Abstract

We examine the role of ESG performance during market-wide financial crisis, triggered in response to the COVID-19 global pandemic. The unique circumstances create an inimitable opportunity to question if investors interpret ESG performance as a signal of future stock performance and/or risk mitigation. Using a novel dataset covering China’s CSI300 constituents, we show (i) high-ESG portfolios generally outperform low-ESG portfolios (ii) ESG performance mitigates financial risk during financial crisis and (iii) the role of ESG performance is attenuated in ‘normal’ times, confirming its incremental importance during crisis. We phrase the results in the context of ESG investment practices.

Keywords: COVID-19; Pandemic; China; Environmental, Social and Governance (ESG); Financial crisis

1. Introduction

ESG (environmental, social and governance) investing has stimulated mainstream interest among asset managers. In 2019, the capitalization of ESG focused portfolios in major markets exceeded US$30 trillion. Investors care about ESG investing for at least two reasons. First, by focusing on ESG investing, ethical investment practices are actively promoted. Second, ESG investing is increasingly considered to enhance the performance of a managed portfolio, increasing returns and reducing portfolio risk.

Early evidence on the benefits of ESG investment was mixed. Renneboog et al. (2008) noted that existing studies hint but do not unequivocally demonstrate that SRI investors are willing to accept suboptimal financial performance to pursue social or ethical objectives. More recently, Hartzmark and Sussman (2019) found investors actively responded to a ‘shock to the salience of the sustainability’, steering money away from funds with low portfolio sustainability ratings to those with high ratings. Interestingly, they found no evidence that high-sustainability funds outperform low-sustainability funds, further supporting the view that investors place intrinsic (non-monetary) value to socially responsible investment.

Emerging evidence supports the view that high sustainability firms enjoy lower downside risk and are resilient during turbulent times. Albuquerque et al. (2020) develop a theoretical framework illustrating conditions under which firms can reduce systematic risk exposure, using CSR investments to increase product differentiation and provide product portfolio diversification. Hoepner et al. (2019) find empirical evidence that engagement with ESG issues reduces downside risk. Ilhan et al. (2019) show that firms with poor ESG profiles, measured by higher carbon emissions, have higher tail risk. Related discussions on the foundations, and value of aspects of ESG investment can be found in Jacobsen, Lee, Ma, 2019 and Giese, Lee, Melas, Nagy, Nishikawa, 2017.

Regarding the specific role of ESG performance during times of crisis, research is limited yet some insights have been gleaned from the 2008-09 global financial crisis (GFC). Lins et al. (2017) found U.S. non-financial firms with high ESG scores have better financial performance than other firms during the period. Cornett et al., 2016 show that U.S. banks’ financial performance during the GFC is positively related to their ESG score, consistent with evidence of a flight to quality.

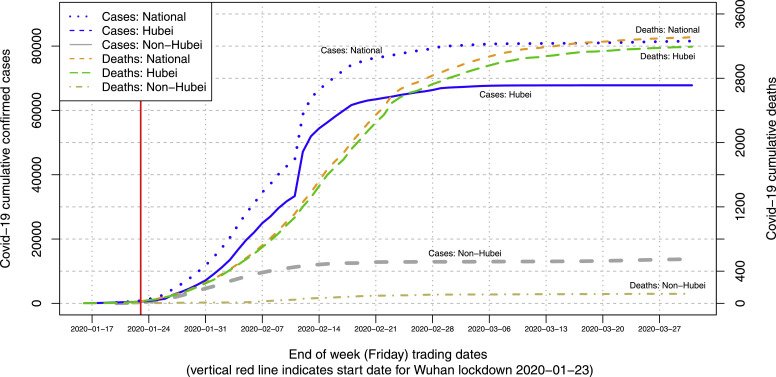

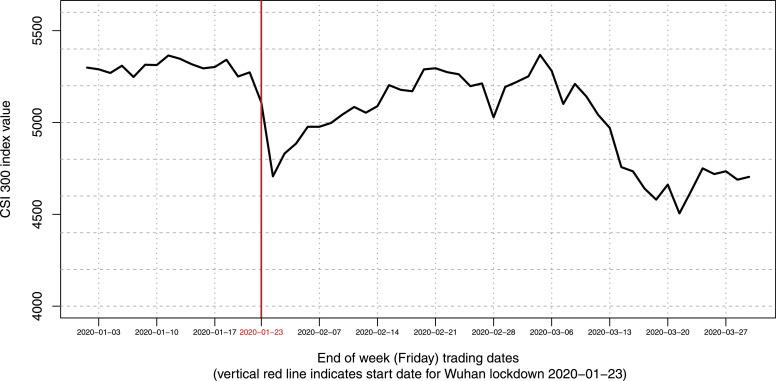

In the opening months of 2020 there was a sudden onset of market-wide financial crisis, triggered in response to an emerging global health crisis whose consequences resonate more closely with the great depression of 1929–1933 than the 2007/2008 global financial crisis. In early January a ‘Novel Coronavirus’, later named Covid-19 was identified in Wuhan, China. Cases within Wuhan grew rapidly to 60,000 within a month leading to the city, province, and eventually most of China entering into ‘lockdown’. Fig. 1 plots the cumulative confirmed COVID-19 cases, and deaths, in Mainland China over the lockdown period. Stock markets did not initially react to unfolding events prior to the lockdown of Wuhan. Shortly after the lockdown, China’s stock markets closed for the Lunar New Year festival. Markets reopened on February 3rd, and the CSI300 declined sharply from 5200 to 4800 points (Fig. 2 ). Markets rebounded quickly, fluctuating around 5000 points for the remainder of February. In March, COVID-19 became a global pandemic. Global markets experienced huge declines and the CSI300 further declined to 4600 points.1

Fig. 1.

