Abstract

The COVID-19 pandemic has seriously affected world economies. In this regard, it is expected that information level and sharing between equity, digital currency, and energy markets has been altered due to the pandemic outbreak. Specifically, the resulting twisted risk among markets is presumed to rise during the abnormal state of world economy. The purpose of the current study is twofold. First, by using Renyi entropy, we analyze the multiscale entropy function in the return time series of Bitcoin, S&P500, WTI, Brent, Gas, Gold, Silver, and investor fear index represented by VIX. Second, by estimating mutual information, we analyze the information sharing between these markets. The analyses are conducted before and during the COVID-19 pandemic. The empirical results from Renyi entropy indicate that for all market indices, randomness and disorder are more concentrated in less probable events. The empirical results from mutual information showed that the information sharing network between markets has changed during the COVID-19 pandemic. From a managerial perspective, we conclude that during the pandemic (i) portfolios composed of Bitcoin and Silver, Bitcoin and WTI, Bitcoin and Gold, Bitcoin and Brent, or Bitcoin and S&P500 could be risky, (ii) diversification opportunities exist by investing in portfolios composed of Gas and Silver, Gold and Silver, Gold and Gas, Brent and Silver, Brent and Gold, or Bitcoin and Gas, and that (iii) the VIX exhibited the lowest level of information disorder at all scales before and during the pandemic. Thus, it seems that the pandemic has not influenced the expectations of investors. Our results provide an insight of the response of stocks, cryptocurrencies, energy, precious metal markets, to expectations of investors in the aftermath of the COVID-19 pandemic in terms of information ordering and sharing.

Keywords: COVID-19 Pandemic, Bitcoin, S&P500, WTI, Brent, Gas, Gold, Silver, VIX, Renyi entropy, Mutual information

1. Introduction

There is no doubt that the COVID-19 pandemic has significantly and negatively affected economies worldwide. In this regard, while the pandemic outbreak is not over yet, a few studies has been published to investigate its effect on international markets. For instance, it was found that stock markets rapidly react to COVID-19 pandemic and this reaction differs over time depending on the stage of outbreak [1], COVID-19 outbreak has a bigger impact on the US geopolitical risk and economic uncertainty than on the US stock market [2], daily growth in total confirmed cases and in total cases of death caused by COVID-19 significantly and negatively affect stock returns of Chinese companies [3], volatility substantially increases in global markets due to the pandemic turmoil [4], existence of fractal contagion effect on the stock markets [5], evidence of large effect on the cross-correlation of multifractal property between crude oil and agricultural future markets [6], and that cryptocurrencies exhibit larger instability and irregularity compared to stock market during the pandemic [7].

This paper aims to investigate the multiscale information order, in one hand, and the information sharing, on the other hand, in stocks, cryptocurrency, energy, and precious metal markets before and during the COVID-19 pandemic. For this purpose, we examine the behaviour of Renyi entropy [8] and mutual information [9] in Bitcoin, S&P500, WTI, Brent, Gas, Gold, Silver, and VIX. Indeed, analyzing information disorder at different scales allows revealing the level of information loss at rare and frequent events occurring in the signal. Besides, scrutinizing mutual information helps finding nonlinear dependencies between two different variables in terms of information sharing. Indeed, mutual information is a symmetric metric used to gauge the mutual dependency between two signals from the perspective of information theory.

In this work, we rely on the concept of entropy as it allows a nonlinear analysis of the signal under study based on information order and sharing in order to better understand the effect of the COVID-19 on world major markets: equity (Bitcoin and S&P500), energy (WTI, Brent, and Gas), and precious metals (Gold and Silver). In addition, we examine the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) used to gauge fear and expectations of investors. Therefore, compared to the very few works on the effect of the COVID-19 on world economies [1], [2], [3], [4], [5], [6], [7], the contributions of our study follow. First, we reveal the effect of the pandemic on the frequent events in a set composed of world major markets. Second, we shed light on the effect of the pandemic on information sharing between world major markets. Third, we analyze the effect of the pandemic the market on investor's expectations, an important issue missing in existing studies. This would help understanding how the pandemic shaped fear and expectations in investors worldwide. Fourth, the comparison analyses are applied with and between market across time (before versus during pandemic). Fifth, we rely on the concept of multiscale entropy and mutual information since they have not been considered in investigating the response of economies to the pandemic, to the best of our knowledge. Being the major topic in information theory, entropy has been widely applied in plenty of fields in econophysics [10], [11], [12], [13], [14], [15], [16], [17], [18], forecasting stock price forecasting [19], stock market earning [20], portfolio optimization [21], block chain evaluation [22], and market clustering [23].

The rest of the study follows. Section 2 introduces Renyi entropy and mutual information. Section 3 presents data and empirical results. Finally, Section 4 concludes.

