Abstract

Using data on monthly community-level confirmed COVID-19 cases and housing price in China, we investigate the impact of COVID-19 on housing price. With the difference-in-difference method, we find that the housing price of the communities with confirmed COVID-19 cases would reduce by 2.47%. The impact persists three months and the extent of the impact basically becomes greater as time goes on. The results are robust after the parallel pre-trend test and the placebo test. Moreover, the impact of COVID-19 on housing price only exists in regions with a higher infection level of COVID-19 or worse medical treatment conditions.

Keywords: COVID-19, Housing price, Infection level, Medical treatment conditions

1. Introduction

COVID-19 has been a worldwide pandemic since March 2020, which will greatly affect asset price. Existing studies have focused on the impact of COVID-19 on the financial asset price such as the US Treasuries (He et al., 2020), sovereign Eurobonds (Sene et al., 2020), corporate bonds (Haddad et al., 2020; Kargar et al., 2020), and stocks (Baek et al., 2020; Gormsen and Koijen, 2020; Just and Echaust, 2020). However, there is a lack of research linking COVID-19 and housing price. Relative to financial assets, the liquidity of house properties is lower and housing price response the shock may be lagging behind, and there is still uncertainty surrounding the impact of COVID-19 on housing market (Francke and Korevaar, 2020). Therefore, we explore the impact of confirmed COVID-19 cases in the residential community on the housing price, using community-level data from China.

When facing risk events, people have risk perception that induces them to reduce risk-taking behavior (Cooper and Faseruk, 2011). It can be inferred that when the house property experiences risk events, people will have risk expectation, and the price will decrease. Current studies have documented the impact of terrorism (Abadie and Dermisi, 2008; Arbel et al., 2010; Mills, 2002), violence (Besley and Mueller, 2012), earthquakes (Deng et al., 2015), hurricanes (Hallstrom and Smith, 2005), and nuclear accidents (Zhu et al., 2016) on housing price; however, we have limited knowledge about the relationship between infectious diseases and housing price.

In general, assessing the impact of epidemics on housing price is challenging, as epidemics are infrequent, such that data availability is limited (Francke and Korevaar, 2020), and there are only several studies on the issue. Using 44 housing estates in Hong Kong, China, Wong (2008) found that the average price declines by 1.6% for estates with the outbreak of 2003 SARS. Francke and Korevaar (2020) examined the effect of the plague in 17th-century Amsterdam and cholera in 19th-century Paris on housing price, and found that the outbreaks resulted in declines in housing price by 13% and 10%, respectively. For the impact of COVID-19, Ling et al. (2020) found that a one standard deviation increase in daily local COVID-19 case depressed real estate investment trust returns by 0.23 percent the following day in US. D'Lima et al. (2020) documented that the housing price in states with shutdown orders in US states decrease with increase in the COVID-19 contagion rate, and a unit increase in the contagion rate decreases prices in affected states by about 5.1% after the effective shutdown dates. However, the above two studies did not use the data of confirmed COVID-19 cases at community level which cannot identify the direct effect of COVID-19 on housing price. Accordingly, we collect data on prices of residential communities with confirmed COVID-19 cases and matched residential communities without cases in China, and utilize the Difference-In-Difference (DID) method to identify the effect of COVID-19 on housing price.

As of September 30, 2020, there were more than 33.71 million confirmed COVID-19 cases worldwide, with over 1,009,000 deaths.1 The high infection rate (Li et al., 2020) and mortality (Tian et al., 2020) of COVID-19 can lead to people's perception of the high risk of infection and even death, especially when there are locally confirmed cases (Bu et al., 2020). As local governments in China timely announce the information of the communities where the confirmed COVID-19 cases are located, people will be afraid of the risk of infection when there are confirmed cases in a residential community. We can conjecture that the risk expectation can reduce the value of houses in the community and then decrease the housing price. Moreover, the risks of infectious diseases are mainly related to the local infection level and medical treatment conditions, and people will have higher risk perception when there is a higher local infection level or worse medical treatment conditions. We further conjecture that the impact of COVID-19 on housing price is more pronounced in regions with a higher infection level or worse medical treatment conditions.

