diagnosed psychiatric disorders and diabetes were of interest because the ratio of mean expenditures of TM stayers to TM-to-MA switchers was lower than 1 (0.60 and 0.84), suggesting that more costly beneficiaries (those with higher costs) switched to MA plans. For beneficiaries with newly diagnosed stroke, cancer, asthma/COPD, osteoporosis/arthritis, ADRD, hardening of arteries, hypertension, and heart attack; however, the ratio of mean expenditures of TM stayers to TM-to-MA switchers was higher than 1 (ranging from 1.02 to 1.58 for heart attack and stroke, respectively), indicating that less costly beneficiaries switched to MA plans. The highest ratios were observed among beneficiaries with newly diagnosed stroke, cancer, and asthma/COPD (1.58, 1.55, and 1.38, respectively).

A different disease-specific pattern was found in the ratio of mean expenditures of MA stayers to MA-to-TM switchers. Beneficiaries with newly diagnosed cancer were of particular interest because cancer was the only disease with the ratio of mean expenditures of MA stayers to MA-to-TM switchers higher than 1 (1.60), indicating that more costly beneficiaries remained in MA plans. For beneficiaries with newly diagnosed all other diseases, the ratio of mean expenditures of MA stayers to MA-to-TM switchers was lower than 1, suggesting that more costly beneficiaries switched out of MA plans. Among them, however, the extent of the ratio varied by disease. Beneficiaries with newly diagnosed psychiatric disorders, ADRD, diabetes, and hypertension had relatively higher ratios of mean expenditures of MA stayers to MA-to-TM switchers (0.77, 0.75, 0.70, and 0.66, respectively) than those with newly diagnosed stroke, asthma/COPD, hardening of arteries, heart attack, and osteoporosis/arthritis (0.49, 0.39, 0.35, 0.30, and 0.19, respectively).

In sum, among beneficiaries with newly diagnosed psychiatric disorders and diabetes, more costly beneficiaries switched into MA plans. For cancer, more costly beneficiaries remained in MA plans.

DISCUSSION

Using the MCBS, a nationally representative study of elderly Medicare beneficiaries, we examined disease-specific variations in plan-switching patterns and baseline expenditure differences of stayers and switchers in 2007 through 2011. It is worth noting that our findings should be interpreted with caution because our analysis is based on descriptive statistics without performing statistical testing.

This study offers a comprehensive picture of plan-switching behavior between TM and MA. First, we found that the rate of switching into MA plans was higher than the rate of switching out of MA plans overall and across almost all disease categories. This finding means that although more beneficiaries switched to MA plans, fewer beneficiaries switched out of MA plans, indicating that MA plans are facing increasing caseloads of exiting beneficiaries overall and that MA growth is not caused by just new Medicare beneficiaries. Furthermore, this switching pattern varied by disease, suggesting that a different case mix is being served in MA plans. Specifically, the rate of switching into MA plans was relatively high for beneficiaries with newly diagnosed ADRD, heart attack, hardening of arteries, hypertension, osteoporosis/arthritis, and psychiatric disorders. On the other hand, the rate of switching out of MA plans was relatively low for beneficiaries with newly diagnosed asthma/COPD, hypertension, psychiatric disorders, cancer, and ADRD. Together, these findings suggest that MA plans serve a different population than TM does, with a higher proportion of beneficiaries with these common chronic diseases, especially ADRD, hypertension, and psychiatric disorders, leading to a different disease burden relative to TM.

This study also provides cost implications of the plan-switching behavior for MA plans. We found that beneficiaries remaining in TM or those switching out of MA plans were higher cost than those switching into MA plans or those remaining in MA plans, respectively, overall and among almost all disease categories. This finding indicates that relatively less costly beneficiaries tend to enroll in MA plans. Although this pattern held for almost all disease categories, there were variations in the magnitude of the relative expenditure difference by disease. For beneficiaries with newly diagnosed psychiatric disorders and diabetes, more costly beneficiaries switched into MA plans. For cancer, on the other hand, more costly beneficiaries remained in MA plans. These findings suggest that MA plans serve a more costly case mix of populations with psychiatric disorders, diabetes, and cancer.

