Abstract

The COVID-19 pandemic provided the first widespread bear market conditions since the inception of cryptocurrencies. We test the widely mooted safe haven properties of Bitcoin, Ethereum and Tether from the perspective of international equity index investors. Bitcoin and Ethereum are not a safe haven for the majority of international equity markets examined, with their inclusion adding to portfolio downside risk. Only investors in the Chinese CSI 300 index realized modest downside risk benefits (contingent on very limited allocations to Bitcoin or Ethereum). As Tether successfully maintained its peg to the US dollar during the COVID-19 turmoil, it acted as a safe haven investment for all of the international indices examined. We caveat the latter findings with a warning that Tether's dollar peg has not always been maintained, with evidence of impaired downside risk hedging properties earlier in our sample.

Keywords: Cryptocurrency, Bitcoin, Ethereum, Tether, Safe Haven, COVID-19

1. Introduction

The recent COVID-19 pandemic provided the first widespread bear market since the trading of cryptocurrencies began. In this article we examine the safe haven benefits of cryptocurrencies during the COVID-19 bear market, from the perspective of international equity index investors.

The concept of an investment safe haven is motivated by investor loss aversion (Tversky and Kahneman, 1991), where investors are more concerned with avoiding losses than any associated prospective gains (Hwang and Satchell, 2010). This loss aversion motivates investors to seek out safe haven assets, i.e. assets that are uncorrelated or negatively correlated with traditional assets during periods of market turmoil (Baur and Lucey, 2010). Various safe haven assets have been established at short to medium horizons, including gold (Bredin et al., 2015), currencies (Ranaldo and Söderlind, 2010), long dated treasury bonds (Flavin et al., 2014) and, most recently, cryptocurrencies.

The growing popularity of cryptocurrencies has inspired numerous studies of their investment benefits, including their safe haven properties. Urquhart and Zhang (2019) look at the hedging and safe haven properties of Bitcoin at the hourly frequency and find that it acts as a hedge, diversifier and safe haven, respectively, for a range of international currencies. Shahzad et al. (2019) use a cross-quantilogram approach to define safe haven characteristics and find some evidence that Bitcoin, gold, and the commodity index are weak safe havens but that this behavior is time-varying. Guesmi et al. (2019) find that portfolio risk is considerably reduced through the inclusion of Bitcoin in a portfolio comprising of gold, oil and emerging market stocks.

Conversely, Smales (2019) finds that Bitcoin is more volatile, less liquid, and costlier to transact than other assets and argues that these features should rule it out as safe haven asset. Klein et al. (2018) contrast the hedging and safe haven properties of gold and Bitcoin, finding that the latter correlates positively with downward moves in developed markets. Some sceptics have highlighted the risk of considering cryptocurrencies as a financial asset in the first place, given the product immaturity, the level of illegal transactions and financial misappropriation (Corbet et al., 2019a, Corbet et al., 2019b). The evidence for speculative behaviour in cryptocurrencies, manifesting in the form of bubbles (Gandal et al., 2018, Corbet et al., 2018), may also shed doubt on their ability to act as a safe haven.

While results pre-Covid are decidedly mixed, many of these studies found evidence supporting the hypothesis that cryptocurrencies had safe haven properties. Due to the absence of a bear market in the historical sample pre-Covid, this hypothesis was not tested under acute market conditions. Conlon and McGee (2020) investigate the safe haven properties of Bitcoin for a US investor investing domestically during the Covid bear market and found that a portfolio allocation to Bitcoin increased rather than decreased downside risk exposure.

There are, however, reasons to believe that safe haven properties may vary internationally. One of the main candidate drivers put forward for the safe haven hypothesis in the literature is the independence of cryptocurrencies in monetary policy. Baker et al. (2016) develop an index of economic policy uncertainty (EPU, including monetary policy uncertainty) based on the measured frequency of related keywords in newspaper coverage. Local events such as elections have been shown to have a significant impact on both policy uncertainty and financial market uncertainty (see, e.g. Kelly et al., 2016, Goodell et al., 2020). There have been a number of papers investigating the relationship between cryptocurrency returns and EPU (see, e.g. Demir et al., 2018, Wang et al., 2019a, Wu et al., 2019, Fang et al., 2019). Wang et al. (2020), for example, find that Bitcoin returns around the highest economic policy uncertainty days (as measured by local versions of the EPU index of Baker et al., 2016) are significantly greater than those around the lowest EPU days. Aysan et al. (2019) investigate the impact of global geopolitical risk (GPR) on Bitcoin. They find that GPR has predictive power on returns and price volatility of Bitcoin. Negative changes in GPR lead to greater Bitcoin returns. Bouri et al. (2017a) examine whether Bitcoin can hedge global uncertainty, measured by the first principal component of the VIX indices of 14 developed and developing equity markets. They find that Bitcoin does act as a hedge against uncertainty: it reacts positively to uncertainty at both higher quantiles and shorter frequency movements of Bitcoin returns. As policy uncertainty (and monetary policy uncertainty) are country-specific, these studies motivate an analysis of the safe haven properties of cryptocurrencies internationally.

In prior work, specifically in the context of international safe havens, Mensi et al. (2020) use wavelet transformation techniques to examine the co-movements between Bitcoin and the Dow Jones World Stock Market Index; regional Islamic stock markets; and Sukuk markets. They find evidence of benefits from diversification with Bitcoin, but these are found to be smaller for longer term investors (order of months) compared to short-term investors (order of days). Kliber et al. (2019) use a multivariate stochastic volatility model with dynamic conditional correlation to examine the time-varying hedging and safe haven properties of Bitcoin. Bitcoin is found to be a weak hedge in all markets when investment in US dollars is considered and a safe haven in Venezuela (with investment in bolivars). Bouri et al. (2017b) use dynamic conditional correlations and find that Bitcoin has hedge and safe haven properties against Asia Pacific stocks. Assessing a wide range of cryptocurrencies, Wang et al. (2019b) find that digital currencies act as a safe haven for most international indices examined.

