Abstract

This paper analyses the price responses of airports to a demand collapse, such as that prompted by Covid-19. In the crisis, airports need to achieve viability, in the short run through sufficient liquidity, and in the long run, by covering costs. From a public policy viewpoint, price increases in a crisis are argued to be undesirable, as they would further jeopardise the viability of airlines and tourism as well as the wider economic transport benefits such as connectivity. The institutional environment of airports differs from airport to airport; some are publicly owned, others are private but regulated, and others face competition. The price response of each (of 6) types of airport is considered, and how policy could respond to keep prices low in the crisis while ensuring longer term viability. Regulated airports could defer price increases until demand had recovered, if regulators insisted they do so. Publicly-owned airports could be directed by governments to keep charges low. Governments might also state that unregulated airports that raised charges could be made subject to price regulation in the future. Competitive airports would be unable to raise charges but this could jeopardise their viability. In this case and others where airports might need financial assistance, assistance could be made conditional on keeping charges low in the crisis.

Highlights

-

•

Airports would adjust their charges in different ways to a large demand decline.

-

•

Competitive airports would not be able to raise charges but monopoly airports and those subject to many kinds of regulation could do so.

-

•

Price increases would be inappropriate from the viewpoint of supporting airline and tourism viability and wider economic benefits such as connectivity.

-

•

Governments may need to intervene with regulators.

-

•

Where the demand decline is due to government policy, financial assistance for airports may be appropriate.

1. Introduction

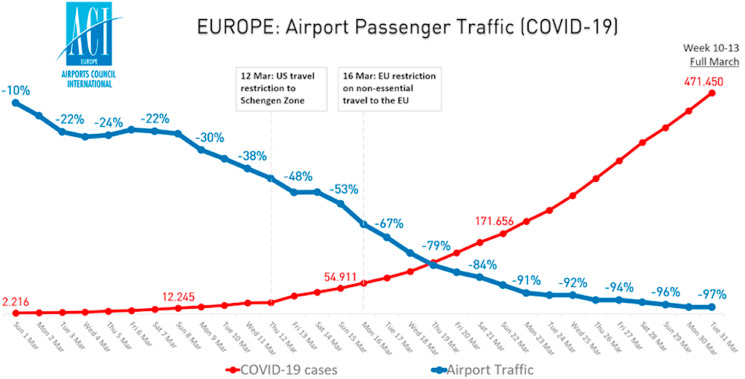

Air transport has been seriously affected by Covid-19, and this has had an impact on the performance of airports. Across the world, they have had very little traffic since March 2020 (Fig. 1 ), and they are set to have slow growth for years to come. Airports typically have substantial fixed sunk costs, and loan repayments to make, but they are receiving little revenue. They face financial problems, and this gives rise to economic difficulties – the entities which own them may have difficulty in achieving long run viability.

Fig. 1.

EUROPE: Airport passenger Traffic (COVID-19).

Source: ACI Europe.

The institutional environment of airports differs from airport to airport; some are publicly owned, others are private but regulated, and others face competition. The crisis has changed the tasks for the airports. In addition to the efficiency and environmental objectives, they now have the problem of long-term viability. Ideally, they need to achieve these while keeping prices low, avoiding the situation which occurred during the Global Financial Crisis, when many European airports put prices up (Wiltshire, 2018), at the expense of the airlines and passengers, and hindering the recovery. There is also the issue of who is best placed to bear the risks-airports or airlines.

In this paper we outline the different institutional environments of airports and analyse the demand crisis they are facing (See also Table 1 ). We focus on European airports and have not examined US or other airports in detail. Taking into account the policy objectives we analyse the problems facing the different types of airports and how they do and can perform. Finally, we consider the policy options to achieve good performance, and touch on what government assistance could be warranted.

Table 1.

Summary of responses to demand shocks.

| Governance of airports: | Price tendency |

|---|---|

| Rate of return regulation | Increase as average cost increases |

| Price-cap regulation | Cap is fixed and charges are not increased. |

| Light-handed regulation | Scope to increase charges |

| Public airports: less formally regulated | Scope for lower or constant unless full cost recovery is applied |

| Competitive airports | Decrease or constant charges but with risk of failure |

| Non-competitive, but non-regulated airports | Increase |

First, though, we summarise the impact of Covid-19 on passenger demand and provide some basic information on airport cost shares.

The data on passenger numbers (see Fig. 1) show that the COVID crisis led to unprecedented reductions in passenger numbers, implying a dramatic reduction in revenues not only for airlines but also for airports. The length and impact of the crisis on airports will depend on the containment of the virus and on the effectiveness of the monetary and fiscal stimulus programs.

