Abstract

The coronavirus pandemic has had a devastating impact on the demand for air transport. One passenger segment that has received relatively little attention is ageing passengers (defined as aged 65+), in spite of the fact that this group has been disproportionately affected by COVID-19, and in recent years has been viewed as a potential growth market. Therefore, the aim of this brief paper is to analyse the attitudes of ageing passengers by assessing air travel plans in the next 12 months, examining the factors influencing future flying decisions, and investigating the impact of the coronavirus pandemic on perceived risks and experiences associated with flying. The findings show that over 60% of ageing passengers are planning to travel by air in the next 12 months, although the nature of their trips may change. Factors such as flexible ticket booking and quarantine rules do not appear to be key drivers affecting travel decisions and within the different stages of the air journey, getting to/from the airport is perceived as the safest stage. The findings suggest that there are various COVID-19 implications for airlines and airports serving this market segment, ranging from the use of self-service technology, the generation of commercial/ancillary revenues and the design of surface access policies.

Keywords: Air travel, Coronavirus, COVID-19, Ageing passengers, 65+age group

Highlights

-

•

Attitudes of ageing passengers (65+ age) since the coronavirus pandemic are assessed.

-

•

An online survey of ageing passengers resident in the United Kingdom is undertaken.

-

•

Over 60% plan to travel next year but the nature of their trips may change.

-

•

Factors influencing future flying decisions and perceived risks are considered.

-

•

There are various implications for airlines and airports serving this market segment.

1. Introduction

The coronavirus pandemic has had a devastating impact on the global air transport industry (International Civil Aviation Organisation (ICAO), 2020; International Air Transport Association (IATA), 2020a; Airports Council International (ACI), 2020). Travel bans and restrictions (such as border closures and visa refusals) as well as quarantine rules and lockdowns, meant that the supply of air services was severely constrained from the early months of 2020 onwards. At the same time, demand virtually collapsed due to a combination of economic factors (e.g. business closure/uncertainty, loss of jobs, declining income) and behavioural factors (e.g. health concerns, fear of flying/travelling, unease with new travelling rules/restrictions). As a result, IATA (2020b) forecasts that air transport will not recover to 2019 levels until 2023 whilst Gudmundsson et al. (2020) have identified mid-2022 as being the most optimistic date for full recovery, with 2026 being the most pessimistic estimate.

In order for passengers to travel they need to perceive it as being safe, have the confidence to travel and there needs to be favourable economic conditions. Even though the pandemic is a very recent development, a number of academic papers have already been published assessing the impact on air travel and tourism demand (e.g. Gallego and Font, 2020; Iacus et al., 2020; Gössling et al., 2020; Gudmundsson et al., 2020; Suau-Sanchez et al., 2020). Moreover, behavioural factors, in particular, have received considerable attention in the travel and tourism industry, which is awash with consumer surveys. For example, globally, IATA, has been undertaking an online survey of passengers of 11 different countries in every two months (IATA, 2020c) and Skyscanner (2020) has been reporting on a weekly travel insights survey. Within individual countries, a number of other travel and tourism surveys have been undertaken. For example, in the UK which is the focus of this research, BVA BDRC (2020) has been producing a weekly consumer tracker report in this area.

However, within this growing set of air transport and coronavirus research, it is very rare to find any specific mention of ageing passengers - defined here as the 65+ age group - and their behavioural influences. This age group is particularly important since it is the most vulnerable as regards to being affected by COVID-19. Indeed, of the deaths registered in the UK involving COVID-19 between March and May, 15% were amongst the 65–74 age range, 32% (75–84 ages) and 42% (85+ ages) (Office for National Statistics (ONS), 2020a).

