Abstract

Introduction: Biosimilars have the potential to enhance the sustainability of evolving health care systems. A sustainable biosimilars market requires all stakeholders to balance competition and supply chain security. However, there is significant variation in the policies for pricing, procurement, and use of biosimilars in the European Union. A modified Delphi process was conducted to achieve expert consensus on biosimilar market sustainability in Europe. Methods: The priorities of 11 stakeholders were explored in three stages: a brainstorming stage supported by a systematic literature review (SLR) and key materials identified by the participants; development and review of statements derived during brainstorming; and a facilitated roundtable discussion. Results: Participants argued that a sustainable biosimilar market must deliver tangible and transparent benefits to the health care system, while meeting the needs of all stakeholders. Key drivers of biosimilar market sustainability included: (i) competition is more effective than regulation; (ii) there should be incentives to ensure industry investment in biosimilar development and innovation; (iii) procurement processes must avoid monopolies and minimize market disruption; and (iv) principles for procurement should be defined by all stakeholders. However, findings from the SLR were limited, with significant gaps on the impact of different tender models on supply risks, savings, and sustainability. Conclusions: A sustainable biosimilar market means that all stakeholders benefit from appropriate and reliable access to biological therapies. Failure to care for biosimilar market sustainability may impoverish biosimilar development and offerings, eventually leading to increased cost for health care systems and patients, with fewer resources for innovation.

Keywords: biosimilar market, biosimilar/supply and distribution, biosimilar sustainability, Delphi technique

1. Introduction

The global biosimilars market was valued at $4.5 billion in 2019 and is expected to reach $23.6 billion by 2024; this is an estimated growth rate of 39.4%, with most of this growth occurring in Europe [1,2]. Such a rapid acceleration in the biosimilars market may result in numerous challenges, and it is important to support a thoughtful deployment of biosimilars. This will provide an opportunity for sustainability of global health care budgets and evolving health care systems [3,4].

At present, the European Medicines Agency (EMA) defines a “biosimilar” as “a biological medicinal product that contains a version of the active substance of an already authorized original biological medicinal product (reference medicinal product)” for which “similarity to the reference medicinal product in terms of quality characteristics, biological activity, safety, and efficacy based on a comprehensive comparability exercise needs to be established” [5,6]. Manufacturers in both the United States and Europe are required to demonstrate that the proposed biosimilar and its reference product are highly similar and have no clinically meaningful differences [5,7].

Thus, biosimilars are manufactured following the same strict standards of quality, safety, and efficacy observed for the reference product [5,7]; this is reflected in the development cost, which ranges from $100 to 300 million [8]. Biosimilars can broaden product choice and have the potential to reduce prices, whilst continuing to support a high standard of patient care [9]. In the United States, potential cost saving from switching from originator biologics to biosimilars is projected to be between $40 and 250 billion by 2025, and in Europe, cost savings are already estimated to be more than €10 billion [2,10,11,12].

Many organizations representing physicians, pharmacists, and patients across Europe support the use of biosimilars [3,4,13,14,15], and have issued position papers outlining best practices for their use. However, biosimilar markets are still evolving, and there are marked differences between policies and practices across European countries [16,17,18]. For example, some payer bodies have implemented single winner tender-based systems. While this can secure significant short-term payer savings, such systems risk locking out many biosimilar manufacturers, and may limit the number of competing manufacturers in the medium term. In addition, single-manufacturer tenders can place a lot of risk on the supply chain and, potentially, on patient access. Therefore, systems need to be set up to ensure that long-term savings are realized for payers and sufficient manufacturer incentives are in place to sustain multiplayer competition. Further, the notion of biosimilar sustainability is currently inconsistently and poorly defined, and there is a lack of awareness on the vulnerability of the current system. Previous analyses of the biosimilars market have concluded that there is a need to improve sustainability, and several areas have been identified for further research to develop a coherent long-term vision of sustainability. These include safeguarding the interests of patients, maintaining physician autonomy and patient choice, effective purchasing/pricing and reimbursement strategies, good pharmacovigilance practices, and healthy levels of competition to ensure consistent supply of a range of high-quality products [11,19,20].

To consider these issues and examine biosimilar market sustainability in more detail, we conducted a systematic literature review (SLR) and Delphi panel discussion to: (i) establish a multistakeholder definition of biosimilar market sustainability; (ii) further identify components of a sustainable biosimilar market; and (iii) identify drivers and risks of a sustainable biosimilar market.

