Abstract

The circumstances surrounding the outbreak of the COVID-19 pandemic have generated substantial international political strain as governments attempt to mitigate the widespread associated social and economic repercussions. One theory has focused on the potential for Chinese informational asymmetry. Using Chinese financial market data, we attempt to establish the scale and direction of information flows during multiple distinct phases of the development of the pandemic. Two specific results are identified. Firstly, the majority of domestically-traded Chinese stocks present evidence of significant information flows at a far earlier stage than internationally-traded comparatives, suggesting that domestic investors recognised the dangers associated with COVID-19 far in advance of the rest of the world. One potential explanation surrounds the view that the severity of domestically-reported Chinese news was not appropriately recognised by international investors. Secondly, while evidence of safe-haven and flight-to-safety behaviour is evident throughout traditional energy and precious metal markets, cryptocurrencies became informationally-synchronised with Chinese equity markets, indicating their use as an investor safe-haven. This is a particularly concerning outcome for international policy-maker and regulatory authorities due to the fragility of these developing markets.

Keywords: COVID-19, Coronavirus, China, Price discovery, Information asymmetry

Highlights

-

•

Analysing Chinese markets we attempt to establish the scale and direction of information flows during the COVID-19 pandemic

-

•

Results suggest that Chinese stocks present significant information flows far earlier than internationally counterparts

-

•

The immediacy and severity of early news release appears to have not been appropriately recognised by international investors

-

•

Evidence of flight-to-safety behaviour is evident throughout traditional energy and precious metal markets.

-

•

Cryptocurrencies appear informationally-synchronised with Chinese equities, indicating their use as an investment safe-haven

1. Introduction

The identification of COVID-19 instigated a transformational process of news dissemination throughout traditional financial markets. Investors and governments were tasked with a quite unique reactionary spectrum when attempting to quantify the potential implications of the growing pandemic. Should governments under-react, they risked exposing vulnerable populations to the harshest exposure to an unknown entity. Should they over-react, such governments faced an unfortunate backlash in the form of a political response from unappeased voters. Investors faced a similar dilemma when attempting to quantify portfolio risk. What has transpired is a multi-directional and multi-faceted international response that takes the shape of cultural tolerances to exceptional risks, ranging from entire nations entering a phase of ‘lock-down,’ while some countries decided to ‘proceed with caution’ and minimise disruption. The economic consequences of the former are far more perilous than that of the latter (Alvarez, Argente, & Lippi, 2020). However, one of the key concerns during a period of growing attribution of responsibility in the post-containment phase, is quite simply who knew what, and when?

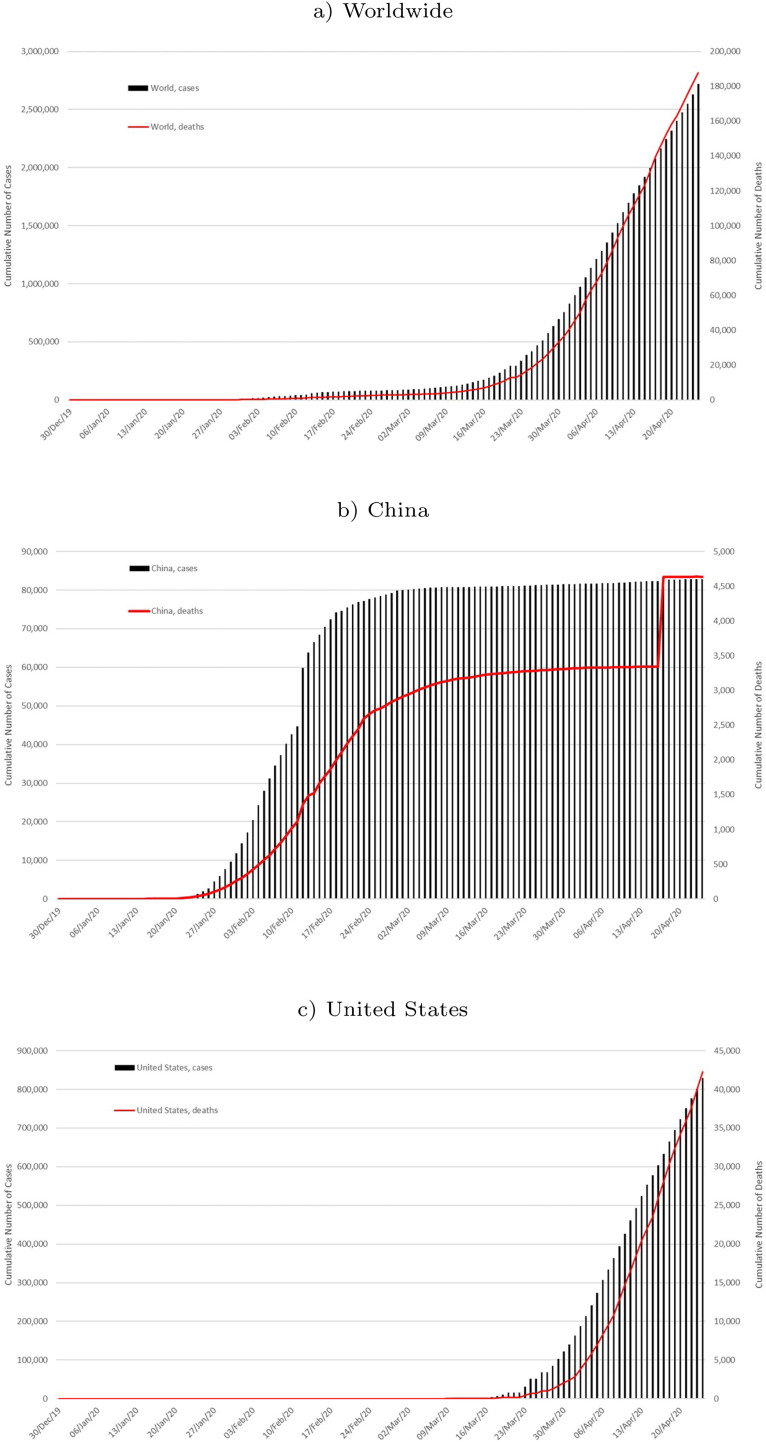

Growing concern has surrounded the role of Chinese authorities in the potential ‘shrouding’ of important information, although to date, no evidence of such behaviour has been presented. Two distinct accusations have transpired: 1) COVID-19 was a man-made phenomenon, initially transmitted from a lab in Wuhan; and 2) Chinese government officials did not transmit information to the outside world in a timely manner. Politically-driven motivations are quite possibly one reason for such inflammatory accusations, however, financial market data can help to either support or refute the latter accusation in particular. Chinese investors, observing the growth of the severity of COVID-19 prior to the international outbreak of the pandemic, would most likely have possessed substantive information in comparison to international investors (Chan, Lien, & Weng, 2008; Chan, Menkveld, & Yang, 2007), even considering the role of social media in today's society (Chen, De, Hu, & Hwang, 2014; Luo, Zhang, & Duan, 2013; Yu, Duan, & Cao, 2013). The first case of someone suffering from COVID-19 can be traced back to 17 November according to media reports on unpublished Chinese government data. It was stated that Chinese authorities had identified at least 266 people who had contracted the virus, and the earliest case was identified weeks before authorities announced the emergence of the new virus. Further, the identification of a number of substantiated ‘rumours’ presents evidence that Chinese citizens were potentially aware of this forthcoming threat, but not of the forthcoming international contagion. The first official identification by international organisations such as the World Heath Organisation (WHO), was on the 31 December 2019, with the BBC reporting on 3 January 2020 of a pneumonia-like ‘mystery virus’ with characteristics similar to the SARs (severe acute respiratory syndrome) pandemic of, 2002 through 2003. Fig. 1 present evidence of the number of countries which have been affected to date and the sharp growth in the number of confirmed cases and deaths as reported by the World Health Organisation (WHO). News dissemination was further muddied through the identification on 20 February of an aggressive strain of H5N1 bird flu has been discovered in Hunan Province.

Fig. 1.

Cumulative number of confirmed cases and deaths since the beginning of the COVID-19 pandemic.

Note: The data was sourced from World Health Organisation (WHO) and presented in?. Data correct as of April 2020.

There are a number of avenues through which evidence sourced in financial markets can help to eradicate such concerns and opaque rumours. To date a number of substantial effects have been identified with regards to the contagion effects of COVID-19, particularly those evident in gold and cryptocurrency markets (Corbet, Larkin, & Lucey, 2020); and side-effects relating to name association (Corbet, Hou, Hu, Lucey, & Oxley, 2020). Otherwise, related research is quite sparse with the exception of that relating to control and continuity (Kamradt-Scott, 2013; Kamradt-Scott, 2015; Sadique et al., 2007; Weiss, 2012), the effects of pandemics, as measured through swine flu of 2008/2009 on tourism (Page, Song, & Wu, 2012), and tracing the conceptual entanglement of financial and biological contagion (Peckham, 2013). In the following research, we focus on three distinct periods of analysis to consider the pre-COVID-19 phase; the China-only-COVID-19 phase; and the international transmission phase of COVID-19, to identify evidence of both contagion effects and price discovery. Financial market responses and behaviour within these three distinct phases presents substantial evidence of knowledge dissemination, even those trades belonging to insiders, which has been supported by the works of Huddart, Hughes, and Levine (2001) and Aktas, De Bodt, and Van Oppens (2008), however, not supported by Chakravarty and McConnell (1999). Quite simply, we test whether there existed an earlier phase through which Chinese investors recognised the dangers of COVID-19 in the denoted period of ‘rumoured’ knowledge superiority in November and December 2019, in advance of the first WHO announcement. Evidence of such, would point to an international failure to recognise local information dissemination in China. Should no evidence be identified, such findings would indicate that Chinese investors were equally caught unaware similar to other international investors. Within our research, we specifically consider the contagion effects and transmission of price discovery between Chinese markets and other traditional international asset classes.

Further, a quite unique characteristic of Chinese financial markets allows us to provide robustness of such a methodological structure through the comparison and contrasting of not only when investors first realised the substantive and inherent dangers within the outbreak of the COVID-19 pandemic, but further, the direct differentials through the segregation of investors by type. This is completed through the division of investors into ‘domestic’ (that is Chinese) and ‘foreign’ investor-groupings, made possible through the use of Chinese B-shares listings, that are best described as equity share investments in companies based in China that trade in foreign currency on two different Chinese exchanges. On the Shanghai Exchange, B-shares trade in US dollars, while on the Shenzhen Exchange, B-shares trade in Hong Kong dollars. B-shares were initially offered to target investment from foreign investors and are considered an alternative to A-shares which are the standard equity market offering from Chinese corporations. A-shares trade in China's local currency the Renminbi, and are used by domestic Chinese investors. The proper name of B-shares is ‘Domestically Listed Foreign Investment Shares’, which used to be referred to as ‘Renminbi Special Shares.’ B-shares were only accessible to foreign investors until February 19, 2001 when the China Securities Regulatory Commission (‘CSRC’) decided to allow domestic residents to buy and sell B shares on the secondary market. While international investors can trade B-shares, there exists a strict, official foreign ownership limit for China A-shares of 30%, however once foreign ownership holding reaches 28%, no further foreign purchases are permitted.1 As a result and in accordance with the ‘Foreign Ownership Restrictions and Minimum Foreign Headroom Requirement rule, ‘foreigners' cannot invest thereafter. The analysis of A-share and B-share interactions provides an opportunity to separate behavioural transmission and price discovery by domestic and foreign investment interactions.