In this paper, we consider the international safe haven properties of cryptocurrencies through a popular methodology in the safe haven literature, specifically by examining whether there is a reduction in downside risk through pairing international equity index investments with portfolio allocations to individual cryptocurrencies (candidate cryptocurrencies include: Bitcoin, Ethereum1 and Tether). Downside risk is estimated using the approach of modified value at risk and modified conditional value at risk proposed by Favre and Galeano (2002) that captures the impact of significant higher order moments, frequently observed in financial returns. We consider a range of international equity indices including: MSCI World; S&P 500 (US); FTSE 100 (UK); FTSE MIB (Italy); IBEX (Spain) and CSI 300 (China). These indices are selected as they represent share prices in countries most seriously impacted by the pandemic at the onset of the Covid bear market, in late February 2020.

We find that Bitcoin and Ethereum are not safe havens for almost all of the indices during the COVID-19 market turmoil. Our findings are in contrast to Feng et al. (2018), who find that the tail risk of Bitcoin is independent of returns in stock indices over a period ending in August 2017. In keeping with the literature, in rolling window analysis, we find that cryptocurrencies may act as a hedge during certain market periods. Consistent with Bouri et al. (2017b), who find that Bitcoin has hedge and safe haven properties for Asia Pacific stocks pre-Covid, we find some limited evidence of safe haven properties relative to the CSI 300 index across the sample range tested and during the Covid crisis. These findings only hold, however, for allocations of up to 16% to Bitcoin and 14% to Ethereum. For larger allocations we again observe increasing relative portfolio downside risk for CSI 300 investors. We also find that the stable coin Tether has safe haven properties across all indices examined during the COVID-19 bear market, but may be redundant as an asset, given its peg to the US dollar.2 We provide evidence that this peg is not consistently maintained over the period examined, impairing the consistency of any downside risk hedging properties.

The paper is organized as follows: Section 2 outlines the methodological approach employed to quantify downside risk. In Section 3, we detail the data under consideration. Empirical findings are described in Section 4, while Section 5 concludes.

2. Methdology

2.1. Downside risk measurement

Olsen (1997) highlights that a primary concern of investors is the potential for large losses stemming from an investment. Such downside risk has been shown to be priced in the market place, with investors requiring higher returns on stocks exhibiting greater downside risk (Ang et al., 2006). In this paper, we focus on value at risk (VaR) and the related conditional value at risk (CVAR), also referred to as expected shortfall, to measure potential losses in a portfolio over a given time horizon (see e.g., Conlon and Cotter, 2013). While other measures of crash risk have also been proposed in the context of cryptocurrencies (Kalyvas et al., 2019), the methods detailed here are appropriate for frequently examined horizons of importance to investors.

Two-moment VaR is appropriate to estimate downside risk for a portfolio with returns strictly distributed according to a normal distribution. Setting a particular confidence interval, VaR is defined as the maximum expected loss on a portfolio over a given time horizon. Under the assumption of normally distributed returns, two moment VaR is estimated using

| (1) |

α is the confidence interval considered, while z(α) is the α quantile of the standardized distribution. μ p and σ p are the mean and standard deviation of portfolio returns respectively. For two-moment VaR, the downside risk of an asset is just a constant multiple of the standard deviation of asset returns.

While frequently applied in practise, two moment VaR may not adequately capture the potential for large losses when the distribution of returns is not normal. Cryptocurrencies have been shown previously to have returns presenting both skewness and excess kurtosis (Conlon and McGee, 2020, Eross et al., 2019), implying that two moment VaR is insufficient as a measure of their downside risk. Using the Cornish–Fisher expansion to adjust the quantiles of the distribution to account for higher-order moments related to skewness and excess kurtosis, we employ the four moment VaR first proposed by Favre and Galeano (2002). Four moment VaR is based upon an approximation for the quantile of the distribution, cut off at the fourth moment, and given by:

| (2) |

S p and K p are the skewness and kurtosis of portfolio P, while is the α quantile of the standard normal distribution. Four moment modified VaR is then given by:

| (3) |

This adjusts the two-moment VaR (Eq. (1)) to account for distributional characteristics commonly found in financial time series.

CVAR looks to capture the loss expectation, conditional on the loss exceeding the modified VaR, MVaR p. Modified CVaR is calculated as a function of modified VaR:

| (4) |

where R p is the negative log return. As there is no simple analytical way to estimate modified value-at-risk, a numerical approach is employed, taking an average of MVaR p across the range of quantiles greater than 1 − α.

To understand the economic impact of allocating a proportion of wealth to cryptocurrencies, we use the approach of relative portfolio downside risk (Conlon and McGee, 2020, Bredin et al., 2017). This is estimated by taking the portfolio downside risk with an allocation to a cryptocurrency relative to a portfolio holding only the equity index under consideration. For MVaR (MCVaR), this is given by (), where MVaR mix and MCVaR mix are downside risk measures representing the mix portfolio containing an equity index and a cryptocurrency, respectively.

3. Data

The focus of this paper is isolate the portfolio risk implications of an allocation to cryptocurrencies for a US investor holding a position in a range of candidate international equity markets. Three cryptocurrencies are studied, namely Bitcoin, Ethereum and Tether. Bitcoin, the best known, mostly widely traded cryptocurrency also has the largest market capitalization. Ethereum is a decentralized computing platform, from which the cryptocurrency Ether, commonly known as Ethereum, is issued as a reward for mining nodes. Finally, Tether is a stable coin, pegged to the US Dollar, meaning that it should maintain a 1-to-1 ratio with the U.S. dollar. This link is, however, not guaranteed by the issuer.