2. Methods

In information theory, the Rényi entropy [8] is a generalization of Shannon entropy. Indeed, as a generalization of Shannon entropy, the Rényi entropy exhibits an appealing property aimed to estimate the signal complexity by incorporating an additional parameter used to capture rare and frequent events separately. For instance, let X be a finite value of the random variable, and P be a finite discrete probability distribution which is suppose P = {p 1, p 2,…, p n} and . Then, the Rényi entropy (RE) of order q, where q≥ 0 and q ≠ 0, is given by:

| (1) |

where q is the order of the entropy. When q < 1, rare events are privileged. In contrary, when q > 1, frequent events are privileged. Finally, when q → 1, Rq converges to the Shannon entropy. In this regard, Rényi entropy is useful to quantify the diversity, uncertainty or randomness of a given system [24]. In this study, the Gaussian kernel function is adopted to estimate the probabilities in Eq. (1) [25].

The mutual information (MI) between two random variables X and Y is defined in bits as follows:

| (2) |

where p(x) = Prob{X = x} and p(y) = Prob{Y = y} are respectively the marginal probability density function (PDF) of X and Y. The p(x,y) represents the joint PDF of X and Y. The higher is the mutual information value, the stronger is the dependency between the variables X and Y. If the mutual information value is zero, the two variables are independent. In this work, the multivariate Gaussian function density estimator is employed to approximate the joint probabilities in Eq. (2) [9].

3. Data and results

We gathered daily closing prices of Bitcoin, S&P500, West Texas Instrument (WTI), Brent, Gas, Gold, Silver, and Chicago Board Options Exchange (CBOE) Volatility Index (VIX) for the period from 1 August 2019 to 26 May 2020. Since the COVID-19 outbreak was declared by the world health organization as pandemic on 30th January 2020, the pre-pandemic period spans 1 August 2019 to 31 December 2019 and the pandemic period from 2 January 2020 to 26 May 2020. After removing missing data, the number of observations in the pre-pandemic period is 102 and the number of observations during the pandemic period is 96. The data was obtained from Yahoo finance. All statistical analyses are applied to return series, where the return is computed as the first logarithmic differences of prices.