Then, we collect data on the price of each residential community with confirmed COVID-19 cases in China as a treatment group and choose the nearest community without cases as the control group, and we examine the impact of COVID-19 on housing price using the DID method. Based on the different regional infection levels and medical treatment conditions, we also study the heterogeneous impacts of COVID-19 on housing price in different regions. This paper expands on the studies on the impact of risk events on housing price and complements the literature on the economic consequence of COVID-19 from the perspective of housing price.

2. Sample and Empirical Specification

2.1. Sample

Our sample contains two sets of data. One is the data on the residential communities with confirmed COVID-19 cases from the Wind database. For each community with confirmed cases, we select the nearest community without confirmed cases from the Baidu map (https://map.baidu.com) as the control group.

The other is the monthly average housing price for each community with confirmed COVID-19 cases and the matched nearest community without cases. The date of confirmed cases found in the sample communities began in January 2020, and we select three periods before and after the shock, and the sample period ranges from October 2019 to April 2020. The data on monthly housing price for each community are hand-collected from Fangtianxia, which is one of the largest real estate agencies in China.2 We also extract the data on characteristics of communities from Fangtianxia. After dropping samples with missing data on community-level characteristics, our sample includes 18,466 observations with 1,319 communities as a treatment group and 1,319 communities as a control group in 90 cities.

2.2. Model specification

We set up the DID method to evaluate the impact of COVID-19 on housing price. As the date of confirmed cases in communities are not consistent, we constructed a multi-period DID model following Beck et al. (2010).

| (1) |

In equation (1), the dependent variable Priceit is the natural logarithm of the monthly average housing price of community i at month t, and the key independent variable DIDit is a dummy variable that equals one in the months after community i has confirmed COVID-19 cases and equals zero otherwise. The coefficient, β, therefore indicates the impact of COVID-19 on housing price. The ui is community fixed effect, and λt is month fixed effect. Xit is a set of community-level and city-level variables. The former includes the age (Housing Age), floor area ratio (Floor Area Ratio), greening ratio (Greening Ratio), elevator status (Elevator), term of property right (Property Right), building type (Building Type), education rating (Education Rating) and property service quality (Property Service) of the community. The latter includes population density (Density), per capita GDP (PGDP), and the investment amount in the real estate industry (Investment) of the city in 2019. Appendix A provides a detailed definition of variables.

2.3. Summary statistics

According to Table 1 , the mean value of Price is 9.836, and the corresponding raw value is 25893.75, indicating that the average price of the sample houses is about 25894 Yuan. The mean value of Housing Age is 2.187, and the corresponding raw value is 11.12, indicating that the average age of the sample houses is about 11 years. The results of Floor Area Ratio and Greening Ratio indicate that the average floor area ratio and greening ratio of the sample houses are 2.742 and 36.2%, respectively. The mean value of Elevator is 0.575, indicating that 57.5% of the sample houses have elevators.

Table 1.

Summary Statistics

This table presents the summary statistics of the main variables. The detailed definition of variables can be found in Appendix A.

| Variable | Observations | Mean | Std. Dev | Min | 25th | Median | 75th | Max |

|---|---|---|---|---|---|---|---|---|

| Price (Ln) | 18466 | 9.836 | 0.759 | 7.968 | 9.265 | 9.641 | 10.336 | 12.027 |

| Housing Age (Ln) | 18466 | 2.187 | 0.724 | 0.000 | 1.792 | 2.303 | 2.708 | 4.190 |

| Floor Area Ratio | 18466 | 2.742 | 1.503 | 0.100 | 1.800 | 2.500 | 3.300 | 15.010 |

| Greening Ratio (%) | 18466 | 0.362 | 0.099 | 0.080 | 0.300 | 0.350 | 0.400 | 0.900 |

| Elevator | 18466 | 0.575 | 0.494 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 |

