Abstract

We examine the effects of financial stress on online pornography consumption. We use novel data on daily accesses to one of the most popular porn website (xHamster) for 43 different cities belonging to 10 countries for the year 2016. In financial cities, in which people are more likely to be affected by financial stress, we observe that on average online porn viewing decreases as financial stress increases. We present some evidence suggesting the causing channel to be altered mood.

Keywords: Financial stress, Uncertainty, Online pornography

1. Introduction

“Stress and anxiety are known to reduce our sexual desire and a preoccupation with the news, our finances, the health of our loved ones, or how much is in our store cupboards, can understandably slow the wheels of our sex life to a standstill”

The Guardian, “Young Americans having less sex than ever, study finds”, Martin Pengelly,

13/06/2020

Today, pornography represents one of the most important entertainment in our society. With no doubts, the advent of Internet has considerably changed the pornography industry in allowing the anonymous consumption of sexually explicit material, even in places in the world were it is legally forbidden. It has been reported that porn sites get more visitors each month than Netflix, Amazon and Twitter combined. According to Covenant Eyes, around 30% percent of Internet content concerns adult entertainment and the number of porn-related web searches per year is above two billions (http://www.covenanteyes.com/pornstats/). Academic studies on internet traffic have shown that, even if only 4% of websites are estimated to be porn-related, web and mobile searches for pornography account for 13% and 20% of total web searches, respectively (Kamvar and Baluja, 2006, Ogas and Gadda, 2012). Such numbers suggest that online pornography embraces a non-negligible interest from the population. And due to the ongoing COVID-19 emergency the percentage of the World’s population interested in porn is probably increasing.