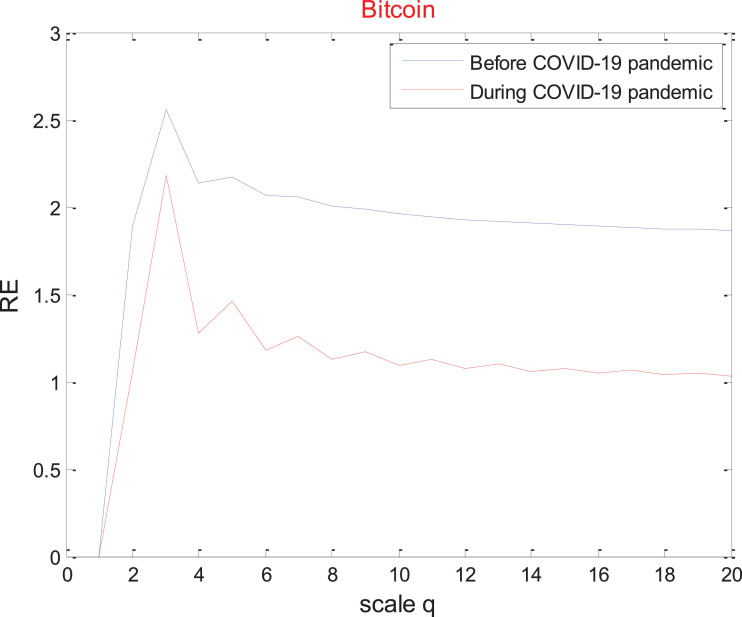

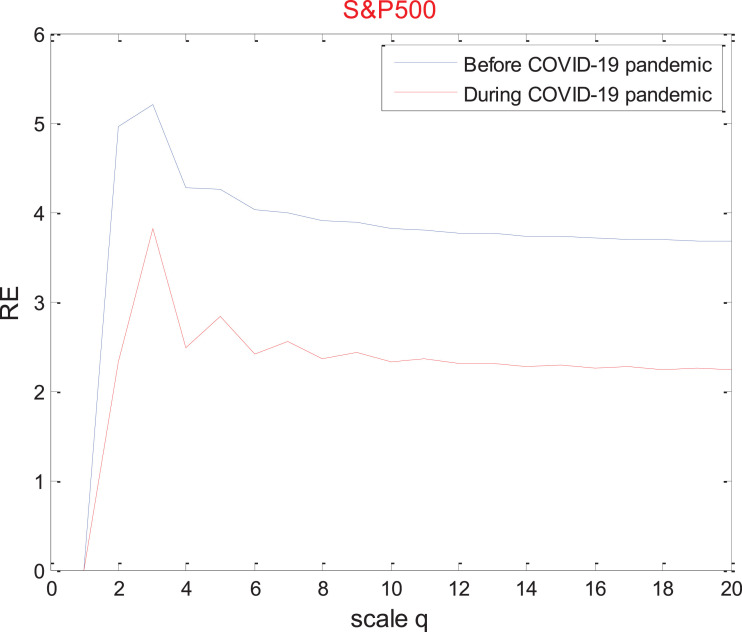

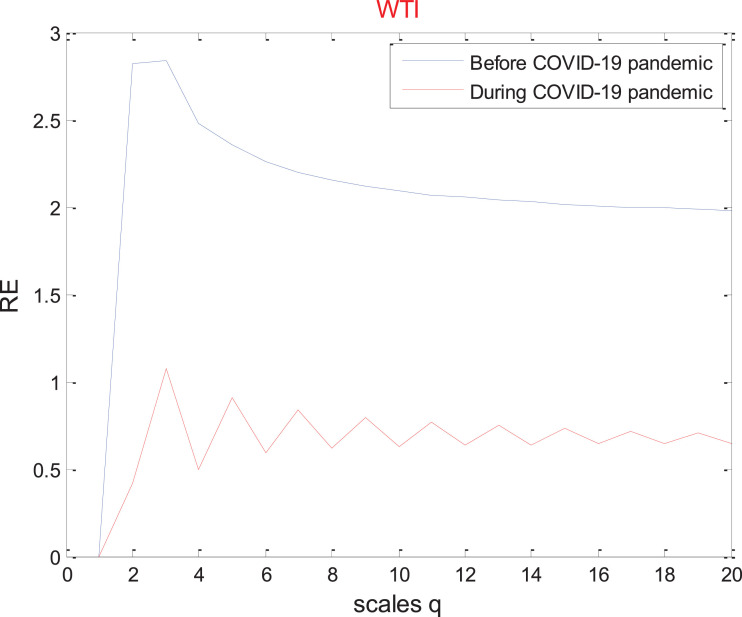

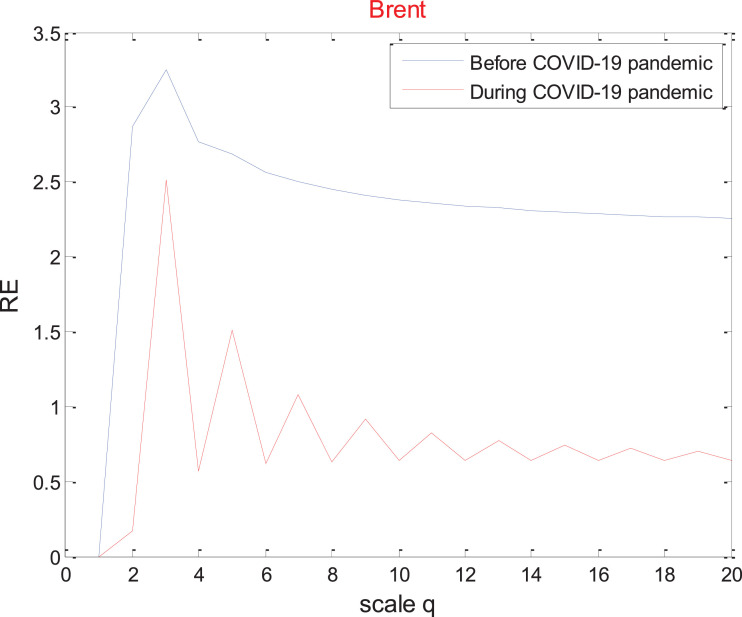

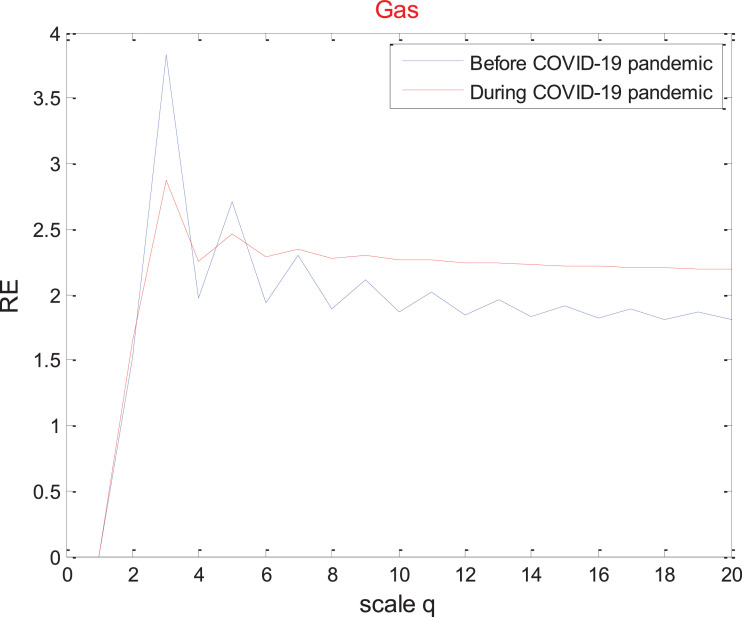

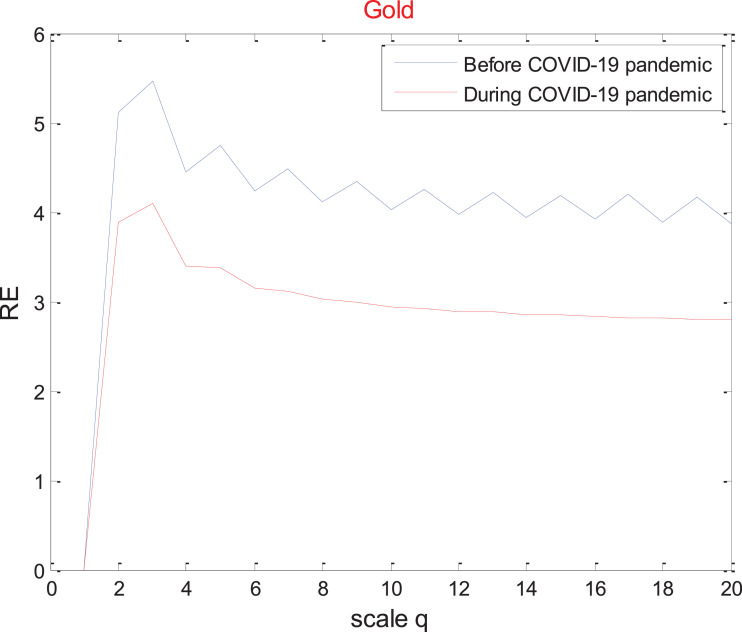

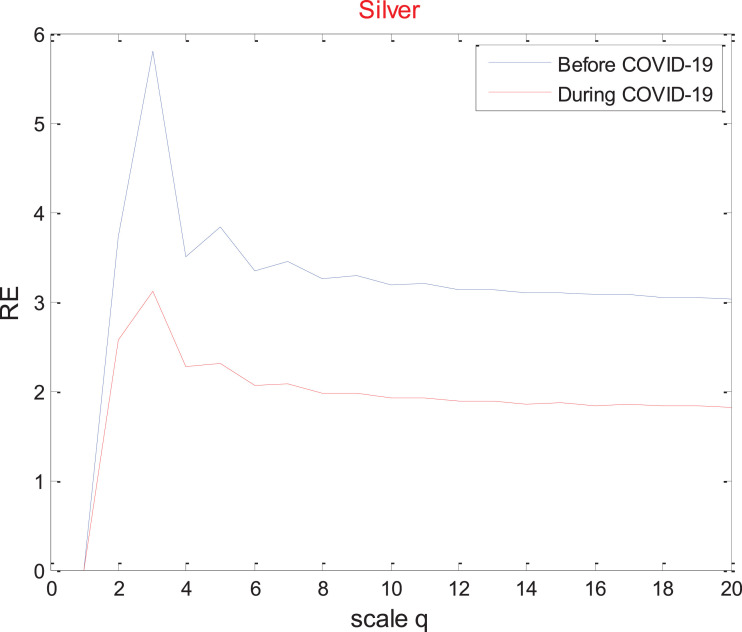

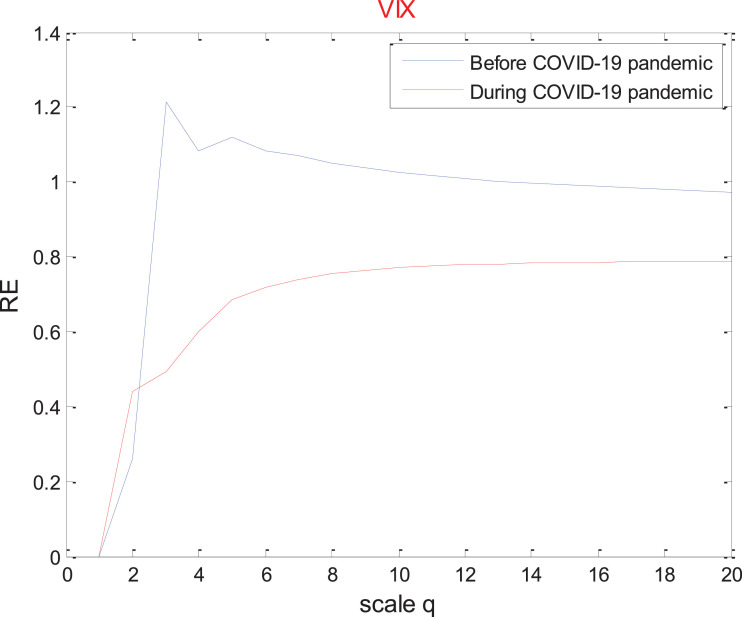

The plot of Renyi entropy (RE) as a function of scale q for Bitcoin, S&P500, WTI, Brent, Gas, Gold, Silver, and VIX before and during COVID-19 pandemic are shown in Fig. 1, Fig. 2, Fig. 3, Fig. 4, Fig. 5, Fig. 6, Fig. 7, Fig. 8 respectively. It is observed for all markets, except Gas, that at all scales, the level of RE before the COVID-19 pandemic is higher than that during the pandemic. These findings suggest that randomness in high probability events has decreased during the COVID-19 pandemic in Bitcoin, S&P500, WTI, Brent, Gold, Silver, and VIX. In contrary, it has increased during COVID-19 pandemic in Gas market. In addition, the empirical results show that there is a strong increase in RE at scales 2 and 3 followed by a decrease for all remaining scales for all markets, except for Gas market. Hence, for Bitcoin, S&P500, WTI, Brent, Gold, Silver, and VIX, randomness and disorder are more concentrated in less probability events. For Gas market, the RE before COVID-19 pandemic is higher than that during the pandemic at low scales (q = 2,3,4,5). On the contrary, RE before COVID-19 pandemic is lower than that during the pandemic at high scales (q = 6 to 20). Thus, for Gas market, randomness and disorder