Daily data on the cryptocurrencies, Bitcoin, Ethereum and Tether is gathered from Coinmetrics, using their CM reference rates. This paper meets the critique for cryptocurrency data of Alexander and Dakos (2020), as it is formed using a methodology which adheres to the International Organisation of Securities Commissions (IOSCO) Principles for Financial Benchmarks. The objective of the IOSCO Principles is to “create an overarching framework of principles for benchmarks used in financial markets”. All cryptocurrencies are examined in US Dollar terms.

We consider the portfolio downside risk implications for a variety of international markets, with a focus on countries known to have been impacted severely by the COVID-19 pandemic. The MSCI World Index is taken as representative of world equity markets, while the S&P 500 is selected to illustrate findings for US Markets. The FTSE 100, FTSE MIB, IBEX and CSI 300 indices are selected to represent the equity investment opportunity set for the United Kingdom, Italy, Spain and China, respectively. All indices are priced in US Dollars and daily logarithmic returns are calculated.

The inception date for each of the Cryptocurrencies differs, resulting in different data availability. Price data for Bitcoin are available from April 2010 through April 2020, data relating to Ethereum are available from August 2015 through April 2020, while data on Tether are from October 2014 through April 2020. In order to isolate the impact of the COVID-19 pandemic, a common period from 11th April 2019 to 9th April 2020 is examined. This period captures the initial bear market in equities associated with the COVID-19 pandemic.3 Finally, we assess the dynamic downside risk hedging ability of cryptocurrencies using a 1 year moving-window.

4. Empirical findings

Summary statistics pertaining to our sample are presented in Table 1 . We examine characteristics over the period April 2010–April 2020 for Bitcoin and each of the indices. Results for Ethereum and Tether are presented from the first point at which traded prices exist. Bitcoin and Ethereum are found to have considerably higher returns and standard deviation than any of the indices examined. While Bitcoin is negatively skewed, Ethereum has positive skewness, in contrast to the equity indices considered. The maximum one-day loss for Bitcoin and Ethereum are −66.5% and −56.56% respectively. The range of one-day losses for equity indices is from −9.42% (CSI 300) to −19.29% (FTSE MIB). The differential characteristics of Tether are notable, presenting an average return of almost zero and a standard deviation of 26%, larger than the majority of equity indices examined. Given the purported peg with the US dollar, it is remarkable that Tether exhibits a maximum one day loss of −14.75%.

Table 1.

Summary statistics.

| All data | Bitcoin | Ethereum | Tether | MSCI World | S&P 500 | FTSE 100 | FTSE MIB | IBEX | CSI 300 |

|---|---|---|---|---|---|---|---|---|---|

| Mean | 113.26 | 102.60 | 0.16 | 5.89 | 9.85 | −0.76 | −3.08 | −5.15 | 3.21 |

| Standard deviation | 97.94 | 123.30 | 26.03 | 14.72 | 17.13 | 18.80 | 27.62 | 24.76 | 23.97 |

| Skewness | −0.54 | 0.46 | 1.46 | −1.21 | −0.91 | −1.08 | −1.06 | −0.89 | −0.75 |

| Kurtosis | 13.96 | 6.56 | 31.71 | 19.81 | 19.74 | 15.70 | 10.91 | 10.41 | 5.16 |

| Max one day loss | −66.49 | −56.56 | −14.75 | −10.44 | −12.77 | −13.47 | −19.29 | −15.90 | −9.42 |

| Cumulative return | 1141.14 | 495.51 | 0.90 | 59.28 | 95.72 | −7.41 | −30.15 | −50.87 | 30.18 |

| 2019–2020 | Bitcoin | Ethereum | Tether | MSCI World | S&P 500 | FTSE 100 | FTSE MIB | IBEX | CSI 300 |

|---|---|---|---|---|---|---|---|---|---|

| Mean | 35.70 | 2.73 | −0.39 | −8.33 | −3.48 | −28.57 | −23.76 | −31.62 | −10.99 |

| Standard deviation | 86.61 | 100.98 | 4.98 | 26.16 | 31.82 | 27.98 | 31.71 | 27.86 | 23.94 |

| Skewness | −0.54 | 0.46 | 1.46 | −1.21 | −0.91 | −1.08 | −1.06 | −0.89 | −0.75 |

| Kurtosis | 21.74 | 24.17 | 16.60 | 15.37 | 12.64 | 19.72 | 37.33 | 28.31 | 6.89 |

| Max one day loss | −47.06 | −56.56 | −2.42 | −10.44 | −12.77 | −13.47 | −19.29 | −15.90 | −9.42 |

| Cumulative return | 35.70 | 2.73 | −0.39 | −8.33 | −3.48 | −28.57 | −23.76 | −31.62 | −10.99 |

This table details summary statistics for Bitcoin and a range of international equity markets. Summary statistics are given in percentage terms and mean and standard deviation are annualized. All Data incorporates periods from April 2010–April 2020 (Bitcoin and equity indices), August 2015–April 2020 (Ethereum) and October 2014–April 2020 (Tether). A one year period from April 2019–April 2020 is also examined for all assets.

We focus upon the most recent one year period, which incorporates the ongoing COVID-19 related market turmoil. Over this period, only Bitcoin and Ethereum display returns for which the mean return is positive, but with a relatively large standard deviation. Each of the equity indices display negative returns ranging from −3.48% for the S&P 500 to −31.62% for the IBEX. During this one year interval, both Bitcoin and Ethereum have a maximum one day loss of −47% and −56.6% respectively. For Tether, the position is more benign, with a maximum one day loss of −2.42%.

4.1. Unconditional downside risk estimates

In Table 2 , we provide an initial assessment of the downside risk exposure of each index alone and for a portfolio with a 10% allocation to the cryptocurrency and the remaining 90% to the index. Downside risk is estimated using both MVaR and MCVaR at a 1% and 5% confidence level.

Table 2.

