Abstract

The objective of this study is to determine whether key hospital-level financial and market characteristics are associated with whether rural hospitals merge. Hospital merger status was derived from proprietary Irving Levin Associates data for 2005 through 2016 and hospital-level characteristics from HCRIS, CMS Impact File Hospital Inpatient Prospective Payment System, Hospital MSA file, AHRF, and U.S. Census data for 2004 through 2016. A discrete-time hazard analysis using generalized estimating equations was used to determine whether factors were associated with merging between 2005 and 2016. Factors included measures of profitability, operational efficiency, capital structure, utilization, and market competitiveness. Between 2005 and 2016, 11% (n = 326) of rural hospitals were involved in at least one merger. Rural hospital mergers have increased in recent years, with more than two-thirds (n = 261) occurring after 2011. The types of rural hospitals that merged during the sample period differed from nonmerged rural hospitals. Rural hospitals with higher odds of merging were less profitable, for-profit, larger, and were less likely to be able to cover current debt. Additional factors associated with higher odds of merging were reporting older plant age, not providing obstetrics, being closer to the nearest large hospital, and not being in the West region. By quantifying the hazard of characteristics associated with whether rural hospitals merged between 2005 and 2016, these findings suggest it is possible to determine leading indicators of rural mergers. This work may serve as a foundation for future research to determine the impact of mergers on rural hospitals.

Keywords: hospitals, rural, health facility merger, hospital financial management

What do we already know about this topic?

The only recent study we are aware of that examined rural hospitals specifically suggested that rural hospitals that merged were more likely to report lower total margins, a smaller proportion of equity (eg, more debt) financing, and a smaller proportion of Medicare outpatient revenue to total outpatient revenue as compared with rural hospitals that did not merge.

How does your research contribute to the field?

This research quantifies the number and frequency of rural hospital mergers between 2005 and 2016, as well as determines that rural hospitals with higher odds of merging were less profitable, for-profit, larger, and were less likely to be able to cover current debt.

What are your research’s implications toward theory, practice, or policy?

Our findings suggested what was previously known about U.S. hospital merger antecedents may not be generalizable to rural hospitals, which could impact how policy-makers address legislation that impacts merger activity and health care in rural communities.

Introduction

Across the nation, hospitals are merging to cut costs and streamline resources1 in the face of growing financial pressures and extensive policy changes.2-6 To thrive or survive amidst decreasing inflation-adjusted reimbursement rates7 and environmental pressures to consolidate resources,1,8 hospitals must become more efficient9 while simultaneously improving health outcomes.1 Merging with another hospital is one mechanism for managing these pressures. A 2017 industry survey of hospital executives conducted by Deloitte and Healthcare Financial Management Association (HFMA) showed that executives from acquiring hospitals most commonly reported merging to increase market share (40%) and deliver care more efficiently (29%).9 The same survey reported that executives of hospitals targeted in a merger most commonly merged to improve access to capital (31%), deliver care more efficiently (29%), and increase market share (14%).9 Since 2010, hospital mergers have increased in frequency, cost, and number of entities involved.10 Between 2011 and 2016, an average of 95 hospital merger transactions occurred annually, compared with 61 per year between 2008 and 2010.10 It is unclear whether rural hospitals followed a similar trend.

Rural hospitals face unique challenges compared with their nonrural counterparts. On average, rural hospitals serve older, sicker, and poorer populations than nonrural populations.11,12 Compared with nonrural hospitals, rural hospitals also provide fewer services, have lower patient volumes, and are more likely to encounter obstacles regarding provider recruitment and patient transfer.11-15 Rural hospitals are also more sensitive to reimbursement changes and are associated with relatively lower profitability than their counterparts.11-14 The confluence of these differences may be associated with the relatively high number of rural hospital closures in recent years (eg, 126 rural hospital closures between 2010 and the first quarter of 2020),16 and many more being at high risk for closure.17 These key differences suggest rural hospital could merge for different reasons than other hospitals and should therefore be examined separately; however, there is limited research that addresses rural hospitals specifically. It is important to understand how many rural hospitals are merging and if certain types of rural hospitals are more likely to merge than others. Then, further research can determine what impacts mergers have on rural communities. For this study, we defined rurality according to the Federal Office of Rural Health Policy definition: short-term, nonfederal general facilities (1) located outside Metropolitan Core-Based Statistical Areas (CBSAs) or (2) within Metropolitan areas and having Rural-Urban Commuting Area (RUCA) codes of 4 or greater or (3) with critical access hospital (CAH) status.18

Previous research found hospitals that merge were more likely to be closer in distance,19,20 not-for-profit, and of similar size to the acquirer.20 However, these studies offer limited inference for recent rural hospital mergers for 2 key reasons. One, none of those studies separately evaluated rural hospitals. And two, none of those studies assessed hospital mergers after 2000, during which time hospital reimbursement underwent substantial shifts from FFS to outcomes-based, which may have impacted merger motives. The only recent study we are aware of that examined rural hospitals specifically suggested that rural hospitals that merged were more likely to report lower total margins, a smaller proportion of equity (eg, more debt) financing, and a smaller proportion of Medicare outpatient revenue to total outpatient revenue as compared with rural hospitals that did not merge21 That study, however, was limited to mergers occurring between 2005 and 2012 and defined hospital mergers as “ever” or “never” during the study period. Such a definition may not have captured temporal changes in financial or market characteristics that led to a merger.

Following a merger, target hospitals have been shown to decrease services provided,22-24 staffing levels,23 and costs,25 but increase capital expenditures9 and prices.26-29 Postmerger effects such as these could have significant impacts on rural communities. (For this research, hospital mergers occurred when an acquiring entity (acquirer) took majority ownership of another hospital (target). In most mergers, one organization (the acquirer) initiated action to take over another (the target).) Rural communities are vulnerable to changes because their residents are, on average, older, poorer, and sicker11,12 than nonrural community members. Any of the aforementioned postmerger effects could jeopardize access to care for vulnerable rural residents30,31 as well as impact the economic state of communities served by these hospitals, which are often the largest employers in rural areas.32

The objective of this study was to determine whether key hospital and market characteristics were associated with whether rural hospitals merged between 2005 and 2016. Policy-makers cannot take informed action on existing and future policies regarding rural merger impacts without first knowing what types of rural hospitals are more likely to merge. Understanding the characteristics of rural hospitals that merge prepares rural hospital leaders and policy-makers to anticipate future mergers and prepare for potential changes within the rural health care landscape.

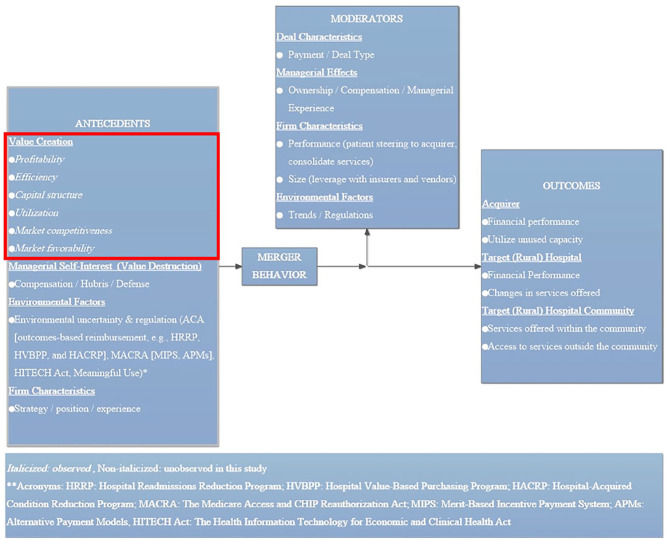

Conceptual Framework

This study builds upon the conceptual framework of mergers and acquisitions developed by Haleblian et al33 that posits an array of antecedents (eg, value creation, managerial self-interest, environmental factors, and firm characteristics) influence merger behavior and that moderators (eg, deal characteristics, managerial effects, firm characteristics, and environmental factors) affect outcomes related to mergers. This framework has been adapted for rural hospitals targeted in a merger and is presented in Figure 1.

Figure 1.

