Highlights

-

•

The COVID crisis could push over 108 million people into extreme poverty by 2021.

-

•

Growth recovery alone is unlikely to reverse the rise in poverty.

-

•

Improvements in financial inclusion could partly offset the increase in poverty.

-

•

Financial outreach reduces the detrimental effect that inequality has on poverty.

-

•

Cheaper forms of financial inclusion are needed to curb rises in poverty.

Keywords: Financial inclusion, Poverty, Inequality, COVID-19, Forecasts

Abstract

The ongoing COVID-19 pandemic risks wiping out years of progress made in reducing global poverty. In this paper, we explore to what extent financial inclusion could help mitigate the increase in poverty using cross-country data across 79 low- and lower-middle-income countries. Unlike other recent cross-country studies, we show that financial inclusion, particularly financial outreach, is a key driver of poverty reduction in these countries. This effect is not direct, but indirect, by mitigating the detrimental effect that inequality has on poverty. Our findings are consistent across all the different measures of poverty used and robust to instrumental variables. Our forecasts suggest that by 2021 the world’s population living on less than $5.50 dollars a day would increase by 231 million people, of which nearly 107.8 million people would be pushed into extreme poverty living on less than $1.90 per day. However, urgent improvements in financial inclusion could substantially reduce the impact on poverty.

1. Introduction

The ongoing COVID-19 pandemic will have a profound health and economic impact, particularly in the developing world. Millions of people in these economies are employed in the informal sector often without regular access to welfare or pension rights (Gutiérrez-Romero, 2021). With the social distancing and lockdown measures implemented to control the spread of COVID-19 millions of people suddenly lost their livelihoods and can no longer rely on their daily earnings to survive. Urgent cash transfers and labour initiatives have been implemented in 181 countries to try mitigating some of the immediate economic impacts of the pandemic (Gentilini et al., 2020). However, other short-term and medium-term policies will be needed to help households receive government transfers and build financial buffers to spread resources over the likely prolonged crisis. Globally, there are 1.7 billion adults without an account at a financial institution or a mobile money provider (World Bank, 2018). In this context, it is more important than ever to understand how severe the economic impact of the ongoing pandemic would be on poverty, and to what extent financial inclusion could contribute to reducing some of this impact.

In this paper, we address both questions. We start our analysis by assessing to what extent changes in poverty have been the product of improvements in income or distributional gains using cross-country data on poverty and inequality over the last two decades. To this end, we follow the poverty decomposition approach proposed by Datt and Ravallion (1992).1 We then extend this decomposition regressions to estimate to what extent financial inclusion has played a direct effect on poverty reduction or an indirect effect by also mediating the impact that inequality and growth have on poverty. Various cross-country studies have found that financial inclusion is beneficial for poverty reduction, particularly when using aggregate measures of financial development such as private credit (Beck, Demirgüç-Kunt, & Levine, 2007) and in wealthy countries (Park & Mercado, 2018).2 However, it is still unclear whether financial inclusion is indeed beneficial for poverty reduction in low- and low-middle income countries giving home to the majority of the population living in extreme poverty. Similarly, it is unclear how financial inclusion could be most effective if by improving financial outreach or financial usage. In this paper, we address these important gaps by assessing the link between poverty and an overall index of financial inclusion we construct using the Financial Access Survey over the period between 2004 and 2018 (IMF, 2019).3 We decompose this index into a sub-index of financial outreach and financial usage to ascertain how improvements in inclusion help poverty reduction the most. Based on this analysis, we then forecast changes in poverty using the latest IMF and World Bank projection of global growth in 2020 and 2021. We also use a range of forecast scenarios to estimate to what extent improvements in financial inclusion could curb increases in poverty. Our focus is on low- and low-middle income countries. Nonetheless, we also provide forecasts on global poverty, for all 121 countries included in our sample.

Our paper offers three key findings. First, we show that over the last two decades, poverty has been relatively unresponsive to economic growth and has been deeply affected by inequality. These findings are in line with earlier literature (Datt and Ravallion, 1992, van der Weide and Branko, 2018). Second, we show that financial inclusion does not directly reduce poverty; however, it strongly reduces the detrimental effect that inequality has on poverty. In other words, unlike other recent cross-country studies, we show that financial inclusion is a key element in reducing extreme forms of poverty in low- and lower-middle-income countries (e.g. Goksu et al., 2017, Park and Mercado, 2018). Moreover, we show that improvement in financial outreach is the most strongly associated with poverty reduction. Our results are robust to using the three components of poverty measures: incidence, intensity, and inequality among the poor and three different international poverty lines ($1.90, $3.20 and $5.50 dollars a day). Since financial inclusion or lack thereof may be a consequence of the persistence of poverty, we show that our results are robust to using instrumental variables specifications (IV). As external instruments, we consider whether the country was colonised, the origin of their legal tradition as well as improvements in mobile phone subscription. A large body of literature has shown these historical conditions as well as improvements in communication technology influence financial development over time (Beck et al., 2007, La Porta et al., 1997). Our findings are also robust to using alternative measures of financial inclusion taken from the World Bank’s Global Findex, which suggest that improving financial inclusion towards men and women is beneficial, but particularly towards women.

Third, our forecast analysis suggests that the world’s population living on less than $5.50 dollars a day would increase by 231 million people, of which nearly 107.8 million people would be pushed into extreme poverty living on less than $1.90 per day if no urgent and adequate measures are implemented. Our forecast analysis also suggests that with improvements in financial inclusion, particularly financial outreach, poverty increases could be curbed. We also provide policy implications and recommendations towards reducing the impact of COVID-19 on poverty.

The remainder of the paper is structured as follows. The next section provides a brief overview of the literature. Section 3 describes the data and discusses our estimation strategy. Section 4 presents the empirical results, while Section 5 shows additional robustness checks. Section 6 shows the forecast analysis and Section 7 presents our conclusion.

2. Literature review

The empirical literature on financial inclusion falls broadly into three main categories. The first one uses randomised control experiments to ascertain the impacts of offering financial services or improving outreach to individuals, households, and firms. The second strand uses quasi-experiments and case studies using mostly ad-hoc measures of financial inclusion. The third strand evaluates the impacts of financial inclusion using cross-country aggregate analysis. What we can learn from this extensive literature is that the role of financial inclusion in poverty reduction is far from conclusive.

During the 1980s and the 1990s, it was widely believed that financial inclusion, particularly in the form of providing micro-credits, could be vastly beneficial for poverty reduction (Morduch, 1999, Yunus, 2013). However, recent evidence of the micro-credit revolution stemming from randomised control trials is more nuanced. Micro-credits do improve people's ability to earn a living and help some to create and expand small businesses, but the evidence on poverty reduction is negligible. Systematic reviews of micro-credits have failed to find positive effects on household income (Duvendack et al., 2014, Stewart et al., 2012), including a meta-analysis from Grameen Bank micro-credits (Yang & Stanley, 2014). Although there are no dramatic changes in poverty reduction, there is no evidence either that these micro-credits lure vulnerable people into indebtedness, as some isolated anecdotal evidence might suggest (Banerjee, Duflo, Glennerster, & Kinnan, 2015).

The literature has also focused on understanding the extent to which broader financial inclusion can be pro-poor and what sort of broader inclusion is needed. Is it merely expanding the outreach, so that poor people can access financial services, or is increasing financial usage more beneficial? The evidence is again, inconclusive. From case studies, we know that increasing financial outreach can be beneficial for poverty reduction, even when outreach expansion might be motivated by political reasons (Cole, 2009). However, questions remain as to whether this is the most effective resource allocation instead of, for instance, direct cash transfers. For example, the largest mandated bank branch expansion established in rural areas in India during 1969–1990 helped to reduce poverty (Burgess & Pande, 2005). Still, the bank loan default rate was 40%, and questions remain about its cost-effectiveness, relative to potential alternative programmes.

Over the last decade, financial inclusion has also focused not only on improving access to credits, but also on broadening access to financial services, such as savings, insurance, and mobile banking (Cai et al., 2009, Dercon, 2005, Flory, 2018). The evidence from randomised control trials of improving household income, thanks to providing access to micro-savings and insurance, is promising. There is also evidence that expanding access to savings can particularly benefit those users that have been typically constrained and reduce sharp gender inequalities. For instance, the first randomised control trial of this kind provided access to non-interest-bearing bank accounts to young women and men in Kenya (Dupas & Robinson, 2013). The experiment showed that, despite hefty withdrawal fees, the majority of women used the accounts, and they were able to save more than men and to increase their investment and expenditures. This study suggests that women, particularly in rural areas, face negative private returns on money if they cannot find secure forms of saving. Similar findings have been found in Nepal and Malawi (Flory, 2018, Prina, 2015).

These recent randomised control trials suggest that financial inclusion might not only help poor people have more productive investments, reduce their consumption from idiosyncratic or local shocks but also help to reduce inequality. Recent quasi-experimental and case studies in developing countries such as in China, India, Nigeria and Ghana also suggest that increasing financial inclusion, in the form of increasing outreach and usage, can help to reduce household vulnerability to poverty, particularly in areas with financial services in distant places (Churchill and Marisetty, 2020, Dimova and Adebowale, 2018, Koomson et al., 2020, Li, 2018). But a remaining question is whether financial inclusion helps reducing poverty directly or via its impact on reducing income and gender inequalities. From cross-country studies, there is some mixed evidence. For instance, Goksu, Deléchat, Newiak, and Yang (2017), using a micro-data set across 140 countries, found a non-linear relationship between financial inclusion and inequality. Their findings suggest that in earlier stages of development, only a small group, the wealthy, benefit from financial inclusion progress, but with a broader level of financial inclusion gradually all other groups benefit. Similarly, using cross-country analysis, Park and Mercado (2018) show that financial inclusion is positively associated with lower levels of poverty in high- and upper-middle-income economies, but not in middle-low and low-income economies. This mixed evidence is perhaps unsurprising, given that high-income economies have a broader welfare system and better regulatory conditions that can further the impact of financial inclusion. However, this earlier analysis needs to be broadened to understand the main factors that drive poverty changes and how financial inclusion might affect poverty, whether directly or indirectly. In this respect, the literature has found two challenges. The first regards how the multidimensional aspects of financial inclusion should be measured, and the second, how to estimate whether financial inclusion affects poverty directly or indirectly by dampening the detrimental effects of inequality.

