Abstract

In this paper, we contribute to a growing literature on debt and mental health and ask whether patterns of unsecured debt accumulation and repayment over two decades are associated with depressive symptoms at age 50. Using data from the National Longitudinal Study of Youth 1979 Cohort and group trajectory models, we have three key findings. First, we find substantial heterogeneity in debt trajectories across the life course. Second, respondents who report consistently high debt levels across the life course or who cycle in and out of high debt report significantly more depressive symptoms than respondents who hold consistently low levels of debt. These findings hold for both absolute and relative (debt-to-income) debt. Third, we find that the association between debt and depressive symptoms is strongest among respondents with less than a college degree, but we find less evidence for heterogeneity by race in this cohort.

Keywords: depressive symptoms, economic strains, life course, socioeconomic status, debt

INTRODUCTION

A long literature in the sociology of mental health examines the impact of socioeconomic resources and family finances on mental health (for a review, see McLeod 2014; Yu and Williams 1999). But over the past several decades, consumer debt has become a more central part of family finances. Rising consumer debt has been fueled by a combination of neoliberal social policies that made credit more widely available and harder to repay for the average American consumer, as well as economic conditions that have necessitated families take on debt to supplement stagnant earnings (Campbell 2010; Hyman 2011; Leicht and Fitzgerald 2007). The rapid rise in consumer debt suggests that many US families are having difficulty paying down debt—either by carrying balances forward or taking on additional debt to supplement household income. This raises questions about how this aspect of family finances is associated with mental health as families accumulate and repay debt.

Recent research on debt and mental health conceptualizes debt as a financial stressor that undermines well-being (Drentea 2000; Drentea and Reynolds 2012, 2015). This is especially the case for unsecured debt, which is often harder to repay than secured debt, is typically used to purchase goods and services (rather than assets or human capital), may be used to supplement stagnant wages, and is borrowed at higher cost than secured debt. Unlike other forms of debt, unsecured debt is often accrued in response to major stressful life events and chronic strains, such as job loss, financial insecurity, or chronic illness (Babiarz, Widdows, and Yilmazer 2013; Houle and Berger 2017; Leicht and Fitzgerald 2007; Sullivan 2008; Sullivan, Warren, and Westbrook 2000). As such, unsecured debt can be both a primary and secondary stressor that undermines mental health (Pearlin 1989). However, most research has examined the relationship between debt and mental health at a single point in time or over a brief time horizon. Thus, studies miss long-term trajectories of debt accumulation and repayment that may be important for mental health. Current evidence on the link between debt and mental health is mixed, with some studies finding that unsecured debt is associated with diminished mental health and well-being (Drentea 2000; Drentea and Reynolds 2012) and others suggesting that debt may have positive or neutral benefits for mental health when used to smooth consumption across the life course (Dwyer, McCloud, and Hodson 2011; Hodson, Dwyer, and Neilson 2014).

In this paper, we build on prior research on debt and mental health and ask three research questions. First, we ask to what extent there is variation in unsecured debt repayment and accumulation trajectories across two decades (1985–2008) among a cohort of adults who came of age during an era of financial deregulation and increased access to credit. Here we examine both absolute debt and relative (debt-to-income [DTI]) debt levels. Second, we ask whether trajectories of debt accumulation and repayment are associated with mental health at midlife. Third, drawing from recent literature on rising debt and inequality by race and socioeconomic status (SES), we test for heterogeneity in the association between debt and depressive symptoms by educational attainment and race.

LITERATURE REVIEW

Research on the social determinants of mental health has long recognized that socioeconomic and financial resources are key predictors of psychological distress and well-being (Link and Phelan 1995; Pearlin 1989; Turner and Lloyd 1999). Much of this research does not, however, recognize that debt and access to credit has become an increasingly important part of family finances. Indeed, Drentea (2000) argues that in the twenty-first century, debt is a unique and independent component of socioeconomic status that has ramifications for mental health.

American households carry two broad types of debt: collateralized debt and noncollateralized debt. Noncollateralized or unsecured debt is thought to be particularly problematic for mental health because it is not tied to an asset and is typically borrowed at high cost to purchase goods and supplement wages. Over the past several decades, unsecured debt has become more profitable for banks and in turn more readily available for US households. Compounded by the deregulatory policies of the 1970s and 1980s—such as the rise of interstate lending, which relaxed interest rate caps—the profitability of lending encouraged banks to aggressively market increasingly complex high-interest revolving credit instruments to US households. At the same time, stagnating wages, rising costs of basic consumer goods and health care, and a flagging social safety net increased the need for unsecured debt (Campbell 2010; Leicht and Fitzgerald 2007; Prasad 2012). As a result of these policies and structural conditions, debt became a more prominent part of the household balance sheet and more difficult for the average family to repay as household debt increased from under 90 percent of disposable income in 1986 to 140 percent by 2007 (Campbell 2010). From 1989 to 1994, average household noncollateralized debt rose from $3,653 to $6,339 per family (Lupton and Stafford 2000) and peaked at $8,500 in 2008 (Foust and Pressman 2008). Rising unsecured debt is both a cause and consequence of financial strain on US households and is associated with a host of negative financial outcomes, including bankruptcy (Godwin 1996).

The rise of unsecured debt and the stress of repaying debt raises questions about the impact of debt on mental health. Drawing from the stress paradigm (Pearlin 1989; Pearlin et al. 2005;Turner and Lloyd 1999), scholars have conceptualized unsecured debt as a stressor that undermines mental health (Drentea 2000; Drentea and Reynolds 2015; Zurlo, Yoon, and Kim 2014). Unlike secured debt (e.g., mortgage debt), unsecured debt is thought to be more financially stressful because it is harder to repay, does not help households build assets or human capital, and is often used to supplement household income. Supporting this notion, Berger, Collins, and Cuesta (2016) find that unsecured debt—but not secured debt—is positively associated with depressive symptoms at midlife. This pattern also holds for children’s well-being (Berger and Houle 2016). Using data from a sample of Miami-Dade County residents, Drentea and Reynolds (2015) further argue that debt is a unique “direct” money-related stressor that is independent of coping resources, social status, and other financial stressors. In another study, Drentea and Reynolds (2012) find that the association between debt and mental health is explained by the stress of paying off debt. Other research finds support for this notion, showing, to varying degrees, that unsecured debtor status, debt amounts, and DTI ratios are positively associated with depressive symptoms and that this association is robust to confounding factors (Berger et al. 2016; Bridges and Disney 2010; Gathergood 2012; Reading and Reynolds 2001; Sweet et al. 2013; Zurlo et al. 2014). A meta-analysis by Richardson, Elliott, and Roberts (2013) found that the association between unsecured debt and well-being is stronger for mental health than it is for physical health and strongest for depression. Taken together, this work suggests that debtors report greater symptoms of depression, anxiety, and anger in large part because of the financial strain and worry surrounding debt repayment (Drentea and Reynolds 2012; Zurlo et al. 2014). From a stress process perspective, debt may be both a primary stressor that undermines mental health and a secondary stressor (Pearlin 1989) that is the result of chronic financial strains and stressful life events, such as job loss and health shocks (Babiarz et al. 2013). Other research, however, suggests a more complex relationship between debt and mental health.

While a growing literature shows that debt undermines mental health, some studies highlight the positive impacts of debt on mental health. The importance of debt in achieving key milestones in life and debt’s ability to smooth consumption across the life course suggests that there may be positive effects on well-being (Babiarz et al. 2013; Hodson et al. 2014; Sullivan 2008). Dwyer and colleagues (2011) find that young borrowers experience debt as empowering as they use debt to prepare themselves for the future. Furthermore, young people are more likely to perceive debt as an investment rather than as a burden when they transition into adulthood. In turn, Dwyer et al. (2011) and Hodson et al. (2014) argue that debt is a double-edged sword—it provides resources that may improve mental health, but eventually debt must be repaid and thus may eventually undermine mental health. In other words, prior research may show contradictory findings because debt can provide access to resources that ameliorate distress but also creates stress as individuals struggle to repay that debt.

