Abstract

During the pandemic, the stock markets of developed countries have reported a jittery trend. The current study focuses on the impact of COVID‐19 on Pakistani stock market, which belongs to a developing economy. The findings of current study have contradicted with the previous studies, which reported an adverse effect of COVID‐19 on developed stock markets. We conclude that KSE‐100 index has confirmed positive increment in stock returns. In addition, by using three predicted scenarios of COVID‐19, we report the significant increase in KSE‐100 index. However, it seems clear that the timely intervention of Pakistani government has safeguard the investors from utter disaster of stock market.

1. INTRODUCTION

COVID‐19 is an infectious disease, which has diagnosed in December 2019, in Wuhan city of China and the first death reported on January 11, 2020 (Pharmaceutical Technology, 2020). Despite of having preventive measure by the authorities of Wuhan city, this virus spread in different cities other than Wuhan and later it has spread, along with travelers, in the different countries of the world. However, on 11 March, the World health organization (WHO) has declared this virus a global pandemic and issue advisory to take preventive measures. Now within 4 months, this virus has been spread in more than 200 countries, having more than 3 million people infected and almost 0.2 million people died in this pandemic. In this pandemic, almost all the countries have banded traveling in other countries, reduced or almost stop flight operations, imposed lockdown where this virus spread more, and quarantine affected people to stop this virus. Due to these preventive measures, almost all the economies are now facing a drastic decline in economic activities, and the ratio of business failure increases. Small businesses are looking for bailout packages from the government and large businesses also facing difficult situations to retain their employees at the time of no economic activities. This decline in the economic activities affect the stock markets, commodity markets and reducing trade between countries.

Researchers argued that the stock markets are always affected by major events (Haque & Sarwar, 2013; Waheed, Wei, Sarwar, & Lv, 2018). However, as this virus becomes global pandemic, it starts effecting the businesses which is reflecting in world stock markets. Some studies have examined the impact of COVID‐19 on developed stock return (Al‐Awadhi, Al‐Saifi, Al‐Awadhi, & Alhamadi, 2020; Kowalewski & Śpiewanowski, 2020), which reported that the Hang Seng index and Shanghai stock exchange, United States and European stock markets reflect negative returns. In March, United States market hit by circuit brake mechanism, four times in 10 days. Similarly, United Kingdom stock market index, FTSE, has a decline of more than 12% worse after 1987 (Al‐Awadhi et al., 2020).

1.1. COVID‐19 and Karachi stock exchange

In Pakistan, the first case of COVID‐19 is reported on February 26, 2020 which has crossed the figure of 13,000, till conducting the study. However, the recovery rate is better as compared to the developed countries, like Italy, France, and United States. The impact of this pandemic situation on Pakistan's economy depends on the time taken in taking preventive measures and the intensity of spreading the disease. According to the Asian Development Bank (ADB), this pandemic situation can cost the Pakistan economy approximately $16.38 million to $4.95 billion, nearly 1.57% of the overall GDP. The report also mentioned that this pandemic cost more than 946,000 job losses. In this way, a country that is at the recovery stage, in the last 2 years, is affecting badly.