Merger antecedents, moderators, and outcomes.

For rural hospitals targeted in a merger, we hypothesize that the most common merger motives are related to Haleblian et al’s value creation antecedent. Specifically, we hypothesize that rural targets merge to improve financial performance and, at times, survive, and that acquirers merge to increase market power.23,34-36 We define market power as a hospital’s ability to influence service prices. For rural hospitals reporting weak finances, a merger may improve the ability to meet the demands of CMS outcomes-based reimbursement policies and EHR adoption requirements that require expensive investments in facilities, equipment, and EHRs37 (unobserved environmental factor antecedents in the Haleblian et al framework). Acquirers seeking greater market power may be particularly attracted to rural merger targets because rural hospitals are (1) often the only acute care providers in the communities they serve11,12 and (2) less likely than nonrural hospitals to provide specialty services offered at larger hospitals.38 Acquirers of rural hospitals may leverage these factors to increase market power by steering patients who require complex and potentially more profitable care away from target hospitals (and competitors in those target markets) to the acquirers.23,35

Because we hypothesize that the finances and potential market power of rural target hospitals determine whether rural hospitals merge, we test a variety of hospital-level characteristics identified in Table 1. Profitability, operational efficiency, capital structure, utilization, and other hospital characteristics depict value creation at the target rural hospital. We hypothesize that the odds of merging are higher for rural hospitals that report worse profitability, operational efficiency, capital structure, and utilization because these hospitals have less leverage by which to negotiate better merger terms. For these rural hospitals, an acquirer may view the merger as opportunistic for efficiency improvements and to increase market power. By evaluating market competitiveness and other market characteristics, hospital administrators can evaluate the potential of a merger to create value through increased market power. We hypothesize that the odds of merging are higher for rural hospitals in larger, more competitive markets. In keeping with Haleblian et al’s framework, other managerial, environmental, and firm antecedents are likely associated with merger behavior but are unobserved in this research.

Table 1.

Rural Hospital Averages for Analysis Year (Year Immediately Prior to Merger).

| Variable | All hospitals | Nonmerged hospitals | Merged hospitals | P value |

|---|---|---|---|---|

| (N = 25 065) | (N = 24 783) | (N = 282) | ||

| Average (SD) or % | ||||

| Profitability | ||||

| Total margin, % | 2.73 (9.39) | 2.73 (9.34) | 2.37 (11.71) | <.001*** |

| Efficiency | ||||

| FTEs per bed | 5.56 (5.27) | 5.58 (5.29) | 4.52 (2.96) | <.001*** |

| Medicare CCR, % | 38.97 (19.10) | 39.30 (19.11) | 28.91 (14.32) | <.001*** |

| Capital structure | ||||

| Ability to cover current debt, % | <.001*** | |||

| Did not report debt service coverage ratios | 21.88 | 21.66 | 34.19 | |

| Unable to cover current debt | 17.31 | 17.27 | 19.84 | |

| Able to cover current debt | 60.81 | 61.08 | 45.96 | |

| Utilization | ||||

| Medicare outpatient payer mix, % | 32.14 (11.38) | 32.27 (11.40) | 28.10 (9.23) | <.001*** |

| Hospital provides obstetrics, % | .32 | |||

| Does not provide obstetrics | 43.81 | 43.88 | 40.01 | |

| Provides obstetrics | 56.19 | 56.12 | 59.99 | |

| Other hospital characteristics | ||||

| Ownership status, % | <.001*** | |||

| Not-for-profit | 54.6 | 54.38 | 66.66 | |

| For-profit | 7.28 | 7.08 | 18.81 | |

| Government | 38.12 | 38.54 | 14.53 | |

| Average plant age (%, quartiles) | .07 | |||

| Percent in newest quartile | 22.79 | 22.89 | 17.22 | |

| Percent in second newest quartile | 25.47 | 25.55 | 20.92 | |

| Percent in second oldest quartile | 25.69 | 25.58 | 32.12 | |

| Percent in oldest quartile | 26.05 | 25.98 | 29.74 | |

| Size (net patient rev, quartiles) | <.001*** | |||

| Percent in smallest quartile | 22.98 | 23.28 | 5.80 | |

| Percent in second smallest quartile | 26.15 | 26.22 | 22.10 | |

| Percent in second largest quartile | 24.37 | 24.25 | 30.84 | |

| Percent in largest quartile | 26.51 | 26.24 | 41.26 | |

| CAH status, % | <.001*** | |||

| Non-CAH, PPS | 48.72 | 48.40 | 67.10 | |

| CAH | 51.28 | 51.60 | 32.90 | |

| Market competitiveness | ||||

| Distance to nearest large (>100 bed) hospital (miles) | 33.45 (29.50) | 33.68 (29.66) | 24.65 (18.16) | <.001*** |

| Market share (cases) captured, % | 24.64 (12.20) | 24.67 (12.23) | 23.70 (10.76) | .003** |

| Other market characteristics | ||||

| Market total population (millions) | 3.24 (5.70) | 3.20 (5.68) | 6.02 (6.25) | <.001*** |

| Market unemployment rate, % | 7.49 (3.46) | 7.48 (3.47) | 8.26 (3.07) | <.001*** |

| Region, % | <.001*** | |||

| Northeast | 7.04 | 6.94 | 1.26 | |

| Midwest | 38.94 | 38.98 | 36.83 | |

| South | 35.51 | 35.29 | 47.86 | |

| West | 18.51 | 18.79 | 14.05 | |

Note. Average is the median for continuous variables, mean for noncontinuous variables. P values by t test for continuous variables and χ2 test for binary/categorical variables.Standard deviation in parentheses. Missing values: Total Margin (104 obs), CCR (48 obs), FTEs per Bed (115 obs), Plant Age (1064 obs), Size (41 obs), Outpatient Payer Mix (26 obs), Distance (64 obs), Market Share (64 obs), Population (64 obs), Unemployment Rate (64 obs). CCR = cost to charge ratio; FTE = full-time equivalents; CAH = critical access hospital.

P < .05. **P < .01. ***P < .001.

Methods

Data Sources

We combined multiple secondary data sources to form a panel for years 2004-2016. Hospital-level characteristics were combined from the CMS Hospital Cost Report Information System (HCRIS) “cost report” data, the CMS Impact File Hospital Inpatient Prospective Payment System, the Hospital Metropolitan Statistical Area (MSA) file, and hospital market population-level data from the Area Health Resources Files (AHRF) and U.S. Census data. A hospital’s merger status was derived from proprietary data from Irving Levin Associates for 2005-2016. These data were supplemented with primary data on merger effective dates collected by searching publicly available data sources (10-Ks from the Securities and Exchange Commission, Form 990s from the Internal Revenue Service, hospital websites) or contacting hospitals directly.

Study Sample

To define the sample, we combined rural hospital merger status with hospital Medicare Cost Reports from 2004 to 2016. The Levin data report a merger “announcement date,” which may have (1) included hospitals that did not merge during the sample period and (2) represented a date other than that on which ownership transferred. To verify when and whether an “announced” merger occurred, we created an “effective” date through searching publicly available documents online (eg, for-profit IRS Form 10-Ks, not-for-profit IRS Form 990s, and annual reports from hospital websites) and, when necessary, calling and emailing leaders of rural hospitals. Because we analyzed data by discrete years, not specific dates within a year, it was necessary to align effective merger dates with the correct hospital fiscal year (HFY). Doing so was essential to compare hospital data from the correct time period because the HFY differed from the calendar year of the effective date approximately two-thirds of the time.39 We excluded partial-year data reporting for less than 360 days40 (n = 2186).

From the Levin data, we identified 395 rural hospitals that were announced to have merged. Of the 395 rural hospitals, we excluded 16 announced deals that did not close, closed in 2017, or may still be pending, thus leaving 379 mergers involving rural hospitals. Because 39 rural hospitals merged more than once during the sample period, there were 326 unique rural hospitals that merged between 2005 and 2016.

Of the 326 unique rural hospitals that merged, we excluded 44 that did not report full-year cost report data in the year of analysis (eg, the year prior to merger), resulting in 282 unique merged rural hospitals. The final sample consisted of 25,065 hospital-years, 282 of which were associated with a merger and 24,783 of which were not.

