Highlights

-

•

45 cryptocurrency and 16 international stock markets are analyzed

-

•

A Big Data set is investigated before and during the COVID-19 pandemic period

-

•

We estimate stability and regularity metrics to infer on the predictability of price fluctuations

-

•

We find that cryptocurrencies embed higher instability and irregularity

-

•

Investing in digital assets during big crises could be considered riskier compared to equities

Keywords: COVID-19, Cryptocurrency, Stock markets, Largest Lyapunov exponent, Approximate entropy

Abstract

We explore the evolution of the informational efficiency in 45 cryptocurrency markets and 16 international stock markets before and during COVID-19 pandemic. The measures of Largest Lyapunov Exponent (LLE) based on the Rosenstein's method and Approximate Entropy (ApEn), which are robust to small samples, are applied to price time series in order to estimate degrees of stability and irregularity in cryptocurrency and international stock markets. The amount of regularity infers on the unpredictability of fluctuations. The t-test and F-test are performed on estimated LLE and ApEn. In total, 36 statistical tests are performed to check for differences between time periods (pre- versus during COVID-19 pandemic samples) on the one hand, as well as check for differences between markets (cryptocurrencies versus stocks), on the other hand. During the COVID-19 pandemic period it was found that (a) the level of stability in cryptocurrency markets has significantly diminished while the irregularity level significantly augmented, (b) the level of stability in international equity markets has not changed but gained more irregularity, (c) cryptocurrencies became more volatile, (d) the variability in stability and irregularity in equities has not been affected, (e) cryptocurrency and stock markets exhibit a similar degree of stability in price dynamics, whilst finally (f) cryptocurrency exhibit a low level of regularity compared to international equity markets. We find that cryptos showed more instability and more irregularity during the COVID-19 pandemic compared to international stock markets. Thus, from an informational efficiency perspective, investing in digital assets during big crises as the COVID-19 pandemic, could be considered riskier as opposed to equities.

1. Introduction

Since the financial crisis of 2008, a large number of studies has focused on the response of equity markets to such long and significant economic crises. For instance, scholars have examined the effect of the subprime mortgage crisis of 2008 upon the hierarchical structure of stock markets [1], markets contagion [2], [3], [4], [5], crude oil markets [6,7], fertilizer markets [8,9], serial correlations in stocks [10], [11], [12], [13], [14] and currency markets [15], or upon the changes in market risk [16], volatility transmission [17], [18], [19], [20], [21], [22], and markets’ connectedness [23,24].

Since the world health organization has declared the Covid-19 pandemic as global health emergency, the world economy has been drastically affected. Sales declined, consumers changed their behaviour, the production was reduced, companies were in serious financial burden, and unemployment rates increased worldwide. Such severe shifts in business and economy across the world are expected to affect equities as well as alternative investments such as cryptocurrency markets. To date, from an investment perspective, there is a need to assess how Covid-19 pandemic affected efficiency in cryptocurrency and stock markets. The purpose of the current work is to examine any complexity traits in cryptocurrency and stock markets before and during Covid-19 Pandemic.

Indeed, this the first study to conduct a formal and robust empirical investigation on the effect of Covid-19 Pandemic upon the efficiency of cryptocurrency and equity markets, to the best of our knowledge. The Covid-19 pandemic is not over yet. However, investors and traders still have time to adjust their decisions based on the current shifts and intrinsic dynamics of these markets. Indeed, market agents and policy makers need a first assessment of current impacts of the COVID-19 outbreak on equity markets to provide better decision making in the short run.

The main purpose of this study is to assess complexity patterns in cryptocurrency and stock markets before and during the Covid-19 pandemic based on the estimation of chaos and randomness in their respective prices. To this end, the Largest Lyapunov Exponent (LLE) [25] and approximate entropy (ApEn) [26] will be applied to price time series in order to estimate the degrees of chaos and randomness respectively. The LLE describes the rate of divergence/convergence of initially close trajectories with time in a given non-stationary signal. It reveals the chaotic characteristic of a nonlinear signal and describes its stable/unstable state. The approximate entropy is suitable to measure the sequential and temporal regularity/irregularity of a nonlinear signal. Hence, measuring both LLE and approximate entropy in price time series allows to assess divergence/convergence and regularity/irregularity of cryptocurrency and stock time series before and during Covid-19 pandemic. The main advantage of using the LLE methodology in [25] and approximate entropy is that they provide efficient estimates even in case the length of original signals is small [26]. For each category of equity markets, the difference in estimated LLE between pre- and during pandemic periods will be tested via a Student t-test and an F-test. Similar tests will be applied to estimated approximate entropy measures.

