Abstract

At the beginning of the 2020 global COVID-2019 pandemic, Chinese financial markets acted as the epicentre of both physical and financial contagion. Our results indicate that a number of characteristics expected during a “flight to safety” were present during the period analysed. The volatility relationship between the main Chinese stock markets and Bitcoin evolved significantly during this period of enormous financial stress. We provide a number of observations as to why this situation occurred. Such dynamic correlations during periods of stress present further evidence to cautiously support the validity of the development of this new financial product within mainstream portfolio design through the diversification benefits provided.

Keywords: COVID-19; Coronavirus; Contagion; Stock market; Sentiment,

1. Introduction

The escalation of the 2020 COVID-19 pandemic represented a global example of the fragility of the world in which we live and as to how vulnerable we are as a society to exceptional risks. However, such financial implications did not proceed without forewarning. In previous pandemics, such as the outbreak of 2003, Bhuyan et al. (2010) found that the stock market returns of the infected countries exhibited a significant increase in the cointegrated relationship and dynamic comovements, when compared to the pre-SARS period. While considering both the physical and psychological re-estimation of financial markets as to how global finance will return to normality in the aftermath the current global pandemic, our understanding of the interactions between financial assets must be scrutinised, particularly due to the ever-expanding side-effects of technological development of both the exchange, the speed of information flow (Corbet, Lucey, Peat, Vigne, 2018a, Corbet, Cumming, Lucey, Peat, Vigne, 2020a), the role of algorithmic trading (Jarrow, Protter, 2012, Kirilenko, Kyle, Samadi, Tuzun, 2017), and in more recent times, as to how digital currencies can act as not only a store of value during periods of market turmoil, but also as a source of portfolio diversification. Gil-Alana et al. (2020) identified a potential role for cryptocurrencies in investor portfolios as a significant diversification option for investors, with particular emphasis on Bitcoin and Ethereum. While Omane-Adjepong and Alagidede (2019) identified that any probable diversification benefits within cryptocurrencies are most like to be found within intra-week to intra-monthly time horizons for specific market pairs, while the level of inter-market connectedness and volatility interlinkages are identified as being sensitive to both liquidity and volatility. Liu (2019) further identified portfolio benefits from the inclusion of cryptocurrency. When specifically investigating the market relationships between cryptocurrency and other traditional financial variables, Bouri et al. (2017) found that Bitcoin is a poor hedge and is suitable for diversification purposes only, a result that was echoed when considering the S&P500 exchange (Tiwari et al., 2019) and for each of the Eurostoxx 50, the Nikkei 225 and the CSI 300 (Feng et al., 2018). More recently, Conlon and McGee (2020) suggests that Bitcoin was neither a safe haven nor a hedge against the extreme bear market in the S&P500 occasioned by the COVID-19 pandemic.

2. Data and methodology

We specifically investigate the contagion effects associated with the onset of the COVID-2019 pandemic between Chinese stock markets, identified as the epicentre of the first registered cases as outlined in the timetable presented in Table 1 . We utilise these events to generate dummy variables through which we analyse the contagion effects centred in the price volatility of both the Shanghai and Shenzhen Stock Exchanges. Ramelli and Wagner (2020) identified that the COVID-19 pandemic had morphed into an economic crisis amplified through financial channels through a whipsaw pattern as corporate investors became increasingly worried about the accumulation of corporate debt and the substantial liquidity shortage that had manifested. Through the inclusion of these Chinese financial markets, denoted as the epicentre of the COVID-2019 pandemic, the Dow Jones Industrial Average as a measure of international financial performance (Ekinci et al., 2019), West Texas Intermediate oil and gold as international flight to safety assets (Akyildirim et al., 2020) and Bitcoin, which has presented evidence of inverse correlations with some international stock exchanges, thereby providing strong diversification benefits (Akhtaruzzaman, Sensoy, Corbet, 2019, Akyildirim, Corbet, Katsiampa, Kellard, Sensoy, 2019a). In this study, we use hourly, and for robustness, daily returns to analyse the dynamic correlations between this range of financial assets. Our hourly returns are calculated as:

| (1) |

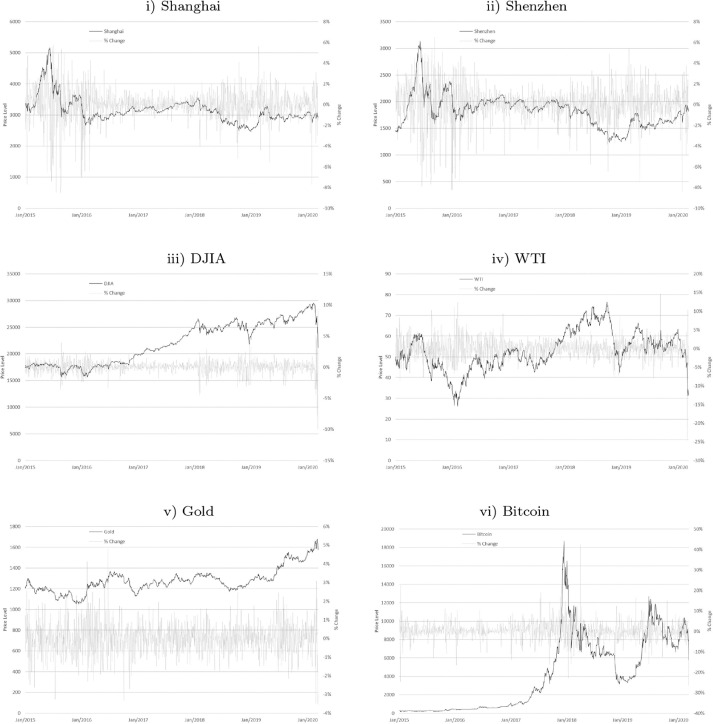

where r t,m is the return for hour h on trading day t. Time periods with no trading activity are determined to be best represented by the last traded price. Hourly data from 11 March 2019 to 10 March 2020 (5701 observations), are used1 denoted as both pre- and post-COVID-2019 pandemic (4580 and 1122 observations respectively) is denoted to be before or after 31 December 2019. Data is sourced through Thomson Reuters Eikon. Evidence of sharp declines are evident in the period thereafter through exceptionally changes evident in the minima, skewness and kurtosis of these short-term returns. The summary statistics for each variable are presented in Table 2 , with evidence of the associated share price behaviour and volatility presented in Fig. 1 . Times are adjusted to Greenwich Mean Time to allow for comparability across the selected geographical regions. For the purpose of exchange comparison out-of-session, daily returns are used to measure dynamic correlations (similarly to the methods used by Akyildirim et al. (2019b); Katsiampa, Corbet, Lucey, 2019a, Katsiampa, Corbet, Lucey, 2019b).

Table 1.

Key dates in the Chinese COVID-2019 outbreak.

| Date | Event |

|---|---|

| December 31, 2019 | Cases of pneumonia detected in Wuhan, China, are first reported to the WHO. During this reported period, the virus is unknown. The cases occur between December 12, and December 29, according to Wuhan Municipal Health. |

| January 1, 2020 | Chinese health authorities close the Huanan Seafood Wholesale Market after it is discovered that wild animals sold there may be the source of the virus. |

| January 5, 2020 | China announces that the unknown pneumonia cases in Wuhan are not SARS or MERS |

| January 7, 2020 | Chinese authorities confirm that they have identified the virus as a novel coronavirus, initially named 2019-nCoV by the WHO. |

| January 11, 2020 | The Wuhan Municipal Health Commission announces the first death caused by the coronavirus. A 61-year-old man, exposed to the virus at the seafood market, died on January 9, after respiratory failure caused by severe pneumonia. |

| January 13, 2020 | First cross-border transmission as Thai authorities report a case of infection caused by the coronavirus. The infected individual is a Chinese national who had arrived from Wuhan. |

| January 30, 2020 | WHO declares 2019-nCoV to be a “Public Health Emergency of International Concern” |

| February 11, 2020 | WHO announces a new name for the virus, COVID-19 |

| March 11, 2020 | WHO declares COVID-19 to be a Pandemic |

Note: The above table consists of the key events relating to the Chinese epicentre COVID-2019 outbreak. The dates represent dummy variables in the associated GARCH and DCC-GARCH estimations.

Table 2.