Over the last decade, the literature has proposed several different measures of financial inclusion, mainly drawing from individual financial surveys, or drawing from the global financial surveys conducted by the World Bank or the IMF (Ahamed & Mallick, 2019). The World Bank has recently made available the Global Financial Inclusion database, which provides information on more than 850 indicators across 151 economies, focusing on the demand side of financial services (Demirgüç-Kunt, Klapper, Singer, Ansar, & Hess, 2018). A main constraint of this database is its periodicity, only available for 2011, 2014, and 2017, which does not allow for an extended comparative analysis across countries over time. An alternative source is the Financial Access Survey, 2004–2018 gathered by the IMF (IMF, 2019). This annual series offers the largest global supply-side data on financial inclusion, including data on access to and usage of financial services by both firms and households that are comparable across countries and over time.

As reviewed here, all strands of the empirical literature are equally relevant for policy analysis. From the experimental literature and quasi-experimental case studies, we learn that financial inclusion needs to consider more than micro-credits. We also learn that financial inclusion might not reduce poverty directly, but indirectly by reducing inequalities in financial access and by broadening financial usage among typically disadvantaged groups. Cross-country analysis has a different advantage. It allows one to use the same measure of financial inclusion to make comparative analysis across countries and over time. Cross-country analysis can also estimate the likely direct and indirect impacts of financial inclusion on poverty.

Next, we take advantage of the poverty-growth-inequality decomposition method proposed by Datt and Ravallion (1992) to understand whether financial inclusion affects poverty reduction directly or indirectly. At the aggregate level, poverty from one period to the next might change as a result of changes in the Gross Domestic Product (GDP), ceteris paribus, or whether GDP is distributed any differently. These simple poverty decompositions, theoretically underpinned by Lorenz Curve principles, can be empirically estimated. Extensive research has shown that inequality in particular is detrimental for poverty reduction since increases in GDP are often captured by middle or upper classes, with a limited trickledown effect for the poor (Gutiérrez-Romero and Méndez-Errico, 2017, Ravallion, 2005, van der Weide and Branko, 2018).

In our empirical analysis, we extend these decomposition regressions to include the potential role of financial inclusion in poverty reduction. Our first hypothesis is whether financial inclusion might affect poverty reduction directly. Our second hypothesis is that financial inclusion might reduce poverty indirectly by mitigating the detrimental effect that inequality has on poverty. To test our two key hypotheses, we construct a financial inclusion index along two associated dimensions of financial outreach and financial usage.

3. Empirical Strategy: Data and method

3.1. Data sources

We use three main data sources. First, to construct the financial inclusion index, described in sub-Section 3.2, we use the Financial Access Survey (FAS) database, available during the 2004–2018 period (IMF, 2019). As an alternative indicator of financial inclusion, we also use the percentage of the population that owns a bank account, taken from the World Bank’s Global Findex database, available during the 2011–2018 period (Demirgüç-Kunt et al., 2018).

Our second key data source is on countries’ annual GDP growth rate from 2004 until 2019. In Section 6, we forecast global levels of poverty post-COVID-19 for which we use the latest IMF economic growth forecasts (at the time of this writing) for the years 2020 and 2021 (IMF, 2020b). As a robustness check of our forecasts, we also use the latest World Bank economic growth projections for the years 2020 and 2021 (World Bank, 2020).

Our third key data source is PovcalNet, which provides inequality and poverty statistics, at the national level, based on over two million randomly sampled households around the globe since the 1980s. We constrain our analysis to the period 2004–2018 where we also have data on financial inclusion. Following standard practice in the literature, we measure the incidence of poverty in the poorest countries of the world using three international poverty lines of $1.90, $3.20 and $5.50 dollars a day (at 2011 purchasing power parity).4 Specifically, we use the poverty headcount ratio which measures the proportion of the population who are poor; the poverty gap index which measures the depth of poverty by considering how far, on average, the poor are from that poverty line, expressed as a percentage; the poverty gap squared, similar to the earlier measure but based on the sum of squared poverty deficits; and the Watts poverty index which is more sensitive to changes in the lowest part of the income distribution. That is, transfers to the poorest of the poor counts more in the Watts index in terms of poverty reduction than transfers to the relatively wealthier of the poor.5

3.2. Constructing the financial inclusion index

We construct an overall index of financial inclusion which we decompose into two sub-indices of financial outreach and financial usage. This approach follows the advice of the recent literature that has suggested to focus on these two dimensions to measure progress made in financial inclusion (Ahamed and Mallick, 2019, Amidžic et al., 2014).

Our sub-index of financial usage includes the number of bank accounts per 1,000 people (that is the sum of loan and deposit accounts), intended to measure the depth of the financial access.6 We estimate the sub-index of financial outreach using principal component analysis that helps us to combine the four indicators described next (Fo1, Fo2, Fo3 and Fo4). Following the approach suggested by Beck, Demirgüç-Kunt, and Martinez Peria (2007), to capture the demographic penetration of bank branches we include the number of bank branches (Fo1) and the number of ATMs per 100,000 people (Fo2). To capture the geographic penetration of bank branches, we include the number of bank branches (Fo3) and the number of ATMs per 1,000 square kilometres (Fo4). Thus, this financial outreach sub-index helps to capture the physical proximity to the point of financial services, which is considered to be one of the most important impediments to inclusive financial development (Allen et al. 2014).

After estimating the financial outreach dimension using principal component analysis, we then construct the overall index of financial inclusion using again principal component analysis, which helps us to weight the financial outreach and financial usage sub-indices, as expressed in Eq. (1).7

| (1) |

where are the component’s loadings or weights, and are the financial outreach and financial usage dimensions.8 To ease interpretation, we normalise the overall index of financial inclusion and assign each country a score from 0 (lowest) to 1 (highest) scale of inclusive financial development.

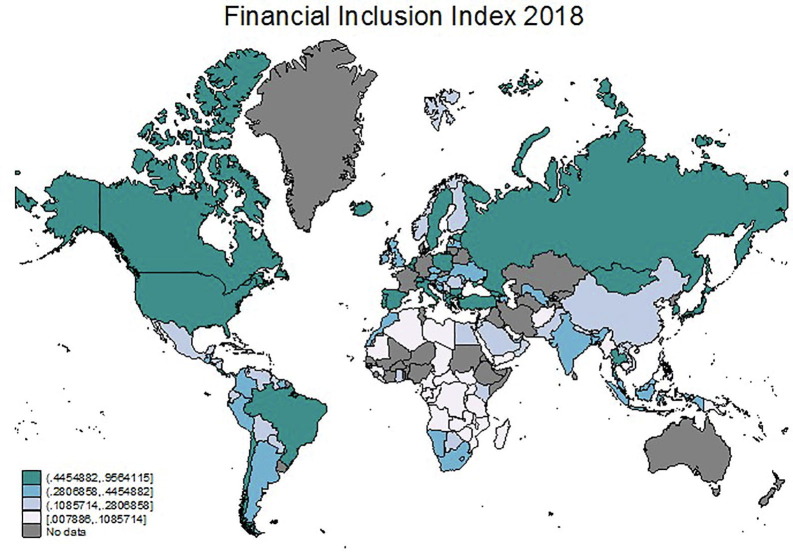

Fig. 1 shows the overall index of financial inclusion around the globe. In the Appendix, in Table A1, Table A2, Table A3, we provide the financial inclusion index on an annual basis for each country for which there are available data, including the two associated dimensions of financial outreach and financial usage from 2004 to 2018. In Table A1, we also include a category of whether the country is low, lower-middle, upper-middle, or high-income. Since some countries have changed income category over time, we present this income category for the year 2018 only. The distinction of income levels is particularly relevant for our analysis because as explained in the next section, we focus on low- and low-middle income countries given that they concentrate most of the population living in extreme levels of poverty (according to all the poverty lines used here of $1.90, $3.20 and $5.50 dollars a day).

Fig. 1.

Financial inclusion around the globe. Source: Own estimates using 2019 Financial Access Survey (IMF, 2019).

3.3. Descriptive statistics

After combining the inequality (Gini index) and poverty statistics with the financial inclusion indices, we remain with 121 countries and 1,694 observations for the 2004–2018 period. We report the overall descriptive statistics in Table 1 over the whole 2004–2018 period. We also present separately the statistics for the 79 low-and lower-middle-income countries contained in our sample and 66 upper-middle and high-income countries. Note that these countries do not add up to the total of countries included in our sample (121) because during the period analysed some countries changed of income category, and these countries, therefore, might appear in different income categories over time, albeit in different years only.

Table 1.

