Abstract

This paper studies the trade effects of COVID‐19 using monthly disaggregated trade data for 28 countries and multiple trading partners from the beginning of the pandemic to June 2020. Regression results based on a sector‐level gravity model show that the negative trade effects induced by COVID‐19 shocks varied widely across sectors. Sectors more amenable to remote work contracted less throughout the pandemic. Importantly, participation in global value chains increased traders’ vulnerability to shocks suffered by trading partners, but it also reduced their vulnerability to domestic shocks.

Keywords: COVID‐19, global value chains, trade

1. INTRODUCTION

The COVID‐19 pandemic has generated a supply and demand shock across many countries. Production, consumption and trade patterns have been affected directly and as a result of lockdowns and social distancing measures. Factory closures in China, Europe, the United States and elsewhere have led to a drop in the supply of exportable goods and disruption in global value chains (GVCs). At the same time, consumers and firms have curtailed spending. This paper studies the near‐term impact on trade of these shocks in different countries and sectors.

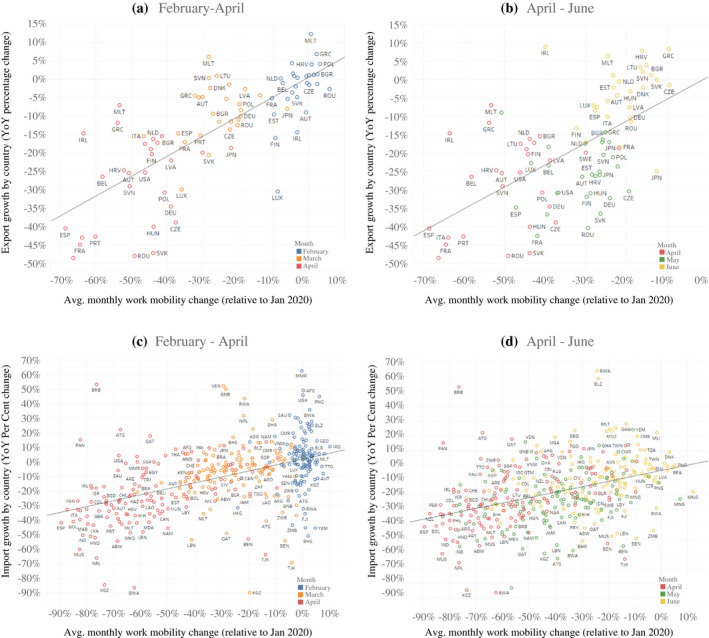

Global trade declined by approximately 13% during the first six months of 2020. In the first three months of the pandemic (February–April 2020), when lockdown policies were implemented in most countries in our sample, changes in work and retail mobility were correlated with changes in exports and imports, respectively (Figure 1a,c). The shift over time of the country sample towards the bottom left suggests both mobility and trade growth declined as the virus advanced. Between the peak of the first wave of COVID‐19 in April until June 2020, both mobility and trade improved gradually, as shown by the shift over time of the country sample towards the top right in Panels 1b and 1d.

FIGURE 1.

Trade during the first wave of the pandemic, February to June 2020

This paper studies the short‐term trade effects of COVID‐19. We use bilateral monthly export data for 28 exporting countries (most EU members, the United States and Japan) and multiple trading partners at a detailed sector level between February and June 2020.

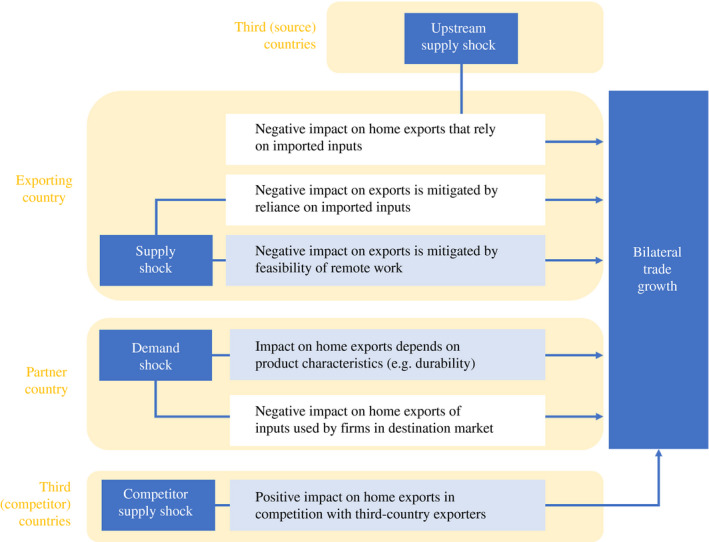

We rely on a simple conceptual framework to organize our thinking. COVID‐19 shocks can hit the exporting economy, importing economy or third countries. Moreover, these shocks can impact trade flows directly or through production linkages in GVCs. While all these shocks and channels work simultaneously, it is helpful to consider them separately.

A shock in the exporting country that reduces mobility and restricts production has a negative impact on exports. But the possibility of remote work can buffer this effect. A shock in the partner country that keeps shops closed and lowers economic activity can also affect trade flows. The direction of the impact depends on the relative strengths of two effects: the contraction in overall demand and the substitution towards imports due to the reduction in domestic production. It also depends on product characteristics: for example, the impact on durable goods such as computers and televisions depends on whether consumers postpone purchases or buy more to facilitate remote work, education and entertainment. Finally, a supply shock in third countries in direct competition with the exporter could provide a boost to its exports.

Participation in GVCs can mitigate or augment the negative trade effects of COVID‐19 shocks. When the exporting country is itself hit by a supply shock, sectors that rely more on imported inputs are hurt less than those that rely primarily on domestic inputs. But when a supply shock hits countries that are a source of inputs for exporters, the more imported input‐dependent sectors are more adversely affected. When a shock disrupts production in the destination country, sectors that export intermediates to other countries are hurt more. From an exporter's perspective, the first channel captures the benefit of GVC participation in the presence of a domestic shock, while the second and third channels capture upstream or downstream disruption due to foreign shocks.

Our empirical strategy is based on a sector‐level gravity model (e.g., Dai et al., 2014). Instead of controlling for country‐level determinants of bilateral trade, we rely on a comprehensive set of fixed effects, as our goal is to identify the role of sector characteristics in mitigating COVID‐19 shocks. Similarly to the large trade literature based on the approach in Rajan and Zingales (1998),1 we focus on interaction terms between a selected time‐varying measure at the country‐level and a time‐invariant sector measure reflecting the sector's vulnerability to the shock.

The baseline results confirm that trade effects vary across sectors. First, the feasibility of remote work mitigated the negative effects of reduced worker mobility in the exporting country on export growth. We find that sectors with a higher share of occupations that can be performed remotely were less severely impacted. Second, results also show a decrease in retail mobility in the partner country, such as closure of retail stores, had a smaller negative impact on imports of durable goods in the same month, but a larger impact in the following month—despite the fact that demand for certain durable goods may have increased due to lockdowns. Third, data for the group of 28 exporters do not support the view that shocks in third countries had a positive impact on exporters that were competing in the same destination markets.

An important issue during the current pandemic has been the relationship between COVID‐19 and GVCs, and particularly whether GVCs absorb or transmit COVID‐19 shocks (Baldwin & Tomiura, 2020; Javorcik, 2020; Miroudot, 2020). We find that while GVC participation increased an exporter's vulnerability to foreign shocks, it reduced vulnerability to domestic shocks. Disruption of production in source countries more adversely affected export growth in sectors that relied more strongly on imported inputs from these source countries. Similarly, a disruption of production in an exporter's partner countries more adversely affected its export growth in sectors with high shares of intermediate inputs. But the negative impact of a disruption in domestic production in exporting countries themselves was mitigated by a sector's higher reliance on imported inputs in export production.

We perform two robustness tests and extend our analysis in two directions. First, we use growth in industrial production rather than changes in mobility as a measure of the COVID‐19 shocks and find all results remain unaltered. Second, we estimate regressions for the sub‐periods February to April 2020 and April to June 2020. As intuition would suggest, the mitigating effects of remote labour mattered more during the severe lockdown of the first three months. Similarly, exports were also most affected by shocks in upstream countries. Third, we include China in the sample. All results are confirmed except we now find supply shocks in third countries provided opportunities to expand exports. As a final extension, we use mirror export data, to expand the set of exporters to 64 developed and developing countries. While we find that remote work plays a smaller role, perhaps due to the weaker diffusion of Internet in developing economies, all results continue to hold.