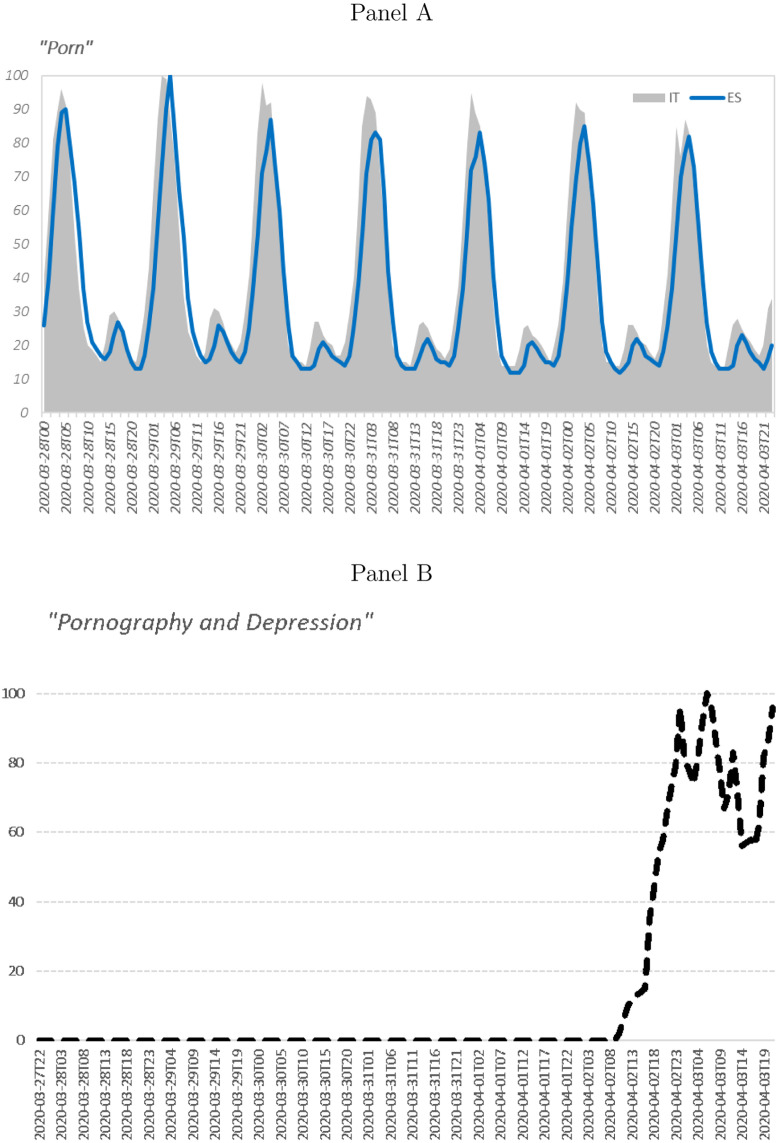

Since the first outbreak in Wuhan the COVID-19 has continued to spread around the world. At the beginning of April 2020 the COVID-19 was affecting 204 countries and territories. Following the Hubei experience, the most affected countries like Italy, Spain and the US after an initial phase of restrictions have imposed lockdowns. As the number of reported cases keeps rising, countries around the world are implementing measures to slow the spread of the coronavirus, from national quarantines to school closures. Today (03.04.2020), more than a third of the planet’s population is under some form of restrictions. This has completely modified the daily behavior of each of us. On the one hand, we have observed and intensification of online shopping activities. On the other hand, internet users and related web searches increased massively. One topic that attracted increasing attention among the World population is “porn”. This stimulated the offer of one of the world’s biggest porn sites to stream its top service for free during the coronavirus quarantine.2 While observing increases in searches for porn during the lockdown around the world (in particular during night times) is not surprising (Fig. 1, Panel A), the skyrocketing dynamics in the search for “porn and depression” is rather worrying (Fig. 1, Panel B). More importantly, this latter evidence embeds a key dimension of novelty, i.e., interests in porn and people mood seem to be empirically related phenomena.

Fig. 1.

Porn and Porn-Related Google Search Intensity.

Notes: Panel A depicts the evolution of the daily frequency of Google searches for “porn” in Italy and Spain during the COVID-19 lockdown period (27.03.2020–03.04.2020). Note that peaks of searches for “porn” in Italy and Spain are on average observed overnight hours (1am–5pm). Panel B depicts the evolution of the most closely-related query to porn (i.e., “pornography and depression”) over the period 27.03.2020–03.04.2020.

Interest in porn is an understudied topic and its causes and consequences remain poorly understood, in part due to the difficulty of getting proper data. In this paper, we study one particular driver of online pornography consumption: stress. Several studies show that stress has inhibitory effects on a variety of activities (e.g., sport and job performances, decision-making, social interactions),3 including sexual activity (Bancroft, 1999, Heaven et al., 2003, Bradford and Meston, 2006). For instance, Bodenmann et al. (2010) document that stressors and experienced stress inhibit the search for sexual activity within couples. In particular, their empirical findings suggest higher self-reported stress to be negatively correlated with sexual activity and satisfaction. On the contrary, recent psychological and human behavior studies indicate that stress (e.g., money stress, work stress and family stress) significantly increases the occurrence of porn watching (Black and Hendy, 2019). While there are neuroscience and human biology explanations for such opposite effects (Heinrichs et al., 2003, Finke et al., 2018), understanding which mechanism prevails is ultimately an empirical question.

Unfortunately, most of the aforementioned empirical studies rely on small experimental samples or on individual surveys, which are not exempt of subjective biases or self-selection issues. We propose to use an exogenous and unexpected specific stress, that we call financial stress, and that is generated by financial markets fluctuations.4 Financial stress has the additional (analytical) advantage of impacting a large set of individuals at the same time. Moreover, some individuals will be more affected than others; we argue that this will be the case for individuals working in the finance industry or living in the proximity of a financial district.

To measure financial stress we rely on various financial volatility indexes, following the literature on the macroeconomic effects of rising financial risk and uncertainty (Bloom, 2009, Dzielinski, 2011, Donadelli, 2015, Baker et al., 2016, Bontempi et al., 2019). The main novelty of the present study is the information on online pornography consumption. We proxy online pornography consumption with data that were kindly provided to us by xHamster, which is among the top five most popular and visited websites for free online pornography.5 Noteworthy, as of 2019 xHamster’s traffic jumped to 1.0B (billions of visitors per month). According to Alexa (a leading Web-traffic tracker), xHamster is also among the planet’s top 100 sites.

