Background

The COVID-19 pandemic is a historic health and economic crisis. One consequence of the pandemic is the record job loss and widespread wage cuts in the United States. In April 2020, the unemployment rate reached a record-high 14.7% (Bureau of Labor Statistics, 2020) and approximately one in five workers claimed unemployment insurance as of July 2020 (Department of Labor, 2020). Many Americans also experienced a loss of income during the pandemic if their employer reduced business hours (Brenan, 2020) or if they experienced pandemic-related caregiving responsibilities that required a reduction in work hours - a burden borne primarily by mothers (Collins et al., 2020; Modestino, 2020). Indeed, some estimates suggest that about 60% of workers who did not lose their jobs experienced a wage cut or wage freeze in March-June 2020 (Cajner et al., 2020). Job loss activates a series of adversities such as financial strain, lowered self-esteem, social withdrawal, and family disruption that undermine mental health (e.g., Brand, 2015; Price, Choi, & Vinokur, 2002). While job loss and partial income loss may not be similarly distressing experiences, any unexpected household income reduction likely causes distress for individuals. As such, job loss and wage cuts on this scale are a significant concern for population health and well-being. In the present study, we refer to the experience of job loss and/or partial income loss as a household income shock for simplicity.

While the impact of income shocks on mental health during the COVID-19 pandemic are likely to be extensive and pervasive, the mental health consequences of income shocks may vary across the U.S. states due to differing sociopolitical contexts. Prior research, however, has yet to consider state variation in the mental health consequences of income shocks before or during the pandemic. Indeed, recent research documenting variation in COVID-19 mortality by state-level income inequality (Oronce et al., 2020) points to the importance of considering how broader state-level sociopolitical contexts shape mental and physical health outcomes related to the COVID-19 pandemic.

Disparities in health and mortality across states are extensive and increasing. Due to the deregulation of industries, devolution of power from the federal government to states, and state preemption laws, states’ social and economic policies have considerable impact on their population’s health and longevity (Montez, 2017; Montez et al., 2020). Indeed, state-level policies and contexts shape how important individuals’ socioeconomic resources are for promoting health and avoiding health risks. Additionally, increased political polarization leads to clustering of social welfare policies across states (e.g., Montez et al., 2020). While prior research links these policies to increased longevity and improved health, little is known about how state contexts shape mental health and to what extent state-level policies exacerbate or ameliorate the mental health consequences of income shocks.

We hypothesize that state contexts have the potential to weaken adverse mental health responses to income shocks from job loss or reduced work hours. For example, losing a job may require increased reliance on existing social safety nets, especially during a recession when finding a new job may be difficult. The loss of employment-based health insurance and regular income would make financial and health policies more important for the recently unemployed, especially during a public health crisis. As a result, these policies may provide tangible benefits to unemployed people and their households, which may buffer some of the stress associated with job loss. That is, recent unemployment may be less stressful and have less deleterious effects on mental health for workers living in a state with generous social policies compared to workers who live in states with less generous social policies. Although some policies may not apply to adults who experience a reduction in work hours but are not unemployed, many social policies may be beneficial if a partial loss of employment income creates financial insecurity.

In addition to variation in state-level policies that existed prior to the COVID-19 pandemic, the federal government has largely allowed states to set their own policies to cope with the pandemic and the ensuing recession. States continue to implement vastly different strategies to contain the spread of disease, salvage local economies, and support citizens. For example, states chose whether and for how long to implement a moratorium on evictions, which likely lessens psychological distress when people who experience a loss of income worry about paying their rent or mortgage. As such, financial insecurity during the pandemic would be more distressing in a state without protective policies. Overall, pre-existing and newly implemented policies create vastly different state contexts, which likely contribute to different experiences of mental health related to income shocks during the pandemic.

Indeed, we argue that residents experiencing unemployment and/or a partial loss of income during the pandemic will be more adversely affected if they live in a state that has limited social protections compared to residents experiencing income loss in a state with more extensive social protections. Prior research on physical health and longevity finds that adults with less education are especially vulnerable to state contexts, whereas college educated adults can use their resources to promote health regardless of state contexts (Montez, Zajacova, & Hayward, 2017; Montez et al., 2019). Although the present study examines income shocks instead of educational attainment, we hypothesize that adults experiencing income loss in their household are in a vulnerable position and will be sensitive to state policies. Taken together, this framework suggests that the mental health of adults experiencing income shocks will vary considerably across states, and social policies have the potential to reduce the adverse mental health consequences of an income shock.

The present study considers the extent to which state policy contexts - pre-existing sociopolitical contexts as well as pandemic-specific policies - shape disparities in mental health by household income shock status during the COVID-19 pandemic. We consider income shocks in the household because the consequences of job loss and income loss tend to spillover to affect the family members of workers. For example, job loss can increase the risk of family conflict and divorce for married couples and can have deleterious effects on children’s self-esteem and academic performance (Brand, 2015). The conflict and disruption stemming from job loss and reduced work hours tends to affect all household members of displaced workers - an important consideration during a time of record job loss and wage cuts.

We focus on depression and anxiety as two specific indicators commonly used to assess mental health that would be sensitive to the health and economic crisis. This study extends prior research by considering the psychological consequences of the pandemic and by documenting variation in these consequences across states and state-level policies. We ask the following specific research questions:

Do disparities in depression and anxiety by household income shock status vary across states during the COVID-19 pandemic?

At the individual level, to what extent does the association between household income shock and mental health (i.e., depression and anxiety) depend on state-level sociopolitical contexts?

Method

Data and Sample

The 2020 Household Pulse Survey is a new national survey administered by the Census Bureau in collaboration with five federal agencies. The 20-minute online survey was specifically designed to understand the experiences of individuals during the COVID-19 pandemic. Data collection for the first phase began in late April 2020 and continued for 90 days. Surveys were administered weekly for twelve weeks with new participants added every week to maintain appropriate sample size and to minimize participant burden. Most participants (80%) only completed one weekly survey, but some participants were enrolled for two (15%) or three (5%) weeks. Because so few participants completed more than one weekly survey, we only use the first observation from any participant with repeated observations.

Respondents are from all 50 states, with state-specific sample size ranging from 11,279 (Wyoming) to 77,811 (California). Thus, the ability to examine prevalence of and variation in depression and anxiety across states with attention to household income shock status is a significant contribution. To examine state-level contexts, we merged data on state-level policies and contexts (detailed below) with the Household Pulse Survey. The analytic sample for the present study includes respondents with non-missing information on mental health outcomes. We further restrict the analytic sample to adults less than 65 years old given the present study’s focus on job loss and the reduction of work hours (n=582,440 for depression; n=582,796 for anxiety). To understand how the Household Pulse Survey sample compares to nationally representative estimates, we compare descriptive statistics from the analytic sample to the 2018 American Community Survey (ACS), restricting the ACS sample to adults aged 18–65. The Household Pulse Survey respondents have greater educational attainment, are more likely to be women, and are slightly more likely to be non-Hispanic White compared to national estimates from the ACS.

Measures

Mental Health.

