Abstract

We characterize inflation dynamics during the Great Lockdown using scanner data covering millions of transactions for fast-moving consumer goods in the United Kingdom. We show that there was a significant and widespread spike in inflation. First, aggregate month-to-month inflation was 2.4% in the first month of lockdown, a rate over 10 times higher than in preceding months. Over half of this increase stems from reduced frequency of promotions. Consumers' purchasing power was further eroded by a reduction in product variety. Second, 96% of households have experienced inflation in 2020, while in prior years around half of households experienced deflation. Third, there was inflation in most product categories, including those that experienced output falls. Only 13% of product categories experienced deflation, compared with over half in previous years. While market-based measures of inflation expectations point to disinflation or deflation, these findings indicate a risk of stagflation should not be ruled out. We hope our approach can serve as a template to facilitate rapid diagnosis of inflation risks during economic crises, leveraging scanner data and appropriate price indices in real-time.

Keywords: Inflation, Great Lockdown

Highlights

-

•

We characterize inflation dynamics during the Great Lockdown using real-time scanner data.

-

•

We show that there was a significant and widespread spike in inflation.

-

•

96% of households have experienced inflation, while in prior years around half of households experienced deflation.

-

•

Our approach can serve as a template to facilitate rapid diagnosis of inflation risks during economic crises.

1. Introduction

The COVID-19 pandemic led many countries to implement social distancing, lockdowns and travel restrictions, which have resulted in a collapse in the world economy unprecedented in peacetime. Although the real-time effects of the “Great Lockdown” on employment and consumer expenditure have been widely documented (e.g., Bartik et al. (2020), Chetty et al. (2020), Villas-Boas et al. (2020)), much less is known about how the crisis is impacting inflation. In this paper we use comprehensive scanner data from the United Kingdom to measure inflation during the Great Lockdown in real-time.

The Great Lockdown entails a combination of substantial shocks to both demand and supply (e.g., Brinca et al. (2020), Guerrieri et al. (2020), Baqaee and Farhi (2020)). It is therefore plausible that the crisis may lead to deflation, disinflation or higher inflation. Falling aggregate demand, due to heightened uncertainty and reductions in incomes and liquid wealth, may lead to deflationary pressures. Conversely, inflationary pressures may arise from increases in production costs, due to interrupted supply chains and to the impact of social distancing restrictions on labor supply. By shutting down some sectors of the economy, the Great Lockdown may lead to changing patterns of demand that translate into shifts in the degree of market power firms exercise, which will affect equilibrium inflation. These pressures will differ across sectors, and therefore it is likely inflation will also. Sectoral inflation heterogeneity in turn is likely to feed through to heterogeneous inflation experiences across households. According to market-based measures of inflation expectations, financial markets expect the COVID-19 pandemic to be a disinflationary shock (Broeders et al. (2020)). However, to date, there is little evidence on how the shock has impacted prices.

Accurate and timely measurement of inflation is key for the design of policies aimed at paving the way for the recovery. It is essential for central banks to track price changes given their mandate to maintain price stability and the dramatic recent increase in their balance sheets. For the design of transfers and social insurance programs, it is important to know whether different types of households have experienced different rates of inflation to better target those with reduced purchasing power. Combined with information on changes in quantities, inflation can also be a useful diagnostic tool to assess whether specific industries are primarily affected by demand or supply shocks.

In this paper we use household level scanner data covering fast-moving consumer goods to document how prices have changed during the Great Lockdown across a wide range of sectors. The dataset tracks around 30,000 households at any point in time. Each participant records all purchases they make and bring into the home at the barcode (UPC) level. This dataset has a number of key advantages for tracking inflation over the crisis. First, it enables us to sidestep a number of biases that afflict inflation measures produced by statistical agencies, including the Bureau of Labor Statistics in the US and the Office for National Statistics in the UK, and that are likely to be particularly important during the Great Lockdown. In particular, we can account for changing expenditure patterns as we observe how consumers' spending shares evolve over time at the barcode level; we can observe changes in product variety and quantify their impact on consumer surplus (as in Feenstra (1994)); we observe prices paid by households inclusive of promotions (which are discarded in official inflation measures if they involve a quantity discount). Second, as the dataset is longitudinal and contains socio-demographic variables, we can use it to compute household-specific inflation rates and relate them to socio-demographic characteristics. Third, the data cover a wide variety of products, including food, non-alcoholic and alcoholic drinks, toiletries, and cleaning products. Given the closure of many sectors of the economy and the increase in time spent at home, these products are particularly important during the Great Lockdown.1 The wide variety of product categories included in the dataset means we can examine the extent of sectoral heterogeneity, which will be important for the design of policy responses to the crisis. Using this dataset, we establish three sets of results regarding aggregate inflation and inflation heterogeneity across households and product categories.

First, we find that in the first month of lockdown month-to-month inflation was 2.4%. This sharp upturn in inflation is unprecedented across the preceding eight years. We show that this comparison is robust to the choice of price index, to whether inflation is computed based on a chained or fixed base index, and whether inflation in measured month-to-month or week-to-week. We also show that over half of this increase in inflation is accounted for by a reduction in the number of promotion transactions. This fall in promotions contrasts with the Great Recession, during which consumers purchased more on sale (see Griffith et al. (2016) for evidence in the UK and Nevo and Wong (2019) for the US). In addition, we find that at the onset of lockdown there was a substantial reduction in product variety. This leads to a further erosion of households' consumer surplus (i.e. in their effective purchasing power). Based on CES preferences, we show the reduction in product variety is equivalent to 85 basis points of additional inflation, compared with prior years where product variety was expanding instead of shrinking. Overall, once we take account of reduced product variety, month-to-month inflation in the first month of lockdown increased by over 3 percentage points relative to the same month in prior years.

Second, we investigate heterogeneity in inflation across households. Using a fixed base Fisher index with household-specific expenditure weights and common prices, we compare the distribution of household-specific inflation rates in the first 5 months of 2020 with the distributions in the first 5 months of previous years. In a typical year there is substantial heterogeneity in household-level inflation, with many households experiencing deflation. For instance, in the first 5 months of 2018 and 2019 the standard deviation in household inflation was around 1.5 percentage points, and for around half of households inflation was negative. The distribution in 2020 exhibits a marked rightwards shift of around 3 percentage points at all points of the distribution compared with 2018 and 2019. The standard deviation of the 2020 distribution is only moderately higher (1.7 percentage points) compared with previous years, and only 4% of households experienced deflation. We relate these household-specific inflation rates to socio-demographic characteristics. Households in the South-East of England, on average, experienced inflation that was around 20 basis points higher than those living further North. In contrast to prior years, more affluent households (in the top quartile of the distribution of total equivalized spending) experienced inflation over 20 basis points higher than those less well off (in the bottom quartile). Finally, households with a main shopper aged 35 or below experienced lower inflation than older households. These differences may become important for purchasing power dynamics if they persist and cumulate over time, but in the short run they are modest relative to the increase in aggregate inflation.

Third, we examine inflation heterogeneity across product categories. The distribution of inflation rates across product categories has shifted rightwards compared with previous years. Since the point of lockdown just 13% of product categories experienced deflation, while over half of categories did over the same period in the preceding year. In addition, the variance in category specific inflation rates has increased, consistent with the fact that different sectors were impacted by different shocks. A natural hypothesis is that increased inflation may be driven by a few categories for which there has been a large increase in demand. We show, however, that there is increased inflation across many categories, including those for which output has fallen. The category-level average inflation rate is 3.2% both for categories with increases and decreases in output.

What lessons about the dynamics of inflation can be drawn from these findings? Lockdown coincided with unusually high inflation, which was experienced by almost all households and in almost all product categories. The pervasive nature of inflation, along with the fact that it is observed even in product categories with declines in output, point towards a risk of stagflation. It is naturally too early to say for sure whether persistent stagflation will materialize: while the higher price level has persisted for several weeks, the inflation spike coincided with a one-time event, the beginning of lockdown; in addition, we do not observe the entirety of households' consumption baskets (e.g., rents and services are not included). Nonetheless, it is crucial for central banks, fiscal authorities, and statistical agencies to closely monitor inflation risks going forward. Our work highlights the advantages of real-time scanner data for this purpose. In particular, one can track changes in spending patterns for disaggregate products in real-time and observe changes in promotion activity and product variety, all of which are important drivers of inflation and are typically overlooked by statistical agencies.

In addition, tracking the impact of inflation on household-level purchasing power is key for the design of transfer programs. We find that the distribution of household-specific inflation has shifted substantially, but that the dispersion has remained broadly constant, and the differences across socio-demographic groups, for now, are modest. These results indicate that price movements, at this stage, have not contributed to the need for targeted support.

We build on and contribute to several strands of literature. A rapidly growing literature uses various novel datasets to document in real-time the evolution of economic activity during the pandemic (e.g., Baker et al., 2020a, Baker et al., 2020b, Kurmann et al. (2020), Kahn et al. (2020), Chen et al. (2020), Alexander and Karger (2020), Andersen et al. (2020), Coibion et al. (2020), Surico et al. (2020)). However, due to data constraints, so far no study has documented price changes on a large scale, a limitation we address in this paper. Another active line of work develops macroeconomic models to forecast the effects of various policies, which our new facts about inflation can help discipline (e.g., Baker et al., 2020a, Baker et al., 2020b, Faria-e Castro (2020), Caballero and Simsek (2020)). Finally, our paper is part of a large literature measuring inflation using scanner data and characterizing inflation heterogeneity across households (e.g., Broda and Weinstein (2010), Ivancic et al. (2011), Kaplan and Schulhofer-Wohl (2017), Jaravel (2019)). More broadly, this paper belongs to a long literature in macroeconomics on the measurement of economic activity at business cycle frequencies. We show how real-time scanner data can be used to support macroeconomic policy. Our hope is the approach we lay out in this paper can serve as a template to facilitate rapid diagnosis of inflation risks during economic crises, leveraging scanner data and appropriate price indices in real-time.

This paper is organized as follows. In Section 2 we discuss the dataset we use and in Section 3 we estimate aggregate inflation, both for continuing products and accounting for changes in product variety. In Section 4 we document heterogeneity in inflation across households and across product categories. A final section concludes, and we present additional results in Appendix A.

2. Data

In this section, we describe the dataset and present key stylized facts about prices and product variety during the lockdown.