Daily Cumulative COVID-19 Cases and Death as end of March 2020: This figure plots the daily number of cumulative confirmed cases of COVID-19 in Hubei province and non-Hubei provinces, and national level cases and deaths on a daily basis. The left axis indicates the number of cumulative confirmed cases, while the right axis indicates the number of cumulative deaths. The data for this plot are taken from the official websites of the health commissions in the seven provinces.

Fig. 2.

China CSI300 index value and stock returns during the COVID-19 outbreak in the first quarter of 2020. The vertical red line on this figure depicts the start of the lockdown. Data are shown for trading days only.. (For interpretation of the references to colour in this figure legend, the reader is referred to the web version of this article.)

These special circumstances create an inimitable opportunity to contribute to the literature by (i) focusing on the potential resilience of stocks with high ESG performance in times of crisis and (ii) evaluating the usefulness of a new dataset allowing a careful analysis of ESG investment practices for China, where existing related research is currently lacking. Specifically we use a novel dataset, released in December 2019, by Syntao containing ESG scores for China’s CSI300 benchmark index members.

We document several empirical regularities. First, overall ESG scores are positively associated with short-term cumulative returnsover 3-, 5- and 11-day event windowsaround the Wuhan lockdown. When decomposing sub-scores for Environment (E), Social (S), and Governance (G) performance, we find cumulative stock returns are positively related to E and G, but not S. We find modest evidence to suggest that higher ESG firms exhibit lower price volatility during the COVID-19 period. Finally, we proffer a test of the internal validity of our results by benchmarking against the empirical relationship between stock returns and ESG scores in periods of crisis, versus ’normal’ times. In brief the ’importance’ of ESG performance is attenuated in normal times, and strengthened during times of crisis, consistent with the assertion that investors in China’s stocks attach higher importance to ESG performance as a signal of future stock performance and/or risk mitigation.

2. ESG investing in China and ESG data

ESG investing in China remains at an early stage of maturity. In developed markets, institutional investors play an important role in influencing ESG investment practices, challenging companies on their ESG performance, and promoting ESG performance within their managed portfolios. Within China, institutional investors remain relatively few, with most investment activity coming from retail investors. Accordingly, the demand for ESG products remains weak, and investors are only recently incorporating ESG into their thought processes.

Among the three dimensions of ESG, Governance (G) is most important. Whereas governance risks are similar and material for all companies, the importance of environmental and social risks vary by sector. Environment (E) factors are most actively discussed, due to wide interest in climate finance, and a proliferation of policies by Governments, regulators, security exchanges, and associations pertaining to pollution and waste management and standards for environmental disclosures.

ESG data for China is provided by SynTao Green Finance,2 a China-based third-party data provider specialized in ESG data and green finance advisory. These data reflect consistent measures of ESG performance, and do not simply reflect firm-specific disclosure activity. Syntao systematize ESG information from public sources including annual reports, sustainability reports, social responsibility report, environment reports, announcements, and notices, and official websites. The rating framework has 3 layers. The primary layer covers Environmental (E), Social (S) and Governance (G) dimensions. The secondary comprises 12 criteria supporting E, S, and G, including environmental management, environmental disclosure and environmental controversies (under E), employee, supply chain, community, product, philanthropy, and social controversies (under S), and business ethics, corporate governance, and governance controversies (under G). The final layer reflects 300+ tertiary criteria formed from approximately 1000 data points. Each score is formed using a combination of core indicators common to all firms, and sector-specific indicators which apply only to companies in that sector. Table 1 provides a schematic for the ESG rating framework. ESG scores are downward adjusted by firm specific controversies sourced from company’s communications, announcements of penalties from regulators, media/news articles and research by NGOs. It is these downwards revisions and adjustments which distinguish Syntao’s ESG scores as measures of ESG performance, and not simply ESG disclosure scores.

Table 1.

Overview of SynTao Green Finance Dataset rating system tiers.

| Tier 1 | Tier 2 | Tier 3 (examples) |

|---|---|---|

| E (Environmental) | Environmental Management | Environmental Management System Certification, Water Conservation Objective, Green Product (Service) and Revenue |

| Environmental Disclosure | Energy Consumption and Conservation, Waste gas Emission and Reduction | |

| Environmental Controversies | Negative Incidents regarding Water Pollution/Air Pollution/Solid Waste Pollution | |

| S (Social) | Employee | Freedom of Association, Anti-Discrimination |

| Supply Chain | Responsible Supply Chain Management | |

| Community | Community Communication | |

| Product | Fair Trade Product, Genetically Modified Food | |

| Philanthropy | Enterprise Foundation, Donation | |

| Social Controversies | Negative Incidents regarding Employees/Clients/etc. | |

| G (Governance) | Business Ethics | Whistleblowing Policy, Overseas Tax Payment |

| Corporate Governance | Board Diversity, Auditor Independence | |

| Governance Controversies | Negative Incidents regarding Business Ethics/Corporate Governance |

The maximum value for is 100, while E, S, G subcomponents have different maxima reflecting the relative importance of sub-scores across different sectors. Raw E, S, and G scores are re-scaled to take a [0,100] range according to the industry specific maximum e.g. for each of the E, S and G dimensions. Syntao also provide a measure capturing firm specific ESG management effort , computed from around 70 indicators.

