Abstract

To address the high prevalence of overweight and obesity in Mexico, an eight percent ad valorem excise tax on non-essential energy-dense foods came into effect on 1 January 2014. This paper estimates price changes after the tax implementation among the top four food categories and by leading vs. non-leading firms using purchase information from over 6000 urban households in the 2012–2015 Nielsen Mexico Consumer Panel. We create product-city-month specific prices that correct for potential biases associated with household and retailer characteristics. Using these corrected prices, we conduct before and after quasi-experimental analyses and find that price increases were larger than eight percent for cookies but were less than eight percent for ready-to-eat cereals, salty snacks, and pre-packaged sweet bread. For the latter food group, event-study analyses on the gradual price change over time suggest that price changes might be the result of an increasing price trend rather than the tax implementation. Firm-level analyses mostly show that price increases by the leading firms were larger than the overall increase at the food market level, helping explain variability in post-tax declines in food purchases as reported in other research. We also find that price changes are generally underestimated when we do not correct prices for biases associated with households and retailers. These results improve our understanding of the mechanisms behind heterogeneous changes in purchases after the tax implementation. Additionally, these results can assist policymakers when designing or improving taxes on non-essential energy-dense foods at a time when these policy options are high on the agenda in many places.

Keywords: Taxes, Price changes, Firms, Energy-dense food

1. Introduction

During the last three decades, Mexico experienced a serious epidemiological and nutritional transition (Barquera et al., 2013; Gutiérrez et al., 2013; Rivera et al., 2002). The prevalence of overweight and obesity has risen among all age groups (Barquera et al., 2013; Gutiérrez et al., 2013). Non-communicable diseases associated with overweight and obesity such as diabetes and hypertension have also increased and now rank among the leading causes of mortality in Mexico and much of the rest of the world (Lozano et al., 2013; Rivera et al., 2002; Stevens et al., 2008). These dire health outcomes have been associated with greater intake of fat, carbohydrates, and sugars due to the presence of high-energy processed foods and sugar-sweetened beverages (SSB) in the Mexican diet (Aburto et al., 2016; Barquera et al., 2008; Sánchez-Pimienta et al., 2016).

In response to these public health problems, Mexico’s federal government released a national strategy including a national tax policy on non-essential energy-dense foods (NEDF) and SSB to be collected directly from manufacturers or distributors starting on January 1, 2014 (Secretaría de Salud, 2013). SSB with added sugar are charged with a specific excise tax of one Mexican Peso per liter, while NEDF (energy density ≥ 275 kcal/100 g) are subject to an eight percent ad valorem excise tax (Secretaría de Gobernación, 2013a). NEDF include cereal-based products with added sugar, chips and snacks, confectionery products, cacao-based products, puddings, ice cream and ice pops, and peanut and hazelnut butter. With this tax initiative, Mexico became the first country in the Americas and one of the few worldwide to implement this kind of policy.

The tax effect on the consumption of taxed foods depends, in part, on to how much of the tax is passed onto prices and how this price increase translates into changes in the relative prices of taxed (unhealthy) and untaxed (healthier) foods. This paper focuses on the first of these subjects by assessing NEDF price changes after the implementation of the eight percent ad valorem tax. We estimate how these price changes vary over time and by food group and by producers to elucidate potential mechanisms contributing to the heterogeneity of the price increase after the tax implementation. This evidence is relevant in the public health field by informing policymakers whether price increased as well as the magnitude of this increase. A null or small change in taxed food prices might keep relatively unchanged the consumption of taxed foods instead of switching to untaxed and healthier foods. Moreover, our findings can also inform on improved tax designs that could encourage a more complete and homogenous tax pass-through (i.e., price increases by eight percent) across NEDF categories and firms so that fiscal policies can better achieve their goals to discourage unhealthy food purchases. Finally, the findings of our study can serve as a reference for other countries considering unhealthy food taxes that share common characteristics with the Mexican setting (e.g., average consumption of energy-dense food and market structure).

2. Background

In perfectly competitive markets, the degree to which taxes are passed on to consumers relative to producers (and vice-versa) depends partly on the relationships between the demand and supply elasticities; the more sensitive agent to prices carries the lowest tax incidence. In a symmetric imperfect competition, the tax pass-through also depends on the demand curvature and the elasticity of a conduct parameter (a function of firm’s markup and the price elasticity of demand) associated with changes in quantity (Weyl and Fabinger, 2013). When costs are linear, the tax pass-through will be lower for concave log-demand curves, while the opposite will be valid for convex log-demand curves (Weyl and Fabinger, 2013). The tax pass-through will also be lower when the elasticity of the conduct parameter is positively associated with quantity such that high prices induce a more competitive market (Weyl and Fabinger, 2013).

The tax pass-through can also vary by tax design. Anderson et al. (2001) showed, in the context of a Bertrand oligopoly model with differentiated products, that specific taxes (e.g., the SSB tax based on volume) are more likely to be over-shifted on prices compared with ad valorem taxes (i.e., set to a certain percentage of a base price). For the Cournot oligopoly model, Delipalla and Keen (1992) reached the same conclusions regarding a higher likelihood of tax over-shifting for specific taxes.

Because few countries have implemented taxes on SSB or NEDF, there are few empirical studies on the pass-through of these taxes onto prices. Most of these studies are limited to analyses of specific taxes such as the cases of SSB in Denmark, France, and Mexico, which mainly show that specific taxes are fully-shifted or over-shifted to prices (Berardi et al., 2016; Bergman and Lynggård Hansen, 2019; Colchero et al., 2015, 2017; Etilé et al., 2018; Grogger, 2017). However, there is a lack of studies on the pass-through of ad valorem taxes, in part, because their tax rate tends to be relatively low. One exception to this low tax rate is the eight percent ad valorem tax on NEDF in Mexico that was implemented to attempt to tackle the prevalence of overweight and obesity. Previous studies (Colchero et al., 2017; Molina et al., 2017), which analyzed the effect of this tax on prices, relied on price information for the Mexican Consumer Price Index (CPI) or retrieved from retailers and showed that for the aggregate group of taxed foods the tax was under-shifted to prices in rural areas (< 20,000 inhabitants) and was fully-shifted in urban areas (≥20,000 inhabitants). Another study focused on salty snacks in urban Mexico, which also used price data for CPI, found that their prices rose by the amount of the tax (Aguilera Aburto et al., 2017).

More evidence on the tax pass-through comes from ex-ante evaluations using structural models for SSB and yogurt in France and butter and margarine in the United Kingdom (UK) (Allais et al., 2015; Bonnet and Réquillart, 2013; Griffith et al., 2010). These studies modeled the strategic behavior by consumers and producers when an ad valorem or a specific tax came into effect. These studies showed that ad valorem taxes were under-shifted to prices while specific taxes were over-shifted. Regarding the tax effect at the brand level for SSB in France, the tax pass-through was generally larger for national brands compared with private labels (Bonnet and Réquillart, 2013). For margarine and butter in the UK, in general, the largest firms passed taxes onto prices across their entire brand portfolio to a greater extent compared with the smallest firms likely due to the advantage by the largest firms of having larger brand portfolios whose products might be considered as substitutes by consumers (Griffith et al., 2010). Similar analyses like these estimating leading vs. non-leading firm response for Mexico’s NEDF have not been done, which we seek to do.

Most of the empirical studies assessing the tax effect on SSB or NEDF prices relied on price information used to estimate the CPI or that comes directly from retailers. Because CPI prices are systematically collected in predetermined points of sales and tend to exclude promotions or discounts as in the case of Mexico (Instituto Nacional de Estadística y Geografía, 2014), price information is not affected by searching behaviors by consumers who seek to pay lower prices. Hence, there is no need to correct for households’ characteristics to estimate the tax effect on prices when using CPI prices. However, the available information on prices for CPI in urban Mexico used in the studies described above (Aguilera Aburto et al., 2017; Molina et al., 2017) is an average at the brand level across retailers so that this information can be vulnerable to what Handbury and Weinstein (2015) call “retailer heterogeneity biases.” These biases are the result of potential systematic differences between the prices of the same product across stores. Others such as Etilé et al. (2018) correct for these biases by removing the influence of retailers and consumers from prices based on the methodology proposed by Handbury and Weinstein (2015) to build price indices in which they accounted for product substitution and product availability across regions. Here we do the equivalent for product-level prices for two reasons. First, information on product-level prices, rather than an aggregate price index, is required for our analyses at the firm level (products are nested within firms). Second, studies for which it is possible to compare results based on price information and CPI reached similar conclusions regarding the tax effect on prices (Aguilera Aburto et al., 2017; Colchero et al., 2015; Etilé et al., 2018; Grogger, 2017). Although previous studies (Aguilera Aburto et al., 2017; Molina et al., 2017) have assessed the NEDF price changes after the tax implementation in urban Mexico, we add to this literature by providing weighted estimates that account for the household’s budget allocated to buy a specific product (from a specific firm), and by correcting for the household and retailer effect on prices. Moreover, our study is the first one that estimates the change in prices by firm after the tax implementation.

