Abstract

Introduction

Many families in the US struggle to pay medical debt. This study aims to investigate the association between having out-of-pocket medical bills from first childbirth sent to debt collection agencies and subsequent childbearing.

Methods

As part of a large-scale birth cohort study (n = 2,169), women in Pennsylvania who delivered their first child in 2009–2011 were asked if any of the out-of-pocket medical expenditures resulting from the delivery were sent to debt collection agencies. Logistic regression models were used to assess the association between childbirth medical bills going to debt collections in the first year after delivery and subsequent childbearing over the following 2 years, controlling for relevant confounders, including maternal age, education, race/ethnicity, marital status, poverty level, insurance coverage, pregnancy intendedness, difficulty paying for basic needs, plans to have another child, pregnancy complications, and childbirth maternal and neonatal complications.

Results

Women received out-of-pocket medical bills for as much as $32,000. Overall, 8.3% reported having medical bills from the childbirth sent to debt collections. These women were substantially less likely to have a subsequent child during the follow-up period (22.4%) compared to their counterparts whose medical bills did not go to collections (44.4%; adjusted odds ratio, 0.60; 95% confidence interval, 0.39–0.93).

Conclusions

When out-of-pocket medical bills from first childbirth are more than American families can afford to pay, they may postpone having a second child. This may be particularly true when childbirth medical bills are sent to debt collection agencies.

Keywords: delivery bills, childbirth, collections, medical debt, family growth

INTRODUCTION

Childbirth is the most frequent reason for hospitalization in the US, and nearly one quarter of all hospital stays involve care during pregnancy, delivery, and the neonatal period (McDermott, Elixhauser, & Ruirui, 2017). A large-scale study of the costs of childbirth for families with employer-based insurance plans in the US reported that the average total cost of maternal care in 2015 for women with a vaginal delivery was $23,148, and $43,774 for women with a cesarean delivery (Moniz et al., 2020). The average out-of-pocket medical expenditures for families with employer-based health insurance were $4,314 for women who had a vaginal delivery and $5,161 for women who had a cesarean delivery. The proportion of maternity care costs assigned to families rose over a seven-year period, from 13.6% for vaginal births and 10.0% for cesarean births in 2008 to 21.7% and 14.6%, respectively, in 2015 (Moniz et al., 2020). In recent years there has been increasing concern about the financial burden of unexpected medical bills, known as “surprise medical bills,” with particular focus on medical bills resulting from childbirth (Bomnin & Gosk, 2019; Chartock, Garmon, & Schutz, 2019; Gantz, 2018).

Graves et al. (2016) have examined the association between high out-of-pocket costs, as is common in high-deductible health plans (HDHPs), and birth rates (Graves, Kozhimannil, Kleinman, & Wharam, 2016). They studied women enrolled in a Massachusetts health plan before and after an employer-required switch from an HMO to an HDHP and compared them to women continuously enrolled in an HMO. Women who switched to HDHP plans were 40% less likely to have a subsequent birth over the course of the first year after the switch in comparison to women who remained covered by an HMO.

In this paper, we extended this line of research using detailed interview data collected from women delivering their first child in Pennsylvania to explore the relationship between difficulty paying medical bills from the first delivery and subsequent childbearing. Specifically, we examined the characteristics of individuals whose bills were sent to debt collection agencies because of their inability to pay and how that event influenced childbearing over the course of a 3-year period after the first birth.

MATERIALS AND METHODS

Data and Sample

Data in this paper were from the First Baby Study (FBS), a large-scale prospective cohort study designed to investigate the association between mode of first delivery and subsequent childbearing (Kjerulff et al., 2013). The First Baby Study participants were recruited during pregnancy from a variety of settings throughout Pennsylvania, including childbirth education classes, hospital tours, targeted mailings, and on-line and print advertisements. Inclusion criteria were as follows: (1) aged 18–35 (at the time of recruitment), (2) singleton pregnancy, (3) nulliparous, (4) English or Spanish speaking, and (5) planning to deliver in Pennsylvania. Exclusion criteria were: (1) planning to have a tubal ligation during the childbirth hospitalization, (2) planning for the infant to be adopted, (3) planning to deliver at home or in a birthing center not associated with a hospital, and (4) prior pregnancy of more than 20 weeks’ gestation. Deliveries occurred at 78 hospitals (76 in Pennsylvania and 2 outside the state)1, from January 2009 to April 2011. Participants were interviewed by telephone during pregnancy and then 1, 6, 12, 18, 24, 30, and 36 months after first childbirth. Birth certificate and medical record data were obtained for the first births and birth certificate data for subsequent births that occurred during the 36 months of follow-up. The FBS was approved by the Penn State College of Medicine ethics review board (IRB number 25732EP) and the ethics review boards of the hospitals and other organizations that supported participant recruitment.