3. Empirical evidence

We provide empirical evidence that ESG performance is systematically priced during COVID-19. For this we require stock price data and firm characteristics variables, which are extracted from the WIND database.3 Summary statistics are given in Table 2 . Average scores for E and S are higher than for G, suggesting that China’s firms may be focusing efforts on E and S, and giving less attention to ’traditional’ governance (G).

Table 2.

Summary Statistics: This table reports the mean (Mean), standard deviation (Std), median (Median), minimum (Min), 25th percentiles (P25), 50th percentiles (P50), 75th percentiles (P75) and maximum (Max) of stock return, ESG scores during the 2020 COVID-19 pandemic period, and other control variables for the CSI300 stock listed in the Shenzhen Stock Exchange (SZSE) and Shanghai Stock Exchange (SHSE). There are 300 Mainland CSI300 A-share stocks in our sample. r[-1,1] refers to cumulative raw returns (in percentage terms) over the three- trading day window (i.e., Jan 23 Feb 4, 2020) around the Wuhan lockdown during the COVID-19 outbreak. r[-2,2] refers to cumulative raw returns over the five-day window (i.e., Jan 22 Feb 5, 2020). r[-5,5] refers to cumulative raw returns over the eleven-day window (i.e., Jan 17 Feb 10, 2020). car[-1,1], car[-2,2] and car[-5,5] refer to three-, five- and eleven-day cumulative abnormal stock returns centering on Feb 3rd, 2020 based obtained using a standard market model. Ln(BM) is the logarithm of book to market ratio computed as the ratio of book value per share to the stock close price per share. Ln(Size) is the market value equity of stock computed as the logarithm of the stock close price and number of outstanding shares two weeks prior to the pandemic (Jan 8,2020). Leverage is ratio of total liability to total assets. All variables are winsorized at 1% and 99%.

| Stats | N | Mean | Std | Min | P25 | P50 | P75 | Max |

|---|---|---|---|---|---|---|---|---|

| r[-1,1] | 300 | -10 | 5.575 | -19.86 | -13.9 | -10.46 | -6.526 | 5.291 |

| r[-2,2] | 300 | -7.833 | 6.749 | -29.56 | -12.21 | -8.652 | -5.075 | 21.53 |

| r[-5,5] | 300 | -5.32 | 9.47 | -23.53 | -11.09 | -7.69 | -2.61 | 26.14 |

| car[-1,1] | 300 | -10.18 | 5.71 | -23.36 | -14.12 | -10.83 | -6.67 | 7.91 |

| car[-2,2] | 300 | -8.18 | 6.36 | -19.70 | -12.55 | -9.14 | -5.75 | 12.19 |

| car[-5,5] | 300 | -6.12 | 9.28 | -26.58 | -11.36 | -8.10 | -3.94 | 24.41 |

| Ln(BM) | 300 | -0.435 | 1.048 | -3.13 | -1.186 | -0.375 | 0.253 | 3.49 |

| Ln(Size) | 300 | 24.65 | 1.034 | 21.86 | 24.09 | 24.49 | 25.17 | 28.1 |

| Leverage | 300 | 0.562 | 0.223 | 0.0435 | 0.402 | 0.57 | 0.736 | 0.94 |

| E | 300 | 50.98 | 8.29 | 27.85 | 45.39 | 49.63 | 56.78 | 83.45 |

| S | 300 | 54.57 | 6.804 | 30.51 | 50.38 | 54.04 | 58.82 | 72.73 |

| G | 300 | 45.67 | 7.015 | 27.23 | 41.29 | 45.26 | 50 | 70.69 |

| ESG_mngt | 300 | 15.03 | 6.378 | 4.25 | 9.938 | 13.38 | 19.81 | 33.38 |

| ESG_total | 300 | 50.45 | 5.338 | 40.38 | 46.25 | 49.63 | 54.38 | 62.88 |

We develop an accumulation of evidence in three parts. First we say something of the materiality of ESG investment strategies by (i) characterizing differentials in trading value and volumes for high-ESG and low-ESG CSI stocks pre and post COVID-19 and (ii) developing industry neutral investment portfolios spanning 2015–2020. Second we illustrate, using an event study, that ESG factors are priced in some fashion during the COVID-19 pandemic. Lastly we test the internal validity of our conjecture that ESG factors are of relatively higher importance during times of crisis, within a multi-factor empirical asset pricing model.

3.1. Low-ESG and high-ESG trading activity & industry neutral portfolio backtesting

Table 3 shows that trading activity for CSI300 constituents intensified in the pandemic period, both in terms of volume and value of trades. Decomposing the sample into high-ESG and low-ESG firms, both sub-samples experience heightened trade activity, especially among low-ESG firms. This suggests high-ESG to be relatively more resilient during the pandemic period, with investors being more patient and not selling their shares to avoid losses during the turbulent market.