Before the coronavirus outbreak, improvements in standards of living, nutrition and medical treatment were extending life expectancy, particularly in the developed world, and enabling a growing number of people to enjoy longer and healthier lives. As a result, the ageing passenger market was a growth segment in air travel with considerable potential. In the UK it accounted for 11% of the trips taken abroad by UK residents in 2019, compared with 9% in 2009, and just 7% in 2000 (ONS, 2020b, 2010; 2001). The latest available trip participation data for 2014 showed that 40% of UK residents aged 65–74 took at least one air trip. Moreover, tourists aged 65 or over accounted for nearly one in four tourism nights for private purposes by EU residents in 2018 (Eurostat, 2019). The growing potential of the market was increasingly recognised by the academic literature, albeit limited in volume (e.g. Alén et al., 2016; Burghouwt et al., 2006, Major and McLeay, 2013; Nielsen, 2014; Tretheway and Mak, 2006). The research has acknowledged some of the key challenges faced by the air travel and tourism industry in serving this segment, especially as a higher proportion of such passengers are disabled or have underlying health problems compared with other age groups (Chang and Chen, 2012; Chang, 2013; Graham et al., 2019; Kim et al., 2017).

Hence the paucity of air travel research examining the ageing market and coronavirus pandemic provides the motivation for this paper, as this age group has been disproportionally affected by COVID-19, and in recent years has been viewed as a potential growth market. Therefore, the aim of the research is to analyse the attitudes of ageing passengers to air travel since the coronavirus pandemic. This has been achieved through undertaking an online consumer survey to achieve the following objectives:

-

1.

To assess air travel plans in the next 12 months

-

2.

To examine the factors influencing future flying decisions

-

3.

To investigate the impact of the coronavirus pandemic on perceived risks and experiences associated with flying

The UK has been chosen as a representative market as the ageing demographics of the UK population are akin to that of other developed and mature aviation markets. Additionally, it has experienced some of the worst effects of COVID-19 amongst all European countries and so illustrates one of the most extreme cases. The next section in this brief paper summaries the methodology that has been used. This is followed by a presentation of the findings, before conclusions are drawn in the final section.

2. Methodology

The research is based on an online survey of UK residents aged 65+. The overall aim of this survey was to gather insight into the experiences and attitudes of the 65+ age group to air travel. The impact of the coronavirus pandemic which is the focus of this paper, was just one issue that was investigated in the survey, and so it is only the responses to these specific questions that are discussed here.

The survey was distributed on behalf of the Westminster research team by Kantar1 which targeted UK residents that were 65 and over and had made at least one air trip in 2019. These conditions were met through various filters and screening questions and a final sample of 600 questionnaires were completed. This provided a sufficient overview of the population whilst accommodating a limited research budget.

The survey began on 10 June 2020 and was closed on 15 June 2020 when there were 600 completed questionnaires. The survey was not undertaken during total lockdown as it was felt that this extreme situation would bias results. However, during the first two weeks of June there were movements towards a relaxation of some lockdown measures (e.g. ‘support bubbles’ for different households, the opening of all non-essential shops although not bars, restaurants, hairdressers), but also importantly with regards to air travel, rules requiring travellers arriving into the UK to quarantine for 14 days came into force on 8 June. Therefore, this time period was considered appropriate to gather a first snapshot of the views of ageing passengers in the complex environment that existed.

The survey contained 21 questions (17 closed and four open excluding the screening questions) - with seven questions specifically related to the coronavirus pandemic - and was conducted using the Qualtrics survey platform. The draft questionnaire was piloted with two aviation academic colleagues at the University of the authors and four aviation academics from other universities (see acknowledgements) with a number of minor changes being made. It was also piloted by Kantar with five of their respondents before the general launch on 10 June.

Table 1 shows the characteristics of the respondents. It may be seen that nearly 80% of all respondents were aged between 65 and 75, with a slightly higher proportion being under 70. Their gender was evenly balanced and about two thirds made one or two air trips last year. A small number declared that they had a disability or health condition when they last flew in 2019.

Table 1.