| Property Right | 18466 | 2.928 | 0.290 | 1.000 | 3.000 | 3.000 | 3.000 | 3.000 |

| Building Type | 18466 | 2.970 | 0.783 | 1.000 | 2.000 | 3.000 | 4.000 | 5.000 |

| Education Rating | 18466 | 1.947 | 0.857 | 1.000 | 1.000 | 2.000 | 2.000 | 4.000 |

| Property Service | 18466 | 2.907 | 0.740 | 1.000 | 3.000 | 3.000 | 3.000 | 4.000 |

| Density | 18466 | 1.120 | 0.872 | 0.000 | 0.614 | 0.833 | 1.281 | 3.823 |

| PGDP(Ln) | 18466 | 11.583 | 0.415 | 9.980 | 11.270 | 11.614 | 11.851 | 12.153 |

| Investment (Ln) | 18466 | 7.338 | 0.859 | 2.814 | 6.792 | 7.498 | 7.911 | 8.398 |

The results of Property Right mean that most of the sample houses have the property right term of 70 years, and the results of Education Rating and Property Service show that there are large discrepancies in the quality of the school district and property service. The results of the three city-level variables also show that the sample cities have different population density, per capita GDP and investments in the real estate industry.

3. COVID-19 and Housing Price

3.1. Baseline regressions

We regress equation (1) by employing ordinary least squares regression with robust standard errors. The results in Table 2 show that DID is negatively correlated with Price, which implies the confirmed COVID-19 cases in the community can significantly reduce the housing price. And the coefficient of the DID estimator in model (3), -0.025, can be interpreted that if there are confirmed COVID-19 cases in a community, the housing price in the community would reduce by 2.47% (=1-exp(-0.025)).

Table 2.

COVID-19 and Housing Price

This table presents the impact of confirmed COVID-19 cases on housing price. The dependent variable is the natural logarithm of monthly housing price of residential community (Price). DID is a dummy variable that equals one in the months after the community has confirmed COVID-19 cases and equals zero otherwise. In Model (1), we control the community effect and month effect. In Model (2), we add the community characteristics including Housing Age, Floor Area Ratio, Greening ratio, Elevator, Education rating, Property service, Property right and Building type. In Model (3), we add the city-level characteristics including Density, PGDP and Investment. The detailed definitions of variables are available in Appendix A. The robust standard errors are reported in the parentheses. ** p<0.05, *** p<0.01.

| Price | |||

|---|---|---|---|

| (1) | (2) | (3) | |

| DID | -0.036*** | -0.032** | -0.025** |

| (0.004) | (0.015) | (0.010) | |

| Housing Age | 0.257*** | 0.084*** | |

| (0.009) | (0.006) | ||

| Floor Area Ratio | 0.071*** | 0.038*** | |

| (0.004) | (0.002) | ||

| Greening Ratio | 0.352*** | 0.128*** | |

| (0.055) | (0.035) | ||

| Elevator | 0.243*** | -0.006 | |

| (0.011) | (0.007) | ||

| Property Right | 0.262*** | 0.031** | |

| (0.018) | (0.012) | ||

| Building Type | -0.045*** | 0.005 | |

| (0.007) | (0.004) | ||

| Education Rating | 0.055*** | 0.057*** | |

| (0.006) | (0.004) | ||

| Property Service | 0.169*** | 0.074*** | |

| (0.009) | (0.006) | ||

| Density | 0.362*** | ||

| (0.005) | |||

| PGDP | 0.406*** | ||

| (0.011) | |||

| Investment | 0.114*** | ||

| (0.005) | |||

| Community Effect | Control | Control | Control |

| Month Effect | Control | Control | Control |

| Constant | 9.830*** | 7.611*** | 3.160*** |

| (0.030) | (0.068) | (0.116) | |

| Observations | 18466 | 18466 | 18466 |

| R-squared | 0.007 | 0.151 | 0.585 |

All the community-level variables except Elevator and Building Type are positively and significantly correlated with Price, indicating that houses with older age, higher floor area ratio, higher greening ratio and longer property right have a higher price, but the status of elevator and building type do not significantly affect the housing price. And all three city-level variables are positively and significantly correlated with Price, which show that the houses in cities with higher population density, higher per capita GDP, and more real estate investments will have a higher price.

