Abstract

A large body of academic research has recently focused on omnichannel retailing especially on brick-and-mortar (offline) retailers adding and integrating online capabilities. Relatedly, trade press has highlighted how offline retailers have been investing heavily in the use of their existing physical retail network for quicker delivery and pick-up of online orders. Looking at the competition between Amazon and Walmart, however, we demonstrate that focusing on quicker delivery is not the best strategy for offline retailers when opening online channels to compete with online retailers. We estimate a multivariate probit model using data from a customer survey and find that offline retailers should instead focus on delivering the fundamentals of retailing to their online customers too – larger assortment, competitive prices, and purchase convenience. Further, we employ cluster analysis to show which demographics are good targets for retailers as they develop omnichannel capabilities, as well as which demographics retailers need to keep loyal to their original channels.

Keywords: Omnichannel retailing, Retail patronage, Store choice, Delivery, Customer segmentation

1. Introduction

In the past decade, trade press and academic research in marketing has highlighted the rise of omnichannel retailing. This type of retailing involves employing multiple channels and integrating activities within and across these channels to correspond with how customers shop (Ailawadi & Farris, 2017). The Marketing Science Institute (MSI) has recognized omnichannel retailing as one of the five marketing research priorities for 2018–20 (Marketing Science Institute, 2018). The growth of internet raised a number of challenges for brick-and-mortar retailers (denoted as offline hereon) starting with the advent of digital-first retailers (denoted as online hereon). Manufacturers started using both kinds of retailers to market their products, which resulted in offline retailers facing cross-channel competition from online retailers. Because online retailers had a lower cost structure, they were able to offer lower prices to customers. This resulted in showrooming where customers would use physical stores to inspect the merchandise but then purchase the merchandise through online stores (Ratchford, 2019). To compete, offline retailers started opening online channels too. On the other hand, online retailers started realizing the importance of physical stores in retailing specific product categories (such as grocery and apparel) and started opening physical stores. Such omnichannel retailing provides customers a seamless experience across offline and online channels of the same retailer (Bhatnagar & Ghose, 2004a). Research has shown that this makes shoppers spend more at a retailer and increases customer loyalty (Neslin et al., 2006). In this context, a lot of attention has been focused on the rivalry between Amazon and Walmart – the respective leaders in online and offline retailing – both in general merchandise and, more recently, in grocery.

According to the National Retail Federation, retail (at 2.6 trillion dollars in sales) is about one-sixth of the entire GDP of the United States. Of this, the “food and consumer products” category is the largest with nearly 1 trillion dollars in sales. According to Nielsen, online grocery sales accounted for just 5 percent of the total sales (Nassauer, 2019c). This share was expected to double by the year 2024 though Covid-19 pandemic has caused a spurt in online purchases by consumers (Nassauer, 2019b). What proportion of this pandemic-induced online purchasing persists is debatable but the bulk of sales will still be conducted offline for the foreseeable future.

Offline grocery stores in the U.S. are of various kinds. These include supermarkets such as Kroger, supercenters such as Walmart, natural food stores such as Whole Foods, limited-variety stores such as Trader Joe’s, and warehouse stores such as Costco. Online food shopping has been considered one of the last major holdouts in online retailing because items are often perishable, fragile, or heavy; and, customers prefer to see, touch, smell, and sometimes taste the products (in the form of samples) to validate their freshness and quality before purchase. Most customers shop for groceries at offline stores located close to them; in this context, delivery fees for online orders are usually high in proportion to the total bill which acts as a disincentive against their online purchase (Griffith, 2018). For online retailers, relatively low margins, small average order size, and the perishable nature of products, along with high consumer price sensitivity and strict delivery preferences, raise economic and logistical challenges (Kumar & Mittal, 2018). For example, customer purchases show cyclical patterns, with increased purchasing over the weekends. This implies that trucks customized for grocery delivery are likely to be under-utilized on weekdays. Also, customer density in a given locality needs to be above a certain threshold to justify the economics of sending a delivery truck (McDonald, Christensen, Yang, & Hollingsworth, 2014).

Because offline retailing is expected to continue accounting for the bulk of grocery sales, there is immense interest in the activities of well-established offline grocery retailers as they try to protect their market shares by initiating and integrating their own online channels. Trade press has reported extensively on the activities of such retailers as Walmart, Target, and Kroger. Although research in retailing has identified a multitude of attributes that influence customer’s store choice behavior, these retailers seem to be focused inordinately on leveraging their physical infrastructure to provide quicker delivery of online orders as they attempt to compete with Amazon for a larger share of online shoppers.

In this article, we explore whether or not this focus on quick delivery is the best strategy for offline retailers to compete with online retailers when attracting online shoppers. We conducted an online survey to collect primary data from customers of both Amazon and Walmart to understand reasons for their patronage behavior. Using a multivariate probit choice model, we show that the key reason customers choose Amazon home delivery lies in the fundamentals of retailing – large assortment, competitive prices, and purchase convenience. Offline retailers such as Walmart should thus focus on providing these attributes in their online stores to wean away customers from online retailers such as Amazon instead of investing inordinately in their physical infrastructure to provide quicker delivery of orders. First, they need to generate an online order by being attractive, competitive, and convenient before they can demonstrate their speed of delivery. To the best of our knowledge, this is the first study to look at the relative importance of the determinants of channel or format choice in an omnichannel context that includes more than one retailer. Furthermore, we employ cluster analysis to show which demographics are good targets for retailers as they develop omnichannel capabilities and which demographics they need to keep loyal to their original channels. Our results provide meaningful and actionable insights, especially for offline retailers looking to optimize their investments in omnichannel retailing.

This article is organized as follows. In the next section, we look at recent omnichannel activities by both Amazon and Walmart. Then we consider extant research in determinants of customer patronage behavior of channels or retail stores. Next, we explain our data, measures, and model estimation technique. We follow this with the discussion of results. We conclude with managerial implications of our findings, limitations of the study, and avenues for future research.

2. Amazon vs. Walmart

Walmart started with, and continues dominating, offline retailing which still accounts for almost 90 percent of retail sales in the U.S. By contrast, Amazon started with, and continues dominating, online retailing. Although both have been aware of the challenges posed by each other, both also “stayed in their lanes” for a long time. With the increasing demand for omnichannel retailing, however, each company has been attracted to the other’s predominant channel. Towards this end, Amazon has taken steps to increase its presence in offline retailing whereas Walmart has taken steps to increase its presence in online retailing. Both retailers are integrating their new channels with existing ones. Amazon is using offline locations as pick-up and return points for online orders, whereas Walmart is using online channel to generate orders that can then be fulfilled by its vast network of stores.

2.1. Amazon: from clicks to bricks

Starting in 1994 as an online book retailer, Amazon has diversified into multiple product and service categories and is now the most dominant brand in online retailing. Its reach among U.S. online shoppers is at least ten times that of any offline retailer (Redman, 2019). It offers the largest assortment of products available at competitive prices. When trying to compete with offline retailers, one of Amazon’s disadvantages however has been the delivery time, especially for certain product categories, such as groceries.

In a recent survey, 80 percent of the respondents who were Prime members indicated that their primary motivation for shopping at Amazon was fast, free shipping (Kestenbaum, 2020). Amazon has been investing heavily to make next-day delivery standard for Prime members. These investments include linking together its fulfillment/distribution centers by adding smaller jets to its rented air-cargo fleet of 70 aircrafts, opening local sortation/collection centers close to large metropolitan areas, operating its own delivery vans, and even asking its own employees to deliver packages (Cameron, 2019). It now operates more than 75 fulfillment centers, some of which are larger than a million square feet, and 25 sortation centers (which group goods by destination) across the U.S. (Mims, 2018). Amazon has a fulfillment node within 20 miles of half of the US population, which is up from the mere 5 percent of the US population within that radius in 2015 (Collis, Wu, Koning, & Sun, 2018). To increase the speed of its supply chain further, Amazon is planning to open a central air hub near Cincinnati in 2021 and regional air hubs in major population centers such as southern California and central Florida (Troy, 2020). To cut costs and complications in the last-mile delivery, Amazon has acquired Zoox, an autonomous vehicle company, for $1.2 billion. It is expected to utilize Zoox’s self-driving technology to automate its distribution network (Acosta, 2020).