Demand for air transport services depends on GDP – a five per cent fall in GDP could be expected to result in a 5–10% fall in demand.2 However, Covid-19 has demonstrated the importance of other factors like health and safety, which can affect demand even more dramatically. Most of the fall in air transport which is shown in Fig. 1 stems from cross-border travel restrictions imposed by governments to limit the transmission of the virus.3 In the medium term new health and safety requirements at airports will increase costs in the recovery phase.

Airport cost shares depend upon the tasks which the airport handles. In many cases, an airport will contract out the tasks, and an airport which is the workplace for around 20,000 employees may have less than 500 direct employees (this is so for Australian and many US airports). For such an airport, fixed capital costs will be a large proportion of the total. In Europe many airports prefer in-house production. For such airports, labour costs will be a smaller proportion of the total. Ceteris paribus, these airports will have higher costs and more commitments (even though they will have some flexibility in the amount of labour they hire).

Aggregating across all member airports (900), ACI World (2018) reports that “the airport cost structure continues to be characterized by predominantly high fixed costs necessary for maintaining and operating the infrastructure components. In 2016, operating expenses made up 64.7% of total costs, the remaining proportion allocated to capital costs.” A recent International Finance Corporation report on the impact of Covid-19 on the airport sector (IFC, 2020) elaborated on these data: “Operating expenses comprise about 65 percent of total costs and include staff costs (30–40 percent), contracted services (20–25 percent), utilities (about 7 percent), and rent or concession fees (about 7 percent). Capital costs (on average, 35 percent) mainly comprise depreciation (about 65 percent) and interest payments (about 32 percent).”

The ACI World report (2018) also found for 2016 that 56% of airport revenues derive from aeronautical charges with nearly all the remainder (40%) from non-aeronautical charges.4

Insofar as both types of revenue derive from passenger use of an airport, both might be expected to move with traffic.

2. Policy objectives

We take it as given that normal objectives for airport efficiency (productive, allocative and in investment) apply and that protection of the environment should be fostered. In addition, with the crisis, achieving viability, in the short run through sufficient liquidity, and long run, in terms of covering costs, have become more challenging. For many airports, it is unlikely that long run viability will be a problem (at least for airports with origin/destination traffic, though perhaps not for airports serving tourism destinations) but there might be a problem for the viability of the owning entity. It is desirable, on grounds of avoiding transaction costs that these entities survive, as long as they are efficient.

There is a new objective, namely that of airport prices being kept low (or discounted), during the crisis period, even though prices may rise again after the crisis has passed and demand has recovered. Keeping prices low will be helpful to increasing the viability of airlines and tourism, and it will enable the wider economic benefits of air transport, such as connectivity, to be reaped. There is a critical distinction between monopoly and competitive airports. Long run viability of monopoly airports is unlikely to be a problem, since it is feasible for them to raise prices once the crisis has passed, even if they are receiving little revenue in the crisis (assuming that they are permitted to do so by owners or regulators). However, there is a real problem for competitive airports – they will be loss making during the crisis, but will not have the ability to raise prices and revenues in the post-crisis period since they are constrained by competition from doing so.

A further policy objective which has become much more of an issue is the bearing of risks. Who should bear the demand risks - airports or airlines? The ways in which airports are owned and operated will substantially affect the allocation of risks. To achieve efficiency, the entity, which can bear the risks most cheaply, should bear the risks.

3. Governance of airports: typical forms

-

(a)

Regulated Airports

Airports with market power and therefore able to levy airlines (and ultimately passengers) with unduly high charges are often subject to some form of regulation. We describe briefly below the three principal formal regulatory methodologies and the impact, which a passenger demand collapse might be expected to have on their airport charges.

3.1. Rate of return (RoR) regulation

A well-known regulatory model is that of rate of return (RoR) regulation, where the emphasis was on limiting returns (while nonetheless appropriately rewarding shareholders) rather than focussing on the level of charges paid by service users. RoR regulation and cost based regulation5 is applied today in many EU countries, in particular at Belgian, German, Dutch, and Greek airports (Forsyth et al., 2020a; Steer Davies Gleave, 2017).

RoR is less used now than in the past, as it was discovered to suffer important shortcomings in terms of protecting users from excessive charges. It offered an incentive for over-investment and offered weak incentives for cost control so that even with regulation, prices might be above their efficient levels (Armstrong et al., 1994). In the context of a collapse in passenger demand, RoR regulation would, for a given asset base, produce a rise in airport charges in order to restore an airport's returns to the allowed rate.