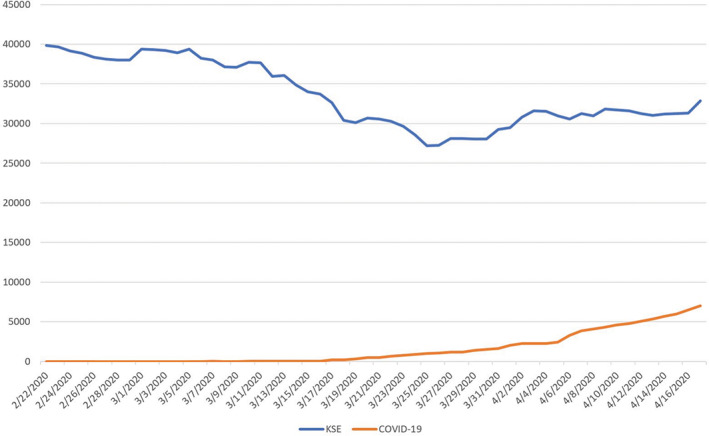

Trade is considered as the backbone of every economy as it brings the foreign reserves in the country to support the balance of payment and control exchange rate, etc. After this pandemic hitting Pakistan, authorities decided to close the industry which caused to shrink the economy. Previously, the stock markets reflect the changes when a major event or problem hits the country. In the same way, as the infected cases reported in Pakistan, the stock market starts declining; on March 19, it hits its lowest value in the last 5 years. The main cause of this sudden decline is the pandemic situation which urges the foreign investors to withdraw their foreign portfolio investments. Due to COVID‐19, industries are affected by the lockdown and this pressure build on the stock market. Resultantly, the stock market has shown a declining trend in start of this uncertain situation, as indicated in Figure 1. Later when IMF and other countries extend the dates of the loan payment, IMF approval of $1.4 billion grant to Pakistan to cope with this pandemic and the funding from the world bank, help indirectly to recover the stock market and business activities in the country. In turn of these efforts, the KSE‐100 index has shown a significant surge in, which moved from 39,382 on March 5 to 44,960 on March 26, respectively (News Desk, 2020).

FIGURE 1.

Recent trends of COVID‐19 and KSE

1.2. Contribution

Previously, the studies are conducted in the developed economies to analyze the relationship between pandemic and stock exchanges (Al‐Awadhi et al., 2020; Kowalewski & Śpiewanowski, 2020). On contrary, we examine the impact of COVID‐19 on developing economy. However, this study is the pioneer which analyzes the effect of the COVID‐19 on the Karachi stock exchange (KSE), Pakistan, which belongs to the top rated emerging stock markets. It is important to study the dynamics of Pakistan stock market for number of reasons: (a) it provides the insight of investors behavior in developing economies, (b) how the lockdown and government intervention reflects in stock market, specifically for predicted case scenarios, and (c) which necessary actions are needed to retain the investment in developing stock markets.

2. DATA AND METHODOLOGY

The study examines the association between COVID‐19 and Karachi stock exchange. For this purpose, we collect the data of COVID‐19 from World Health Organization (WHO) and the KSE‐10 index data is taken from Karachi stock exchange (https://www.psx.com.pk/). The first patient of COVID‐19 is reported on February 26, 2020, however, we use the data of COVID‐19 and KSE from February 26 to April 17, 2020. Using the present data, we have estimated the quantile‐on‐quantile estimations to examine the impact of COVID‐19 on KSE‐100 index. Afterward, we employ auto regressive integrated moving average (ARIMA) and exponential smoothing (ES) approach to forecast the three scenarios; low cases in future, average cases in future and high cases in future. By using the predicted values of different scenarios, we estimate the trend of KSE‐100 index for May and June.

2.1. Quantile‐on‐quantile estimation

In this study, we adopt the quantile on quantile approach (QQR) to investigate the effect of COVID‐19 on the stock market of Pakistan (KSE 100 index). This approach is proposed by Sim and Zhou (2015) in order to understand the asymmetric behavior of variables in time series data. Different researchers have also proposed to analyze the data normality before proceeding to correlation or regression analysis. This QQR approach helps the researcher in understanding the impact of variables on conditional quantile variables. According to (Sharif, Afshan, & Qureshi, 2019) QQR is a combination of nonparametric estimation and quantile regression. It can also be applied on the nonnormal dataset. Moreover, it presents the asymmetric distribution of the variables (Shahbaz, Zakaria, Jawad, Shahzad, & Mahalik, 2018). This technique provides us the in‐depth analysis of the COVID‐19 spread effect on the stock market of Pakistan. The following equation reflecting the linear relation of Q–Q analysis.

KSE t mentions the daily stock index of Karachi stock exchange; COVID t is indicating the daily virus cases confirmed by authorities, in Pakistan. ∅∁ and ∂ ∁ are the error term effect and uncertanity, respectively. Afterward, the coefficients of COVID t turn to different conditional quantiles. We use these quantiles‐on‐quantiles based coefficients to form a surf graph.