In addition to these initiatives for faster delivery, Amazon is also increasing its brick-and-mortar presence, betting that shoppers still want to buy groceries and other consumer products at physical stores. Amazon acquired Whole Foods stores in 2017 for about $13.5 billion. The company has now started offering grocery pick-up and one-hour delivery from some Whole Foods stores and plans to expand these services to nearly all 477 stores. Amazon is planning to build Whole Foods stores in more suburbs and other areas to put more customers within range of a two-hour delivery service (Haddon & Stevens, 2018b). Amazon’s brick-and-mortar initiatives also include Amazon Go convenience stores, which are just 1800 square feet in area but sell a range of drinks, prepared foods and groceries (Haddon & Stevens, 2018a). With improvements in camera technology, Amazon extended its Go concept in early 2020 to an urban grocery store larger than ten thousand square feet (Herrera & Tilley, 2020). It is also exploring purchase of smaller regional grocery chains to broaden its reach. Another kind of stores launched in 2018 are named “4-star” stores which carry such items as Amazon devices, electronics, toys, books, and home goods rated at least four stars by customers on Amazon.com. Prime members get preferential prices at these stores (Accardi, 2020).

Amazon also has thousands of self-service kiosks/lockers in almost a thousand cities in the U.S. It has installed lockers at Whole Foods Markets, various convenience stores, and at thousands of apartment complexes and college dormitories throughout the country for residential package pick-up. It is also leveraging existing offline retailers’ infrastructure to expand last-mile delivery options to its online customers. For example, shoppers will be able to pick up their online purchases at specialized counters in more than 1500 Rite Aid locations by the end of the year (Herrera, 2019a).

2.2. Walmart: From bricks to clicks

Walmart dominates offline retailing in the U.S. with domestic annual revenue of about $332 billion in 2019 (excluding its international revenue and Sam's Club revenue). The company has a store within 10 miles of 90 percent of Americans. Walmart entered grocery sector in 1988 with the opening of its first supercenter. Since then, food and other staples have come to account for more than half of Walmart’s total revenue in the U.S., and it has become the country’s largest grocer with a 23 percent share of the market (Hsu, 2018). In fact, Walmart’s revenue from grocery is more than double of Kroger’s and five times that of Amazon’s in the sector (Nassauer, 2019a).

Walmart is taking several initiatives to continue its hold on grocery retailing as online purchasing has gradually increased. Walmart has been aggressively pursuing click-and-collect model where customers buy an item online and pick it up at the store, usually curbside or in the parking lot. Compared with home delivery, click-and-collect is an attractive model for retailers because they can achieve higher profit margins by avoiding shipping fees (Meyersohn, 2018). It offers customers the best of both conventional offline shopping and home delivery of online orders – they can make their purchases in the comfort of their home and get it faster than waiting for delivery or without waiting in a checkout line at the store. Walmart has added grocery pick-up to more than 2,000 of its approximately 4,600 stores in the past four years, and pick-up of general items to 700 stores in the past two years. It has cut the number of new store openings in favor of offering pick-up and same-day delivery options at more stores (Haddon & Fung, 2019). Trade press has highlighted related moves such as partnerships with start-ups employing automated carts to fulfill grocery pick-up orders at stores (Griffith, 2018), as well as restructuring store employee roles to adapt to shifting shopping habits.

In the past, Walmart resisted the more expensive model of home delivery in favor of click-and-collect but is now investing heavily in quick home delivery too (Chin & Nassauer, 2018). In 2015, Walmart began opening dedicated online fulfillment centers and increased product quantities in these centers to deliver online orders more quickly. These centers are supplemented by a large number of smaller centers, as well as store shipments. This allows Walmart to put 98 percent of the U.S. population within two days of ground shipping (Mims, 2018). It is also offering delivery from 800 stores, with another 800 planned this year, mostly by joining hands with firms such as DoorDash and Instacart that crowdsource drivers. It is testing employing its own store workers to make deliveries in a few locations too (Nassauer, 2019b). Walmart offers free next-day delivery of about 200,000 products on orders costing $35 or more in 40 of the top 50 U.S. metro areas. Through this strategy, it aims to match Amazon Prime, which is considered a key driver of Amazon’s growth and has set standards for fast shipping of online orders.

Walmart is also testing out delivery services with an eye on the future including delivering groceries directly to customers’ refrigerators. This move is in response to Amazon’s Prime Now service which drops orders (including fresh groceries from Whole Foods) on doorsteps within hours, and its in-home delivery service “Key by Amazon” which leaves fresh groceries just inside a door, garage or the trunk of a car (Nassauer, 2019c).

Although we have primarily looked at Walmart’s activities in expediting delivery, it is not the only offline retailer trying to compete with Amazon in getting products into customer’s hands more quickly. Other retailers are devising their own strategies too. Target, for example, is utilizing its local stores as distribution hubs, rather than developing dedicated distribution centers for online orders. Using Shipt, a delivery company it acquired in 2017, Target is able to deliver over 90 percent of its online orders within 2 days (Mims, 2018). This has allowed it to keep its delivery costs low. On the other hand, Kroger, the largest supermarket chain, is building a network of automated warehouses for online grocery services (Haddon & Fung, 2019) and has announced a partnership with Ocado, an online grocery company, to use its robots to pack online orders (Griffith, 2018). It now offers delivery or pick-up of online orders at more than 90 percent of its stores (Haddon, 2019a).

3. Determinants of store and channel choice behavior

Existing research has identified several factors that influence customer choice of a channel or retail store. These can be categorized into product-related factors (e.g., product quality), store-related factors (such as product assortment, price, convenience, purchase experience, order-fulfillment time, store atmosphere, service quality, friendliness of salespeople, and store image), and customer-related demographic factors (primarily age, income, and gender) (Blut et al., 2018, Gensler et al., 2012, Melis et al., 2015, Neslin et al., 2006, Pan and Zinkhan, 2006).

Research in store patronage behavior has extensively employed the theory of reasoned action (TRA) which asserts that perceptions of important attributes determine customer attitudes which in turn determine their behavior (Fishbein & Ajzen, 1975). Thus, customer perceptions of these key attributes of each channel are assumed to translate into the attractiveness of each channel’s value proposition, which in turn affects customer channel choice (Verhoef, Neslin, & Vroomen, 2007). We too employ this theoretical lens in our study to identify which attributes have the strongest influence on each of the customers’ choices across both offline and online channels of both retailers.

Product assortment has been identified as one of the most important determinants of customers’ channel choice (Briesch et al., 2009, Verhoef et al., 2007). It is usually measured by the extent of breadth (number of product categories), depth (number of SKUs within a category), and brand choice (number of brands) available. Research has shown that customers’ attitudes toward a retail store or website are strongly related to the assortment offered (Srinivasan, Anderson, & Ponnavolu, 2002). They are also likely to evaluate selected items more positively when the assortment is more comprehensive (Morales, Kahn, McAlister, & Broniarczyk, 2005). As long as it does not confuse the customers, a larger assortment is preferred because it offers more choice flexibility, reduces search costs, and enhances feelings of autonomy for the customer (Iyengar and Lepper, 2000, Oppewal and Koelemeijer, 2005, Sloot et al., 2006). Pan and Zinkhan (2006) found that product assortment had the highest average correlation with store choice, followed by other factors such as service quality, product quality, store atmosphere, price, purchase experience, fast checkout, and friendliness of salespeople.

Price dimension has also been shown as a strong determinant of store patronage and customer satisfaction with a channel (Gensler et al., 2012). Besides the price of the product and any discounts, the price dimension also includes acquisition cost, i.e., the cost a customer incurs in either traveling to the store or the cost she pays for home delivery. Customers consider price differences when choosing a store and are more likely to purchase at the channel that offers them most attractive price (Bell et al., 1998, Vroegrijk et al., 2013).

Time dimension of order fulfillment varies depending on the mode of purchase and delivery. For offline purchase, it consists of travel time and transaction time, i.e., the time required to locate the product and checkout. For home delivery of an online order, it consists of the time required to place the order and to wait for its arrival, i.e., time taken for the product to be delivered. For pick-up of an online order, it consists of the time required to place the order, travel time, and pick-up time, i.e., time required to pick up the order from dedicated pick-up area inside or outside the store. Customers are more likely to choose the channel that minimizes overall time taken (Baker, Parasuraman, Grewal, & Voss, 2002).

Purchase experience is an amalgam of perceived savings in time and effort during the purchase process, including the stages of search, evaluation, and acquisition (Gupta & Kim, 2010). Thus, purchase experience subsumes such attributes as store atmosphere, service quality, friendliness of salespeople, and ease of returning the product. Customer evaluations of purchase experience and service also determine customer satisfaction with both offline and online shopping experiences (Benoit et al., 2019, Berry et al., 2002, Wolfinbarger and Gilly, 2003).