2.1. Dataset

We use household level scanner data that is collected by the market research firm Kantar FMCG Purchase Panel. The data cover purchases of fast-moving consumer goods brought into the home by a sample of households living in Great Britain (i.e. the UK excluding Northern Ireland).2 This sample includes all food and drinks (including alcohol), as well as toiletries, cleaning products, and pet foods. At any point in time (including over the lockdown) the data set contains purchase records of around 30,000 households. Participating households are typically in the data for many months. Each household records all UPCs (or barcodes) that they purchase using a handheld scanner, and they send their receipts (either electronically or by post) to Kantar. For each transaction we observe quantity, expenditure, price paid, UPCs characteristics (including product category) and whether the item was on promotion. We also observe socio-demographic characteristics of households, including the age of household members, and the region they live.

Our data set runs until May 17, 2020. In the UK lockdown started in March 23, 2020. Lockdown had a large impact on the UK shopping experience. Only stores selling essentials remained open. These included stores specializing in fast-moving consumer goods, such as supermarkets, convenience and liquor stores. Stores selling durables and the entire restaurant and bar sector were mandated to close. Strict social distancing rules were mandatory in all stores, which led to widespread lines outside the stores. Consumers were encouraged to shop locally. These new rules led consumers to switch to online shopping. By the end of our period of data, the share of expenditure made online is 50% higher than what we observe pre-lockdown.3

The availability of historical data enables us to compare inflation in 2020 with preceding years, as far back as 2013. We focus on the period from the beginning of the year to May 17.4 Over this period in 2020 we observe 13.4 million transactions and 102,000 distinct UPCs.5 We measure both week-to-week inflation and month-to-month inflation. In the former case we focus on the twenty 7-day periods starting from December 30, through to May 17.6 For the monthly analysis we define months as running from the 18th of one month to the 17th of the following month. We focus on the 5 months running from December 18 to May 17.

The dataset has several advantages for measuring inflation. We observe the evolution of prices and expenditure shares at the UPC level. This enables us to capture how expenditure shares change over time and avoids concerns about changes in product quality (in contrast, an analysis based on unit prices across product category would be plagued by compositional changes). The large sample also allows us to track the number of UPCs purchased at a particular point of time, which provides a way of measuring changes in product variety. Finally, the richness of the data enables us to document heterogeneity in inflation across households (exploiting the panel dimension) and product categories.

2.2. Stylized facts

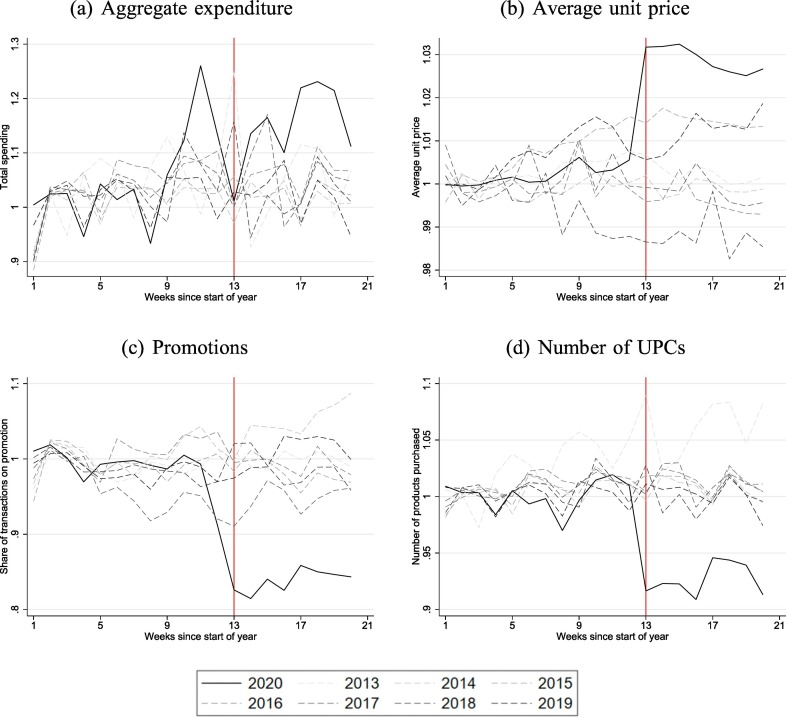

Fig. 1 presents descriptive evidence. We report what happened to aggregate expenditure, average unit price, the share of transactions that involve either a price promotion (e.g. 25% off, £1 off) or a quantity discount (e.g. 2 for the price of one, 25% extra) and the number of unique UPCs purchased, at the weekly level in 2020 in comparison to previous years. The red line denotes the week in which the UK's lockdown was introduced.

Fig. 1.

Stylized facts.

Notes: Panel (a) shows total expenditure, panel (b) average unit price, panel (c) shows the share of transactions that involve a price or quantity promotion and panel (d) shows the number of unique UPCs purchased, in each of the first 20 weeks of the year. Panel (b) conditions on UPCs purchased in all weeks (which account for around 77% of total expenditure). In each case the line is normalized by the mean value in the first four weeks. The red vertical line denotes the first week of lockdown. (For interpretation of the references to colour in this figure legend, the reader is referred to the web version of this article.)

Panel (a) shows that for the first 9 weeks of the year the evolution of aggregate expenditure is similar across years. However, in 2020 expenditure increases markedly in weeks 10-12. This period began with the publication of the UK Government's Coronavirus action plan7 and coincided with the introduction of lockdowns in France, Italy and Spain. Some of this higher spending likely reflects hoarding. On the week of lockdown spending returned to a level similar to prior to the crisis, before rising again to around 10-15% higher than the level in previous years. This likely reflects a switch to at-home food and alcohol consumption as bars and restaurants were closed throughout the UK and people were advised to work from home.

Panel (b) shows the evolution of average unit price over time. In each week, for every UPC, we compute the unit prices as the ratio of total expenditure on that UPC to total quantity. The figure shows how the average of these unit prices varies across weeks. Average unit price evolved similarly across years up until the week of lockdown, when it jumped by almost 3%. The increase has persisted in the following weeks. This figure provides simple descriptive evidence of an increase in prices around the point of lockdown. However, whether this translates into higher inflation will depend on the composition of the UPCs in households' grocery baskets. In the next section we capture this by measuring inflation based on a set of theoretically coherent price indices.

Panel (c) shows that the share of transactions on promotion in 2020 dropped by around 15% from the beginning of lockdown. Both price promotions and quantity discounts exhibit similar percentage falls; because price promotions account for close to 2.5 times as many transactions as quantity discounts, they account for a proportionaly larger percentage point decline. This reduction in the promotion frequency is one possible driver of higher average unit prices and any associated inflation, which we investigate further in the next section.

Panel (d) documents the changes in the number of unique UPCs sold over time. Prior to the start of the lockdown, and similar to previous years, the number of UPCs sold in each week is stable. However, from the beginning of lockdown there is a fall of around 8% in the number of UPCs we observe purchased. This points towards a reduction in product variety, which, independently of price rises, will have a negative impact on consumer welfare.8 In the next section we use a particular parametrization of consumer preferences that allows us to capture the effect of this reduced product variety on consumer surplus.

3. Aggregate price indices

In this section use a series of different price indices to measure the change in the cost of living for the basket of fast-moving consumer goods and for a representative household. This measure of aggregate inflation reflects changes in the prices of the 100,000 different products (or UPCs) across millions of transaction, using expenditure weights to reflect the importance of different products in the basket. We begin by computing inflation for continuing products, before accounting for the impact of changing product variety.

3.1. Continuing products

Price indices entail weighting product price changes between two periods using expenditure weights. Indices vary in the form of this weighting. The Laspeyres and Paasche price indices use expenditure weights in a base or current/final period. Superlative indices, such as the Fisher, Tornqvist, and CES price indices use some combination of base and current/final period expenditures and provide second order approximations to true cost-of-living indices.

Price indices can either be chained, where the weights are updated each period, or fixed base (i.e. computed using fixed weights). Chained indices reflect consumer substitution in response to price changes. This enables the index to capture changes in households' expenditure patterns, providing a better approximation to a true cost of living index. This may be particularly important during lockdown, where there are likely to be substantial changes in consumer spending.

A downside of chained indices is that they can suffer from chain drift. Intuitively this problem arises when there is a high-frequency relationship between changes in price and expenditure weights, which can lead to a chained index either under- or over-stating inflation between two non-consecutive time periods, relative to a direct comparison between prices and expenditure weights in the two periods. Fixed base indices have the advantage that they do not exhibit chain drift, but they have the significant disadvantages that they can only be computed over UPCs observed in all periods9 and the weights are susceptible to being less representative of true expenditure patterns than the weights in chained indices.10

Consider first chained indices. Let i denote all UPCs present in two contiguous time periods, t and t + 1. We refer to this set of UPCs as “continuing products”. Denote by p i, t the average price of product (i.e. UPC) i in time period t , 11 denote by q i, t the total quantity of product i at time t, and by the share of total period t expenditure on continuing products allocated to product i. We use the following chained indices:

π t, t+1 I denotes the rate of inflation between period t and t + 1 computed with price index I = {Laspeyres, Paasche, Fisher, Tornqvist, CES}.

We also compute fixed base Laspeyres, Paasche and Fisher price indices. Let t={1,…, T} denote the time periods over which we compute inflation (i.e. either 20 weeks or 5 months). The fixed base Layspeyres and Paasche indices are given by and , where the sum over i is taken over products available in all periods. The fixed base Fisher index is given by 1 + π t, t+1 Fix_Fisher ≡ ((1 + π t, t+1 Fix_Laspeyres)(1 + π t, t+1 Fix_Paasche))1/2.