We investigate whether financial stress does reduce pornography consumption. We do not see a clear and precise pattern relating financial stress and online pornography consumption overall. However, people living in financial cities are arguably more influenced by financial market turmoil and, accordingly, we observe that consumption of online pornography decreases as financial stress rises in financial cities. This suggests that stress might indeed affect online pornography consumption more generally; we only observe an effect for financial cities because we focus on one particular type of stress, financial stress, that most likely affects people living in financial cities. Further investigations on the US subsample suggest that financial stress affects online pornography consumption through an impact on people’s mood and not through a re-balancing of their working and leisure time.

The paper is structured as follows. Section 2 describes the data and the empirical framework. Section 3 documents the main empirical findings and the implications for online pornography consumption of rising financial stress. Section 4 concludes.

2. Data and methodology

Online Pornography. Daily pornographic videos accesses at the city-level (43 cities in 10 countries) for the year 2016 were kindly provided to us by xHamster. These consist in percentage deviations from the mean observed within the year 2016 and within city. We therefore abstract from level effects at the city-level and focus on deviations from the “normal” daily online pornography consumption in each city.6 The time series of the online pornography data for each city are provided in section A of the Appendix.7

Financial Stress. For the sake of robustness, a large set of standard volatility measures is employed. For each country, we make use of seven contemporaneous volatility indexes. First, using daily returns computed from MSCI Country Equity Price Indexes,8 we develop the following four volatility indexes: () RW 2-weeks rolling window standard deviation; () squared daily returns; () GARCH = volatility computed from conditional variance estimated from a GARCH(1,1); () E-GARCH volatility computed from conditional variance estimated from a E-GARCH(1,1). We then employ the () 5 min realized volatility and () 10 min realized volatility. Both realized volatility measures are from the Oxford-Man Institute of Quantitative Finance Realized Library.9 Finally, we employ () the option implied volatility index. For each country, this has been retrieved from https://www.investing.com/indices.10 As indicated by Datta et al. (2017), these volatility indexes can be classified as equity market-based measures of risk and uncertainty.

Therefore, we additionally use () a news-based measure of risk and uncertainty, i.e. the US Economic Policy Uncertainty (EPU) Index of Baker et al. (2016), () two commodity market-based measures of risk and uncertainty, i.e. the CBOE Crude Oil ETF Volatility Index and the CBOE Gold ETF Volatility Index. The EPU index is taken from http://www.policyuncertainty.com/, whereas the Oil VIX and the Gold VIX are both from the St. Louis Fed.

Empirical strategy. To analyze the effect of financial stress on online adult entertainment, we regress online pornographic videos accesses on the previously described finance-related volatility indexes. Formally,

| (1) |

where represents daily pornographic videos accesses in city in country and denotes daily financial market stress in country . is a dummy variable taking value 1 if city is a financial city and zero otherwise.11 are country dummies. Robust standard errors are clustered at the city-level. We hypothesize that financial stress will negatively affect online pornography consumption, i.e. that will be negative. Furthermore, financial cities, that have a larger fraction of the population working in the finance industry, should be even more impacted. In other words, we expect the coefficient to be negative.

In addition to the pooled analysis, we also perform regressions separately by city and by country, i.e,

| (2) |

| (3) |

where represents the Porn Access Index in country .12

3. Empirical evidence

Pooled regressions. Table 1 presents estimation results for the different volatilities we use to capture financial stress. Coefficients on volatility measures are neither consistently positive or negative nor always significant. However, coefficients on volatility measures interacted with the financial city dummy are globally negative and significant at the 10% level. In financial cities, people are more likely to be affected by financial stress, either because they work themselves in the finance industry or are subject to (negative) externalities from others working in the finance industry and with whom they interact. Our result therefore suggests that, when people are likely to be affected by stress, their demand for online pornography entertainment decreases.13 Broadly, our findings are in line with experimental studies indicating that subjective stress induced by external stressors is negatively correlated with sexual behavior, sexual satisfaction and orgasm frequency (Bodenmann et al., 2010).