Debt Accumulation, Repayment, and Mental Health: The Importance of Debt Trajectories over Time

Previous research on debt and well-being tends to measure debt at a single point in time (Dew 2007; Drentea 2000; Drentea and Lavrakas 2000; Drentea and Reynolds 2012; Dwyer et al. 2011; Kalousova and Burgard 2013) or uses longitudinal data over a short time period (Berger et al. 2016; Dew 2008; Dwyer et al. 2016; Hodson et al. 2014). In a review of the literature, Richardson and colleagues (2013) note that the lack of longitudinal data on debt amounts and mental health is a major limitation of current research. A key shortcoming to this approach is that it conflates the short- and long-term consequences of debt, whereby accumulating debt in the short term may be beneficial or nonconsequential for mental health but repayment may be linked with diminished mental health. For example, a respondent with “high” debt at a single point in time may have taken out debt recently and will have little trouble repaying it, while another may have had chronically high debt that he or she has been struggling to repay for several years. Current research on debt and mental health suggests that repayment stress is a key mechanism linking debt and mental health, yet processes of accumulation and repayment—or trajectories of debt over time—have not been measured in prior research.

Research on debt accumulation and repayment suggests variation in trajectories of indebtedness over time that may have implications for well-being. The life cycle savings model (Modigliani 1966) assumes that the modal individual accumulates debt, including unsecured debt (Yilmazer and DeVaney 2005), in young adulthood to smooth consumption and facilitate early life transitions and pays down that debt—and accumulates assets—as he or she ages. However, there are very few tests of this assumption, and recent evidence suggests that this may not be the modal unsecured debt pathway in the United States in an era of credit expansion (Tippett 2010). Debt researchers have long noted that “debt traps”— whereby individuals cycle in and out of debt or fail to pay off debts over time—are common among socioeconomically disadvantaged groups (Bird, Hagstrom, and Wild 1999; Sullivan et al. 2000; Tach and Greene 2014). Moreover, Tippett (2010) challenges the life cycle savings model and finds substantial heterogeneity in the percentage of individuals carrying any unsecured debt across the life course. High and rising levels of unsecured debt and default among older adults nearing retirement (Mann 2011) also cast doubt on the life cycle savings model as it applies to unsecured debt and suggests heterogeneity in accumulation and repayment of debt across the life course. From a life course perspective, departing from normative debt accumulation and repayment trajectories may adversely affect mental well-being because it interferes with life achievement and hinders age-appropriate status attainment (Pearlin et al. 2005). Therefore, carrying high debt burdens across the life course or cycling in and out of high debt levels may have deleterious consequences for mental health.

Also important to consider are relative debt measures or debt relative to economic resources. Absolute measures of debt focus on the total amount of debt owed. Relative measures operationalize debt as a proportion of one’s economic resources—such as a DTI ratio. This distinction is important because socially advantaged households tend to carry higher absolute levels of debt than disadvantaged households, but the amount of debt constitutes a smaller proportion of household income in advantaged households than it does in disadvantaged households (Bird et al. 1999; Johnson and Li 2010). Moreover, high DTI ratios are a stronger indicator of ability to repay debt than absolute debt. If debt invokes stress due to worries about repayment, it is possible that relative debt will be more strongly associated with mental health than absolute debt levels.

A Resource for Some, a Liability for Others? Heterogeneity by Race and SES

Access to credit for socioeconomically disadvantaged groups and people of color has increased over the past several decades, providing these groups with the ability to borrow money in formal credit markets to which they were historically denied access (Bird et al. 1999; Hyman 2011; Seamster and Charron-Chénier 2017). For example, while white households are more likely to have credit cards than minority households, from 1989 to 2004, the percentage of African American households holding debt increased by 21 percent (Garcia 2007). This is also true of socioeconomically disadvantaged households (Bird et al. 1999; Garcia 2007).

Debt scholars have long argued that the social meaning and burden of debt may vary by race and socioeconomic status, and in turn, debt may be more distressing for people of color and those with low socioeconomic status than their more socially advantaged counterparts (Berger and Houle 2016; Hodson et al. 2014; Houle 2014b; Tach and Greene 2014; Walsemann, Ailshire, and Gee 2016).This implies that even when disadvantaged groups have similar levels of debt as their more advantaged counterparts, that debt is more stressful and distressing for disadvantaged groups. Why might this be?

First, while access to credit has increased for disadvantaged groups, this access has come at a cost and on unequal terms. That is, socioeconomically disadvantaged populations and populations of color are disproportionately likely to have access only to high-cost (subprime) credit instruments—such as payday and title loans— that feature high interest rates and fees and are therefore more difficult to pay off (Seamster and Charron-Chénier 2017; Williams, Nesiba, and McConnell 2005). Put differently, historically disadvantaged groups by race and SES have struggled to gain fair access to credit, but in an era of credit expansion, these groups now struggle to gain access to fair credit (Williams et al. 2005).

Second, in addition to the high cost of credit, the need for credit is high among disadvantaged households to meet basic expenses. Most disadvantaged households lack the financial resources to maintain household functioning in the wake of an income shock (McKernan and Ratcliffe 2008), and having insufficient funds to meet basic needs encourages borrowing, even at high cost (Shah, Mullainathan, and Shafir 2012). Disadvantaged households also frequently lack insurance against adverse events and thus borrow, often using a high cost mechanism, in response (Barr 2012; Sullivan 2008). For example, Houle and Berger (2017) find that disadvantaged households are more likely to have a child with a disability, and in response to a birth of a disabled child, they take on more unsecured debt and have difficulty repaying that debt over time. Hodson and colleagues (2014) also find SES-specific effects of debt on mental health: Those with the least resources for repayment have the greatest emotional distress.

The aforementioned literature suggests that debt is more burdensome and more of a liability for low SES groups and people of color than their more advantaged, white counterparts. Stress theory predicts that those who lack resources may experience more deleterious mental health consequences in response to stressors—such as debt burden—than those with more resources (Pearlin 1989). Indeed, these groups tend to incur debt with less agency and at a higher cost than their more advantaged counterparts. In turn, they are: (a) more likely to experience high debt burdens and (b) subject to greater stress and distress in response to these debt burdens (stressors). For these reasons, it is plausible that the link between debt and depressive symptoms are stronger for (a) low SES and (b) people of color than their more advantaged counterparts.

Based on the previously described research and theory, we ask three key research questions:

Research Question 1: Are there distinct trajectories or patterns of debt accumulation and repayment across the life course?

Research Question 2: Are trajectories of relative and absolute debt accumulation and repayment over time associated with subsequent mental health?

Research Question 3: Does this association vary by socioeconomic status and race?

DATA AND METHODS

Data

Data are drawn from the National Longitudinal Study of Youth, 1979 Cohort (NLSY-79). The NLSY-79 is a nationally representative sample of 12,686 young men and women who were between the ages of 14 and 22 in 1979. The response rate across survey years is well over 90 percent in most years, and over three-quarters of initial respondents have been retained (Bureau of Labor Statistics 2005). NLSY-79 respondents were interviewed annually until 1994 and have been interviewed biannually ever since. Our analysis is limited to respondents who were eligible to complete the age 501 health survey by 2014 (N = 7,694). Nine hundred sixty-two respondents were initially omitted due to missing data on study covariates (N = 6,732).1 To account for these missing data, we use multiple imputation using the ICE command in Stata 15.0 (Royston 2005). Multiple imputation is a more efficient and less biased strategy for missing data than listwise deletion (Lee and Carin 2010). The procedure iteratively replaces missing values on all variables with predictions based on random draws from the posterior distributions of parameters observed in the sample, creating multiple complete data sets (Allison 2001) (N = 7,694). We then average results across 10 imputation samples and account for random variation across samples (Royston 2005). The multiply imputed results presented here are similar to results using listwise deletion.

Measures

Absolute and Relative Unsecured Debt.

Data on respondents’ unsecured debt was collected every year from 1985 to 1990 and 1992 to 1994, every two years from 1996 to 2000, and every four years between 2004 and 2008. In total, the NLSY includes 14 repeated measures of unsecured debt over 23 years. During these survey years, after being asked about debts on their homes and automobiles, respondents are asked whether they owe any money on credit cards or to stores, hospitals, or banks. Unsecured debt includes credit (bank or store) card debt; money owed to businesses, individuals, or banks (including auto and payday loans); and medical debt. Unfortunately, our data do not allow us to assess unsecured debt in distinct categories. However, credit card debt is differentiated from other types of unsecured debt in 2004 and 2008 and accounted for approximately two-thirds of all unsecured debt in those years. Following previous research that measures debt over time (Berger et al. 2016; Berger and Houle 2016; Houle and Berger 2017), we applied a ninety-eighth percentile top code to debt in each year and adjusted for inflation so that debt is in constant 2013 dollars. To measure relative debt, we divide total unsecured debt by family income to create a DTI ratio.2 We take the natural logarithm transformation of debt and debt burden (plus a constant to account for 0 debt values) because debt is highly right-skewed (Berger et al. 2016). We then use the logged debt measure across all years to create the debt trajectories described below.