3. Data and methods

Data came from the Nielsen Mexico Consumer Panel Service that has a panel of > 6,000 households in 54 cities across Mexico in areas with a population of > 50,000 inhabitants based on a probabilistic sampling design (The Nielsen Company, 2016). Nielsen CPS represented 63% of the Mexican population and 75% of food and beverage expenditure in 2014 (Colchero et al., 2016; Instituto Nacional de Estadistica y Geografia, 2014). Information collected includes packaged food and beverage purchases and their prices paid by sampled households from January 2012 through December 2015. Price information came from diaries, barcodes on product packaging from selected products, receipts, and pantry surveys (Colchero et al., 2016; The Nielsen Company, 2016). We focused on the four most important taxed foods in terms of their sales volume: cookies, ready-to-eat cereals, salty snacks and peanuts, and pre-packaged sweet bread. These four food groups collectively accounted for about 85% of taxed foods in the Nielsen CPS data in 2015 (The Nielsen Company, 2016). Table Al in the Appendix shows examples of foods for each food group.

Unique product identifiers (UPI) were derived from brand, firm, and package size information in Nielsen CPS. We reviewed the brand variable in Nielsen CPS and homologated brands’ names when it was clear that a potential misspelling issue caused the difference in names (e.g., an additional letter “s”). To maximize the number of observations for longitudinal analyses, we set 20-gram groups for ready-to-eat cereals in terms of package size (e.g., 40–59 g) and 10-gram groups for the remaining food groups (e.g., 40–49 g).1 We did not distinguish products as a specific brand when the brand varied by flavor or additional ingredients (e.g., a brand of chips with three flavor varieties only counted as a single brand). For store brands, a brand was a combination of the store’s name and the taxed food group (e.g., store “A” taxed cookies). For each firm with a market share in terms of volume below one percent in 2012, we considered all of its products as a unique brand with a unique package size. Brand and firm variables were de-identified with numerical identifiers. We assigned a common firm identifier to those firms with market shares below one percent in 2012 and another common firm identifier for store brands. Therefore, the UPI was the combination of the brand and firm identifiers, and the package size groups.

3.1. Price measures

We first calculated (uncorrected) prices at the UPI level as monthly unit values (i.e., total monthly expenditure divided by total monthly quantity purchased) by retailer type. We calculated monthly unit values for each household in Nielsen CPS for each of the six retailer types (supermarkets, hypermarkets, wholesalers and price clubs, convenience stores, traditional stores, and other small retailers) where household shopped. From this, we dropped UPI with information only for one of the pre- or post-tax periods or that were bought fewer than 100 occasions across all households between 2012 and 2015. This resulted in the exclusion of around four percent of observations in our analytical data. For the remaining UPI, we dropped prices in the extreme tails of the price distribution ( ± 0.1%). Consequently, the available number of UPI was 416 for cookies, 215 for ready-to-eat cereals, 436 for salty snacks and peanuts, and 80 for pre-packaged sweet bread.

To correct prices for biases associated with household and retailer characteristics, we applied Eq. (1) following Handbury and Weinstein (2015):

| (1) |

where pucrh is the logarithm of the unit value price paid by household h in city c for UPI u in retailer type r. Fixed effects at the UPI, city, and retailer levels are αu, αc, and αr, respectively. Zh is a vector of households’ characteristics and β their associated vector of coefficients. εucrh is the stochastic component of the model.

Corrected prices Pucrh are the result of subtracting the coefficients and variables associated with households’ characteristics and retailer fixed effects as in Eq. (2):

| (2) |

Handbury and Weinstein (2015) proposed formulas to calculate corrected expenditure (v) and quantity (q) for UPI u in city c. However, we instead used the formulas adapted by Etilé et al. (2018) to have comparable corrected expenditures across cities by considering their population size.

| (3) |

| (4) |

Nc, Hc, and Rc are the population size, the total number of households and retailers in city c, respectively. whc is the sampling weight and Sizehc is the number of members of household h in city c. qucrh is the quantity purchased of UPI u in kilograms by household h in city c.2 The first division in Eqs. (3) and (4) reflects the relative weight of household h with respect to all households in city c while the second division represents the per capita consumption of UPI u for each household. Information on Nc comes from the National Population Council in Mexico (2014) and the remaining information comes from Nielsen CPS (2016). To scale up corrected prices Pucrh to prices at the city and UPI level (Puc), we divide vuc by quc.

To estimate Eq. (1), Zh included the highest education degree reached by the head of the household, the number of children (≤ 11 years), adolescents (12–19 years), and adults (≥ 20 years) in the household, and the household’s socioeconomic status (SES). For the head of the household’s education degree, we included indicator variables for less than elementary school (reference group), elementary school, high school, middle school, and college or more. Households were classified into three groups: low SES (reference group), middle SES, and high SES. This SES classification was based on the quality and quantity of seven assets such as floor type, number of bedrooms, and vehicle ownership. Information on households’ characteristics in Nielsen CPS (2016) can vary on a yearly basis.

Following Etilé et al. (2018), we estimated Eq. (1) on a monthly basis and weighed each observation based on the household’s sampling weight and its expenditure on UPI u in one particular retailer. Therefore, we ran 48 monthly regressions for each of the four food groups. Then, we used Eqs. (2)-(4) to remove from prices the potential biases associated with households and retailers and to calculate monthly corrected prices at the UPI and city level. Regarding Eq. (2), we only considered those estimated coefficients with a p-value of up to 0.10. Finally, monthly prices at the UPI and city level were transformed into real prices using the monthly CPI (Instituto Nacional de Estadística y Geografía, 2015a) and setting Mexico City in January 2012 as the reference.

3.2. Pre-post analyses

To evaluate the effect of the eight percent ad valorem tax on prices, we chose a pre-post quasi-experimental design given the lack of an appropriate control group. We did not use a difference-in-differences research design for two reasons. First, to identify the treatment effect, this model requires treated and untreated groups not to be differentially exposed to any change other than the treatment implementation. However, this is unlikely to hold for the NEDF case because several firms produce both taxed and untaxed foods, and thus these firms might set the price and the level of the tax pass-through that maximize profits over their whole product portfolio. Therefore, some prices of the control group might be subject to this strategic firm behavior. Second, difference-in-differences models rely on the parallel trend assumption between treated and untreated groups before the treatment implementation. However, we found that this assumption did not hold.3 We also used the synthetic control method, but we did not achieve a good fit for the pre-tax price trend between each taxed food group and the synthetic control.4 Thus, a pre-post approach was deemed most feasible given the available data.

Our main regression model specification is:

| (5) |

where ln(Puct) is the logarithm of the corrected real price of UPI u in city c in month t, which runs from January 2012 (t = 1) to December 2015 (t = 48). By having this log transformation, the right-hand side variables have the percentage change interpretation. Post is a binary variable that indicates that the price information was collected in the post-tax years 2014 or 2015. βPost, is the main coefficients of interest and captures the average price change over 2014 and 2015 after the tax implementation. Popcy is the yearly population (in millions) in city c and GIEAt–1 is the lagged monthly Global Indicator of Economic Activity (GIEA) (Consejo Nacional de Población, 2014; Instituto Nacional de Estadística y Geografía, 2015b). By using the lagged value of GIEA, there is no problem of simultaneity between GIEA and prices. The vector Trendt includes a counting variable for t ∈ {1, …, 48} and its squared transformation to account for the time trend in prices. αu are UPI fixed effects that account for time-invariant factors that influence prices such as product quality or product attributes, which we assume do not change meaningfully within a brand during the time period analyzed here. αc are city fixed effects that control for differences across cities such as product availability. αm are month fixed effects to account for season effects. εuct stands for the stochastic part of the model.

3.3. Event study analyses

In addition to the estimation of the overall price change before and after the tax implementation, we assessed the gradual price change over time by setting the quarter right before the tax implementation (i.e., October 2013-December 2013) as the reference period. Our model specification for this analysis is:

| (6) |

where quarters running from Q = 1 to Q = 7 precede the quarter right before the tax implementation while the remaining quarters (i.e., Q ≥ 9) are part of the post-tax period in 2014 and 2015. The coefficients β9–β16 will capture the gradual price change after the tax implementation. Eq. (6) does not include a time trend or month fixed effects to minimize multicollinearity problems with the quarterly variables. The remaining variables have the same interpretation as in Eq. (5). This event-study analysis will allow us to assess whether there were any pre-existing trends in prices over time, given that there are no appropriate control groups to use as reference.