are more concentrated in less probability events, but at longer spectrum (q = 2,3,4,5) compared to the other market (q = 2,3). Finally, it is worth noticing that for the VIX, the level of information disorder in frequent events has decreased during the pandemic. This result suggest that the investors showed lower level of fear and eventually higher level of future expectations regarding most frequent events.

Fig. 1.

Plot of Renyi entropy (RE) as a function of scale q for Bitcoin.

Fig. 2.

Plot of Renyi entropy (RE) as a function of scale q for S&P500.

Fig. 3.

Plot of Renyi entropy (RE) as a function of scale q for WTI.

Fig. 4.

Plot of Renyi entropy (RE) as a function of scale q for Brent.

Fig. 5.

Plot of Renyi entropy (RE) as a function of scale q for Gas.

Fig. 6.

Plot of Renyi entropy (RE) as a function of scale q for Gold.

Fig. 7.

Plot of Renyi entropy (RE) as a function of scale q for Silver.

Fig. 8.

Plot of Renyi entropy (RE) as a function of scale q for VIX.

The results from mutual information (MI) estimations prior to and during the COVID-19 pandemic are provided in Tables 1 and 2 respectively. The changes in MI are shown in Table 3 . According to Table 1, the noticeable large values of MI are between Gold and Silver (0.6429), Brent and WTI (0.4568), and VIX and S&P500 (0.7534). Therefore, the mutual information transferred between Gold and Silver, between Brent and WTI, and between VIX and S&P500 is large prior to the COVID-19 pandemic compared to the other pairs of markets. Instead, the noticeable low values of MI