Summary statistics of selected financial market variables.

| Shanghai | Shenzhen | DJIA | WTI | Gold | Bitcoin | |

|---|---|---|---|---|---|---|

| Total Period Analysed (5701 observations) | ||||||

| Mean | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0001 |

| Std Dev | 0.0023 | 0.0028 | 0.0023 | 0.0047 | 0.0018 | 0.0092 |

| Minimum | −0.0718 | −0.0750 | −0.0615 | −0.0666 | −0.0225 | −0.0886 |

| Maximum | 0.0252 | 0.0304 | 0.0295 | 0.0724 | 0.0175 | 0.0865 |

| Variance | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0001 |

| Skewness | −5.9042 | −3.4336 | −4.3918 | −0.0317 | −0.6658 | −0.2070 |

| Kurtosis | 196.9949 | 113.1889 | 140.2742 | 35.0332 | 17.6908 | 8.9373 |

| Before Coronavirus (4580 observations) | ||||||

| Mean | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0001 |

| Std Dev | 0.0020 | 0.0025 | 0.0016 | 0.0039 | 0.0016 | 0.0097 |

| Minimum | −0.0337 | −0.0371 | −0.0189 | −0.0410 | −0.0225 | −0.0886 |

| Maximum | 0.0252 | 0.0304 | 0.0175 | 0.0337 | 0.0138 | 0.0865 |

| Variance | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0001 |

| Skewness | −0.5488 | −0.2841 | −1.0825 | −0.5360 | −0.4233 | −0.2010 |

| Kurtosis | 41.2553 | 33.4127 | 34.5759 | 10.4541 | 16.9029 | 8.3757 |

| After Coronavirus (1122 observations) | ||||||

| Mean | 0.0000 | 0.0001 | −0.0001 | −0.0002 | 0.0000 | 0.0002 |

| Std Dev | 0.0031 | 0.0037 | 0.0040 | 0.0072 | 0.0022 | 0.0067 |

| Minimum | −0.0718 | −0.0750 | −0.0615 | −0.0666 | −0.0209 | −0.0530 |

| Maximum | 0.0129 | 0.0248 | 0.0295 | 0.0724 | 0.0175 | 0.0428 |

| Variance | 0.0000 | 0.0000 | 0.0000 | 0.0001 | 0.0000 | 0.0000 |

| Skewness | −11.6273 | −6.9313 | −3.8890 | 0.3583 | −0.9857 | −0.1866 |

| Kurtosis | 271.3470 | 151.0273 | 72.4226 | 28.6361 | 14.7752 | 7.6318 |

Note: Hourly data is presented to the period 11 March 2019 and 10 March 2020, where the period denoted as both pre- and post-COVID-2019 pandemic is denoted to be before and after 31 December 2019.

Fig. 1.

Price and volatility performance of the selected traditional financial assets Note: The above figure represents the estimated price and volatility behaviour of the selected Chinese stock exchange and the selected traditional financial assets.

The changing correlations between these financial assets are presented in Table 3 . Comparing the periods both before and after the COVID-2019 pandemic, we observe some strong changes in dynamic behaviour. There is evidence of elevated correlations between the selected Chinese exchanges, increasing from +0.889 to +0.967 as market conditions began to deteriorate. Particularly sharp increased correlation is also evident between Chinese markets and WTI (increasing sharply from +0.091 to +0.485), while the correlation between Chinese markets and gold, which was negative prior to the COVID-19 outbreak, grew to +0.335 and +0.347 respectively with the Shanghai and Shenzhen stock exchanges. However, with regards to the interactions between Chinese stock markets and digital currencies, we observe sharp, short-term, dynamic correlations between Bitcoin and Chinese stock markets in the period after the identification of the COVID-19 pandemic. To specifically To analyse the dynamic correlations between the corporate entities exposed to reputational exposure due to naming similarity from the COVID-2019 pandemic, we employ a standard GARCH (1,1) methodology of Bollerslev (1986) and extract dynamic conditional correlations (of Engle, 2002) that takes the form:

| (2) |

| (3) |

where rt, et and ht are the returns of the investigated lagged corporate returns, international exchanges (Shanghai SE, Shenzhen SE and DJIA) and hedging alternatives (WTI, gold and BTC) at time t respectively. σ, η and γ represent the effects of lagged returns of each selected variable on the returns of the company’s hourly price volatility. The variance equation includes the long-term average volatility α 0. Similar methodological structures were utilised by Corbet et al. (2015) and Corbet et al. (2020c). We explore the dynamic co-movements via the dynamic conditional correlations of Engle (2002). The GARCH (1,1) specification requires that in the conditional variance equation, parameters α 0, α 1 and β should be positive for a non-negativity condition and the sum of α 1 and β should be less than one to secure the covariance stationarity of the conditional variance. Moreover, the sum of the coefficients α 1 and β must be less than or equal to unity for stability to hold. The GARCH (1,1) methodology used in this study has the following form:

| (4) |

| (5) |

| (6) |

Table 3.

