Abstract

This paper assesses the impact of the September 11 terrorist attacks and its after-effects on U.S. airline demand. Using monthly time-series data from 1986 to 2003, we find that September 11 resulted in both a negative transitory shock of over 30% and an ongoing negative demand shock amounting to roughly 7.4% of pre-September 11 demand. This ongoing demand shock has yet to dissipate (as of November 2003) and cannot be explained by economic, seasonal, or other factors.

Keywords: Airlines, Structural change, Attenuating shock, September 11

1. Introduction

No industry has suffered greater economic damage from the terrorist attacks of September 11, 2001 than the U.S. airline industry. In addition to directly causing a temporary but complete shut-down of the commercial aviation system, the attacks caused many travelers to reduce or avoid air travel, weary of a newly-perceived risk associated with flying. Likewise, following September 11, many businesses put temporary freezes on all but the most essential travel for their employees.1 And although the initial “panic” driven fear of flying immediately following September 11 appears to have largely dissipated, the stringent new security requirements that were implemented as a direct result of the terrorist attacks have made traveling by air more cumbersome and time-consuming than prior to September 11.2 The purpose of this paper is to examine the impact of September 11 on U.S. airline demand and to determine whether or not September 11 and its after-effects have resulted in a negative shift in the demand for air travel.

Since September 11, 2001, numerous airlines (both in the U.S. and abroad) have been experiencing a financial crisis unlike any in modern aviation history. While United Airlines and US Airways have already filed for Chapter 11 bankruptcy, many other large U.S. carriers have engaged in dramatic cost-cutting programs. The prospects for (or lack of) a recovery in passenger demand has been the primary issue in the minds of aviation industry leaders and policymakers alike. In this paper, we investigate the form and extent of the downturn in demand for domestic air travel following September 11, 2001. While there is little doubt that September 11 and its after-effects resulted in industry turmoil in the days and months directly following the attacks, there is controversy regarding the longer term impact of September 11 on the airline industry. This controversy arises due to the fact that weak economic conditions (particularly in the labor market) pre-dated and have largely persisted since September 11, 2001.

Although the airline industry has always been highly cyclical, it has traditionally been able to weather through temporary economic downturns. The impact of September 11 on airline demand has been so severe, however, that demand still remains well below pre-attack levels more than 2 years after the attacks. Our research purpose is to measure the magnitude of this ongoing shift in demand by disentangling it from both the immediate downward spike following the terrorist attacks (resulting from factors such as the temporary shutdown of the aviation system and the initial panic driven fear of flying) as well as economic cycle effects. Measuring the magnitude of the ongoing demand shift is important for three reasons. First, since the terrorist attacks, there have been and continue to be numerous arbitrations between airlines and their labor unions related to the impact of September 11 on airline demand. Since many airline labor contracts expressly prohibit laying off employees due to weak economic conditions (i.e., recessions), determining both the initial and ongoing impact of the September 11 terrorist attacks has important ramifications on labor negotiations within the industry. In particular, many contracts between airlines and their unions have “no furlough” clauses that prohibit layoffs except in the case of extraordinary circumstances beyond the control of the airline, known as force majeure events. Second, in the weeks and months leading up to September 11, one of the primary concerns of aviation policymakers was airport and air traffic control congestion and delays.3 Consequently, understanding the ongoing impact of September 11 on airline demand is important for aviation capacity planners. Finally, to the extent that the demands for air travel has spill-over effects into other sectors of local economies (Brueckner, 2004, Button et al., 1999), the impact of lower demand for air travel has much broader economic effects than those impacting solely the airline industry.

While the events of September 11 and its after-effects have been the focus of much industry and policy attention (Air Transport Association, 2003, Bureau of Transportation Statistics, 2002, Masse, 2001), it has thus far received little attention in the economics literature. One exception is Rupp, Holmes, and DeSimone (2004), which studies airline schedule recoveries following airport closures since September 11.4

Our basic methodology is to estimate a reduced form model of demand for domestic air services using monthly time-series data since 1986. After controlling for cyclical, seasonal and other unique events impacting the industry, we model the post-September 11 period using an attenuating shock process that has both a transitory component as well as an ongoing (as of November 2003) component. After controlling for factors such as trend, seasonality and general macroeconomic conditions, we find that the events of September 11 led to both an initial demand shock of more than 30% as well as an ongoing downward shift in the demand for commercial air service of roughly 7.4%. We estimate that this ongoing demand shock accounts for over 90% of the current weakness in domestic airline demand relative to its pre-September 11 peak.

The remainder of this paper is organized as follows. Section 2 provides a brief overview of U.S. airline demand prior to and following September 11 and discusses some reasons why September 11 may have resulted in a longer-term structural change. Section 3 presents our model and empirical analysis. A summary of our findings and concluding remarks are provided in Section 4.

2. Analytical framework

The purpose of our investigation is to determine what–if any–structural impact the terrorist attacks of September 11 has had on domestic airline demand. It is well known that the demand for commercial airline service is both seasonal and cyclical. Thus, an integral part of our analysis of the effects of September 11 requires that we effectively control for seasonal, economic and other unique factors that are known to have impacted the demand for air service. After controlling for these factors, we should be able to assess the degree to which the current industry malaise is related to September 11 and its after-effects.