Our study relates to the growing body of literature on the economic effects of COVID‐19 (Baldwin and Weder di Mauro, 2020). In particular, it is closely linked to recent studies assessing its impact on trade and GVCs, and on supply and demand shocks2 more broadly. Several organizations have published estimates using computable general equilibrium (CGE) models. While all studies predict a substantial drop in output and trade, results are sensitive to changes in underlying assumptions, such as the length of lockdown measures.3 A recent study relies on a newly developed economic disaster model to assess the supply chain effects of different COVID‐19 control measures, emphasizing indirect impacts on other countries through supply chain linkages (Guan et al., 2020).4 Bonadio et al. (2020) calibrate the possible impact of lockdown measures on GDP for a sample of 64 countries, differentiating between foreign and domestic shocks. To identify the contribution of GVCs, the study also simulates the effects in a counterfactual world without GVC trade and pure reliance on domestic inputs. Finally, Eppinger et al. (2020) and Gerschel et al. (2020) study the propagation of the productivity slowdown in the Hubei province of China to the global economy, through international trade and GVCs.

Differently from these papers, our study is based on econometric analysis, and to our knowledge, this is one of the first papers on trade and COVID‐19 that takes this approach. One exception is Hayakawa and Mukunoki (2020). They assess the impact of numbers of COVID‐19 cases and deaths on bilateral export and import growth of machinery goods between January and June 2020 for 26 reporting and 185 partner countries. They find that while COVID‐19 did not have a significant demand effect in importing countries, COVID‐19 shocks in supplier countries negatively affected exporters’ final machinery exports. COVID‐19 cases and deaths in an exporter country are also found to hurt its exports of finished machinery products, but to a lesser extent. A second exception is the contemporaneous and independent work by Fernandes et al. (2020). Like our paper, they estimate difference‐in‐differences specifications that explain monthly trade flows by interactions between measures of the COVID‐19 pandemic or measures to contain it and several sector characteristics. Their focus is on measures of trade resilience such as a sector's dependence on China for inputs, a sector's labour intensity of production, and technological proximity to other sectors.

The remainder of this paper is structured as follows: Section 2 introduces the empirical strategy and describes the data. Section 3 shows the baseline regression results. Robustness tests and extensions are presented in Section 4. Section 5 concludes.

2. EMPIRICAL STRATEGY AND DATA

2.1. Trade effects of COVID‐19

COVID‐19 and subsequent lockdown policies represent supply and demand shocks across many countries. Their impact on trade depends on factors that vary at the country and sector level. Figure 2 depicts a simplified framework which outlines the various transmission channels, as well as the role of sectoral characteristics in mitigating or augmenting the effect of such shocks.

FIGURE 2.

A simplified framework of bilateral trade growth

As a first step, we focus on production, consumption and competition channels (light blue boxes). Consider a supply shock in the exporting country. Reduced worker mobility—the source of the supply shock—lowers the exporting country's production capacity and thus negatively affects export growth. This impact depends on sector‐specific characteristics. Given the importance of social distancing in limiting the spread of the virus, the efficiency of remote work arrangements is expected to be a key factor in maintaining production processes in a safe environment. In particular, we hypothesize that the higher the share of occupations in a sector that can be performed remotely the lower the negative impact of the exporting country's supply shock.

Similarly, a demand shock in the partner country can affect bilateral trade through the consumption channel. Declines in retail mobility in the partner country, such as closure of retail stores, reduce demand for imported consumer goods. This effect varies by type of product. Durable consumer goods tend to be more strongly affected during a crisis as consumers may choose to postpone their purchase when uncertainty is high. As durables are generally ordered by retailers in advance, this effect is likely to be transmitted to imports with a lag. The COVID‐19 pandemic may have some offsetting effects. First, the attributes of durable goods are observable through the Internet, increasing the willingness of customers to purchase them online. Second, the demand for durable goods such as computers, televisions or home appliances increases with remote work, education and entertainment.5

Supply shocks in third countries may also have an impact through the competition channel. If COVID‐19 leads to mobility restrictions in third countries, firms in the exporting country can take advantage of production disruption of rivals, and export more to the partner's market. This effect is expected to be stronger in sectors in which third countries hit by a negative supply shock have a larger global export share and the exporter has the capacity to rapidly scale up production.

Last, we consider the different channels through which reduced productive activity in the exporting, partner or third country could affect production within GVCs (white boxes). The effect of a shock depends on the extent of a sector's reliance on imported inputs, as well as on geographic location of the shock. When it takes place in the exporting country, higher reliance of a sector's exports on imported inputs helps to better withstand disruption in domestic production, thus supporting export growth. When the shock takes place in the partner country, demand for the exporter's intermediate inputs would decrease relative to demand for final goods as production is disrupted. When the shock takes place in a third source country that is an upstream supplier of inputs, the exporter experiences a production disruption that hurts its exports.6

2.2. Empirical strategy

Our empirical strategy is based on the assumption that bilateral trade growth between two countries is affected by supply and demand shocks induced by the health crisis in the exporting country, partner country and in third countries. The negative impact of these shocks is expected to be heterogeneous across sectors. We estimate difference‐in‐difference specifications that interact COVID‐19 shocks with sector characteristics. The model is estimated for 28 exporting countries and over 50 trading partners at the ISIC Rev. 3 4‐digit level for February to June 2020.

The general estimation equation can be expressed as follows:

| (1) |

where growth ijkt denotes bilateral annualized growth of exports from country i to partner country j in sector k at time t. The explanatory variables include the supply shock in the exporting country and demand shock in the partner country interacted with the relevant sector characteristics, exporter supply shockjt*sector_characteristicik and partner demand shock jt*sector_characteristic jk , and the supply shock in third countries, third country supply shock ikt

We also include a set of controls, namely exporter‐partner‐sector (γ ijk ), exporter‐time (γ it ), partner‐time (γ jt ) and sector time (γ zt ) fixed effects to account for potentially omitted variables, while ε ijkt is the error term. Standard errors are clustered at exporter‐partner pair‐level.7 The sector‐time fixed effects cannot be at a highly disaggregated level due to collinearity with some of the sector characteristics. To account for differences in sectoral output growth and minimize the concern of possible omitted variable bias, we construct a global monthly industrial production index (IPI) growth variable at the ISIC Rev. 3 2‐digit level, global output mt , as an additional control.

The final specification combines all the channels that have been identified in the conceptual framework:

| (2) |

Here, the supply shock in the exporting country is captured by the variable work mobility, work mobility it , while retail mobility, retail mobility jt , measures the demand shock in the partner country. Both vary at the country‐time level and are computed as monthly changes relative to January 2020.8

As for sector intensities, the feasibility of performing work remotely is captured by remoteik . We expect β 1 to be positive as the greater feasibility to perform remote work in a given sector would shield it from the negative effect of a supply shock in the exporting country. The variable durablek designates the average percentage of durable (including semi‐durable and transport equipment) products within a sector. The coefficient β 3 has a priori an ambiguous sign as durable goods tend to be more affected during a crisis, but a pandemic may lead to an increase in demand for certain products such as computers. Moreover, as orders of durables can be placed before imported goods arrive, the impact of the shock may appear with a lag.

To capture the third‐country competition channel, we compute a time‐varying third‐country shock at the exporter‐partner‐sector level as follows:

where subscript o denotes third country (with ). w is the export share of a third country o in total exports of third countries in sector k, , excluding exporter i and partner j. This term ensures that industrial production shocks in a third country, ipi ot , have a larger effect on an exporter i's trade growth in a ISIC Rev. 3 4‐digit sector the larger the third country's share in world trade is. Since mobility data are unavailable for China, we rely on the IPI as shock variable. We expect β 5 to be negative as less robust growth in industrial production in third countries would provide opportunities to competing producers in the exporting country to expand exports in their partner's market.

Three variables are considered to assess the impact of COVID‐19 through the GVC channel. The first two are straightforward: gvcil measures an exporter‐sector's share of imported inputs in its exports and gvc_partnerjl a partner country‐sector's reliance on imported inputs in its total imports. To account for shocks in an exporter's source (third) countries, we compute the following upstream shock variable:

where subscript i denotes exporting country, l output sector, s source country and n input sector. The variable ipi measures the IPI in the source country and w is the weight of input sector n from source country s in all imported inputs used by output sector l in exporter country i. The equation shows the larger is an exporter's dependence on imported inputs (as captured by w), the more can upstream shocks in source countries hurt export growth. Also in this case, we use IPI as our preferred shock measure due to unavailability of mobility data for China.