Downside risk analysis.

| (i) 1% Confidence level | MVaR | MCVaR | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| All data | S&P 500 | MSCI | FTSE 100 | MIB | IBEX | CSI 300 | S&P 500 | MSCI | FTSE 100 | MIB | IBEX | CSI 300 |

| Equity only | 6.09 | 7.08 | 6.69 | 7.90 | 6.91 | 4.77 | 10.17 | 11.94 | 10.75 | 11.79 | 10.30 | 6.14 |

| 10% Bitcoin, 90% Equity | 7.28 | 7.64 | 7.77 | 9.23 | 7.86 | 4.32 | 12.16 | 12.68 | 12.67 | 14.50 | 12.16 | 5.34 |

| 10% Ethereum, 90% Equity | 9.80 | 9.89 | 9.89 | 15.32 | 12.83 | 4.81 | 16.71 | 16.63 | 16.63 | 26.56 | 21.95 | 6.10 |

| 10% Tether, 90% Equity | 7.01 | 7.72 | 7.77 | 10.23 | 9.12 | 4.89 | 12.08 | 13.26 | 12.99 | 16.95 | 15.19 | 6.32 |

| 2019–2020 | S&P 500 | MSCI | FTSE 100 | MIB | IBEX | CSI 300 | S&P 500 | MSCI | FTSE 100 | MIB | IBEX | CSI 300 |

| Equity only | 9.09 | 9.92 | 11.57 | 15.48 | 12.47 | 5.37 | 14.27 | 15.40 | 18.98 | 25.62 | 20.26 | 6.98 |

| 10% Bitcoin, 90% Equity | 11.57 | 11.84 | 14.52 | 17.03 | 14.83 | 4.77 | 18.68 | 18.8 | 24.29 | 28.59 | 24.67 | 5.88 |

| 10% Ethereum, 90% Equity | 12.33 | 12.70 | 14.90 | 17.61 | 15.29 | 5.03 | 19.87 | 20.20 | 24.77 | 29.53 | 25.35 | 6.21 |

| 10% Tether, 90% Equity | 8.23 | 8.99 | 10.44 | 13.98 | 11.25 | 4.84 | 12.91 | 13.97 | 17.10 | 23.14 | 18.25 | 6.30 |

| (ii) 5% Confidence level | MVaR | MCVaR | ||||||||||

| All data | S&P 500 | MSCI | FTSE 100 | MIB | IBEX | CSI 300 | S&P 500 | MSCI | FTSE 100 | MIB | IBEX | CSI 300 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity only | 1.63 | 1.48 | 1.98 | 3.08 | 2.72 | 2.71 | 5.06 | 4.38 | 4.94 | 6.09 | 5.34 | 3.98 |

| 10% Bitcoin, 90% Equity | 1.89 | 1.73 | 2.11 | 2.98 | 2.71 | 2.63 | 5.50 | 5.22 | 5.66 | 6.89 | 5.93 | 3.67 |

| 10% Ethereum, 90% Equity | 2.03 | 2.27 | 2.38 | 2.73 | 2.53 | 2.80 | 6.92 | 7.06 | 7.74 | 10.64 | 9.00 | 4.04 |

| 10% Tether, 90% Equity | 1.37 | 1.58 | 1.86 | 2.51 | 2.18 | 2.73 | 4.92 | 5.45 | 5.57 | 7.35 | 6.54 | 4.06 |

| 2019–2020 | S&P 500 | MSCI | FTSE 100 | MIB | IBEX | CSI 300 | S&P 500 | MSCI | FTSE 100 | MIB | IBEX | CSI 300 |

| Equity Only | 2.95 | 3.41 | 3.09 | 3.61 | 3.32 | 2.93 | 6.79 | 7.48 | 8.41 | 11.04 | 9.05 | 4.45 |

| 10% Bitcoin, 90% Equity | 3.21 | 3.62 | 3.30 | 3.49 | 3.31 | 2.85 | 8.44 | 8.76 | 10.33 | 11.96 | 10.52 | 4.04 |

| 10% Ethereum, 90% Equity | 3.43 | 3.85 | 3.46 | 3.62 | 3.45 | 3.03 | 9.00 | 9.40 | 10.63 | 12.38 | 10.86 | 4.26 |

| 10% Tether, 90% Equity | 2.81 | 3.24 | 2.94 | 3.44 | 3.16 | 2.79 | 6.47 | 7.13 | 8.00 | 10.51 | 8.61 | 4.22 |

Downside risk is detailed for a portfolio consisting only of an equity index and for a portfolio consisting of 10% Bitcoin and 90% equity. All Data incorporates periods from April 2010–April 2020 (Bitcoin and equity indices), August 2015–April 2020 (Ethereum) and October 2014–April 2020 (Tether). A one year period from April 2019–April 2020 is also examined for all assets. Modified Value at Risk (MVaR) and Modified Conditional Value at Risk (MCVaR) are calculated using the Cornish-Fisher expansion using confidence levels of 1% and 5%.

For both confidence levels, the Italian MIB index presents the highest MVaR and MCVaR among the equity indices examined. Over the most recent one year period, the MVaR for the MIB is 15.48% at a 1% confidence level. Creating a portfolio consisting of 10% Bitcoin and 90% equity increases downside risk for all indices with the exception of the CSI 300. For example, the 1% MVaR for the MIB increases from 7.90% to 9.23% during 2010–2020, an increase of 16.8%. In contrast, combining Bitcoin with the CSI 300 results in a decrease in MVaR from 4.77% to 4.32%.

We can directly compare downside risk for portfolios containing Ethereum and Tether with index-only investments during the 2019–2020 period. For Ethereum, the only evidence for a reduction in downside risk is again observed for the CSI 300. The most substantial increase is found for the FTSE 100, which has an MVaR of 11.47% at a 1% confidence level, but increases by 28.9% when combined in a portfolio consisting of 10% Ethereum with the remaining 90% allocated to the FTSE 100. Tether provides some safe haven characteristics over this period. For each of the equity indices, we find that an allocation to Tether results in a reduction in downside risk. This alone is insufficient to confirm the safe haven properties of Tether. If a firm peg between Tether and the US dollar exists, a 10% allocation is equivalent to 10% of the portfolio being unallocated and should result in a 10% decrease in downside risk. We next test this and the proportional reduction in downside risk across all assets for a range of different allocation weights.