2. Methods

2.1. Design

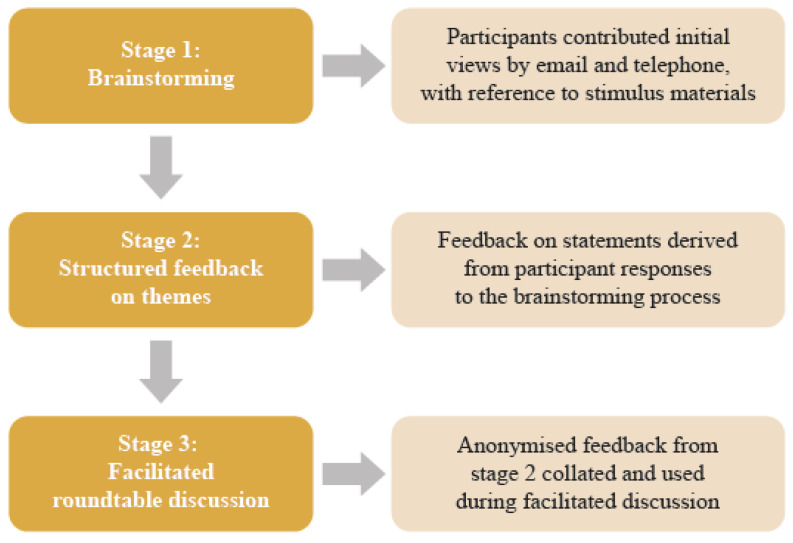

The modified Delphi process is a commonly published approach to generate discussion around topics without consensus and is an effective way to start dealing with complex multifactorial challenges [21]. A modified Delphi process, involving 11 key opinion leaders representing various sectors of the health care system in Europe, was conducted between September and November 2019. Participating stakeholders comprised one patient advocate, two physicians, two hospital pharmacists, two procurement pharmacists, one national payer, two policy advisors, and one manufacturer from across Europe. The modified Delphi process was based on a published approach, [22] and consisted of brainstorming, structured feedback, and a facilitated roundtable discussion (Figure 1).

Figure 1.

Modified Delphi process.

2.2. Procedure

The Delphi process was initiated by multiple stages of brainstorming, in which participants contributed their initial views by email and telephone using the questionnaire shown in Appendix A. Participants were provided with stimulus materials identified by an SLR and they were also asked to identify any key papers to support their feedback. The SLR is briefly described in this paper, but it is published elsewhere [18].

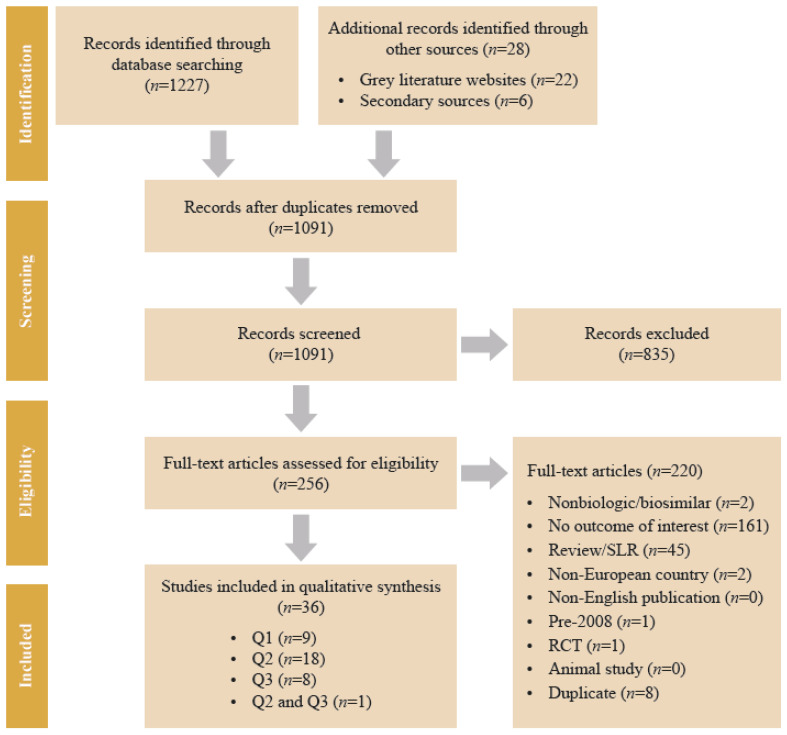

The SLR was conducted using EMBASE, MEDLINE, and grey literature searches. The searches were conducted using recent evidence (from 2008 to 2019) to capture all key biosimilar publications after their introduction in Europe in 2006. Only publications in English were included. Search methods were based on recommendations from the Cochrane Handbook [23] and the Centre for Reviews and Dissemination [24]. The SLR identified materials relating to major economies in Europe and answered three predefined key questions on the: (Q1) frequency, causes, and consequences of shortages of reference product biologics and biosimilars; (Q2) costs (direct and indirect costs, resource utilization, and external costs) and impacts resulting from switching patients between biosimilar products; and (Q3) causation between tendering, market concentration, drug shortages, and achievement of savings, and the implications of tender models for supply risk (reliability) and sustainability of competitive biosimilar markets.

In an initial screening phase, one reviewer identified relevant titles and abstracts from among all retrieved records; in a second screening stage, one reviewer re-evaluated each selected publication in a full-text review. In both stages, a second reviewer was consulted in cases of uncertainty, and consensus between the two was reached. Data extraction was performed by two reviewers, with one extracting the data and the second checking the data against the original publication. Any discrepancies were resolved through discussion or through the intervention of a third reviewer. The SLR flow chart is shown in Appendix B. The findings of the SLR were provided to the panel during the brainstorming stage; participants reviewed the material (amendments were allowed) and provided their ideas. The feedback was discussed with each participant via telephone to ensure that it was interpreted correctly, and the finalized brainstorming responses were collected via email. The amended stimulus material is shown in Appendix C [3,4,16,17,18,25,26,27]. These references and the brainstorming responses were used to develop the themes and statements for the second stage.