We expect β 2 to be positive because a higher reliance of a sector's exports on imported inputs shields the sector from disruption in the domestic economy and supports export growth. We expect β 4 to be negative because a shock in the partner country lowers demand for an exporter's GVC exports. Finally, we expect the upstream shock variable to be positively associated with export growth in the exporting countries (i.e., a positive β 6 ). Disruptions in industrial production in source countries are expected to be linked to declines in exports in the exporting country, as exporters face bottlenecks in imported inputs.

2.3. Data

We use monthly bilateral trade data for a total of 289 exporting countries covering the period January/February to June 2020. Data were collected from the COVID‐19 Trade Watch (World Bank, 2020): specific sources of data are, respectively, customs for China, Eurostat for the European Union, Ministry of Finance for Japan and U.S. International Trade Commission for the United States. Export data are aggregated at the ISIC Rev. 3 4‐digit level, which consists of over 140 sectors. Bilateral annualized export growth in a sector (growthijkt ) is computed based on export levels for a month in 2020 relative to export levels of the same month in 2019. The estimations exclude mining sectors such as oil and coke from the sample. We also winsorize10 the export growth data and exclude Serbia as partner country in order to deal with extreme outliers.

To assess the demand and supply shocks, we use monthly information from the Google mobility data from the COVID‐19 Global Community Reports11 which are published on a daily basis for 132 countries. This captures people's movement trends across different places and is provided relative to the median daily value from the 5‐week period from 3 January 2020 to 6 February 2020 (the baseline day). We select two components of Google mobility, namely work mobility (work mobilityit ) and retail and recreation mobility (retail mobilityjt ) to measure, respectively, the supply and demand shocks of the pandemic. Work mobility measures mobility trends for places of work, while retail and recreation mobility capture mobility trends for places like restaurants, cafes, shopping centres, theme parks, museums, libraries and movie theatres. We compute the mean over all daily measures to obtain monthly Google mobility measures.

Changes in industrial production relative to the previous year are calculated using the IPI from UNIDO,12 which is available on a monthly basis for a set of 60 countries. Industrial production refers to the output of industrial establishments and covers sectors such as mining, manufacturing, electricity, gas and steam and air‐conditioning. We use IPI data in other exporting countries (ipiot ) which are weighted using sectoral export shares obtained from 2018 UN Comtrade data to compute the average competition shock in third countries (competition shockijkt ). We also rely on IPI data to capture supply shocks in source countries (ipist ). Both allow for the inclusion of China for which mobility measures are unavailable. In robustness checks, we use IPI as alternative supply shocks in exporting countries (ipiit ) and alternative demand shocks in partner countries (ipijt ).

To capture the potential heterogeneous impact of reduced mobility across sectors, we construct a variable that measures the per cent of occupations within an ISIC Rev. 3 4‐digit sector that can be performed remotely based on U.S. 2017 O*NET data.13 To obtain a remote labour measure that varies across exporting countries (remoteik ), we multiply this percentage with a country's Internet density defined as individuals using the Internet (as % of population) from the World Development Indicators for 2017. These measures are then indexed to range from 0 to 1. It seems counterintuitive that production‐related activities like assembly can be performed remotely. However, the trade data and remote labour index are classified by sectors and not tasks. That is, services tasks that are embodied in goods such as research and development, design or marketing are also classified under goods sectors. Table A1 ranks ISIC Rev.3–2 digit sectors by their average remote labour index and shows that the possibility of remote work is highest in publishing, printing and reproduction of recorded media, followed by electronics and machinery sectors, while it is lowest in labour‐intensive forestry, fishing, agriculture and food production.

To assess the durability of products, we calculate the sector's share of durable consumer products, semi‐durable consumer products and cars and transport equipment (durablek ). Durable, semi‐durable and transport products at the HS6‐digit level are identified based on the UN BEC classification.14 Durability measures the percentage of HS‐6 products that are classified in each of these three non‐overlapping categories within an ISIC Rev. 3 4‐digit sector. If an ISIC Rev. 3 4‐digit does not contain any products classified as durable, semi‐durable or transport products, the share takes the value of 0. In an extension, we examine the role of durable consumer products (cons_durk ), semi‐durable consumer products (cons_semik ) and transport products (transpk ) separately and also include a measure that combines the share of both durable and semi‐durable consumer products only (consk ).

GVC participation of a country sector (gvcil ) is measured as the import content of exports (as per cent of a sector's exports) for the 28 exporting countries for the year 2015 (latest available). The measure is based on data from the OECD International Input‐Output tables and computed following the approach by Borin and Mancini (2019). While the GVC participation measure varies across exporting countries, it is only available at a more aggregate sector level covering 15 TiVA sectors.

To capture the importance of imported inputs for production, we rely on import data from UN Comtrade for 2017 and compute a sector's share of parts and components (as per cent of total imports) in partner countries (gvc partnerjl ). Parts and components15 at the HS6‐digit product level are determined based on the UN Broad Economic Category (BEC) classification and then further aggregated to the TiVA sector level to be consistent with the backward GVC participation measure.16 We interact GVC measures with the shock measure in the exporting and partner country to reflect a shock's transmission through the GVC channel. The upstream shock variable (upstream shockilt ) is computed based on IPI growth and data from the OECD International Input‐Output tables to compute weights.17

To control for global sector‐time trends, we use industrial production growth data from UNIDO INDSTAT which are available at the 2‐digit ISIC level and cover 60 countries representing more than 90% of world GDP and 95% of manufacturing value added. Our measure global outputmt is based on manufacturing value added in constant 2015 USD. The global average is based on the relative contribution of a country (weight) to the world's total manufacturing value added. The correlation matrix between independent variables is shown in Table A2, while the summary statistics are reported in Table A3.

3. REGRESSION RESULTS

Initial results are reported in Table 1. These suggest bilateral export growth is positively correlated with both supply shocks in the exporting country (Column (1)) and demand shocks in the partner country (Column (2)). Specifically, a 1 percentage point decline in worker mobility relative to January 2020 is associated with a 0.42 percentage point decline in annualized export growth on average (Column (1)), while a 1 percentage point decline in retail mobility in partner countries is linked to a 0.30 percentage point decline on average (Column (2)).

TABLE 1.

Supply, demand and third‐country shocks and bilateral export growth, OLS regression results

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | growthijkt | growthijkt | growthijkt | |

| work mobilityit (supply) | 0.419 *** | 0.439 *** | 0.319 *** | 0.347 *** | |||

| (0.085) | (0.086) | (0.088) | (0.089) | ||||

| retail mobilityjt (demand) | 0.300 *** | 0.313 *** | 0.299 *** | 0.306 *** | |||

| (0.048) | (0.048) | (0.048) | (0.048) | ||||

| competition shockijkt | −0.337 ** | −0.372 ** | −0.358 ** | −0.390 ** | |||

| (0.165) | (0.161) | (0.165) | (0.161) | ||||

| upstream shockilt | 2.035 ** | 1.634 *** | 2.075 ** | 1.485 *** | |||

| (0.843) | (0.379) | (0.843) | |||||

| global outputmt | 1.085 *** | 1.040 *** | 0.915 *** | 1.058 *** | 0.952 *** | 0.878 *** | 0.926 *** |

| (0.144) | (0.144) | (0.155) | (0.144) | (0.15) | (0.154) | (0.15) | |

| Constant | 0.949 *** | 0.924 *** | 0.984 *** | 1.045 *** | 1.029 *** | 1.071 *** | 1.108 *** |

| (0.026) | (0.02) | (0.077) | (0.029) | (0.044) | (0.078) | (0.045) | |

| Observations | 631,111 | 631,111 | 631,111 | 631,111 | 631,111 | 631,111 | 631,111 |

| R‐squared | .400 | .399 | .400 | .398 | .400 | .399 | .398 |

| Exporter‐time FE | No | Yes | Yes | No | No | Yes | No |

| Importer‐time FE | Yes | No | Yes | No | Yes | No | No |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sector‐time FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Exporter‐partner‐time FEs could not be included due to collinearity with the country shocks. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

By contrast, competition shocks are negatively associated with bilateral export growth (Column (3)) which is in line with expectations because reduced production in third countries could be expected to boost export growth. Finally, the coefficient capturing the upstream shock is positive and significant, suggesting declines in industrial production in an exporter's source countries, weighted by a sector's reliance on imported inputs from them, negatively affected export growth. The findings hold for different combinations of these shocks in Columns (4)–(6) and also when all shocks are simultaneously included in Column (7), suggesting that on average, all the transmission channels played a role in explaining the impact of the pandemic on export growth.

