Highlights

-

•

The mass adoption of electric vehicles (EVs) is expected in the years ahead.

-

•

The CoMIT framework models the impact of EV adoption of critical materials demand.

-

•

By 2030, relative to 2015, demand for lithium and cobalt will increase 18 and 37 times.

-

•

China is expected to be an increasing important buyer of inputs to EV manufacturing.

-

•

Without changes to supply chains the widespread deployment of EV will be constrained.

Keywords: Decarbonisation, Electric vehicles, Metal, Mined commodities

Abstract

Mass adoption of electric vehicles (EVs) is anticipated in the years ahead, driven primarily by policy incentives, rising incomes, and technological advancements. However, mass adoption is predicated on the availability and affordability of the raw materials required to facilitate this transformation. The implications of material shortages are currently not well understood and previous research tends to be limited by weak representation of technological change, a lack of regional disaggregation, often inflexible and opaque assumptions and drivers, and a failure to place insights in the broader context of the raw materials industries. This paper proposes a CoMIT (Cost, Macro, Infrastructure, Technology) model that can be used to analyse the impact of mass EV adoption on critical raw materials demand and forecasts that, by 2030, demand for vehicles will increase by 27.4%, of which 13.3% will be EVs. The model also predicts large increases in demand for certain base metals, including a 37 and 18-fold increase in demand for cobalt and lithium (relative to 2015 levels), respectively. Without major changes in certain technologies, the cobalt and lithium supply chains could seriously constrain the widespread deployment of EVs. Significant demand increases are also predicted for copper, chrome and aluminium. The results also highlight the importance of China in driving demand for EVs and the critical materials needed to produce them.

Nomenclature

Abbreviations

- kg

kilogram (s)

- km

kilometre (s)

- kt

thousand tonne (s) ( kg)

- kVA

kilovolt-ampere (s)

- kW

kilowatt (s)

- kWh

kilowatt-hour (s)

- MW

Megawatt (s)

- mt

million tonne (s) ( kg)

Acronyms

- AL

Aluminium

- BEV

Battery Electric Vehicle

- CAFE

Corporate Average Fuel Economy

- CAGR

Compound Annual Growth Rate

- CCS

Carbon dioxide Capture and Storage

- CO

Cobalt

- CR

Chrome

- CU

Copper

- EOL

End-of-life

- EV

Electric Vehicle

- FCEV

Fuel Cell Electric Vehicle

- FE

Steel

- GDP

Gross Domestic Product

- GHG

Green-house Gas

- HDV

High Duty Vehicle

- HEV

Hybrid Electric Vehicle

- ICE

Internal Combustion Engine

- ICEV

Internal Combustion Electric Vehicle

- LDV

Light Duty Vehicle

- LFP

Lithium Iron Phosphate

- LI

Lithium

- LIB

Lithium-ion batteries

- LMO

Lithium Manganese Oxide

- MN

Manganese

- NCA

Lithium Nickel Cobalt Aluminium Oxide

- NEV

New Energy Vehicle

- NI

Nikel

- NiMH

Nickel Metal Hydride

- NMC

Lithtium Nickel Manganese Cobalt Oxide

- OEM

Original Equipment Manufacturer

- PHEV

Plug-in Hybrid Electric Vehicle

- PFCEV

Plugin Fuel Cell Electric Vehicle

- PV

Photovoltaics

- TCO

Total Cost of Ownership

- WAP

Working Age Person

1. Introduction

Limiting the damage from climate change is a major challenge facing the global economy. The Paris Accord aims to curb emissions of Carbon Dioxide (CO2) and other Greenhouse Gases (GHGs) in an attempt to keep the average temperature rise under 1.5°C [1], [2]. Meeting these ambitious goals will require mass adoption of environmental technologies such as renewable power, Carbon Dioxide Capture and Storage (CCS), [3], and energy-saving household appliances and industrial equipment [4]. In this context, the electrification of road transportation represents a major opportunity to reduce emissions [5] in a sector that currently accounts for around 14% of global GHG emissions [6].

Policy makers are actively encouraging the mass adoption of EVs with the express intention, in many cases, of replacing sales of Internal Combustion Engine Vehicles (ICEVs) within a given time frame (e.g. recently changed to 2035 in the United Kingdom). Among the governments active in promoting EVs are Canada, China, Finland, France, Germany, India, Japan, Mexico, Netherlands, Norway, Sweden, the United Kingdom (UK) and the United States (US) [7]. Such government led policy initiatives are beginning to catalyse both EV production and sales. For example, the global year-on-year growth rate for new EVs reached 54% in 2017 with global sales exceeding one million units [7]. In response to an anticipated rapid increase in demand, auto makers and their suppliers have made plans for large scale investments in EV related production capacity. 1 However, such a rapid transformation will require a step change in the demand for, and supply of, the raw materials that are used in the EV production process and raises questions regarding the availability and cost of these raw materials.

The purpose of this paper is to analyse the complex relationships between the production of EVs, material demand, and the global supply chain. This is an important area of research given the resource intensity of EV production, typically requiring, for example, 3–4 times as much copper as a traditional gasoline vehicle. Likewise, the batteries, central to all EVs, are commonly rich in materials such as cobalt, lithium, nickel, manganese and graphite. There are at least three reasons why the supply of raw materials could be a bottleneck for the transition to a low-carbon future. First, the growth in demand for these technologies is likely to be exponential, requiring a step change in resource industry investment for certain materials. Second, the uneven spatial distribution in the supply and demand for raw materials raises the potential for supply chain disruption caused, for example, by natural disasters, pandemics such as COVID-19, trade wars, civil conflicts and so on. Such concerns are particularly relevant when there is a mismatch between demand and supply at any stage of, what are oftentimes, highly complex mineral value chains. In this regard, it is noteworthy that the vast majority of ‘downstream’ battery chemical and cell manufacturing capacity is currently situated in a small number of countries such as China, Japan and South Korea. Third, there are a range of potential market failures and barriers that may limit the ability of different primary resource sectors to respond rapidly to rising demand (for example, extended project development lags, financial constraints or environmental concerns).

Hence, there is growing awareness of the need to understand and manage supply side risks. For example, the US government has an official list of the 35 minerals that it defines as ‘critical’ in the sense that they are essential to economic and national security, but are exposed to the risk of potential supply disruption [9]. 2 Similar concerns in other regions of the world mean that countries are increasingly seeing the strategic need to secure access to the raw materials that are necessary to support planned increases in investment in certain areas of advanced manufacturing. These considerations have the potential to shape both future and current trade negotiations and national investment strategies across both resource consuming and producing countries. Rapid growth in demand for the materials associated with the EV revolution, coupled with the concentration of the supply chain in certain countries and regions, is likely to draw these issues into still sharper focus in the coming months and years. The recent COVID-19 pandemic is likely to further accelerate these concerns.

In the existing literature, a number of studies have examined supply criticality issues associated with the growth of green technologies. At the global level Dawkins, Chadwick, Roelich and Falk [10], assert that, of three metal-reliant technologies, namely Photovoltaics (PV), wind power, and plug-in vehicles, these issues are of most concern in the case of PV (a conclusion also supported by Elshkaki and Graedel [11]). Other studies identify potential risks associated with a broader set of technologies and commodities. Vidal, Goffé and Arndt [12], for example, emphasise the significant increase in demand for base metals and raw materials arising from the rapidly advancing deployment of both wind and solar PV technologies. Fizaine and Court [13] propose a sensitivity metric that shows how the degradation of metal ore grades could significantly affect the return on investment in wind, solar, hydropower, and nuclear power. Similarly, Tokimatsu, Wachtmeister, McLellan, Davidsson, Murakami, Höök, Yasuoka and Nishio [14] raise concerns regarding the metal requirements for the production of PV, nuclear and plug-in vehicles while Grandell, Lehtilä, Kivinen, Koljonen, Kihlman and Lauri [15] find that critical raw material issues associated with various energy generation, storage, and mobility technologies have the potential to constrain the feasibility of the renewable energy scenarios presented by the IPCC Fifth Assessment Report. WB and EGPS [16] analyse metal demand associated with wind, solar, and energy storage batteries under different IEA energy transition scenarios, highlighting particularly strong demand growth for aluminium, cobalt, iron, lead, lithium, manganese, and nickel in a ‘2 degree world’. Finally, de Koning, Kleijn, Huppes, Sprecher, van Engelen and Tukker [17] agree that decarbonisation of the power generation and automotive sectors will substantially increase demand for a range of metals but argue that supply could be increased (although there is a degree of uncertainty with regards to return on investment, lead times and geopolitical concerns over raw material mining).

In addition to these global studies, demand for the critical raw materials associated with the transition to a low carbon economy, and the adoption of green technologies (and associated supply chain issues), has been analysed from the perspectives of a number of developed countries, including the US [18], [19], the EU [20], [21], the UK [22], Australia [23], [19] and Japan [24]. The majority of these studies include EVs in their calculation, together with their components (including batteries). Although no published studies have been undertaken for developing regions, WB and EGPS [16] highlight the potential importance of this issue for resource rich host countries, including countries in Africa and Latin America, but do not analyse the nature of these impacts in any detail.