Table 1.

Effect of financial stress on online pornography consumption (pooled regressions).

| Dependent variable: Online Pornographic Videos Accesses | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| Volatility | −0.00351 | 0.670 | 3.237 | 3.013 | 388.0 | 433.1 | −0.230 | −0.220⁎⁎⁎ | −0.705 |

| (0.0690) | (1.810) | (2.969) | (2.849) | (372.1) | (432.0) | (0.201) | (0.0706) | (0.981) | |

| [0.960] | [0.713] | [0.282] | [0.296] | [0.303] | [0.322] | [0.261] | [0.003] | [0.477] | |

| Volatility⁎Financial City | −0.249 | −7.731⁎ | −9.820⁎ | −11.01⁎ | −924.0⁎ | −1052.6⁎ | −0.951⁎ | −0.0620 | −0.0462 |

| (0.174) | (4.183) | (5.132) | (5.783) | (533.8) | (599.8) | (0.554) | (0.108) | (1.581) | |

| [0.160] | [0.072] | [0.063] | [0.064] | [0.091] | [0.087] | [0.096] | [0.569] | [0.977] | |

| Financial City | 0.897⁎⁎⁎ | 8.965⁎⁎ | 12.33⁎⁎ | 13.47⁎⁎ | 7.968⁎ | 8.958⁎ | 18.64⁎ | 0.588⁎⁎ | 0.546 |

| (0.330) | (4.406) | (5.910) | (6.521) | (4.329) | (4.848) | (10.77) | (0.250) | (1.717) | |

| [0.009] | [0.048] | [0.043] | [0.045] | [0.073] | [0.072] | [0.093] | [0.024] | [0.752] | |

| Country Dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| 0.005 | 0.012 | 0.013 | 0.014 | 0.013 | 0.014 | 0.055 | 0.005 | 0.004 | |

| Observations | 11 180 | 11 180 | 11 180 | 11 180 | 10 778 | 10 778 | 8 080 | 11 180 | 11 180 |

| (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | ||

| Volatility | −2.760⁎⁎ | −1.755 | −23.07 | −35.32 | 0.000677 | −0.00939 | 0.0211 | 0.271 | |

| (1.322) | (1.468) | (336.9) | (347.3) | (0.302) | (0.0126) | (0.186) | (0.652) | ||

| [0.043] | [0.239] | [0.946] | [0.919] | [0.998] | [0.461] | [0.910] | [0.680] | ||

| Volatility⁎Financial City | −1.523 | −0.810 | −980.6⁎ | −992.0⁎ | 0.0371 | −0.980⁎ | −0.507⁎ | −1.520 | |

| (2.137) | (2.267) | (540.2) | (554.3) | (0.544) | (0.0228) | (0.281) | (0.990) | ||

| [0.480] | [0.723] | [0.077] | [0.081] | [0.079] | [0.111] | [0.079] | [0.132] | ||

| Financial City | 2.324 | 1.468 | 5.951⁎ | 5.974⁎ | 15.31⁎ | −3.218 | 22.35⁎ | 27.38 | |

| (2.537) | (2.708) | (2.973) | (3.029) | (8.180) | (1.974) | (12.09) | (17.48) | ||

| [0.365] | [0.590] | [0.052] | [0.055] | [0.068] | [0.111] | [0.071] | [0.125] | ||

| Country Dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| 0.005 | 0.004 | 0.009 | 0.009 | 0.010 | 0.002 | 0.016 | 0.011 | ||

| Observations | 11 180 | 11 180 | 10 793 | 10 793 | 10 793 | 15 738 | 10 793 | 10 793 | |

Robust standard errors in parentheses, clustered at the city-level and p-values in squared brackets.