In addition to product- and store-related factors, consumer-related demographic factors are also dominant predictors of customers’ channel patronage and shopping frequency (Pan & Zinkhan, 2006). Given their greater comfort with using internet for shopping, younger shoppers and those with higher levels of education may be more likely to adopt newer channels such as buy-online-pick-up-in-store (BOPIS). Income level may play a role in using home delivery formats because of the need to pay delivery fees or to purchase above a certain amount to qualify for free delivery. Household characteristics, such as the number of members who work, may influence preference for pick-up formats. Relatedly, multi-channel customer segmentation has gained attention too (Konus, Verhoef, & Neslin, 2008), which can help retailers more effectively target potential patrons.

Most of these store-, product-, and customer-related attributes have been conventionally studied in offline and online retailing separately. Some attributes of choice behavior (such as service quality) are ideally comparable within-channel competition only (i.e., comparing service quality at offline channel of one retailer with service quality at offline channel of another retailer). However, other attributes (such as assortment and price) are agnostic of within-channel (within offline or within online channels) or cross-channel competition (between offline and online channels) in that they are comparable across disparate channels of different retailers (Brynjolfsson and Smith, 2000, Degeratu et al., 2000). For most of the attributes, Amazon and Walmart had conventionally taken opposite approaches as they offered different value propositions (either offline or online) to customers (Kumar & Mittal, 2018). When choosing one channel over the other, customers made trade-offs according to their individual preferences. Sometimes these preferences could be mapped along demographic dimensions. In this cross-channel competitive scenario, it was easy to understand customers’ choice of Amazon or Walmart because these two retailers (with their dominant channels) clearly differed in their relative strengths on various attributes (Verhoef et al., 2007). But their efforts in omnichannel retailing to become attractive to customers of each other have turned this cross-channel competition into a mix of simultaneous within-channel and cross-channel competition. Although the direction of patronage determinants’ association with each channel is conceivable, their relative strengths for each channel of each retailer are an empirical issue.

In the past few years, exploration of attributes leading to channel patronage in the context of omnichannel retailing has gathered pace. For example, Emrich, Paul, and Rudolph (2015) showed that limited-line retailers who have a high assortment depth (compared with broad-line retailers who have a high assortment breadth) are better off having the same product assortment at their offline and online stores. Broad-line retailers, on the other hand, are better off providing a larger assortment at their online channels. In grocery retailing, Melis et al. (2015) showed that shoppers adopted the online channel of their preferred offline grocer at first but with time chose an online grocer on the basis of online product assortment. A large proportion of research in this stream has focused on the effects of opening an offline (online) channel for an online (offline) retailer and has documented positive effects on overall sales (Avery et al., 2012, Gallino and Moreno, 2014, Pauwels and Neslin, 2015). Research on the effects of integrating multiple channels to provide customers an omnichannel experience has also documented overall positive results (Cao & Li, 2015).

Specifically examining the issue of delivery, Fisher, Gallino, and Xu (2019) used quasi-experimental data to show that faster delivery of online orders increased sales in both online and offline channels of an apparel retailer. They showed that each business-day reduction in delivery period increased online sales of the apparel retailer by about 1.45 percent and offline sales by about 0.61 percent. The average reduction in delivery time across various states however was just about half a day from the baseline delivery period of 7 business days. In this study, we consider competition between Amazon and Walmart both of which have much shorter delivery periods for most online orders. Consumer behavior too likely differs in purchase of apparel and grocery due to factors such as concern for freshness and quality of groceries, and feasibility of returning grocery purchases. Furthermore, we explore the relative importance of various attributes in customers’ choice behavior across online and offline channels of both retailers. We also show which demographics are good targets for them as they develop omnichannel capabilities and which demographics they need to keep loyal to their original channels. In Table 1 , we provide a summary of relevant empirical research in omnichannel retailing.

Table 1.

Summary of Empirical Literature on Omnichannel Retailing.

| Study | Data & Method | Key result |

|---|---|---|

| Avery et al. (2012) | Quasi-experimental design | Opening an offline store increased catalog and internet sales for the retailer in the long run. |

| Gallino and Moreno (2014) | Store-level purchase data & Difference-in-difference model | Buy-online-pick-up-in-store (BOPIS) mode decreased online sales of the retailer but increased offline sales resulting in a net increase. |

| Cao and Li (2015) | Archival data & Panel estimation | Integration of multiple channels improved overall sales for the retailer. |

| Emrich et al. (2015) | Experimental data | Limited-line retailers who have a high assortment depth (compared with broad-line retailers who have a high assortment breadth) are better off having the same product assortment at their offline and online stores. |

| Melis et al. (2015) | Household panel data & Multinomial logit model | Grocery shoppers adopted the online channel of their preferred offline grocer at first but with time chose an online grocer on the basis of online product assortment. |

| Pauwels and Neslin (2015) | Time-series purchase data & VARX models | Opening an offline store cannibalized catalog sales of the retailer but did not significantly reduce its internet sales. Overall, it led to higher revenue. |

| Gallino, Moreno, and Stamatopoulos (2017) | Customer-level purchase data & Pareto curve regression | Ship-to-store mode increased the sales of less popular items at offline channels of the retailer. |

| Wang and Goldfarb (2017) | Customer-level purchase data & Poisson regression | Opening an offline store increased online sales of the retailer in areas with no prior brand presence but decreased online sales in areas with existing brand presence. |

| Fisher et al. (2019) | Quasi-experimental design | Faster delivery of online orders increased sales in both online and offline channels of an apparel retailer. |

| This study | Survey data & Multivariate probit model | When opening online stores, offline retailers should provide larger assortment, competitive prices, and purchase convenience instead of relying unduly on quicker delivery to compete against online retailers. |

4. Methodology

4.1. Data

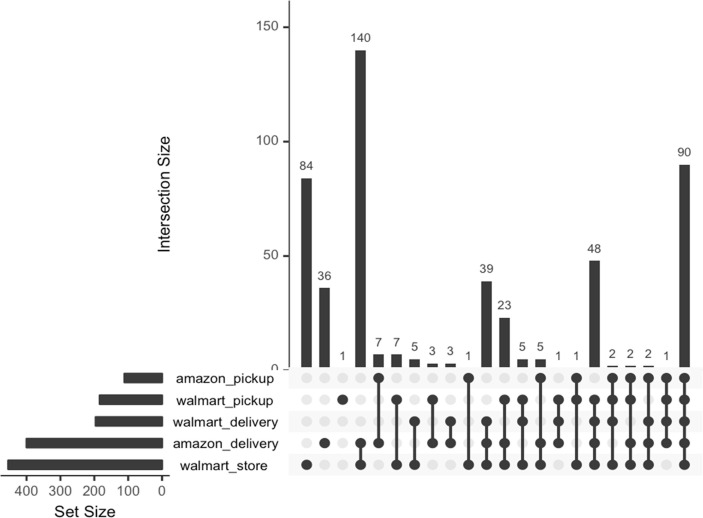

We designed a survey and asked participants to report their shopping behavior at Amazon and Walmart, as well as their perceptions of the various factors discussed in the previous section. The survey was administered in early 2018 by a market research company which recruited a random population of respondents from its sample panel of consumers in the U.S. The company recruits individuals from across the U.S. using a variety of methods to obtain sample diversity, and regularly cleans the database so that it reflects a representative sample. 524 respondents completed all survey questions. We report the summary statistics in Table 2 . Among these respondents, 76 percent shop frequently (defined as more than once per month) on Amazon.com and have products delivered to home, while only 21 percent frequently use the pick-up option when shopping on Amazon.com. Regarding Walmart, 87 percent of participants shop frequently at Walmart stores; 37 percent shop frequently on Walmart.com and choose to ship to home; and 35 percent shop frequently on Walmart.com and use the pick-up option. Fig. 1 depicts an UpSet plot of the proportion of respondents who frequently use a shopping mode exclusively or various combinations of the five shopping modes.

Table 2.