Study Variables

Dependent variable

The dependent variable was a binary measure equal to 1 if a hospital merged during a year and 0 otherwise.

Independent variables

As described in the “Conceptual Framework” section, we hypothesized that the most likely rural hospitals to merge were (1) less profitable and (2) in more favorable markets. We tested these hypotheses with hospital-level characteristics that have been found to impact hospital performance17,41-45 and may have affected the odds that a hospital will merge (outlined in Table 1).9,19-21,46

Profitability

We measured profitability with total margin. Total margin was calculated as net income divided by total revenues. Total margin is widely encompassing and is often used to assess the financial performance of hospitals involved in mergers and system consolidations.1,34,47-50

Operational efficiency

We measured hospital operational efficiency with full-time equivalents (FTEs) per bed and the Medicare outpatient cost to charge ratio (CCR). Full-time equivalents per bed51 controlled for potential differences in patient volumes and/or staff productivity. Cost to charge ratio controlled for potential differences in billing and/or cost inefficiencies.51

Capital structure

We measured capital structure with a measure of a hospital’s ability to cover debt payments. To control for a hospital’s ability to pay existing debt, we created a measure called “ability to cover debt payments” using debt service coverage ratios (DSCRs).51 We categorized nonmissing DSCRs ≥1 as able to cover current debt and nonmissing DSCRs <1 as unable to cover current debt.

Utilization

We measured utilization with Medicare outpatient payer mix19,52 and whether a hospital provided obstetric services. The proportion of Medicare outpatient payer mix controlled for government-reimbursed payer mix. Outpatient revenue accounted for the largest proportion (nearly two-thirds) of all revenue generated by rural hospitals in the sample.39 Whether a rural hospital provided obstetric services controlled for service mix differences. Fewer rural hospitals provide obstetrics, with more than 7% of all rural hospitals closing their obstetric units between 2004 and 2014.53-55 Providing obstetrics may indicate broader associations with other services provided by rural hospitals.

Other hospital characteristics

We measured other hospital characteristics we hypothesized determine whether rural hospitals merge. Those factors included ownership status, average plant age, hospital size, and whether a hospital is a CAH. Hospital ownership—categorized as private for-profit, private not-for-profit, and government-owned—controlled for differing financial objectives.56-59 Average plant age, measured as quartiles for all merged and nonmerged rural hospitals in each analytical year, controlled for the age of fixed assets.51 Hospital size, measured by Net Patient Revenue (NPR) (quartiles), controlled for potential scale opportunities. Compared with measuring hospital size by the number of beds, NPR has been theorized to be a more sensitive measure for rural hospitals.17

For this research, CAHs were compared with rural PPS hospitals—an approach informed by prior hospital finance literature60 that served to control for Medicare cost-based reimbursement to CAHs.61 Critical access hospitals receive cost-based reimbursement to reduce financial vulnerability and improve access to care in rural communities.15 Critical access hospitals generally have smaller, less competitive markets than other rural PPS hospitals.51,62

Market competitiveness

We measured market competitiveness with distance to the nearest large (eg, >100 bed) hospital and the proportion of total market share captured.

Hospital market areas were created using Medicare discharge counts by ZIP code from the CMS Hospital Service Area File. A ZIP code was included in the market if, when sorted in descending number of that hospital’s Medicare discharges, it was among the ZIPs that comprised the first 75% of that hospital’s Medicare discharges63 or if it contributed at least 3% of that hospital’s Medicare admissions for the year. Except for hospitals in Alaska and Hawaii, ZIP codes more than 150 miles from the hospital were disqualified from being in its market. The market areas were not specified to be mutually exclusive, exhaustive, or contiguous. Low-population or low-Medicare-population ZIP code areas in otherwise dense areas were more likely to be excluded from a market based on this definition. Averages for market variables were calculated as the population-weighted average of the ZIP code data.

Distance to the nearest large (eg, >100 bed) hospital controlled for proximity to other hospitals. Various measures of proximity have been associated with an acquirer’s ability to increase market power.28,34,64 While the nearest large hospital was not always the acquirer, this research was limited by not knowing the acquirer. Therefore, distance was measured to the nearest large hospital. We determined the distance from each hospital to the next closest hospital using straight-line distance between coordinates geocoded from CMS addresses. We took the natural log of distance to address suspected variation in the rate of the relationship of distance with the odds of merging. Market share captured, measured as the proportion of inpatient discharges captured within a hospital’s market, controlled for market competition.

Other market characteristics

We measured other market characteristics with total population,25 unemployment rate,65,66 and region.48 Population controlled for market size.61 Unemployment rate controlled for local economic conditions61 and the average community member’s likelihood to seek and ability to pay for health care services.13,30 Region controlled for potential unobserved geographic differences.

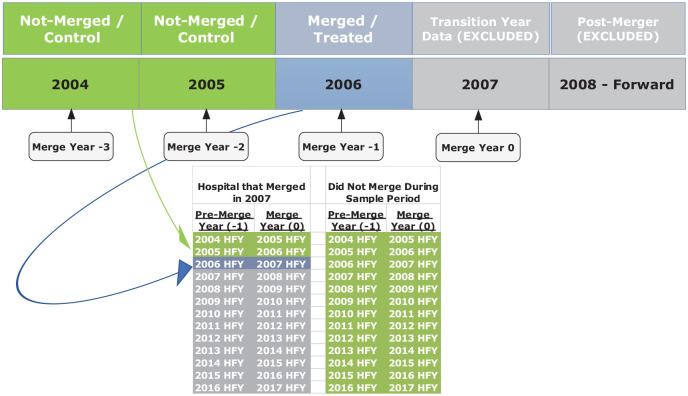

Study Design

The study used a discrete-time hazard analysis to identify hospital and market characteristics predictive of a merger using a panel of data for years 2004 through 2016. Following Dranove and Lindrooth’s (2003) approach,19 only hospital characteristics from the year prior to a merger were used to model merger activity. For example, a hospital’s 2004 profitability was used to predict its 2005 merger status. Therefore, data for years 2004 through 2015 were used to determine the relationship of key hospital factors with merging for analytical years 2005 through 2016. We estimated generalized estimating equations with a logit link and an exchangeable error term for repeated observations on a binary outcome for whether a rural hospital merged as follows:

Merge denotes the binary dependent variable for whether a rural hospital merged in re-centered year 0. t denotes the year of a merger, re-centered at 0. α denotes the constant. β1 . . . βn represent coefficients. X and Z denote time-varying and time-invariant independent variables, respectively. t − 1 denotes the year prior to a merger, from which antecedent data are compared for hospitals that merged in re-centered year 0. β3*Yeart − 1 = 2004 . . . 2015 represent year fixed effects. ε represents the error term, specified as exchangeable within hospital.

Because we were interested in modeling merger activity in a year, we leveraged the longitudinal nature of the data and specified a discrete-time hazard analysis. As with any merger analysis, our sample was limited by left and right censoring (eg, we did not know which hospitals merged before the sample period began in 2005 or after the sample period ended in 2016). However, we leveraged the new knowledge of which hospitals merged and did not merge during the sample period to create a comparison group. We compared hospitals that merged during the sample period to a control group comprising (1) rural hospitals that did not merge during the sample period and (2) rural hospitals that ultimately merged during the sample period—but merged more than 1 year in the future. We further explain the treatment and control groups with an example in the appendix.

We accounted for unobserved correlation of year-specific effects with model variables and merger status (eg, implementation of various CMS reimbursement policies) by including year fixed effects. We cleaned data using complete case analysis and addressed extreme values by Winsorizing67 (censoring) those values at the 1% tails of each variable’s distribution.25 Standard errors were calculated with a bootstrap (500 repetitions). Descriptive statistics were weighted by 2 factors: (1) the annual proportion of merged hospitals relative to all mergers and (2) days in period For example, 7 of the 282 merged hospital-years occurred in 2005. Therefore, descriptive statistics for merged and nonmerged hospital-years for 2005 were weighted as 7/282nds of the overall means/medians. Statistics were then weighted at the hospital-year level for days in periods. Differences between groups were tested using Pearson χ2 (categorical variables) and Wilcoxon rank test of medians (continuous variables) using .05 as the probability of type 1 error.

