INTRODUCTION

Over 33% of Medicare beneficiaries are enrolled in Medicare Advantage (MA).1 The MA Quality Improvement Program (QIP), which the Centers for Medicare and Medicaid Services (CMS) launched as a demonstration in 2012 and made permanent in 2014, rates all MA contracts from 2 to 5 stars based on quality measures. CMS rewards contracts rated 4+ stars with 5% per capita bonus payments and has paid over $3.1 billion in bonuses annually.

Under CMS policy, an insurer with multiple MA contracts may consolidate all enrollees from a contract with a low star rating into another contract with a rating of 4+ stars.2 The insurer would then receive bonus payments for the transferred enrollees whether or not there were any changes to these enrollees’ quality of care. The Medicare Payment and Advisory Commission described this practice as “an erosion of the integrity and utility of the tools used to measure quality.”3 We studied trends in MA contract consolidations and the characteristics of contracts and enrollees associated with consolidation from 2006 to 2016.

METHODS

The Medicare Beneficiary Summary File and the Healthcare Effectiveness and Information Data Set provided demographic characteristics and enrollment status. We defined a contract as consolidated if over 75% of enrollees move into a different contract owned by the same insurer in the following year, with the previous contract terminated. As a sensitivity check, we use CMS plan crosswalk files which report which contracts consolidated, and find similar trends.

We compared characteristics of the enrollees and contracts that were consolidated, those that were the destination following consolidation, and those that were neither using chi2 and ANOVA tests (α = 0.05, Stata 15).

RESULTS

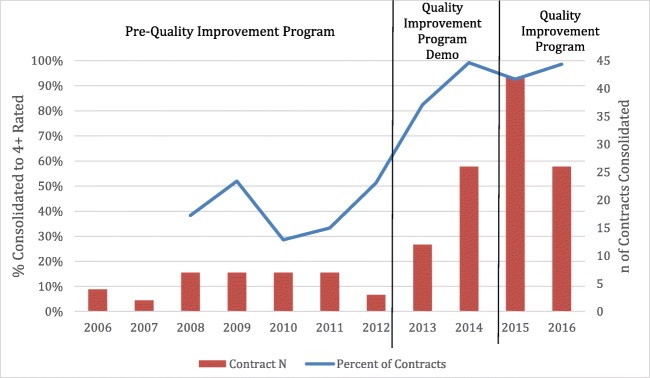

The study population included 28,496,847 enrollees across 733 contracts from 2006 to 2016. Figure 1 plots the annual number of consolidated contracts and the percentage of those consolidations that were to a contract with 4+ stars. The number of consolidations and the proportion that were consolidated to 4+ stars increased after the QIP.

Figure 1.

Number of consolidated contracts and proportion consolidated to 4+ stars, 2006–2016. The bars correspond to the right axis and represent the number of contracts that consolidate each year. The line corresponds to the left axis and is the percent of contracts that were consolidated to a 4+ star contract. Each year represents a consolidation from that year into the following (i.e., 2006 represents the number of 2006 contracts and enrollees who were consolidated into a different plan in 2007). The first bonuses were paid during the demo starting in 2012. The program was made permanent in 2014. Star ratings were launched in 2009, so the line graph is unavailable for 2006–2007.

From 2012 to 2016, we estimate a cumulative 3,361,889 enrollees were in a consolidated contract, representing 11.8% of the MA population over this time period (Table 1). Of these, 2,599,783 (77.3%) were consolidated from a lower-rated to a bonus-receiving contract. As compared with contracts that were not consolidated, consolidated contracts were more likely to be PPOs (55.2 vs. 22.9%; p < 0.001) and for-profit (95.2% vs. 57.3%; p < 0.001). While 88.4% of the destination contracts were 4+, 54.8% of consolidated contracts were < 4 stars.

Table 1.