Descriptive Statistics.

| Variables | Meana | Minimum | Maximum |

|---|---|---|---|

| Amazon home delivery | 0.76 | 0 | 1 |

| Amazon pick-up | 0.21 | 0 | 1 |

| Walmart in-store shopping | 0.87 | 0 | 1 |

| Walmart home delivery | 0.37 | 0 | 1 |

| Walmart pick-up | 0.35 | 0 | 1 |

| Gender (Female = 0, Male = 1) | 0.36 | 0 | 1 |

| Age | 41.06 | 18 | 75 |

| Married | 0.59 | 0 | 1 |

| Do not have children | 0.49 | 0 | 1 |

| Having children under 5 | 0.21 | 0 | 1 |

| Having children 5 to 17 | 0.34 | 0 | 1 |

| Having children 18 and older | 0.10 | 0 | 1 |

| Education: High school or less | 0.21 | 0 | 1 |

| Education: Some college | 0.31 | 0 | 1 |

| Education: College degree | 0.33 | 0 | 1 |

| Education: Master’s or higher degree | 0.14 | 0 | 1 |

| Income: Less than $25 k | 0.15 | 0 | 1 |

| Income: $25 k to $50 k | 0.31 | 0 | 1 |

| Income: $50 k to $100 k | 0.35 | 0 | 1 |

| Income: $100 k to $150 k | 0.12 | 0 | 1 |

| Income: $150 k or more | 0.08 | 0 | 1 |

| No one in household working | 0.36 | 0 | 1 |

| One person in household working | 0.31 | 0 | 1 |

| Two persons in household working | 0.32 | 0 | 1 |

All variables except age are categorical. Mean value for each categorical variable indicates the proportion of respondents checking “Yes” option for the question. Standard deviation for age is 15.23 years.

Fig. 1.

UpSet Plot – Shoppers’ Choice of Various Modes of Shopping.

36 percent of respondents are male, and the average age is around 41 years. 59 percent respondents are married, and almost two-third of the respondents have children. The largest proportion of respondents (33 percent) have college degrees and the largest proportion of respondents (35 percent) earn between 50 thousand and 100 thousand dollars per annum. Almost one-third of the respondents each report that either one or two members in the household work.

The various attributes conventionally considered influential in store choice and outlined in the previous section may be correlated. To reduce the dimensions of the ratings, we performed a principal component analysis to extract orthogonal components. We report the rotated factor loadings in Table 3 . For the 18 attributes we identified three components (with eigenvalue of 10.16, 1.73, and 0.95 respectively) that account for 71 percent of total variance. The first component – comprised of such attributes as offering pleasant shopping experience, speedy checkout, good customer service, helpful employees, and free 2-day shipping for online purchases – broadly reflects purchase experience, customer service, and product delivery. Hence, we named this component experience, service, and delivery (ESD). The second component – comprised of such attributes as offering competitive prices, a wide range of product choices, preferred brands, easy returns, and an easy-to-use website – broadly reflects product assortment, competitive price, and purchase convenience. Hence, we named this component assortment, price, and convenience (APC). The third component – comprised of such attributes as offering fresh produce, quality private-label products, quality meat and poultry, and availability of organic items – broadly reflects freshness and quality of products, as well as the ability to validate these qualities. Hence, we named this component freshness and quality validation (FQV).

Table 3.

Principal Component Analysis Loading Matrix.

| Mean | Factor 1: Experience, Service, & Delivery (ESD) | Factor 2: Assortment, Price, & Convenience (APC) | Factor 3: Freshness & Quality Validation (FQV) | |

|---|---|---|---|---|

| Competitive prices | 4.17 | 0.79 | ||

| Wide range of product choices | 4.24 | 0.79 | ||

| Offers brands I want | 4.11 | 0.74 | ||

| Easy to return items | 4.00 | 0.59 | ||

| Easy to use website | 4.12 | 0.72 | ||

| Keeps my data safe & secure | 4.03 | 0.60 | ||

| Pleasant shopping experience | 3.95 | 0.62 | ||

| Speed of checkout or purchase | 3.94 | 0.65 | ||

| Good customer service | 3.84 | 0.72 | ||

| Helpful employees | 3.71 | 0.71 | ||

| Honesty and trustworthiness | 3.95 | 0.65 | ||

| Environmentally conscious | 3.69 | 0.73 | ||

| Socially responsible | 3.73 | 0.73 | ||

| Free 2-day shipping for online purchases | 3.90 | 0.60 | ||

| Freshness of produce | 3.66 | 0.83 | ||

| Quality of private label products | 3.73 | 0.80 | ||

| Quality of meat & poultry | 3.64 | 0.86 | ||

| Availability of organic items | 3.60 | 0.80 |

4.2. Model specification

We propose a multivariate probit model (MVP) to explain a survey participant’s decision to shop frequently at one or more of the five options – Amazon home delivery, Amazon pick-up, Walmart in-store shopping, Walmart home delivery, and Walmart pick-up. A multivariate probit model is a flexible approach to explain the contemporaneous incidence outcomes in this situation where participants may choose more than one option (see Seetharaman et al., 2005 for a review).

We assume the utility of buying from option i(i = 1,…,5) for household h can be written as:

| (1) |

where h stands for participants, i stands for the five shopping options, ESD, APC, and FQV are the three principal components, and X h is a vector that includes demographic variables for household h.

The observed shopping decisions (more than once per month vs. less frequent) for option i can be written as:

| (2) |

We assume that the error terms of different options for a survey participant, ɛh = {ɛh1, ɛh2, …, ɛh5}, follow a multivariate normal distribution. That is,

| (3) |

where ∑ is a 5 × 5 covariance matrix. The covariance matrix allows very flexible substitution patterns and captures the co-incidences in the outcomes (Manchanda, Ansari, & Gupta, 1999). For identification purposes, all diagonal elements of the covariance matrix are set to 1, and the covariance matrix is essentially estimated as a correlation matrix. We estimated the model using simulated maximum likelihood implemented by Stata CMP module (Roodman, 2011).

4.3. Results

4.3.1. Estimation results from multivariate probit model

We report the estimation results in Table 4 and present them for each choice available to the customers. We have standardized the coefficients (covariates only) to infer the strength of each attribute in forming a customer’s preference for each choice.

Table 4.

Estimates of Multivariate Probit model (MVP).

|

Amazon home delivery |

Amazon pick-up |

Walmart in-store shopping |

Walmart home delivery |

Walmart pick-up |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Coeff. | S.E. | Coeff. | S.E. | Coeff. | S.E. | Coeff. | S.E. | Coeff. | S.E. | |

| F1: Experience, service, & delivery (ESD) | 0.21*** | 0.07 | 0.20*** | 0.07 | 0.04 | 0.08 | 0.26*** | 0.06 | 0.37*** | 0.07 |

| F2: Assortment, price, & convenience (APC) | 0.39*** | 0.07 | −0.11 | 0.07 | 0.13 | 0.08 | 0.23*** | 0.06 | 0.16** | 0.06 |

| F3: Freshness & quality validation (FQV) | 0.16** | 0.07 | 0.46*** | 0.09 | 0.32*** | 0.08 | 0.07 | 0.06 | 0.14** | 0.06 |

| Gender (Female = 0, Male = 1) | 0.21*** | 0.07 | 0.23*** | 0.08 | 0.03 | 0.08 | 0.13** | 0.06 | 0.13* | 0.06 |

| Age | −0.29*** | 0.08 | −0.43*** | 0.09 | −0.05 | 0.08 | −0.31*** | 0.07 | −0.26*** | 0.07 |

| Married | 0.12 | 0.09 | −0.05 | 0.11 | 0.17* | 0.10 | 0.05 | 0.08 | <0.01 | 0.08 |

| Having children under 5 | 0.08 | 0.08 | 0.01 | 0.08 | 0.12 | 0.10 | −0.04 | 0.07 | 0.10 | 0.07 |

| Having children 5 to 17 | 0.10 | 0.07 | 0.01 | 0.07 | 0.08 | 0.08 | 0.11* | 0.06 | 0.05 | 0.06 |

| Having children 18 and older | 0.08 | 0.07 | 0.14* | 0.08 | −0.07 | 0.07 | 0.06 | 0.06 | 0.08 | 0.06 |

| Education: Some college | 0.04 | 0.09 | <0.01 | 0.10 | −0.09 | 0.11 | −0.09 | 0.08 | 0.06 | 0.08 |

| Education: College degree | 0.04 | 0.09 | 0.03 | 0.10 | −0.20* | 0.11 | 0.06 | 0.08 | 0.01 | 0.09 |

| Education: Master’s degree or higher | 0.25** | 0.10 | 0.02 | 0.09 | −0.02 | 0.11 | −0.02 | 0.08 | 0.06 | 0.08 |

| Income: $25 k to 50 k | −0.05 | 0.09 | −0.06 | 0.12 | −0.04 | 0.12 | −0.10 | 0.09 | −0.04 | 0.09 |

| Income: $50 k to $100 k | 0.20** | 0.10 | 0.08 | 0.12 | −0.16 | 0.13 | −0.01 | 0.10 | −0.07 | 0.10 |

| Income: $100 k to $150 k | 0.20** | 0.10 | 0.14 | 0.10 | 0.03 | 0.11 | 0.04 | 0.08 | <0.01 | 0.09 |

| Income: $150 k or more | 0.14 | 0.09 | 0.23*** | 0.09 | −0.09 | 0.10 | 0.12 | 0.08 | 0.14* | 0.08 |

| One person in household working | 0.11 | 0.08 | 0.08 | 0.10 | −0.03 | 0.09 | −0.02 | 0.07 | −0.05 | 0.08 |

| Two persons in household working | 0.02 | 0.10 | 0.11 | 0.12 | 0.02 | 0.11 | 0.07 | 0.09 | 0.09 | 0.09 |

| Intercept | 0.87*** | 0.07 | −1.11*** | 0.09 | 1.28*** | 0.08 | −0.35*** | 0.06 | −0.44*** | 0.06 |

Notes: All tests are two-tailed.