There were 3,006 participants enrolled in the FBS. The study participants were significantly more likely to be married, to have a college degree, to be covered by private insurance, and to be in the oldest age category (30 to 35 years old) than women aged 18 to 35 at first childbirth in the state of Pennsylvania as a whole, as we have reported previously (Kjerulff et al., 2013). There were 583 women who were lost to follow-up over the course of the 36-month follow-up period, leaving a sample of 2,423 women (80.6% retention rate). We were not able to ascertain subsequent childbearing for the women who were lost to follow-up. For this study we excluded 230 women who reported a pregnancy by 12 months postpartum because these women could have become pregnant before the bills from the first childbirth went to collections.2 In addition, there were 24 women with missing data on one or more of the covariates, leaving an analytic sample of 2,169 women.

Study variables

In the 1-month interviews the participants were informed that study interviewers would ask about their childbirth bills in follow up interviews and to be sure to keep a record of those bills. In the 6- and 12-month interviews participants were asked several questions about trouble paying their medical bills from the delivery (described in more detail in the appendix).

We examined the following demographic and personal characteristics as potential covariates: maternal age, race, education, insurance coverage at the first delivery, income relative to the federal poverty level, marital status, whether or not the first pregnancy was intended, trouble paying for basic needs, pregnancy and delivery complications, and whether or not they planned to have another baby within the coming three years. These variables are described in more detail in the appendix.

Data Analysis

Descriptive statistics were used to characterize the study sample in terms of background characteristics and answers to the questions about the delivery bills. Because it may take more than 6 months before families receive the last of the childbirth delivery bills and the bills have been sent to collections, we combined women’s answers to the questions about delivery bills asked at the 6- and 12-month postpartum interviews as follows. Women were classified as having trouble paying the delivery bills if they reported having “a lot,” “some,” or “a little” trouble paying the delivery bills at 6 and/or 12 months postpartum. Women were classified as experiencing the delivery bills going to collections if they reported that these bills had been sent to collections at 6 and/or 12 months. Women were classified as receiving letters or phone calls from the collection agencies if they reported this happening at the 6- and/or 12-month interviews. Women were classified as being worried about how the family would pay the hospital and doctor bills from the delivery if they reported being “extremely,” “quite a bit,” “some,” or “a little” worried at 6 and/or 12 months. Chi-square analyses were conducted to investigate the associations between women’s answers to the questions about the delivery bills and whether or not they had a second child during the follow-up period. In order to delineate the effect of simply having trouble paying the delivery bills from the effect of having the bills sent to collections, we created a separate variable which combined these two variables—reporting that they were having trouble paying the delivery bills and the bills had been sent to collections—such that there were four categories in this new variable: no trouble paying delivery bills and these bills did not go to collections, trouble paying the delivery bills but these bills did not go to collections, no trouble paying the delivery bills but these bills did go to collections, and trouble paying the delivery bills and the bills did go to collections. Chi-square analyses were conducted to measure the associations between the covariates and the delivery bills being sent to collections.

Multivariable logistic regression models were used to estimate the associations between the primary predictor (medical bills sent to collection agencies) and the primary outcome (having a subsequent child by 36 months), unadjusted and then controlling for the potential confounders of age, race/ethnicity, education, insurance coverage at the first delivery, poverty level, marital status, whether or not the first child was intended, trouble paying for basic needs, whether or not they planned to have an additional child within the coming 3 years, and childbirth complications. We conducted these analyses first in the entire analytic sample, and then only among the women who intended to have a second child within three years. In addition, we examined the association between having the childbirth bills sent to collections and answers to several questions asked at the 36-month survey, including whether they had tried to become pregnant since the birth of their first child, whether they were currently pregnant, and whether they planned to have one or more additional children in the future. These variables are described in more detail in the appendix. We used Stata version 15.1 for these analyses (StataCorp, 2017). We used robust standard errors in all models to account for heteroscedasticity and reported odds ratios (ORs) and 95% confidence intervals (CIs).

RESULTS

The 2,169 study participants were largely White (87.6%), college educated (63.2%), and married (76.9%), as seen in Table 1. Nearly a fifth of the women (18.8%) reported having “a lot,” “some,” or “a little” trouble paying the delivery bills and 8.3% of the women reported by the 12-month interview that medical bills from the delivery had been sent to collection agencies. Nearly a quarter of the women (23.0%) reported being “extremely,” “quite a bit,” “some,” or “a little” worried at 6 and/or 12 months postpartum about how they would be able to pay the hospital and doctor bills from the delivery.

TABLE 1.

