Abstract

Environmental tax and environmental policy stringency are becoming central policy instruments for combating environmental degradation but there is a lack of studies that assess their combined effectiveness in mitigating emissions especially for emerging economies. We address this important gap by assessing the effectiveness of these two policy instruments in reducing CO2 emission in a panel of 7 emerging economies for the period 1994–2015. We believe that this is the first attempt to apply these two important policy instruments in the same framework for testing their effectiveness in reducing CO2 emissions in these 7 emerging economies. We apply heterogeneous panel data considering cross-sectional dependence and slope heterogeneity tests by using the Augmented Mean Group (AMG) which is efficient and unbiased and produces consistent estimates. We found an inverted U-shaped relationship between CO2 emissions and environmental policy stringency suggesting that it takes time for environmental policy stringency to be effective. We also found unidirectional causality running from environmental policy stringency to CO2 emission. CO2 emission was negatively and significantly related to total environmental tax with causality running from total environmental tax to CO2 emission thus supporting the “green dividend” hypothesis of improving environmental quality. In contrast, CO2 emission and energy taxes were not causality related but CO2 emission was negatively and significantly related to energy taxes. Robustness checks using the FMOLS also show that both environmental policy stringency and environmental taxes can be effective in mitigating CO2 emissions.

Keywords: CO2 emissions, Emerging economies, Environmental policy stringency, Environmental taxes, Green dividend, Panel causality, Panel cointegration

Introduction

Environmental degradation has become one of the greatest threats facing humanity as it adversely affects not only human health but also economic growth (World Bank 2016). As emission levels are constantly rising, the IPCC (2018) warns that we are confronted by “painful environmental problems” sooner than expected. Despite this alarming warning, however, “the climate crisis continues unabated as the global community shies away from the full commitment required for its reversal” (UN 2020, p. 50). The UN further warns that “if the world does not act now, and forcefully [emphasis added], the catastrophic effect of climate change will be far greater than the current pandemic (COVID-19)” (UN 2020, p. 50). This dire warning comes from the fact that global warming is increasing, with the year 2019 being the second warmest on record causing massive wildfires, hurricanes, droughts, floods, and other climate disasters across all continents (UN 2020). What is more worrying is that while the Paris Agreement (2015). calls for limiting global warming to 1.5 °C, the world is way off track to meet this target at the current level of nationally determined contributions (UN 2020). With the drive for fast economic growth, energy consumption has increased with its attendant evils of increasing atmospheric carbon dioxide emissions that cause climate change and global warming. The energy sector accounts for more than two-thirds of total green gas emissions and more than 80% of CO2 emissions (International Energy Agency, IEA 2019). CO2 emission is considered to be the driving force of global warming and climate change. Global energy-related CO2 emissions have increased from 20,521 million tonnes of CO2 in 1990 to around 32,840 million tonnes in 2017 (International Energy Agency, IEA 2020).

Between 1990 and 2017, the total CO2 emissions (kt) of the 7 emerging economies under consideration increased by more than 55% but their share in the world total CO2 emissions (kt) declined marginally from 6.0% in 1990 to 5.8% in 2017. The largest increase of almost threefold was recorded in Turkey. Turkey is a high resource intensity country with the share of renewable energy in total energy consumption declined significantly by almost 55% between 1990 and 2017 (World Bank 2020). This was followed by South Korea where total CO2 emissions (kt) more than doubled between 19990 and 2917, making Korea the eighth largest emitter of CO2 emissions in the world (World Bank 2020). Korea’s energy mix is dominated by fossil fuels and the share of renewables is the lowest in the OECD accounting for only 2.7% of total energy consumption in 2017 (World Bank 2020). In South Africa, a highly fossil fuel–dependent economy, total CO2 emissions increased by around 73% for the same period. In contrast, in the Czech Republic, Greece, Hungary, and Poland, total CO2 emissions declined. The decline in CO2 emissions, for instance, in the Czech Republic can be attributed to the way the country has managed to decouple many environmental pressures from its economic growth and from improved environmental infrastructure (OECD Environmental Performance Reviews 2018a). In the case of Greece, progress in decoupling air pollutant emissions from GDP has been made with improving the conservation status of natural habitats. The energy mix of Greece has shifted towards cleaner fuels, but the economy strongly relies on fossil fuels with renewable energy accounting for only 17.2% of total energy consumption (World Bank 2020). All these 7 countries have lower than the world average of renewable energy consumption in total final energy consumption (World Bank 2020).

The increase in CO2 emissions has several ramifications for economic growth, human health, and environmental degradation (International Energy Agency, IEA 2019). Irrespective of the decrease or increase in CO2 emissions in these 7 countries, still, climate change caused by increased emissions has harmful and irreversible effects on economic growth and human life. Many empirical studies show that CO2 emission has a detrimental effect on economic growth and on the quality of the environment (Ahmed et al. 2020; Mardani et al. 2019; Purcel 2020; Sarkodie and Strezov 2019; Shahbaz and Sinha 2019; Tiba and Omri 2017). Thus, reducing CO2 emissions prevents the adverse effects of global warming and can have a positive impact on the quality of the environment and economic growth.

All these eminent threats of global warming and climate change definitely require an effective energy policy to combat their adverse effects. Recognizing these eminent threats and also recognizing that market forces alone do not provide solutions to environmental problems (Pigou 1920), environmental taxes and stringent environmental policies are now becoming the cornerstones of environmental sustainability and a panacea for reducing CO2 emissions. Nevertheless, the paper recognizes that these two policy instruments are among the many policy instruments available for addressing the adverse effects of global warming and climate change. Equally, we also recognize that these two policy instruments are not in themselves sufficient to reduce the harmful effects of CO2 emissions. For instance, according to OECD, there are more than 3200 environmental instruments, of which more than 2800 are in force. Carbon tax also commonly known as an Emissions Trading Scheme (ETS) is one of the most efficient policy instrument for cutting greenhouse gas emissions.1 It is widely argued that putting a price on greenhouse gas (GHG) emissions (carbon pricing) can be one of the most effective means of reducing emissions (Haites 2018; IBRD 2017; Tol 2013). The carbon taxing system puts a price and the tax that must be paid on carbon measured in metric tons of carbon dioxide equivalent or tCO2e of a product or process (Haites 2018). Carbon tax is considered to be one of the most effective instrument for curbing carbon emissions as carbon tax is levied on the carbon content of fuels (Haites 2018; Lin and Li 2011; Schmalensee and Stavins 2017; Tol 2013). All these measures are intended to encourage firms to seek eco-friendly technologies so that fossil fuels are replaced by renewable energy for eventually a carbon-free society.

In conjunction with several environmental regulations, promoting renewable energy is at the heart of environmental policy. The development of green technologies both nationally and through international cooperation is becoming a cornerstone of energy policy and also the best hope for sustainable development and emission-free society. Several researches are being undertaken to replace conventional technologies by eco-friendly technologies (International Energy Agency, IEA 2019). Environmentally sustainable production and consumption of energy is now one of the stated goals of the UN Sustainable Development Goals, as global warming is a global problem, and encouraging collaboration on green technology innovation that addresses global climate change or regional pollution is becoming an important international energy policy agenda. Furthermore, even though global climate conventions are not binding, several countries are a party to the Paris Agreement that have pledged a joint intervention agreement to combat climate change (Neves et al. 2020). This agreement became effective in 2020 to fight climate change globally by limiting global average temperatures to 2 °C above pre-industrial levels (UN 2015). Effective collaboration and adherence to international conventions and treaties is fundamental to combating global warming and climate change.

The aim of this paper is to assess the effectiveness of environmental taxes and stringent environmental policy in reducing CO2 emissions in a panel of 7 emerging economies that include the Czech Republic, Greece, Hungary, Korea, Poland, South Africa, and Turkey for the period 1994–2015. Even though our study does not include the major emerging countries such as Brazil, China, and India, still, these seven countries constitute major important players in emerging economies and also in the world economy. Our strategy is to exploit not only the data on total environmental tax but also on energy tax, where among the list of the emerging countries, only for these 7 countries is a complete set of data on both total environmental tax, energy tax, and environmental policy stringent available for the period 1994–2015. By doing so, we hope to test the “green dividend” hypothesis that total environmental tax and energy tax can play an important role in improving environmental quality in these 7 emerging countries.

To the best knowledge of the current authors, there is no study that sets these two instruments in the same framework to assess their effectiveness in reducing CO2 emissions. However, there are several studies that separately assessed the effectiveness of either environmental tax or environmental policy stringent. For instance, Aydin and Esen 2018; Freire-González 2018; Freire-González and Ho 2018; Shahzad 2020; Timilsinas 2018) assessed the effectiveness of environmental taxes in reducing CO2 emissions while the effectiveness of environmental policy stringency was assessed by Ambec et al. (2013); Cohen and Tubb (2018); Dechezleprêtre and Sato (2017); van Leeuwen and Mohnen (2017); Wang and Shen (2016); and Wolde-Rufael and Mulat-Weldemichael (2020). Despite these extensive studies, none of them combined both environmental taxes and environmental policy stringency in the same framework to test the combined effectiveness of these policy instruments in mitigating CO2 emissions (see Shahzad 2020). None of these papers also tested the effectiveness of these two instruments using both consumption-based and territory-based CO2 emission. As these studies do not include both policy instruments in the same framework to assess their effectiveness in mitigating CO2 emissions, we believe that a shift in focus towards assessing the effectiveness of policy instruments such as environmental rules and regulations and environmental taxes in mitigating CO2 emissions can advance our understanding the nexus between environmental policies and CO2 emission (Ozcan et al. 2020; Khan et al. 2019; Wolde-Rufael and Mulat-Weldemeskel 2020). Moreover, we believe that the potential importance of environmental taxes and strict environmental rules and regulations in combating emissions necessitates not only further research but also the application of a relatively new econometric technique that addresses cross-sectional dependence, slope homogeneity, and homogeneous causality.