3.1.1. Results with chained price indices

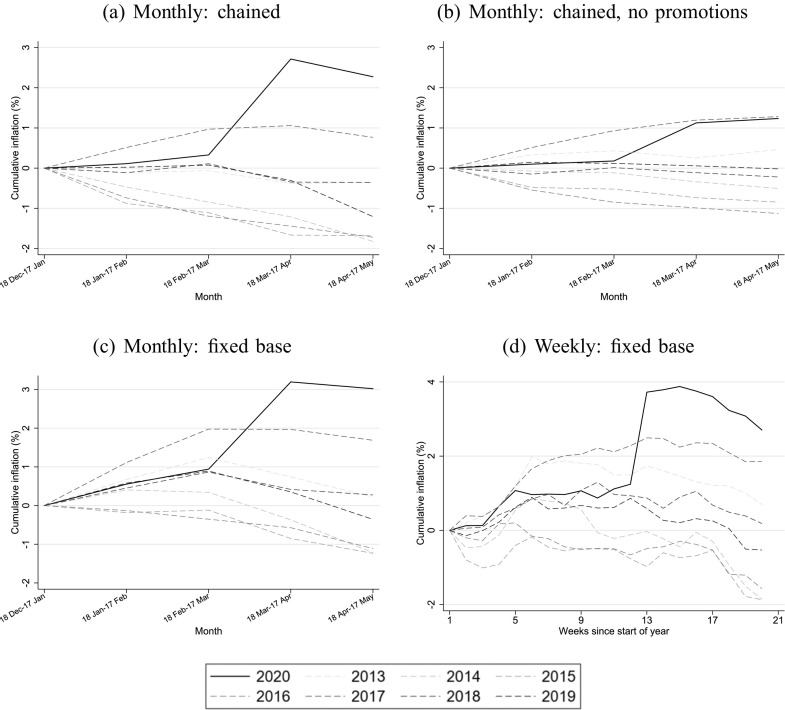

Fig. 2(a) plots cumulative inflation over the 5 months running to May 17 based on the Fisher index for all years from 2013 to 2020. In the first 3 months of 2020 month-to-month inflation is close to zero and similar to previous years. However, in the month March 18 - April 17 there is a large increase in inflation of 2.4 percentage points. This is unprecedented across all comparison years. In the month April 18 - May 17 there is modest deflation, though prices remain well above their pre-lockdown level. In Fig. A2 in Appendix A, we show results are very similar for Tornqvist and CES price indices.12

Fig. 2.

Aggregate inflation.

Notes: Panels (a) and (b) show cumulative monthly inflation based on a chained Fisher price index, based on all transactions and only non-promotion transactions. Panels (c) and (d) show cumulative monthly and weekly inflation based on a fixed base Fisher index. Panel (c) conditions on UPCs available in all months (which represent around 91% of total expenditure). Panel (d) conditions on UPCs available in all weeks (which represent around 77% of total expenditure).

Panel (b) shows the same information as panel (a), except it is based only on transactions that do not involve price or quantity promotions. It shows that inflation for non-promoted items in the month of lockdown is considerably less (1 percentage point) than inflation across all transactions. This shows that the reduction in the frequency of promoted items (see Fig. 1(c)) is a significant driver of the lockdown inflation. When excluding promotions, we find modest inflation in the month April 18 - May 17.

3.1.2. Results with fixed base price indices

Fig. 2(c) shows cumulative monthly inflation computed with a fixed base Fisher index, which combines the fixed base Laspeyres index (with expenditure weights set in the first month) with the fixed based Paasche index (with expenditure weights set in the final month).13 To compute this fixed base index we include only UPCs present in each of the 5 months; in all years, these UPCs account for over 90% of total expenditure. The figure shows our conclusions drawn from the chained index hold also with the fixed base index; inflation in the first 3 months of 2020 is similar to in previous years, but in month March 18 - April 17 there is a large and atypical upturn in inflation.

In panel (d) we show the evolution of inflation computed using the fixed base Fisher index at a weekly level. For this we need to condition on UPCs available in all 20 weeks – which account for around 77% of total expenditure. The weekly inflation measure shows that inflation sharply rose at the very beginning of lockdown; up until week 12 weekly inflation in 2020 is very similar to in previous years, in week 13 (which corresponds with the introduction of lockdown) inflation rises by around 2.5 percentage points, and afterwards inflation is close to zero or negative, but by May 17 prices remain well above their pre-lockdown level.

3.2. Accounting for product entry and exit

In the preceding section we show there was a significant spike in inflation at the beginning of lockdown. However, this analysis conditions on continuing products. As is clear from Fig. 1(d), from the beginning of lockdown there was a reduction in the number of UPCs we observed being purchased. This reduction in product variety will also impact consumers' effective cost of living.

To quantify consumers' willingness to pay for changes in product variety we need to make assumptions about the underlying preference structure. Conceptually, by assuming a well-behaved utility function, if one knows the relevant demand elasticities one can infer the infra-marginal consumer surplus created or destroyed by changes in product variety from the observed spending shares on new and exiting products. A prominent choice in the literature is the CES utility function, following Feenstra (1994) and Broda and Weinstein (2010). With product entry and exit, the change in the exact CES price index from t to t + 1 is:

where π t, t+1 CES is the CES inflation rate for continuing products defined above; s N, t+1 is the spending share on “new” products (available at time t + 1 but not at t) and s E, t+1 is the spending share on “exiting” product (available at time t but no longer at t + 1); and σ is the elasticity of substitution between products.

The term leads a higher expenditure share for new products, or a lower expenditure share for exiting products, to reduce the exact price index () relative to the price index focusing on continuing products (1 + π t, t+1 CES). The strength of the welfare effect from changes in product variety depends on the elasticity of substitution between varieties, σ. As σ grows, the term converges to one and the inflation bias from ignoring changes in product variety goes to zero. Intuitively, when existing varieties are close substitutes to new or disappearing varieties, a law of one price applies and price changes in the set of existing products perfectly reflect price changes for new and exiting varieties. We examine the sensitivity of the results to the choice of σ, using a range of estimates from the literature.

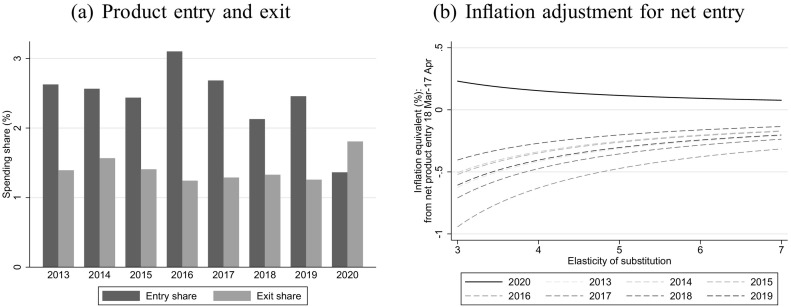

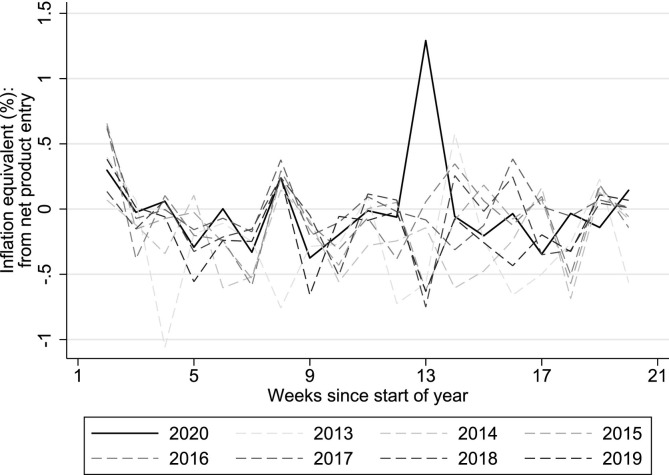

Fig. 3 shows the impact of product variety on inflation in the first month of lockdown (March 17 - April 18). Panel (a) shows changes in the expenditure shares of new and exiting products in all year from 2013 to 2020. In all years preceding 2020 there was net entry, however during the Great Lockdown there is large net exit of products. The entry share is around 50% of its average value in previous years, while the exit shares are around 30% larger. This shows the reduction in UPCs depicted in Fig. 1(d) is reflected in expenditure shares.

Fig. 3.

Product variety and consumer surplus around lockdown.

Notes: Panel (a) shows the share of expenditure in month March 18 - April 17 on products not purchased in the preceding and the share of expenditure in month February 18 - March 17 on products not purchased in the following month. Panel (b) shows the additional inflation, based on a chained CES price index, in March 18 - April 17 attributable to net product entry for different values of the elasticity of substitution.

Panel (b) plots the difference in CES inflation with and without accounting for changing product variety (i.e. between and π t, t+1 CES) for the first month of lockdown, and in the same month in previous years, as a function of the elasticity of substitution, σ. We vary σ between 3, the reduced-form estimate in DellaVigna and Gentzkow (2019) and 7, the structural estimate in Broda and Weinstein (2010). In all years prior to 2020 net entry acted to reduce the CES price index, while in 2020 net entry raised inflation. When σ=3, in prior years (positive) net entry reduces effective inflation by an average of 62 basis points; in 2020 (negative) net entry leads to additional inflation of 23 basis points. When σ=7 the impact of net entry on inflation is smaller, but there remains a difference of 28 basis points between its impact in a typical year and in 2020.14

These estimates underline that it is important to account for changes in product variety when assessing consumer welfare effects. Inflation based on the first month of lockdown for continuing products is 2.4 percentage points. Accounting for the simultaneous reduction in product variety adds another 8-23 basis points to the increase in consumer prices, while in prior years doing so would have reduced inflation by 20-62 basis points. Due to their focus on a fixed basket of products, statistical agencies do not incorporate the impact of changes in product variety into official inflation measures. Our results suggest that reduced variety was an additional source of inflation at lockdown, and may continue to be going forward.

4. Heterogeneity in inflation rates

In this section we document the degree of heterogeneity in inflation across households and product categories.

4.1. Heterogeneity in household inflation rates

It is important to monitor heterogeneity in inflation across households for two reasons. First, even if there is a change in aggregate inflation, households' inflation expectations may not adjust if they are subject to large and idiosyncratic heterogeneity in the inflation rates they actually experience, which is important for the effects of monetary policy. Second, it is important to identify if there are particular groups disproportionately exposed to price changes as this may provide a case for targeted support to preserve purchasing power.

4.1.1. Household-specific inflation rates

To compute household-specific inflation rates over the first 5 months of 2020, and in previous years, we leverage a fixed base Fisher index with household-specific expenditure weights and common prices. Concretely, let q h, i, 1 denote the quantity of product i purchased by household h in month 1, and q h, i, T be the corresponding quantity in the final month, month 5. We compute a household-specific fixed base Fisher index as:

Note that we use average unit prices computed across all households. Therefore differences in π h, t, t+1 HH_Fisher across households will reflect differences in the products they purchase. An advantage of using common prices is that we avoid the need to condition on products purchased in every period at the households level (which restricts households' baskets to a very small number of products, typically representing a small fraction of their expenditure). Instead we need only require that a product is observed purchased in each period by any household (which is the same conditioning as for the aggregate fixed base indices). A potential downside of this approach is it does not capture heterogeneity in inflation arising from differences in prices paid for the same good. However, to the extent that these differences reflect changes in search costs incurred by the household, these costs themselves have a direct impact on welfare and it is not clear it is desirable to include differences in price paid, without changes in search costs, in computed inflation.15 In this analysis we focus on households that record at least £ 40 of spending in each of month 1 and 5 (22,556 of the 28,429 households in 2020).