4.2. Cryptocurrency allocation weights

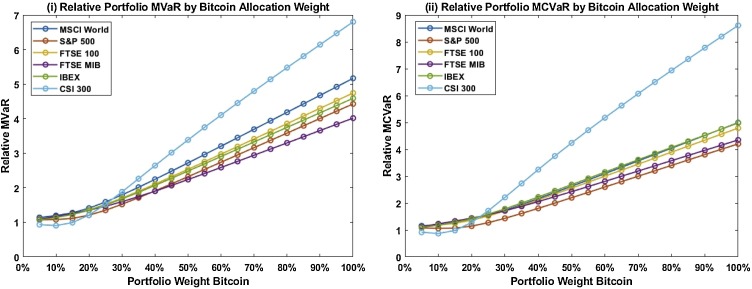

Fig. 1 details the reduction in MVaR and MCVaR for a set of Bitcoin allocation weights, relative to holding only the equity index over the period 2010–2020. Results are emphatic. Any allocation to Bitcoin results in increased MVaR and MCVaR for a portfolio consisting of Bitcoin combined with the MSCI World, S&P 500, FTSE 100, FTSE MIB and IBEX, relative to holding only the respective index. The CSI 300 is the only index for which diversifying with Bitcoin results in a reduction in downside risk, and there only for an allocation of up to 16%. These findings indicate that Bitcoin does not act as a consistent safe haven for international equity indices, with allocations generally resulting in increased downside risk.

Fig. 1.

Relative portfolio risk for different Bitcoin allocation weights (April 2010–April 2020). Relative MVaR (MCVaR) shows the increase in MVaR (MCVaR) for a portfolio with proportional allocation to Bitcoin relative to a portfolio holding only the relevant equity index. MVaR and MCVaR are estimated using a 1% confidence level.

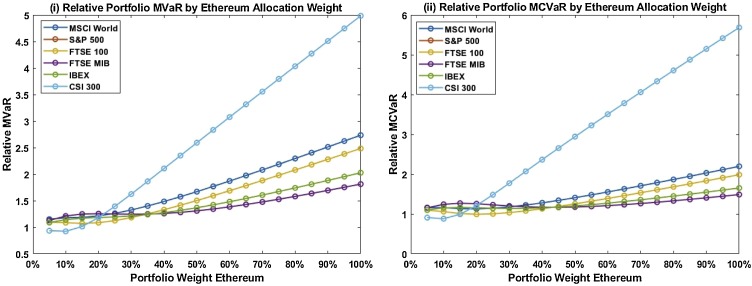

Similar conclusions are found for Ethereum over the period August 2015 through April 2020, as detailed in Fig. 2 . As the allocation to Ethereum is increased, portfolio MVaR and MCVaR increases relative to holding just the equity index for the MSCI World, S&P 500, FTSE 100, FTSE MIB and IBEX. Ethereum provides some downside risk diversification for the CSI 300 for allocations of up to 14%. As the allocation increases beyond this point, relative portfolio risk for the CSI 300 accelerates considerably. For a 50% allocation to Ethereum, relative portfolio MVaR is 2.59 for the CSI 300 portfolio compared with 1.50 for the S&P 500. Our findings highlight that Ethereum also does not have strong safe haven properties for international equity indices. For most allocation weightings Ethereum results in increased downside risk when combined with traditional equity markets.

Fig. 2.

Relative portfolio risk for different Ethereum allocation weights (August 2015–April 2020). Relative MVaR (MCVaR) shows the increase in MVaR (MCVaR) for a portfolio with proportional allocation to Ethereum relative to a portfolio holding only the relevant equity index. MVaR and MCVaR are estimated using a 1% confidence level.

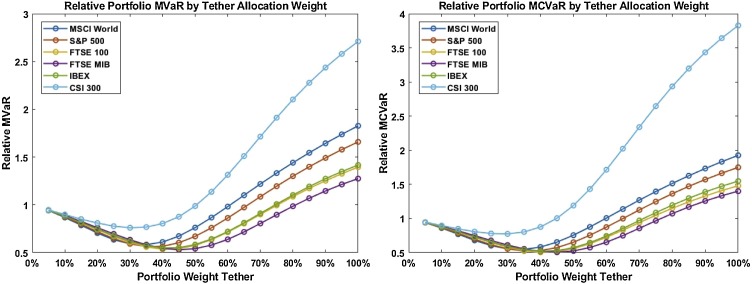

Finally, we assess whether an allocation to Tether helps in reducing portfolio downside risk between October 2014 and April 2020. Tether was designed such that each coin is worth one US dollar. Worries about credit risk or the volume of currency underpinning the cryptocurrency may, however, result in Tether trading at less than one US dollar. This, in turn, may impact any potential as a safe haven. This is borne out in our findings, Fig. 3 . If Tether were to act as a US dollar equivalent investment, portfolio downside risk should decrease in a linear fashion for larger allocations. In fact, relative downside risk decreases for allocations of between 30% and 50%, depending upon the equity index considered. For larger allocations, relative downside risk increases. With the exception of the CSI 300, downside risk declines one-for-one for each Tether allocation unit for weights of up to 35%. The increasing relative downside risk beyond this point is attributed to the large one-day maximum loss associated with Tether of 14.75%, which occurred on 5th May 2015. Large daily losses such as these have not been unusual in the case of Tether, with losses of greater than 10% occurring on 5 occasions since 2014. Beyond its consideration as a safe haven, these losses highlight additional investment risks, most likely associated with credit risk concerns, for investors in Tether.

Fig. 3.