Summary statistics of poverty and financial inclusion over 2004–2018.

| All countries |

Low- and lower-middle-income countries |

Upper-middle and high-income countries |

||||

|---|---|---|---|---|---|---|

| Mean | St dev. | Mean | St dev. | Mean | St dev. | |

| Headcount under $1.9 a day | 0.156 | 0.219 | 0.270 | 0.244 | 0.026 | 0.053 |

| Poverty gap under $1.9 a day | 0.060 | 0.101 | 0.105 | 0.121 | 0.009 | 0.019 |

| Poverty gap squared under $1.9 a day | 0.032 | 0.061 | 0.056 | 0.076 | 0.005 | 0.012 |

| Watts index under $1.9 a day | 0.091 | 0.168 | 0.161 | 0.205 | 0.011 | 0.024 |

| Gini | 0.395 | 0.084 | 0.412 | 0.075 | 0.375 | 0.090 |

| GDP growth rate | 0.037 | 0.038 | 0.045 | 0.039 | 0.028 | 0.035 |

| Financial inclusion index | 0.267 | 0.230 | 0.124 | 0.117 | 0.428 | 0.219 |

| Financial outreach | 0.225 | 0.221 | 0.102 | 0.099 | 0.365 | 0.237 |

| Financial usage | 0.320 | 0.288 | 0.153 | 0.159 | 0.510 | 0.283 |

| Number of countries | 121 | 79 | 66 | |||

| Number of observations | 1694 | 899 | 795 | |||

Source: Own estimates using PovcalNet and Financial Access Survey (IMF, 2019).

Table 1 shows that over the whole period analysed, only 2.6% of the population in upper-middle and high-income countries lived on less than $1.90 dollars a day. In sharp contrast, an average of 27% of the population in low- and lower-middle-income countries lived on less than $1.90 dollars a day. People in these poorer countries also faced significant disadvantages in terms of experiencing higher levels of inequality and significantly lower levels of financial inclusion than people in wealthier countries. In Section 5, we discuss further the statistics related to the other two poverty lines of $3.20 and $5.50 dollars a day. In Section 6 we show in further depth the progress made in reducing poverty over the period analysed, and the likely rises in poverty expected as a result of the COVID-19 economic crisis.

Table 2 shows the percentage of the population that own a bank account, according to the Global Findex database on average during 2011–2018, which can be interpreted as an alternative indicator of financial inclusion. This table shows there are sharp differences in financial inclusion between wealthier countries and those low- and lower-middle-income countries. Moreover, although in general, women have a lower percentage of bank ownership than men, women in low- and lower-middle-income countries are significantly constrained from these financial services (see Table 2).

Table 2.

Summary statistics of account ownership over 2011–2018.

| All countries |

Low- and lower-middle-income countries |

Upper-middle and high-income countries |

||||

|---|---|---|---|---|---|---|

| Mean | St dev. | Mean | St dev. | Mean | St dev. | |

| Account ownership | 0.473 | 0.296 | 0.269 | 0.165 | 0.686 | 0.247 |

| Account ownership (Male) | 0.503 | 0.291 | 0.300 | 0.170 | 0.716 | 0.233 |

| Account ownership (Female) | 0.443 | 0.305 | 0.238 | 0.168 | 0.657 | 0.266 |

| Number of countries | 108 | 68 | 60 | |||

| Number of observations | 1512 | 773 | 739 | |||

Source: Own estimates using World Bank’s Global Findex database (Demirgüç-Kunt et al., 2018).

Going back to the overall index of financial inclusion constructed for this paper, at the country level, we also note that, on average for the period of analysis 2004–2018, low- and lower-middle-income countries with higher levels of overall financial inclusion were associated with lower levels of poverty headcount ratio (using the $1.90 a day) and lower levels of income inequality (Fig. 2 ). In the next section, we assess this potential relationship between financial inclusion, poverty and inequality over the period 2004–2018, which can inform the current policy debate on whether financial inclusion development is indeed related to poverty reduction, and the potential mechanisms involved. To do so, we first apply the poverty decomposition proposed by Datt and Ravallion (1992), which we then extend to include the indicator of financial inclusion.

Fig. 2.

Financial inclusion, poverty, and inequality in low- and lower-middle-income countries.

3.4. Estimation framework

We start by applying the decomposition methodology proposed by Datt and Ravallion (1992) to examine to what extent poverty changes observed at the national level can be ascribed to changes in economic growth or income inequality. From the theoretical properties of the Lorenz curve, these authors show that the levels of poverty from one period to the next may change due to three key components. These are either a change in the mean income while holding the Lorenz curve constant at that of the reference year, the so-called growth component; or due to a change in the Lorenz curve, while holding the mean income constant, referred to as the redistribution component; or due to changes in a residual term that capture changes in poverty due to the interaction between these two other terms. Thus, at the national level, a change in poverty from one period to the next one can be expressed as in Eq. (2).

| (2) |

where P denotes the poverty measure at date f, or f + n that can be fully characterised by a poverty line z, and the Lorenz curve. G(.); D(.) and R(.) stand for the growth, redistribution, and residual components. The last argument r denotes the reference date with respect to which the observed change in poverty is being decomposed. According to Datt and Ravallion (1992), the residual term can be interpreted as the difference between the growth (redistribution) components evaluated at the terminal and initial Lorenz curves. Therefore, if the mean income or the Lorenz curve remain unchanged over the decomposition period, the residual vanishes.

This poverty decomposition can be easily implemented by regressing changes in poverty on changes in income inequality, proxied by changes in the Gini index, and on changes in the real Gross Domestic Product growth, as shown in Eq. (3).9 Note that the decomposition technique is not intended to prove causality, nor to account for the causal determinants of the differences in the levels of poverty, which can be numerous. Instead, this regression, based on the theoretical properties of the Lorenz curve, estimates to what extent changes in poverty at the macro-level can be attributed to changes in economic growth, redistribution changes, or the interaction between these two. Since this regression is usually run on several years, the literature usually merely adds year fixed effects as controls to capture to what extent fluctuations in particular years exacerbate changes in poverty, an approach that we follow here (Freije, 2014).

| (3) |

where ΔPit denotes annual change in poverty in country i in annual period t. We separately use four measures of poverty (headcount ratio, poverty gap, poverty gap squared, and the Watts index). ΔGini denotes annual changes in the Gini index, and φ represents the regression coefficient for the year fixed effects. We estimate this regression using panel fixed effects at the country level, clustering the Huber–White standard errors at the country level.

To consider to what extent changes in financial inclusion affect changes in poverty, we amend this poverty decomposition regression. We do so by adding the annual change in the financial inclusion index and the interaction between changes in the financial inclusion index and the change in the Gini index, as shown in Eq. (4). We add these two factors to understand whether improvements in financial inclusion contribute directly towards poverty reduction or indirectly by dampening the detrimental effect of increases in inequality.10

| (4) |

where ΔFinancial inclusionit stands for the change in the overall financial inclusion index in country i in annual period t. To understand further how financial inclusion might be helping poverty, we run three separate regressions, using either the change in the overall index of financial inclusion, or the change in the sub-index of financial outreach, or the change in the sub-index of financial usage. The regression coefficient η, is the interaction between changes in financial inclusion and change in inequality. A negative interaction coefficient η would suggest that improvements in financial inclusion would have a larger contribution to poverty reduction in countries with higher levels of income inequality. We estimate this regression using panel fixed effects at the country level, clustering the Huber–White standard errors at the country level.

This panel fixed effects regression can help us to forecast to what extent a major drop in GDP growth, such as the one expected as a result of COVID-19, or likely changes in inequality could impact poverty in the near future. More importantly, for policy insights, we can also learn to what extent improvements in financial inclusion, could help to reduce poverty directly or indirectly.

Our panel fixed effects regression specification helps to mitigate some potential concerns with endogeneity, particularly for any omitted time-invariant regressors that might be correlated with the error term. Nonetheless, we acknowledge that a potential limitation of this approach could be a potential reverse causality between changes in financial inclusion and changes in poverty. That is, changes in financial inclusion, or lack thereof, may be a consequence of changes in poverty over time, which are perhaps more likely to occur in poorer countries where with some exceptions, financial inclusion is still not widely spread. To test for and address such potential endogeneity bias we will also run a separate instrumental variable specification. As shown in Section 4, although we find some evidence of endogeneity our core conclusions remain the same as from our benchmark panel fixed specifications.

Specifically, to test and account for endogeneity we use a panel random effects (RE) model with two-stage least squares (IV-2SLS) instrumental variables. This RE model has the flexibility of simultaneously modelling both time-variant and time-invariant effects, unlike panel fixed effects (Bell & Jones, 2015). Eqs. (5) and (6) represent the first-stage regressions of our two potential endogenous variables, ΔFinancial inclusion and therefore, its interaction term ΔFinancial inclusion*ΔGini.

| (5) |

| (6) |

where Zit and Zi refer to the three external instruments used, uit and vit refer to the disturbance terms. The first instrument used, denoted by Zit is the number of mobile phone subscriptions, per 10,000 people, 11 which varies on an annual basis during our sample period, and has been shown to be strongly associated with financial development (Beck, Demirgüç-Kunt, & Martinez Peria, 2007).12 Since new mobile phone subscriptions are unlikely to turn immediately into more financial inclusion, we lag our instrument by two periods. We also use as external instruments the origin of countries’ legal code and whether they were former colonies. Earlier research has shown that these external instruments account for substantial cross-country differences in financial development (La Porta et al., 1997, La Porta et al., 2008, Beck et al., 2000). The origin of countries’ legal code can be broadly classified into two, the English common law and the civil law tradition (along its several sub-traditions, the French, Socialist, German and Scandinavian). These legal traditions are derived from the Roman law, which were developed over time into the distinct schools we know today and which through colonialism and occupation were transplanted from few countries to the rest of the world (Beck et al., 2000). Thus, we treat these legal traditions, as well as who was the Western coloniser (if any), as exogenous ‘endowments’ which up to date continue to affect financial development during our sample period.

The second-stage IV random-effects model estimates the impact of changes in financial inclusion on changes in poverty, as shown in Eq. (7).

| (7) |

where κ4 and κ5 are the regression coefficients of the instrumented endogenous variables. The so-called ‘random’ part of the model in parenthesis consists of the residual κi for country i, which allows for differential intercepts for countries, and eit represents the time-varying residuals.