Table 3.

Trading Volume of CSI300 Stocks Before and During the COVID-19 Pandemic Period: This table reports averages of the trading volume of Mainland CSI300 firms traded on Shanghai Stock Exchange and Shenzhen Stock Exchange. The ‘Normal period’ is from Feb 11, 2019 to Mar 31, 2019, and the ‘Pandemic period’ is from Feb 3, 2020 to Mar 31, 2020. High-ESG firms are portfolios above sample median, low-ESG firms otherwise. These two periods cover 2 months after the Chinese New Year holidays. Trading volume data are from the Wind database. The symbols *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

| All CSI300 firms | |||

| Average daily trading volume | Average daily number of trades | Average trade size | |

| (RMB Yuan, in million) | (RMB Yuan) | ||

| Normal period | 792 | 32550.9 | 24.28 |

| Pandemic period | 878 | 36698.4 | 30.72 |

| Difference | -85.8 | -4147.5 | -6.44 |

| T-statistics | -6.26*** | -8.44*** | -7.17*** |

| High ESG firms | |||

| Average daily trading volume | Average daily number of trades | Average trade size | |

| (RMB Yuan, in million) | (RMB Yuan) | ||

| Normal period | 775 | 33114.2 | 24.64 |

| Pandemic period | 856 | 35658.5 | 33.36 |

| Difference | -80.8 | -2544.3 | -8.72 |

| T-statistics | -3.92*** | -3.17*** | -8.29*** |

| Low ESG firms | |||

| Average daily trading volume | Average daily number of trades | Average trade size | |

| (RMB Yuan, in million) | (RMB Yuan) | ||

| Normal period | 805 | 32125.6 | 24.01 |

| Pandemic period | 896 | 37517.5 | 28.64 |

| Difference | -90.3 | -5391.9 | -4.63 |

| T-statistics | -4.92*** | -8.82*** | -3.39*** |

| High ESG firms minus Low ESG firms | |||

| Average daily trading volume | Average daily number of trades | Average trade size | |

| (RMB Yuan, in million) | (RMB Yuan) | ||

| Normal period | -30.2 | 988.5 | 0.63 |

| T-statistics | -1.61 | 1.39* | 0.63 |

| Pandemic period | -39.7 | -1859 | 4.72 |

| T-statistics | -1.97** | -2.70*** | 3.26*** |

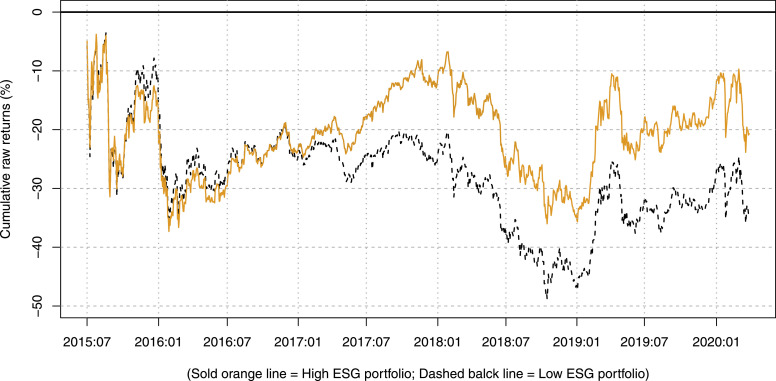

Fig. 3 provides supportive evidence, plotting industry neutral, bi-annually re-balanced portfolios constructed using ESG scores from 2015:06-2019:12, noting that the 2019:12 ESG scores define portfolio allocations stretching to 2020:6, allowing us to trace portfolio performance in the early part of 2020. Industry neutrality is provided by identifying high- or low-ESG stocks on an industry-by-industry basis, such that each industry is guaranteed to be present in each of the high/low portfolios. A more formal treatment of the steps in constructing these portfolios is given in the Appendix. An interesting observation is that beginning July 2017 the high-ESG portfolio remains consistently higher than that of the low ESG group. The differential cumulative return for the two groups is about 12.83% during the July 2017-December 2019 period, and for the whole sample is 9.4%. These figures imply that, even in normal times, an industry neutral ESG based investment strategy allows an investor to earn substantially higher returns in the Chinese market.

Fig. 3.

Cumulative raw returns for ‘industry neutral’ high- vs low-ESG portfolios between July 1, 2015 and March 31, 2020: This figure plots the cumulative raw returns for industry neutral high- vs low-ESG groups over time. Detailed description of the construction of the portfolios is offered in the appendix.

3.2. Event study results

Table 4 reports the main results. Estimation is conducted for 3-, 5- and 11-trading day windows around the Wuhan lockdown, both for cumulative raw returns in Panel A i.e. r[-1,1], r[-2,2] and r[-5,5], as well as for cumulative abnormal returns over the same windows ion Panel B i.e. car[-1,1], car[-2,2] and car[-5,5]. We regress the returns on the ESG scores, after controlling for leverage, book-to-market, and firm size. For the control variables, the coefficient for ln(BM) is significantly negative in all models, suggesting firms with higher book-to-market ratios experience smaller price declines. The coefficient of leverage is negative and significant in most of the models, suggesting that the more leveraged companies will suffer bigger price declines.

Table 4.