We address this important gap in the literature by throwing some insights into how environmental stringency policies and how environmental taxes affect the mitigation efforts of these 7 emerging economies. By highlighting the potential importance of these two policy instruments in the mitigating strategies of these emerging economies, the paper attempts to make some contributions to the debate on the relationship between environmental degradation, environmental policy stringency, and environmental taxes. First, to the best of our knowledge, this is the first attempt to assess the simultaneous effectiveness of environmental stringency and environmental taxes on the environmental quality of the 7 emerging economies. Second, as the effectiveness of environmental policy stringent and environmental tax on carbon emissions adjusted for international trade has not been investigated for these economies, we fill this gap by using the consumption-based carbon emission data developed by Peters et al. (2011). Unlike the territory-based CO2 emissions which do not include emissions embodied in international trade, the consumption-based carbon emissions are estimated based on the domestic use of fossil fuels plus the embodied emissions from imports less exports (Liddle 2018). As international trade plays an important role in these emerging economies, CO2 emissions adjusted for international trade may be relatively more important than territorial-based CO2 emissions. Third, for measuring the stringency of environmental policies, we use the newly developed and “internationally comparable measure of environmental stringency,” the environmental policy stringency index developed by OECD (2016). As our fourth contribution, since the true relationship between CO2 emissions and environmental policy stringency can be non-monotonic, we model our empirical study in a non-linear framework that includes the square of environmental policy, the stringency index, to test our hypothesize that the relationship between environmental policy stringency and CO2 emissions is an inverted U-shape. It takes time for the stringency regulations to be effective (Neves et al. 2020). Further, in order that our outcome does not depend on one measure of environmental tax, unlike many previous studies that attempted to test the effectiveness of environmental tax on CO2 emissions, we distinguish between total environmental tax and energy tax measured as (i) as % of GDP, (ii) as % of total tax revenue, and (iii) as real tax per capita. For our empirical test, we apply heterogeneous panel data considering cross-sectional dependence and slope heterogeneity tests using the augmented mean group (AMG) which is efficient and unbiased and produces consistent estimates.

We organize the rest of the paper as follows. In “A brief review of the literature,” we briefly review the related literature. In “Material and methods,” we present the data and the methodology we used. “Results and discussion” provides a discussion on our empirical findings while “Concluding remarks” presents a summary and concluding remarks.

A brief review of the literature2

Environmental taxes and environmental degradation

Since the seminal work of Pigou (1920) which highlighted that environmental degradation has negative externalities and that these externalities should not be left to the market alone to provide solutions, environmental taxes and stringent environmental rules and regulations have become two of the most important policy instruments for addressing environmental degradation (Haites 2018; Pigou 1920; Tol 2009, 2017, 2018). The ultimate objective of an environmental tax is not only to bring revenues for the state but also to fundamentally bring about behavioral changes on businesses to use environmentally friendly technologies and on consumers to consume less pollutant products so that the harm to the environment is reduced (Aydin and Esen 2018; Borozan 2019; European Environment Agency 2005; ILO 2014; Pigou 1920; Shahzad 2020; Wolde-Rufael and Mulat-Weldemeskel 2020). To many, a carbon tax can change the structure of production and consumption in favor of more environmentally friendly production and consumption of energy-related products (Mardones and Baeza 2018; Shahzad 2020; Tol 2018). These proponents further believe that environmental-related taxes can reduce emissions as well as promote green technological innovations, energy efficiency, and cleaner and healthier environment (Shahzad 2020). An early study by Ligthart and Van Der Ploeg (1999) showed that environment tax can achieve multiple objectives such as a greener environment as well as bolster economic growth, reduce unemployment, and cut labor taxes (see Shahzad 2020).

The dual role of environmental tax, as postulated by the “double dividend” hypothesis (Pearce 1991) is also to improve environmental quality, the “green dividend” as well as achieve a less distortional tax, the “blue dividend” (de Angelis et al. 2019; Ciaschini et al. 2012; Goulder 1995; Karydas and Zhang 2019). Furthermore, as Pearce (1991) argues: “While most taxes distort incentives, an environmental tax corrects a distortion, namely the externalities arising from the excessive use of environmental services.” (p. 940). The “double dividend” hypothesis also predicts that environmental taxes can raise revenues to be recycled for correcting other distortions in the economy (Pearce 1991).

However, environmental taxes can also increase the cost of production for firms and can undermine their international competitiveness (see Mulatu 2018). Moreover, firms can shift the increased cost of environmental tax to consumers that can hurt low-income people and exacerbate income inequality (Fremstad and Paul 2019; Lin and Li 2011; Oueslati et al. 2017; Shahzad 2020). If firms shift the increased cost of environmental tax to consumers, environmental tax may undermine the fight against environmental degradation and end up instead of only adding to the fiscal revenue of the state (Lin and Li 2011; ILO 2014; Vehmas 2005).

Empirical evidence on the effectiveness of environmental tax in mitigating environmental degradation is mixed with some studies supporting the effectiveness of environmental tax in reducing emissions while others find no evidence to support the claim that environmental taxes improve environmental quality (see Aydin and Esen 2018; Freire-González 2018; Shahzad 2020; He et al. 2019a; Timilsinas 2018). Among those who found that environmental taxes reduce CO2 emissions include (Haites 2018; Lin and Li 2011; Miller and Vela 2013; Morley 2012). In addition to the above, Nakata and Lamont (2001) for Japan also found that environmental taxes reduce carbon emissions and also lead to the use of energy with lower emissions. Filipović and Golušin (2015); Morley (2012) also found that energy taxes can decrease energy consumption as well as reduce GHG emissions. For China, Guo et al. (2014); Lu et al. (2010); Xu and Long (2014); Yang et al. (2014); Zhang et al. (2016) also found that environmental taxes can reduce carbon emissions. Applying quantile regression, Borozan (2019) found that energy tax increases energy consumption in lower energy-consuming EU countries but at higher quantiles, energy tax insignificantly reduces energy consumption. Similarly, for a group of 15 European countries, Aydin and Esen (2018) also found that environmental taxes reduce emissions and promote technological innovation. According to Sen and Vollebergh (2018) for a group of OECD countries, a one euro increase in energy taxes reduces carbon emissions from fossil fuel consumption by 0.73 percent. Similarly, for a group of OECD countries and China, He et al. (2019a) found that environmental taxes reduce pollutant emissions. According to Hashmi and Alam (2019), a 1% increase in environmental tax revenue per capita reduces CO2 emissions by 0.033% in OECD countries.

While the above studies found that environmental taxes were effective in reducing emissions and improving environmental quality, other studies have not found that environmental taxes are effective in reducing environmental degradation. For instance, for a group of 18 European countries, Hotunluoğlu and Tekel (2007) did not find that carbon taxes reduce emissions. Equally, Loganathan et al. (2014) for Malaysia and Radulescu et al. (2017) for Romania did not find that environmental taxes reduce CO2 emissions. Similarly, Gerlagh and Lise (2005) and Lin and Li (2011) did not find that environmental taxes were effective in reducing CO2 emissions. Liobikienè et al. (2019) also did not find that energy taxes influence GHG emissions in EU countries. Zhang (2016) also found that the impact of environmental regulations in China were low.

Environmental policy stringency and environmental degradation

Another policy instrument that is being implemented to combat environmental degradation is stringent environmental policy and regulations. The purpose of stringent policies is to make pollution and other environmental services more costly in order to change the behavior of both producers and consumers towards more environmental-friendly products (Neves et al. 2020; OECD 2016). This is done by imposing restrictions on polluting agents to increase the cost of polluting activities and make them less attractive (Neves et al. 2020). Since the seminal work of Porter and van der Linde (1995), the debate between environmental regulation and environmental outcomes has been at the forefront of the regulation-environmental-outcome nexus (see Mulatu 2018). To Porter and van der Linde (1995), a carefully designed environmental policy can help industries to adopt environmentally friendly technologies which can lead to a reduction in emissions (Dechezleprêtre and Sato 2017; Ramanathan et al. 2017). Ambec et al. (2013); Cohen and Tubb (2018); Dechezleprêtre and Sato (2017) also believe that stringent environmental policies can minimize the adverse effects of pollution by promoting environmentally friendly technologies and by discouraging environmentally “dirty” technologies. Thus, like environmental taxes, stringent environmental rules and regulations have the ability to potentially change the behavior of producers and consumers towards eco-friendly production and consumption of energy products (Lagreid and Povitkina 2018).

