Highlights

-

•

Africa’s agricultural productivity depends on the formation of physical capital.

-

•

Capital formation is imperative to overcome potential post COVID-19 food insecurity.

-

•

Instantaneous impact of agricultural ODA on agricultural fixed capital formation.

-

•

Corruption and rule of law do matter for agricultural ODA inflows to SSA.

-

•

ODA is necessary to accelerate agricultural investments and enhance food security.

Keywords: Official development assistance, Agricultural aid, Agricultural fixed capital formation, SDGs, COVID-19 implications, Sub-Saharan Africa

Abstract

The formation of physical capital in Sub-Saharan Africa (SSA) in agriculture is imperative to help the continent (1) overcome the effect of the COVID-19 pandemic on food insecurity and (2) still be on track towards achieving the Sustainable Development Goals (SDGs) of “No poverty” and “Zero hunger” in the midst of the COVID-19 pandemic. Using country-level data on 40 SSA countries from 1996 to 2014 and rainfall deviations as an instrument for agricultural official development assistance (ODA) in fixed-effect estimation settings, this paper examines the ‘instantaneous’ impact of agricultural ODA on agricultural fixed capital formation in SSA. The question here is whether aid to agriculture does translate instantaneously to building fixed capital urgently needed to address the effect of any potential crisis on food insecurity. Measuring agricultural fixed capital as fixed investments in farm machinery, dams, industrial buildings for agricultural and agro-processing, fences, ditches, drains, etc., we find that capital formation in SSA agriculture improves instantaneously with agricultural ODA inflows. Second, we find that even though rainfall deviations are associated with agricultural ODA inflows to SSA, institutions particularly those designed to control corruption and strengthen rule of law, do matter for agricultural aid inflows to SSA. These results suggest that agricultural ODA is necessary to accelerate agricultural investments and achieve food security. Our results are robust to sensitivity analysis on the specification of the instantaneous model.

1. Introduction

The paper studies the instantaneous impact of agricultural Official Development Assistance (ODA) on Agricultural Gross Fixed Capital Formation (GFCF) in Sub-Saharan Africa (SSA). Over the past decade, ODA to Sub-Saharan Africa (SSA) has increased significantly. In 2008, the amount of ODA flows to the region was $80 billion and rapidly reached $125 billion in 2010 (McCloskey, 2019, Ogundipe et al., 2014). In 2018, data suggest that total ODA to SSA increased to $149.3 billion (McCloskey, 2019). In general, over the past five decades, SSA has received about $1 trillion in foreign aid. The broader question here is whether the ODA to SSA has had significant impacts on receiving countries. The more specific question is whether agricultural ODA to SSA has had significant and instantaneous impacts on the formation of agricultural physical capital and for which reason, in the midst of crisis, can be used as a tool to address vulnerabilities in the food system. Thus, in the era of possible food insecurity in SSA due to the increasing threat of climate change and the aftermath effect of the COVID-19 pandemic, it is important to examine whether aid can have immediate impacts and as such help to create the needed fixed capital required in the shortest possible time (see Sasson, 2012 for elaboration on pre-pandemic food insecurity in SSA).

Importantly, in the midst of any crisis, be it climate-induced or pandemic-induced, it is important to explore both the short-term as well as long-term solutions. Resolving the problem of food insecurity induced by climate change or by a pandemic is crucial to development in low-income countries. Anecdotal evidence so far shows rising food insecurity due to the COVID-19 lockdown in a number of SSA countries. 1 Although the aftermath of the COVID-19 pandemic could heighten food insecurity in many SSA countries, we argue that an instantaneous improvement in agricultural physical capital formation could lessen the impact. Thus, in this paper, we explore the instantaneous impacts of agricultural-specific aid on the formation of agricultural fixed capital in the form of farm machinery, dams, industrial buildings for agricultural and agro-processing, fences, ditches, drains, etc., in SSA’s agriculture sector. We consider the associations between current agricultural ODA and current levels of agricultural fixed capital formation.

ODA to SSA based on the motive for the support can be categorized into social (education, health, water, and sanitation), economic (transport, communication, energy, and banking), production (agriculture, industry, and trade), humanitarian, multisector. general program aid and debt (see OECD, 2010a, OECD, 2010b). While there is a general greater understanding of the impact of aid at the national and sub-national level (see (Alesina and Dollar, 2000, Arndt et al., 2015, Qian, 2015, Briggs, 2014, Briggs, 2018, Masaki, 2018), 2 nonetheless there is scanty empirical evidence on the impact of sector-specific aid, particularly aid to the agricultural sector of SSA countries.

Traditionally, agriculture in SSA had been largely traditional with limited use of productivity-enhancing machinery such as tractors, plows, harvesters, etc. (see Daum and Birner, 2017, Benin, 2015). Support for agricultural mechanization has increased significantly since the last food price crisis in 2007, culminating in the introduction of policies – including subsidies on farm implements – to ease access to farm implements and increase food production (Benin, 2015). The need for increased capital formation in agriculture to increase food production, and reduce food insecurity and hunger particularly in SSA is heightened by the daunting effect of climate change and the coronavirus (COVID-19) outbreak. Scholars argue that food insecurity and hunger can lead to social upheaval and can create a new ‘security’ threat for SSA (Hendrix and Brinkman, 2013, Brown et al., 2007, Paarlberg, 1999). For completeness, we also examine the long-term impact of agricultural aid,

One of the ways to still be on track towards achieving the Sustainable Development Goals (SDGs) of “No poverty” and “Zero hunger in the midst of a pandemic and climate change is to aggressively increase access and use of agricultural machinery, in order to increase food production. Improving capital formation is therefore imperative for agricultural development. Agricultural development is a goal in itself, and if reached can help to reduce poverty and hunger in SSA. It can also help SSA countries to be resilient in terms of food security in the face of any crisis such as the COVID-19 pandemic. There exist very few country-specific studies that have examined the impact of agricultural ODA in developing countries. The preponderance of evidence has focused on project and country-specific ODA. For example, Nkonya et al. (2012) have shown that a multilateral agricultural aid programme that was initiated in Nigeria led to the neglect of investment in postharvest technology, leading to increased storage losses. Abdulai et al. (2005) examined the effect of food aid on household-level food production. They find no effect of food aid on food production.

Investment in infrastructure and other capital goods is particularly crucial in the development process of developing countries. Dams, warehouses, farm machinery, etc., can enhance agricultural productivity. Fixed capital formation in agriculture is therefore imperative for pro-poor growth and poverty reduction. The theoretical argument is that ODA has the potential of augmenting scarce domestic resources to aid the formation of fixed capital needed for economic growth. Nonetheless, ODA can also be a disincentive to wealth building by depressing governments’ motivation for revenue generation and thereby impeding capital formation. Against this backdrop, we contribute to the literature by focusing on a sectoral analysis of official development assistance, and to the best of our knowledge, this study is one of the few studies that examine the impact of agricultural-specific ODA on agricultural fixed capital formation in SSA.

We draw on data across forty (40) SSA countries from 1996 to 2014 and address the endogeneity of agricultural ODA received by a country through an instrumental variable (IV) estimation an approach. We instrumented agricultural ODA by countries' (lagged) rainfall deviations from their own long-run average rainfall. For comparison purposes, informed by the literature on aid competition, we use the countries' yearly rainfall deviations from the SSA continental average rainfall also as an instrument for agricultural aid. Lahiri and Raimondos-Møller (1997) noted that recipient countries use their domestic situation and policy instruments in competing with each other for foreign aid. Thus, we argue that countries with relatively higher deviations from the SSA average, compared with those with smaller deviations, are more likely to receive more agricultural ODA.

Our main results are the following: We find an association between ODA received in the current period and agricultural capital formation in the same period. The coefficient on the agricultural ODA variable in the fixed capital formation model is positive and highly significant at the 1% level. Our finding is consistent even if we model the instantaneous effect of agricultural ODA with a one-year lag. The short-run elasticity of capital formation in agriculture with respect to agricultural ODA ranges between 0.5 and 0.8. 3 This economic significant effect is non-trivial, and consistent with the view that agricultural ODA stimulates agricultural capital formation in SSA. Our two-stage least squares (2SLS) estimation approach adopted also allows us to probe the drivers of agricultural aid to SSA. We find that even though some part of agricultural ODA inflows is driven by the recipient country’s need, in our case measured by the extent of rainfall deviations, the quality of recipient country’s institutions still matters for agricultural aid. Generally, we find that agricultural aid is directed to well-governed countries, countries in periods of high rainfall deviations, and high exchange rates. In a nutshell, we find that agricultural aid is useful for building agricultural fixed capital and that countries can attract more agricultural ODA if institutions are strengthened.

The rest of the paper proceeds as follows; Section 2 briefly presents a review of previous works on aid and investments. Section 3 presents a conceptual framework and empirical issues in assessing the impact of agricultural ODA. Section 4 presents the data used for our analysis and time period under consideration. Section 5 presents and discusses the empirical results whereas Section 5 concludes.