The Impact of ESG Indices on Stock Market Reactions to COVID-19: This table provides the results on relationship between ESG scores of Mainland CSI300 firms and stock market reaction during the COVID-19 outbreak period. r[-1,1] refers to cumulative raw return (in percentage) over Jan 23 Feb 4, 2020. r[-2,2] refers to the cumulative raw return over Jan 22 Feb 5, 2020. r[-5,5] refers to cumulative raw returns over the eleven-days window (i.e., Jan 17 Feb 10, 2020). car[-1,1], car[-2,2] and car[-5,5] refer to three-, five- and eleven-day cumulative abnormal stock returns centering on Feb 3rd, 2020 based obtained using a standard market model. Ln(BM) is the logarithm of book to market ratio. Ln(Size) is the logarithm of the market value equity two weeks prior to the start of the pandemic. Leverage is ratio of total liability to total assets. All of the regressions include controls variables, industry fixed effects (not reported for brevity). *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

|

Panel A - Dependent variables: Cumulative raw returns | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| r[-1,1] | r[-2,2] | r[-5,5] | r[-1,1] | r[-2,2] | r[-5,5] | r[-1,1] | r[-2,2] | r[-5,5] | |

| Variables | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| ESG_total | 0.095** | 0.107* | 0.123 | ||||||

| E | 0.069** | 0.114*** | 0.105* | ||||||

| S | -0.098*** | -0.146*** | -0.105 | ||||||

| G | 0.122*** | 0.124*** | 0.108* | ||||||

| ESG_mngt | 0.152*** | 0.171*** | 0.200** | ||||||

| Leverage | -3.850*** | -3.903** | -4.069* | -3.954*** | -4.020** | -4.115* | -3.700*** | -3.576** | -3.803 |

| Ln(BM) | -0.681** | -1.055*** | -1.222** | -0.910*** | -1.313*** | -1.585*** | -0.769** | -1.189*** | -1.338** |

| Ln(Size) | 1.476*** | 0.828** | -0.413 | 1.054*** | 0.351 | -0.932* | 1.348*** | 0.620* | -0.549 |

| Constant | -51.246*** | -35.499*** | -5.2 | -38.936*** | -21.591** | 9.913 | -47.609*** | -29.057*** | -0.657 |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 |

| R-squared | 0.177 | 0.192 | 0.193 | 0.196 | 0.212 | 0.204 | 0.221 | 0.254 | 0.209 |

| Panel B - Dependent variables: CAR from market model | |||||||||

| car[-1,1] | car[-2,2] | car[-5,5] | car[-1,1] | car[-2,2] | car[-5,5] | car[-1,1] | car[-2,2] | car[-5,5] | |

| Variables | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| ESG_total | 0.096** | 0.108** | 0.117 | ||||||

| E | 0.068** | 0.109*** | 0.098* | ||||||

| S | -0.098*** | -0.135*** | -0.114* | ||||||

| G | 0.123*** | 0.120*** | 0.119** | ||||||

| ESG_mngt | 0.149*** | 0.167*** | 0.187** | ||||||

| Leverage | -3.838*** | -3.719** | -3.021 | -3.941*** | -3.835** | -3.066 | -3.693** | -3.414** | -2.774 |

| Ln (BM) | -0.835*** | -1.192*** | -1.770*** | -1.056*** | -1.439*** | -2.105*** | -0.921*** | -1.317*** | -1.885*** |

| Ln (SIZE) | 1.517*** | 0.888** | -0.403 | 1.107*** | 0.431 | -0.883 | 1.391*** | 0.694* | -0.536 |

| Constant | -52.061*** | -36.839*** | -4.467 | -39.965*** | -23.300** | 9.619 | -48.499*** | -30.793*** | -0.081 |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 |

| R-squared | 0.191 | 0.214 | 0.224 | 0.207 | 0.231 | 0.233 | 0.232 | 0.268 | 0.242 |

For the main variable of interest, ESG_total in columns [1], [2] and [3], we find it is positively and significantly related to cumulative returns, both for raw and abnormal returns (which is a commonly used form of risk-adjusted measure), as shown in Panels A and B respectively. This indicates firms with higher ESG ratings experience smaller stock price declines during the COVID-19 pandemic. As a robustness test on our main results we treat ESG_mngt in columns [4], [5] and [6], as an alternative measure for ESG_total, with consistent findings.

We further explore the importance of individual E, S and G scores in columns [7], [8] and [9] of Table 4, noting the following results and commentary:

-

•

Higher E scores impact event window returns positively: To achieve high E scores a firm must have performed well in areas such as environmental management system certification, water conservation, energy efficiency, waste gas emission reductions, and reducing accidental waste and spills. Such efforts help mitigate long-term environmental risks and ensure a lean and ambidextrous organization, Broadstock et al. (2019). Therefore, firms with high E performance can be better prepared to navigate away from negative business impacts such as those emerging during COVID-19.

-

•

Higher S scores impact event window returns negatively: Strong S scores imply consistent performance in areas including employee benefits, supply chain management, community engagement, philanthropy and managing social controversies. Plausibly, high performance in the S dimension coincides with relatively higher commitment/pressure to retain (or furlough) staff during the crisis i.e. to steer the socially responsible course of action, rather than laying off staff to manage cost pressures.