Results

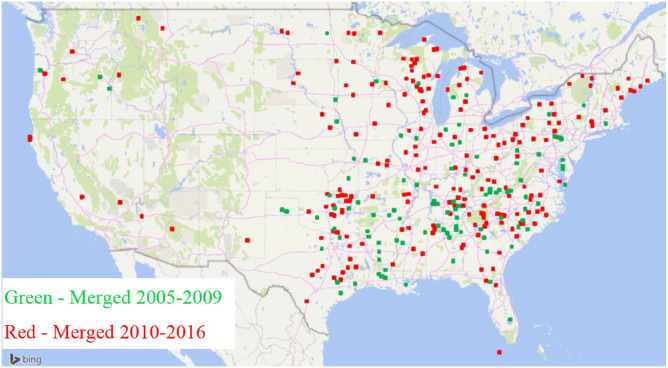

Geographic Distribution of Rural Hospitals That Merged Between 2005 and 2016

The geographic location of all 326 unique rural hospitals that merged from 2005 through 2016 is displayed in Figure 2. More than half of all merged hospitals (n = 173) were in 11 states (OK, TX, WI, NC, TN, PA, VA, AL, MI, GA, and IL). Mergers occurred the most frequently in Oklahoma (n = 22), Texas (n = 22), and Wisconsin (n = 19). Of states with at least 25 total rural hospitals, Virginia (44%), South Carolina (37%), and Pennsylvania (29%) had the highest proportion of mergers.

Figure 2.

Geographic distribution of rural hospitals that merged between 2005 and 2016.

Annually, rural mergers increased more than 200% since 2010 (averaging 20 mergers/year from 2005 to 2010 and 44/year from 2011 to 2016). (The average annual number of rural hospital mergers was based on the total number of rural mergers (379) between 2005 and 2016. That number included each merger for any rural hospital that merged more than once. We chose the total number of mergers for annual averages rather than the number of unique rural hospitals that merged to account for rural hospitals that merged more than once in the 2 time periods we classified (eg, 2005-2010 and 2011-2016).) The increase in mergers during recent years is represented in Figure 2 by the higher proportion of darker red shaded squares. Further description of state-level distributions and annual occurrences can be found in other work from the authors.68

Unadjusted Descriptive Statistics of Rural Hospitals Prior to Merger

In Table 1, we present descriptive statistics of rural hospitals in the year of analysis (year 1). Results represent differences in the premerger period between merged and nonmerged rural hospital-years. The first column of data depicts averages for all (eg, nonmerged and merged) rural hospital-years. The second data column depicts averages for nonmerged rural hospital-years, and the third data column depicts averages for merged rural hospital-years.

Profitability

Compared with nonmerged rural hospitals, merged rural hospitals reported significantly lower premerger total margins.

Operational efficiency

By both measures of operational efficiency, FTEs per bed and CCR, merged rural hospitals were more efficient premerger than nonmerged rural hospitals.

Capital structure

Compared with nonmerged rural hospitals, a larger proportion of merged rural hospitals were significantly less likely to be able to pay existing debt in the premerger period.

Utilization

The proportion of outpatient payer mix attributed to Medicare was 4 percentage points lower for merged, relative to nonmerged, rural hospitals. Whether a rural hospital provided obstetric services premerger did not differ significantly between merged and nonmerged rural hospitals.

Other hospital characteristics

Relative to the comparison group, merged rural hospitals were more than twice as likely to be for-profit entities and less than half as likely to be government-owned. Compared with the same group, a larger proportion of merged rural hospitals reported older plant age. The unadjusted plant age finding was not statistically significant (P = .07) but showed a statistical trend and may have been of clinical importance. Merged rural hospitals, compared with nonmerged rural hospitals, were significantly more likely to be among the largest quartile of rural hospitals and 4 times less likely to be among the smallest quartile of all rural hospitals in the premerger period. Merged rural hospitals were much more likely to be non-CAH, rural PPS hospitals.

Market competitiveness

Merged rural hospitals were significantly closer to the nearest large hospital than nonmerged rural hospitals. The difference was sizeable, 9 miles. Merged rural hospitals captured a smaller proportion of total market share.

Other narket characteristics

Merged rural hospital markets were nearly 2 times the size of nonmerged rural comparators. Unemployment was nearly 1 percentage point higher in merged rural hospital markets than nonmerged markets. While a high proportion of rural hospitals in general were in the south (35.51%), merged rural hospitals were disproportionately in the south (47.86%).

Factors Associated With Rural Hospitals That Merged

The relationship of key hospital factors with merging between 2005 and 2016 was determined using generalized estimating equations with a logit link and an exchangeable error term for repeated observations. Results are presented in Table 2.

Table 2.

Factors Associated With Rural Hospitals in the Year Prior to Merger (2004-2015).

| Variable | Odds ratio | 95% confidence interval |

|---|---|---|

| (N = 23 894) | ||

| Profitability | ||

| Total margin, % | 0.97*** | 0.95-0.98 |

| Efficiency | ||

| FTEs per bed | 0.97 | 0.92-1.02 |

| Medicare CCR, % | 0.99 | 0.98-1.00 |

| Capital structure | ||

| Ability to cover current debt, % | ||

| Unable to cover current debt (ref) | ||

| Able to cover current debt | 0.64* | 0.45-0.93 |

| Utilization | ||

| Medicare outpatient payer mix, % | 0.99 | 0.97-1.01 |

| Hospital provides obstetrics, % | ||

| Does not provide obstetrics (ref) | ||

| Provides obstetrics | 0.56*** | 0.40-0.80 |

| Other hospital characteristics | ||

| Ownership status, % | ||

| Not-for-profit (ref) | ||

| For-profit | 1.71* | 1.01-2.88 |

| Government | 0.60** | 0.40-0.88 |

| Average plant age, %, quartiles | ||

| Percent in newest quartile (ref) | ||

| Percent in second newest quartile | 1.28 | 0.85-1.93 |

| Percent in second oldest quartile | 1.53* | 1.00-2.34 |

| Percent in oldest quartile | 1.62* | 1.03-2.53 |

| Size (net patient rev, quartiles) | ||

| Percent in smallest quartile (ref) | ||

| Percent in second smallest quartile | 2.20* | 1.12-4.00 |

| Percent in second largest quartile | 3.40*** | 1.74-6.64 |

| Percent in largest quartile | 4.50*** | 1.98-10.22 |

| CAH status, % | ||

| Non-CAH, PPS (ref) | ||

| CAH | 1.15 | 0.74-1.78 |

| Market competitiveness | ||

| Distance to nearest large (>100 bed) hospital (logged miles) | 0.78* | 0.65-0.95 |

| Market share (cases) captured, % | 1.00 | 0.99-1.02 |

| Other market characteristics | ||

| Market total population (logged) | 1.2 | 0.91-1.58 |

| Market unemployment rate, % | 0.99 | 0.94-1.04 |

| Region, % | ||

| South (ref) | ||

| Midwest | 1.06 | 0.70-1.61 |

| Northeast | 1.07 | 0.65-1.77 |

| West | 0.26** | 0.11-0.64 |

| Constant | 0.0023** | 0.0001-0.0919 |

Note. Missing values: Total Margin (104 obs), CCR (48 obs), FTEs per Bed (115 obs), Plant Age (1,064 obs), Size (41 obs), Outpatient Payer Mix (26 obs), Distance (64 obs), Market Share (64 obs), Population (64 obs), Unemployment Rate (64 obs). CCR = Cost to charge ratio; FTE = full-time equivalents; CAH = critical access hospital.

P < .05. **P < .01. ***P < .001.

Profitability

Controlling for other factors, an increase in total margin of 1 percentage point reduced odds of merging by 3%.

Operational efficiency

After controlling for other factors, neither CCR nor FTEs per bed was associated with the odds of merging in a statistically significant way.

Capital structure

Compared with rural hospitals that could not afford current debt, being able to cover current debt reduced odds of merging by 36%.