3.4. Firm-level analyses

For our firm-level analysis of price changes, we use:

| (7) |

where βPost captures the price change in 2014 and 2015 for the leading firm (i.e., the firm with the largest market share). βf,Post is the differential price change by firm f ∈ {2, …,F} with respect to the leading firm in the post-implementation period. f = 2 is the firm with the second largest market share, f = F – 1 is the firm with the lowest market share but above one percent, and f = F represents the set of firms that individually made up less than one percent of the market share. The firm ranking was based on market shares in 2012 to avoid changes in the firm categories due to variations in market shares over time. The remaining variables have the same interpretation as in Eq. (5).

We estimated Eqs. (5)-(7) for each food group and clustered standard errors at the firm level. We weighed these equations using the expenditure on UPI u by all households in city c for the whole period (i.e., 2012–2015) and bootstrapped standard errors with 500 replications. For comparison purposes, we re-estimated Eqs. (5)-(7) using uncorrected real prices at the UPI and city level, which were derived as weighted unit values across households and retailers by city and month.

4. Results

4.1. Descriptive statistics

Table 1 shows the weighted summary statistics. Food groups other than ready-to-eat cereals experienced price increases from 2012 to 2015 for both corrected and uncorrected prices. Ready-to-eat cereals displayed a decreasing price pattern except in 2014 when their prices rose. In general, corrected prices were larger than their uncorrected counterparts. The covariates for the empirical models (i.e., lagged GIEA and population) showed a steady rise over time.

Table 1.

Summary statistics.

| Cookies |

Ready-to-eat cereals |

|||||||

|---|---|---|---|---|---|---|---|---|

| Variable | 2012 | 2013 | 2014 | 2015 | 2012 | 2013 | 2014 | 2015 |

| Corrected price per kg | 66.01 | 66.85 | 73.52 | 72.51 | 65.72 | 63.03 | 64.12 | 62.95 |

| (0.34) | (0.33) | (0.37) | (0.40) | (0.30) | (0.28) | (0.33) | (0.37) | |

| Uncorrected price per kg | 59.10 | 61.08 | 65.34 | 66.98 | 66.64 | 62.66 | 63.69 | 62.27 |

| (0.31) | (0.30) | (0.33) | (0.37) | (0.31) | (0.29) | (0.33) | (0.37) | |

| GIEA (lagged) | 98.56 | 99.83 | 102.23 | 105.54 | 98.75 | 99.89 | 102.13 | 105.53 |

| (0.05) | (0.04) | (0.04) | (0.04) | (0.05) | (0.05) | (0.06) | (0.06) | |

| Population | 6.41 | 6.59 | 6.73 | 6.79 | 6.64 | 6.47 | 6.58 | 6.45 |

| (0.19) | (0.19) | (0.19) | (0.20) | (0.21) | (0.21) | (0.23) | (0.26) | |

| Yearly HHI | 3954.19 | 3792.78 | 3692.01 | 3555.23 | 4520.89 | 4496.23 | 4213.97 | 4489.81 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Corrected price per kg: LF | 64.35 | 65.16 | 72.13 | 71.83 | 68.39 | 65.15 | 66.89 | 64.66 |

| (0.51) | (0.50) | (0.57) | (0.61) | (0.41) | (0.39) | (0.48) | (0.51) | |

| Corrected price per kg: NLF | 68.28 | 68.99 | 75.26 | 73.37 | 61.12 | 58.64 | 58.24 | 59.34 |

| (0.38) | (0.33) | (0.41) | (0.45) | (0.46) | (0.42) | (0.44) | (0.55) | |

| Number of brands: LF | 27.00 | 27.00 | 27.00 | 27.00 | 10.00 | 11.00 | 11.00 | 11.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Number of brands: NLF | 15.00 | 15.60 | 15.60 | 14.60 | 9.00 | 9.33 | 9.33 | 9.33 |

| (11.36) | (11.80) | (11.80) | (11.22) | (2.65) | (2.08) | (2.08) | (2.08) | |

| Number of UPI: LF | 122.00 | 140.00 | 141.00 | 129.00 | 88.00 | 101.00 | 101.00 | 81.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Number of UPI: NLF | 43.00 | 47.00 | 47.60 | 44.00 | 29.00 | 31.67 | 31.33 | 27.33 |

| (31.33) | (36.48) | (36.61) | (32.89) | (7.00) | (10.02) | (9.45) | (11.02) | |

| Mean of UPI by city | 68.43 | 72.45 | 67.78 | 59.83 | 36.07 | 38.78 | 34.42 | 26.85 |

| (39.30) | (42.89) | (41.56) | (36.23) | (22.07) | (23.83) | (21.32) | (17.17) | |

| Max number of UPI by city | 229.00 | 248.67 | 235.67 | 204.67 | 127.50 | 138.92 | 124.25 | 99.42 |

| (9.40) | (14.05) | (6.97) | (8.49) | (6.89) | (6.13) | (8.90) | (6.39) | |

| Min number of UPI by city | 27.00 | 31.83 | 28.83 | 21.17 | 16.75 | 18.33 | 14.92 | 9.92 |

| (2.89) | (4.22) | (4.28) | (3.65) | (2.09) | (1.97) | (3.04) | (2.18) | |

| N | 44,342 | 46,948 | 43,922 | 38,772 | 23,373 | 25,132 | 22,301 | 17,402 |

| Salty snacks and peanuts |

Pre-packaged sweet bread |

|||||||

| Variable | 2012 | 2013 | 2014 | 2015 | 2012 | 2013 | 2014 | 2015 |

| Corrected price per kg | 130.17 | 132.22 | 142.39 | 143.03 | 88.95 | 92.03 | 98.88 | 99.40 |

| (0.70) | (0.66) | (0.72) | (0.74) | (0.42) | (0.43) | (0.46) | (0.53) | |

| Uncorrected price per kg | 116.35 | 118.68 | 126.29 | 127.82 | 77.58 | 80.05 | 85.78 | 86.72 |

| (0.63) | (0.60) | (0.64) | (0.67) | (0.37) | (0.38) | (0.41) | (0.46) | |

| GIEA (lagged) | 98.53 | 99.82 | 102.23 | 105.55 | 98.52 | 99.84 | 102.22 | 105.55 |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.11) | (0.10) | (0.11) | (0.10) | |

| Population | 6.10 | 6.19 | 6.23 | 6.42 | 9.60 | 9.62 | 9.88 | 10.35 |

| (0.22) | (0.21) | (0.21) | (0.22) | (0.42) | (0.41) | (0.42) | (0.43) | |

| Yearly HHI | 3909.00 | 3811.09 | 3585.43 | 3728.77 | 8892.27 | 8912.55 | 8878.88 | 9261.86 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Corrected price per kg: LF | 140.56 | 143.78 | 154.82 | 154.51 | 88.15 | 91.02 | 98.19 | 99.74 |

| (0.77) | (0.69) | (0.77) | (0.82) | (0.43) | (0.43) | (0.46) | (0.55) | |

| Corrected price per kg: NLF | 108.05 | 107.74 | 115.93 | 118.83 | 101.01 | 107.47 | 109.72 | 89.59 |

| (1.04) | (1.00) | (1.09) | (1.13) | (1.87) | (2.05) | (2.03) | (2.58) | |

| Number of brands: LF | 31.00 | 31.00 | 31.00 | 29.00 | 18.00 | 19.00 | 19.00 | 18.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Number of brands: NLF | 11.25 | 11.50 | 11.50 | 11.13 | 6.50 | 6.50 | 6.50 | 6.50 |

| (9.69) | (10.03) | (10.03) | (9.57) | (7.78) | (7.78) | (7.78) | (7.78) | |

| Number of UPI: LF | 136.00 | 151.00 | 149.00 | 142.00 | 58.00 | 61.00 | 62.00 | 57.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Number of UPI: NLF | 27.88 | 29.38 | 29.38 | 28.13 | 7.50 | 7.50 | 7.50 | 7.50 |

| (23.59) | (24.15) | (24.15) | (22.86) | (9.19) | (9.19) | (9.19) | (9.19) | |

| Mean of UPI by city | 61.27 | 64.97 | 62.32 | 56.63 | 17.94 | 18.46 | 17.38 | 14.36 |

| (37.51) | (39.51) | (39.79) | (36.81) | (9.53) | (9.41) | (10.13) | (8.83) | |

| Max number of UPI by city | 231.50 | 247.58 | 247.42 | 224.17 | 57.00 | 58.08 | 59.76 | 52.67 |

| (6.11) | (13.59) | (9.98) | (9.52) | (3.47) | (2.33) | (3.04) | (2.87) | |

| Min number of UPI by city | 22.67 | 29.08 | 24.67 | 18.25 | 3.50 | 5.67 | 2.58 | 1.91 |

| (3.43) | (2.75) | (2.53) | (1.92) | (1.19) | (1.38) | (1.04) | (0.76) | |

| N | 39,703 | 42,101 | 40,386 | 36,698 | 11,628 | 11,963 | 11,229 | 9,263 |

Note: Standard error in parentheses. Corrected prices correct for biases associated with households’ and retailers’ characteristics. GIEA: Global Indicator of Economic Activity, HHI: Herfindahl-Hirschman Index, LF: leading firm; NLF: Non-leading firm, UPI: Unique product identifier.

Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

Based on the Herfindahl-Hirschman Index (HHI), which measures the market concentration (zero represents a perfectly competitive market and 10,000 for a monopoly), the lowest degree of competition was for pre-packaged sweet bread. The other food groups’ HHI ranged between 3500 and 4500. Regarding the corrected prices by firm before the tax implementation, these tended to be similar among leading firms (LF) and non-leading firms (NLF) for cookies and ready-to-eat cereals; however, this pattern did not hold for salty snacks and pre-packaged sweet bread. Across all food markets, LF displayed a larger price increase in 2014 compared to NLF. Moreover, most of the LF had a larger number of brands compared with the average number of brands owned by NLF. For food groups other than ready-to-eat cereals, the LF, in general, doubled the average number of brands of NLF. LF doubled or tripled the number of UPI (i.e., brands along with package sizes) compared with the average number across NLF. While the number of brands is relatively constant across firms in all food groups, the distribution of UPI over time displayed the highest number of observations in 2013 and 2014. However, this variation in the number of UPI over time was not differential among LF and NLF across the four food groups except for NLF in the pre-packaged sweet bread market, which had a constant average number of UPI for the four years of analysis. There was not a large variation in the mean number of UPI across cities over time except for a slight decline in 2015. However, there was variation in the number of UPI across cities with an approximated ten-time difference across cities with the highest and the lowest number of UPI. As expected, there was a positive correlation between the city’s population and the number of UPI (results not shown).

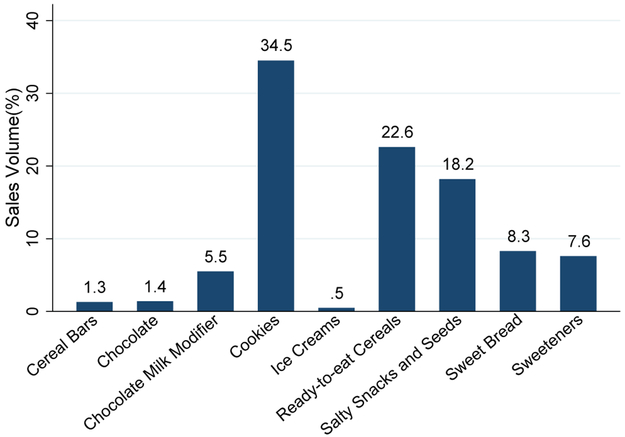

Fig. 1 shows the sales volume percentages in urban Mexico in 2015 for taxed foods in Nielsen CPS (2016). The four taxed food groups with the highest sales volume that were part of this study accounted for about 85% of the sales volume of taxed foods.

Fig. 1.

Sales volume by taxed food group: Nielsen CPS in 2015. Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 –December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

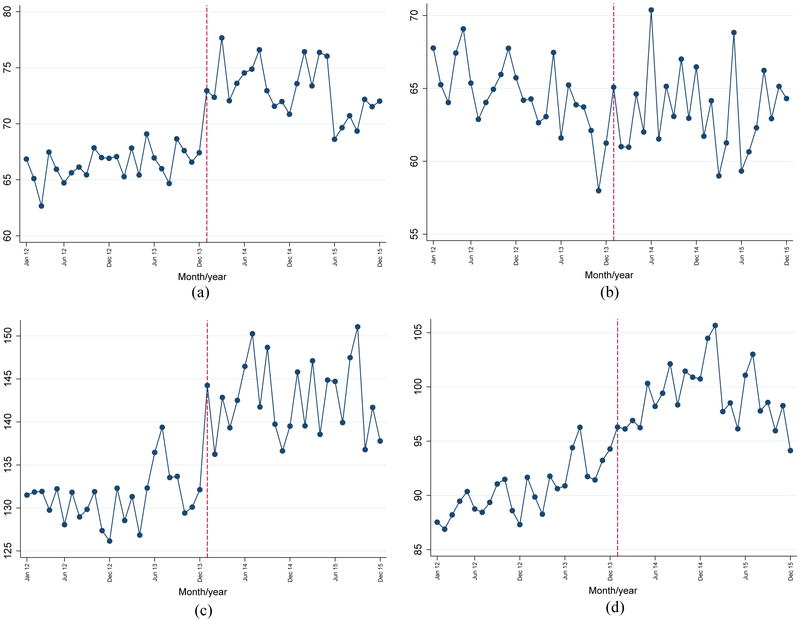

Fig. 2 shows the descriptive corrected price trends by food group. For the pre-tax period, prices of cookies and, to a lower extent, prices of salty snacks and peanuts showed a relatively constant pattern, whereas prices of pre-packaged sweet bread revealed an increasing trend. Inversely, prices of ready-to-eat cereals were decreasing during 2012 and 2013. In January 2014, when the eight percent ad valorem tax came into effect (red vertical dotted line), prices of all taxed foods showed a rise compared with the previous month. Upon visual inspection, prices of ready-to-eat cereals and salty snacks and peanuts remained relatively steady after the tax was implemented, while prices of cookies and pre-packaged sweet bread seemed to drop slightly in 2015 after the initial increase in 2014.

Fig. 2.

Weighted average of real corrected price per kg. (a) Cookies, (b) Ready-to-eat cereals, (c) Salty snacks and peanuts, (d) Pre-packaged sweet bread. Note: Corrected prices correct for biases associated with households’ and retailers’ characteristics. Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 –December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

4.2. Pre-post price changes

Table 2 Panel A shows the estimates for Eq. (5) when the dependent variable is corrected prices. Compared with 2012 and 2013, prices rose by an average of 9.8% for cookies, 5.1% for ready-to-eat cereals, 6.6% for salty snacks and peanuts, and 5% for pre-packaged sweet bread over the first two years after the tax implementation. All these price changes were statistically significant at the 1% significance level.

Table 2.

Changes in prices: Food group analyses.

| Cookies | Ready-to-eat cereals | Salty snacks and peanuts | Pre-packaged sweet bread | |||||

|---|---|---|---|---|---|---|---|---|

| A. Corrected prices | ||||||||

| Post | 0.098 | *** | 0.051 | *** | 0.066 | *** | 0.05 | *** |

| (0.002) | (0.004) | (0.002) | (0.004) | |||||

| Lagged GIEA | 0.006 | *** | 0.002 | ** | −0.005 | *** | 0.001 | |

| (0.001) | (0.001) | (0.001) | (0.001) | |||||

| Population | −0.072 | *** | −0.064 | *** | −0.075 | *** | −0.066 | *** |

| (0.010) | (0.017) | (0.010) | (0.013) | |||||

| N | 173,984 | 88,208 | 158,888 | 44,083 | ||||

| B. Uncorrected prices | ||||||||

| Post | 0.044 | *** | 0.063 | ** | 0.048 | *** | 0.046 | *** |

| (0.005) | (0.018) | (0.001) | (0.005) | |||||

| Lagged GIEA | 0.001 | 0.003 | 0 | 0.001 | * | |||

| (0.001) | (0.002) | (0.001) | (0.000) | |||||

| Population | −0.071 | *** | −0.065 | *** | −0.068 | *** | −0.071 | *** |

| (0.011) | (0.013) | (0.012) | (0.007) | |||||

| N | 173,984 | 88,208 | 158,888 | 44,083 | ||||

Notes: Standard error in parentheses. Corrected prices correct for biases associated with households’ and retailers’ characteristics. Models included UPI, city, and month fixed effects, a constant, and linear and squared time trends.

p < 0.10

p < 0.05

p < 0.010. post: years 2014–15, GIEA: Global Indicator of Economic.

Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

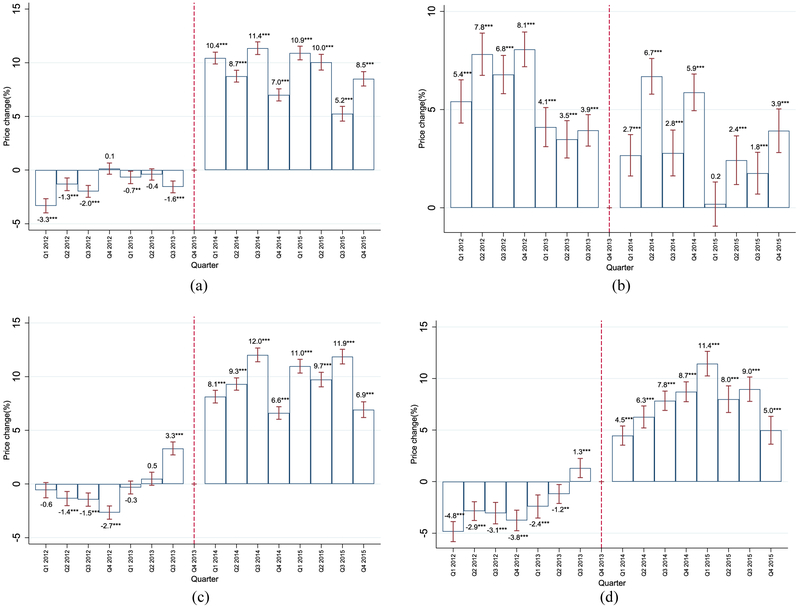

4.3. Event study analyses of corrected price changes

Fig. 3 shows the price change based on Eq. (6). For cookies and salty snacks, their pre-tax prices were below as well as above with respect to the reference quarter (i.e., October 2013–December 2013 with the red vertical dotted line) with no clear trend. In 2014 and 2015, all of the prices for these two food groups were larger than the price in the reference quarter, and price increases for several of the post-tax quarters were above 8% (p-value < 0.05 and p-value < 0.01). However, none of these food groups displayed an increasing price growth over time. For ready-to-cereals, there was a slight downward trend in pre-tax prices until the reference quarter (consistent with Fig. 2). In contrast, the prices of pre-packaged bread displayed an increasing price trend from the beginning of 2012 to the first quarter in 2015 and started decreasing afterward (p-value < 0.05 and p-value < 0.01).

Fig. 3.

Quarterly changes in corrected prices. (a) Cookies, (b) Ready-to-eat cereals, (c) Salty snacks and peanuts, (d) Pre-packaged sweet bread. Notes: Confidence Intervals (95%) in red-capped spikes. Corrected prices correct for biases associated with households’ and retailers’ characteristics. Models included UPI and city fixed effects, a constant, lagged global indicator of economic activity, and population. ** p < 0.05, *** p < 0.010. Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein. (For interpretation of the references to colour in this figure legend, the reader is referred to the web version of this article.)

4.4. Firm-level analyses of changes in corrected prices

Table 3 presents the results of Eq. (7). The coefficient for Post shows the change in prices of products from LF. The coefficients for the interactions between Post and each NLF shows the change in prices from each NLF relative to the LF. Compared with the pre-tax period (2012–2013), LF’s prices went up by a magnitude larger than or similar to the price increase at the food group level (as shown in Table 2 Panel A). Compared with LFs after the tax implementation, NLF increased prices by a lower magnitude in the cookie market (p-value < 0.01) and by an equal or lower amount (p-value < 0.01) in the pre-packaged sweet bread market. Across NLF for salty snacks and peanuts, most of them displayed a lower price increase or did not differentially change prices with respect to the LF. For ready-to-eat cereals, two out of four NLF showed equal or lower price growths than the LF in 2014 and 2015. The remaining NLF’s prices rose by a magnitude close to or larger than eight percent.

Table 3.

Changes in prices: Firm analyses with corrected prices.

| Cookies | Ready-to-eat cereals | Salty snacks and peanuts | Pre-packaged sweet bread | |||||

|---|---|---|---|---|---|---|---|---|

| Post | 0.115 | *** | 0.054 | *** | 0.067 | *** | 0.053 | *** |

| (0.003) | (0.005) | (0.002) | (0.004) | |||||

| NLF#1-Post | −0.018 | *** | −0.04 | *** | 0.002 | −0.041 | *** | |

| (0.002) | (0.005) | (0.002) | (0.007) | |||||

| NLF#2-Post | −0.055 | *** | −0.001 | 0.012 | *** | −0.039 | *** | |

| (0.006) | (0.008) | (0.004) | (0.005) | |||||

| NLF#3-Post | −0.153 | *** | 0.076 | *** | −0.031 | *** | −0.005 | |

| (0.009) | (0.012) | (0.009) | (0.015) | |||||

| NLF#4-Post | −0.063 | *** | 0.043 | *** | 0.049 | *** | ||

| (0.009) | (0.012) | (0.004) | ||||||

| NLF#5-Post | −0.125 | *** | −0.005 | |||||

| (0.019) | (0.011) | |||||||

| NLF#6-Post | −0.058 | *** | −0.077 | *** | ||||

| (0.006) | (0.008) | |||||||

| NLF#7-Post | 0.026 | *** | ||||||

| (0.005) | ||||||||

| NLF#8-Post | 0.017 | *** | ||||||

| (0.006) | ||||||||

| NLF#9-Post | −0.050 | *** | ||||||

| (0.009) | ||||||||

| Lagged GIEA | 0.006 | *** | 0.003 | ** | −0.005 | *** | 0.001 | |

| −0.001 | −0.001 | (0.001) | −0.001 | |||||

| Population | −0.069 | *** | −0.063 | *** | −0.072 | *** | −0.071 | *** |

| −0.01 | −0.017 | (0.01) | −0.014 | |||||

| N | 173,984 | 88,208 | 158,888 | 44,083 | ||||

Notes: Standard error in parentheses. Corrected prices correct for biases associated with households’ and retailers’ characteristics. Models included UPI, city, and month fixed effects, a constant, and linear and squared time trends.

p < 0.10

p < 0.05

p < 0.010. Post: years 2014–15, NLF: Non-leading firm, GIEA: Global Indicator of Economic

Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

4.5. Comparing results using uncorrected prices

Table 2 Panel B shows the price increases at the food group level when the dependent variable is uncorrected prices. All of these increases are statistically significant either at the 1% or 5% significance level; however, they tend to be lower compared with those based on corrected prices. For cookies, the price increase did not achieve eight percent using uncorrected prices as we found in our analyses with corrected prices. Conversely, the price increase for ready-to-eat cereals was larger using the uncorrected prices but remained below eight percent. Results at the firm level based on uncorrected prices in Table 4, in general, resemble the price changes that we found with corrected prices (see Table 3). However, consistent with overall results, the price changes were, in general, larger using the latter information.

Table 4.

Changes in prices: Firm analyses with uncorrected prices.

| Cookies | Ready-to-eat cereals | Salty snacks and peanuts | Pre-packaged sweet bread | |||||

|---|---|---|---|---|---|---|---|---|

| Post | 0.06 | *** | 0.066 | *** | 0.047 | *** | 0.048 | *** |

| (0.01) | (0.013) | (0.003) | (0.002) | |||||

| NLF#1-Post | −0.017 | *** | −0.038 | *** | 0.003 | *** | −0.041 | *** |

| (0.000) | (0.000) | (0.000) | (0.001) | |||||

| NLF#2-Post | −0.065 | *** | −0.001 | 0.02 | *** | −0.042 | *** | |

| (0.000) | (0.001) | (0.000) | (0.000) | |||||

| NLF#3-Post | −0.163 | *** | 0.077 | *** | −0.023 | *** | −0.007 | *** |

| (0.001) | (0.001) | (0.000) | (0.000) | |||||

| NLF#4-Post | −0.067 | *** | 0.043 | *** | 0.05 | *** | ||

| (0.001) | (0.001) | (0.000) | (0.000) | |||||

| NLF#5-Post | −0.136 | *** | 0.001 | |||||

| (0.001) | (0.001) | |||||||

| NLF#6-Post | −0.053 | *** | −0.051 | *** | ||||

| (0.000) | (0.000) | |||||||

| NLF#7-Post | 0.028 | *** | ||||||

| (0.001) | ||||||||

| NLF#8-Post | 0.013 | *** | ||||||

| (0.001) | ||||||||

| NLF#9-Post | −0.05 | *** | ||||||

| (0.000) | ||||||||

| Lagged GIEA | 0.000 | 0.003 | * | 0.000 | 0.001 | * | ||

| (0.000) | (0.001) | (0.001) | (0.000) | |||||

| Population | −0.069 | *** | −0.064 | *** | −0.065 | *** | −0.076 | *** |

| (0.012) | (0.013) | (0.009) | (0.002) | |||||

| N | 173,984 | 88,208 | 158,888 | 44,083 | ||||

Notes: Standard error in parentheses. Uncorrected prices do not correct for biases associated with households’ and retailers’ characteristics. Models included UPI, city, and month fixed effects, a constant, and linear and squared time trends.

p < 0.10

p < 0.05

p < 0.010. Post: years 2014–15, NLF: Non-leading firm, GIEA: Global Indicator of Economic

Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

4.6. Sensitivity analyses

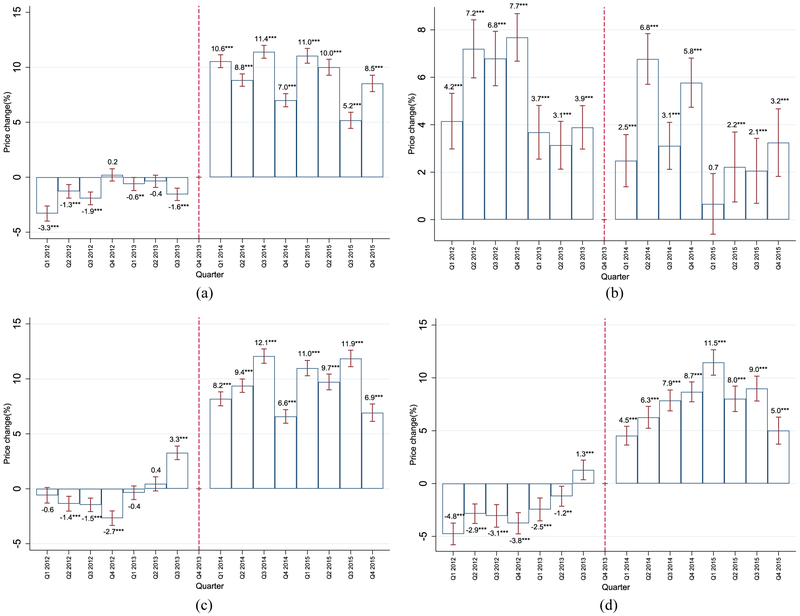

For sensitivity analyses, we restricted our analytical data to UPI with information for every year to assess whether the higher number of UPI in 2013 and 2014 might have driven the price changes described above. This limited the number of UPI to 70 for pre-packaged sweet bread, 338 for cookies, 156 for ready-to-eat cereals, and 387 for salty snacks and peanuts. Results for Eqs. (5)-(7) based on corrected prices, the new analytical data, and bootstrapped standard errors are shown in Tables A2 and A3 and Fig. A1 in the Appendix. We found that the results were consistent with those in Tables 2 and 3 and Fig. 3 based on corrected prices and no data restrictions, with only slight variations in the magnitude of the estimated price change.

5. Discussion

Our results are, in general, consistent with the other two studies on the effect of the eight percent ad valorem tax on NEDF prices in urban Mexico. In their working paper, Molina et al. (2017) found that for the post-tax period (2014–2015), prices of cereals and snacks went up by less than eight percent. Aguilera Aburto et al. (2017) in their study for salty snacks analyzed different subcategories of this food group (e.g., popcorns and chips) separately. The authors found that for several of these subcategories price increases were below eight percent. Similarly, we found price growths for ready-to-eat cereals and salty snacks and peanuts that did not reach eight percent. However, our results of a price increase for pre-packaged sweet bread below eight percent differ from the findings by Molina et al. (2017) who showed that the prices of this food group rose by more than eight percent.

Our results are not identical to those from the two studies in urban Mexico likely due to three reasons. First, and as part of the contribution of this study, we controlled for the retailers where households went shopping and weighed econometric models using expenditures at the UPI level. These weights allowed us to account for how much money each household allocated to buy a specific UPI. In contrast, the authors of the two previous studies were not able to control for retailers, nor did they weigh their econometric analyses (Aguilera Aburto et al., 2017; Molina et al., 2017). Second, price information for our study came from cities with a population larger than 50,000 inhabitants while the information used in previous studies on NEDF prices came from cities with a population of more than 20,000. Third, each study used different food categorizations. For example, Molina et al. (2017) merged cereal bars and ready-to-eat cereals into one category while we only focused on ready-to-eat cereals.

Our analyses on the gradual price change over time showed that prior to the implementation of the ad valorem tax in 2014, there was no clear price trend for cookies and salty snacks. In contrast, their prices in 2014 and 2015 were larger than prices right before the tax came into effect; consistent with pre-post price change results. For ready-to-eat cereals, the downward trend in their prices prior to the tax implementation may explain the incomplete tax pass-through. For pre-packaged bread, its increasing price trend up to the first quarter in 2015 seems to suggest its prices would have reached the observed levels in 2014 and 2015 even in the absence of the tax. Therefore, we have to be cautious when interpreting the price changes for pre-packaged bread as a consequence of the tax implementation.

For the analyses at the firm level for cookies and pre-packaged sweet bread, a clear pattern arose: LF’s prices displayed the largest price increases in their market. The exception was the group of firms with an individual market below one percent in the pre-packaged sweet bread market (i.e., NLF#3) whose price increase was not statistically different compared with the LF. For salty snacks and peanuts, this pattern was less robust because between two and three NLF out of nine NLF had a price increase larger than the LF while the remaining NLF had lower or equal price increases compared with the LF. For all these market foods, their respective LF had a larger number of brands compared to the average number across NLF. This advantage might have allowed the LF to increase prices to a larger extent compared to its competitors by exploiting the potentially high degree of substitution by consumers within LF’s brands as suggested by Griffith et al. (2010).

Price elasticities are fundamental to assess price changes after the tax implementation because the more sensitive agent (i.e., consumers or producers) to price changes will carry a larger tax burden; however, there is no study on price elasticities in Mexico that overlaps in food groups and population as those used in our study. Instead, we infer how sensitive consumers are to price changes using results from a previous study by Batis et al. (2016) who analyzed food purchase changes in 2014 using Nielsen CPS. Consumers of the taxed foods in our study seemed to have an unit-elastic or inelastic price demand because purchase drops for these foods were either proportionally equal to or lower than their price increases. Based on the analyses on purchase changes by Batis et al. (2016), there was a 5.2% reduction in purchases for cereal-based sweets to a 5.0–9.0% price increase for pre-packaged sweet bread and cookies found here; a 1.6% reduction in ready-to-eat cereal purchases to a 5.1% price increase found here; and a 6.1% drop in salty-snack purchases to a 6.6% price increase here.

Another component to consider when assessing the price changes in this study is the presence of untaxed foods that are close substitutes. These substitutes are either foods that their energy density (< 275 kcal/100 g) does not make them subject to the tax, or energy-dense foods from small producers exempt from paying the tax when their annual income does not surpass $100,000 Mexican pesos (≈ USD 5,000) (Secretaría de Gobernación, 2013b, 2014). Untaxed close substitutes are likely to be available for food groups other than cookies and may partially explain why price increases were below eight percent for these other food groups. Specifically, cereals as oats (energy density < 275 kcal/100 g) might work as untaxed counterparts for ready-to-eat cereals while consumers could substitute pre-packaged salty snacks or sweet bread for unpackaged salty snacks produced by street vendors or sweet bread produced by small bakeries (both very prevalent at the national level). In contrast, cookies are unlikely to have a close substitute because their energy density makes most of them subject to the tax or because their small-scale production is less common. However, more research is needed to elucidate the contribution of these components to the changes in prices once the eight percent ad valorem tax came into effect.

6. Strengths and limitations

This current study has several strengths built upon the richness of information in Nielsen CPS and a method to accommodate price information at the household level for price analyses. First, the price correction method by Handbury and Weinstein (2015) allowed us to remove the potential bias associated with searching behaviors by consumers who seek to pay lower prices as well as the bias that might arise due to systematic differences in prices of the same UPI across retailers. Our results based on uncorrected prices suggest that by ignoring these biases, we would have considerably underestimated price changes after the tax implementation for most of the taxed groups. Another strength of our study is the use of weights for the econometric models to account for the expenditure allocated by households to buy a specific UPI. Moreover, given the lack of appropriate control groups, our event-study analyses provide insights on whether there were any pre-existing price trends and thus whether price increases post-tax might have occurred in the absence of the tax, which is suggested in the case of sweet bread. The final advantage of our study was the firm-related analysis that allowed us to improve our understanding of the potential mechanisms behind the heterogeneous price increases. Likewise, our analysis of prices is the first one to examine price changes at the firm level in the context of the SSB and NEDF taxes in Mexico.

There were, however, some limitations to this study. First, our pre-post research design could not identify how much of price changes was attributable to the tax or to other variables (e.g., input costs and available technology) that might also influence prices. However, we tried to minimize this influence by controlling for a number of factors as mentioned in Eqs. (5)-(7). Second, prices reported by households might exclude information from taxed products that might be removed from the market or whose prices substantially increased in the post-tax implementation period, which could have happened in 2015 when there was a reduction in the number of UPI. If this were true, our estimates of price changes would be biased downward. Third, sensitivity analyses showed that firms varied their number of UPI over time; however, we found that this variation was not differential among LF or NLF and found no major change in the magnitude of the estimated price changes. Finally, we should be cautious in extrapolating our results to the whole country, since the Nielsen CPS data represent 63% of the Mexican population and 75% of food and beverage expenditure in 2014 (Colchero et al., 2016; Instituto Nacional de Estadistica y Geografia, 2014).