In addition the multiple-technology assessment studies, there is a body of literature that provides detailed analyses of different low-carbon technologies. Of these, the electrification of transport receives considerable attention, in part, because EVs are increasingly dependent on lithium (a key component of lithium-ion batteries). An early assessment by Gruber, Medina, Keoleian, Kesler, Everson and Wallington [25] suggests that the supply of lithium, together with active recycling, is sufficient to support the adoption of EVs, even in the most rapid and widespread penetration scenario. Grosjean, Herrera Miranda, Perrin and Poggi [26] share such an optimistic view, but raise concerns about the geographical concentration of lithium supply. However, Vikström, Davidsson and Höök [27] claim that lithium could be a constraint for EV penetration rates if the ambitious electrification scenarios, such as the Blue Map Scenarios developed by the International Energy Agency, are to be realised. A review by Speirs, Contestabile, Houari and Gross [28] highlights the substantial degree of uncertainty surrounding the parameters used in the existing literature, especially those related to metal intensity and EV penetration rates, with the uncertainty helping to explain the mixed conclusions regarding the criticality of lithium to the future of low-carbon mobility. A different approach is taken by Narins [29] who argues that ‘lithium scarcity’ is a matter of quality rather than quantity and that the excitement over future demand related to EV technologies has led to an overheated market for lithium and that it will take time for supply to adjust. In an effort to endogenise the supply chain model of raw materials, Hache, Seck, Simoen, Bonnet and Carcanague [30] conclude that economic, industrial, geopolitical and environmental (rather than geological) risks are the primary supply chain issues that will affect the potential for the mass marketisation of EVs. 3

Despite the growing body of research looking at lithium, the other important material inputs that go into the production of EVs are less well researched. For example, an early assessment of EV materials by Andersson and Råde [40] identifies rare earth elements, vanadium and cobalt, as critical to the diffusion of EV batteries, and that the production of vanadium and cobalt is unlikely to keep pace with the the increase in global demand. For the EU, Simon, Ziemann and Weil [41] analyse the relationship between supply and demand for four metals and suggests that there will be a shortage of lithium and nickel by 2025 while reserves for cobalt and manganese are projected to be more than sufficient while Sullivan, Kelly and Elgowainy [42] analyse the reduction in demand for different powertrains and how this changes demand for steel and aluminium. In a study of supply side risks, EC [43] identify cobalt, natural graphite and silicon as the materials giving cause for concern with platinum identified by Spiegel [44], Yang [45], Alonso, Field and Kirchain [46] as a supply risk for Fuel Cell Electric Vehicles (FCEVs).

The existing literature has employed various modelling approaches. However, those models that are available tend to lack a degree of transparency and consistency that makes it difficult for academics and policymakers to obtain a complete picture of the outlook for mined commodities under a wide range of different assumptions underpinning the global transition to EVs. In terms of geographic scope, global studies tend not to be detailed enough to address regional concerns while regional specific studies tend to be constructed in isolation from wider considerations affecting the global market. Other criticality assessments focus on one or several material market(s), especially those directly related to EV batteries, but neglect potential interconnections between different mined commodities. However, in the case of many critical materials, it is difficult to imagine how sufficient financial resources could be mobilised without taking into account the competition for funds from competing markets including those less critical but much larger in terms of capitalised values such as steel, copper, and aluminium. In addition, the supply of commodities that are rarely mined as a primary product such as cobalt, is largely dependent on the production of other metals such as copper and nickel. In terms of transparency, some models do not disclose the data used and often oversimplify those factors related to future technical changes in EVs and batteries. Finally, a number of the projections in the literature appear to be over-reliant on subjective policy commitments or decarbonisation scenarios obtained from external sources such as the IPCC [6], IEA [47], SDSN and IDDRI [48], Jacobson et al. [49] that suffer from a lack of visibility and tend to be rather inflexible with respect to their underlying assumptions and respective market impacts.

The contribution of this paper is to present a modelling framework called CoMIT (Cost, Macro, Infrastructure, Technology) that is designed to address a number of the concerns outlined above. Specifically, a unified framework is presented that allows for demand to be simulated for a large number of the raw materials essential for e-mobility in a way that is transparent, consistent and inclusive of numerous drivers of e-mobility. These drivers include macroeconomic conditions, infrastructure, technology, policies and customer behaviour as well as factors specific to different countries and regions. As a result, the model is able to generate a set of reliable estimates of future metal demand that are compatible with various usage objectives and is transparent and simple to update when new data becomes available.

More specifically, this paper makes the following contributions. First, it provides a framework for evaluating the key drivers of any EV market transformation and their impact on the demand for different metals. Second, the framework includes a degree of regional disaggregation that enables the study of spatial differences in demand across countries and regions. A regional analysis is also important for helping to understand the supply chain implications associated with changes in the patterns of trade in raw materials. Third, the paper considers eight different mined commodities important for EV and EV battery production. Fourth, the framework provides a more sophisticated representation of technological change than previous studies have been able to incorporate, drawing on detailed market intelligence including, for example, information on average metal utilisation rates in vehicles by power train. The metal ‘loadings’ used in the framework are derived from information on vehicle class, battery size and type, as well as material substitution possibilities and constraints. Fifth, the framework takes into account potential future supply constraints and cost pressures affecting future materials choices. Finally, the impact of the EV revolution on raw material demand is placed within the broader context of raw material supply and investment. The emergence of ‘supply gaps’ is fairly common in the mined resources sector and is a reflection of the time it takes for firms to respond as market conditions change. However, some supply gaps are more challenging to close than others. In order to understand the potential implications of shifting demand patterns, it is therefore critical to understand the wider market conditions that shape investment and production decisions.

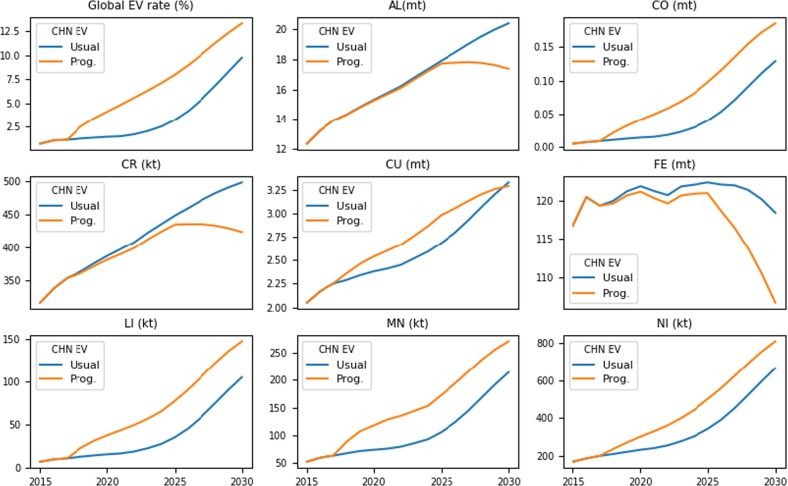

To briefly summarise the results, when the full model is estimated over the course of 15 years, it is shown that annual demand for passenger cars, heavy trucks and buses is projected to increase by 27.4% with the share of EVs increasing from almost zero to 13.3%. As a result, substantial changes in demand for mined commodities in terms of both size and structure are predicted. By 2030, demand for cobalt and lithium for EVs is projected to far exceed, by up to 37 and 18 times, the 2015 production levels of these commodities, respectively. Electrification is also projected to increase the amount of nickel and manganese required for new vehicles by five times 2015 levels. Demand for aluminium, copper and chrome are also found to increase significantly. The sensitivity analysis shows the importance of the Chinese market to both EV demand and the critical materials needed to produce them. For example, as the largest market for future EVs, Chinese demand would account for about 68% of global lithium and cobalt demand for transport in 2030.

The remainder of the paper is organised as follow. Section 2 describes the framework and key equations behind each module. Section 3 lists the sources of data and states the key assumptions. Section 4 illustrates the results and discuss their implication. Section 5 concludes.

2. CoMIT framework

2.1. Scope and notation

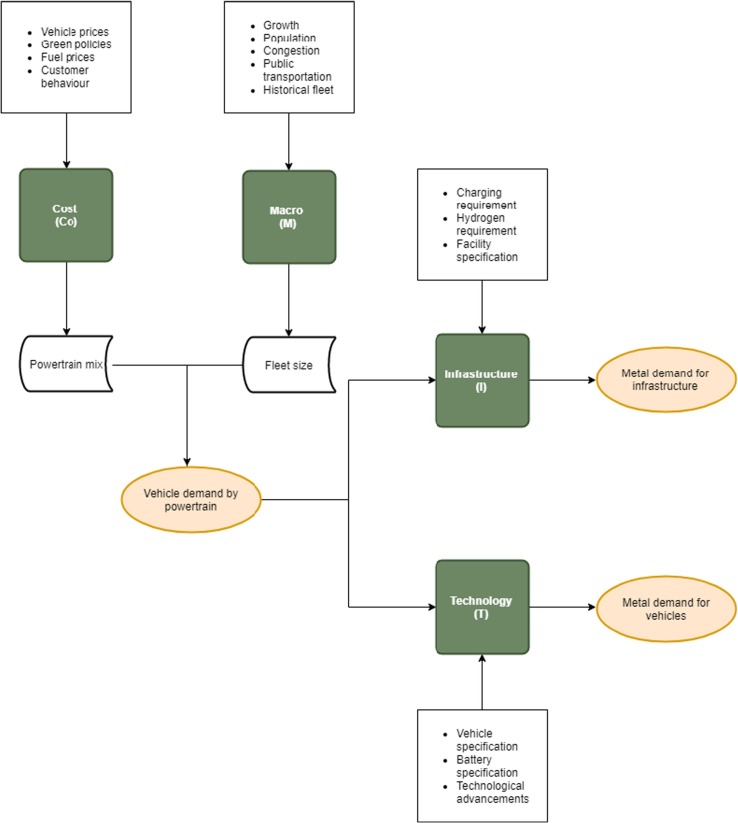

The methodological approach (the CoMIT framework) used in this paper is summarised in Fig. 1 . Fig. 1 shows the four individually defined modules each of which has a list of inputs and outputs. The modules are named Cost (Co), Macro (M), Infrastructure (I), and Technology (T). This framework is able to convert a set of assumptions on the future dynamics of a range of macroeconomic factors, infrastructure capacity, demography, markets, policies and technology, to the demand for a number of metals that are critical to the production of vehicles (electric and non-electric) and the facilities that are complementary to vehicle production such as charging poles and hydrogen stations. The model includes indices for region (i), vehicle type (j), powertrain (k), year (t), fuel type (f), power source (s) and metal (m) and are now discussed in more detail.

Fig. 1.

CoMIT framework overview. Note: Our analytic framework is specific for 10 regions 3 vehicle types 7 powertrains 8 mined commodities as detailed in Section 2.1 and summarised in Supplement Table 1. Section 4 only illustrates and discusses key findings from aggregated results while more disaggregated results are available upon appropriate request.

Geographically, the model divides the globe into ten regions: China (CHN); India (IND); North America (NAM); Brazil (BRZ); North Asia Developed (NAD); the Commonwealth of Independent States (CIS); Western Europe (WEU); the Rest of Europe (REU); Southeast Asia (SEA); and Other Countries (OTH). 4 OTH is treated as a residual with no EV sales. The region code WTO is used when referring to the aggregation of all regions (the world).

The framework uses annual data from 1980 and provides projections up to the year 2030. The time scale is important when modelling an innovative sector such as electrified transportation where breakthroughs are difficult to predict over longer periods. To derive the initial data inputs for the model, real data between 2015, 2016 and 2017 are used.