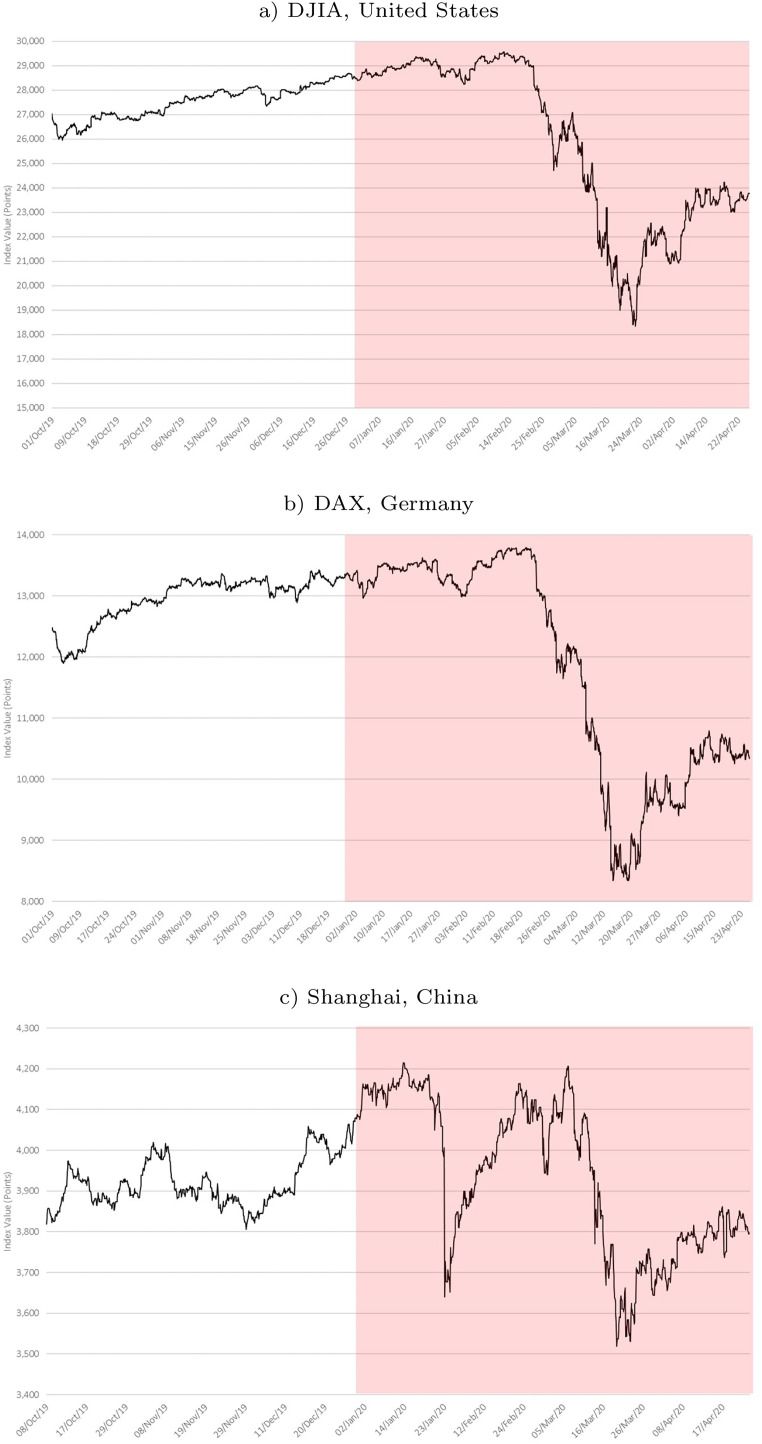

To date, to the best of the authors knowledge, no research has focused on such specific questions, through which both the timing and evidence provided could be quite useful in mitigating some of the strained rhetoric that has developed as both economic and social social conditions are strained due to COVID-19. The political and cultural undertones of multifaceted response are also evident in the extensive attribution of blame that has subsequently followed. While the economic ramifications of this exceptional shock continue to unfold, as evidenced in the recent stock market performance presented in Fig. 2 , some countries have determined that the development of a rhetoric of blaming China might be best to deal with the negative sentiment that has begun to unfold in the face of ‘tremendous’ economic uncertainty. Such determination without fact could generate substantial damage to inter-regional relations. US President Donald Trump displayed a broad range of emotional responses to the threat of coronavirus, all evidenced in the political undertones that extended within each statement. First exhibiting a range of statements undermining the threat that the US faced, the US President originally declared the COVID-19 pandemic to not exist, moving quickly to state that everything was ‘under control’. On 22 January, he declared on CNBC ‘We have it totally under control. It's one person coming in from China, and we have it under control. It's going to be just fine’ before stating in a New Hampshire rally that warmer temperatures in April would make it go away. Before re-affirming the safety and strength of US financial markets, the US President then proceeded to downplay the risks before finally acknowledging the severity of the pandemic and declaring a national emergency on 14 March and backtracking on earlier remarks, stating on 17 March ‘I felt it was a pandemic long before it was called a pandemic’. The breadth of this emotional response was astonishing for a person in possession of such control. However, on 18 March, the undertones of the US President's response took the form of a somewhat darker line when he tweeted ‘I always treated the Chinese Virus very seriously, and have done a very good job from the beginning, including my very early decision to close the ‘borders' from China – against the wishes of almost all’. The use of the term ‘Chinese Virus' quickly expanded to include ‘Wuhan virus' and ‘Chinese flu’ before further manifestation of daily reiterations that China was the source and future recipient of punishment should further evidence suggest that ‘they’ knowingly misled the world. For many nations, the cause did not prioritise the need for a solution. The transmission of blame to China demonstrated quite an alarming tactical selection by an international superpower. In one of the most incredible cases observed on 22 April, and widely considered to be a publicity stunt, the US state of Missouri attempted to sue the Chinese government over its handling of the coronavirus which it says has led to severe economic losses.

Fig. 2.

Selected stock market performance, 5-min performance.

Note: The above data represents the 5-min price levels of US, German and Chinese markets between the period October 2019 and April 2020. The shaded-area presents the period since 30 December 2019 when the WHO first identified the existence of Coronavirus through a public announcement.

While the benefits of this research not only attempt to somewhat dispel substantial rumour and sources of geopolitical tensions sourced in political rhetoric, the identification of information flows and channels of price discovery sourced within Chinese financial markets are particularly important during periods of extreme financial stress. This is particularly important due to the rather opaque nature of news dissemination through social media buffers and controls. Further considering the economic challenges through which COVID-19 presents for the worldwide economy, there are also a number of specific lessons through which we can learn from recent international crises. It is hoped that the sudden shock sourced in the spread of the coronavirus pandemic could manifest in a particularly severe economic trough, but subsequent U-shaped recovery. However, we must monitor certain aspects of our economy with particular care such as deterioration of liquidity and asset quality, both of which are conducive to further economic deterioration (Cavallo & Valenzuela, 2010; Corbet, 2016; Corbet & Larkin, 2017; Donaldson, 1992), deterioration of financial institutions (Allen & Gale, 1998; Chang & Velasco, 2001; Meegan, Corbet, & Larkin, 2018), systemic risk (Allen & Carletti, 2013; Chang & Chen, 2014; Covitz, Liang, & Suarez, 2013; Gorton & Metrick, 2012), and the maintenance of regulation in the face of financial desperation (Kroszner, 1999; Ahuja, Barrett, Corbet, and Larkin (2019); Barrett, Corbet, & Larkin, 2019; Barrett, Corbet, & Larkin, 2020).

Our research provides a number of interesting results relating to information shares and price discovery during the period surrounding the initial COVID-19 outbreak. Primarily, we identify that Chinese crude oil, corn and international Bitcoin markets play a leading role in the price discovery processes. Moreover, the dynamic relative information share of the SSEA and SSEB indices significantly changes as domestic contagion of the COVID-19 in mainland China begins at a substantially earlier time period than that of the rest of the world. Evidence suggests that Chinese financial markets were responding to news relating to a ‘mystery pneumonia’ up to 6 weeks in advance of the official WHO identification of COVID-19. With respect to the time varying net spillovers of higher moments from the SSEA and SSEB indices to other assets, the SSEA index is an information transmitter to domestic crude oil and corn markets in the short run, whereas it receives information shocks from the US dollar index. Both volatility and skewness spillovers are an information transmitter of the SSEA and to the Bitcoin market, while kurtosis spillovers identify a net transmission in the opposite direction. We find evidence supporting the fact that the short-run informational spillovers significantly change across the various stages of the domestic and global contagion of COVID-19.

Furthermore, we detect large variations in the movements of the information share and higher moments' spillovers around two critical dates after which domestic and global COVID-19 outbreaks respectively occur. The result reflect the responses of investors to the progression of COVID-19. In addition, the Chinese A-share market has a more important informational role for the crude oil price in China in the short run, whereas the Chinese B-share market has a more important short-run informational role in the foreign exchange market. These roles are intensified as COVID-19 becomes globally contagious and severe. Such evidence suggests two important results. First, the majority of Chinese-traded financial markets occur in the SSEA which shows evidence of an increased informational response across a number of moments at a much earlier stage when compared to the more internationally-traded SSEB. This suggests that financial markets in China recognised the dangers associated with COVID-19 in advance of the rest of the world, a result that does not suggest government collusion such as that identified by other international governments, but rather that local news in China did not filter through to international broadcasters and that international investors did not identify COVID-19 in its infancy. Secondly, while evidence of safe-haven and flight-to-safety behaviour is evident across traditional energy and precious metal markets such as Chinese oil and gold markets, results suggest that cryptocurrencies offered another platform through which wealth was stored during periods of extreme financial market volatility. This result supports the growing literature that has identified potential safe-haven properties in cryptocurrency during the extreme pandemic-related financial market stress (Conlon, Corbet, & McGhee, 2020; Corbet, Hu, Hou, Larkin, & Oxley, 2020; Corbet, Hu, Hou, & Oxley, 2020; Yarovaya, Brzeszczynski, Goodell, Lucey, & Lau, 2020). This latter result, while supporting the views of cryptocurrency enthusiasts, will be of particular concern to policy-makers and regulators due to the large number of fundamental flaws that exist within these relatively juvenile financial products (Corbet & Cumming, 2020; Corbet, Larkin, Lucey, Meegan, & Yarovaya, 2018; Corbet, Larkin, Lucey, & Yarovaya, 2020; Gandal, Hamrick, Moore, & Oberman, 2018; Griffin & Shams, 2018). One particular explanation for this outcome could be due to the education schemes that have been developed and progressed by the Chinese Communist Party aimed at educating the population of China about the nature and future of digital currencies.2

The paper is structured as follows: previous literature that guide the selection of areas of interest pursued in the paper, are summarised in Section 2. Section 3 presents a thorough explanation of the data used in this analyses, while Section 4 presents a concise overview of the methodologies utilised to analyse the hypotheses to be evaluated. Section 5 specifically investigates the interactions between Chinese financial markets and other traditional financial market asset classes, while Section 6 concludes.

2. Previous literature

Chinese financial markets have received growing attention due to a number of unique characteristics they display, particularly the existence of A-share and B-share exchanges in both Shanghai and Shenzhen. Chakravarty, Sarkar, and Wu (1998) found that Chinese foreign class B-shares trade at an average discount of approximately 60% compared to the prices at which domestic A-shares trade, which seems to be caused by an information asymmetry where foreign investors have less information on Chinese stocks than domestic investors. Chui and Kwok (1998) further argues that correlations between A- and B-shares are consistent with the same notion of information asymmetry, which is likely due to informational barriers that are present in China. Schuppli and Bohl (2010) found that foreign institutions presented a stabilising effect on the Chinese stock markets and contributed to improved market efficiency, a factor which Wang, Wei, and Wu (2010) identified as the cause of declining cross-correlations over time. Yuan, Zhuang, and Liu (2012) found the same cross-correlation to be multi-fractal, and both Los and Yu (2008) and Wang and Iorio (2007) argued this provided evidence of gradual integration. Chen, Lee, and Rui (2001) suggested that initial price differentials relating to B-shares was likely attributable to illiquidity, while Fung, Lee, and Leung (2000) found that weak correlations suggest that both the A- and B-shares markets reflect different fundamental drivers. Mei, Scheinkman, and Xiong (2009) found that trading caused by investors' speculative motives can help explain a significant fraction of the price difference between Chinese dual-class shares, while Chan et al. (2007) identified evidence of shifting informational patterns due to regulatory changes in February 2001, however A-shares continued to dominate the price discovery process.