Our findings provide key implications for MA plans to recognize the disease burden of their enrollees and to prepare for an increased caseload. Specifically, MA plans should expect a growing prevalence of ADRD, hypertension, and psychiatric disorders. In particular, psychiatric disorders are of interest because the beneficiaries covered by MA plans were relatively higher cost than those covered by TM. This finding indicates that MA may have not only higher caseloads but also a more costly case mix of beneficiaries with this disease than TM does. Although overall the prevalence of diabetes cases in MA plans was relatively low, high-cost beneficiaries with newly diagnosed diabetes were more likely to switch into MA plans, indicating that MA plans may have a more costly case mix of beneficiaries with diabetes. A similar trend was observed among beneficiaries with newly diagnosed cancer. Whereas the prevalence of cancer in MA plans was relatively low, high-cost beneficiaries were more likely to remain in MA plans, suggesting that MA plans may serve a more costly case mix of beneficiaries with cancer. Together, our findings suggest the need for MA plans to focus on cost-effective disease management protocols, which could include establishing physician networks, designing value-based drug prescription benefits, or including behavioral interventions, to satisfy health care needs for beneficiaries with these diseases.

Our study has several limitations. First, we examined only descriptive statistics without adjusting for potential confounding factors such as individual-level medical and socioeconomic factors. Hence, our findings should be interpreted with caution. Moreover, information on diagnoses is based on self-report, and therefore incidence rates may not be clinically accurate. However, there is no reason to expect that there are any differences in self-reported incidence between beneficiaries enrolled in either TM or MA, so any errors should be in overall illness rates rather than by plan. We also used self-reports to estimate total Medicare expenditures for MA beneficiaries. Because self-reported expenditures tend to be underreported,19 total Medicare expenditures for MA beneficiaries are not directly comparable with total Medicare expenditures for TM beneficiaries. To address this potential source of bias, we reported relative expenditures within insurance plans rather than attempt comparisons between TM and MA. Furthermore, although the magnitude of the bias might be greater for beneficiaries with more severe health conditions, we did not adjust for demographic and diagnostic factors. However, this issue might be mitigated to some extent because we compared total Medicare expenditures for beneficiaries with new diagnoses of the same disease, whose health conditions might be similar. Another limitation was small sample sizes. This raises a concern about whether our sample size was sufficiently large to detect statistical significance. Findings from our power analysis suggest that we could detect significance for switches that are at least 20%. Finally, the most recent year of data available to us was 2012. Thus, additional examination with a larger sample from more recent data is warranted.

CONCLUSION

This study found that beneficiaries with newly diagnosed ADRD, hypertension, and psychiatric disorders had relatively high rates of switching into MA plans and low rates of switching out of MA plans. For psychiatric disorders and diabetes, more costly beneficiaries tended to switch into MA plans. For cancer, more costly beneficiaries were more likely to remain in MA plans. These patterns suggest that MA plans are now serving a higher proportion of populations with certain diseases as well as a more costly case mix of the populations than they used to. Future studies should examine whether MA plans have well-established care provisions and well-designed benefits to meet the health care needs of these populations.

Acknowledgments

This study was supported by the Department of Health Services at the University of Washington and the National Institute of Health (R01 AG049815).

Kathleen Louden, ELS, of Louden Health Communicatins performed a primary copy edit.

Footnotes

Disclosure Statement

The author(s) have no conflicts of interest to disclose.

References

- 1.Lochner KA, Cox CS. Prevalence of multiple chronic conditions among Medicare beneficiaries, United States, 2010. Prev Chronic Dis. 2013 Apr 25;10:E61. doi: 10.5888/pcd10.120137. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Report to the Congress: Medicare and the health care delivery system [Internet: fact sheet] Washington, DC: Medicare Payment Advisory Commission; 2017. Jun, [cited 2019 Aug 5]. Available from: www.medpac.gov/docs/default-source/fact-sheets/june2017_factsheet.pdf?sfvrsn=0. [Google Scholar]

- 3.Report to Congress: Medical payment policy [Internet] Washington, DC: Medicare Payment Advisory Commission; 2017. [cited 2019 Aug 8]. Available from: http://medpac.gov/docs/default-source/reports/mar17_entirereport.pdf. [Google Scholar]

- 4.Jacobson GA, Trilling A, Neuman T, Damico A, Gold M. Medicare Advantage hospital networks: How much do they vary? [Internet] San Francisco, CA: Kaiser Family Foundation; 2016. Jun 20, [cited 2019 Aug 5]. Available from: www.kff.org/medicare/report/medicare-advantage-hospital-networks-how-much-do-they-vary/ [Google Scholar]

- 5.Park S, Basu A, Coe NB, Khalil F. NBER Working Paper no 24038 [Internet] National Bureau of Economic Research; 2017. Nov, Service-level selection: Strategic risk selection in Medicare Advantage in response to risk adjustment. [cited 2019 Aug 5]. Available from: www.nber.org/papers/w24038. [Google Scholar]