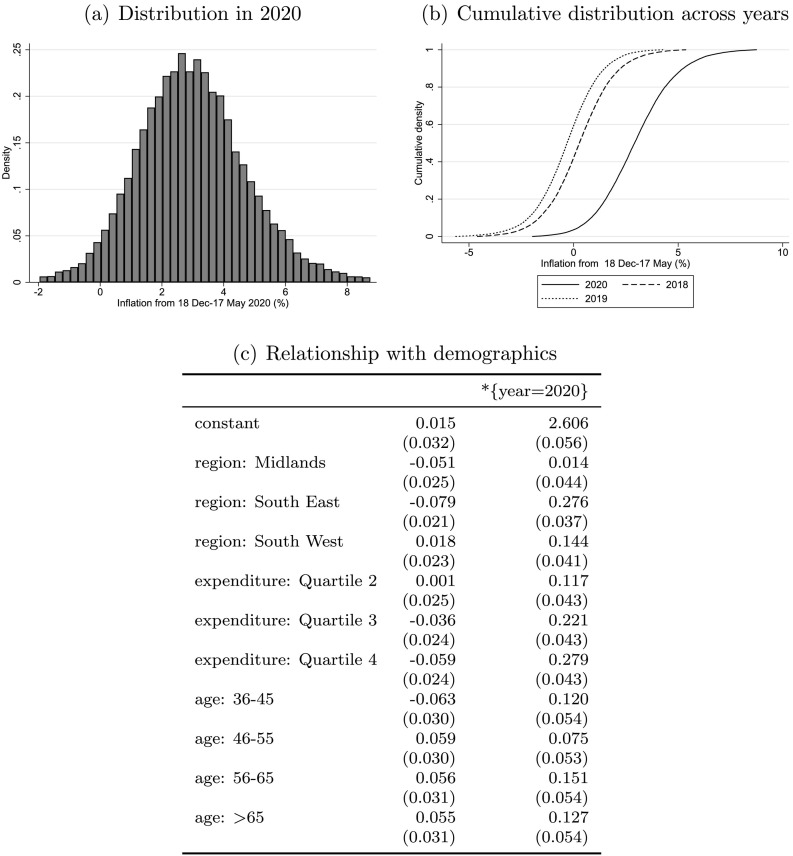

Fig. 4(a) shows the distribution of household-specific inflation rates in 2020 (i.e. over December 18, 2019 to May 17, 2020). It shows substantial heterogeneity, with an interquartile range of over 2.3 percentage points, though with almost all households experiencing inflation. This contrasts with the distribution of household-specific inflation in previous years. Panel (b) illustrates this, plotting the cumulative distribution function of household-specific inflation rates over the same time period in years 2018-2020. In 2018 and 2019 the distributions are similar, with about half of households experiencing deflation. The 2020 distribution is shifted rights in comparison, by around 3 percentage points at each point. This shift in the entire distribution suggests, if higher inflation persists, it may well feed into higher household inflation expectations.

Fig. 4.

Household-specific inflation rates.

Notes: For each household that records at least £40 expenditure in December 18 - January 17 and 18 April - 17 May, we compute household level inflation using a fixed base Fisher index and common prices. This conditions on UPCs available in all months (which represent around 93% of total expenditure). Panel (a) shows a histogram for 2020 household cumulative inflation over December 18 - May 17; panel (b) shows the cumulative densities for different years. In each case we trim the top and bottom 0.5% of the distribution. Panel (c) shows the coefficients from a regression of household-specific inflation in the 5 months of each of 2018-2020 (68,975 observations) on demographic variables and demographic variables interacted with a 2020 dummy.

4.1.2. Inflation across socio-demographic groups

We investigate the extent to which heterogeneity in inflation is systematically related to socio-demographic characteristics. We regress household-specific inflation in years 2018-2020 on categorical variables capturing the broad region households live in, their quartile of the total equivalized spending distribution in the preceding year, and the age of the household's main shopper, and interactions of all variables with a indicator variable for 2020.16 Panel (c) shows the coefficient estimates.

The partial regression R 2 associated with the demographic variables and their interaction with the 2020 dummy is less than 0.01, indicating the significant majority of heterogeneity in inflation across households is idiosyncratic. Nevertheless, there is heterogeneity in inflation across socio-demographics that, while not large, is significant both economically and statistically. Across space, in 2018 and 2019 inflation was lowest, on average, in the South-East. However, in 2020, the pattern is reversed, with households in the South-East seeing inflation 20 basis point higher than those in the North. Furthermore, households in the top quartile (quartile 4) of the distribution of total expenditure experienced the lowest inflation in 2018 and 2019, whereas in the 2020 they experienced the highest, 22 basis points higher than households in the bottom quartile.17 Finally, in 2020 inflation among older households (those with a main shopper aged 56 or above) was around 20 basis points higher that for households with a main shopper aged 35 or under.

These differences may become important for purchasing power dynamics if they persist and cumulate over time, but in the short run they are small relative to the increase in aggregate inflation.

4.2. Inflation heterogeneity across product categories

Documenting inflation heterogeneity across product categories is instructive to assess whether increased inflation may stem from a temporary increase in demand. Supermarkets and food and drink retailers were allowed to remain open during lockdown, while many other sectors of the economy were closed. Any resultant increase in demand may act to bid up prices. If the rise in aggregate inflation is driven by product categories that experiences a surge in demand, it is plausible that the increase in prices will be short-lived and potentially reverse as the economy opens up and consumption patterns revert to normal. In contrast, if the increase in inflation is observed across the board, including in categories that did not experience raised demand, this indicates that stagflation may constitute a plausible risk going forward.

To investigate these questions, for each of the 261 detailed product categories available in our sample,18 we compute a monthly chained Fisher price index between the two months from December 18 to February 17, and the two months from February 18 to April 17. The first period covers the period prior to lockdown when both aggregate expenditure and inflation were similar to in previous years (see Fig. 1). The second period cover the pre lockdown spike in spending, as well as the subsequent rise in price at the beginning of lockdown.

In Table A.1, Table A.5 in Appendix A, we report all the product categories and their inflation rates over these two periods, both in 2020 and 2019. Inflation rates from February 18 to April 17, 2020 vary substantially across categories, with many seeing substantial price rises – for instance, frozen pizzas (+9.47%), margarine (+10.63%), tea (+7.38%), facial tissues (+10.95%) and liquid soap (+8.11%). Very few items experienced deflation during lockdown, with some exceptions including hayfever remedies (−10.21%).

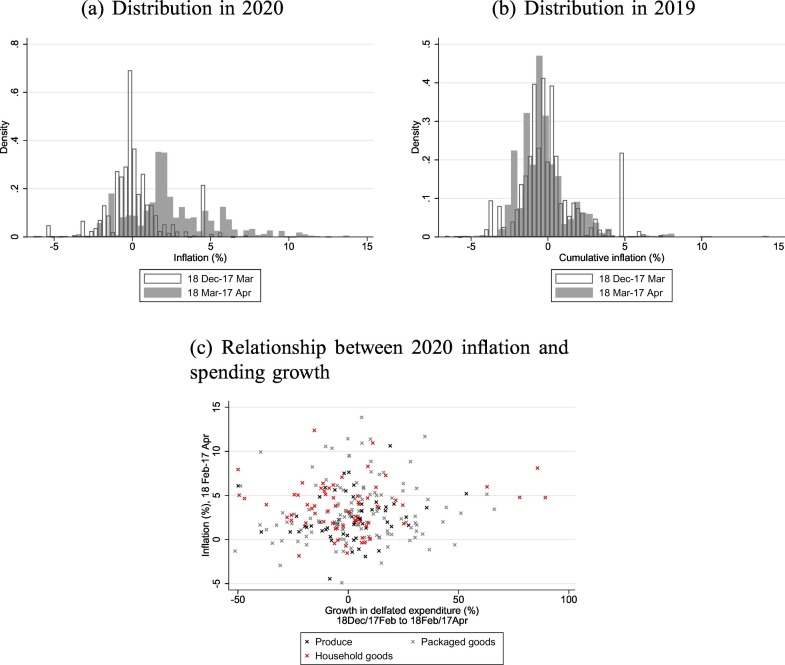

We depict this heterogeneity graphically in Fig. 5(a) and (b). Panel (a) shows a histogram of inflation over December 18 to February 17, and over February 18 to April 17 across product categories in 2020 and panel (b) reports results for 2019. In each case we weight the histogram by the share of expenditure accounted for by each category in the corresponding year. In 2019 the distribution of category inflation rates is similar across the two periods. In contrast, in 2020 the distribution shifts markedly to the right, and it's variance increases. The fraction of categories with double digit positive inflation rates in the two months from February 18 increased from 1% in 2019 to 5% in 2020, while the fraction of categories exhibiting deflation fell from 54% in 2019 to 13% in 2020.

Fig. 5.

Inflation heterogeneity across product categories.

Notes: Panel (a) shows histograms of product category inflation between December 18 to February 17, and February 18 to April 17 in 2020 based on a chained Fisher price index. Figure (b) shows this for 2019. In each case the distributions are weighted by product category expenditure shares in the first five months of the corresponding year. Panel (c) is a scatter plot of product category inflation between February 18 to April 17, 2020 with the growth in deflated spending between December 18 - February 17 and February 18 - April 17. Product categories are shown in Table A.1, Table A.5. All figures omit the bottom and top 1% from any distributions. “Produce” are product categories classified as bakery, dairy, fresh fruit and vegetables and uncooked meat; “Packaged goods” are products classified as non-alcoholic drinks, cupboard ingredients, chilled prepared, confectionery, prepared ambient foods, non fresh fruit and vegetables, cooked and tinned meat and alcohol; “Household goods” are non food and drink products.

In panel (c) we consider the category-level correlation between inflation and changes in output. We plot inflation over February 18 to April 17 in 2020 against the growth in deflated expenditure (i.e. a measure of real quantities purchased) between the period December 18-February 17 to February 18-April 17.19 The figure shows there is little relationship between output changes and inflation; inflation increases across many categories including a large fraction with a fall in output. The category average inflation rate is 3.2% both for categories with increases and decreases in output.

