Abstract

In this paper, we employ a combination of time regression discontinuity design method (T‐RD) and the difference‐in‐difference method (DID) to identify and quantify the causal effects of the strict lockdown policy on vegetable prices using multiple‐year daily price data from 151 wholesale markets of Chinese cabbage. We find that the lockdown policy caused a large and immediate surge in price and price dispersion of Chinese cabbage, though they fluctuated smoothly for the same period in normal years. The DID results further show that the price surge peaked in the fourth week of lockdown but gradually came down to the level of a normal year by week 11. However, the price rose again (though to a much smaller extent) in response to the resurgence of COVID‐19 in a few provinces in early‐mid April but quickly returned to the normal level in week 15 when the lockdown measures were largely removed. We also find that the supply chain disruption is the driving factor for the price hike. Policy implications are drawn.

Keywords: China, Chinese cabbage, COVID‐19, nationwide lockdowns, price dispersion, time regression discontinuity design, vegetable price, wholesale markets

JEL codes: H12, I18, Q11, Q18

With more than 97.8 million confirmed cases and over 2.1 million deaths worldwide by January 25, 2021, 1 the COVID‐19 pandemic has undoubtedly been the biggest health crisis in modern history. To contain the spread of the virus, many countries have implemented lockdowns and widespread shelter‐in‐place orders (Fang, Wang, and Yang 2020; Yap et al. 2020). In the absence of vaccines and therapeutics, these stringent measures not only are the necessary tools to minimize deaths and health damages caused by the virus but have also been shown to be effective in containing the spread of the virus in China and many other countries (Fang, Wang, and Yang 2020; Kraemer et al. 2020; Mohammad and Khan 2020). However, the economic costs of these measures could be exorbitant (Andersen et al. 2020; Baek et al. 2020; Chen et al. 2020; Coibion, Gorodnichenko, and Weber 2020a; Coibion, Gorodnichenko, and Weber 2020b). The global economy is projected to contract sharply by 3% in 2020, and the level of GDP at the end of 2021 is expected to remain below the pre‐virus baseline globally (IMF 2020).

Although the lockdown measures have had a profound impact on every aspect of the economy, how these measures affect food security is one of the top concerns of policy makers and scholars (Arndt et al. 2020; Devereux, Béné, and Hoddinott 2020; Harris et al. 2020; Laborde et al. 2020; Reardon et al. 2020). The past literature has shown that the outbreak of a severe infectious disease is often accompanied by a food crisis (Tse et al. 2006; Kuwonu 2014). Several recent studies conceptualize the potential effects of the COVID‐19 and lockdowns on food security (Cullen 2020; Devereux, Béné, and Hoddinott 2020; Reardon et al. 2020). They posit that the lockdowns would pose a full range of threats to food security, such as reduction in production, disruption of the food supply chain, restrictive trade flow, and reduced dietary options. In the meantime, a large number of empirical studies have shown overwhelming evidence to support the negative effects of COVID‐19 and the lockdown measures on food security (Abdul 2020; Akter 2020; Fan, Si, and Zhang 2020; Harris et al. 2020; Matsungo and Chopera 2020; Zhang et al. 2020a, 2020c.

The disruption of the food supply chain caused by the lockdown measures are expected to result in higher food prices that could further aggravate the food insecurity concern. Weinberg and Bakker (2014) argue that food price is the most important measure of individual well‐being and provides a more accurate assessment of food scarcity than any other indicators. High food prices are also found to cause social unrests (Bellemare 2015), extreme and moderate poverty, nutritional deficiency and psychosocial stress, and the decline of social capital (Headey and Fan 2008; Hadley et al. 2012; Ferreira et al. 2013). Beyond the immediate impact of higher food prices on the cost of the food purchased by households, there is evidence that higher overall price inflation hurts the poor the most (Easterly and Fischer 2001; Wodon and Zaman 2008; Chen et al. 2020; Fan, Si, and Zhang 2020; Siche 2020). The price theory implies that a distorted high price and/or high price variation over space are key indicators of market inefficiency (Jensen 2007; Aker 2010).

The importance of food price noted earlier and the increasing anecdotal evidence on the rising prices of food items in response to the lockdown measures have motivated an emerging (but still limited) number of studies to empirically investigate the effects of lockdowns on food prices (Abdul 2020; Akter 2020; Cullen 2020; Narayanan and Saha 2020; Rude 2020; Wang et al. 2020; Yu et al. 2020; Zhang et al. 2020c). Several important findings emerge from these studies. First, the lockdown measures have consistently increased food prices with considerable variation in the degree of increase. For example, Rude (2020) finds a 40% increase in food price, whereas Narayanan and Saha (2020) show a more moderate increase of 20%. Second, the effects of lockdowns on food price show considerable heterogeneity across types of food commodities. The price hike is generally more pronounced in perishable commodities, such as meat, fruits, and vegetables, which are more income elastic in demand and require a large amount of labor to produce (Cullen 2020; Richards and Rickard 2020; Yu et al. 2020; Zhang et al. 2020c). Notably, Yu et al. (2020) posit that although pork and vegetables experienced a noticeable price hike, wheat and rice experienced no significant price change. Third, some studies also show considerable increase in price variability in response to the lockdowns (Yu et al. 2020).