Characteristics of People and Contracts Consolidated from 2012 to 2016

| Plan characteristic | Consolidated n (population weighted %) |

Destination n (population weighted %) |

Neither n (population weighted %) |

p value |

|---|---|---|---|---|

| n of contracts | 128 (18.3) | 73 (28.8) | 532 (52.8) | |

| Type | ||||

| HMO | 59 (38.2) | 50 (57.0) | 398 (64.3) | < 0.001 |

| PPO | 61 (55.2) | 19 (42.0) | 98 (22.9) | |

| Other | 7 (6.6) | 2 (1.0) | 34 (12.8) | |

| For profit | 111 (95.2) | 47 (84.2) | 227 (57.3) | < 0.001 |

| Star rating | 3.9 (0.7) | 4.2 (0.4) | 3.6 (0.4) | |

| Unrated | 17 (0.6) | 9 (0.6) | 210 (6.3) | < 0.001 |

| 2–2.5 stars | 3 (2.0) | 0 (0) | 29 (3.4) | |

| 3–3.5 stars | 78 (54.8) | 15 (10.9) | 173 (38.3) | |

| 4–5 stars | 30 (42.7) | 49 (88.4) | 120 (52.1) | |

| Mean star rating (sd) | 3.6 (0.4) | 4.2 (0.4) | 3.9 (0.7) | < 0.001 |

| Mean N counties in service area (sd) | 220.3 (366.7) | 133.9 (150.1) | 287.6 (708.2) | 0.625 |

| Mean N states in service area (sd) | 7.4 (12.3) | 6.8 (8.5) | 5.2 (11.5) | 0.002 |

| Service area category | ||||

| Single state | 86 (54.2) | 33 (25.7) | 381 (76.8) | < 0.001 |

| Regional (2–5 states) | 32 (24.2) | 22 (38.8) | 53 (10.6) | |

| National (> 5 states) | 10 (21.6) | 18 (35.6) | 98 (12.7) | |

| Plan size | ||||

| Small (0–5000) | 24 (18.8) | 5 (6.9) | 146 (27.4) | < 0.001 |

| Medium (500–25,000) | 55 (43.0) | 17 (23.3) | 161 (30.3) | |

| Large (> 25,000) | 49 (38.3) | 51 (69.9) | 225 (42.3) | |

| Enrollees’ Characteristics | N (%) | N (%) | N (%) | p value |

| n of enrollees | 3,361,889 | 8,170,716 | 16,964,242 | |

| Mean age (sd) | 65.7 (9.2) | 66.7 (9.6) | 67 (11.2) | < 0.001 |

| Female | 1,917,970 (57.1) | 4,576,609 (56.0) | 9,258,790 (54.6) | < 0.001 |

| Dual eligibility | 410,053 (12.2) | 1,115,690 (13.7) | 3,267,422 (19.3) | < 0.001 |

| Race/ethnicity | ||||

| White | 2,413,213 (71.8) | 5,737,864 (70.3) | 11,225,861 (67.2) | < 0.001 |

| Black | 461,411 (13.7) | 927,219 (11.4) | 1,951,756 (11.7) | |

| Hispanic | 278,845 (8.3) | 999,638 (12.2) | 2,218,330 (13.3) | |

| Asian | 74,919 (2.2) | 186,377 (2.3) | 643,554 (3.9) | |

| NA/AI | 5838 (0.2) | 11,850 (0.2) | 38,475 (0.2) | |

| Other/unknown | 126,813 (3.8) | 301,621 (3.7) | 634,473 (3.8) | |

| Census region | ||||

| Northeast | 318,196 (9.6) | 1,069,288 (13.6) | 3,888,068 (23.9) | < 0.001 |

| Midwest | 777,712 (23.5) | 2,317,187 (29.5) | 2,710,945 (16.7) | |

| South | 1,608,275 (48.5) | 2,910,067 (37.0) | 4,838,546 (29.8) | |

| West | 609,385 (18.4) | 1,567,233 (19.9) | 4,823,107 (29.7) | |

p values from chi2 or ANOVA tests as appropriate. Ns for contract characteristics represent contracts. Percentages in parentheses represent enrollment-weighed percentages for each characteristic. Ns and %s for enrollee characteristics are individual level. Consolidated represents contracts that were eliminated and merged into another contract. Destination represents contracts that consolidated contracts were merged into. Neither represents contracts that were not consolidated at all during the time period. If a contract were terminated, and enrollees from that contract were not consolidated, that contract would be included in the Neither category. All characteristics are from the year before the consolidation occurred. Contract level data comes from publically available MA plan registry and characteristic files. Enrollee characteristics come from the Medicare Beneficiary Summary file. Characteristic level counts may not match overall counts due to missing data