6.1. Policy implications

From a public health perspective, larger price increases for cookies, which is the food group with the largest volume sales (≈34%) among taxed foods, after the tax implementation might lead to more pronounced decreases in the NEDF consumption and thus to larger drops in the expected prevalence of overweight and obesity. In contrast, the price increases below the tax rate for ready-to-eat cereals, pre-packaged bread, and salty snacks and peanuts supports earlier work that suggests that ad valorem taxes are less likely to be passed through to prices, and thus generate lower reductions in purchases compared with specific taxes (Anderson et al., 2001; Bonnet and Réquillart, 2013; Griffith et al., 2010). In the light of these findings, a specific tax, at least for the latter food groups, might achieve a more complete tax pass-through. Other advantages associated with specific taxes compared with ad valorem taxes are more stable tax revenues, a lower administrative burden, and a lower vulnerability to price strategies (since specific taxes are not a function of the base price) (Brownell et al., 2009; Chriqui et al., 2013). However, practical considerations on what unit of measure to base a specific tax (e.g., the weight of the product or a nutrient content measure) could create challenges. Another possibility is for buffering for incomplete pass-through and hence setting a higher ad valorem tax rate to get closer to the objectives of lowering purchases and consumption. Beyond the tax design, efforts to maximize the tax pass-through to discourage unhealthy food purchases should consider the interplay among variability in firms’ market shares and consumers’ demand elasticities.

6.2. Conclusions

Our study contributes to the literature on price changes after the implementation of the eight percent ad valorem tax on NEDF in Mexico by providing evidence that corrects for the household and retailer effects on prices and accounts for the household’s budget allocated to buy a specific product. Moreover, this is the first study to analyze the price change by firm in Mexico. Our findings strongly suggest that price elasticities of demand, the availability of untaxed substitutes, and firms’ brand portfolios are likely important factors behind the heterogenous price changes across groups and firms. However, more research is needed to disentangle the mechanisms that explain the heterogeneous levels of price changes as well as the tax effect on consumer welfare, firm profit, and revenue. These kinds of evidence will inform on the most appropriate tax design depending on whether the government is trying to maximize revenue, maximize reducing the consumption of unhealthy foods, or to minimize losses in the consumer welfare.

Acknowledgements

Juan Carlos Salgado thanks the Mexican National Council of Science and Technology for his doctoral scholarship. We also wish to thank Dr. Donna Miles for exceptional assistane with the data management, Emily Yoon for administrative assistance, and Dr. Arantxa Colchero and Dr. Pourya Valizadeh for their comments on an early version of this study.

Funding

This work was funded primarily by Bloomberg Philanthropies (grants to the Carolina Population Center and the Instituto Nacional de Salud Pública), with support from the National Institutes of Health (NIH), United States (grant number R01DK108148), the Robert Wood Johnson Foundation, United States (Grant No. 71698), the Carolina Population Center’s NIH Center Grant, United States (grant number P2C HD050924), and the Mexican National Council of Science and Technology (335806) . Funders had no direct role in the study design, analysis or manuscript preparation. None of the authors have conflict of interests to declare.

Appendix

Fig. A1.

Quarterly changes in corrected prices on restricted sample. (a) Cookies, (b) Ready-to-eat cereals, (c) Salty snacks and peanuts, (d) Pre-packaged sweet bread. Notes: Confidence Intervals (95%) in red-capped spikes. Corrected prices correct for biases associated with households’ and retailers’ characteristics. Models included UPI and city fixed effects, a constant, lagged global indicator of economic activity, and population. ** p < 0.05, *** p < 0.010. Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

Table A1.

Taxed food groups.

| Group | Examples |

|---|---|

| Cookies | Cookies with chocolate, sandwich cookies, plain cookies |

| Ready-to-eat cereals | Ready-to-eat cereals |

| Salty snacks and peanuts | Fried/corn/potato chips, popcorn for microwave, popcorn ready-to-eat, crackers, peanuts and seeds, peanut butter, nut butter |

| Pre-packaged sweet bread | Pre-packaged sweet bread |

Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

Table A2.

Changes in prices: Food group analyses with corrected prices on restricted sample.

| Cookies | Ready-to-eat cereals | Salty snacks and peanuts | Pre-packaged sweet bread | |||||

|---|---|---|---|---|---|---|---|---|

| Post | 0.099 | *** | 0.050 | *** | 0.067 | *** | 0.051 | *** |

| (0.002) | (0.004) | (0.002) | (0.004) | |||||

| Lagged GIEA | 0.006 | *** | 0.003 | ** | −0.005 | *** | 0.001 | |

| (0.001) | (0.001) | (0.001) | (0.001) | |||||

| Population | −0.069 | *** | −0.054 | *** | −0.076 | *** | −0.066 | *** |

| (0.011) | (0.020) | (0.010) | (0.013) | |||||

| N | 160,856 | 67,666 | 148,434 | 42,722 | ||||

Notes: Standard error in parentheses. Corrected prices correct for biases associated with households’ and retailers’ characteristics. Models included UPI, city, and month fixed effects, a constant, and linear and squared time trends.

p < 0.10

p < 0.05

p < 0.010. post: years 2014–15, GIEA: Global Indicator of Economic.

Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

Table A3.

Changes in prices: Firm analyses with corrected prices on restricted sample.

| Cookies | Ready-to-eat cereals | Salty snacks and peanuts | Pre-packaged sweet bread | |||||

|---|---|---|---|---|---|---|---|---|

| Post | 0.115 | *** | 0.051 | *** | 0.068 | *** | 0.053 | *** |

| (0.003) | (0.005) | (0.002) | (0.004) | |||||

| NLF#1-Post | −0.017 | *** | −0.042 | *** | 0.002 | −0.041 | *** | |

| (0.002) | (0.006) | (0.002) | (0.006) | |||||

| NLF#2-Post | −0.055 | *** | −0.003 | 0.012 | *** | −0.039 | *** | |

| (0.005) | (0.008) | (0.004) | (0.005) | |||||

| NLF#3-Post | −0.155 | *** | 0.078 | *** | −0.032 | *** | −0.006 | |

| (0.008) | (0.013) | (0.009) | (0.014) | |||||

| NLF#4-Post | −0.063 | *** | 0.042 | *** | 0.049 | *** | ||

| (0.009) | (0.012) | (0.004) | ||||||

| NLF#5-Post | −0.126 | *** | −0.005 | |||||

| (0.022) | (0.011) | |||||||

| NLF#6-Post | −0.058 | *** | −0.078 | *** | ||||

| (0.007) | (0.008) | |||||||

| NLF#7-Post | 0.026 | *** | ||||||

| (0.006) | ||||||||

| NLF#8-Post | 0.016 | *** | ||||||

| (0.006) | ||||||||

| NLF#9-Post | −0.05 | *** | ||||||

| (0.009) | ||||||||

| Lagged GIEA | 0.006 | *** | 0.003 | ** | −0.005 | *** | 0.001 | |

| (0.001) | (0.001) | (0.001) | (0.001) | |||||

| Population | −0.067 | *** | −0.051 | *** | −0.073 | *** | −0.071 | *** |

| (0.01) | (0.019) | (0.01) | (0.015) | |||||

| N | 160,856 | 67,666 | 148,434 | 42,722 | ||||

Notes: Standard error in parentheses. Corrected prices correct for biases associated with households’ and retailers’ characteristics. Models included UPI, city, and month fixed effects, a constant, and linear and squared time trends.

p < 0.10

p < 0.05

p < 0.010. Post: years 2014–15, NLF: Non-leading firm, GIEA: Global Indicator of Economic.

Source: Authors’ own analyses and calculations based on data from Nielsen through its Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015. The Nielsen Company, 2016. Nielsen is not responsible for and had no role in preparing the results reported herein.

Footnotes

We set a 20-gram group for ready-to-eat cereals because their average package size was twice as large as the average package size among the other food groups.

Results were similar by using the formulas by Etilé et al. (2018) or Handbury and Weinstein (2015).

We used equivalent foods that were untaxed (e.g., prices of untaxed cereals with an energy density < 275 kcal/100 gr) or untaxed SSB or bottled water as ‘controls’.