Although these studies give insights into our understanding of the lockdown measures on food prices, they also suffer from several empirical and data limitations, making rigorous quantification of the lockdown effects on food prices difficult and findings of limited policy use. First, the number of studies is disproportionately small compared to the vast number of countries severely affected by the virus. Second, except for Akter (2020) and Yu et al. (2020), results in most studies are based on descriptive analysis. Third, the sample sizes used in these studies are typically small. For example, Akter (2020) used monthly price data of vegetables from thirty countries for 10 months, whereas Yu et al. (2020) used time‐series data on food price index data from four Chinese regions. Finally, although the potential mechanisms triggering the price hike were discussed in many of these papers, none of the studies empirically tested these mechanisms.

We aim to fill some of these gaps by evaluating the effects of lockdown measures on vegetable prices using multiple‐year daily price data from 151 vegetable wholesale markets in China. We focus our analysis on vegetables for two important reasons. First, as noted earlier, the perishability and seasonality of vegetables make vegetable prices more susceptible to exogeneous shocks, such as emergencies, climate change, and natural disasters, compared with grain crops (Bellemare 2015). Second, vegetable industry is the second largest crop industry in China with a total planting area of 20.4 million hectares and a total output of 703.5 million metric tons and a per capita occupancy of 504 kg. The annual sale of vegetables in China accounts for as much as 50% of the world's total volume (Zhang et al. 2020a). The vegetable industry in China not only has a special position in diet structure of China's urban and rural residents but also plays a significant role in generating income and employment for rural residents.

We further narrow our study down to Chinese cabbage (one of the most important leafy vegetables in China) because data for other vegetables are not available to us. The annual sown area of Chinese cabbage is about 40 million mu, accounting for 14% of the total sown area of vegetables in China. The production is more than 100 million tons, accounting for about 18% of the total vegetable production and a per capita occupancy of over 75 kg. 2 Chinese cabbage also shares similar characteristics with a large majority of green leafy vegetables in terms of perishability, storability, and nutrition. Therefore, we posit that Chinese cabbage is a good representation of the general category of the green leafy vegetables.

Time‐regression discontinuity (T‐RD) design is employed to causally attribute changes in the level and dispersion of vegetable prices to the strict lockdown measures. In the T‐RD design, a comparison of average price immediately before and after the announcement of the nationwide lockdown policy identifies discontinuous changes in price at the time of the lockdown. The T‐RD results show that lockdown measures led to an immediate surge of the Chinese cabbage price by approximately 46%, whereas the price movement followed a smooth pattern for the same period in any of the normal years (2017–2019). The main results are robust to different specifications of time trend polynomial and the difference‐in‐difference (DID) strategy. The DID results further show that the price peaked around week 4 after the implementation of the lockdown policy. It then started to decline when most of provinces lowered the level of lockdown measures. The resurgence of COVID‐19 in a few provinces in early‐mid April caused the price to go up again. However, the price hike during that period (weeks 11–13) was more moderate and short lived, and the price returned to the level of that in a normal year by week 15.

The results from mechanism analysis show that the supply chain interruption is the main driver for the vegetable prices to increase. The supporting evidence for this argument includes a rapid surge in price dispersion (as a signal for market disintegration), the immediate slump in the labor mobility intensity and freight volume following the announcement of the nationwide lockdown measures, and the fact that the price surge was more pronounced in vegetable‐importing areas than in vegetable‐producing areas.

The overall goal of this study is, therefore, to investigate the causal effects of one of the stringent lockdown measures on vegetable prices, as well as price dispersion, and identify the underlying mechanisms. The results of the study are important to guide the design of complementary policy measures to mitigate the negative effects of lockdown measures on the level and variability of food prices. As the COVID‐19 pandemic is still ravaging a large number of countries in the world, our findings that stringent lockdowns, though effective in containing the spread of virus, also caused a quantitatively large increase in the level and dispersion of vegetable prices have important implications for those countries (especially for those developing countries where poor residents are likely to suffer disproportionately more from the price hike and price variability of agricultural commodities) in designing strategies to cope with the ongoing or future pandemics.

The next few sections are arranged as the following. Section 2 discusses the background with focus on the timing of lockdown measures and the implication for identification, and the potential mechanisms triggering the effects of lockdown measures on vegetable prices. Section 3 presents data and identification strategies. Section 4 presents the main results, robustness checks, heterogeneity analysis, and DID estimation. Section 5 investigates the mechanisms, and finally Section 6 concludes with some policy implications.