are observed between Gas and WTI (0.0722), Bitcoin and Gas (0.0878), and Bitcoin and WTI (0.0946). Therefore, the mutual information transferred between Gas and WTI, Bitcoin and Gas, and Bitcoin and WTI is low prior to the COVID-19 pandemic compared to the other pairs of markets. Accordingly, the Bitcoin market shared low information with WTI and Gas markets prior to the COVID-19 pandemic. This finding suggests a potential diversification opportunity between Bitcoin market and these two energy markets.

Table 1.

Values of mutual information before COVID-19 pandemic.

| Silver | WTI | Gas | Gold | Brent | S&P500 | VIX | Bitcoin | |

|---|---|---|---|---|---|---|---|---|

| Silver | 0.1047 | 0.1027 | 0.6429 | 0.1336 | 0.1048 | 0.1016 | 0.1367 | |

| WTI | 0.0722 | 0.1074 | 0.4568 | 0.123 | 0.1312 | 0.0946 | ||

| Gas | 0.1091 | 0.1019 | 0.1004 | 0.1241 | 0.0878 | |||

| Gold | 0.1366 | 0.1205 | 0.1329 | 0.1067 | ||||

| Brent | 0.2005 | 0.1815 | 0.1042 | |||||

| S&P500 | 0.7534 | 0.1205 | ||||||

| VIX | 0.1571 |

Table 2.

Values of mutual information during COVID-19 pandemic.

| Silver | WTI | Gas | Gold | Brent | S&P500 | VIX | Bitcoin | |

|---|---|---|---|---|---|---|---|---|

| Silver | 0.1056 | 0.0736 | 0.6274 | 0.0932 | 0.2172 | 0.0933 | 0.1392 | |

| WTI | 0.1623 | 0.1221 | 0.5891 | 0.1902 | 0.1397 | 0.1162 | ||

| Gas | 0.0823 | 0.1712 | 0.1151 | 0.0788 | 0.0837 | |||

| Gold | 0.1067 | 0.2106 | 0.1192 | 0.1225 | ||||

| Brent | 0.2439 | 0.1662 | 0.1219 | |||||

| S&P500 | 0.6392 | 0.1868 | ||||||

| VIX | 0.1563 |

Table 3.