Coefficients are standardized.

Income category “Less than $25 k” is the base category for income, and education level “High school or less” is the base category for education.

: p < 0.1.

: p < 0.05.

: p < 0.01.

Home delivery of online orders placed at Amazon.com seems to be preferred the most by customers who place high importance on APC, i.e., product assortment, price competitiveness, and purchase convenience (βstd = 0.39; p < 0.01). Amazon home delivery is preferred second most by customers who place high importance on ESD, i.e., purchase experience, customer service, and product delivery (βstd = 0.21; p < 0.01). It is interesting to note that the choice of home delivery mode is driven more by APC than by ESD. FQV, i.e., Product freshness and quality validation understandably drives customers to Amazon home delivery to a much smaller extent (βstd = 0.16; p < 0.05). This is driven partly by the fact that it is difficult to validate quality for a product that is going to be delivered. Comparing the three attributes, APC is almost twice as effective as ESD and almost two and a half times as effective as FQV. In terms of customer demographics, this mode is preferred by males (βstd = 0.21; p < 0.01), younger customers (βstd = −0.29; p < 0.01), customers with a master’s degree or higher (βstd = 0.25; p < 0.05), customers earning between 50,000 and 100,000 dollars per year (βstd = 0.20; p < 0.05), and customers earning between 100,000 and 150,000 dollars per year (βstd = 0.20; p < 0.05).

Picking up one’s Amazon orders at one of the stores or pick-up points provided by Amazon seems to be preferred primarily by customers who place high importance on FQV (βstd = 0.46; p < 0.01). It is also preferred by customers who place importance on ESD, though not to the same extent (βstd = 0.20; p < 0.01). Choice of this mode does not seem to be associated with the level of importance customers place on APC (βstd = −0.11; n.s.). Understandably, those customers who consider purchase convenience important are less likely to choose picking up their own purchase. This could also be partly driven by Prime members who qualify for free delivery and may not want to expend time and money involved in pick-up, which effectively increases the price for them. Comparing the attributes, FQV is more than twice as effective as ESD, whereas APC is not effective at all. In terms of customer demographics, this mode is preferred by male customers (βstd = 0.23; p < 0.01), younger customers (βstd = −0.43; p < 0.01), customers with adult children (βstd = 0.14; p < 0.10), and customers earning more than 150,000 dollars (βstd = 0.23; p < 0.01). Preference for this mode among households with adult children may be driven partly by the availability of additional adults to pick up online orders.

Offline purchasing in-store at Walmart seems to be preferred the most by those customers who place high importance on FQV (βstd = 0.32; p < 0.01). This finding is self-explanatory – purchasing products at a store in person provides the best opportunity to validate freshness and quality. However, it is not associated with importance customers place on ESD (βstd = 0.04; n.s.) nor on APC (βstd = 0.13; n.s.). Other than giving shoppers an opportunity to validate freshness and quality of products, Walmart does not seem able to attract customers on any other attribute. In terms of customer demographics, this mode is preferred by married customers (βstd = 0.17; p < 0.10) but less preferred by customers with college degrees (βstd = −0.20; p < 0.10). Surprisingly, shopping at Walmart stores is not significantly associated with any other demographic variable, which implies that no customer demographic segment has offline shopping at Walmart as its favorite mode.

Home delivery of online orders placed at Walmart.com seems to be preferred by customers who place high importance on ESD (βstd = 0.26; p < 0.01). It is also preferred, though to a slightly lower extent, by customers who value APC (βstd = 0.23; p < 0.01). Choice of this mode does not seem to be associated with the level of importance customers place on FQV (βstd = 0.07; n.s.). In terms of customer demographics, this mode is preferred by males (βstd = 0.13; p < 0.05), younger customers (βstd = −0.31; p < 0.01), and customers who have children between ages 5 and 17 (βstd = 0.11; p < 0.10).

Picking up online Walmart orders at one of the stores seems to be preferred by customers who place high importance on ESD (βstd = 0.37; p < 0.01). It is preferred second most by customers who place importance on APC (βstd = 0.16; p < 0.05). Valuing FQV also drives customers to Walmart pick-up, though not to the same extent (βstd = 0.14; p < 0.05). Comparing the three attributes, ESD is more than twice as effective as APC and more than two and a half times as effective as FQV. In terms of customer demographics, this mode is preferred by males (βstd = 0.13; p < 0.10), younger customers (βstd = −0.26; p < 0.01), and customers earning more than 150,000 dollars (βstd = 0.14; p < 0.10).

Home delivery of online Amazon orders and in-store shopping at Walmart are the original formats of these two retailers and are in a way a study in contrasts. Results broadly suggest that shoppers prefer Amazon home delivery primarily because they think they get better product assortment, competitive prices, and purchase convenience; other factors influence Amazon shoppers too, though not to the same extent. In-store Walmart shoppers mainly shop there because they think they can validate product freshness and quality; they do not seem to be motivated by any other factor. To cut into each other’s market share in these formats they need to counter their rival’s main attraction for the customers, i.e., Amazon needs to provide an opportunity for product freshness and quality validation while Walmart needs to provide a stronger motivation for customers who value assortment, price, and convenience.

By expanding into pick-up of online orders from various kinds of pick-up points including Whole Foods stores, Amazon seems to have successfully achieved its objective. The influence of freshness and quality validation is the main driving factor for customers choosing Amazon pick-up and is almost fifty percent more than the influence on customers choosing Walmart in-store shopping. Hence, between its two formats Amazon seems to provide incentives for most customers.

By expanding home delivery of online orders and pick-up of online orders from its stores, Walmart seems to have addressed the insufficiencies of purchase experience, customer service, and product delivery associated with the retailer’s in-store shopping. Customers who place higher importance on experience, service, and delivery are more likely to choose Walmart’s newer formats, though pick-up more so than home delivery. Trade press validates Walmart’s vast investments to provide experience, service, and faster delivery especially through pick-up of online orders for the past few years. However, these new formats do not seem to have fully addressed the key reason Amazon home delivery shoppers use Amazon – product assortment, competitive prices, and purchase convenience; such customers are still more likely to choose Amazon home delivery. The effect of these attributes on customers choosing Walmart delivery is more than forty percent less than its effect on customers choosing Amazon delivery. The attributes’ effect on customers choosing Walmart pick-up is less than half of the effect on customers choosing Amazon delivery. This is especially ironic given Walmart’s Everyday Low Prices (EDLP) strategy and its slogan of “Always low prices” since inception. Hence, the key challenge for Walmart is to deliver a larger assortment at competitive prices while making shopping convenient for customers. This challenge is distinct from that of delivering purchase experience and quick delivery, which has been a focus for Walmart over the past few years. A piece of validating empirical evidence: Walmart’s online assortment of stock keeping units (SKUs) is only ten percent of Amazon.com’s assortment, which is more than half a billion. Walmart needs to actively enlarge its online assortment in order to effectively cut into Amazon’s market share. Although it professes “Always low prices,” empirical evidence has also shown that Walmart’s prices are not always the lowest (Profitero, 2018).

In terms of attracting specific demographic segments, Amazon home delivery appears popular among males, younger customers, customers with higher education, and customers with a middle-to-high income. By expanding into pick-up, Amazon not only seems to have retained males and younger customers but has also attracted households with the highest levels of income and households with adult children at home, perhaps because the number of members in the household who can pick up online orders is higher. On the other hand, there is no particular demographic group that appears to be strongly attracted to Walmart in-store shopping. By providing home delivery and pick-up of online orders, Walmart seems to have attracted more males and younger customers, who form the core customer base for Amazon home delivery. Thus, it seems that at least to some extent Walmart has succeeded in attracting Amazon customers with its newer channels. Walmart home delivery also seems to have attracted households with school-going children, which could perhaps be because they appreciate their purchases home-delivered due to paucity of time. Walmart pick-up seems to have attracted households with highest levels of income. However, this segment seems to prefer pick-up option at Amazon too. Thus, compared with Amazon, Walmart still needs to do more to attract customers with higher levels of education and income to its newer formats.