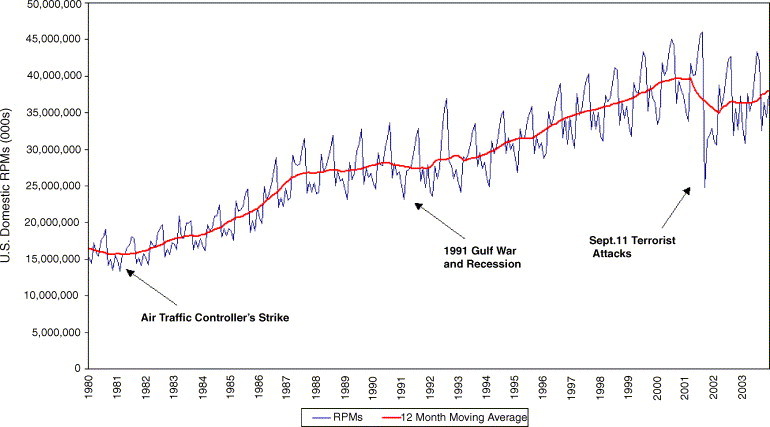

Fig. 1 depicts monthly U.S. domestic airline industry revenue passenger miles (RPMs) in addition to its 12-month moving average from January 1980 through December 2003. A revenue passenger mile is defined as one paying passenger traveling one mile. Fig. 1 demonstrates (a) the seasonal component of airline demand (RPMs tend to peak in the summer and bottom during the winter); (b) the cyclical component of airline demand; and (c) that prior to September 2001, industry demand has been steadily trending upwards. Fig. 1 also highlights a number of notable events that have impacted the U.S. airline industry since 1980, such as the air traffic controller's strike that started in August 1981 and culminated with the firing of over 11,000 controllers.5 Likewise, the 1991 Gulf War and ensuing recession resulted in an industry-wide decline in RPMs for roughly 11 months (compared to the same months of the previous year), after which point RPMs resumed their upward trend.

Fig. 1.

U.S. Domestic RPMs, January 1980 to December 2003.

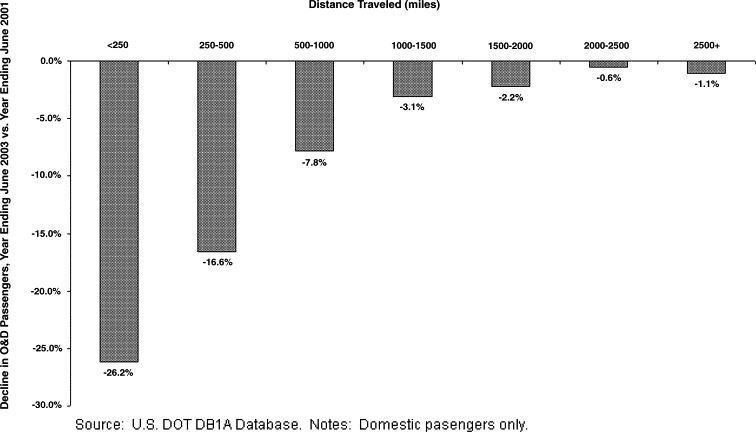

Although Fig. 1 illustrates that the U.S. airline industry has faced a number of negative demand “shocks” throughout its history, airline demand—as measured by industry RPMs—has proven to be quite resilient and most negative shocks have dissipated (on an industry-wide basis) within a relatively short period of time. However, there are a number of reasons to suggest that September 11 and its aftermath may have imposed a more lasting impact on the demand for airline services. First, September 11 likely caused more consumers to be unwilling to fly because of an increased fear of flying. Another significant factor impacting demand has been the increased security measures that have made traveling by air post-September 11 more time-consuming and far less convenient than before the terrorist attacks. This effect, often referred to as the “hassle factor” has been especially noticeable on the demand for short-haul trips. Fig. 2 , for example, summarizes the percentage decline in the number of domestic origin and destination (O&D) passengers for the year ending June 2003 compared to the year ending June 2001.6

Fig. 2.

Change in domestic O&D passengers before and after September 11, 2001.

If the current weak demand for air services were solely related to cyclical factors, one would expect that the decline in passengers, by distance, would assume a fairly uniform pattern. Fig. 2 demonstrates, however, that the drop in demand for domestic air service has been most pronounced in short-haul (less than 500 mile) markets, where increased elapsed travel times due to tighter security have made travel by alternative means such as driving or taking the train relatively more attractive following September 11. As trip distance increases and traveling by air becomes the only viable form of transportation for most travelers, the percentage decline in O&D passengers pre- and post-September 11 moderates substantially. And while the 26% drop in the less than 250 mile segment is likely also a result of weakened economic conditions (as a high proportion of passengers flying 250 miles or less tend to be business travelers on one-day trips), it is important to emphasize that such a dramatic decline in short-haul traffic is unprecedented. For example, we also compared two similar periods prior to and during the 1991 Gulf War and ensuing recession and found that the decline in trips of 250 miles or less only decreased by 10.5%. Moreover, the percentage decline across all other flight distances was largely uniform.

In order to model the impact of September 11 on airline demand, we allow for the possibility of both a transitory as well as an ongoing shock component. The ongoing component (i.e., a downward shift in demand) attempts to capture both the post-September 11 “hassle” factor as well as an increased reluctance to fly based on concerns of further terrorist attacks (i.e., an increased fear of flying). We characterize such changes as “ongoing” since they are likely to persist at least until there have been significant improvements in the efficiency and perceived effectiveness of the passenger screening and security systems. The transitory component, in contrast, attempts to capture the relatively short term “panic” or uneasiness with air travel that kept many passengers from flying in the weeks and months directly following September 11, but have now—for many passengers subsided. Separating the persistent and ongoing components of the September 11 shock is the key component of our empirical analysis we develop in the next section.

3. The data and the model

Data for U.S. airline industry demand comes from the Air Transport Association's (ATA) monthly database of passenger traffic and represents all revenue (i.e., paying) passengers carried by ATA member carriers.7 In light of the dramatic change in the regulatory environment following deregulation, our analysis focuses on the post-deregulatory era.8 Moreover, within the post-deregulatory era, we focus our analysis on domestic travel from January 1986 until November 2003, due to data availability for some of our variables.

Our primary measure of airline demand is domestic RPMs. Although the number of O&D passengers is another possible measure, we chose RPMs as our proxy for demand since the average trip length of passengers has been steadily increasing over time.9 Our measure of the airline prices is the average domestic monthly passenger yield (average revenue per RPM) as reported by the ATA.10 Our baseline model is a reduced form estimation of the natural log of quantity (RPMs) and price (yield).