Taken together, these findings show that inflation is widespread, including in categories with declines in output, and that stagflation is plausible going forward.

5. Conclusion

In this paper, we use detailed scanner data to provide a portrait of inflation during the Great Lockdown, covering millions of transactions in the UK fast-moving consumer goods sector. We find that there was an unprecedented spike in inflation at the beginning of lockdown, which coincided with a reduction in product variety. Higher prices and reduced variety have persisted in the following weeks, have led to a rightwards shift in the distribution of household-specific inflation, and impacted the vast majority of product categories. Many households are subject to reduced income and liquid wealth, and higher prices for foods, drinks and household goods will feed into squeezed household budgets.

The inflation spike we document comes at a time when financial markets expect prolonged disinflation (Broeders et al. (2020)). After the dramatic increase in central banks' balance sheets in response to the crisis, it is essential to track price stability. The widespread nature of the inflationary spike we document points towards a risk of higher inflation in the COVID-19 induced recession. Stagflation cannot be ruled out. Higher household level inflation may translate into higher inflation expectations. The price increases we found for many categories, including those not subject to demand spikes, indicate supply disruptions and changes in market power may be playing an important role. While it is too early to say whether a period of stagflation will materialize, as Rudi Dornbusch famously quipped, “In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.” Now is the time to monitor and prepare for a possible return to stagflation.

Acknowledgements

The authors would like to gratefully acknowledge financial support from the Nuffield Foundation under grant number WEL /FR-000022585 and the Economic and Social Research Council (ESRC) under grant number ES/V003968/1, and under the Centre for the Microeconomic Analysis of Public Policy (CPP), grant number ES/M010147/1. Data supplied by Kantar FMCG Purchase Panel. The use of Kantar FMCG Purchase Panel data in this work does not imply the endorsement of Kantar FMCG Purchase Panel in relation to the interpretation or analysis of the data. All errors and omissions remain the responsibility of the authors. Correspondence: x.jaravel@lse.ac.uk and martin_o@ifs.org.uk

Footnotes

In prior years the scanner data account for approximately 40% of household expenditures on goods, and 15% of total household expenditures on both goods and service (see Jaravel (2019)). The coverage offered by the scanner data, as a fraction of total household expenditures, should increase during the Great Lockdown because sectors that are entirely shut down are typically not covered by the scanner data. In particular, Cavallo (2020) shows that consumers spend relatively more on food during confinement.

See Table A.1, Table A.5 in the Appendix for a list of all the product categories covered by the data.

We directly observe online purchases. But some of the other changes in the shopping experience, such as waiting times at stores, are unobserved and may in themselves have a welfare cost, which is not captured by our price indices. They would likely constitute another source of increase in the cost of living during lockdown.

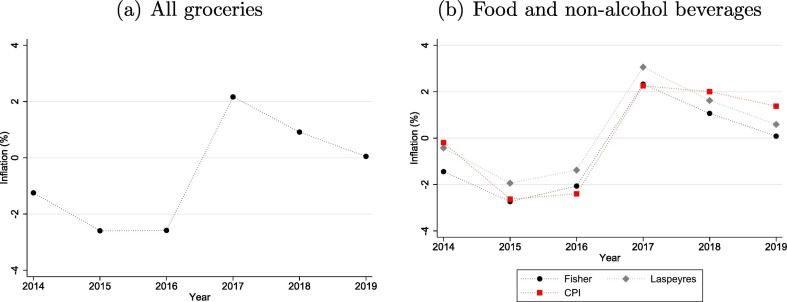

In the Appendix (Figure A1) we report annual inflation over 2013-2019 computed with our dataset and show that it is very similar to official Consumer Price Index inflation computed by the UK Office for National Statistics.

In our analysis we drop transactions in the top 0.5% of the expenditure or quantity distribution; this does not impact our findings.

This means for 2020, weeks run Monday-Sunday. For preceding years weeks may start on a different day.

We do not directly observe product availability, so we cannot rule out that some of this drop is due to some available products post-lockdown never being chosen. However, given that retailers stated they were cutting back on product lines (see https://www.bbc.co.uk/news/business-51961624) and given the increase in total expenditure on fast-moving consumer goods post lockdown, we think this is unlikely.

National statistical offices deal with this issue by imputing missing prices, which tends to lead to an understatement of increases in the cost of living (see Diewert and Fox (2020)).

Multilateral index numbers provide an alternative way of avoiding chain drift. They entail taking a geometric average of all fixed base Fisher indices between the periods over which inflation is being computed (for more details see Ivancic et al. (2011)).

We compute this as the sum of total expenditure on the UPC divided by total quantity.

In the Appendix we explore whether the inflation spike could be driven by a switch towards online shopping, or cross-retailer switching. The former played no role, and the latter a modest role (see Figure A3).

In Fig. 7 we show the Laspeyres, Paasche and Fisher fixed base indices for 2020.

In Fig. A4 in the Appendix we show that the inflationary spike associated with reduced product variety happened in the first week of lockdown.

To the best of our knowledge, this paper is the first to propose to document inflation heterogeneity using household-specific fixed base Fisher indices with common prices. Prior work has focused on the set of continuing products within a households, which captures a relatively small fraction of total households expenditure (Kaplan and Schulhofer-Wohl (2017)).

Specifically, letting i index household and t year, we estimate πit = a + bDi + c1{t=2020} + d1{t=2020}∗Di + εit where πit is inflation for household i over the first 5 months of year t, Di are demographic variables and 1{t=2020} is an indicator variable for year 2020.

The results are similar with other proxies for households' permanent income, included banded household income (not reported).

We omit a handful of product categories with fewer than 1000 transactions in 2020.

Deflated expenditure is measured as nominal spending on the category divided by a category specific Fisher price index.

Appendix A. Additional figures and tables

Fig. A1.

Annual Inflation, 2013-2019.

Notes: Panel (a) shows annual inflation based on a chained Fisher price index for all groceries. Panel (b) shows annual inflation for food and non-alcoholic beverages measured with chained Fisher and Lasperyes price indices. It also shows official CPI inflation for food and non-alcoholic beverages.

Fig. A2.

Aggregate Inflation in 2020, different indices.

Notes: Panel (a) shows cumulative monthly inflation in 2020 based on various chained price indices. Panels (b) and (c) show monthly and weekly inflation based on various fixed base price indices.

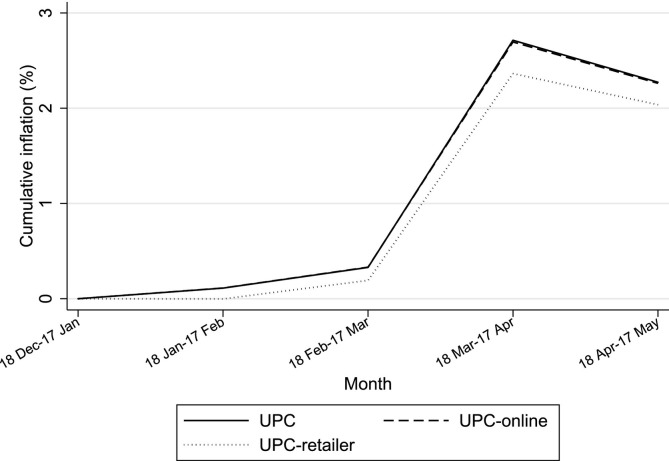

Fig. A3.

Aggregate Inflation in 2020, different product definitions.

Notes: The solid line is based on products defined as UPCs. The dashed line is based on products defined as UPC-online, where “online” is an indicator variable for an online transaction. This holds fixed switching from store to online. The dotted line is based on products defined as UPC-retailer, where “retailer” is a categorical variable consisting of major retailers and aggregations of smaller retailers; Asda, Morrisons, Sainsbury's, Tesco, Premium, Discounters, Convenience, Non food stores. This holds fixed switching across these retailers.

Fig. A4.

Impact of Changing Product Variety on Inflation, by week.

Notes: Figure shows the additional inflation, based on a chained CES price index with elasticity of substitution equal to 3, in each week attributable to net product entry across different years.

Table A.1.

Product category inflation (1).