Results from the difference-in-differences models and synthetic control method are available upon request

References

- Aburto TC, Pedraza LS, Sanchez-Pimienta TG, Batis C, Rivera JA, 2016. Discretionary foods have a high contribution and fruit, vegetables, and legumes have a low contribution to the total energy intake of the mexican population. J. Nutr 146, 1881S–1887S. 10.3945/jn.115.219121. [DOI] [PubMed] [Google Scholar]

- Aguilera Aburto N, Rodríguez Aguilar R, Sansores Martínez DN-H, Gutiérrez Delgado C, 2017. Impuestos en botanas. Su impacto en precio y consumo en México. Trimest. Económico 84, 773–803. 10.20430/ete.v84i336.606. [DOI] [Google Scholar]

- Allais O, Etilé F, Lecocq S, 2015. Mandatory labels, taxes and market forces: an empirical evaluation of fat policies. J. Health Econ 43, 27–44. 10.1016/j.jhealeco.2015.06.003. [DOI] [PubMed] [Google Scholar]

- Anderson SP, De Palma A, Kreider B, 2001. Tax incidence in differentiated product oligopoly. J. Public Econ 81, 173–192. 10.1016/S0047-2727(00)00079-7. [DOI] [Google Scholar]

- Barquera S, Campos-Nonato I, Hernández-Barrera L, Pedroza A, Rivera-Dommarco J.a., 2013. Prevalencia de obesidad en adultos mexicanos 2000–2012. Salud Publica Mex. 55, 151–160. [PubMed] [Google Scholar]

- Barquera S, Hernandez-Barrera L, Tolentino ML, Espinosa J, Ng SW, Rivera J.a., Popkin BM, 2008. Energy intake from beverages is increasing among Mexican adolescents and adults. J. Nutr 138, 2454–2461. 10.3945/jn.108.092163. [DOI] [PubMed] [Google Scholar]

- Batis C, Rivera JA, Popkin BM, Taillie LS, 2016. First-year evaluation of mexico’s tax on nonessential energy-dense foods: an observational study. PLoS Med. 13, 1–14. 10.1371/journal.pmed.1002057. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Berardi N, Sevestre P, Tépaut M, Vigneron A, 2016. The impact of a ‘soda tax’ on prices: evidence from French micro data. Appl. Econ 10.1080/00036846.2016.1150946. [DOI] [Google Scholar]

- Bergman UM, Lynggård Hansen N, 2019. Are excise taxes on beverages fully passed through to prices? The Danish evidence. FinanzArchiv. 10.1628/fa-2019-0010. [DOI] [Google Scholar]

- Bonnet C, Réquillart V, 2013. Tax incidence with strategic firms in the soft drink market. J. Public Econ 106, 77–88. 10.1016/j.jpubeco.2013.06.010. [DOI] [Google Scholar]

- Brownell KD, Farley T, Popkin BM, Chaloupka FJ, Thompson JW, Ludwig DS, 2009. The public health and economic benefits of taxing sugar-sweetened beverages. N Engl. J. Med 361, 1599–1605. 10.1056/NEJMhpr0905723. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chriqui JF, Chaloupka FJ, Powell LM, Eidson SS, 2013. A typology of beverage taxation: multiple approaches for obesity prevention and obesity prevention-related revenue generation. J. Public Health Policy 34, 403–423. 10.1057/jphp.2013.17. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Colchero MA, Popkin BM, Rivera JA, Ng SW, 2016. Beverage purchases from stores in Mexico under the excise tax on sugar sweetened beverages: observational study. BMJ 352, 1–9. 10.1136/bmj.h6704. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Colchero MA, Salgado JC, Unar-Munguía M, Molina M, Ng S, Rivera-Dommarco JA, 2015. Changes in prices after an excise tax to sweetened sugar beverages was implemented in Mexico: evidence from urban areas. PLoS One 10, e0144408 10.1371/journal.pone.0144408. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Colchero MA, Zavala J, Batis C, Shamah-Levy T, Rivera-Dommarco J, 2017. Cambios en los precios de bebidas y alimentos con impuesto en áreas rurales y semirrurales de México. Salud Publica Mex. 59, 137–146. 10.21149/7994. [DOI] [PubMed] [Google Scholar]

- Consejo Nacional de Población, 2014. [Population Projections 2010-2050] [WWW Document]. URL < http://www.conapo.gob.mx/es/CONAPO/Proyecciones > (accessed 5.1.17).

- Delipalla S, Keen M, 1992. The comparison between ad-valorem and specific taxation under imperfect competition. J. Public Econ 49, 351–367. 10.1016/0047-2727(92)90073-O. [DOI] [Google Scholar]

- Etilé F, Lecocq S, Boizot-Szantai C, 2018. The incidence of soft-drink taxes on consumer prices and welfare: evidence from the French “Soda Tax”. PSE Work. Pap 24. [Google Scholar]

- Griffith R, Nesheim L, O’Connell M, 2010. Sin taxes in differentiated product oligopoly: an application to the butter and margarine market. CeMMAP Work. Pap 10.1920/wp.cem.2010.3710. [DOI] [Google Scholar]

- Grogger J, 2017. Soda taxes and the prices of sodas and other drinks: evidence from Mexico. Am. J. Agric. Econ 99, 481–498. 10.1093/ajae/aax024. [DOI] [Google Scholar]

- Gutiérrez JP, Rivera-Dommarco Juan A, Shamah-Levy T, Villalpando-Hernández S, Franco A, Cuevas-Nasu L, Romero-Martínez Martin, Hernández-Ávila M, 2013. Encuesta Nacional de Salud y Nutrición 2012 Resultados Nacionales, 2a ed. ed. Instituto Nacional de Salud Pública, Cuernavaca, México. [PubMed] [Google Scholar]

- Handbury J, Weinstein DE, 2015. Goods Prices and Availability in Cities. Rev. Econ. Stud 82, 258–296. 10.1093/restud/rdu033. [DOI] [Google Scholar]

- Instituto Nacional de Estadistica y Geografia, 2014. [National Household Income and Expenditure Survey 2014] [WWW Document]. URL < http://www.beta.inegi.org.mx/proyectos/enchogares/regulares/enigh/tradicional/2014/ > (accessed 5.1.16).

- Instituto Nacional de Estadística y Geografía, 2015a. [National Consumer Price Index] [WWW Document]. URL http://www.beta.inegi.org.mx/proyectos/precios/inpc/ (accessed 6.13.16).

- Instituto Nacional de Estadística y Geografía, 2015b. [Global Indicator of Economic Activity] [WWW Document]. URL http://en.www.inegi.org.mx/temas/igae/ (accessed 3.27.18).

- Instituto Nacional de Estadística y Geografía, 2014. [National Consumer Price Index. Methodological Document].

- Lozano R, Gómez-Dantés H, Garrido-Latorre F, Jiménez-Corona A, Campuzano-Rincón JC, Franco-Marina F, Medina-Mora ME, Borges G, Naghavi M, Wang H, Vos T, Lopez AD, Murray CJL, 2013. Burden of disease, injuries, risk factors and challenges for the health system in Mexico. Salud Publica Mex. 55, 580–594. 10.21149/spm.v55i6.7304. [DOI] [PubMed] [Google Scholar]

- Molina M, Guerrero-López CM, Colchero MA, 2017. Changes in urban prices and national sales after a tax on nonessential energy-dense was implemented in Mexico. Unpubl. results. [Google Scholar]

- Rivera JA, Barquera S, Campirano F, Campos I, Safdie M, Tovar V, 2002. Epidemiological and nutritional transition in Mexico: rapid increase of non-communicable chronic diseases and obesity. Public Health Nutr. 5, 113–122. 10.1079/PHN2001282. [DOI] [PubMed] [Google Scholar]

- Sánchez-Pimienta T, Batis C, Lutter CK, Rivera JA, 2016. Sugar-sweetened beverages are the main sources of added sugar intake in the Mexican. J. Nutr 1–9. 10.3945/jn.115.220301.1S. [DOI] [PubMed] [Google Scholar]

- Secretaría de Gobernación, 2014. [Second Article, Section I, September 10 2014]. [WWW Document]. D. Of. la Fed; URL < http://dof.gob.mx/nota_detalle.php?codigo=5359611&fecha=10/09/2014 > . [Google Scholar]

- Secretaría de Gobernación, 2013a. [Excise Tax Law for Production and Services, December 11 2013] [WWW Document]. D. Of. la Fed; URL < http://www.dof.gob.mx/nota_detalle.php?codigo=5325371&fecha=11/12/2013 > . [Google Scholar]

- Secretaría de Gobernación, 2013b. [Seventh Transitional Article, Section II, December 26 2013] [WWW Document]. D. Of. la Fed; URL < http://www.dof.gob.mx/nota_detalle.php?codigo=5328028&fecha=26/12/2013 > . [Google Scholar]

- Secretaría de Salud, 2013. [National Strategy for the Prevention and Control of Overweight, Obesity and Diabetes]. Mexico City. [Google Scholar]

- Stevens G, Dias RH, Thomas K.J.a., Rivera J.a., Carvalho N, Barquera S, Hill K, Ezzati M, 2008. Characterizing the epidemiological transition in Mexico: national and subnational burden of diseases, injuries, and risk factors. PLoS Med. 5, 0900–0910. 10.1371/journal.pmed.0050125. [DOI] [PMC free article] [PubMed] [Google Scholar]

- The Nielsen Company, 2016. Mexico Consumer Panel Service (CPS) for the food and beverage categories for January 2012 – December 2015.

- Weyl EG, Fabinger M, 2013. Pass-through as an economic tool: principles of incidence under imperfect competition. J. Polit. Econ 121, 528–583. 10.1086/670401. [DOI] [Google Scholar]