2. Literature review

The impact of aid on investments has been previously examined by Lensink and Morrissey, 2000, Hansen and Tarp, 2001, Gomanee et al., 2005, Boone, 1994, Boone, 1996, Boone, 1996, Gang and Khan, 1991, etc.. For example, using data on 75 developing countries and 36 SSA countries, Lensink and Morrissey (2000) find that aid has a significant positive effect on the volume of investment. Hansen and Tarp (2001) find similar results for a sample of 45 countries with 21 being SSA countries. Precisely, they conclude that aid continues to impact on growth via investment. Gomanee et al. (2005) in their study which focused entirely on SSA countries (25 countries) reinforced the positive relationship between aid and aggregate investment. The insignificant link between aid and government consumption is articulated as one of the key reasons for the positive relationship between aid and investment/capital accumulation (see Gang and Khan, 1991),

However, a number of empirical studies particularly carried out in the 1990s on aid effectiveness find no impact of aid on investment but rather aid increases the size of government (see Boone, 1994, Boone, 1996, White, 1994). Obstfeld (1999) qualified the results by Boone (1994 and 1996), by arguing that aid raises both consumption and investment, as well as the growth rate, provided the economy is initially below the steady-state. The studies by Hadjimichael et al., 1995, Durbarry et al., 1998, and Burnside and Dollar (2000) have all questioned the findings by Boone, 1994, Boone, 1996, Boone, 1996.

Aside from the impact of aid on investment, in terms of the impact of aid on economic growth and poverty reduction, while a number of studies (Levy, 1988, Arndt et al., 2010, Hansen and Tarp, 2001, Lensink and Morrissey, 2000, Burnside and Dollar, 2000, Karras, 2006, Galiani et al., 2017) find evidence for the positive impact of foreign aid on economic growth and poverty reduction. Interestingly, a similarly large number of studies also find evidence for the opposite (Bräutigam and Knack, 2004, Javid and Qayyum, 2011, Tracy, 2010; and Uzonwanne & Ezenekwe, 2015). Another group of researchers finds evidence for aid neutrality (Jensen and Paldam, 2006, Djankov et al., 2008 suggest that aid has effects that are analogous to a natural resource curse (see also Arndt et al., 2010). Thus, the empirical aid effectiveness literature has produced mixed results and is inconclusive about the usefulness of general aid.

Beyond examining the impact of aid on investment and growth, quite a number of studies have also examined the patterns and drivers of aid giving across the world. Shafer (2004) argues that the presence of corrupt, abusive, or ineffective government can undermine or nullify efforts to enact change through aid. Broadly, the reasons for sending and receiving aid in the literature range from the desire to help other countries (Neumayer, 2003), good governance and strong institutions in the recipient country (Alesina and Dollar, 2000, Neumayer, 2003, Shafer, 2004, Wright and Winters, 2010), cultural closeness measured by religious closeness (Shafer, 2004, Alesina and Dollar, 2000). historical closeness measured by colonial relationships (Arndt et al., 2010, Alesina and Dollar, 2000), to food insecurity in the recipient countries (Abdulai et al., 2005). Alesina and Dollar (2000) argue however that the major donors also give aid to just about every developing country, indicating that some donors like to be involved everywhere.

In terms of agricultural specific aid, there is very little evidence across countries, and particularly for SSA Africa. Country-level programmes such as the multilateral aid for Nigeria’s agricultural development have found weak impact of the “National Fadama Development Programme” on infrastructure (post-harvest technologies and irrigation) and assets accumulation in Nigeria (see Nkonya et al., 2012). They find that the project succeeded in targeting the poor and women farmers in its productive asset acquisition component. One of perhaps the most closely related studies on the impact of aid on agricultural-related activities is the study by Miller (2014). In this study, the authors examined the extent and trends of international aid to biodiversity conservation and development goals from 1991 to 2008 in 86 countries. The study using an OLS multivariate multiple regression model finds that biodiversity aid generally was directed to biodiversity-rich and well-governed countries. Abdulai et al. (2005) also examine the impact of food aid in SSA. The authors find no disincentive effects of food aid on recipient food production. In this study, we fill the gap in the literature by focusing on the effectiveness of agricultural specific aid in promoting the building of fixed capital, which is imperative for poverty reduction.

In attempting to estimate the effect of aid on investments and growth, issues of endogeneity, or selection, are important to consider, and therefore attempts need to be made to mitigate these issues. First, aid is not sent randomly to countries, and therefore it is possible that receiving countries are different from non-receiving countries. Importantly, if aid sending countries send aid in response to a certain observable recipient country characteristic (s), then aid will be endogenous. One way to address the endogeneity problem regarding aid is to use instrumental variable (IV) techniques relying on external instruments (see Maruta et al, 2020; Galiani et al., 2017). Others have used ordinary least squares (OLS) as well as a generalized method of moments (GMM) estimators (see Lensink and Morrissey, 2000, Hansen and Tarp, 2001, Gomanee et al., 2005, Boone, 1994, Boone, 1996, Boone, 1996). Maruta et al., (2020) instrumented foreign aid with recipient and donor countries similar voting positions in the UN General Assembly. Galiani et al. (2017) instrumented general foreign aid based on the fact that, since 1987, eligibility for aid from the International Development Association (IDA) has been based partly on whether or not a country is below a certain threshold of per capita income. In this paper, we instrumented agricultural aid flows partly by rainfall deviations, and partly by domestic institutions.

In order to reduce the high poverty levels that continue to plague many rural areas in SSA, it is imperative to find innovative and sustainable ways to increase capital formation in agriculture. Doing so, and doing it rapidly, can help to hasten recovery from the COVID-19 pandemic and remain on track to still to achieve the Sustainable Development Goals (SDGs) of “No poverty” and “Zero hunger” in SSA. Agriculture still remains the backbone of the majority of economies in Africa (Gabre-Madhin and Haggblade, 2004, FAO, 2005, Godfray et al., 2010). As of 2018, the sector contributes an average of 15.6% to gross domestic product (GDP) with the minimum contribution being 2.0% in Botswana and a maximum of 44.9% in Chad (World Bank, 2019). Diao et al (2010) argue that the growth of the agricultural sector triggered by increased fixed capital formation is more pro-poor than growth in other sectors.

3. Conceptual framework and issues in assessing the impact of agricultural ODA

A lump-sum gift of aid should have a positive effect on agricultural investments. The consensus is that aid allows countries to expand public spending (see Doucouliagos and Paldam, 2006). Foreign aid flows therefore once received by a country adds to their existing capital stock. However, Doucouliagos are Paldam (2006) from a meta-analysis of aid studies that conclude that only about a quarter of aid is invested. They argue that aid generates dependency by replacing domestic savings.

Consider the following simple model (Eq. (1)). Let be a gross fixed capital formation (investments) in agriculture —the value of agricultural investment—of country i at time t. include the value of land improvements (fences, ditches, drains, etc), livestock that is used continuously in production year to year (breeding stock, dairy cattle, sheep reared for wool and draught animals.), tree stock (trees cultivated in plantations and yields year to year such as fruit trees, vines, rubber trees, palm trees, cocoa trees), farm machinery such as tillers, fertilizer spreaders, harrows, harvesters; plants and equipment such as cages for fish farming; and also roads, railways, dams, industrial buildings for agricultural and agro-processing purposes. According to the 1993 System of National Accounts (SNA) of the United Nations Statistics Division (UNSD), net acquisitions of valuables are also considered capital formation. Let equal the value of agricultural ODA received by country i at time t, thus exploring the instantaneous effect of ODA. In other specifications, we include a one-year lag of the agricultural ODA variable. We however still consider the one-year lag as an immediate impact of ODA. There may also be some random factors that cause gross fixed capital formation in agriculture to differ and we denote these as .

| (1) |

In this study, the parameter β1 captures unbiased estimate of the effect of agricultural ODA on agricultural fixed capital formation, provided that it is uncorrelated with . This would be true if agricultural ODA were randomly distributed to countries in SSA. However, this is unlikely to be true. In this case, Eq. (1) will generate biased estimates of β1 because the assumption underlying the regression analysis, that E( = 0, is violated.

A better representation of the relationship between current agricultural ODA and current gross capital formation 4 is, therefore:

| (2) |

Here, is a vector of control variables in-country at time whereas are fixed-time effects to capture the impact of worldwide business cycles. The choice of controls to include in this model is informed by the literature on investments across developing countries (see Bleaney and Greenaway, 2001; Bleaney and Greenaway, 1993; Hadjimichael and Ghura 1995; Greene and Villanueva, 1991, Servén, 1997). Our control variables include a one-year lag of real GDP per capita, the real interest rate, the inflation rate, and volatility of the real exchange rate. Thus, as is common in the literature we control for the one-year lag of GDP per capita. Thus, we allow agricultural gross capital formation (agricultural investments) in period to depend on the one-year lagged GDP per capita i.e., initial real GDP per capita or GD per capita at the beginning of the period. We expect the coefficient on the one-year lag GDP per capita to be positive, with a higher GDP in the previous year expected to have a positive impact on the current year’s agricultural investments. Bleaney and Greenaway (2001) also included a two-year lag of GDP per capita in the investment model. As argued by Alesina and Perotti, 1996, Levine and Renelt, 1992, empirically GDP enters a cross-country investment model with a consistently positive sign, suggesting that the convergence in GDP per capita occurs through channels different from increases in physical investment. Here, we also control for GDP per capita in the ODA model.