Cai, McGuinness, and Zhang (2011) found that weakening informational asymmetries underlie much of the change in the markets' relative pricing, where policy and corporate governance change appears to be the principal force driving the efficiency gains, while Meng, Li, Chan, and Gao (2020) identified, through the use of A-share data, the presence of a negative information effect from short-selling restrictions. Xianghai (1996) identified cross-sectional differences between the prices of both A- and B-shares, with evidence suggesting the presence of a correlation with investors' attitudes towards risk. Further, Tan, Chiang, Mason, and Nelling (2008) and Yao, Ma, and He (2014) examined herding behaviour in dual-listed A-share and B-share stocks, identifying evidence of herding within both the Shanghai and Shenzhen A-share markets and also within both B-share markets. Herding by A-share investors in the Shanghai market is found to be more pronounced under conditions of rising markets, high trading volume, and high volatility, while no asymmetry is apparent in the B-share market. Further evidence suggests that herding is more prevalent at the industry-level, stronger for the largest and smallest stocks, and is stronger for growth stocks relative to value stocks, while evidence suggests that this diminishes over time. Wang and Jiang (2004) found that B-shares retain significant exposure to their domestic market and therefore provide foreign investors with diversification opportunities, while Lin and Tsai (2019) found evidence supporting the usage of B-shares as a hedging tool for the Shanghai housing market, to which no benefits were identified through the use of A-shares.

When considering specific Chinese financial market effects, Eun and Huang (2007), and in the early 1990s Bailey (1994), found that Chinese investors are willing to pay a significant premium for more liquid stocks or for dividend-paying stocks, while investors value local A-shares more if there are offshore counterparts, implying that a Chinese firm with a foreign shareholder base has a lower cost of capital. Qiao and Dam (2020) analysed the Chinese overnight return puzzle, finding empirical support that the T + 1 induced discount is estimated to be 14 bps, and that the T + 1 discount contributes significantly to overnight risk. Lan, Huang, and Yan (2020) examined whether and how the market interacts with investor sentiment in the context of seasoned equity offerings (SEOs) by Chinese listed firms, to find robust evidence that investor sentiment drives the pre-announcement abnormal return. In the post-announcement period, the market corrects the sentiment-driven overvaluation within approximately 1 month. Qi, Wu, and Zhang (2000) found that the ownership structure composition and relative dominance by various classes of shareholders can affect the performance of state-owned enterprise (SOE)-transformed and listed firms. While investigating the impacts of securities supervision and the law-enforcing regulations upon stock pricing efficiency, He and Fang (2019) found that the pricing efficiency of the sanctioned companies is significantly lower than that of non-offending companies; therefore the administrative supervision and law-enforcing regulations of China's regulatory authorities do not promote pricing efficiency in the stock market.

The transmission of market sentiment through the form of price discovery and information flows can provide substantial signals as to the presence of particular accumulation of pressure, market discontinuity, and indeed, warnings of forthcoming deterioration of financial conditions as traders seek shelter. Hasbrouck (2002) presented an overview of the econometric approaches available to characterise the random-walk component in single- and multiple-price settings, while De Jong (2002) presented clarification of the relationship between the information share and the common factor component weight. Yan and Zivot (2010) found that the information share can provide information on the relative informativeness of individual markets.

When applying such price discovery techniques to financial market data, Su and Chong (2007) studied the price-discovery process for a number of Chinese cross-listed stocks to find that Hong Kong-based stocks are cointegrated, mutually adjusting and contributing more to stocks cross-listed on the New York Stock Exchange. Such information flows have been analysed within commodity markets such as oil and gold (Zhang & Wei, 2010) where oil prices are found to Granger-cause and contribute to the volatility of gold, and geographical regions such as US and Canadian cross-listings (Chen & Choi, 2012; Frijns, Gilbert, & Tourani-Rad, 2015), Australia and New Zealand (Frijns, Gilbert, & Tourani-Rad, 2010), the US and Spain (Pascual, Pascual-Fuster, & Climent, 2006), the US and Germany (Grammig, Melvin, & Schlag, 2005), cross-listing within the US (Harris, McInish, & Wood, 2002), and sequentially across the world (Wang & Yang, 2011). Another significant area involves the interlinkages between spot markets and derivatives products such as futures and options markets. Within this context, spot prices were found to provide more price discovery when considering foreign exchange futures from the Chicago Mercantile Exchange (Chen & Gau, 2010). Muravyev, Pearson, and Paul Broussard (2013) and Fricke and Menkhoff (2011) found no evidence of price discovery when considering US equity options and their spot counterparts using tick-by-tick data during periods of market disagreement, and German Bond futures respectively. Whereas, while accounting for transaction costs, Theissen (2012) find evidence that DAX futures lead price discovery to comparative spot markets, while Lin, Chou, and Wang (2018) find similar evidence in the market for US ETFs, however, the effect is found to diminish during high-sentiment periods as informed traders become less willing to leverage their information advantages on the futures market. Chen and Tsai (2017) and Choy and Zhang (2010) found that futures markets also led the price discovery relationship in both the VIX and Hong Kong regular and mini futures markets' effects on their respective spot markets. Further, Anand, Gatchev, Madureira, Pirinsky, and Underwood (2011) identified the role of geographic influence, while Nimalendran and Ray (2014) showed that algorithmic trades for less liquid stocks are correlated with higher spreads and price impact, as well as contemporaneous trading on the lit venues. In recent research relating to rapidly growing cryptocurrency markets, price discovery and information flows have been analysed using Bitcoin (Akyildirim, Corbet, Katsiampa, Kellard, & Sensoy, 2020; Brandvold, Molnár, Vagstad, & Andreas Valstad, 2015; Corbet, Lucey, Peat, & Vigne, 2018; Katsiampa, Corbet, & Lucey, 2019a; Katsiampa, Corbet, & Lucey, 2019b) where Mt.Gox and BTC-e were identified to be market leaders with the highest information share and Bitcoin futures dominate price discovery relative to spot markets.

3. Data

We collect high-frequency market data, at 30-min intervals, for the purpose of this analysis, including the Shanghai Stock Exchange A-share index (SSEA index), the Shanghai Stock Exchange B-share index (SSEB index), the Chinese crude oil commodity futures (traded on the Shanghai International Energy Exchange), Chinese corn commodity futures (traded on the Dalian Commodity Exchange), Bitcoin spot prices (which trade on the Bitstamp cryptocurrency trading exchange) and the US dollar currency index. It should be noted that the Chinese crude oil futures contracts were firstly introduced on 26 March 2018 and they were the first futures contract in the Chinese mainland open to overseas investors. The underlying spot asset for oil futures contract is medium sour crude oil which is one major crude oil product imported by China and most heavily utilised to support economic development. The SSEA index comprises the A-share stocks traded in the Shanghai Stock Exchange while the SSEB index consists of all the B-share stocks traded in the same exchange. Both A-share and B-share stocks are available for domestic investors to trade; however, foreign investors are allowed to trade B-share stocks only. Normally, overseas investors are prohibited from access to trading A-share stocks in China. The selection of data from the Bitstamp cryptocurrency trading exchange is based on the fact that it is one of the largest and longest trading platforms of cryptocurrencies in the world. Prices of Bitcoin traded on that platform are deemed representative of the global performance of Bitcoin. All the data are collected from Thomson Reuters Datascope and Thomson Reuters Eikon.

The sample period for data collection is 1 July 2019 through to 10 April 2020, which includes three distinct stages of the COVID-19 outbreak. The first sub-period runs from 1 July 2019 through 16 November 2019. This selection is made due to the media identification on the 17 November 2019 of the first case of COVID-19 detected in mainland China, reported by the South China Morning Post. Hence, this sub-period is the first stage without the latent impacts of COVID-19 and hereafter labelled as (P1). The second sub-period is from 17 November 2019 through to 30 December 2019. On the 30 December 2019, as reported by World Health Organisation (WHO), the Wuhan Municipal Health Commission in China reported a cluster of cases of pneumonia in Wuhan, Hubei Province. The novel coronavirus, in its current form was subsequently identified and announced to the world as a global pandemic. After this date, COVID-19 was gradually acknowledged globally and its impacts became internationally contagious. Hence, we identify the second sub-period (P2) as a stage where the COVID-19 affects only domestic China. The third sub-period (P3) runs from 31 December 2019 to 10 April 2020 and is the final stage of analysis, where COVID-19 subsequently spreads from China and starts a widespread contagious period to the rest of the world.

We match prices of the SSEA or SSEB index with those of oil futures, corn futures, Bitcoin and US dollar currency index. High-frequency data during overlapped trading times are chosen to create the samples and any data point that falls outside the overlapped trading frame is excluded. Henceforth there are four samples of SSEA–Oil, SSEA–Corn, SSEA–Bitcoin and SSEA–USD, as well as SSEB–Oil, SSEB–Corn, SSEB–Bitcoin and SSEB–USD via which each pair is analysed in detail. With these samples, we investigate both long-term price discovery and short-run information transmission of higher moments from either the SSEA or SSEB index to the other assets. From our discussion above, we may expect to see different results associated with the A-share index from those of the B-shares, which would help shed light on the different responses of stock markets in China to the COVID-19 outbreak. Table 1 presents descriptive statistics of return series for the SSEA index, SSEB index, oil futures, corn futures, Bitcoin and US dollar currency index. We should note that returns are calculated by taking the first differences of logarithmic prices. Results for the full sample period as well as the three sub-periods (P1, P2 and P3) are presented. As can be observed in Table 1, across the whole sample period, the mean returns of SSEA, SSEB, oil and Bitcoin are negative while the mean returns for the US dollar index and corn are positive. This presents evidence of a bear market for stock markets, oil and Bitcoin markets while a more bullish, upward-trending market for US foreign exchange and corn markets, across the whole timeline of the COVID-19 outbreak. The volatility of Bitcoin is the largest, followed by that of oil. The volatility levels of SSEA, SSEB, US dollar index and corn are quite low in comparison. For all of the assets under observation, the Jarque-Bera normality test rejects the hypothesis that return series follow a normal distribution. Non-zero skewness and excess kurtosis are observed for all the assets.

Table 1.

Descriptive statistics of return series.

| SSEA | SSEB | Oil | Bitcoin | US dollar | Corn | |

|---|---|---|---|---|---|---|

| Full sample period: July 1, 2019 – April 10, 2020 | ||||||

| Mean | −4.73E−05 | −2.32E−04 | −3.98E−04 | −3.34E−04 | 2.34E−05 | 5.26E−05 |

| STD | 0.005 | 0.005 | 0.013 | 0.026 | 0.001 | 0.003 |

| Maximum | 0.031 | 0.052 | 0.090 | 0.269 | 0.018 | 0.041 |

| Minimum | −0.091 | −0.103 | −0.140 | −0.619 | −0.015 | −0.018 |

| Skewness | −5.506 | −7.151 | −1.548 | −9.367 | 0.864 | 4.387 |

| Kurtosis | 105.966 | 168.235 | 32.763 | 266.829 | 49.866 | 63.252 |

| JB test | 5.97E+05⁎⁎⁎ | 1.53E+06⁎⁎⁎ | 4.30E+04⁎⁎⁎ | 3.89E+06⁎⁎⁎ | 1.22E+05⁎⁎⁎ | 1.60E+05⁎⁎⁎ |

| P1: July 1, 2019 – November 16, 2019 | ||||||

| Mean | −3.90E−05 | −2.24E−04 | 4.98E−06 | −3.63E−04 | 2.84E−05 | −4.63E−05 |

| STD | 0.003 | 0.003 | 0.012 | 0.020 | 0.001 | 0.003 |

| Maximum | 0.015 | 0.010 | 0.090 | 0.269 | 0.008 | 0.021 |

| Minimum | −0.017 | −0.020 | −0.140 | −0.128 | −0.007 | −0.018 |

| Skewness | −0.598 | −1.242 | −1.882 | 3.589 | −0.508 | 0.626 |

| Kurtosis | 8.774 | 10.722 | 50.522 | 63.454 | 19.108 | 20.681 |

| JB test | 951.791⁎⁎⁎ | 1801.367⁎⁎⁎ | 5.50E+04⁎⁎⁎ | 1.01E+05⁎⁎⁎ | 7131.146⁎⁎⁎ | 6231.389⁎⁎⁎ |