Depressive Symptoms.

Depressive symptoms are measured with a seven-item measure of the Center for Epidemiologic Studies Depression Scale (CES-D) during the age 501 health module. The 501 health module is completed by respondents once in the survey year closest to their fiftieth birthday, in 2008, 2010, 2012, or 2014. As part of the seven-item version of the CES-D scale, respondents were asked the extent to which during the past week “I could not get going,” “I felt sad,” “My sleep was restless,” “I felt that everything I did was an effort,” “I felt depressed,” I had trouble keeping my mind on what I was doing,” and “I did not feel like eating/my appetite was poor.” Ordinal response categories were: rarely/none of the time (0), some/a little of the time (1), occasionally/moderate amount of the time to (2), and most all of the time (3). Responses were summed across all items into a single scale ranging from 0 to 24, with higher scores indicating greater depressive symptoms. We model CES-D scores with a started natural logarithm to account for skewness and heteroscedasticity (Miech and Shanahan 2000). The results presented in the following are substantively similar to results using the untransformed CES-D scale.

Covariates.

Because early adulthood social status is likely to influence both debt accumulation and mental health in adulthood (Addo 2014; Houle 2014a; Nau, Dwyer, and Hodson 2015), we control for early adulthood measures (measured in 1990) of marital status (married [referent], never married, divorced/separated/widowed), highest educational attainment (less than or equal to a high school degree [referent], some college, four-year college degree or more), sex (1 = male; 0 = female), and age at baseline. To ensure that the association between debt and adult mental health is not driven by prior mental health status, we also adjust for lagged depressive symptoms measured in 1992, as measured by a seven-item version of the CES-D scale, identical to the measure administered in the age 501 module. We also control for a dichotomous measure of physical health in early life, which indicates whether the respondent reported a health condition that prevented them from working at any survey wave between 1979 and 1985 (1 = yes). Finally, because debt accumulation and repayment may be affected by employment difficulties and health shocks, we control for two additional measures: (1) measure of the number of unemployment spells of six months or more from 1986 to 2008 (the period during which the debt trajectories are measured) and (2) a measure of the number of waves the respondent reported having a disabling health condition from 1985 to 2008. Descriptive statistics for all variables under study are shown in the Appendix.

Analytic Strategy

Our analysis unfolds in two steps. First, we separately model trajectories of unsecured debt and DTI ratios across the life course using group-based trajectory models with the “traj” command in STATA 15.0 (Jones and Nagin 2013; Nagin 2005). We use a censored normal model because debt has many zeroes and is continuous. Group-based trajectory models are a class of finite mixture models that allow researchers to identify differences in trajectories of outcomes over time. While hierarchical linear models and other trajectory models tend to assume a single average population trajectory, group-based trajectory models allow researchers to ask whether there are multiple trajectories that follow different pathways. The number of trajectory groups are identified based on the best fitting model according to the Bayesian Information Criterion (BIC) and Akaike Information Criterion (AIC) (Jones and Nagin 2013; Nagin 2005). As a form of finite mixture models, group trajectory models can handle incomplete data—that is, respondents need not respond to debt questions at every wave, gaps between time periods can be unequal, and the number of observations (debt measurements) need not be equal across respondents (Haviland, Jones, and Nagin 2011; Nagin 2005).

In the second step of the analyses, we regress depressive symptoms on age 50 on respondent’s predicted debt and DTI trajectory class (previously described) and covariates. Finally, we stratify models by race and educational attainment to test whether the association between indebtedness and mental health varies by race and SES.

RESULTS

Unsecured Debt and Debt-to-income Trajectories across the Life Course: Evidence from Group Trajectory Models

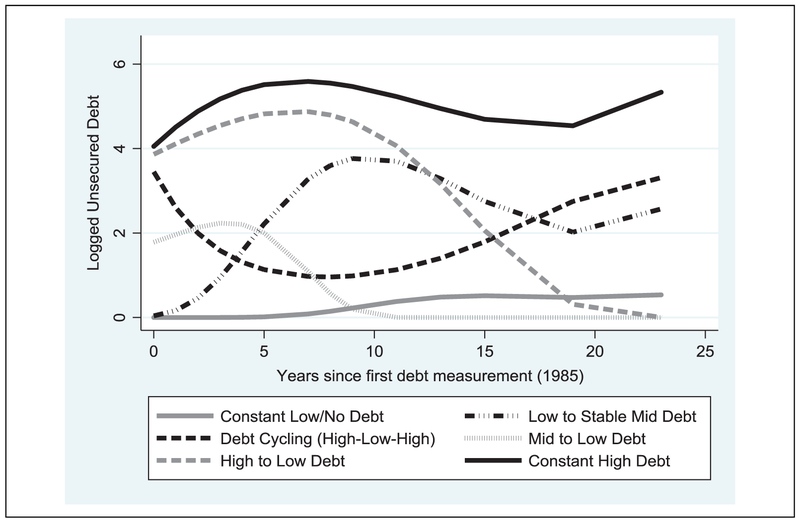

Figures 1 and 2 show results from group trajectory models that estimate heterogeneity in trajectories of logged unsecured debt (Figure 1) and DTI ratios (Figure 2) from 1985 to 2008 in the NLSY-79. The results from these models show that patterns of both absolute and relative (DTI) debt trajectories are more diverse than suggested by a life cycle savings model. Beginning with Figure 1, results from group trajectory models reveal substantial variation in trajectories of unsecured debt over time. The best fitting models (according to BIC and AIC fit statistics) suggest six trajectories in unsecured debt: constant no/low debt = respondents who have low debt or no debt across the life course (16.8 percent of the sample), high to low = respondents who have high levels of debt early in life and pay that debt down (19.4 percent); mid to low = repondents who have moderate debt levels early in life and pay that debt down (11.7 percent), low to stable mid = respondents who begin with low levels of debt and then retain moderate levels of debt over time (17.7 percent), high/low/high = respondents who cycle in and out of high debt over time (13.7 percent), and finally, constant high = respondents who consistently report high levels of debt throughout the observation period (20.9 percent).

Figure 1.

Logged unsecured debt trajectories, 1985–2008.

Source. National Longitudinal Study of Youth, 1979 Cohort.

Note. Trajectories derived from best-fitting group trajectory models. N = 7,694.

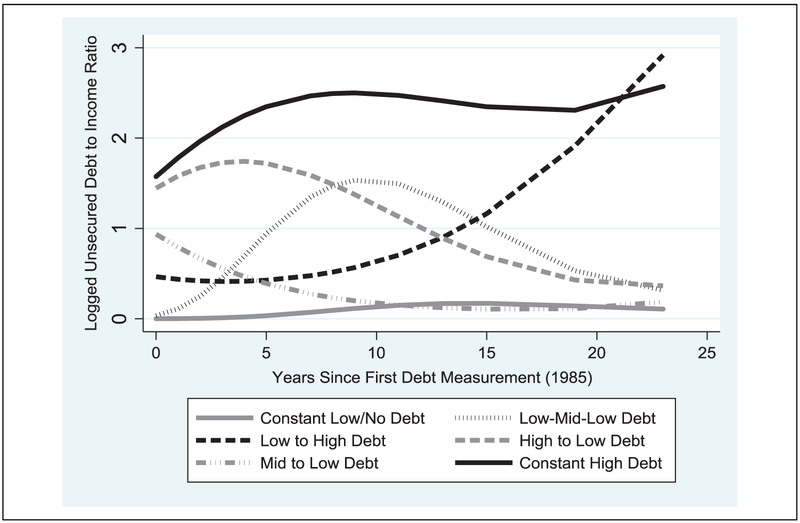

Figure 2.

Logged unsecured debt-to-income ratio trajectories, 1985–2008.

Source. National Longitudinal Study of Youth, 1979 Cohort.

Note. Trajectories derived from best-fitting group trajectory models. N = 7,694.