Baseline model:

| (1) |

| (2) |

X t represents a vector of exogenous variables, including both demand and supply shifters. D t is a vector of dummy variables, accounting for seasonality and various events that may have impacted the market for passenger airline service. Finally, ɛ t and ν t are mean-zero error terms. We use OLS estimation and account for the auto-correlated nature of the errors by using Newey–West standard error estimates. The descriptions of our independent variables, in addition to further details of our modelling approach, are detailed below.

Seasonality: Airline demand is known to be highly seasonal, with the summer and holiday seasons being the strongest. Therefore, we include monthly dummy variables to control for such seasonality. In addition, we also control for some calendar irregularities such as Thanksgiving holiday seasons that overflow into December and longer than average months of February due to leap years.

Economic trend and cyclicality: Prior to September 2001, the demand for the air travel had been growing rapidly (see Fig. 1), fueled by steady economic growth and declining real airfares. The demand for air travel is also known to be highly sensitive to business cycles. To control for trend and cyclicality factors, we introduce two macroeconomic variables that we consider to be major demand-shifters. Firstly, we use the national unemployment rate as our business cycle indicator. Secondly, we use the domestic labor force to control for the long-term growth of the overall economy.11 While we recognize that gross domestic product is the standard variable for measuring economic activity and its fluctuations, GDP statistics are only available on a quarterly basis, which is not sufficient for our analysis.12

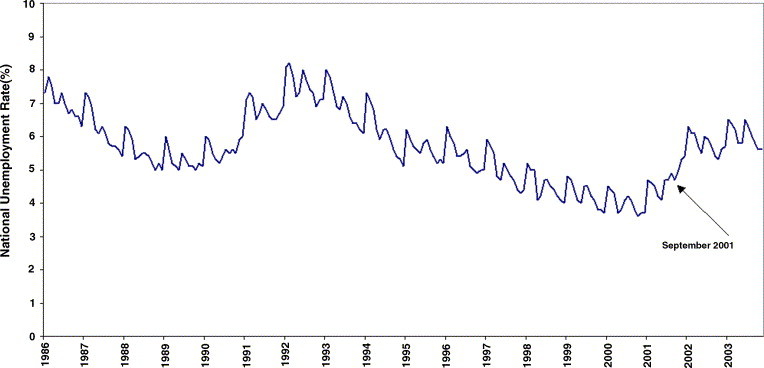

Fig. 3 plots the national unemployment rate from 1986 to 2003. After reaching historically low rates in 2000 and 2001, Fig. 3 demonstrates that the onset of the economic downturn is readily apparent prior to September 2001. Moreover, despite the fact that GDP resumed growing in late 2001, Fig. 3 illustrates that the labor market has remained relatively weak.

Fig. 3.

U.S. unemployment rate.

One natural question that arises is the degree to which September 11 directly or indirectly resulted in a weakened economy, and in turn, higher unemployment. Numerous researchers have studied various economic effects of September 11 (i.e., Garner, 2002, Hobijn, 2002, Virgo, 2001). Moreover, it has been well documented that at least some mass layoffs following September 11 (especially those in the travel and tourism industries) were directly attributable to the terrorist attacks rather than prevailing economic conditions.13 Determining aggregate job losses at the national level attributable to September 11, however, is almost impossible, since there are literally thousands of small firms whose layoffs would not be recorded by the Bureau of Labor Statistics. Thus, for the purpose of our analysis, we do not attempt to differentiate between the sources of job losses (i.e., general economic conditions versus September 11). Consequently, to the extent that September 11 was directly or indirectly responsible for higher levels of national unemployment, our estimation results will underestimate September 11s’ impact on airline demand.

In the quantity equation, the RPM and labor force variables are both upwardly trended, raising the suspicion of a spurious regression. However, a Johansen test confirmed that these two variables are indeed co-integrated with a time trend.14 Consequently, the estimated coefficient on the labor force variable is superconsistent, while estimates on other variables remain unbiased (Davidson & Mackinnon, 1993). An alternative model such as one using first differences with an error correction term may be able to specify the dynamic relationship between the co-integrated variables more precisely. However, the September 11 attack was a long-lag event, making the first different estimation problematic. Moreover, pinning down the precise dynamics of September 11 is not our main research focus. Rather, we would like to control for the overall economic activity level while isolating the September 11 effect.

Airline fatalities: Fear of flying is not a new phenomena. Since 1986, there have been 30 fatal airline accidents involving U.S. scheduled commercial carriers—excluding the September 11 terrorist attacks—including one known terrorist attack (the Pan-Am Lockerbie bombing in December 1988). It is reasonable to expect some travelers to experience increased apprehension of flying, especially when there have been accidents involving a large number of fatalities. We include a variable that measures the number of fatalities on U.S. carriers in order to control for the generic demand impact of airline accidents. If fear of flying from the September 11 terrorist attacks is comparable to that from other fatal accidents, we expect this variable to pick up the generic fear effect. However, it is possible that travelers reacted more strongly to the potential for greater “systematic risk” since September 11 than the “idiosyncratic risk” inherent with air travel.

Supply-side variables: We also include two supply-side variables. The first is LCCshare, the share of domestic industry RPMs serviced by low-cost carriers in each month. Many researchers (i.e., Bennett & Craun, 1993; Ito & Lee, 2003; Morrison, 2001) have documented the impact of low cost carriers on the U.S. airline industry. Indeed, one recent, comprehensive study (Transportation Research Board, 1999, page 49) of the U.S. airline industry noted that “Probably the most significant development in the U.S. airline industry during the past decade [the 1990s] has been the continued expansion of Southwest and the resurgence of low-fare entry generally”. The second supply-side variable is the cost per gallon of jet fuel, as reported by the Department of Transportation. Since fuel accounts for approximately 10–15% of airline operating costs, its exogenous fluctuation is likely to influence airline pricing.

Some extraordinary events: Although the post-deregulatory U.S. airline industry experienced steady growth until 2001, a few events resulted in temporary negative “shocks” and require special attention. Our model accounts for the 1991 Gulf War, the 2003 Iraq War, and the Severe Acute Respiratory Syndrome (i.e., “SARS”) epidemic. Controlling for the last two events is especially important because they may have imposed downward pressure on demand during the post-September 2001 period. Failing to control for these events, therefore, would result in over-estimating the impact of September 11.