Changes in mutual information.

An increase (decrease) in mutual information is indicated by 1 (0).

| Silver | WTI | Gas | Gold | Brent | S&P500 | VIX | Bitcoin | |

|---|---|---|---|---|---|---|---|---|

| Silver | 1 | 0 | 0 | 0 | 1 | 0 | 1 | |

| WTI | 1 | 1 | 1 | 1 | 1 | 1 | ||

| Gas | 0 | 1 | 1 | 0 | 0 | |||

| Gold | 0 | 1 | 0 | 1 | ||||

| Brent | 1 | 0 | 1 | |||||

| S&P500 | 0 | 1 | ||||||

| VIX | 0 |

According to Table 2, the obvious large values of MI are shown between Gold and Silver (0.6274), Brent and WTI (0.5891), and VIX and S&P500 (0.6392). Therefore, the mutual information transferred between Gold and Silver, between Brent and WTI, and between VIX and S&P500 is large prior to the COVID-19 pandemic compared to the other pairs of markets during the same period. As a result, these pairs of markets showed the highest information sharing. On the contrary, the visible low values of MI are between Gas and Silver (0.0736), Gold and Gas (0.0823), Bitcoin and Gas (0.0837), VIX and Gas (0.0788), and VIX and Silver (0.0933). Therefore, the mutual information transferred between Gold and Silver, Brent and WTI, and VIX and S&P500 is low during the COVID-19 pandemic compared to the other pairs of markets. Consequently, these pairs of markets showed the lowest level of information sharing during the COVID-19 pandemic.