Three types of vehicle are modelled: Light Duty Vehicles (LDVs!); High Duty Vehicles (HDVs!); and Buses (BUSes). When required, HDVs can also be split into Light Trucks (HDVLT) and Heavy Trucks (HDVHT). Seven different powertrains are considered. For traditional vehicles that only use an Internal Combustion Engine (ICE) for propulsion, differentiation is based on fuel types which are coded as ICE PETROL and ICE DIESEL. For vehicles that use both ICE and electric motors, the differentiation is between Hybrid Electric Vehicles (HEVs), which can be charged by the ICE only and Plug-in Hybrid Electric Vehicles (PHEVs), which can be connected to the grid for charging. 5 Battery Electric Vehicles (BEVs) are referred to as those that have no ICE and are dependent on batteries that rely on grid charging. Fuel cell electric vehicles (FCEVs) use hydrogen fuel cells to power their electric motors and Plugin Fuel Cell Electric Vehicles (PFCEVs) combine features of BEVs and FCEVs. In the paper, EVs are referred to as a combination of PHEVs, BEVs, FCEVs and PFCEVs. In terms of charging infrastructure, CHARGE is defined as those vehicles that need chargers including PHEVs, BEVs, PFCEVs, and HYDRO is defined as those vehicles that require hydrogen charging stations including FCEVs and PFCEVs.

Four types of fuel are considered: Diesels (DIE); Petrol (PET); Electricity (ELE); and Hydrogen (HYD). To model the source of the electricity used to charge the batteries, three non-renewable sources are included: Coal (COA); Gas (GAS); and Oil (OIL). 6 For the output variables, the analysis includes the demand for eight different metals, namely: Aluminium (AL); Cobalt (CO); Chrome (CR); Copper (CU); Lithium (LI); Manganese (MN); Nickel (NI); and Steel (FE). These metals were selected because they are used, to a greater or lesser extent, in the production of vehicles and are also important commodity markets in their own right. Details of the notation used in this paper can be found in Supplementary Table 1.

The following sections discuss each module in turn.

2.2. Cost module (C)

The relatively high cost of EVs is currently preventing the wholesale replacement of ICEVs. However, cost differences could be reduced through the use of targeted decarbonisation policies to reduce purchase prices and/or technological advances that improve the relative performance of EVs.

The Cost module of the CoMIT framework predicts the future powertrain mix by modelling the purchasing behaviour of customers using the Total Cost of Ownership (TCO) method. TCO has been widely used to evaluate the cost competitiveness of different vehicle technologies and to analyse the effectiveness of different policies implemented to support EV adoption. For example, for the US, TCO is used to model the whole-life costs of PHEVs [50] and hybrid cars [51]. For China, TCO is used to study the the competitiveness of BEVs [52] while it has been used to analyses the EV market for Germany [53], and Italy [54].

The key assumption in any TCO study is that consumers are able to take into account all of the different monetary costs that will occur over the life cycle of the product. Therefore, anything that impacts the current vehicle price or current and future operating costs, will affect the relative competitiveness of the different powertrains. The TCO for each powertrain j is calculated as the sum of net present value (NPV) discounted by the discount rate for four different components: the upfront payment needed to acquire the vehicle (); maintenance costs, roughly estimated as a share () of the initial price of the vehicle (); total annual operating costs () during the use phase; and finally the remaining value of the vehicle net the scrapping cost at the end of its life (). 7 Hence, the TCO for a given vehicle is given by:

| (1) |

In Eq. (1), is the life span of a typical vehicle type j in a given regional market i and is assigned a negative value (which is to say there is a positive scrappage value so it reduces the TCO). The upfront payment is computed from the vehicle price (), tax rate (), subsidy (), registration fees () and tailpipe compliance cost (), such that:

| (2) |

The operating cost includes an annual cost for fuel (), a carbon tax cost () and a road tax cost () such that:

| (3) |

The first two components in Eq. (3) depend on the annual consumption of each fuel type f (). In turn, consumption relies on the annual mileage travelled (), the share of vehicles operated by electricity () and the amount of fuel required to deliver one mile travelled () such that:

| (4) |

In addition to fuel consumption, to model the projected annual fuel cost requires a projection of future fuel prices () and fuel taxes () such that:

| (5) |

To estimate the carbon tax for the annual operation of powertrain k Eq. (6) is estimated where is the emissions from the consumption of a unit of fuel f and is the carbon tax rate in region i such that:

| (6) |

It is important to note that the actual content of electricity depends on the power mix that generates the electricity for the grid. For simplicity, the analysis in this paper considers three sources of energy: coal; natural gas; and oil, assuming that that the other sources of electricity in the power mix (including renewable energy sources) are carbon neutral. The content of electricity is then computed as the average intensity of each power source (), weighted by their share in the power mix () and is given by:

| (7) |

Hence, to compare the TCOs of different powertrains, it is important to benchmark each powertrain’s TCO with the TCO of the most popular powertrains (), which are ICE PETROL for LDV, and ICE DIESEL for HDV and BUS, and compute the Inverse Relative Total Cost of Ownership (InvRTCO) given by:

| (8) |

A higher means that powertrain k has become cheaper relative to the conventional ICE powertrain and hence is expected to gain a larger market share in total sales of vehicle type j. It should be noted that at this stage, the model separates HDV into HDVLT (light trucks) and HDVHT (heavy trucks). The above equation applies to HDVHT only. For HDVLT, the same relative costs as LDV are assumed: .

The next step is to project the market share of EVs and HEVs using an autoregressive model that incorporates a logistic function of InvRTCO. Hence, the powertrain share () is given by:

| (9) |

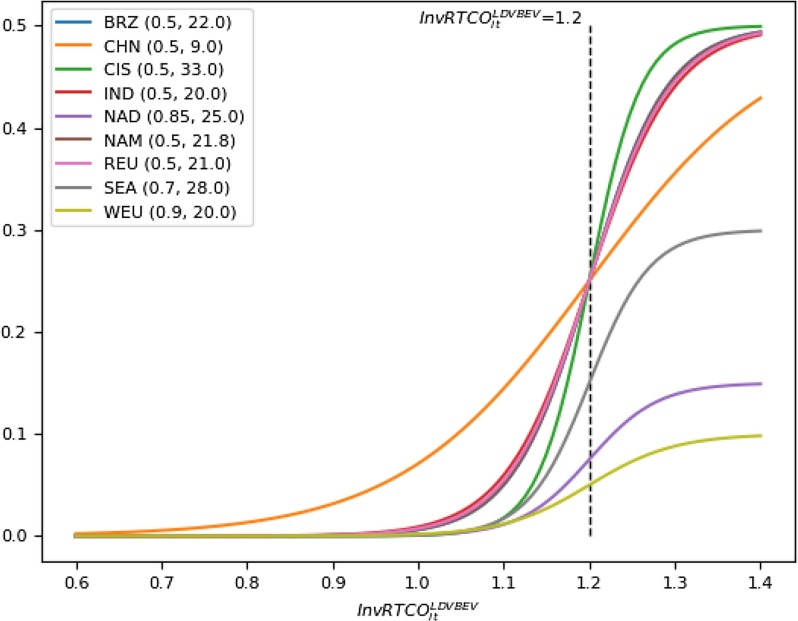

The AR(1) model is characterised by the parameter , that captures the stickiness of the market with respect to price. A larger value of means more influence is given to the previous market share () and a lower influence is given to RTCO. The logistic function has an S shape characterised by two parameters: the steepness of the curve (); and the midpoint of the curve (), which is the point at which the market share achieves the fastest growth rate. The assumption underlying this choice of functional form is that a powertrain starts to gain market share when it is reasonably cheap and then the growth rate continues to accelerate up until a point is reached where most people realize that it has a lower TCO. Then, if it is cheap enough, the growth rate of market share will gradually decline as the market share approaches 100%. Based on insights from historical data, a midpoint of 1.2 is chosen for LDVs and HDVs, and 1.3 for BUS. Steepness, , is calibrated using historical values for each powertrain. For powertrains with little or no historical data a series of sensitivity tests are run on the estimated values and the one that seems most reasonable, taking into account the trend in RTCO, the current market trend, raw material constraints and infrastructure accessibility, is chosen. To illustrate the approach, Fig. 2 presents the market share of LDV BEVs for a range of different values of InvRTCO assuming zero sales using Eq. (9) and parameters calibrated for each of the ten regions.

Fig. 2.

The share of BEV in LDV market as a logistics function of Inverse Relative Total Cost of Ownership (InvRTCO). Note: This figure illustrates an example of logistics functions used to simulate market shares of different powertrains as presented in Eq. (9). For the illustrative purpose, this figure assumes zero market share in the previous year and as a such, the market share simulated by an AR(1) process is totally dependent on the Inverse Relative Total Cost of Ownership (InvRTCO). The figure legend is specific for each logistic shape including a region code i and a pair of parameters defined in Eq. (9), where other indexes are fixed and . The midpoints of all logistic shapes in this figures are at 1.2.

For the incumbent technology (ICE), the market share as the residual of EVs is simulated:

| (10) |

An exception, in this paper, is how LDVs for China (CHN) are modelled, which is not estimated using Eq. (10). The future growth in passenger EVs in China is expected to be driven largely by the dual credit system. This newly introduced policy replaces the subsidy scheme for EVs, which is scheduled to end in 2020. The importance given to this policy and the relative size of the Chinese market means it is necessary to model it separately (see Supplementary Table 2). For region OTH, the EV market is not modelled, but it is assumed that the market mix (including ICE PETROL and ICE DIESEL) is unchanged overtime. In particular, the powertrain mix of HDVs is calculated as the average of the powertrain mix of HDVLT and HDVHT by assuming a time-invariant split between the two () such that:

| (11) |

Once the powertrain mix, based on the costs of ownership across regions and time, has been calculated, the next step is to introduce broader macroeconomic drivers of the overall fleet size.

2.3. Macro (M) module

The purpose of the macro (M) module is to simulate the demand for new vehicles based on various macro-drivers. To briefly summarise, it is assumed that the growth of the vehicle fleet follows the economic and population growth rates of a region. The vehicle fleet size is also related to road capacity (congestion) and the development of public transport (i.e. rail). Subject to these broader trends, the demand for new vehicles is based on fleet growth and the demand for replacement vehicles.