We next move to sectoral analysis and estimate Equation (2). The results using OLS are reported in Table 2. Column (1) assesses the relationship between supply shocks in exporting countries and bilateral export growth through the production and GVC channels. The first interaction term (work mobilityit*remoteik ) captures the role of remote work in mitigating the negative impact of the supply shock through the production channel.18 A positive and statistically significant coefficient at the 1%‐level suggests a higher percentage of occupations that can be performed remotely in a sector mitigates the negative trade effect of a production shock in exporting countries. For example, in country sectors such as Hungary's manufacture of pulp, paper and paperboard, where less than one‐third of occupations can be performed remotely, the negative effect of COVID‐19 through decreased work mobility is 19 percentage points larger than for manufacture of electric motors, generators and transformers in countries such as Japan, where more than two‐thirds of production can be performed remotely.19

TABLE 2.

Supply, demand and third‐country shocks and bilateral export growth, the role of sector characteristics, OLS regression results

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | work mobilityit *remoteik | 1.509 *** | 1.587 *** | ||

| (0.361) | (0.375) | ||||

| work mobilityit *gvcil | 1.293 ** | 1.564 *** | |||

| (0.518) | (0.522) | ||||

| Partner demand shock*sector characteristic | retail mobilityjt *durablek | 0.456 *** | 0.414 *** | ||

| (0.094) | (0.097) | ||||

| retail mobilityjt *gvc partnerjl | −0.215 *** | −0.234 *** | |||

| (0.074) | (0.074) | ||||

| Third country supply shock | competition shockijkt | −0.089 | 0.335* | ||

| (0.173) | (0.181) | ||||

| upstream shockilt | 2.082 ** | 2.172 ** | |||

| (0.890) | (0.891) | ||||

| global outputmt | 1.102 *** | 0.839 *** | 1.054 *** | 0.753 *** | |

| (0.151) | (0.158) | (0.162) | (0.166) | ||

| Constant | 1.013 *** | 0.732 *** | 0.947 *** | 1.243 *** | |

| (0.053) | (0.018) | (0.082) | (0.103) | ||

| Observations | 496,295 | 496,295 | 496,295 | 496,295 | |

| R‐squared | .424 | .424 | .424 | .424 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

The second interaction term presented in Column (1) (work mobilityit*gvcil ) captures the relationship between the supply shock and export growth through the GVC channel. The estimated coefficient suggests that the trade effect of a negative shock in exporting countries is lower in sectors that rely more strongly on imported inputs for their exports. This supports the hypothesis that importing inputs can help alleviate the impact of domestic supply shocks. The negative impact of a decrease in mobility for country‐sectors in the first quartile of the distribution, where imported inputs account for less than one‐quarter of total exports (e.g., Spain manufactures of agricultural and forestry machinery), is 20 percentage points higher than for country‐sectors in the third quartile of the distribution where shares of imported inputs over exports reach up to 37% (e.g., Austria's manufacture of other chemical products).20

The results presented in Column (2) illustrate the link between the demand shock, captured by decreases in retail mobility, and export growth. For the consumption channel, a positive coefficient of the interaction term (retail mobilityjt*durablek ) suggests that the (contemporaneous) negative trade effect of a demand shock in partner countries is smaller for those sectors with larger shares of durable goods. Specifically, for sectors where all products are classified as durable or semi‐durable (e.g., manufactures of parts and accessories for motor vehicles) the negative impact is 41 percentage points smaller compared with those sectors where no products are classified as durable or semi‐durable (e.g., processing and preserving of fruit and vegetables).21 To understand whether this effect is driven by a surge in demand for durable goods that are needed during the pandemic or reflects a mismatch between the time durables are ordered and delivered, we run Equation (2) with a lag in the demand shock. Results show that the sign of the interaction term is reversed and strongly significant (Table A4) which is consistent with the view that imports of durable goods were affected with a lag.

The interaction between GVC participation in partner countries and retail mobility (retail mobilityjt*gvc partnerjl ) shows that the negative effect on bilateral exports of a shock in the exporters’ partner countries is more pronounced in sectors with a larger share of imported inputs. The impact of the demand shock in country‐sectors with low shares (1st quartile of the distribution) is almost 12 percentage points smaller than for those with high shares (3rd quartile of the distribution).22 This suggests that buyer firms in partner country‐sectors hit by the COVID‐19 shock import fewer inputs from their suppliers. This result can also be explained by the fact that disruptions in production caused by the pandemic prevent firms in partner countries to satisfy consumer demand for final goods which translates into higher shares of imports of final goods relative to intermediate inputs from foreign suppliers.

Finally, Column (3) presents the impact of a supply shock in third countries on bilateral export growth through the competition and GVC channels. The coefficient capturing the former (competition shockijkt ) has the expected negative sign but is not statistically significant, possibly because shocks impacted the set of 28 exporters in our sample simultaneously, restricting bilateral trade growth to adjust through the competition channel. We return to this question later where we include China in the set of exporters. The coefficient capturing the upstream shock (upstream shockjlt ) is statistically significant and slightly larger, compared to the results in Table 1. This confirms that changes in industrial production in third countries, by affecting the supply of intermediate inputs, have an impact on export growth of the exporting country. Specifically, an average decline in the weighted annualized IPI growth in an exporter's source countries by one percentage point is linked to a 2.2 percentage point decline in bilateral annualized export growth.

The last column of Table 2 combines all shocks and channels in one regression. All coefficients of interest remain significant and do not vary in terms of their magnitudes. Results therefore confirm that the negative trade effects of COVID‐19 were mitigated for sectors with a higher percentage of occupations that can be performed remotely and contemporaneously also for durable goods. Shocks in third countries did not translate into increased exports in destination markets. In terms of GVC channels, disruption of production in an exporter's source countries more adversely affected its export growth in sectors that rely more on imported inputs from these countries. Similarly, negative shocks in an exporter's partner countries more adversely affected its export growth in sectors with high shares of intermediate inputs. But the negative impact of disruption in domestic production in exporting countries was mitigated by a sector's higher reliance on imported inputs. Thus, while GVC participation increased an exporter's vulnerability to foreign shocks, it reduced vulnerability to domestic shocks.

Other product characteristics can affect how imports respond to shocks in partner countries. In Table A5, we focus on homogeneous goods, that is those that are standardized and do not differ substantially across suppliers (Rauch, 1999). One can assume that adjustments on the demand side, such as cancellations of orders, are easier when products are homogenous and hence that these are more affected during a crisis. Our results support this hypothesis, showing that bilateral trade growth in sectors with a higher share of homogeneous products suffered more from a demand shock in partner countries as compared to non‐homogeneous products.

Our baseline regressions use export values which can be subject to large price fluctuations during a pandemic. While the regressions already excluded mining sectors such as oil and coke which are more strongly affected by price fluctuations, we also estimate the model based on export quantities. The country sample is reduced to the EU countries for which export quantities (in kilograms) are readily available. Results are reported in Table A6 and broadly support our findings except for the role of an exporter's reliance on imported inputs in a sector which remains positive but loses statistical significance.

4. ROBUSTNESS TESTS AND EXTENSIONS

4.1. Industrial production as an alternative measure of the demand and supply shocks

Results presented in Table 2 could potentially be biased by measurement error. To control for this, Equation (2) is estimated using growth in industrial production as an alternative proxy for supply and demand shocks. Interacting GVC‐related sector intensities with IPI growth is more closely related to the GVC channel than the broader work and retail mobility measures. The results presented in Table 3 hold, confirming the heterogeneous impact of the demand and supply shocks across sectors.

TABLE 3.