With regards to the inclusion of real interest rate, inflation, and real exchange rate as part of the controls in the agricultural investment (agricultural gross fixed capital formation) model, Serven (1997) documents how recent investment theory have paid attention to uncertainty and instability as important drivers of investment. The theoretical argument is that, if the investment is costly or difficult to reverse (as in the case for many fixed capital investments), investors have an incentive to postpone commitment and wait for new information in order to avoid costly mistakes. And this “value of waiting” can be quite considerable, especially in highly uncertain environments. For example, scholars conjectured that a higher interest rate can lead to “investment pause”. Thus, higher interest rates and for that matter higher inflation may delay investment (Serven, 1997).

In terms of the effect of exchange rate devaluation on investment, as noted by Bleaney and Greenaway (2001), in general, a lower real exchange rate stimulates investment, and this implies that real exchange rate overvaluation is bad for investment. In general, Rodrik (2008) argues that overvalued currencies are associated with foreign currency shortages, rent-seeking, unsustainably large current account deficits, balance of payments crises, and stop-and-go macroeconomic cycles, all of which are damaging to investment and growth.

Others argue that the optimal response to a lower exchange rate will depend on the country’s reliance or otherwise on imported inputs and the level of foreign export. A country that is more dependent on imported inputs will have an increase in variable costs and therefore a reduction in the marginal value of capital (see Nucci and Pozzolo, 2001 for detailed theoretical exposition). But for a country with a larger share of revenues from the export markets, exchange rate devaluation is likely to increase the expected value of its capital and therefore in its level of investment (Campa and Goldberg, 1999; Nucci and Pozzolo, 2001).

A number of empirical literature have demonstrated a relationship between s Africa’s poor investment, inflation, and exchange rate depreciation (see Bleaney and Greenaway, 2001, Serven, 1997, Bleaney, 1996; Hadjimichael and Ghura, 1995; Aizenman and Marion, 1995; Baldwin and Krugman, 1989). These listed studies provide enough justification for the inclusion of these variables in the agricultural gross fixed capital formation model.

In addition to these general conceptual considerations, we also acknowledge that receipt of agricultural ODA is not random i.e., other factors may drive differences in agricultural ODA receipts. Also, there could be the issue of reverse causality, in that, higher (lower) gross fixed capital formation in agriculture in a particular country could trigger lower (higher) agricultural ODA inflows. Thus, in our modeling, and to enhance the robustness of our estimates, we also consider agricultural ODA to be endogenous. We estimated a two-stage least-squares (2SLS) regression, instrumenting agricultural ODA with country-level rainfall deviations from the regional SSA mean rainfall. Increased deviations in rainfall could lead to erratic rainfall patterns affecting the planting and harvesting patterns of farmers. Severe deviation does indeed have the tendency to reduce food production and heighten national food insecurity, and therefore, increase the likelihood of a country receiving ODA. The inclusion of rainfall deviations in the agricultural ODA equation is consistent with earlier works on aid, which finds that donors to developing countries do indeed respond to recipient need (see Harrigan and Wang, 2011, Miller, 2014). The yearly country-level rainfall deviations are computed from the SSA mean rainfall over the period of the study. An alternate approach will be to use the rainfall deviations from the country’s own long-term mean rainfall. For the purposes of a robustness check, we also provide estimates for the latter. In all cases, we include a one-year lag of the rainfall deviation variable in the agricultural ODA equation.

In addition, to further strengthen the achievement of identification we include a composite governance indicator in the agricultural ODA equation as an instrument to capture the strength of local institutions on aid receipt. Burnside and Dollar (2000) in a neoclassical growth model postulates that the impact of aid will be greater when there are fewer policy distortions affecting the incentives of economic agents. They also argue that effects may work either through increased productivity of capital or via a larger fraction of the aid flow is actually invested. Murata et al. (2020) found that foreign aid is improved by the level of institutional quality. The good governance composite variable used was derived from the Worldwide Governance Indicators (WGI), which captures six dimensions of governance. Elaboration on the six governance indicators is presented in the data section. As found by Dollar and Levin, 2006, Miller, 2014, aid targets developing countries depending on how well-governed they judge the recipient country to be (see also Neumayer, 2003, Wright and Winters, 2010). Wright and Winters (2010) argue that donors may avoid politically unstable countries, or they may deliver emergency aid rather than make longer-term infrastructure investments in response to corruption, inefficiency, or anti-democratic behavior. Thus, we build the specification of the agricultural fixed capital formation equation drawing on the large empirical literature on investment and the literature on aid allocation. The simple bivariate simultaneous equation model which treats agricultural ODA as an endogenous variable is written as follow:

| (3) |

| (4) |

4. Data, sample period and descriptive Statistics

-

A.

Data

-

a.

Agricultural official development assistance (ODA)

Official development assistance is defined as all resources such as physical goods, skills, technical know-how, financial grants and/or loans (at concessional rates) transferred by donors to recipient governments (Riddell, 2007). In addition, technical co-operation costs are included as ODA, but grants, loans, and credits for military purposes are excluded. Transfer payments to private individuals, public donations, commercial loans, and foreign direct investment (FDI) are not also regarded as ODA. In general, the FAO classifies agriculture ODA as financial support – either grants or “concessional” loans from Organisation for Economic Cooperation and Development (OECD) member countries to developing countries for the purpose of achieving food security, nutrition, and agriculture, and rural development. The data on agricultural official development assistance (ODA) is obtained from the OECD Creditor Reporting System which aggregates the data to reflect the over 50 FAO-related subsectors, such as agriculture, forestry, fishery, rural development, agricultural policy and management, cooperatives, etc. It must be noted that the new Food and Agriculture Organization (FAO) aid database “AIDmonitor” also contains the same data, extracted from the OECD Creditor Reporting System.

-

b.

Agricultural fixed capital formation

Data on the agricultural gross fixed capital formation (GFCF) is obtained from the Food and Agriculture Organization (FAO) FAOSTAT database. FAO publishes country-by-country data on physical investment in agriculture, forestry, and fishery and measured by the System of National Accounts (SNA) concept. Gross fixed capital formation (GFCF) is measured as the total value of agricultural acquisitions, fewer disposals, of fixed assets during the accounting period plus certain specified expenditure on services. GFCF also includes improvements to existing fixed assets, such as buildings and structures, that increase their productive capacity, extend their service lives, or both. In the case of land, improvements are treated as the creation of a new fixed asset and are not regarded as giving rise to an increase in the value of the natural resource. However, if the land, once improved, is further improved, then the normal treatment of improvements to existing fixed assets applies. 5 The FAO agricultural GFCF data consolidates the GFCF data from the United Nations Statistics Division (UNSD) and the Organisation for Economic Co-operation and Development OECD. Previous studies on trends in agricultural capital formation have used this data (see Butzer et al., 2010, Larson et al., 2000).

-

c.

Rainfall deviation variable

The rainfall deviations data used to instrument for agricultural ODA was derived from the Weatherbase website. The data has been used extensively in the area of crop science, environmental science, and climatology to examine the impact of rainfall variability in agricultural production (see Covarrubias and Thach, 2015, Larson and Lohrengel, 2011, Yukimura et al., 2009). To capture deviations in rainfall over time, we computed the country’s own average rainfall over the period of the study, from 1996 to 2014, and examined each year’s deviation from the long-run average country rainfall. We argue that deviations from the country’s own average could signal country ‘need’, and therefore drive ODA inflows. For completeness and also as a robustness check, instead of the year-by-year country deviations from the country’s own average rainfall, we alternatively generated the yearly rainfall deviations from the SSA average over the period of the study. The estimated results from the latter are presented in the appendix. Deviations from the SSA average are in line with the argument that aid will go to countries with the most need (Dipendra, 2020, Lahiri and Raimondos-Møller, 1997). These rainfall indicators assume that donors would respond to huge deviations from either rainfall deviations from the country’s own average rainfall or that of the SSA average.

-

d.

Recipient institutional variables

We obtained the recipient institutional quality indicator variables from the World Bank’s World Governance Indicators (WGI). The data have been used by a number of related studies on aid effectiveness (see Akanbi, 2012, Miller, 2014, Pinar, 2015). As an indicator of the quality of local institutions, countries are ranked on six dimensions of good governance: government effectiveness, control of corruption, voice and accountability, rule of law, political stability, and regulatory quality. As can be seen, all the six indicators are clearly linked to good local institutions, and scaled in units of the standard normal distribution, with mean zero, the standard deviation of one, and a range from – 2.5 to 2.5 (see Miller, 2014, Kaufmann et al., 2011). Higher values indicate higher governance effectiveness, less corruption, higher voice and accountability, better law and order enforcement, stronger political stability, and higher regulatory quality. We compute a composite institutional quality indicator (labeled Ave_WGI) by averaging the six indicators to reflect the overall quality of institutions.