Results from best fitting group trajectory models predicting relative debt (DTI) also suggest six unique trajectories: constant low/no debt = respondents who report very low DTI ratios over time (18.6 percent), high to low debt = respondents who start with high debt burdens that gradually decline over time (27.2 percent), mid to low = respondents who start with moderate debt burdens that decline over time (17.3 percent), low to high = respondents who begin with low levels of debt burden that increase to high levels over time (11.3 percent), low-mid-low = respondents who begin with low DTI ratios that increase to moderate levels and then decline over time (13.9 percent), and constant high debt = respondents who consistently report high DTI ratios over time (11.7 percent).

Taken together, the results from the group trajectory models suggest that there is substantial heterogeneity in debt and DTI trajectories over time in the NLSY-79. Although the life cycle savings hypothesis suggests that most individuals begin young adulthood with elevated levels of debt and pay that debt down as they age, only a minority of respondents follow a path that resembles that debt trajectory. For example, only 31.1 percent of respondents have high or moderate levels of debt in early life that decrease as they age (high to low and mid to low/no debt trajectory classes), and 44.5 percent of respondents transition from high or moderate DTI ratios in early life to low levels (mid to low and high to low classes).

Debt Trajectory Groups and Mental Health: Results from Ordinary Least Squares Regression Models

Tables 1 and 2 show results from ordinary least squares (OLS) regression models that estimate the association between absolute unsecured debt trajectories (Table 1) and DTI ratio (relative debt) trajectories (Table 2) derived from the group trajectory models described previously and shown in Figure 1 (unsecured debt) and Figure 2 (DTI ratios). In Model 1, we show the bivariate association between debt and depressive symptoms. To assess whether sociodemographic and early life characteristics confound the association, we add race, sex, educational attainment, and age as covariates in Model 2. We add a lagged measure of depressive symptoms and early life health limitations in Model 3. In Model 4, we add measures of unemployment spells and debilitating health conditions across the adult life course, which may confound the association between the debt trajectory patterns and subsequent mental health.

Table 1.

Ordinary Least Squares Regression Models of the Association between Unsecured Debt Trajectory Groups (1985–2008) and Depressive Symptoms (Logged CES-D) at Midlife.

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Unsecured debt trajectories (reference = constant no/low debt) | ||||

| Low to stable mid debt | .045 (.037) |

.080* (.036) |

.039 (.035) |

.045 (.035) |

| High to low debt | −.043 (.038) |

.038 (.039) |

.009 (.037) |

.029 (.036) |

| Mid to low debt | −.110** (.042) |

−.048 (.042) |

−.058 (.041) |

−.039 (.041) |

| Debt cycling (high-low-high) | .131** (.041) |

.141*** (.041) |

.114** (.040) |

.128*** (.039) |

| Constant high debt | .193*** (.037) |

.242*** (.037) |

.171*** (.035) |

.164*** (.034) |

| Early adult social status characteristics | ||||

| Sex (male = 1; female = 0) | −.263*** (.021) |

−.198*** (.020) |

−.186*** (.020) |

|

| Race (white = reference) | ||||

| Black | .043+ (.024) |

−.001 (.023) |

−.030 (.023) |

|

| Other race | −.001 (.045) |

−.038 (.044) |

−.053 (.043) |

|

| Age (1985) | .027*** (.005) |

.028*** (.005) |

.022*** (.005) |

|

| Marital status (married = reference) | ||||

| Never married | .152*** (.025) |

.104*** (.024) |

.062** (.023) |

|

| Divorced/separated/widowed | .159*** (.032) |

.112*** (.030) |

.075* (.030) |

|

| Educational attainment (high school degree or less = reference) | ||||

| Four-year college degree or more | −.248*** (.027) |

−.161*** (.026) |

−.104 *** (.026) |

|

| Some college | −.203*** (.026) |

−.145*** (.025) |

−.107*** (.025) |

|

| Early life (lagged) CES-D (ln) | .294*** (.013) |

.259*** (.013) |

||

| Early life health limitations (1 = yes) | .145*** (.027) |

.018 (.027) |

||

| Number of unemployment spells (1985–2008) | .074*** (.011) |

|||

| Number of disabling health spells (1985–2008) | .070*** (.004) |

|||

| Constant | 1.135 (.027)*** |

.588*** (.117) |

.153 (.114) |

.250* (.112) |

| R2 | .012 | .057 | .131 | .166 |

Note. N = 7,694. CES-D = Center for Epidemiologic Studies Depression Scale.

p < .10.

p < .05.

p < .01.

p < .001.

Table 2.

Ordinary Least Squares Regression Models of the Association between Unsecured Debt-to-income Trajectory Groups (1985–2008) and Depressive Symptoms (Logged CES-D) at Midlife.

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| DTI trajectories (reference = constant no/low debt) | ||||

| Low-mid-low DTI | .021 (.040) |

.060 (.039) |

.041 (.037) |

.050 (.037) |

| High to low DTI | .047 (.033) |

.111*** (.033) |

.083** (.032) |

.092** (.031) |

| Mid to low DTI | −.037 (.036) |

.006 (.036) |

.000 (.034) |

.019 (.033) |

| Low to high DTI | .230*** (.042) |

.223*** (.042) |

.189*** (.040) |

.172*** (.040) |

| Constant high debt | .300*** (.041) |

.322*** (.041) |

.228*** (.039) |

.192*** (.039) |

| Early adult social status characteristics | ||||

| Sex (male = 1; female = 0) | −.259*** (.021) |

−.196*** (.020) |

−.186*** (.020) |

|

| Race (white = reference) | ||||

| Black | .041+ (.024) |

−.003 (.023) |

−.030 (.023) |

|

| Other race | −.001 (.045) |

−.037 (.044) |

−.052 (.043) |

|

| Age (1985) | .028*** (.005) |

.029*** (.005) |

.023*** (.005) |

|

| Marital status (married = reference) | ||||

| Never married | .143*** (.025) |

.098*** (.024) |

.058* (.023) |

|

| Divorced/separated/widowed | .155*** (.032) |

.110*** (.030) |

.074* (.030) |

|

| Educational attainment (high school degree or less = reference) | ||||

| Four-year college degree or more | −.253*** (.027) |

−.166*** (.026) |

−.111*** (.026) |

|

| Some college | −.205*** (.026) |

.147*** (.025) |

.109*** (.025) |

|

| Early life (lagged) CES-D (ln) | .292*** (.013) |

.259*** (.013) |

||

| Early life health limitations (1 = yes) | .143*** (.027) |

.019 (.027) |

||

| Number of unemployment spells (1985–2008) | .052*** (.011) |

|||

| Number of disabling health spells (1985–2008) | .069*** (.004) |

|||

| Constant | 1.109*** (.025) |

.566*** (.117) |

.125 (.115) |

.226* (.112) |

| R2 | .015 | .059 | .131 | .166 |

Note. N = 7,694. CES-D = Center for Epidemiologic Studies Depression Scale; DTI = debt-to-income.

p < .10.

p < .05.

p < .01.

p < .001.

Beginning with Table 1, we find substantive differences in depressive symptoms across absolute debt trajectory groups. Overall, we find that respondents who cycle in and out of high debt levels or have consistently high debt levels have elevated depressive symptoms relative to those with low or no debt. In Model 1, for example, respondents who have consistently elevated levels of debt across the life course report 21 percent higher depressive symptoms (e.193; p < .001) than respondents who report no or low debt across the life course. Similarly, those who cycle in and out of high debt levels (high-low-high) report 14 percent higher depressive symptoms (e.131; p < .001) than respondents with consistently low or zero debt. These findings are robust to controls for social status (Model 2), lagged health and depressive symptoms3 (Model 3), and unemployment and debilitating spells in adulthood (Model 4), though the coefficients do reduce in size as the confounders are added to the models. In supplementary models, we switched the reference group to respondents who followed a “normative” pattern of debt accumulation and repayment according to the life cycle savings model (high to low debt; mid to low debt). These results were similar to the models presented in Table 2. Thus, to the extent that debt is associated with depressive symptoms, it appears most consequential for those who hold high debt over extended periods of time or cycle in and out of high debt levels over time, and these associations are independent of a range of confounding factors across the life course.