Characteristics of study cohort (N = 2169)

| Characteristic | n (%) |

|---|---|

| Age (y) | |

| 18–24 | 434 (20.0) |

| 25–29 | 930 (42.9) |

| 30–36 | 805 (37.1) |

| Race/ethnicity | |

| White, non-Hispanic | 1901 (87.6) |

| Black, non-Hispanic | 99 (4.6) |

| Hispanic | 87 (4.0) |

| Other | 82 (3.8) |

| Education | |

| High school degree or less | 250 (11.5) |

| Some college or technical school | 548 (25.3) |

| College graduate or higher | 1371 (63.2) |

| Insurance at delivery | |

| Private | 1811 (83.5) |

| Medicaid | 358 (16.5) |

| Poverty level | |

| Poverty | 125 (5.8) |

| Near poverty | 193 (8.9) |

| Not poverty | 1846 (85.3) |

| Marital status | |

| Married | 1669 (76.9) |

| Living with partner | 312 (14.4) |

| Not living with partner | 103 (4.7) |

| Unattached | 85 (3.9) |

| Pregnancy intended | |

| Yes | 1563 (72.7) |

| No | 586 (27.3) |

| Trouble paying for basic needs | |

| Some or a lot of trouble | 368 (17.0) |

| No trouble | 1797 (83.0) |

| Plan to have another baby within 3 years | |

| Yes | 1339 (61.7) |

| No or don’t know | 830 (38.2) |

| High risk delivery | 971 (44.9) |

| Neonatal morbidities | 275 (12.7) |

| Maternal morbidities | 580 (26.9) |

| Trouble paying delivery bills | |

| Not at all at both 6 and 12 months | 1698 (78.3) |

| A lot, some, or a little at 6 and/or 12 months | 407 (18.8) |

| Medical bills from delivery turned over to collection agencies | |

| No at both 6 and 12 months | 1990 (91.7) |

| Yes at 6 and/or 12 months | 179 (8.3) |

| Letters or phone calls from collection agencies | |

| No at both 6 and 12 months | 2013 (92.8) |

| Yes at 6 and/or 12 months | 156 (7.2) |

| Worried about how family will pay the hospital and doctor bills from the delivery | |

| Not at all at both 6 and 12 months | 1671 (77.0) |

| Extremely, quite a bit, some, or a little reported at 6 and/or 12 months | 498 (23.0) |

The associations between answers to the delivery bills questions and having a subsequent live birth by 36 months (Table 2) were all highly significant, such that women who reported having trouble paying the delivery bills, the bills being sent to collections, receiving letters or phone calls from collection agencies, and being worried about how they would pay the delivery bills were less likely to have a subsequent live birth during the first 36 months after the birth of their first child (all p < .001). Among these four questions about the delivery bills, having the delivery bills sent to collections had the strongest association with whether or not the woman had a subsequent child during the follow-up period, as evidenced by the chi-square values. These four survey items were highly collinear; therefore the collections item was chosen as the primary predictor for the logistic regression models. The variable that combined trouble paying delivery bills with bills being sent to collections indicated that subsequent childbearing was lower among women who had bills sent to collections, regardless of whether they reported trouble paying the delivery bills. Put differently, the problem for families is not just that they have trouble paying the delivery bills but that the bills end up in collections.

TABLE 2.

Answers to questions about delivery bills at 6 and 12 months postpartum in relation to subsequent childbearing

| Second child born by 36 months | χ2 | P-value | ||

|---|---|---|---|---|

| Yes | No | |||

| Trouble paying delivery bills | 15.21 | < .001 | ||

| Not at all at both 6 and 12 months | 765 (45.1) | 933 (54.9) | ||

| A lot, some, or a little at 6 and/or 12 months | 140 (34.4) | 267 (65.6) | ||

| Medical bills from delivery turned over to collection agencies | 30.95 | < .001 | ||

| No at both 6 and 12 months | 883 (44.4) | 1107 (55.6) | ||

| Yes at 6 and/or 12 months | 41 (22.9) | 138 (77.1) | ||

| Trouble paying delivery bills by bills going to collections | 35.39 | < .001 | ||

| No trouble at both 6 and 12 months and medical bills were not sent to collections | 754 (45.8) | 893 (54.2) | ||

| A lot, some, or a little trouble paying delivery bills at 6 and/or 12 months, but bills not sent to collections | 110 (39.1) | 171 (60.9) | ||

| No trouble paying delivery bills at 6 and/or 12 months, but bills were sent to collections | 11 (21.6) | 40 (78.4) | ||

| A lot, some, or a little trouble paying delivery bills at 6 and/or 12 months and delivery bills were sent to collections | 30 (23.8) | 96 (76.2) | ||

| Letters or phone calls from collection agencies | 29.76 | < .001 | ||

| No at both 6 and 12 months | 890 (44.2) | 1123 (55.8) | ||

| Yes at 6 and/or 12 months | 34 (21.8) | 122 (78.2) | ||

| Worried about how family will pay the hospital and doctor bills from the delivery | 18.05 | < .001 | ||

| No at both 6 and 12 months | 753 (45.1) | 918 (54.9) | ||

| Extremely, quite a bit, some, or a little at 6 and/or 12 months | 171 (34.3) | 327 (65.7) | ||