Our contributions include a fist attempt to investigate the effect of COVID-19 pandemic on the stability of a Big Data set composed of 45 cryptocurrencies and 16 international stock markets. Next, we compare the effects of COVID-19 pandemic across cryptocurrency and stock markets to shed light on which markets have been more affected by such outbreak. Moreover, we enrich the relevant literature on the efficiency of cryptocurrency markets [27], [28], [29], [30], [31], [32] and spillovers of stock markets due to financial crises [1], [2], [3], [4], [5], [6], [7], [8], [9], [10], [11], [12], [13], [14], [15], [16], [17], [18], [19], [20], [21], [22], [23], [24]. Section 2 presents the Largest Lyapunov Exponent (LLE) and approximate entropy (ApEn) approaches. Section 3 describes the Big Data sets and provides with the empirical results. Finally, Section 4 concludes.

2. Regularity and stability methodologies

2.1. The largest Lyapunov exponent

The largest Lyapunov Exponent describes the divergence/convergence of two trajectories with similar initial conditions. Following the approach by Rosenstein et al [25], let's define a time series {x 1,x 2,…,x N} and Xi=(xi,xi + J,…,xi +( m - t ) J) a system state at discrete time i, where J is the lag or reconstruction delay and m is the embedding dimension. Thus, the reconstructed trajectory is X = (X1 X2 … XM)T. Afterwards, the method requires localizing the nearest neighbor of each point of the reconstructed trajectory X. The nearest neighbor X j to X i is determined by calculating the smallest distance dj(0) expressed as follows [25]:

| (1) |

The divergence is the average exponential rate characterized by the largest Lyapunov exponent λ1 as follows:

| (2) |

where d(t) is the average divergence at time t and C is a constant that normalizes the initial separation. If we assume that the j-th pair of nearest neighbors diverges approximately at a rate given by the LLE, then we obtain:

| (3) |

where Δt is the sampling rate and dj(i) the distance between the jth pair of nearest neighbors after i discrete-time steps. By taking the logarithm of both sides of Eq.3, we obtain:

| (4) |

Then, Eq.4 describes a set of almost parallel lines (for j = 0, 1,…, M-1), with slope roughly analogous to λ1 [25]. Finally, the LLE is estimated by using a least-squares fit to the average line expressed as:

| (5) |

where 〈⋅〉 denotes the average over all pairs of j. Following the approach in [25], it is assumed that the delay J corresponds to the lag before the first decline of the autocorrelation function, and the embedding dimension m is determined based on the smallest value that allows convergence. This way fast computation is enhanced. Recall that a positive value of λ1 indicates divergent trajectories (unstable system) whilst a negative value indicates convergent trajectories (stable system). Accuracy, robustness to small and noisy data sets, and fast computation are the main advantages of using the approach by Rosenstein et al [25].

2.2. Approximate entropy

The Approximate entropy [26] was introduced to measure regularity/irregularity of a time-series. Consider a time series 〈x(n) = x(1), x(2), x(3), . . ., x(N)〉 where N is the time series length. Let m be a positive integer used to represent an embedding dimension and let r be a filter factor. Then, let's form the m-vectors X(1), X(2),…, X(N−m+1) where X(i)=[x(i), x(i+1),…, x(i+m−1)] and i=1, N−m+1. The distance between X(i) and X(j) is expressed as follows:

| (6) |

Next, for each i=1, (N−m+1), the are computed where:

| (7) |

The quantity Φm(r) is computed as follows:

| (8) |

In a similar way, the quantity Φm +1(r) is computed after increasing the dimension to m+1. Finally, the ApEn value of the time series can be calculated by:

| (9) |

Hence, a large value of ApEn represents strong irregularity and unpredictability of the current time series as opposed to a low ApEn value which implies regularity.