Nevertheless, it is also possible that the cost of environmental stringency policies can hinder firms from adopting environmentally friendly investments that prevent them from seeking innovations that can improve environmental quality (see Mulatu 2018; Wolde-Rufael and Mulat-Weldemeskel 2020). To circumvent these additional costs and also avoid these stringent environmental policies, as the Pollution Haven Hypothesis (Porter and van der Linde 1995) pustulates, firms in developed countries can export their production of environmentally “dirty” goods to countries with relatively weak environmental rules and regulations (Levinson and Taylor 2008; Mulatu 2018). The “race to the bottom hypothesis” also predicts that developing countries may lower their environmental standards in order to enhance their international competitiveness and attract foreign capital (Kim and Rhee 2019). However, as development progresses and developing countries themselves became more environmentally stringent, these countries can implement their own stringent environmental rules and regulations that can promote clean and environmentally friendly technologies (Dechezleprêtre and Sato 2017; Ramanathan et al. 2017). Thus, at an early stage of the development process, environmental regulations may not have an impact on improving environmental quality, but at a later stage, they can improve environmental quality (Ferris et al. 2019). Hence, as it takes time for environmental regulation to be effective, we hypothesize an inverted U-shaped relationship between environmental policy stringency and CO2 emissions in the 7 economies under consideration.

Regarding the empirical evidence on the relationship between environmental quality and environmental policy stringency, similar to the relationship between environmental taxes and environmental quality, the evidence is also not conclusive. Ambec et al. (2013); Cohen and Tubb (2018); Dechezleprêtre and Sato (2017); and van Leeuwen and Mohnen (2017) found that environmental regulations can lead to innovation in clean technologies and can discourage the development of “dirty” technologies thereby minimizing environmental degradation. For instance, in the case of China, Wang and Shen (2016) found that environmental regulations positively affect clean production industries. Similarly, Liu et al. (2018) found that environmental regulations were negatively related to energy consumption. Again, for China, Wang et al. (2019a) also found that environmental regulations have a positive impact on ecological efficiency. According to Yin et al. (2015), environmental regulations reduce CO2 emission in China. Shapiro and Walker (2018) also argue that most of the reductions in air pollution emissions that occurred in the USA between 1990 and 2008 were due to environmental policies. In a similar vein, for a group of OECD countries, de Angelis et al. (2019) also found that CO2 emissions were negatively and significantly related to environmental stringency. Similarly, according to Cole et al. (2005), environmental regulations have been successful in reducing pollution intensity in UK industries. Song et al. (2020a) also found that environmental regulation can directly alleviate environmental pollution in China. Similarly, Pei et al. (2019) also found that environmental regulations could potentially reduce carbon emissions. Danish, et al. (2020) also found that environmental regulations are helpful in reducing pollution in BRICS countries. Similar to Danish, et al. (2020), Wolde-Rufael and Mulat-Weldemeskel (2020) also found that environmental stringency reduces CO2 emissions.

In contrast to the above, Hao et al. (2018) and Zhang et al. (2016) found that environmental regulations were not effective in reducing pollution in China. Equally, Li (2019) also found that environmental regulations did not promote technical progress in the Chinese industrial sector. Wang and Wei (2020) also found that environmental policy stringency did not make an appreciable effect on CO2 reductions (see Wolde-Rufael and Mulat-Weldemeskel 2020).

The “green paradox”

While many believe that environmental regulations and environmental taxes can provide solutions to environmental externalities, there are others who are skeptical about the effectiveness of these policy instruments in mitigating environmental externalities. According to the proponents of the “green paradox” (Sinn 2015), there is a fear that such policies can produce unintended and undesirable consequences that can exacerbate environmental degradation (Jensen et al. 2015). To the advocates of the “green paradox,” these imperfect carbon emission mitigation policies, instead of reducing carbon emissions, they can lead to the opposite effect of increasing emissions (Jensen et al. 2015; Sinn 2015). Sinn (2015) argues that environmental regulations only address the demand side of the externalities: the consumption of fossil energy without addressing the supply side of fossil production. To Sinn (2015): “If suppliers do not react, demand reductions by a subset of countries are ineffective …, [and] if suppliers feel threatened by a gradual greening of economic policies …; they will extract their stocks more rapidly, thus accelerating global warming” (p. 360). The central tenet of Sinn’s (2015) argument is that there is a time lag between environmental policy announcement and its implementation. This lag enables fossil resource owners to anticipate that increases in environmental taxes can reduce demand for their fossil resource. Consequently, these environmental regulatory policies prompt these resource owners to extract more resources rapidly. Environmental regulations make fossil fuel producers fear that their assets will become worthless; consequently, they increase production of fossil fuel more quickly thereby accelerating and exacerbating global warming instead of reducing it (Jensen et al. 2015; Sinn 2015; van der Ploeg and Withagen 2015). Thus, the efforts of fossil fuel–consuming countries to reduce global warming can be undermined by fossil owners. However, the empirical evidence on the Green Paradox is not conclusive (see He et al. 2019b; van der Werf and Di Maria 2012; Zhang et al. 2017). It is for this and other similar reasons that pollution is not only one of the “greatest existential challenges” (Landrigan et al. 2018) but also one of the “hardest to tackle for governments all over the world” (Van der Werf and Di Maria 2012).

In contrast to the above, there are others who contend that environmental regulation initially increases CO2 emissions, the “green paradox” but at a later stage, environmental degradation helps to reduce CO2 emissions. Thus, a U-shaped trend is anticipated between CO2 emissions and environmental degradation where initially the “green paradox” dominates but later followed by the “emission reduction effect” (Min 2018). For a group of OECD and emerging countries, Wang and Wei (2020) found the possibility of a “Green Paradox” occurring in response to strict environmental regulation policies. Wang and Wei (2020) are of the opinion that strict level of environmental regulation in emerging economies will cause ‘green paradox’ effects and that can hinder economic development.

Against the backdrop of the above complex issues and inconclusive evidence, undertaking an empirical assessment that investigates whether the environmental performance of a country can be related to its environmental policy stringency and to its environmental taxes may add some light on the ongoing debate between environmental degradation, environmental taxes, and environmental policy stringency.

Material and methods

The paper uses a balanced annual panel data covering the period 1994–2015. The choice of countries and period is based on the availability of data for both environmental taxes and environmental policy stringent index (EPS) for the 7 emerging economies. As previously stated, among the list of the emerging countries, only for the Czech Republic, Greece, Hungary, Korea, Poland, South Africa, and Turkey is a complete set of data available for the period 1994–20153. Data on environmental taxes and environmental policy stringency index are from the OECD database (OECD Environmental Performance Reviews 2018b) and from Wang and Wei (2020)4. Data on real GDP per capita, fossil energy, and renewable energy come from the World Development Indicators (2018). Consumption and territory-based CO2 emissions per capita are from Peters et al. (2011).

Background statistics for all the variables are presented in Table 1. Environmental policy stringency index (EPS) ranges from 0 (not stringent) to 6 (highest degree of stringency). According to the OECD (2016) stringency is defined as the “… implicit or explicit cost of environmentally harmful behavior” (p. 5). The indicator focuses on upstream sectors, such as energy and transport and their effects on air and climate policies (Botta and Koźluk 2014; European Environmental Agency, EEA 2005; OECD 2016). According to the OECD, an environmental tax is defined as a tax whose base is “a physical unit, for example, a liter of petrol or a passenger flight that has a proven negative impact on the environment” (OECD 2018b).

Table 1:

Descriptive statistics

| Variables | Obs | Mean | Std. dev. | Min | Max | Source |

|---|---|---|---|---|---|---|

| Consumption-based CO2 per capita | 154 | 8.13 | 2.54 | 3.45 | 12.77 | Peters et al. (2011) |

| Environmental policy stringency | 154 | 1.59 | 0.89 | 0.40 | 3.52 | OECD |

| Total environmental tax per capita | 154 | 512.41 | 205.01 | 122.1 | 973.19 | OECD |

| Energy tax per capita | 154 | 391.89 | 150.32 | 98.78 | 728.91 | OECD |

| Total environmental tax as % of GDP | 154 | 2.54 | 0.53 | 1.08 | 4.04 | OECD |

| Energy tax as % of GDP | 154 | 1.98 | 0.47 | 0.72 | 3.23 | OECD |

| Total environmental tax as % of total tax revenue | 154 | 8.92 | 2.44 | 4.73 | 16.96 | OECD |

| energy tax as % of total tax revenue | 154 | 6.89 | 1.88 | 3.29 | 12.9 | OECD |

| Fossil energy consumption as % of total energy consumption | 154 | 86.44 | 6.04 | 68.19 | 96.32 | WDI |

| Renewable energy consumption as % of total energy consumption | 154 | 9.9 | 5.89 | 0.44 | 24.24 | WDI |

| Real GDP per capital in $USA | 154 | 14,055 | 6,356 | 5,564 | 30,055 | WDI |

As can be seen from Table 1, CO2 emissions exhibit a considerable cross-country variation from 5.46 metric tons per capita in Turkey to 12.77 metric tons per capita in Korea. In terms of real GDP per capita, South Africa has the lowest and Greece the highest.

