Abstract

In the wake of recent pandemic of COVID-19, we explore its unprecedented impact on the cryptocurrencies' market. Specifically, we check how the changing intensity of the COVID-19 represented by the daily addition in new infections worldwide affects the daily returns of the top 10 cryptocurrencies according to the market capitalization. The results from Quantile-on-Quantile Regression (QQR) approach reveal that the changing intensity levels of the COVID-19 affect the Bearish and the Bullish market scenarios of cryptocurrencies differently (asymmetric impact). Additionally, there are differences between these currencies in their responses to the changing levels of this pandemic's intensity. Most of the currencies absorbed the small shocks of COVID-19 by registering positive gains but failed to resist against the huge changes except Bitcoin, ADA, CRO, and up to some extent Ethereum. Our results reveal new and asymmetric dynamics of this emerging asset class against an extremely stressful and unpredictable event (COVID-19). Moreover, these results are robust to the use of alternative proxy (COVID-19 deaths) for pandemic intensity. Our findings help to improve investors and policymakers' understanding of the cryptocurrencies' market dynamics, especially in the times of extremely stressful and unseen events.

Keywords: COVID-19, Bitcoin, Top 10 Cryptocurrencies, World, Quantile-on-Quantile Regression

Highlights

-

•

We study the impact of COVID-19 outbreak on the top 10 cryptocurrencies' returns.

-

•

The QQR approach reveals an asymmetric impact of pandemic intensity on othe Bearish and Bullish scenarios in cryptocurrencies.

-

•

Majority of the cryptocurrencies performed better against small shocks of COVID-19.

-

•

Bitcoin, ADA, CRO and Ethereum performed better against the negative effects of the highest intensity of COVID-19.

-

•

Our results are robust to the use of alternative proxy for the pandemic.

1. Introduction

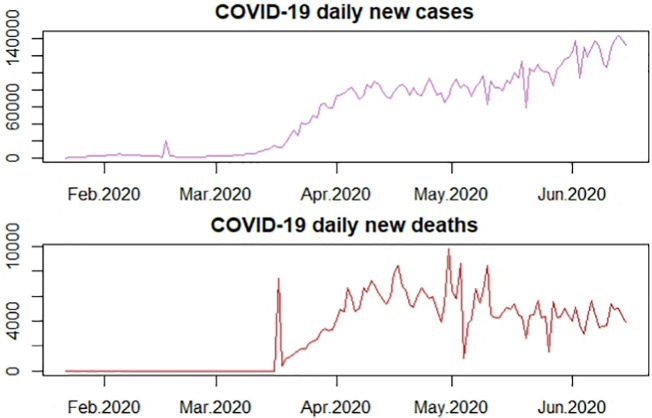

Financial and commodity markets around the world have tumbled due to the global outbreak of COVID-19, also known as SARS-COV-2. The total number of confirmed cases and deaths has reached a staggering amount of 8,546,919 and 456,726 (2010-06-20, 1815 h Beijing time), respectively. The Dow Jones and the S&P 500 had suffered as much as a 30% decline in values, and recorded the worst single day point drop in the history during March 2020. Moreover, the markets in Asia, Europe, UK, and Australia also recorded similar declines (Zhang, Hu, & Ji, 2020). Due to the unprecedented low demand and unavailability of further storage capacity, oil crossed all the lower limits and recorded a negative price for May 2020 futures, which couldn't have been imagined a few weeks ago (Sharif, Aloui, & Yarovaya, 2020). Unemployment is at a historic high in most of the world economies, and creating multiple social and psychological issues (Kawohl & Nordt, 2020). Such turmoil is once in a while kind of thing to be observed in the modern history. Fig. 1 shows the daily addition in new COVID-19 infections and deaths worldwide till June 16, 2020.

Fig. 1.

Daily addition in COVID-19 cases and deaths worldwide (till June 16, 2020) Data source: World Health Organization.

The search for safe assets during such an uncertain and disastrous market situation is a natural desire for most of the investors. One of the many forms of such safe assets may include digital cryptocurrencies as proposed by several studies (Mnif, Jarboui, & Mouakhar, 2020; Shahzad, Bouri, Roubaud, Kristoufek, & Lucey, 2019; Urquhart & Zhang, 2019). Where all traditional financial assets seemed to lose value freely, a lot of investors were watching closely the behavior of these digital cryptocurrencies, especially the Bitcoin during this stressful period. Cryptocurrencies which started merely as a peer-to-peer payment system, have emerged as an important asset class recently (Chaim & Laurini, 2019; Corbet, Lucey, Urquhart, & Yarovaya, 2019). These assets have gained a lot of investors' attention recently due to the huge returns provided since theirinception merely a decade ago. The unprecedented gains provided by these assets, and a huge increase in their demand has attracted the attention of the scholars also. The number of studies trying to model this market's pricing mechanism, volatility, and bubbles is ever increasing in order to improve the understanding related to the crypto-assets (Chu, Chan, Nadarajah, & Osterrieder, 2017; Fry & Cheah, 2016; Shen, Urquhart, & Wang, 2019). As Bitcoin and other cryptocurrencies are emerging as an important asset class generally, and as a hedging and diversification instrument specifically, it is important to know that how this asset class behaves in the times of extreme and varying stress, and how much is it useful for hedging against the traditional equity markets. The recent pandemic of COVID-19 provides us an opportunity to examine and evaluate the behavior of cryptocurrencies in extremely stressful periods.

The paper currency is being considered as a means of spreading contagious viruses due to changing hands frequently in a pandemic situation like we are facing recently. The need for a contactless payment system and replacement of the paper money is never felt more before now. However, the lack of regulatory control and a possible major digital hack are only a few among the many concerns associated with the wide-spread usage of such forms of digital payments (Corbet et al., 2019, Corbet, Cumming, et al., 2020a). Pertaining to the high complexity associated with the operational mechanism of this market, it is difficult to assess the market efficiency with confidence. A recent study points towards a possible management of the Bitcoin-Tether market from a few very highly influential nodes in the trading system/network. Consistent and predictable patterns of trading in the Bitcoin and Tether issuance are identified by this research published in the most prestigious journal of finance (Griffin & Shams, 2020). Yet another concern is its ability to cope with an unseen and uncertain situation, like a rapid decline in trust or market failures that may lead to a complete collapse of the prices in the absence of a centralized regulatory system (Fry, 2018). Table 1 shows the top 10 cryptocurrencies worldwide according to the market capitalization.

Table 1.

Top 10 Cryptocurrencies by Market Capitalization (16 June 2020).

| Rank | Name | Symbol | Market Cap ($) | Price ($) | Volume (24) | Circulating Supply | Change (24 hrs, %) |

|---|---|---|---|---|---|---|---|

| 1 | Bitcoin |

BTC BTC |

174,678,220,468 | 9490.18 | 23,670,504,078 | 18,406,206 | 3.88 |

| 2 | Ethereum |

ETH ETH |

25,923,546,607 | 232.77 | 8,757,682,506 | 111,370,353 | 3.40 |

| 3 | Tether |

USDT USDT |

9,205,723,881 | 1.00 | 27,675,541,936 | 9,187,991,663 | 0.01 |

| 4 | XRP |

XRP XRP |

8,469,737,599 | 0.191373 | 1,301,431,858 | 44,257,803,618 | 2.99 |

| 5 | Bitcoin Cash |

BCH BCH |

4,377,211,291 | 237.42 | 1,576,944,850 | 18,436,319 | 3.53 |

| 6 | Bitcoin SV |

BSV BSV |

3,212,361,072 | 174.26 | 1,081,756,483 | 18,434,796 | 1.39 |

| 7 | Litecoin |

LTC LTC |

2,834,957,182 | 43.64 | 1,950,001,910 | 64,962,438 | 2.08 |

| 8 | Binance Coin |

BNB BNB |

2,544,788,598 | 16.36 | 183,657,473 | 155,536,713 | 2.82 |

| 9 | EOS |

EOS EOS |

2,372,648,001 | 2.54 | 1,600,634,925 | 933,531,842 | 2.30 |

| 10 | Cardano |

ADA ADA |

2,044,845,239 | 0.078869 | 280,949,028 | 25,927,070,538 | 9.67 |

| 11 | Tezos |

XTZ XTZ |

1,942,917,076 | 2.65 | 97,717,853 | 733,138,468 | 5.35 |

Source: http://coinmarketcap.com/

A lot of people used to think of Bitcoin as a hedge against the Bearish market scenarios (Dyhrberg, 2016). It proved to be so in some cases but not this time (Conlon et al., 2020; Conlon & McGee, 2020; Ji et al., 2020; Maniff, Minhas, Rodziewicz, & Ruiz, 2020). During the early stages of the COVID-19 spread, Bitcoin seem to have performed like a hedge but soon after that, it fell more in value as compared to the other assets.1