Characteristics of survey respondents (n = 600).

| Age | % Share | Gender | % Share | Air trips(*) in 2019 | % Share | Disability or health condition during last 2019 air trip (+) | % Share |

|---|---|---|---|---|---|---|---|

| 65–69 | 44.7 | Male | 50.7 | 1 | 35.8 | Yes | 13.2 |

| 70–74 | 34.0 | Female | 49.3 | 2 | 32.0 | No | 86.8 |

| 75–79 | 16.3 | 3 | 18.3 | ||||

| 80–84 | 4.3 | 4 | 8.0 | ||||

| 85+ | 0.7 | 5+ | 5.8 | ||||

| Total | 100 | Total | 100 | Total | 100 | Total | 100 |

The numbers may not add to 100% due to rounding.

(*) Outbound and return flights and any transfers counted as one trip.

(+) The question asked was ‘Do you have a disability or health condition that made flying, getting to/from and using the airport difficult in your last trip in 2019? This could be a physical disability or health condition (e.g. affecting your movement, balance, vision or hearing) or non-physical disability or health condition (e.g. affecting thinking, remembering, learning, communications, mental health).

3. Findings

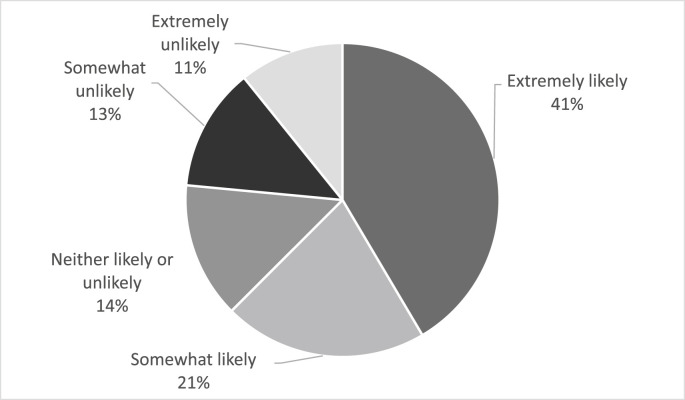

The survey results indicate that over 60% of respondents are likely to travel within the next 12 months (Fig. 1 ). Thus, it is a false assumption, as this group is more vulnerable to COVID-19, that they will overwhelmingly not want to travel by air in the near future. However, despite the likelihood of future travel, nearly 60% of respondents indicated that they planned fewer trips in the upcoming 12 months (Table 2 ). In addition, nearly 30% stated that they were planning more domestic trips in lieu of international trips, thus adjusting the tourism market in favour of more local destinations. All these factors could, as expected, reflect caution or nervousness within this age group in their future trip planning. In addition, about one in five were more likely to choose other modes of travel for their trips instead of air travel. Overall, given the severe impact that the virus has had in the UK and elsewhere in all areas of life, it is surprising that only around two-thirds of the respondents definitely claimed that it would influence their future travel decisions.

Fig. 1.

Likelihood to travel by air in the next 12 months.

Table 2.

Future travel behaviour.

| 1 Strongly agree | 2 Somewhat agree | 3 Neither agree nor disagree | 4 Somwewhat disagree | 5 Strongly disagree | |

|---|---|---|---|---|---|

| I will make fewer air trips than before the coronavirus pandemic. | 30.1% | 27.9% | 30.9% | 7.5% | 3.8% |

| I will make more domestic trips and less international trips than before. | 9.5% | 19.7% | 38.7% | 19.0% | 13.2% |

| I will make more trips than before by other modes of transport compared to air to similar destinations. | 5.8% | 16.3% | 38.7% | 24.0% | 15.2% |

| I will make more international short -haul/European air trips and less international/long-haul air trips than before. | 6.7% | 12.3% | 39.7% | 23.0% | 18.3% |

| The coronavirus pandemic will not influence my trip decisions. | 6.8% | 11.2% | 18.5% | 27.3% | 36.2% |