The Household Pulse Survey assesses the frequency of anxiety and depression symptoms. For depression, we use the validated two-item Patient Health Questionnaire (PHQ-2; Gilbody et al., 2007). Respondents report how often they have been bothered by 1) having little interest or pleasure in doing things and 2) feeling down, depressed, or hopeless over the past seven days. For anxiety, we use the validated two-item Generalized Anxiety Disorder scale (GAD-2; Kroenke et al., 2007). Respondents report how often they have been bothered by 1) feeling nervous, anxious, or on edge and 2) not being able to stop or control worrying over the past seven days. Each of these four questions has four response options: not at all (0), several days (1), more than half the days (2), nearly every day (3). The two responses for each scale (depression, anxiety) are summed. In line with prior research, we consider a score equal to 3 or more on the PHQ-2 to be indicative of major depressive disorder (Gilbody et al., 2007; Kroenke, Spitzer, & Williams, 2003) and a score equal to 3 or more on the GAD-2 to be indicative of generalized anxiety disorder (Kroenke et al., 2007). For the present study, we use these validated cut points to create dichotomous measures for depression and anxiety.

Household Income Shock.

Respondents were asked: “have you, or has anyone in your household, experienced a loss of employment income since March 13, 2020.” Respondents who answered affirmatively are coded as experiencing a household income shock during the pandemic (1=yes). A loss of employment income could be due to job loss, quitting a job, and/or reduced work hours or wage cuts.

State Contexts.

We focus on several social, economic, and health policies that vary across states, including existing state policies, as well as new policies in response to the pandemic and recession. Existing policies include whether the state has an Earned Income Tax Credit (EITC) in 2020 (1=yes; Tax Credits for Working Families, n.d.), whether the state expanded Medicaid qualifications under the Affordable Care Act as of 2020 (1=yes; Kaiser Family Foundation, 2020), the state’s weekly maximum amount of unemployment insurance in 2020 (range $190–$823), and the state’s maximum number of weeks that workers could collect unemployment insurance in 2020 (range 12–28 weeks; Department of Labor, n.d.). For the two measures of unemployment insurance, we use the values that existed prior to the CARES act, since adjustments to unemployment insurance were universally applied across states. We also consider the political context of the state (Leip, n.d.) by measuring the percent of national elections that went to the republican candidate between 1980 and 2016 (range 0–100), as well as whether the state favored Trump during the 2016 election (1=yes). State policies in response to COVID-19 and the recession (Raifman et al., 2020), include whether the state adopted a moratorium on evictions (1=yes) and whether the state ordered a freeze on utility shut offs (1=yes).

Covariates.

Models account for individual sociodemographic covariates that are likely associated with income shocks and mental health. Covariates include age (in years), gender (1=female), race/ethnicity (non-Hispanic White (reference), non-Hispanic Black, Hispanic, other race/ethnicity), educational attainment (less than high school degree (reference), high school graduate, some college, associate’s degree, bachelor’s degree, or graduate degree), and marital status (married (reference), widowed, divorced/separated, never married). Models also include a measure of the week of survey to account for changes in mental health during data collection (April-July 2020).