Correlations between traditional financial markets, both before and after the COVID-2019 outbreak.

| Shanghai | Shenzhen | DJIA | WTI | Gold | Bitcoin | |

|---|---|---|---|---|---|---|

| Before COVID-2019 | ||||||

| Shanghai | 1.0000 | |||||

| Shenzen | 0.8894 | 1.0000 | ||||

| DJIA | 0.1652 | 0.1454 | 1.0000 | |||

| WTI | 0.0911 | 0.0802 | 0.3023 | 1.0000 | ||

| Gold | −0.0091 | −0.0141 | −0.1805 | 0.0136 | 1.0000 | |

| Bitcoin | 0.0188 | 0.0209 | 0.0361 | −0.0071 | 0.0392 | 1.0000 |

| After COVID-2019 | ||||||

| Shanghai | 1.0000 | |||||

| Shenzhen | 0.9670 | 1.0000 | ||||

| DJIA | 0.2439 | 0.2630 | 1.0000 | |||

| WTI | 0.4849 | 0.4880 | 0.6012 | 1.0000 | ||

| Gold | 0.3350 | 0.3473 | −0.1168 | 0.0143 | 1.0000 | |

| Bitcoin | 0.3436 | 0.3857 | 0.4299 | 0.2792 | 0.4688 | 1.0000 |

Note: In the above table, the changing correlations between the identified companies susceptible to the ‘corona’ naming shock and these financial assets. The date indicating the start of the pandemic is that of 31 December 2019, when cases of pneumonia detected in Wuhan, China, are first reported to the WHO.

represents the lagged value of the selected Chinese stock exchanges, the first being the Shanghai Stock Exchange, the second being the Shenzhen Stock Exchange. j reprents the number of hourly periods before Rt is observed. b 2 DJIAt represents the interactions between the selected Chinese stock exchange and the DJIA, representing the influence of international effects. b 3 WTIt, b 4 Gt and b 5 BTC represent the relationship between the selected companies and the returns of WTI, gold and Bitcoin respectively. Dt and are included in both the mean and variance equations to provide estimates of the corporate pricing and volatility estimates relating directly to the COVID-2019 pandemic. Bollerslev (1986) argued for restrictions on the parameters for positivity, ω > 0, α ≥ 0 and β ≥ 0, and the wide-sense stationarity condition, . While the GARCH (1,1) process is uniquely stationary if Bollerslev (1986) also proved that if the fourth order moment exists, then the model can handle leptokurtosis. Bonferroni adjusted results are presented in this analysis. To cater the multiple hypothesis problem, we adjust the significance level using the Bonferroni correction, which leads to a significance level of 0.1%. The generalised Bonferroni method adjusts the significance level such that hypothesis is deemed rejected if and only if:

This procedure has the advantage of being robust to the dependence structure of the hypothesis tests.