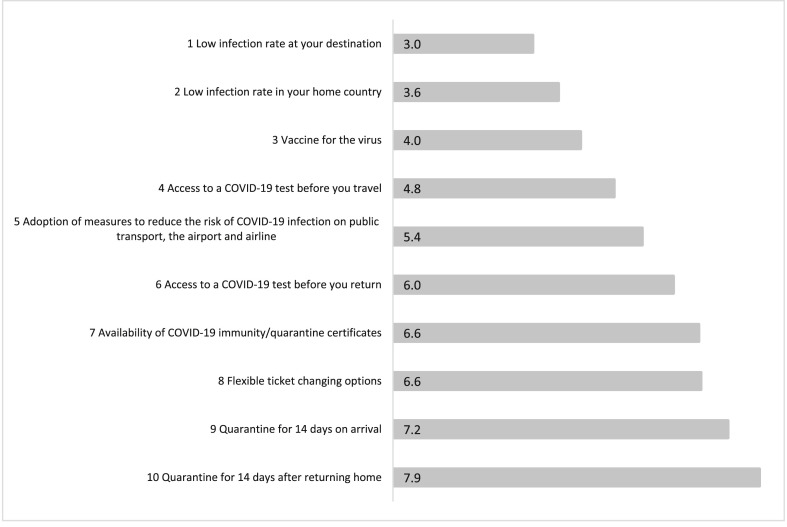

The decision to travel is based on a number of factors with the most important being related to low infection rates, both at home and abroad; availability of a vaccine was ranked as being the third most important factor (Fig. 2 ). The least important factors were those related to quarantines, both upon arrival (at the destination) and upon returning home. This is a somewhat surprising finding because of the disruption that quarantine can cause to lives, but given the age of the respondents, they are less likely to be in employment, and would perhaps be less inconvenienced by a quarantine than those individuals who are working. Interestingly having flexible ticket changing options does not seem to be a key factor.

Fig. 2.

Factors influencing future travel behaviour: mean score of rankings

Note: Respondents were asked to rank the factors 1–10 with 1 being the most important, so the lower the mean score of responses the more important the factor.

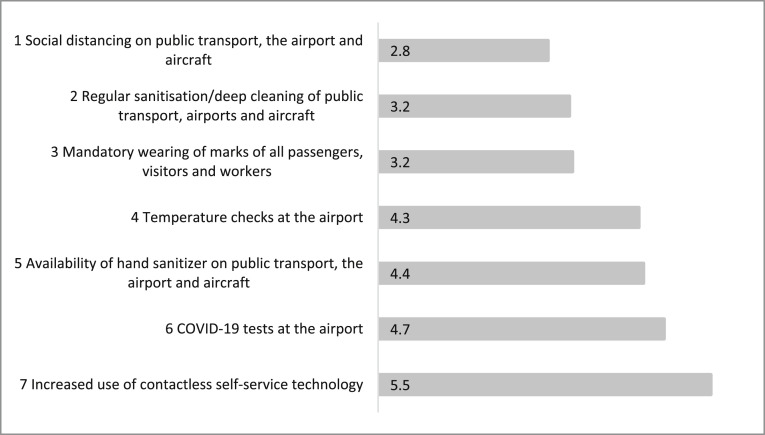

As air travel resumes, there are elements which could be incorporated into flight provisions to enhance the safety aspects of the trip. The respondents ranked social distancing, regular sanitisation and the mandatory use of masks as the most important elements contributing to their perception of a safe trip (Fig. 3 ). Although increased use of technology would reduce the need to interact with others, this was considered to be the least important factor. This perhaps links with the common perception that many older people are less comfortable with technology.

Fig. 3.

Factors contributing towards the perception of a safe passenger journey: mean score of rankings

Note: Respondents were asked to rank the factors 1–7 with 1 being the most important, so the lower the mean score of responses the more important the factor.

