Introduction

In only a few weeks since the first reported COVID-19 case in the United States, the pandemic has spread quickly across the country, and in the process plunged the economy into a severe economic crisis. While much of the government's response has focused on mitigation and containment measures such as shelter-in-place and stay-at-home directives, mounting pressure from the various parties bearing the financial fallout – including households and businesses – has prompted policymakers to also draft initial economic recovery plans. In this research, we use an open market valuation approach to assess the expected fallout in four major subsectors within the travel industry – airlines, hotels, cruise lines and rental cars - as a path to gauge how pandemic related bailout funds may be prioritized in the travel industry. The approach used here is advantageous because it is forward-looking and therefore it permits an assessment of impacts before possible irreversible damage has occurred. Moreover, the open-market method does not involve accounting measures, and is therefore more robust against possible managerial overstatement of needed governmental aid.

Of course, at the household level, some assistance has come in the form of stimulus checks, whereas for a number small business, the paycheck protection program has provided temporary but nonetheless welcome relief. But for larger corporations there have been calls for increased governmental interventions and welfare in the form of corporate bailouts reminiscent in many ways of the economic crisis of 2008 which struck the financial industry particularly severely. Despite the seemingly omnipresent financial duress, one might quite justifiably reckon that the effect of the current crisis has also been disproportionate across the various economic sectors. The atypical nature of this particular financial crisis – one resulting from a pandemic precipitated by a highly transmissible pathogen – has obliterated the demand for travel and generated much uncertainty about people's future travel behaviors (Li et al., 2020), leaving the travel and tourism sector especially vulnerable (Reddy et al., 2020). The government's role is critical to these sectors' recovery (Assaf & Scuderi, 2020; Fong et al., 2020), and as these authorities deliberate the allocation of bailout monies, an understanding of the impact of the pandemic on the specific subsectors that constitute the travel sector might provide some guidance on how bailout funds might be distributed within this sector.

Our goal is not to debate the merits of such interventions from the point of view of economic efficiency – we recognize that the issue of whether corporate bailouts are warranted can be highly contentious, and has extensively been debated in the academic scholarship. We are instead concerned simply with investigating the extent to which the airline, hotel, cruise line and rental car industries, despite collectively comprising the general travel sector, might be disparately impacted by the pandemic, such that available bailout funds might be prioritized accordingly. While some economic aid might already have been distributed to companies in distress at the time the present study becomes publicly available, we anticipate that the enormity of crisis might necessitate additional assistance in the weeks and months coming in order to keep certain segments of the industry from collapse.

Data and methodology

In order to assess how governmental aid might be prioritized across the travel sector, we adapt Karafiath's (1988) securities market-based approach to model the impact of COVID-19 on the hotel, airline, cruise and rental car industries. This is because we recognize that the shock is not an isolated event, but rather better modeled as having an evolving nature. Accordingly, we assume the dynamic severity of this time-distributed shock to be reflected in the daily infections and fatality count data, which we obtained from the Johns Hopkins University's Coronavirus Resource Center website.1 The effects of this shock on the other hand - both current as well as discounted future effects - like in traditional studies of this kind are implicitly captured in market valuation of industries. Dow Jones industry specific indexes are obtained from Market Watch2 for the hotel and airline industries and assumed to be representative of the two industries, respectively. Due to non-availability of car rental and cruise industry specific indexes, we construct representational indexes by averaging daily stock returns for the major publicly traded companies in each of these industries. The general Dow Jones Industrial Average is the market index of choice in the analysis. Because daily infection and fatality data is typically reported after the close of markets, effects lagged by one day are investigated. We use daily returns series of 20 months (from September 2018 to April 2020). Karafiath's (1988) market-based approach implies the estimation of the market model, which is defined, for number of infections (NI t) and number of fatalities (NF t), as follows:

where R it is the returns on the Dow Jones industry specific index i (i = hotel, airlines, cruise lines and car rental) on day t obtained as ln(Pricet/Pricet-1), RM t is the rate of returns on the market portfolio (the general Dow Jones index) on day t, TII t is a travel industrial index which controls for the evolution of the travel industry in general, in line with Ross (1976). The parameters α i and β i are the constant and the systematic risk, γ i is the effect of the travel industrial index; ξ i and η i represent the effects of number of infections and fatalities, respectively on the industrial index, and ε it is the error term.