4. Results

4.1. Poverty decomposition

Table 3 reports the estimation results of the poverty decomposition shown in Eq. (3), estimated with a panel fixed effect specification, and robust standard errors clustered at the country level. This regression assesses the extent to which annual changes in poverty rates are attributable to changes in economic growth or distribution of income. We use four separate dependent variables. That is the change (denoted by Δ) of the poverty headcount ratio, poverty gap, poverty gap squared, and the Watts index. In columns 1–4, we estimate the poverty decomposition for all 121 countries in our sample for the whole period 2014–2018. In columns 5–8, we focus on only the 79 low- and lower-middle-income countries in the sample, and the remaining columns 9–12 refer to upper-middle and high-income countries only. All these poverty statistics refer to the $1.90 dollars a day poverty line. In Section 5, as a robustness check, we re-run our results for the poverty lines of $3.20 and $5.50 dollars a day.

Table 3.

Poverty growth-redistribution decomposition of those living under $1.90 dollars a day.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

(11) |

(12) |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| All countries |

Low- and lower-middle-income countries |

Upper-middle and high-income countries |

||||||||||

| ΔHeadcount | ΔPoverty gap | ΔPoverty gap squared | ΔWatts | ΔHeadcount | ΔPoverty gap | ΔPoverty gap squared | ΔWatts | ΔHeadcount | ΔPoverty gap | ΔPoverty gap squared | ΔWatts | |

| ΔGini | 0.604*** | 0.378*** | 0.273*** | 0.679*** | 0.738*** | 0.500*** | 0.359*** | 0.986*** | 0.411*** | 0.207*** | 0.151*** | 0.251*** |

| (0.162) | (0.093) | (0.064) | (0.187) | (0.278) | (0.156) | (0.107) | (0.297) | (0.074) | (0.053) | (0.046) | (0.054) | |

| GDP growth rate | −0.011 | −0.006 | −0.005 | −0.009 | 0.010 | −0.002 | −0.004 | −0.007 | −0.029 | −0.010 | −0.007 | −0.008 |

| (0.022) | (0.013) | (0.009) | (0.024) | (0.036) | (0.020) | (0.014) | (0.037) | (0.019) | (0.010) | (0.006) | (0.015) | |

| Constant | −0.004* | −0.002 | −0.001 | −0.003 | −0.006* | −0.003* | −0.002 | −0.004 | −0.002 | −0.001 | 0.000 | −0.002 |

| (0.002) | (0.001) | (0.001) | (0.002) | (0.003) | (0.002) | (0.001) | (0.003) | (0.003) | (0.001) | (0.001) | (0.002) | |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1,694 | 1,694 | 1,694 | 1,694 | 899 | 899 | 899 | 899 | 795 | 795 | 795 | 795 |

| Adjusted R2 | 0.140 | 0.155 | 0.156 | 0.141 | 0.137 | 0.169 | 0.169 | 0.179 | 0.291 | 0.293 | 0.303 | 0.237 |

| Number of countries | 121 | 121 | 121 | 121 | 79 | 79 | 79 | 79 | 66 | 66 | 66 | 66 |

Note: Panel fixed effects model. Δ indicates change from one period to the next. Robust standard errors, clustered at the country level in parentheses. Significance level *** p < 0.01, ** p < 0.05, * p < 0.1.

Source: World Bank’s PovcalNet database and IMF. Coverage: 2004–2018 period.

The results show that the redistribution component (change in the Gini index) is statistically significant, suggesting that increases in inequality contribute to rises in poverty. The strength of this association is stronger for low- and lower-middle-income countries than for wealthier countries.13 In contrast, the regression coefficient of economic growth is statistically insignificant for all columns.

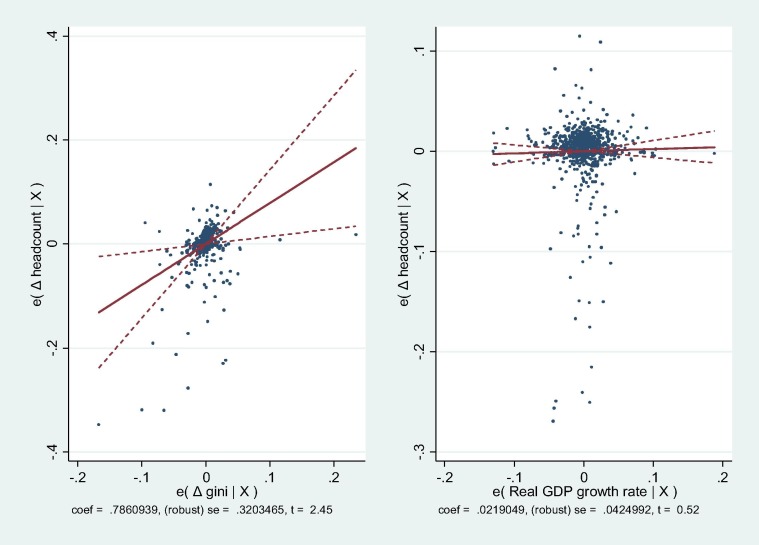

In Fig. 3 , we plot the marginal effects of the regression coefficients shown in column 5 for low- and lower-middle-income countries. These marginal effects illustrate the null effect of growth on poverty reduction, but the strong effect of changes in inequality. Overall, these results imply that the poverty reduction seen over the whole period analysed 2004–2018 has been mostly driven by redistribution of income towards the poor.

Fig. 3.

Marginal effects of change in inequality and growth on changes on poverty headcount ratio in low- and low-middle-income countries.

4.2. The role of financial inclusion

We move on to assess the role of improvements in financial inclusion on poverty reduction. Since our interest is particularly on extreme levels of poverty, we focus exclusively on the 79 low- and lower-middle-income countries in our sample, which are home to the majority of the population living under a $1.90 dollars a day.

In Table 4 , we start by showing the panel fixed effects specification as expressed in Eq. (4). As before, we use four separate measures of poverty as dependent variables, all referring to the $1.90 dollars a day poverty line. For each of these poverty measures, we separately estimate the association between changes in the overall index of financial inclusion, the sub-index financial outreach, and the sub-index financial usage.

Table 4.

Growth-redistribution decomposition of poverty in low- and low-middle income countries: the role of financial inclusion.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

(11) |

(12) |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dependent variable: | ΔHeadcount | ΔPoverty gap | ΔPoverty gap squared | ΔWatts | ||||||||

| ΔGini | 0.961*** | 0.953*** | 0.866*** | 0.638*** | 0.641*** | 0.575*** | 0.454*** | 0.459*** | 0.410*** | 1.246*** | 1.257*** | 1.127*** |

| (0.309) | (0.313) | (0.289) | (0.175) | (0.181) | (0.162) | (0.121) | (0.126) | (0.112) | (0.340) | (0.351) | (0.314) | |

| GDP growth rate | 0.007 | 0.011 | 0.009 | −0.002 | −0.001 | −0.002 | −0.003 | −0.003 | −0.003 | −0.007 | −0.006 | −0.006 |

| (0.035) | (0.035) | (0.035) | (0.020) | (0.020) | (0.020) | (0.013) | (0.013) | (0.014) | (0.036) | (0.036) | (0.036) | |

| ΔFinancial inclusion | 0.136* | 0.044* | 0.019 | 0.058 | ||||||||

| (0.072) | (0.025) | (0.015) | (0.041) | |||||||||

| ΔGini × ΔFinancial inclusion | −34.622* | −21.368** | −14.643** | −40.275** | ||||||||

| (18.028) | (9.788) | (6.555) | (18.275) | |||||||||

| ΔFinancial inclusion outreach | 0.040 | 0.019 | 0.013 | 0.033 | ||||||||

| (0.058) | (0.032) | (0.022) | (0.059) | |||||||||

| ΔGini × ΔFinancial inclusion outreach | −39.437** | −25.917** | −18.275** | −49.745** | ||||||||

| (19.753) | (11.718) | (8.093) | (22.317) | |||||||||

| ΔFinancial inclusion usage | 0.089* | 0.025 | 0.009 | 0.028 | ||||||||

| (0.050) | (0.019) | (0.011) | (0.030) | |||||||||

| ΔGini × ΔFinancial inclusion usage | −16.387 | −9.767 | −6.576* | −18.221* | ||||||||

| (11.252) | (5.940) | (3.886) | (10.785) | |||||||||

| Constant | −0.006* | −0.006* | −0.006* | −0.003* | −0.003* | −0.003* | −0.002 | −0.002 | −0.002 | −0.004 | −0.004 | −0.004 |

| (0.003) | (0.003) | (0.003) | (0.002) | (0.002) | (0.002) | (0.001) | (0.001) | (0.001) | (0.003) | (0.003) | (0.003) | |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 899 | 899 | 899 | 899 | 899 | 899 | 899 | 899 | 899 | 899 | 899 | 899 |

| Adjusted R2 | 0.163 | 0.157 | 0.155 | 0.194 | 0.193 | 0.184 | 0.191 | 0.191 | 0.181 | 0.203 | 0.202 | 0.192 |

| Number of countries | 79 | 79 | 79 | 79 | 79 | 79 | 79 | 79 | 79 | 79 | 79 | 79 |

Note: Panel fixed effects model. Δ indicates change from one period to the next. Robust standard errors, clustered at the country level in parentheses. Significance level *** p < 0.01, ** p < 0.05, * p < 0.1.

Source: World Bank’s PovcalNet database and IMF. Coverage: 2004–2018 period.

Table 4 shows that changes in inequality (proxied by changes in the Gini index) are positive and statistically significantly associated with changes in poverty, as our earlier estimations had shown. Similarly, we find that GDP growth rate is not statistically associated with changes in poverty.