3. Empirical results

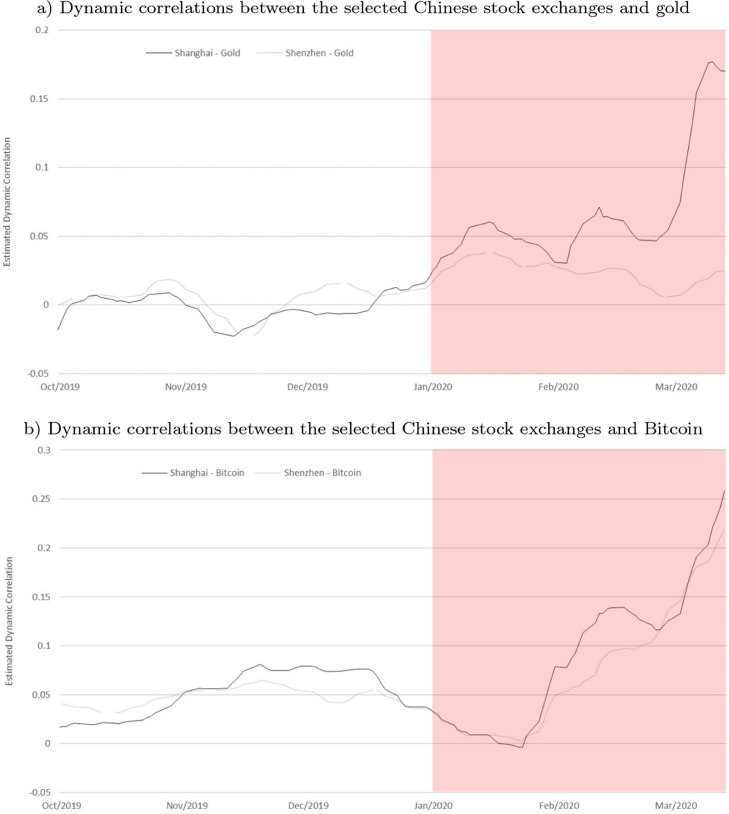

In Table 4 we observe the results of the estimated GARCH methodology which was also presented as separated by the staxrting date of the Chinese outbreak of COVID-19. While some strong relationships between markets are identified when analysing the full sample of data, a number of interesting observations arise when considering the periods both before and after the start of the pandemic. Considering both the Shanghai and Shenzhen Stock Exchanges, COVID-19 is found to have a strong, significant positive impact on the volatility of each exchange. There is evidence of quite a sheltered interaction between Chinese and US financial markets, +0.119 and +0.160 for Shanghai and Shenzhen respectively. Similarly, there is quite a subdued positive interrelationship between WTI and Chinese stock markets, albeit it strongly significant. It is very interesting to note that neither gold nor cryptocurrencies, as measured through the price dynamics of Bitcoin, are found to have a significant relationship with Chinese stock markets. However, when analysing this same relationship using high-frequency data as presented in Fig. 2 , we notice a peculiar interaction between Chinese stocks indices at the point of the onset of the COVID-19 outbreak. There is evidence of sharp elevations in dynamic correlations between these markets. Despite the elevation in dynamic correlations, the Chinese markets themselves held up remarkably well in the face of the domestic phase of the pandemic. A partial explanation might arise from the findings in Albulescu (2020) which finds that the spread of COVID-19 geographically is closely related to the degree of financial instability. Similarly (Caporale et al., 2020) shows profound non-linear and phase transition behaviour in cryptocurrencies. Bitcoin is also exceptionally volatile. In the January-February period it showed a significant rise, led it is argued by fundamentals including position forming before an expected May forking event,2 much but not all of which was erased as the global spread of the virus manifested. The two Chinese indices showed resilience over this period, as there was a sharp drop quickly erased as the Wuhan situation peaked as the perception of the Chinese government taking control was widespread. Gold prices also rose over this period, the early March period excepted but then showing a massive spiking as global travel restrictions and supply chain disruptions impacted supply.

Table 4.

GARCH methodology estimates.