-

e.

Other control variables

As explained in the previous section, we control for one – year lag of GDP per capita in the agricultural gross fixed capital formation model. We used GDP in purchasing power parity (GDP PPP) per capita which corrects for differences in cost of living and differences in total population for each year for each country.

With regards to examining the effect of real exchange rate (RER) distortions, we follow the three-step methodology as Rodrik (2008) to obtain a PPP-based index of RER undervaluation (see also Rapetti et al., 2012). Our index of undervaluation is a measure of the domestic price level adjusted for the Balassa-Samuelson effect. Precisely, we first computed the real exchange rate (RER) as the ratio between the nominal exchange rate (XRAT) and the purchasing power parity conversion factor (PPP). Both XRAT and PPP are expressed as national currency units per U.S. dollar with values of RER greater than 1 suggesting that the value of the currency is lower (more depreciated) than indicated by purchasing power parity. However, since PPP is calculated using the entire GDP including non-tradables and non- tradables are also cheaper in poorer countries, we adjust for this Balassa-Samuelson effect. We adjust for the Balassa-Samuelson effect by regressing RER on real GDP per capita (RGDPCH):

| (5) |

where ft accounts for time fixed effects and is the error term. This regression yields an estimate of β of −0.66, which is significant at the 1% level. The estimated coefficient for Rodrik, 2008, Rapetti et al., 2012 was −0.24 for all developing countries. percent. Our estimated coefficient is in line with Balassa-Samuelson's prediction. In our case, a 10% increase in RGDPCH is associated with a 6.6% real appreciation. Following Rodrik (2008) we estimated the undervaluation (UNDERVAL) as the difference between the actual real exchange rates and Balassa-Samuelson-adjusted real exchange rates: . When UNDERVAL exceeds unity, it means the currency is undervalued, and that domestically produced goods are relatively cheaper in dollar terms. The advantage of using the index is that it is comparable across countries and over time. For our sample, UNDERVAL index has a mean of zero and a standard deviation of 0.71. The data for the the the real interest rate, inflation, and for the computation of the real exchange rate undervaluation measure were obtained from the World Bank’s World Development Indicator (WDI) database.

-

B.

Sample period

Our sample consists of 40 SSA countries that have received agricultural ODA within the period of the study, from 1996 to 2014. Table 1 presents the country in our sample

-

C.

Descriptive statistics

Table 1.

SSA countries in the sample.

| Angola | Congo, | Kenya | Nigeria |

| Benin | Côte d'Ivoire | Lesotho | Rwanda |

| Botswana | The Democratic Republic of the Congo | Madagascar | Senegal |

| Benin | Djibouti | Malawi | Seychelles |

| Burundi | Ethiopia | Mali | South Africa |

| Cape Verde | Gabon | Mauritania | Swaziland |

| Cameroon | The Gambia | Mauritius | Tanzania |

| The Central African Republic | Ghana | Mozambique | Togo |

| Chad | Guinea | Namibia | Uganda |

| Comoros | Guinea-Bissau | Niger | Zambia |

Table 2 presents the descriptive statistics for the key variables. The mean interest rate in the sample over the period of the study is 9.1% with the mean inflation being 17%. The mean governance indicator (Ave_WGI) of −0.55 on the scale of −2.5 to 2.5, suggests that on average SSA countries have weak institutions over the period of the study. The mean of the individual components of the governance index mirrors that of the index. On average, SSA countries rank low on voice and accountability, political stability, governance effectiveness, rule of law and controlling corruption. The standard deviation of these governance indicators shows, however, variability across countries. In terms of the rainfall deviation variable, we find higher deviations from the SSA average rainfall compared to the within-country deviations. Precisely, the high average rainfall deviation suggests high variability in rainfall across countries, whereas countries do not deviate so much from their own long-run rainfall.

Table 2.

Descriptive Statistics.

| Variable | Obs | Mean | Std.Dev. |

|---|---|---|---|

| lnGFCF | 759 | 4.19 | 1.493 |

| lnODA | 760 | 2.571 | 1.729 |

| lnpcGDP | 760 | 7.001 | 1.108 |

| INT (Interest rate) | 596 | 9.096 | 11.552 |

| INF (Inflation) | 727 | 17.024 | 157.812 |

| DXR (Exchange undervaluation) | 756 | 0.000 | 0.705 |

| Ave_WGI (Governance index) | 639 | −0.547 | 0.588 |

| GoEf (Government effectiveness) | 639 | −0.645 | 0.592 |

| CoC (Control of corruption) | 640 | −0.554 | 0.605 |

| VaA (Voice and accountability) | 640 | −0.506 | 0.677 |

| RoL (Rule of Law) | 640 | −0.600 | 0.630 |

| PS (Political stability) | 640 | −0.424 | 0.896 |

| RegQ (Regulatory quality) | 640 | −0.544 | 0.534 |

| RFD (Rainfall deviations from country’s average) | 760 | 0.000 | 6.442 |

| RMD (Rainfall deviations from SSA average) | 760 | 0.065 | 28.715 |

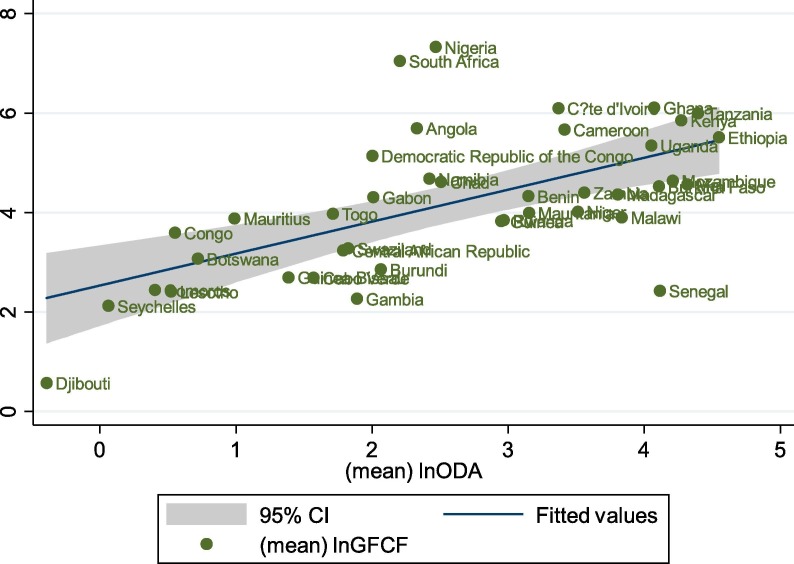

Fig. 1 depicts a positive cross-country association between average agricultural aid and average agricultural gross fixed capital formation in the period 1996–2014. Even though we find a positive correlation, in the next section, we systematically investigate the effects of agricultural aid on agricultural gross fixed capital formation using econometric techniques and controlling for other factors, country- and time-specific effects, and possible endogeneity of agricultural aid.

Fig. 1.

Average GFCF and Average ODA (1996–2014).

5. Empirical results

Our hypothesis is that agricultural-specific ODA increases agricultural fixed capital formation. Thus, the paper estimates agricultural fixed capital formation as a function of agricultural-specific ODA controlling for several core country characteristics as delineated in the previous section. Our relatively long panel dataset of 19 years for the forty (40) countries allows us to control for time-invariant omitted-variable bias. Our first model examines the instantaneous impact of agricultural ODA (level effect) on agricultural fixed capital formation. Our estimated fixed-effect reduced-form model is presented in Table 3 . The fixed-effects technique assumes that the individual-specific effects are correlated with the regressors and therefore the approach removes the effect of the unobserved time-invariant characteristics in order to assess the net effect of the independent variables. The fixed effects in panel data permit us to control for each country’s idiosyncratic features and, therefore, to account for their heterogeneity. Thus, including both the individual- and time-specific effects into the specification can eliminate a larger portion of the omitted-variable bias. The random-effect models on the other hand assume that all covariates are uncorrelated with the unobserved effect. This is unlikely to be true. Hausman’s test justifies the use of the fixed-effects model. We, therefore, present the results from the fixed effect.

Table 3.