The following volatility measures are used in the different specifications: daily returns squared (1), 2-weeks rolling window standard deviation (2), GARCH estimated volatility (3), EGARCH estimated volatility (4), realized volatility with intraday average computed every 10 min (5), realized volatility with intraday average computed every 5 min (6), option implied volatility index (7), US daily returns squared (8), US volatility within 2-weeks rolling window (9), US GARCH estimated volatility (10), US EGARCH estimated volatility (11), US realized volatility with intraday average computed every 10 min (12), US realized volatility with intraday average computed every 5 min (13), US option implied volatility index (14), Economic Policy Uncertainty Index (15), US oil option implied volatility index (16) and US gold option implied volatility index (17).

Statistical significance levels .

Statistical significance levels .

Statistical significance levels .

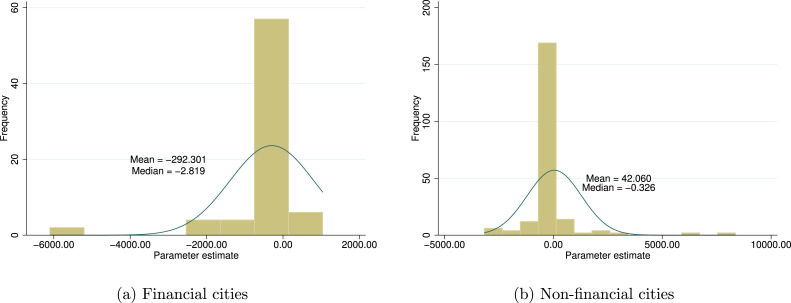

City-by-City. We run 290 regressions at the city-level using our seven main volatility measures (see Tables C.2–C.10 in the Appendix). We collect all coefficient estimates on the financial stress variable and compute the related mean and median values. The average is found to be negative (−42.106): financial stress negatively impacts the consumption of online pornography on average. Fig. 2, Fig. 2 plot the distribution of coefficient estimates separately for financial and non-financial cities. The overall negative average of coefficient estimates seems to be driven by financial cities, as expected. The average (median) coefficient estimate for non-financial cities is 42.060 (−0.326), while it is −292.301 (−2.819) for financial cities: online pornography consumption is negatively impacted by financial stress in financial cities. For instance, in France and Japan only Paris and Tokyo exhibit negative coefficients. On the contrary, in non-financial cities like Lyon, Marseille, Nice, Toulouse, Osaka, Nagoya and Yokohama rising financial market volatility boosts online porn consumption (see Tables C.3 and C.6).14 15 Actually, the influence of stress on pornography consumption might change over different periods of the year. For instance, the relatively high frequency of sunny days during spring and summer times, which is well-known to induce good mood, can easily mitigate the negative impact of stress on sexual activity. To account for this, we perform our regression analysis by (a) focusing separately on the winter/autumn and spring/summer seasons (Figures C.5 and C.6) (b) including seasonal dummies (Figure C.7). Overall, very similar results are obtained, i.e., across financial cities the inhibitory effect of stress is stronger than across non-financial cities. Noteworthy, a weaker impact of financial stress on on-line pornography consumption during spring/summer times is observed (see Figure C.5 vs. Figure C.6). This is in line with existing findings predicting that sunny weather is associated with upbeat mood (Hirshleifer and Shumway, 2003), which in turn mitigate the inhibitory effects of external stress.16

Fig. 2.

Distribution of financial stress coefficient estimates by city type (main estimates).