Consolidated enrollees were less likely to be dual-eligible (12.2% vs. 19.3%; p < 0.001), more likely to be white (71.8% vs. 67.2%; p < 0.001), and living in the South (48.5% vs. 29.8%; p < 0.001). Over 50% of all consolidated enrollees came from four insurers (UnitedHealthcare 25.9%; Medica 10.0%, Humana 9.1%; Regence 5.2%).

DISCUSSION

The QIP was accompanied by a substantial increase in contract consolidation in the MA program, affecting over 10% of MA enrollees from 2012 to 2016. Consolidations primarily occurred from contracts rated < 4 stars to those with 4+ stars and were therefore eligible for bonuses, suggesting that this consolidation increased performance-based payments to MA insurers without requiring improved quality of care among enrollees who were transitioned. Some consolidations occurred before the launch of the QIP, which may be driven by other strategic goals such as reducing administrative costs; however, most consolidations occurred after the QIP. We build upon prior work2 by studying individual-level data before and after the QIP and the characteristics of contracts that engage in consolidation.

Following reports of this practice, CMS promulgated new regulations effective in 2020 that weigh the rating of the origin and destination contract when calculating bonuses.4 This policy may reduce incentives for insurers to “game” their bonus payments though consolidations. However, from 2012 to 2016, assuming a $9000 mean annual per capita payment for enrollees in consolidated contracts with < 4 stars, we estimate that CMS may have paid out as much as $1.1 billion in bonus payments for this population. Furthermore, this consolidation may undermine the accuracy of star ratings in MA and beneficiaries’ ability to identify relative quality in making enrollment decisions.5 These findings highlight the need for CMS to anticipate and monitor unintended consequences of pay-for-performance initiatives including efforts to game quality ratings and bonus payments.

Contributors

There were no other contributors beyond those included as authors.

Funders

This work is supported in part by NIA P01AG027296.

Compliance with Ethical Standards

Conflict of Interest

David J Meyers has no conflicts of interest to disclose.

Ira Wilson has no conflicts of interest to disclose.

Momotazur Rahman has no conflicts of interest to disclose.

Vincent Mor is the Chair of the Independent Quality Committee at HCR Manor Care, and Chair of the Scientific Advisory Board and consultant on NaviHealth Inc., as well as a former Director of PointRight Inc., where he holds less than 1% equity.

Amal Trivedi has no conflicts of interest to disclose.

Footnotes

Prior Presentations

There are no prior presentations to report.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

References

- 1.Neuman P, Jacobson GA. Medicare advantage checkup. N Engl J Med. 2018;0(0):null. doi: 10.1056/NEJMhpr1804089. [DOI] [PubMed] [Google Scholar]

- 2.Mathews AW, Weaver C. Insurers game medicare system to boost federal bonus payments. Wall Street J. https://www.wsj.com/articles/insurers-game-medicare-system-to-boost-federal-bonus-payments-1520788658. Published March 11, 2018. Accessed July 10, 2018.

- 3.Medicare Payment Advisory Commission. Report to the Congress: Medicare Payment Policy; 2018.

- 4.Center for Medicare and Medicaid Services. Announcement of Calendar Year (CY) 2019 Medicare Advantage Capitation Rates and Medicare Advantage and Part D Payment Policies and Final Call Letter. April 2018. https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/Announcement2019.pdf. Accessed April 2, 2018.

- 5.Reid RO, Deb P, Howell BL, Conway PH, Shrank WH. The roles of cost and quality information in medicare advantage plan enrollment decisions: an observational study. J Gen Intern Med. 2016;31(2):234–241. doi: 10.1007/s11606-015-3467-3. [DOI] [PMC free article] [PubMed] [Google Scholar]