| Expenditure share in 2019 (%) | Inflation (%): |

||||

|---|---|---|---|---|---|

| 2019 |

2020 |

||||

| 18 Dec-17 Feb | 18 Feb-17 Apr | 18 Dec-17 Feb | 18 Feb-17 Apr | ||

| Bakery | |||||

| Ambient Cakes+Pastries | 1.55 | −3.79 | 0.57 | −5.32 | 1.98 |

| Ambient Sponge Puddings | 0.02 | 4.10 | 4.10 | −3.70 | 18.88 |

| Canned Rice Puddings | 0.03 | 1.72 | 3.43 | 1.05 | 5.20 |

| Chilled Breads | 0.13 | −10.56 | 7.85 | −0.13 | −8.32 |

| Chilled Cakes | 0.31 | 1.60 | 1.29 | −0.93 | 1.30 |

| Chilled Desserts | 0.71 | −3.63 | 0.10 | −1.89 | 1.81 |

| Crackers + Crispbreads | 0.39 | −1.13 | 1.51 | −1.43 | 4.84 |

| Fresh/Chilled Pastry | 0.06 | 3.23 | −3.37 | 5.49 | −4.44 |

| Frozen Bread | 0.04 | −5.17 | 7.26 | −0.43 | 4.02 |

| Frozen Savoury Bakery | 0.23 | −3.08 | 3.68 | −0.20 | 5.62 |

| Morning Goods | 1.79 | −0.68 | −0.45 | 0.65 | 1.80 |

| Savoury Biscuits | 0.14 | 0.97 | −4.20 | 1.20 | 1.39 |

| Toaster Pastries | 0.03 | −3.33 | 2.59 | 3.75 | 25.76 |

| Total Bread | 1.61 | 0.67 | −0.32 | −0.27 | −0.06 |

| Dairy | |||||

| Butter | 1.01 | −0.10 | −1.90 | 0.85 | 3.60 |

| Chilled Flavoured Milk | 0.13 | 1.11 | −4.70 | −1.35 | −1.28 |

| Defined Milk+Cream Prd(B) | 0.09 | 4.15 | −3.05 | 0.63 | 1.61 |

| Fresh Cream | 0.37 | 0.79 | −0.60 | −0.70 | 0.87 |

| Fromage Frais | 0.16 | −0.69 | −0.41 | −2.78 | 5.52 |

| Instant Milk | 0.01 | 1.64 | −0.20 | 2.40 | −0.35 |

| Lards+Compounds | 0.02 | 5.49 | −2.22 | 2.20 | 0.87 |

| Margarine | 0.52 | −0.29 | 0.07 | −0.19 | 10.63 |

| Total Cheese | 3.12 | −0.25 | −0.83 | −0.12 | 2.58 |

| Total Ice Cream | 1.14 | −1.07 | −0.98 | −0.71 | 4.03 |

| Total Milk | 2.98 | 0.39 | −0.66 | 0.06 | 1.91 |

| Yoghurt | 1.66 | −3.12 | −0.65 | −3.16 | 6.18 |

| Yoghurt Drinks And Juices | 0.28 | 0.68 | 2.05 | 0.33 | 7.52 |

| Non-alcoholic drinks | |||||

| Ambient Flavoured Milk | 0.06 | −0.29 | 2.04 | 3.41 | 1.66 |

| Ambient One Shot Drinks | 0.29 | −2.07 | 1.05 | 0.57 | 1.98 |

| Ambnt Fruit/Yght Juc + Drnk | 0.31 | 1.49 | −0.43 | 0.91 | 1.22 |

| Bitter Lemon | 0.01 | 3.60 | −0.28 | 6.48 | −0.40 |

| Bottled Colas | 0.57 | 1.60 | 0.69 | 1.61 | 3.18 |

| Bottled Lemonade | 0.10 | 0.63 | 3.27 | −0.10 | −1.34 |

| Bottled Other Flavours | 0.43 | 5.89 | −0.01 | 5.64 | 2.40 |

| Canned Colas | 0.53 | 4.01 | 2.05 | 2.58 | 4.91 |

| Canned Lemonade | 0.01 | 2.22 | 3.12 | −0.06 | 6.15 |

| Canned Other Flavours | 0.31 | 1.87 | −0.24 | 0.41 | 2.57 |

| Chilled One Shot Drinks | 0.09 | −3.80 | 6.29 | −1.48 | 6.07 |

| Food Drinks | 0.18 | −1.88 | 0.54 | −0.15 | 5.61 |

| Ginger Ale | 0.02 | 2.46 | −0.20 | 7.36 | 3.39 |

| Mineral Water | 0.47 | −1.74 | 2.60 | 0.47 | 3.86 |

| Non Alcoholic Beer | 0.04 | −2.53 | 10.47 | 2.35 | 2.87 |

| Soda Water | 0.02 | 2.21 | −1.31 | 1.43 | 3.31 |

| Tonic Water | 0.16 | 4.77 | −0.73 | 7.39 | −1.00 |

| Total Fruit Squash | 0.59 | 2.16 | −0.30 | −0.27 | 3.55 |

| Fruit and vegetables | |||||

| Chilled Fruit Juice+Drink | 0.64 | 0.08 | −0.88 | −1.74 | 2.96 |

| Chilled Olives | 0.07 | 1.98 | −1.61 | −0.39 | 2.64 |

| Chilled Prepared Frt + Veg | 0.99 | 0.96 | −0.58 | 0.92 | 1.73 |

| Chilled Prepared Salad | 0.35 | 1.48 | −1.10 | 0.35 | 0.32 |

| Chilled Salad Accomps | 0.01 | 1.18 | −1.25 | −2.94 | 3.25 |

| Chilled Vegetarian | 0.13 | −0.13 | 3.04 | 1.31 | 5.89 |

| Fruit | 5.33 | −0.87 | −1.46 | −0.50 | 1.72 |

| Prepared Peas+Beans | 0.17 | −0.01 | 0.30 | −0.23 | 3.69 |

| Vegetable | 5.64 | 4.65 | −2.37 | 4.48 | −1.42 |

Table A.2.

Product category inflation (2).

| Expenditure share in 2019 (%) | Inflation (%): |

||||

|---|---|---|---|---|---|

| 2019 |

2020 |

||||

| 18 Dec-17 Feb | 18 Feb-17 Apr | 18 Dec-17 Feb | 18 Feb-17 Apr | ||

| Cupboard ingredients | |||||

| Ambient Condiments | 0.08 | 2.90 | 0.11 | 4.14 | −0.41 |

| Ambient Cooking Sauces | 0.74 | −2.14 | 3.89 | −0.08 | 8.86 |

| Ambient Dips | 0.04 | 3.61 | 3.71 | 1.85 | 10.35 |

| Ambient Pastes+Spreads | 0.03 | −1.75 | 2.75 | −1.32 | −0.84 |

| Ambient Slimming Products | 0.04 | −0.30 | 10.15 | −5.04 | 9.93 |

| Ambnt Salad Accompanimet | 0.27 | 0.09 | 1.77 | −0.15 | 7.61 |

| Artificial Sweeteners | 0.07 | −0.93 | 5.36 | −1.39 | 11.43 |

| Breakfast Cereals | 1.72 | −0.34 | 2.16 | 0.20 | 5.81 |

| Cereal+Fruit Bars | 0.37 | −0.41 | 1.19 | 0.47 | 3.12 |

| Chocolate Spread | 0.09 | −2.80 | 1.09 | −5.88 | 11.69 |

| Cooking Oils | 0.35 | −0.35 | 0.04 | −0.33 | 5.06 |

| Cous Cous | 0.02 | −2.00 | 0.52 | 2.69 | 0.62 |

| Crisps | 0.96 | 2.98 | −0.92 | −0.03 | 1.95 |

| Dry Pasta | 0.23 | 0.93 | −0.14 | 0.30 | 4.55 |

| Dry Pulses+Cereal | 0.10 | 0.11 | 2.53 | −0.24 | 3.40 |

| Ethnic Ingredients | 0.24 | −3.94 | 2.56 | −0.06 | 9.53 |

| Everyday Treats | 0.41 | −1.92 | −0.26 | −2.47 | 5.81 |

| Flour | 0.11 | 1.86 | −2.57 | −0.89 | 3.43 |

| Herbal Tea | 0.11 | 1.34 | 3.54 | 1.41 | 5.86 |

| Herbs+Spices | 0.23 | −0.60 | 0.16 | 0.73 | 1.70 |

| Home Baking | 0.49 | 0.78 | −0.16 | 0.07 | 2.92 |

| Honey | 0.11 | −1.08 | 1.48 | −0.57 | 3.20 |

| Ice Cream Cone | 0.01 | −5.84 | 5.74 | 2.19 | −0.10 |

| Instant Coffee | 0.86 | −1.18 | 1.85 | 0.72 | 6.43 |

| Lemon+Lime Juices | 0.01 | 0.44 | −1.91 | −0.90 | −1.14 |

| Liquid+Grnd Coffee+Beans | 0.45 | 0.39 | −1.24 | 0.41 | 3.18 |

| Milkshake Mixes | 0.03 | −3.08 | −0.80 | 1.55 | 2.67 |

| Mustard | 0.03 | 4.75 | −3.70 | 3.33 | −4.90 |

| Nuts | 0.64 | 0.10 | −0.23 | 0.04 | 2.10 |

| Packet Stuffing | 0.04 | 5.62 | 1.23 | 10.09 | −2.94 |

| Peanut Butter | 0.11 | −1.18 | 1.17 | −1.94 | 11.37 |

| Pickles Chutneys+Relish | 0.10 | 2.02 | −1.63 | 3.50 | 0.35 |

| Popcorn | 0.10 | −0.57 | 2.06 | −0.05 | 7.68 |

| Powd Desserts+Custard(B) | 0.09 | −1.42 | −1.65 | −1.05 | 0.23 |

| Preserves | 0.15 | −1.46 | −1.46 | −3.12 | 1.65 |

| R.T.S. Custard | 0.07 | 3.67 | −0.49 | 2.05 | 1.68 |

| RTS Desserts Long Life | 0.11 | −3.08 | 4.80 | −1.89 | 10.56 |

| Ready To Use Icing | 0.04 | 2.08 | −3.41 | −1.44 | 2.79 |

| Salt | 0.04 | 0.12 | −1.36 | −0.01 | 0.48 |

| Savoury Snacks | 1.15 | 2.15 | 2.01 | 1.43 | 2.66 |

| Sour+Speciality Pickles | 0.13 | 7.48 | −3.08 | 5.07 | −0.22 |

| Special Treats | 0.17 | −2.91 | −1.04 | −3.80 | 3.22 |

| Suet | 0.01 | −3.35 | 0.40 | −0.32 | −2.67 |

| Sugar | 0.25 | 0.10 | −0.92 | 0.39 | 0.24 |

| Sweet+Savoury Mixes | 0.11 | 2.93 | 0.05 | −1.13 | 2.99 |

| Syrup + Treacle | 0.03 | −1.05 | −1.90 | 2.20 | 1.34 |

| Table Sauces | 0.29 | −0.71 | 0.84 | −0.08 | 5.01 |

| Table+Quick Set Jellies | 0.03 | 0.73 | −1.61 | −0.93 | 1.88 |

| Tea | 0.49 | 1.64 | 1.28 | −2.12 | 7.38 |

| Vinegar | 0.05 | −0.35 | −0.63 | 1.41 | 0.03 |

| Alcohol | |||||

| Beer+Lager | 1.20 | 2.01 | −1.45 | 2.04 | 0.64 |

| Cider | 0.44 | 2.95 | −1.46 | 2.97 | 0.22 |

| Fabs | 0.13 | 0.16 | −0.54 | 3.91 | 3.03 |

| Fortified Wines | 0.15 | 4.90 | −1.36 | 4.55 | 1.63 |

| Sparkling Wine | 0.33 | 1.69 | −0.87 | 1.72 | 1.66 |

| Spirits | 0.59 | 1.63 | 0.23 | 1.06 | 1.07 |

| Wine | 2.45 | 0.11 | −2.75 | 1.11 | 0.98 |

Table A.3.