The results from Fig. 3 are supported by the perception of risk of contracting COVID-19 during the various stages of their journey. As seen in Table 3 , more than half of all respondents were either very concerned or extremely concerned with contracting the virus onboard the aircraft. This was followed by the perceived risk in the arrival terminal (combined 36%) and in the departure terminal (combined 30%). Respondents were least concerned during their trip to the airport, although it should be noted that more than half of all respondents travelled to the airport, during the last trip in 2019, in either their own vehicle or were given a ride by a family member or friend and another 27% travelled in either a taxi, mini-cab or uber.

Table 3.

Risk perception of contracting COVID-19 during different journey stages.

| 1 Extremely concerned | 2 Very concerned | 3 Somewhat concerned | 4 A little concerned | 5 Not at all concerned | |

|---|---|---|---|---|---|

| Getting to the airport | 5.4% | 4.5% | 15.1% | 21.8% | 53.2% |

| In the departure terminal | 12.2% | 17.4% | 28.3% | 35.7% | 6.4% |

| Onboard the aircraft | 29.3% | 20.7% | 27.0% | 18.2% | 4.8% |

| In the arrival terminal | 14.3% | 21.7% | 28.0% | 28.5% | 7.5% |

| Getting from the airport | 7.8% | 11.4% | 24.9% | 32.6% | 23.4% |

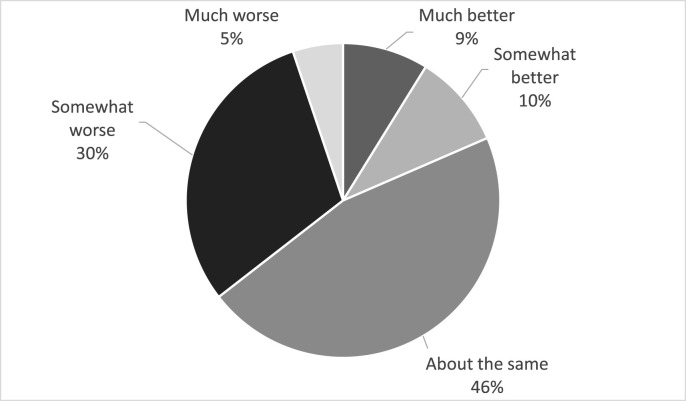

In terms of the passenger journey experience, a consequence of the virus is that the provision and availability of facilities such as airport shops/bars/cafes and onboard catering may be restricted. The survey asked if this would affect the journey experience (Fig. 4 ). Nearly half said that it would not, and whilst a third stated that it would have a negative impact, a relatively high number (19%) said it would have a positive impact.

Fig. 4.

Impact on journey experience with restricted provision/availability of airport shops/bars/cafes and onboard catering.

Finally, the analysis of the survey also sought to establish whether there were any important differences observed according to the survey respondents as detailed in Table 1. Mann-Whitney U tests (for gender, disability) and Kruskal Wallis H tests (for age, travel frequency) were run on with the variables discussed in the tables/figures above, but no statistically significant relationships were found.

4. Discussion and conclusions

The results of the survey have some important implications for the air transport industry as it struggles to recover from the devastating impacts of the coronavirus pandemic. On a positive note, a reasonably high percentage of ageing passengers are still planning to travel by air in the next year. Their travel patterns may change though, with less travel than before, more domestic travel and more travel with different modes of transport. This may mean that, for the short term at least, this market segment - previously considered as a potential growth market – may not be viewed in such a favourable light and indeed may need more encouragement from the industry than other segments to return to previous levels of travel.

Surprisingly, flexible ticket booking does not seem to be a key priority for such passengers and so further research is needed to investigate what measures, if any, might encourage this age group to travel, and whether such measures are different than those required for other age groups. Another somewhat surprising result is the relatively low share of passengers who feel that a more limited retail and catering offer would negatively affect their experience. Given that in normal times these revenues are important sources of income for the industry, this may be another area where more attention should be given specifically to the ageing market to ensure that their particular needs are satisfied, whilst at the same time maintaining commercial/ancillary revenue levels.