In the second stage of the Delphi process, the brainstorming responses and evidence extracted from the stimulus materials were converted into themes and statements (Appendix D), using standard primary research methodology. Feedback was sought on: (i) the components for a definition of biosimilar market sustainability and (ii) drivers and risks to achieving sustainability. Participants were asked to indicate on a Likert scale (from “strongly disagree” to “strongly agree”) their level of agreement with each theme and statement, and how strongly they felt the evidence supported each theme and statement. Each participant had 1 week to provide their responses.

Stage 3 was a facilitated roundtable discussion that aimed to derive a multistakeholder definition of sustainability and achieve consensus on the components of a sustainable biosimilar market. First, the participants were presented with a definition of sustainability (derived from feedback supplied in stage 2) and were then asked to provide feedback on the definition, stating their level of agreement (“strongly disagree” to “strongly agree”), and providing any revisions they wished to make in free text. Based on the responses, the initial definition was revised and presented to participants for comment and final agreement at the end of the roundtable discussion. Participants were then presented with eight statements on the components of a sustainable biosimilar market and on drivers and risks to sustainability (derived from feedback supplied in stage 2). Participants were asked to provide individual feedback regarding how much they agreed with each statement, how important each statement was to them, and free-text suggestions on how to rephrase each statement so that it would align better with their views. The purpose of the discussions on each statement was to explore areas of agreement and disagreement between stakeholder groups. Where groups agreed, consensus was noted; however, the process could cease if stakeholder views remained divergent.

3. Results

3.1. Delphi Panel Consensus

3.1.1. A Multistakeholder Definition of Biosimilar Market Sustainability

The multistakeholder consensus definition of a sustainable biosimilars market is provided in Box 1. After much deliberation, this definition was agreed upon by all participants; however, different stakeholder groups emphasized different priorities within this definition. Patients wanted to be well-informed, physicians wanted biosimilar-related savings reinvested, pharmacists/manufacturers emphasized quality, and payers/policy advisers focused on mechanisms (e.g., competition) to lower prices. These differing priorities were not considered to be mutually exclusive, and all participants considered it important to incorporate the perspectives of all stakeholders into the definition of a sustainable biosimilar market in Europe.

Box 1. A multistakeholder consensus definition of a sustainable biosimilar market.

-

A sustainable biosimilar market means that…

“All stakeholders, including patients, benefit from appropriate and reliable access to biological therapies. Competition leads to a long-term predictable price level, without compromising quality, while delivering savings that may be reinvested.”

3.1.2. Components of a Sustainable Biosimilar Market

Participants agreed that a sustainable biosimilar market: (i) must deliver tangible and transparent benefits to the health care system; (ii) must address the needs of all stakeholders; and (iii) requires collaboration between stakeholders. The level of consensus achieved on these key points is summarized in Box 2 and Table 1.

Box 2. Consensus on components of a sustainable biosimilar market.

A sustainable biosimilar market must:

Deliver tangible and transparent benefits to the health care system, while

Addressing the needs of all stakeholders

This requires collaboration between stakeholders.

Table 1.

Consensus on components of a sustainable biosimilar market.

| |

| Biosimilars have the potential to reduce the cost of treatment; this, in turn, strengthens the sustainability of health care expenditure |

|

| Biosimilar-related savings must be tangible and transparent and should be reinvested efficiently; this may include addressing deficits, and funding innovative therapies, health care or other public services. Biosimilars have the potential to expand access |

|

| Providers (physicians and pharmacists) incur real costs when transitioning to a new biosimilar; transition should only occur if savings substantially exceed these transition costs and a portion of the savings are used to meet these costs |

|

| |

| Transitioning between biosimilars causes disruption to patient care and health care services. Unnecessary disruptions (i.e., frequent transitions and/or transitions that do not deliver tangible savings) should be minimized |

|

| Disruption caused by biosimilar transition may be unavoidable in some therapeutic areas (e.g., acute vs. chronic conditions); however, switch is not advisable if treatment duration is short |

|

| Disruption and transition costs occur in both hospital and out-of-hospital (including retail and home care) settings; these differences may need to be considered |

|

| |

| Policies and practices must encourage trust in biosimilar use among patients through effective communication between stakeholders |

|

| Language and messaging should be consistent among stakeholders and coordinated nationally |

|

| Clear guidance from regulators and clinical organisations at European and national levels is required to motivate multiple switches (i.e., following the initial transition from original biological to biosimilar) |

|

|

|

|

|

Note: icons shown on the right represent level of agreement between the stakeholders. The ‘consensus’ icon indicates that all stakeholders (physicians, payers, policy advisors, manufacturers, pharmacists, and patients) agreed on that point. Benefits, such as expanded access, have also been noted in the literature [9].