Product category inflation (3).

| Expenditure share in 2019 (%) | Inflation (%): |

||||

|---|---|---|---|---|---|

| 2019 |

2020 |

||||

| 18 Dec-17 Feb | 18 Feb-17 Apr | 18 Dec-17 Feb | 18 Feb-17 Apr | ||

| Uncooked meat | |||||

| Chilled Black+White Pudng | 0.03 | −3.29 | 5.38 | −4.13 | 6.09 |

| Chilled Burgers+Grills | 0.31 | −1.73 | 0.23 | −0.99 | 3.62 |

| Chilled Prepared Fish | 0.24 | 0.16 | −0.89 | −0.13 | 0.98 |

| Chilled Processed Poultry | 0.43 | −0.33 | −0.67 | −0.06 | −0.09 |

| Chilled Sausage Meat | 0.04 | −0.52 | 2.59 | −0.35 | 4.64 |

| Chld Frnkfurter/Cont Ssgs | 0.16 | −2.28 | 2.00 | 1.16 | 1.98 |

| Eggs | 0.85 | −0.11 | −1.30 | −0.25 | 0.16 |

| Fresh Bacon Joint | 0.22 | −1.43 | 1.49 | 1.34 | 1.50 |

| Fresh Bacon Rashers | 0.87 | −0.34 | −1.23 | 0.23 | 1.13 |

| Fresh Bacon Steaks | 0.12 | 1.54 | −1.73 | −2.00 | 2.39 |

| Fresh Beef | 2.01 | 0.17 | −1.57 | 0.66 | −1.92 |

| Fresh Flavoured Meats | 0.16 | −1.07 | 1.27 | −1.58 | 4.24 |

| Fresh Lamb | 0.42 | 2.94 | −2.49 | 1.12 | 1.48 |

| Fresh Other Meat + Offal | 0.06 | 0.85 | −0.26 | 0.69 | 0.26 |

| Fresh Pork | 0.67 | −1.55 | −0.14 | 0.03 | 3.27 |

| Fresh Poultry | 2.24 | 0.28 | −0.76 | −0.90 | 1.32 |

| Fresh Sausages | 0.70 | −1.16 | 0.42 | −0.20 | 3.26 |

| Frozen Bacon | 0.03 | 0.44 | −0.33 | −0.15 | 0.64 |

| Frozen Beef | 0.05 | −0.52 | 2.20 | 0.43 | 2.54 |

| Frozen Fish | 0.99 | −0.74 | 0.20 | −0.53 | 4.84 |

| Frozen Lamb | 0.03 | −0.12 | 1.46 | −0.25 | −1.09 |

| Frozen Meat Products | 0.19 | 0.16 | −1.66 | 0.12 | 3.38 |

| Frozen Poultry | 0.28 | −0.47 | 0.16 | −1.83 | 0.46 |

| Frozen Processed Poultry | 0.56 | −0.17 | −0.77 | −0.10 | 7.63 |

| Frozen Sausages | 0.09 | −0.99 | −2.89 | 2.39 | 2.29 |

| Lse Fresh Meat + Pastry | 0.05 | −4.35 | −9.92 | −2.19 | 0.89 |

| Meat Extract | 0.40 | 3.24 | −2.44 | 2.47 | 2.46 |

| Shellfish | 0.19 | 2.01 | −1.20 | 0.29 | 1.54 |

| Wet/Smoked Fish | 0.93 | −0.74 | −1.49 | −0.85 | 2.25 |

| Chilled prepared | |||||

| Chilled Cooking Sauces | 0.08 | −0.29 | −1.36 | −0.39 | 3.04 |

| Chilled Dips | 0.22 | 0.66 | −0.49 | 2.38 | −0.59 |

| Chilled Pate+Paste+Spread | 0.08 | 1.42 | 0.04 | 2.49 | 1.13 |

| Chilled Pizza+Bases | 0.55 | 1.25 | −1.78 | 1.56 | 1.19 |

| Chilled Ready Meals | 2.65 | −1.36 | −0.29 | −0.69 | 1.99 |

| Chilled Rice | 0.02 | −2.84 | 0.57 | −7.29 | 1.86 |

| Chld Sandwich Fillers | 0.12 | 0.39 | −0.41 | −1.03 | 1.13 |

| Fresh Pasta | 0.17 | −0.50 | 0.74 | 0.76 | 2.43 |

| Fresh Soup | 0.10 | −2.01 | −2.07 | −1.64 | 6.78 |

| Frozen Pizzas | 0.64 | −0.82 | 2.95 | −2.19 | 9.47 |

| Frozen Ready Meals | 0.76 | −1.28 | 2.53 | −0.78 | 1.62 |

| Other Chilled Convenience | 0.30 | −1.06 | −0.74 | −1.65 | −1.30 |

| Other Frozen Foods | 0.17 | 0.80 | −1.70 | 0.74 | −0.14 |

| Confectionery | |||||

| Childrens Biscuits | 0.14 | −1.38 | 0.60 | 0.54 | 4.59 |

| Chocolate Biscuit Bars | 0.42 | −0.86 | 2.31 | 0.76 | 6.34 |

| Chocolate Confectionery | 2.68 | −1.82 | −2.20 | −1.03 | −0.60 |

| Confect. + Other Exclusions | 0.21 | −3.10 | 0.91 | −0.51 | 4.04 |

| Everyday Biscuits | 0.33 | 0.24 | −0.55 | −0.22 | 2.01 |

| Frozen Confectionery | 0.35 | −2.34 | −0.24 | −1.42 | 1.81 |

| Gum Confectionery | 0.09 | 1.60 | −3.12 | −0.99 | 0.84 |

| Healthier Biscuits | 0.24 | −2.13 | 3.07 | −1.88 | 4.16 |

| Seasonal Biscuits | 0.12 | −6.70 | −3.87 | −10.54 | 3.67 |

| Sugar Confectionery | 0.77 | −0.30 | −0.13 | 0.04 | 0.01 |

Table A.4.

Product category inflation (4).