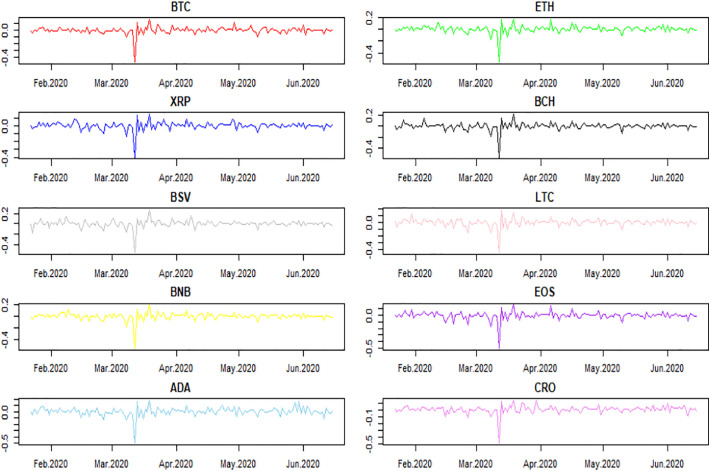

According to some recent studies, the Bitcoin's association with the traditional equity markets is not symmetric (Gajardo et al., 2018). Additionally, there are differences in the correlations exhibited by the intra-market characteristics also in case of different cryptocurrencies (Aste, 2019; Czapliński & Nazmutdinova, 2019). So, it can reasonably be inferred that the cryptocurrency market may exhibit a nonlinear and asymmetric association with the COVID-19 outbreak too. While several recent studies have discussed the impact of COVID-19 on cryptocurrency markets worldwide (Conlon et al., 2020; Corbet, Hou, et al., 2020c; Lahmiri & Bekiros, 2020), most of these authors ignored the possibility of an asymmetric nature of such an association, as revealed in earlier studies related to the cryptocurrencies (Baur & Dimpfl, 2018). Hence, it is very much possible that the small and the large changes in the COVID-19 intensity (infections and deaths) may affect the returns of the digital cryptocurrencies differently, at various quantiles of its returns. Additionally, most of these studies focus on Bitcoin only, ignoring the dynamics of other cryptocurrencies which form a considerable portion of the overall market now. So, we attempt to fill this research gap by examining the asymmetric nexus between COVID-19 outbreak and the cryptocurrencies' returns. For this purpose, we investigate how the daily addition in confirmed cases of COVID-19 worldwide (pandemic intensity) affects the daily returns in the cryptocurrency market, specifically the top ten currencies according to market capitalization, using the QQR approach. Additionally, we have employed an alternative proxy also for the pandemic intensity (Daily number of new deaths) to increase the robustness of our results. In this way, we plan to uncover not only the asymmetric impact of various quantiles of COVID-19 on cryptocurrencies' returns but also consider the variation in this influence over the Bearish (Prior low level returns) and the Bullish (Prior high level returns) market scenarios of these assets. Fig. 2 shows the time trend of daily returns of the top 10 cryptocurrencies from January 1, 2020 to June 15, 2020. A steep decline in the values of all currencies is visible during March, and then the varying speed of recoveries.

Fig. 2.

Time trend of Cryptocurrencies daily returns (January 1, 2020 to June 15, 2020) Source: www.coinmarketcap.com

The recent decision of the Peoples' Bank of China to test-launch its digital RMB in three cities at a limited level also adds to the significance of our study.2 This step of the Chinese government is an indication that the future may belong to the cryptocurrencies, and that the paper money may be replaced gradually by the digital currency. The seriousness of this policy can be judged from the inclusion of more cities recently to this pilot program.3 Although the Chinese digital currency will be centrally-managed as compared to the decentralized system of today's cryptocurrencies, still both of these are the kinds of digital currencies and expected to possess certain similar features. In the wake of growing use and importance of the digital currencies, it is imperative that the literature on this market be enriched to enhance the understanding of its dynamics during the varying/volatile market conditions, especially the extreme events. Hence, any study related to the behavior of digital cryptocurrencies, especially during a crisis like a pandemic, should be of great value and significance to the policymakers, investors, and regulators alike. Our study contributes to the existing literature on the association between COVID-19 and cryptocurrencies in three ways. Firstly, we identify how the major cryptocurrencies' returns respond to the changing severity of the pandemic overall. Secondly, we check for any differences in the pattern of this association following small and large changes in the severity of the pandemic given low, middle, and high levels of prior returns of cryptocurrencies (asymmetric nature of the relationship). Finally, we identify the differences in responses of the top cryptocurrencies to the pandemic intensity.

In this section, we have presented a background and overview of our topic, and the next section consists of the theoretical development. The third section defines data and econometric methodology used in this study. The fourth section presents results and discussions whereas the last section concludes our paper.

2. Literature and theory

The recent pandemic of COVID-19 is a form of an extreme stress test for the global markets. As this pandemic has caused havoc in the equity and commodity markets around the world through negative returns, increased uncertainty, and higher volatility, cryptocurrency markets are also affected as a result of this contagion. It is hard to find an example of similar financial markets' response in the modern history (Ashraf, 2020; Baker et al., 2020; Zhang et al., 2020). Periods of extreme financial stress can cause spillover effects in the cryptocurrency markets (Ji, Bouri, Lau, & Roubaud, 2019). A recent study suggests that the direction of contagion in case of financial disasters is from traditional to crypto-markets, and investors avoid crypto-assets in the times of extreme stress (Matkovskyy & Jalan, 2019). Stress in the global financial markets can cause significant changes in the upper and lower distributions of the returns of cryptocurrencies such as Bitcoin, exhibited by the copula-based quantile models (Bouri, Gupta, Lau, et al., 2018c). A study on 973 types of cryptocurrencies and 30 different indices finds that the safe-haven feature of the cryptocurrencies is market and region specific (Performs better as a safe haven in developed markets), and its hedging capacity is very limited (Wang, Zhang, Li, & Shen, 2019). During the early days of pandemic, Bitcoin showed a high correlation with the equity markets and dropped in value in tandem with the other financial markets due to the lack of demand for risky assets in a highly uncertain situation.4 Additionally, cryptocurrencies are found to overreact against the negative news more profoundly when compared with the traditional equities' behavior (Borgards & Czudaj, 2020).

On the other hands, a number of studies find that the behavior of cryptocurrencies is different as compared with the traditional assets including equities, commodities, and currencies, and investors' enthusiasm driven by the extreme news and events (both positive and negative) causes an increase in the crypto-markets' returns (Liu & Tsyvinski, 2018; Rognone, Hyde, & Zhang, 2020). In the wake of conflicting evidence on the behavior of cryptocurrencies, it is interesting to examine how these assets perform during the recent pandemic which is an extremely rare event with unprecedented characteristics.

Some researchers have attempted to document the impact of this outbreak on the Bitcoin returns and found that it performed poorly during this situation, and showed a high correlation with the equity markets (Conlon & McGee, 2020). Some of them even compare it to the gold and conclude that the Bitcoin is not the so-called "digital gold" (Conlon & McGee, 2020; Klein et al., 2018). Gold once again came out as a triumphant when it came to a natural hedge against the market disasters like the current pandemic (Ji et al., 2020). Some sane voices advised the people not to expect too much from Bitcoin in this regard, and treat it as a hedge against fiat money and not the huge market falls and failures (Ali, Alam, & Rizvi, 2020).

Where everyone seems to curse the Bitcoin and call it a complete failure during the recent market turmoil, only a few if any have paid an attention to the detailed analysis of the situation. According to a study, the relationship of Bitcoin returns with the U.S. stock markets is not symmetric, and only specific market conditions related to the S&P and the Bitcoin show co-movements (Bouri, Gupta, Tiwari, & Roubaud, 2017). Similarly, another study reports that nonlinear methodologies extract the asymmetric impact of positive and negative news more efficiently in case of cryptocurrency markets (Katsiampa, Corbet, & Lucey, 2019; Bouri, Das, Gupta, and Roubaud, 2018b). The volatility in the cryptocurrency market exhibits a different asymmetry as compared to the equity markets, and shows more sensitivity to positive as compared to the negative shocks, induced by the noise traders (Baur & Dimpfl, 2018). Bouri, Das, Gupta, and Roubaud (2018b) suggest the use of non-traditional and nonlinear techniques to study the behavior of Bitcoin for unraveling the hidden characteristics and patterns.

With such guide from the literature, it is interesting to investigate if the recent COVID-19 outbreak has an asymmetric impact on the returns of the top cryptocurrencies. For instance, the small and large increments in the severity of the pandemic may affect the market for cryptocurrencies differently not only in its entirety but also in the case of Bearish and Bullish scenarios. For this purpose, we have employed a recently developed technique-QQR regression to study the asymmetric association between our variables of interest (Sim & Zhou, 2015). This technique has already been used in the financial studies related to the Bitcoin returns and oil market prices (Bouri et al., 2017). The top ten currencies according to market capitalization represent the major portion of cryptocurrencies' market, and remaining currencies are highly correlated with these assets leading to the contagion like effects among them (Yi, Xu, & Wang, 2018; Bouri, Roubaud, and Shahzad, 2019a; Bouri, Shahzad, and Roubaud, 2019b; Katsiampa et al., 2019).

3. Data and methodology

3.1. Data

We have collected daily prices of the top ten cryptocurrencies according to market capitalization from an online source (https://coinmarketcap.com/), and calculated the daily returns manually and converted into the logarithmic values (log differences). All values are stationary at the first differences. The data about daily additions in the active cases of COVID-19 worldwide (Severity of the pandemic) is collected from the website designed by the Johns Hopkins University for the purpose. The series is divided by 100 after converting into log values. Such a transformation is supported by the relevant literature (Gan & Xu, 2019), and the proponents of the QQR methodology advise the normalization of values in this case (Sim & Zhou, 2015). The Sample period comprises of daily observations starting from January 1, 2020 and ending on June 15, 2020 (146 observations). Additionally, we use the “daily addition in number of deaths due to COVID-19” as an alternative proxy for the severity of the pandemic to check for the robustness of our results. This data is also collected from the website of the Johns Hopkins University.