In brief, participants strongly agreed that biosimilars have the potential to promote competition among biologic options and reduce treatment costs. However, there was a need to identify and minimize transition and disruption costs when switching to a biosimilar or between biosimilars to improve savings associated with these products further. These savings should be tangible (i.e., measurable) and reinvested in health care or other public services where possible. This could include budget deficits and funding of innovative therapies; biosimilars have the potential to expand access [8]. Transparency regarding reinvestment was regarded as another important motivator for physicians and patients to use biosimilars. Minimizing transition costs could be achieved by identifying key differences between therapeutic areas and clinical settings. For example, oncology treatments usually follow a short, defined treatment course reducing the need for switch, whereas rheumatoid arthritis treatments may be chronic with multiple use of biosimilars and combinations. Clear guidance (policies and practices) from regulators and clinical organizations, such as the EMA, regarding biosimilar transition is warranted with the need for real-world evidence based on biosimilars that physicians can effectively communicate to patients to avoid any negative perceptions. Collaboration between stakeholders would help enable any guidance to be consistent, more comprehensive, and more easily communicated.

3.1.3. Drivers and Risks of a Sustainable Biosimilar Market (Competition and Incentives)

The consensus achieved by participants regarding drivers and risks of a sustainable biosimilar market is summarized in Box 3 and Table 2. Points of consensus were formulated as follows: (i) competition is a more effective mechanism to achieve a long-term predictable price level than regulation; (ii) there needs to be incentives for investment in future biosimilars; and (iii) government and pricing bodies need to drive incentives.

Box 3. Consensus on drivers of and risks to a sustainable biosimilar market.

Competition is a more effective mechanism to achieve a long-term predictable price level, compared to regulation

There needs to be incentives for industry investment in future biosimilars

Government and pricing bodies need to drive incentives

Procurement processes should avoid monopolies and minimize patient discomfort and disruption to the health care system

The principles for procurement should be defined by all stakeholders.

Table 2.

Consensus on drivers and risks to biosimilar market sustainability (competition and incentives).

| |

| Increased competition leads to more rapid price reduction and, if procurement policies contribute to business continuity, a sustained lower price level |

|

| There is a need to develop better prospective indicators to warn about potential risk of de facto monopoly |

|

|

|

| New entrants may bring minor improvements (e.g., administration devices), although competition has been primarily price-focused and has led to a reduction in “value-add” (e.g., patient support programs) |

|

| Price-setting regulation, if needed to prevent predatory behaviour, should not aim primarily at the lowest possible prices but at long-term viability of a vibrant and competitive marketplace |

|

| |

| Continued investment in biosimilar development and market entry is important to generate competition for biological therapies for which no biosimilar is currently available and, to a lesser extent, therapies with biosimilars already available |

|

| Price expectations of policy and budget holders must reflect market opportunity, e.g., biosimilars of orphan therapies may require lower price discount levels |

|

| A stable, predictable price level enables manufacturers to make the long-term decisions that are required to invest in biosimilar development |

|

| |

| These bodies need to supply incentives that enable enough suppliers to survive free market onslaught; this may assure the continuity of long-term competition and sustainable discounts from originator biological therapy price levels |

|

|

|

Note: icons shown on the right represent level of agreement between the stakeholders. The ‘consensus’ icon indicates that all stakeholders (physicians, payers, policy advisors, manufacturers, pharmacists, and patients) agreed on that point.

For key market drivers, participants agreed that competition generated by the introduction of biosimilars has been effective in reducing prices for biological therapies in Europe [28,29]. Participants also agreed that the price expectations of decision makers must reflect market opportunity. This was illustrated by the case of adalimumab biosimilars, the entry of which into the market in 2018 triggered almost immediate and substantial discounting. However, adalimumab was used in a large patient population and had achieved extremely high revenues prior to biosimilar entry, making it a very attractive target for biosimilar manufacturers. Consequently, the price levels achieved by adalimumab biosimilars might not be repeated in other biosimilar products, especially those with orphan status. Incentives driven by governments and pricing bodies (such as limits on tender) were also identified as key drivers for future market; these incentives could include procurement design, including contract length, a cap on the number of manufacturers selected, and introduction of geographical divisions (national vs. regional vs. local).

For key market risks, there was agreement that there is a need for better indicators than those currently available (e.g., the number of biosimilar manufacturers and manufacturing sites) to warn of potential de facto monopoly [30]. Participants agreed that the emergence of monopolies could lead to higher price levels and/or enhanced supply risks (such as poor quality), or supply shortages (e.g., limited production capabilities and poor distribution channels) for biosimilars. This risk also exists for generics, but it would be greater for biosimilars due to the lengthier development and market entry processes, and the much longer lead time in manufacturing (1 year or more). Participants felt that there was a need for more research to identify prospective indicators of market performance; these should be based on a thorough understanding of the role that procurement level (national vs. subnational (procurement is described below)), market size, number of awarded contracts (and market share awarded), and tender criteria may play in ensuring markets perform well. Unfortunately, published evidence on indicator performance or biosimilar supply risks and shortages are scarce making generalizability difficult, but also highlighting the need for establishing validated approaches to long-term quantification of these frameworks.