Fixed effects level (short-term) panel regressions for investment.

| (1) | (2) | |

|---|---|---|

| VARIABLES | lnGFCF | lnGFCF |

| lnODA | 0.526** | |

| (0.205) | ||

| lnODA (t-1) | 0.493** | |

| (0.198) | ||

| lnpcGDP (t-1) | 1.377*** | 1.394*** |

| (0.243) | (0.255) | |

| INT | 0.0015 | 0.0013 |

| (0.002) | (0.002) | |

| INF | 0.003 | 0.003 |

| (0.0027) | (0.0026) | |

| lnUNDERVAL | 0.450*** | 0.462*** |

| (0.117) | (0.119) | |

| Constant | −6.001*** | −6.076*** |

| (1.662) | (1.746) | |

| Observations | 547 | 547 |

| R-squared | 0.454 | 0.444 |

| No. of Countries | 39 | 39 |

| Country FE | YES | YES |

Robust standard errors in parentheses.

*** p < 0.01, ** p < 0.05, * p < 0.1.

Column 1 reports our specification for agricultural fixed capital formation (investments) and agricultural ODA in the same period, whereas column 2 presents the results for a one-year lag of agricultural ODA. Both models, we argue capture the instantaneous effect of agricultural ODA on fixed capital formation in SSA. The coefficient on the agricultural ODA variable in period t, is positive and significant at the 5% level. We find almost similar results if we lag the agricultural ODA variable by one year, as shown in column 2. The only difference is the magnitude. We show that the marginal effect for the impact of agricultural ODA in period t on the agricultural fixed capital formation (0.526) is larger than that of the one-year lagged agricultural ODA (0.493). The results are consistent with the findings of earlier studies on the general impact of ODA on the capital formation (see Alvi and Senbeta, 2012) and contrary to studies that find no impact of ODA on investment (Boone, 1994, Boone, 1996, Boone, 1996). It is also contrary to studies that find that aid replaced domestic savings and planned domestic spending (see Doucouliagos & Paldam, 2006). Thus, in both regression models in Table 3, we find a significant positive association between agricultural aid agricultural fixed capital formation.

One can argue that, because aid to the agricultural sector is partly driven by recipient country’s needs – potential and/or urgent food insecurity and vulnerabilities – countries must apply the aid urgently in a manner to address the underlying vulnerabilities. Hendrix and Brinkman (2013) have shown that food insecurity can indeed trigger political instability and therefore receiving agricultural aid must be properly invested in tangle inputs. Thus, in all from our fixed-effect models, we find that agricultural aid either model at time t, or with a one-year lag impacts physical capital formation in agriculture in SSA.

In addition, we report strong accelerator effects, as shown by the positive coefficient for the initial income per capita (lnpcGDP (t-1)). Thus, higher real GDP per capita in the previous year impacts positively on fixed capital formation in agriculture in the current year. It seems agricultural aid receiving countries that perform well in terms of GDP growth are rewarded with more agricultural aid. With respect to the other control variables, interest rate and inflation have no significant impact on fixed capital formation. The results on the interest rate and inflation are consistent with findings by Bleaney and Greenaway (2001) for general investments.

In terms of the effect of undervaluation, an increase in undervaluation in the real exchange rate is associated with an increase in agricultural investments or gross fixed capital. Therefore, our findings support the theoretical proposition that countries with a larger share of revenues from the export markets 6, an exchange rate devaluation is likely to increase investments, and therefore increase the expected value of its capital. The estimate suggests that a 10 percent undervaluation is associated approximately 4.5 percent increase in agricultural fixed capital formation during the same period. As noted by Rajan and Subramanian (2007), if aid is spent on the production of tradable goods such as agricultural products produced by SSA, the more the supply of factors of production and non-traded domestically produced goods respond to aid inflow. Also, as noted by Rodrik (2008), for most countries, periods of rapid growth are associated with undervaluation. In general, our fixed effect models show that foreign agricultural aid affects agricultural fixed capital positively and the effect is very much instantaneous.

Aside from our basic reduced-form model, we do acknowledge that agricultural ODA to a country is not random. Thus, ODA could be driven by other factors that are not captured by the model as presented in Eq. (1), and as such any observed effect of ODA without accounting for this non-randomness cannot be interpreted as causal effects of ODA. This raises a typical issue of omitted variable bias. There could also be an issue of reverse causality, in that, higher fixed capital formation in agriculture in a country could trigger lower agriculture ODA inflows. We therefore in addition to the simple fixed-effect model, present the results for the estimated agricultural fixed capital formation equation by the fixed-effects instrumental variable (IV) method (using the two-stage least-squares estimator). In explaining the allocation of agricultural aid to SSA, As indicated earlier, we use ‘good governance index’ and rainfall deviation variables as external instruments for agricultural aid. Table 4 presents the 2- stage least-squares (2SLS) fixed-effects results. To examine the instantaneous effect of ODA (as done also in the fixed effect model), Model 1 includes ODA in time, t, whereas Model 2 captures the effect of the one-year lag of ODA i.e., ODA in time t-1. Columns 1 and 3 present the results first-stage agricultural ODA models which while columns 2 and 4 present the results for the second-stage agricultural fixed capital formation models. For the 2SLS estimation, under each model, we first examine the impact of our external instruments on agricultural ODA in the first stage, and then the subsequent impact of agricultural ODA on fixed capital formation in the second stage.

Table 4.

Fixed Effects Two-Stage Least Squares (2SLS) Regressions.

| 2SLS-FE (1) |

2SLS-FE (2) |

|||

|---|---|---|---|---|

| VARIABLES | lnODA | lnGFCF | lnODA | lnGFCF |

| lnODA | 0.812*** | |||

| (0.287) | ||||

| lnODA (t-1) | 0.797*** | |||

| (0.303) | ||||

| lnpcGDP (t-1) | 1.477** | 1.625*** | 1.873** | 1.630** |

| (0.708) | (0.528) | (0.706) | (0.621) | |

| RFD (t-1) | 0.005** | 0.006** | ||

| (0.002) | (0.002) | |||

| Ave_WGI (t-1) | 0.635** | 0.524** | ||

| (0.344) | (0.264) | |||

| INT | −0.002 | 0.003 | −0.006 | 0.003 |

| (0.005) | (0.002) | (0.004) | (0.002) | |

| lnUNDERVAL | − 0.232** | 0.321*** | − 0.184** | 0.347*** |

| (0.101) | (0.107) | (0.088) | (0.110) | |

| INF | 0.0003 | 0.003*** | −0.0001 | 0.003*** |

| (0.002) | (0.001) | (0.001) | (0.001) | |

| Constant | −8.532* | −7.492** | −10.52** | −7.502* |

| (4.975) | (3.316) | (4.976) | (3.756) | |

| Observations | 472 | 472 | 472 | 472 |

| R-squared | 0.132 | 0.425 | 0.171 | 0.425 |

| No. of Countries | 39 | 39 | 39 | 39 |

| Country FE | YES | YES | YES | YES |

| Weak ident. test (Wald F stat.) | 18.78 | 18.63 | ||

Robust standard errors in parentheses.

*** p < 0.01, ** p < 0.05, * p < 0.1.

In all estimated models, we find a positive impact of lagged GDP per capita on agricultural ODA. Thus, the coefficient on the initial real GDP per capita is positive and highly significant in the ODA model, as found under the fixed effect model as well. This result could suggest that for poor SSA countries receiving aid, improvement in economic performance is rewarded with more agricultural aid.

In terms of the other determinants of agricultural ODA to SSA, from Columns 1 and 3, the coefficients on the two instruments (rainfall deviations from SSA mean and the governance index) are assessed. Estimated results using rainfall deviations from the country’s own mean rainfall are qualitatively similar and are presented in the appendix. In all both models the coefficients on the composite good governance indicator are positive and significant at the 5% level. The results imply that a one percentage point increase in governance quality is associated with the range of 52 to 64 percent increase in agricultural ODA. Note, however, a percentage point increase in governance quality will require a substantial improvement in governance effectiveness, reduction in corruption, improvement in voice and accountability, improvement in law and order enforcement, improvement in political stability, and higher overall regulatory quality. The descriptive statistics as presented in Table 2 on a scale of −2.5 to 2.5 show that the levels of these governance indicators are quite very low for the average SSA country. Thus, an improvement in governance can increase agricultural-linked ODA.

In addition, we find that rainfall deviations, just like governance are very important for agricultural aid inflows to SSA. The coefficients on the rainfall deviation variable (RFD (t-1)) in the first-stage equations in both 2SLS models as presented in Table 4 are positive and significant at the 5% level. Our instruments are reasonably strong according to the first stage regression results. According to Staiger & Stock, (1997), an F-test statistic of at least 10 shows that the endogenous regressor is not weakly identified. The Cragg-Donald Wald F statistic test for a weak identification test shows that our instruments are plausible, and the estimates are robust across both specifications. Thus, overall, we find that recipient countries' institutions and weather situations matter for agricultural ODA receipts in SSA.

One more factor which matters for agricultural ODA receipts is the recipient countries' exchange rate devaluation. We find a negative association between the real exchange rate devaluation and agricultural ODA inflows to SSA. Exchange rate overvaluation is expected to shrink the tradable goods sector, reduce revenues from exports, and worsen the wellbeing of people who live in the country. Deteriorating economic situations will, therefore, drive the need for aid inflows. In terms of other possible drivers of agricultural ODA, we don’t find any association between agricultural ODA inflows, on one hand, domestic interest rate and inflation on the other.