Among the women whose delivery bills were sent to collections, more than a third (37.4%) were in the youngest age group, while only 18.4% of those whose bills did not go to collections were in the youngest age group (p < .001), as seen in Table 3. In addition, more than a third of women whose delivery bills were sent to collections (35.8%) were covered by Medicaid, while only 14.8% of the women whose bills did not go to collections were covered by Medicaid (p < .001). Other factors associated with bills going to collections were race/ethnicity, education, poverty level, marital status, pregnancy intendedness, trouble paying for basic needs, plans to have another baby within the coming 3 years, and having a high-risk delivery.

TABLE 3.

Covariates by delivery bills sent to debt collections

| Delivery bills sent to debt collections | |||

|---|---|---|---|

| Characteristic | Yes | No | P-value |

| n (%) | n (%) | ||

| Age (y) | <0.001 | ||

| 18–24 | 67 (37.4) | 367 (18.4) | |

| 25–29 | 74 (41.3) | 856 (43.0) | |

| 30–36 | 38 (21.2) | 765 (38.5) | |

| Race/ethnicity | <0.001 | ||

| White, non-Hispanic | 138 (77.1) | 1763 (88.6) | |

| Black, non-Hispanic | 17 (9.5) | 82 (4.1) | |

| Hispanic | 15 (8.4) | 72 (3.6) | |

| Other | 9 (5.0) | 73 (3.7) | |

| Education | <0.001 | ||

| High school degree or less | 52 (29.1) | 198 (9.9) | |

| Some college or technical school | 73 (40.8) | 475 (23.9) | |

| College graduate or higher | 54 (30.2) | 1317 (66.2) | |

| Insurance at delivery | <0.001 | ||

| Private | 115 (64.2) | 1696 (85.2) | |

| Medicaid | 64 (35.8) | 294 (14.8) | |

| Poverty level | <0.001 | ||

| Poverty | 20 (11.2) | 105 (5.3) | |

| Near poverty | 39 (21.8) | 154 (7.8) | |

| Not poverty | 120 (67.0) | 1726 (87.0) | |

| Marital status | <0.001 | ||

| Married | 91 (50.8) | 1578 (79.3) | |

| Living with partner | 60 (33.5) | 252 (12.7) | |

| Not living with partner | 12 (6.7) | 91 (4.6) | |

| Unattached | 16 (8.9) | 69 (3.5) | |

| Pregnancy intended | <0.001 | ||

| Yes | 105 (59.0) | 1458 (74.0) | |

| No | 73 (41.0) | 513 (26.0) | |

| Trouble paying for basic needs | <0.001 | ||

| Some or a lot of trouble | 82 (41.6) | 286 (14.4) | |

| No trouble | 96 (53.9) | 1701 (85.6) | |

| Plan to have another baby within 3 years | 0.004 | ||

| Yes | 92 (51.4) | 1247 (62.7) | |

| No or don’t know | 87 (48.6) | 743 (37.3) | |

| High risk delivery | 102 (57.0) | 836 (43.8) | 0.001 |

| Neonatal morbidities | 27 (15.1) | 236 (12.5) | 0.348 |

| Maternal morbidities | 60 (33.5) | 496 (26.2) | 0.042 |

Column percentages shown

The multivariable logistic regression models (Table 4) indicated that women whose delivery bills from first childbirth were sent to collections were substantially less likely to have a second child in the three years after first childbirth (OR: 0.60, 95% CI: 0.39–0.93). The results, when limited to women who reported that they planned to have another child within three years, remained significant (OR 0.50, 95% CI: 0.30–0.85).3 In terms of the magnitudes, the marginal effect plots obtained from the adjusted regressions (Appendix Figure A1) show that, when bills from first childbirth went to collections, the probability of having a second child decreased by approximately 10 percentage points (from 45% to 35%) for the overall sample. The probability decreased by 16 percentage points (from 53% to 37%) for women who reported that they planned to have another child within three years.

TABLE 4.