Descriptive statistics for the variables described above are presented in Table 1 .

Table 1.

Variable definitions and descriptive statistics

| Variable name | Definition | Mean (S.D.) |

|---|---|---|

| ln(RPMt) | Natural log of domestic RPMs (000s) in month t | 17.2580 (0.179) |

| ln(Yieldt) | Natural log of domestic yield (CPI deflated) in month t | 2.181 (0.145) |

| ln(Labort) | Natural log of national labor force in month t (000s) | 11.790 (0.066) |

| Unemployt | National unemployment rate (percent) in month t | 5.671 (1.050) |

| LCCsharet | Low cost carriers’ share of domestic RPMs | 0.095 (0.048) |

| Fuelt | Price/gal of jet fuel (PPI deflated) in month t | 3.939 (0.166) |

| Fatalitiest | Airline fatalities on U.S. carriers in month t | 9.808 (38.953) |

| D(leapt) | Dummy variable taking value 1 if period t is Feburary during leap year, and is 0 otherwise | 0.019 (0.136) |

| D(Thanks11)t | Dummy variable taking value 1 if period t is November and the Sunday after Thanksgiving is in December, and is 0 otherwise | 0.014 (0.118) |

| D(Thanks12)t | Dummy variable taking value 1 if period t is December and the Sunday after Thanksgiving is in December, and is 0 otherwise | 0.014 (0.118) |

| D(Iraq War)t | Dummy variable taking value 1 from February to April 2003, and is 0 otherwise | 0.014 (0.118) |

| D(Gulf War)t | Dummy variable taking value 1 if period t is between August 1990 and March 1991 and is 0 otherwise. | 0.037 (0.190) |

| D(SARS)t | Dummy variable taking value 1 from March to July 2003, and is 0 otherwise | 0.023 (0.151) |

| N | Number of observations | 215 |

3.1. Modeling the impact of September 11

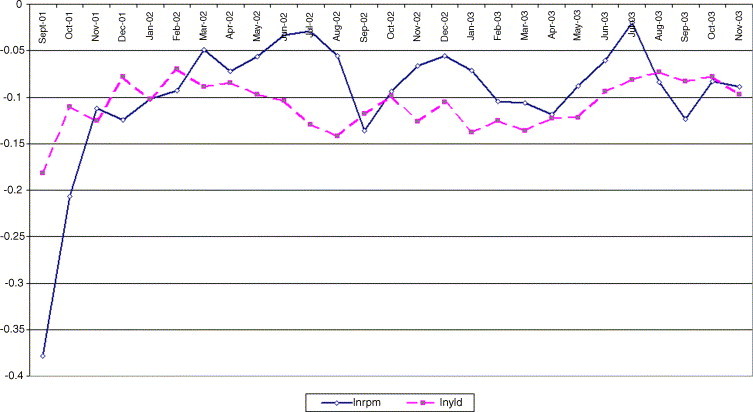

Having described the baseline model, we now turn our attention to modeling the impact of September 11. As a starting point, we first take a non-parametric approach by fitting 27 dummy variables—one for each month on and after September 2001—onto the baseline model we introduced in the previous section. For this exercise, we also included the seasonality dummy variables but excluded the Iraq War and SARS dummy variables. Fig. 4 plots the coefficient estimates of those 27 monthly dummy variables across time. Each data point represents the gap between the actual log of the RPMs/yield observation and what the baseline model predicts, after controlling for economic fluctuations and other demand and supply factors. Fig. 4 demonstrates that after the sharp drop in September 2001, there was an initial recovery phase. By mid 2002, however, the recovery began to taper off, and through November 2003, the gap for both RPMs and yield continues to hover well below zero, without any apparent tendency of closing.

Fig. 4.

Dummy variable estimates.

Next, we construct two simple non-linear models that allow us to measure the magnitude of this ongoing stagnation while controlling for the effects of concurrent events such as the recent Iraq War and SARS epidemic (which are not isolated in Fig. 4). Both models need to accommodate for two different types of impacts from September 11: (a) an ongoing downward shift in the demand for air travel resulting from the increased apprehension of flying and inconveniences such as the hassle factor and (b) the initial panic driven fear of flying directly following September 11. We allow for the possibility of an ongoing downward shift in demand by including an dummy variable, D post911 that takes the value 0 for all observations before September 2001 and 1 thereafter. Thus, the estimated coefficient on D post911 will measure the relative magnitude in the downward shift in demand following September 2001. To account for the sharp decline in demand following September 11 that was likely transitory in nature, we also include a shock component that attenuates over time.

Model 1: Define T 911 as the number of months since September 2001 plus one (for example, T 911 = 2 in October 2001, 3 in November 2001, and so forth). In Model 1, we simply include the inverse of (T 911)2 as an additional regressor. The implicit assumption is that the transitory shock will decay at a rate equal to the squared reciprocal of time.15 Although this specification is somewhat ad hoc, it has the advantage of being simple to estimate.

| (3) |

We append this component to both the RPMs and yield equations in the baseline model. The key parameter of interest is the magnitude of the estimate for β shift, which represents the portion of the demand decline that has not yet recovered since September 2001.

The dramatic decline (37.8%) in RPMs during September 2001 was an unprecedented event in the history of U.S. aviation and was partly a result of the FAAs complete shutdown of commercial air space for two and a half days.16 Thus, some of the decline in RPMs in September 2001 is likely due to the government imposed supply constraint. Moreover, we would like to check for the possibility that such an extraordinary month becomes an influential observation, pulling down the estimate of β shift, our measure of the ongoing demand shift. In order to investigate this issue, Model 2 isolates the September 2001 observation from the rest of the data.17

Model 2: Define D 911 as a dummy variable that takes value 1 for September 2001 and 0 for all other months. Now, is defined as the number of months since October 2001 (rather than September 2001) plus one. Similarly, takes value 1 for all the months starting from October 2001 and 0 otherwise.

| (4) |

If the extraordinary dip in September 2001 is indeed an influential observation, Model 2 will produce a smaller estimate for β shift than Model 1.