| P2: November 17, 2019 – December 30, 2019 | ||||||

| Mean | 2.11E−04 | −2.86E−06 | 4.62E−04 | −7.03E−04 | −6.26E−05 | −2.51E−05 |

| STD | 0.002 | 0.003 | 0.007 | 0.014 | 0.001 | 0.002 |

| Maximum | 0.009 | 0.009 | 0.039 | 0.079 | 0.004 | 0.011 |

| Minimum | −0.010 | −0.029 | −0.033 | −0.104 | −0.006 | −0.007 |

| Skewness | 0.327 | −3.116 | 0.613 | 0.169 | −2.266 | 1.333 |

| Kurtosis | 5.222 | 27.237 | 14.207 | 27.082 | 21.234 | 16.746 |

| JB test | 48.518⁎⁎⁎ | 5662.304⁎⁎⁎ | 969.061⁎⁎⁎ | 5244.571⁎⁎⁎ | 3191.956⁎⁎⁎ | 1772.635⁎⁎⁎ |

| P3: December 31, 2019 – April 10, 2020 | ||||||

| Mean | −1.80E-04 | −3.50E−04 | −0.001 | −1.20E−04 | 5.67E−05 | 2.40E−04 |

| STD | 0.007 | 0.007 | 0.015 | 0.035 | 0.002 | 0.004 |

| Maximum | 0.031 | 0.052 | 0.073 | 0.136 | 0.018 | 0.041 |

| Minimum | −0.091 | −0.103 | −0.095 | −0.619 | −0.015 | −0.013 |

| Skewness | −4.798 | −6.025 | −1.146 | −11.517 | 0.976 | 5.545 |

| Kurtosis | 63.035 | 98.665 | 14.001 | 209.524 | 32.854 | 58.047 |

| JB test | 7.12E+04⁎⁎⁎ | 1.79E+05⁎⁎⁎ | 2046.612⁎⁎⁎ | 8.31E+05⁎⁎⁎ | 1.72E+04⁎⁎⁎ | 4.47E+04⁎⁎⁎ |

Note: Returns are calculated by taking the first differences of logarithmic prices. SSEA is the Shanghai Stock Exchange A-share index; SSEB is the Shanghai Stock Exchange B-share index. Oil, the Chinese crude oil commodity futures traded in the Shanghai International Energy Exchange; Gold, the Chinese gold commodity futures; Corn, the Chinese corn commodity futures; Bitcoin, bitcoin traded in the Bitstamp cryptocurrency exchange; US dollar, US dollar currency index. STD denotes standard deviation. JB test is the Jarque-Bera normality test. E stands for scientific notation. ⁎⁎⁎ represents significance at the 1% level.

Furthermore, the mean returns for both SSEA and SSEB indices remain negative in the three sub-periods with one exception, SSEA during P2, where its mean return is positive. This particular result suggests that when COVID-19 spread across mainland China, before it was officially announced as contagious to the rest of the world, the Chinese A-share market experienced a sharp increase in value. When looking at the performance of the commodity oil and corn futures in China, the mean returns for oil are positive during P1 and P2, however, in the same periods, the corn market presents negative mean returns. When it comes to P3, the oil market has negative mean returns which are large in size. In contrast, the corn market undergoes an increase in value. It seems when the COVID-19 became an international concern, crude oil prices in China were significantly affected. Turning to Bitcoin, its mean return remains negative across the three sub-periods and its value falls significantly during the P2. The US dollar currency index experiences increase in values during both P1 and P3, whereas its mean return is negative during P2.

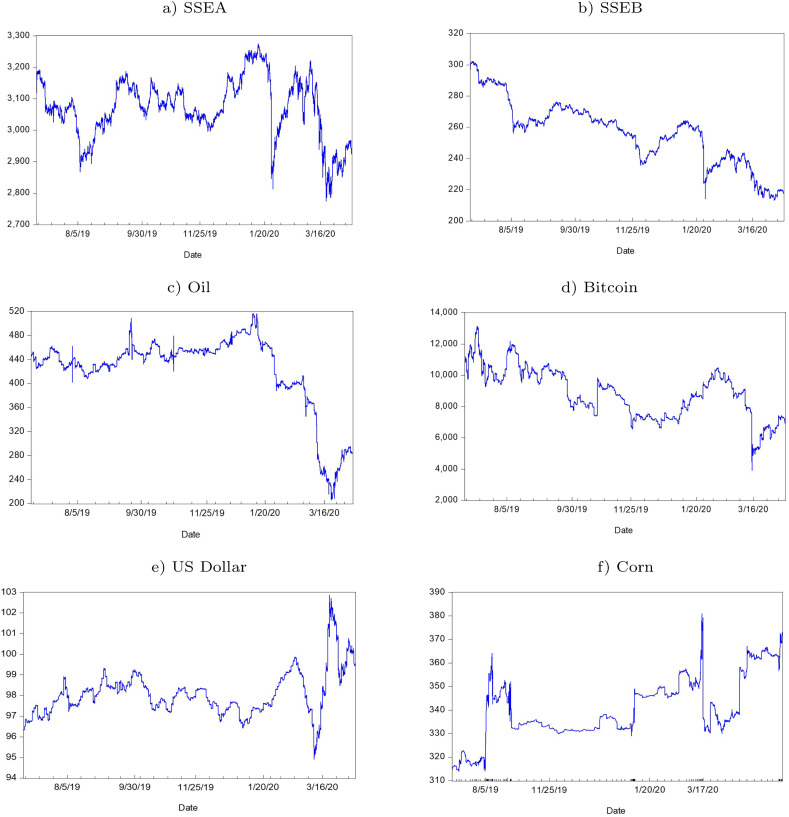

Fig. 3 shows how the price series, at 30-min intervals, change across the time-periods analysed. Two interesting observations are noteworthy. First, the price series for the SSEA index moves in tandem with that of oil, Bitcoin, corn and US dollar index. A similar observation is found for price movements for the SSEB index. It would seem sensible at this stage, therefore, to test whether there exists a long-run equilibrium relationship between the stock indices and other assets, i.e., are the stock indices and other assets cointegrated? Second, there is a substantial decrease in prices during the P3 followed by substantial oscillations in price towards the end of sample period. This observation corresponds with a series of intensive measures and policies made by the Chinese government to mitigate the development of the COVID-19 pandemic, including the lock-down of Wuhan city and Hubei province on 23 January 2020 and the sequential lock-downs across the whole country thereafter. We test the stationarity of all of the logarithmic prices by using the traditional ADF and PP tests where the results indicate that all the prices are integrated of order one, or I(1). We therefore employ the Johansen cointegration test to examine whether either the SSEA series is cointegrated with each series of oil, corn, Bitcoin or US dollar currency index and then the same using SSEB. Our results show that both the SSEA and SSEB price series are cointegrated with those of oil, corn, Bitcoin and US dollar currency index in each paired sample during the whole sample period. This indicates that there exists a long-run equilibrium between the stock indices and alternative asset in each paired sample. Their prices are found to be driven by a common efficient price and information share measure which will be calculated to evaluate the price discovery performance in the long run.

Fig. 3.

Price movements of Stock Indices, Commodities, Bitcoin and US dollar currency index.

Note: SSEA is the Shanghai Stock Exchange A-share index. SSEB is the Shanghai Stock Exchange B-share index. Oil is the Chinese crude oil commodity futures traded in the Shanghai International Energy Exchange. Gold is the Chinese gold commodity futures. Corn is the Chinese corn commodity futures. Bitcoin is bitcoin traded in the Bitstamp cryptocurrency exchange. US dollar is the US dollar currency index. (For interpretation of the references to colour in this figure legend, the reader is referred to the web version of this article.)

4. Methodology

4.1. Information share measures

To investigate information shares between the selected markets, we first let Y t be a 2 x 1 vector of price series of two markets integrated as I(1). If the two price series are cointegrated at order zero, which means Y t contains one single common stochastic trend, then Y t can be specified in the following bivariate vector error correction model (Engle & Granger, 1987):

| (1) |

where Π = αβ t. Both α = [α 1, α 2]′ and β = [1, −β]′ are both 2 x 1 vectors. α 1 and α 2 are the error correction coefficients, measuring responses of two markets to deviations of the past long-run equilibrium. β is the cointegrating coefficient, while Δ is the first-order difference operator. ε t is a vector of innovations, where the lag order k is chosen by Akaike Information Criteria (AIC). According to Hasbrouck (1995), Eq. (1) can be rearranged into the following vector moving average (VMA) model:

| (2) |

where Ψ(1)ε t represents the long run impact of innovations on the price series. If we let Ψ(1) and Ψ(2) be each row of Ψ(1) in Eq. (2), following Hasbrouck (1995), Ψ(1) = Ψ(2), which is determined by the cointegrating coefficient β equal to one. Ψ(1)(Ψ(2))ε t, represents the long-run impacts of innovations on the first (second) price series. If we let Let Ω be the covariance matrix of ε t and Ψ denote either Ψ(1) or Ψ(2). Given a general case where Ω is not diagonal, the Information Share (IS) of market j (j = 1,2) is given by Hasbrouck (1995) as:

| (3) |

where F is the Cholesky factorisation of Ω such that Ω = FF′. [ΨF]j is the jth element of the vector ΨF. Due to the order of price series j in Y t in the process of Cholesky factorisation, the upper (lower) bound of series j's information share arises if series j is the first (last) variable in Y t. It has been widely adopted in the literature that IS of market j can be represented by a mid-point of IS upper and lower bounds (see, for example Baillie, Booth, Tse, & Zabotina, 2002; Booth, Lin, Martikainen, & Tse, 2002; Chen & Gau, 2010; Putniņš, 2013, among others). Following the literature, we calculate two bounds of IS for each market and take the simple average as a result of information share. The IS of market j is the contribution of market j to the total variance of the common efficient price or permanent impact (Baillie et al., 2002; Lien & Shrestha, 2014). Yan and Zivot (2010) further suggest that IS measures a combination of relative level of noise and relative leadership in reflecting innovations in the fundamental value (Putniņš, 2013). Gonzalo and Granger (1995) propose that the two price series in Y t, if cointegrated, can be decomposed into the following form:

| (4) |

where Y t is comprised of one permanent component f t and one transitory component . f t is a so-called common factor that is a non-stationary series while is stationary. Two assumptions underlying the validation of Eq. (4) are (i). f t is a linear function of the series in ; (ii). does not Granger cause f t in the long run. In other words, the justification of Eq. (4) requires:

| (5) |

where θ is the 2 x 1 permanent component coefficient vector. It should be noted that the dimension of the permanent component is one since cointegration suggests one common stochastic trend in Y t. Booth et al. (2002); Booth, So, and Tse (1999) and Harris et al. (2002) develop normalised coefficients in θ′ that convey information with respect to contributions to the common factor made by the original non-stationary series in Y t. Such information is interpreted as the contribution of the series to the price discovery process. Let θ =[θ 1,θ 2]’ and θ is orthogonal to α in Eq. (1) Then we can have component share (CS) as follows

| (6) |

where θ 1 is the component share of the first series in Y t and θ 2 is the component share of the second series in Y t. Yan and Zivot (2010) interpret CS as the level of noise in one price series relative to the other.