Relative portfolio risk for different Tether allocation weights (October 2014–April 2020). Relative MVaR (MCVaR) shows the increase in MVaR (MCVaR) for a portfolio with proportional allocation to Tether relative to a portfolio holding only the relevant equity index. MVaR and MCVaR are estimated using a 1% confidence level.

4.3. Moving window analysis

In this section, we examine the relative downside risk of a portfolio consisting of 10% cryptocurrency combined with a 90% allocation to the relevant equity index using a moving window of 1 year. This analysis allows us to assess whether cryptocurrencies were a hedge for equity markets during the relatively benign period up to the beginning of the COVID-19 market crisis. This may help in reconciling the previous evidence that cryptocurrencies, especially Bitcoin, have sometimes acted as a hedge for equity markets (Shahzad et al., 2019, Chan et al., 2019, Bouri et al., 2017b).

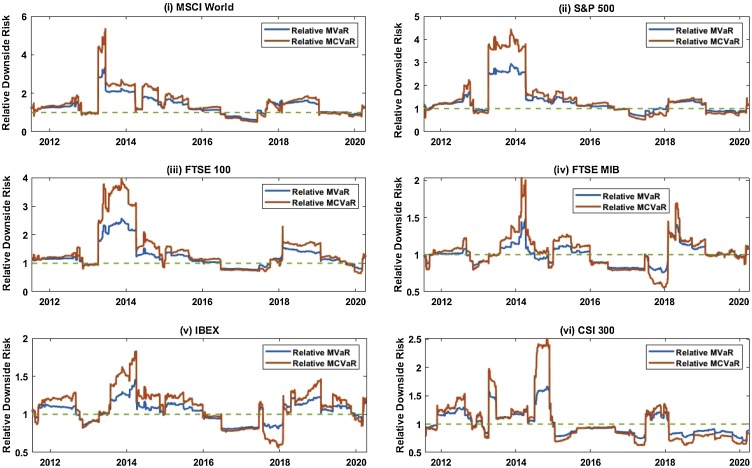

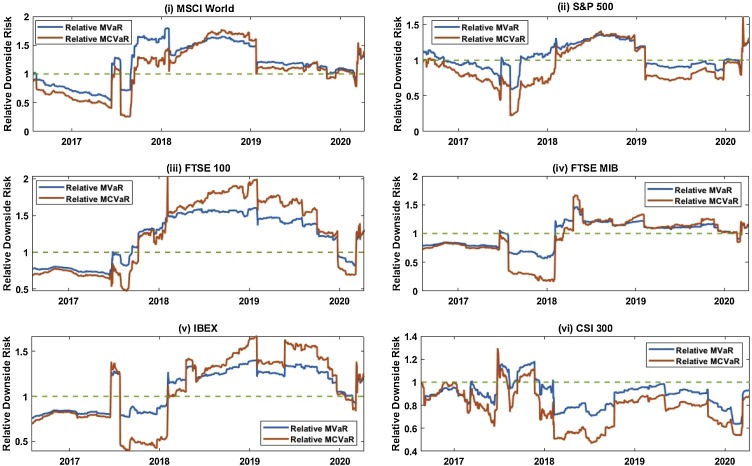

The downside risk reduction potential for Bitcoin over time is examined in Fig. 4 . Throughout the plots, a relative risk reduction below one indicates that a portfolio containing 10% cryptocurrency and 90% equity has lower downside risk than a portfolio containing a full 100% allocation to the relevant equity index. Taking the FTSE 100 as an example, only on limited occasions is portfolio downside risk, whether measured by MVaR or MCVaR, reduced by allocating to Bitcoin. Over the sample considered, MVaR is increased by an average of 24.77% by allocating 10% to Bitcoin, while MCVaR is increased by 44.4%. Only for a brief period from June 2016 through October 2017 does Bitcoin consistently reduce portfolio downside risk for the FTSE 100. With the exception of the CSI 300, similar findings are evident for the other indices examined. The CSI 300 shows some evidence of downside risk reduction since 2015, coinciding with the period from which the Bitcoin market has been suggested as being most efficient (Conlon and McGee, 2019, Urquhart, 2016).

Fig. 4.

Bitcoin downside risk moving window analysis. Relative downside risk is calculated using a one-year moving window for each international market. Relative MVaR (MCVaR) shows the increase in MVaR (MCVaR) for a portfolio holding 10% Bitcoin and 90% of the relevant equity index relative to a portfolio holding only the equity index. MVaR and MCVaR are estimated using a 1% confidence level.

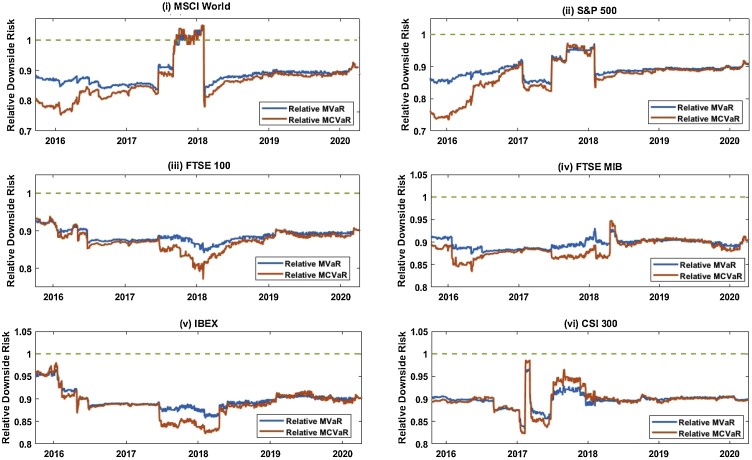

Similar findings are evident for Ethereum, Fig. 5 . Some early evidence for risk reduction is found for most markets, coinciding with a similar brief period where Bitcoin acted as a hedge for equity markets. From 2018 onward, only limited evidence that Ethereum helps in reducing portfolio downside risk is found. In keeping with earlier findings, a portfolio consisting of a 10% allocation to Ethereum and 90% to the CSI 300 has lower downside risk post 2018 than when the latter is held alone. This finding is also evident in the period incorporating the COVID-19 crisis, but a noteworthy increase in portfolio risk is evident across all equity indices during this phase. This indicates that Ethereum has limited safe haven properties and a small allocation may increase portfolio downside risk in many circumstances.