Analytic Strategy

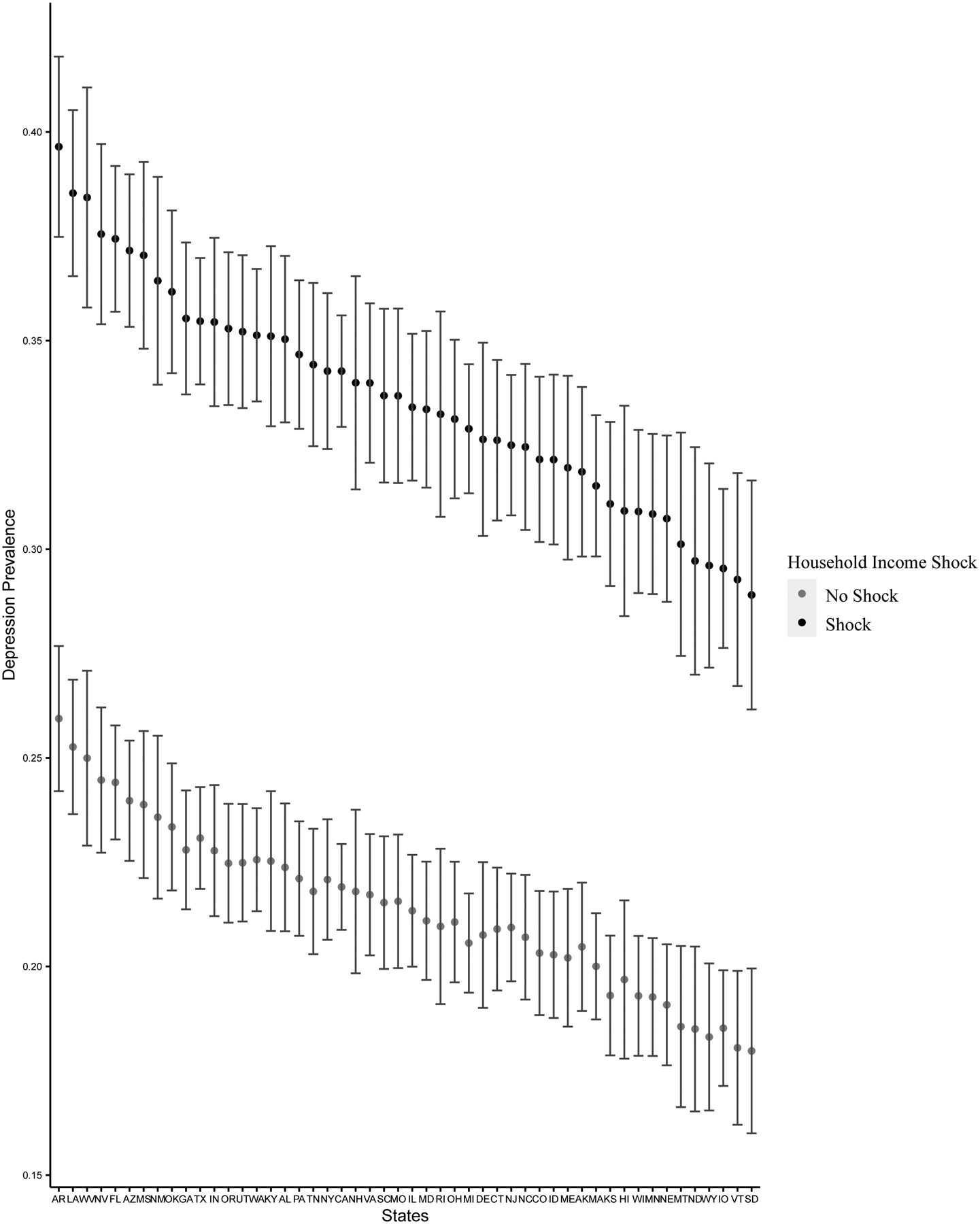

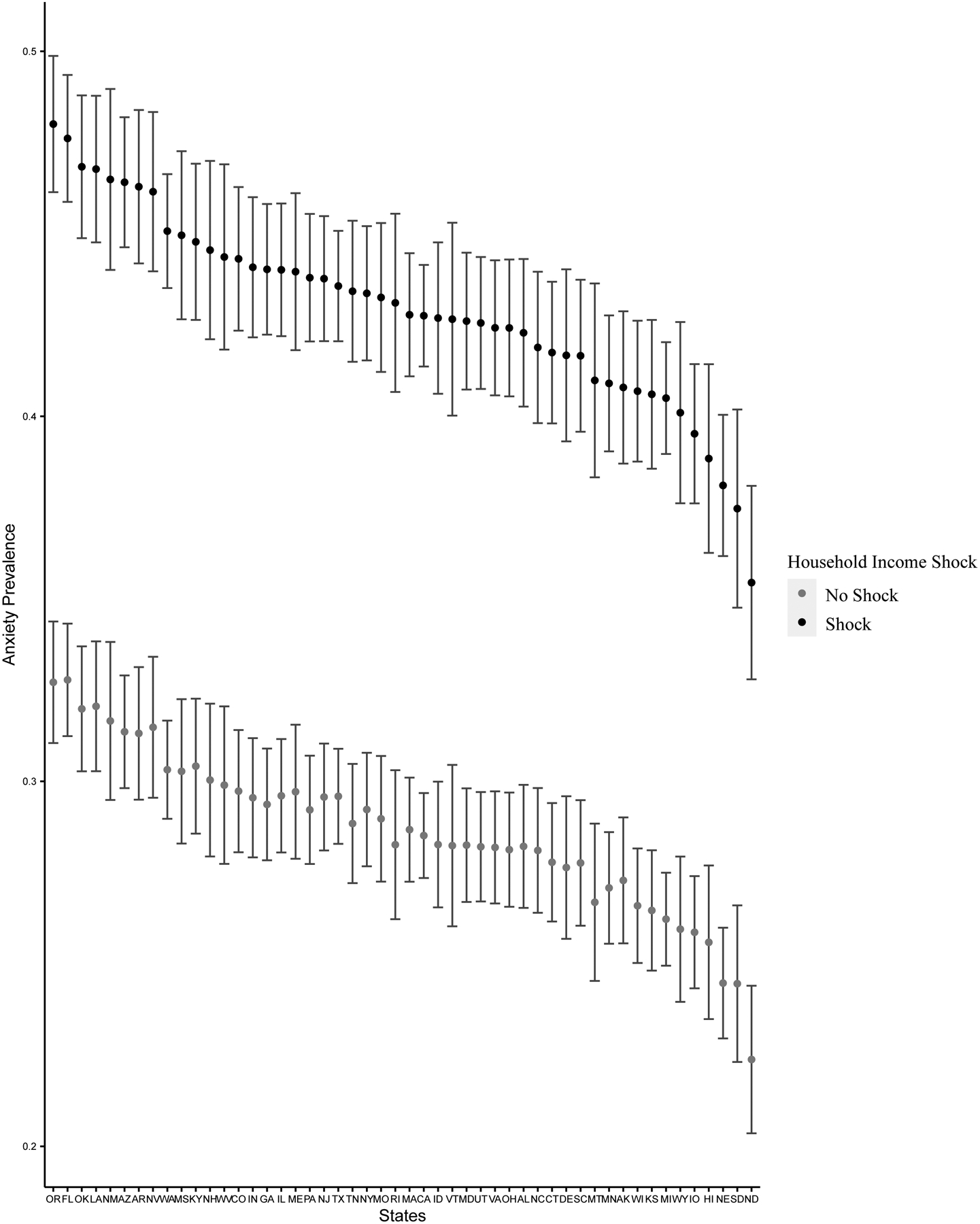

To examine variation in depression and anxiety by household income shock status across states, we estimate logistic regression models predicting depression and anxiety, including household income shock, age, and gender as covariates. We graph the predicted probabilities of depression and anxiety from these models in Figure 1 and Figure 2 to show the differences in mental health by household income shock in each state.

Figure 1.

Predicted Prevalence of Depression by Household Income Shock (Household Pulse Survey, 2020)

Figure 2.

Predicted Prevalence of Anxiety by Household Income Shock (Household Pulse Survey, 2020)