Yan and Zivot (2010) further reveal that, given a case of two price series in Y t, the resulting CS is a function of the dynamic responses of the two series to transitory shocks only, whereby transitory shocks are represented by noise due to trading frictions. Meanwhile, IS is a function of the dynamic response of the two series to both transitory and permanent shocks and permanent shocks are denoted by innovations in the fundamental values. In this case, IS and CS may give misleading information regarding price discovery in some situations due to their dependence on the dynamic response to transitory shocks (Putniņš, 2013). To circumvent this problem, Yan and Zivot (2010) propose the information leadership share (ILS) to generate cleaner contribution of the series to the price discovery process as follows:

| (7) |

where IS 1 and IS 2 are the mid-points of information share of the two price series in Y t while CS 1 and CS 2 are component share of the two price series in Y t. (Putniņš, 2013) proposes normalised metrics based on Eq. (7) so that the range of ILS can be controlled between 0 and 1. Hence, we have the following:

| (8) |

As can be seen from the equation above, ILS is a combination of CS and IS so that the impact from dynamic responses to transitory shocks is cancelled out and a clean measure of relative informational leadership is achieved.

In this paper, not only do we offer traditional static CS, IS and ILS measures, we also consider time variations of these metrics. The way to obtain time varying CS, IS and ILS measures is as follows. First, we obtain time varying error correction coefficients in the vector α of Eq. (1) through applying a rolling window procedure to the full sample of the data.3 Then the time varying coefficients are used to calculate time varying CS, IS and ILS measures. Second, the variance and covariance of innovations in the matrix Ω of Eq. (3) are replaced by the conditional time series of the variance and covariance which are obtained from a two-state regime switching model. This model will be illustrated in detail in the next section. In our procedure the error correction coefficients and the variance-covariance matrix of innovations which carry key information of information share measures, are both modelled to be time-dependent. Moreover, to present a clearer picture of the role of stock index relative to another type of asset including commodities, Bitcoin or the US dollar currency index in the long-run price discovery process, we calculate logarithmic ratios of the information share measures as follows:

| (9) |

where log(.) denotes the natural logarithm. CS s and CS c are the component share of the stock index and counterpart asset, respectively. IS s and IS c are mid-points of the information share of the stock index and counterpart asset, respectively. ILS s and ILS c are information leadership share of the stock index and counterpart asset, respectively. Note that a positive log ratio suggests that the stock index dominates in the long-run price discovery process while a negative value suggests the counterpart asset dominates in the long-run price discovery process. We also calculate time varying ratios by using time varying CS, IS and ILS in Eq. (9).

4.2. Two-state regime switching model

Next, we employ a two-state regime switching model developed by Chan, Yang, and Zhou (2018) to specify a conditional series for the variance, skewness and kurtosis for stock indices, commodities, Bitcoin and the US dollar currency index. As stated by Chan et al. (2018), a salient feature of this model is that it considers two regimes of market status, that is, high return-low volatility in the bull state and low return-high volatility in the bear state. A bivariate two-state regime switching model is shown as

| (10) |

| (11) |

| (12) |

where r t = (r t s, r t c)′ is a vector of return series of one stock index and one other asset including commodities, Bitcoin or the US dollar currency index at time t. r t s represents the stock index return while r t c denotes the counterpart asset return. s t represents the unobserved regime at time t. s t = 1 indicates regime 1 at time t while s t = 2 indicates regime 2 at time t. u it = (u it s, u it c)′ is a vector of conditional means of return series at regime i, dependant on the past information up to time t-1, that is, F t−1. F t−1 contains the past information with respect to the bivariate distribution of r t s and r t c at either state. Note that any information on s t, lagged s t or their probabilities is excluded from F t−1. ε it = (ε it s, ε it c)′ is a vector of innovations at regime i. H it is a conditional variance-covariance matrix of r t at regime i. ε it is assumed to follow a bivariate normal distribution under each regime. Further, the conditional means of r t at regime i are specified in a Vector Autoregressive (VAR) model as below:

| (13) |

| (14) |

where i = 1,2. u i s and u i c are the unconditional means of r t s and r t c at regime i. a i s and b i s (a i c and b i c) measure the effects of the lagged values of r t s and r t c on current r t s (r t c). In Eq. (13), the lag order of VAR is chosen to be 1 according to Akaike Information Criteria (AIC). Following Chan et al. (2018), H it in Eq. (10) is specified as:

| (15) |

where h it s and h it c are the variances of r t s and r t c at regime i, respectively. ρ i is the regime-dependant correlation between oil and Bitcoin returns at regime i. Further, to take into account the effects of the COVID-19 outbreak on volatility levels, h it s and h it c are specified4 as:

| (16) |

| (17) |

where d 2t is a dummy variable taking a value of 1 when the sample period is between 17 November 2019 and 30 December 2019 and zero otherwise. d 3t is a dummy variable taking a value of 1 when the sample period is between 31 December 2019 and 10 April 2020 and zero otherwise. γ i, 1 s (γ i, 1 c) measures whether the outbreak of the COVID-19 in mainland China affects h it s (h it s) locally. γ i, 2 s (γ i, 2 c) examines whether the outbreak of the COVID-19 affects h it s (h it c) when the virus becomes internationally contagious. In the context of a two-state regime switching model, we specify the transition probabilities between two regimes to be time-dependent. This is because substantial flexibility can be obtained by allowing for time varying transition probabilities compared to the static ones (Chan et al., 2018; Gray, 1996). The transition probabilities are specified as:

| (18) |

| (19) |

| (20) |

and p ij, t is specified to be a simple function of time trend as follows:

| (21) |

where i = 1,2. trend is the time trend. Φ(.) is the cumulative normal distribution function, which ensures that 0 < p ii, t < 1. Our choice to use the time trend as an instrumental variable for conditioning transition probabilities that govern the regime switching process aligns with Chan et al. (2018) who propose that specifying time variations of transition probabilities improves model performance.5 The model estimates of the two-state regime switching model of Eqs. (18), (19), (20), (21) are obtained by a quasi-maximum likelihood estimation (QMLE). Based on the estimation results, we follow Chan et al. (2018) to compute the conditional series of variance, skewness and kurtosis of return series of r t s and r t c2. Based on these calculated conditional higher moments' series we specify informational spillovers of variance, skewness and kurtosis in the next section.

4.3. Spillovers of higher moments

Finally, we employ an extended VAR(1) methodology to examine the spillovers of variance, skewness and kurtosis between the stock index and one alternative type of asset including commodities, Bitcoin or the US dollar currency index. This model is analogous to the GARCH-family of models used to examine volatility spillovers in the literature (see, for example Chan & Chen, 1991; Iihara, Kato, and Tokunaga (1996); Tse, 1999; Del Brio, Mora-Valencia, & Perote, 2017; among others). It also aligns with the work of Del Brio et al. (2017) with respect to the specification of skewness and kurtosis spillovers. The model is shown as follows:

| (22) |

| (23) |

where HMS s, t and HMS c, t are conditional series of variance, skewness or kurtosis for the stock index and counterpart asset returns respectively. η s, t−1 (η c, t−1) is the information shocks of higher moments at time t − 1 for the stock index (counterpart asset) returns. For variance spillovers, η k, t−1 = (∑i=1 2 p it ε i, t−1 k)2 where k denotes s (stock index) or c (counterpart asset) and p it is the probability of regime i (i = 1,2) at time t. where ε i, t−1 k is the lagged residuals at regime i (i = 1,2) from Eq. (10). For skewness and kurtosis spillovers, η k, t−1 = (∑i=1 2 p it ε i, t−1 k)3 and η k, t−1 = (∑i=1 2 p it ε i, t−1 k)4 respectively. δ 3 and ϕ 3 measure the spillover effects from counterpart asset to stock index and the vice versa, respectively. Furthermore, we are interested in the spillover effects across difference stages of the COVID-19 outbreak. Then we extend Eq. (22) to have the following forms:

| (24) |

| (25) |

where d 1t, d 2t and d 3t are dummy variables which are created to track different stages of the COVID-19 outbreak. d 1t takes a value of 1 from July 1, 2019 to November 16, 2019, and zero otherwise and is referred to as P1. As in Section 3.2, d 2t is a dummy variable taking a value of 1 between November 17, 2019 and December 30, 2019, and zero otherwise, and referred to as P2. d 3t is a dummy variable taking a value of 1 December 31, 2019 and April 10, 2020, and zero otherwise, referred to as P3. δ 3, 1, δ 3, 2 and δ 3, 3 (ϕ 3, 1, ϕ 3, 2 and ϕ 3, 3) measure the spillover effects from the counterpart asset to the stock index (from the stock index to counterpart asset) during P1, P2 and P3, respectively. Eq. (24), (25) is used to estimate static spillovers of the higher moments using the full period.

In this paper, we focus on time varying spillovers of higher moments across different stages of the COVID-19 outbreak. In doing so, we apply a rolling-window procedure to Eq. (22), (23) with a window size of 100 observations and step size of 1 observation, where the full sample is utilised in this process. Henceforth we obtain time varying estimated values of coefficients δ 3 and ϕ 3 which are important for our analysis. The time varying coefficients are labelled δ 3t and ϕ 3t. In addition, we calculate net spillovers of the higher moments running from stock index to the counterpart asset. The static net spillovers are calculated as ∣ϕ 3 ∣ − ∣ δ 3∣ and the time varying versions are calculated as ∣ϕ 3t ∣ − ∣ δ 3t∣. The latter helps us reveal time variant patterns of information flow, if they are present, from the stock index to different types of financial assets and foreign exchange across different stages of the COVID-19 outbreak. It should be noted that positive net spillovers indicate the stock index plays a leading role in the short-term information transmission process while a negative value suggests that the counterpart asset plays a leading role in the same process.

5. Results

5.1. Two-state regime switching model

In Table 2, Table 3 , we present the estimation results of the two-state regime switching model. We can see that the current returns for either regime can be significantly affected by lagged effects. More importantly, from the estimation of each paired sample, a state with high volatilities between two markets (a bear-state) and a state with low volatilities between two markets (a bull-state) are clearly identified. Both time-periods P2 and P3 present evidence of significant impacts on volatility under both states. Such a result indicates that there exist multiple stages of contagion, or indeed shifting interactions during the COVID-19 pandemic.

Table 2.

SSEA Two-state regime switching model (Estimation from data at 30-min intervals).

| Coef. | SSEA – Oil |

SSEA – Bitcoin |

SSEA – US dollar |

SSEA – Corn |

||||

|---|---|---|---|---|---|---|---|---|

| Reg 1 (i = 1) | Reg 2 (i = 2) | Reg 1 (i = 1) | Reg 2 (i = 2) | Reg 1 (i = 1) | Reg 2 (i = 2) | Reg 1 (i = 1) | Reg 2 (i = 2) | |

| uis | −5.78E−05 | 8.21E−05 | 1.69E−04⁎ | −0.001⁎ | 8.83E−05 | −4.39E−05 | 6.77E−05 | 1.32E−04 |

| (0.8889) | (0.3807) | (0.0839) | (0.0648) | (0.4069) | (0.7551) | (0.4513) | (0.8608) | |

| ais | 0.170 | −0.084⁎⁎⁎ | −0.053⁎⁎ | 0.037 | −0.022 | −0.105⁎⁎ | −0.078⁎⁎ | 0.003 |

| (0.1703) | (0.0000) | (0.0170) | (0.5734) | (0.3661) | (0.0143) | (0.0141) | (0.9898) | |

| bis | 0.085⁎⁎⁎ | 0.027⁎⁎⁎ | −0.006 | 0.060⁎⁎⁎ | −0.185⁎⁎ | 0.288⁎⁎⁎ | −0.044 | −0.122 |

| (0.0000) | (0.0007) | (0.1598) | (0.0000) | (0.0101) | (0.0003) | (0.1981) | (0.7846) | |

| uic | −0.001 | 4.63E−05 | −2.90E−04⁎⁎ | −0.001 | 1.27E−05 | −9.30E−06 | −5.93E−06 | −1.94E−05 |

| (0.6186) | (0.5990) | (0.0117) | (0.7570) | (0.2942) | (0.4148) | (0.9005) | (0.9657) | |

| aic | 0.634 | −0.021 | −0.019 | −0.390 | −0.001 | 0.002 | 0.014⁎ | −0.161⁎ |

| (0.1264) | (0.2800) | (0.4583) | (0.7599) | (0.8852) | (0.5130) | (0.0780) | (0.0970) | |

| bic | −0.447⁎⁎⁎ | −8.40E−05 | −0.014⁎⁎⁎ | −0.047 | −0.004 | −0.006 | −0.032 | −0.845⁎⁎⁎ |