-

•

Higher G scores impact event window returns positively: To score well under G, firms should have performed well in areas including: policy, overseas tax commitments, board diversity, auditor independence, whistleblowing and managing negative incidents regarding governance. Strong performance in these areas should help ensure overall financial stability of a firm, and offer a heightened resilience to any shock event, including COVID-19.

The results above provide empirical evidence consistent with the notion of the flight to security hypothesis and the signaling role that ESG performance might offer investors in terms of potential resilience against downside risk.

Table 5 reports the relationship between stock return volatility during the COVID-19 period and ESG variables. Volatility is measured as the standard deviation of 2-month daily returns. We find that ESG_total is negatively related to volatility in some models. However, once the book-to-market ratio variable is controlled, the relationship becomes insignificant.

Table 5.

The Impact of ESG Indices on Stock Price Volatility During COVID-19: This table provides the results on relationship between ESG scores of Mainland CSI300 firms and stock price volatility during the Covid-19 outbreak period. volat[-1,39] is computed as the standard deviation of stock daily returns between the last trading day of Jan and the last trading day of Mar, 2020. Ln (BM) is the logarithm of book to market ratio. Ln (Size) is the logarithm of the market value equity two weeks prior to the start of the pandemic. Leverage is ratio of total liability to total assets. All of the regressions include controls variables, industry fixed effects (not reported for brevity). *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

| volat[-1,39] | volat[-1,39] | volat[-1,39] | volat[-1,39] | |

|---|---|---|---|---|

| Variables | [1] | [2] | [3] | [5] |

| ESG_total | -0.029** | -0.007 | ||

| E | -0.004 | |||

| S | -0.006 | |||

| G | 0.006 | |||

| ESG_mngt | -0.004 | |||

| Leverage | -0.227 | 0.037 | 0.041 | 0.09 |

| Ln(BM) | -0.059** | -0.061** | -0.079** | |

| Ln(Size) | -0.033 | |||

| Constant | 4.233*** | 0.027 | -0.284 | 0.672 |

| Industry FE | yes | yes | yes | yes |

| Observations | 300 | 300 | 300 | 300 |

| R-squared | 0.31 | 0.195 | 0.19 | 0.211 |

3.3. ESG Factors in times of crisis, versus ’normal’ times

As a final exploratory test, we deploy an empirical asset pricing model to examine the role of information in the cross-section of ESG scores during COVID-19 versus a ’normal’ period, taken as Feb 11, 2019 to Mar 30, 2019 i.e. the same period one year earlier. For this we introduce the dummy variable post, to permit both intercept and slope shifts.

From Table 6 we learn that COVID-19 presented a strong and negative impact on the market. There is a large, significant and negative intercept shift in all model specifications. The coefficient on ESG*Post captures the importance of ESG scores after the lockdown. Under the null hypothesis, stock returns do not depend on ESG performance and the ESG*Post coefficient should be zero. Under the alternative hypothesis, ESG investors assign incremental importance to ESG performance in times of crisis. When a market-wide crisis event occurs, investors lower expectation of future earnings, yet they could have better (worse) confidence on higher (lower) ESG profile firms. Consequently, the alternative hypothesis predicts that the coefficient of ESG*Post will be positive.

Table 6.

ESG Scores and the Impact of COVID-19 on Stock Returns: This table provides the results on the relationship between ESG scores and stock market reaction of Mainland CSI300 firms during the normal vs. COVID-19 outbreak period. ‘Ret’ is the daily stock return of stock i on day t, ‘Market ret’ is the daily market return on day t, Post equals to one after Feb 2nd, 2020, during the Wuhan lockdown period, and 0 in the previous year. The estimation period includes the normal period from Feb 11, 2019 to Mar 30, 2019, and pandemic period from Feb 3, 2020 to Mar 30, 2020. We include the interactions terms ‘market ret’ × post, ESG_total × post, E × post, S × post, G × post, and ESG_mngt × post for testing the resilience of ESG rating in different dimensions. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

| Ret | Ret | Ret | Ret | Ret | Ret | |

|---|---|---|---|---|---|---|

| VARIABLES | [1] | [2] | [3] | [4] | [5] | [6] |

| Market ret | 1.029*** | 1.029*** | 1.029*** | 1.029*** | 1.029*** | 1.029*** |

| Market ret × post | -0.065*** | -0.065*** | -0.065*** | -0.065*** | -0.065*** | -0.065*** |

| Post | -0.609** | -0.278** | -0.246 | -0.504*** | -0.274*** | -0.521*** |

| ESG_total | -0.015*** | |||||

| ESG_total × post | 0.010** | |||||

| E | -0.007*** | -0.005** | ||||

| E × post | 0.003 | 0.001 | ||||

| S | -0.003 | 0.002 | ||||

| S × post | 0.002 | 0 | ||||

| G | -0.009*** | -0.008*** | ||||

| G × post | 0.008*** | 0.008** | ||||

| ESG_mngt | -0.014*** | |||||

| ESG_mngt × post | 0.009*** | |||||

| Constant | 0.743*** | 0.331*** | 0.156 | 0.413*** | 0.201*** | 0.527*** |

| Observations | 22,117 | 22,117 | 22,117 | 22,117 | 22,117 | 22,117 |

| R-squared | 0.426 | 0.426 | 0.425 | 0.425 | 0.426 | 0.426 |

Table 6 indicates the alternative hypothesis is supported. The ESG*Post coefficient in model [1] is 0.010, and significant at the 5% level. This result supports our conjecture that high-ESG firms are more resilient in terms of stock price reaction to the COVID-19 pandemic. It is interesting to note that the coefficient on ESG_total is negative. Such features have been recognized in related literature and accommodated by explanations including an insurance function for high-ESG stocks i.e. that investors pay an insurance premium through lower returns in normal times, with the expected benefit of market resilience in times of crisis, Engle et al. (2020).