It is important to emphasize that neither of our two models impose the presence of an ongoing shift in demand. If there has been no ongoing shift in demand as a result of September 11, we would expect the estimated coefficients for to be close to zero. Thus, in both models, the possibility of an ongoing shift in demand can be empirically tested by performing the following hypothesis test:

Likewise, the presence of a transitory shock can be tested by performing appropriate hypothesis tests on β 1/t.

3.2. Estimation results

The ordinary least squares estimates for Models 1 and 2 are presented in Table 2 . Since the model is static and the regressors are identical in equations, there is no gain from estimating the two equations together. Table 2 also reports Newey–West robust standard errors in order to account for a non-spherical distribution of the error term.18

Table 2.

Reduced form estimates

| ln(RPMs) |

ln(Yield) |

|||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 1 | Model 2 | |

| Constant | −6.603* (2.715) | −6.505* (2.740) | 14.989** (3.595) | 14.986** (3.614) |

| ln(Labort) | 2.029** (0.227) | 2.021** (0.229) | −1.071** (0.299) | −1.071** (0.301) |

| Unemployt | −0.033** (0.007) | −0.033** (0.007) | −0.02* (0.010) | −0.02* (0.010) |

| LCCsharet | 0.157 (0.283) | 0.164 (0.285) | −0.969** (0.356) | −0.968** (0.358) |

| Fuelt | 0.012 (0.018) | 0.011 (0.018) | 0.019 (0.027) | 0.020 (0.028) |

| Fatalitiest | 0.000 (0.000) | 0.000 (0.000) | 0.000 (0.000) | 0.000 (0.000) |

| D(Thanks11)t | −0.035** (0.008) | −0.035** (0.008) | −0.021 (0.013) | −0.021 (0.013) |

| D(Thanks12)t | 0.061** (0.011) | 0.061** (0.010) | 0 (0.019) | 0.001 (0.019) |

| D(leap)t | 0.033 (0.019) | 0.034 (0.019) | 0.008 (0.032) | 0.007 (0.032) |

| D(Gulf War)t | −0.017 (0.015) | −0.017 (0.015) | 0.008 (0.017) | 0.007 (0.017) |

| D(Iraq War)t | −0.042** (0.011) | −0.043** (0.011) | −0.030** (0.011) | −0.029** (0.011) |

| D(SARS)t | 0.013 (0.015) | 0.013 (0.015) | 0 (0.010) | 0.001 (0.010) |

| β1/t | −0.313** (0.020) | −0.134** (0.012) | −0.073** (0.025) | −0.012 (0.015) |

| βshift | −0.075** (0.018) | −0.074** (0.017) | −0.101** (0.023) | −0.102** (0.023) |

| β911 | −0.371** (0.020) | −0.176** (0.026) | ||

| N | 215 | 215 | 215 | 215 |

| 0.9674 | 0.9677 | 0.9235 | 0.9231 | |

| Root MSE | 0.0323 | 0.0322 | 0.0403 | 0.0404 |

Note: Monthly dummy variables have been suppressed, Newey–West autocorrelation-robust standard errors are reported.

Significant at the 5% level.

Significant at the 1% level.

Both the labor force and the unemployment rate are powerful and significant predictors of RPMs (quantity), consistent with our a priori belief. A higher unemployment rate also reduces yields (prices), which is intuitive.19 A larger labor force, however, also tends to reduce yields. This result is somewhat counterintuitive, and we expect that this is probably due to the fact that the labor force tends to be somewhat correlated with the growth of low-cost carriers. Since the reduced form estimates reflect the combined effects of the supply and demand, we caution the reader from drawing too many inferences from these estimates. However, if the estimates in both the quantity and price equation are significant and in the same direction for the same variable, we strongly suspect that it reflects a demand change. Conversely, if the price and quantity effect move in opposite directions, we suspect that it reflects a supply change.

Consistent with the previous literature, LCCshare has a powerful positive impact on RPMs and a large negative effect on yield. The estimated coefficient on fuel is positive in the yield equation, but is not statistically significant. Fatalities showed almost no impact in either the quantity or price equation. We suspect that this may reflect a temporary substitution away from the carrier involved in the accident towards other carriers while leaving aggregate demand unchanged. This supports our conjecture that the September 11 attacks were unique in the sense that they resulted in a perceived increase in systematic (as opposed to idiosyncratic) risk.

The recent Iraq War had a negative and significant impact on both domestic RPMs and yield, while the 1991 Gulf War did not. This result is likely a reflection of the fact that our analysis is limited to domestic travel, as the 1991 Gulf War had a strong negative impact on international traffic. Moreover, as noted by the NBER's business cycle dating committee, the downturn in the U.S. economy coincided almost exactly with the timing of the Gulf War variable.20 Likewise, in light of the September 11 terrorist attacks, there was a heightened awareness of the possibility of additional terrorist attacks on domestic flights during the recent Iraq War. Finally, given that the recent Iraq War largely overlapped with the SARS epidemic, it is possible that the model cannot fully distinguish between these two events. Thus, the Iraq War coefficients likely reflect the combined effect of these two events.

Turning our attention to the ongoing impact of September 11, we see that the estimated coefficients on β shift are powerfully negative (and significant at the 1% level) in both the RPMs and yield equations, suggesting a large demand contraction. The decline in RPMs is approximately 7.4% while the yield decline was 10.0%. The negative impacts on both the quantity (RPMs) and price (yields) indicate that 9/11 resulted in a negative demand shift, rather than a supply contraction. Moreover, the estimated effect of the ongoing demand shift remains almost the same even after we isolate the September 2001 observation from the remainder of the data in Model 2. Thus, these results do not appear to be the outcome of one influential observation. If we assume the estimated coefficients reflect a pure demand shift, which, as discussed earlier, is consistent with the simultaneous decline in both quantity and price—the implied elasticity of the airline supply is 0.74.