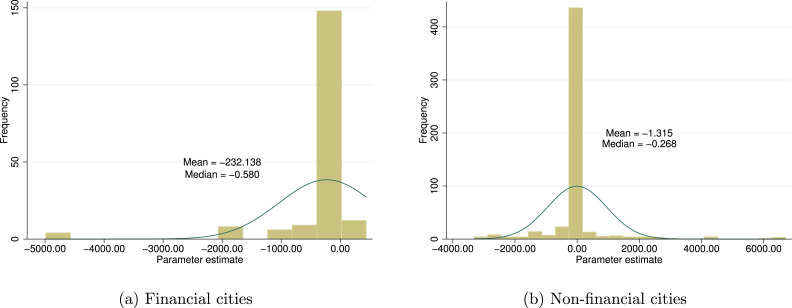

Robustness checks. For the sake of robustness, we have replicated the above regression analysis by () using lagged volatility (Tables C.11–C.19); () employing US volatility for all countries (Tables C.20–C.27) as the US financial market can arguably be considered as the most important worldwide, and () using alternative measures of financial stress/uncertainty (i.e., US Economic Policy Uncertainty Index, US oil option implied volatility index and US gold option implied volatility index (Tables C.28–C.36). By doing this, we collect an extra 731 coefficient estimates whose average is again negative (−60.362). As for the main coefficient estimates, we observe a larger negative effect on online pornography consumption for financial cities compared to non-financial cities (see Fig. 3, Fig. 3).17

Fig. 3.

Distribution of financial stress coefficient estimates by city type (robust estimates).

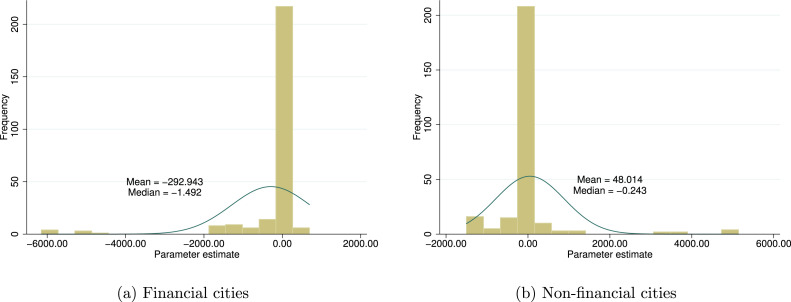

Country-by-country. We finally perform the similar exercise at the country-level (see Tables C.37–C.48 in the Appendix). To that aim, we use the Porn Access Index (PAI) for each country, separately for financial and non-financial cities. We look at the distribution of all estimates here (main and robust ones). We observe again that the average coefficient estimate for financial cities is negative (−292.943), while it is positive for non-financial cities (48.014). Median estimated values also confirm that the adverse effect of rising financial stress in financial cities (−1.492) is stronger than in non-financial cities (−0.243) (see Fig. 4).

Fig. 4.

Distribution of financial stress coefficient estimates by city type (country-level).

On the Mechanism. We find that online pornography consumption decreases as financial stress increases. Either this stress affects people’s mood or affects people’s amount of available leisure time (because, for instance, they have to work more). We look at the amount of time people spend doing various activities (sleep, work, leisure, and so on) in 2016 in the US using data from the American Time Use Survey. We do not find any significant differences in (in particular) working or leisure time due to financial stress (see Tables C.49 and C.50 in the Appendix) and therefore interpret our results as driven by the sentiment channel.

4. Concluding remarks

This paper employs a unique and novel dataset providing accesses to one of the most visited porn website for several cities around the world in order to examine the relationship between financial stress and online pornography consumption. Regression results suggest that during stressing days people are less prone to go for online pornography. The effect seems to be driven by financial cities: financial stress does indeed affect pornography demand as people living in the proximity of financial districts are more likely to be impacted by stock markets fluctuations.

Unfortunately, our data are not granular enough to (strictly) capture the behavior of people working in the financial industry (e.g., financial analysts, traders, market makers, private bankers etc...) or living (strictly) in cities’ financial districts (e.g., Canary Wharf in London or FiDi in New York). Moreover, we rely on accesses to xHamster only. In this respect, future research could make an effort to retrieve richer data in order to get more insights on the relationship between online pornography consumption and financial market dynamics. We believe that examining the effects of rising financial stress on people’s daily standard entertainment activity (including online pornography viewing) represents an interesting avenue of future research.

Declaration of Competing Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Footnotes

See, among others, Burton (1988), Dohmen (2008), Kirsch and Windmann (2009), Kang et al. (2012) and Wu et al. (2013).