S subscores are not significant in either normal or crisis times. Competing explanations could be offered as to why, but one rational explanation is that E and G scores are more tangible metrics of firm resilience in times of crisis, owing to them reflecting a combination of good governance and leaner production processes.

In closing we briefly reconcile our results against emerging literature. Goodell (2020) elaborates on the ‘enormous’ implications of COVID-19, and the wide ranging research agenda that is likely to be “... grappled with by financial academics for many years to come”. Our results complement and contribute to a rapidly growing corpus of literature, predominantly working papers at the time of writing, on dimensions of ESG performance and COVID-19. For example Ding et al. (2020) discuss how factors including ESG performance provide ‘corporate immunity’ during the pandemic, focusing on average responses across an international sample of stocks. Our results are consistent with what we would term as a weak form of the ‘immunity’ hypothesis/explanation inasmuch as we document relative resilience to financial risk during times of financial crisis by high ESG performing stocks, albeit not total immunity. In another strand of research Takahashi and Yamada (2020) offer mixed evidence on the relation between ESG and stock performance in Japan during COVID-19. While they find ESG ratings do not influence stock returns, they do find evidence of a non-linear relation between stock performance and the level of investment in firms by ESG oriented funds.

4. Conclusion

The dramatic fall in global equity values during the COVID-19 pandemic reflects a strong negative sentiment among investors. We question if this negative sentiment transfers, indiscriminately, across all forms, or whether it is possible that ESG performance acts as a valuable indicator to systematically navigate away from negative risk during times of crisis.

Taking advantage of a unique environmental setting, and access to a timely and novel dataset, we show that ESG performance is positively associated with the short-term cumulative returns of CSI300 stocks around the COVID-19 crisis. In doing so, we contribute to the literature by empirically illustrating the resilience of stocks with high ESG performance in times of market-wide financial crisis, consistent with the view that investors in may interpret ESG performance as a signal of future stock performance and/or risk mitigation in times of crisis.

CRediT authorship contribution statement

David C. Broadstock: Writing - original draft, Visualization, Writing - review & editing, Software. Kalok Chan: Data curation, Writing - original draft, Formal analysis, Writing - review & editing. Louis T.W. Cheng: Data curation, Writing - original draft, Formal analysis, Writing - review & editing. Xiaowei Wang: Data curation, Writing - original draft, Formal analysis, Software.

Acknowledgements

We thank SynTao Green Finance for providing the ESG data support. A previous working paper version of this study is given in Broadstock et al. (2020).

Footnotes

We would like to thank an anonymous reviewer presenting us with the question “... why the ESG investments may be related to a health crisis period (rather than any crisis period) ... would we expect firms with high ESG performance to be more resilient to this pandemic crisis?” The nature of this question is not entirely within the scope of our study, since primarily we focus on the sudden-onset financial crisis arising from the Covid-19 pandemic. Nonetheless it would seem viable that the intensive margin of the ESG-performance/financial performance nexus may vary with the intensity of the pandemic itself. This would be a possible avenue for future research, making more explicit use of evolving infection and death rate data throughout the course of the pandemic. At the time of writing, timely ESG data to test this conjecture are not yet available. We note that studies such as Zaremba et al. (2020) examine the pandemic from the lens of a healthcare crisis with implications to a country’s financial immunity.

Additional information on Syntao’s ESG rating system can be found at: http://syntaogf.com/Menu_EN.asp?ID=34, last accessed on July 17th, 2020.

WIND is a leading provider of financial and economic data for China. Details of the data provider can be found at: https://www.wind.com.cn/en/about.html, last accessed on July 17th 2020. According to their website they “... serve more than 90% of [China’s] financial institutions ... [and] 70% of Qualified Foreign Institutional Investors (QFII).”

Appendix A. Industry-neutral portfolio construction

Here we describe the approach to constructing our industry-neutral high- and low-ESG portfolios. The description here reflects the approach taken for historical back-testing.

Initial portfolio allocations

In the following description we generally omit the time subscript t to simplify exposition, without loss of generality. The initial period is taken as 2015:6. In this initial period, the initial portfolio allocations are obtained as follows:

-

1.

Partition the data according to industry j ∈ J. Let j* denote the number of stocks from industry j. Also let denote the subsets of stocks in each industry j.

-

2.

Define as the median score within industry j.

-

3.Classify each stock i ∈ I as being either high-ESG or low-ESG (ESG ij) according to the rule:

(A.1) (A.2) -

4.Taking R as the (percentage) stock price return, construct within-industry equally-weighted portfolios as:

(A.3) (A.4) where is an indicator function taking the value 1 if and 0 otherwise. This term ensures that only stocks in industry j contribute to the industry specific portfolio. The pre-multiplication by either or ESG ij plays the role of partitioning the prices into high-ESG and low-ESG ‘buckets’.