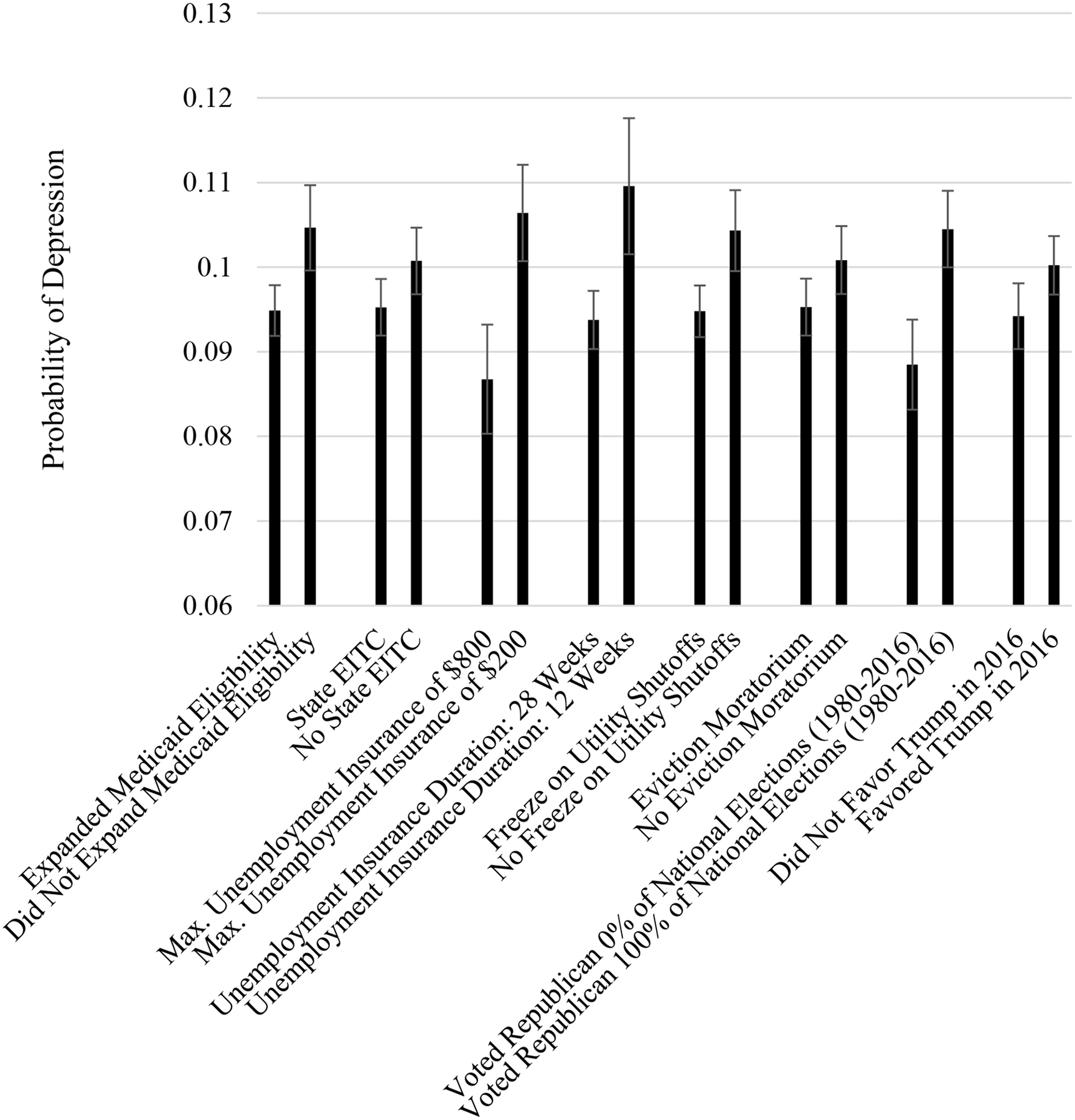

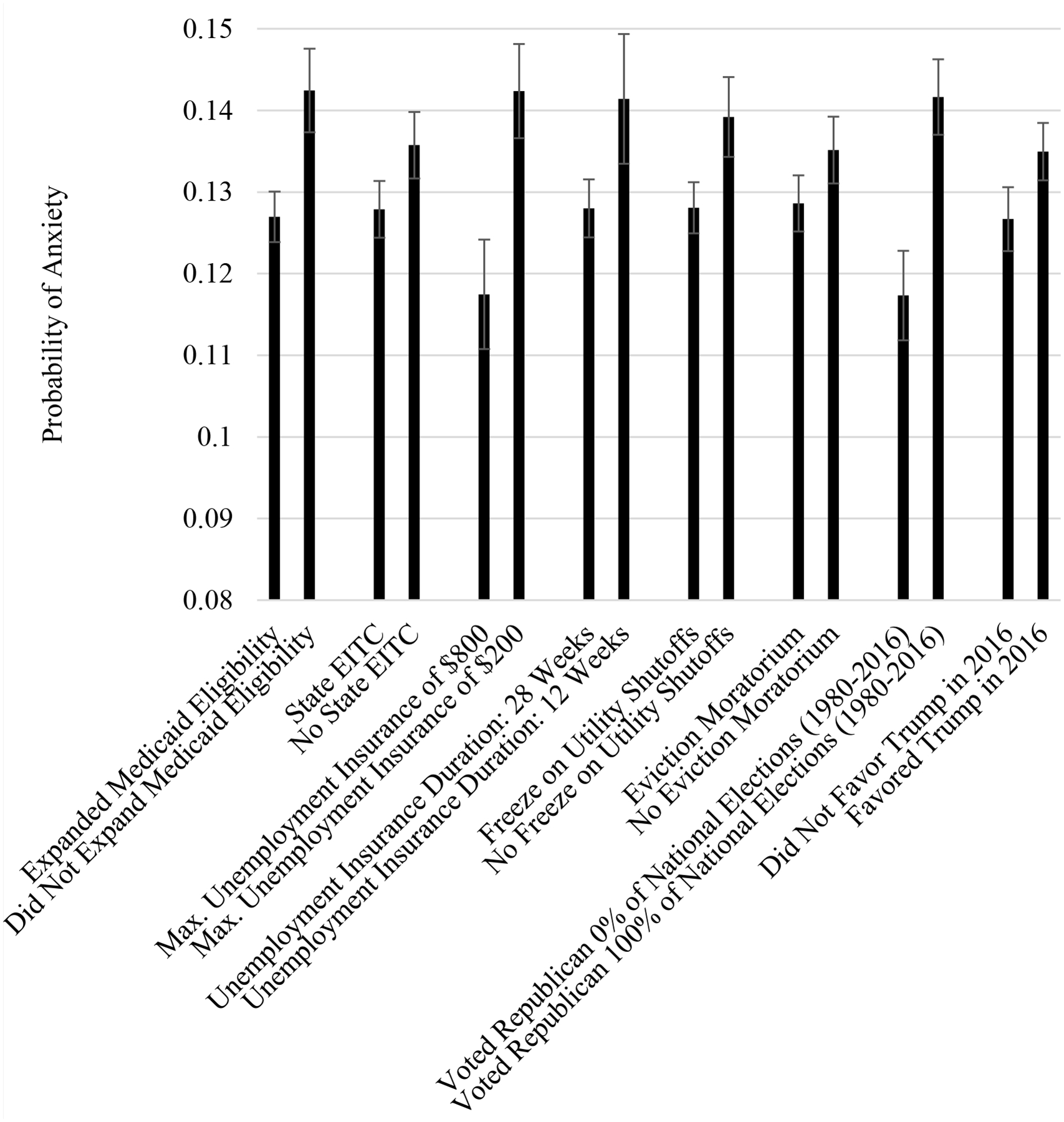

To test whether the associations between household income shock and mental health (i.e., depression and anxiety) vary by state-level policies and political context we estimate a series of multilevel logistic regression models. The models account for the multilevel structure of the data, with individuals nested within states, and include a random effect for states. The analytic approach is similar for depression and anxiety. For each outcome, we estimate the first model including household income shock and sociodemographic covariates to examine the association between an income shock and mental health before considering state sociopolitical context. In subsequent models, we separately add each state-level policy or context and the interaction of each state measures with household income shock to examine whether the mental health consequences of income shocks vary by specific state-level policies, net of sociodemographic covariates. Tables 2 and 3 present the odds ratios for the key measures of interest: household income shock, state sociopolitical context measures, and the interaction of income shock with the state measures. Complete tables with covariates are included in Supplementary Materials. To illustrate the pattern of results, Figures 3 and 4 present the average marginal effect of household income shocks across state contexts on the predicted probability of depression and anxiety, respectively

Table 2.

Multilevel Logistic Regression Models Predicting Depression for U.S. Adults Aged 18–65, Household Pulse Survey

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|---|---|---|---|---|

| Household Income Shock | 1.75*** (1.72–1.78) | 1.82*** (1.79–1.85) | 1.77*** (1.72–1.82) | 1.88*** (1.80–1.96) | 1.95*** (1.86–2.04) | 1.81*** (1.77–1.86) | 1.79*** (1.75–1.82) | 1.67*** (1.61–1.74) | 1.72*** (1.68–1.77) |

| State Policies | |||||||||

| Medicaid Expansion | 1.01 (0.94–1.08) | ||||||||

| Income Shock*Medicaid Expansion | 0.95*** (0.92–0.97) | ||||||||

| State EITC | 0.95 (0.89–1.02) | ||||||||

| Income Shock*State EITC | 0.99 (0.95–1.02) | ||||||||

| Max Unemployment Insurance (in hundreds) | 0.99 (0.97–1.02) | ||||||||

| Income Shock* Unemployment Insurance Weeks of Unemployment | 0.99*** (0.98–0.99) | 0.99 (0.99–1.00) | |||||||

| Income Shock*Weeks of Unemployment | 0.99*** (0.99–1.00) | ||||||||

| Freeze on Utility Shutoff | 1.01 (0.93–1.10) | ||||||||

| Income Shock*Freeze on Utility Shutoff | 0.95** (0.92–0.98) | ||||||||

| Eviction Moratorium | 1.02 (0.96–1.09) | ||||||||

| Income Shock* Eviction Moratorium | 0.97 (0.94–1.00) | ||||||||

| Political Environment | |||||||||

| National Elections Voted Republican (1980–2016) | 1.00 (0.99–1.00) | ||||||||

| Income Shock*History of Republican Elections | 1.00** (1.00–1.00) | ||||||||

| State Favored Trump in 2016 | 1.00 (0.93–1.06) | ||||||||

| Income Shock*State Favored Trump | 1.03 (1.00–1.07) |

Note. Odds ratios presented with 95% confidence intervals in parentheses; Models control for age, race/ethnicity, gender, educational attainment, marital status, and week of interview and include a state random coefficient; Full models available in Supplementary Materials; EITC: Earned Income Tax Credit;

p<.05

p<.01

p<.001

Table 3.