3. Data and empirical results

The COVID-19 outbreak started in December 2019 in Wuhan city in China and has been declared by the world health organization as pandemic on 30th January 2020. To investigate the impact of COVID-19 pandemic upon the stability of daily prices of cryptocurrency and stock markets, we consider two different time periods. The pre-pandemic period spans September 2019 to December 2019 and the pandemic period from January 2020 to April 2020. The data was gathered from Yahoo finance. There comprise respectively 123 and 120 samples in the pre-pandemic and pandemic periods. Thus, we explore the chaotic and irregularity properties of 45 cryptocurrency markets and 16 international stock markets under a Big Data framework. The list of cryptocurrencies includes Bitcoin, Ethereum, XRP, Tether, Bitcoin Cash, Litecoin, Binance, EOS, Stellar, Cardano, Chainlink, Monero, Tron, Ethereum, Dash, Neo, IOTA, Zcash, NEM, Dogecoin, BigiByte, Basic Attention Token, VeChain, 0X, Decred, Bitcoin Gold, Qtum, ICON, Lisk, Augur, Kyber Network, Waves, OmiseGO, Status, Siacoin, MCO, MonaCoin, Nano, DigixDAO, Komodo, Steem, Verge, BitShares, Bytecoin, Horizen, MaidSafeCoin. The list of international stock markets comprises TSX (Canada), S&P500 (USA), DAX (Germany), CAC40 (France), BEL20 (Belgium), MOEX (Russia), Nikkei225 (Japan), HANG SENG (China), SSE Composite (Shanghai), All Ordinaries (Australia), BSE SENSEX (Bombay, India), KOSPI (South Korea), TSEC (Taiwan), IBOVESPA (Brazil), IPC (Mexico), and MERVAL (Argentina).

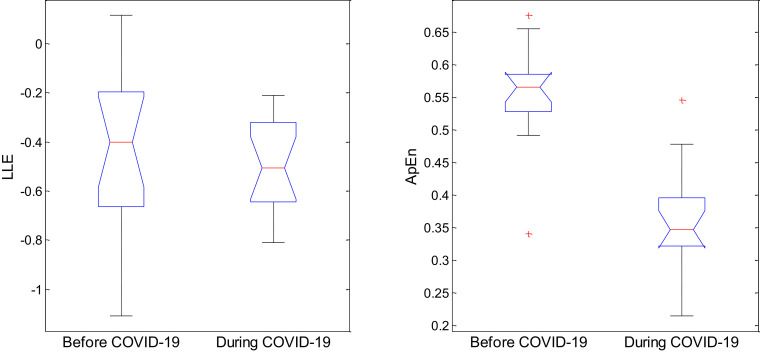

For illustration purposes, Fig. 1 plots Bitcoin price evolution before and during COVID-19 pandemic and Fig. 2 depicts the S&P500 price evolution. As shown, the dynamics of each price data are different across pre- and during the COVID-19 pandemic. In addition, Fig. 3 displays the boxplots of LLE and ApEn for cryptocurrency markets, and Fig. 4 the boxplots of LLE and ApEn for international equity markets.

Fig. 1.

Plots of Bitcoin price data before and during the COVID-19 pandemic.

Fig. 2.

Plots of S&P500 price index before and during the COVID-19 pandemic.

Fig. 3.

Boxplots of the LLE and ApEn metrics for cryptocurrency markets before and during COVID-19 pandemic. The dataset includes 45 cryptocurrency markets.

Fig.4.

Boxplots of the LLE and ApEn metrics for international equity markets before and during COVID-19 pandemic. The dataset includes 16 international equity markets.

To check if the distributions of the LLE and ApEn of each category of markets are significantly altered by the impact of the COVID-19 pandemic, a Student's t-test (test for equality of means) and an F-test (test for equality of variances) are both applied to the estimated sample populations of the LLE and ApEn metrics. The results are provided in Tables 1 and 2 respectively. Table 3 provides the results from the t-test and F-test when performed to check if LLE and ApEn metrics are different between cryptocurrency and international stock markets. In other words, the two statistical tests are applied at two different levels: firstly, checking differences between time periods and secondly checking for differences between markets. Consequently, the total number of performed statistical tests is 36, all at 5% statistical significance level. A given null hypothesis is rejected when the test p-value is less than 5%.