Unadjusted and adjusted ORs of the effect of delivery bills sent to collections on subsequent childbearing

| Delivery bills not sent to collections | Delivery bills sent to collections | ||

|---|---|---|---|

| OR | 95% CI | ||

| Unadjusted model of the effect of delivery bills sent to collections | Reference | 0.37 | 0.26–0.53 |

| Adjusted model of the effect of delivery bills sent to collectionsa | Reference | 0.60 | 0.39–0.93 |

| Unadjusted model of the effect of delivery bills sent to collections among women who planned to have another child within 3 years | Reference | 0.31 | 0.19–0.50 |

| Adjusted model of the effect of delivery bills sent to collections among women who planned to have another child within 3 yearsb | Reference | 0.50 | 0.30–0.85 |

The adjusted model controls for age, race/ethnicity, education, insurance, poverty level, marital status, pregnancy intendedness, trouble paying for basic needs, childbirth complications (high risk delivery, maternal morbidities, and newborn morbidities), and plans to have another baby within 3 years.

The adjusted model controls for age, race/ethnicity, education, insurance, poverty level, marital status, pregnancy intendedness, trouble paying for basic needs, and childbirth complications (high risk delivery, maternal morbidities, and newborn morbidities).

The women whose delivery bills from the first childbirth were sent to collections were significantly less likely to report at the 36-month survey that they had tried to have another child in the previous three years (29.6%) than the women whose bills had not been sent to collections (57.1%), p < .001. In addition, they were significantly less likely to be pregnant with their second child (7.1%) at the time of the 36-month survey than the women whose delivery bills had not been sent to collections (12.3%), p = .047. Among the women whose delivery bills had been sent to collections and who had not had a second child during the 3 years of follow-up and were not pregnant, 90% reported at the 36-month survey that they planned to have another child at some point in the future.

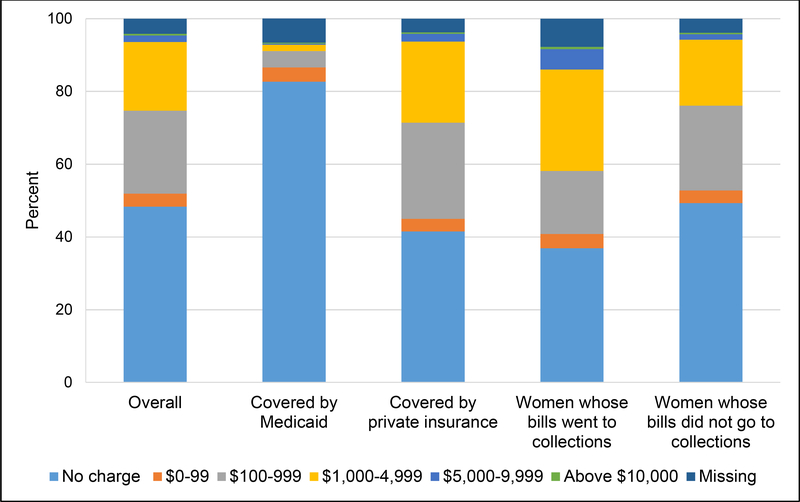

At the 6-month postpartum interview slightly less than half of the women (48.3%) reported that at that point they had not received any bills for the delivery that they had to pay out of pocket (Figure 1). Women covered by private insurance were more likely to have received out-of-pocket bills (58.5%) by 6 months postpartum than the women covered by public insurance (17.3%). Among women who had received out-of-pocket bills by 6 months postpartum, the overall out-of-pocket charges reported by the study participants ranged from $3.00 to $32,000, with a median of $700.00. Among women covered by Medicaid, the out-of-pocket bills ranged from $7.00 to $20,000, with a median of $197.00; and among women covered by private insurance, the out-of-pocket bills ranged from $3.00 to $32,000, with a median of $700.00. The women who reported by 12 months postpartum that their bills had been sent to collections were more likely to have received bills for the childbirth by 6 months postpartum (63.1%) than the women whose bills had not been sent to collections by 12 months postpartum (50.7%). Women who reported bills sent to collection at 12 months postpartum also reported higher median bills ($1,000.00) than the women whose bills had not been sent to collections by 12 months postpartum ($600.00).

FIGURE 1.

The amount that women were asked to pay for the childbirth, as of 6 months postpartum

DISCUSSION

In this study, we investigated the association between the event of having medical bills resulting from first childbirth sent to collections and subsequent childbearing. We found that when these medical bills were sent to collections, families were substantially less likely to have the second child they had planned to have within 3 years after the birth of the first child. We also found that it was not simply having difficulty paying the medical bills that affected subsequent childbearing, it was having the medical bills from the delivery sent to collections (regardless of whether or not women reported difficulty paying the medical bills) that had the most powerful effect on subsequent childbearing. Nearly a quarter of the women in this study (23.0%) reported at the 6- and/or 12-month interviews that they were worried about how their family was going to pay the medical bills from the delivery, and those who were worried were less likely to have a second child than the women who were not worried.