3.1.4. Drivers and Risks of a Sustainable Biosimilar Market (Procurement Processes)

Issues surrounding procurement processes are summarized in Box 3 and Table 3. Participants agreed that procurement processes should avoid monopolies and minimize patient and health care system disruption, and the principles for procurement should be agreed by all stakeholders. The participants also identified two main goals of procurement design from a multistakeholder perspective. The first goal was to prevent predatory behavior by considering factors in selection criteria other than price or aggressive price discounting; these could include differentiation based on formulation and quality attributes, or stock and distribution channels. The second goal was to minimize disruptions to patient care based on the needs of individual therapy areas, perhaps by setting a contract duration that is proportional to the duration of treatment. Given the potential implications of procurement policies for all stakeholders, participants agreed that all stakeholders should have a voice in setting procurement policies. Participants agreed that there cannot be a “one size fits all” approach to procurement, as the structure and characteristics of health care systems vary; however, procurement policies should be consistent, guided by a common set of principles, and abide with European Union rules on tendering. Participants also advised that biosimilar procurement must be managed carefully over the product lifecycle to preserve competition and promote new investment in biosimilar development.

Table 3.

Consensus on drivers and risks to biosimilar market sustainability (procurement processes).

| |

| The emergence of monopolies may lead to higher price levels and/or enhanced supply risks |

|

|

|

| Procurement design should aim to: | |

|

|

|

|

| |

| There should be a multistakeholder group that sets principles for policy and practice around biosimilar procurement |

|

| Patients and physicians should have an opportunity for their views to be represented (e.g., in a national forum) and patients should be informed of the rationale behind procurement decisions that impact on their care |

|

| There can be no one-size-fits-all approach to procurement, as the structure and characteristics of health care systems vary; however, there should be a consistent approach and a common set of guiding principles |

|

Note: icons shown on the right represent level of agreement between the stakeholders. The ‘consensus’ icon indicates that all stakeholders (physicians, payers, policy advisors, manufacturers, pharmacists, and patients) agreed on that point.

3.2. Key Findings from the SLR

A total of 36 studies were identified in the SLR (Appendix B). Nine publications were identified that discussed (Q1). However, these were too limited to provide any comprehensive evidence and demonstrate the lack of a consistent, comprehensive database of medicine shortages in Europe. Nineteen publications addressed (Q2). None of these reported switching between biosimilars; rather, all considered switches from a reference product to a biosimilar. Nine publications focused on (Q3). These offered insufficient evidence from which to reach generalized conclusions about the effects of different tender models on the outcomes of interest. However, one policy paper concluded that barriers to entry, including the use of single-manufacturer tenders, will limit competition in biosimilars [16]. This paper was considered by the panel, together with additional evidence summarized in Appendix C.

4. Discussion

A Delphi process, involving diverse stakeholders from across Europe, was conducted to achieve a consensus opinion on biosimilar market sustainability in Europe. Divergent views between stakeholder groups, and the reasons for these, were explored through individual, anonymized feedback and facilitated discussion at a roundtable meeting. This important exercise was undertaken to increase our understanding of the current system and to address concerns regarding sustainability, including the unmet need to develop a long-term vision, as highlighted in previous analyses [11,19,20]. Participants agreed that a sustainable biosimilar market must deliver tangible and transparent benefits to the health care system, while meeting the needs of all stakeholders. The definition (as shown in Box 1) was approved by all participants; however, different stakeholder groups emphasized different priorities within this definition, which is consistent with the previous literature on a lack of a unified approach [19,20]. Participants also agreed that, to make this approach work, collaboration between stakeholders is required and a greater awareness of the drivers of and threats to a sustainable market. In brief, strategies around competition, incentives, and procurement policies were identified and discussed with key consensus highlighted in the tables. These areas (notably the need to establish healthy competition, pricing, and market access policies (considering gain sharing and price reductions), government policy and guidance, identification of risks associated with biosimilar drug supply (e.g., quality issues), and patient access to information and education) were highlighted in the previous literature as key areas requiring further improvements [11,19]. Participants in the Delphi process agreed that these key findings should be developed further into a white paper that highlights the need for multistakeholder collaboration on establishing principles for biosimilar procurement in Europe.

Several priorities for future research were identified by stakeholders. First, understanding and measuring the impact of biosimilar transition on hospital and health care services will better enable costs and benefits to be weighed up and help minimize disruption for patients and health care services. Second, there is a need to understand and develop prospective indicators of market sustainability and potential risks to competitive biosimilar markets, particularly the emergence of de facto monopolies and supply risks. Finally, it will also be important to understand the implications of procurement structure and design for biosimilar market sustainability, especially with regard to how the procurement level (national vs. subnational), market size, number of awarded contracts (and market share awarded), and tender criteria affect market sustainability.

There is currently very limited published evidence available to support detailed arguments in the three priority areas described above, largely because there are limited data with which to conduct analyses. Biosimilar markets are still relatively new in Europe, which means that the available data relate to limited time periods and newly emerging trends that may be expected to mature over time. Further, the currently available data (e.g., on supply shortages of biosimilars) are kept at the national level; this allows cross-country comparisons but poses a challenge for pan-European analysis. It is therefore recommended that any further research begins with a scoping phase, in which the available data are reviewed in detail to assess their suitability for the proposed purpose. Further research would also benefit from a more quantifiable approach to the sustainability framework, allowing us to measure the extent to which a biosimilar market in a specific jurisdiction can be effectively maintained.