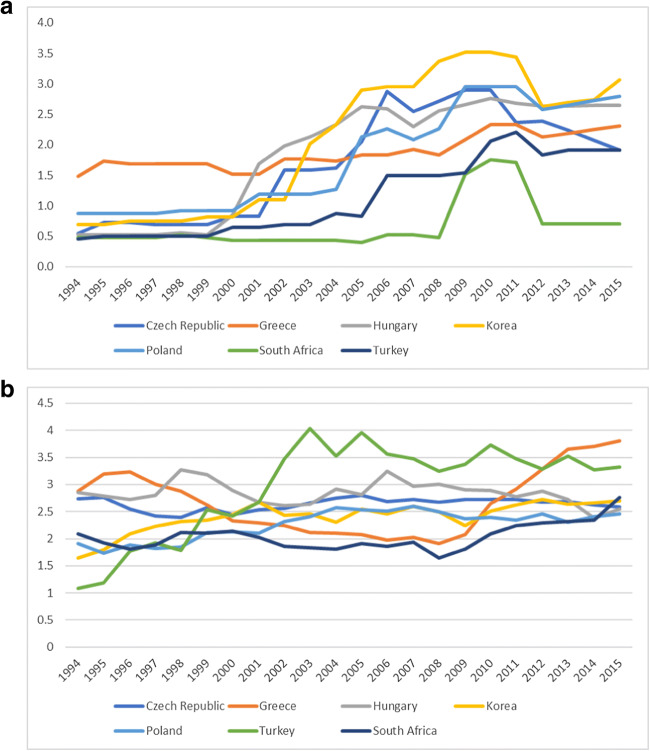

In terms of the environmental policy stringency index, as can be seen from Fig. 1a, South Korea has the highest while South Africa the lowest. Except for South Africa and Greece, for all the remaining five countries, the index has substantially increased over the period under consideration. Environmental taxes also show some variations. As can be seen from Fig 1b, total environmental taxes as % of GDP varies from 4.04% in Turkey to 2.60% in Poland.

Fig. 1.

a Environmental policy stringency index. b Total environmental tax as % of GDP

The model

In this paper even though our primary aim is not to test the validity of the EKC (Environmental Kuznets Curve), we augment our model by including environmental policy stringency index and environmental taxes as determinants of environmental quality to the standard EKC model as follows:

| 1 |

where co2 is consumption-based CO2 emissions per capita, yyit is real GDP per capita, (yyit)2 is squared real GDP per capita, ssit is environmental policy stringency index, (ssit)2 is the square of the environmental policy stringency index, taxit is environment tax (total and energy), ffit is fossil energy consumption as % of total energy consumption, rrit is renewable energy consumption as % of total energy consumption, and εit is the error term. Total environmental and energy taxes are each measured: (i) as % of GDP, (ii) as % of total tax revenue, and (iii) as real tax per capita (OECD 2018). Equation 1 is estimated for six models, three models using the three measures of total environmental tax and three models using the three measures of energy tax. To avoid heteroscedasticity and to interpret the coefficients as long-run elasticities, all variables in the lower case indicate that they are logarithmically transformed variables.

Results and discussion

For estimating the relationship between environmental quality, environmental taxes and environmental policy stringency we use the augmented mean group (AMG) estimator developed by Eberhardt and Bond (2009), Bond and Eberhardt (2013). This estimator does not require any pre-testing procedure of unit root or cointegration and allows the examination of the parameters of non-stationary variables (Destek and Sarkodie 2019). The AMG procedure also takes into account cross-sectional dependence and country-specific heterogeneity among countries (Danish et al. 2019; Destek and Sarkodie 2019). For testing the causal relationship among the variables, we use the heterogeneous panel Granger non-causality test proposed by Dumitrescu and Hurlin (2012).

Cross-sectional dependence unit root test

Testing for cross-dependence (CD) has become a prerequisite for testing for cointegration as ignoring cross-section dependency can lead to bias and size distortions (Pesaran 2006). Results of the CD tests are presented in Table 2. As can be seen from Table 2, according to the Pesaran (2004) CD test, the null hypothesis of no cross-sectional dependence for five out of the six is rejected, but for the other three tests, namely the Breusch-Pagan LM, the Pesaran scaled LM, and the Bias-corrected scaled LM tests, the null hypothesis is not rejected. Since the majority of the CD tests did not reject the null hypothesis of no cross-section independence, we conclude that the series are cross-sectionally related.

Table 2.

Cross-sectional dependence test

| Model | Breusch-Pagan LM | Pesaran scaled LM | Bias-corrected scaled LM | Pesaran CD | ||||

|---|---|---|---|---|---|---|---|---|

| Statistic | p value | Statistic | p value | Statistic | p value | Statistic | p value | |

| cc ss ss2 tpx ee yy yy2 | 70.412*** | 0.000 | 7.624*** | 0.000 | 7.458*** | 0.000 | 1.318 | 0.187 |

| cc ss ss2 trx ee yy yy2 | 58.077*** | 0.000 | 5.721*** | 0.000 | 5.554*** | 0.000 | 1.383 | 0.167 |

| cc ss ss2 tyx ee yy yy2 | 70.463*** | 0.000 | 7.632*** | 0.000 | 7.466*** | 0.000 | 1.296 | 0.195 |

| cc ss ss2 epx ee yy yy2 | 75.086*** | 0.000 | 8.346*** | 0.000 | 8.179*** | 0.000 | 1.283 | 0.200 |

| cc ss ss2 erx ee yy yy2 | 74.082*** | 0.000 | 8.191*** | 0.000 | 8.024*** | 0.000 | 1.716* | 0.086 |

| cc ss ss2 eyx ee yy yy2 | 75.133*** | 0.000 | 8.353*** | 0.000 | 8.186*** | 0.000 | 1.270 | 0.204 |

cc trade adjusted CO2 per capita, ss environmental policy stringency index, ss2 the square of environmental policy stringency, tpx total environmental tax per capita index, trx total environmental tax as % of total tax revenue, tyx total environmental tax as % of GDP, epx energy tax per capita, erx energy tax as % of total tax revenue, eyx energy tax as % of GDP, ff fossil energy consumption as % of total energy consumption, rr renewable energy consumption as % of total energy consumption, yy real GDP per capital $US, yy2 the square of real GDP per capital $US

***, *Denote significant levels at 1% and 10% respectively

Slope homogeneity test

Despite the possible dependence across countries, still countries can maintain their own independent policies and it is therefore crucial to test for cross-country heterogeneity. Results of applying the Pesaran and Yamagata (2008) slope homogeneity test are presented in Table 3 and they show that there is a country-specific heterogeneity among these economies.

Table 3:

Pesaran and Yamagata slope homogeneity

| Model | Test | |

|---|---|---|

| cc ss ss2 tpx ee yy yy2 | 3.268*** | 3.494*** |

| cc ss ss2 trx ee yy yy2 | 3.099*** | 3.312*** |

| cc ss ss2 tyx ee yy yy2 | 3.410*** | 3.645*** |

| cc ss ss2 epx ee yy yy2 | 3.369*** | 3.601*** |

| cc ss ss2 erx ee yy yy2 | 3.716*** | 3.972*** |

| cc ss ss2 eyx ee yy yy2 | 3.663*** | 3.916*** |

***Denotes rejection of the null hypothesis of slope homogeneity for the analyzed variables at 1% statistical significance. For the definition of the variables, see Table 2

Panel long-run estimates

In this section, we first report the AMG long-run estimation results for the linear models without including the squared of the environmental policy stringent variable (ss2). Table 4 shows that there is a positive and a statistically significant relationship between CO2 emissions (cc) and environmental policy stringency (ss) implying that higher CO2 emissions are associated with relatively low level of environmental policy stringency. South Africa and Turkey should make their environmental policy more stringent as these two countries have a relatively low EPS index while they are among the top pollutant countries. In these linear models, the relationship between total environmental tax and CO2 emissions is negative but not statistically significant. In contrast, the relationship between energy tax and CO2 emissions is negative and statistically significant.

Table 4.

AMG results linear estimation, dependent variable cc (CO2 per capita)

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| Coefficients | ||||||

| ss | 0.049*** | 0.079*** | 0.054*** | 0.062*** | 0.072*** | 0.064*** |

| tpx | − 0.024 | |||||

| trx | − 0.087* | |||||

| tyx | − 0.032 | |||||

| epx | − 0.108*** | |||||

| erx | − 0.145*** | |||||

| eyx | − 0.111*** | |||||

| ff | 0.650** | 0.657** | 0.650** | 0.759** | 0.737* | 0.755** |

| rr | − 0.184** | − 0.180** | − 0.184** | − 0.187*** | − 0.193** | − 0.185*** |

| yy | 0.625 | 1.988 | 0.444 | − 2.066 | 0.003 | − 2.090 |

| yy2 | 0.036 | − 0.056 | 0.043 | 0.186 | 0.059 | 0.181 |

***, **, * Denote significant levels at 1%, 5%, and 10% respectively. For the definition of the variables, see Table 2

Since the true relationship between environmental policy stringency and CO2 emissions could be non-monotonic, models that do not allow for non-monotonicity will lead to a downward bias in the estimated relationship (Kim et al. 2020). Thus, to assess whether CO2 emissions and environmental policy stringency are a non-monotonically related, we estimate the models by including the square of the environmental policy stringency (ss2). Results of these tests are presented in Table 5. As can be seen from the Table, the ss variable is significantly positive, while its square (ss2) is significantly negative for all models suggesting an inverted U-shaped or concave relationship between CO2 emissions and environmental policy stringency. This implies that initially strict stringent environmental policy may lead to environmental degradation but after a threshold point is reached, environmental stringency policy may lead to reduction in CO2 emissions suggesting that the more stringent the environmental regulation is, the lesser the increases in CO2 emissions. Our evidence is in line with Ouyang et al. (2019) who found an inverted U-shaped relationship between environmental policy stringency index and PM2.5 emissions for 30 OECD countries. Our evidence is also in line with the findings of Guo et al. (2018) and Wang et al. (2019b) for China even though they did not use the same environmental policy stringency we used in this paper. Wenbo and Yan (2018) also found a significant inverted U-shaped curve relationship between environmental regulation and CO2 emissions in China. Similarly, Zhou et al. (2019) also found an inverted U-shaped relationship between PM2.5 and environmental regulations for 277 Chinese cities. Chen et al. (2020) have also found an inverted U-shaped relationship between environmental regulations and CO2 emissions in the Chinese iron and steel industry. Our evidence is also in line with Wolde-Rufael and Mulat-Weldemeskel (2020) who found an inverted U-shaped relationship between environmental policy stringency index and CO2 emissions for BRIICTS countries (Brazil, Russia, India, Indonesia, China, Turkey, and South Africa). Song et al. (2020b) and Zhang et al. (2020) have also found a U-shaped relationship between environmental regulation and green product innovation for China. Our evidence together with the above indicates that regulations take time to be effective (Neve, et al, 2020). In this respect, our evidence gives credence to the Environmental Kuznets Curve (EKC) hypothesis between environmental policy stringency and CO2 emissions.