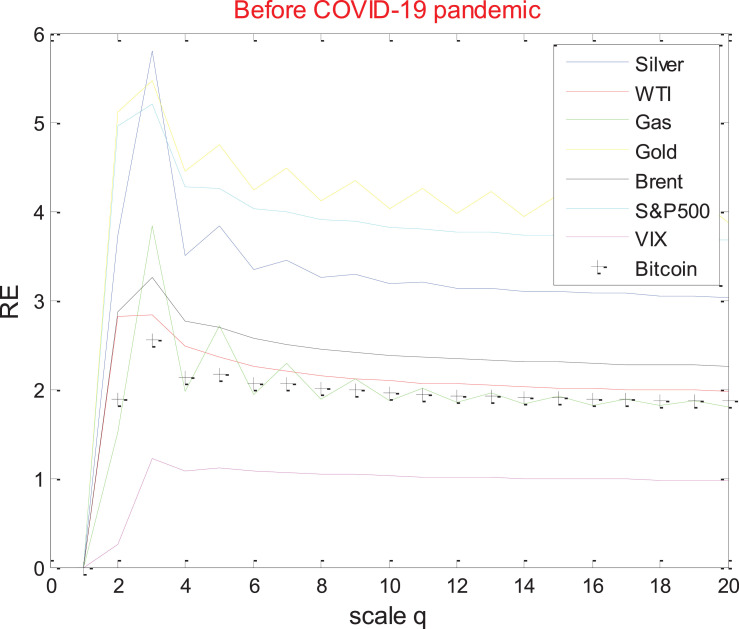

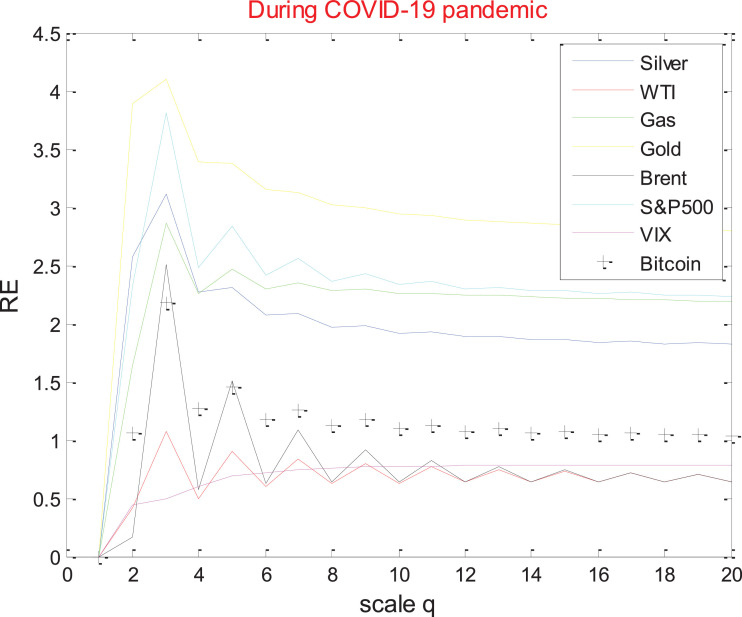

For comparison purposes between markets and fear index VIX, we depict Fig. 9, Fig. 10 plots of all Renyi entropies as a function of scale q respectively prior and during the COVID-19 pandemic. Following Fig. 9, before the COVID-19 pandemic, at all scales, Gold market showed the highest Renyi entropy followed by S&P500, Silver, Brent, WTI, Gas, Bitcoin, and fear index VIX. Therefore, Gold, S&P500, and Silver markets showed higher level of informational disorder, whilst Bitcoin market showed a lower level. Accordingly, the Bitcoin market was a safe investment before the COVID-19 outbreak. Following Fig. 10, during the COVID-19 pandemic, at all scales, Gold market showed the highest Renyi entropy followed by S&P500, Gas, Silver, Bitcoin, Brent, WTI, and fear index VIX. For that reason, Gold, S&P500, Gas, and Silver market are considered the risky markets during the COVID-19 pandemic compared to WTI and Brent, and Bitcoin market. Lastly, it is interesting to observe that VIX showed the lowest level of information disorder both before and during the pandemic. This could indicate that information perceived by investors has not influenced their level of fear during the COVID-19 pandemic.

Fig. 9.

Plot of all Renyi entropies as a function of scale q prior to the COVID-19 pandemic.

Fig. 10.

Plot of all Renyi entropies as a function of scale q during the COVID-19 pandemic.

Finally, according to Table 3, compared to the period prior to the COVID-19 pandemic, the most salient findings during the pandemic period are that (i) information shared by S&P500 with all other markets has increased, (ii) information shared by fear index VIX with all other markets (except WTI) has decreased (increased), and (iii) information shared by Bitcoin with all other markets (except Gas and fear index VIX) has increased (decreased). The increase in mutual information between WTI market and fear index VIX during the pandemic period could be explained by the serious fall in oil prices due to the 2020 Russia-Saudi Arabia oil price war. Another interesting finding is that investing in portfolios composed of Bitcoin and Silver, Bitcoin and WTI, Bitcoin and Gold, Bitcoin and Brent, or Bitcoin and S&P500 could be risky due to the increased level of mutual information between these pair of markets during the pandemic period. Besides, safe investment portfolios could be constructed by investing in Gas and Silver, Gold and Silver, Gold and Gas, Brent and Silver, Brent and Gold, or in Bitcoin and Gas.

Hence our findings are summarized as follows:

-

•

For all market indices, randomness and disorder are more concentrated on low probability events rather than on high probability events.

-

•

Portfolios composed of Bitcoin and Silver, Bitcoin and WTI, Bitcoin and Gold, Bitcoin and Brent, or Bitcoin and S&P500 could be risky.

-

•

Diversification opportunities exist during the COVID-19 pandemic by investing in balanced portfolios between Gas and Silver, Gold and Silver, Gold and Gas, Brent and Silver, Brent and Gold, or in Bitcoin and Gas.

-

•

VIX has the lowest level of information disorder both before and during the pandemic period. This could indicate that information perceived by investors has not influenced their level of fear during the COVID-19 pandemic.

4. Conclusions

The purpose of this study was to investigate the multiscale entropy behaviour and mutual information in Bitcoin, S&P500, WTI, Brent, Gas, Gold, Silver markets and VIX prior to and during the COVID-19 pandemic. Indeed, the goal was to reveal the information disorder at high probability events and information sharing in all markets and investors’ expectations with respect to the two periods.

Our obtained results showed that for all markets and VIX, randomness and disorder are more (less) concentrated in low (high) probability events. Specifically, VIX showed the lowest level of information disorder both before and during the pandemic. From a managerial perspective, our findings suggest that portfolios composed of Bitcoin and Silver, Bitcoin and WTI, Bitcoin and Gold, Bitcoin and Brent, or Bitcoin and S&P500 could be highly risky. In addition, diversification opportunities exist during the COVID-19 pandemic by investing in balanced portfolios between Gas and Silver, Gold and Silver, Gold and Gas, Brent and Silver, Brent and Gold, or in Bitcoin and Gas. Furthermore, the pandemic has not influenced seriously the expectations of investors. These findings offer a valuable insight vis-à-vis the response of stocks, cryptocurrency, energy, precious metal markets, as well as regarding market agent expectations as an after-effect of the COVID-19 pandemic in terms of information ordering and sharing.

Declaration of Competing Interest

The authors declare no conflict of interest.