Table 1.

Reported probability values from t-test

| Null hypothesis | Cryptocurrency markets | Stock markets |

|---|---|---|

| Two-side tests | ||

| LLE mean before pandemic = LLE mean during pandemic | 0.0474 | 0.7562 |

| ApEn mean before pandemic = ApEn mean during pandemic | 0.0200 | 8.8244×10−08 |

| One-side tests | ||

| LLE mean before pandemic > LLE mean during pandemic | 0.9763 | 0.3781 |

| LLE mean before pandemic < LLE mean during pandemic | 0.0237 | 0.6219 |

| ApEn mean before pandemic > ApEn mean during pandemic | 0.0100 | 4.4122×10−08 |

| ApEn mean before pandemic < ApEn mean during pandemic | 0.9900 | 1.0000 |

Table 2.

Reported probability values from F-test

| Null hypothesis | Cryptocurrency markets | Stock markets |

|---|---|---|

| Two-side tests | ||

| LLE variance before pandemic = LLE variance during pandemic | 2.9275×10−04 | 0.2629 |

| ApEn variance before pandemic = ApEn variance during pandemic | 0.0916 | 0.8502 |

| One-side tests | ||

| LLE variance before pandemic > LLE variance during pandemic | 1.4637×10−04 | 0.1315 |

| LLE variance before pandemic < LLE variance during pandemic | 0.9999 | 0.8685 |

| ApEn variance before pandemic > ApEn variance during pandemic | 0.0458 | 0.5749 |

| ApEn variance before pandemic < ApEn variance during pandemic | 0.9542 | 0.4251 |

Table 3.

Reported probability values of comparative testing of cryptocurrency vs. stock markets

| Null hypothesis | p-value |

|---|---|

| t-tests applied to LLE samples | |

| LLE mean in cryptocurrency markets before pandemic = LLE mean in stock markets before pandemic | 0.0305 |

| LLE mean in cryptocurrency markets before pandemic > LLE mean in stock markets before pandemic | 0.9847 |

| LLE mean in cryptocurrency markets before pandemic < LLE mean in stock markets before pandemic | 0.0153 |

| LLE mean in cryptocurrency markets during pandemic = LLE mean in stock markets during pandemic | 0.3289 |

| LLE mean in cryptocurrency markets during pandemic > LLE mean in stock markets during pandemic | 0.8355 |

| LLE mean in cryptocurrency markets during pandemic < LLE mean in stock markets during pandemic | 0.1645 |

| F-tests applied to LLE samples | |

| LLE variance in cryptocurrency markets before pandemic = LLE variance in stock markets before pandemic | 0.1103 |

| LLE variance in cryptocurrency markets before pandemic > LLE variance in stock markets before pandemic | 0.0551 |

| LLE variance in cryptocurrency markets before pandemic < LLE variance in stock markets before pandemic | 0.9449 |

| LLE variance in cryptocurrency markets during pandemic = LLE variance in stock markets during pandemic | 0.8294 |

| LLE variance in cryptocurrency markets during pandemic > LLE variance in stock markets during pandemic | 0.4147 |

| LLE variance in cryptocurrency markets during pandemic < LLE variance in stock markets during pandemic | 0.5853 |

| t-tests applied to ApEn samples | |

| ApEn mean in cryptocurrency markets before pandemic = ApEn mean in stock markets before pandemic | 0.3529 |

| ApEn mean in cryptocurrency markets before pandemic > ApEn mean in stock markets before pandemic | 0.1764 |

| ApEn mean in cryptocurrency markets before pandemic < ApEn mean in stock markets before pandemic | 0.8236 |

| ApEn mean in cryptocurrency markets during pandemic = ApEn mean in stock markets during pandemic | 1.1670×10−08 |

| ApEn mean in cryptocurrency markets during pandemic > ApEn mean in stock markets during pandemic | 5.8348×10-09 |

| ApEn mean in cryptocurrency markets during pandemic < ApEn mean in stock markets during pandemic | 1.0000 |