3.2. Price-cap regulation (PCR)

PCR is a widely used form of price regulation, across jurisdictions and sectors (Forsyth et al., 2020b). Examples include many of the largest European airports, including London Heathrow, Paris Charles de Gaulle, Lisbon, Vienna and the major Italian airports. Each pricing period (e.g. 5 years), a regulator scrutinises an airport's spending plans (opex and capex) and traffic forecasts for the period ahead, and consults with airlines about their willingness to pay for proposed investments. A maximum allowed airport charge is set for the next regulatory period. Normally, in order to protect the airport's incentive to find economies, the price cap is not re-opened during the price-control period. Some regulators have indicated that only threatened airport bankruptcy would warrant a resetting of the price. In the context of a collapse in passenger demand, reopening the price cap would, on a conventional approach, produce a (sharp) rise in airport charges since a mechanical forecast of the ratio of (unchanged) costs to (reduced) traffic would yield much higher charges. Mechanical application of PCR would of course tend to undermine its efficiency features. Without determined scrutiny of future costs, PCR degenerates into cost-plus regulation.

3.3. Light-handed regulation

Light-handed regulation is a relatively recent form of airport regulation, begun in countries like Australia and New Zealand (Forsyth, 2008). The basic approach is to avoid formally setting or approving airport charges. Airports have the commercial freedom to decide prices. The level and time trend of charges are then monitored by a public agency, which publishes charges and other relevant data, including traffic, service quality, income and spending accounts, profits and RoR, for a set of airports (for Australia, see Australian Competition and Consumer Commission, 2020). A final element of this kind of regulation is that the public authorities reserve the right to introduce additional regulation, (for Australia, on the advice of the Productivity Commission - Productivity Copenhagen Economics, 2012) should an airport show evidence of systematically using its market power to set unduly high charges. Light-handed regulation therefore relies on price transparency and scrutiny of price negotiations alongside the credible threat of additional regulation if required.

Arguably the light-handed form of regulation, under conditions of a collapse in airport passenger demand, would offer airlines the least protection from large price increases. This risk might be constrained in the short term by the terms of airline-airport price contracts, should the latter for a period of years prevent price changes outside the terms of the agreement. Over the longer term, the authorities might conclude that it was the exploitation of market power that permitted the airports to protect themselves from the losses on the scale that would otherwise follow from the traffic demand collapse.

3.4. Public airports: less formally regulated

Many airports and especially regional airports are owned by governments or local authorities. Publicly owned airports are often considered not to require formal regulation, though sometimes they are regulated.6 There are many possible responses of these airports to a demand shock. As public bodies, they can keep charges low, if permitted to do so by the government. On the other hand, governments often require their enterprises to cover costs each year – if this were so, the airports would be forced to raise charges during the current crisis.

3.5. Competitive airports

Turning now to unregulated airports, we consider first the case of competitive airports. In this case, airport charges are constrained by competition in both the short and the longer term.7 Examples are Manchester and London Stansted, judged by the CAA in 2007 and 2014 to fail the test of possession of significant market power, testifying to the presence of considerable inter-airport competition. A demand collapse would threaten the financial viability of such an airport and in particular to its owners. Airports have large fixed costs, in particular debts used to finance fixed assets. An airport without significant revenues and that therefore breached the terms of its loan agreements could become bankrupt. However, the assets would remain available to a new owner who could buy them from creditors. Thus, under competition, there will be pressure for the airports to keep prices down, though at risk of bankruptcy of its owners.

3.6. Non-competitive but non-regulated airports

The last case to consider is that of non-competitive but non-regulated airports. There are such airports in the EU and elsewhere, unregulated but not subject to significant competition. These include those airports below the threshold of the EU directive (of 5 million passengers) that are not regulated by national law. Many of these small airports are facing countervailing power, but that might not be sufficient e.g. Luxembourg airport (with 4 million pax in 2018) Ljubljana (2 mill pax) in Slovenia. Furthermore, there are larger airports in countries, which have just adopted the EU directive. One could doubt that these are yet regulated. Sofia in Bulgaria is such a case, along with Riga in Latvia, and Bucharest airport in Romania. Outside Europe, in Australia all but the largest four airports are unregulated.

General competition law is usually not very specific, and little constraint on airport behaviour. In this instance, neither competition nor regulation restrains price setting. A very large fall in demand could be offset at least partly by a large increase in charges, as long as it was profitable (revenue increasing) for the airport to do so.