Background

Lockdown Response to COVID‐19

COVID‐19 is a disease caused by severe acute respiratory syndrome coronavirus 2 (SARS‐CoV‐2), first identified in Wuhan, China, in December 2019. This highly infectious virus has since become the global pandemic that has already caused more than 1.9 million deaths and infected more than 90.7 million people (WTO 2020). On January 23, 2020, Wuhan implemented a citywide lockdown to control the spread of the virus. Similar measures were immediately adopted by other provinces. On January 25, China's central government published a nationwide traffic blockage and quarantine policy (Li et al. 2020). By January 29, all thirty‐one provinces adopted lockdown measures to interrupt the spread of virus between provinces and within province as well. 3 Except for essential hospitals and public health offices, almost all factories and businesses were closed, people were ordered to shelter in place to avoid the virus infection. These are the most stringent and widespread disease control measures that have ever been practiced in China's modern history.

The lockdown measures adopted by the central and local governments have been effective in restricting the human mobility and curbing the spread of the virus (Fang, Wang, and Yang 2020; Kraemer et al. 2020). On February 3, traffic and delivery industry started to recover, and ten provinces announced work resumption, and by February 10, thirty provinces (except for Hubei, the origin of the outbreak of the virus) resumed work and loosened mobility restrictions (Chen et al. 2020). Traffic and delivery industry started to recover. In late February, many provincial governments started to lower their emergency response levels. By March 4, twenty‐one provinces lowered their emergency responses from the first level to the second level. On March 19, no new locally transmitted cases of COVID‐19 in the whole country were reported, including Wuhan. The National Development and Reform Commission said on March 21 that it would promote the restoration of normal traffic order. The lockdown measures were lifted in Hubei province except for Wuhan on March 25 and then including Wuhan on April 8 (Xu, Wu, and Cao 2020; Zhang et al. 2020c). The number of confirmed cases resurged in several provinces, such as Heilongjiang, Neimenggu, and Shanxi during early‐mid April, 4 and by the end of April, the resurgence was largely under control.

A couple of key time points are worth highlighting because they have significant implications on our design of empirical analysis. The first time point is January 23, the first day when the lockdowns were implemented in Wuhan city, Hubei province. The second time point is January 29, when all thirty‐one provinces enforced the nationwide lockdown measures. Our aim is to evaluate the impact of the nationwide lockdown policy on vegetable prices, so January 29 (the first day of the nationwide lockdown) is the policy cutoff point. Any time after January 29 is the after‐policy period and any time before would be the before‐policy period. We exclude the period between January 23 and January 28 because the lockdown policy was adopted by some provinces during that period and that it cannot be a valid control. 5

How Do Lockdown Measures Affect the Vegetable Prices?

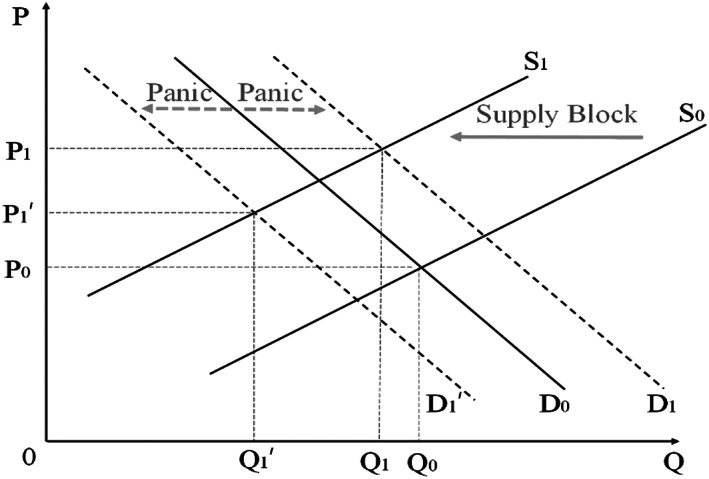

The equilibrium market price of Chinese cabbage is determined by the supply and demand of the vegetable in the market. Any factors that could affect either the supply or the demand of Chinese cabbage would affect Chinese cabbage price. In the literature, it is commonly discussed that lockdown measures affect both the supply and the demand of food items (Goddard 2020; Hailu 2020; Hobbs 2020; Yu et al. 2020; Zhang et al. 2020b). On the supply side, lockdowns may cause the reduction of vegetable production due to reduced labor activities in response to the lockdown and shelter‐in‐place orders. Additionally, provincial lockdown measures impose very stringent restrictions on food transportation from producers to the markets and from one market to another market. The high‐value perishable commodities are likely to be affected the most by the lockdown measures (Zhang et al. 2020c). Either the reduction of production or the disruption of supply chain could cause vegetable prices to go up. On the demand side, the outbreak of COVID‐19 crisis could cause social panic, and in some scenarios consumers may hoard food, leading to a vicious cycle to hike food prices (Vercammen 2020; Yu et al. 2020). Uncertainty about the future and limited information cause abnormal behaviors of consumers and lead to limited food availability in the market (Xu and Sattar 2020). Mixed news with pictures of empty shelves, circulating on social media, contributes to a nervous atmosphere of panic buying, thus sharply increasing market prices (Devereux, Béné, and Hoddinott 2020). However, for fresh and perishable vegetables, the panic and hoarding behaviors may cause the vegetable prices to decline due to the potential substitution effects between fresh vegetables and other nonperishable food items (Richards and Rickard 2020). Therefore, the net effects of the panic and food hoarding behaviors are not clear.