The approach used here has at least two advantages. First, because it stems from the postulations of neoclassical finance theory which suggests that asset prices reflect all factors affecting a firm, one could conclude that true financial fallout of an industry is more accurately estimated, and thus the true need for supplemental funding better understood. One expects, for instance, that industry executives are likely to overstate true need when requesting government bailouts. Our approach, in comparison, does not rely on stated need. A second advantage of our approach is that we use forward-looking measures unlike other measures such as reductions in guest reservations, which are backward looking. Consequently, our approach allows us to anticipate the expected fallout resulting from the crisis soon after the shock, rather than at the end of the accounting period. This in turn helps assess possible bailout requirements at the time when funds are most needed, rather than after much of the damage has already been done.

Results

We estimate the market model through different autoregressive conditional heteroskedasticity models and find that the best fitting model—according to the Akaike Information Criterion—is the threshold autoregressive conditional heteroskedasticity model. While stationarity in the return series is not rejected by the Dickey-Fuller and Phillips-Perron tests, regarding parameter stability, the fact that the World Health Organization officially declared COVID-19 a pandemic on March 11th may be relevant to this analysis. Thus, it is appropriate to check whether a structural change occurred on this date. According to the Chow breakdown tests, for the four industries analyzed we cannot reject a structural change in the values of parameters after the day the pandemic was officially declared.

Derived from this tested structural change in the parameter estimates, we include separate pre- and post-pandemic declaration parameters for infections and fatalities, post-pandemic parameters for the market portfolio and non-separate pre- and post-pandemic declaration parameters for the travel industrial index. Preliminary analyses show that the magnitude of the event is such that the market portfolio captures everything by itself and no abnormal returns for any specific industry are observed; however, if the COVID-19 related variables are analyzed alone in the pre-pandemic declaration period, interestingly both variables, infections and fatalities, are significant and negative in the industries examined (these results are available from the authors upon request). These contradictory results suggest that the structural change detected by the Chow test exists and the model should accommodate those changes.

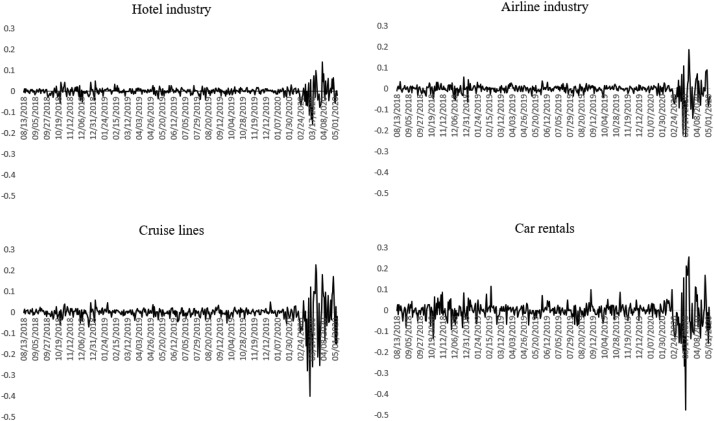

As indicated, the models in Table 1 break down the parameter estimates of the COVID-19 related variables, distinguishing pre- and post-pandemic declaration parameters. All the pre-pandemic parameters related to COVID-19 variables are significant and negative; however, no post-pandemic parameters related to COVID-19 variables are significant, implying that the market portfolio takes all the trends and “engulfs” the impact of infections and fatalities. Also, regarding the travel industrial index, the only industry that shows a parameter greater than one (γ = 1.2806) is cruise lines (χ2 = 8.390; prob<0.01)—see bottom panel in Table 1—and this same industry is the only one with a beta parameter (β = 1.1324) that is not significantly different from one (χ2 = 0.098; prob<0.7541) (the other three industries have betas significantly lower than one)—see top panel in Table 1. These results mean that the firms in this cruise industry have more volatility than the market and the travel industry they belong to. When the parameters of pre-pandemic infections and fatalities are compared across industries, we see that the effect of infections and fatalities on the cruise lines are the greatest, which are significantly higher than the rest (χ2 = 30.22; prob<0.01 and χ2 = 1109.8; prob<0.01, respectively). Fig. 1 shows that while car rentals present a drastic one-time drop, cruise lines hold low negative return longer than the other industries.

Table 1.