The participants in this study delivered their first child in the years 2009 to 2011. Although the Affordable Care Act (ACA) was signed into law in the US in March 2010, Pennsylvania did not implement the health insurance marketplace until January 2014, and expanded Medicaid coverage beginning in January 2015 (Medicaid and CHIP Payment and Access Commission, 2015). More pregnant women in the U.S. have become eligible for Medicaid coverage in recent years—the median income eligibility level rose from 185% to 205% of the federal poverty line between 2009 and 2020 (Brooks, Roygardner, Artiga, Pham, & Dolan, 2020). However, cost-sharing continues to be allowed for some services for pregnant women covered by Medicaid, including the delivery hospitalization (Brooks et al., 2020; Chen & Hayes, 2018; Medicaid and CHIP Payment and Access Commission, 2014). Likewise, although the ACA requires most private plans to cover maternity care, this is not a requirement for some plans (e.g., short term plans), cost sharing is allowed (e.g., co-payments and deductibles), and some plans have exclusions (e.g., not covering dependents) that force families to incur expenses.

While the majority of the women covered by Medicaid in this study (82.7%) had not received out-of-pocket bills by 6 months postpartum, the median charge among those who had received out-of-pocket bills by 6 months was $197.00, which may be considerably more than some low-income families could afford to pay. In a study of the cost of childbirth for uncomplicated pregnancies and deliveries in the US in 2009, women covered by Medicaid paid 0.6% of the total costs out-of-pocket on average (Rohde & Machlin, 2009). However, that study did not report the percent of women covered by Medicaid who had out-of-pocket charges, the actual dollar amounts and maximum dollar amounts that families covered by Medicaid were asked to pay among those who were sent out-of-pocket medical bills, or whether or not these bills were sent to collection agencies. In addition, because that study only included women with uncomplicated pregnancies and deliveries, the more costly childbirths were excluded.

This study has several limitations. The participants in this study were of higher average socioeconomic status than women at first childbirth in Pennsylvania overall, and likely in comparison to the population of women delivering their first child in the US. This, coupled with the state-to-state variation in policies and plans, means that our findings cannot be extrapolated to the entire U.S. population. Currently it is not clear how often families in the US are unable to pay medical debt resulting from childbirth, leading to bills being turned over to collection agencies or even bankruptcy. Likewise, our sample is largely white, college-educated, and married. The effect of medical debt on childbearing decisions might be different in a more heterogeneous population.

Births in this study occurred in the years 2009–2011, roughly a decade ago. Since that time period there have been several relevant changes in the health care system, including: 1.) implementation of the ACA, 2.) expansion of Medicaid coverage in 36 US states and the District of Columbia, 3.) implementation of the Fair Debt Collection Practices Act (designed to provide consumer protection from unfair and abusive debt collection practices), 4.) enactment of new laws in several states to increase protection of families from surprise medical bills (Hoadley, Lucia, & Maanasa, 2019), and 5.) increased use of high-deductible health insurance plans. While implementation of the ACA and expansion of Medicaid coverage have decreased the percent of reproductive aged women who are uninsured (Daw & Sommers, 2019), it is not clear how these events have affected out-of-pocket medical expenditures for the mother and newborn. If families with incomes too high to qualify for Medicaid coverage purchase a health insurance plan through the marketplace they may find themselves liable for a large portion of the cost of childbirth because the annual out-of-pocket maximum costs for health care can be as much as $8,200 for an individual and $16,400 for a family as of 2020 (Department of Health and Human Services, 2020). For families covered by group insurance through an employer, enrollment in high-deductible health plans has more than quadrupled in the past decade (Inserro, 2018). Families covered by these types of plans may also face high maximum out-of-pocket costs, as much as $6,900 for individual coverage and $13,800 for family coverage in 2020 (United Healthcare, 2019). Recent polls indicate that 60% of American families do not have savings to cover a $1,000 out-of-pocket medical bill and 27% would need to borrow or sell something to pay for an unexpected expense of $400 (Board of Governors of the Federal Reserve System, 2019; Nova, 2019).

A third limitation is that the key independent variable in this study (having medical bills going to collections) may be misreported, as it was based on women’s self-report. However, the results of this study are in accord with those reported based on credit bureau data. Caswell and Waidmann (2019) reported that in the years 2010–2015, 28.5% of individuals in the age range of 18–39 living in non-Medicaid expansion states had medical bills sent to collections, and 8.9% had medical bills that were sent to collections in the previous 6 months (Caswell & Waidmann, 2019). This was similar to the 8.3% of childbirth bills going to collections found in this study.

Finally, given that the event of bills going to collections was not randomly assigned as in an experimental study, the findings cannot be interpreted as causal. In our analysis, the timing of the independent variable (bills going to collections in the first year after first birth) precedes that of the dependent variable (whether or not they had a second birth over the following 2 years), thus reducing the possibility of reverse causality. Likewise, we have included a wide range of potential confounders on which families whose bills went to collections and whose bills did not go to collection differ. Nonetheless, some of the observed difference in the likelihood of having a second child within the study period may be due to non-observable characteristics, such as underlying health conditions that were not measured.