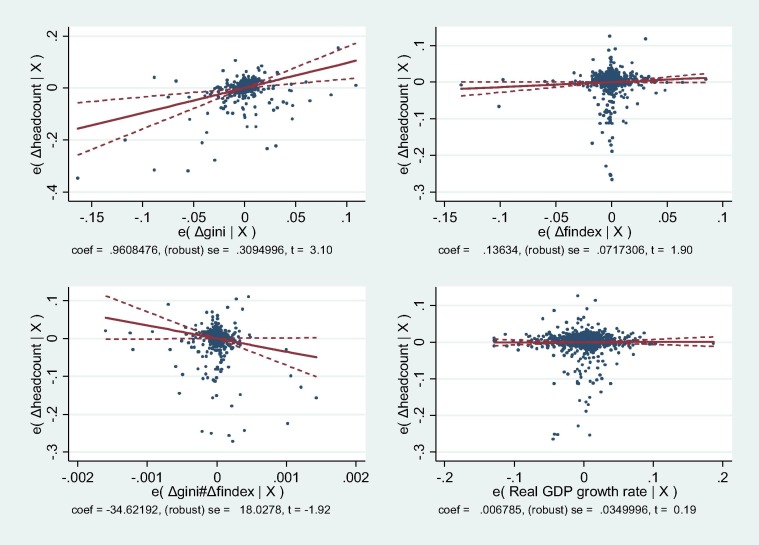

We find some positive association between the changes in financial inclusion and changes in poverty (columns 1 and 4). However, the net effect of financial inclusion14 is negative, given that the interaction between the change in financial inclusion and change in the Gini index is negative and large in magnitude. This interaction is statistically significant for all the measures of poverty used, suggesting that the detrimental effect of inequality on poverty is strongly dampened in countries that have a greater level of financial inclusion. Also, the interactions between changes in Gini and financial outreach are statistically significant for all poverty measures. This interaction with the financial usage index is however, only significant in columns 9 and 12, for the squared poverty gap and the Watts index. These results suggest that the financial outreach dimension is the one that contributes the most to reducing the detrimental effect of inequality on poverty. As a robustness check, we have also estimated alternative specifications where we interacted the GDP growth rate with changes in the financial inclusion index (or either of its two dimensions). These alternative interactions turned statistically insignificant (reason why we do not report them), findings that suggest financial inclusion helps poverty reduction via dampening the damaging effect of inequality but not through boosting the effect of economic growth.

In Fig. 4 , we plot the marginal effects of all the regression coefficients shown in column 1. These marginal effects illustrate a strong association between poverty reduction and financial inclusion by reducing the detrimental effect of inequality.

Fig. 4.

Marginal effect of growth, change in inequality, and change in financial inclusion on poverty in low- and low-middle income countries.

4.3. Addressing endogeneity concerns

We acknowledge that the associations between changes in financial inclusion and poverty might suffer from endogeneity bias. Therefore, to address this potential concern, we continue by presenting our instrumental variable specifications.

The first-stage relationship between our instruments (country’s coloniser, origin of legal code, and two-year lagged mobile phone subscriptions) and our potential endogenous variables (change in financial inclusion and its interaction with Gini) is strong as expected (see Table A4). That is, in line with earlier literature, improvements in mobile phone subscription lead to higher levels of financial inclusion. Also, countries with the civil law tradition have worse levels of financial inclusion than countries with the common law legal tradition, and colonial origin influences financial inclusion. The two-stage panel random IV specifications are shown in Table 5 . The bottom of this table shows the Sargan-Hansen overidentification test, which suggests our instruments are valid. That is, as the null hypothesis of this test suggests, the instruments are uncorrelated with the error term, and that the excluded instruments are correctly excluded from the second-stage regression. We also report the endogeneity test showing that there are unobserved factors correlated with the error, therefore the need for instrumental variable model specifications.

Table 5.

Growth-redistribution decomposition of those living under $1.90 dollars a day in low- and low-middle income countries: the role of financial inclusion. Second-stage IV random effects specification.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

(11) |

(12) |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dependent variable: | ΔHeadcount | ΔPoverty gap | ΔPoverty gap squared | ΔWatts | ||||||||

| ΔGini | 1.240*** | 1.352*** | 0.858** | 0.757*** | 0.832*** | 0.555*** | 0.517*** | 0.576*** | 0.386*** | 1.414*** | 1.584*** | 1.049*** |

| (0.429) | (0.394) | (0.377) | (0.223) | (0.211) | (0.202) | (0.153) | (0.144) | (0.138) | (0.423) | (0.401) | (0.380) | |

| GDP growth rate | −0.029 | −0.046 | −0.033 | −0.031 | −0.043 | −0.032 | −0.026 | −0.034 | −0.026 | −0.066 | −0.087 | −0.068 |

| (0.036) | (0.038) | (0.036) | (0.025) | (0.027) | (0.026) | (0.020) | (0.021) | (0.021) | (0.053) | (0.056) | (0.054) | |

| ΔFinancial inclusion | −0.037 | 0.163 | 0.165 | 0.423 | ||||||||

| (0.275) | (0.197) | (0.163) | (0.432) | |||||||||

| ΔGini × ΔFinancial inclusion | −80.883 | −44.397 | −27.062 | −70.913 | ||||||||

| (52.948) | (27.490) | (19.413) | (52.801) | |||||||||

| ΔFinancial inclusion outreach | 0.285 | 0.429 | 0.360 | 0.936 | ||||||||

| (0.433) | (0.292) | (0.235) | (0.624) | |||||||||

| ΔGini × ΔFinancial inclusion outreach | −105.063** | −60.947** | −40.397** | −109.589** | ||||||||

| (40.849) | (24.109) | (16.336) | (42.700) | |||||||||

| ΔFinancial inclusion usage | 0.002 | 0.124 | 0.126 | 0.338 | ||||||||

| (0.230) | (0.169) | (0.139) | (0.375) | |||||||||

| ΔGini × ΔFinancial inclusion usage | 14.254 | 5.731 | 5.697 | 20.213 | ||||||||

| (48.192) | (28.639) | (20.780) | (57.328) | |||||||||

| Constant | 0.002 | 0.002 | 0.003 | 0.001 | 0.002 | 0.001 | 0.001 | 0.001 | 0.001 | 0.002 | 0.003 | 0.002 |

| (0.002) | (0.002) | (0.003) | (0.001) | (0.001) | (0.002) | (0.001) | (0.001) | (0.002) | (0.003) | (0.003) | (0.004) | |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 701 | 701 | 701 | 701 | 701 | 701 | 701 | 701 | 701 | 701 | 701 | 701 |

| Number of countries | 66 | 66 | 66 | 66 | 66 | 66 | 66 | 66 | 66 | 66 | 66 | 66 |

| Test of overidentifying restrictions: | ||||||||||||

| Sargan-Hansen statistic Chi-sq | 5.848 | 4.543 | 5.059 | 6.663 | 4.129 | 6.972 | 5.993 | 3.784 | 6.468 | 6.218 | 3.903 | 6.262 |

| Sargan-Hansen statistic P-value | 0.321 | 0.474 | 0.409 | 0.247 | 0.531 | 0.223 | 0.307 | 0.581 | 0.263 | 0.286 | 0.563 | 0.282 |

| Endogenity test: | ||||||||||||

| Chi-sq | 14.690 | 10.980 | 14.510 | 17.850 | 14.040 | 15.380 | 17.830 | 15.240 | 15.480 | 17.750 | 15.160 | 15.480 |

| P-value | 0.001 | 0.004 | 0.001 | 0.000 | 0.001 | 0.001 | 0.000 | 0.001 | 0.000 | 0.000 | 0.001 | 0.000 |

Note: Δ indicates change from one period to the next. Robust standard errors, clustered at the country level in parentheses. Significance level *** p < 0.01, ** p < 0.05, * p < 0.1. Respective first-stage IV regression in Table A4. Source: World Bank’s PovcalNet database and IMF. Coverage: 2004–2018 period.

Despite finding evidence of endogeneity, Table 5, our second-stage IV estimations confirm our core messages. That is, changes in inequality are strongly associated with changes in poverty, whereas economic growth is not. However, this time we find that only the interaction between changes in the Gini index and the financial inclusion outreach index is statistically significant, and again negative in sign, for each of our four dependent variables. The magnitude of these IV interactions, although with the same sign, are larger than the panel fixed specifications shown earlier. We conclude that our earlier panel fixed effects regression offers more conservative estimates of the association between financial inclusion outreach and poverty reduction.

To assess the magnitude of the IV effects, Table A5 re-estimates our results but using standardised coefficients. That is, we de-mean all our continuous dependent and independent variables and divide them by their standard deviation. In this way, the regression coefficients represent effects in terms of standard deviations. The standardised coefficients for changes in the Gini coefficient on poverty change are mostly between 0.50 and 0.80, therefore would be considered of medium magnitude following Cohen’s (1988) guidelines. The standardised interaction coefficients between the change in the Gini coefficient and the financial inclusion outreach indices are greater than 0.90, therefore of large magnitude.

5. Additional checks

5.1. Using alternative poverty lines

All our earlier findings focused on the poverty line of $1.90 dollars a day. In this section, we focus instead on those living under $3.20 and $5.50 dollars a day. Although, we do not necessarily expect to find exactly the same relationship between our key explanatory variables and changes in poverty, it is worth assessing whether improvements in financial inclusion could lead to similar reductions in less extreme forms of poverty, and whether through similar channels, such as improvements in financial outreach.

Table A6 shows a substantial percentage of the population lives under $3.20 and $5.50 dollars a day in low- and low-middle income countries, that is 48% and 70% respectively. In contrast, only a small percentage of the population lives under these poverty lines in upper-middle and high-income countries, only 6.5% and 15.4% respectively.