Pre- and post-pandemic declaration effects.

| Hotel |

Airlines |

Cruise lines |

Car rental |

|||||

|---|---|---|---|---|---|---|---|---|

| Parameter | SD | Parameter | SD | Parameter | SD | Parameter | SD | |

| Constant | 0.0002 | 0.0006 | −0.0003 | 0.0007 | −0.0007 | 0.0008 | −0.0005 | 0.0014 |

| Pre-pandemic infections | −0.0025b | 0.0011 | −0.0063a | 0.0011 | −0.0125a | 0.0035 | −0.0070b | 0.0031 |

| Post-pandemic infections | 0.0002 | 0.0004 | −0.0012 | 0.0007 | −0.0002 | 0.0013 | −0.0013 | 0.0010 |

| Post-pandemic market portfolio | 0.2449a | 0.0617 | 0.6056a | 0.1503 | 1.1324a | 0.4226 | 0.3861a | 0.1395 |

| Travel industrial index | 0.4842a | 0.0254 | 0.4947a | 0.0234 | 0.5217a | 0.0285 | 0.9256a | 0.0754 |

| R-squared | 0.5178 | 0.4820 | 0.4428 | 0.3611 | ||||

| Chow breakdown test | 18.56a | 27.24a | 69.78a | 18.54a | ||||

| Constant | 0.0001 | 0.0021 | −0.0003 | 0.0007 | −0.0011 | 0.0048 | −0.0006 | 0.0014 |

| Pre-pandemic fatalities | −0.0164b | 0.0078 | −0.0422a | 0.0045 | −0.0641a | 0.0107 | −0.0366b | 0.0163 |

| Post-pandemic fatalities | −0.0002 | 0.0008 | −0.0016 | 0.0009 | −0.0001 | 0.0015 | −0.0017 | 0.0014 |

| Post-pandemic market portfolio | 0.2665b | 0.1171 | 0.6121a | 0.1285 | 0.1569 | 0.2494 | 0.3843a | 0.1331 |

| Travel industrial index | 0.6490a | 0.0519 | 0.4862a | 0.0238 | 1.2806a | 0.0969 | 0.9183a | 0.0762 |

| R-squared | 0.5630 | 0.4964 | 0.5576 | 0.3603 | ||||

| Chow breakdown test | 18.16a | 26.74a | 58.61a | 16.43a | ||||

prob<1%.

prob<5%.

Fig. 1.

Evolution of the four industries' returns.

Our results suggest that as a consequence of the pandemic, each of the four industries—hotels, airlines, cruise lines and car rentals—have experienced a substantial fall in valuation. The drop is significant enough in each industry to warrant concerns about the long-term outlook for each of the industries. What is apparent, is nonetheless, that the most serious concerns pertain to the cruise industry. This is perhaps not surprising. One reason for this is possibly because the business-leisure traveler ratio is likely lower for the cruise industry than it is for other industries we investigated. One certainly presumes that business travel might recover quicker than leisure travel, and might indeed deduce this from our findings. Moreover, concerns about the cruise industry might also pertain to the nature of its product – vessels that are essentially confined public spaces of the type people might have apprehensions about during the current crisis. Indeed, the highly publicized outbreaks aboard the Diamond Princess and other cruise ships confirm concerns people may have about the cruise industry. Accordingly, we believe that government assistance available for the travel sector be prioritized for the cruise industry.

It is important to note that our findings do not suggest that the most funds be allocated toward the cruise industry. The level of funding would depend of course on other factors such as the size of the industry. We do, however, believe that cruise industry might be the most severely impacted by the crisis, and perhaps ought to be prioritized in the allocation of financial assistance. We nonetheless recognize that there are other considerations that might go into the allocation of bailout funds, and that the availability of governmental assistance to non-travel related activities is also necessary in order to restore a certain level of normalcy to the economy. Also, our analysis in this paper has focused on comparison between travel sector industries. As a future line of research, it would be useful to make inter-company comparisons using variables such as company size to understand effects of the pandemic more closely.

Declaration of competing interest

None.

Associate editor: Yang Yang

Footnotes

References

- Assaf A., Scuderi R. COVID-19 and the recovery of the tourism industry. Tourism Economics. 2020 doi: 10.1177/1354816620933712. [DOI] [Google Scholar]

- Fong L.H.N., Law R., Ye B.H. Outlook of tourism recovery amid an epidemic: Importance of outbreak control by the government. Annals of Tourism Research. 2020 doi: 10.1016/j.annals.2020.102951. (In press, corrected proof Available online 25 May 2020 Article 102951) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Karafiath I. Using dummy variables in the event methodology. The Financial Review. 1988;23(3):351–357. [Google Scholar]

- Li J., Nguyen T.H.H., Coca-Stefaniak J.A. Coronavirus impacts on post-pandemic planned travel behaviours. Annals of Tourism Research. 2020 doi: 10.1016/j.annals.2020.102964. (In press, corrected proof Available online 28 May 2020 Article 102964) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Reddy M.V., Boyd S.W., Nica M. Towards a post-conflict tourism recovery framework. Annals of Tourism Research. 2020;84 doi: 10.1016/j.annals.2020.102940. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ross S.A. The arbitrage theory of capital asset pricing. Journal of Economic Theory. 1976;13(3):341–360. [Google Scholar]