Supply, demand and third‐country shocks and bilateral export growth, the role of sector characteristics, OLS regression results, alternative shocks

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | ipiit *remoteik | 1.003 ** | 1.122 ** | ||

| (0.498) | (0.520) | ||||

| ipiit *gvcil | 2.060 *** | 2.343 *** | |||

| (0.668) | (0.677) | ||||

| Partner demand shock*sector characteristic | ipijt *durablek | 0.499 *** | 0.470 ** | ||

| (0.185) | (0.191) | ||||

| ipijt *gvc partnerjl | −0.390 *** | −0.394 *** | |||

| (0.141) | (0.141) | ||||

| Third country supply shock | competition shockijkt | −0.067 | 0.187 | ||

| (0.175) | (0.182) | ||||

| upstream shockilt | 1.828 ** | 2.207 ** | |||

| (0.877) | (0.886) | ||||

| global outputmt | 0.941 *** | 0.755 *** | 0.885 *** | 0.662 *** | |

| (0.155) | (0.162) | (0.167) | (0.171) | ||

| Constant | 0.818 *** | 0.672 *** | 0.862 *** | 1.032 *** | |

| (0.034) | (0.017) | (0.081) | (0.095) | ||

| Observations | 450,629 | 450,629 | 450,629 | 450,629 | |

| R‐squared | .429 | .429 | .429 | .429 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

The availability of production data for years before 2020 also allows us to replicate the analysis for February‐June 2019. The results, reported in Table A7, show sectoral differences related to the possibility of working remotely or the level of dependence on imported inputs for export production did not significantly influence the relationship between growth of industrial production and bilateral trade in 2019. Similarly, a higher share of durable goods in a sector in partner countries did not significantly influence the link between growth of industrial production and bilateral trade in the year prior to the first COVID‐19 wave. A significant positive coefficient capturing the shock on demand of final goods relative to intermediates suggests that GVCs were more resilient to negative demand shocks when there was no pandemic. The positive and significant coefficient of the competition effect also suggests that during non‐pandemic times, the pro‐competitive effect of production and trade mattered. These results confirm that the differential impact of the supply and demand shocks across sectors is a specific feature of the COVID‐19 pandemic.

4.2. Focusing on the periods of lockdowns and progressive opening

Figure 1 shows the contrast in mobility and trade during the period February to April 2020, when lockdown policies were imposed, and April to June 2020 when these were progressively reversed. Tables 4 and 5 examine these two periods separately. Both report results using the specification that is comparable to Table 2 which covers the full period. Results show that, while the direction and significance of the previous findings hold, several variables changed their magnitude. Between February and April, the possibility of remote work mitigated the negative trade effect of a supply shock in exporting countries more strongly, as shown in Columns (1) and (4). Between April and June, by contrast, the possibility of remote labour no longer had a mitigating effect.

TABLE 4.

Supply, demand and third‐country shocks and bilateral export growth, the role of sector characteristics, OLS regression results, February to April 2020 only

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | work mobilityit *remoteik | 1.616 *** | 1.847 *** | ||

| (0.371) | (0.390) | ||||

| work mobilityit *gvcil | 0.911* | 1.204 ** | |||

| (0.535) | (0.539) | ||||

| Partner demand shock*sector characteristic | retail mobilityjt *durablek | 0.401 *** | 0.346 *** | ||

| (0.102) | (0.107) | ||||

| retail mobilityjt *gvc partnerjl | −0.168 ** | −0.178 ** | |||

| (0.080) | (0.081) | ||||

| Third country supply shock | competition shockijkt | −0.160 | 0.358* | ||

| (0.198) | (0.209) | ||||

| upstream shockilt | 3.679 *** | 3.883 *** | |||

| (1.058) | (1.067) | ||||

| global outputmt | 1.408 *** | 1.166 *** | 1.275 *** | 1.004 *** | |

| (0.179) | (0.189) | (0.195) | (0.200) | ||

| Constant | 1.014 *** | 0.760 *** | 1.063 *** | 1.374 *** | |

| (0.053) | (0.020) | (0.085) | (0.108) | ||

| Observations | 292,452 | 292,452 | 292,452 | 292,452 | |

| R‐squared | .521 | .521 | .521 | .521 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

TABLE 5.

Supply, demand and third‐country shocks and bilateral export growth, the role of sector characteristics, OLS regression results, April to June 2020 only

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | work mobilityit *remoteik | 1.437 ** | 0.766 | ||

| (0.559) | (0.599) | ||||

| work mobilityit *gvcil | 2.719 *** | 2.720 *** | |||

| (0.820) | (0.832) | ||||

| Partner demand shock*sector characteristic | retail mobilityjt *durablek | 0.809 *** | 0.740 *** | ||

| (0.143) | (0.147) | ||||

| retail mobilityjt *gvc partnerjl | −0.364 *** | −0.388 *** | |||

| (0.112) | (0.113) | ||||

| Third country supply shock | competition shockijkt | −1.213*** | −0.594 | ||

| (0.361) | (0.382) | ||||

| upstream shockilt | 0.841 | 1.211 | |||

| (1.154) | (1.164) | ||||

| global outputmt | 0.851 *** | 0.308 | 0.787 *** | 0.215 | |

| (0.195) | (0.216) | (0.205) | (0.224) | ||

| Constant | 1.092 *** | 0.552 *** | 0.573 *** | 1.004 *** | |

| (0.103) | (0.034) | (0.149) | (0.207) | ||

| Observations | 285,783 | 285,783 | 285,783 | 285,783 | |

| R‐squared | .535 | .535 | .535 | .535 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Note: Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

The durability of a sector's products mattered less strongly in offsetting the negative trade effects from demand shocks in partner countries, as reported in Columns (2) and (4), during February and April, whereas its mitigating role mattered much more during April to June. Both results are intuitive. The possibility of remote work increases in importance under more severe lockdowns. Similarly, during a global downturn, consumers withhold expenditures, including on durable goods, given the uncertainty they are facing.

Regarding the GVC channel, both the positive influence of an exporting country's reliance on imported inputs in buffering domestic shocks and the negative influence of GVC participation in a partner country's sector were smaller between February and April, as reported in Columns (1), (2) and (4), while their role was enhanced between April and June. By contrast, the upstream shock showed a magnified effect on bilateral trade growth during the first three months of our time period, as reported in Columns (3) and (4), whereas the relationship between the upstream shock and bilateral export growth was no longer significant between April and June. This implies that shocks in an exporter's source countries represented stronger bottlenecks to export during the early period of the first lockdown, whereas shocks in the partner countries were less disruptive. The smaller role of an exporter's reliance on imported inputs in mitigating domestic shocks between February and April could also reflect simultaneous production shocks in key source countries such as China and Germany which made importing inputs less viable. The insignificant upstream shock during April and June, by contrast, could point to reduced bottlenecks in supply as production picked up in China.

4.3. Including China

As a third robustness check, we combine trade data for January‐February for our sample of 28 exporting countries and measure COVID‐19‐related shocks with the industrial production variable to be able to include China in our regressions. That is, monthly growth rates that were previously computed for February only are now computed for January and February combined. Worker mobility changes are replaced with annualized IPI growth in the exporting countries and retail mobility with annualized IPI growth in the partner countries. Results are reported in Table 6.

TABLE 6.

Supply, demand and third‐country shocks and bilateral export growth, the role of sector characteristics, including China, OLS regression results

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | ipiit *remoteik | 1.309 *** | 0.772 * | ||

| (0.440) | (0.469) | ||||

| ipiit *gvcil | 2.104 *** | 2.571 *** | |||

| (0.616) | (0.638) | ||||

| Partner demand shock*sector characteristic | ipijt *durablek | 0.475 *** | 0.382 ** | ||

| (0.161) | (0.167) | ||||

| ipijt *gvc partnerjl | −0.197 | −0.239 * | |||

| (0.122) | (0.127) | ||||

| Third country supply shock | competition shockijkt | −0.549 *** | −0.244 | ||

| (0.141) | (0.158) | ||||

| upstream shockilt | 1.804 ** | 2.400 *** | |||

| (0.727) | (0.789) | ||||

| global outputmt | 0.851 *** | 0.710 *** | 0.754 *** | 0.611 *** | |

| (0.143) | (0.148) | (0.143) | (0.153) | ||

| Constant | 0.840 *** | 0.657 *** | 0.813 *** | 0.971 *** | |

| (0.030) | (0.018) | (0.069) | (0.085) | ||

| Observations | 561,693 | 510,641 | 588,245 | 487,264 | |

| R‐squared | .433 | .433 | .433 | .433 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

Interestingly, while the previous findings hold in terms of significance and direction, several differences stand out.23 First, while a higher percentage of occupations that can be performed remotely still mitigates the negative trade effect of a production shock, the coefficient of 0.77 in Column (4) is 0.35 percentage point smaller compared with the original country sample (Table 3) and also shows a lower statistical significance. Second, third‐country effects in Column (3) have the expected sign and are statistically significant, suggesting China's exports grew in destination markets. This coefficient keeps the expected sign but loses statistical significance in Column (4). Finally, regarding the GVC channel, the positive role of an exporting country's share of imported inputs in mitigating shocks is 0.2 percentage point larger in the extended country sample including China, whereas the negative role of GVC participation in a partner country's sector is 0.15 percentage point smaller. The upstream shock, however, matters more strongly for bilateral trade growth, consistently with the centrality of China in modern GVCs.