3.2. Parallel pre-trends and dynamic effects

The parallel pre-trend assumption is a key assumption for the validity of the DID approach. Following Beck et al. (2010), we employ equation (2) to conduct the parallel pre-trend assumption test and the dynamic effects:

| (2) |

Where the “DID’s” equal zero, except as follows: DID−j equals one for communities in the j th month before COVID-19 cases were confirmed, while DID+j equals one for communities in the j th month after COVID-19 cases were confirmed. The coefficients β-3, β-2, and β-1 measure the trends of housing price of the treatment and control communities before the COVID-19 cases were confirmed. The coefficients β0, β1, β2, and β3 capture the dynamic responses of the housing price of the treatment and control communities after the COVID-19 cases were confirmed.

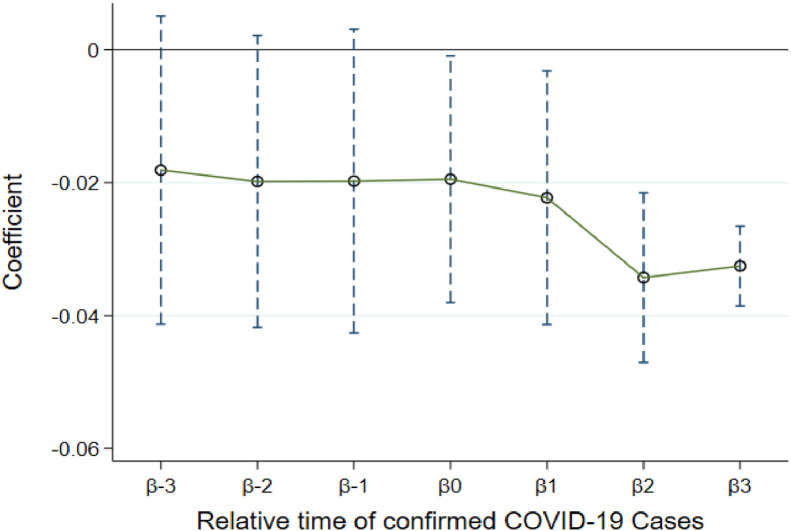

We regress equation (2) and plot the figure of the coefficient βs with a 90% confidence interval in Figure 1 . The results show that the coefficients β-3, β-2, and β-1 are statistically insignificant, which means that the housing price between the treatment group and the control group has no significant difference before the COVID-19 cases were confirmed, and the samples conform to the parallel pre-trend assumption. And all four coefficients β0, β1, β2, and β3 are negative and significant and basically show a decreasing trend, indicating that the housing price will decrease when there are confirmed cases in the community, and the negative impact persists three months while the extent of impact basically becomes greater as time goes on.

Figure 1.

The Dynamic Impact of COVID-19 on Housing Price

Notes: The figure plots the dynamic impact of confirmed COVID-19 cases on housing price. We consider a 6-month window, spanning from 3 months before COVID-19 cases were confirmed until 3 months after COVID-19 cases were confirmed. The dotted lines represent 90% confidence intervals and we report estimated coefficients from the equation (2).

3.3. Placebo test

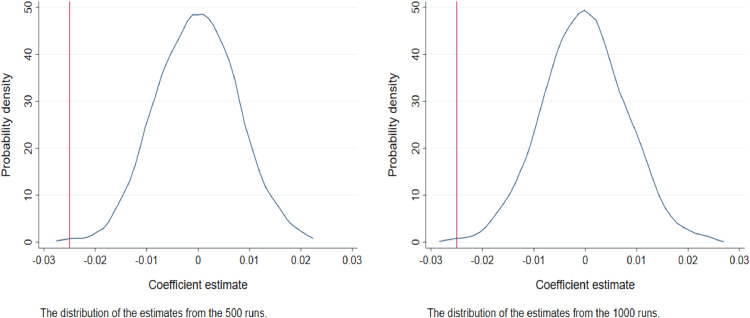

To further check to what extent the results in baseline regressions are influenced by omitted variables, we conduct a placebo test following Li et al. (2016) by randomly assigning communities with confirmed cases in which the quantity of communities is consistent with communities with real confirmed cases, and then we re-regress model (1). We repeat the data generation and regression processes with 500 times and 1,000 times, respectively.