The supply‐side effects due to the disruption of supply chain and the demand‐side effect caused by the panic buying behaviors can be shown in a simple graph where the equilibrium price and quantity of vegetables are determined by the aggregate demand and the aggregate supply curves (figure 1). First, the limited labor activities and traffic restrictions caused a severe disruption in the supply of vegetables to consumers, driving the supply curve to move inward from S0 to S1. Second, on the demand side, uncertainty about whether the deadly and extremely infectious virus would be controlled or not caused panic buying behaviors, resulting in an increase in demand for food in the early period and the ensuing shift of the demand curve outward. However, conversely, the panic buying behaviors could reduce the demand for perishable fresh vegetables and their prices due to the substitution toward nonperishable food items instead. The net effect of panic buying and hoarding behaviors could either shift the demand curve from D0 outward to D1 or inward to D1', depending on the two competing effects of panic buying behaviors.

Figure 1.

Possible channels for the lockdown policy to affect vegetable prices

The net effects of lockdown measures on vegetable prices will be determined by the slopes of the supply and demand curves and whether the demand curve is shifted inward or outward. Given the elastic nature of the perishable commodities such as Chinese cabbage, we hypothesize that the lockdown policy has a substantial effect on its price, and the supply chain disruption is the main driver for the price change. Also, this will be a testable hypothesis of our study. In our empirical analysis, we will first evaluate the effect of lockdown measures on price change, then we will test the underlying channels with focus on the supply chain disruption.

Data and Empirical Strategy

Data

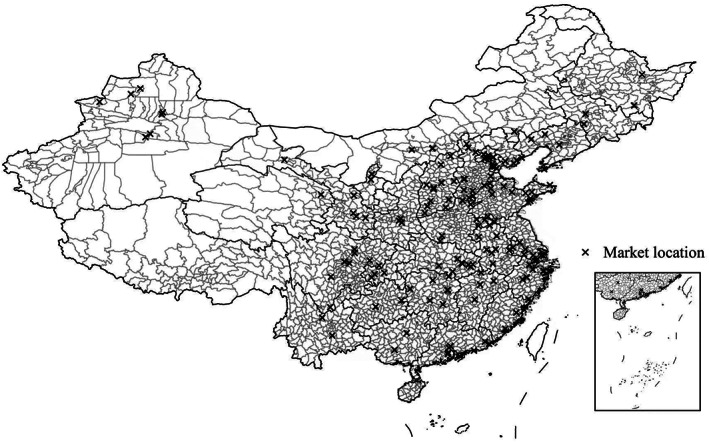

The data used for this study are from three different sources. The price and market information data were collected from the National Agricultural Products Price Database using web crawling method. 6 The authors acquired the daily Chinese cabbage price data from 151 Chinese wholesale markets from December 1 to May 7 for 2020 and the previous two years. We divided the entire period into twenty‐three weeks (eight weeks before and fifteen weeks after the implementation of the nationwide lockdown policy, i.e., January 29, 2020). The 151 wholesale markets include the country's major wholesale markets of Chinese cabbage, with the exception of just a few with poor digitalization facility. Figure 2 shows the distribution of the 151 wholesale markets across the country. They cover twenty‐seven major provinces except for four remote inner provinces. We also collected the daily price data for the same period from 2018 to 2019 to serve as the control or placebo groups. We adopt the lunar calendar (instead of the regular calendar) to match the time periods across years for two reasons. First, the lockdowns occurred during the Spring Festival, which is the most important national holiday (like Christmas in USA). Matching time periods by lunar calendar allows us to control holiday effects on vegetable prices. Second, the sowing time of Chinese cabbage is based on the solar terms of the lunar calendar; matching the treatment group and the control groups by lunar calendar allows to control for additional seasonality effects.

Figure 2.

Distribution of the 151 wholesale markets

To estimate the heterogenous effects of lockdown on cabbage price and the mechanisms of supply block, we assemble data on the various levels of prevention and control measures in different cities from Fang, Wang, and Yang (2020), city‐level data on daily infected cases and daily within‐city movement intensity from Harvard, 7 as well as transport data from Ministry of Transport of the People's Republic of China. 8