IMPLICATIONS FOR PRACTICE AND POLICY

The results of this study speak to the impact of high health care costs in the US on families’ important life decisions, such as childbearing. In our regression models the women whose medical bills from first childbirth were sent to collections were 40% less likely to have a subsequent child overall and 50% less likely among those who had specifically planned to have a second child within 3 years. These results were strikingly close to the 40% reduction in the odds of giving birth due to high-deductible health plans, reported by Graves and colleagues (Graves et al., 2016).

More broadly, and consistent with previous studies (Pew Research Center, 2011; Verick & Verick, 2009), our findings suggest that economic distress resulting from delivery costs or other factors may partly be responsible for the declining fertility in the US. Despite a recovering economy this past decade, the US birth rate continues to decline, puzzling researchers and policymakers (Chappell, 2019). In May 2019, a study by the Centers for Disease Control and Prevention reported that the general fertility rate for women ages 15 to 44 in 2018 was 59 births per 1,000 women, the lowest ever recorded (Hamilton, Martin, Osterman, Driscoll, & Rossen, 2019).

As health care reform moves forward it is important for policymakers to keep in mind that programs that require that families pay more than they can afford to pay for medical care—resulting in medical debt—may have unintended and adverse outcomes for the long-term well-being of the American family.

CONCLUSION

In this large-scale prospective interview study of women delivering their first child in Pennsylvania we found that families were asked to pay as much as $32,000 out-of-pocket for childbirth and more than 8% reported that their medical bills from the childbirth were sent to debt collection agencies. We found that even after controlling for relevant confounders, families that experienced this event of having their medical bills from first childbirth sent to debt collections were substantially less likely to have the second child that they were planning on having during the 3-year follow-up period.

Supplementary Material

Acknowledgments

Funding statement

This research was supported by a grant from the Eunice Kennedy Shriver National Institute of Child Health and Human Development, National Institutes of Health (R01-HD052990).

Footnotes

Two of the respondents were planning to deliver in Pennsylvania, but delivered early while out of state. The respondents had completed the baseline interview, and were kept in the study.

Medical bills can take anywhere from 1 to 15 months after hospitalization to be sent (Almond, 2019) and then 90 to 120 days after that before they are sent to debt collection agencies (Greeley, 2020).

The odds ratios are similar when we limit the analysis to women with private insurance (Appendix Table A1), although the 95% confidence intervals are wider because of the reduced sample size.

Conflict of interest statement

All authors declare that they have no conflict of interest.

Data access and responsibility

Kristen Kjerulff and Yubraj Acharya had full access to all the data in the study and take responsibility for the integrity of the data and the accuracy of the data analysis.

Ethical clearance statement

The First Baby Study was approved by the Penn State College of Medicine ethics review board (IRB number 25732EP) and the ethics review boards of the hospitals and other organizations which supported participant recruitment.

Publisher's Disclaimer: This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final form. Please note that during the production process errors may be discovered which could a?ect the content, and all legal disclaimers that apply to the journal pertain.

REFERENCES

- Almond T (2019). How long does medical billing usually take to arrive at your home after the initial office visit? Retrieved May 11, 2020, from https://www.quora.com/How-long-does-medical-billing-usually-take-to-arrive-at-your-home-after-the-initial-office-visit

- Board of Governors of the Federal Reserve System. (2019). Report on the Economic Well-Being of U.S. Households in 2018. Retrieved from https://www.federalreserve.gov/publications/files/2018-report-economic-well-being-us-households-201905.pdf

- Bomnin L, & Gosk S (2019, April 23). Surprise medical bills: Two babies, two very different price tags. NBC News. Retrieved from https://www.nbcnews.com/health/health-care/surprise-medical-bills-two-babies-two-very-different-price-tags-n988926

- Brooks T, Roygardner L, Artiga S, Pham O, & Dolan R (2020). Medicaid and CHIP Eligibility, Enrollment, and Cost-Sharing Policies as of January 2020: Findings from a 50-State Survey, (March), 1–74. [Google Scholar]

- Caswell KJ, & Waidmann TA (2019). The Affordable Care Act Medicaid Expansions and Personal Finance. Medical Care Research and Review, 76(5), 538–571. 10.1177/1077558717725164 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chappell B (2019, May 15). U.S. Births Fell To A 32-Year Low In 2018; CDC Says Birthrate Is In Record Slump. National Public Radio. Retrieved from https://www.npr.org/2019/05/15/723518379/u-s-births-fell-to-a-32-year-low-in-2018-cdc-says-birthrate-is-at-record-level