Multilevel Logistic Regression Models Predicting Anxiety for U.S. Adults Aged 18–65, Household Pulse Survey

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|---|---|---|---|---|

| Household Income Shock | 1.83*** (1.80–1.87) | 1.93*** (1.89–1.97) | 1.87*** (1.81–1.93) | 1.99*** (1.90–2.10) | 1.98*** (1.83–2.14) | 1.90*** (1.85–1.95) | 1.87*** (1.83–1.92) | 1.70*** (1.64–1.77) | 1.78*** (1.73–1.83) |

| State Policies | |||||||||

| Medicaid Expansion | 1.06 (0.99–1.13) | ||||||||

| Income Shock*Medicaid Expansion | 0.93*** (0.90–0.96) | ||||||||

| State EITC | 1.02 (0.96–1.09) | ||||||||

| Income Shock*State EITC | 0.97 (.93–1.00) | ||||||||

| Max Unemployment Insurance (in hundreds) | 1.01 (.99–1.03) | ||||||||

| Income Shock* Unemployment Insurance | 0.98*** (0.97–0.99) | ||||||||

| Weeks of Unemployment | 1.00 (0.99–1.01) | ||||||||

| Income Shock*Weeks of Unemployment | 0.99* (0.99–1.00) | ||||||||

| Freeze on Utility Shutoff | 1.05 (0.98–1.14) | ||||||||

| Income Shock*Freeze on Utility Shutoff | 0.95** (0.92–0.98) | ||||||||

| Eviction Moratorium | 1.07* (1.00–1.13) | ||||||||

| Income Shock* Eviction Moratorium | 0.97 (0.93–1.00) | ||||||||

| Political Environment | |||||||||

| National Elections Voted Republican (1980–2016) | 0.99** (0.99–1.00) | ||||||||

| Income Shock*History of Republican Elections | 1.00*** (1.00–1.00) | ||||||||

| State Favored Trump in 2016 | 0.91*** (0.86–0.96) | ||||||||

| Income Shock*State Favored Trump | 1.05** (1.02–1.09) |

Note. Odds ratios presented with 95% confidence intervals in parentheses; Models control for age, race/ethnicity, gender, educational attainment, marital status, and week of interview and include a state random coefficient; Full models available in Supplementary Materials; EITC: Earned Income Tax Credit;

p<.05

p<.01

p<.001

Figure 3.

Average Marginal Effect of Household Income Shocks Across State Sociopolitical Contexts on Predicted Probability of Depression

Note: Estimates calculated from results in Table 2 (Models 2–9). Larger positive values indicate greater differences in the predicted probability of depression between respondents experiencing a household income shock and respondents not experiencing an income shock, by state context.

Figure 4.

Average Marginal Effect of Household Income Shocks Across State Sociopolitical Contexts on Predicted Probability of Anxiety

Note: Estimates calculated from results in Table 3 (Models 2–9). Larger positive values indicate greater differences in the predicted probability of anxiety between respondents experiencing a household income shock and respondents not experiencing an income shock, by state context.

We apply person-level weights to the descriptive results in Table 1 and the results in Figures 1–2 to adjust for different sampling probabilities and survey non-response. Because design weights are not available at the state-level, we do not apply weights to the multilevel models. Nevertheless, the inclusion of covariates associated with sample selection can produce unbiased coefficients without weights (Heeringa et al, 2017; Winship & Radbill 1994). Moreover, unweighted multilevel models tend not to lead to different inferential conclusions when compared to weighted estimates (Carle, 2009). Stata codes for the analyses are available on GitHub at https://github.com/mateofarina/SSM_StatePolicy-MentalHealth.git. All analyses were conducted using Stata 14.2.

Table 1.

Descriptive Information of Analytic Sample (Household Pulse Survey)

| Overall | No Household Income Shock | Household Income Shock | ||||

|---|---|---|---|---|---|---|

| Mean/% | (S.D.) | Mean/% | (S.D.) | Mean/% | (S.D.) | |

| Household Income Shock | 45.30% | |||||

| Depression | 24.20% | 18.78% | 30.80% | |||

| Anxiety | 34.57% | 27.91% | 42.64% | |||

| Age (Range: 18–65 years) | 44.40 | (11.86) | 44.83 | (11.79) | 43.93 | (11.93) |

| Race/ethnicity | ||||||

| Non-Hispanic White | 71.59% | 74.87% | 67.67% | |||

| Hispanic | 8.74% | 7.67% | 10.02% | |||

| Non-Hispanic Black | 10.56% | 8.55% | 12.97% | |||

| ”Other” race/ethnicity | 9.10% | 8.92% | 9.34% | |||

| Female | 61.76% | 61.23% | 62.42% | |||

| Educational Attainment | ||||||

| Less than High School | 2.60% | 1.97% | 3.34% | |||

| High School | 12.60% | 10.72% | 14.83% | |||

| Some College | 21.88% | 18.89% | 25.49% | |||

| Associate degree | 10.96% | 9.93% | 12.22% | |||

| Bachelor’s Degree | 29.54% | 31.71% | 26.94% | |||

| Graduate Degree | 22.42% | 26.78% | 17.17% | |||

| Marital Status | ||||||

| Married | 57.19% | 59.15% | 54.83% | |||

| Widowed | 1.85% | 1.94% | 1.73% | |||

| Divorced/Separated | 16.36% | 15.49% | 17.42% | |||

| Never Married | 24.60% | 23.43% | 26.03% | |||

| States that Expanded Medicaid Eligibility | 70.90% | 70.50% | 71.37% | |||

| States with Earned Income Tax Credit (EITC) | 55.66% | 55.10% | 56.34% | |||

| Maximum Weekly Unemployment Insurance Amount (in $100) | 4.64 | (140) | 4.64 | (139) | 4.36 | (140) |

| Maximum Unemployment Insurance Duration (in weeks) | 24.08 | (4.32) | 24.1 | (4.28) | 24.02 | (4.37) |

| States Prohibiting Utility Shut Offs | 69.41% | 69.90% | 69.80% | |||

| States with Eviction Moratorium | 58.50% | 58.00% | 59.13% | |||

| Percent of National Elections Favoring Republican Candidate (1980–2016) | 58.10% | (29.98) | 59.40% | (30.10) | 56.94% | (29.78) |