Figure 2 shows the distribution of estimates from the 500 runs and 1,000 runs along with the benchmark estimate, -0.025, from column (3) of Table 2. The results indicate that the distribution of estimates from random assignments is clearly centered around zero, and both the standard deviations of the estimates are 0.008, suggesting that there is no significant impact with the randomly constructed variable DID on housing price. Meanwhile, both benchmark estimates are beyond the 99% confidence interval at 500 runs and 1,000 runs. These findings suggest that the negative and significant impact of DID on the housing price is not driven by the unobserved factors.

Figure 2.

Distributions of Estimated Coefficients of the Placebo Test

Notes: The figure plots the cumulative distribution density of the estimated coefficients from 500 and 1000 runs by randomly assigning confirmed COVID-19 cases to communities. The vertical lines present the results of column (3) in Table 2.

3.4. Heterogeneity analysis

To test the second conjecture, we first consider the effect of regional infection level and divide the whole sample into two subsamples according to the sample median of infection level of COVID-19. As people show the phenomenon of probability neglecting when facing major disaster events, that is, people pay more attention to the serious consequences of events, but are not sensitive to the probability of their occurrence (Sunstein, 2003), we measure the infection level of COVID-19 using the number of confirmed COVID-19 cases and the number of deaths caused by COVID-19 in the city, and the data are obtained from the Wind database.

The subgroup More Cases refers to the group with more confirmed cases than the sample median, and the subgroup Fewer Cases refers to the group with fewer confirmed cases than the sample median. The definition method also applies to the grouping of More Deaths and Fewer Deaths. The more confirmed COVID-19 cases and more deaths caused by COVID-19 indicate a higher infection level of COVID-19. We re-regress model (1) using the two subsamples, respectively. The results of Panel A in Table 3 show that DID is negative and significant in the subsamples of More Cases and More Deaths but is insignificant in the subsamples of Fewer Cases and Fewer Deaths. According to the coefficients, the housing price with confirmed cases will decrease by 3.4% (=1-exp (-0.035)) and 6.4% (=1-exp (-0.066)) in cities with higher confirmed COVID-19 cases and more deaths caused by COVID-19, respectively.

Table 3.

COVID-19 and Housing Price: Heterogeneity Analysis

This table presents the role of regional infection level of COVID-19 and medical treatment conditions on the relationship between confirmed COVID-19 cases and housing price. The dependent variable is the natural logarithm of monthly housing price of residential community (Price), and the independent variables are same as those of column (2) in Table 2. In Panel A, the sample is divided by the sample median of the number of confirmed COVID-19 cases and the number of deaths caused by COVID-19 in the city, and the data are obtained from the Wind database. The subgroup More Cases refers to the group with more confirmed cases than the sample median, and the subgroup Fewer Cases refers to the group with fewer confirmed cases than the sample median. The definition method also applies to the grouping of More Deaths and Fewer Deaths. In Panel B, the sample is divided by the sample median of provincial medical treatment conditions which is measured by the number of per capita tertiary hospitals (the highest level in China) and the mortality of infectious diseases, and the data are extracted from the China Health Statistical Yearbook. The subgroup More Tertiary Hospitals refers to the group with more per capita tertiary hospitals than the sample median, and Fewer Tertiary Hospitals refers to the group with fewer per capita tertiary hospitals than the sample median. The definition method also applies to the groupings of Higher Mortality and Lower Mortality. The robust standard errors are reported in the parentheses. ** p<0.05, *** p<0.01.