Table A7, Table A8 show the poverty decomposition using the $3.20 and $5.50 a day poverty lines respectively using Eq. (3). Columns 1–4 refer to all countries in our sample, columns 5–9 to low- and low-middle income countries only, and columns 10–12 to wealthier countries only. As before, we find that economic growth has a null effect on poverty changes in low-middle income countries. Similarly, increases in inequality lead to higher levels of poverty. However, this time we find that the regression coefficient of changes in inequality is not statistically significant when using as dependent variable the change in the poverty headcount ratio in low- and low-middle income countries, but it is in other countries, as well as for the other three poverty measures.

Then we proceed to estimate the relationship between changes in financial inclusion and poverty, using the same instrumental variables we used earlier on, again focusing on low- and low-middle income countries.

The first-stage regression for the $3.20 dollar a day poverty line is shown in Table A9, and the first-stage regression for the $5.50 dollar a day poverty line is in Table A11. The respective second-stage IV panel random effects regressions are reported in Table A10, Table A12. As shown at the bottom of these tables, once again we find evidence of endogeneity, and that our instruments are valid according to the Sargan-Hansen overidentification statistics.

The interaction between changes in financial inclusion index and the Gini index is statistically insignificant for all our poverty measures using the $3.20 and $5.50 dollars a day poverty lines (Table A10, Table A12). Focusing on the $3.20 dollars a day, we find that the interaction between changes in Gini and financial outreach is statistically significant for all poverty measures except for the poverty headcount. For the $5.50 dollars a day, we find that the interaction between the Gini index and financial outreach is once again statistically significant, and negative, but only for the poverty gap square and the Watts index. These results strongly suggest that improvements in financial outreach help to mitigate the detrimental effect of inequality, particularly for the poorest of the poor.

5.2. Alternative measure of financial inclusion

As an additional robustness check, we use an alternative measure of financial inclusion, focusing this time on the so-called demand-side measures. That is the percentage of account ownership at a financial institution.

We re-run our instrumental panel random effects specifications, shown in Eqs. (5)–(7) replacing our measures of financial inclusion with the information on account ownership. As the Global Findex database starts reporting this information from the year 2011, we restrict our analysis for the period 2011–2018.15 As before, we re-run our results using first the $1.90 a day, and then separately for the $3.20 and $5.50 a day poverty lines.

Table A13 shows the first-stage of the instrumental variable panel random-effects regression for our instrumented endogenous variables.16 Table 6 shows the second-stage IV panel random effects using as dependent variable the poverty statistics for the $1.90 a day poverty line.17 We use the indicator of account ownership in columns 1–4, and those accounts owned by males and females in columns 5–8 and 9–12, respectively. The results are consistent with our earlier findings. We find that the detrimental effect of changes in inequality on poverty is dampened in countries that have higher account ownership at a financial institution. We also find that higher account ownership by men or women reduces poverty in a country where there is a higher level of income inequality, across all four statistics of poverty used. However, the magnitude of the coefficients for females is larger. To assess the magnitude of these effects, Table A14 re-estimates our results but using standardised coefficients. All the interactions between the change in account ownership and the Gini index are above 0.80, therefore of large magnitude.

Table 6.

Growth-redistribution decomposition of those living under $1.90 dollars a day: the role of financial inclusion using an alternative measure of financial inclusion. Second-stage IV random effects specification.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dependent variable: | ΔHeadcount | ΔPoverty gap | ΔPoverty gap squared | ΔWatts | ΔHeadcount | ΔPoverty gap | ΔPoverty gap squared | ΔWatts | ΔHeadcount | ΔPoverty gap | ΔPoverty gap squared | ΔWatts |

| ΔGini | 1.766*** | 1.220*** | 0.881*** | 2.406*** | 1.539*** | 1.029*** | 0.736*** | 2.015*** | 1.830*** | 1.300*** | 0.949*** | 2.584*** |

| (0.567) | (0.384) | (0.278) | (0.758) | (0.527) | (0.341) | (0.243) | (0.673) | (0.568) | (0.402) | (0.298) | (0.806) | |

| GDP growth rate | 0.139 | 0.087 | 0.057 | 0.157 | 0.121 | 0.070 | 0.045 | 0.123 | 0.133 | 0.086 | 0.058 | 0.158 |

| (0.149) | (0.100) | (0.071) | (0.194) | (0.130) | (0.082) | (0.057) | (0.156) | (0.148) | (0.103) | (0.075) | (0.203) | |

| ΔAccount ownership | −0.338 | −0.164 | −0.092 | −0.252 | ||||||||

| (0.420) | (0.295) | (0.217) | (0.585) | |||||||||

| ΔGini × ΔAccount ownership | −34.057* | −24.040* | −17.245* | −46.603* | ||||||||

| (18.391) | (13.729) | (10.204) | (27.376) | |||||||||

| ΔAccount ownership male | −0.326 | −0.156 | −0.088 | −0.241 | ||||||||

| (0.344) | (0.233) | (0.171) | (0.462) | |||||||||

| ΔGini × ΔAccount ownership male | −27.178* | −17.724* | −12.352* | −33.491* | ||||||||

| (15.834) | (10.510) | (7.414) | (20.048) | |||||||||

| ΔAccount ownership female | −0.315 | −0.149 | −0.080 | −0.220 | ||||||||

| (0.467) | (0.339) | (0.251) | (0.678) | |||||||||

| ΔGini × ΔAccount ownership female | −32.422** | −24.026** | −17.559** | −47.282** | ||||||||

| (13.677) | (10.949) | (8.495) | (22.626) | |||||||||

| Constant | −0.022* | −0.012* | −0.007 | −0.020 | −0.021* | −0.011* | −0.006 | −0.018 | −0.022* | −0.012 | −0.007 | −0.020 |

| (0.012) | (0.007) | (0.005) | (0.013) | (0.011) | (0.006) | (0.004) | (0.011) | (0.012) | (0.007) | (0.005) | (0.014) | |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 |

| Number of countries | 53 | 53 | 53 | 53 | 53 | 53 | 53 | 53 | 53 | 53 | 53 | 53 |

| Test of overidentifying restrictions: | ||||||||||||

| Sargan-Hansen statistic Chi-sq | 0.450 | 1.505 | 1.872 | 1.735 | 1.906 | 3.594 | 3.862 | 3.680 | 0.413 | 0.472 | 0.499 | 0.434 |

| Sargan-Hansen statistic P-value | 0.798 | 0.471 | 0.392 | 0.420 | 0.386 | 0.166 | 0.145 | 0.159 | 0.814 | 0.790 | 0.779 | 0.805 |

| Endogenity test: | ||||||||||||

| Chi-sq | 11.500 | 9.240 | 8.060 | 8.090 | 11.540 | 9.920 | 8.630 | 8.620 | 10.700 | 8.640 | 7.590 | 7.630 |

| P-value | 0.003 | 0.010 | 0.018 | 0.018 | 0.003 | 0.007 | 0.013 | 0.013 | 0.005 | 0.013 | 0.023 | 0.022 |

Note: Δ indicates change from one period to the next. Robust standard errors, clustered at the country level in parentheses. Significance level *** p < 0.01, ** p < 0.05, * p < 0.1. Respective first-stage IV regression in Table A13. Source: World Bank’s PovcalNet database and Global Findex. Coverage: 2011–2018 period.

As before, we re-run our instrumental variable panel regressions using instead the poverty statistics for those living under $3.20 and $5.50 dollars a day. These additional results help us gauge whether improvements in account ownership would lead to similar reductions in less extreme forms of poverty and whether the impacts are also larger for females than males.

Table A16, Table A18 show the second-stage IV panel random estimates for the poverty statistics using the $3.20 and $5.50 a day poverty lines. The respective first-stage IV regressions, using the same instruments we just used, are reported in Table A15, Table A17.

We find that our results remain fairly consistent for the $3.20 dollars a day line. Again, the interaction between changes in inequality and account ownership is negative and statistically significant. Similarly, the interaction coefficient is larger for the bank account ownership of females than males, with the exception of the poverty headcount ratio measure (Table A16).

For the $5.50 dollar a day poverty line, we find again that the interaction between changes in inequality and account ownership is negative and statistically significant, except for the poverty headcount ratio statistic. This is perhaps not surprising since we had shown in the earlier poverty decomposition analysis (Table A8) that the association between changes in inequality and changes in poverty is not significant for the poverty headcount ratio if measured using the $5.50 dollars a day. For this poverty line, we also find evidence that interaction coefficient between the Gini index and the account ownership tends to be larger for females and males, particularly for the changes in poverty gap squared and the Watts index.

5.3. What are the main constraints for financial inclusion?

Here, we try to unravel further what are the most important barriers to financial inclusion, using this time the micro-data from the latest 2017 Global Findex survey. According to this dataset, we find that poorer households have major differences in the main sources of emergency funds. The poorest households (in the bottom quintiles) rely more on family and friends than wealthier households (in top quintiles) who rely more on savings (Table 7 ). These differences are also quite relevant between males and females (Table 8 ). Women rely more on friends and family than men for emergency funds (37% versus 27%). Moreover, money from working is the main source of emergency for only 19% of women compared to 30% of men.

Table 7.