Empirical Strategy: Time RD Design

We employ a parametric T‐RD design to identify any short‐run, discontinuous change in price level as a result of the nationwide first‐level lockdown in the outbreak of COVID‐19. 9 Specifically, the T‐RD design of parametric estimation is shown in equation (1):

| (1) |

where ln(Price i,t ) is logarithm of Chinese cabbage price in wholesale market i at time t; After is a dummy equal to one if time is post nationwide first‐level lockdown, that is after January 29, and zero otherwise; 10 λ i and γ mon indicate market fixed effects (FEs) and monthly time fixed effects (FEs), respectively, and the interaction term between market FEs and time FEs is also included. f(time) contains the polynomial time trend to flexibly control for time series variation in vegetable price that would have occurred in the absence of the lockdown, which would also pick up the smooth changes in vegetable price due to changes in agriculture market and other factors that take effect slowly over time (Hahn, Todd, and Wilbert 2001). We also include the interaction term After* f(time) to allow the time trend in vegetable price to differ on either side of the lockdown date. Including market FEs takes care of time‐invariant, market‐specific factors, such as geographic accessibility, climatic conditions, agro‐ecological conditions, and agriculture production potential. Monthly time FEs capture time‐related factors such as weather conditions and agricultural seasons. Finally, the interaction term between month FEs and district FEs would account for the intra‐annual district‐specific factors. Our coefficient of interest, β 1 , estimates the reduced form effect of the nationwide lockdown policy on vegetable price.

The appeal of RD design is derived from its close proximity to the randomized controlled trial (RCT), described as a “local randomized experiment” (Lee and Lemieux 2010). The intuition behind our identification strategy is straightforward. The key assumption is that the only reason for vegetable price to discontinuously change on the day of nationwide lockdown is the lockdown policy itself (Chen and Whalley 2012). By flexibly controlling for nonlinearities in vegetable price from other factors using the polynomial time trends, we are able to isolate the change in vegetable price solely due to the first‐level nationwide lockdown policy to COVID‐19.

Estimation Results

Results of T‐RD Estimates

The identification assumption of T‐RD designs is violated if there is self‐selection at the cutoff (Hausman and Rapson 2017). The violation is unlikely to be the case for this emergency event. It is reported that COVID‐19 can be carried by person and spread in a rapid speed. Each province implemented the first‐level lockdown policy immediately within one week after the outbreak of the virus. All the wholesale markets across the country are affected by the policy simultaneously; therefore the selection problem associated with the timing of the treatment does not arise. Furthermore, measures and supervisions were carried out strictly by governments at all levels to ensure that the rules of lockdown were enforced without exception.

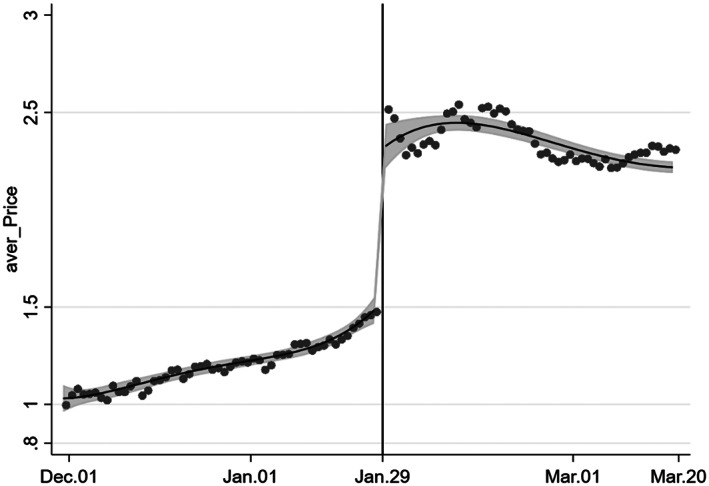

In an RD estimation, graphical analyses play an important role in visually quantifying the magnitudes of the treatment effects (Ito 2015). Figure 3 presents a graphical analysis of the T‐RD estimation based on equation (1) with a fourth‐order polynomial of time trend, using Chinese cabbage price data from the nationwide wholesale markets. There is a clear discontinuous jump in price at the cutoff point. It shows visual evidence that the nationwide lockdown caused a significant and sharp increase in the price of Chinese cabbage.

Figure 3.

Discontinuity in Chinese cabbage price. Notes: The solid line shows the fit of fourth‐order polynomial T‐RD estimation and the shaded areas are the 95 percent confidence intervals. The results are robust to the lower orders of polynomial specifications.

Table 1 presents the T‐RD estimates for the effect of lockdown on the price of Chinese cabbage. In columns 1–4, different orders of time trend are added into the equation so that we can check for the robustness of the results. Each column includes market FEs, month FEs, and the interaction of market FEs and month FEs, and each equation is estimated using the best bandwidth using codes developed by Calonico, Cattaneo, and Titiunik (2014). Finally, the standard errors are clustered at the market level. As shown in table 1, using different polynomials barely change the level of significance (consistently at 1% level) and the magnitude of the key coefficient of interest, β 1 . The emergent lockdown policy led to the price surge of Chinese cabbage by 45.9%–47.7%. The AIC and BIC criteria indicate that the estimation with fourth‐order polynomial of time trend performs the best.

TABLE 1.