- 6.Han T, Lavetti K. Does Part D abet advantageous selection in Medicare Advantage? J Health Econ. 2017 Dec;56:368–82. doi: 10.1016/j.jhealeco.2017.06.007. [DOI] [PubMed] [Google Scholar]

- 7.Newhouse JP, Price M, Huang J, McWilliams JM, Hsu J. Steps to reduce favorable risk selection in Medicare Advantage largely succeeded, boding well for health insurance exchanges. Health Aff (Millwood) 2012 Dec;31(12):2618–28. doi: 10.1377/hlthaff.2012.0345. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.McWilliams JM, Hsu J, Newhouse JP. New risk-adjustment system was associated with reduced favorable selection in Medicare Advantage. Health Aff (Millwood) 2012 Dec;31(12):2630–40. doi: 10.1377/hlthaff.2011.1344. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Newhouse JP, Price M, McWilliams JM, Hsu J, McGuire TG. How much favorable selection is left in Medicare Advantage? Am J Health Econ. 2015 Winter;1(1):1–26. doi: 10.1162/AJHE_a_00001. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Morrisey MA, Kilgore ML, Becker DJ, Smith W, Delzell E. Favorable selection, risk adjustment, and the Medicare Advantage program. Health Serv Res. 2013 Jun;48(3):1039–56. doi: 10.1111/1475-6773.12006. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Jacobson G, Damico A, Neuman T, Gold M. Medicare Advantage 2017 Spotlight: Enrollment market update [Internet] San Francisco, CA: Kaiser Family Foundation; 2017. Jun 6, [cited 2019 Aug 5]. Available from: www.kff.org/medicare/issue-brief/medicare-advantage-2017-spotlight-enrollment-market-update/ [Google Scholar]

- 12.Rahman M, Laura K, Trivedi AN, Mor V. High-cost patients had substantial rates of leaving Medicare Advantage and joining Traditional Medicare. Health Aff (Millwood) 2015 Oct;34(10):1675–81. doi: 10.1377/hlthaff.2015.0272. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Goldberg EM, Trivedi AN, Mor V, Jung H-Y, Rahman M. Favorable risk selection in Medicare Advantage: Trends in mortality and plan exits among nursing home beneficiaries. Med Care Med Res. 2017 Dec;74(6):736–49. doi: 10.1177/1077558716662565. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Meyers DJ, Belanger E, Joyce N, McHugh J, Rahman M, Mor V. Analysis of drivers of disenrollment and plan switching among Medicare Advantage beneficiaries. JAMA Intern Med. 2019 Feb 25; doi: 10.1001/jamainternmed.2018.7639. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.McCormack L, Squire C, Morton J, Lynch J, Mobley L, Salib P. RTI Project 7659. Research Triangle Park NC: RTI International; 2005. Jun 27, Disenrollment from Medicare Advantage health plans: A qualitative assessment [Internet] [cited 2019 Aug 5]. Available from: www.cms.gov/Research-Statistics-Data-and-Systems/Research/CAHPS/downloads/2004CAHPSDisenrolSvyFocusGrpsFinalRPT.pdf. [Google Scholar]

- 16.Medicare Advantage: CMS should use data on disenrollment and beneficiary health status to strengthen oversight [Internet] Washington DC: Government Accountability Office; 2017. Apr, Publication no. GAO-17-393. [cited 2019 Aug 5]. Available from: www.gao.gov/assets/690/684386.pdf. [Google Scholar]

- 17.Medicare Advantage achieves cost-effective care and better outcomes for beneficiaries with chronic conditions relative to fee-for-service Medicare [Internet] Washington, DC: Avalere Health; 2018. [cited 2019 Aug 8]. Available from: https://avalere.com/press-releases/medicare-advantage-achieves-better-health-outcomes-and-lower-utilization-of-high-cost-services-compared-to-fee-for-service-medicare. [Google Scholar]

- 18.Jacobson GA, Neuman P, Damico A. At least half of new Medicare advantage enrollees had switched from traditional Medicare during 2006–11. Health Aff (Millwood) 2015 Jan;34(1):48–55. doi: 10.1377/hlthaff.2014.0218. [DOI] [PubMed] [Google Scholar]

- 19.Eppig FJ, Chulis GS. Matching MCBS (Medicare Current Beneficiary Survey) and Medicare data: The best of both worlds. Health Care Financ Rev. 1997 Spring;18(3):211–29. [PMC free article] [PubMed] [Google Scholar]