3. RESULT AND DISCUSSION

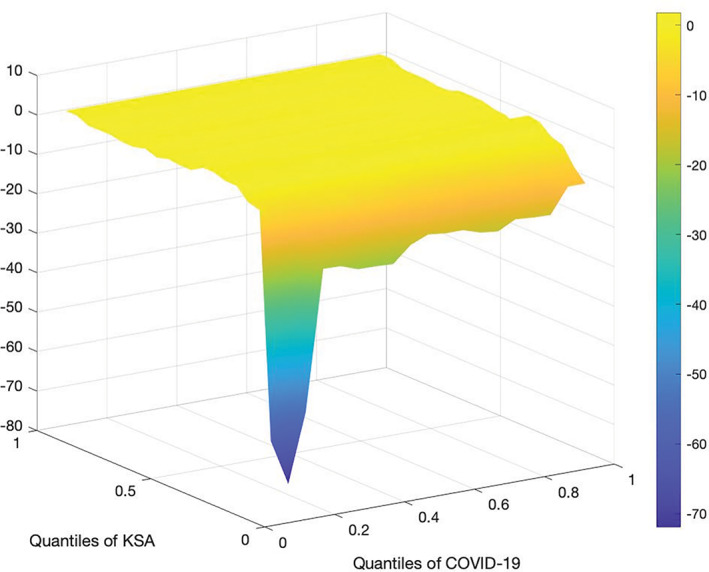

By using quantile‐on‐quantile based coefficients, we examine the relationship between the spreading of COVID‐19 and KSE index in Pakistan, mention in Figure 2. The findings argue that stock market has reported mix evidence with COVID‐19.

FIGURE 2.

Q–Q based impact of COVID‐19 on KSE

As in the figure, we can see that it starts declining at the start of March. However, in March, the trading has stopped in KSE due to sudden downfall in KSE‐100 index. It has been observed that the KSE index start declining which turn to its historic lowest point of the last 5 years. One of the reasons for such decline is the drawing of foreign investment; in the last 2 years, there were $3.5 billion of foreign portfolio investments in the stock market of Pakistan which started withdrawing. Resultantly, within 2 weeks, $2 billion has withdrawn from Pakistani stock market. At the same time, cases started increasing in Pakistan and at the end of March, this figure is close to 5,000 cases.

Moreover, this relationship is significant and positive on quantile 0.2 of COVID‐19 and 0.3 of Karachi stock exchange, mentioning that on upper quantiles the situation is turning better. At the end of March, the market starts recovering due to number of reasons: firstly, the decline in interest rate motivates the investors to turn back and invest in Pakistani economy. The significant reduction in interest rate boosts the investors' confidence to take a loan and invest, which deliver a positive signal to investors. The second reason for increment in stock index is the economic package from the government of Pakistan to help the public and small businesses. The government has announced the economic package of Rs. 900 which is equal to $5.66 billion (Haris, 2020). From this package, the government has fixed Rs. 100 billion for exporters to enhance the exports and economic activity in the country. In turn of these significant and timely measures, the stock market is now booting up.

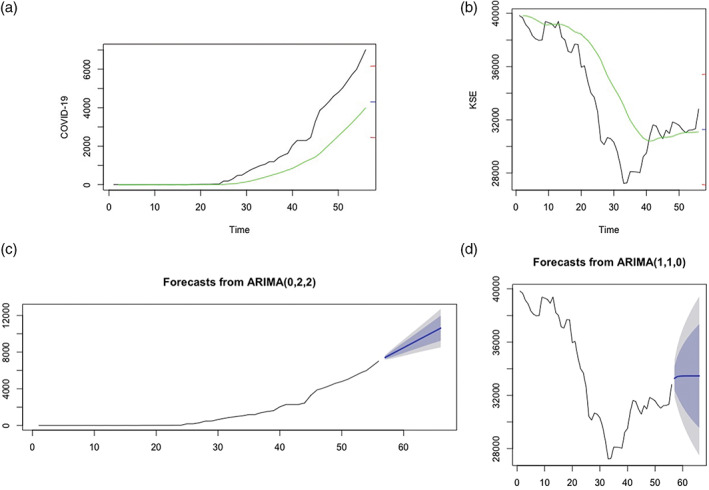

The forecasting based analysis shows that within the period of the next 2 months, the situation is going to be normal, as indicated by Figure 3. It has been analyzed that due to the steps taken by the Pakistani government, especially economic package and interest rate announcements, stock market index is showing the significant surge in index point.

FIGURE 3.

Exponential smoothing and ARIMA based forecasting. ARIMA, auto regressive integrated moving average