Overall, Amazon seems to have had greater success at adopting omnichannel retailing than Walmart. Walmart should focus more on offering larger online product assortment, competitive prices, and purchase convenience in addition to making investments in customer experience and faster delivery. Additionally, it should increase its efforts in attempting to gain the more educated and higher income shoppers that Amazon currently attracts.

4.3.2. Segmentation analysis

Ailawadi and Farris (2017, p. 133) suggest that “segmenting consumers not just based on their preferences for different channels but based on the attributes or reasons for those preferences is important. Segmentation schemes that show whether and how the importance of convenience- and price-based attributes correlate in different segments can give suppliers insight into how they need to control the availability, presentation, and pricing of their brands online. And they can give retailers insights into how they can differentiate to appeal to important segments while controlling costs on aspects that are less important to the segments.” Multichannel customer segmentation has frequently been identified as a key consumer behavior issue for designing effective multichannel strategies (Bhatnagar and Ghose, 2004a, Bhatnagar and Ghose, 2004b, Ganesh et al., 2010, Konus et al., 2008, Namin and Dehdashti, 2019).

To further understand the differences in customer needs, we conducted a segmentation analysis on the extracted principal components using K-means clustering. A three-cluster solution provides clear distinction between respondents’ shopping choices, and we report the results in Table 5, Table 6 . Approximately 13 percent of respondents seem loyal solely to Amazon home delivery, driven primarily by better product assortment, competitive prices, and purchase convenience available at Amazon, as well as by better purchase experience, customer service, and product delivery provided by the retailer. This cluster also has very low perception of Walmart on all the three key factors. Unmarried customers, customers with children 18 years and older, those with college degrees, and customers earning between 50 thousand and 100 thousand dollars seem to be relatively better represented in this cluster.

Table 5.

Segmentation Analysis: Cluster Analysis Results.

| # of Obs | Amazon home delivery | Amazon pick-up | Walmart In-store shopping | Walmart home delivery | Walmart pick-up | |

|---|---|---|---|---|---|---|

| Cluster 1 (Amazon shoppers) | 68 | 72% | 10% | 0% | 4% | 6% |

| Cluster 2 (Brand-agnostic omnichannel shoppers) | 152 | 95% | 64% | 99% | 98% | 99% |

| Cluster 3 (Original format shoppers) | 304 | 68% | 2% | 100% | 14% | 10% |

Table 6.

Segmentation Analysis: Comparison of Variable Means across Clusters.

| Cluster 1 (Amazon shoppers) | Cluster 2 (Brand-agnostic omnichannel shoppers) | Cluster 3 (Original format shoppers) | |

|---|---|---|---|

| Amazon’s experience, service, & delivery | 0.28 | 0.48 | 0.30 |

| Amazon’s assortment, price, & convenience | 0.27 | −0.03 | 0.23 |

| Amazon’s freshness & quality validation | −0.45 | 0.29 | −0.58 |

| Walmart’s experience, service, & delivery | −0.57 | 0.27 | −0.60 |

| Walmart’s assortment, price, & convenience | −0.53 | −0.09 | −0.06 |

| Walmart’s freshness & quality validation | −0.22 | 0.53 | 0.35 |

| Gender (Female = 0, Male = 1) | 0.40 | 0.43 | 0.32 |

| Age | 44.09 | 34.39 | 43.73 |

| Married | 0.43 | 0.63 | 0.61 |

| Having children under 5 | 0.07 | 0.28 | 0.20 |

| Having children 5–17 | 0.25 | 0.45 | 0.31 |

| Having children 18 and older | 0.15 | 0.08 | 0.11 |

| Education: High school | 0.10 | 0.23 | 0.23 |

| Education: Some college | 0.28 | 0.25 | 0.35 |

| Education: College degree | 0.49 | 0.35 | 0.29 |

| Education: Master’s degree or higher | 0.13 | 0.17 | 0.13 |

| Income: Less than $25 k | 0.09 | 0.13 | 0.17 |

| Income: $25 k to $50 k | 0.25 | 0.24 | 0.36 |

| Income: $50 k to $100 k | 0.47 | 0.34 | 0.32 |

| Income: $100 k to $150 k | 0.09 | 0.14 | 0.11 |

| Income: $150 k or more | 0.10 | 0.14 | 0.04 |

| One person in household working | 0.34 | 0.25 | 0.34 |

| Two persons in household working | 0.22 | 0.42 | 0.29 |

Approximately 29 percent of the respondents seem to have embraced omnichannel retailing unmindful of which retailer it is. They may choose one retailer or channel over another to meet their specific needs at the time of purchase (Kumar & Mittal, 2018). As expected, they seem to rate both Amazon and Walmart high on purchase experience, customer service, and product delivery, as well as on product freshness and quality validation. Younger customers, as well as customers with legally minor children, with higher education, with higher levels of income, and double-income households are relatively better represented in this cluster.

Approximately 58 percent of the respondents seem hesitant to utilize new formats introduced by their preferred retailers. A larger proportion of these respondents shop in-store at Walmart and seem to be doing so for the ability to validate freshness and quality of product. A smaller proportion use Amazon home delivery for reasons of purchase experience, customer service, and product delivery, as well as product assortment, competitive price, and purchase convenience. Female customers, as well as customers with relatively lower levels of education and income seem to be better represented in this cluster.

Overall, as these retailers invest in newer formats, the ideal potential customers for those formats are highly educated married young people (with or without young children) with high incomes, especially with both members of the household working. This desirable profile is widely validated in popular press too. At the same time, Amazon needs to hold on to college-educated singles with a middle-to-high level of income, a demographic that seems to form their loyal customer segment. Finally, female customers with lower levels of education or income appear averse to trying out new formats from both retailers. Hence, both retailers will do well to hold onto this core set of their customers.

5. Discussion

Offline retailers may be making a mistake in the way they are trying to compete with Amazon. Most of their recent investments and activities are focused on quicker delivery of online orders. This focus is understandable given their ready network of delivery and pick-up points in the form of thousands of physical stores. But what they need to examine is why a customer will shop at their online store in the first place if the best they can do is match Amazon on delivery. Offline retailers are focused on gaining parity in distribution of online orders—but what about the assortment and price of products they are making available online and the convenience with which customers can shop for those products? Most offline retailers’ online assortment is a fraction of what is available at Amazon. For example, compared to 536 million SKUs available on Amazon.com in 2016, Walmart.com had only 38 million SKUs (Collis et al., 2018). Some offline retailers, including Walmart, have tried to charge higher prices online than they do in their stores. Is that an attractive proposition to compete with online retailers?

Teixeira (2019) argues that the misplaced focus may be based on offline retailers’ assumption that their industry is being disrupted by technology and innovation of online retailers. He contends that although technological in nature the roots of this disruption lie in better customer value. The recession in 2008 enhanced the importance of price and value for the customer, but traditional grocers kept increasing prices at historical levels to maintain their gross margins. This harmed their value perception. Customers started seeing higher value in online retailers, given their larger assortments and lower prices. Amazon calls it the “flywheel” effect: more product selection and growth leads to lower costs and prices, which gives customers reasons to keep shopping at Amazon (Haddon & Stevens, 2018b). Offline retailers need to recognize this phenomenon, otherwise their investments in technology to ensure quicker delivery of online orders will only further raise their costs. If these costs are then passed onto customers in the form of higher prices, these investments will ultimately worsen their value perception (Gomes, 2019). In a survey conducted by Forrester, the price of an item was the biggest reason shoppers favored a particular retailer; expedited shipping drove purchase decisions for less than 10 percent of the respondents (Smith, 2019).

Offline retailers need to understand and leverage their comparative advantages (Gomes, 2019). They should invest in tracking their supply chain in real time to get a better sense of what, and how much of it, is where and when. Evidence suggests that faster delivery may not be as important for customers as “certain” delivery, i.e., meeting the promised delivery date (Kumar & Mittal, 2018). In an analysis of its online business, REI Inc. found that “if we can provide four-day or less service for our customers consistently, we’re retaining them and getting wallet share” (Smith, 2019). When Amazon missed its two-day delivery promise to several of its Prime customers on Prime Day in 2019 it led to such reactions as “If you can’t fulfill it, don’t promise it.” Amazon explained the high traffic of customers through price: “People are not focused on speed, they are focused on deals.” This validates the primary importance of pricing in customers’ patronage behavior. (Herrera, 2019b). Tracking their inventory in real-time would allow offline retailers to fulfill their promised delivery dates.