The first stage of the macro module is to predict the fleet size for each type of vehicle. More specifically, the LDV adoption rate for region i and year t, denoted , is the average number of cars owned by a working age adult and is given by:

| (12) |

The first term, , is a time-invariant parameter that captures region-specific trends. The second and the third terms model the stickiness of the adoption rate [55]. The Calvo method is widely used to model macro-variables that are thought to exhibit sluggish behaviour. In this analysis, it is assumed that, for a given year, that LDV ownership status is the same as the previous year with a probability of (). When an individual considers future LDV ownership, they take into account both their current income and the general condition of current infrastructure (i.e. levels of congestion).

At the aggregate level, changes in car ownership are modelled at the regional level as a quadratic function of the log of Gross Domestic Product (GDP) per working age person (WAP), denoted by , and the responsiveness of the adoption rate to income captured by an elasticity parameter . This functional form implies that when a country or region becomes richer, car ownership will increase. However, the functional form also implies that as roads become more crowded then the rate of increase in car ownership will begin to decline and eventually car ownership will fall when GDP per WAP reaches a critical point and congestion becomes a major constraint.

To take into account the fact that China and India are likely to become congested before they get rich, the turning point is modelled by , where is an universal GDP per WAP level (in log form) optimal for LDV adoption, adjusted by a congestion factor , which is specific to each region. 8

The optimal GDP per WAP level is calibrated at $54,600 (2010 USD) for all countries, except for CIS, which is given a value of 33,100 (2010 USD). 9 More specifically, is a congestion score, ranging from 1 (less congested) to 5 (more congested). All 360 cities with a population over 1 million are considered and allows for demographic heterogeneity within each region. For each city, four locations are chosen in four directions that are all five kilometres from the city centre. The average of the estimated travelling time from these four locations to the city centre at 8.30 a.m. is then calculated, and then average travelling time is weighted by the population for each city in a region to get a regional average travelling time. Congestion at each region is scored from 1 (less congested) to 5 (most congested), corresponding to five ranges of average travelling time (in minutes): [21,23); [23,25); [25;27); [27,29); [29,). The coefficient is a specific parameter calibrated to the value of .

Similarly, the adoption rates of HDV and BUS are modelled by Eqs. (13), (14), respectively, and given by:

| (13) |

| (14) |

There are several differences to the LDV adoption rate given by Eq. (12). For HDVs, individual income is measured by industrial production per head, under the assumption that HDVs are used for industrial activity and the optimal value is set at $30,000 (2010 USD). For BUSs the adoption rate, , is measured as the number of buses per capita and correspondingly, and are GDP per capita and its optimal value, respectively. These numbers reflect the fact that buses serve the general public and not just the working age population. In addition, historical data suggest no significant correlation between BUS ownership and congestion. Instead, research has revealed that the adoption of passenger railways, in tandem with economic development, has a greater effect on bus ownership, in both long distance travel and daily commuting. Hence, a rail transport development level score is used to adjust the turning point of . The indicative variable , takes three values −1, 0, 1, whether a railway service, a possible substitute for buses in a particular region, is considered to be mature, sufficient or insufficient. The signs imply a negative, neutral or positive impact on the adoption rate of buses. The ratio of the annual number of passengers carried by the railway system (including light tracks) to total population is used as well as three thresholds suggested by cross sectional data. If the ratio is below 1 (that is, each person on average takes fewer than 1 trip by rail each year), it suggests an insufficient passenger railway system, thus boosting BUS demand. If the ratio is above 10 (that is, each person on average takes more than 10 trips by rail each year), it suggests a mature and convenient railway system that will substitute for BUS demand. Ratios between 1 and 10 have generally no impact on BUS demand. The coefficient is a specific parameter calibrated to the value of . Once the adoption rate has been predicted it is possible to calculate the fleet size of a given region in a given year as:

| (15) |

where is a measure of population corresponding to the measure of , which varies by vehicle type. More specifically, it is WAP for and the total population for . The fleet size of the OTH region is proportional to the sum of the fleet size of the major modelled regions, assuming that the ratio between the OTH fleet size and the combined size of other fleets, denoted is unchanged over time such that:

| (16) |

Once the projected fleet size has been calculated it is possible to simulate the demand for new vehicles by type based on the expansion of the fleet () and the need to replace retired vehicles () given by:

| (17) |

The demand for replacement vehicles, , in the above equation is estimated by:

| (18) |

This means that the number of vehicles retired in year t is given by the sum of all vehicles sold in the past (traced back to 1980) that fail in year t. For a particular vehicle sold in year , the number of vehicles that need to be replaced in year t is given by the product of the failure rate, approximated by a Weibull distribution and the sales of that vehicle, estimated by where historical data is not available. The Weibull distribution [56] is a continuous probability function that has a wide range of applications in survival analysis and reliability analysis, where time-to-failure is an important metric.

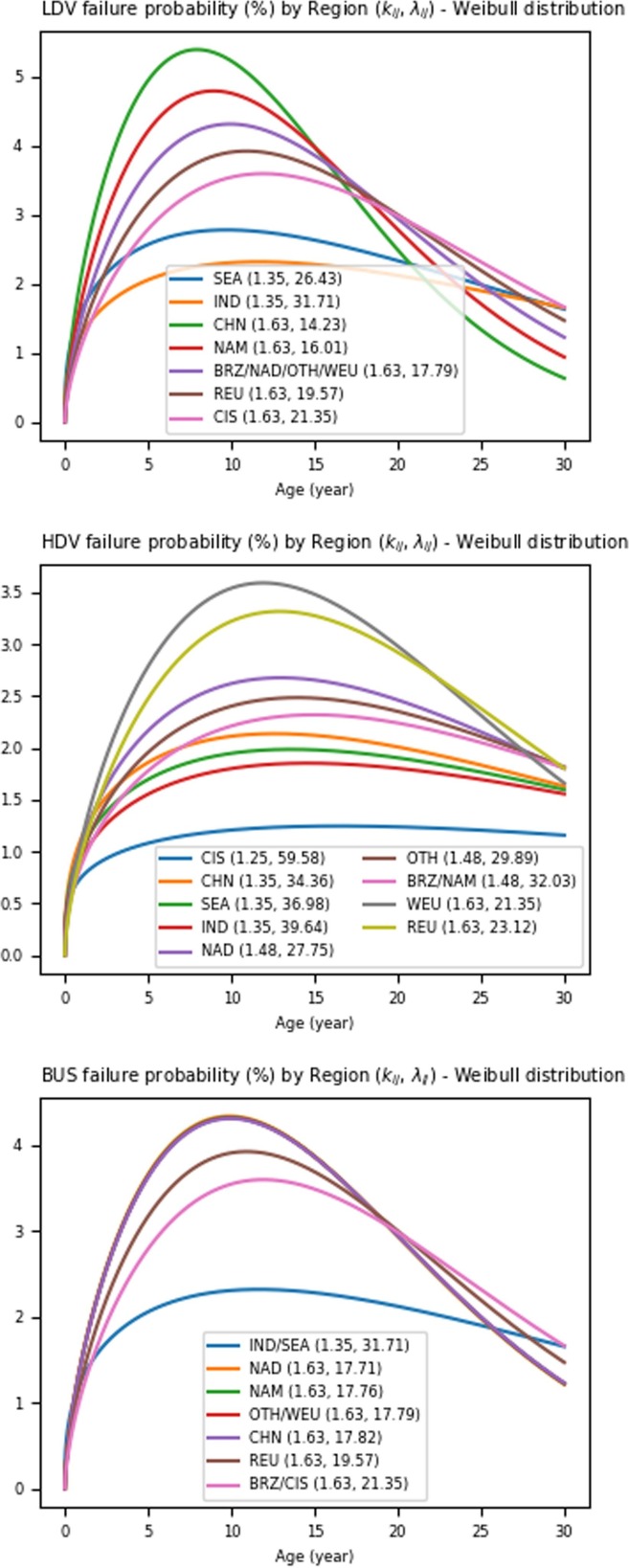

In this context, the Weibull distribution is used to estimate the probability that a car fails and need replacing across a range of ages (). Fig. 3 presents a Weibull distribution for each vehicle type by region using historical data on the average and skewness of vehicle lifespans. The distribution is characterised by a shape parameter and a scale parameter . As can be seen in Fig. 3, all shape parameters are greater than 1 implying, not surprisingly, that the failure rate increases over time. 10

Fig. 3.

Weibull distribution for failure probability approximation. Sources: This figure illustrates Weibull functions used in Eq. (18) to approximate the failure rates of three fleets (LDV, HDV, BUS) at different regions. Figure legends specify region codes and two parameters that are defined in Eq. (18) and calibrated from LMCA data.

Hence, the annual demand for each powertrain is calculated by the product of the market share by powertrain (calculated in the Cost module) and demand for each vehicle type given by:

| (19) |

The macro module therefore gives predictions of the demand for different vehicles which is crucial for estimating critical material demand. In the third module the infrastructure needed to charge EV batteries is taken into account and linked to the demand for raw materials.

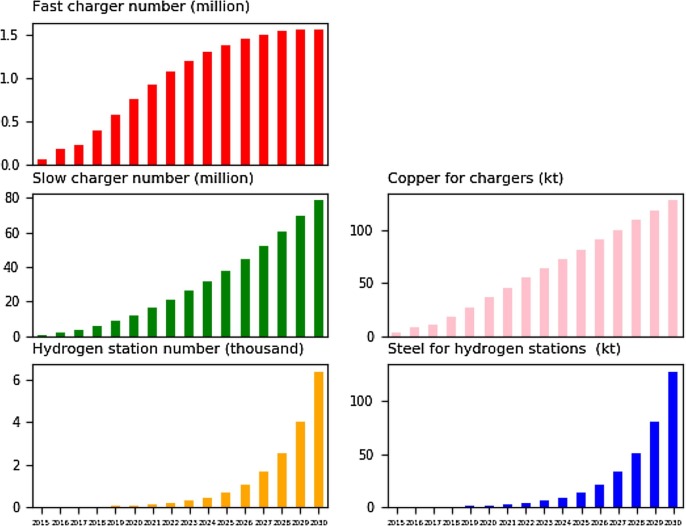

2.4. Infrastructure (I) module

If there is to be a widespread adoption of EVs, it is crucial that the complementary charging infrastructure is put in place. Such an infrastructure build out will also add to an increase in demand for certain raw materials.