We now turn our attention to the second stage gross fixed capital formation (GFCF) regression equations. The estimated results are presented in Columns 2 and 4. The second stage results from the 2SLS estimations confirm that the exogenous component of agricultural ODA has agricultural capital formation-enhancing effects. As the results from the reduced-form fixed-effect model presented in Table 3, the coefficient on agricultural ODA variable, in the current term, time t and the one-year lagged term of the variable are both positive and significant. Thus, both the current level and the one-year lagged level of agricultural ODA have significantly positive coefficients. Comparing the simple fixed-effect model results to that of the 2SLS, the key difference is the magnitude of the agricultural ODA impact. The coefficient on the agricultural ODA as presented in Columns 2 and 4 of the 2SLS regressions are quite similar to the fixed-effect model estimates, but they tend to be somewhat higher and closer to one. For example, the 2SLS estimates of are 0.812 and 0.797, compared with the fixed effect estimates of 0.526 and 0.493. The evidence-based on these elasticities support the preposition that most agricultural aid intended for fixed capital formation over the period of the study is indeed invested. In summary, the overall instantaneous effect of agricultural ODA from both the fixed-effects and the 2SLS regressions is positive: a change in the agricultural ODA moves agricultural fixed capital formation in the same direction.

In terms of other controls in the agricultural fixed capital formation models, consistent with the estimated results for the fixed-effect model, we find that gross fixed capital formation is associated positively with real exchange rate undervaluation. Thus, overvaluation negatively impacts the formation of agricultural fixed capital. The explanations presented under Table 3 for the impact of real exchange rate undervaluation on agricultural fixed capital formation still holds here. The domestic interest rate and inflation have no impact on agricultural fixed capital formation, consistent with the results under the fixed-effect model and that found by Bleaney and Greenaway (2001).

Lastly, while there is a greater understanding of the role of institutions in aid inflows (see Maruta et al., 2019, Nunnenkamp et al., 2017, Jones and Tarp, 2016; Öhler and Nunnenkamp, 2014; Akanbi, 2012, Bräutigam and Knack, 2004, Boone, 1996), there are important gaps in our understanding regarding which institutions actually matter. For example, Öhler and Nunnenkamp (2014) found that countries with better governance practices, for example, received higher aid allocation. Nunnenkamp et al. (2017) in their study on sub-national governments India however did not find any evidence that aid projects by the World Bank went to areas with less pervasive corruption for example. We, therefore, examine the associations between the various components of good governance, agricultural aid, and agricultural fixed capital formation. Precisely, we explore the impact of government effectiveness (GoEf), control of corruption (CoC), voice and accountability (VaA), rule of law (RoL), political stability (PS), and regulatory quality (RegQ) on agricultural aid flows to SSA. In order to avoid over-identification, we examine the institutional variables as instruments in pairs. The results are presented in Table 5 . In Model 1 of Table 5, we instrumented agricultural ODA with the rule of law and control of corruption, while in Model 2, we used voice and accountability and political stability as instruments for agricultural ODA. In Model 3 of Table 5, we instrumented agricultural ODA with government effectiveness and regulatory quality.

Table 5.

Fixed Effects Two-Stage Least Squares (2SLS) Regressions – Instrumenting with Individual Institutional Indicators.

| 2SLS-FE (1) |

2SLS-FE (2) |

2SLS-FE (3) |

||||

|---|---|---|---|---|---|---|

| VARIABLES | lnODA | lnGFCF | lnODA | lnGFCF | lnODA | lnGFCF |

| lnODA | 0.399* | 0.240 | 0.222 | |||

| (0.213) | (0.205) | (0.283) | ||||

| lnpcGDP(t-1) | 1.985*** | 1.177*** | 1.912*** | 1.808*** | 1.908*** | 1.965** |

| (0.458) | (0.304) | (0.688) | (0.521) | (0.693) | (0.820) | |

| RFD(t-1) | 0.004** | 0.005** | 0.006 | |||

| (0.002) | (0.002) | (0.005) | ||||

| RoL (t-1) | 1.109*** | |||||

| (0.303) | ||||||

| CoC (t-1) | 0.515** | |||||

| (0.242) | ||||||

| VaA (t-1) | 0.508 | |||||

| (0.327) | ||||||

| PS (t-1) | 0.0231 | |||||

| (0.239) | ||||||

| GoEf (t-1) | 0.146 | |||||

| (0.321) | ||||||

| RegQ (t-1) | 0.023 | |||||

| (0.388) | ||||||

| INT | −0.007 | 0.000 | −0.005 | 0.002 | −0.007 | 0.001 |

| (0.006) | (0.000) | (0.004) | (0.00237) | (0.004) | (0.003) | |

| INF | 0.001*** | 0.002 | 0.001*** | 0.001*** | 0.001*** | 0.001** |

| (0.000) | (0.001) | (0.000) | (0.000) | (0.000) | (0.000) | |

| lnUNDERVAL | −0.204* | 0.465** | −0.284 | 0.396** | −0.261 | 0.443** |

| (0.120) | (0.198) | (0.208) | (0.200) | (0.182) | (0.180) | |

| Constant | −10.83** | −8.570** | −10.81** | −8.530** | −10.93** | −9.440* |

| (4.801) | (4.824) | (4.787) | (3.201) | (4.808) | (4.846) | |

| Observations | 472 | 472 | 472 | 472 | 472 | 472 |

| R-squared | 0.218 | 0.426 | 0.175 | 0.426 | 0.165 | 0.426 |

| No. of Countries | 39 | 39 | 39 | 39 | 39 | 39 |

| Country FE | YES | YES | YES | YES | YES | YES |

| Weak ident. test (Wald F stat.) | 14.12 | 10.20 | 7.53 | |||

Robust standard errors in parentheses.

*** p < 0.01, ** p < 0.05, * p < 0.

Some key findings are noteworthy from these regression models. First, we find that agricultural ODA inflows into recipient countries depend positively on the and rule of law and control corruption (see Model 1 of Table 6 ). The coefficient of control corruption and rule of law are positive and significant highly significant. The Cragg-Donald Wald F statistic test for a weak identification test shows that these two instruments are plausible (F-stat. = 14.12). Also, in Column 2 of Model 1, the coefficient on the agricultural ODA variable in the gross fixed capital formation equation is positive and significant at the 10% level.

Table 6.

Agricultural ODA long-term (growth) impact.

| (1) | (2) | |

|---|---|---|

| D.lnGFCF | Arellano-Bond | System GMM |

| D.lnODA | 0.063 | 0.0684* |

| (0.041) | (0.0358) | |

| LD.lnGFCF | −0.292*** | −0.411*** |

| (0.054) | (0.124) | |

| D.lnpcGDP | 3.694** | 9.568*** |

| (1.796) | (2.692) | |

| D.lnUNDERVAL | 1.061 | 1.464* |

| (1.054) | (0.723) | |

| D.lnINF | 0.124** | 0.174 |

| (0.058) | (0.105) | |

| D.INT | −0.001 | 0.098 |

| (0.001) | (0.069) | |

| Constant | 0.868* | |

| (0.492) | ||

| Observations | 296 | 296 |

| Number of ID | 38 | 38 |

| Country FE | YES | YES |

| Hansen J test | 0.55 | 0.52 |

| (Overid. res) | ||

| AR(2) | 0.71 | 0.74 |

Robust standard errors in parentheses.

*** p < 0.01, ** p < 0.05, * p < 0.1.

Contrasting the findings in Model 1 with that of Model 2 and 3, we find that voice and accountability, political stability, government effectiveness, and regulatory quality do not strongly correlate with agricultural aid flows to SSA. The coefficients on these variables are positive in all models are positive but not significant. The coefficients on the agricultural ODA in the gross fixed capital formation in both Model 2 and 3 are also not significant. Thus, the key institutional variables critical for agricultural aid flows to SSA are the rule of law and the control of corruption. These findings regarding the specific institutions that matter for agricultural ODA suggest that, for SSA countries to attract agricultural aid to boost their capital formation and reduce food insecurity, there must be conscious efforts towards improving the rule of law and controlling corruption.

5.1. Path-dependency

We now turn our attention to the empirics that help answer the question of whether ODA has a long-term growth effect on agricultural fixed capital formation. This, even though we are mainly interested in the instantaneous impact of agricultural ODA, for completeness, we also examine the long-term growth effect. As noted by Mogues & Benin (2012), this estimation is more indicative of the longer-term trajectory that agricultural fixed capital formation may undergo as a result of the inflows of official agricultural development assistance. Hence, a growth model is estimated as:

| (5) |

In the growth model, a possible path-dependency of growth in agricultural fixed capital formation is accounted for by including each country’s past growth of fixed capital formation as an independent variable. Allowance is also made for the possibility that low-income countries may have a different growth trajectory than high-income countries by including the lagged level of fixed capital formation; this variable clarifies the nature of convergence or divergence of each country’s fixed capital formation over time. Thus, the model estimates growth or changes in agricultural fixed capital formation as a function of changes in the first lag of agricultural fixed capital formation by following the lagged-investment in the fixed capital concept of Eberly et al., 2012, Mogues and Benin, 2012.