| (0.0000) | (0.9942) | (0.0059) | (0.8092) | (0.8122) | (0.2602) | (0.1199) | (0.0002) | |

| his | 2.76E−05⁎⁎⁎ | 5.94E−06⁎⁎⁎ | 6.15E−06⁎⁎⁎ | 2.21E−05⁎⁎⁎ | 5.17E−06⁎⁎⁎ | 2.13E−05⁎⁎⁎ | 5.40E−06⁎⁎⁎ | 6.94E−05⁎⁎⁎ |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0006) | |

| γi, 1s | −1.39E−05⁎⁎⁎ | −1.92E−06⁎⁎⁎ | −1.32E−06⁎⁎ | −1.29E−05⁎⁎⁎ | 7.51E−06⁎⁎⁎ | −1.83E−05⁎⁎⁎ | −2.04E−06⁎⁎⁎ | −5.01E−05⁎⁎ |

| (0.0024) | (0.0031) | (0.0143) | (0.0000) | (0.0012) | (0.0000) | (0.0024) | (0.0106) | |

| γi, 2s | 1.29E−04⁎⁎⁎ | 8.33E−06⁎⁎⁎ | 4.38E−05⁎⁎⁎ | 4.00E−06 | 1.74E−05⁎⁎⁎ | 4.23E−05⁎⁎⁎ | 1.41E−05⁎⁎⁎ | 3.00E−04 |

| (0.0000) | (0.0000) | (0.0000) | (0.4197) | (0.0000) | (0.0000) | (0.0000) | (0.2393) | |

| hic | 6.36E−04⁎⁎⁎ | 5.93E−06⁎⁎⁎ | 1.24E−05⁎⁎⁎ | 0.002⁎⁎⁎ | 5.81E−08⁎⁎⁎ | 4.40E−06⁎⁎⁎ | 1.51E−06⁎⁎⁎ | 2.76E−05⁎⁎⁎ |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| γi, 1c | −4.71E−04⁎⁎⁎ | −2.84E−06⁎⁎⁎ | −6.06E−06⁎⁎⁎ | −0.001⁎⁎⁎ | 2.62E−06⁎⁎⁎ | −4.38E−06⁎⁎⁎ | −5.54E−07⁎⁎ | −1.74E−05⁎⁎ |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0314) | (0.0171) | |

| γi, 2c | 1.86E−04 | 1.89E−06⁎⁎ | 7.46E−06⁎⁎⁎ | 0.005⁎⁎⁎ | 1.37E−05⁎⁎⁎ | −4.32E−06⁎⁎⁎ | 4.52E−07 | 9.56E−05 |

| (0.1034) | (0.0222) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.3645) | (0.2059) | |

| pi | 0.142⁎ | −0.033 | 0.097⁎⁎⁎ | 0.042 | 0.047 | −0.022 | −0.026 | −0.207⁎⁎⁎ |

| (0.0708) | (0.4275) | (0.0054) | (0.7356) | (0.2617) | (0.6989) | (0.4634) | (0.0028) | |

| ai | −6.877⁎ | 0.703⁎⁎⁎ | 1.210⁎⁎⁎ | 1.046⁎⁎⁎ | 2.358⁎⁎⁎ | 1.277⁎⁎ | 0.919⁎⁎⁎ | −1.025 |

| (0.0810) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0104) | (0.0003) | (0.4148) | |

| bi | 0.007⁎⁎ | 4.13E−05 | −3.45E−04 | −0.005⁎⁎ | −0.003⁎⁎⁎ | −0.001⁎⁎ | 4.16E−04 | 1.63E−04 |

| (0.0465) | (0.9179) | (0.3372) | (0.0296) | (0.0000) | (0.0464) | (0.2929) | (0.7154) | |

| Log−likelihood | 9198 | 10,106 | 13,508 | 9446 | ||||

| Hansen's p−value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||

Note: This table reports the estimation result of the two-state regime switching model. Estimation is done for five sample pairs consisting of one Shanghai Stock Exchange A- or B-share index and one commodity asset and results are separately shown. Coef. denotes model coefficients. SSEA index is the Shanghai Stock Exchange A-share index; SSEB index is the Shanghai Stock Exchange B-share index. Hansen (1992)’s standardized likelihood ratio test is employed to test the existence of regimes and associated p-value of test statistic is shown. E stands for scientific notation. Figures in parentheses are p values of significance check. ⁎⁎⁎, ⁎⁎ and ⁎ represent significance at the 1%, 5% and 10%, respectively.

Table 3.

SSEB Two-state regime switching model (Estimation from data at 30-min intervals).

| Coef. | SSEB – Oil |

SSEB – Bitcoin |

SSEB – US dollar |

SSEB – Corn |

||||

|---|---|---|---|---|---|---|---|---|

| Reg 1 (i = 1) | Reg 2 (i = 2) | Reg 1 (i = 1) | Reg 2 (i = 2) | Reg 1 (i = 1) | Reg 2 (i = 2) | Reg 1 (i = 1) | Reg 2 (i = 2) | |

| uis | −0.001⁎ | −1.60E−06 | −1.60E−06 | −0.001⁎ | −9.62E−05 | −3.57E−05 | −0.001⁎ | −4.26E−05 |

| (0.0825) | (0.9851) | (0.9842) | (0.0593) | (0.2761) | (0.7657) | (0.0920) | (0.6044) | |

| ais | −0.012 | 0.049⁎⁎ | 0.059 | 0.200⁎ | 0.082⁎⁎⁎ | 0.115⁎⁎⁎ | 0.018 | 0.036 |

| (0.7967) | (0.0150) | (0.1603) | (0.0998) | (0.0012) | (0.0000) | (0.9262) | (0.2464) | |

| bis | 0.078⁎⁎⁎ | 0.015 | −0.002 | 0.033⁎⁎⁎ | −3.27E−04 | 0.113 | −0.377 | 0.012 |

| (0.0000) | (0.1197) | (0.5896) | (0.0004) | (0.9974) | (0.1588) | (0.4021) | (0.5540) | |

| uic | −1.14E−04 | 6.98E−05 | −2.97E−04⁎⁎ | −0.001 | 1.08E−05 | −1.12E−05 | −1.51E−04 | −1.93E−05 |

| (0.4633) | (0.4671) | (0.0103) | (0.7480) | (0.3697) | (0.3955) | (0.7055) | (0.6661) | |

| aic | 0.017 | 0.006 | −0.002 | 0.055 | −0.001 | 0.001 | −0.181⁎⁎ | 0.007 |

| (0.2274) | (0.7947) | (0.9210) | (0.9314) | (0.7716) | (0.7369) | (0.0447) | (0.3980) | |

| bic | −0.023⁎⁎⁎ | −0.006 | −0.010 | −0.049 | −0.007 | 0.010 | −0.947⁎⁎⁎ | −0.039⁎ |

| (0.0066) | (0.7200) | (0.1868) | (0.6056) | (0.5884) | (0.2372) | (0.0000) | (0.0527) | |

| his | 2.73E−05⁎⁎⁎ | 3.93E−06⁎⁎⁎ | 3.46E−06⁎⁎⁎ | 2.07E−05⁎⁎⁎ | 2.85E−06⁎⁎⁎ | 1.89E−05⁎⁎⁎ | 4.78E−05⁎⁎⁎ | 3.52E−06⁎⁎⁎ |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| γi, 1s | 2.46E−05⁎⁎⁎ | −9.29E−07⁎ | 2.91E−07 | 1.71E−05 | 4.10E−05⁎⁎⁎ | −1.52E−05⁎⁎⁎ | 1.46E−05 | 3.98E−07 |

| (0.0000) | (0.0641) | (0.7406) | (0.3359) | (0.0000) | (0.0000) | (0.6505) | (0.6448) | |

| γi, 2s | 6.28E−05⁎⁎⁎ | 1.87E−05⁎⁎⁎ | 5.49E−05⁎ | 2.63E−06 | 2.12E−04⁎⁎⁎ | −5.99E−06⁎⁎⁎ | 0.001 | 1.43E−05⁎⁎⁎ |

| (0.0000) | (0.0000) | (0.0725) | (0.7131) | (0.0000) | (0.0000) | (0.1599) | (0.0000) | |

| hic | 7.16E−04⁎⁎⁎ | 5.74E−06⁎⁎⁎ | 1.18E−05⁎⁎⁎ | 0.002⁎⁎⁎ | 5.23E−08⁎⁎⁎ | 3.73E−06⁎⁎⁎ | 2.29E−05⁎⁎⁎ | 1.48E−06⁎⁎⁎ |

| (0.0000) | (0.0000) | (0.0000) | (0.0053) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| γi, 1c | −5.62E−04⁎⁎⁎ | −3.55E−06⁎⁎⁎ | −5.18E−06⁎⁎⁎ | −8.10E−04 | 3.78E−06⁎⁎⁎ | −3.70E−06⁎⁎⁎ | −1.16E−05⁎ | −5.24E−07⁎⁎ |

| (0.0000) | (0.0000) | (0.0074) | (0.2585) | (0.0000) | (0.0000) | (0.0991) | (0.0323) | |

| γi, 2c | −7.13E−04⁎⁎⁎ | 4.54E−04⁎⁎⁎ | 5.16E−06 | 0.005 | 2.15E−05⁎⁎⁎ | −3.51E−06⁎⁎⁎ | 1.53E−04⁎ | 6.57E−07 |

| (0.0000) | (0.0000) | (0.1906) | (0.3756) | (0.0000) | (0.0000) | (0.0954) | (0.1670) | |

| pi | 0.048 | −0.048 | 0.033 | 0.060⁎ | −0.019 | 0.006 | −0.198⁎⁎⁎ | −0.008 |

| (0.5191) | (0.1790) | (0.4061) | (0.0883) | (0.7338) | (0.8962) | (0.0072) | (0.8159) | |

| ai | 1.805⁎⁎⁎ | 2.273⁎⁎⁎ | 1.181⁎⁎ | 1.173⁎⁎ | 9.004⁎⁎⁎ | 4.312⁎⁎⁎ | 1.198⁎⁎⁎ | 1.824⁎⁎⁎ |

| (0.0054) | (0.0014) | (0.0108) | (0.0107) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| bi | −0.006⁎⁎⁎ | −0.004⁎⁎⁎ | −4.08E−04 | −0.005⁎⁎⁎ | −0.010⁎⁎⁎ | −0.003⁎⁎⁎ | 0.001⁎⁎ | 0.001⁎⁎ |

| (0.0026) | (0.0000) | (0.4336) | (0.0062) | (0.0000) | (0.0000) | (0.0176) | (0.0101) | |

| Log−likelihood | 9088 | 10,130 | 13,708 | 9523 | ||||

| Hansen's p−value | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||

Note: This table reports the estimation result of the two-state regime switching model. Estimation is done for five sample pairs consisting of one Shanghai Stock Exchange A- or B-share index and one commodity asset and results are separately shown. Coef. denotes model coefficients. SSEA index is the Shanghai Stock Exchange A-share index; SSEB index is the Shanghai Stock Exchange B-share index. Hansen (1992)’s standardized likelihood ratio test is employed to test the existence of regimes and associated p-value of test statistic is shown. E stands for scientific notation. Figures in parentheses are p values of significance check. ⁎⁎⁎, ⁎⁎ and ⁎ represent significance at the 1%, 5% and 10%, respectively.

The pairwise correlations at either regimes 1 or 2 are found significant. It should be noted that some insignificant regime-dependent pairwise correlations would not rule out non-zero regime-free pairwise correlations which are calculated from regime-dependent volatilities of the two markets, probabilities of regimes 1 and 2 and regime-dependent correlations themselves. This is because regime-dependent volatilities are significant and we find probabilities of the two regimes are significantly driven by time. In this sense, regime-free pairwise correlations are significant across paired samples. Finally, the Hansen (1992) standardized likelihood ratio test rejects the null of mis-specification of the two-state regime switching model.