The infrastructure module estimate the demand for EV charging stations which is assumed to be made up of EV chargers and hydrogen stations with the former predicted to be more important. First, the size of the fleet for those powertrains that use chargers (PHEVs, BEVs, PFCEVs) is estimated, denoted by , which includes two components: new sales (); and existing vehicles given by:

| (20) |

Eq. (20) assumes that powertrain, k, has the same retirement rate as vehicle type j (). Assuming that this is the case, the total charging fleet size can be aggregated to the regional level by:

| (21) |

In terms of the type of charging pole, they are categorised in this paper into slow chargers and fast chargers. The underlying charging infrastructure assumptions are discussed in Section 3.4.3. The number of implied chargers by region, either slow () or fast () is given by:

| (22) |

| (23) |

where is the percentage of EV owners that own a vehicle that needs charging and who have a designated parking place and is the ratio of fast chargers per charge requiring EV. Both fast and slow chargers increase the demand for copper which is estimated using different copper intensities for slow chargers () and fast chargers () given by:

| (24) |

In a similar way to how EV charger demand is modelled, it is also possible to predict the number of hydrogen vehicles that require charging stations such that:

| (25) |

The aggregate demand for hydrogen stations by region is given by Eq. (26), where is the hydrogen consumption of powertrain k given by:

| (26) |

For given hydrogen demand, the number of hydrogen stations () required can then be calculated using the daily capacity of each station () such that:

| (27) |

The steel required for hydrogen stations in each region () is given by:

| (28) |

where is the weight ratio of stored hydrogen to the total storage facility.

Once the demand for charging stations, the powertrain mix, and the overall fleet size, have been estimated it is also necessary to make a number of assumptions regarding the technologies underpinning vehicle and battery production.

2.5. Technology (T) module

The technology module estimates critical material demand, denoted , for each of the seven powertrains using Eq. (29) where:

| (29) |

Recall that m is the subscript for metal. is the intensity of metal, m, in a specified vehicle and is the share of this metal used in the manufacture of EV batteries only. and are the average lifespans of the vehicle and battery, respectively. The first term in Eq. (29) is the metal demand for virgin vehicles and the second term is metal demand for replacement batteries if the initially installed batteries fail before the end of the vehicle life. Note that is the number of batteries used throughout the full vehicle life and it is necessary to subtract one for the battery that is initially included in a new vehicle. 11

The technology module therefore provides the demand and supply for eight different metals that are considered crucial for the EV market (vehicles and batteries). Combined with the cost, marco and infrastructure models, the framework enables an investigation into how closely the expectations of a growing EV sector match the supply of critical materials crucial to meeting this predicted demand.

3. Data and assumptions

To generate predictions from the CoMIT model described in Section 2 it is necessary to collect a wide range of data. For example, historical data is used to calibrate parameters and to generate initial values for the variables in the model. The calibration data are from 1980 although the exact starting date varies depending on the variable. For data initiation, data for 2015 and 2016 are used for almost every variable in the Macro and Cost modules and the variables of interest are simulated for the period 2017–2030. For some variables data for 2017 are used. In addition, a number of assumptions on the future realisation of variables that are assumed to be exogenous are made. This section describes the sources of the data and the key contextual assumptions.

3.1. Macro variables

For measures of GDP, population, and industrial production, data are provided by Oxford Economics. 12 All monetary values are deflated to 2010 prices. Supplementary Fig. 1 presents the assumed values for these variables up until 2013. Supplementary Fig. 2 provides a score for congestion and the number of rail passengers per capita, by region, using the assessment procedure outlined in Section 2.3. Supplementary Table 3 presents predictions of the future fuel price changes by region between 2017 and 2030 based on prices (before tax) of future crude oil price trends assuming that the tax rate in each region remains unchanged over time.

Fuel prices are taken from the IEA, adjusted where necessary for local taxes. For power prices, costs are broken down into their fuel and non-fuel components. For the fuel component, a CRU internal coal price forecast is used (built from the bottom up based on a long run marginal supply cost) (CRU Thermal Coal Market Outlook and Cost Services) combined with oil and gas price forecasts form the IEA, weighted according to the share of power generation for each region (again obtained from the IEA), and the estimated cost share (i.e. the proportion of fuel used in total power production costs for each generation technology (using internal assumptions, derived from an extensive literature on levelized power costs). Hydrogen prices are indexed to regional gas prices. The non-fuel share component is projected forward using the cost share assumption and the projected national inflation rate (IMF, Oxford Economics).

Electricity prices are based on the average household electricity price in each region, which is assumed to change over time at the same rate that US electricity prices change [57]. A uniform 20% mark-up is applied to account for the assumption that car charging will become a commercial service in the future. In terms of hydrogen fuel infrastructure for automotive use, this element is still in its commercial infancy, with production facilities and refuelling stations almost non-existent outside of a small number of networks in California, Japan, and Northern Europe. Hence, the forecast for the hydrogen price is for it to fall steadily throughout the period and assumed to approach gasoline’s equivalent hydrogen price by 2025 [58]. As this gap closes, the emphasis that consumers will place on engine efficiency will increase. Based on the analysis of the various channels that predict a decreasing hydrogen price (feedstock, production, transport and retail), a global compound annual growth rate (CAGR) of −5.1% is imposed for the period 2017–2030. A sensitivity analysis in Section 4.4.2 investigates how the results are influenced by the assumptions on economic growth and other key variables.

3.2. Vehicle-related variables

3.2.1. Vehicle choice

The historical data on vehicles sales and vehicle ownership rates by powertrain, and by region, are sourced from LMC Automative (LMCA). For modelling purposes one vehicle is chosen to be representative of each powertrain, for each region, based on current market share. The price, cost, and technical aspects of the chosen vehicles are considered to be representative. Supplementary Table 4 lists the make of vehicle chosen for each type and region. For example, for light-duty BEVs the Tesla 3 for North America is chosen, BAIC EU260 EVs for China, Volkswagen for both Western Europe and Rest of Europe, LADA Ellada for the Commonwealth of Independent States, the Nissan Leaf for Asia developed and Southeast Asia, Mahindra eVerito D6 for India and the BMW i3 for Brazil.

3.2.2. Vehicle prices

The price of individual vehicles are collected via primary and secondary research. For LDVs the manufacturer’s suggested retail prices (MSRP) is used and sourced from various consumer aggregate websites for each region. For HDVs information is gathered from individual retailers and dealerships in the different regions. 13 The price of BUSs was collected from the winning bids of government’s tenders in regions where there was sufficient government transparency, and from industry journals when this was not possible. 14

For ICEVs, the prices used in the model are based on historical series. For EVs no such data exists. In addition, the dynamic nature of the industry means that costs and prices are changing rapidly. Hence, the the price of EVs is benchmarked against ICEVs based on a comparison of different cost structures. A cost structure that includes direct costs (raw materials and manufacturing), indirect costs and net profit (dealer selling fee, marketing, transportation, labour, administration maintenance, depreciation and amortisation, R&D and warranty costs) is considered. It is also assumed that direct costs can be split into two components: the first that is specific to each powertrain; 15 and the second, that the residuals of direct cost, are assumed to be common across powertrains. It is also assumed that the common direct costs, indirect costs and net profit per vehicle made by the original equipment manufacturers (OEM) are the same for all powertrains for an identical scale of production.

Based on this cost structure, the key differences in the technical construction of different forms of EVs, their current respective costs shares, and specific learning rates for each technical construct are identified. To take productivity gains into account the residual cost is modelled such that parity with ICE vehicles is achieved at a specific time in the future that is dependent on current investment in new energy vehicles and the setting up of a supply chain in each region. This enables a forecast of a baseline scenario for vehicle prices to be made. Of the factors mentioned above, battery packs and fuel cells play an important role in the price forecasting for EVs as they account for around 30–50% of vehicle cost. The prices of battery packs have decreased by 20% over 5 years up to 2016 as a result of a substantial growth in scale, learning curves in manufacturing, improvement in battery performance, and less volatile material prices. While a continuing reduction in battery prices is forecast, it is anticipated that there will be lower decreasing rates, 3–4% per annum by 2020 and 2–3% per annum by 2030, as the cost reduction is likely to slow down and technological advancements tend to be more difficult and costly to achieve. Accordingly, large-format battery pack prices are forecast to fall to $120–140 per kWh by 2030.

3.2.3. Vehicle and battery lifespan

The TCO of any vehicle is dependent on assumptions regarding the average lifespan of a vehicle. A typical lifespan can vary considerably and depends on the type of vehicle, usage, regional differences (e.g. weather), income levels, and legislation, among other factors. The lifespan used in the model is based on the mode of the lifespan of vehicles calculated from data provided by auto industry associations and government agencies. The variable is assumed to be time-invariant, except for LDVs in China, where vehicle lifespan is assumed to increase from 8 to 9 years after 2020. In addition, batteries are assumed to have a shorter lifespan than the vehicles where they are initially located, meaning that each vehicle will require a battery replacement at least once during its lifetime (see Supplementary Table 5 for details on the assumed lifespan of both batteries and vehicles for each powertrain). Vehicle usage varies across countries and is captured by a variable that measures the annual miles travelled collated from the literature for each vehicle type and illustrated in Supplementary Table 6.

3.2.4. Vehicle fuel efficiency

Measures of the current fuel efficiency of vehicles is obtained from certification tests on the representative vehicles and OEM reported figures. Credible user data from fleet operators and city transport authorities collected by CRU have also been used to revise these efficiency statistics so it is possible to reflect real driving conditions (given that tests for certification and by OEMs are carried out under controlled conditions).

The fuel efficiency of conventional cars is largely driven by policy and legislation on carbon emissions. The Corporate Average Fuel Economy (CAFE) standards prescribed in the USA form the basis of the forecasts for fuel efficiency of petrol and diesel cars. 16 Other regions may also follow CAFE standards or introduce their own fuel efficiency standards normalised to US CAFE by the International Council on Clean Transportation. It is assumed that the current 30% markdown from CAFE standards to real on-road standards will not change over the time period used in this paper.

The efficiency for other regions is calculated using a similar methodology and uses the emission standards in each country as a guide for estimating fuel efficiency levels with efficiency adjusted to match on-road recorded efficiencies.