Impacts of the nationwide lockdown on Chinese cabbage price: T‐RD estimates

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| After | 0.473 *** | 0.477 *** | 0.459 *** | 0.477 *** |

| (11.08) | (9.71) | (9.33) | (9.16) | |

| Time | 0.0154 *** | 0.0244 *** | 0.0272 *** | 0.0289 *** |

| (6.48) | (4.47) | (4.26) | (3.36) | |

| After×Time | −0.00686 | −0.0306 ** | −0.0200 | −0.0382 * |

| (−1.36) | (−2.27) | (−1.25) | (−1.90) | |

| Time 2 | 0.000810 ** | 0.00138 ** | 0.00178 * | |

| (2.42) | (2.45) | (1.68) | ||

| After×Time 2 | 0.000335 | −0.000856 | 0.00111 | |

| (0.44) | (−0.68) | (0.51) | ||

| Time 3 | 0.0000301 * | 0.0000619 | ||

| (1.96) | (1.22) | |||

| After×Time 3 | −0.0000581 * | −0.000217 ** | ||

| (−1.81) | (−2.40) | |||

| Time 4 | 0.000000822 | |||

| (1.03) | ||||

| After×Time 4 | 0.00000145 | |||

| (0.99) | ||||

| Constant | 0.384 *** | 0.346 *** | 0.297 *** | 0.294 *** |

| (26.87) | (17.90) | (13.65) | (12.06) | |

| Market FEs | Yes | Yes | Yes | Yes |

| Month FEs | Yes | Yes | Yes | Yes |

| Market×Month FEs | Yes | Yes | Yes | Yes |

| AIC | −2087.27 | −2756.46 | −5007.05 | −7054.98 |

| BIC | −2070.41 | −2727.08 | −4962.06 | −6994.16 |

| Best bandwidth | 21.30 | 27.18 | 44.32 | 60.88 |

| Effective N | 2041 | 2633 | 4572 | 6363 |

| adj. R 2 | 0.863 | 0.877 | 0.898 | 0.903 |

Notes: This table presents the T‐RD estimates of the ATEs of nationwide lockdown on Chinese cabbage price. Under the different specifications with different orders of polynomial, the best bandwidth is calculated using MSE‐optimal bandwidth selector for the RD treatment effect estimator (MSERD). Standard errors are clustered at market level and t statistics are in parentheses.

= p < 0.1.

= p < 0.05.

= p < 0.01.

Robustness of the T‐RD Estimates

In general, there are three fundamental challenges in evaluating an unbiased effect of the treatment using the T‐RD framework, particularly in applications where time is the running variable and the treatment begins at a particular threshold in time (Hausman and Rapson 2017). In this section, we describe these challenges in detail and show the robustness of our main findings.

First, the choice of time window is important as a local randomization interpretation of the T‐RD design is valid within a small neighborhood around the threshold. The use of observations far from the threshold is a substantial conceptual departure from the identifying assumptions, and it can lead to bias resulting from unobservable confounders. Therefore, we use different choices of bandwidths to check if the estimated results are robust. Table 2 reports the estimates of β 1 with different bandwidths in columns 1 and 2 and different types of standard errors in panels A–C. The T‐RD estimates are highly robust to different bandwidth choices. The second potential pitfall in T‐RD implementation relates to its use of time‐series data, which are likely to show serial dependence. High‐frequency data, while allowing for more power, may be more likely to demonstrate qualitatively important autoregression (Hausman and Rapson 2017). To find out the true dynamic process, we include the lagged dependent variable in the basic T‐RD regression. The results reported in the Online Supplementary Appendix, table A1 show that estimates of the lockdown effect are similar to those in table 1, in terms of both the level of significance and the magnitude of effect when applied AR(1). Allowing for AR(2) by adding the second‐order lagged dependent variable only slightly reduced the coefficient of interest (from 0.45 to 0.36), but, overall, the magnitude of price surge remains large and significant. 11 Adding the lagged dependent variables to control for autocorrelation has been a common practice in the T‐RD literature (Chen and Whalley 2012; Lang and Siler 2013).

TABLE 2.

Impacts of the nationwide lockdown on Chinese cabbage price: T‐RD estimates with different bandwidth

| (1) | (2) | |

|---|---|---|

| Panel A | Conventional | |

| 0.445 *** | 0.543 *** | |

| (20.19) | (36.23) | |

| Panel B | Bias corrected | |

| 0.438 *** | 0.456 *** | |

| (19.84) | (30.38) | |

| Panel C | Robust | |

| 0.438 *** | 0.456 *** | |

| (11.95) | (19.03) | |

| Effective N | 3075 | 9562 |

| Bandwidth | 0.5 × Best Bandwidth | 1.5 × Best Bandwidth |

Notes: Each cell reports the coefficient of After from one regression with controls for market FE, month FE, the interaction, and a fourth‐order polynomial time trend. In each panel, the dependent variable is ln(Price) and the results are calculated with different types of standard errors. Columns 1 and 2 respectively choose 0.5 and 1.5 times the best bandwidth in column 4 of Table 1. t statistics are in parentheses.

* = p < 0.1.

** = p < 0.05.

= p < 0.01.