Utilization

After controlling for other factors, Medicare outpatient payer mix did not affect the odds of merging in a statistically significant way. Providing obstetrics services reduced the odds of merging by 44%.

Other hospital characteristics

After controlling for other factors, for-profits had 76% higher odds of merging than not-for-profits; government-owned hospitals had 40% lower odds of merging than not-for-profits. Relative to rural hospitals that reported plant age among the newest quartile of all rural hospitals, hospitals with the oldest plant age had 62% higher odds of merging. The larger the hospital, the higher the odds of merger. Compared with rural hospitals among the smallest quartile of all rural hospitals, those in the largest quartile had 4.5 times the odds of merging. After controlling for other factors, CAH status was not associated with the odds of merging in a statistically significant way.

Market competitiveness

Controlling for other factors, an increase in logged miles between the merged rural hospital and the nearest large hospital reduced odds of merging by 22%. After controlling for other factors, market share captured was not associated with the odds of merging in a statistically significant way.

Other market characteristics

After controlling for other factors, neither population nor unemployment rate was associated with the odds of merging in a statistically significant way. Compared with rural hospitals located in the south, being in the west region reduced the odds of merging by 74%.

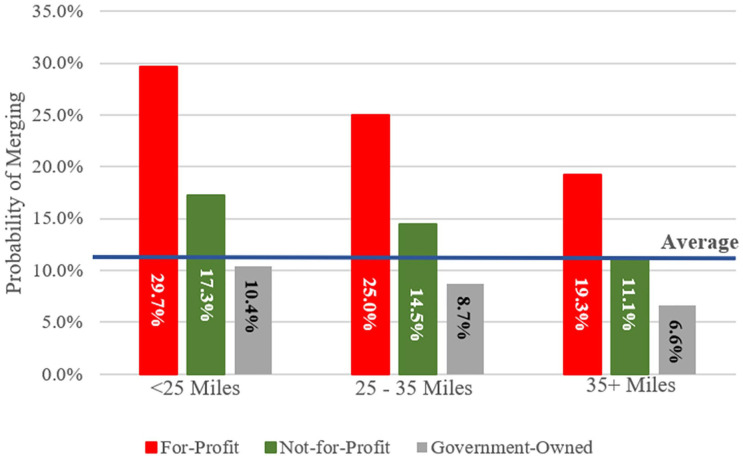

Probability of Merging Between 2005 and 2016 by Distance to Nearest Large Hospital and Ownership Type

We further investigated the relatively large unadjusted differences by merger status in distance and ownership status identified in Table 1 for 2 reasons. One, in studies of U.S. (eg, not specifically rural) hospitals, proximity has been associated with acquirers’ abilities to influence changes at target hospitals.69,70 And two, for-profit hospitals have different financial objectives than other ownership types.56-59 We expected the relatively large proportion of for-profit rural hospitals that merged to be closer to the nearest large hospital so the acquirer can influence changes at the target. Therefore, we determined the relationship of distance and ownership status with merging between 2005 and 2016. Unlike the descriptive statistics (Table 1) and regression model (Table 2), distance was categorized as <25, 25 to 35, and >35 miles to visually display differences in the relationship of distance and ownership status across policy-relevant categories. These categories were considered policy-relevant because of the potential impact of distance to the nearest hospital on CAH eligibility. (Hospitals must meet certain criteria to be eligible for the Critical Access designation. Most hospitals must be located in a rural area, be more than a 35-mile drive to the next hospital, and maintain no more than 25 inpatient beds (with certain allowable exceptions).62) Results are presented in Figure 3.

Figure 3.

Probability of merging between 2005 and 2016 by distance to nearest large hospital and ownership type.

Closer, for-profit hospitals were more likely to merge than farther, not-for-profit or government-owned hospitals. As distance increased, the likelihood of merging fell for rural hospitals of all ownership types. The closest (eg, <25 miles to the nearest large hospital) for-profits were 10.4 percentage points more likely to merge than the farthest for-profits (29.7% probability and 19.3%, respectively). No matter the distance, when compared with not-for-profits or government-owned hospitals, for-profits were more likely to merge. The farthest for-profits were more likely to merge than the closest not-for-profits (19.3% probability and 17.3%, respectively).

Discussion

We identified several significant antecedents associated with rural hospitals that merged between 2005 and 2016. These factors included total margin, ownership status, ability to cover current debt, average plant age, size, whether a hospital provided obstetric services, distance to the nearest large hospital, and region.

In general, findings provided some support for our hypothesis that rural hospitals merge to improve financial performance and access capital, whereas acquirers merge with rural hospitals to increase market power. Broadly, rural hospitals with worse financial performance had higher odds of merging. As total margin increased, odds of merging decreased. Merger odds were lower for rural hospitals that could afford to pay existing debt, compared with those that could not. These findings were consistent with Noles et al, who showed rural hospitals with higher total margins and a larger proportion of equity financing were less likely to merge.21 Results from our study and prior research suggested rural hospitals in worse financial standing were more likely to merge. Operating older facilities was associated with higher odds of a rural hospital merging. Rural hospitals with these characteristics may have merged to improve profits, payoff existing debt, and/or access capital to replace aging facilities.

Rural hospitals that were closer to the nearest large hospital and larger had higher odds of merging. In separate (unreported) work, we evaluated distance for patients in a rural hospital’s market (rather than the rural hospital itself) to the nearest large hospital and found similar, statistically significant differences in miles to the nearest large hospital by merger status. Both distance findings suggested proximity to the nearest large hospital increased the odds of merging. Our findings are consistent with previous work that found proximity, measured between target hospital and the nearest large hospital, was associated with a higher likelihood of U.S. hospitals merging.19,20 However, inference to these studies should be limited due to differences in samples (eg, we evaluated only rural hospitals, these studies evaluated a combination of rural and nonrural hospitals) and time periods (eg, our sample was 2005 through 2016, Harrison’s sample was 1981-1998, Dranove and Lindrooth’s was 1988-2000).19,20

One explanation for our proximity finding could have been that those rural hospitals were appealing targets for acquirers seeking to increase market power. Various measures of proximity have been shown to affect acquirers’ abilities to make postmerger operational changes at targets.28,34,64 While proximity is linked to higher postmerger prices at merged U.S. hospitals (eg, not specifically rural),26 those increases have also been shown to dissipate as proximity decreases.69 Cooper et al found target U.S. hospitals significantly increased postmerger prices when merging entities were geographically close (eg, ≤5 miles apart) but did not increase prices for hospitals that were geographically distant (eg, >25 miles apart).69 However, hospitals in Cooper et al’s sample generally operated in highly competitive markets, with more than 50% operating markets with 3 or more competitors.69 A disproportionately low 16% of hospitals in Cooper et al’s sample were rural.69 Rural hospitals typically operated in less competitive markets.71 Therefore, the association between proximity and postmerger price changes may differ at rural hospitals. Different mileage thresholds, such as those we evaluated around CAH eligibility mileage, may be more relevant to contextualize those changes. In our sample, 60% of rural hospitals were more than 25 miles from our proximity measure. Future work should consider the potential impact of proximity on postmerger changes at rural hospitals and how that impact may differ between rural and nonrural hospitals. Such work could be helpful for decision-makers addressing postmerger changes at rural hospitals.

We found for-profit rural hospitals had significantly higher odds of merging than not-for-profits or government-owned hospitals. This finding contradicted a previous finding from Harrison that not-for-profit U.S. hospitals were more likely to merge, particularly with other not-for-profits.20 It is possible findings varied due to differences in studies, (eg, samples and time periods). It is possible that a replication of Harrison’s study in today’s environment would find a shift in the impact of ownership status on merging U.S. hospitals that reflects our findings for rural mergers. We explored potential differences by comparing ownership status of all U.S. hospitals for a period of Harrison’s study to ours and found, in general, for-profit ownership of rural and nonrural hospitals has increased over the past 2 decades.39 For-profits have different financial objectives, relative to other ownership types,56-59 which may be associated with an increase in for-profit ownership and with faster decision-making that led to more for-profit hospitals mergers, regardless of rurality. Another potential explanation for differences between studies could be that more for-profit rural hospitals merged than for-profit nonrural hospitals. During the sample period, one of the largest for-profit rural hospital owners, Community Health Systems (CHS), divested most of its rural hospitals to reduce debt and ultimately improves cash flow and profits.72 As several of our findings suggested financially constrained rural hospitals with higher debt loads had greater odds of merging, many for-profit rural hospitals could have merged during the sample period as part of a for-profit sell-off.