| States Where Trump Won State in 2016 | 57.54% | 58.64% | 56.22% | |||

| Survey Week | ||||||

| Week 1 (4/23–5/5) | 8.66% | 8.89% | 8.39% | |||

| Week 2 (5/7–5/12) | 2.58% | 2.55% | 2.62% | |||

| Week 3 (5/14–5/19) | 13.30% | 13.47% | 13.04% | |||

| Week 4 (5/21–5/26) | 8.04% | 8.14% | 7.91% | |||

| Week 5 (5/28–6/2) | 8.99% | 9.05% | 8.92% | |||

| Week 6 (6/4–6/9) | 7.01% | 7.07% | 6.94% | |||

| Week 7 (6/11–6/16) | 6.85% | 6.93% | 6.78% | |||

| Week 8 (6/18–6/23) | 10.99% | 11.02% | 10.99% | |||

| Week 9 (6/25–6/30) | 8.86% | 8.72% | 9.04% | |||

| Week 10 (7/2–7/7) | 8.09% | 7.98% | 8.23% | |||

| Week 11 (7/9 −7/14) | 8.54% | 8.29% | 8.83% | |||

| Week 12 (7/16–7/21) | 8.08% | 7.89% | 8.31% | |||

Note. S.D.: standard deviation

Results

Descriptive Results

Descriptive statistics are presented in Table 1. Depression and anxiety were elevated during the study period (April-July 2020), with 24% of the sample categorized as depressed and 35% of the sample categorized as having anxiety. During a similar period in 2019 prior to the pandemic, 6.5% of Americans had symptoms of a depressive disorder and 8% of Americans had symptoms of an anxiety disorder (Czeisler et al., 2020). Experiencing a household income shock was common during this phase of the pandemic: 45% of the analytic sample experienced a loss of income in their household after March 13, 2020. Table 1 also provides information about state-level policies and contexts. Approximately 70% of states expanded Medicaid eligibility by 2020 and about half of states had their own supplement to the federal Earned Income Tax Credit. The average maximum weekly unemployment insurance amount across states was $464 for an average maximum of 24 weeks. Turning to pandemic-specific policies, many states (69%) enacted policy prohibiting utility shut offs and over half of states (59%) adopted a moratorium on evictions. The descriptive information for political context shows that between 1980 and 2016 states voted for the Republican presidential candidate about 58% of the time and over half of states voted for Trump in the 2016 election (58%).

Table 1 also shows the descriptive results stratified by household income shock status. Compared to respondents in households that did not experience an income shock, respondents in households that experienced an income shock were more likely to meet the threshold for depression and anxiety, to be non-white, to have lower levels of educational attainment, and to be divorced or never married. Notably, state-level sociopolitical contexts were similar across household income shock status.

Mental Health by Household Income Shock Status Across States

Figure 1 shows the proportion of adults in each state reporting depression by household income shock status during this early phase of the COVID-19 pandemic (April-July 2020), accounting for age and gender. Among those experiencing an income shock in their household, the prevalence of depression ranged from approximately 30% in South Dakota and Vermont to almost 40% in Arkansas. The prevalence of depression was lower among respondents who did not experience a household income shock in every state and ranged from 18% in South Dakota and Vermont to 26% in Arkansas.

We document a similar pattern for the prevalence of anxiety in each state (Figure 2). The highest prevalence of anxiety was among respondents who experienced a household income shock residing in Oregon and Florida (almost 50%). As a comparison, the lowest prevalence of anxiety among those experiencing a household income shock was for respondents living in South Dakota (approximately 35%). Among those who did not experience a household income shock between March and late July of 2020, the prevalence of anxiety ranged from 23% in North Dakota to 33% in Florida and Oregon. Overall, Figure 1 and Figure 2 show that depression and anxiety vary across states among those who did and did not experience a household income shock.

Household Income Shock and State-level Sociopolitical Contexts

To examine whether the association between household income shocks and mental health depends on the state-level sociopolitical context, we test the interaction of household income shock with several state-level measures (Table 2). Starting with depression, we first test the main effect for household income shocks before accounting for state-level contexts (Table 2, Model 1). Model 1 shows that adults who experienced an income shock in their household have 75% greater odds of depression compared to adults who did not experience a household income shock (p<.001), net of sociodemographic covariates. All models include a covariate for the week of survey completion to account for any changes in depression and anxiety over the study period. The full tables available in the Supplementary Materials show that the prevalence of depression and anxiety increased during the study period, with a notable increase in depression and anxiety around the 9th week of data collection until the end of the study (late June to mid-July 2020). Supplemental Table 1 shows that the odds of depression were greater for younger adults, women, respondents with less education, nonmarried adults, and adults classified as having an “other” race/ethnicity.

Models 2 through 9 (Table 2) each include an interaction of household income shock with a different state-level policy or context variable. Findings in Table 2 indicate that the consequences of household income shock for depression are lessened if respondents lived in a state that expanded Medicaid eligibility under the Affordable Care Act (Model 2; p<.001), offered a greater maximum amount of unemployment insurance (Model 4; p<.001) or more weeks of unemployment insurance (Model 5; p<.001), or implemented a freeze on utility shutoffs during the pandemic (Model 6; p<.01). State-level EITC and COVID-specific eviction moratoriums did not moderate the association between household income shock and depression. The state’s political environment also shapes the association between household income shocks and depression. In Model 8, the positive interaction term for household income shock and the percent of presidential elections in which the state favored the Republican candidate (1980–2016) indicates that household income shock is increasingly detrimental for depression in states with a higher percentage of elections favoring the Republican presidential candidate (Model 8).

To aide in the interpretation of results, we used the regression estimates from Table 2 (Models 2–9) to calculate the average marginal effect of household income shocks across state sociopolitical contexts on predicted probability of depression (Fig. 3). That is, Fig. 3 shows the difference in probability of depression between individuals in households experiencing an income shock and those who did not experience an income shock during the first phase of the COVID-19 pandemic (April–July 2020), with attention to the state sociopolitical context. For state-level measures that are on a continuous scale (i.e., unemployment insurance amount, unemployment insurance duration, and the percent of national elections favoring the Republican candidate), we show the average marginal effect of household income shocks at low and high values of these measures. For example, the results for unemployment insurance amount show that the probability pf depression is almost 11 percentage points greater for respondents who experienced an income shock compared to respondents who did not experience an income shock if they live in a state that only offers a maximum amount of $200 per week in unemployment insurance. On the other hand, if respondents live in a state that offers a maximum amount of $800 per week in unemployment insurance, this difference is reduced to less than 9 percentage points. These findings show that while depression is still elevated for respondents experiencing a household income shock, the probability of depression shrinks as the state's weekly unemployment insurance amount increases. Fig. 3 also shows a stark difference depending on the political environment. That is, the more conservative a state's historical political record is (from 1980 to 2016), the greater the probability of depression when experiencing a household income shock. Overall, Fig. 3 shows that while some state policies have a small impact on depression, unemployment insurance and the historical political environment have the greatest impacts on depression for households that experience an income shock.

Table 3 shows a similar story for anxiety. We first show the association between household income shock and anxiety before accounting for the state context. Model 1 shows that household income shock is associated with anxiety such that adults experiencing an income shock in their household have 83% greater odds of anxiety compared to adults without household income shock (p<.001), net of sociodemographic covariates. The full table (Supplemental Table 2) shows that the odds of anxiety were greater for younger adults, white adults, women, adults with less education, and non-married adults.