Third, it is still possible that some confounding factors that cannot be isolated from the estimates of T‐RD method, nevertheless. For example, days before and after the implementation of the lockdown policy may differ in ways that could affect the level of vegetable price, such as seasonal variation in supply and demand. Any such differences that smoothly change near the lockdown date will be absorbed by the flexible polynomial time trend and will not contribute to the bias. However, discontinuous changes in price on the lockdown date driven by unobservable factors could pose a threat to our identification strategy, such as Chinese Traditional Spring Festival.

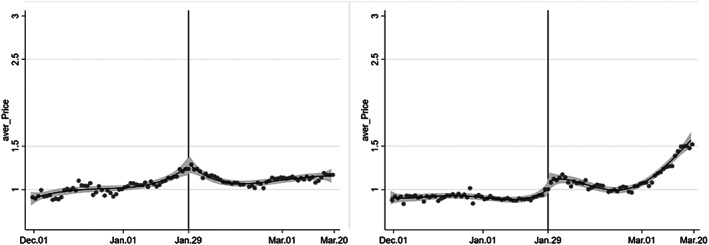

As it cannot be isolated using one‐year data, we applied additional data from 2018 to 2019 in the same time interval as in 2020 to test if there are any factors that contribute to the surge of vegetable prices on the date of lockdown implementation. As shown clearly in figure 4, there is no significant discontinuous jump at the cutoff date for these two years, which further validates our T‐RD results.

Figure 4.

Falsification test: Chinese cabbage price of 2018 and 2019. Notes: The solid line shows the fit of fourth‐order polynomial T‐RD estimation and the shaded areas are the 95 percent confidence intervals.

An alternative placebo test can be performed by moving the policy timing three weeks before or three weeks after the actual time when the nationwide lockdown policy was announced. 12 If the upsurge in price shown in figure 1 at the cutoff point or the significant price effects estimated in table 1 are caused by the policy change, then we would not expect a significant price change around these “artificial” cutoff points. The results of these alternative placebo tests are shown in Panel A of the Online Supplementary Appendix, table A2. The fact that the price difference around these artificial time cutoff points is not only small in magnitude but also insignificant in all the model specifications further validates our T‐RD results.

Heterogeneous Effects

The significant price increase caused by the virus and the nationwide lockdown measures identified so far represents the average effects across the entire sample. However, it is possible that the effects of the lockdown measures may vary by region. For example, the stringency of the lockdown measures in Wuhan and the other cities in Hubei is much higher compared with other provinces. Just as we expect the supply chain to be more disrupted in Hubei than in other provinces, so also the vegetable prices. If the supply chain disruption is the main channel through which the lockdown affects the price, we also expect that the vegetable‐producing provinces are less likely to be affected by the supply chain disruption compared to the vegetable‐importing provinces. Finally, we expect the effects of lockdown measures to have larger effects on areas that are more seriously affected by the virus because the lockdown measures in these areas are likely to be harsher. To explore the heterogeneity effects across these dimensions, we run the same T‐RD regressions across several different subsamples.

The results of the heterogeneity regressions shown in table 3 are largely consistent with our expectations. The price effect appears to be much larger for the wholesale markets located in Hubei cities than those located in other provinces (0.59 vs. 0.44). However, the estimated price effect in the Hubei sample is statistically insignificant, which is likely caused by the fact that the sample size in Hubei province is rather small (290 in Hubei vs. 10,581 for the rest of the country). The price increase in response to the lockdown measures is much higher for the wholesale markets located in provinces, such that much of the fresh vegetable is imported than those located in the key vegetable‐producing provinces. The lockdown measures caused the vegetable price to increase by 50% in the vegetable‐importing provinces versus 36.5% increase in the vegetable‐producing provinces. Finally, the price hike is much greater in the provinces with the number of confirmed cases above 100 at the time of lockdowns than in the provinces whose number of confirmed cases are below 100.

TABLE 3.

Heterogeneous effects of the lockdown policy on Chinese cabbage prices

| (1) Hubei province | (2) Non‐Hubei provinces | (3) Import provinces | (4) Producing provinces | (5) High case provinces | (6) Low case provinces | |

|---|---|---|---|---|---|---|

| Panel A | Conventional | |||||

| 0.594 | 0.438 *** | 0.496 *** | 0.365 *** | 0.532 *** | 0.421 *** | |

| (1.20) | (8.92) | (6.16) | (5.20) | (4.33) | (7.07) | |

| Panel B | Bias corrected | |||||

| 0.634 | 0.440 *** | 0.499 *** | 0.367 *** | 0.538 *** | 0.419 *** | |

| (1.28) | (8.96) | (6.19) | (5.22) | (4.37) | (7.04) | |

| Panel C | Robust | |||||

| 0.634 | 0.440 *** | 0.499 *** | 0.367 *** | 0.538 *** | 0.419 *** | |

| (1.18) | (8.27) | (5.85) | (4.93) | (4.00) | (6.67) | |

| Effective N | 290 | 10581 | 5383 | 5488 | 1690 | 9181 |

Notes: Each cell reports the coefficient of After from one regression with controls for market FE, month FE, the interaction, and a fourth‐order polynomial time trend. In each panel, the dependent variable is ln(Price) and the results are calculated with different types of standard errors. t statistics are in parentheses.