Given the limited number of observations after September 2001, it remains to be seen if this ongoing shift in demand is a permanent one. It is possible, for example, that we are observing a portion of a protracted non-linear response with long lags that have lasted more than 27 months. Such a protracted recovery, however, would also be unprecedented in the airline industry. For example, we applied our model to the 27 months following the invasion of Kuwait and subsequent 1991 Gulf War and found no evidence of a negative demand shift.

We also tested to see if the ongoing shift had any attenuating tendency by inserting a linear time trend on post-September 2001 observations and allowing for a jackknife modification (the results are not reported in Table 2). The estimated time trends were extremely small and statistically insignificant while the other estimates remained mostly unchanged. This result suggests that the ongoing shift has no apparent tendency to narrow its gap within the observed time period.

Finally, it is also important to note that we identify this ongoing shift separately from the transitory shock of September 11 and the estimation results also confirm that a substantial transitory shock was present. In Model 1, the estimated coefficient on β 1/t of −0.313 implies that the initial shock of September 11 resulted in a 31% reduction in RPMs (in addition to the 7.5% ongoing shift). Put differently, domestic RPMs reached a historical peak in August 2001 of approximately 46.0 billion miles and dropped precipitously to 24.7 billion miles in September 2001, then recovering to 31.4 billion miles in October 2001. The transitory shock to yields of 7.3% was significantly smaller than the corresponding shock to RPMs, which makes sense since many airline tickets are purchased well in advance.

Under Model 1, the transitory impact of September 11 diminishes to less than a 1% reduction after 5 months (i.e., by February 2002) for RPMs and after 2 months (November 2002) for yields. Thus, the estimated coefficients on β shift apply mostly to the remaining 20 and 23 months of the RPM and yield data, respectively.

3.2.1. Goodness of fit

The fit of both models is extremely good, with an of 0.967 for RPMs and 0.923 for yields. Since s are often high in time-series data, we evaluate the fit of Model 1 relative to an alternative benchmark model consisting only of a linear time trend and seasonal dummy variables. Table 3 compares the goodness-of-fit of the two models. While the benchmark model accounts for 89 and 83% of the variations in the RPMs and yield, respectively, the improvements in fit from Model 1 are substantial. For the RPMs equation, the residual sum of squares are reduced by 74.7% and for the yield equation, the reduction is 60.4%. Thus, we conclude that our model generates substantial improvements over this alternative benchmark of a linear time trend and seasonal dummy variables.

Table 3.

Goodness-of-fit comparison

| ln(RPMs) |

ln(Yields) |

|||

|---|---|---|---|---|

| Model 1 | Benchmark | Model 1 | Benchmark | |

| Model degree of freedom | 190 | 199 | 190 | 199 |

| R2 | 0.9726 | 0.8917 | 0.9331 | 0.8312 |

| 0.9691 | 0.8835 | 0.9247 | 0.8185 | |

| RRS | 0.1880 | 0.7422 | 0.3043 | 0.7679 |

| TTS | 6.8542 | 6.8542 | 4.5486 | 4.5486 |

RRS: residual sum of squares; TTS: total sum of squares; benchmark model employs a linear trend and seasonal dummies.

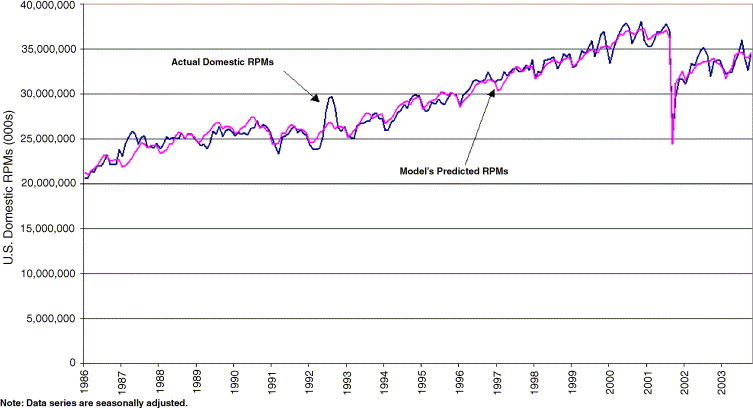

Fig. 5 plots the predicted RPM values of Model 1 along with their actual values (both series are seasonally adjusted). The model's predictions appear to capture the post-September 11 demand dynamics remarkably well.

Fig. 5.

Domestic RPMs vs. Model 1 predictions.

3.3. Analysis of post-September 11 airline demand

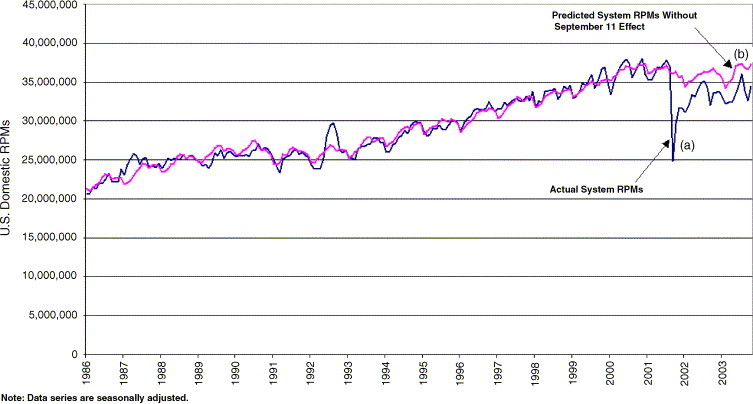

Having estimated the impact of September 11 on U.S. airline demand, we now use our model's estimates to predict what demand would have been had it not been for the terrorist attacks. For our analysis in this section, we use the predicted values from Model l.

Our methodology is as follows. From the predicted values of the regression model, we subtract both the ongoing and transitory estimated effects of September 11, along with the seasonal fluctuation (series (b)). This counterfactual demand prediction is plotted in Fig. 6 , along with the actual (seasonally adjusted) level of RPMs (series (a)). As illustrated in Fig. 6, the model predicts a significantly higher level of demand had September 11 not occurred, notwithstanding the weakness in the labor market. Recall also that the immediate shock of September 11 is largely dissipated after 5 months. The difference between the counterfactual (b) and actual (a) RPMs after 5 months is the ongoing shift predicted by the model of roughly 7.4%.