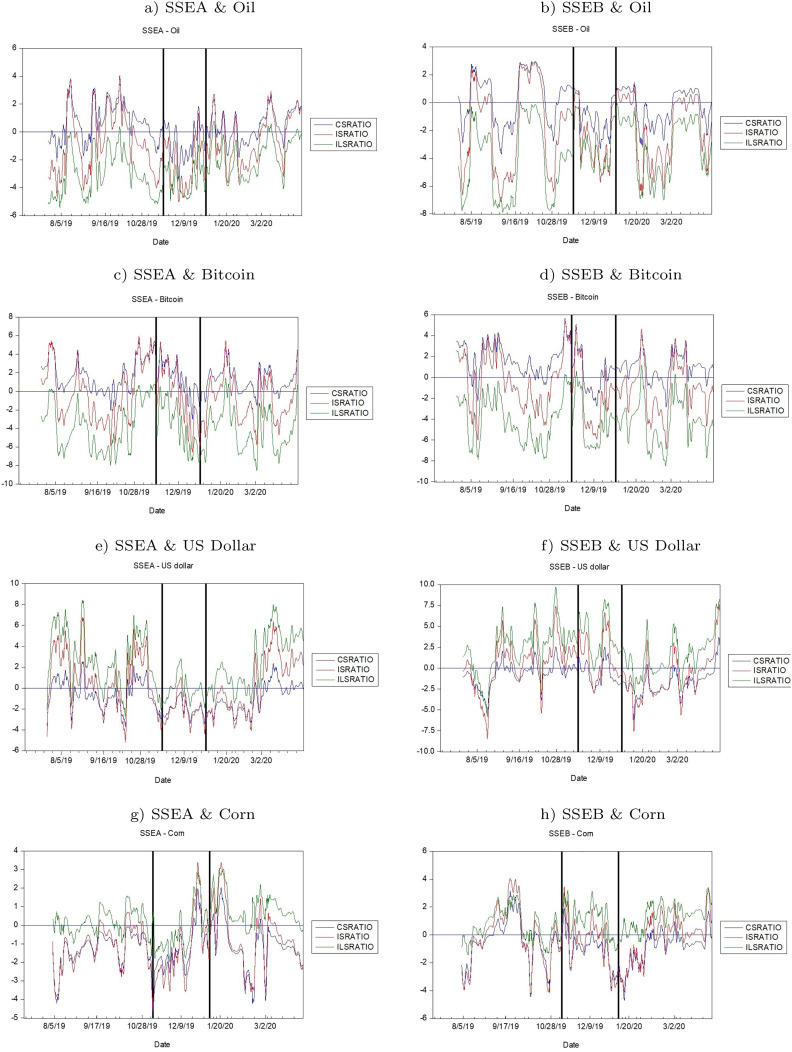

5.2. Time varying information share measures

Table 4, Table 5 present the means and standard deviations of the time varying logarithmic ratios for three information share measures in the bivariate case of one stock index and one alternative asset respectively. The results of the three sub-periods are presented separately. As can be seen in Table 4, the informational role of SSEA, with respect to the ability of adjusting to innovations in fundamental values in the long run, varies across the different stages of the COVID-19 outbreak. During P1, most of the mean log ratios are positive for the sample of SSEA and the US dollar currency index, suggesting that the SSEA index possesses higher information share, on average, compared to the US dollar currency index. Thus, the SSEA index leads the US dollar index in the long run. Oil, corn and Bitcoin have higher means of information shares relative to the SSEA index, given that most means of log ratios are negative. Hence, they play a dominant role in price discovery. During P2, all four analysed assets lead the SSEA index since most means of the log information share ratios are negative. Therefore, the SSEA index is overshadowed in this period by multiple assets. In the final stage, P3, the result is similar to that of P1, suggesting a superior role for the SSEA index relative to the US dollar index, but a subordinate role relative to oil, corn and Bitcoin.

Table 4.

Means and standard deviations of logarithmic ratios of time varying information share measures at 30-min intervals, Ratios of information share measures between SSEA index and other assets.

| Oil | Bitcoin | US dollar | Corn | ||

|---|---|---|---|---|---|

| P1: July 1, 2019 – November 16, 2019 | |||||

| CS ratio | Mean | 0.757 | 1.866 | −0.603 | −1.341 |

| STD | 1.513 | 1.856 | 1.53 | 1.129 | |

| IS ratio | Mean | −0.8 | −0.014 | 0.77 | −1.237 |

| STD | 2.299 | 3.161 | 2.976 | 1.243 | |

| ILS ratio | Mean | −3.115 | −3.759 | 2.746 | 0.208 |

| STD | 1.687 | 2.686 | 2.91 | 1.077 | |

| P2: November 17, 2019 – December 30, 2019 | |||||

| CS ratio | Mean | −0.665 | 1.314 | −2.027 | −1.21 |

| STD | 1.463 | 2.108 | 0.774 | 1.259 | |

| IS ratio | Mean | −2.394 | −0.642 | −2.079 | −1.307 |

| STD | 1.946 | 3.334 | 1.36 | 1.965 | |

| ILS ratio | Mean | −3.457 | −3.913 | −0.104 | −0.193 |

| STD | 1.37 | 2.639 | 1.206 | 1.49 | |

| P3: December 31, 2019 – April 10, 2020 | |||||

| CS ratio | Mean | 0.502 | 1.185 | −0.93 | −1.172 |

| STD | 1.202 | 1.399 | 1.421 | 1.401 | |

| IS ratio | Mean | −0.384 | −0.909 | 0.441 | −0.719 |

| STD | 1.912 | 2.584 | 2.746 | 1.729 | |

| ILS ratio | Mean | −1.771 | −4.188 | 2.742 | 0.906 |

| STD | 1.455 | 2.391 | 2.659 | 1.145 | |

| Changes in means between sub-periods | |||||

| Means in P2 minus Means in P1 | |||||

| CS ratio | Diff. | −1.422 | −0.552 | −1.424 | 0.131 |

| F-stat | 249.490⁎⁎⁎ | 233.677⁎⁎⁎ | 85.783⁎⁎⁎ | 75.108⁎⁎⁎ | |

| IS ratio | Diff. | −1.594 | −0.628 | −2.849 | −0.07 |

| F-stat | 116.012⁎⁎⁎ | 182.623⁎⁎⁎ | 158.729⁎⁎⁎ | 77.813⁎⁎⁎ | |

| ILS ratio | Diff. | −0.342 | −0.154 | −2.85 | −0.401 |

| F-stat | 130.538⁎⁎⁎ | 158.415⁎⁎⁎ | 253.257⁎⁎⁎ | 186.772⁎⁎⁎ | |

| Means in P3 minus Means in P2 | |||||

| CS ratio | Diff. | 1.167 | −0.129 | 1.097 | 0.038 |

| F-stat | 138.980⁎⁎⁎ | 135.776⁎⁎⁎ | 97.318⁎⁎⁎ | 61.929⁎⁎⁎ | |

| IS ratio | Diff. | 2.01 | −0.267 | 2.52 | 0.588 |

| F-stat | 55.427⁎⁎⁎ | 121.187⁎⁎⁎ | 120.971⁎⁎⁎ | 114.207⁎⁎⁎ | |

| ILS ratio | Diff. | 1.686 | −0.275 | 2.846 | 1.099 |

| F-stat | 34.931⁎⁎⁎ | 124.751⁎⁎⁎ | 159.924⁎⁎⁎ | 177.958⁎⁎⁎ | |

Note: Logarithmic ratios of information share measures are calculated as the natural logarithms of ratios of time varying information share measures of Shanghai Stock Exchange A and B-share indices over the other five assets. CS, component share; IS, information share; ILS, information leadership share. Time varying information share measures are computed based on time varying error correction coefficients from a rolling window procedure as well as the variance-covariance matrix of innovations derived from a two-state regime switching model. SSEA index is the Shanghai Stock Exchange A-share index; SSEB index is the Shanghai Stock Exchange B-share index. STD is standard deviation. Diff. represents the result of subtraction in means. F-stat denotes the F test statistic for the hypothesis testing on equality between means of different Sub-periods. ⁎⁎⁎ denotes significance at the 1% level.

Table 5.

Means and standard deviations of logarithmic ratios of time varying information share measures at 30-min intervals, Ratios of information share measures between SSEB index and other assets.

| Oil | Bitcoin | US dollar | Corn | ||

|---|---|---|---|---|---|

| P1: July 1, 2019 – November 16, 2019 | |||||

| CS ratio | Mean | 0.38 | 1.854 | −0.71 | −0.509 |

| STD | 1.908 | 1.588 | 1.526 | 1.717 | |

| IS ratio | Mean | −1.739 | −0.179 | 0.518 | −0.177 |

| STD | 3.221 | 2.697 | 3.045 | 2.204 | |

| ILS ratio | Mean | −4.238 | −4.067 | 2.456 | 0.664 |

| STD | 2.744 | 2.276 | 3.064 | 1.438 | |

| P2: November 17, 2019 – December 30, 2019 | |||||

| CS ratio | Mean | −0.885 | 0.32 | −0.777 | −1.138 |

| STD | 1.458 | 1.918 | 1.522 | 1.415 | |

| IS ratio | Mean | −2.376 | −1.88 | 1.049 | −0.582 |

| STD | 2.324 | 3.007 | 2.741 | 2.006 | |

| ILS ratio | Mean | −2.981 | −4.399 | 3.652 | 1.111 |

| STD | 1.864 | 2.324 | 2.479 | 1.454 | |

| P3: December 31, 2019 – April 10, 2020 | |||||

| CS ratio | Mean | −0.275 | 0.989 | −1.8 | −0.845 |

| STD | 1.367 | 1.356 | 1.669 | 1.371 | |

| IS ratio | Mean | −1.917 | −1.153 | −1.072 | −0.127 |

| STD | 2.43 | 2.436 | 2.908 | 1.816 | |

| ILS ratio | Mean | −3.284 | −4.284 | 1.457 | 1.436 |

| STD | 2.18 | 2.22 | 2.569 | 1.105 | |

| Changes in means between sub-periods | |||||

| Means in P2 minus Means in P1 | |||||

| CS ratio | Diff. | −1.265 | −1.534 | −0.067 | −0.629 |

| F-stat | 150.441⁎⁎⁎ | 211.594⁎⁎⁎ | 35.509⁎⁎⁎ | 50.557⁎⁎⁎ | |

| IS ratio | Diff. | −0.637 | −1.701 | 0.531 | −0.405 |

| F-stat | 95.603⁎⁎⁎ | 127.562⁎⁎⁎ | 120.847⁎⁎⁎ | 130.368⁎⁎⁎ | |

| ILS ratio | Diff. | 1.257 | −0.332 | 1.196 | 0.447 |

| F-stat | 271.111⁎⁎⁎ | 126.741⁎⁎⁎ | 188.183⁎⁎⁎ | 179.073⁎⁎⁎ | |

| Means in P3 minus Means in P2 | |||||

| CS ratio | Diff. | 0.61 | 0.669 | −1.023 | 0.293 |

| F-stat | 96.832⁎⁎⁎ | 184.042⁎⁎⁎ | 92.172⁎⁎⁎ | 56.733⁎⁎⁎ | |

| IS ratio | Diff. | 0.459 | 0.727 | −2.121 | 0.455 |

| F-stat | 48.089⁎⁎⁎ | 137.220⁎⁎⁎ | 195.538⁎⁎⁎ | 79.335⁎⁎⁎ | |

| ILS ratio | Diff. | −0.303 | 0.115 | −2.195 | 0.325 |

| F-stat | 91.666⁎⁎⁎ | 87.623⁎⁎⁎ | 123.523⁎⁎⁎ | 105.200⁎⁎⁎ | |

Note: Logarithmic ratios of information share measures are calculated as the natural logarithms of ratios of time varying information share measures of Shanghai Stock Exchange A and B-share indices over the other five assets. CS, component share; IS, information share; ILS, information leadership share. Time varying information share measures are computed based on time varying error correction coefficients from a rolling window procedure as well as the variance-covariance matrix of innovations derived from a two-state regime switching model. SSEA index is the Shanghai Stock Exchange A-share index; SSEB index is the Shanghai Stock Exchange B-share index. STD is standard deviation. Diff. represents the result of subtraction in means. F-stat denotes the F test statistic for the hypothesis testing on equality between means of different Sub-periods. ⁎⁎⁎ denotes significance at the 1% level.