In Eq. (5) above, although the objective of the study is to estimate , the difficulty is to estimate accurately because the lagged growth term of fixed capital formation correlates with the stochastic error term.

For simplicity, rewriting Eq. (5) as;

| (6) |

where , it is evident that both and depend on the time-invariant effects, . Thus, the introduction of the lagged dependent variable makes OLS estimation inconsistent and bias (Nickel, 1981; Jones & Tarp, 2016). The OLS estimate of is upward-biased, because is positively correlated with.

To avoid the inconsistent estimates of the pooled OLS estimation of an AR (1) process caused by endogeneity, the difference (Arrelano and Bond estimator) and system-GMM (Blundell and Bond estimator) estimation techniques are used. The techniques remove the unobservable, time-invariant country fixed effect among other corrections, so as to eliminate the inconsistency caused by the dependence of . Thus, the rationale for the differencing is that time-invariant country fixed effects are purged from the data. For the analysis of the results, we will focus on the system GMM. A number of empirical simulations have shown that the system GMM estimator has a lower bias and higher efficiency than the standard first-differences GMM estimator particularly in finite samples (see Blundell and Bond, 1998, Blundell et al., 2001). For robustness purposes, we present both results.

Column 1 of Table 6 reports the result for the difference GMM (Arrelano and Bond estimator) while Column 2 reports that of the system GMM estimator. We find that both the difference and system GMM estimated effect show a positive impact of agricultural aid on capital formation in SSA’s agriculture as shown by the coefficient on the agricultural ODA variable. However, the coefficient on the agricultural ODA in the ‘difference model’ presented in Column 1 is not statistically significant. The coefficient on the agricultural ODA variable in the system GMM model is however significant at the 10% level. Our system GMM estimates show evidence that agricultural ODA to SSA is associated with growth in agricultural capital formation. The estimated result under the system GMM regression model indeed confirms our findings using external instruments under the 2SLS estimation approach.

6. Concluding remarks

Aid effectiveness still remains a contentious area of debate. Sub-Saharan Africa (SSA) has received a substantial amount of aid, and therefore it is important to understand the impact of such aid. Considering the perception that aid has been ineffective (see Boone, 1994, Boone, 1996, Boone, 1996), we have estimated the instantaneous effect of agricultural aid on agricultural fixed capital formation using a panel of 40 countries in sub-Saharan Africa (SSA). Precisely, we explored whether agricultural aid given to SSA’s agriculture does have instantaneous impacts on building the needed physical capital. Even though the COVID-19 pandemic and climate change could heighten food insecurity on the African continent, we argue that an instantaneous improvement in agricultural physical capital formation could lessen the impact. It is important to note that, a very long lagged impact of agricultural aid on the agricultural capital formation (more than 2 years) will challenge the ability of SSA countries to deal with the impact of any crisis, such as that of the COVID-19 pandemic or the potential threat of climate change.

Using a fairly standard investment/agricultural capital formation model that addresses the endogeneity of agricultural ODA, with both within-country and cross-country rainfall deviations, and the strength of domestic institutions, and also relying on a comprehensive data on 40 agricultural aid receiving countries, we find that agricultural fixed capital formation depends on aid received for agriculture in the same year (contemporaneous effect). We also find a positive effect of the one-year lag of aid on gross agriculture fixed capital formation. Both empirical results suggest an instantaneous effect of agricultural aid on the formation of agricultural capital, which is needed to address any global shocks to food security. This finding has powerful implications for the way we fight crisis-induced food insecurity both in the short-term and in the long-term. Estimates from fixed-effects and 2SLS are quite similar. Our findings on agricultural aid are therefore contrary to studies that find that aid, in general, replaced domestic savings and planned domestic spending (see Doucouliagos & Paldam, 2006) and supports studies that have found a positive relationship between general aid on investments (Lensink and Morrissey, 2000, Hansen and Tarp, 2001), Gomanee et al., 2005, Gang and Khan, 1991). We argue that since food insecurity could give rise to hunger and political instability as articulated by Hendrix and Brinkman (2013), and smallholder farmers constitute over 50% of the workforce in many SSA countries, it is in the best interest for political leaders to use agricultural aid effectively and instantaneously to maximize the wellbeing of their people. Thus, in this study, we do not find strong evidence to support the assertion that agricultural ODA replaces domestic savings and spending.

We also contribute significantly to the literature on the drivers of aid. In terms of the drivers of agricultural aid to SSA, we find that deviations in rainfall from both country and continent’s average rainfall are positively associated with agricultural ODA inflows. However, we also find that even though agricultural ODA is given to countries to build food production capacities and help such countries better deal with food insecurity, countries with stronger institutions are more likely to receive more agricultural ODA. Thus even though the recipient country needs are important for agricultural aid receipts, institutions do matter for agricultural aid flows. SSA countries can attract more agricultural ODA if particularly, institutions that are responsible for the control of corruption and the enforcement of rule of law are strengthened. Good institutions regularly emerge as significant in aid and investment equations (Pinar, 2015, Jones and Tarp, 2016, Bräutigam and Knack, 2004), and our findings reinforce this for agricultural ODA. Overall, our study shows that agricultural ODA is necessary to accelerate agricultural investments and help the continent deal with the effect of crisis on food security.

Footnotes

Still inconclusive evidence on the causal effect of aid on growth (see Galiani et al., 2017)

This is approaching unity.

One-year lag of ODA on fixed capital formation is also estimated.

For details on the GFCF, see http://www.fao.org/economic/ess/ess-economic/capitalstock/en/

In many SSA countries, large share of export revenues is from agricultural products such as coco, coffee, tea etc.

Appendix

Table A1.

Fixed Effects Two-Stage Least Squares Level Regressions – Using within-country rainfall Deviations.

| 2SLS-FE (1) |

2SLS-FE (2) |

|||

|---|---|---|---|---|

| VARIABLES | lnODA | lnGFCF | lnODA | lnGFCF |

| lnODA | 0.729** | |||

| (0.100) | ||||

| lnODA (t-1) | 0.738** | |||

| (0.103) | ||||

| lnpcGDP (t-1) | 1.873** | 1.630** | 1.916*** | 2.028*** |

| (0.706) | (0.621) | (0.465) | (0.736) | |

| RMD (t-1) | 0.006** | 0.004** | ||

| (0.003) | (0.002) | |||

| Ave_WGI (t-1) | 0.524** | 0.444** | ||

| (0.247) | (0.213) | |||

| INT | −0.006 | 0.003 | −0.009 | −0.004 |

| (0.004) | (0.003) | (0.006) | (0.005) | |

| INF | 0.001 | 0.001 | 0.001 | 0.0001 |

| (0.003) | (0.001) | (0.002) | (0.002) | |

| lnUNDERVAL | − 0.240** | 0.401*** | − 0.222** | 0.347*** |

| (0.112) | (0.132) | (0.096) | (0.128) | |

| Constant | −10.520** | −7.502* | −9.954** | −7.460* |

| (4.976) | (3.756) | (4.912) | (3.843) | |

| Observations | 472 | 472 | 472 | 472 |

| R-squared | 0.171 | 0.425 | 0.060 | |

| No. of Countries | 39 | 39 | 39 | 39 |

| Country FE | YES | YES | YES | |

| Weak ident. test (Wald F stat.) | 16.64 | 16.92 | ||

Robust standard errors in parentheses.

*** p < 0.01, ** p < 0.05, * p < 0.1.

References

- Abdulai A., Barrett C.B., Hoddinott J. Does food aid really have disincentive effects? New evidence from sub-Saharan Africa. World Development. 2005;33(10):1689–1704. [Google Scholar]

- Akanbi, O. A. (2012). Role of governance in explaining domestic investment in Nigeria. South African Journal of Economics, 80(4), 473-489.