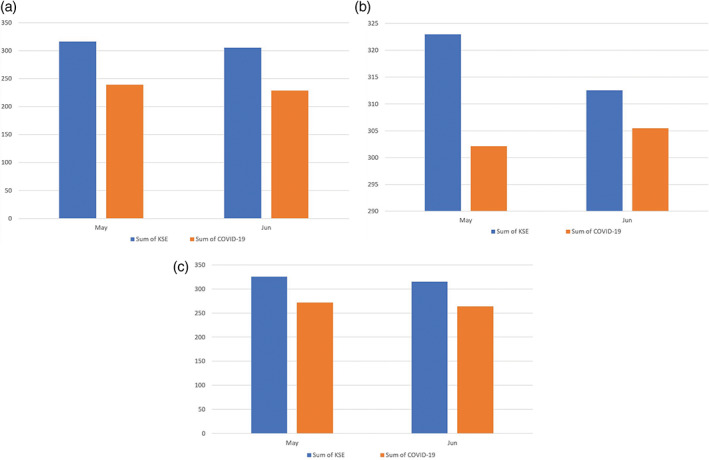

In Figure 4, we can see the forecasted trend of KSE in three scenarios of COVID‐19: low growth in cases, average growth in cases and high growth in cases. Figure 4a indicates the low case scenario, which mentions less cases in May and June. Figure 4b,c indicates the scenario of average growth and high growth in COVID‐19 cases, respectively. In all three scenarios, it seems clear that the performance of Karachi stock exchange is stable. Remarkably, the performance of stock market is higher in high growth scenario. However, we can conclude that COVID‐19 have not documented adverse effect on KSE‐100 index.

FIGURE 4.

Forecasted trend of COVID‐19 and KSE

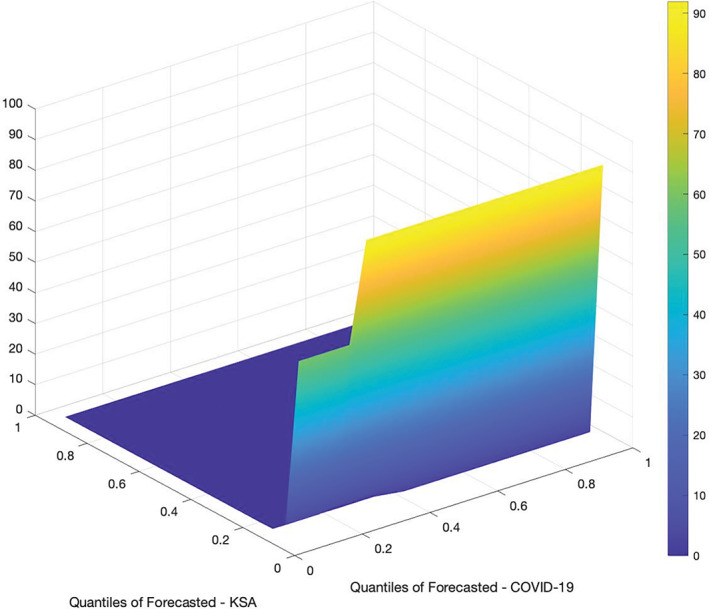

Similarly, Figure 5 reveals that in Pakistan, which is a developing country, the situation is opposite to the stock markets of developed countries, like Europe and United States, where the stock index has hit hard (Al‐Awadhi et al., 2020). 1 According to the predicted data, the KSE‐100 index is moving upward in May and June. The main cause for such surprising response of Karachi stock exchange are the economic support packages to industries, economic aid to general public to maintain their consumption of industrial goods and the increase in business activities due to the special month and the Muslim festival ahead. In this month economic activity remain more as compared to other months (Haris, 2020).

FIGURE 5.

Q–Q forecasted impact of COVID‐19 on KSE

The coefficients of quantile‐on‐quantile approach of predicted data reflects the optimistic behavior of investors toward stock market; around 0.15th quantile the response of stock market turn to be positive. Moreover, the timely intervention and packages by government of Pakistan has provided a positive signal in stock market. In turn, the KSE‐100 index is reporting positive returns.

4. CONCLUSION

This article provides an analysis of the COVID‐19 effect on the stock market returns of Pakistan stock exchange. Previously, the studies have reported that stock markets of the developed economies are struggling a lot during the pandemic. The stock markets of the developed economies have faced circuit breaks several times during this period. On the other hand, the stock market of developing economies, like Pakistan, have reported opposite trend. It has a dip at the start of a pandemic but after taking preventive measures by the government, the situation is turning better. These preventive measures, such as relief package for public, industries, small businesses, decline in the interest rate have a positive impact on the stock market. As it becomes easy for the businesses to take loan for operational activities. On other hand, the government has attempted to maintain the industrial consumption through dispersing money to the jobless persons. It is also forecasted that this betterment in the economic position will continue in three predicted scenarios of COVID‐19: low growth in cases, average growth in cases and high growth in cases. It shows that this pandemic has a diverse effect on the stock market of developing economies, as compared to the stock markets of developed economies.

In a nutshell, the authorities have to foresee the COVID‐19 trend, stock market and economy, etc. to take preemptive measures on timely basis. In such scenarios, it is more than important to provide the economic relief to general public and business diaspora. These economic packages help the local community to maintain their demand for industrial goods which trigger the economic activity and attract the investment opportunities.