The forecasts for the efficiency of hybrid powertrains uses current mark-ups on the base conventional vehicle. For PHEVs, the efficiencies for the two driving modes are assumed to be the same as that of the corresponding pure powertrain, ICEVs and BEVs, respectively. The overall efficiency is determined by the distance driven in each mode. For LDV PHEVs, it is assumed that the vehicle is driven in electric mode for 70% of the distance travelled with the remaining 30% petrol. For bus PHEVs in China, it is assumed that 40% of the driving is in electric mode. These distance shares are based on the typical driving distance between consecutive charges and the electric range of the vehicle. A similar approach was taken for PFCEVs with the share of distance assumed to be 50% each for battery-electric and hydrogen modes in LDV PFCEVs. The efficiency forecast for BEVs is based on an understanding that the energy efficiency of this powertrain is currently higher than that of conventional or hydrogen fuel modes. As such, the efficiency of BEVs grows more slowly than that of its peers. FCEVs have a greater scope for improvement in the energy efficiency of its powertrain and therefore their efficiency levels grow faster than those of BEVs. Supplementary Table 7 summarises the assumptions on the CAGR of Average Fuel Efficiency between 2015 and 2030.

3.2.5. Vehicles maintenance

Part of the cost of vehicle ownership is the ongoing maintenance costs. In the model, maintenance costs for LDVs in each region are based on data compiled from the monthly or annual cost to owners using data from independent studies and that published by OEMs themselves. User reported figures are then used to validate the data. For HDVs and BUSs, the maintenance cost is normally reported in USD/km. Data was compiled from a large number of sources, including fleet operators, industry publications, government and policy reports, and academic papers. Once the maintenance cost per kilometre is established and how this changes with distance and age, it was scaled by the annual driving cost of the vehicle. Maintenance costs were found to be considerably higher for HDVs than for LDVs, which was not unexpected given the comparative sizes and uses of such vehicles. BUSs, however, were found to incur even greater maintenance costs which, although in part due the stringent standards implicit in the operation of a public service vehicle, is mainly the result of the additional strain placed on the brakes and engine from the frequent acceleration and deceleration between stops. Supplementary Table 8 provides the details that underpin the maintenance cost assumptions.

3.2.6. End-of-life values

A vehicle is assumed to retain some of its value at the end of its useful life because it can be recycled. For the purposes of this model, what is of interest is the cash value that is returned to the owner who is scrapping or disposing of their vehicle. For ICE, weight and age are likely to be the most important determinants of scrap value. Based on the scrap values quoted by authorised scrap facilities using a typical life cycle of 12 years and a 5% discount rate, it is found that the net present value (NPV) of the residual value of a LDV is negligible and can be assumed to be zero. 17 For ICE-diesel and HEV buses, the end-of-life value is set to be between 10–20% depending on the region. Also included is a resale value since the first users in the bus industry tend to sell their buses after around 10–12 years of service after which they continue to be used. The different end-of-life values across regions and time are illustrated in Supplementary Table 9.

For EVs, although there is the possibility of recycling the vehicle and their batteries at their end of life (EOL), these developments are at a nascent stage and hence are not included in the base case. In addition, it is unlikely that the spread in the costs of recycling and value of the salvaged material from BEVs will increase to a level where it will result in realisations any greater than from ICE. For BEV buses, the EOL value has been set to zero and hence it is forecast that one possible battery replacement will be needed during the lifetime of a bus. However, the cost of this replacement is calculated to be equal to the value of the resale realisation for the first user. Therefore, the EOL value to the user is set to zero for all EVs. As FCEV scrappage and salvage values have been given little consideration, any appreciable realisation for the user of an FCEV at the end of the vehicle’s life is not considered. In future work, it is hoped that it will be possible to include a recycling (R) module so that it will then be possible to estimate how recycling impacts the results that are currently found for critical metal demand. Although it will reduce demand it would be useful to know by how much as this would then enable investors to gauge the potential profit from setting up a recycling plant in a given location.

3.3. Policy related variables

The price of a vehicle and operating costs can also be affected by government legislation especially with regard to the imposition of taxes on fuel and the granting of subsidies to reduce the purchase price of an EV for individual consumers.

3.3.1. Subsidies

Many countries offer subsidies for the purchase of EVs, in part, to enable a country to meet policy objectives, that includes the desire to expand the market share of EVs. The projections are based on the assumption that subsidies currently available in the leading countries of each region will eventually taper off as EVs become price competitive with more traditional powertrains. Two different methods have been used to forecast subsidy values: in regions where the government has fixed a deadline for subsidies to end, such as China, these deadlines have been kept; elsewhere, and in the absence of an objectively quantifiable way to predict at what point subsidies would run out, they have been stopped when the subsidised powertrain’s capital cost reaches parity with its petrol equivalent. In all regions except China, blanket subsidies for trucks and buses are not commonplace, with governments preferring to award grants to individual operators on a case-by-case basis. Because of the variable and ad-hoc nature of these grants they are not included as subsidies in the analysis.

3.3.2. Regulatory standards and compliance costs

It is common for governments to mandate vehicle producers to meet certain performance standards on tailpipe emissions and to meet fuel efficiency standards. When manufacturers implement government policy it tends to mean an increase in costs associated with the development and implementation of new technologies. Details on existing and future standards are shown in Supplementary Fig. 3 which shows that, with the exception of the US and Japan, the majority of the regions in the model are using some form of European standards. China and India, for example, are using historical (less stringent) European standards. These regulations are expected to become more stringent over time with the associated implications for vehicle costs. Compliance costs for standards that are currently in place or have been announced for enforcement in regions are modelled based on the relative increase in stringency of new regulations over older regulations (Supplementary Table 10).

3.3.3. Taxes and charges

In addition to subsidies, also included is a range of taxes and charges such as VAT/sales tax, excise duties, and registration fees. It should be noted that tax rates differ significantly across regions. However, the interest of this paper is limited to variation in tax rates across powertrains within a region and how this impacts the relative price of different powertrains. For example, India levies a 12% tax on BEVs but a 28% tax on diesel and petrol cars. In addition, annual charges for owning a vehicle such as road tax or annual circulation tax (ACT) are also included. Details on the different taxes and charges can be found in Supplementary Table 11.

3.4. Metal content variables

In order to estimate the ‘Technology’ module in the CoMIT framework it is necessary to make a number of assumptions on the metal content in vehicles. Two separate components are modelled: the metal in batteries; and the metal in other parts of the vehicles.

3.4.1. The metal requirement for vehicle batteries

The first stage is to match key battery types to powertrains and then model the metal demand associated with each of these batteries. Three main battery types are considered: Lead-acid; Nickel Metal Hydride (NiMH); and Lithium-ion batteries (LIBs). Lead-acid remains the most commonly used in (starting-lighting-ignition) batteries in ICEVs in the form of a 12 V lead acid cell. NiMH is the principle technology in HEVs and PHEVs, where it’s small size and higher energy density compared with non-LIB cell chemistries gives it a distinct niche. LIBs are the most popular form of BEVs battery thanks to its high life-cycle and high energy density. Depending on the cathode chemistries, LIBs can be divided into four categorises listed in order of increasing energy density: Lithium Iron Phosphate (LFP); Lithium Manganese Oxide (LMO); Lithium Nickel Manganese Cobalt Oxide (NMC); and Lithium Nickel Cobalt Aluminium Oxide (NCA) (see Andwari, Pesiridis, Rajoo, Martinez-Botas and Esfahanian [59] for more details).

A vehicle’s battery metal intensity (Ni, Co, Li, Mn, Al, steel) is modelled by summing: (1) The nickel, cobalt and manganese content in the active cathode material; (2) The lithium content in the active cathode material, electrolyte and anode material (for LFP/LTO type batteries); (3) The aluminium content in the active cathode material (for NCA), and in current collector (for all battery types); and (4) The copper content in current collector (for all battery types); (5) The steel content in the battery casing. For these calculations, the BatPAC model, developed by Argonne National Laboratory [60], is used in addition to a range of other academic sources on material intensity and information on developments in battery densities from primary research. Supplementary Table 12 provides the details, including the assumptions on the future metal intensity of batteries. The average size of the battery packs by vehicle type and powertrain is estimated for each region using the representative vehicles referred to in Section 3.2.1. The product of metal intensity and battery size enables the current metal content of batteries to be estimated.

To forecast cathode material volumes, the following assumptions are made based on work by a number of specialist research companies, in particular Avicenne research and CRU:

-

•

Older chemistry’s, such as LMO and NMC 1:1:1 are gradually being phased out from vehicle manufacturing;

-

•

LFP chemistry, currently in use in EVs in China and, to some extent, in India, is expected to be phased out in light vehicles, but will continue to be used in buses;

-

•

NCA, developed by Panasonic and used in Tesla BEVs and in Toyota Prius PHEVs, is expected to prevail in vehicles sold in US and to take a substantial share in vehicles sold in Europe. However, other EV producers are not expected to adopt this technology, leading to a gradual decline in its market share over time.

-

•

Within the NMC chemistry, the trend towards eliminating cobalt and increasing the nickel content is expected to continue and result in gradual change in vehicle producer’s choices, moving away from NMC 1:1:1: to NMC 5:3:2, then to NMC 6:2:2 and to NMC 8:1:1.

-

•

This trend is expected to be slow and gradual (with China the most rapid adopter). The uptake of NMC 8:1:1 chemistry, which is currently in development and trial production and is not yet widely used in EVs, is expected in the mid 2020s, assuming all outstanding issues with its technology (stability, overheating, cycling behaviour) are resolved.

3.4.2. The metal requirement for vehicles excluding the battery

To estimate the steel and aluminium content of each vehicle, a number of assumptions are made and are listed in Supplementary Table 13. Light-weighting is taken into account, motivated by increasingly stringent emissions legislation, and is seen as a key driver when forecasting a gradual reduction in a vehicle’s steel content and an increase in the aluminium content. The only exception is India, where the size, weight and steel content of cars is expected to rise as manufacturers increasingly attempt to emulate the construction methods and style of Western cars. Aluminium substitution is also still occurring but tends to be offset by an increase in the steel content. For ICE light vehicles and heavy vehicles, there is an assumed annual average increase in aluminium content of approximately 2%. For buses, an average annual increase of 1% is assumed for North America, Europe and other developed regions and 3% for China and the rest of Asia. In the light vehicle segment, most BEV models currently in production are more aluminium intensive than the comparable ICEVs due to a more urgent desire for a lower weight to achieve a better range. 18 Some manufacturers, however, have recently begun to revert back to the use of steel. As a result, the powertrain weight reduction seen in some second-generation mass-market EVs have been nullified by the weight increase in the body and other parts [61]. 19 Considering the net effect of these mixed trends, an increasing aluminium intensity of BEVs, HEVs and PHEVs, but at a slower pace compared to ICE powertrains, is assumed.