The relative unimportance of contactless self-service as a means to feel safe during the passenger journey is interesting in that it could tentatively confirm common perceptions that the ageing market is generally less comfortable with self-service technology. Whilst in itself this is not very surprising, it does act as a reminder to the industry, in that attempting to ensure a safer environment by using technology, it needs to be aware that the attitudes towards such technology may differ for ageing passengers compared with other passenger segments.

The lack of significant differences according to age, gender, frequency of travel and disability could suggest that ageing passenger segment is a fairly homogeneous group, although previous research indicates that this is unlikely to be the case. It is more likely that the simple characteristic variables used in this survey are unable to explain the diversity of the market, and that more complex ones, particularly related to lifestyle and more complicated socio-economic and demographic factors, are needed. This could potentially provide some insight into how the industry should target different groups of ageing passengers in the post-coronavirus era. Moreover, disability is not found to be a significant factor but the sample size here is small. Of course, while many older passengers may be disabled due to the consequences of ageing, there are also many disabled passengers that are of a younger age who are particularly vulnerable to COVID-19. Clearly, more research in this area is needed.

Finally, in terms of the different stages of the passenger journey, it is interesting that the journey to and from the airport is perceived as less of a risk for contracting COVID-19 than actually within the terminal or onboard. This seems somewhat surprising given that travelling by public transport is generally perceived as a risky undertaking. However, it can perhaps be explained by the fact that this age group tends to disproportionately use private transport to travel to and from the airport, compared to other passenger segments. The coronavirus pandemic might merely reinforce these ageing passenger preferences for private transport, and thus increase the challenge that many airport operators face in trying to shift passengers flows from private to public surface transport in order to become more sustainable.

Inevitably this research has limitations. It uses a relatively small sample for just one country, does not cover other age groups for comparisons, and only provides a snapshot in time of attitudes. The impacts of the coronavirus are changing very rapidly, so another survey later in the year might show whether attitudes are remaining consistent or changing. Moreover, in being part of a larger general survey into the attitudes of ageing passengers, there was only limited scope, within an acceptable completion time for respondents, to include specific questions about the virus. However, as this research is ongoing, more survey work is planned, together with detailed in-depth interviews in order to delve deeper into some of the key issues discussed in this paper.

Acknowledgements

We would like to thank Debbie Ancell and Andrew Cook from the University of Westminster, Lucy Budd and Steve Ison from De Montfort University, Romano Pagliari from Cranfield University and Nigel Halpern from Kristiania University College Oslo for their help with the survey preparation.

Footnotes

Kantar is a large market research company (28,000 employees working in 90 world markets) (Kantar, 2020). The ‘research-ready permission-based’ respondents used by Kantar are recruited through a variety of recruiting sources and minimises any inherent biases that may occur with more limited sources, with the company also undertaking various quality checks.

References

- ACI Economic impact assessment of COVID-19 on the airport business. 2020. https://aci.aero/wp-content/uploads/2020/05/200505-Third-Economic-Impact-Bulletin-FINAL.pdf Available at. accessed 10 May.

- Alén E., Losada N., Domínguez T. The impact of ageing on the tourism industry: an approach to the senior tourist profile. Soc. Indicat. Res. 2016;127(1):303–322. [Google Scholar]

- Burghouwt G., de Wit J., van der Bruggen J. The impact of ageing on aviation. 2006. www.airneth.nl/uploads/media/Airneth_Report_3.pdf Airneth report No. 3. Available at: accessed 20 May.

- BVA BDRC Tracking consumer sentiment on the impact of COVID-19, travel mobility, leisure and hospitality. 2020. Available at: https://www.bva-bdrc.com/products/tracking-consumer-sentiment-on-the-impact-of-covid-19/ accessed 20 May.

- Chang Y.C., Chen C.-F. Service needs of elderly air passengers. J. Air Transport. Manag. 2012;18:26–29. [Google Scholar]

- Chang Y.C. Factors affecting airport access mode choice for elderly air passengers. Transport. Res. E Logist. Transport. Rev. 2013;57:105–112. [Google Scholar]

- Eurostat Tourism trends and ageing. 2019. https://ec.europa.eu/eurostat/statistics-explained/index.php/Tourism_trends_and_ageing Available at. accessed 20 May.