4. Demand risks and who is best placed to manage them?

The scope to manage risks depends on the predictability of the risk factors, as well as on the ability to respond to the demand changes. The Covid-19 crisis led to subsequent shutdowns with dramatic economic effects that were largely unforeseeable. Airports’ responses depend on their scope to reduce costs and preserve liquidity. A large proportion of the total airport costs is fixed and sunk. The share of fixed costs differs substantially depending on the scale of investment. Given the speed of the 2020 decline of demand, even a highly flexible airport would not have been able to adjust variable costs fast enough. Even rapid adjustments take some time; wage and other contracts and commitments generally will need some period to be renegotiated or adjusted, whereas the demand collapse was close to instantaneous. This creates balance sheet problems and the need for cash.

Price regulatory settings determine risk assignment. With price caps, a price control period of, say, five years, the regulatory regime must prescribe how deviations from traffic forecasts are to be treated. Does the airport keep the additional revenue from above-forecast traffic (and vice versa), or is the revenue impact (positive or negative) divided between airports and airlines according to a formula?8 In the case of price-regulated airports, it has been customary to leave this demand risk with the airport.9 Given the normal economic cycle, the gains and losses from this assignment broadly cancel out over the medium term. Moreover, in an economic downturn, airlines suffer a large direct loss of income from fewer passengers flying; if they were also to carry or share the impact of the downturn on airport finances, their viability would be further jeopardised. One might object that the Covid-19 Crisis is not part of a normal economic cycle. This is correct and this might be a reason for state assistance (see section 7).

Other forms of regulation imply different risk assignments. RoR regulation allows an airport with market power to shift demand risk onto airlines. Cost-based regulation of airports with market power also shifts traffic risk to the airlines so that under these conditions the regulated airport can bear risks as well as an unregulated airport monopoly.

Airports can bear more risk for the following reasons. Airports are considered to offer a steadier revenue stream, often with monopoly power. Monopoly airports can cover their costs in the long run, even if they are forced to incur a deficit in the crisis period. Public ownership boosts an airport's creditworthiness. The same holds for partially privatised airports with a minority or majority share, which are typical for continental Europe.

5. The pricing of airports: past and present

The aftermath of the Global Financial Crisis (GFC), beginning in 2008, offers some lessons in regard to airport pricing responses to a material fall in passenger demand.

Pricing data indicate that in the four-year period at the height of the GFC (2009–2012), airport charges were increased in no fewer than 30% of airports in each of these four years, and by 75% of airports in 2011. Initially (2009), 50% of airports reduced charges, but thereafter fewer than 20% of airports reduced charges. Each year, some 20%–50% of airports left charges unchanged (Wiltshire, 2018)10. Wiltshire concludes that there is “a lack of compelling evidence that the European [airport] sector is subject to competitive pressures.” Strong passenger preferences for their local airport makes airport switching by airlines costly and serves to support airport market power and thus scope for higher airport charges when demand falls.

These findings point to airports possessing significant market power which - in the absence of some of the actions and policies discussed in this paper - could be expected to be manifested in higher airport charges in the context of the Covid-19 pandemic. So far, the reaction of airports has been mixed. ACI World (2020, p.8) has recommended to protect airports from an “overall suspension” of airport charges and even argued against “temporarily reducing the level of airport charges” as “an ill-advised response to the ongoing crisis.” ACI EUROPE (2020) follows this line to some extent, but argues that airports are best placed to find out how to support airlines in generating traffic. ACI-Europe stresses that discounts are a successful strategy of a competitive airport industry and have proven so. Some airports like Athens (private) and Nürnberg (public) as well as the Finish airport operator Finavia (public) have offered discounts (IATA/ACCC, 2020).

In the 2020 pandemic, a number of important aviation services in public ownership were instructed to defer charges in return for government financial assistance. In particular, some air navigation service providers (ANSPs) and Eurocontrol deferred charges to assist airlines (ibid.). Though not concerning airports, this aviation example would suggest that, in extremis, public ownership, without regulation, allows governments to keep prices low even when demand falls, to the benefit of airlines and passengers.

6. Policy options

This paper has classified airports into six categories, three forms of price regulation and three others. It has considered whether and how each type of airport might adjust their prices in response to a collapse in demand, and evaluated these responses with respect to an efficiency standard (airport charges set to cover the efficient level of costs) while also enabling the long-term viability of the airports and meeting environmental goals.