| F-tests applied to ApEn samples | |

| ApEn variance in cryptocurrency markets before pandemic = ApEn variance in stock markets before pandemic | 0.0689 |

| ApEn variance in cryptocurrency markets before pandemic > ApEn variance in stock markets before pandemic | 0.0344 |

| ApEn variance in cryptocurrency markets before pandemic < ApEn variance in stock markets before pandemic | 0.9656 |

| ApEn variance in cryptocurrency markets during pandemic = ApEn variance in stock markets during pandemic | 0.6012 |

| ApEn variance in cryptocurrency markets during pandemic > ApEn variance in stock markets during pandemic | 0.3006 |

| ApEn variance in cryptocurrency markets during pandemic < ApEn variance in stock markets during pandemic | 0.6994 |

According to Table 1, in case of cryptocurrency markets, the null hypothesis of equality of means for the LLE across the two time periods is rejected. The one-side t-test results show that the null that the mean of LLEs before COVID-19 pandemic is larger than the one during the pandemic period is not rejected. On the contrary, the reverse null hypothesis is rejected. Therefore, for cryptocurrency markets the average level of LLEs has decreased during the COVID-19 period, hence stability has significantly diminished. Similarly, according to Table 1, the null hypothesis of equality of the means of ApEn across the two time periods is rejected. Interestingly, the null hypothesis that the mean of ApEn before the period in question is smaller than the mean of ApEn during COVID-19 pandemic, is strongly not rejected. We see that the average level of ApEn has increased during the COVID-19 pandemic and consequently irregularity in cryptocurrency markets significantly augmented.

Turning to international stock markets, we can see that the null hypothesis of equality of means of the LLE across the two time periods is not rejected. The one-side t-test findings reveal that the null that the mean of the LLEs before the pandemic is larger than during this period is not rejected. Likewise, the null that the mean before the COVID-19 is smaller than the mean of LLEs during the pandemic is not rejected too. Thus, for equity markets, the average level of the LLE has not statistically altered during the pandemic and the level of stability remained unchanged during the pandemic period. Similarly, the null of equality of means for the ApEn across the two time periods is rejected. Also, the null hypothesis that the mean of the ApEn before the pandemic period is smaller than the mean of ApEn during the outbreak, is strongly not rejected. For international stock markets, the average level of ApEn has increased hence they demonstrated higher irregularity during the pandemic time period.

Next we analyze Table 2. In case of cryptocurrency markets, the two-side F-test shows that the variance of the LLEs for the pre-COVID-19 period is not equal to the one during the pandemic. In this regard, an one-side F-test indicates that the variance of LLEs in cryptocurrency markets has significantly increased during the outbreak and we deduce that stability was severely perturbed across cryptocurrency markets during the pandemic period. Furthermore, the variance of ApEn has significantly increased during the pandemic, thus the level of sequential irregularity increased across cryptocurrency markets. Now, for international stock markets based on the F-tests the variance of the LLE as well as the variance of ApEn has not been altered during COVID-19. In other words, the variability in stability and irregularity in stock markets has not been affected by the pandemic.

According to the comparative Table 3, we show that the mean of the LLEs in cryptocurrency markets before the pandemic is higher than that of equity markets whilst during the outbreak it is statistically equal to that of stock markets during the pandemic. While the variance of LLE for the cryptos before COVID-19 is statistically lower than if stock markets before the pandemic, yet they are similar during the pandemic period. It also concluded from our testing that the mean of ApEn in cryptocurrency markets before the pandemic is equal to that of stock markets when the mean of ApEn in cryptocurrencies is lower compared to stock markets. Finally, while we observe that the fluctuations of the ApEn variance in cryptocurrency markets before the pandemic are lower than in stock markets, during the pandemic the variance of ApEn in cryptocurrency markets is equal to that of equity indices. Therefore, cryptocurrency and stock markets exhibit a similar degree of stability in price dynamics during the pandemic. In addition, during the pandemic time period, the cryptocurrency markets exhibit a low level of regularity compared to equity indices but with equal variability.

Our empirical findings can be summarized as follows:

-

•

The level of stability in cryptocurrency markets has significantly decreased during the pandemic whilst irregularity augmented.