| Panel A The Role of Infection Level of COVID-19 | ||||

|---|---|---|---|---|

| Price | Price | |||

| VARIABLES | More Cases | Fewer Cases | More Deaths | Fewer Deaths |

| DID | -0.035** | -0.004 | -0.066*** | 0.010 |

| (0.015) | (0.014) | (0.018) | (0.012) | |

| Other Variables inTable 2 | Y | Y | Y | Y |

| Observations | 10402 | 8064 | 10024 | 8442 |

| R-squared | 0.592 | 0.392 | 0.611 | 0.461 |

| Panel B The Role of Medical Treatment Conditions | ||||

|---|---|---|---|---|

| Price | Price | |||

| VARIABLES | More Tertiary Hospitals | Fewer Tertiary Hospitals | Higher Mortality | Lower Mortality |

| DID | 0.009 | -0.041*** | -0.027** | -0.012 |

| (0.015) | (0.012) | (0.011) | (0.015) | |

| Other Variables inTable 2 | Y | Y | Y | Y |

| Observations | 9338 | 9128 | 10752 | 7714 |

| R-squared | 0.618 | 0.375 | 0.682 | 0.597 |

We then consider the effect of regional medical treatment conditions and divide the whole sample into two subsamples according to the sample median of medical treatment conditions, which is measured by the number of per capita tertiary hospitals (the highest level in China), and the mortality of infectious diseases. As the city-level data of the two grouping variables are not available, we measure them at the provincial level, and the data are extracted from the China Health Statistical Yearbook at 2019 (National Health Commission, 2019).

The subgroup More Tertiary Hospitals refers to the group with more per capita tertiary hospitals than the sample median, and Fewer Tertiary Hospitals refers to the group with fewer per capita tertiary hospitals than the sample median. The definition method also applies to the groupings of Higher Mortality and Lower Mortality. The fewer tertiary hospitals and higher mortality indicate worse medical treatment conditions. The results of Panel B in Table 3 show that the variable DID is negative and significant in the subsamples of Fewer Tertiary Hospitals and Higher Mortality but is insignificant in the subsamples of More Tertiary Hospitals and Lower Mortality. According to the coefficients, the housing price with confirmed cases will decrease by 4.02% (=1-exp (-0.041)) and 2.66% (=1-exp (-0.027)) in provinces with fewer per capita tertiary hospitals and higher mortality of infectious diseases, respectively.

The above results suggest that although the housing price will suffer a reduction when there are confirmed COVID-19 cases in the community, the effect only exists in regions with a higher infection level of COVID-19 and worse medical treatment conditions, but the effect will not be apparent in regions with a lower infection level of COVID-19 and better medical treatment conditions, as people have a lower risk perception of COVID-19.

4. Conclusions

By employing data on monthly community-level confirmed COVID-19 cases and housing price in China, this paper explores the impact of COVID-19 on housing price and further investigates the role of regional infection level of COVID-19 and medical treatment conditions.

The results using the DID method show that when there are confirmed COVID-19 cases in the community, the housing price will reduce by 2.47% and the negative impact can persist three months, while the extent of the impact basically becomes greater as time goes on. We conduct the parallel pre-trend test and placebo test, and conclude that the results are robust. The negative effect is consistent with the studies on the impact of other infectious disease on housing price and the impact of COVID-19 on financial asset price, which highlights the general effect of infectious diseases on asset price. According to the estimated coefficients, the impacting extent of COVID-19 on housing price is larger than the effect of SARS which is 1.6% in Wong (2008), but less than that of the plague and cholera which are 13% and 10% in Francke and Korevaar (2020). Moreover, the heterogeneity analysis in this paper show that the negative impact of COVID-19 on housing price only exists in the regions with a higher infection level of COVID-19 and worse medical treatment conditions.

As the real estate industry plays an important role in the national economy, the findings of this paper indicate that the authorities should pay more attention to the impact of COVID-19 on housing price and implement corresponding real estate policies. In addition, the authorities should also consider the heterogeneity of regions and focus on the regions with a higher infection level of COVID-19 and worse medical treatment conditions.