4.4. Including developing countries

In a final extension, we use mirror trade data to obtain a larger sample of exporting countries. Since the weights used for the computation of the upstream shock variable are based on 64 countries in the TiVA data set, we need to limit the number of exporters to the TiVA sample too. This includes several upper‐ and lower‐middle‐income countries. The caveat is that the mirror data only consider bilateral exports to 26 EU member states, Japan and the United States.

Results reported in Table 7 show that the general findings still hold. The only exception is the role of remote work in a country and sector which is no longer significant and has a much smaller coefficient. It appears that in middle‐income countries, the possibility of remote work matters much less in hampering the negative trade effect of shocks, possibly because the type of occupations cannot be performed remotely. This is consistent with the lower mitigating role of remote work when we included China as exporter in the sample. Another interesting difference is the smaller upstream shock. A possible explanation could be that the composition of export goods are likely to be more upstream in the supply chain, implying that a negative shock in an exporter's source countries has a weaker negative impact on its export growth. The other findings are comparable to the baseline effects reported in Table 2.

TABLE 7.

Supply, demand and third‐country shocks and bilateral export growth, the role of sector characteristics, mirror data, OLS regression results

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | work mobilityit *remoteik | 0.074 | 0.044 | ||

| (0.336) | (0.353) | ||||

| work mobilityit *gvcil | 1.398 *** | 1.647 *** | |||

| (0.510) | (0.517) | ||||

| Partner demand shock*sector characteristic | retail mobilityjt *durablek | 0.414 *** | 0.425 *** | ||

| (0.099) | (0.103) | ||||

| retail mobilityjt *gvc partnerjl | −0.186 ** | −0.214 *** | |||

| (0.072) | (0.074) | ||||

| Third country supply shock | competition shockijkt | −0.012 | 0.203 | ||

| (0.180) | (0.187) | ||||

| upstream shockilt | 1.835 ** | 1.673 * | |||

| (0.865) | (0.870) | ||||

| global outputmt | 0.765 *** | 0.502 *** | 0.729 *** | 0.426 ** | |

| (0.160) | (0.172) | (0.171) | (0.179) | ||

| Constant | 0.748 *** | 0.607 *** | 0.802 *** | 0.906 *** | |

| (0.049) | (0.018) | (0.078) | (0.094) | ||

| Observations | 323,998 | 323,998 | 323,998 | 323,998 | |

| R‐squared | .446 | .446 | .446 | .446 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

5. CONCLUSIONS

Using monthly trade data for 28 exporting countries and multiple importers over the January‐June 2020 period, we investigated how the COVID‐19 pandemic impacted international trade. We find strong evidence that sectoral characteristics such as the feasibility of remote work, durability of goods and integration into GVCs played a large role in mitigating or augmenting trade effects. While more research is needed, particularly to include sectoral trade data from a larger set of developing countries, these findings provide relevant policy insights. First, they help identify the sectoral attributes that create vulnerability during a pandemic, providing guidance for policy intervention. Second, they show how countries are impacted by domestic and foreign shocks during a global pandemic, which offers insights on strategies for GVC diversification.

APPENDIX A.

TABLE A1.

Remote labour index

| ISIC Rev 3.1 d | Sector | Remote Labour Index |

|---|---|---|

| 2 | Forestry, logging and related service activities | 0.15 |

| 5 | Fishing, operation of fish hatcheries and fish farms; service activities incidental to fishing | 0.16 |

| 16 | Manufacture of tobacco products | 0.22 |

| 15 | Manufacture of food products and beverages | 0.25 |

| 1 | Agriculture, hunting and related service activities | 0.26 |

| 27 | Manufacture of basic metals | 0.27 |

| 34 | Manufacture of motor vehicles, trailers and semi‐trailers | 0.31 |

| 21 | Manufacture of paper and paper products | 0.32 |

| 20 | Manufacture of wood and of products of wood and cork, except furniture; manufacture of articles of straw and plaiting materials | 0.34 |

| 25 | Manufacture of rubber and plastics products | 0.34 |

| 28 | Manufacture of fabricated metal products, except machinery and equipment | 0.34 |

| 19 | Tanning and dressing of leather; manufacture of luggage, handbags, saddlery, harness and footwear | 0.35 |

| 17 | Manufacture of textiles | 0.35 |

| 35 | Manufacture of other transport equipment | 0.35 |

| 36 | Manufacture of furniture; manufacturing n.e.c. | 0.35 |

| 24 | Manufacture of chemicals and chemical products | 0.35 |

| 29 | Manufacture of machinery and equipment n.e.c. | 0.37 |

| 18 | Manufacture of wearing apparel; dressing and dyeing of fur | 0.37 |

| 26 | Manufacture of other non‐metallic mineral products | 0.38 |

| 31 | Manufacture of electrical machinery and apparatus n.e.c. | 0.39 |

| 30 | Manufacture of office, accounting and computing machinery | 0.40 |

| 33 | Manufacture of medical, precision and optical instruments, watches and clocks | 0.42 |

| 32 | Manufacture of radio, television and communication equipment and apparatus | 0.45 |

| 22 | Publishing, printing and reproduction of recorded media | 0.54 |

Source: U.S. 2017 O*NET and WDI (see data description for details).

TABLE A2.

Correlation matrix between interaction terms

| work mobilityit*remoteik | ipiit*gvcil | retail mobilityjt*durablek | ipijt*gvc partnerjl | upstream shockilt | competition shockijkt | global outputmt | work mobilityit*gvcil | retail mobilityjt*gvc partnerjl | |

|---|---|---|---|---|---|---|---|---|---|

| work_mobilityit*remoteik | 1 | ||||||||

| ipiit*gvcil | 0.53 | 1 | |||||||

| retail_mobilityjt*durablek | 0.24 | 0.16 | 1 | ||||||

| ipijt*gvc partnerjl | 0.35 | 0.32 | 0.01 | 1 | |||||

| upstream shockilt | 0.72 | 0.72 | 0.22 | 0.44 | 1 | ||||

| competition shockijkt | 0.56 | 0.57 | 0.07 | 0.41 | 0.85 | 1 | |||

| global outputmt | 0.37 | 0.39 | 0.43 | 0.11 | 0.55 | 0.45 | 1 | ||

| work mobilityit*gvcil | 0.82 | 0.70 | 0.18 | 0.34 | 0.73 | 0.55 | 0.34 | 1 | |

| retail mobilityjt*gvc partnerjl | 0.39 | 0.30 | 0.01 | 0.77 | 0.41 | 0.38 | 0.02 | 0.37 | 1 |

TABLE A3.