3.2. Methodology

We have employed the QQR (Quantile-on-Quantile Regression) technique developed by Sim and Zhou (2015) recently. This technique has already been used effectively in numerous studies related to economics and finance to check the asymmetric nexus between the variables of interest (Bouri et al., 2017; Gupta et al., 2018). The main advantage of this technique is to capture the association at different quantiles of the both variables. In this way, we can know how the upper, lower, and middle quantiles of COVID-19 affect the upper, lower, and middle quantiles of the cryptocurrencies' returns differently. Moreover, we can divide the whole distribution of variables of interest in varying numbers of quantiles according to our own requirements.

3.3. Quantile on quantile methodology

In this section, we briefly highlight the basic importance and the characteristics of Sim and Zhou (2015) quantile-on-quantile regression method, which is structured to explore the asymmetric connection between COVID-19 and world's top ten cryptocurrencies' returns here. The QQR is a general form of standard quantile regression technique. This novel econometric method allows us to investigate how the quantiles of an independent variable impact the conditional quantiles of the dependent variable. The QQR method is implemented with a combination of the non-parametric estimation and quantile regression.

Firstly, Koenker and Bassett Jr (1978) develop the quantile regression that determines how the regressor (Independent variable) affects the conditional quantiles of the regressand (Dependent variable). Secondly, quantile regression is a modified version of the classical linear regression approach. In line with the ordinary least square (OLS), quantile regression determines the effect of regressor on regressand at the lower, middle and top quantile distributions. Thirdly, the local linear regression model is proposed by Stone (1977) and Cleveland (1979) that classifies the local effects of specific quantiles of the regressor on the fitted regressand. Furthermore, one of the many advantages of local linear regression method over the nonparametric method is to overwhelm the situation of the “curse of dimensionality.” Hence, the combination of these two methodologies helps us to understand the linkages between the quantiles of regressor and the regressand, and then provides more profound information than the conventional regression approaches such as ordinary least square and/or quantile regression.

The current study aims to apply the QQR method to capture the quantiles' impact of COVID-19 daily cases on the quantiles of cryptocurrencies' returns (BTC, ETH, XRP, BCH, BSV, LTC, BNB, EOS, ADA, and CRO). In this direction, the nonparametric quantile regression is defined below.

| (1) |

Where Crypto t explains a given cryptocurrency's returns (BTC, ETH, XRP, BCH, BSV, LTC, BNB, EOS, ADA, and CRO) in period t, the COVID19 t is the daily new confirmed cases globally in period t, σ is the σth quantile of the conditional distribution of Crypto t, and η σ is a quantile error term for which σth quantile is equal to zero, β σ'(.) is a feature that is an unidentified function since we do not assume a prior hypothesis about the form of connection between COVID19 t and Crypto t.

The quantile regression is an efficient approach as it considers the variations in effects of COVID19 t at different points of the Crypto t distribution. However, the quantile regression cannot extract the entire nature of dependency between the regressor and the regressand. Specifically, it is unable to analyze the asymmetric nature of small and large positive shocks of COVID19 t that can affect the Crypto t differently. Therefore, the novel QQR approach has been proposed by Sim and Zhou (2015) that can derive the dependency relationship more profoundly between COVID19 t and Crypto t.

For studying the linkages between σth quantile of Crypto t and τth quantile of COVID19 t, we inspect Eq. (1) in the neighborhood of COVID19 t. The unknown function of β σ'(.) instigates us to extend the basic regression function by using the first-order Taylor expansion of β σ'(.) around Crypto t as below.

| (2) |

Whereβ σ'signifies the partial derivative of β σ(COVID19t) for COVID19 t in Eq. (2), relating the marginal effect. Yet, it provides the same explanation to the slope of the coefficients in the linear regression framework. Moreover, following Sim and Zhou (2015), β σ(COVID19t) can be renamedβ 0(σ, τ). Accordingly, we can reformulate Eq. (2) as under;

| (3) |

After substituting Eq. (3) into Eq. (1), we can get Eq. (4).

| (4) |

In the above described Eq. (4), the (*) shows the σthconditional quantile function of Crypto t. Due to the dual index of β 0 & β 1 in σ and τ, the standard quantile function conditionally reflects the true association between σth quantile of Crypto t and τth quantile of COVID19tin the given formula of Eq. (4). These parameters may produce different outputs based on σth quantile of Crypto t and τth quantile of COVID19t. Moreover, there is no linear relationship anticipated at any point in time, hence, Eq. (4) measures the overall dependence relationship between Crypto t and COVID19tthrough their distributions.

Finally, we provide the estimated coefficients of cryptocurrencies, as represented by b 0 and b 1, in Eq. (5) by applying local linear regression contingent upon the minimization problem. Moreover, b 0 and b 1 are the estimated values of β 0andβ 1 in Eq. (5).

| (5) |

Where ρ σ(.) shows quantile loss function and K(.) the Gaussian kernel function in both the minimization problems as minimal weighting criterion to improve the estimation efficiency.

Finally, when applying a nonparametric estimation, bandwidth selection is very important. A higher bandwidth provides us low variances but greater bias in the results, while a lower bandwidth produces unbiased estimates with high variances. Following Sim and Zhou (2015), the current research is based on a bandwidth parameter of h = 0.05.

4. Results and discussions

4.1. Summary statistics

Table 2 reports summary statistics of all the variables included here. The average number of daily addition in COVID-19 cases, and deaths worldwide is 53,582, and 2955, respectively. Daily values range from a minimum of 32 to a maximum of 143,000 for new cases whereas, from zero to 9796 for new deaths. Mean returns for all currencies are negative except for BTC, ETH, ADA, and CRO during the sample period. The values of standard deviation are huge for all variables with a wider gap between minimum and maximum values of the observations. The least value of returns on a single day is observed for BCH (− 56.1%) while the maximum for BSV (27%) which also shows the maximum standard deviation (74%). The positive average returns posted by the above mentioned four currencies do not mean the net realized positive gains at the end of the sample period as compared with the prices at the start (For that purpose, cumulative returns must be considered). Significance of the Jarque-Bera test shows abnormality in the data distribution, which further advocates the use of the QQR approach in such a scenario (Shahbaz, Zakaria, Shahzad, & Mahalik, 2018). The unit root tests of ADF (Augmented Dickey-Fuller) and ZA (Zivot & Andrews, 2002) show that all the variables are non-stationary at levels but turn into stationary at the first differences. The structural break test is applied following Ahmed et al., (2019) to check a single break-in-time which is 17th and 18th of March for most of the currencies, while 6th April for the COVID-19 cases, and 18th April for the deaths.

Table 2.

Summary Statistics and unit root tests.

| Variables | N | Mean | Std. Dev. | Min | Max | J-B Stats | ADF-1(1) | ZA-1(1) | Break Day |

|---|---|---|---|---|---|---|---|---|---|

| COVID-19 and Cryptocurrencies | |||||||||

| COVID-19C | 146 | 53,582.24 | 45,522.04 | 32 | 143,000 | 12.08*** | −20.532*** | −9.957*** | 06apr2020 |

| COVID-19D | 146 | 2955.76 | 2719.161 | 0 | 9796 | 10.64*** | −18.906*** | −9.665*** | 18apr2020 |

| BTC | 146 | 0.001 | 0.054 | −0.465 | 0.167 | 8766*** | −14.236*** | −6.292*** | 17mar2020 |

| ETH | 146 | 0.002 | 0.067 | −0.551 | 0.173 | 5905*** | −14.375*** | −5.506*** | 18mar2020 |

| XRP | 146 | −0.001 | 0.051 | −0.399 | 0.143 | 3780 *** | −14.284*** | −6.076*** | 17mar2020 |

| BCH | 146 | −0.003 | 0.068 | −0.561 | 0.211 | 5948 *** | −14.129*** | −5.973*** | 16mar2020 |

| BSV | 146 | −0.004 | 0.074 | −0.56 | 0.27 | 3144*** | −12.793*** | −5.967*** | 17mar2020 |

| LTC | 146 | −0.002 | 0.06 | −0.449 | 0.191 | 2924*** | −14.723*** | −5.845*** | 18mar2020 |

| BNB | 146 | −0.001 | 0.064 | −0.543 | 0.193 | 7401 *** | −13.702*** | −5.483*** | 16mar2020 |

| EOS | 146 | −0.003 | 0.063 | −0.503 | 0.161 | 4390*** | −14.546*** | −5.734*** | 18mar2020 |

| ADA | 146 | 0.004 | 0.069 | −0.504 | 0.184 | 2441*** | −14.309*** | −5.352*** | 18mar2020 |

| CRO | 146 | 0.006 | 0.059 | −0.49 | 0.141 | 7258 *** | −13.794*** | −14.416*** | 17mar2020 |

***, **, and * denote 1%, 5% and 10% level of significance respectively. COVID-19C and COVID-19D represent the daily new COVID-19 cases and daily new COVID-19 deaths, respectively.