CRediT Author Statement

Authors’ Contribution

All authors contributed equally. All authors read and approved the final manuscript.

Declaration of Competing Interest

The authors declare that they have no competing interests.

Footnotes

We acknowledge financial support from Project of Humanities and Social Science from MOE of China (18YJC790129, 18YJC790214), Program for Innovation Research in Central University of Finance and Economics, the Project for COVID-19 of School of Economics at Shandong University, the Program of Qilu Young Scholars of Shandong University, and the Taishan Scholar Program of Shandong Province.

The website is https://systems.jhu.edu/research/public-health/ncov.

The website is https://www.fang.com.

Appendix A. Variable Definitions.

| Variables | Description | Definition |

|---|---|---|

| Price | The average housing price of community | The natural logarithm of the monthly average housing price of community |

| DID | The difference-in-difference impact of COVID-19 | Dummy variable that equals one in the months after the community has confirmed COVID-19 cases and equals zero otherwise |

| Housing Age | The age of the community | The natural logarithm of the years from the house completion time to year 2020 |

| Floor Area Ratio | The floor area ratio of the community | The ratio of total aboveground building area to the net land area of the community |

| Greening Ratio | The floor area ratio of the community | The ratio of green land area to total land area of the community |

| Elevator | The elevator status of the community | Dummy variable that equals 1 if the community has elevators and zero otherwise |

| Property Right | The term of property right of the community | The term of property right of includes three types that are 40 years, 50 years, and 70 years, and we assign 1, 2, and 3 to each type, respectively. We also define it as the number of years, and the main results are robust |

| Building Type | The building type of the community | There are five types of building in the sample—brick building, tower building, plate building, plate—tower combination building, and villa—and we assign 1, 2, 3, 4, and 5 to each type, respectively. We also define it as dummy variables, and the main results are robust |

| Education Rating | The education rating of the community | There are four types of education rating in the sample—the non-school district, lower quality school district, medium quality school district, and higher quality school district—and we assign 1, 2, 3, and 4 to each type, respectively |

| Property Service | The property service quality of the community | There are four types of property service quality in the sample—the service remained to be improved, medium quality, good quality, and excellent quality —and we assign 1, 2, 3, and 4 to each type, respectively |

| Density | The population density of the city | The ratio of permanent resident population to the land area of the city in 2019 |

| PGDP | The per capita GDP of the city | The natural logarithm of per capita GDP of the city in 2019 |

| Investment | the investment amount in the real estate industry of the city | The natural logarithm of the investment in the real estate industry of the city in 2019 |

References

- Abadie A., Dermisi S. Is terrorism eroding agglomeration economies in central business districts? Lessons from the office real estate market in downtown Chicago. Journal of Urban Economics. 2008;64(2):451–463. [Google Scholar]

- Arbel Y., Ben-Shahar D., Gabriel S., Tobol Y. The local cost of terror: Effects of the second Palestinian Intifada on Jerusalem house prices. Regional Science and Urban Economics. 2010;40(6):415–426. [Google Scholar]

- Baek S., Mohanty S.B., Glambosky M. COVID-19 and stock market volatility: An industry level analysis. Finance Research Letters. 2020 doi: 10.1016/j.frl.2020.101748. forthcoming. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Beck T., Levine R., Levkov A. Big bad banks? the winners and losers from bank deregulation in the united states. Journal of Finance. 2010;65(5):1637–1667. [Google Scholar]

- Besley T., Mueller H. Estimating the peace dividend: the impact of violence on house prices in northern Ireland. American Economic Review. 2012;102(2):810–833. [Google Scholar]

- Bu D., Hanspal Tobin, Yin L., Yong L. SSRN Working Papers No.3559870. 2020. Risk taking during a global crisis: Evidence from Wuhan. [Google Scholar]