Models 2 through 9 (Table 3) each include an interaction term for household income shock and a specific state-level policy or context variable to test whether state contexts modify the association between household income shock and anxiety. Findings in Table 3 indicate that household income shocks are less consequential for anxiety if individuals live in a state that expanded Medicaid eligibility under the Affordable Care Act (Model 2; p<.001), offered a greater maximum amount in weekly unemployment insurance (Model 4; p<.001), offered more weeks of unemployment insurance (Model 5; p<.05), or suspended utility shut offs during the pandemic (Model 6; p<.001). Moreover, living in a state with a history of voting for the Republican presidential candidate (Model 8; p<.001) or in a state that favored Trump in the 2016 election (Model 9; p<.01) exacerbates the consequences of household income shock for anxiety during the COVID-19 pandemic (April to July 2020). State-level EITC and COVID-specific eviction moratoriums do not moderate the association between household income shock and anxiety.

To illustrate the pattern of results, Fig. 4 shows the average marginal effect of household income shocks across state contexts on predicted probability of anxiety based on regression estimates from Table 3 (Models 2–9). Overall, Fig. 4 shows that, for several state sociopolitical contexts, the difference in probability of anxiety between adults experiencing a household income shock and those not experiencing an income shock is smaller if respondents live in a state with more social protections and benefits in place, although the magnitude of the reduction varies depending on the specific policy. For example, the results for Medicaid eligibility show that the probability of anxiety is over 14 percentage points greater for adults who experienced an income shock relative to adults who did not experience an income shock if they live in a state that did not expand eligibility for Medicaid. However, if respondents live in a state with expanded Medicaid eligibility, this difference in the probability of anxiety is reduced to less than 13 percentage points. Moreover, Fig. 4 shows differences in anxiety relative to the state political environment. The gap in anxiety by household income shock status is over two percentage points smaller in states that never voted for the Republican candidate since 1980 compared to states that favored the Republican candidate in every presidential election since 1980.

Discussion

Experiencing a job loss or a reduction of work hours is a distressing event and the tremendous unemployment from the COVID-19 pandemic raises concerns about the mental health of the population. Experiences of job loss and income shocks may differ across U.S. states during the pandemic, as states have different policy contexts that likely influence mental health. This possibility has not yet been examined in prior research. Using national survey data, we provided key insights into how state-level policies exacerbate or ameliorate the mental health consequences of a household income shock. We find that rates of depression and anxiety differ across states by household income shock status, and that supportive social policies weaken the association between household income shocks and mental health.

To our knowledge, no previous studies have examined mental health disparities by household job loss and/or income loss across U.S. states during the COVID-19 pandemic. We found that the prevalence of depression and anxiety varied across states. For example, about 30% of people who experienced a household income shock in Vermont and South Dakota were depressed compared to almost 40% of people who experienced an income shock in Arkansas, Louisiana, and West Virginia. Notably, most of the states with the highest prevalence of depression among people experiencing household income shocks tend to lack important social policies related to economic security and health. This finding aligns with recent research showing that states with more conservative policies experienced a reduction in life expectancy in recent years (Montez et al., 2020). We add our voices to those scholars warning that the lack of social policies in numerous states are detrimental for population health and well-being. Although residents can vote for the implementation of policies - as evidenced by the August 2020 vote to expand Medicaid in Missouri - this haphazard adoption of social policies across states spells disaster for disparities in health and well-being in the United States. This is especially relevant during a public health crisis and economic recession.

The present study offers needed insight as state and federal governments consider whether to extend existing protections and implement new policies related to the COVID-19 pandemic. Indeed, we found that experiencing a household income shock during the first phase of the pandemic (April-July 2020) is less distressing when individuals live in states with supportive social policies, including policies existing before the pandemic and those enacted during the pandemic. Although the magnitude of the effect of state policies varies depending on the specific policy, we find the largest effect for states’ unemployment insurance benefits. This finding suggests that the expanded unemployment insurance under the CARES Act - a policy enacted similarly across states - likely had significant benefits for the mental health of unemployed workers. We also find strong evidence that the states’ longer-term political environment shapes the mental health consequences of income shocks during the pandemic suggesting the broader political environment is an important determinant of health and well-being. The historical political environment may capture specific policies not examined in the present study and may also be an indicator of the general sociopolitical climate that affects mental health.

Overall, findings align with prior research on physical health and longevity documenting that adults with fewer socioeconomic resources are especially vulnerable to state contexts (Montez, Zajacova, & Hayward, 2017; Montez et al., 2019). Notably, unemployment during the COVID-19 economic downturn has concentrated among lower socioeconomic status adults (Kochar, 2020) - a population typically sensitive to state environments. At a time when politicians debate whether to extend eviction moratoriums and unemployment benefits, our results suggest that these protections help households that experience job loss or a loss of income during the pandemic. In a period of rampant unemployment, wage cuts, and reduced work hours, these findings apply to many households in the United States.

Our results also suggest that the lack of a strong federal response to the pandemic alongside the devolution of federal power to states over the past 40 years contributes to inequalities in mental health across states. That is, respondents in households experiencing an income shock during the pandemic are less distressed if they happen to live in states that provide social policies that reduce economic insecurity (e.g., unemployment insurance) and ensure access to health care (e.g., Medicaid expansion). Given linkages between mental health and physical health and mortality (Chapman, Perry, & Strine, 2005; Kiecolt-Glaser et al., 2002; Walker, McGee, & Druss, 2015), geographic inequalities in mental health during the pandemic may fuel growing geographic inequalities in life expectancy.

This study takes an important first step in documenting different experiences of household income shocks and mental health during the COVID-19 pandemic; however, limitations should be noted. First, the Household Pulse Survey asks participants about recent loss of employment income in the household, so we do not know which household member - or how many members - lost their income. Because the consequences of income loss tend to spillover to affect other members of the household (e.g., Brand, 2015), we do not expect the pattern of results to change substantially. Moreover, the loss of employment income could be due to job loss or the partial loss of income and the consequences for mental health may differ depending on the extent of the household income loss. However, linkages between household income shocks and mental health may be stronger if the participant lost their job instead of another household member or if the income loss is due to unemployment instead of partial income loss. Thus, the results in the present study may be conservative estimates. Moreover, because only unemployed adults are eligible for unemployment insurance, the impact of unemployment insurance may be underestimated in the present study.

Second, we cannot determine causal order in the present study such that adults experiencing depression or anxiety during the pandemic may find it difficult to maintain their typical work schedules and may subsequently lose or quit their job or reduce their work hours. Moreover, parents may experience elevated depression or anxiety due to the increased demands of caregiving during the pandemic, and these additional duties at home may force them to reduce their work hours or quit their job. Future data collection efforts should aim to understand more nuanced details about Americans’ employment experiences and reasons for any loss of employment income. Finally, the Pulse Survey is an internet-based survey, which excludes people without internet access or those who choose not to use the internet. This likely omits some of the most vulnerable adults such as people who are home insecure, people with lower income, or people with disabilities. As discussed above, the analytic sample of the present study is more educated and less racially diverse compared to national estimates of Americans aged 18–65 based on the American Community Survey. Because adults with less education are especially vulnerable to state contexts (Montez et al., 2017; Montez et al., 2019), the findings in the present study may be even more striking in a more nationally representative sample. That is, we expect the policies examined in the present study to be even more important for vulnerable populations.