Summary statistics

| Variable | Obs | Mean | Std. dev. | Min | Max |

|---|---|---|---|---|---|

| Dependent variable | |||||

| growthijkt | 439,807 | 0.620 | 3.448 | −0.977 | 30.070 |

| Production and consumption channels | |||||

| Mobility changes | |||||

| work mobilityit | 439,807 | −0.257 | 0.169 | −0.686 | 0.059 |

| retail mobilityjt | 439,807 | −0.293 | 0.249 | −0.894 | 0.121 |

| Sector intensities | |||||

| remoteik | 439,807 | 0.381 | 0.096 | 0.111 | 0.901 |

| durablek | 439,807 | 0.126 | 0.255 | 0.000 | 1.000 |

| Interaction terms | |||||

| work mobilityit* remoteik | 439,807 | −0.098 | 0.070 | −0.598 | 0.035 |

| retail obilityjt*durablek | 439,807 | −0.036 | 0.101 | −0.894 | 0.121 |

| GVC channel | |||||

| Industrial production | |||||

| ipiit | 439,807 | −0.119 | 0.131 | −0.479 | 0.282 |

| ipijt | 439,807 | −0.108 | 0.143 | −0.905 | 0.388 |

| Sector intensities | |||||

| gvcil | 439,807 | 0.310 | 0.102 | 0.082 | 0.713 |

| gvc_partnerjl | 439,807 | 0.312 | 0.282 | 0.013 | 1.000 |

| Interaction terms | |||||

| ipiit*gvcil | 439,807 | −0.037 | 0.046 | −0.316 | 0.128 |

| ipijt*gvc_partnerjl | 439,807 | −0.035 | 0.070 | −0.905 | 0.388 |

| work mobilityit*gvcil | 439,807 | −0.080 | 0.060 | −0.443 | 0.022 |

| retail mobilityjt*gvc partnerjl | 439,807 | −0.092 | 0.135 | −0.892 | 0.121 |

| Third‐country shocks | |||||

| competition shockijkt | 439,807 | −0.101 | 0.076 | −0.350 | 0.036 |

| upstream_shockilt | 433,772 | −0.097 | 0.083 | −0.284 | 0.034 |

| Control | |||||

| global outputmt | 439,807 | −0.101 | 0.087 | −0.514 | 0.008 |

TABLE A4.

Supply, demand and third‐country shocks and bilateral export growth, the role of sector characteristics, OLS regression results, one month lag on durable goods

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | work mobilityit *remoteik | 0.805 | 1.065 ** | ||

| (0.495) | (0.520) | ||||

| work mobilityi *gvcil | 2.955 *** | 3.135 *** | |||

| (0.774) | (0.779) | ||||

| Partner demand shock*sector characteristic | retail mobilityjt−1 *durablek | −0.408 *** | −0.404 *** | ||

| (0.090) | (0.091) | ||||

| retail mobilityjt *gvc partnerjl | −0.268 *** | −0.291 *** | |||

| (0.101) | (0.101) | ||||

| Third country supply shock | competition shockijkt | −0.063 | 0.038 | ||

| (0.256) | (0.270) | ||||

| upstream shockilt | 1.899 * | 2.389 ** | |||

| (0.996) | (1.003) | ||||

| global outputmt | 0.831 *** | 0.857 *** | 0.772 *** | 0.750 *** | |

| (0.154) | (0.164) | (0.164) | (0.172) | ||

| Constant | 0.961*** | 0.531*** | 0.793*** | 1.246*** | |

| (0.089) | (0.024) | (0.113) | (0.163) | ||

| Observations | 361,359 | 361,359 | 361,359 | 361,359 | |

| R‐squared | .469 | .469 | .469 | .469 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

TABLE A5.

The role of homogenous goods, OLS regression results

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | work mobilityit *remoteik | 1.077 *** | 1.187 *** | ||

| (0.398) | (0.397) | ||||

| work mobilityit *gvcil | 1.285 ** | 1.412 *** | |||

| (0.521) | (0.520) | ||||

| Partner demand shock*sector characteristic | retail mobilityjt *homog_conk | −0.402 *** | −0.321 *** | ||

| (0.064) | (0.070) | ||||

| retail mobilityjt *homog_libk | −0.336 *** | −0.252 *** | |||

| (0.060) | (0.065) | ||||

| retail mobilityjt *gvc partnerjk | −0.199 *** | −0.221 *** | −0.194 *** | −0.222 *** | |

| (0.073) | (0.074) | (0.073) | (0.074) | ||

| Third country supply shock | competition shockijkt | 0.338* | 0.306* | ||

| (0.180) | (0.179) | ||||

| upstream shockilt | 1.891 ** | 1.901 ** | |||

| (0.887) | (0.889) | ||||

| global outputmt | 0.865 *** | 0.829 *** | 0.912 *** | 0.862 *** | |

| (0.156) | (0.166) | (0.156) | (0.165) | ||

| Constant | 0.696*** | 1.118*** | 0.701*** | 1.142*** | |

| (0.019) | (0.105) | (0.019) | (0.105) | ||

| Observations | 496,295 | 496,295 | 496,295 | 496,295 | |

| R‐squared | .424 | .424 | .424 | .424 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends. The share of homogenous products traded on an organized exchange in a sector is based on the Rauch classification and serves as inverse measure of a sector's average share of differentiated products. We apply both a more conservative (homog_conk ) and a more liberal classification (homog_libk ) of homogenous products.

p < .01.

p < .05.

p < .1.

TABLE A6.

Supply, demand and third‐country shocks and bilateral export growth based on quantities, the role of sector characteristics, OLS regression results, EU countries

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growth_qijkt | growth_qijkt | growth_qijkt | growth_qijkt | ||

| Exporter supply shock*sector characteristic | work mobilityit *remoteik | 4.927 *** | 5.225 *** | ||

| (1.337) | (1.406) | ||||

| work mobilityit *gvcil | 0.849 | 1.358 | |||

| (1.782) | (1.797) | ||||

| Partner demand shock*sector characteristic | retail mobilityjt *durablek | 0.645 ** | 0.436 | ||

| (0.325) | (0.336) | ||||

| retail mobilityjt *gvc partnerjl | −0.723 ** | −0.763 *** | |||

| (0.288) | (0.289) | ||||

| Third country supply shock | competition shockijkt | −0.600 | 0.366 | ||

| (0.604) | (0.637) | ||||

| upstream shockilt | 5.659 * | 5.683 * | |||

| (3.115) | (3.149) | ||||

| global outputmt | 1.528 *** | 1.021 * | 1.258 ** | 0.789 | |

| (0.566) | (0.594) | (0.602) | (0.620) | ||

| Constant | 2.889 *** | 2.229 *** | 2.795 *** | 3.431 *** | |

| (0.197) | (0.068) | (0.291) | (0.388) | ||

| Observations | 446,472 | 446,472 | 446,472 | 446,472 | |

| R‐squared | .414 | .414 | .414 | .414 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | Yes | Yes | Yes | Yes | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

TABLE A7.

Supply, demand and third shocks and bilateral export growth, the role of sector characteristics, OLS regression results, February to June 2019

| Framework | Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|---|

| growthijkt | growthijkt | growthijkt | growthijkt | ||

| Exporter supply shock*sector characteristic | ipiit *remoteik | 0.892 | 0.849 | ||

| (1.307) | (1.329) | ||||

| ipiit *gvcil | 1.372 | 1.383 | |||

| (2.042) | (2.065) | ||||

| Partner demand shock*sector characteristic | ipijt *durablek | 0.247 | 0.298 | ||

| (0.456) | (0.465) | ||||

| ipijt *gvc partnerjl | 1.031** | 1.010** | |||

| (0.408) | (0.408) | ||||

| Third country supply shock | competition shockijkt | 1.545** | 1.590** | ||

| (0.744) | (0.756) | ||||

| upstream shockilt | −2.442 | −2.135 | |||

| (2.112) | (2.137) | ||||

| global outputmt | 0.604 | 0.616 | 0.564 | 0.599 | |

| (0.548) | (0.553) | (0.546) | (0.558) | ||

| Constant | 0.745*** | 0.752*** | 0.742*** | 0.721*** | |

| (0.017) | (0.010) | (0.014) | (0.022) | ||

| Observations | 504,038 | 504,038 | 504,038 | 504,038 | |

| R‐squared | .418 | .418 | .418 | .418 | |

| Exporter‐time FE | Yes | Yes | Yes | Yes | |

| Importer‐time FE | Yes | Yes | Yes | Yes | |

| Exporter‐partner‐sector FE | Yes | Yes | Yes | Yes | |

| Sector‐time FE | gvc_time | gvc_time | gvc_time | gvc_time | |

| Cluster | Exporter‐partner | Exporter‐partner | Exporter‐partner | Exporter‐partner |

Robust standard errors in parentheses. Sector‐time fixed effects control for unobserved effects affecting aggregated sectors over time (see Footnote 10). The variable global outputmt additionally controls for global sector‐time trends.

p < .01.

p < .05.

p < .1.