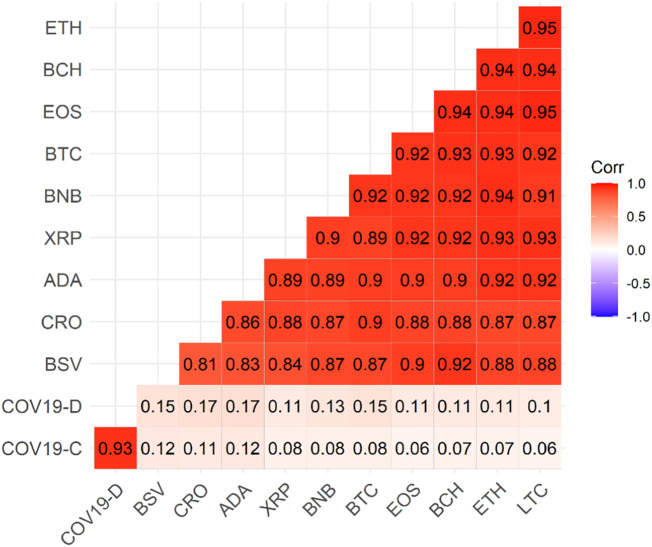

As evident from Fig. 3 , the correlation between COVID-19 related deaths and infections, and all cryptocurrencies is dominantly negative and strong with few exceptions showing a moderate negative association. Those currencies with a moderate negative association with COVID-19 include CRO, BNB, and BSV, while BTC also indicates a relatively less strong relationship as compared to other than these mentioned currencies. On the other hand, the correlation between all pairs of cryptocurrencies is strongly positive except CRO-BSV, XRP-BSV, CRO-BNB, and ETH-CRO, where it is positive but not very strong. Such an asymmetry observed in the correlations furthers our approach to inquiry in this study. The new cases of both COVID-19 infections and deaths have similar associations with almost all the currencies.

Fig. 3.

Correlation Matrix.

4.2. QQR results

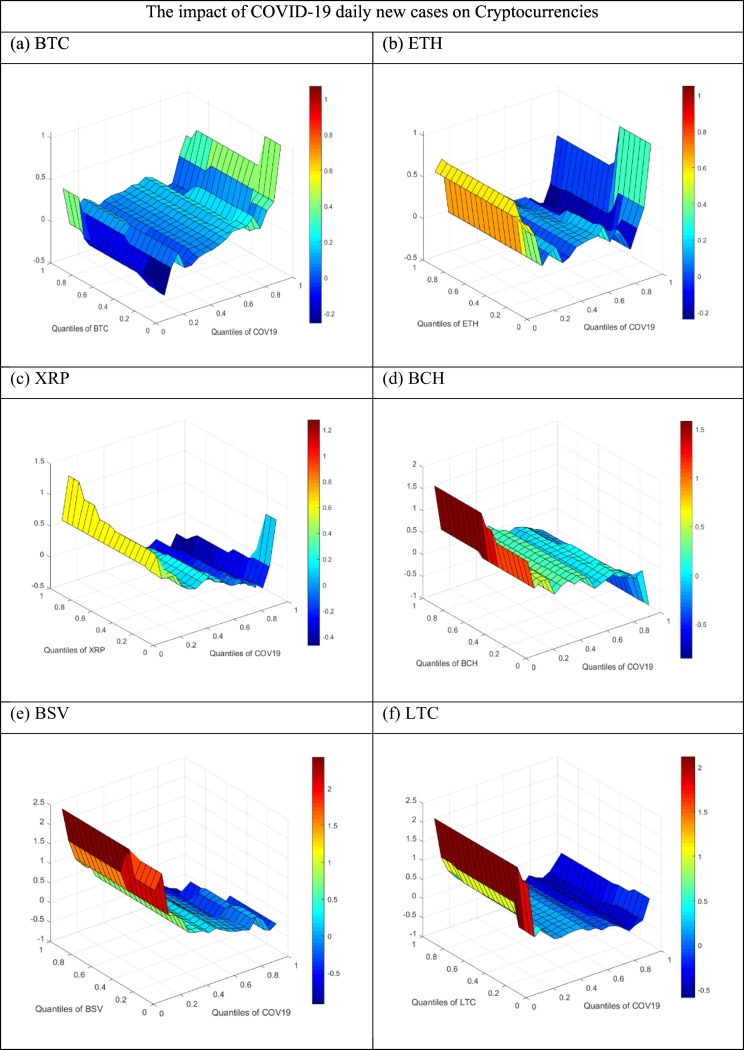

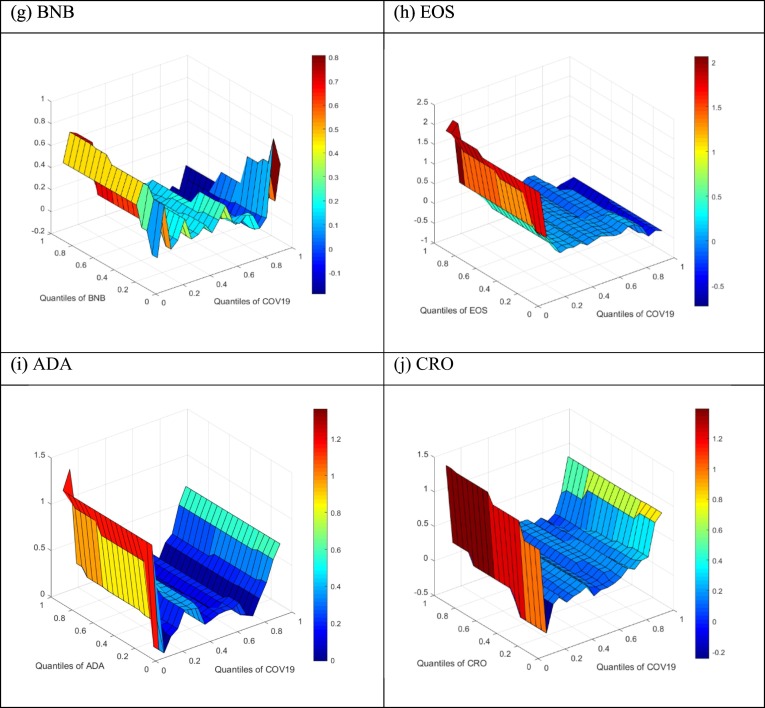

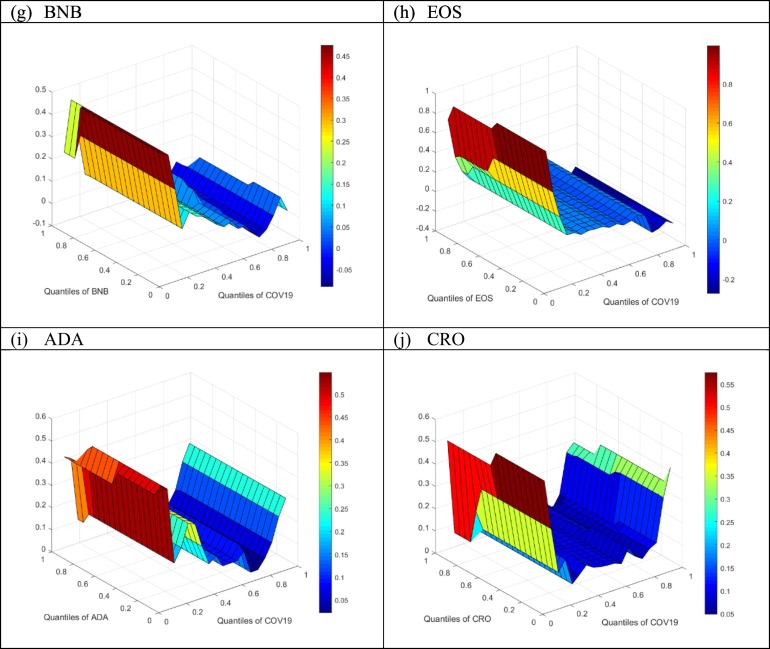

Fig. 4 presents the results from QQR regression between the numbers of daily new COVID-19 cases worldwide and daily returns of the top ten cryptocurrencies in the world according to market capitalization.

Fig. 4.

Quantile on Quantile regression estimates for the slope of the coefficients, Note: These graphs show the slope of the coefficients estimated from the QQR method. The coefficients are placed on the z-axis against the quantiles of the COVID-19 daily new cases (τ) on the x-axis and quantiles of the cryptocurrencies (σ) on the y-axis. The colored bar shows the strength and direction of association between COVID-19 and cryptocurrencies. The dark blue color shows the negative and week relationship while the dark red color shows the positive and strong relationship. The selected ten cryptocurrencies are Bitcoin (BTC), Ethereum (ETH), XRP, Bitcoin Cash (BCH), Bitcoin SV (BSV), Litecoin (LTC), Binance Coin (BNB), EOS, Cardano (ADA) and Tezos (XTZ). (For interpretation of the references to color in this figure legend, the reader is referred to the web version of this article.)