Collaboration with stakeholders to develop principles for biosimilar procurement may be progressed in tandem with further research. The objective of establishing processes is to ensure that the concerns of all stakeholders—patients, physicians, pharmacists, payers, policy advisers, and manufacturers—are considered in procurement design. In the absence of evidence, open communication and collaboration between stakeholders may provide the necessary information that procurement decision makers need to prevent risks to biosimilar market sustainability from materializing.

This Delphi process involved a limited number of stakeholders and, as with any Delphi exercise, may also be biased by those who chose to participate [31]. For example, a number of issues were not considered such as the evolution of the biosimilar production process over time. However, the process encompassed evidence from a broad review of available literature and covered a broad range of stakeholder perspectives. Despite a rigorous approach, the findings of the SLR indicated that there was an absence of consistent, comprehensive information about drug shortages (specifically biosimilar shortages) and the costs of switching to biosimilars in Europe; these gaps exacerbate a lack of evidence regarding the impact of different tender models for savings, sustainable competition, and supply risk. The panel identified eight key papers (Appendix C), some of which were not identified by the SLR. The consensus reached by the Delphi process provides further direction for future research into, and implementation of, potential strategies to support these different aspects of sustainability.

5. Conclusions

A sustainable biologics market including biosimilars is essential for ensuring that health care savings are maintained into the future, both for existing molecules and those approaching a loss of exclusivity. This Delphi approach resulted in a consensus definition of biosimilar market sustainability in Europe, specified the components of a sustainable biosimilar market, and identified key drivers and risks to sustainability. Crucially, participants in the Delphi process highlighted the need for multistakeholder collaboration in designing policy and practice relating to biosimilars (including procurement). Further research is required alongside stakeholder collaboration to inform biosimilar policy and practice in alignment with the principles identified in this Delphi process. Failure to care for biosimilar market sustainability may impoverish the biosimilar development and offerings, eventually leading to increased cost for health care systems and patients, with fewer resources for innovation.

Acknowledgments

The authors would like to thank the following for their participation in the panel discussions: Nathalie Deparis (patient advocating, rheumatoid arthritis), Hans-Christian Kolberg (physician), Stuart Parkes and Noemi Martinez Lopez De Castro (hospital pharmacists), Jean-Michel Descoutures and Tim Visser (procurement pharmacists), Jorge Mestre Ferrandiz (policy advisers, health economist), and Stephan Rönninger (manufacturer).

Appendix A

Table A1.

Brainstorming questionnaire (Delphi process stage 1).

| |

|

|

| |

|

|

| |

|

|

Appendix B

Figure A1.

PRISMA Flow Diagram. RCT, randomized controlled trial. SLR, systematic literature review.

Appendix C

Table A2.

Key literature identified during brainstorming (Delphi process stage 1).

| Topic | Source | References |

|---|---|---|

| Savings (implications for health system sustainability) |

Systematic literature review/targeted additional search | Vulto A, et al. (2019) [18] |

| Sustainable competition | Systematic literature review | Mestre-Ferrandiz J, et al. (2016) [16] Dave CV, et al. (2017) [25] Dave CV, et al. (2018) [26] |

| Access and pricing | Targeted additional search | Moorkens E, et al. (2017) [17] Kawalec P, et al. (2017) [27] |

| Procurement/purchasing | Review of tender documents (2018) | Vulto A, et al. (2019) [18] |

| Patient safety/use | Targeted additional search | Tabernero J, et al. (2016) [4] EULAR PARE (2018) [3] |

Appendix D

Table A3.

Themes and statements (Delphi process stage 2).

| Presence of multiple suppliers on an ongoing basis—although there is no “correct” number of suppliers |

|

| Competition that is effective in reducing prices for biologics/biosimilars to a sustainable level |

|

| Shared decision making with payer, pharmacist, physician, and patients around biosimilar use |

|

| Reliable supply of biosimilars that meet appropriate standards for quality |

|

| Stability in procurement structure and approach |

|

| Avoidance of price erosion that leads to market exit and the emergence of monopolies or the consolidation of suppliers |

|

Author Contributions

Conceptualization, A.G.V. and J.H.; methodology, A.G.V. and J.H.; validation, A.G.V., J.V.-O., M.v.d.G., S.R.A.S. and L.D.; informal analysis, A.G.V., J.V.-O. and B.M.; investigation, A.G.V., M.v.d.G., S.R.A.S. and L.D.; resources, A.G.V. and J.V.-O.; data curation, A.G.V. and J.V.-O.; writing—original draft preparation, J.V.-O. and J.L.; writing—review and editing, All authors; visualization, All authors; supervision, A.G.V. and J.V.-O.; project administration, B.M.; funding acquisition, A.G.V. and J.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received funding from Amgen.