We calculate the changes in means of log ratios across different stages in a sequential way. From sub-period P1 to P2, means of ratios decrease for price discovery processes for the SSEA index relative to oil, US dollar index and corn, given negative changes in means. However, we identify an increase in the means of ratios for the same processes when we move from sub-periods P2 to P3. This result suggests that price discovery performance of the Chinese A-share market is adversely impacted by the domestic outbreak of the COVID-19 in China. When the pandemic is globally contagious, the price discovery role of SSEA recovers to some extent. This is the case when investigating the long-run relationships between the Chinese A-share market with the oil, corn and US dollar indices. Looking at the price discovery process of the SSEA index and Bitcoin, the means of ratios continue to fall sequentially as we move from sub-periods P1 to P3. This result suggests that when Bitcoin is considered in the pairwise price discovery process with the Chinese A-share market, the international outbreak of COVID-19 highlights the long-run informational role of the latter pair, when compared to the cases of oil, corn and US dollar index. It should be noted that all the changes in the respective means are found to be statistically significant. As can be seen from Table 5, during P1, the price discovery of the SSEB index presents similar results to those from the SSEA index during the same period. That is, on average the SSEB index plays a dominant role in the price discovery process with the US dollar index, whereas oil, corn and Bitcoin dominate the processes in relation to the SSEB index. The result suggests that the Chinese A-share and B-share markets are both led by oil, corn and the Bitcoin markets in the long run process of adjusting to innovations in the fundamental values, during a relative tranquil period ahead of the COVID-19 outbreak. This result might be attributed to the important roles for crude oil and corn in the economic growth in China such that they are deemed to be key inputs for industrial products (see for example, Li & Wei, 2018; Luo & Ji, 2018).

It was something of a surprise to find that during episodes of exceptional financial market volatility, Bitcoin was found to interact quite substantially with both the Chinese A-share and B-share stock markets in the long run price discovery process. The result appears to be fundamentally new in the literature where prior studies conclude that few informational linkages exist between Bitcoin and major financial markets (Bouri, Azzi, & Dyhrberg, 2016; Corbet, Meegan, Larkin, Lucey, & Yarovaya, 2018; Giudici & Abu-Hashish, 2019). The dominant role of Bitcoin in price discovery in the domestic Chinese stock markets might be due to the effects brought about via a growing interest, partly driven by the Chinese government's educational initiatives around blockchain, in the Bitcoin markets (Corbet, Meegan, et al., 2018). On the other hand, the Chinese A-share and B-share stock markets both lead the US dollar index in the long run during the relative tranquil periods, suggesting the importance of China's economy, as mirrored by Chinese stock markets, to international foreign exchange markets. When focusing on sub-period P2, a similar result holds to that of P1. During the domestic contagion of COVID-19 in China, the SSEB index still plays a crucial role of price discovery in leading the US dollar index, whereas it has an inferior role in the price discovery processes in relation to oil, corn and Bitcoin. When the outbreak of the COVID-19 becomes internationally widespread, that is, during P3, we find that the SSEB index leads none of assets in the long run; instead, it is overshadowed by all four others assets.

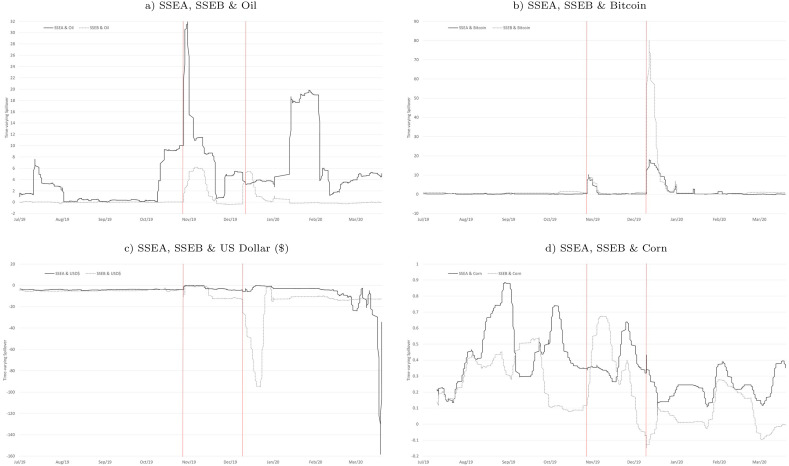

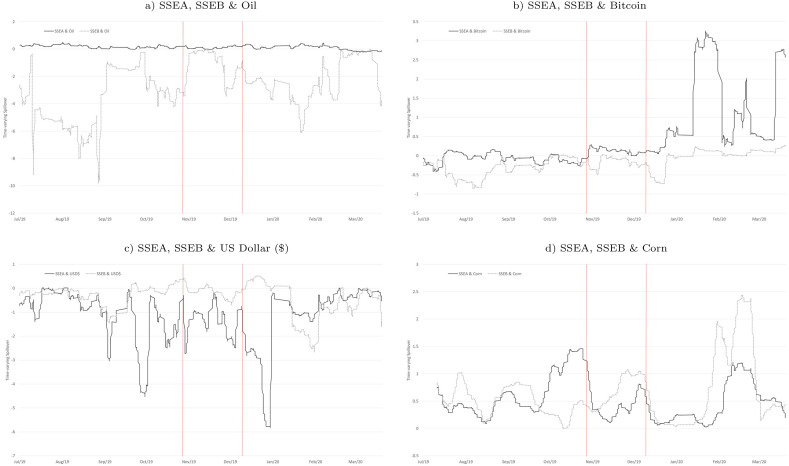

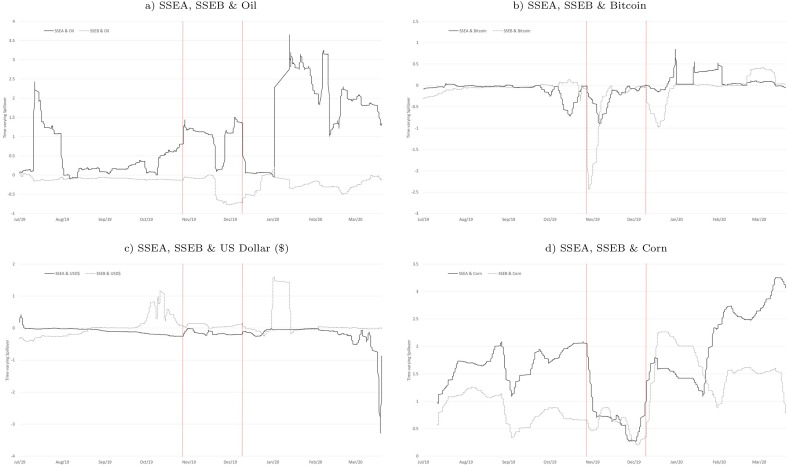

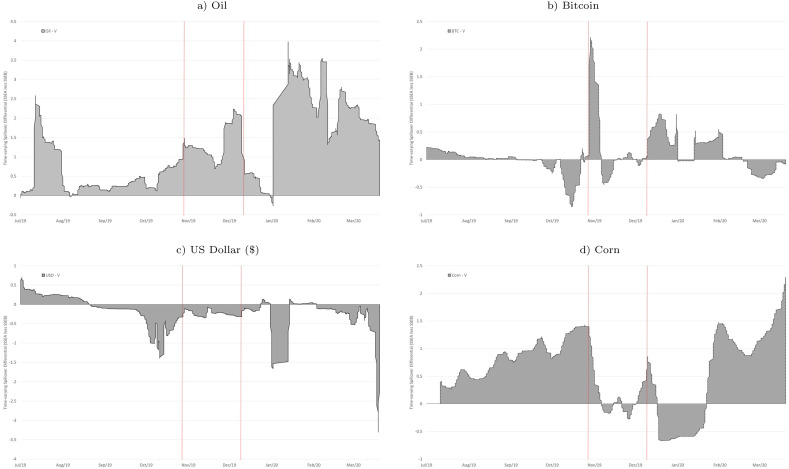

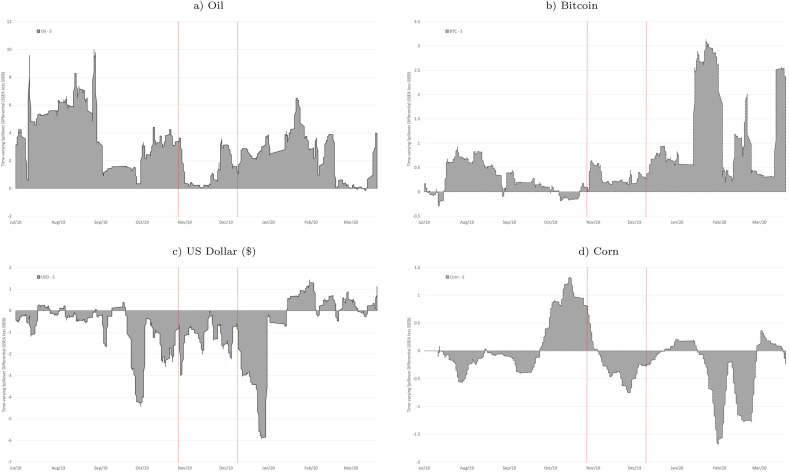

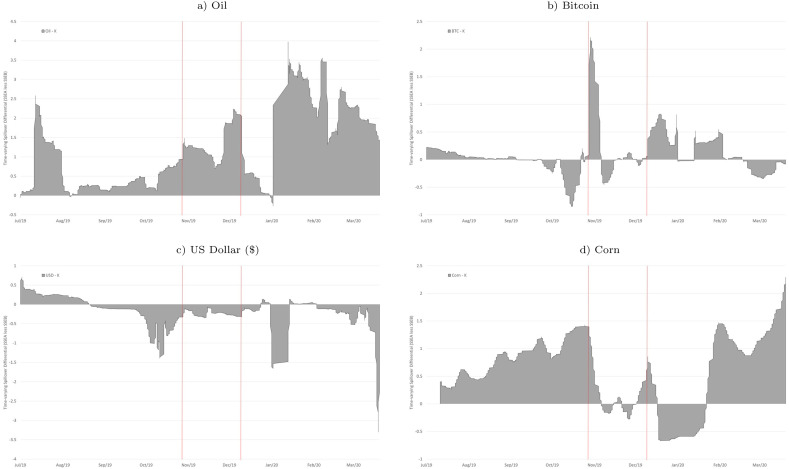

To have a clearer view of how averaged price discovery performance of SSEB index changes throughout the COVID-19 contagion, in Table 4, we calculate changes in the means sequentially across the three sub-periods and some patterns can be identified. For samples of the SSEB index with oil, Bitcoin and corn, the means of log ratios firstly decline from sub-periods P1 to P2 and then increase for sub-periods P2 to P3. This sugests that during the domestic outbreak of COVID-19 in China (before the outbreak becomes global), the price discovery function of the SSEB index is adversely impacted. It recovers to some extent when the outbreak is acknowledged outside China. A reversed pattern is observed for the sample relating to the SSEA and US dollar index. The means of log ratios firstly increases from sub-periods P1 to P2 and then declines for sub-periods P2 to P3. It is during the global contagion of the COVID-19 that the price discovery of the SSEB index is substantially reduced relative to the US dollar index. Note that all the changes across sub-periods are statistically significant. To sum up, Table 4, Table 5 suggest the mean relative price discovery performance of SSEA and SSEB indices is indeed affected by the COVID-19 outbreak. Multiple changing patterns are found in the price discovery of stock indices with the other four assets. Those patterns also differ between SSEA and SSEB indices. Domestic contagion of the COVID-19 outbreak in China results in different effects on price discovery of the stock indices from the time of the international outbreak of the COVID-19.