The literature in cognitive neuroscience does show physiological stress-related responses to high market volatility (see Coates and Herbert (2008) for increase in the stress hormone cortisol and Lo and Repin (2002) for electrodermal responses and cardiovascular measures).

Sources: https://toppornsites.com/, https://mypornbible.com/, https://www.allinallspace.com/check-out-porn-sites-traffic-in-2019/.

Level-effects might be important as individuals self-select into different cities. For example, urban cities might have a larger proportion of individuals willing or able to consume online pornography compared to rural cities.

xHamster agreed to give us data for year 2016 and for the 43 cities only. While this represents some obvious data constraint, we believe the data are still informative and exempt from important selection issues.

All equity price indexes are denominated in local currency and have been retrieved from Datastream.

See for details Heber, Gerd, Asger Lunde, Neil Shephard and Kevin Sheppard (2009) “Oxford-Man Institute’s realized library”, Library Version 0.3, Oxford-Man Institute, University of Oxford.

Option implied volatility is not available for China, Italy and Singapore.

A complete list of cities and their financial status is provided in Table B.1 of the Appendix.

For each country, we obtain the PAI by computing the average daily percentage deviation for all cities of the country.

Because of potential serial correlation in the volatility measures, we estimate again equation (1) but adding the one lag and two lags volatilities. Results are presented in Table C.1 of the Appendix and show essentially the same.

Figure C.1 in the Appendix presents the distribution of coefficient estimates from regressions controlling for potential serial correlation. Results are essentially similar.

Because coefficient estimates associated with volatility measures 5 (realized volatility with intraday average computed every 10 min) and 6 (realized volatility with intraday average computed every 5 min) are much higher than the other coefficient estimates and might disproportionally affect the average, we provide in the Appendix three robustness checks: 1. we exclude these two measures; 2. we trim the extreme values of the distribution; 3. we normalize coefficients by dividing them by their standard errors. All six plots (for financial and non-financial cities) can be found in Figures C.2, C.3 and C.4 in the Appendix and present similar results, i.e., the negative relationship between stress and online pornography consumption is stronger among financial cities.

In line with the most recent financial literature exploiting market sentiment effects (see, among others, Kaplanski and Levy, 2010, Donadelli et al., 2017), we also account for the trading/working days effect. Median and average estimates including trading days dummies and both seasonal and trading days dummies are illustrated in Figure C.8 and Figure C.9, respectively. Finally, Figure C.10 shows results for when city size is controlled for. Results are essentially unchanged.

Because China has specific Internet restrictions, we compute the average of all coefficient estimates excluding Chinese cities. The resulting average coefficient estimate for non-financial cities is −135.322, while it is −316.504 for financial cities. This result is again in line with the overall evidence that on-line porn consumption in financial cities is relatively more affected by financial stress.

Supplementary material related to this article can be found online at https://doi.org/10.1016/j.jbef.2020.100379.

Appendix A. Supplementary data

The following is the Supplementary material related to this article.

.

References

- Baker S.R., Bloom N., Davis S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016;131:1593–1636. [Google Scholar]

- Bancroft J. Central inhibition of sexual response in the male: A theoretical perspective. Neurosci. Biobehav. Rev. 1999;23(6):763–784. doi: 10.1016/s0149-7634(99)00019-6. [DOI] [PubMed] [Google Scholar]

- Black P., Hendy H.M. Perceived powerlessness as a mediator between life stressors and deviant behaviors. Deviant Behav. 2019;40:1080–1089. [Google Scholar]

- Bloom N. The impact of uncertainty shocks. Econometrica. 2009;77:623–685. [Google Scholar]

- Bodenmann G., Atkins D.C., Schaär M., Poffet V. The association between daily stress and sexual activity. J. Family Psychol. 2010;24:271–279. doi: 10.1037/a0019365. [DOI] [PubMed] [Google Scholar]