| Shanghai |

Shenzhen |

|||||

|---|---|---|---|---|---|---|

| Before | After | Total | Before | After | Total | |

| L1 | −0.0090 | −0.0207 | −0.0658*** | −0.0121 | −0.0755 | −0.0755* |

| (0.0129) | (0.0199) | (0.0233) | (0.0272) | (0.0461) | (0.0461) | |

| L2 | −0.0090 | 0.0321* | −0.0468*** | 0.0041 | −0.0169 | −0.0169 |

| (0.0119) | (0.0181) | (0.0145) | (0.0188) | (0.0376) | (0.0376) | |

| DJIA | 0.0435* | 0.1141*** | 0.1198*** | 0.1789*** | 0.1598*** | 0.1598*** |

| (0.0247) | (0.0226) | (0.0304) | (0.0550) | (0.0618) | (0.0618) | |

| WTI | 0.0059 | 0.0195 | 0.0427*** | 0.0115 | 0.1102 | 0.1102 |

| (0.0081) | (0.0115) | (0.0133) | (0.0191) | (0.0290) | (0.0290) | |

| Gold | 0.0179 | 0.0354 | 0.0110 | 0.0170 | 0.0238 | 0.0238 |

| (0.0253) | (0.0245) | (0.0407) | (0.0644) | (0.0689) | (0.0689) | |

| Bitcoin | 0.0028 | −0.0011 | −0.0029 | 0.0080 | 0.0170 | 0.0170 |

| (0.0044) | (0.0045) | (0.0072) | (0.0133) | (0.0108) | (0.0108) | |

| COVID-19 Mean | 0.0000*** | 0.0000*** | ||||

| (0.0000) | (0.0000) | |||||

| COVID-19 Volatility | 0.0044*** | 0.0018*** | ||||

| (0.0001) | (0.0003) | |||||

| Constant | 0.0001* | 0.0002* | 0.0001*** | 0.0001*** | 0.0001*** | 0.0001*** |

| (0.0001) | (0.0001) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| ARCH | 0.4294 | 0.4382 | 0.4424 | 0.4022 | 0.0251 | 0.0126*** |

| (0.0602) | (0.0662) | (0.0446) | (0.0506) | (0.0153) | (0.0153) | |

| GARCH | 0.5314 | 0.5161 | 0.5548 | 0.5156 | 0.9632 | 0.9824*** |

| (0.0510) | (0.2057) | (0.0291) | (0.0467) | (0.0158) | (0.0158) | |

| Log-likelihood | 2,432.8 | 1,740.0 | 2,557.7 | 1,815.4 | 1,278.7 | 2,389.7 |

| Chi2(10) | 4325.19 | 4325.19 | 7,542.1 | 220.2 | 456.4 | 420.3 |

| Prob >Chi2 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

Note: The presented analysis was conducted using hourly data between the period 11 March 2019 and 10 March 2020 (5701 observations), where the period denoted as both pre- and post-COVID-2019 pandemic (4580 and 1122 observations respectively) is denoted to be before and after 31 December 2019. ****, ***, ** and * indicates statistical significance at the 0.1%, 1%, 5% and 10% levels respectively.

Fig. 2.

Dynamic correlations between denoted company and the Shanghai & Shenzhen Stock Exchanges Note: The above figure represents the estimated dynamic correlations between the selected traditional financial assets and the Chinese stock exchange.

4. Concluding comments

Cryptocurrencies have emerged as a new financial instrument. Their novelty, both in terms of time and their nature, makes it as yet unclear what their final status will be as a potential diversifier or otherwise. The evidence here, and in papers such as Conlon and McGee (2020) indicates that in times of serious financial and economic disruption these assets do not act as hedges, or safe havens, but perhaps rather as amplifiers of contagion. The behaviour of gold relative to cryptocurrencies in the Chinese markets reinforces results in papers by Corbet et al. (2018b) and Corbet et al. (2019).

Footnotes

The time period also allows us to disaggregate the effects of the COVID-19 pandemic from the generalised equity market rout that was occasioned by the widespread arrival of the virus to the USA and European countries (on 27 February 2020 new cases outside China exceeded those within China for the first time, on 30 January 2020 the World Health Organization recognized the disease as a “Public Health Emergency of International Concern” and on 11 March 2020 declared it a Pandemic) and the “oil price war” which began on 9–10 March. Similar techniques were used by Corbet et al. (2020b).

References

- Akhtaruzzaman M., Sensoy A., Corbet S. The influence of Bitcoin on portfolio diversification and design. Finance Res. Lett. 2019:101344. [Google Scholar]

- Akyildirim E., Corbet S., Efthymiou M., Guiomard C., O’Connell J., Sensoy A. The financial market effects of international aviation disasters. Int. Rev. Financ. Anal. 2020;69 [Google Scholar]

- Akyildirim E., Corbet S., Katsiampa P., Kellard N., Sensoy A. The development of Bitcoin futures: exploring the interactions between cryptocurrency derivatives. Finance Res. Lett. 2019 [Google Scholar]

- Akyildirim E., Corbet S., Lucey B., Sensoy A., Yarovaya L. The relationship between implied volatility and cryptocurrency returns. Finance Res. Lett. 2019 [Google Scholar]

- Albulescu, C., 2020. Coronavirus and financial volatility: 40 days of fasting and fear. arXiv preprint arXiv:2003.04005.