- Chartock B, Garmon C, & Schutz S (2019). Consumers’ responses to surprise medical bills in elective situations. Health Affairs, 38(3), 425–430. 10.1377/hlthaff.2018.05399 [DOI] [PubMed] [Google Scholar]

- Chen A, & Hayes E (2018). Q&A on Pregnant Women’s Coverage under Medicaid and the ACA. National Health Law Program, (September), 1–11. Retrieved from https://healthlaw.org/resource/qa-on-pregnant-womens-coverage-under-medicaid-and-the-aca/ [Google Scholar]

- Daw J, & Sommers B (2019). The Affordable Care Act and access to care for reproductive-aged and pregnant women in the United States, 2010–2016. American Journal of Public Health, 109(4), 565–571. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Department of Health and Human Services. (2020). Healthcare.gov. [DOI] [PubMed]

- Gantz S (2018, June 13). A bundle of joy, a pile of bills: Childbirth can cost thousands in out-of-pocket expenses. The Philadelphia Inquirer. Retrieved from https://www.inquirer.com/philly/health/health-costs/health-care-costs-child-birth-20180613.html

- Graves AJ, Kozhimannil KB, Kleinman KP, & Wharam JF (2016). The association between high-deductible health plan transition and contraception and birth rates. Health Services Research, 51(1), 187–204. 10.1111/1475-6773.12326 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Greeley R (2020). Everything You Need to Know About Debt Collections. Retrieved May 11, 2020, from https://bettercreditblog.org/everything-about-debt-collections/

- Hamilton BE, Martin JA, Osterman MJK, Driscoll AK, & Rossen LM (2019). Births: Provisional data for 2018. NVSS Vital Statistics Rapid Release. Retrieved from https://www.cdc.gov/nchs/data/vsrr/report002.pdf

- Hoadley J, Lucia K, & Maanasa K (2019). State Efforts to Protect Consumers from Balance Billing. Retrieved from https://www.commonwealthfund.org/blog/2019/state-efforts-protect-consumers-balance-billing

- Inserro A (2018, August 9). Enrollment in High-Deductible Health Plans Continues to Grow. American Journal of Managed Care. Retrieved from https://www.ajmc.com/newsroom/enrollment-in-highdeductible-health-plans-continues-to-grow

- Kjerulff KH, Velott DL, Zhu J, Chuang CH, Hillemeier MM, Paul IM, & Repke JT (2013). Mode of first delivery and women’s intentions for subsequent childbearing: Findings from the first baby study. Paediatric and Perinatal Epidemiology, 27(1), 62–71. 10.1111/ppe.12014 [DOI] [PMC free article] [PubMed] [Google Scholar]

- McDermott K, Elixhauser A, & Ruirui S (2017). Trends in hospital inpatient stays in the United States, 2005–2014 HCUP Statistical Brief #225; Agency for Healthcare Research and Quality, Rockville, MD, (June). [Google Scholar]

- Medicaid and CHIP Payment and Access Commission. (2014). Issues in Pregnancy Coverage under Medicaid and Exchange Plans. MACPAC Chapter 3 Report to the Congress on Medicaid and CHIP.

- Medicaid and CHIP Payment and Access Commission. (2015). Pennsylvania Medicaid Expansion Waiver September 2015 MACPAC Fact Sheet.

- Moniz MH, Fendrick AM, Kolenic GE, Tilea A, Admon LK, & Dalton VK (2020). Out-Of-Pocket Spending For Maternity Care Among Women With Employer-Based Insurance, 2008–15. Health Affairs (Project Hope), 39(1), 18–23. 10.1377/hlthaff.2019.00296 [DOI] [PubMed] [Google Scholar]

- Nova A (2019, January 23). A $1,000 emergency would push many Americans into debt. CNBC.Com. Retrieved from https://www.cnbc.com/2019/01/23/most-americans-dont-have-the-savings-to-cover-a-1000-emergency.html

- Pew Research Center. (2011). In a Down Economy, Fewer Births, 1–15. Retrieved from www.pewsocialtrends.org

- Rohde F, & Machlin S (2009). Health Care Expenditures for Uncomplicated Pregnancies, 2009 Research Findings #32. Rockville, MD: Retrieved from https://meps.ahrq.gov/data_files/publications/rf32/rf32.shtml [Google Scholar]

- StataCorp. (2017). Stata Statistical Software: Release 15. 2017 10.2307/2234838 [DOI]

- United Healthcare. (2019, June 12). IRS sets new 2020 limits for group plans and HDHP/HSA plans. Uhc.Com.

- Verick S (2009). Who Is Hit Hardest during a Financial Crisis? The Vulnerability of Young Men and Women to Unemployment in an Economic Downturn. IZA Discussion Paper No. 4359. Available: http://ftp.iza.org/dp4359.pdf Accessed: July 26, 2020. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.