The paper argues that in many instances, temporary deficits and deferred cost recovery would be sufficient to allow airport charges to be kept low during the pandemic, but that in other cases, airports would need government financial assistance. There are at least two legitimate reasons for government assistance to airports during the crisis. The government has made it very difficult for airports to cover their costs, essentially by engineering a sharp downturn in demand (which can be justified in that it was necessary to limit the external diseconomies created by exposure to the virus). In this case there is a case for (all) airports to be compensated. The second reason lies in the wider economic benefits of air transport (such as connectivity). By assisting airports, the government will be supporting air transport and thus its wider economic benefits.11

Medium-term airport risks depend upon many factors: the tasks which the airport handles, including the proportion of tasks and thus costs carried out in-house versus outsourced; the response of the regulatory regime, as discussed in this paper, and the host country's response to the virus; the pace of economic recovery and the duration of travel restrictions. If Covid-19 leads to a long-term structural change in passenger demand, risks will also depend on airports' revisions to their investment plans. In the medium term, assuming that passenger demand recovers partly but not fully, fixed costs will be constant, revenues will have recovered partly and operational costs will increase from current levels. Overall, average costs will be higher than normal, and the airports will not be able to cover their costs at pre-pandemic charges.

We summarise the policy options for each type of airport below.

6.1. Regulated monopoly airports

Achieving these objectives with regulated monopoly airports is not difficult. The regulator can insist on low charges (such as, at 2019 levels) during the crisis, and allow a carry-over to enable cost recovery over the longer term after the crisis has passed. The government would need to insist that the regulator do this; many regulators would be inclined to allow prices to rise during the crisis, and some set prices on a year-to-year basis – mindlessly following the Regulated Asset Base (RAB) model (Davies, 2020).

6.2. Public airports

Ultimately, the government can insist that public non-regulated airports keep charges low during the crisis (and allow them to rise after). To do this, it may have to override earlier instructions to the airports, as public enterprises, to cover costs each year. Unless specifically instructed, these airports will make use of their market power to put prices up in the crisis.

6.3. Light handed and non-regulated monopoly airports

These airports have the ability to increase their prices during the crisis. With the light-handed regulation case, the body that has the task of reviewing performance does have a lever over the performance of the airport. It can make it clear, ex ante, that keeping prices high during the crisis could be interpreted as a misuse of market power, signalling the possibility of re-regulation. Ultimately, airports have discretion over prices, and they may manipulate the review body and put prices up during the crisis. This would be less of a problem if the review body has established credibility.

However, this lever is absent for unregulated monopoly airports. Nonetheless, In the case of non-regulated airports with market power, the government has the option of only offering conditional assistance. These airports can be offered financial assistance, but only if they keep their prices down during the crisis.

6.4. Competitive airports

There is a different problem with competitive airports. These will have a problem in achieving long-term viability. They will be forced to keep prices low during the crisis, but they will have difficulty in putting up prices once it has passed. This is the normal situation with competitive industries, which suffer long-term losses if they face unexpected downturns in demand. As discussed, government assistance can help them.

7. Conclusions

This paper has argued that, even in the face of a collapse in demand, the viability of airports can be achieved without simply transferring the financial shock onto airport users, by a mixture of an appropriate application of the regulatory regime and the provision of (outright or conditional) financial assistance. Many airports have significant market power, and as long as demand recovers, they should be viable in the long run. Whatever the form of regulation they face, airports should not need to make major adjustments to their charges in the crisis period. Regulators should be aware that the airports they regulate do not need to cover costs in every period, as long as they are permitted to cover their costs over time. This is not the case with airports that face strong competition, and such airports can pose difficult issues for policy makers.

CRediT authorship contribution statement

Peter Forsyth: Writing - original draft, Writing - review & editing. Cathal Guiomard: Writing - original draft, Writing - review & editing. Hans-Martin Niemeier: Conceptualization, Resources, Writing - original draft, Writing - review & editing.

Footnotes

The authors wish to thank Brian Pearce of IATA and Michael Stanton-Geddes of ACI for helpful discussions and data, and also two anonymous referees for their comments.

Values of income elasticity are in the range between 1 and 2 (InterVISTAS, 2017).

“Since the beginning of the pandemic, virtually all Member States have implemented restrictions on non-essential travel, often accompanied by requirements for cross-border travellers to stay in quarantine. The EU's external borders have been closed to nonessential travel and many Member States have temporarily reintroduced internal border controls.” (EU Commission Communication, May 2020.).