Most grocers lack the ability of real-time tracking – 15 percent of consumer products listed on U.S. online ordering services are out of stock when it comes to fulfilling them (Haddon, 2019b). These items are not in the nearest stores fulfilling a delivery order, which forces employees to make necessary substitutions in the order, but these substitutions are not always optimal. At Instacart, the largest third-party grocery-delivery service, incomplete orders are the second most frequent source of customer dissatisfaction, after high price. Mishandling substitutions often lead to returns and refunds which decrease an online order’s profitability (Haddon, 2019b).

In conclusion, Walmart perhaps has the best physical distribution and retail network in the world. Instead of imitating Amazon, which offers a different value proposition to its customers, Walmart should invest in this competitive advantage. It has moved away from focusing on its brand identity as a retailer providing everyday low prices. It should invest in and leverage its core competencies both offline and online and make it convenient for shoppers to make purchases (Yohn, 2017).

5.1. Managerial implications

Although based on competition between Amazon and Walmart, the key results of this study have managerial implications for all retailers pursuing omnichannel strategies. Online retailers’ key limitation is that shoppers cannot validate freshness and quality at the time of purchase. They can overcome this limitation by offering pick-up of online orders in customers’ vicinity. Pick-up option seems to especially attract high very income customers too. Offline retailers need to ensure that their online assortment and prices are competitive with major online retailers and the purchase experience is convenient for the shoppers. These are the key attributes that attract shoppers, especially younger shoppers, to online channels. It may be overrated for them to invest inordinately in quicker delivery, as evidence suggests that delivering on a “promised” date is as effective as, if not better than, quicker delivery.

In general, omnichannel retailers would be advised to target younger double-income households with higher levels of education and income, as they seem the most receptive to addition of newer channels by retailers. However, when targeting these segments of customers by adding newer channels, retailers need to continue providing benefits for their existing customers to maintain their loyalty. These customers likely have lower levels of education and income, which again highlights the critical need to offer greater assortments at competitive prices while making the purchase process convenient to attract all different kinds of customers.

5.2. Limitations and future research

Although this study contributes to our understanding of strategies omnichannel retailers can utilize to compete more effectively, there are some limitations. First is the issue of generalizability. Our analysis is based on customers’ patronage of two retailers only – Amazon and Walmart. As such results may be biased by certain unobservable dimensions of competition between these two specific retailers. Future research should consider other major offline and online retailers too. Second, the retailing sector is undergoing changes and developments at a fast pace especially after the economy was hit by Covid-19 pandemic at the beginning of year 2020. As such, results based on data collected more than a year ago may not fully hold now or in the future. Third, we have not considered the relative cost or capacity issues involved in terms of providing various attributes to the customers. Future research should consider these issues as well in omnichannel retailing. Fourth, we collected information only about the frequency with which customers shop at each of the channels – more frequently than once a month or not. We did not collect how they divided their budget between these different channels, which could have provided a more insightful outcome variable to validate the relative effects of various attributes. Fifth, our results suggest that by expanding into various kinds of pick-up points, Amazon seems to have addressed the freshness and quality validation issue. Picking up an order however is not a direct validation of product freshness; after all, one cannot validate the freshness or quality unless one unpacks the order. Thus, there could be a number of reasons why customers perceive picked up orders to be high on freshness or quality. For example, picking up an order may cut down the transit time from the time of packing to the time one acquires the product, or picking up one’s order at Whole Foods store may psychologically bestow “freshness” on the order. Future research should explore the reasons for this customer perception. Finally, we utilized cross-sectional data of consumer perceptions, but arguably longitudinal data could better capture the dynamic effects of retailers’ omnichannel strategies.

Acknowledgement

The last author was supported by the Social Sciences and Humanities Research Council of Canada (SSHRC-435-2018-0631).

Footnotes

Supplementary data to this article can be found online at https://doi.org/10.1016/j.jbusres.2020.08.053.

Appendix A. Supplementary material

The following are the Supplementary data to this article:

References

- Accardi, N. (2020). Amazon to open 2 brick-and-mortar stores in N.J. Available at https://www.nj.com/business/2020/01/amazon-to-open-2-brick-and-mortar-stores-in-nj.html.

- Acosta, G. (2020). Amazon's vision for autonomous delivery. Available at https://retailleader.com/amazons-vision-autonomous-delivery.

- Ailawadi K.L., Farris P.W. Managing multi- and omni-channel distribution: Metrics and research directions. Journal of Retailing. 2017;93(1):120–135. [Google Scholar]

- Avery J., Steenburgh T.J., Deighton J., Caravella M. Adding bricks to clicks: Predicting the patterns of cross-channel elasticities over time. Journal of Marketing. 2012;76(3):96–111. [Google Scholar]

- Baker J., Parasuraman A., Grewal D., Voss G.B. The influence of multiple store environment cues on perceived merchandise value and patronage intentions. Journal of Marketing. 2002;66(2):120–141. [Google Scholar]

- Bell D.R., Ho T.-H., Tang C.S. Determining where to shop: Fixed and variable costs of shopping. Journal of Marketing Research. 1998;35(3):352–369. [Google Scholar]

- Benoit S., Evanschitzky H., Teller C. Retail format selection in on-the-go shopping situations. Journal of Business Research. 2019;100:268–278. [Google Scholar]

- Berry L.L., Seiders K., Grewal D. Understanding service convenience. Journal of Marketing. 2002;66(3):1–17. [Google Scholar]

- Bhatnagar A., Ghose S. A latent class segmentation analysis of e-shoppers. Journal of Business Research. 2004;57:758–767. [Google Scholar]

- Bhatnagar A., Ghose S. Segmenting consumers based on the benefits and risks of Internet shopping. Journal of Business Research. 2004;57(12):1352–1360. [Google Scholar]

- Blut M., Teller C., Floh A. Testing retail marketing-mix effects on patronage: A meta-analysis. Journal of Retailing. 2018;94(2):113–135. [Google Scholar]

- Briesch R.A., Chintagunta P.K., Fox E.J. How does assortment affect grocery store choice? Journal of Marketing Research. 2009;46(2):176–189. [Google Scholar]

- Brynjolfsson E., Smith M.D. Frictionless commerce? A comparison of internet and conventional retailers. Management Science. 2000;46(4):563–585. [Google Scholar]

- Cameron D. Amazon rents more jets to expand next-day delivery. The Wall Street Journal. 2019 June 18. [Google Scholar]

- Cao L., Li L. The impact of cross-channel integration on retailers’ sales growth. Journal of Retailing. 2015;91(2):198–216. [Google Scholar]

- Chin K., Nassauer S. Walmart tries out own home-delivery service. The Wall Street Journal. 2018 September 5. [Google Scholar]

- Collis D., Wu A., Koning R., Sun H.C. Harvard Business School Publishing; Boston, MA: 2018. Walmart Inc. takes on Amazon.com. [Google Scholar]

- Degeratu A.M., Rangaswamy A., Wu J. Consumer choice behavior in online and traditional supermarkets: The effects of brand name, price, and other search attributes. International Journal of Research in Marketing. 2000;17(1):55–78. [Google Scholar]

- Emrich O., Paul M., Rudolph T. Shopping benefits of multichannel assortment integration and the moderating role of retailer type. Journal of Retailing. 2015;91(2):326–342. [Google Scholar]

- Fishbein M., Ajzen I. Addison Wesley Publishing Company; Reading, MA: 1975. Belief, attitude, intention, and behavior: An introduction to theory and research. [Google Scholar]

- Fisher M.L., Gallino S., Xu J.J. The value of rapid delivery in omnichannel retailing. Journal of Marketing Research. 2019;56(5):732–748. [Google Scholar]

- Gallino S., Moreno A. Integration of online and offline channels in retail: The impact of sharing reliable inventory availability information. Management Science. 2014;60(6):1434–1451. [Google Scholar]

- Gallino S., Moreno A., Stamatopoulos I. Channel integration, sales dispersion, and inventory management. Management Science. 2017;63(9):2813–2831. [Google Scholar]

- Ganesh J., Reynolds K.E., Luckett M., Pomirleanu N. Online shopper motivations, and e-store attributes: An examination of online patronage behavior and shopper typologies. Journal of Retailing. 2010;86(1):106–115. [Google Scholar]

- Gensler S., Verhoef P.C., Böhm M. Understanding consumers’ multichannel choices across the different stages of the buying process. Marketing Letters. 2012;23(4):987–1003. [Google Scholar]

- Gomes, J. (2019). Retailers are focusing on the wrong kind of disruption – It’s not about technology per se. At https://www.forbes.com/sites/forbestechcouncil/2019/04/17/retailers-are-focusing-on-the-wrong-kind-of-disruption-its-not-about-technology-per-se/#601f65685dd1.