Fig. 6.

Domestic RPMs vs. Model 1 predictions without 9/11.

To put this figure into context, domestic RPMs for the 12 month period ending November 2003 (439.0 billion) were approximately 7.9% lower than their historical peak that occurred during the 12 months ending August 2001 (476.6 billion). Thus, our analysis would suggest that the ongoing, negative demand shock from September 11 accounts for roughly 94% of the decline in domestic RPMs from this historical peak.

3.4. Limitations of the current analysis

While our analysis provides strong evidence of a negative structural change in airline demand following September 11, we should emphasize that our analysis has some limitations. To begin with, at the time of our analysis, only 27 monthly observations since September 2001 are available, which limits the degrees of freedom for our analysis concerning the post-September 11 period. While the U.S. airline industry has typically recovered from other negative shocks considerably faster than 27 months, a catastrophic event such as September 11 could obviously require a longer recovery period. If this is the case, we are still observing the recovery. Based on the data, one cannot rule out the possibility that we are still on the recovery trajectory from September 11, especially when events such as the Iraq War and the SARS epidemic have put additional downward pressure on the demand for air travel. Consequently, it will be useful to repeat the current analysis as additional observations become available.

Moreover, it is possible that the industry adapts to the post-September 11 environment in some unexpected way. For example, new technological innovations in security screening might eliminate some of the waiting time at airports, thus, reducing the hassle factor and making air travel more convenient. Likewise, new forms of passenger screening (i.e., facial recognition) may become widespread and improve passengers’ sense of security.

Finally, we emphasize that our analysis does not attempt to account for any macroeconomic effects caused by the terrorist attacks. Because it is probable that September 11 directly or indirectly led to lower levels of macroeconomic activity, and in turn, increased unemployment, our results likely understate the impact of September 11 on airline demand. Moreover, our macroeconomic indicator variables, the labor force and unemployment rate, will tend to overstate the impact of the negative economy on airline demand relative to other variables such as GDP. Nevertheless, we believe that our analysis is useful in that it provides an approach to assist policymakers and industry leaders evaluating the impact of major external shocks—such as the terrorist attacks of September 11, on the U.S. airline industry.

4. Conclusions

The terrorist attacks of September 11 had a dramatic impact on the U.S. airline industry. Although some of the initial panic and fear of flying directly following September 11 has dissipated, more rigorous security screening and passengers’ perceptions of the risk of flying have altered the demand for and experience of air travel, especially in the United States.

While there is little doubt that September 11 and its after-effects resulted in industry turmoil in the days and months directly following the attacks, there is controversy regarding the longer term impact of September 11 on the airline industry. This controversy arises due to the fact that weak economic conditions pre-dated, and persisted, past September 11, 2001. Our analysis attempts to disentangle these macroeconomic effects on airline demand from the more direct effects of the September 11 terrorist attacks. In addition, our analysis separates the effects of September 11 into its effects temporary and ongoing components. In summary, we find that September 11 resulted in both a transitory, negative demand shock of more than 30% in addition to an ongoing negative demand shift of approximately 7.4% that cannot be explained by cyclical, seasonal or other factors. Moreover, we estimate that this structural demand shock accounts for over 90% of the current weakness in domestic airline demand relative to its pre-September 11 peak.

Acknowledgements

The authors thank John Driscoll, Stephanie Giaume, Dan Kasper, Bent Sørensen, two anonymous referees and conference participants at the 2003 Southern Economics Association Meetings for helpful comments.

Footnotes

For example, a survey conducted by the National Business Travel Association shortly after the attacks found that 23% of corporations temporarily suspended domestic travel and 34% of corporations temporarily suspended international travel. Source: NBTA Press Release, September 19, 2001.

See, for example “Hassle factor hurting airlines”, Atlanta Business Chronicle, April 15, 2002 or “Drive instead of fly? Maybe a good idea”, Philadelphia Inquirer, May 12, 2002.

For example, the Department of Transportation issued a Notice of Market-based Actions to Relieve Airport Congestion and Delay, (Docket No. OST-2001-9849) on August 21, 2001. See also Brueckner (2002) and Mayer and Sinai (2003).

Rose (1992) studied general air safety concerns following the industry's deregulation in 1978 and Borenstein and Zimmerman (1988) investigated the impact of fatal air accidents on airline's profits and traffic. Likewise, Mitchell and Maloney (1989) analyzed the impact crashes on a carrier's (and its competitors’) profits and insurance premia.

The 1981 strike was unlike other labor disruptions among air traffic controllers in that President Reagan issued a directive prohibiting the FAA from re-hiring any of the fired controllers. This directive remained in effect until August 12, 1993.

O&D passengers count travelers based on the starting and ending point of their journey, regardless of whether or not they make a connection. We compare these two time periods because the year ending June 2003 represents the most recent data available from the Department of Transportation's DB1A quarterly database of O&D passengers. Likewise, the year ending June 2001 represents the last four quarters of data unaffected by the events of September 11.

Carriers in the dataset include: Air Florida, Air New England, AirCal, Alaska, Aloha, America West, American, ATA, Best, Braniff, Capitol, Continental, Delta, Eastern, Hawaiian, Hughes Airwest, Jet America, JetBlue, Midwest, New York Air, Northeastern, Northwest, Ozark, Pacific Southwest, Pan Am, Piedmont, Reeve Aleutian, Republic, Southwest, Texas International, Trans World, United, US Airways, and Western. This data is available from the Air Transport Association at http://airlines.org.