-

•

While the level of stability in international stock markets has not been altered during the pandemic outbreak, yet equity markets embedded more irregularity.

-

•

Stability became severely perturbed and volatile across cryptocurrency markets during the pandemic period and sequential irregularity presented higher volatility across cryptocurrencies rendering them more unpredictable and chaotic.

-

•

The variability in stability and irregularity in stock markets has not been affected by the pandemic.

-

•

Both cryptocurrency and stock markets exhibit similar degree of stability in price dynamics during the pandemic, albeit cryptos exhibit lower level of regularity compared to international stock markets.

4. Conclusions

The COVID-19 pandemic has seriously affected global economy causing major declines in sales, production, and employment rates. In this study we attempted to analyze the stability and sequential regularity detected within the prices of 45 cryptocurrencies and 16 stock markets prior and during the COVID-19 pandemic by estimating the Largest Lyapunov Exponents and the Approximate Entropy. A large number of robust statistical tests was employed to check any differences between prior and during COVID-19 outbreak and across cryptocurrencies and stock markets.

We concluded that both stability and regularity in these markets have been significantly altered during the pandemic time period. Cryptocurrency fluctuations are found to be more affected by the pandemic than international stock markets. Specifically, cryptocurrency markets revealed more instability and higher irregularity during the pandemic period compared to the equities. Therefore, cryptocurrency markets are riskier and more unpredictable.

Although our empirical findings are preliminary in nature, our study constitutes a first attempt to assess the stability and regularity of fluctuations in both cryptocurrency and stock markets. Our results could be essential to investors, traders and policy makers in order to take appropriate decisions. Hopefully, our future work will consider a longer time period incorporating the aftermath of the pandemic for optimal comparative purposes.

Declaration of Competing Interest

The authors declare the following financial interests/personal relationships which may be considered as potential competing interests.

References

- 1.Zhang J.-B, Gao Y.-C., Cai S.-M. The hierarchical structure of stock market in times of global financial crisis. Phys A. 2020;54215 Article. [Google Scholar]

- 2.BenMim I., BenSaïda A. Financial contagion across major stock markets: a study during crisis episodes. North Am J Econ Financ. 2019;48:187–201. [Google Scholar]

- 3.Wang G.-J., Xie Chi, Lin Min, Stanley H.Eugene. Stock market contagion during the global financial crisis: a multiscale approach. Financ Res Lett. 2017;22:163–168. [Google Scholar]

- 4.Jin X., An X. Global financial crisis and emerging stock market contagion: a volatility impulse response function approach. Res Int Bus Financ. 2016;36:179–195. [Google Scholar]

- 5.Jin X. The impact of 2008 financial crisis on the efficiency and contagion of Asian stock markets: a Hurst exponent approach. Financ Res Lett. 2016;17:167–175. [Google Scholar]

- 6.Junttila J., Pesonen J., Raatikainen J. Commodity market based hedging against stock market risk in times of financial crisis: the case of crude oil and gold. J Int Financ Mark, Inst Money. 2018;56:255–280. [Google Scholar]

- 7.S. Lahmiri, A study on chaos in crude oil markets before and after 2008 international financial crisis, Phys A466 (2017) 389-395.

- 8.Lahmiri S. Cointegration and causal linkages in fertilizer markets across different regimes. Phys A. 2017;471:181–189. [Google Scholar]

- 9.Lahmiri S. Asymmetric and persistent responses in price volatility of fertilizers through stable and unstable periods. Phys A. 2017;466:405–414. [Google Scholar]

- 10.Gao H.-L., Mei D.-C. The correlation structure in the international stock markets during global financial crisis. Phys. 2019;A534:122056. [Google Scholar]

- 11.Anagnostidis P., Varsakelis C., Emmanouilides C.J. Has the 2008 financial crisis affected stock market efficiency? The case of Eurozone. Phys A. 2016;447:116–128. [Google Scholar]

- 12.R. Hasan, S.M. Mohammad, Multifractal analysis of Asian markets during 2007-2008 financial crisis, Phys A419 (2015) 746-761.

- 13.P. Horta, S. Lagoa, L. Martins, The impact of the 2008 and 2010 financial crises on the Hurst exponents of international stock markets: implications for efficiency and contagionInt Rev Financ Anal35 (2014) 140-153.