The vertical bars on the right side of the 3D graphs show the scale, direction and magnitude of the beta coefficients. The x, y, and z-axis show the quantiles of COVID-19, the quantiles of cryptocurrencies, and the beta coefficients, respectively. The coefficient values and the relationship between variables move from lower and negative to the higher and positive, respectively as the color shifts from blue (downward) to red (upward). As the colored bar is scaled which also shows the numerical values associated with the different colors for the coefficients, we have not presented the tables of coefficients to avoid redundancy,5 following other studies in literature that use the QQR technique (Shahbaz et al., 2018; Shahzad et al., 2020; Sim, 2016; Sim & Zhou, 2015).

In Fig. 4(a) the association between COVID-19 and Bitcoin is dominantly negative as indicated by an overwhelming blue color throughout the graph with only a few exceptions where the green and light green color is present. Initial huge decline in the value of Bitcoin represented by the blue color at the onset of the COVID-19 is in line with the recent literature which suggests that negative overreactions are more dominant as compared to the positive ones in the cryptocurrency market (Borgards & Czudaj, 2020). The link between uppermost quantiles (90th to 95th) of COVID-19 and the lowermost to upper-middle quantiles (10th to 75th) of Bitcoin is represented by green color showing a moderate positive correlation while the uppermost quantiles (90th to 95th) of both the variables are also linked positively but weakly as shown by light green color. This shows that after a sharp decline in the returns of Bitcoin during the early stages of pandemic, it quickly started to regain the lost value. The lowermost quantiles (Below 20th) of the both variables show a stronger negative association as compared to other quantiles. This feature shows the earliest negative response of Bitcoin to the starting of COVID-19. To sum it up, the COVID-19 affected Bitcoin returns negatively in the start and the middle of the COVID-19 pandemic dominantly, but the large additions in COVID-19 cases lead to a positive change in the Bitcoin returns at majority of the Bitcoin's quantiles. A little anomaly is also exhibited by the huge positive returns of Bitcoin resulting from a small increase in the COVID-19 cases at the higher most quantile of Bitcoin. This spike tantamounts to a sharp rebound in the value. These results confirm that the different levels of severity of the COVID-19 pandemic (Represented by the changing level of daily increase in the new cases) affect the returns of Bitcoin asymmetrically, and Bitcoin performed as a hedge against the highest levels of the pandemic severity. These results are consistent with the findings of multiple studies which have revealed the asymmetric hedging characteristics of Bitcoin recently (Shahzad et al., 2019; Selmi, Mensi, Hammoudeh, & Bouoiyour, 2018). Some authors declare it as an overall safe haven against COVID-19 (Corbet et al., 2020b). Our results are also in line with an earlier study by Bouri et al., (2018) who conclude that cryptocurrency market is not completely disconnected in terms of volatility and returns spillovers, and is the recipient of the external shocks mainly rather than a transmitter for other financial and commodity markets. Additionally, our results are also in line with another study which concludes that Bitcoin's behavior is quantiles-specific, by deploying the QQR approach (Selmi, Mensi, Hammoudeh, & Bouoiyour, 2018).

The Fig. 4(b) shows the graph for Ethereum which is almost similar to the Bitcoin with only notable differences at two places; at the junction of the uppermost quantiles (80th to 95th) of COVID-19 and middle to uppermost quantiles (40th to 95th) of Ethereum as shown by the blue, and the lowermost quantiles (below 20th) of COVID-19 and almost all quantiles of Ethereum as shown by yellow to light red color, respectively. This result demonstrates that the small increments in COVID-19 lead to a significant increase in the daily returns of Ethereum, while huge increments lead to moderately negative returns. Although, the time trend of daily returns for Bitcoin and Ethereum looks almost similar, and the correlation between these two currencies is also high, still there are differences in the way COVID-19 is associated with the uppermost and the lowermost parts of their distributions. Such findings also show the advantages of using QQR approach to unravel the asymmetric nexus between the variables of interest.

The next four currencies, i.e. from Fig. 4(c) to Fig. 4(f) and Fig. 4(h) (XRP, Bitcoin Cash, Bitcoin SV, Litecoin, and EOS) show almost similar patterns of association with COVID-19 at various quantiles. The lowermost quantiles (below 20th) of COVID-19 are associated with nearly all the quantiles of these five currencies positively. This implies that the small increments in the COVID-19 cases always resulted in an increase in these currencies' returns. We can call these assets as the good absorbers of the small shocks of COVID-19. On the other hand, this positive relationship keeps on turning into negative and stronger as the number of daily COVID-19 cases increases significantly (from 20th to 95th quantiles). As the COVID-19 values rise from the middle to the upper quantiles, its impact on these five currencies moves from low positive (light green and light blue color) to negative (blue color). A significant rise in the daily cases of COVID-19 leads to negative returns for these five cryptocurrencies. Our results are quite similar to the earlier findings where uncertainty and stress in the global financial markets is reported to cause increased connectedness among cryptocurrencies' returns, especially the negative returns (Ji et al., 2019).

In Fig. 4(g) Binance coin shows more dynamic and mixed association with COVID-19 as compared with any other cryptocurrency in our sample. Almost all the colors and various spikes at different quantiles are observable from its graph. The lower quantiles (below 25th) of COVID-19 and almost all quantiles of Binance coin show a positive association as represented by dark yellow and red colors, implying a small rise in COVID-19 leading to positive returns. As we move from the lower middle to the uppermost quantiles of both variables, the association keeps turning into strong and negative from weak and positive. The only exception can be observed by the dark red color at the junction of the uppermost quantiles (80th to 95th) of COVID-19 and the lowermost quantiles (below 25th) of Binance coin, implying small positive returns resulting from the huge addition in COVID-19 cases.

In Fig. 4(i) & 4(j) the graphs of Cardano and Tezos show significant similarities in their association with the COVID-19. The lowermost (below 20th) and the uppermost quantiles (90th to 95th) of COVID-19 affect the returns positively at almost all quantiles of these two currencies. The lower distribution of COVID-19 has a stronger positive impact as compared to the upper parts of its distribution. From the lower-middle to the upper-middle distribution of the COVID-19, there is almost no relationship with Cardano and Tezos as shown by the large blue areas, thus representing the characteristics of a good diversification asset. The asymmetric behavior shown by the majority of the cryptocurrencies in our analysis is similar to the mainstream literature on these assets (Philippas, Philippas, Tziogkidis, & Rjiba, 2020).

4.3. Robustness check for the QQR methodology

The QQR methodology can be thought of as an approach that disintegrates the estimates from a standard quantile regression, making it possible for the specific estimates to be observed for varying quantiles of the independent variable. In our study, the QQR model is used for regressing the σth quantiles of the cryptocurrencies' returns on τth quantiles of COVID19; hence, the parameters will be indexed here by both σ and τ. Thus, the QQR method contains more localized information regarding the COVID19-cryptocurrencies link than the standard quantile regression (if used). Such an association is perceived to be potentially heterogeneous by the QQR approach, across different quantiles of cryptocurrencies' returns and COVID-19. Because of the presence of such an inherent property of decomposition in the QQR method, it should be possible to employ the QQR estimates to recover the standard quantile regression estimates (Shahzad, Shahbaz, Ferrer, & Kumar, 2017; Sim & Zhou, 2015). More specifically, the parameters of quantile regression, only indexed by σ, should be generated through averaging the QQR parameters along τ. The slope coefficient for the quantile regression model that measures the impact of COVID-19 on the quantiles of cryptocurrencies' returns, and is denoted by γ 1(σ), can be obtained through the following equation:

| (6) |

Where S = 19 is the number of quantiles, τ = [0.05, 0.10, …, 0.95], considered here in this study.

So, a simple way of observing the validity of QQR approach should be to compare the parameters estimated through quantile regression with the τ-averaged QQR parameters.