The U.S. domestic airline industry was deregulated in 1978, effectively eliminating regulatory constraints that governed route entry and pricing (Morrison & Winston, 1986). A small number of airports in the U.S. are still subject to various regulatory restrictions. For example, Washington National (DCA), and New York's LaGuardia (LGA) and JFK airports are subject to the High Density Rule, which limits the number of take-offs and landings; Dallas’ Love Field (DAL) is subject to the Wright and Shelby Amendments, prohibiting carriers from flying between Love Field and airports in states other than Texas, Louisiana, Arkansas, Oklahoma, New Mexico, Mississippi, and Alabama; and DCA is subject to the Perimeter Rule, which prohibits most flights of more than 1250 miles to and from this airport.

While we feel that monthly RPMs provide a very good proxy for airline demand, it is important to note that RPMs actually represent the national market clearing level of quantity for commercial air service in any given month, and thus, incorporate elements of both demand and supply. However, to the extent that industry supply (as measured by available seat miles) responds to changes in industry demand (albeit, with a lag), RPMs should provide a good proxy for actual demand.

It should be noted that the ATA's yield data represents the following subset of carriers: Alaska, American, America West, Continental, Delta, Northwest, United and US Airways. While this monthly data excludes several carriers—including the low-cost carriers—it has been well established in the literature (Morrison 2001, Transportation Research Board, 1999) that the prices of all carriers have fallen as a result of competition from low cost carriers.

We also experimented with the level of non-farm employment as our macroeconomic variable, which yielded similar results. However, employment figures embody not only trend, but also cyclical fluctuations. Consequently, we elected to use two separate variables to account for them.

We also experimented with average weakly earnings as a measure of business cycles. But, the results were not much different from those obtained with the unemployment rate.

For example, in the 18 weeks following September 11th, employers reported 430 mass layoff (i.e., greater than 40 employees) events related to 9/11 to the Bureau of Labor Statistics. See Impact of the Events of September 11,2001, on Mass Layoff Statistics Data Series, Bureau of Labor Statistics, March 1, 2002.

We used Johansen's test in the EasyReg software package written by Bierens (2003).

We also ran the same regression using 1/T911 in place of 1/(T911)2 (not shown). The fit of the model was considerably better with 1/(T911)2.

Although the FAA re-opened commercial airspace at 11 am on September 13th, most carriers did not resume flight operations-other than repositioning diverted aircraft—for another day or two.

We thank an anonymous referee for suggesting this modeling approach.

We present the Newey–West standard errors in order to account for heteroscedasticity and autocorrelated errors, which are natural concerns because of the nature of the data and the reduced form analysis. We have also calculated the standard errors with a stationary bootstrap method and the results were almost identical to the regular OLS standard errors, except that the standard error of the coefficient became unusually large due to the extreme non-convexity of the 1/T2 variable.

We also estimated the model with a simple linear trend in place of the labor force variable. The results show higher predicted RPMs for the post 9/11 period than the results with the labor force variable.

The peak of the business cycle began in July 1990 and reached its trough in March 1991. Source: http://nber.org/cycles.

Contributor Information

Harumi Ito, Email: Harumi_ito@brown.edu.

Darin Lee, Email: darin_lee@lecg.com.

References

- Air Transport Association (2003). Airlines in crisis: the perfect economic storm. Air Transport Association: Washington, D.C.

- Bennett R., Craun J. Office of Aviation Analysis, U.S. Department of Transportation; Washington, D.C.: 1993. The airline deregulation evolution continues: the southwest effect. [Google Scholar]

- Bierens H.J. Department of Economics, Pennsylvania State University; University Park, PA: 2003. EasyReg International. [Google Scholar]

- Borenstein S., Zimmerman M. Market incentives for safe commercial airline operation. American Economic Review. 1988;78:913–935. [Google Scholar]

- Brueckner J. Airport congestion when carriers have market power. American Economic Review. 2002;92:1357–1375. [Google Scholar]

- Brueckner J. Airline traffic and urban economic development. Urban Studies. 2004;40:1455–1469. [Google Scholar]

- Bureau of Transportation Statistics (2002). A Time Series Analysis of Domestic Air Seat and Passenger Miles, Transportation Indicators, October 2002, pp. 125–128.

- Button K., Lall S., Stough R., Trice M. High technology employment and hub airports. Journal of Air Transport Management. 1999;5:53–59. [Google Scholar]

- Davidson R., Mackinnon J. Oxford University Press; New York: 1993. Estimation and inference in econometrics. [Google Scholar]

- Garner A. Consumer confidence after September 11. Federal Reserve Bank of Kansas City Economic Review. 2002;87:5–25. [Google Scholar]

- Hobijn B. What will homeland security cost? Federal Reserve Bank of New York Economic Policy Review. 2002;8:21–33. [Google Scholar]

- Ito, H., Lee, D. (2003). Low cost carrier growth in the U.S. airline industry: past, present and future. Brown University Working Paper, No. 2003-12.

- Masse, R. (2001). How much did the airline industry recover since September 11, 2001? Statistics Canada Research Paper, No. 51F009XIE.

- Mayer C., Sinai T. Network effects, congestion externalities, and air traffic delays: or why all delays are not evil. American Economic Review. 2003;93(4):1194–1215. [Google Scholar]

- Mitchell M., Maloney M. Crisis in the cockpit? The role of market forces in promoting air travel safety. Journal of Law and Economics. 1989;XXXII:329–355. [Google Scholar]

- Morrison S.A. Actual, adjacent and potential competition: estimating the full effect of Southwest airlines. Journal of Transport Economics and Policy. 2001;35:239–256. [Google Scholar]

- Morrison S., Winston C. The Brookings Institution; Washington, D.C.: 1986. The economic effects of airline deregulation. [Google Scholar]

- Rose N. Fear of flying? Economic analyses of airline safety. Journal of Economic Perspectives. 1992;6:75–94. [Google Scholar]

- Rupp, N., Holmes G., Desimone, J. (2004). Airline schedule recovery after aiport closures: empirical evidence since September 11th, Southern Economics Journal, in press.

- Transportation Research Board (1999). Entry and competition in the U.S. airline industry: issues and opportunities. National Research Council, Special Report 255, Washington, D.C.

- Virgo J. Economic impact of the terrorist attacks of September 11, 2001. Atlantic Economic Journal. 2001;29:353–357. [Google Scholar]