In Table 2, we show results from models that predict the association between DTI trajectories and depressive symptoms. Broadly, we find that respondents who experienced high debt burdens at any point in the life course report elevated depressive symptoms, with the largest associations for respondents who have recently taken on high debt burdens or have consistently high debt burdens over time. For example, in Model 4, after adjusting for social status variables, lagged health and depressive symptoms,4 and unemployment and debilitating health spells, we find that those who have consistently high DTI ratios report 21 percent higher depressive symptoms (e.192; p < .001) than those with consistent low or zero DTI ratios. In addition, respondents whose DTI ratios increase over time (low to high) report 19 percent higher depressive symptom scores (e.172; p < .001) than their counterparts with consistently low or zero DTI ratios. In addition, respondents who had very high DTI ratios early in life but pay that debt down report 9 percent higher depressive symptom scores (e.09; p < .001) than those with consistently low or 0 DTI ratios. One interpretation of this result is that having very high debt burdens (DTI) in early life continues to be problematic for mental health even well after that debt is paid off. Results from supplementary analyses also revealed that those who have constantly high or low to high debt burdens also report significantly higher depressive symptoms than respondents who begin adulthood with moderate debt burdens but pay that debt down (mid to low).

Does the Association between Debt and Mental Health Vary by Race and SES?

We present stratified analyses by race and educational attainment in Table 3 (unsecured debt trajectory groups) and Table 4 (DTI ratio trajectory groups). In Panel A, we show stratified models by educational attainment, comparing respondents who have a four-year college degree with those who have less than a college degree. In Panel B, we show stratified models by race, comparing black and white respondents. All models presented include early life social status, lagged physical and mental health, and unemployment spells.

Table 3.

Ordinary Least Squares Regression Models of the Association between Unsecured Debt Trajectory Groups (1985–2008) and Depressive Symptoms at Midlife Stratified by (Panel A) Educational Attainment and (Panel B) Race.

| Panel A: Models Stratified by Educational Attainment | ||

|---|---|---|

| Four-year College Degree + | <Four-year College Degree | |

| Unsecured debt trajectories (reference = constant no/low debt) | ||

| Low to stable mid debt | −.125a (.081) |

.069+a (.038) |

| High to low debt | −.059 (.081) |

.025 (.040) |

| Mid to low debt | −.160+a (.082) |

−.018a (.045) |

| Debt cycling (high-low-high) | .017 (.098) |

.140*** (.041) |

| Constant high debt | .030a (.081) |

.176***a (.038) |

| Constant | .435+ (.233) |

.176 (.127) |

| R2 | .159 | .158 |

| N | 1,648 | 6,046 |

| Panel B: Models Stratified by Race | ||

| White | Black | |

| Unsecured debt trajectories (reference = constant no/low debt) | ||

| Low to stable mid debt | .020 (.046) |

.081 (.058) |

| High to low debt | .035 (.046) |

−.036 (.066) |

| Mid to low debt | −.071 (.052) |

−.019 (.071) |

| Debt cycling (high-low-high) | .113* (.053) |

.127* (.063) |

| Constant high debt | .166*** (.045) |

.160** (.059) |

| Constant | .426** (.140) |

−.108 (.205) |

| R2 | .175 | .153 |

| N | 4,847 | 2,399 |

Note. Models include all study covariates.

Coefficients significantly different across stratified models (p < .10; z test for difference of coefficients).

p < .10.

p < .05.

p < .01.

p < .001.

Table 4.

Ordinary Least Squares Regression Models of the Association between Unsecured Debt-to-income Trajectory Groups (1985–2008) and Depressive Symptoms at Midlife Stratified by (Panel A) Educational Attainment and (Panel B) Race.

| Panel A: Models Stratified by Educational Attainment | ||

|---|---|---|

| Four-year College Degree + | <Four-year College Degree | |

| Unsecured DTI trajectories (reference = constant zero/low DTI) | ||

| Low-mid-low DTI | −.089a (.083) |

.070+a (.041) |

| High to low DTI | .002 (.064) |

.097** (.037) |

| Mid to low DTI | −.080 (.069) |

.034 (.038) |

| Low to high DTI | .051 (.111) |

.187*** (.042) |

| Constant high debt | .063a (.087) |

.202***a (.044) |

| Constant | .407+ (.231) |

.148 (.128) |

| R2 | .156 | .158 |

| N | 1,648 | 6,046 |

| Panel B: Models Stratified by Race | ||

| White | Black | |

| Unsecured DTI trajectories (reference = constant zero/low DTI) | ||

| Low-mid-low DTI | .025 (.046) |

.109 (.069) |

| High to low DTI | .091* (.040) |

.083 (.055) |

| Mid to low DTI | .006 (.044) |

−.010 (.063) |

| Low to high DTI | .204*** (.053) |

.126* (.061) |

| Constant high debt | .202*** (.050) |

.167* (.069) |

| Constant | .402** (.139) |

−.139 (.207) |

| R2 | .175 | .151 |

| N | 4,847 | 2,399 |

Note. Models include all study covariates. DTI = debt-to-income.

Coefficients significantly different across stratified models (p < .10; z test for difference of coefficients).

p < .10.

p < .05.

p < .01.

p < .001.

In models presented in Table 3, we find considerable evidence that the association between debt and depression is strongest for those with less than a college degree. For example, among respondents with less than a college degree, those with constant high levels of debt report 19 percent higher depressive symptom scores (e.176; p <.001) than those with consistently low debt levels. This association is small and nonsignificant among four-year college graduates. Put differently, the association between having consistently high debt loads and depressive symptoms is six times as large for those who lack a college degree (coefficients differ significantly). In addition, among respondents with less than a college degree, those with early increasing debt loads that then level off have significantly higher depressive symptoms than those with low or no debt, and this coefficient is significantly larger than for those who have a four-year college degree or more (z test comparison of coefficients). We find a similar pattern of results when comparing coefficients for those with volatile high debt levels by educational attainment, though the difference in these coefficients is not statistically significant at standard alpha levels.

In Panel B, we find little evidence that the association between debt and depressive symptoms differs for blacks and whites. Across all models, the debt coefficients for blacks and whites are largely similar and are not statistically distinguishable from one another.

When looking at DTI ratio trajectories, we find a similar pattern of results in Table 4. Overall, the association between DTI ratio trajectories and depressive symptoms is stronger among respondents with less than a college degree than among respondents with a college degree or more. For example, the coefficient for constant high DTI ratios is more than three times larger for respondents with less than a college degree compared to respondents with a college degree or more. In Panel B, we find less evidence that the association between DTI trajectory groups and depressive symptoms is larger for blacks than whites.

In addition to the aforementioned models, we estimated additional models to shed further light on the link between debt and depressive symptoms. First, to replicate previous research on debt and mental health, we estimated the association between mean debt across the life course (averaged across all survey waves) and subsequent mental health. Supporting prior research, we found that respondents with higher average levels of debt and debt burdens reported significantly higher levels of depressive symptoms than those with less debt. Second, to further examine differences in the association between debt and mental health across social groups, we stratified models by gender. However, we found few substantive or significant differences in the association between debt and mental health for men and women with one exception: The high-to-low DTI trajectory was associated with greater depressive symptoms for women but not men.

In sum, we find that debtors at the highest risk of depressive symptoms are those who cycle in and out of high debt levels as well as those with consistently high debt. When examining DTI ratios, or relative debt, we find that those who report high debt burdens more frequently and more recently have the highest risk for depressive symptoms. Finally, we find that these associations tend to be strongest among the least educated respondents, but we find less evidence for variation in the association by race.

DISCUSSION

Rising consumer debt in the United States has raised scholarly concern about the impact of this debt on population well-being and mental health. A growing literature suggests that high debt levels are associated with poor mental health, but to date, findings have been mixed, and most studies have focused on the link between debt at a single point in time and concurrent or subsequent mental health. While these findings are informative, research has not considered that debt accumulation and repayment is a process that unfolds across the life course. In this paper, we build on the growing literature on debt and mental health and ask how trajectories of unsecured debt across the life course are linked to mental health at midlife. We have three key findings. First, we find substantial heterogeneity in absolute and relative debt trajectories across the life course, based on results from group trajectory models, and these patterns challenge the assumption that most households accumulate unsecured debt at younger ages and pay that debt down as they age. Second, we find that debt and DTI trajectories are significantly associated with depressive symptoms at midlife. Specifically, that those with consistently elevated debt levels across the life course report the highest levels of depressive symptoms at midlife, on average. Third, we find that the deleterious association between debt and depressive symptoms is generally stronger for those with lower levels of educational attainment. We find less evidence that the association between debt and depressive symptoms varies by race.