- Griffith E. Amazon’s ripple effect on grocery industry: Rivals stock up on start-ups. The New York Times. 2018 August 21. [Google Scholar]

- Gupta S., Kim H.-W. Value-driven Internet shopping: The mental accounting theory perspective: Value-Driven Internet Shopping. Psychology & Marketing. 2010;27(1):13–35. [Google Scholar]

- Haddon H. Kroger shares fall as online investments dent profit. The Wall Street Journal. 2019 March 7. [Google Scholar]

- Haddon H. Amazon to Whole Foods online delivery customers: We’re out of celery, how’s kale? The Wall Street Journal. 2019 March 24. [Google Scholar]

- Haddon H., Fung E. Grocers brace for another blow from Amazon. The Wall Street Journal. 2019 March 3. [Google Scholar]

- Haddon H., Stevens L. Amazon tests its cashierless technology for bigger stores. The Wall Street Journal. 2018 December 2. [Google Scholar]

- Haddon H., Stevens L. Amazon plans to add Whole Foods stores. The Wall Street Journal. 2018 December 31. [Google Scholar]

- Herrera S. Amazon adds Rite Aid locations to package delivery network. The Wall Street Journal. 2019 June 27. [Google Scholar]

- Herrera S. Amazon’s two-day shipping standard slips for some on Prime day. The Wall Street Journal. 2019 July 16. [Google Scholar]

- Herrera S., Tilley A. Amazon opens cashierless supermarket in latest push to sell food. The Wall Street Journal. 2020 25th February 2020. [Google Scholar]

- Hsu T. Walmart is finding success in the grocery aisle. The New York Times. 2018 August 16. [Google Scholar]

- Iyengar S.S., Lepper M.R. When choice is demotivating: Can one desire too much of a good thing? Journal of Personality and Social Psychology. 2000;79(6):995–1006. doi: 10.1037//0022-3514.79.6.995. [DOI] [PubMed] [Google Scholar]

- Kestenbaum, R. (2020). Amazon could be vulnerable to competition, and this is how. Available at https://www.forbes.com/sites/richardkestenbaum/2020/02/05/amazon-could-be-vulnerable-to-competition-and-this-is-how/#cf6dd7052a02.

- Konus U., Verhoef P.C., Neslin S.A. Multichannel shopper segments and their covariates. Journal of Retailing. 2008;84(4):398–413. [Google Scholar]

- Kumar N., Mittal S. Singapore Management University; Singapore: 2018. Amazon and Walmart on collision course. [Google Scholar]

- Manchanda P., Ansari A., Gupta S. The “Shopping Basket”: A model for multicategory purchase incidence decisions. Marketing Science. 1999;18(2):95–114. [Google Scholar]

- McDonald R., Christensen C., Yang R., Hollingsworth T. Harvard Business School Publishing; Boston, MA: 2014. AmazonFresh: Rekindling the online grocery market. [Google Scholar]

- Melis K., Campo K., Breugelmans E., Lamey L. The impact of the multi-channel retail mix on online store choice: Does online experience matter? Journal of Retailing. 2015;91(2):272–288. [Google Scholar]

- Meyersohn, N. (2018). Retail’s Amazon antidote: Buy online, pickup in store. At https://www.cnn.com/2018/12/29/business/walmart-target-best-buy-amazon-online-pickup/index.html.

- Mims C. The Prime effect: How Amazon’s two-day shipping is disrupting retail. The Wall Street Journal. 2018 September 20. [Google Scholar]

- Morales A., Kahn B.E., McAlister L., Broniarczyk S. Perceptions of assortment variety: The effects of congruency between consumers’ internal and retailers’ external organization. Journal of Retailing. 2005;81(2):159–169. [Google Scholar]

- MSI Marketing Science Institute (2018). Research priorities 2018–20. Cambridge, MA: Marketing Science Institute.

- Namin A., Dehdashti Y. A “hidden” side of consumer grocery shopping choice. Journal of Retailing and Consumer Services. 2019;48:16–27. [Google Scholar]

- Nassauer S. Walmart posts strong holiday sales gains in U.S. The Wall Street Journal. 2019 February 19. [Google Scholar]

- Nassauer S. Walmart’s food-delivery challenges: Patchwork of drivers, tolls, crowded aisles. The Wall Street Journal. 2019 March 14. [Google Scholar]

- Nassauer S. Walmart wants to put groceries into your fridge. The Wall Street Journal. 2019 June 7. [Google Scholar]

- Neslin S.A., Grewal D., Leghorn R., Shankar V., Teerling M.L., Thomas J.S., Verhoef P.C. Challenges and opportunities in multichannel customer management. Journal of Service Research. 2006;9(2):95–112. [Google Scholar]

- Oppewal H., Koelemeijer K. More choice is better: Effects of assortment size and composition on assortment evaluation. International Journal of Research in Marketing. 2005;22:45–60. [Google Scholar]

- Pan Y., Zinkhan G.M. Determinants of retail patronage: A meta-analytical perspective. Journal of Retailing. 2006;82(3):229–243. [Google Scholar]

- Pauwels K., Neslin S.A. Building with bricks and mortar: The revenue impact of opening physical stores in a multichannel environment. Journal of Retailing. 2015;91(2):182–197. [Google Scholar]

- Profitero (2018). Price Wars – Grocery, Household & Beauty. Volume 2, February 2018. At http://insights.profitero.com/022018-AmazonPricingStudy_LP.html.

- Ratchford, B. T. (2019). The impact of digital innovations on marketing and consumers. In Marketing in a Digital World (Review of Marketing Research, Vol. 16). Emerald Publishing Limited, pp. 35−61.

- Redman, R. (2019). Brick-and-mortar retailers narrow gap with Amazon. Supermarket News, March 18, At https://www.supermarketnews.com/online-retail/brick-and-mortar-retailers-narrow-gap-amazon.

- Roodman D. Fitting fully observed recursive mixed-process models with cmp. The Stata Journal. 2011;11(2):159–206. [Google Scholar]

- Seetharaman P.B., Chib S., Ainslie A., Boatwright P., Chan T., Gupta S.…Strijnev A. Models of multi-category choice behavior. Marketing Letters. 2005;16(3-4):239–254. [Google Scholar]

- Sloot L.M., Fok D., Verhoef P.C. The short- and long-term impact of an assortment reduction on category sales. Journal of Marketing Research. 2006;43(4):536–548. [Google Scholar]

- Smith J. Retailers are warned to step slowly into one-day shipping. The Wall Street Journal. 2019 May 10. [Google Scholar]

- Srinivasan S.S., Anderson R., Ponnavolu K. Customer loyalty in e-commerce: An exploration of its antecedents and consequences. Journal of Retailing. 2002;78(1):41–50. [Google Scholar]

- Teixeira T. Currency; New York, NY: 2019. Unlocking the customer value chain. [Google Scholar]

- Troy, M. (2020). An Amazon advantage other retailers can’t replicate. Available at https://retailleader.com/amazon-advantage-other-retailers-cant-replicate.

- Verhoef P.C., Neslin S.A., Vroomen B. Multichannel customer management: Understanding the research-shopper phenomenon. International Journal of Research in Marketing. 2007;24(2):129–148. [Google Scholar]

- Vroegrijk M., Gijsbrechts E., Campo K. Close encounter with the hard discounter: A multiple-store shopping perspective on the entry of local hard-discounter entry. Journal of Marketing Research. 2013;50(5):606–626. [Google Scholar]

- Wang K., Goldfarb A. Can offline stores drive online sales? Journal of Marketing Research. 2017;54(5):706–719. [Google Scholar]

- Wolfinbarger M., Gilly M.C. eTailQ: Dimensionalizing, measuring and predicting etail quality. Journal of Retailing. 2003;79(3):183–198. [Google Scholar]

- Yohn D.L. Walmart won’t stay on top if its strategy is “copy Amazon”. Harvard Business Review. 2017 March 21, 2017. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.