Larger rural hospitals had higher odds of merging. This could be consistent with Harrison’s finding that U.S. hospital acquirers and targets were of similar size.20 We did not assess if merged rural hospitals were of similar size to the acquirer. However, rural hospitals were generally much smaller than nonrural hospitals; therefore, it is possible that the largest rural hospitals were closer in size to acquirers.

We did not identify statistically significant associations of several factors with merging. These factors included Medicare CCR, FTEs per bed, market share captured, population, and unemployment rate. Further research is warranted to better understand value-creating antecedents associated with rural hospital mergers.

Implications

Findings contributed to the literature in at least 4 meaningful ways. One, we identified which rural hospitals merged. Two, we determined when rural hospitals merged. The Levin data’s announcement date was essential to identify rural hospitals that potentially merged. However, we expected our effective date would be more precise to determine associations of time-varying antecedents with whether rural hospitals merged than the announcement date because it captured the same moment of ownership transfer at every merged hospital. The average announcement date occurred 109 days prior to the effective date. However, the announced date did not always precede the effective date. Five percent of announced dates followed the effective date. Nineteen percent of announced and effective dates were the same. Because we evaluated mergers at discrete time periods (eg, relative to the HFY), differences in dates were only relevant if the announced date did not occur in the correct HFY. Had we evaluated rural mergers using the HFY associated with the announced date rather than the effective date, we would have evaluated different HFYs 64% of the time. We tested for the effect of the difference in announced and effective dates on findings by performing separate (unreported) analyses using the announced date instead of the effective date and determined there were statistically significant differences between models. It is likely that the model using the announced dates introduced measurement error that attenuated estimates toward the null. In the future, researchers should consider the potential for divergent findings based on how merger dates are measured.

Three, we described unadjusted characteristics of rural hospitals that merged and compared those characteristics to nonmerged rural hospitals. Four, we determined whether several value-creating antecedents were associated with whether rural hospitals merged using multivariate regression and controlling for relevant factors. Differences in the unadjusted descriptive statistics (Table 1) and adjusted regression estimates (Table 2) highlighted the importance of the latter estimates for accurately determining antecedents associated with whether rural hospitals merge.

Findings from this study expanded our understanding of rural hospital merger antecedents. Similar to previous work, we found performing worse financially was associated with higher odds of merging.21 We added to what was previously known by determining several other value-adding antecedents, like the association of older plant age with merging. Therefore, financially fragile rural hospitals may have merged to access capital for facility renovations and replacements. In future work, we will determine whether rural hospitals increase capital expenditures in the postmerger period.

Our findings also suggested what was previously known about U.S. hospital merger antecedents may not be generalizable to rural hospitals. We found for-profit rural hospitals were more likely to merge, whereas prior work found not-for-profit U.S. hospitals were more likely to merge, particularly with other not-for-profits.20 Also, we linked proximity with rural hospitals merging, which was consistent with prior U.S. hospital merger findings.19,20 However, a more detailed look at proximity and postmerger changes (eg, prices)69 led us to question whether unique differences between rural and nonrural hospital proximity may have impacted postmerger outcomes at rural hospitals in unknown ways. Researchers could determine whether baseline differences lead to divergent impacts on rural, relative to nonrural, hospitals. Such findings might impact how policy-makers address legislation that impacts merger activity and health care in rural communities.

Conclusions

There are 3 principal findings from this study. First, rural hospitals have been active participants in the decade-long merger boom that has reconfigured hospital care. Moreover, the extent of this participation increased substantially during the study period, supporting the need for more recent rural merger research. Second, rural hospitals with worse financial performance had higher odds of merging. This finding could suggest that rural hospitals merge to improve financial performance and access capital. This finding is particularly important for rural hospitals, which typically perform worse financially than urban hospitals73 and may be at an increased risk of closure. Finally, research findings about rural hospital mergers can vary with how merger dates are measured. Thus, results may vary depending on whether the announced or effective date is used.

Limitations

This study had several limitations that should be considered when interpreting the results. First, our treatment sample included only hospitals that met our definition of a merger. Thus, hospitals engaging in affiliations and other integration models between 2 hospitals were included as controls. Failing to identify nonmerged affiliations could have attenuated coefficients toward the null if similar characteristics are predictive of merger and other forms of integration. Second, our sample was limited by left and right censoring (eg, we did not know which hospitals merged before the sample period began in 2005 or after the sample period ended in 2016). Still, our design allowed us to examine hospital characteristics in the period immediately prior to a merger. Finally, generalized estimating equations were limited to population-level average interpretations. Therefore, associations could not be interpreted for specific hospitals.

Supplementary Material

Acknowledgments

The authors greatly appreciate the collaboration of Hilda Ann Howard and Randy Randolph, who helped determine whether and when rural hospitals merged as well as provided technical data assistance. The authors also thank the Federal Office of Rural Health Policy for making this research possible.

Appendix

Inclusion/Exclusion Criteria for Rural Hospitals Based on Merger Status

Consider a rural hospital in Oklahoma that merged in 2007. Because this hospital reported cost reports for all years of the sample period, it was included in the treatment group once (eg, 2006) and in the control group twice (eg, 2004 and 2005) (as represented by the blue and green years, respectively, in Appendix Figure 1). While this hospital did not merge prior to 2007, we considered it a valid comparison to hospitals that merged in those years. Because we limited our analysis to the first merger during our study period, we exclude merged hospitals from re-entering the comparison group postmerger (gray in Appendix Figure 1). Rural hospitals that did not merge during the sample period but reported cost report data for each of the 12 analytical years (2004-2015) were included in the comparison group all 12 years (represented as the green years in the bottom right image of Appendix Figure 1).

Figure A1.

The inclusion of merged hospitals in treatment and comparison group analytical year.

Note. HFY = hospital fiscal year.

Footnotes

Author Contributions: DW performed primary research question development, data collection, cleaning, analysis, and paper composition. All other authors substantially contributed to research question development, theoretical motivation, data collection, analysis, and paper editing.

Declaration of Conflicting Interests: The author(s) declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding: The author(s) disclosed receipt of the following financial support for the research, authorship, and/or publication of this article: This research was partially supported by (1) a National Research Service Award Pre-Doctoral/Post-Doctoral Traineeship from the Agency for HealthCare Research and Quality sponsored by The Cecil G. Sheps Center for Health Services Research, The University of North Carolina at Chapel Hill, Grant No. T32-HS000032. (2) This study was also partially supported by the Federal Office of Rural Health Policy (FORHP), Health Resources and Services Administration (HRSA), U.S. Department of Health and Human Services (HHS) under cooperative agreement # U1GRH07633. The information, conclusions, and opinions expressed in this brief are those of the authors and no endorsement by FORHP, HRSA, HHS, or the University of North Carolina is intended or should be inferred. Dr. Williams was partially supported by the Health Resources and Services Administration (HRSA) of the U.S. Department of Health and Human Services (HHS) as part of the National Telehealth Center of Excellence Award (U66 RH31458).

ORCID iD: Dunc Williams  https://orcid.org/0000-0002-8716-0052

https://orcid.org/0000-0002-8716-0052

Supplemental Material: Supplemental material for this article is available online.

References

- 1. Cutler DM, Morton FS. Hospitals, market share, and consolidation. JAMA. 2013;310(18):1964-1970. [DOI] [PubMed] [Google Scholar]

- 2. The HITECH Act was part of the American Recovery Reinvestment Act (ARRA). In: 2009. https://www.congress.gov/bill/111th-congress/house-bill/1/text. Accessed May 3, 2020.