Fig. 5.

Ethereum downside risk moving window analysis. Relative downside risk is calculated using a one-year moving window for each international market. Relative MVaR (MCVaR) shows the increase in MVaR (MCVaR) for a portfolio holding 10% Ethereum and 90% of the relevant equity index relative to a portfolio holding only the equity index. MVaR and MCVaR are estimated using a 1% confidence level.

In Fig. 6 , we examine the downside risk implications for a portfolio diversified with a 10% allocation to Tether. If Tether has a consistent peg to the US dollar, a 10% allocation should result in a stable 10% reduction in downside risk at all points in time. The level of downside risk reduction is not found to be static and fluctuates around 0.90. In the case of the MSCI World index, allocating to Tether results in increased portfolio risk in the period from September 2017 to February 2018. This highlights some underlying risks for investors using Tether as a safe haven, linked to the previously described large one-day downward price moves in the cryptocurrency. Tether retained its peg to the US dollar during the COVID-19 crisis, however, with only very limited increases in downside risk observed relative to the expected reduction to 0.90. For example, a portfolio with a 10% allocation to Tether had a reduction of 0.907 (0.906) in MCVaR (MVaR) relative to one holding only the S&P 500.

Fig. 6.

Tether downside risk moving window analysis. Relative downside risk is calculated using a one-year moving window for each international market. Relative MVaR (MCVaR) shows the increase in MVaR (MCVaR) for a portfolio holding 10% Tether and 90% of the relevant equity index relative to a portfolio holding only the equity index. MVaR and MCVaR are estimated using a 1% confidence level.

5. Conclusion

While cyptocurrencies are frequently part of the discussion regarding potential safe haven investments, empirical research on their relevance before the Corona pandemic lacked a period of significant turmoil in global equity markets. This paper considers the downside risk reduction properties of three cryptocurrencies, Bitcoin, Ether and Tether, during the initial bear market period associated with the COVID-19 crisis. We examine downside risk reduction for six international equity markets, shedding new light on the safe haven properties of cryptocurrencies for international investors.

Bitcoin and Ethereum are not, in general, found to act as a safe haven for international equity markets. We provide evidence of increased downside risk for portfolios consisting of any allocation to these two assets relative to holding the underlying equity index in isolation. An exception is for the CSI 300 index, where allocations of up to 16% to Bitcoin and 14% to Ethereum may reduce downside risk. Above these thresholds, however, we observe a marked relative increase in downside risk. Tether is found to act as a safe haven over the most recent period including the COVID-19 crisis. Such downside risk hedging properties are not, however, found to be consistent over time, due to large short-term historical losses in Tether, a consequence of an unstable peg with the US dollar. It's unclear, from an asset management perspective, as to why an investor would favor investment in Tether over cash holdings in US dollars. Tether is exposed to added counter-party; technological; security and liquidity risk, in addition to further issues around the stability of maintaining the USD peg during periods of exceptional financial crisis.

Acknowledgement

This publication has emanated from research conducted with the financial support of Science Foundation Ireland under Grant Numbers 16/SPP/3347, 13/RC/2106 and 17/SP/5447.

Footnotes

Beneki et al. (2019) find that Bitcoin and Ethereum are linked through a volatility transmission channel.

Tether has additional costs relative to holding cash such as a 0.1% deposit fee and a maximum of 0.1% or $1000 withdrawal fee into fiat currency.

A bear market is often defined as one where the stock market drops by more than 20% from a recent high.

References

- Alexander C., Dakos M. A critical investigation of cryptocurrency data and analysis. Quant. Finance. 2020;20(2):173–188. [Google Scholar]

- Ang A., Chen J., Xing Y. Downside risk. Rev. Financial Stud. 2006;19(4):1191–1239. [Google Scholar]

- Aysan A.F., Demir E., Gozgor G., Lau C.K.M. Effects of the geopolitical risks on Bitcoin returns and volatility. Res. Int. Bus. Finance. 2019;47:511–518. [Google Scholar]

- Baker S.R., Bloom N., Davis S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016;131(4):1593–1636. [Google Scholar]

- Baur D.G., Lucey B.M. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Rev. 2010;45(2):217–229. [Google Scholar]

- Beneki C., Koulis A., Kyriazis N.A., Papadamou S. Investigating volatility transmission and hedging properties between Bitcoin and Ethereum. Res. Int. Bus. Finance. 2019;48:219–227. [Google Scholar]

- Bouri E., Gupta R., Tiwari A.K., Roubaud D. Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Res. Lett. 2017;23:87–95. [Google Scholar]

- Bouri E., Molnár P., Azzi G., Roubaud D., Hagfors L.I. On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier? Finance Res. Lett. 2017;20:192–198. [Google Scholar]

- Bredin D., Conlon T., Potì V. Does gold glitter in the long-run? Gold as a hedge and safe haven across time and investment horizon. Int. Rev. Financial Anal. 2015;41:320–328. [Google Scholar]

- Bredin D., Conlon T., Potì V. The price of shelter – downside risk reduction with precious metals. Int. Rev. Financial Anal. 2017;49:48–58. [Google Scholar]

- Chan W.H., Le M., Wu Y.W. Holding Bitcoin longer: the dynamic hedging abilities of Bitcoin. Q. Rev. Econ. Finance. 2019;71:107–113. [Google Scholar]

- Conlon T., Cotter J. Downside risk and the energy hedger's horizon. Energy Econ. 2013;36:371–379. [Google Scholar]

- Conlon T., McGee R.J. Betting on Bitcoin: does gambling volume on the blockchain explain Bitcoin price changes? Econ. Lett. 2019:108727. [Google Scholar]