| Expenditure share in 2019 (%) | Inflation (%): |

||||

|---|---|---|---|---|---|

| 2019 |

2020 |

||||

| 18 Dec-17 Feb | 18 Feb-17 Apr | 18 Dec-17 Feb | 18 Feb-17 Apr | ||

| Household goods | |||||

| Air Fresheners | 0.32 | −3.87 | −2.93 | −2.50 | 2.78 |

| Anti-Diarrhoeals | 0.03 | −1.06 | 0.24 | −0.17 | 3.24 |

| Antiseptics+Liq Dsnfctnt | 0.04 | 1.16 | 0.56 | −1.37 | 4.78 |

| Bar Soap | 0.05 | 3.25 | 2.98 | 0.46 | 5.98 |

| Bath+Shower Products | 0.39 | −2.95 | −0.59 | −1.86 | 5.04 |

| Batteries | 0.21 | 6.22 | 0.03 | 5.15 | 2.17 |

| Bin Liners | 0.13 | −2.41 | 0.31 | −2.57 | 4.01 |

| Bleaches+Lavatory Clnrs | 0.27 | −0.59 | −1.33 | −0.17 | 1.90 |

| Carpet Clnrs/Stain Rmvers | 0.07 | −1.43 | −3.03 | 0.79 | 5.09 |

| Cat Litter | 0.13 | −1.26 | 1.13 | −1.22 | 1.28 |

| Cat+Dog Treats | 0.64 | −1.17 | −0.65 | −0.09 | 1.22 |

| Cleaning Accessories | 0.14 | −1.47 | −0.21 | −0.51 | 2.19 |

| Cold Treatments | 0.08 | 0.46 | 3.28 | −2.18 | 3.94 |

| Cotton Wool | 0.05 | −0.49 | 0.22 | 0.68 | −0.36 |

| Cough Liquids | 0.05 | −0.57 | 6.35 | −0.35 | 2.52 |

| Cough Lozenges | 0.07 | 0.72 | 3.04 | −0.05 | 5.12 |

| Decongestants | 0.06 | 0.14 | 0.66 | 1.02 | 3.81 |

| Dental Floss/Sticks | 0.02 | −5.39 | 0.58 | −1.96 | 2.02 |

| Denture Products | 0.04 | 0.80 | −0.50 | −2.34 | 2.09 |

| Deodorants | 0.43 | −0.04 | −2.01 | −0.78 | 5.82 |

| Dog Food | 0.52 | 0.56 | 0.44 | 1.00 | 2.14 |

| Electric Light Bulbs | 0.04 | 0.06 | −4.03 | −0.98 | 3.95 |

| Eye Care | 0.03 | 2.72 | −1.24 | −0.35 | 0.11 |

| Fabric Conditioners | 0.43 | −0.66 | −0.33 | −1.84 | 5.83 |

| Facial Tissues | 0.26 | −0.22 | −0.21 | −3.52 | 10.95 |

| Female Body Sprays | 0.04 | 0.37 | −2.21 | −3.62 | 5.03 |

| Feminine Care | 0.08 | 1.98 | −1.82 | −1.91 | 3.76 |

| First Aid Dressings | 0.03 | 0.16 | −2.66 | 0.26 | −0.72 |

| Foot Preparations | 0.06 | −0.46 | −5.84 | 3.92 | −1.85 |

| Furniture Polish | 0.02 | −1.85 | −0.85 | 0.25 | 2.62 |

| Hair Colourants | 0.13 | −1.32 | −0.10 | −0.23 | 4.45 |

| Hair Conditioners | 0.19 | −2.38 | −0.72 | −2.67 | 6.37 |

| Hair Styling | 0.07 | −2.75 | 1.57 | −1.08 | 2.96 |

| Hairsprays | 0.07 | −1.28 | −0.46 | −0.41 | 3.52 |

| Hayfever Remedies | 0.06 | −0.53 | −6.93 | 2.81 | −10.21 |

| Household Cleaners | 0.42 | −1.06 | 0.78 | −0.85 | 7.27 |

| Household Food Wraps | 0.24 | −2.17 | 0.28 | 0.03 | −0.36 |

| Incontinence Products | 0.10 | −1.45 | 0.17 | −1.21 | 1.86 |

| Indigestion Remedies | 0.09 | 1.22 | −1.08 | 2.78 | −1.53 |

| Kitchen Towels | 0.40 | 1.20 | −0.28 | 0.50 | 8.30 |

| Laxatives | 0.02 | 2.34 | 0.32 | 1.77 | 2.04 |

| Liquid Soap | 0.15 | 1.40 | −0.99 | −0.73 | 8.11 |

| Lmscle Rmvrs/Water Softener | 0.05 | −1.17 | 1.55 | 1.76 | −0.07 |

| Machine Wash Products | 0.83 | −0.39 | −0.46 | −1.71 | 3.81 |

| Mens Skincare | 0.03 | 10.17 | −6.08 | −3.05 | 4.65 |

| Moist Wipes | 0.15 | 0.27 | −0.36 | −0.27 | 4.94 |

| Mouthwashes | 0.16 | −0.39 | 0.24 | −2.30 | 3.15 |

| Oral Analgesics | 0.24 | 0.99 | 0.66 | 2.58 | 3.91 |

| Pot Pourri+Scented Candles+Oil | 0.06 | −5.44 | −8.11 | −6.32 | 7.95 |

| Razor Blades | 0.12 | 2.61 | −0.61 | −2.50 | 5.49 |

| Shampoo | 0.32 | −0.46 | −0.52 | −2.10 | 6.18 |

| Shaving Soaps | 0.05 | 1.08 | −0.75 | −4.64 | 12.38 |

| Skincare | 0.49 | 0.26 | −1.79 | −0.19 | 4.73 |

| Sun Care | 0.08 | −6.05 | −9.52 | −4.40 | 4.76 |

| Talcum Powder | 0.01 | 3.77 | −1.53 | −2.46 | 7.07 |

| Toilet Tissues | 0.97 | 0.20 | 0.71 | −0.19 | 5.92 |

| ToothPastes | 0.39 | −1.78 | −0.16 | −2.23 | 4.21 |

| Topical Analgesics | 0.06 | −1.33 | 3.76 | −3.05 | −0.44 |

| Topical Antiseptics | 0.03 | 0.31 | 1.61 | −0.42 | 1.80 |

| Total Cat Food inc.Bulk | 1.23 | −0.41 | 0.66 | 0.39 | 1.51 |

| Total Dry Dog Food | 0.08 | −1.25 | 2.83 | −0.76 | 4.70 |

| Total Toothbrushes | 0.11 | −1.24 | −1.51 | −1.96 | 6.43 |

| Vitamins.Minerals/splmnts | 0.24 | −0.20 | −0.75 | −0.61 | 0.19 |

| Wash Additives | 0.11 | −0.40 | −1.05 | −0.43 | 1.87 |

| Washing Up Products | 0.47 | −0.79 | 0.22 | 0.13 | 1.53 |

Table A.5.

Product category inflation (5).

| Expenditure share in 2019 (%) | Inflation (%): |

||||

|---|---|---|---|---|---|

| 2019 |

2020 |

||||

| 18 Dec-17 Feb | 18 Feb-17 Apr | 18 Dec-17 Feb | 18 Feb-17 Apr | ||

| Prepared ambient food | |||||

| Ambient Rice+Svry Noodles | 0.62 | −0.79 | 2.65 | −0.66 | 5.54 |

| Ambient Soup | 0.31 | −0.24 | 1.76 | 0.39 | 5.11 |

| Ambient Vgtrn Products | 0.01 | 0.18 | 3.88 | −3.28 | 5.33 |

| Canned Pasta Products | 0.10 | 1.85 | 6.88 | 10.54 | 5.95 |

| Instant Hot Snacks | 0.19 | −0.94 | 8.19 | 1.86 | 13.85 |

| Packet Soup | 0.11 | −3.77 | 14.35 | −0.80 | 10.93 |

| Non fresh fruit and vegetables | |||||

| Ambient Olives | 0.04 | 2.11 | −1.95 | 0.35 | 0.34 |

| Baked Bean | 0.38 | −0.84 | 2.13 | 3.40 | 1.96 |

| Canned Vegetables | 0.14 | −0.25 | 0.37 | 0.89 | 0.95 |

| Frozen Potato Products | 0.89 | 0.15 | −0.74 | −0.20 | 4.55 |

| Frozen Vegetables | 0.58 | 0.99 | 0.20 | 0.69 | −0.25 |

| Frozen Vegetarian Prods | 0.26 | −3.60 | 7.56 | 0.23 | 6.12 |

| Instant Mashed Potato | 0.02 | −0.47 | −0.27 | −0.17 | 3.64 |

| Tinned Fruit | 0.16 | −0.47 | 0.26 | 0.08 | 2.63 |

| Tomato Products | 0.28 | 0.53 | −0.96 | 0.24 | 2.36 |

| Vegetable in Jar | 0.03 | 0.53 | −3.48 | 0.14 | 0.05 |

| Cooked and tinned meat | |||||

| Canned Fish | 0.57 | 0.69 | 0.79 | −0.38 | 4.70 |

| Canned Hot Meats | 0.16 | 0.81 | 3.14 | −1.78 | 8.83 |

| Cold Canned Meats | 0.12 | 0.20 | 1.63 | −0.24 | 5.14 |

| Complete Dry/Ambient Mls | 0.02 | 1.27 | −2.89 | 3.92 | 8.23 |

| Cooked Meats | 2.24 | −0.86 | −0.49 | −0.02 | 2.23 |

| Cooked Poultry | 0.54 | −0.10 | 0.27 | −0.61 | −1.39 |

| Frozen Cooked Poultry | 0.05 | −0.04 | −1.55 | −0.43 | 0.58 |

| P/P Fresh Meat+Veg + Pastry | 1.01 | −0.48 | −0.23 | −1.54 | 3.17 |

Notes: The final four columns shows the numbers in Fig. 5(a) and (b).

References

- Alexander D., Karger E. 2020. Do Stay-at-home Orders Cause People to Stay at Home? Effects of Stay-at-home Orders on Consumer Behavior. [Google Scholar]

- Andersen A.L., Hansen E.T., Johannesen N., Sheridan A. 2020. Consumer Responses to the COVID-19 Crisis: Evidence from Bank Account Transaction Data. (Available at SSRN 3609814) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Baker S.R., Bloom N., Davis S.J., Terry S.J. In: COVID-Induced Economic Uncertainty. National Bureau of Economic Research, editor. 2020. Technical report. [Google Scholar]

- Baker S.R., Farrokhnia R.A., Meyer S., Pagel M., Yannelis C. In: How Does Household Spending Respond to an Epidemic? Consumption during the 2020 Covid-19 Pandemic. National Bureau of Economic Research, editor. 2020. Technical report. [Google Scholar]

- Baqaee D.R., Farhi E. 2020. Supply and Demand in Disaggregated Keynesian Economies with an Application to the Covid-19 Crisis. (CEPR Discussion Paper 14743) [Google Scholar]

- Bartik A.W., Bertrand M., Cullen Z.B., Glaeser E.L., Luca M., Stanton C.T. In: How Are Small Businesses Adjusting to Covid-19? Early Evidence From a Survey. National Bureau of Economic Research Working Paper, editor. 2020. [Google Scholar]

- Brinca P., Duarte J.B., Faria e Castro M. Louis Working Paper (2020-011) 2020. Measuring sectoral supply and demand shocks during covid-19. FRB St. [Google Scholar]

- Broda C., Weinstein D.E. Product creation and destruction: evidence and price implications. Am. Econ. Rev. 2010;100(3):691–723. [Google Scholar]

- Broeders D., Goy G., Petersen A., de Vette N. In: Gauging the Impact of COVID-19 on Market-based Inflation Expectations. VOX CEPR Policy Portal, editor. 2020. [Google Scholar]

- Caballero R.J., Simsek A. In: A Model of Asset Price Spirals and Aggregate Demand Amplification of a “Covid-19” Shock. National Bureau of Economic Research, editor. 2020. Technical report. [Google Scholar]

- Cavallo A. 2020. Inflation with Covid Consumption Baskets. [Google Scholar]

- Chen H., Qian W., Wen Q. 2020. The Impact of the COVID-19 Pandemic on Consumption: Learning from High Frequency Transaction Data. (Available at SSRN 3568574) [Google Scholar]

- Chetty R., Friedman J.N., Hendren N., Stepner M. Real-time Economics: A New Platform to Track the Impacts of COVID-19 on People, Businesses, and Communities Using Private Sector Data. 2020. https://opportunityinsights.org/wp-content/uploads/2020/05/tracker_paper.pdf

- Coibion O., Gorodnichenko Y., Weber M. In: Labor Markets during the COVID-19 Crisis: A Preliminary View. National Bureau of Economic Research, editor. 2020. Technical report. [Google Scholar]

- DellaVigna S., Gentzkow M. Uniform pricing in us retail chains. Q. J. Econ. 2019;134(4):2011–2084. [Google Scholar]

- Diewert W.E., Fox K.J. In: Measuring Real Consumption and cpi Bias Under Lockdown Conditions. National Bureau of Economic Research, editor. 2020. Technical report. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Faria-e Castro, M. (2020). Fiscal policy during a pandemic. FRB St. Louis Working Paper (2020-006).

- Feenstra R.C. New product varieties and the measurement of international prices. Am. Econ. Rev. 1994:157–177. [Google Scholar]

- Griffith R., O’Connell M., Smith K. Shopping around: how households adjusted food spending over the great recession. Economica. 2016;83(330):247–280. [Google Scholar]

- Guerrieri V., Lorenzoni G., Straub L., Werning I. In: Macroeconomic Implications of Covid-19: Can Negative Supply Shocks Cause Demand Shortages? National Bureau of Economic Research, editor. 2020. Technical report. [Google Scholar]

- Ivancic L., Diewert W.E., Fox K.J. Scanner data, time aggregation and the construction of price indexes. J. Econ. 2011;161(1):24–35. [Google Scholar]

- Jaravel X. The unequal gains from product innovations: evidence from the us retail sector. Q. J. Econ. 2019;134(2):715–783. [Google Scholar]

- Kahn L.B., Lange F., Wiczer D.G. In: Labor Demand in the Time of COVID-19: Evidence From Vacancy Postings and Ui Claims. National Bureau of Economic Research, editor. 2020. Technical report. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kaplan G., Schulhofer-Wohl S. Inflation at the household level. J. Monet. Econ. 2017;91:19–38. [Google Scholar]

- Kurmann A., Lale E., Ta L. The Impact of Covid-19 on us Employment and Hours: Real-time Estimates with Homebase Data. 2020. http://www.andrekurmann.com/hb_covid

- Nevo A., Wong A. The elasticity of substitution between time and market goods: evidence from the great recession. Int. Econ. Rev. 2019;60(1):25–51. [Google Scholar]

- Surico P., Känzig D., Hacioglu S. 2020. Consumption in the Time of Covid-19: Evidence from UK Transaction Data. [Google Scholar]

- Villas-Boas, S. B., J. Sears, M. Villas-Boas, and V. Villas-Boas (2020). Are we # stayinghome to flatten the curve?