We are grateful to Cristina Constantinescu for help with the data and to Caroline Freund and seminar participants at the World Bank for valuable comments and suggestions. Errors are our responsibility only. Alvaro Espitia, Consultant, World Bank (aespitia@woldbank.org); Aaditya Mattoo, Chief Economist East Asia and Pacific, World Bank (amattoo@worldbank.org); Nadia Rocha, Senior Economist, World Bank (nrocha@worldbank.org); Michele Ruta, Lead Economist, World Bank (mruta@worldbank.org); Deborah Winkler, Senior Consultant, World Bank (dwinkler2@worldbank.org). The findings, interpretations and conclusions expressed in this paper are entirely those of the authors. They do not necessarily represent the views of the International Bank for Reconstruction and Development/World Bank and its affiliated organizations, or those of the Executive Directors of the World Bank or the governments they represent.

Funding information

This paper has benefited from support from the World Bank’s Umbrella Facility for Trade trust fund financed by the governments of the Netherlands, Norway, Sweden, Switzerland and the United Kingdom.

Footnotes

Studies using this framework have assessed the role of financial development (Beck, 2003; Manova, 2008), factor endowments (Romalis, 2004), institutions (Costinot, 2009; Levchenko, 2007; Nunn, 2007) and labour market flexibility (Cuñat & Melitz, 2012).

For example Rio‐Chanona et al. (2020) for the United States.

The model differs from CGE models as it assesses short‐term economic impacts of disasters over weeks or months, before production and trade have time to adjust, but does not aim to examine the economic cost.

Indeed, Chetty et al. (2020) find that, differently from spending behaviour in previous recessions, purchases of durable goods increased during COVID‐19, while consumption of in‐person (i.e., non‐tradable) services such as restaurants remained depressed due to the risk of infection.

Production disruptions could also have trade effects if firms can switch input suppliers. However, switching input suppliers is difficult in the short term, particularly when inputs are customized in GVCs. We therefore expect that a reshaping of value chains in response to a shock is a longer‐term process and is more difficult in the period considered in this paper. For an empirical analysis of longer‐term effects of natural disasters on GVomiurCs, see Freund, Mattoo, Mulabdic, Ruta (2020).

This is the most common approach in a sectoral bilateral gravity trade model setting since there are explanatory determinants of bilateral trade (like distance) that only vary by country‐pair. See, for example, Dai et al. (2014).

Mobility data are unavailable for 2019 which restricts us from computing annualized mobility changes.

The 28 exporting countries include all members of the European Union excluding Cyprus, Japan and the United States. While Chinese trade data are also available, the trade data are combined for January and February due to the Chinese New Year. As Google mobility data (our measure of the shock) are not available for China, our baseline regressions do not include China.

Trade growth data at the exporter‐partner‐sector level exceeding the top (99) percentile and those below the bottom (1) percentile of the distribution are set to the growth rates of these percentiles, respectively.

Following del Rio‐Chanona et al. (2020).

Durable consumer products correspond to BEC sector 61, semi‐durable consumer products correspond to BEC sector 62 and transport products correspond to BEC sectors 51 and 522.

Parts and components are defined as BEC sectors 111, 121, 21, 22, 42 and 53, as well as the Standard Industrial Classification Sector 65.

We prefer this measure over the imported input share of exports in the partner country because we are mainly interested in a sector's dependence on imported inputs, regardless of whether these are used in the partner country's export or domestic production.

That is, source countries are limited to 64 TiVA countries.

Rather than including work mobility separately in the regression, the production shock in the exporting country is captured by the exporter‐time fixed effect.

We cannot compute the total effect of the exporter shock on bilateral export growth accounting for differences in remote work because Equation (2) does not include the exporter shock individually, but controls for it using exporter‐time fixed effects. The total effect would be given as follows: (coefficient of exporter shock + β 1*remoteik ). We can, however, compare the differential impact at two selected points of the distribution in remote work (β 1*remoteik ). From Table 1, Column (4) we obtain β 1 = 1.587 which is multiplied with the remote work share at the first quartile of the distribution (Q1 = 31.4%) and again with remote work share at the third quartile of the distribution (Q3 = 43.5%). Taking the interquartile difference yields 1.587*(43.5%–31.4%) = 19.2%‐pts.

We compare the differential impact at the first and third quartile of the distribution in GVC participation (β 2*gvcil ). From Table 1, Column (4) we obtain β 2 = 1.564 which is multiplied with GVC participation at the first quartile of the distribution (Q1 = 24.4%) and again with GVC participation at the third quartile of the distribution (Q3 = 37.0%). Taking the interquartile difference yields 1.564*(37.0%–24.4%) = 19.7%‐pts.

From Table 2, Column (4) we obtain β 3 = 0.414 which is multiplied with 0% (for sectors where no underlying products are durable) and again with 100% (for sectors where all underlying products are durable). Taking the difference yields 0.414*(100%–0%) = 41.4%‐pts.

We compare the differential impact at the first and third quartile of the distribution in the partner's GVC participation (β 4*gvc partneril ). From Table 1, Column (4) we obtain β 4 = 0.234 which is multiplied with GVC participation at the first quartile of the distribution (Q1 = 7.4%) and again with GVC participation at the third quartile of the distribution (Q3 = 57.7%). Taking the interquartile difference yields 0.234*(57.7%–7.4%) = 11.8%‐pts.

Table A4 presents the comparison. We cannot rule out that the aggregation of January and February data is driving some of these differences.

Contributor Information

Michele Ruta, Email: mruta@worldbank.org.

Deborah Winkler, Email: dwinkler2@worldbank.org.

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available from the corresponding author upon reasonable request.

REFERENCES

- Baldwin, R. , & Tomiura, E. (2020). Thinking ahead about the trade impact of COVID‐19. In Baldwin R., & Weder di Mauro B. (Eds.), Economics in the time of COVID‐19. pp. 59–71. CEPR Press. [Google Scholar]

- Beck, T. (2003). Financial dependence and international trade. Review of International Economics, 11, 296–316. [Google Scholar]

- Bonadio, B. , Huo, Z. , Levchenko, A. , & Pandalai‐Nayar, N. (2020). Global supply chains in the pandemic (CEPR Discussion Paper, 14766). Retrieved from CEPR website: https://cepr.org/active/publications/discussion_papers/dp.php?dpno=14766 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Borin, A. , & Mancini, M. (2019). Measuring What Matters in Global Value Chains and Value‐Added Trade, Policy Research Paper 8804. Washington, DC: World Bank. [Google Scholar]

- Chetty, R. , Friedman, J. , Hendren, N. , & Stepner, M. (2020). How did COVID‐19 and stabilization policies affect spending and employment? A new real‐time economic tracker based on private sector data, mimeograph, Harvard University. [Google Scholar]

- Costinot, A. (2009). On the origins of comparative advantage. Journal of International Economics, 77, 255–264. [Google Scholar]

- Cuñat, A. , & Melitz, M. (2012). Volatility, labor market flexibility, and the pattern of comparative advantage. Journal of the European Economic Association, 10(2), 225–254. [Google Scholar]

- Dai, M. , Yotov, Y. , & Zylkin, T. (2014). On the trade‐diversion effects of free trade agreements. Economics Letters, 122, 321–325. [Google Scholar]

- del Rio‐Chanona, R. M. , Mealy, P. , Pichler, A. , Lafond, F. , & Farmer, J. D. (2020). Supply and demand shocks in the COVID‐19 pandemic: An industry and occupation perspective. Covid Economics, 6, 65–104. [Google Scholar]

- Eppinger, P. , Felbermayr, G. , Krebs, O. , & Kukharskyy, B. (2020). Covid‐19 shocking global value chains (CESifo Working Paper Series 8572, CESifo). Retrieved from CESifo website: https://www.cesifo.org/en/publikationen/2020/working-paper/covid-19-shocking-global-value-chains [Google Scholar]

- European Commission (2020). The impact of the Covid‐19 pandemic on global and EU trade, Chief Economist Team, DG Trade, 27 May 2020. [Google Scholar]

- Fernandes, A. , Paunov, C. , & Bas, M. (2020). The resilience of trade to COVID‐19, Work in progress, World Bank. [Google Scholar]

- Freund, C. , Mattoo, A. , Mulabdic, A. , & Ruta, M. (2020). Natural disasters and the reconfiguration of global value chains, Work in progress, World Bank. [Google Scholar]

- Gerschel, E. , Martinez, A. , & Méjean, I. (2020). Propagation of shocks in global value chains: The coronavirus case. IPP Policy Briefs, 53. https://www.ipp.eu/en/publication/march-2020-propagation-shocks-global-value-chains-coronavirus-covid19/ [Google Scholar]