- Alesina A., Dollar D. Who gives foreign aid to whom and why? Journal of Economic Growth. 2000;5(1):33–63. [Google Scholar]

- Alesina A., Perotti R. Income distribution, political instability, and investment. European Economic Review. 1996;40(6):1203–1228. [Google Scholar]

- Alvi E., Senbeta A. Foreign aid: Good for investment, bad for productivity. Oxford Development Studies. 2012;40(2):139–161. [Google Scholar]

- Arndt C., Jones S., Tarp F. Aid, growth, and development: Have we come full circle? Journal of Globalization and Development. 2010;1(2):1–27. [Google Scholar]

- Arndt C., Jones S., Tarp F. Assessing foreign aid’s long-run contribution to growth and development. World Development. 2015;69:6–18. [Google Scholar]

- Benin S. Impact of Ghana's agricultural mechanization services center program. Agricultural Economics. 2015;46(S1):103–117. [Google Scholar]

- Bleaney M.F. Macroeconomic stability, investment and growth in developing countries. Journal of Development Economics. 1996;48(2):461–477. [Google Scholar]

- Bleaney M., Greenaway D. Adjustment to external imbalance and investment slumps in developing countries. European Economic Review. 1993;37(2–3):577–585. [Google Scholar]

- Bleaney M., Greenaway D. The impact of terms of trade and real exchange rate volatility on investment and growth in sub-Saharan Africa. Journal of Development Economics. 2001;65(2):491–500. [Google Scholar]

- Blundell R., Bond S. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics. 1998;87:115–143. [Google Scholar]

- Blundell, R., Bond, S., & Windmeijer, F. (2001). Estimation in dynamic panel data models: improving on the performance of the standard GMM estimator. In Non-stationary panels, panel co-integration, and dynamic panels Emerald Group Publishing Limited (pp. 53-91).

- Boone P. London School of Economics and Political Science, Centre for Economic Performance; 1994. The impact of foreign aid on savings and growth. [Google Scholar]

- Boone P. Politics and the effectiveness of foreign aid. European Economic Review. 1996;40(2):289–329. [Google Scholar]

- Boone P. Politics and the effectiveness of foreign aid. European Economic Review. 1996;40(2):289–329. [Google Scholar]

- Bräutigam D.A., Knack S. Foreign aid, institutions, and governance in Sub- Saharan Africa. Economic Development and Cultural Change. 2004;52(2):255–285. [Google Scholar]

- Briggs R.C. Aiding and abetting: Project aid and ethnic politics in Kenya. World Development. 2014;64:194–205. [Google Scholar]

- Briggs R.C. Poor targeting: A gridded spatial analysis of the degree to which aid reaches the poor in Africa. World Development. 2018;103:133–148. [Google Scholar]

- Brown O., Hammill A., McLeman R. Climate change as the ‘new’security threat: Implications for Africa. International affairs. 2007;83(6):1141–1154. [Google Scholar]

- Burnside C., Dollar D. Aid, policies, and growth. American Economic Review. 2000;90(4):847–868. [Google Scholar]

- Butzer R., Mundlak Y., Larson D.F. Measures of fixed capital in agriculture. World Bank Policy Research Working Paper. 2010;5472 [Google Scholar]

- Campa J.M., Goldberg L.S. Investment, pass-through, and exchange rates: a cross-country comparison. International Economic Review. 1999;40(2):287–314. [Google Scholar]

- Covarrubias J., Thach L. Wines of Baja Mexico: A qualitative study examining viticulture, enology, and marketing practices. Wine Economics and Policy. 2015;4(2):110–115. [Google Scholar]

- Daum T., Birner R. The neglected governance challenges of agricultural mechanisation in Africa–insights from Ghana. Food Security. 2017;9(5):959–979. [Google Scholar]

- Diao X., Hazell P., Thurlow J. The role of agriculture in African development. World Development. 2010;38(10):1375–1383. [Google Scholar]

- Dipendra K.C. Which aid targets poor at the sub-national level? World DevelopmentPerspectives. 2020;100177 [Google Scholar]

- Djankov S., Montalvo J.G., Reynal-Querol M. The curse of aid. Journal of Economic Growth. 2008;13(3):169–194. [Google Scholar]

- Dollar D., Levin V. The increasing selectivity of foreign aid, 1984–2003. World Development. 2006;34(12):2034–2046. [Google Scholar]

- Doucouliagos H., Paldam M. Aid effectiveness on accumulation: A meta study. KYKLOS. 2006;59(2):227–254. [Google Scholar]

- Durbarry, R., Gemmell, N., & Greenaway, D. (1998). New evidence on the impact of foreign aid on economic growth (No. 98/8). CREDIT Research paper.

- Eberly J., Rebelo S., Vincent N. What explains the lagged-investment effect? Journal of Monetary Economics. 2012;59(4):370–380. [Google Scholar]

- FAO (2005). Food security and agricultural development in Sub-Saharan Africa: Building a case for more public support. Rome.

- Gabre-Madhin E.Z., Haggblade S. Successes in African agriculture: Results of an expert survey. World Development. 2004;32(5):745–766. [Google Scholar]

- Galiani S., Knack S., Xu L.C., Zou B. The effect of aid on growth: Evidence from a quasi-experiment. Journal of Economic Growth. 2017;22(1):1–33. [Google Scholar]

- Gang I.N., Khan H. Foreign aid and public expenditures in LDC's. Atlantic Economic Journal. 1991;14(3):56–58. [Google Scholar]

- Godfray H.C.J., Beddington J.R., Crute I.R., Haddad L., Lawrence D., Muir J.F.…Toulmin C. Food security: The challenge of feeding 9 billion people. Science. 2010;327(5967):812–818. doi: 10.1126/science.1185383. [DOI] [PubMed] [Google Scholar]

- Gomanee K., Girma S., Morrisey O. Aid and growth in Sub-Saharan Africa: Accounting for transmission mechanisms. Journal of International Development. 2005;17(8):1055–1075. [Google Scholar]

- Hadjimichael, M., & Ghura, D. others, 1995, Sub-Saharan Africa: Growth, Savings, and Investment, 1986-93. IMF Occasional Paper, (118).

- Hansen H., Tarp F. Aid and growth regressions. Journal of Development Economics. 2001;64(2):547–570. [Google Scholar]

- Harrigan J., Wang C. A new approach to the allocation of aid among developing countries: Is the USA different from the rest? World Development. 2011;39(8):1281–1293. [Google Scholar]

- Hendrix C., Brinkman H.J. Food insecurity and conflict dynamics: Causal linkages and complex feedbacks. Stability: International Journal of Security and Development. 2013;2(2) [Google Scholar]

- Javid, L. & Qayyum, A. S. (2011). Aid effectiveness in Africa, The Authors Journal Compilation: African Development Bank.

- Jensen P.S., Paldam M. Can the two new aid-growth models be replicated? Public Choice. 2006;127(1–2):147–175. [Google Scholar]

- Jones S., Tarp F. Does foreign aid harm political institutions? Journal of Development Economics. 2016;118:266–281. [Google Scholar]

- Karras G. Foreign aid and long-run economic growth: empirical evidence for a panel of developing countries. Journal of International Development: The Journal of the Development Studies Association. 2006;18(1):15–28. [Google Scholar]

- Kaufmann D., Kraay A., Mastruzzi M. The worldwide governance indicators: Methodology and analytical issues. Hague Journal on the Rule of Law. 2011;3(2):220–246. [Google Scholar]

- Lahiri S., Raimondos-Møller P. Competition for aid and trade policy. Journal of International Economics. 1997;43(3–4):369–385. [Google Scholar]

- Larson D.F., Butzer R., Mundlak Y., Crego A. A cross-country database for sector investment and capital. The World Bank Economic Review. 2000;14(2):371–391. [Google Scholar]

- Larson P.R., Lohrengel C.F. A new tool for climatic analysis using the Köppen climate classification. Journal of Geography. 2011;110(3):120–130. [Google Scholar]

- Lensink R., Morrissey O. Aid instability as a measure of uncertainty and the positive impact of aid on growth. The Journal of Development Studies. 2000;36(3):31–49. [Google Scholar]

- Levine R., Renelt D. A sensitivity analysis of cross-country growth regressions. The American Economic Review. 1992:942–963. [Google Scholar]

- Levy V. Aid and growth in Sub-Saharan Africa: The recent experience. European Economic Review. 1988;32(9):1777–1795. [Google Scholar]

- Maruta A.A., Banerjee R., Cavoli T. Foreign aid, institutional quality and economic growth: Evidence from the developing world. Economic Modelling. 2020;89:444–463. [Google Scholar]

- Maruta, A. A., Banerjee, R., & Cavoli, T. (2019). Foreign aid, institutional quality and economic growth: Evidence from the developing world. Economic Modelling.

- Masaki T. The political economy of aid allocation in Africa: Evidence from Zambia. African Studies Review. 2018;61(1):55–82. [Google Scholar]

- McCloskey, S. (2019). The Sustainable Development Goals, Neoliberalism And NGOs: It's Time To Pursue A Transformative Path To Social Justice. Policy & Practice: A Development Education Review, (29).

- Miller, D. C. (2014). Explaining global patterns of international aid for linked biodiversity conservation and development. World Development, 59, 341-359.

- Mogues T., Benin S. Do external grants to district governments discourage own revenue generation? A look at local public finance dynamics in Ghana. World Development. 2012;40(5):1054–1067. [Google Scholar]

- Neumayer, E. (2003). The pattern of aid giving: the impact of good governance on development assistance. Routledge.

- Nkonya E., Phillip D., Mogues T., Pender J., Kato E. Impacts of community-driven development programs on income and asset acquisition in Africa: The case of Nigeria. World Development. 2012;40(9):1824–1838. [Google Scholar]