- 14.Lahmiri S. Long memory in international financial markets trends and short movements during 2008 financial crisis based on variational mode decomposition and detrended fluctuation analysis. Phys A. 2015;437:130–138. [Google Scholar]

- 15.Lahmiri S., Salah Uddin G., Bekiros S. Nonlinear dynamics of equity, currency and commodity markets in the aftermath of the global financial crisis. Chaos, Solitons Fractals. 2017;103:342–346. [Google Scholar]

- 16.P.A. Grout, A. Zalewska, Stock market risk in the financial crisis, Int Rev Financ Anal46 (2016) 326-345.

- 17.T. Syriopoulos, B. Makram, A. Boubaker, Stock market volatility spillovers and portfolio hedging: BRICS and the financial crisis, Int Rev Financ Anal39 (2015) 7-18.

- 18.Dimitriou D., Kenourgios D., Simos T. Global financial crisis and emerging stock market contagion: a multivariate FIAPARCH-DCC approach. Int Rev Financ Anal. 2013;30:46–56. [Google Scholar]

- 19.Lien D., Lee G., Yang L., Zhang Y. Volatility spillovers among the U.S. and Asian stock markets: A comparison between the periods of Asian currency crisis and subprime credit crisis. North Am J Econ Financ. 2018;46:187–201. [Google Scholar]

- 20.Xu Y., Taylor N., Lu W. Illiquidity and volatility spillover effects in equity markets during and after the global financial crisis: an MEM approach. Int Rev Financ Anal. 2018;56:208–220. [Google Scholar]

- 21.Karanasos M., Yfanti S., Karoglou M. Multivariate FIAPARCH modelling of financial markets with dynamic correlations in times of crisis. Int Rev Financ Anal. 2016;45:332–349. [Google Scholar]

- 22.Chowdhury B., Dungey M., Kangogo M., Abu Sayeed M., Volkov, V. The changing network of financial market linkages: the Asian experience. Int RevFinanc Anal. 2019;64:71–92. [Google Scholar]

- 23.Lahmiri S., Salah Uddin G., Bekiros S. Clustering of short and long-term co-movements in international financial and commodity markets in wavelet domain. Phys A. 2017;486:947–955. [Google Scholar]

- 24.Rosenstein M.T., Collins J.J., De Luca C.J. A practical method for calculating largest Lyapunov exponents from small data sets. Phys D. 1993;65:117–134. [Google Scholar]

- 25.Pincus S.M. Approximate entropy as a measure of system complexity. Proc Natl Acad Sci U S A. 1991;88:2297–2301. doi: 10.1073/pnas.88.6.2297. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Bouri E., Gil‐Alana L.A., Gupta R., Roubaud D. Modelling long memory volatility in the Bitcoin market: evidence of persistence and structural breaks. Int J Financ Econ. 2019;24:412–426. [Google Scholar]

- 27.Quintino D., Campoli J., Burnquist H., Ferreira P. Efficiency of the Brazilian Bitcoin: a DFA approach. Int J Financ Stud. 2020;8:25. [Google Scholar]

- 28.Costa N., Silva C., Ferreira P. Long-range behaviour and correlation in DFA and DCCA analysis of cryptocurrencies. Int J Financ Stud. 2019;7:15. [Google Scholar]

- 29.Takaishi T., Adachi T. Market efficiency, liquidity, and multifractality of Bitcoin: a dynamic study. Asia-Pac Financ Mark. 2020;27:145–154. [Google Scholar]

- 30.Catania L., Sandholdt M. Bitcoin at high frequency. J Risk Financ Manag. 2019;12:36. [Google Scholar]

- 31.Gajardo G., Kristjanpoller W.D., Minutolo Marcel. Does Bitcoin exhibit the same asymmetric multifractal cross-correlations with crude oil, gold and DJIA as the Euro, Great British Pound and Yen? Chaos, Solitons Fractals. 2018;109:195–205. [Google Scholar]

- 32.Alves P.R.L. Dynamic characteristic of Bitcoin cryptocurrency in the reconstruction scheme. Chaos, Solitons Fractals. 2020;134 Article. [Google Scholar]