- 3. MACRA Alternative Payment Models (APMs) Merit-Based Incentive Payment System (MIPS). In: 2015. https://www.cms.gov/Medicare/Quality-Initiatives-Patient-Assessment-Instruments/Value-Based-Programs/Value-Based-Programs.html.

- 4. Centers for Medicare & Medicaid Services. Fiscal year 2015 results for the CMS Hospital-Acquired Condition Reduction Program and hospital value-based purchasing program. https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2014-Fact-sheets-items/2014-12-18-2.html. Published 2014. Accessed January 31, 2018.

- 5. Centers for Medicare & Medicaid Services. Hospital-Acquired Condition (HAC) Reduction Program. https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/HAC-Reduction-Program.html. Published 2014. Accessed January 31, 2018. [DOI] [PubMed]

- 6. Centers for Medicare & Medicaid Services. Better care. Smarter spending. Healthier people: paying providers for value, not volume. https://www.cms.gov/Medicare/medicare-fee-for-service-payment/acuteinpatientPPS/readmissions-reduction-program.html. Published January 26, 2015. Accessed January 31, 2018.

- 7. Zuckerman AMF. Healthcare mergers and acquisitions: strategies for consolidation. Front Health Serv Manage. 2011; 27(4):3; discussion 39-41. [PubMed] [Google Scholar]

- 8. KPMG. 2015. M&A Outlook Survey Report. https://imaa-institute.org/docs/m&a/kpmg_01_Unlocking-Shareholder-Value-The-Keys-to-Success.pdf. Published 2015. Accessed June 18, 2020.

- 9. Knapp C, Peterson J, Gundling R, Mulvany C, Gerhardt W. Hospital M&A: when done well M&A can achieve valuable outcomes. In: Deloitte & HFMA; 2017. https://www2.deloitte.com/us/en/pages/life-sciences-and-health-care/articles/hospital-mergers-and-acquisitions.html. Accessed June 23, 2020.

- 10. Author’s analysis of Irving Levin’s “The Health Care Services Acquisition Reports . . .” 2005-2016. https://products.levinassociates.com/downloads/har2020/.

- 11. Gamm L, Van Nostrand JF. Rural Healthy People 2010: a companion document to healthy people 2010. School of Rural Public Health, Texas A&M University System Health Science Center, Southwest Rural Health Research Center; 2003. https://srhrc.tamhsc.edu/docs/rhp-2010-volume1.pdf. Accessed June 18, 2020. [Google Scholar]

- 12. Hilsenrath PFK. Economic transformation in health care: implications for rural communities. J Rural Health. 2013;29(4):337-338. [DOI] [PubMed] [Google Scholar]

- 13. Arcury TA, Gesler WM, Preisser JS, Sherman J, Spencer J, Perin J. The effects of geography and spatial behavior on health care utilization among the residents of a rural region. Health Serv Res. 2005;40(1):135-156. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14. Jane van D. Where we live: health care in rural vs urban America. JAMA. 2002;287(1):108-113. [PubMed] [Google Scholar]

- 15. Clawar M, Thompson KW, Pink G. Range matters: rural averages can conceal important information. North Carolina Rural Health Research Program; 2018. https://www.ruralhealthresearch.org/alerts/214. Accessed June 18, 2020.

- 16. Rural Hospital Closures: January 2010-Present. North Carolina Rural Health Research Program. http://www.shepscenter.unc.edu/programs-projects/rural-health/rural-hospital-closures/. Accessed July 14, 2015.

- 17. Holmes GM, Kaufman BG, Pink GH. Predicting financial distress and closure in rural hospitals. The Journal of Rural Health. 2017;33(3):239-249. [DOI] [PubMed] [Google Scholar]

- 18. Federal Office of Rural Health Policy Defining Rural Population. Health Resources & Services Administration; 2010. https://www.hrsa.gov/rural-health/about-us/definition/index.html.

- 19. Dranove D, Lindrooth R. Hospital consolidation and costs: another look at the evidence. J Health Econ. 2003;22(6):983-997. [DOI] [PubMed] [Google Scholar]

- 20. Harrison TD. Hospital mergers: who merges with whom? Appl Econ. 2006;38(6):637-647. [Google Scholar]

- 21. Noles MJ, Reiter KL, Boortz-Marx J., Pink G. Rural hospital mergers and acquisitions: which hospitals are being acquired and how are they performing afterward? J Healthc Manag. 2015;60(6):395-407. [PubMed] [Google Scholar]

- 22. Harrison TD. Do mergers really reduce costs? evidence from hospitals. Econ Inq. 2011;49(4):1054-1069. [DOI] [PubMed] [Google Scholar]

- 23. Bazzoli GJ, LoSasso A, Arnould R, Shalowitz M. Hospital reorganization and restructuring achieved through merger. Health Care Manag Rev. 2002;27(1):7-20. [DOI] [PubMed] [Google Scholar]

- 24. Bogue RJ, Shortell SM, Sohn MW, Manheim LM, Bazzoli G, Chan CL. Hospital reorganization after merger. Med Care. 1995;33(7):676-686. [DOI] [PubMed] [Google Scholar]

- 25. Schmitt M. Do hospital mergers reduce costs? J Health Econ. 2017;52:74-94. [DOI] [PubMed] [Google Scholar]

- 26. Examining the Impact of Health Care Consolidation Statement. The committee on energy and commerce oversight and investigations subcommittee U.S. house of representatives by Martin Gaynor; 2018. https://docs.house.gov/meetings/IF/IF02/20180214/106855/HHRG-115-IF02-Wstate-GaynorM-20180214.pdf. Accessed June 18, 2020.

- 27. Gaynor M. Health care industry consolidation. In Committee on Ways and Means Health Subcommittee. Waysandmeans.house.gov 2013. https://gop-waysandmeans.house.gov/hearing-on-health-care-industry-consolidation/.

- 28. Krishnan R. Market restructuring and pricing in the hospital industry. J Health Econ. 2001;20(2):213-237. [DOI] [PubMed] [Google Scholar]

- 29. Connor RA, Feldman RD, Dowd BE, Radcliff TA. Which types of hospital mergers save consumers money? Health Aff. 1997;16(6):62-74. [DOI] [PubMed] [Google Scholar]

- 30. Syed ST, Gerber BS, Sharp LK. Traveling towards disease: transportation barriers to health care access. J Community Health. 2013;38(5):976-993. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31. Sparling AS, Song E, Klepin HD, Foley KL. Is distance to chemotherapy an obstacle to adjuvant care among the N.C. Medicaid-enrolled colon cancer patients? J Gastrointest Oncol. 2016;7(3):336-344. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32. Ricketts TC, Heaphy PE. Hospitals in rural America. West J Med. 2000;173(6):418-422. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33. Haleblian J, Devers CE, McNamara G, Carpenter MA, Davison RB. Taking stock of what we know about mergers and acquisitions: a review and research agenda. J Manag. 2009;35(3):469-502. [Google Scholar]

- 34. Krishnan RA, Krishnan H. Effects of hospital mergers and acquisitions on prices. J Bus Res. 2003;56(8):647-656. [Google Scholar]

- 35. Nakamura S. Hospital mergers and referrals in the United States: patient steering or integrated delivery of care? Inquiry. 2010;47(3):226-241. [DOI] [PubMed] [Google Scholar]

- 36. Alexander JA, Halpern MT, Lee SYD. The short-term effects of merger on hospital operations. Health Serv Res. 1996;30(6):827-847. [PMC free article] [PubMed] [Google Scholar]

- 37. Sandefer RH, Marc DT, Kleeberg P. Meaningful use attestations among US hospitals: the growing rural-urban divide. Perspect Health Inf Manag. 2015;12:1f. [PMC free article] [PubMed] [Google Scholar]

- 38. Freeman VATK, Howard HA, Randolph R, Holmes GM. The 21st century rural hospital. North Carolina Rural Health Research Program, Cecil G. Sheps Center for Health Services Research; 2015. http://www.shepscenter.unc.edu/wp-content/uploads/2015/02/21stCenturyRuralHospitalsChartBook.pdf. Accessed July 14, 2015.