Usage of emergency funds and constraints for financial access by quintiles.

| Poorest |

Wealthiest |

||||

|---|---|---|---|---|---|

| Quintiles: |

I |

II |

III |

IV |

V |

| Panel A: Main source of emergency funds | Percent | ||||

| Savings | 26.05 | 28.70 | 30.99 | 32.95 | 35.96 |

| Family or friends | 39.56 | 36.27 | 33.30 | 29.81 | 25.07 |

| Money from working | 19.43 | 21.78 | 24.06 | 26.11 | 29.78 |

| Borrowing from a bank | 6.74 | 6.36 | 5.72 | 5.60 | 4.45 |

| Selling assets | 4.57 | 4.01 | 3.42 | 3.01 | 2.17 |

| Some other source | 2.09 | 1.83 | 1.71 | 1.69 | 1.93 |

| Panel B: If received government transfers into an account | |||||

| Yes | 56.41 | 58.55 | 61.04 | 63.80 | 65.34 |

| No | 42.56 | 40.63 | 38.15 | 35.61 | 33.97 |

| Panel C: If received government transfers through a mobile phone | |||||

| Yes | 4.07 | 3.41 | 4.44 | 4.51 | 5.34 |

| No | 95.07 | 95.72 | 94.78 | 94.63 | 93.82 |

| Panel D: Main reason for not having an account is lack of money | |||||

| Yes | 67.08 | 66.55 | 64.62 | 61.63 | 57.56 |

| No | 30.03 | 31.20 | 33.12 | 36.13 | 39.82 |

| Panel E: Main reason for not having an account is because it is too expensive | |||||

| Yes | 32.05 | 31.30 | 29.54 | 27.28 | 26.78 |

| No | 59.99 | 61.65 | 63.85 | 65.79 | 66.83 |

| Panel F: Main reason for not having an account is because institution is too far away | |||||

| Yes | 24.56 | 21.89 | 21.21 | 18.69 | 17.37 |

| No | 70.93 | 74.22 | 75.40 | 77.85 | 78.73 |

| Panel G: Main reason for not having an account is because lacks documentation | |||||

| Yes | 22.89 | 23.33 | 23.13 | 22.20 | 22.86 |

| No | 72.50 | 73.52 | 73.63 | 74.56 | 73.82 |

| Panel H: Main reason for not having an account is because of religious reasons | |||||

| Yes | 7.50 | 6.85 | 6.90 | 6.43 | 7.10 |

| No | 88.20 | 89.55 | 89.42 | 90.20 | 89.38 |

Source: Own estimates using World Bank’s 2017 Global Findex.

Table 8.

Main source of emergency funds by males and females.

| Male |

Female |

|

|---|---|---|

| Main source of emergency funds | Percent | |

| Savings | 30.87 | 32.66 |

| Family or friends | 27.27 | 36.61 |

| Money from working | 30.26 | 19.15 |

| Borrowing from a bank | 5.47 | 5.75 |

| Selling assets | 3.52 | 2.94 |

| Some other source | 1.77 | 1.90 |

Source: Own estimates using World Bank’s 2017 Global Findex.

In Table 7 (Panels B and C) we learn that the majority of the population (about 60%) has received government transfers into one of their accounts, but surprisingly <5% of households have received a government transfer through a mobile phone. This information is potentially quite relevant for how government should provide welfare assistance for COVID-19 response. To reach the poorest households, more reliance is needed on digital and remote technologies such as mobile banking.

Table 7 also shows the main barriers preventing people from having a financial account. By far, the biggest constraint is lack of money (60% of households) across the board regardless of household income (Panel D). Also, roughly 30% of households state that the main reason for them not to have an account is financial institution fees (Panel E). About 21% say that the main reason for not having an account is that the financial institution is too far away (Panel F). A similar percentage also claim that the main constraint in opening an account is not having the documentation required (Panel G). These constraints prevent millions of households from benefiting from financial inclusion and limit countries’ ability to make a significant dent in poverty.

6. Forecasts

Another way to inform policy is to forecast the potential short-term effects of the fall in global economic growth due to the COVID-19 crisis on poverty. In this section, we forecast changes in the poverty headcount ratio using the $1.90, $3.20 and $5.50 dollars a day poverty lines.

At the time of this writing (August 2020) the IMF had released two forecasts for the World Economic Outlook (WEO), the first one released in April and an updated one in June 2020, which is the one we used in this analysis (IMF, 2020b).18 According to this latest IMF projection, global growth is projected at −4.9% in 2020, and at 5.4% in 2021. Despite this expected recovery in 2021, the sudden drop of household income and GDP is likely to adversely impact low-income households particularly, potentially wiping out years of progress made in reducing poverty. In June 2020, the World Bank also released predictions for global growth in 2020, predicting a 5.2% contraction, the deepest global recession in eight decades, despite unprecedented social welfare and fiscal support (World Bank, 2020). Both the IMF and the World Bank estimate that the global recession will be deeper than anticipated at the beginning of the pandemic. But the question remains, how severe would these economic impacts be on poverty? More importantly, what tools could policymakers use to smooth the damaging impact of the fall in GDP and the likely rise in inequality? To shed light on these two questions, we forecast the likely impacts on extreme levels of poverty as well as to what extent improvements in financial inclusion could mitigate some of these impacts.

6.1. Impact of COVID-19 on people living under $1.90 dollars a day

We start by forecasting the expected global change in poverty using the $1.90 dollars a day poverty line. We use the poverty headcount ratio drawn from the PovcalNet dataset during the period 2004–2018. We forecast changes in poverty for all 121 countries in our sample for which we have both data on financial inclusion and the poverty headcount ratio. We focus on the extent to which improvements in the sub-index of the financial outreach would curb poverty since that was the dimension that both our panel fixed effects and IV specifications suggest is the most important in reducing poverty. We use Eq. (4), the panel fixed effects specifications, as the basis for our forecasts as they offer more conservative estimates than the IV-specifications.19 These IV specifications control for a remaining endogeneity bias, however they are also subject to upward bias depending on the strength of the instruments used.

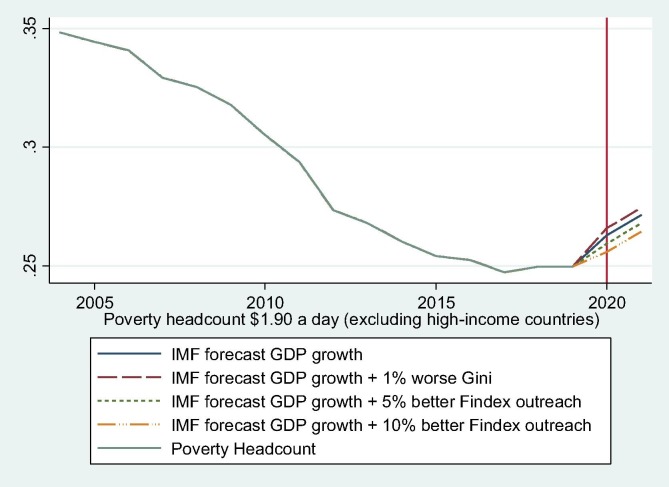

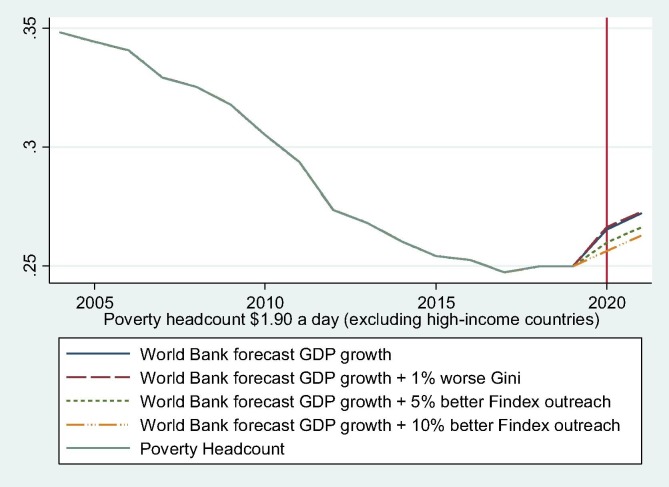

In this global forecast for poverty we focus on two scenarios only. The first one assumes the change in GDP growth for each country as estimated by the IMF for the years 2020 and 2021 (IMF, 2020a). As a robustness test, the second scenario assumes the World Bank global economic growth projections. In both these scenarios, we are assuming that inequality and financial inclusion outreach will remain at their pre-COVID levels. Fig. 5 shows that both scenarios lead to almost identical forecasts. That is, globally, the percentage of people living under $1.90 a day would increase from 13.1% in 2019, to about 13.8% in 2020 and 14.5% by 2021. This represents an increase of 107.8 million people in poverty, using the $1.90 dollars a day poverty line.

Fig. 5.

Forecast poverty headcount $1.90 a day, all countries.

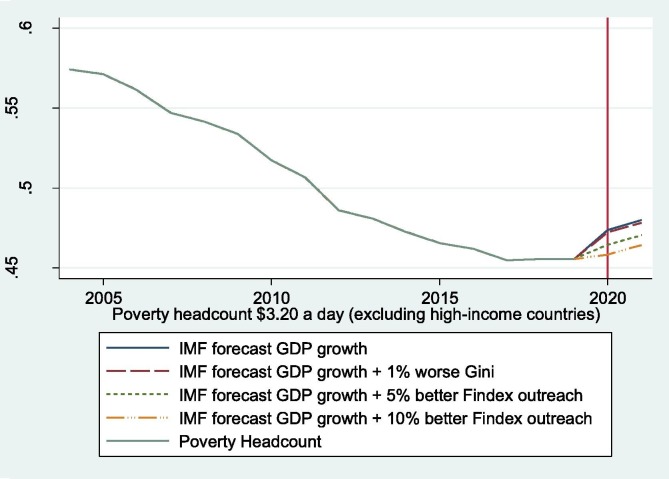

Since extreme levels of poverty are concentrated in poorer countries, we next explore to what extent improvements in financial inclusion could reduce the impacts on the poverty headcount ratio for the 79 low- and low-middle income countries included in our sample. Fig. 6 presents four forecast scenarios using the IMF growth projections, whereas Fig. 7 uses instead the World Bank growth projections. Our first forecast shows the baseline scenario, assuming only the forecasted change in GDP growth for each country for the years 2020 and 2021. The second scenario, on top of these changes in GDP growth also assumes that inequality (proxied by the Gini index) will increase by 1% in each country.20 The third scenario assumes that on top of the fall in GDP growth, there is an improvement of 5% in the financial outreach index, assuming no changes in the Gini indices. The fourth scenario is the same as the third one, but assumes instead an improvement of 10% in the financial outreach index. We acknowledge that these scenarios are rather arbitrary but are, to some extent guided by the recent changes in the financial inclusion and financial outreach indices.21

Fig. 6.