These shares depend also on the degree of outsourcing. In particular ground handling can make a substantial difference. See Graham and Morrell (2016).

In theory there is a difference between RoR regulation and cost based regulation, but not in practice.

Dublin Airport, German and Dutch airports are exceptions.

In reality competition is imperfect so that the constraint is less binding than under perfect competition.

An inverse traffic risk mechanism has been applied at many airports like Budapest, Vienna, Paris Orly and Charles De Gaulle (for a critical discussion see Forsyth et al., 2020b). European ATC price regulation applies a risk-sharing rule of this kind, as required by the governing EU regulation.

Certainly in the UK and Ireland.

For further evidence ee also Leigh Fisher, 2012. ACI offers a different view on airport competition and airport charges (Copenhagen Economics, 2012). The issue demands further rigorous econometric analysis.

The wider economic benefits should not be mistaken for catalytic effects of aviation, though the two concepts are related (Forsyth et al., 2020b ).

Supplementary data to this article can be found online at https://doi.org/10.1016/j.jairtraman.2020.101932.

Appendix A. Supplementary data

The following is the Supplementary data to this article:

References

- Australian Competition and Consumer Commission (ACCC) 2020. Airport Monitoring Report 2018-19.www.accc.gov.au [Google Scholar]

- ACI EUROPE Working paper – “Off the Ground” . Pricing of aeronautical services during the recovery. 2020. https://www.aci-europe.org/downloads/resources/OFF%20THE%20GROUND%20Working%20Paper%20%20-%20%20Pricing%20of%20aeronautical%20services%20during%20the%20recovery.pdf

- ACI World . 2018. Airport economics report. [Google Scholar]

- ACI World . 2020. COVID-19: Relief Measures to Ensure the Survival of the Airport Industry, Policy Brief. Montreal. [Google Scholar]

- Armstrong M., Cowan S., Vickers J. MIT Press; Cambridge, Mass. and London: 1994. Regulatory Reform. Economic Analysis and British Experience. [Google Scholar]

- Copenhagen Economics . Copenhagen Economics; Copenhagen: 2012. Airport Competition in Europe, a Report for ACI Europe. [Google Scholar]

- Davies R. Destination unknown: airport regulation in the wake of COVID-19, Oxera. 2020. https://www.oxera.com/wp-content/uploads/2020/04/Destination-unknown-airport-regulation-in-the-wake-of-COVID-19.pdf 2020.

- Davies Gleave Steer. MOVE; Brussels: 2017. Support Study to the Ex-Post Evaluation of Directive 2009/12/EC on Airport Charges, Final Report Study Contract DG. [Google Scholar]

- EU Commission Communication, may 2020. 2020. https://ec.europa.eu/info/sites/info/files/communication-commission-tourism-transport-2020-and-beyond_en.pdf

- Fisher Leigh. 2012. 2012 Review of Airport Charges. London. [Google Scholar]

- Forsyth P. Airport policy in Australia and New Zealand: privatization, light-handed regulation, and performance. In: Winston C., de Rus G., editors. Aviation Infrastructure Performance A Study in Comparative Political Economy. Brookings Institution Press; Washington: 2008. [Google Scholar]

- Forsyth P., Guiomard C., Müller J., Niemeier H.-M. Changing airport governance and regulation. The regional aspect. In: Graham A., Adler A., Niemeier H.-M., Betancor O., Antunes A., Bilotkach V., Calderón E., Martini G., editors. Air Transport and Regional Development Policies. Routledge, forthcoming; London: 2020. [Google Scholar]

- Forsyth P., Niemeier H.-M., Njoya E. Economic evaluation of investments in airports: recent developments. Journal of Benefit-Cost Analysis, forthcoming. 2020 [Google Scholar]

- Graham A., Morrell P. Routledge; London: 2016. Airport Finance and Investment in the Global Economy. [Google Scholar]

- IFC The impact of COVID-19 on airports: an analysis. 2020. https://www.ifc.org/wps/wcm/connect/26d83b55-4f7d-47b1-bcf3-01eb996df35a/IFC-Covid19-Airport-FINAL_web3.pdf?MOD=AJPERES&CVID=n8lgpkG downloaded.

- InterVISTAS . Prepared for IATA; 2017. Estimating Air Travel Demand Elasticities.https://www.iata.org/en/iata-repository/publications/economic-reports/estimating-air-travel-demand-elasticities---by-intervistas/ [Google Scholar]

- Wiltshire J. Airport competition: reality or myth? J. Air Transport. Manag. 2018;67:241–248. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.