- 39. Author’s analysis of preliminary data for all rural and non-rural hospitals filing Medicare Cost Reports, 2005-2016. https://www.cms.gov/Research-Statistics-Data-and-Systems/Downloadable-Public-Use-Files/Cost-Reports#:~:text=The%20cost%20report%20contains%20provider,Reporting%20Information%20System%20(HCRIS).

- 40. Kaufman BG, Thomas SR, Randolph RK, et al. The rising rate of rural hospital closures. J Rural Health. 2016;32: 35-43. [DOI] [PubMed] [Google Scholar]

- 41. Landry AYP, Landry RJIIIJDP, Nowak MCF. Factors associated with hospital bankruptcies: a political and economic framework/PRACTITIONER APPLICATION. Journal of Healthcare Management. 2009;54(4):252-271; discussion 271-272. [PubMed] [Google Scholar]

- 42. Foster D, Zrull L, Chenoweth J. Hospital Performance Differences by Ownership. Ann Arbor, MI: Truven Health Analytics; 2013. [Google Scholar]

- 43. Younis M, Rice J, Barkoulas J. An empirical investigation of hospital profitability in the Post-PPS era. J Health Care Finance. 2001;28(2):65-73. [PubMed] [Google Scholar]

- 44. Sear AM. Comparison of efficiency and profitability of investor-owned multihospital systems with not-for-profit hospitals. Health Care Manage Rev. 1991;16(2):31-37. [DOI] [PubMed] [Google Scholar]

- 45. Glied SA, Altman SH. Beyond antitrust: health care and health insurance market trends and the future of competition. Health Aff. 2017;36(9):1572-1577. [DOI] [PubMed] [Google Scholar]

- 46. Brooks GR, Jones VG. Hospital mergers and market overlap. Health Serv Res. 1997;31(6):701-722. [PMC free article] [PubMed] [Google Scholar]

- 47. Saxena SB, Sharma A, Wong A. Succeeding in Hospital & Health Systems M&A Why So Many Deals Have Failed, and How to Succeed in the Future. New York, NY: Booz; 2013. [Google Scholar]

- 48. Drain M, Godkin L, Valentine S. Examining closure rates of rural hospitals: an assessment of a strategic taxonomy. Health Care Manag Rev. 2001;26(4):27-51. [DOI] [PubMed] [Google Scholar]

- 49. Tennyson DH, Fottler MD. Does system membership enhance financial performance in hospitals? Med Care Res Rev. 2000;57(1):29-50. [DOI] [PubMed] [Google Scholar]

- 50. Williams DR, Spaulding TJ. An empirical study of the determinants of location of hospital mergers and acquisitions: 1997-2016. J Health Care Finance. 2018;45 https://www.healthfinancejournal.com/index.php/johcf/article/view/156. Accessed June 18, 2015. [Google Scholar]

- 51. CAH Financial Indicators Team HG, Pink GH, Flex Monitoring Team. CAH Financial Indicators Reports (CAHFIR): indicator means & quartiles by state & peer group. Flex Monitoring Team; 2014. https://www.flexmonitoring.org/publications/annual-financial-indicator-reports/. Accessed June 18, 2015.

- 52. Noles MJ, Reiter K. L., Boortz-Marx J., Pink G. Rural hospital mergers and acquisitions: which hospitals are being acquired and how are they performing afterward? J Healthc Manag. 2015;60(6):395-407. [PubMed] [Google Scholar]

- 53. Hung PY, Henning-Smith CE, Casey MM, Kozhimannil KB. Access to obstetric services in rural counties still declining, with 9 percent losing services, 2004-14. Health Aff. 2017;36(9):1663-1671. [DOI] [PubMed] [Google Scholar]

- 54. Hung PY, Kozhimannil KB, Casey MM, Moscovice IS. Why are obstetric units in rural hospitals closing their doors? Health Serv Res. 2016;51(4):1546-1560. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 55. Hung PY, Kozhimannil KB, Henning-Smith CE, Casey MM. Closure of hospital obstetric services disproportionately affects less-populated rural counties. University of Minnesota Rural Health Research Center; 2017. http://worh.org/library/closure-hospital-obstetric-services-disproportionately-affects-less-populated-rural-counties. Accessed June 18, 2015.

- 56. Hawkins WL, Reiter KL, Pink GH. Peer group factors related to the financial performance of critical access hospitals. J Health Care Finance. 2017;43 http://healthfinancejournal.com/index.php/johcf/article/view/126/130. Accessed June 18, 2015. [Google Scholar]

- 57. Horwitz JR. Making profits and providing care: comparing nonprofit, for-profit, and government hospitals. Health Aff. 2005;24(3):790-801. [DOI] [PubMed] [Google Scholar]

- 58. Horwitz JR, Nichols A. Hospital ownership and medical services: market mix, spillover effects, and nonprofit objectives. J Health Econ. 2009;28(5):924-937. [DOI] [PubMed] [Google Scholar]

- 59. Horwitz JR, Nichols A. Rural hospital ownership: medical service provision, market mix, and spillover effects. Health Serv Res. 2011;46(5):1452-1472. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 60. Kaufman BG, Thomas SR, Randolph RK, et al. The rising rate of rural hospital closures. J Rural Health. 2016;32(1):35-43. [DOI] [PubMed] [Google Scholar]

- 61. Kaufman BG, Reiter KL, Pink GH, Holmes GM. Medicaid expansion affects rural and urban hospitals differently. Health Aff. 2016;35(9):1665-1672. [DOI] [PubMed] [Google Scholar]

- 62. CMS. Critical access hospital fact sheet. https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/downloads/CritAccessHospfctsht.pdf. Published 2016. Accessed June 18, 2015.

- 63. Gresenz CR, Rogowski J, Escarce JJ. Updated variable-radius measures of hospital competition. Health Serv Res. 2004;39(2):417-430. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 64. Dafny L. Estimation and identification of merger effects: an application to hospital mergers. J Law Econ. 2009;52(3):523-550. [Google Scholar]

- 65. Holmes GM, Slifkin RT, Randolph RK, Poley S. The effect of rural hospital closures on community economic health. Health Serv Res. 2006;41(2):467-485. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 66. Patidar N, Weech-Maldonado RO, Connor SJ, Sen B, Trimm JM, Camargo CA. Contextual factors associated with hospitals’ decision to operate freestanding emergency departments. Health Care Manag Rev. 2017;42(3):269-279. [DOI] [PubMed] [Google Scholar]

- 67. Rivest LP. Statistical properties of winsorized means for skewed distributions. Biometrika. 1994;81(2):373-383. [Google Scholar]

- 68. Williams D, Thomas SR, Howard HA, Pink G. Rural hospital mergers from 2005 through 2016. Findings brief for the federal office of rural health policy. NC Rural Health Research Program. August, 2018. https://www.ruralhealthresearch.org/publications/1208. Accessed June 18, 2015.

- 69. Cooper Z, Craig SVC, Gaynor M, Reenen JV. The price ain’t right? hospital prices and health spending on the privately insured. Q J Econ. 2019; 134:51-107. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 70. Dafny LS. Health care industry consolidation: what is happening, why it matters, and what public agencies might want to do about it. Testimony of Leemore S. Dafny. House Committee on Energy and Commerce, Subcommittee on Oversight and Investigations; 2018. https://www.hbs.edu/faculty/Publication%20Files/02.14.2018%20Dafny%20Testimony_4eab90a9-6061-45f1-992a-ccc5c8471483.pdf. Accessed June 18, 2015.

- 71. Author’s analysis of combined dataset and author’s defined markets. [Google Scholar]

- 72. Farmer B. What LifePoint’s merger says about the state of rural hospitals. 2018. https://wpln.org/post/what-lifepoints-merger-says-about-the-state-of-rural-hospitals/. Published July 23, 2018. Accessed September 20, 2018.

- 73. Freeman VATK, Howard HA, Randolph R, Holmes GM. The 21st century rural hospital. North Carolina Rural Health Research Program, Cecil G. Sheps Center for Health Services Research. http://www.shepscenter.unc.edu/wp-content/uploads/2015/02/21stCenturyRuralHospitalsChartBook.pdf. Published 2015. Accessed June 18, 2015.

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.