Biographies

Dr. Rida Waheed works as Assistant Professor in Finance and Economics Department, College of Business, University of Jeddah, Saudi Arabia. She has number of articles related to financial analysis, energy finance, energy economics, environmental economics etc. in multiple journals.

Dr. Suleman Sarwar is offering his services as Assistant Professor in Finance and Economics Department, College of Business, University of Jeddah, Saudi Arabia. He works related to energy economics, environmental economics, financial economics etc, which have published in Energy Economics, Journal of Cleaner Production, Energy Policy etc.

Sahar Sarwar is a research scholar in Department of Economics, Government College University Faisalabad, Pakistan. Her research domain is finance, energy economics and environmental economics. She has published her articles in Science of Total Environment, Energy Reports etc.

Dr. Muhamad Kaleem Khan is an Assistant Professor in COMSATS University, Pakistan. Currently, he is doing Post‐Doctorate from School of Management, Xian Jiaotong University, Xian, China. His area of research is purely Finance, e.g. corporate finance, stock markets, etc. He has published his work in China Economic Review, Journal of Business Economics and Management, Asia Pacific Journal of Marketing and Logistics, etc.

Waheed R, Sarwar S, Sarwar S, Khan MK. The impact of COVID‐19 on Karachi stock exchange: Quantile‐on‐quantile approach using secondary and predicted data. J Public Affairs. 2020;20:e2290. 10.1002/pa.2290

Endnote

We used the coefficients of quantile‐on‐quantile based estimations, for predicted data, to draw a 3‐D graph which reflects the impact of COVID‐19 on Karachi stock market.

Contributor Information

Rida Waheed, Email: ridawaheed.sdu@gmail.com.

Suleman Sarwar, Email: ch.sulemansarwar@gmail.com.

Sahar Sarwar, Email: saharsarwar@yahoo.com.

Muhammad Kaleem Khan, Email: mkaleemkhan@yahoo.com.

REFERENCES

- Al‐Awadhi, A. M. , Al‐Saifi, K. , Al‐Awadhi, A. , & Alhamadi, S. (2020). Death and contagious infectious diseases: Impact of the COVID‐19 virus on stock market returns. Journal of Behavioral and Experimental Finance, 27, 100326. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Haque, A. , & Sarwar, S. (2013). Effect of fundamental and stock market variables on equity return in Pakistan. Science International, 25(4), 981–987. [Google Scholar]

- Haris, D . (2020). Stocks appear tempting as COVID‐19 engenders discounted prices. The News. Retrieved from https://www.thenews.com.pk/print/636083‐stocks‐appear‐tempting‐as‐covid‐19‐engenders‐discounted‐prices

- Kowalewski, O. , & Śpiewanowski, P. (2020). Stock market response to potash mine disasters. Journal of Commodity Markets, 100124. 10.1016/j.jcomm.2020.100124. [DOI] [Google Scholar]

- News Desk . 2020. Another day of losses as KSE‐100 index down by 491.81 points. 24News, Lahore, Pakistan: 24 News. Retrieved from https://www.24newshd.tv/27-Apr-2020/another-day-of-losses-as-kse-100-index-down-by-491-81-points [Google Scholar]

- Pharmaceutical Technology . (2020). Coronavirus: A timeline of how the deadly Covid‐19 outbreak is evolving.

- Shahbaz, M. , Zakaria, M. , Jawad, S. , Shahzad, H. , & Mahalik, M. K. (2018). The energy consumption and economic growth nexus in top ten energy‐consuming countries: Fresh evidence from using the quantile‐on‐quantile approach. Energy Economics, 71, 282–301. 10.1016/j.eneco.2018.02.023 [DOI] [Google Scholar]

- Sharif, A. , Afshan, S. , & Qureshi, M. A. (2019). Idolization and ramification between globalization and ecological footprints: Evidence from quantile‐on‐quantile approach. Environmental Science and Pollution Research, 26, 11191–11211. [DOI] [PubMed] [Google Scholar]

- Sim, N. , & Zhou, H. (2015). Oil prices, US stock return, and the dependence between their quantiles. Journal of Banking & Finance, 55, 1–8. 10.1016/j.jbankfin.2015.01.013 [DOI] [Google Scholar]

- Waheed, R. , Wei, C. , Sarwar, S. , & Lv, Y. (2018). Impact of oil prices on firm stock return: Industry‐wise analysis. Empirical Economics, 55(2), 765–780. 10.1007/s00181-017-1296-4 [DOI] [Google Scholar]