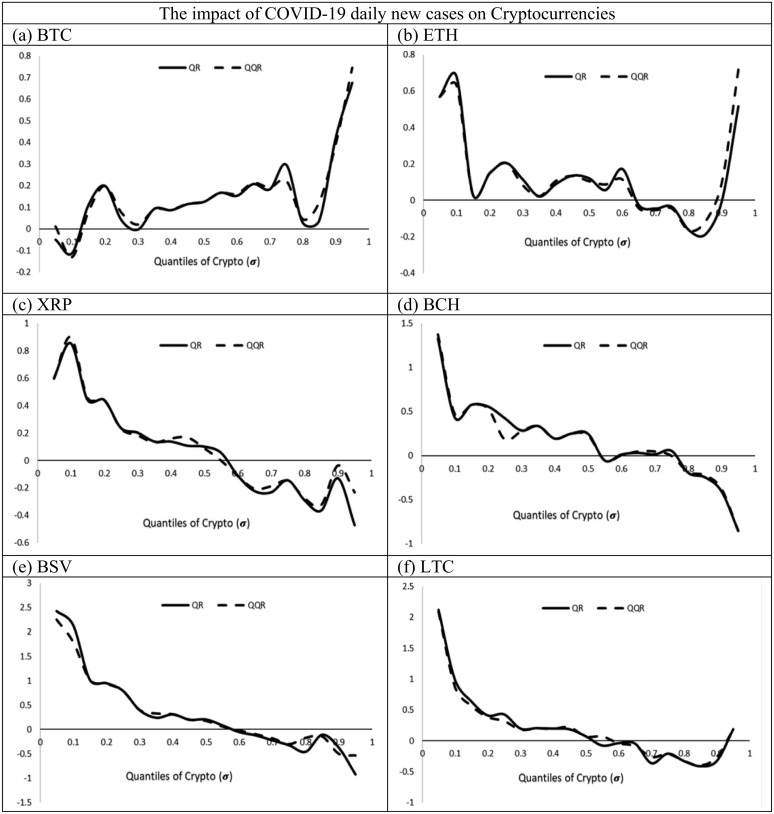

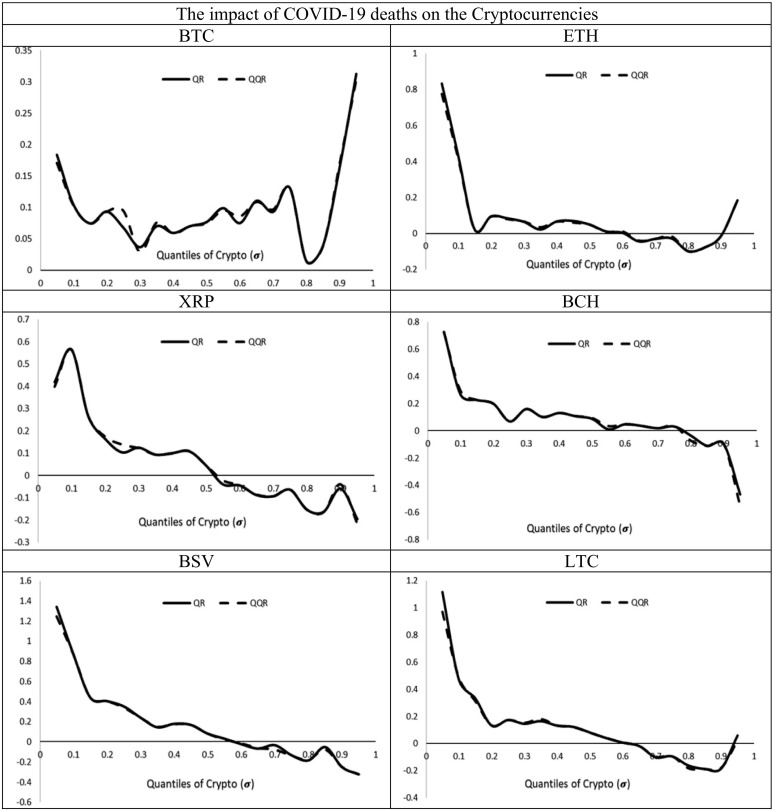

Fig. 5 shows the plot of estimates from the quantile regression and the averaged QQR approach towards the slope coefficient, measuring the effect of COVID-19 on returns of the top 10 cryptocurrencies. The graphs generated in Fig. 5(a)-(j) clearly show that the averaged-QQR estimates for the slope coefficients look similar to the estimates from the quantile regression for all the cryptocurrencies. Such graphical evidence can provide a simple way of validating the QQR methodology by representing that the primary features related to the quantile regression can be regenerated by summarizing the detailed information available in the QQR estimates. Therefore, Fig. 5 largely validates the results obtained from the QQR analysis reported above.

Fig. 5.

Comparison between estimated coefficients of QQR & QR Note: These graphs indicate the validity of QQR estimates through comparing the slope of the coefficients from standard quantile regression and the averaged quantile on quantile regression. The plain lines show the QR coefficients while the dotted lines indicate the QQR coefficients. In each graph, the x-axis shows the quantiles (0.5–0.95) while the y-axis shows the coefficients of Cryptot, estimated from QR & QQR. The selected cryptocurrencies are Bitcoin (BTC), Ethereum (ETH), XRP, Bitcoin Cash (BCH), Bitcoin SV (BSV), Litecoin (LTC), Binance Coin (BNB), EOS, Cardano (ADA) and Tezos (XTZ).

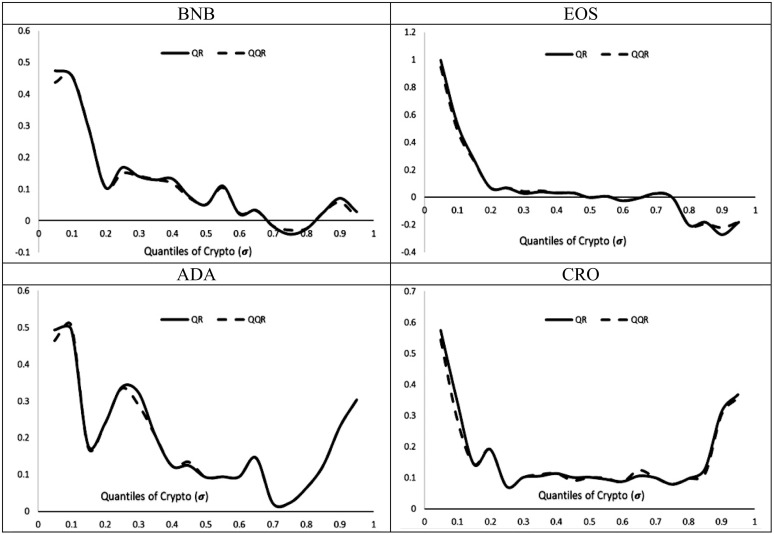

4.4. Robustness check with alternative proxy

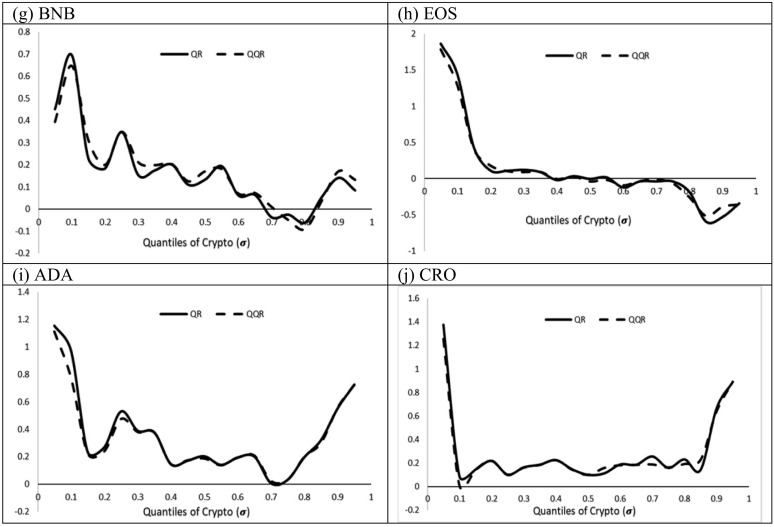

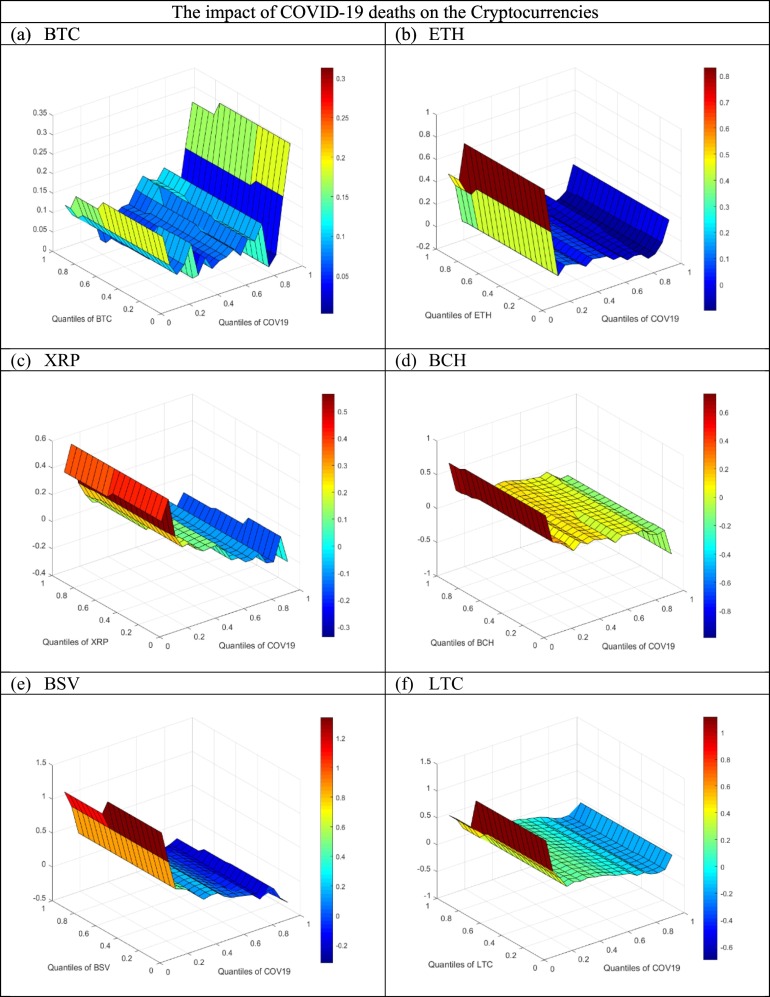

To increase the robustness of our results, we further apply the same econometric technique between cryptocurrencies' returns and COVID-19 related deaths instead of infections, following other studies on COVID-19 (Fareed et al., 2020). Resulting graphs for QQR and robustness are reported in Fig. 6 and Fig. 7 correspondingly. No obvious differences are observed between the graphs reported above (for COVID-19 related infections, Fig. 4 and Fig. 5) and these from Fig. 6 and Fig. 7 (for COVID-19 related deaths).