The nickel, manganese, and chrome content in vehicle parts other than the battery, are derived from the assumed stainless-steel content. In fact, stainless steel is widely used in car exhaust systems and for parts such as hose clamps and seat-belt springs. For light vehicles, it is assumed that the stainless steel content is approximately 1%-2%, depending on the region, which is equivalent to 15–20 kg. It is assumed that virtually all of this steel is 304s grade with 18%, 9% and 2% of Chrome, Nickel and Manganese content, respectively. For HDVs and BUS the estimates are scaled up, assuming around 30 kg of stainless steel to be used in heavy vehicles and around 40 kg in buses. An average annual increase in stainless steel intensity of 2% is forecast for all vehicle types, assuming an increasing application of stainless steel in the chassis, suspension, body, fuel tank and catalytic converters.

EVs are known to be more copper intensive compared to conventional ICEVs. Approximately 40–80 kg of copper per vehicle is required in the windings of the electric motors and additional cabling to move power from the battery to the motors. The key driver behind the increasing copper content in EVs is increasing the average battery size in light vehicles and buses. Supplementary Table 13 presents and the assumptions underpinning the copper content estimates.

3.4.3. EV infrastructure capacity variables

Charging poles are a critical part of the infrastructure needed for a region to have a successful EV sector [62]. In the model, chargers are categorised as fast or slow. Slow chargers use alternating current and usually have a power capacity below 3.7 kW and take 6–12 h to fully charge a typical BEV. Although mostly home chargers, some are publicly owned with restricted accessibility (e.g. in shared apartment blocks, shared parks, company carparks, hotels, shopping centres, etc.). Whilst these semi-public chargers tend to have higher power capacity, they are not fundamentally different from home chargers and are therefore categorised as slow chargers. It is estimated that a slow charger uses, on average, 1 kg of copper.

Fast chargers, on the other hand, are all publicly owned and use direct current rather than alternating current, which gives them a higher power capacity (22–200 kW) and a much faster charging speed (15–45 min). However, as the grid uses alternating current, transformers are needed for fast chargers. It is estimated that four fast chargers, when activated at the same time, consume 1 MW of electricity. The field research used in this paper for China reveals that fast charging stations typically allocate one 1250 kVA transformer for every four fast chargers. It is therefore estimated that a fast charger uses 32 kg of copper on average, including copper used in the transformers.

As people tend to only buy a charge-needed EV when they have access to a charger, it is assumed that there is a 1–1 relationship between charging poles and the fleet of charge-needed EVs. Most charging poles will be slow chargers while fast chargers will be scarcer as their reduced charging times means a smaller number is needed to cater to a larger fleet. In addition, fast charging is more expensive as it tends to be provided as a service and so will only be used when necessary. However, in densely populated areas with limited private parking in for example, China, or Japan, it is expected that there will be a greater penetration of fast chargers, necessitated by the lower roll out of home or semi-publicly owned slow chargers.

For hydrogen stations, the average station fuelling capacity st calculated from current data. Then, based on the fact that petrol stations are on average, refuelled once per day, it is assumed the same holds for hydrogen stations, and therefore estimate the storage capacity of a hydrogen station to be 1/2 of the station fuelling capacity. Using the principle of cost minimisation, it is assumed that hydrogen stations will compress hydrogen and store it in steel tank racks at 200 Bar (some may use liquid hydrogen). A compressor and a heat exchanger (cooler) are needed to raise the pressure to the level of the tank in a FCEV (350 – 700 bar). The gravimetric density of a typical system described above is roughly 2%, meaning that a 100 kg storage system could store approximately 2 kg of hydrogen.

4. Results and discussion

4.1. Fleet size and annual sales

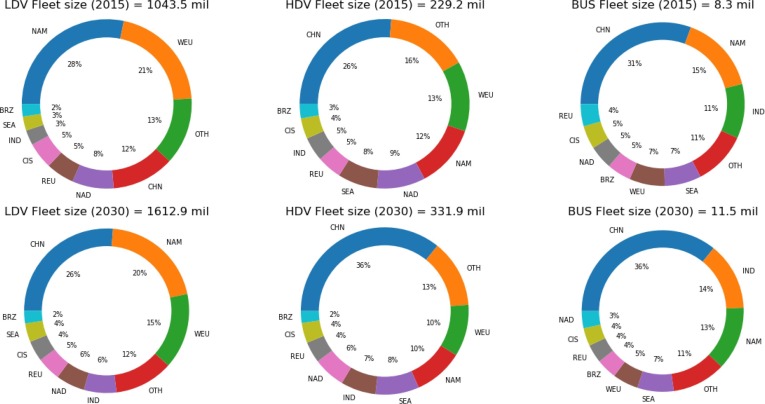

Fig. 4 illustrates the global projections that are used in the paper for the stock of vehicles that will be in existence in 2030 compared with 2015 and the spatial distribution. As the world is expected to become more prosperous and populous, the sizes of all three fleets including LDV, HDV and BUS, are projected to increase by approximately a half over 15 years, reaching 1,612.9, 331.9 and 11.5 million, respectively. However, it is expected that there will be a substantial change in regional shares with a remarkable rise in Asian countries. NAM and WEU are still projected to be important markets, even though their fleet sizes are predicted to decrease. CHN is expected to double its share of LDVs and becomes the largest market, while maintaining its leading position in terms of both HDV and BUS ownership. IND is also expected to double its share of the global LDV fleet, from 3% in 2015 to 6% in 2030.

Fig. 4.

Global fleet size (million): 2015 (historical) vs 2030 (projected). Sources: Authors calculated from LMCA data for 2015 and projected for 2030 by the CoMIT model.

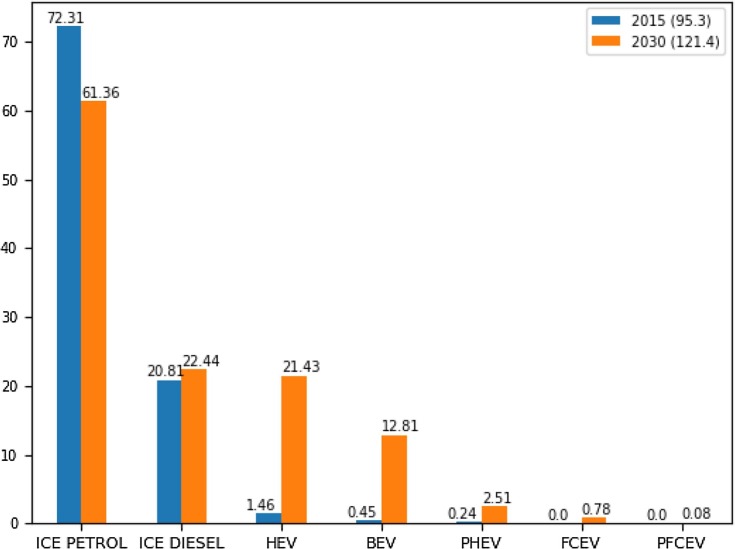

Assuming that vehicle demand is supplied by OEMs, it is forecast that vehicle sales will increase from 95.3 million in 2015 to 121.4 million in 2030. The ‘Cost’ module enables a detailed decomposition by powertrains to be provided. This decomposition is demonstrated in Fig. 5 . ICEVs using petrol are expected to decrease from 72.31 to 61.36 million but are still predicted to dominate the market. In contrast, ICEVs using diesel are predicted to increase from 20.81 to 22.44 million, mainly because of rising demand for HDVs, while demand for these powertrains slightly decreases in the LDV and BUS categories. In terms of EVs, HEVs increase dramatically from 1.46 million to a level comparable to ICE DIESEL. Likewise, PHEV demand increases tenfold to 2.51 million and BEVs demand increases by 28 times to 2.51 million. Despite remarkable growth, vehicles using fuel cells remain a relatively modest segment when compared to other powertrains.

Fig. 5.

Sales by powertrains (million). Sources: Authors calculated from LMCA data for 2015 and projected for 2030 by the CoMIT model.

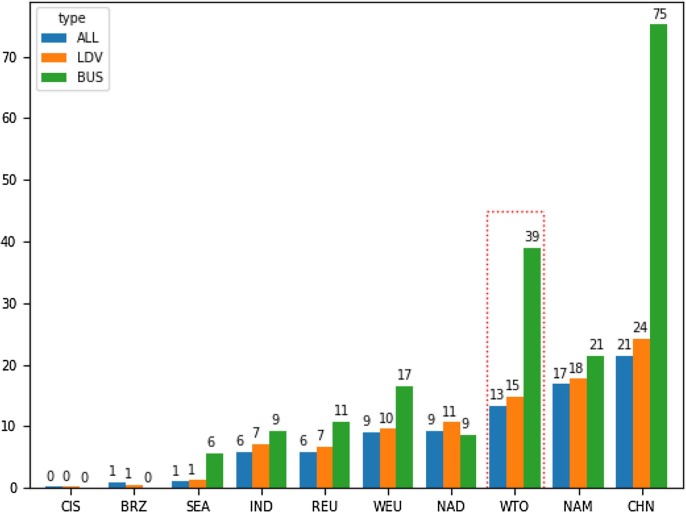

Fig. 6 presents an assessment of the predicted electrification rates in 2030 by region. Regions are sorted by the increasing share of EVs in annual sales of all vehicles. The global average is 13%. China and North America are projected to be the only two regions that surpass the global average, at 21% and 17%, respectively. These electrification rates remain some distance away from the ambitious targets advocated by EV30@30 campaign, which has the goal of a 30% of market share for EVs in 2030 [63]. In general, the electrification rate of BUS sales is expected to be much higher than that of LDVs and peak at 75% in CHN. It should be noted that HDVs are excluded for Fig. 6 as the share of EVs in their sales in 2030 is still negligible and remains constrained by a lack of feasible and economical battery technology for long-distance and heavy-load travel.

Fig. 6.

EV share as % of 2030 sales. Sources: Authors calculated from LMCA data for 2015 and projected for 2030 by the CoMIT model.