- Conlon T., McGee R.J. 2020. Safe Haven or Risky Hazard? Bitcoin during the Covid-19 Bear Market. Bitcoin during the Covid-19 Bear Market (March 24, 2020) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Corbet S., Lucey B., Yarovaya L. Datestamping the Bitcoin and Ethereum bubbles. Finance Res. Lett. 2018;26:81–88. [Google Scholar]

- Corbet S., Lucey B., Urquhart A., Yarovaya L. Cryptocurrencies as a financial asset: a systematic analysis. Int. Rev. Financial Anal. 2019;62:182–199. [Google Scholar]

- Corbet S., Cumming D.J., Lucey B.M., Peat M., Vigne S.A. The destabilising effects of cryptocurrency cybercriminality. Econ. Lett. 2019:108741. [Google Scholar]

- Demir E., Gozgor G., Lau C.K.M., Vigne S.A. Does economic policy uncertainty predict the Bitcoin returns? An empirical investigation. Finance Res. Lett. 2018;26:145–149. [Google Scholar]

- Eross A., McGroarty F., Urquhart A., Wolfe S. The intraday dynamics of Bitcoin. Res. Int. Bus. Finance. 2019;49:71–81. [Google Scholar]

- Fang L., Bouri E., Gupta R., Roubaud D. Does global economic uncertainty matter for the volatility and hedging effectiveness of Bitcoin? Int. Rev. Financial Anal. 2019;61:29–36. [Google Scholar]

- Favre L., Galeano J.-A. Mean-modified value-at-risk optimization with hedge funds. J. Altern. Invest. 2002;5(2):21–25. [Google Scholar]

- Feng W., Wang Y., Zhang Z. Can cryptocurrencies be a safe haven: a tail risk perspective analysis. Appl. Econ. 2018;50(44):4745–4762. [Google Scholar]

- Flavin T.J., Morley C.E., Panopoulou E. Identifying safe haven assets for equity investors through an analysis of the stability of shock transmission. J. Int. Financial Mark. Inst. Money. 2014;33:137–154. [Google Scholar]

- Gandal N., Hamrick J.T., Moore T., Oberman T. Price manipulation in the Bitcoin ecosystem. J. Monet. Econ. 2018;95:86–96. [Google Scholar]

- Goodell J.W., McGee R.J., McGroarty F. Election uncertainty, economic policy uncertainty and financial market uncertainty: a prediction market analysis. J. Bank. Finance. 2020;110:105684. [Google Scholar]

- Guesmi K., Saadi S., Abid I., Ftiti Z. Portfolio diversification with virtual currency: evidence from bitcoin. Int. Rev. Financial Anal. 2019;63:431–437. [Google Scholar]

- Hwang S., Satchell S.E. How loss averse are investors in financial markets? J. Bank. Finance. 2010;34(10):2425–2438. [Google Scholar]

- Kalyvas A., Papakyriakou P., Sakkas A., Urquhart A. What drives Bitcoin's price crash risk? Econ. Lett. 2019:108777. [Google Scholar]

- Kelly B., Pástor L., Veronesi P. The price of political uncertainty: theory and evidence from the option market. J. Finance. 2016 [Google Scholar]

- Klein T., Thu H.P., Walther T. Bitcoin is not the New Gold – a comparison of volatility, correlation, and portfolio performance. Int. Rev. Financial Anal. 2018;59:105–116. [Google Scholar]

- Kliber A., Marszałek P., Musiałkowska I., Świerczyńska K. Bitcoin: safe haven, hedge or diversifier? Perception of bitcoin in the context of a country's economic situation – a stochastic volatility approach. Physica A: Stat. Mech. Appl. 2019;524:246–257. [Google Scholar]

- Mensi W., Rehman M.U., Maitra D., Al-Yahyaee K.H., Sensoy A. Does Bitcoin co-move and share risk with Sukuk and world and regional Islamic stock markets? Evidence using a time-frequency approach. Res. Int. Bus. Finance. 2020:101230. [Google Scholar]

- Olsen R.A. Investment risk: the experts’ perspective. Financial Anal. J. 1997;53(2):62–66. [Google Scholar]

- Ranaldo A., Söderlind P. Safe haven currencies. Rev. Finance. 2010;14(3):385–407. [Google Scholar]

- Shahzad S.J.H., Bouri E., Roubaud D., Kristoufek L., Lucey B. Is Bitcoin a better safe-haven investment than gold and commodities? Int. Rev. Financial Anal. 2019;63:322–330. [Google Scholar]

- Smales L.A. Bitcoin as a safe haven: is it even worth considering? Finance Res. Lett. 2019;30:385–393. [Google Scholar]

- Tversky A., Kahneman D. Loss aversion in riskless choice: a reference-dependent model. Q. J. Econ. 1991;106(4):1039–1061. [Google Scholar]

- Urquhart A. The inefficiency of Bitcoin. Econ. Lett. 2016;148:80–82. [Google Scholar]

- Urquhart A., Zhang H. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. Int. Rev. Financial Anal. 2019;63:49–57. [Google Scholar]

- Wang G.-J., Xie C., Wen D., Zhao L. When Bitcoin meets economic policy uncertainty (EPU): measuring risk spillover effect from EPU to Bitcoin. Finance Res. Lett. 2019:31. [Google Scholar]

- Wang P., Zhang W., Li X., Shen D. Is cryptocurrency a hedge or a safe haven for international indices? A comprehensive and dynamic perspective. Finance Res. Lett. 2019;31:1–18. [Google Scholar]

- Wang P., Li X., Shen D., Zhang W. How does economic policy uncertainty affect the Bitcoin market? Res. Int. Bus. Finance. 2020:101234. [Google Scholar]

- Wu S., Tong M., Yang Z., Derbali A. Does gold or Bitcoin hedge economic policy uncertainty? Finance Res. Lett. 2019;31:171–178. [Google Scholar]