Table 5.

Long-run AMG non-linear estimates, dependent variable cc (CO2 per capita)

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| ss | 0.132** | 0.140* | 0.135* | 0.099** | 0.065* | 0.086** |

| ss2 | − 0.118** | − 0.103** | − 0.116** | − 0.071** | − 0.035 | − 0.057*** |

| tpx | − 0.051 | |||||

| trx | − 0.087** | |||||

| tyx | − 0.060** | |||||

| epx | − 0.112*** | |||||

| erx | − 0.140*** | |||||

| eyx | − 0.118*** | |||||

| ff | 0.909*** | 0.990*** | 0.914*** | 0.976*** | 1.065*** | 0.980*** |

| rr | − 0.114 | − 0.096 | − 0.114 | − 0.128* | − 0.116* | − 0.125* |

| yy | 3.000 | 4.273 | 2.746 | 0.015 | 0.753 | − 0.292 |

| yy2 | − 0.086 | − 0.176 | − 0.077 | 0.074 | 0.014 | 0.082 |

***, **, * Denote significant levels at 1%, 5%, and 10% respectively. For the definition of the variables, see Table 2

Turning to the relationship between CO2 emissions and environmental tax, Table 5 shows that the relationship is negative but not statistically significant when total environmental tax is measured in per capita terms (tpx, column 1) but when total environmental tax is measured as % of total tax revenue (trx, column 2) and also when measured as % of GDP (tyx, column 3), CO2 emission is negatively and significantly related to total environmental tax. A 1% increase in total environmental tax decreases CO2 emission between 0.060 and 0.087%. Similarly, the relationship between CO2 emissions and the three measures of energy tax (epx, erx, eyx) is negative and statistically significant where a 1% increase in energy tax decreases CO2 emissions between 0.112 and 0.140%. Our evidence is in line with Lu et al. (2010); Guo et al. (2014); Xu and Long (2014); Yang et al. (2014); Zhang et al. (2016) who found that environmental taxes can reduce carbon emissions. Our evidence is also in line with Hashmiand and Alam (2019) who found that a 1% increase in environmental tax revenue per capita reduces CO2 emissions by 0.033% in OECD countries. Similarly, our evidence is also in line with Ulucak et al. (2020) who found that environmental tax reduces CO2 emissions. Equally, our evidence is also in line with He et al. (2020) who found that a significant reduction in greenhouse gas emissions through the imposition of energy taxes. Further, similar to our finding, Neves et al. (2020) also found that environmental tax contributes to decreasing CO2 emissions in the long-run.

Coming to the relationship between CO2 emissions and renewable energy consumption, we found a negative but not statistically significant relationship between CO2 emissions (cc) and renewable energy consumption (rr) in models that include total environmental tax (columns 1 to 3). In contrast, in models that include energy tax (columns 4–6), we found negative and statistically significant relationship between CO2 emissions (cc) and renewable energy consumption (rr). Our evidence is similar to the findings of Saidi and Omri (2020) for the Czech Republic and Koc and Bulus (2020) for Korea but contrary to Saidi and Omri for Korea who found that renewable energy increases CO2 emissions. Pata (2018) did not find that renewable energy contributes to CO2 emission reductions in Turkey. Danish et al. (2019) for South Africa did not find that renewable energy had any impact on CO2 emissions.

The relationship between CO2 emissions (cc) and fossil energy consumption (ff) was positive and statistically significant. Our evidence is in line with most studies (see Adewuyia and Awodumi 2017; Jebli and Kahia 2020). For instance, Bulut (2017) for the case of Turkey found that CO2 emissions were positively and significantly related to CO2 emissions. For the case of South Africa, Banday and Aneja (2019) found a unidirectional causality running from non-renewable energy to CO2 emission.

Concerning the EKC hypothesis, Table 5 shows the coefficients of the income (yy) and the square of income (yy2) variables show the correct sign but are not statistically significant. The relationship between CO2 emissions and economic growth is also divergent in these 7 countries. For instance, Lază et al. (2019) found that the effects of the three polynomial terms in GDP were not statistically significant for the Czech Republic, Hungary, and Poland. However, using a quadratic function shows that the effect of the two GDP terms is statistically significant in the Czech Republic and Hungary showing an inverted-U-shaped relationship that confirms the environmental Kuznets curve. In the case of Korea, Koc and Bulus (2020) did not find support for the EKC hypothesis. For Greece, a recent study by Kotroni et al. (2020) found that the relationship between per capita GDP and CO2 emissions did not support the EKC hypothesis while an earlier study by Acaravci and Ozturk (2010) confirmed an EKC pattern in Greece in the 1960–2005 period. For South Africa, Danish, et al. (2020) found support for the EKC.

The significant positive relationship between CO2 emissions and fossil energy consumption may highlight the dilemma between promoting economic growth and safeguarding their environmental quality these countries are facing (Wolde-Rufael and Mulat-Weldemeskel 2020). Unlike in the past, these countries should be more cautious not to endanger their environmental quality at the expense of fast economic growth. There is a need to balance fast economic growth with protecting the environment. The empirical evidence presented in this paper indicates that there is a need for these countries to make their environmental rules and regulation more stringent and also to make their environmental taxes more effective. A long-term goal of environmental sustainability in these countries should strive to promote more renewable energy by promoting green technology, alter their energy mix towards fossil fuel–free economy, and increase energy efficiency (Wolde-Rufael and Mulat-Weldemeskel 2020). There is evidence to indicate that energy efficiency is crucial for the reduction of CO2 emission (Akram et al. 2020).

Robustness checks

For robustness checks, we applied the FMOLS estimator5. As this estimator requires that the data are stationary and cointegrated, we carried out several first-generation unit root tests and cointegration tests using the Pedroni (1999, 2004) and Kao (1999) panel cointegration tests. Results of the unit root and panel cointegration tests indicate that the series were difference stationary and cointegrated6. The long-run FMOLS estimates are presented in Table 6. Concerning the relationship between CO2 emissions and environmental policy stringency, similar to the AMG estimates, we found an inverted U-shaped relationship.

Table 6.

FMOLS long-run estimates, dependent variable cc (CO2 per capita)

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | Coefficient | Variable | Coefficient | Variable | Coefficient | Variable | Coefficient | Variable | Coefficient | Variable | Coefficient |

| ss | 0.024** | ss | 0.025** | ss | 0.023** | ss | 0.017* | ss | 0.017* | ss | 0.017* |

| ss2 | − 0.034* | ss2 | − 0.040* | ss2 | − 0.035* | ss2 | − 0.045* | ss2 | − 0.051** | ss2 | − 0.045* |

| tpx | − 0.016 | trx | 0.001 | tyx | − 0.020 | epx | − 0.042** | erx | − 0.038** | eyx | − 0.044** |

| ff | 0.587*** | ff | 0.530*** | ff | 0.585*** | ff | 0.488*** | ff | 0.427** | ff | 0.486** |

| rr | − 0.186*** | rr | − 0.198*** | rr | − 0.185*** | rr | − 0.184*** | rr | − 0.192*** | rr | -0.183** |

| yy | 5.245** | yy | 4.734*** | yy | 5.290** | yy | 4.675** | yy | 4.629*** | yy | 4.740** |

| yy2 | − 0.245** | yy2 | − 0.222** | yy2 | − 0.248** | yy2 | − 0.214** | yy2 | − 0.215** | yy2 | -0.219** |

***, **, * Denote significant levels at 1%, 5%, and 10% respectively. For the definition of the variables, see Table 2

As can be seen from Table 6, the relationship between CO2 emissions and total environmental taxes is negative but not statistically significant. In contrast, similar to the AMG estimates, we find a negative and a statistically significant relationship between energy taxes and CO2 emissions. In line with the AMG estimates, the FMOLS estimates also show that there is a positive and statistically significant relationship between CO2 emissions and fossil energy consumption; and a negative and statistically significant relationship between CO2 emissions and renewable energy consumption. Coming to the evidence concerning the EKC hypothesis, Table 6 shows the coefficients of the income (yy) and the square of income (yy2) variables show the correct sign and they are statistically significant and thus there is support for EKC by the FMOLS estimator but not by the AMG estimator.