Our main findings dovetail with recent research on debt and mental health that show debt is positively associated with depression (Berger et al. 2016; Drentea and Reynolds 2012, 2015; Zurlo et al. 2014) in part because it creates stress over debt repayment (Drentea and Reynolds 2012; Zurlo et al. 2014). Indeed, our findings show that respondents with debt trajectories that are indicative of difficulty with repayment tend to report the highest depressive symptoms. For example, we find that those with consistently high debt levels report higher level of depressive symptoms than those with low or no debt, net of a range of confounders and a lagged measure of mental health. Additionally, those who are cycling in and out of high debt levels—who are likely struggling with debt repayment—also report high depressive symptoms. Those who began young adulthood with moderate or high absolute debt levels but repaid that debt over time reported similar levels of depressive symptoms to those with low or no debt.

We also find that our measure of relative debt (DTI ratios) is more strongly related to depression than absolute debt levels (see e.g., the constant high coefficient in Model 1 Table 1 compared to its corresponding coefficient in Table 2), suggesting that relative debt burdens are more indicative of debt-related stress than absolute levels. However, our pattern of results is broadly similar for both relative and absolute debt, which is likely because our focus on trajectories over time better allows us to capture debt and repayment level stress than point-in-time measures. Taken together, our findings complement recent research that suggests that unsecured debt is a stressor that may undermine mental health.

Our study also builds on prior work in other important ways. First, our study provides insight on the importance of the duration of high indebtedness for mental health. Respondents in our study who reported high levels of debt or DTI ratios for long periods of time (constant high) reported the highest level of depressive symptoms, on average. This suggests that length of exposure is a key dimension of the debt–mental health association. Second, our findings suggest that the timing of debt accumulation relative to one’s life stage may also be an important determinant of mental health. Those who accumulate debt as they approach middle age (low to high debt trajectory) tend to report higher depressive symptoms than those who accumulate debt earlier in life and then pay if off. From a life course perspective, departing from normative debt accumulation and repayment trajectories may adversely affect well-being because it interferes with achievement and hinders age-appropriate status attainment (Pearlin et al. 2005), such as retirement (Mann 2011). As such, future research on this topic should incorporate a life course perspective on debt accumulation and repayment (Elder, Johnson, and Crosnoe 2004; Houle 2014a). While our focus is on unsecured debt, future research might examine how trajectories of secured debt across the life course are associated with mental health and well-being in later life, particularly given the recent foreclosure crisis (Burgard and Kalousova 2015; Houle and Light 2014; Keene and Houle 2014).

Relatedly, our study findings suggest that research that examines debt at a single point in time or over a short time horizon is likely to underestimate the association between debt and mental health. This is because those with elevated debt at a single point in time may have little difficulty paying that debt down and thus may not experience stress or strain repaying that debt. Meanwhile, those who carry balances forward or take on additional debt to help make ends meet may experience stress and poor mental health as a result. One exception to these findings is that respondents who report high DTI ratios early in life but then pay that debt down also report high depressive symptoms. We speculate that this may be because having high DTI ratios (as opposed to high debt levels) in early life may have a scarring effect on future mental health. Theoretically, this could operate through two related mechanisms: First, high DTI ratios can decrease credit scores, and even a few years of low credit scores in early adulthood could reverberate over time and limit access to credit, housing, and labor markets (Fellowes 2006). Second, those with high DTI ratios have a high risk of bankruptcy, and those who pay down that debt may be discharging the debt in bankruptcy. Prior research shows that bankruptcy is a stigmatizing and costly stressful life event that has long-term social and economic consequences (Maroto 2012) as well as consequences for mental health. For example, Addo (2017) uses the NLSY79 and finds that filing for bankruptcy is associated with poor physical health and mental health at midlife. Furthermore, Addo shows that the health consequences of bankruptcy disproportionately affect women and socially disadvantaged populations, which aligns with our finding that the high-to-low DTI coefficient was stronger for women (see aforementioned supplementary analyses) and the least educated.

Our study also contributes to a growing literature on the intersection of debt and social inequality and suggests that indebtedness has greater mental health consequences for less educated populations. In addition to having higher debt burdens, lower SES individuals are more likely to take on debt with higher interest rates, take on debt to help make ends meet, and have more difficulty repaying debt than their more advantaged counterparts (Garcia 2007; Tach and Greene 2014). This suggests that debt is more burdensome and stressful for socioeconomically disadvantaged populations and may contribute to social disparities in mental health. Although we do not find evidence that the link between debt and mental health varies by race, other evidence suggests that the consequences of debt for well-being outcomes are racialized among more recently born cohorts (Houle and Warner 2017; Seamster and Charron-Chénier 2017; Walsemann et al. 2016). We speculate that we may not detect the expected racial differences because blacks in the NLSY79 cohort lack access to credit relative to later born cohorts (Dwyer 2018) and perhaps because our measure of depressive symptoms does not adequately capture mental health problems experienced by black Americans (Brown 2003). To the extent that rising unsecured debt may reinforce and reproduce social disparities in mental health, future research should continue to interrogate the causes and consequences of social disparities in debt and heterogeneity in the consequences of debt by socioeconomic status and race.

This is the first study to our knowledge to examine the link between debt trajectories across the life course and subsequent mental health, but it is not without limitations. First, our study focuses only on the experience of a single cohort (NLSY-79) that came of age and entered adulthood during an era of unprecedented financial deregulation and rising access to credit. It is not clear whether these results or ensuing debt trajectories are generalizable to other cohorts. Future research should consider cohort differences in debt trajectories over time and implications for mental health. Second, while we improve on cross-sectional studies of debt and mental health and adjust for potential confounders and lagged depressive symptoms, our study is ultimately descriptive and does not identify causal effects of debt on mental health (Richardson et al. 2013). Though we control for a range of early life characteristics and stressful life events that may influence debt and mental health, there may be other omitted variables that confound our associations of interest. Third, our measure of mental health is limited to the items in the CES-D, which may not tap other relevant aspects of mental health, including externalizing problems (drug use and heavy drinking), anger, or anxiety. Future research should leverage longitudinal data and alternative measures of mental health to better identify these effects. Finally, we recognize that group trajectory models have limitations and may not accurately depict the true number of underlying trajectory groupings (Warren et al. 2015). However, these models produced theoretically meaningful trajectories, and the findings presented here are substantively similar to findings from models where we hand-coded “naïve” debt trajectories.

Despite limitations, our study sheds new light on the link between indebtedness and mental health and suggests that a substantial number of individuals and families are struggling to pay down unsecured debt, which has implications for levels of and disparities in mental health. Mental health is one of many collateral consequences of financial deregulatory policies that made credit more profitable for banks and more difficult to repay for the American consumer. Rising debt has created new stresses and financial strains in US households and has the potential to exacerbate and reproduce long-standing social disparities in mental health.

ACKNOWLEDGMENTS

We thank Fenaba Addo, Lonnie Berger, Janice McCabe, Kim Rogers, and Emily Walton for their valuable feedback on earlier drafts of this manuscript. This research was supported by a core grant to the Center for Demography and Ecology at the University of Wisconsin-Madison (P2C HD047873) and a grant from the Rockefeller Center at Dartmouth College.

Appendix Descriptive Statistics.

| Mean/Proportion | Standard Deviation | |

|---|---|---|

| Logged CES-D scale (age 50) | 1.180 | .921 |

| Average unsecured debt (1985–2008), 2013 $ | 4,212.00 | 6,653.00 |

| Debt trajectory groups | ||

| Constant no/low debt (referent) | .168 | |

| Low to stable mid debt | .177 | |

| Cycling debt (high-low-high) | .137 | |

| High to low debt | .194 | |

| Mid to low debt | .117 | |

| Constant high debt | .209 | |

| Average debt-to-income ratio (1985–2008) | .148 | .902 |

| Debt-to-income trajectory groups | ||

| Constant no/low debt (referent) | .186 | |

| Low-mid-low debt | .139 | |

| Low to high debt | .113 | |

| High to low debt | .272 | |

| Mid to low debt | .173 | |

| Constant high debt | .117 | |

| Early adulthood characteristics | ||

| Race | ||

| White (referent) | .630 | |

| Black | .312 | |

| Other race | .058 | |

| Sex (male = 1; female = 0) | .486 | |

| Age at first debt measurement (1985) | 23.63 | 2.227 |

| Marital status (1990) | ||

| Married | .517 | |

| Never married (referent) | .339 | |

| Divorced/separated/widowed | .144 | |

| Educational attainment (1990) | ||

| Four-year college degree+ | .214 | |

| Some college | .217 | |

| High school degree or less (referent) | .569 | |

| Logged CES-D scale (1992) | 1.342 | .828 |

| Early life health limitations (by 1985; 1 = yes) | .172 | |

| Number of debilitating health spells (1986–2008) | 1.29 | 2.54 |

| Number of unemployment spells (1986–2008) | .446 | .971 |

Note. N = 7,694. CES-D = Center for Epidemiologic Studies Depression Scale.