- Bhuyan R., Lin E., Ricci P. Asian stock markets and the severe acute respiratory syndrome (SARS) epidemic: implications for health risk management. Int. J. Environ. Health. 2010;4(1):40–56. [Google Scholar]

- Bollerslev T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986;31(3):307–327. [Google Scholar]

- Bouri E., Molnar P., Azzi G., Roubaud D., Hagfors L. On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier? Finance Res. Lett. 2017;20:192–198. [Google Scholar]

- Caporale G.M., Kang W.-Y., Spagnolo F., Spagnolo N. Non-linearities, cyber attacks and cryptocurrencies. Finance Res. Lett. 2020;32:101297. [Google Scholar]

- Conlon, T., McGee, R., 2020. Safe Haven or Risky Hazard? Bitcoin during the COVID-19 Bear Market. Available at SSRN: https://ssrn.com/abstract=3560361. [DOI] [PMC free article] [PubMed]

- Corbet S., Cumming D.J., Lucey B.M., Peat M., Vigne S. Investigating the dynamics between price volatility, price discovery, and criminality in cryptocurrency markets. Econ. Lett. 2020 [Google Scholar]

- Corbet S., Dowling M., Cummins M. Analyst recommendations and volatility in a rising, falling, and crisis equity market. Finance Res. Lett. 2015;15:187–194. [Google Scholar]

- Corbet, S., Hu, Y., Lucey, B. M., Oxley, L., 2020b. Aye Corona! The Contagion Effects of Being Named Corona during the COVID-19 Pandemic. Available at SSRN: https://ssrn.com/abstract=3561866. [DOI] [PMC free article] [PubMed]

- Corbet S., Larkin C., Lucey B., Meegan A., Yarovaya L. The impact of macroeconomic news on Bitcoin returns. Eur. J. Finance. 2020;3(7):1–21. [Google Scholar]

- Corbet S., Lucey B., Peat M., Vigne S. Bitcoin futures—what use are they? Econ. Lett. 2018;172:23–27. [Google Scholar]

- Corbet S., Lucey B.M., Urquhart A., Yarovaya L. Cryptocurrencies as a financial asset: a systematic analysis. Int. Rev. Financ. Anal. 2019;62:182–199. [Google Scholar]

- Corbet S., Meegan A., Larkin C., Lucey B., Yarovaya L. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Econ. Lett. 2018;165:28–34. [Google Scholar]

- Ekinci C., Akyildirim E., Corbet S. Analysing the dynamic influence of us macroeconomic news releases on turkish stock markets. Finance Res. Lett. 2019;31:155–164. [Google Scholar]

- Engle R. Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002;20(3):339–350. [Google Scholar]

- Feng W., Wang Y., Zhang Z. Can cryptocurrencies be a safe haven: a tail risk perspective analysis. Appl. Econ. 2018;50(44):4745–4762. [Google Scholar]

- Gil-Alana L., Abakah E., Rojo M. Cryptocurrencies and stock market indices. are they related? Res. Int. Bus. Finance. 2020;51 [Google Scholar]

- Jarrow R.A., Protter P. A dysfunctional role of high frequency trading in electronic markets. Int. J. Theor. Appl. Finance. 2012;15(03):1250022. [Google Scholar]

- Katsiampa P., Corbet S., Lucey B. High frequency volatility co-movements in cryptocurrency markets. J. Int. Financ. Mark. Inst. Money. 2019;62:35–52. [Google Scholar]

- Katsiampa P., Corbet S., Lucey B. Volatility spillover effects in leading cryptocurrencies: a BEKK-MGARCH analysis. Finance Res. Lett. 2019;29:68–74. [Google Scholar]

- Kirilenko A., Kyle A.S., Samadi M., Tuzun T. The flash crash: high-frequency trading in an electronic market. J. Finance. 2017;72(3):967–998. [Google Scholar]

- Liu W. Portfolio diversification across cryptocurrencies. Finance Res. Lett. 2019;29:200–205. [Google Scholar]

- Omane-Adjepong M., Alagidede I. Multiresolution analysis and spillovers of major cryptocurrency markets. Res. Int. Bus. Finance. 2019;49:191–206. [Google Scholar]

- Ramelli, S., Wagner, A. F., 2020. Feverish stock price reactions to covid-19. Available at SSRN: https://ssrn.com/abstract=3550274.

- Tiwari A., Raheem I., Kang S. Time-varying dynamic conditional correlation between stock and cryptocurrency markets using the copula-ADCC-EGARCH model. Phys. A. 2019;535 [Google Scholar]