The unprecedented level of unemployment during the COVID-19 pandemic - the highest since the Great Depression - is a troubling issue for mental health and well-being. More than 4 in 10 Americans across the United States have reported that they or someone in their household lost a job during the pandemic (Parker, Horowitz, & Brown, 2020). Moreover, many parents, especially women, have left the labor force or reduced their work hours (Collins et al., 2020; Modestino, 2020). The disparate experiences of psychological distress stemming from income shocks across state lines further exacerbates the problem. Our findings indicate that state policies that improve economic security and provide access to health care reduce adverse effects of income shocks for mental health during the pandemic. Although the COVID-19 pandemic upended daily life for Americans, long-standing and emergency-related social policies can fill important resource gaps created by the loss of employment income in households, reducing the harmful effects that income shocks may have on population health and well-being.

Supplementary Material

Highlights.

Rates of depression, anxiety are greatest for adults experiencing an income shock

Depression and anxiety vary across states by household income shock status.

Many state policies reduce the mental health consequences of household income shocks

States’ political environments also reduced the consequences of income shocks

Footnotes

Publisher's Disclaimer: This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final form. Please note that during the production process errors may be discovered which could affect the content, and all legal disclaimers that apply to the journal pertain.

REFERENCES

- Brand JE (2015). The Far-Reaching Impact of Job Loss and Unemployment. American Review of Sociology, 41(1), 359–375 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Brenan Megan. 2020. U.S. Employees Increasingly Seeing COVID-19 Effects at Work. Gallup. [Google Scholar]

- Bureau of Labor Statistics. (2020). Unemployment Rate Rises to Record High 14.7 Percent in April 2020. The Economics Daily https://www.bls.gov/opub/ted/2020/unemployment-rate-rises-to-record-high-14-point-7-percent-in-april-2020.htm [Google Scholar]

- Cajner T, Crane LD, Decker RA, Grigsby J, Hamins-Puertolas A, Hurst E, Kurz C, & Yildirmaz A (2020). The U.S. Labor Market During the Beginning of the Pandemic Recession. National Bureau of Economic Research. Working Paper 27159. [Google Scholar]

- Carle AC (2009). Fitting Multilevel Models in Complex Survey Data with Design Weights: Recommendations. BMC Medical Research Methodology, 9, 49. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chapman DP, Perry GS & Strine TW (2005). The Vital Link between Chronic Disease and Depressive Disorders. Preventive Chronic Disease, 2, 1–10 [PMC free article] [PubMed] [Google Scholar]

- Collins C, Landivar LC, Ruppanner L, & Scarborough WJ (2020). COVID-19 and the Gender Gap in Work Hours. Gender, Work, & Organization, 1–12. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Czeisler ME, Lane RI, Petrosky E, et al. (2020). Mental Health, Substance Use, and Suicidal Ideation During the COVID-19 Pandemic - United States, June 24–30, 2020. MMWR Morbidity and Mortality Weekly Report. 69:1049–1057. Doi: 10.15585/mmwr.mm6932alexternal_icon. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Department of Labor. (2020). Unemployment Insurance Weekly Claims. https://oui.doleta.gov/press/2020/072320.pdf

- Department of Labor. (n.d.). Monthly Program and Financial Data. https://oui.doleta.gov/unemploy/claimssum.asp

- Gilbody S, Richards D, Brealey S, & Hewitt C (2007). Screening for depression in medical settings with the Patient Health Questionnaire (PHQ): A diagnostic meta-analysis. Journal of General Internal Medicine, 22(11), 1596–1602. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Heeringa SG, West BT, & Berglund PA (2017). Applied Survey Data Analysis (2nd ed.). New York: Chapman and Hall. [Google Scholar]

- Kaiser Family Foundation. (2020). Status of State Medicaid Expansion Decisions. https://www.kff.org/medicaid/issue-brief/status-of-state-medicaid-expansion-decisions-interactive-map/

- Kiecolt-Glaser JK, McGuire L, Robles TF, & Glaser R (2002). Emotions, Morbidity, and Mortality: New Perspectives from Psychoneuroimmunology. Annual Review of Psychology, 53, 83–107. [DOI] [PubMed] [Google Scholar]

- Kochar R (2020). Unemployment rose higher in three months of COVID-19 than it did in two years of the Great Recession. Pew Research Center. https://pewrsr.ch/2UADTTZ [Google Scholar]

- Kroenke K, Spitzer RL, & Williams JBW (2003). The Patient Health Questionnaire-2: Validity of a two-item depression screener. Medical Care, 41(11), 1284–1292. [DOI] [PubMed] [Google Scholar]

- Kroenke K, Spitzer RL, Williams JBW, Monahan PO, & Löwe B (2007). Anxiety disorders in primary care: prevalence, impairment, comorbidity, and detection. Annals of Internal Medicine, 146, 317–25. [DOI] [PubMed] [Google Scholar]

- Leip D (n.d.). Atlas of U.S. Presidential Elections. http://www.uselectionatlas.org.

- Modestino AS (2020). Coronavirus Child-care Crisis Will Set Women Back a Generation. The Washington Post. [Google Scholar]

- Montez JK (2017). Deregulation, Devolution, and State Preemption Laws’ Impact on US Mortality Trends. American Journal of Public Health, 107(11), 1749–50. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Montez JK, Beckfield J, Cooney JK, Grumbach JM, Hayward MD, Koytak HZ, Woolf SH, Zajacova A (2020). US State Policies, Politics, and Life Expectancy. The Milbank Quarterly. Online First. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Montez JK, Zajacova A, & Hayward MD (2017). Disparities in disability by educational attainment across U.S. states. American Journal of Public Health, 107(7), 1101–1108. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Montez JK, Zajacova A, Hayward MD, Woolf SH, Chapman D, & Beckfield J (2019). Educational disparities in adult mortality across U.S. states: How do they differ, and have they changed since the mid-1980s? Demography, 56(2), 621–644. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Prince CIA, Scannell CA, Kawachi I, & Tsugawa Y (2020). Association between state-level income inequality and COVID-19 Cases and Mortality in the USA. Journal of General Internal Medicine. Online First. 10.1007/s11606-020-05971-3 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Parker K, Horowitz JM, & Brown A (2020). About Half of Lower-income Americans Report Household Job or Wage Loss Due to COVID-19. Pew Research Center [Google Scholar]

- Price RH, Choi JN, & Vinokur AD (2002). Links in the Chain of Adversity Following Job Loss: How Financial Strain and Loss of Personal Control Lead to Depression, Impaired Functioning, and Poor Health. Journal of Occupational Health Psychology, 7(4), 302–312. [DOI] [PubMed] [Google Scholar]

- Raifman J, Nocka K, Jones D, Bor J, Lipson S, Jay J, and Chan P. (2020). COVID-19 US state policy database. Available at: www.tinyurl.com/statepolicies

- Tax Credits for Working Families. (n.d.). http://www.taxcreditsforworkingfamilies.org/.

- Walker ER, McGee RE, & Druss BG (2015). Mortality in mental disorders and global disease burden implications: A systematic review and meta-analysis. JAMA Psychiatry, 72, 334–41. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Winship C, & Radbill R (1994). Sampling Weights and Regression Analysis. Sociological Methods & Research, 23(2), 230–257. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.