Fig. 6.

Quantile on Quantile regression estimates for the slope of the coefficients,(Robustness check).

Note: These graphs show the slope of the coefficients estimated from the QQR method. The coefficients are placed on the z-axis against the quantiles of the COVID-19 daily new deaths (τ) on the x-axis and quantiles of the cryptocurrencies (σ) on the y-axis. The colored bar shows the strength and direction of association between COVID-19 and cryptocurrencies. The dark blue color shows the negative and week relationship while the dark red color shows the positive and strong relationship. The selected ten cryptocurrencies are Bitcoin (BTC), Ethereum (ETH), XRP, Bitcoin Cash (BCH), Bitcoin SV (BSV), Litecoin (LTC), Binance Coin (BNB), EOS, Cardano (ADA) and Tezos (XTZ). (For interpretation of the references to color in this figure legend, the reader is referred to the web version of this article.)

Fig. 7.

Comparison between estimated coefficients of QQR & QR.

Note: These graphs indicate the validity of QQR estimates through comparing the slope of the coefficients from standard quantile regression and the averaged quantile on quantile regression. The plain lines show the QR coefficients while the dotted lines indicate the QQR coefficients. In each graph, the x-axis shows the quantiles (0.5–0.95) while the y-axis shows the coefficients of Cryptot, estimated from QR & QQR. The selected cryptocurrencies are Bitcoin (BTC), Ethereum (ETH), XRP, Bitcoin Cash (BCH), Bitcoin SV (BSV), Litecoin (LTC), Binance Coin (BNB), EOS, Cardano (ADA) and Tezos (XTZ).

By thinking logically, and referring to the recent literature on the COVID-19 and cryptocurrencies, we are unable to find any third variable which might affect the COVID-19 and cryptocurrencies' returns simultaneously, and cause a spurious relationship resultantly (Distort the true relationship among our variables). The only variable that can be thought to have an effect on both of COVID-19 and cryptocurrencies' returns is the “weather”. A number of recent articles have discussed the role of weather in causing/reducing the COVID-19 cases (Iqbal et al., 2020; Shahzad et al., 2020). At the same time, weather has the potential to cause changes in investors' moods, which in turn may affect their investment behavior. In this way, weather cannot directly affect the cryptocurrencies returns, and can only influence this market through a behavioral variable, like mood which has no known/obvious link to cause the COVID-19. Investors' mood cannot cause more/less COVID-19 cases. Additionally, the impact of weather on the market returns of cryptocurrencies may be feeble/negligible only. Reverse causality is also not an expected phenomenon in our case as increase/decrease in cryptocurrencies' returns in no way can cause increase/decrease in the cases or deaths related to COVID-19.

5. Conclusion

This study attempts to explore the impact of COVID-19 outbreak on the market returns of top 10 cryptocurrencies in the world according to the market capitalization. To check how small and large increments in the pandemic intensity affect the returns of these currencies differently, conditional on the various quantiles of given returns, we have employed QQR (Quantile-on-Quantile Regression) approach which is suitable for this purpose. Results reveal that the association between the COVID-19 and the cryptocurrencies' returns is not symmetric and varies in magnitude and direction at different quantiles of both variables. These findings are similar to the earlier results where cryptocurrency market is found to behave in a nonlinear fashion with the Global Financial Stress Index (Bouri et al., 2018). Apart from this, although the overall trend in cryptocurrencies market is same for all currencies, still there are differences in these assets' responses to the changes in the COVID-19 intensity. This result is similar to another recent study, and could not be revealed through traditional linear, or standard quantile regression techniques alone (Conlon et al., 2020).

Furthermore, in combating the negative impacts of COVID-19 on financial markets, and serving as an alternative investment tool in the times of stress, panic and uncertainty, BTC, Ethereum, ADA and CRO performed better as compared with the other currencies. This finding is contrary to an earlier study of Conlon and McGee (2020) that branded Bitcoin as a failure in this pandemic, and is in line with Huynh et al., (2020) who find Bitcoin as a better hedge as compared to other cryptocurrencies due to its independence.

Most of the other cryptocurrencies in our sample posted positive gains in response to small additions in the COVID-19 cases. Such a behavior shows the ability of these assets to absorb small external shocks and perform as a hedge during limited market-turmoil conditions. Further, this phenomenon reveals that a selective and cautious approach needs to be adopted in case of diversifying with cryptocurrencies against systematic risks of a global nature, such as the recent pandemic.

The intensity of the COVID-19 pandemic as measured by the daily new cases/deaths can also be regarded as a global market stress due to its wide scale devastation in terms of lockdowns, deaths, panic, fear, psychological distress and uncertainty in the absence of any vaccine or a sound cure. In this way, our results also correspond to another study by Bouri et al., 2018a, Bouri et al., 2018b, Bouri et al., 2018c. They examined the quantile causality and extreme right and left tail dependencies between Bitcoin and Global Financial Stress Index, and concluded that the lower and the higher quantiles of Bitcoin returns were dependent on the GFSI, against a limited dependency between the middle quantiles.

Our results are robust to the use of alternative proxy for the severity of the pandemic (Daily addition in death). These results have important implications for investors, especially in understanding the behavior of cryptocurrencies in times of huge stress/disaster, such as a pandemic, and making informed investment decisions. Regulators and governments may benefit from this research to formulate policies for stabilizing this market, reducing its high volatility, and enhancing the investors' confidence there.

Contributions

Najaf Iqbal: Abstract, Introduction, Literature Review, Supervision, and reviewing and Editing.

Zeeshan Fareed: Data analysis, Writing results and discussion, Methodology.

Wan Guangcai: Conceptualization, Supervision.

Farrukh Shahzad: Conceptualization, Data curation, Conclusion.

Funding Information

This research is not funded by any organization.

Footnotes

During the early and mid of the March 2020, it recorded a decline of more than 50% in value, moved in tandem with the traditional financial assets' prices (https://www.cnbc.com/2020/03/13/bitcoin-loses-half-of-its-value-in-two-day-plunge.html).

https://www.theguardian.com/world/2020/apr/28/china-starts-major-trial-of-state-run-digital-currency

The DJIA dropped 9.99% in value in a matter of few hours which was the biggest single-day drop since 1987. The Bitcoin followed the course and recorded a decline of more than 50% in value till 17th of March 2020. https://cointelegraph.com/news/crypto-traders-explain-what-caused-the-bitcoin-price-plunge-to-3-000.

The QQR output generates a 19*19 matrix of beta coefficients (in case of 19 quantiles) for one cryptocurrency. If we report all matrices, it requires additional ten tables which consumes a lot of space and is not efficient as those coefficients are already represented by the colored 3D graphs included above.

References

- Ahmed Z., Wang Z., Ali S. Investigating the non-linear relationship between urbanization and CO 2 emissions: An empirical analysis. Air Quality, Atmosphere & Health. 2019;12(8):945–953. [Google Scholar]

- Ali M., Alam N., Rizvi S.A.R. Coronavirus (COVID-19)–an epidemic or pandemic for financial markets. Journal of Behavioral and Experimental Finance. 2020;100341 doi: 10.1016/j.jbef.2020.100341. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ashraf B.N. Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance. 2020:101249. doi: 10.1016/j.ribaf.2020.101249. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Aste T. Cryptocurrency market structure: Connecting emotions and economics. Digital Finance. 2019;1(1–4):5–21. [Google Scholar]

- Baker S.R., Bloom N., Davis S.J., Kost K.J., Sammon M.C., Viratyosin T. National Bureau of Economic Research; 2020. The unprecedented stock market impact of COVID-19 (no. w26945) [Google Scholar]

- Baur D.G., Dimpfl T. Asymmetric volatility in cryptocurrencies. Economics Letters. 2018;173:148–151. [Google Scholar]

- Borgards O., Czudaj R.L. The prevalence of price overreactions in the cryptocurrency market. Journal of International Financial Markets, Institutions and Money. 2020;65:101194. [Google Scholar]

- Bouri E., Das M., Gupta R., Roubaud D. Spillovers between Bitcoin and other assets during bear and bull markets. Applied Economics. 2018;50(55):5935–5949. [Google Scholar]

- Bouri E., Gupta R., Lahiani A., Shahbaz M. Testing for asymmetric nonlinear short-and long-run relationships between bitcoin, aggregate commodity and gold prices. Resources Policy. 2018;57:224–235. [Google Scholar]

- Bouri E., Gupta R., Lau C.K.M., Roubaud D., Wang S. Bitcoin and global financial stress: A copula-based approach to dependence and causality in the quantiles. The Quarterly Review of Economics and Finance. 2018;69:297–307. [Google Scholar]

- Bouri E., Gupta R., Tiwari A.K., Roubaud D. Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Research Letters. 2017;23:87–95. [Google Scholar]

- Bouri E., Roubaud D., Shahzad S.J.H. Do Bitcoin and other cryptocurrencies jump together? The Quarterly Review of Economics and Finance. 2019;76:396–409. [Google Scholar]

- Bouri E., Shahzad S.J.H., Roubaud D. Co-explosivity in the cryptocurrency market. Finance Research Letters. 2019;29:178–183. [Google Scholar]