- Bontempi M.E., Golinelli R., Squadrani M. 2019. Uncertainty, perception and the internet. Università di Bologna- Working Paper DSE (1134) [Google Scholar]

- Bradford A., Meston C.M. The impact of anxiety on sexual arousal in women. Behav. Res. Therapy. 2006;44:1067–1077. doi: 10.1016/j.brat.2005.08.006. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Burton D. Do anxious swimmers swim slower? Reexamining the elusive anxiety-performance relationship. J. Sport Exerc. Psychol. 1988;10:45–61. [Google Scholar]

- Coates J.M., Herbert J. Endogenous steroids and financial risk taking on a London trading floor. Proc. Natl. Acad. Sci. 2008;105(16):6167–6172. doi: 10.1073/pnas.0704025105. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Datta D., Londono J.M., Sun B., Beltran D., Ferreira T., Iacoviello M., Jahan-Parvar M.R., Li C., Rodriguez M., Rogers J. International Finance Discussion Papers 1216. 2017. Taxonomy of global risk, uncertainty, and volatility measures. [Google Scholar]

- Dohmen T.J. Do professionals choke under pressure? J. Econ. Behav. Organ. 2008;65(3–4):636–653. [Google Scholar]

- Donadelli M. Google-search based metrics, policy-related uncertainty and macroeconomic conditions. Appl. Econ. Lett. 2015;22:801–807. [Google Scholar]

- Donadelli M., Kizys R., Riedel M. Dangerous infectious diseases: Bad news for main street, good news for wall street? J. Financial Mark. 2017;35:84–103. [Google Scholar]

- Dzielinski M. Measuring economic uncertainty and its impact on the stock market. Finance Res. Lett. 2011;9:167–175. [Google Scholar]

- Finke J.B., Behrje A., Schächinger H. Acute stress enhances pupillary responses to erotic nudes: Evidence for differential effects of sympathetic activation and cortisol. Biol. Psychol. 2018;137:73–82. doi: 10.1016/j.biopsycho.2018.07.005. [DOI] [PubMed] [Google Scholar]

- Heaven P.C., Crocker D., Edwards B., Preston N., Ward R., Woodbridge N. Personality and sex. Pers. Individ. Diff. 2003;35:411–419. [Google Scholar]

- Heinrichs M., Baumgartner T., Kirschbaum C., Ehlert U. Social support and oxytocin interact to suppress cortisol and subjective responses to psychosocial stress. Biol. Psychiat. 2003;54(12):1389–1398. doi: 10.1016/s0006-3223(03)00465-7. [DOI] [PubMed] [Google Scholar]

- Hirshleifer D., Shumway T. Good day sunshine: Stock returns and the weather. J. Finance. 2003;58(3):1009–1032. [Google Scholar]

- Kamvar M., Baluja S. 2006. A large scale study of wireless search behavior: Google mobile search. Working Paper, Columbia University and Google Inc. [Google Scholar]

- Kang M., Ray D., Camerer C. 2012. Measured anxiety and choices in experimental timing games. Working Paper, California Institute of Technology. [Google Scholar]

- Kaplanski G., Levy H. Sentiment and stock prices: The case of aviation disasters. J. Financ. Econ. 2010;95(2):174–201. [Google Scholar]

- Kirsch M., Windmann S. The role of anxiety in decision-making. Rev. Psychol. 2009;16(1):19–28. [Google Scholar]

- Lo A.W., Repin D.V. The psychophysiology of real-time financial risk processing. J. Cogn. Neurosci. 2002;14(3):323–339. doi: 10.1162/089892902317361877. [DOI] [PubMed] [Google Scholar]

- Ogas O., Gadda S. 2012. A billion wicked thoughts: What the internet tells us about sex and relationships. Plume, NY. [Google Scholar]

- Wu T., Luo Y., Broster L.S., Gu R., Luo Y. The impact of anxiety on social decision-making: Behavioral and electrodermal findings. Soc. Neurosci. 2013;8:11–21. doi: 10.1080/17470919.2012.694372. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

.