In summary, both for the AMG and the FMOLS estimates we found that the coefficient of the energy tax is greater than the coefficient of the total environmental tax. Energy taxes are relatively more effective than total environmental tax in reducing CO2 emissions7. Our overall findings highlighting the crucial role environmental taxes and environmental policy stringency can play in achieving environmental targets. While this may be encouraging, it is hard to tell whether the current level of environmental tax is sufficient to achieve climate change objectives as environmental tax rates may be low relative to the social cost of carbon emissions (Haites 2018). In these countries, the environmental tax rate has not changed very much over the last few years. Further, these countries have not reached the turning point of the environmental policy stringent Kuznets curve. As Fig 1b shows, the environmental policy stringent index has declined in recent years. There is no doubt that effective measures to combat global warming cannot be solved by these two policy instruments nor by individual countries themselves alone. Adhering to and strengthening international agreements and conventions and strengthening them through international collaboration in green technology is an important path towards addressing the challenges of global warming.

Causality tests

The above analyses do not indicate the direction of causality among the variables. In this section, we carry a test of causality by applying the Dumitrescu and Hurlin (2012) panel Granger causality test. Since our main concern is the relationship between CO2 emissions, environmental stringency policy, and environmental taxes, we concentrate on these causal relationships. Results of the causality tests are presented in Table 7. As can be seen from the table, there is a unidirectional causality running from environmental policy stringency to CO2 emissions. There is also a bi-directional causality between total environmental tax (measured as % of GDP) and CO2 emissions but a unidirectional causality from total environmental tax measured as % of total tax revenue and per capita total environmental tax. Thus, total environmental tax causes CO2 emissions. In contrast, we found no causality between energy tax and CO2 emissions. Similarly, there was a unidirectional causality from total environmental tax to environmental policy stringency. There was also a unidirectional causality from per capita energy tax to environmental policy stringency. We also found a unidirectional causality from environmental policy stringency to renewable energy and from energy tax to renewable energy. However, we did not find any causality running in any direction between CO2 emissions and income, between renewable energy and CO2 emissions, and between fossil energy and CO2 emissions.

Table 7.

Dumitrescu and Hurlin (2012) panel Granger causality test

| Null hypothesis | W-bar | Z-bar | p value | Decision | Null hypothesis | W-bar | Z-bar | p value | decision |

|---|---|---|---|---|---|---|---|---|---|

| ddss↛ dcc | 2.538 | 2.877 | 0.080 | uni | dtpx↛ dyy | 1.514 | 0.961 | 0.380 | no |

| dcc↛ dss | 0.751 | − 0.465 | 0.700 | no | dyy↛ dtpx | 9.386 | 3.670 | 0.160 | no |

| dff↛ dcc | 0.505 | − 0.926 | 0.300 | no | dtrx↛ dyy | 1.552 | 1.032 | 0.320 | no |

| dcc↛ dff | 4.030 | 2.685 | 0.120 | no | dyy↛ dtrx | 2.314 | 2.457 | 0.060 | uni |

| drr↛ dcc | 1.191 | 0.357 | 0.800 | no | dtyx↛ dyy | 1.466 | 0.872 | 0.380 | no |

| dcc↛ drr | 2.162 | 2.174 | 0.060 | uni | dyy↛ dtyx | 6.798 | 2.617 | 0.180 | no |

| dyy↛ dcc | 2.831 | 1.099 | 0.380 | no | depx ↛ dyy | 2.314 | 2.459 | 0.020 | uni |

| dcc↛ dyy | 1.811 | 1.518 | 0.200 | no | dyy↛ depx | 8.898 | 3.261 | 0.320 | no |

| dtpx↛ dcc | 1.765 | 1.432 | 0.100 | uni | derx↛ dyy | 1.899 | 1.682 | 0.060 | uni |

| dcc↛ dtpx | 14.104 | 7.617 | 0.140 | no | dyy↛ derx | 1.454 | 0.849 | 0.380 | no |

| dtrx↛ dcc | 2.112 | 2.080 | 0.040 | uni | deyx↛ dyy | 2.232 | 2.304 | 0.060 | uni |

| dcc↛ dtrx | 9.589 | 3.840 | 0.180 | no | dyy↛ deyx | 1.413 | 0.772 | 0.560 | no |

| dtyx↛ dcc | 2.131 | 2.117 | 0.080 | bi | dtpx↛ drr | 12.239 | 6.057 | 0.120 | no |

| dcc↛ dtyx | 14.234 | 7.726 | 0.080 | drr↛ dtpx | 1.095 | 0.178 | 0.860 | no | |

| depx ↛ dcc | 1.571 | 1.067 | 0.240 | no | dtrx↛ drr | 10.633 | 4.713 | 0.120 | no |

| dcc↛ depx | 8.858 | 3.228 | 0.400 | no | drr↛ dtrx | 0.645 | − 0.665 | 0.480 | no |

| derx↛ dcc | 1.678 | 1.269 | 0.120 | no | dtyx↛ drr | 13.923 | 7.465 | 0.080 | uni |

| dcc↛ derx | 5.855 | 3.083 | 0.040 | uni | drr↛ dtyx | 0.493 | − 0.949 | 0.460 | no |

| deyx↛ dcc | 1.818 | 1.531 | 0.120 | no | depx ↛ drr | 10.046 | 4.221 | 0.200 | no |

| dcc↛ deyx | 5.287 | 2.470 | 0.120 | no | drr↛ depx | 0.631 | − 0.691 | 0.580 | no |

| dtpx↛ dss | 2.797 | 3.361 | 0.000 | uni | derx↛ drr | 10.748 | 4.809 | 0.180 | no |

| dss↛ dtpx | 0.826 | − 0.326 | 0.780 | no | drr↛ derx | 0.482 | − 0.970 | 0.360 | no |

| dtrx↛ dss | 3.106 | 3.939 | 0.000 | uni | deyx↛ drr | 7.354 | 1.969 | 0.500 | no |

| dss↛ dtrx | 0.532 | − 0.875 | 0.480 | no | drr↛ deyx | 0.291 | − 1.326 | 0.280 | no |

| dtyx↛ dss | 2.889 | 3.534 | 0.000 | uni | dtpx ↛ dff | 8.171 | 2.653 | 0.320 | no |

| dss↛ dtyx | 0.771 | − 0.428 | 0.720 | no | dff ↛ dtpx | 12.670 | 6.417 | 0.120 | no |

| depx ↛ dss | 21.892 | 14.133 | 0.020 | uni | dtrx ↛ dff | 21.292 | 13.631 | 0.000 | bi |

| dss↛ depx | 9.527 | 3.788 | 0.320 | no | dff↛ dtrx | 17.776 | 10.689 | 0.020 | |

| derx↛ dss | 10.066 | 4.238 | 0.180 | on | dtyx ↛ dff | 12.280 | 6.091 | 0.080 | bi |

| dss↛ derx | 0.302 | − 1.307 | 0.240 | no | dff ↛ dtrx | 21.139 | 13.503 | 0.000 | |

| deyx↛ dss | 11.744 | 5.642 | 0.200 | no | depx ↛ dff | 8.658 | 3.061 | 0.300 | no |

| dss↛ deyx | 0.583 | − 0.780 | 0.560 | no | dff ↛ depx | 25.044 | 16.770 | 0.020 | uni |

| dff ↛ dss | 9.365 | 3.652 | 0.260 | no | derx ↛ dff | 1.450 | 0.842 | 0.400 | no |

| dss ↛ dff | 6.253 | 1.049 | 0.640 | no | dff ↛ derx | 0.683 | − 0.593 | 0.680 | no |

| drr ↛ dss | 2.681 | 0.901 | 0.500 | no | deyx ↛ dff | 10.867 | 4.908 | 0.140 | no |

| dss ↛ drr | 2.617 | 3.025 | 0.000 | uni | dff ↛ deyx | 17.905 | 10.797 | 0.000 | uni |

| dyy ↛ dss | 0.460 | − 1.010 | 0.420 | no | dff ↛ dyy | 1.357 | 0.667 | 0.460 | no |

| dss ↛ dyy | 0.887 | − 0.212 | 0.800 | no | dyy ↛ dff | 2.571 | 0.756 | 0.540 | no |

| dff↛ drr | 3.200 | 4.115 | 0.020 | uni | drr ↛ dyy | 10.352 | 4.478 | 0.380 | no |

| drr ↛ dff | 1.385 | 0.720 | 0.520 | no | dyy ↛ drr | 14.411 | 7.874 | 0.180 | no |

uni unidirectional, bi bidirectional, d first difference. For the definition of the variables, see Table 2