Forecast poverty headcount $1.90 a day, including low- and lower-middle-income countries only using IMF forecast GDP growth.

Fig. 7.

Forecast poverty headcount $1.90 a day, including low- and lower-middle-income countries only using World Bank forecast GDP growth.

The baseline scenario in both Fig. 6, Fig. 7 suggests that the percentage of people living under $1.90 a day would increase from 25.2% in 2019 to 26.2% by 2020, and to 27.1% by 2021 in low- and lower-middle-income countries. If on top of the change in GDP there is a rise in inequality, then poverty would increase even further to near 28% by 2021. Poverty rises could be curbed with substantial improvements in financial inclusion, as suggested by our third and fourth scenarios in both Fig. 6, Fig. 7.

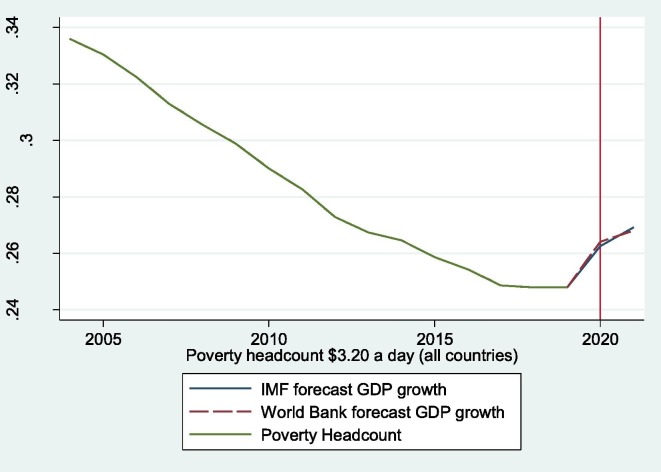

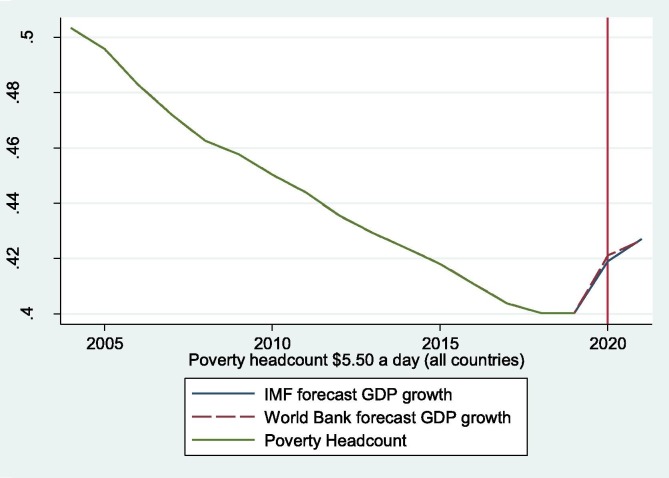

6.2. Impact of COVID-19 on people living under $3.20 and $5.50 dollar a day

We continue by forecasting the expected global change in poverty using the $3.20 and $5.50 dollars a day poverty lines for all 121 countries in our sample using Eq. (4) specification as before. Fig. A1 suggests that the percentage of people worldwide living under $3.20 a day would increase from 24.8% in 2019 to nearly 27% by 2021, pushing nearly 169.4 million people in poverty. Fig. A2 shows that in terms of the percentage of people living under $5.50 a day, poverty would increase from 40% in 2019 to nearly 43% by 2021, pushing nearly 231 million people in poverty.

Fig. A1.

Forecast poverty headcount $3.20 a day, all countries.

Fig. A2.

Forecast poverty headcount $5.50 a day, all countries.

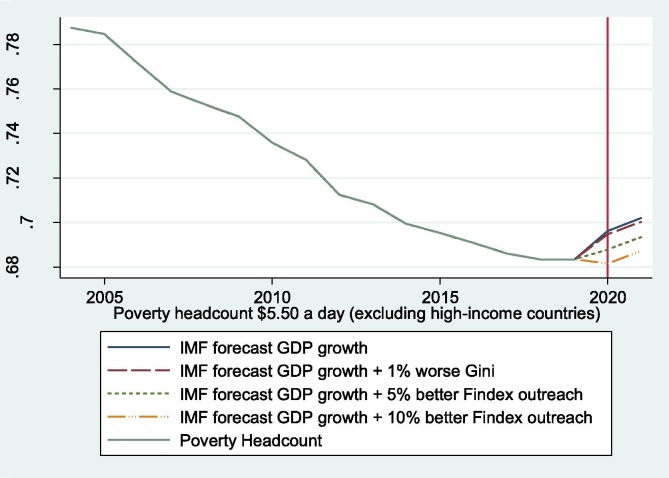

If focused only on the 79 low- and low-middle income countries included in our sample, Fig. A3 suggests that the percentage of people living under $3.20 a day would increase from 45.5% in 2019 to nearly 48.0% by 2021.22 However, that rise of poverty could be smoothed to 46.4% with an increase of 10% in the financial inclusion index. Similarly, Fig. A4 suggests that the percentage of people living under $5.50 a day would increase from 68.3% in 2019 to 70.0% by 2021. However, that rise of poverty could be smoothed to 68.7% with an increase of 10% in the financial inclusion outreach sub-index alone.

Fig. A3.

Forecast poverty headcount $3.20 a day, including low- and lower-middle-income countries only using IMF forecast GDP growth.

Fig. A4.

Forecast poverty headcount $5.50 a day, including low- and lower-middle-income countries only using IMF forecast GDP growth.

6.3. Limitations and policy implications of our analysis

Overall, our poverty forecasts are in the same range of other studies also using PovcalNet (Sumner et al., 2020). Nonetheless, we acknowledge the limitations of these types of forecasts. They rely on economic growth projections which understandably involve subjective judgements made by forecasters within the IMF and the World Bank and a considerable margin of error (Sandefur & Subramanian, 2020). This is particularly so given that significant slowdowns have historically proven to be difficult to predict (Ravallion, 2013). Plus, the world has never seen such a sudden and widespread drop in economic activity. Although over 181 countries have implemented urgent welfare assistance that is likely to continue in months to come and perhaps mitigate further some welfare impacts (Gentilini et al., 2020), the perception that the pandemic has been mismanaged in some countries, together with economic downturn are an explosive combination for political crises. For instance, ten of the elections held soon after the lockdowns have suffered from electoral violence, which could prolong the economic downturn even further in some countries (Birch et al., 2020). None of these important considerations is directly modelled in our analysis nor on how soon a COVID-19 vaccine would be available. Still, from our analysis we can shed light into five key implications for policymaking.

First, economic growth recovery alone is unlikely to reverse the expected rise in extreme poverty, as growth gains do not automatically trickle down to the bottom quintiles. Second, poor households are likely to suffer the double burden of rising levels of inequality which requires urgent tailored policies to address it. Although most of low-income and lower-income countries have implemented urgent COVID-19 welfare assistance, in some countries, these funds might be used for political clientelism, risking benefiting only a fraction of those who need it (Birch et al., 2020). Moreover, most of these packages have been translated in urgent temporary cash transfers, but not in any short- or medium-term plans for job recovery urgently needed for reducing both poverty and inequality (Gutiérrez-Romero, 2020).23

Third, our analysis suggests that the poorest households would benefit from having much wider financial inclusion outreach. However, we are not under the illusion that simply building more bank branches and ATMs near poorer households could be a weapon to reduce poverty per se.24 A very high share of the poorest population still does not have access to financial services because of lack of money, financial services are not available either physically or remotely and fees to open or use accounts are too high. All these constraints need to be addressed to enable the poor to benefit from financial inclusion.

Fourth, for financial inclusion to continue to expand, despite the ongoing pandemic, greater collaboration between governments and financial institutions would be needed to find cheaper forms of financial inclusion such as remote or mobile banking, and reduce the red tape to open and use financial accounts. This is a worthy task as earlier studies have suggested that improving financial inclusion towards the poor is likely to create fewer distortions to the economy than potential taxes (Beck et al., 2007, Beck et al., 2007).

Fifth, drawing from the extensive randomised-control literature, it is clear that the type of financial services offered is important. If the goal is poverty reduction of those living under extreme levels of poverty, offering more inclusive micro-saving and micro-insurance services is far more promising, than simply offering the extreme poor micro-credit for opening up small businesses (Cai et al., 2009, Dupas and Robinson, 2013).25

7. Conclusion

Our findings showed that over the last two decades, financial inclusion, in particular financial outreach, has been instrumental in reducing poverty. Unlike other recent cross-country studies, we have shown that financial inclusion has an important role in poverty reduction, even in low- and lower-middle-income countries. These findings are robust to using different measures of financial inclusion, measures of poverty, and instrumental variable analysis to address potential endogeneity concerns (e.g. Goksu et al., 2017, Park and Mercado, 2018).

Another important aspect of our results is that financial outreach reduces poverty by offsetting the detrimental effect that inequality has on poverty. In other words, financial outreach helps reduce existing inequalities in financial services that are likely to enable poor people to smooth their consumption from significant shocks like the ongoing pandemic. Our findings are in line with the experimental literature which has found that financial inclusion helps to break inequality barriers among the most vulnerable groups (e.g. Banerjee et al., 2015, Dupas and Robinson, 2013, Koomson et al., 2020, Li, 2018).