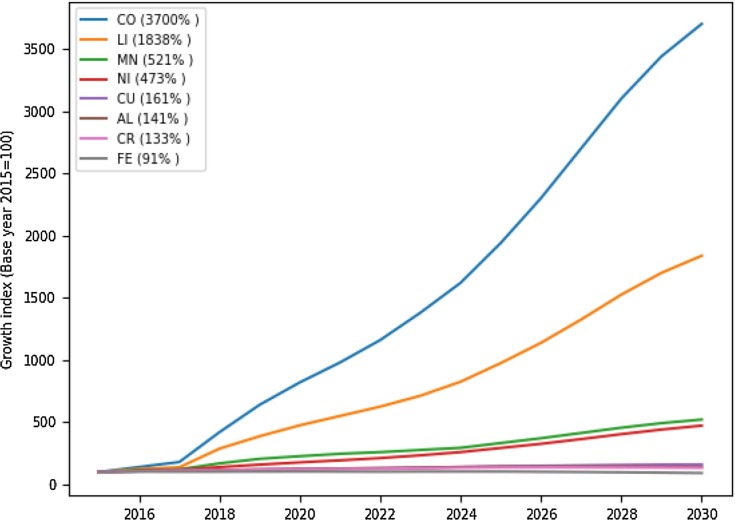

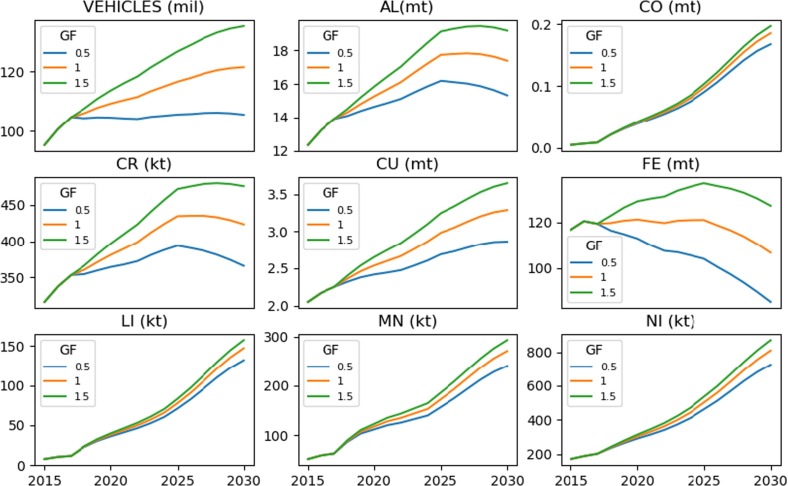

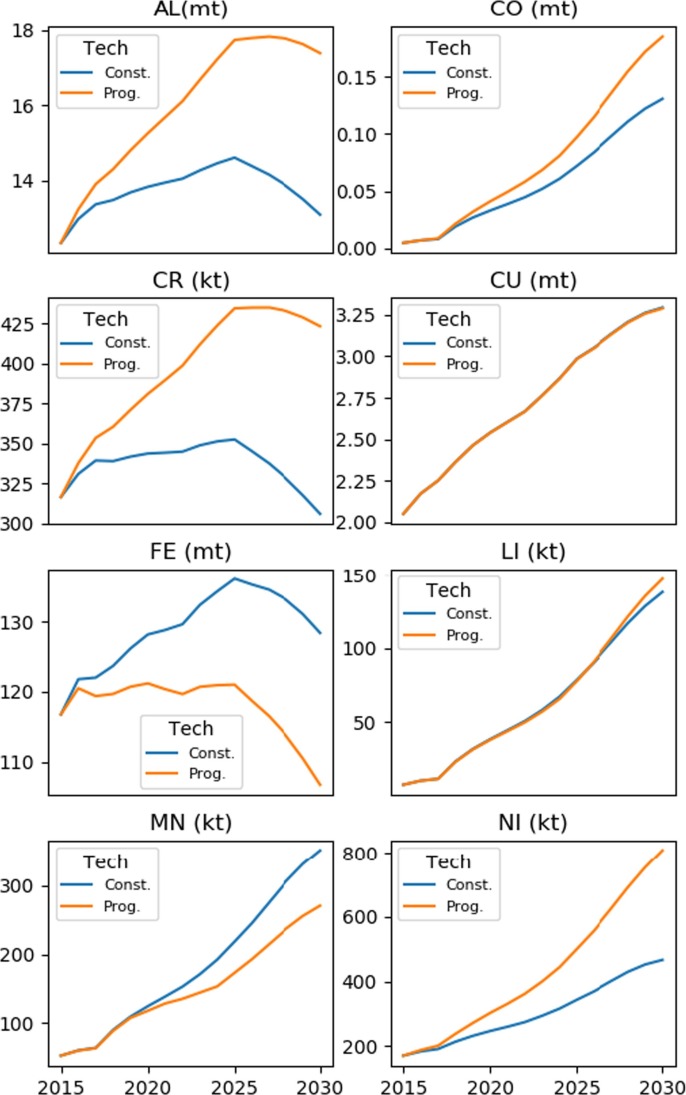

Table 1 and Fig. 7 present the results of the Technology module and show how metal demand responds to changes in annual vehicle sales. To meet the demand for metal to match the predicted vehicle sales in 2030, the projection is that 106.7 million tonnes (mt) steel, 17.4 mt aluminium, and 3.3 mt copper will be required. Over 15 years, while vehicles sales are predicted to increase by 27.4%, demand for steel is predicted to fall by 9% and demand for aluminium and chrome to increase by 41% and 34%, respectively, consistent with the material substitution and reduced demand because of lightweighting. Demand for the metals used intensively in EVs tends to grow faster but at different speeds. Demand for copper increases by more than 50% and demand for manganese and nickel increases fivefold. More importantly, demand for lithium is projected to dramatically increase by up to 18 times and demand for cobalt grows from 5 to 185 thousand tonnes (kt) (or a 37-fold increase). Reassuringly, estimates of demand of 147 kt for lithium and 185 kt for cobalt, derived from vehicle sales in 2030, lie between the two estimates from [7], namely the New Policies Scenario and the EV30@30 Scenario. 20 This provides a strong degree of confidence in the modelling framework presented in this paper, with the former model projecting an annual demand for 91 kt lithium and 101 kt for cobalt while the latter projects a demand of 263 kt of lithium and 291 kt of cobalt.

Table 1.

Metal demand for vehicles (kt).

| Region | AL | CO | CR | CU | FE | LI | MN | NI |

|---|---|---|---|---|---|---|---|---|

| Year = 2015 (estimated) |

||||||||

| BRZ | 238 | 0 | 2 | 42 | 1,704 | 0 | 1 | 3 |

| CHN | 3,656 | 2 | 86 | 650 | 37,002 | 6 | 21 | 48 |

| CIS | 257 | 0 | 7 | 38 | 2,003 | 0 | 1 | 3 |

| IND | 382 | 0 | 6 | 78 | 4,535 | 0 | 1 | 2 |

| NAD | 941 | 0 | 29 | 161 | 9,762 | 0 | 3 | 15 |

| NAM | 2,928 | 1 | 77 | 434 | 24,048 | 1 | 11 | 41 |

| OTH | 1,063 | 0 | 28 | 184 | 10,737 | 0 | 3 | 13 |

| REU | 297 | 0 | 9 | 49 | 3,628 | 0 | 1 | 4 |

| SEA | 360 | 0 | 12 | 64 | 5,281 | 0 | 1 | 6 |

| WEU | 2,223 | 1 | 61 | 349 | 18,064 | 1 | 8 | 34 |

| WTO | 12,345 | 5 | 317 | 2,049 | 116,765 | 8 | 52 | 171 |

| Year = 2030 (projected) |

||||||||

| BRZ | 474 | 0 | 8 | 64 | 1,934 | 0 | 1 | 6 |

| CHN | 5,142 | 125 | 108 | 1426 | 39,085 | 101 | 172 | 452 |

| CIS | 597 | 0 | 17 | 70 | 3,205 | 0 | 2 | 8 |

| IND | 1,303 | 7 | 32 | 269 | 12,796 | 6 | 12 | 36 |

| NAD | 1,228 | 5 | 37 | 196 | 7,687 | 4 | 9 | 38 |

| NAM | 3,193 | 23 | 75 | 489 | 13,810 | 17 | 31 | 110 |

| OTH | 1,287 | 0 | 34 | 161 | 6,636 | 0 | 4 | 16 |

| REU | 533 | 3 | 14 | 78 | 2,971 | 2 | 5 | 17 |

| SEA | 828 | 0 | 26 | 110 | 6,262 | 0 | 3 | 14 |

| WEU | 2,799 | 22 | 72 | 428 | 12,343 | 17 | 32 | 109 |

| WTO | 17,385 | 185 | 423 | 3289 | 106,731 | 147 | 271 | 808 |

| Reference data [64] |

||||||||

| Production (2017) | 60,000 | 110 | 31,000 | 19,700 | 1,700,000 | 43 | 16,000 | 2100 |

| Reserve | – | 7100 | 510,000 | 790,000 | – | 16,000 | 680,000 | 74,000 |

| WTO demand/WTO production (2017) |

||||||||

| 2015 | 20.6% | 4.5% | 1.0% | 10.4% | 6.9% | 18.6% | 0.3% | 8.1% |

| 2030 | 29.0% | 168.2% | 1.4% | 16.7% | 6.3% | 341.9% | 1.7% | 38.5% |

| WTO reserve/WTO demand (years) |

||||||||

| 2015 | – | 1,420 | 1,609 | 386 | – | 2,000 | 13,077 | 433 |

| 2030 | – | 38 | 1,206 | 240 | – | 109 | 2,509 | 92 |

Note: See Supplement Table 1 and Section 2.1 for details of notations.

Fig. 7.

The growth of metal demand for vehicles. Sources: Authors’ calculation. Figures in brackets next to legend indicate projected growth indices of metal demands in 2030 in comparison with base year 2015 (set at 100).

4.2. Metal demand for vehicles and infrastructure

To understand the implications of this dramatic increase in metal demand for vehicles, the estimates are compared with projections from global production in 2017 and global reserves, as shown in the lower panels of Table 1 using the latest publicly available data [64]. Changes in the vehicle market are likely to completely change the lithium and cobalt markets. Vehicle sales in 2030 are projected to create a demand equivalent to 3.4 times the amount of lithium and 1.7 times the amount of cobalt that was produced in 2017 for all purposes.