Concluding remarks

As there is a lack of study that examines the combined effectiveness of environmental policy stringency and environmental taxes on mitigating CO2, this paper attempted to address this gap for 7 emerging economics for the period 1994–2015. Our evidence indicates a unidirectional causality running from environmental policy stringency to CO2 emissions (adjusted for international trade). We also found an inverted U–shaped relationship between environmental policy stringency and CO2 emissions suggesting that initially strict environmental policy does not lead to reductions in CO2 emissions but after a certain threshold is reached, environmental policy stringency leads to improvement in environmental quality. We also found a negative relationship between CO2 emissions and total environmental taxes where causality runs from total environmental taxes to CO2 emissions. Even though we found no causality running between energy taxes and CO2 emissions, CO2 emissions were negatively and significantly related to energy tax. The evidence seems to suggest that environmental policy stringent and environmental taxes can be two effective policy instruments in combating negative environmental externalities. Stringent environmental policy and environmental taxes can lead to CO2 emissions reduction indicating that the environmental performance of a country may be related to its stringent environmental policies and to its environmental taxes highlighting their crucial role in environmental externalities. The policy implication is that making environmental rules and regulations more stringent and increasing environmental taxes can be two effective instruments for reducing CO2 emissions. However, these two instruments alone are not in themselves sufficient to reduce the harmful effects of energy consumption and CO2 emissions. Our finding has further highlighted the significance of the dilemma of promoting economic growth and safeguarding the environment. Reducing overall emissions while maintaining high levels of economic development should be the core guiding principle towards sustainable development for these emerging economies. These countries should create a balance between promoting economic growth and safeguarding their environmental quality. An effective policy of making their environmental rules and regulation more stringent and at the same time promoting renewable energy, altering the energy mix towards fossil fuel–free economy, and increasing energy efficiency should be their long-term goal of caring for the environment. Our finding of negative relations between CO2 emissions and environmental tax, on the one hand, and a positive relationship between CO2 emissions and fossil energy, on the other, suggests that the most effective way of mitigating CO2 emissions is to reduce fossil fuel consumption by promoting renewable energy. All these countries have lower than the world average of renewable energy consumption in total final energy consumption. Increased utilization of renewable energy over time not only reduces emission but also promotes sustainable energy supply for a zero-emission strategy. These countries should also develop incentives for their citizens to consume more eco-friendly goods and services. Attracting foreign direct investment that promotes innovative green technology and renewables should also help in their quest for sustainable energy development and better environmental quality. These countries have to develop their abilities to imitate the green technology from developed countries and cooperate among themselves for clean technologies. CO2 emission is a global problem and it needs also a global solution. Thus, these countries should actively engage themselves in global cooperation to be able to mitigate pollution. Increasing energy efficiency and developing renewable energy should be a pathway for clean growth in the future.

Acknowledgments

We are very grateful to the constructive comments and recommendations of the two anonymous reviewers of the Journal which greatly contributed to improving the quality of the paper.

Author contribution

Eyob Mulat-Weldemeskel and Yemane Wolde-Rufael equally contributed to the paper.

Data availability

The data used in the paper are available on request from the corresponding author.

Compliance with ethical standards

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

The manuscript is not submitted to any other journal.

Consent to participate

The paper did not involve any human participants.

Consent to publish

The submitted work is original.

Footnotes

ETS works by putting a limit on overall emissions from covered installations where this limit is reduced each year for the participating companies. An ETS establishes a cap either on total emissions or on emissions intensity, as measured by emissions per unit of gross domestic product (GDP, Haites 2018).

For an excellent summary of the impact of environmental tax on energy consumption and environmental quality, see Shahzad (2020).

For Brazil, China, India, Indonesia and Russia there are data on EPS for 1990-2015 but not environmental taxes for the whole period.

Wang and Wei (2020) extrapolated some of the missing data (2013-2015) for Czech Republic, Greece, Hungary and Poland.

According to the popular Pesaran (2004) CD test, the null hypothesis of no cross-sectional dependence, except for one of the six models, for all the variables in the remaining five models, and for all the models the null hypothesis of no-cross dependence is rejected. Thus, we can use the first generation of unit root and cointegration tests.

Results available for the authors.

All these tests were carried out using the consumption-based CO2 emissions. When we used the territory-based CO2 emissions form Peters et al. (2011) and the World Bank, World Development Data CO2 emissions per capita, we found no evidence of a U-shaped relationship between the territory-based emissions CO2 and environmental policy stringency. Results available from the authors.

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Contributor Information

Yemane Wolde-Rufael, Email: ywolde@gmail.com.

Eyob Mulat-Weldemeskel, Email: e.mulat-weldemeskel@londonmet.ac.uk.

References

- Acaravci A, Ozturk I. On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy. 2010;35:5412–5420. [Google Scholar]

- Adewuyia AO, Awodumi OB. Renewable and non-renewable energy-growth-emissions linkages: Review of emerging trends with policy implications. Renew Sust Energ Rev. 2017;69:275–291. doi: 10.1016/j.rser.2016.11.178. [DOI] [Google Scholar]

- Ahmed AU, et al. Pollutant Emissions, Renewable Energy Consumption and Economic Growth: An Empirical Review from 2015-2019. J Environ Treat Tech. 2020;8(1):323–335. [Google Scholar]

- Akram R, Majeed MT, Fareed Z, Khalid F, Ye H. Asymmetric effects of energy efficiency and renewable energy on carbon emissions of BRICS economies: evidence from nonlinear panel autoregressive distributed lag model. Environ Sci Pollut Res. 2020;27:18254–18268. doi: 10.1007/s11356-020-08353-8. [DOI] [PubMed] [Google Scholar]

- Ambec S, Cohen A, Elgie S, Lanoie P. The Porter Hypothesis at 20: Can environmental regulation enhances innovation and competitiveness? Rev Environ Econ Policy. 2013;7:2–22. doi: 10.1093/reep/res016. [DOI] [Google Scholar]

- Aydin C, Esen Ö. Reducing CO2 emissions in the EU member states: Do environmental taxes work? J Environ Plan Manag. 2018;61:2396–2420. doi: 10.1080/09640568.2017.1395731. [DOI] [Google Scholar]

- Banday UJ, Aneja R. Renewable and non-renewable energy consumption, economic growth and carbon emission in BRICS Evidence from bootstrap panel causality. Int J Energy Sector Manag. 2019;14:248–260. doi: 10.1108/IJESM-02-2019-0007. [DOI] [Google Scholar]

- Bond S, Eberhardt M (2013) Accounting for Unobserved Heterogeneity in Panel Time Series Models. Nuffield College, University of Oxford, Mimeo.

- Borozan D. Unveiling the heterogeneous effect of energy taxes and income on residential energy consumption. Energy Policy. 2019;129:13–22. doi: 10.1016/j.enpol.2019.01.069. [DOI] [Google Scholar]

- Botta E, Koźluk T (2014). Measuring environmental policy stringency in OECD countries: A composite index approach, OECD Economics Department Working Papers, No. 1177, OECD Publishing, Paris. https://www.oecd-ilibrary.org/economics/measuring-environmental-policy-stringency-in-oecd-countries_5jxrjnc45gvg-en. Accessed March 2017.

- Bulut U. The impacts of non-renewable and renewable energy on CO2 emissions in Turkey. Environ Sci Pollut Res. 2017;24:15416–15426. doi: 10.1007/s11356-017-9175-2. [DOI] [PubMed] [Google Scholar]

- Chen Y, Fan X, Zhou Q. An Inverted-U Impact of Environmental Regulations on Carbon Emissions in China’s Iron and Steel Industry: Mechanisms of Synergy and Innovation Effects. Sustainability. 2020;2020(12):1038. doi: 10.3390/su12031038. [DOI] [Google Scholar]

- Climate Change UN (2015) The Paris agreement. https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement. Accessed (20 May 2020)

- Ciaschini M, Pretaroli R, Severini F, Socci C. Regional double dividend from environmental tax reform: an application for the Italian economy. Res Econ. 2012;66:273–283. doi: 10.1016/j.rie.2012.04.002. [DOI] [Google Scholar]

- Cohen MA, Tubb A (2018) The impact of environmental regulation on firm and country competitiveness: a meta-analysis of the porter hypothesis. J Asso Environ Res Economists 5:371–399

- Cole MA, Elliot RJR, Shimamoto K. Industrial characteristics, environmental regulations and air pollution: an analysis of the UK manufacturing sector. J Environ Econ Manag. 2005;50:121–143. doi: 10.1016/j.jeem.2004.08.001. [DOI] [Google Scholar]

- Danish, Baloch MA, Mahmood N, Zhang JW. Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. The Scie Total Environ. 2019;678:632–638. doi: 10.1016/j.scitotenv.2019.05.028. [DOI] [PubMed] [Google Scholar]

- Danish, et al. Mitigation pathways toward sustainable development: Is there any trade-off between environmental regulation and carbon emissions reduction? Sustain Dev. 2020;28:813–822. doi: 10.1002/sd.2032. [DOI] [Google Scholar]

- de Angelis EM, Giacomo MD, Vannoni D. Climate change and economic growth: The role of environmental policy stringency. Sustainability. 2019;11(8):2273. doi: 10.3390/su11082273. [DOI] [Google Scholar]

- Dechezleprêtre A, Sato M. The impacts of environmental regulations on competitiveness. Rev Environ Econ Policy. 2017;11:183–206. doi: 10.1093/reep/rex013. [DOI] [Google Scholar]

- Destek MA, Sarkodie SA. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci Total Environ. 2019;650:2483–2489. doi: 10.1016/j.scitotenv.2018.10.017. [DOI] [PubMed] [Google Scholar]

- Dumitrescu E-I, Hurlin C (2012) Testing for granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