Footnotes

Most of the missing data is from the debt variables. Nine hundred and three cases (11.74 percent of total sample) were missing data on debt trajectories. Only 1 percent (80 cases) were missing on depressive symptoms at age 50. Respondents with missing data were significantly more likely to be black, male, younger, and college educated and report lower unsecured debt at baseline than respondents who remained in the sample. Respondents with missing data reported similar levels of depressive symptoms at baseline and age 50 as respondents who did not have missing data.

When constructing debt-to-income ratios, there is debate about how to handle respondents who report debt but zero income. For respondents with zero income, we assumed that the debt-to-income ratio was equal to total debt but top-coded these cases at the maximum debt-to-income ratio observed for respondents with positive income. Results using this strategy were substantively similar to results where we (1) omitted those with zero income from the analysis or (2) added a small dollar amount ($500) to those with zero income.

Additional analyses (not shown, available on request) revealed that those with constant high debt across the life course had significantly higher levels of depressive symptoms at baseline than respondents who had constant no/low debt or who followed normative debt patterns (mid to low or high to low) according to the life cycle savings hypothesis.

Additional analyses (not shown, available on request) revealed that those with constant high debt-to-income across the life course had significantly higher levels of depressive symptoms at baseline than respondents who had constant no/low debt-to-income or who followed normative debt patterns (mid to low or high to low debt-to-income) according to the life cycle savings hypothesis.

REFERENCES

- Addo Fenaba R. 2014. “Debt, Cohabitation, and Marriage in Young Adulthood.” Demography 51(5): 1677–701. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Addo Fenaba R. 2017. “Seeking Relief: Bankruptcy and Health Outcomes of Adult Women.” SSM Population Health 3:326–34. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Allison Paul D. 2001. Missing Data. Thousand Oaks, CA: Sage Publications. [Google Scholar]

- Babiarz Patryk, Widdows Richard, and Yilmazer Tansel. 2013. “Borrowing to Cope with Adverse Health Events: Liquidity Constraints, Insurance Coverage, and Unsecured Debt.” Health Economics 22(10):1177–98. [DOI] [PubMed] [Google Scholar]

- Barr Michael S. 2012. No Slack: The Financial Lives of Low-income Americans. Washington, DC: Brookings Institution Press. [Google Scholar]

- Berger Lawrence M., Collins J. Michael, and Cuesta Laura. 2016. “Household Debt and Adult Depressive Symtpoms in the United States.” Journal of Family and Economic Issues 37(1):42–57. [Google Scholar]

- Berger Lawrence M., and Houle Jason N.. 2016. “Parental Debt and Child Well-being.” Pediatrics 137:1–8. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bird Edward J., Hagstrom Paul A., and Wild Robert. 1999. “Credit Card Debts of the Poor: High and Rising.” Journal of Policy Analyisis and Management 18(1):125–33. [Google Scholar]

- Bridges Sarah, and Disney Richard. 2010. “Debt and Depression.” Journal of Health Economics 29(3): 388–403. [DOI] [PubMed] [Google Scholar]

- Brown Tony. 2003. “Critical Race Theory Speaks to the Sociology of Mental Health: Mental Health Problems Produced by Racial Stratification.” Journal of Health and Social Behavior 44(3):292–301. [PubMed] [Google Scholar]

- Bureau of Labor Statistics. 2005. National Longitudinal Studies Handbook. Washington, DC: US Department of Labor. [Google Scholar]

- Burgard Sarah A., and Kalousova Lucie. 2015. “Effects of the Great Recession: Health and Well-being.” Annual Review of Sociology 41:181–201. [Google Scholar]

- Campbell John. 2010. “Neoliberalism in Crisis: Regulatory Roots of the U.S. Financial Meltdown.” Research in the Sociology of Organizations 30B:65–101. [Google Scholar]

- Dew Jeff. 2007. “Two Sides of the Same Coin? The Differing Roles of Assets and Consumer Debt in Marriage.” Journal of Family and Economic Issues 28: 89–104. [Google Scholar]

- Dew Jeff. 2008. “Debt Change and Marital Satisfaction Change in Recently Married Couples.” Family Relations 57:60–71. [Google Scholar]

- Drentea Patricia. 2000. “Age, Debt and Anxiety.” Journal of Health and Social Behavior 41:437–50. [PubMed] [Google Scholar]

- Drentea Patricia, and Lavrakas Paul J.. 2000. “Over the Limit: The Association among Health, Race, and Debt.” Social Science & Medicine 50(4):517–29. [DOI] [PubMed] [Google Scholar]

- Drentea Patricia, and Reynolds John R.. 2012. “Neither a Borrower nor a Lender Be: The Relative Importance of Debt and SES for Mental Health among Older Adults.” Journal of Aging and Health 24(4): 673–95. [DOI] [PubMed] [Google Scholar]

- Drentea Patricia, and Reynolds John R.. 2015. “Where Does Debt Fit in the Stress Process Model?” Society and Mental Health 5(1):16–32. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Dwyer Rachel E. 2018. “Credit, Debt, and Inequality.” Annual Review of Sociology 44:237–61. [Google Scholar]

- Dwyer Rachel E., McCloud Laura, and Hodson Randy. 2011. “Youth Debt, Mastery, and Self-esteem: Class-stratified Effects of Indebtedness on Self-concept.” Social Science Research 40(3):727–41. [Google Scholar]

- Dwyer Rachel E., Neilson Lisa A., Nau Michael, and Hodson Randy. 2016. “Mortgage Worries: Young Adults and the US Housing Crisis.” Socio-Economic Review 14(3):483–505. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Elder Glen H., Johnson Monica Kirkpatrick, and Crosnoe Robert. 2004. “The Emergence and Development of Life Course Theory” Pp. 3–22 in Handbook of the Life Course, edited by Mortimer J and Shanahan M. New York: Springer. [Google Scholar]

- Fellowes Matt. 2006. Credit Scores, Reports, and Getting Ahead in America. Washington, DC: Brookings. [Google Scholar]

- Foust Dean, and Pressman Aaron. 2008. “Credit Scores: Not-so-magic Numbers.” Businessweek, February 6, pp. 38–41. [Google Scholar]

- Garcia Jose. 2007. Borrowing to Make Ends Meet: The Rapid Growth of Credit Card Debt in America. New York, NY: Demos. [Google Scholar]

- Gathergood John. 2012. “Debt and Depression: Causal Links and Social Norm Effects.” The Economic Journal 122:1094–114. [Google Scholar]

- Godwin Deborah D. 1996. “Newlywed Couples’ Debt Portfolios: Are All Debts Created Equally?” Financial Counseling and Planning 7:57–70. [Google Scholar]

- Haviland Amelia M., Jones Bobby L., and Nagin Daniel S.. 2011. “Group-based Trajectory Modeling Extended to Account for Nonrandom Participant Attrition.” Sociological Methods and Research 40(2):367–90. [Google Scholar]

- Hodson Randy, Dwyer Rachel E., and Neilson Lisa A.. 2014. “Credit Card Blues: The Middle Class and the Hidden Costs of Easy Credit.” The Sociological Quarterly 55(2):315–40. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Houle Jason N. 2014a. “A Generation Indebted: Young Adult Debt across Three Cohorts.” Social Problems 61:448–65. [Google Scholar]

- Houle Jason N. 2014b. “Mental Health in the Foreclosure Crisis.” Social Science & Medicine 118:1–8. [DOI] [PubMed] [Google Scholar]

- Houle Jason N., and Berger Lawrence. 2017. “Children with Disabilities and Trajectories of Parents’ Unsecured Debt across the Life Course.” Social Science Research 64:184–96. [DOI] [PubMed] [Google Scholar]