Conflicts of Interest

A.G.V. reports personal fees from AbbVie, Accord-Healthcare, Amgen, Biogen Idec, Febelgen, Fresenius-Kabi, Hexal, Medicines for Europe, Mundipharma, Novartis, Pfizer, Samsung, and Sandoz; J.V.-O., R.M., and B.M. are employees of Parexel who were contracted by Amgen; M.v.d.G. reports personal fees from Amgen and BioMarin; L.D. reports personal fees from Abbvie, Amgen, Biogen, BMS, Celltrion, Novartis, Pfizer, Roche, Sanofi-Genzyme, and SOBI; J.L. and J.H. are employees of Amgen; S.G.M. is an Amgen employee and stockholder; S.S. is one of the founders of the KU Leuven Fund on Market Analysis of Biologics and Biosimilars following Loss of Exclusivity (MABEL). He was involved in a European stakeholder roundtable on biologics and biosimilars sponsored by Amgen, Merck Sharp and Dohme, and Pfizer; he has participated in advisory board meetings for Amgen and Pfizer; and he has contributed to studies on biologics and biosimilars for Celltrion, Hospira, Mundipharma, and Pfizer. S.S. is also member of the leadership team of the International Society for Pharmacoeconomics and Outcomes Research Special Interest Group on Biosimilars.

Footnotes

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations.

References

- 1.Market Data Forecast Biosimilars Market. [(accessed on 13 May 2020)]; Available online: https://www.marketdataforecast.com/market-reports/biosimilars-market.

- 2.Technavio Global Biosimilars Market 2018–2022. [(accessed on 13 May 2020)]; Available online: https://www.technavio.com/report/global-biosimilars-market-analysis-share-2018?tnplus.

- 3.EULAR (European League Against Rheumatism) Standing Committee of People with Arthritis/Rheumatism in Europe (PARE) Biosimilars—Position Paper. Updating Position Statement from the European League against Rheumatism (EULAR) Standing Committee of People with Arthritis/Rheumatism in Europe (PARE) [(accessed on 13 May 2020)]; Available online: https://www.eular.org/myUploadData/files/biosimilars_paper_updated_2018_09_14_dw.pdf.

- 4.Tabernero J., Vyas M., Giuliani R., Arnold D., Cardoso F., Casali P.G., Cervantes A., Eggermont A.M., Eniu A., Jassem J., et al. Biosimilars: A position paper of the European Society for Medical Oncology, with particular reference to oncology prescribers. ESMO Open. 2016;1:e000142. doi: 10.1136/esmoopen-2016-000142. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.EMA (European Medicines Agency) European Commission. Biosimilars in the EU. Information Guide for Healthcare Professionals. [(accessed on 13 May 2020)]; Available online: https://www.ema.europa.eu/en/documents/leaflet/biosimilars-eu-information-guide-healthcare-professionals_en.pdf.

- 6.EMA (European Medicines Agency) Guidelines on Similar Biological Medicinal Products. [(accessed on 13 May 2020)]; Available online: https://www.ema.europa.eu/en/documents/scientific-guideline/guideline-similar-biological-medicinal-products-rev1_en.pdf.

- 7.US FDA (Food and Drug Administration) Biosimilar and Interchangeable Products. [(accessed on 13 May 2020)]; Available online: https://www.fda.gov/drugs/biosimilars/biosimilar-and-interchangeable-products#generic.

- 8.IQVIA Institute The Impact of Biosimilar Competition in Europe. [(accessed on 13 May 2020)]; Available online: https://ec.europa.eu/docsroom/documents/38461.

- 9.Dutta B., Huys I., Vulto A.G., Simoens S. Identifying key benefits in European off-patent biologics and biosimilar markets: It is not only about price! BioDrugs. 2020;34:159–170. doi: 10.1007/s40259-019-00395-w. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.IQVIA Institute The Global Use of Medicine in 2019 and Outlook to 2023. Forecasts and Areas to Watch. Institute Report. [(accessed on 13 May 2020)]; Available online: https://www.iqvia.com/insights/the-iqvia-institute/reports/the-global-use-of-medicine-in-2019-and-outlook-to-2023.

- 11.IQVIA Institute Advancing Biosimilar Sustainability in Europe. A Multi-Stakeholder Assessment. Institute Report. [(accessed on 13 May 2020)]; Available online: https://www.iqvia.com/insights/the-iqvia-institute/reports/advancing-biosimilar-sustainability-in-europe.

- 12.Deloitte Development LLC Winning with Biosimilars: Opportunities in Global Markets. [(accessed on 13 May 2020)]; Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/life-sciences-health-care/us-lshc-biosimilars-whitepaper-final.pdf.

- 13.Danese S., Fiorino G., Raine T., Ferrante M., Kemp K., Kierkus J., Lakatos P.L., Mantzaris G., Van Der Woude J., Panes J., et al. ECCO position statement on the use of biosimilars for inflammatory bowel disease-an update. J. Crohns Colitis. 2017;11:26–34. doi: 10.1093/ecco-jcc/jjw198. [DOI] [PubMed] [Google Scholar]

- 14.Digestive Cancers Europe Position Paper on the Use of Biosimilar Medicines in Colorectal Cancer. [(accessed on 13 May 2020)]; Available online: https://digestivecancers.eu/Documents/Uploaded/468-Document-Positionpaperbiosimilarsfinal.pdf.