References

- 1.Ashraf B.N. Stock markets’ reaction to COVID-19: Cases or fatalities? Res Int Bus Finance. 2020;54 doi: 10.1016/j.ribaf.2020.101249. Article 101249. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Sharif A., Aloui C., Yarovaya L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. Int Rev Financ Anal. 2020;70 doi: 10.1016/j.irfa.2020.101496. Article 101496. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Al-Awadhi A.M., Alsaifi K., Al-Awadhi A., Alhammadi S. Death and contagious infectious diseases: impact of the COVID-19 virus on stock market returns. J Behav Exp Finance. 2020;27 doi: 10.1016/j.jbef.2020.100326. Article 100326. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Zhang D., Hu M., Ji Q. Financial markets under the global pandemic of COVID-19. Finance Res Lett. 2020 doi: 10.1016/j.frl.2020.101528. Article 101528. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Okorie D.I., Lin B. Stock markets and the COVID-19 fractal contagion effects. Finance Res Lett. 2020 doi: 10.1016/j.frl.2020.101640. Article 101640. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Wang J., Shao Wei, Kim J. Analysis of the impact of COVID-19 on the correlations between crude oil and agricultural futures. Chaos, Solitons Fractals. 2020;136 doi: 10.1016/j.chaos.2020.109896. Article 109896. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Lahmiri S., Bekiros S. The impact of COVID-19 pandemic upon stability and sequential irregularity of equity and cryptocurrency markets. Chaos, Solitons Fractals. 2020;138 doi: 10.1016/j.chaos.2020.109936. Article 109936. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Rényi A. Proceedings of the 4th Berkeley symposium on mathematics, statistics and probability. 1960. On measures of information and entropy; pp. 547–561. [Google Scholar]

- 9.Moon Y.I., Rajagopalan B., Lall U. Estimation of mutual information using kernel density estimators. Phys Rev E. 1995;52:2318–2321. doi: 10.1103/physreve.52.2318. [DOI] [PubMed] [Google Scholar]

- 10.Lahmiri S., Bekiros S. Nonlinear analysis of Casablanca stock exchange, Dow Jones and S&P500 industrial sectors with a comparison. Physica A. 2020;5391 Article 122923. [Google Scholar]

- 11.Lahmiri S., Bekiros S., Avdoulas C. Time-dependent complexity measurement of causality in international equity markets: a spatial approach. Chaos, Solitons Fractals. 2018;116:215–219. [Google Scholar]

- 12.Argyroudis G.S., Siokis F.M. Spillover effects of Great recession on Hong-Kong's real estate market: an analysis based on causality plane and Tsallis curves of complexity-entropy. Physica A. 2019;524:576–586. doi: 10.1016/j.physa.2019.04.052. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Zhou Q., Shang P. Weighted multiscale cumulative residual Rényi permutation entropy of financial time series. Physica A. 2020;540 Article 123089. [Google Scholar]

- 14.Ishizaki R., Inoue M. Analysis of local and global instability in foreign exchange rates using short-term information entropy. Physica A. 2020;555 Article 124595. [Google Scholar]

- 15.Lahmiri S., Bekiros S. Chaos, randomness and multi-fractality in Bitcoin market. Chaos, Solitons Fractals. 2018;106:28–34. [Google Scholar]

- 16.Lahmiri S., Bekiros S. Disturbances and complexity in volatility time series. Chaos, Solitons Fractals. 2017;105:38–42. [Google Scholar]

- 17.Zhao X., Zhang P. Multiscale horizontal visibility entropy: measuring the temporal complexity of financial time series. Physica A. 2020;537 Article 122674. [Google Scholar]

- 18.Lahmiri S., Uddin G.S., Bekiros S. Nonlinear dynamics of equity, currency and commodity markets in the aftermath of the global financial crisis. Chaos, Solitons Fractals. 2017;103:342–346. [Google Scholar]

- 19.Karaca Y., Zhang Y.-D., Muhammad K. Characterizing complexity and self-similarity based on fractal and entropy analyses for stock market forecast modelling. Expert Syst Appl. 2020;144 Article 113098. [Google Scholar]

- 20.Wang P., Zong L., Ma Y. An integrated early warning system for stock market turbulence. Expert Syst Appl. 2020;153 Article 113463. [Google Scholar]

- 21.Aksaraylı M., Pala O. A polynomial goal programming model for portfolio optimization based on entropy and higher moments. Expert Syst Appl. 2018;94:185–192. [Google Scholar]

- 22.Tang H., Shi Y., Dong P. Public blockchain evaluation using entropy and TOPSIS. Expert Syst Appl. 2019;117:204–210. [Google Scholar]

- 23.Cheng C.-H., Wei L.-Y. Data spread-based entropy clustering method using adaptive learning. Expert Syst Appl. 2009;36:12357–12361. [Google Scholar]

- 24.Zmeskal O., Dzik P., Vesely M. Entropy of fractal systems. Comput Math Appl. 2013;66:135–146. [Google Scholar]

- 25.Principe J.C. Springer; New York: 2010. Information Theoretic Learning: Renyi's Entropy and Kernel Perspectives. [Google Scholar]