- Houle Jason N., and Light Michael T.. 2014. “The Home Foreclosure Crisis and Rising Suicide Rates, 2005–2010.” American Journal of Public Health 104(6):1073–79. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Houle Jason N., and Warner Cody. 2017. “Into the Red and Back to the Nest? Student Debt, College Completion, and Returning to the Parental Home among Young Adults.” Sociology of Education 90:89–108. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hyman Louis. 2011. Debtor Nation: The History of America in Red Ink. Princeton: Princeton University Press. [Google Scholar]

- Johnson Kathleen W., and Li Geng. 2010. “The Debt-payment-to-income Ratio as an Indicator of Borrowing Constraints: Evidence from Two Household Surveys.” Journal of Money, Credit and Banking 42(7):1373–90. [Google Scholar]

- Jones Bobby L., and Nagin Daniel S.. 2013. “A Note on a Stata Plugin for Estimating Group-based Trajectory Models.” Sociological Methods and Research 42(4): 608–13. [Google Scholar]

- Kalousova Lucie, and Burgard Sarah A.. 2013. “Debt and Foregone Medical Care.” Journal of Health and Social Behavior 54(2):204–20. [DOI] [PubMed] [Google Scholar]

- Keene Danya, and Houle Jason N.. 2014. “Getting Sick and Falling behind: Health and the Risk of Mortgage Default and Home Foreclosure.” Journal of Epidemiology & Community Health 69(4):382–87. [DOI] [PubMed] [Google Scholar]

- Lee Katherine J., and Carin John B.. 2010. “Multiple Imputation for Missing Data: Fully Conditional Specification Versus Multivariate Normal Imputation.” American Journal of Epidemiology 171(5):624–32. [DOI] [PubMed] [Google Scholar]

- Leicht Kevin T., and Fitzgerald Scott T.. 2007. Postindustrial Peasants: The Illusion of Middle-class Prosperity. New York: Worth Publishers. [Google Scholar]

- Link Bruce, and Phelan Jo C.. 1995. “Social Conditions as Fundamental Causes of Disease.” Journal of Health and Social Behavior 35:80–94. [PubMed] [Google Scholar]

- Lupton Joseph, and Stafford Frank. 2000. Five Years Older: Much Richer or Deeper in Debt? Panel Study of Income Dynamics. Boston, MA: Institute for Social Research, University of Michigan. [Google Scholar]

- Mann Allison. 2011. “The Effect of Late-life Debt Use on Retirement Decisions.” Social Science Research 40(6):1623–37. [Google Scholar]

- Maroto Michelle. 2012. “The Scarring Effects of Bankruptcy: Cumulative Disadvantage across Credit and Labor Markets.” Social Forces 91(1):99–130. [Google Scholar]

- McKernan Signe-Mary, and Ratcliffe Caroline. 2008. Enabling Families to Weather Emergencies and Develop: The Role of Assets. Washington, DC: Urban Institute. [Google Scholar]

- McLeod Jane. 2014. “Social Stratification and Inequality” Pp. 229–53 in Handbook of the Sociology of Mental Health, edited by Aneshensel CS, Phelan JC, and Bierman A. New York: Springer. [Google Scholar]

- Miech Richard, and Shanahan Michael. 2000. “Socioeconomic Status and Depression over the Life Course.” Journal of Health and Social Behavior 41(2):162–76. [Google Scholar]

- Modigliani Franco. 1966. “The Life Cycle Hypothesis of Saving, the Demand for Wealth and the Supply of Capital.” Social Research 33(2):160–217. [Google Scholar]

- Nagin Daniel S. 2005. Group-based Modeling of Development. Cambridge, MA: Harvard University Press. [Google Scholar]

- Nau Michael, Dwyer Rachel E., and Hodson Randy. 2015. “Can’t Afford a Baby? Debt and Young Americans.” Research in Social Stratification and Mobility 42:114–22. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Pearlin Leonard I. 1989. “The Sociological Study of Stress.” Journal of Health and Social Behavior 30(3):241–56. [PubMed] [Google Scholar]

- Pearlin Leonard I., Schieman Scott, Fazio Elena M., and Meersman Stephen C.. 2005. “Stress, Health, and the Life Course: Some Conceptual Perspectives.” Journal of Health and Social Behavior 46(2):205–19. [DOI] [PubMed] [Google Scholar]

- Prasad Monica. 2012. The Land of too Much: American Abundance and the Paradox of Poverty. Cambridge: Harvard University Press. [Google Scholar]

- Reading Richard, and Reynolds Shirley. 2001. “Debt, Social Disadvantage, and Maternal Depression.” Social Science and Medicine 53(4):441–53. [DOI] [PubMed] [Google Scholar]

- Richardson Thomas, Elliott Peter, and Roberts Ronald. 2013. “The Relationship between Personal Unsecured Debt and Mental and Physical Health: A Systematic Review and Meta-analysis.” Clinical Psychology Review 33(8):1148–62. [DOI] [PubMed] [Google Scholar]

- Royston P 2005. “Multiple Imputation of Missing Values: Update of Ice.” Stata Journal 5(4):527–36. [Google Scholar]

- Seamster Louise, and Charron-Chénier Raphaël. 2017. “Predatory Inclusion and Education Debt: Rethinking the Racial Wealth Gap.” Social Currents 4(3): 199–207. [Google Scholar]

- Shah Anuj K., Mullainathan Sendhil, and Shafir Eldar. 2012. “Some Consequences of Having too Little.” Science 338(6107):682–85. [DOI] [PubMed] [Google Scholar]

- Sullivan James X. 2008. “Borrowing during Unemployment: Unsecured Debt as a Safety Net.” The Journal of Human Resources 43(2):383–412. [Google Scholar]

- Sullivan Teresa A., Warren Elizabeth, and Lawrence Westbrook Jay. 2000. The Fragile Middle Class: Americans in Debt. New Haven: Yale University Press. [Google Scholar]

- Sweet Elizabeth, Nandi Arijit, Adam Emma K., and McDade Thomas W.. 2013. “The High Price of Debt: Household Financial Debt and Its Impact on Mental and Physical Health." Social Science & Medicine 91:94–100. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Tach Laura, and Greene Sara Sternberg. 2014. “‘Robbing Peter to Pay Paul’: Economic and Cultural Explanations for How Lower-income Families Manage Debt.” Social Problems 61(1):1–21. [Google Scholar]

- Tippett Rebecca M. 2010. “Household Debt across the Life Course: An Analysis of the Late Baby Boomers.” Doctor of Philosophy, Department of Sociology, Duke University, Durham. [Google Scholar]

- Turner R. Jay, and Lloyd Donald A.. 1999. “The Stress Process and the Social Distribution of Depression.” Journal of Health and Social Behavior 40(4): 374–404. [PubMed] [Google Scholar]

- Walsemann Katrina M., Ailshire Jennifer A., and Gee Gilbert C.. 2016. “Student Loans and Racial Disparities in Self-reported Sleep Duration: Evidence from a Nationally Representative Sample of US Young Adults.” Journal of Epidemiology & Community Health 70:42–48. [DOI] [PubMed] [Google Scholar]

- Warren John Robert, Luo Liying, Halpern-Manners Andrew, Raymo James M., and Palloni Alberto. 2015. “Do Different Methods for Modeling Age-graded Trajectories Yield Consistent and Valid Results?” American Journal of Sociology 120(6): 1809–56. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Williams Richard, Nesiba Reynold, and McConnell Eileen Diaz. 2005. “The Changing Face of Inequality in Home Mortgage Lending.” Social Problems 52(2): 181–208. [Google Scholar]

- Yilmazer Tansel, and DeVaney Sharon A.. 2005. “Household Debt over the Life Cycle.” Financial Services Review 14:285–304. [Google Scholar]

- Yu Yan, and Williams David R.. 1999. “Socioeconomic Status and Mental Health” Pp. 151–66 in Handbook of the Sociology of Mental Health, edited by Aneshensel CS and Phelan JC. Boston, MA: Springer. [Google Scholar]

- Zurlo Karen, Yoon WonAh, and Kim Hyungsoo. 2014. “Unsecured Consumer Debt and Mental Health Outcomes in Middle-aged and Older Americans.” The Journals of Gerontology Series B 69(3):461–69. [DOI] [PubMed] [Google Scholar]