- Gallego I., Font X. Changes in air passenger demand as a result of the COVID-19 crisis: using Big Data to inform tourism policy. J. Sustain. Tourism. 2020:1–20. [Google Scholar]

- Gössling S., Scott D., Hall C.M. Pandemics, tourism and global change: a rapid assessment of COVID-19. J. Sustain. Tourism. 2020:1–20. [Google Scholar]

- Graham A., Budd L., Ison S., Timmis A. Airports and ageing passengers: a study of the UK. Res. Trans. Bus. Manag. 2019;30:100380. [Google Scholar]

- Gudmundsson S.V., Cattaneo M., Redondi R. 2020. Forecasting Recovery Time in Air Transport Markets in the Presence of Large Economic Shocks: COVID-19. Available at: SSRN 3623040. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Iacus S.M., Natale F., Santamaria C., Spyratos S., Vespe M. Safety Science; 2020. Estimating and Projecting Air Passenger Traffic during the COVID-19 Coronavirus Outbreak and its Socio-Economic Impact. 104791. [DOI] [PMC free article] [PubMed] [Google Scholar]

- IATA COVID-19 update impact assessment. 2020. https://www.iata.org/en/iata-repository/publications/economic-reports/covid-fourth-impact-assessment/ Available at. accessed 15 May.

- IATA Outlook for air travel in the next 5 years. 2020. https://www.iata.org/en/iata-repository/publications/economic-reports/covid-19-outlook-for-air-travel-in-the-next-5-years/ Available at. accessed 15 May.

- IATA IATA COVID-19 passenger survey. 2020. https://www.iata.org/en/publications/store/covid-passenger-survey/ Available at. accessed 22 May.

- ICAO Effects of novel coronavirus (COVID-19) on Civil aviation: economic impact analysis. 2020. https://www.icao.int/sustainability/Documents/COVID-19/ICAO_Coronavirus_Econ_Impact.pdf Available at. assessed 22 May 2020.

- Kantar About kantar. 2020. https://www.kantar.com/about Available at. accessed 15 May 2020.

- Kim T.H., Wu C.L., Koo T.R. Implications of the ageing society and internationalisation for airport services: a perspective on passenger demand for personal space at airport terminals. J. Air Transport. Manag. 2017;60:84–92. [Google Scholar]

- Major B., McLeay F. Alive and kicking: evaluating the overseas package holiday experience of grey consumers in the United Kingdom. J. Vacat. Mark. 2013;19(1):5–18. [Google Scholar]

- Nielsen K. Approaches to seniors' tourist behaviour. Tourism Rev. 2014;69(2):111–121. [Google Scholar]

- ONS Weekly provisional figures on deaths registered in the UK. 2020. https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/deaths/datasets/weeklyprovisionalfiguresondeathsregisteredinenglandandwales Available at. (accessed 30 May)

- ONS . ONS; London: 2001. Travel Trends: 2000. [Google Scholar]

- ONS . ONS; London: 2010. Travel Trends: 2009. [Google Scholar]

- ONS . ONS; London: 2020. Travel Trends: 2019. [Google Scholar]

- Skyscanner Weekly travel insights. 2020. https://www.partners.skyscanner.net/news-case-studies/latest-covid-insights accessed 25 May 2020.

- Suau-Sanchez P., Voltes-Dorta A., Cugueró-Escofet N. An early assessment of the impact of COVID-19 on air transport: just another crisis or the end of aviation as we know it? J. Transport Geogr. 2020:102749. doi: 10.1016/j.jtrangeo.2020.102749. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Tretheway M., Mak D. Emerging tourism markets: ageing and developing economies. J. Air Transport. Manag. 2006;12:21–27. [Google Scholar]