- Chaim P., Laurini M.P. Nonlinear dependence in cryptocurrency markets. The North American Journal of Economics and Finance. 2019;48:32–47. [Google Scholar]

- Chu J., Chan S., Nadarajah S., Osterrieder J. GARCH modelling of cryptocurrencies. Journal of Risk and Financial Management. 2017;10(4):17. [Google Scholar]

- Cleveland W.S. Robust locally weighted regression and smoothing scatterplots. Journal of the American Statistical Association. 1979;74(368):829–836. [Google Scholar]

- Conlon T., McGee R. Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Finance Research Letters. 2020;101607 doi: 10.1016/j.frl.2020.101607. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Conlon T. Are Cryptocurrencies a safe haven for equity markets? An international perspective from the COVID-19 pandemic. Research in International Business and Finance. 2020:101248. doi: 10.1016/j.ribaf.2020.101248. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Corbet S., Cumming D.J., Lucey B.M., Peat M., Vigne S.A. The destabilising effects of cryptocurrency cybercriminality. Economics Letters. 2020;191:108741. [Google Scholar]

- Corbet S., Hou G., Hu Y., Larkin C.J., Oxley L. 2020. Any port in a storm: Cryptocurrency safe-havens during the COVID-19 pandemic. Available at SSRN 3610461. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Corbet S., Larkin C., Lucey B. The contagion effects of the covid-19 pandemic: Evidence from gold and cryptocurrencies. Finance Research Letters. 2020;101554 doi: 10.1016/j.frl.2020.101554. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Corbet S., Lucey B., Urquhart A., Yarovaya L. Cryptocurrencies as a financial asset: A systematic analysis. International Review of Financial Analysis. 2019;62:182–199. [Google Scholar]

- Czapliński T., Nazmutdinova E. Using FIAT currencies to arbitrage on cryptocurrency exchanges. Journal of International Studies. 2019;12(1):184–192. [Google Scholar]

- Dyhrberg A.H. Bitcoin, gold and the dollar–a GARCH volatility analysis. Finance Research Letters. 2016;16:85–92. [Google Scholar]

- Fareed Z., Iqbal N., Shahzad F., Shah S.G.M., Zulfiqar B., Shahzad K.…Shahzad U. Co-variance nexus between COVID-19 mortality, humidity, and air quality index in Wuhan, China: New insights from partial and multiple wavelet coherence. Air Quality, Atmosphere, & Health. 2020;1 doi: 10.1007/s11869-020-00847-1. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Fry J. Booms, busts and heavy-tails: The story of Bitcoin and cryptocurrency markets? Economics Letters. 2018;171:225–229. [Google Scholar]

- Fry J., Cheah E.T. Negative bubbles and shocks in cryptocurrency markets. International Review of Financial Analysis. 2016;47:343–352. [Google Scholar]

- Gajardo G. Does Bitcoin exhibit the same asymmetric multifractal cross-correlations with crude oil, gold and DJIA as the euro, great British pound and yen? Chaos, Solitons & Fractals. 2018;109:195–205. [Google Scholar]

- Gan W., Xu X. Does anti-corruption campaign promote corporate R&D investment? Evidence from China. Finance Research Letters. 2019;30:292–296. [Google Scholar]

- Griffin J.M., Shams A. Is Bitcoin really untethered? The Journal of Finance. 2020;75(4):1913–1964. [Google Scholar]

- Gupta R. Does partisan conflict predict a reduction in US stock market (realized) volatility? Evidence from a quantile-on-quantile regression model☆. The North American Journal of Economics and Finance. 2018;43:87–96. [Google Scholar]

- Huynh T.L.D., Nasir M.A., Vo V.X., Nguyen T.T. “Small things matter most”: The spillover effects in the cryptocurrency market and gold as a silver bullet. The North American Journal of Economics and Finance. 2020;101277 [Google Scholar]

- Iqbal N., Fareed Z., Shahzad F., He X., Shahzad U., Lina M. Nexus between COVID-19, temperature and exchange rate in Wuhan City: New findings from partial and multiple wavelet coherence. Science of the Total Environment. 2020;138916 doi: 10.1016/j.scitotenv.2020.138916. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ji Q., Bouri E., Lau C.K.M., Roubaud D. Dynamic connectedness and integration in cryptocurrency markets. International Review of Financial Analysis. 2019;63:257–272. [Google Scholar]

- Ji Q. Searching for safe-haven assets during the COVID-19 pandemic. International Review of Financial Analysis. 2020:101526. doi: 10.1016/j.irfa.2020.101526. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Katsiampa P., Corbet S., Lucey B. High frequency volatility co-movements in cryptocurrency markets. Journal of International Financial Markets, Institutions and Money. 2019;62:35–52. [Google Scholar]

- Kawohl W., Nordt C. COVID-19, unemployment, and suicide. The Lancet Psychiatry. 2020;7(5):389–390. doi: 10.1016/S2215-0366(20)30141-3. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Klein T. Bitcoin is not the new gold–a comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis. 2018;59:105–116. [Google Scholar]

- Koenker R., Bassett G., Jr. Regression quantiles. Econometrica: Journal of the Econometric Society. 1978:33–50. [Google Scholar]

- Lahmiri S., Bekiros S. The impact of COVID-19 pandemic upon stability and sequential irregularity of equity and cryptocurrency markets. Chaos, Solitons & Fractals. 2020;109936 doi: 10.1016/j.chaos.2020.109936. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Liu Y., Tsyvinski A. National Bureau of Economic Research; 2018. Risks and returns of cryptocurrency (no w24877) [Google Scholar]

- Maniff J.L., Minhas S., Rodziewicz D., Ruiz R. Safe-haven performance in the age of Bitcoin. Economic Bulletin. 2020:1–4. (April 15, 2020) [Google Scholar]

- Matkovskyy R., Jalan A. From financial markets to Bitcoin markets: A fresh look at the contagion effect. Finance Research Letters. 2019;31:93–97. [Google Scholar]

- Mnif E., Jarboui A., Mouakhar K. 2020. How the cryptocurrency market has performed during COVID 19? A multifractal analysis. Finance research letters, 101647. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Philippas D., Philippas N., Tziogkidis P., Rjiba H. Signal-herding in cryptocurrencies. Journal of International Financial Markets, Institutions and Money. 2020:101191. [Google Scholar]

- Rognone L., Hyde S., Zhang S.S. News sentiment in the cryptocurrency market: An empirical comparison with Forex. International Review of Financial Analysis. 2020;69:101462. [Google Scholar]

- Selmi R., Mensi W., Hammoudeh S., Bouoiyour J. Is Bitcoin a hedge, a safe haven or a diversifier for oil price movements? A comparison with gold. Energy Economics. 2018;74:787–801. [Google Scholar]

- Shahbaz M., Zakaria M., Shahzad S.J.H., Mahalik M.K. The energy consumption and economic growth nexus in top ten energy-consuming countries: Fresh evidence from using the quantile-on-quantile approach. Energy Economics. 2018;71:282–301. [Google Scholar]

- Shahzad S.J.H., Bouri E., Roubaud D., Kristoufek L., Lucey B. Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis. 2019;63:322–330. [Google Scholar]

- Shahzad S.J.H., Shahbaz M., Ferrer R., Kumar R.R. Tourism-led growth hypothesis in the top ten tourist destinations: New evidence using the quantile-on-quantile approach. Tourism Management. 2017;60:223–232. [Google Scholar]

- Shahzad F., Shahzad U., Fareed Z., Iqbal N., Hashmi S.H., Ahmad F. Asymmetric nexus between temperature and COVID-19 in the top ten affected provinces of China: A current application of quantile-on-quantile approach. Science of The Total Environment. 2020:139115. doi: 10.1016/j.scitotenv.2020.139115. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sharif A., Aloui C., Yarovaya L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis. 2020:101496. doi: 10.1016/j.irfa.2020.101496. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Shen D., Urquhart A., Wang P. A three-factor pricing model for cryptocurrencies. Finance Research Letters. 2019;34 [Google Scholar]

- Sim N. Modeling the dependence structures of financial assets through the copula Quantile-on-Quantile approach. International Review of Financial Analysis. 2016;48:31–45. [Google Scholar]

- Sim N., Zhou H. Oil prices, US stock return, and the dependence between their quantiles. Journal of Banking & Finance. 2015;55:1–8. [Google Scholar]

- Stone C.J. Consistent nonparametric regression. The Annals of Statistics. 1977:595–620. [Google Scholar]

- Urquhart A., Zhang H. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. International Review of Financial Analysis. 2019;63:49–57. [Google Scholar]

- Wang P., Zhang W., Li X., Shen D. Is cryptocurrency a hedge or a safe haven for international indices? A comprehensive and dynamic perspective. Finance Research Letters. 2019;31:1–18. [Google Scholar]

- Yi S., Xu Z., Wang G.J. Volatility connectedness in the cryptocurrency market: Is Bitcoin a dominant cryptocurrency? International Review of Financial Analysis. 2018;60:98–114. [Google Scholar]

- Zhang D., Hu M., Ji Q. Financial markets under the global pandemic of COVID-19. Finance Research Letters. 2020;101528 doi: 10.1016/j.frl.2020.101528. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zivot E., Andrews D.W.K. Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics. 2002;20(1):25–44. [Google Scholar]