- Eberhardt M , Bond S (2009) Cross-section dependence in nonstationary panel models: a novel estimator. Munich Personal RePEc Archive Working Paper No. 17870, Germany. https://mpra.ub.unimuenchen.de/17692/

- European Environmental Agency (EEA) Market-based instruments for environmental policy in Europe, Technical report No 8/2005. Denmark: Copenhagen; 2005. [Google Scholar]

- Ferris A, Garbaccio R, Marten A, Wolverton A (2019) The Impacts of Environmental Regulation on the U.S. Economy. Oxford Research Encyclopedia of Environmental Science. Accessed March (2019)

- Filipović S, Golušin M. Environmental taxation policy in the EU-New methodology approach. J Clean Prod. 2015;88:308–317. doi: 10.1016/j.jclepro.2014.03.002. [DOI] [Google Scholar]

- Freire-González J. Environmental taxation and the double dividend hypothesis in CGE modelling literature: A critical review. J Policy Model. 2018;40:194–223. doi: 10.1016/j.jpolmod.2017.11.002. [DOI] [Google Scholar]

- Freire-González J, Ho MS. Environmental fiscal reform and the double dividend: Evidence from a Dynamic General Equilibrium Model. Sustainability. 2018;10(2):501. doi: 10.3390/su10020501. [DOI] [Google Scholar]

- Fremstad A, Paul M. The impact of a carbon tax on inequality. Ecol Econ. 2019;163:88–97. doi: 10.1016/j.ecolecon.2019.04.016. [DOI] [Google Scholar]

- Gerlagh R, Lise W. Carbon taxes: A drop in the ocean, or a drop that erodes the stone? The effect of carbon taxes on technological change. Ecol Econ. 2005;54:241–260. doi: 10.1016/j.ecolecon.2004.12.037. [DOI] [Google Scholar]

- Goulder LH. Environmental taxation and the double dividend: a reader’s guide. Inter Tax Publ Fina. 1995;2:157–183. doi: 10.1007/BF00877495. [DOI] [Google Scholar]

- Guo Z, Zhang X, Zheng Y, Rao R. Exploring the impacts of a carbon tax on the Chinese economy using a CGE model with a detailed disaggregation of energy sectors. Energy Econ. 2014;45:455–462. doi: 10.1016/j.eneco.2014.08.016. [DOI] [Google Scholar]

- Guo Y, Xia X, Zhang S, Zhang DD (2018) Environmental regulation, government R&D funding and green technology innovation: Evidence from China provincial data. Sustainability 10(4):940

- Haites E. Carbon taxes and greenhouse gas emissions trading systems: what have we learned? Clim Pol. 2018;18:955–966. doi: 10.1080/14693062.2018.1492897. [DOI] [Google Scholar]

- Hao YU, Deng H, Lu Z, Chen H. Is environmental regulation effective in China? Evidence from city-level panel data. J Clean Prod. 2018;188:966–976. doi: 10.1016/j.jclepro.2018.04.003. [DOI] [Google Scholar]

- Hashmi R, Alam K. Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: A panel investigation. J Clean Prod. 2019;231:1100–1110. doi: 10.1016/j.jclepro.2019.05.325. [DOI] [Google Scholar]

- He P, Chen L, Zou X, Li S, Shen H, Jian J. Energy Taxes, Carbon Dioxide Emissions, Energy Consumption and Economic Consequences: A Comparative Study of Nordic and G7 Countries. Sustainability. 2019;11:6100. doi: 10.3390/su11216100. [DOI] [Google Scholar]

- He P, Ning J, Yu Z, Xiong H, Shen H, Jin H. Can environmental tax policy really help to reduce pollutant emissions? An empirical study of a panel ARDL model based on OECD countries and China. Sustainability (Basel, Switzerland) 2019;11:4384. doi: 10.3390/su11164384. [DOI] [Google Scholar]

- Hotunluoğlu H, Tekel R. Analysis and effects of carbon tax: Does carbon tax reduce emissions? Sosyo Ekonomi Temmuz. 2007;2:107–125. [Google Scholar]

- IBRD, (2017). International Bank for Reconstruction and Development and International Development Association / The World Bank (2017) Report of the High-Level Commission on Carbon Prices. https://static1.squarespace.com/static/54ff9c5ce4b0a53decccfb4c/t/59b7f26b3c91f1bb0de2e41a/1505227373770/CarbonPricing_EnglishSummary.pdf. Accessed 12 June 2019

- International Energy Agency, IEA (2019). CO2 Emissions from Fuel Combustion: Overview An essential tool for analysts and policy makers Statistics report — July 2020. https://www.iea.org/reports/co2-emissions-from-fuel-combustion-overview. Accessed 10 Jan 2020

- International Energy Agency, IEA (2020) CO2 Emissions from Fuel Combustion 2019 Highlights https://webstore.iea.org/co2-emissions-from-fuel-combustion-2019-highlights. Accessed 20 June 2020

- IEA, International Energy Agency (2019) Global CO2 emissions in 2019. https://www.iea.org/articles/global-co2-emissions-in-2019. Accessed 10 Jan 2020

- ILO (2014) The double dividend and environmental tax reforms in Europe. EC-IILS joint discussion paper series No. 13. https://www.ilo.org/wcmsp5/groups/public/%2D%2D-dgreports/%2D%2D-inst/documents/publication/wcms_194183.pdf. Accessed 12 June 2018

- IPCC et al. (2018) Summary for Policymakers. In: Global warming of 1.5 °C. An IPCC Special Report on the impacts of global warming of 1.5 °C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. World Meteorological Organization, Geneva

- Jebli MB, Kahia M (2020) The interdependence between CO2 emissions, economic growth, renewable and non-renewable energies, and service development: evidence from 65 countries. Climate Change 162:193–212

- Jensen S, Mohlin K, Pittel K, Sterner T. An Introduction to the Green Paradox: The Unintended Consequences of Climate Policies. Rev Environ Econ Policy. 2015;9:246–265. doi: 10.1093/reep/rev010. [DOI] [Google Scholar]

- Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90(1):1–44

- Karydas C, Zhang L. Green tax reform, endogenous innovation and the growth dividend. J Environ Econ Manag. 2019;97:58–181. doi: 10.1016/j.jeem.2017.09.005. [DOI] [Google Scholar]

- Khan Z, Sisi Z, Siqun Y. Environmental regulations an option: Asymmetry effect of environmental regulations on carbon emissions using non-linear ARDL. Energ Sour Part A: Recov, Utiliz, Environ Effec. 2019;41:137–155. doi: 10.1080/15567036.2018.1504145. [DOI] [Google Scholar]

- Kim Y, Rhee DE. Do stringent environmental regulations attract foreign direct investment in developing countries? Evidence on the “race to the top” from cross-country panel data. Emerg Mark Financ Trade. 2019;55:2796–2808. doi: 10.1080/1540496X.2018.1531240. [DOI] [Google Scholar]

- Kim DH, Wu YC, Lin SC. Carbon dioxide emissions and the finance curse. Energy Econ. 2020;88:104788. doi: 10.1016/j.eneco.2020.104788. [DOI] [Google Scholar]

- Koc S, Bulus GC (2020) Testing validity of the EKC hypothesis in South Korea: role of renewable energy and trade openness. Environ Sci Pollut Res 27:29043–29054 [DOI] [PubMed]

- Kotroni E, Dimitra Kaika D, Zervas E. Environmental Kuznets Curve in Greece in the Period 1960-2014. Int J Energy Econ Policy. 2020;10(4):364–370. doi: 10.32479/ijeep.9671. [DOI] [Google Scholar]

- Lagreid OM, Povitkina M. Do political institutions moderate the GDP-CO2 relationship? Ecol Econ. 2018;145:441–450. doi: 10.1016/j.ecolecon.2017.11.014. [DOI] [Google Scholar]

- Landrigan PJ, Fuller R, Acosta NJR, Adeyi O, Arnold R, Basu N(N), Baldé AB, Bertollini R, Bose-O'Reilly S, Boufford JI, Breysse PN, Chiles T, Mahidol C, Coll-Seck AM, Cropper ML, Fobil J, Fuster V, Greenstone M, Haines A, Hanrahan D, Hunter D, Khare M, Krupnick A, Lanphear B, Lohani B, Martin K, Mathiasen KV, McTeer MA, Murray CJL, Ndahimananjara JD, Perera F, Potočnik J, Preker AS, Ramesh J, Rockström J, Salinas C, Samson LD, Sandilya K, Sly PD, Smith KR, Steiner A, Stewart RB, Suk WA, van Schayck OCP, Yadama GN, Yumkella K, Zhong M. Commission on pollution and health. (2017) Lancet. 2018;391:462–512. doi: 10.1016/S0140-6736(17)32345-0. [DOI] [PubMed] [Google Scholar]

- Lază D, Minea A, Purcel A-A (2019) Pollution and economic growth: Evidence from Central and Eastern European countries. Energy Econ 81:1121–1131

- Levinson A, Taylor MA. Unmasking the Pollution Haven Effect. Int Econ Rev. 2008;49:223–254. doi: 10.1111/j.1468-2354.2008.00478.x. [DOI] [Google Scholar]

- Li C. How does environmental regulation affect different approaches of technical progress? Evidence from China’s industrial sectors from 2005 to 2015. J Clean Prod. 2019;209:572–580. doi: 10.1016/j.jclepro.2018.10.235. [DOI] [Google Scholar]