- 15.EAHP (European Association of Hospital Pharmacists) EAHP Position Paper on Biosimilar Medicines. [(accessed on 13 May 2020)]; Available online: https://www.eahp.eu/content/position-paper-biosimilar-medicines-0.

- 16.Mestre-Ferrandiz J., Towse A., Berdud M. Biosimilars: How can payers get long-term savings? Pharmacoeconomics. 2016;34:609–616. doi: 10.1007/s40273-015-0380-x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Moorkens E., Vulto A.G., Huys I., Dylst P., Godman B., Keuerleber S., Claus B., Dimitrova M., Petrova G., Sović-Brkičić L., et al. Policies for biosimilar uptake in Europe: An overview. PLoS ONE. 2017;12:e0190147. doi: 10.1371/journal.pone.0190147. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Vulto A., Cheesman S., Gonzalez-McQuire S., Lebioda A., Bech A., Hippenmeyer J., Lapham K. Sustainable biosimilar procurement in Europe: A review of current policies and their potential impact. Value Health. 2019;22:S427. doi: 10.1016/j.jval.2019.09.160. [DOI] [Google Scholar]

- 19.Simon Kucher & Partners Payers’ Price & Market Access Policies Supporting a Sustainable Biosimilar Medicines Market. Final Report. [(accessed on 13 May 2020)]; Available online: https://www.medicinesforeurope.com/wp-content/uploads/2016/09/Simon-Kucher-2016-Policy-requirements-for-a-sustainable-biosimilar-market-FINAL-report_for-publication2.pdf.

- 20.Pugatch Consilium Towards a Sustainable European Market for Off-Patent Biologics. [(accessed on 13 May 2020)]; Available online: https://www.pugatch-consilium.com/?p=2760.

- 21.Eubank B.H., Mohtadi N.G., Lafave M.R., Wiley J.P., Bois A.J., Boorman R.S., Sheps D.M. Using the modified Delphi method to establish clinical consensus for the diagnosis and treatment of patients with rotator cuff pathology. BMC Med. Res. Methodol. 2016;16:56. doi: 10.1186/s12874-016-0165-8. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.Hirschhorn F. Reflections on the application of the Delphi method: Lessons from a case in public transport research. Int. J. Soc. Res. Methodol. 2019;22:309–322. doi: 10.1080/13645579.2018.1543841. [DOI] [Google Scholar]

- 23.Higgins J.P.T., Green S., editors. The Cochrane Collaboration. Cochrane Handbook for Systematic Reviews of Interventions. Version 5.1.0 (updated March 2011) [(accessed on 13 May 2020)]; Available online: https://handbook-5-1.cochrane.org/front_page.htm.

- 24.Centre for Reviews and Dissemination Systematic Reviews. CRD’s Guidance for Undertaking Reviews in Health Care. [(accessed on 13 May 2020)]; Available online: https://www.york.ac.uk/media/crd/Systematic_Reviews.pdf.

- 25.Dave C.V., Kesselheim A.S., Fox E.R., Qiu P., Hartzema A. High generic drug prices and market competition: A retrospective cohort study. Ann. Intern. Med. 2017;167:145–151. doi: 10.7326/M16-1432. [DOI] [PubMed] [Google Scholar]

- 26.Dave C.V., Pawar A., Fox E.R., Brill G., Kesselheim A.S. Predictors of drug shortages and association with generic drug prices: A retrospective cohort study. Value Health. 2018;21:1286–1290. doi: 10.1016/j.jval.2018.04.1826. [DOI] [PubMed] [Google Scholar]

- 27.Kawalec P., Stawowczyk E., Tesar T., Skoupa J., Turcu-Stiolica A., Dimitrova M., Petrova G.I., Rugaja Z., Männik A., Harsanyi A., et al. Pricing and reimbursement of biosimilars in central and eastern European countries. Front. Pharmacol. 2017;8:288. doi: 10.3389/fphar.2017.00288. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.NHS (National Health Service) NHS Cuts Medicines Costs by Three Quarters of a Billion Pounds. [(accessed on 13 May 2020)]; Available online: https://www.england.nhs.uk/2019/08/nhs-cuts-medicines-costs-by-three-quarters-of-a-billion-pounds/

- 29.Zorginstituut Nederland GIPdatabank.nl. [(accessed on 13 May 2020)]; Available online: https://www.gipdatabank.nl/databank.

- 30.Amgros Price Negotiations and Effective Competition. [(accessed on 13 May 2020)]; Available online: https://amgros.dk/en/pharmaceuticals/price-negotiations-and-effective-competition/

- 31.Strober B., Ryan C., van de Kerkhof P., Van Der Walt J., Kimball A.B., Barker J., Blauvelt A., Bourcier M., Carvalho A., Cohen A., et al. Recategorization of psoriasis severity: Delphi consensus from the International Psoriasis Council. J. Am. Acad. Dermatol. 2020;82:117–122. doi: 10.1016/j.jaad.2019.08.026. [DOI] [PubMed] [Google Scholar]