- Cooper T., Faseruk A. Strategic risk, risk perception and risk behavior: Meta-analysis. Journal of Financial Management and Analysis. 2011;24(2):20–29. [Google Scholar]

- D'Lima W., Lop L.A., Pradhan A. SSRN Working Papers No. 3647252. 2020. COVID-19 and housing market effects: Evidence from U.S. shutdown orders. [Google Scholar]

- Deng G., Gan L., Hernandez M.A. Do natural disasters cause an excessive fear of heights? Evidence from the Wenchuan earthquake. Journal of Urban Economics. 2015;90(1):79–89. doi: 10.1016/j.jue.2015.10.002. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Francke M., Korevaar M. SSRN Working Papers No. 3566909. 2020. Housing markets in a pandemic: Evidence from historical outbreaks. [Google Scholar]

- Gormsen N.J., Koijen R.S.J. NBER Working Papers No. 27387. 2020. Coronavirus: impact on stock prices and growth expectations. [Google Scholar]

- Haddad V., Moreira A., Muir T. NBER Working Papers No.27168. 2020. When selling becomes viral: disruptions in debt markets in the Covid-19 crisis and the Fed's response. [Google Scholar]

- Hallstrom D.G., Smith V.K. Market responses to hurricanes. Journal of Environmental Economics & Management. 2005;50(3):541–561. [Google Scholar]

- He Z., Nagel S., Song Z. NBER Working Papers No. 27416. 2020. Treasury inconvenience yields during the COVID-19 Crisis. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Just M., Echaust K. Stock market returns, volatility, correlation and liquidity during the COVID-19 crisis: Evidence from the Markov switching approach. Finance Research Letters. 2020 doi: 10.1016/j.frl.2020.101775. forthcoming. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kargar M., Lester B., Lindsay D., Liu S., Weill P.O., Zúiga D. NBER Working Papers No. 27355. 2020. Corporate bond liquidity during the Covid-19 crisis. [Google Scholar]

- Li P., Lu Y., Wang J. Does flattening government improve economic performance? Evidence from China. Journal of Development Economics. 2016;123(1):18–37. [Google Scholar]

- Li R., Pei S., Chen B., Song Y., Zhang T., Yang W., Shaman J. Substantial undocumented infection facilitates the rapid dissemination of Novel Coronavirus (SARS-CoV-2) Science. 2020;368(6490):489–493. doi: 10.1126/science.abb3221. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ling D.C., Wang C., Zho T. SSRN Working Papers No. 3593101. 2020. A first look at the impact of COVID-19 on commercial real estate prices: Asset-level evidence. [Google Scholar]

- Mills E.S. Terrorism and U.S. Real Estate. Journal of Urban Economics. 2002;51(2):198–204. [Google Scholar]

- National Health Commission . China Health Statistical Yearbook. Peking Union Medical College Press; Beijing: 2019. [Google Scholar]

- Sene B., Mbengue M.L., Allaya M.M. Overshooting of sovereign emerging Eurobond yields in the context of COVID-19. Finance Research Letters. 2020 doi: 10.1016/j.frl.2020.101746. forthcoming. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sunstein C.R. Terrorism and probability neglect. Journal of Risk and Uncertainty. 2003;26(1):121–136. [Google Scholar]

- Tian F., Li H., Tian S., Yang J., Shao J., Tian C. Psychological symptoms of ordinary Chinese citizens based on SCL-90 during the level I emergency response to COVID-19. Psychiatry Research. 2020;288 doi: 10.1016/j.psychres.2020.112992. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Wong G. Has SARS infected the property market? Evidence from Hong Kong. Journal of Urban Economics. 2008;63(1):74–95. doi: 10.1016/j.jue.2006.12.007. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zhu H., Deng Y., Zhu R., He X. Fear of nuclear power? Evidence from Fukushima nuclear accident and land markets in China. Regional Science and Urban Economics. 2016;60(1):139–154. doi: 10.1016/j.regsciurbeco.2016.06.008. [DOI] [PMC free article] [PubMed] [Google Scholar]