-

5.Finally, construct the ‘industry-neutral’ portfolio returns as the equally weighted sum of the within-industry portfolio returns:

(A.5) (A.6)

In the context of our application, these initial portfolios are constructed at 2015:6, and stocks are held until 2015:12. At 2015:12 the stock allocations are re-evaluated on the basis of the most recent ESG performance scores. This portfolio ‘re-balancing’ process is described next.

Portfolio re-balancing

We will now introduce some concept of time back into the notation:

-

•

Denote the start of each investment period as 2015:6, 2015:12, 2016:6, 2016:12, 2017:6, 2017:12, 2018:6, 2018:12, 2019:6, 2019:12} such that τ 0 denotes 2015:5, τ 1 denotes 2015:12 and so forth.

-

•

START and END are used to indicate the beginning and end of the individual holding periods. As such, reflects the value of the high-ESG portfolio, at the end of the initial investment period.

With this additional notation, we may now formalize the steps in re-balancing the portfolio:

-

6.For investment period τ 1:

-

(a)Repeat steps [1]-[5] to obtain and

-

(b)In each period, historical returns and are obtained by splicing the time series:

(A.7) (A.8)

-

(a)

-

7.

Repeat the steps above for with appropriate substitutions, until the latest investment period is reached.

-

8.Index values are recovered by accumulating portfolio (percentage) returns over time, for example at τ 1 we have:

(A.9) (A.10)

Supplementary material

Supplementary material associated with this article can be found, in the online version, at 10.1016/j.frl.2020.101716

Appendix B. Supplementary materials

Supplementary Raw Research Data. This is open data under the CC BY license http://creativecommons.org/licenses/by/4.0/

References

- Albuquerque, R. A., Koskinen, Y. J., Yang, S., Zhang, C., 2020. Love in the time of COVID-19: The resiliency of environmental and social stocks. Working paper, Available at SSRN: https://ssrn.com/abstract=3583611.

- Broadstock, D. C., Chan, K., Cheng, L. T., Wang, X. W., 2020. The role of ESG performance during times of financial crisis: Evidence from COVID-19 in china. Available at SSRN 3627439. [DOI] [PMC free article] [PubMed]

- Broadstock D.C., Matousek R., Meyer M., Tzeremes N.G. Does corporate social responsibility impact firms’ innovation capacity? the indirect link between environmental & social governance implementation and innovation performance. Journal of Business Research. 2019 [Google Scholar]; Forthcoming

- Cornett M.M., Erhemjamts O., Tehranian H. Greed or good deeds: An examination of the relation between corporate social responsibility and the financial performance of U.S. commercial banks around the financial crisis. J. Bank. Finance. 2016;70(C):137–159. [Google Scholar]

- Ding W., Levine R., Lin C., Xie W. Corporate immunity to the COVID-19 pandemic (no. w27055) Natl. Bureau Econ. Res. 2020 doi: 10.1016/j.jfineco.2021.03.005. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Engle R.F., Giglio S., Kelly B., Lee H., Stroebel J. Hedging climate change news. Rev. Financ. Stud. 2020;33(3):1184–1216. [Google Scholar]

- Giese, G., Lee, L.E., Melas, D., Nagy, Z., and Nishikawa, L., 2017, Foundations of ESG Investing. MSCI ESG Research LLC.

- Goodell J.W. COVID-19 And finance: agendas for future research. Finance Res. Lett. 2020:101512. doi: 10.1016/j.frl.2020.101512. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hartzmark S.M., Sussman A.B. Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows. The Journal of Finance. 2019;74(6):2789–2837. [Google Scholar]

- Hoepner, A. G. F., Oikonomou, I., Sautner, Z., Starks, L. T., Zhou, X., 2019. ESG shareholder engagement and downside risk. Working paper, September 2019, Available at SSRN: https://ssrn.com/abstract=2874252.

- Ilhan, E., Sautner, Z., Vilkov, G., 2019. Carbon tail risk. Working paper, Available at SSRN: https://ssrn.com/abstract=3204420.

- Jacobsen B., Lee W., Ma C. The alpha, beta, and sigma of ESG: better beta. Additional Alpha? J. Portfol. Manag. 2019;45(6):6–15. [Google Scholar]

- Lins K.V., Servaes H., Tamayo A. Soc. Capit. Trust Firm Perform.: The Value of Corporate Social Responsibility during the Financial Crisis The Journal of Finance. 2017;72(4):1785–1824. [Google Scholar]

- Renneboog L., Ter Horst J., Zhang C. Socially responsible investments: institutional aspects, performance, and investor behavior. J. Bank. Finance. 2008;32(9):1723–1742. [Google Scholar]

- Takahashi H., Yamada K. Trading, ESG, and Liquidity Channels. 2020. When japanese stock market meets COVID-19: Impact of ownership, trading, ESG, and liquidity channels. [Google Scholar]; April 16, 2020

- Zaremba, A., Kizys, R., Tzouvanas, P., Aharon, D. Y., Demir, E., 2020. The quest for multidimensional financial immunity to the COVID-19 pandemic: Evidence from international stock markets. Available at SSRN 3632466.

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Supplementary Raw Research Data. This is open data under the CC BY license http://creativecommons.org/licenses/by/4.0/