* = p < 0.1.

** = p < 0.05.

= p < 0.01.

Results of DID Strategy

DID Specification

Although we have shown that T‐RD strategy is a valid method to identify the immediate price surge in response to the nationwide lockdown measures, a key limitation of the T‐RD estimates is that it does not allow us to elucidate much about how the effects of the nationwide lockdown policy on vegetable price vary over time or respond to the relaxation or lift of the lockdown policy. In this section, we employ DID strategy to (a) show the robustness of the T‐RD results, and (b) explore how the estimated effect changes over time. More specifically, the DID estimation equation that allows us to examine the effects of lockdown measures on vegetable prices over time can be defined as follows:

| (2) |

where is the logarithm of average vegetable price of wholesale market i in week τ; I(Week i = τ) is a set of dummy variables representing the τ‐th week before and after the first‐level nationwide lockdown with ‘+’ and ‘‐’ signs after and before the nationwide lockdown, respectively. Week i = −1 represents the first week before the nationwide lockdown, Week i = 1 represents the first week after the national level response, and so on. Especially, Week i = 6 represents the week since the emergency response level was lowered in twenty‐one provinces and thirty‐one provinces in Week i = 15. Treat is a dummy variable (=1 if time window is from December 1, 2019 to May 7, 2020, and = 0 for the same time window in previous years); λ i is the market fixed effect. The intersection between δ prov and Treat controls for variables that may change in provinces across years, such as population, vegetable planting area, and GDP level. Another intersection term, λ i × Time, indicates different time trend of each wholesale market. The coefficient estimates of β τ s corresponding to all the negative τ (e.g., τ = −1… τ = −7) allow us to examine whether the parallel trend assumption for DID is satisfied, and the coefficient estimates of β τ s corresponding to all the positive τ (e.g., τ = 1… τ = 15) indicate week‐specific price effects in response to the lockdown policy.

Results from DID Estimation

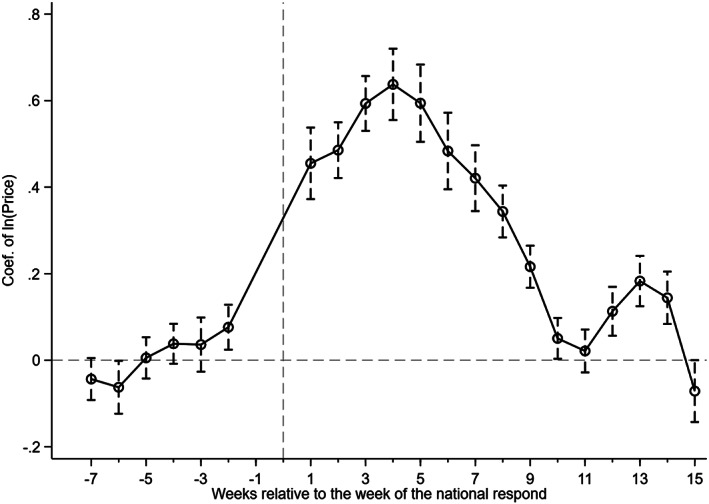

The DID results are shown in figure 5 and table 4. Although figure 5 is much easier to interpret visually, the magnitude of the price change is more clearly presented in table 4. We will present the results using the combination of figure 5 and table 4. First, the estimated coefficients for six of the seven prepolicy weeks (i.e., week −7, … week −2) are not significantly different from zero, 13 confirming that the parallel trend assumption is largely satisfied. Second, figure 5 clearly shows two episodes of price surges on the right side of the cutoff point. The first episode of price surge from week 1 to week 4 is the immediate price response (as identified by the T‐RD regression) to the implementation of the nationwide lockdown measures, whereas the second episode of price surge from week 11 to week 14 is a reaction to the resurgence of pandemic in a few provinces. The fact that the price response to the resurgence of the virus is much less remarkable compared to the initial lockdown policy is expected for two reasons: (a) the resurgence itself is more sporadic, less serious, and short‐lived and the associated control measures were less remarkable as well; and (b) people are more prepared and have learned how to better adapt to the situation. 14

Figure 5.

Weekly impacts of nationwide lockdown on Chinese cabbage price. Notes: The circles are point estimates of DID and the intervals are the 95 percent confidence intervals. The week before lockdown is excluded as baseline group.

TABLE 4.

Weekly impacts of nationwide lockdown on Chinese cabbage price: DID estimates

| (1) | (2) | (3) | |

|---|---|---|---|

| 1 week after | 0.460*** | 0.466*** | 0.455*** |

| (9.63) | (9.85) | (9.38) | |

| 2 weeks after | 0.496*** | 0.501*** | 0.486*** |

| (13.83) | (13.86) | (12.86) | |

| 3 weeks after | 0.604*** | 0.609*** | 0.593*** |

| (16.82) | (17.05) | (15.97) | |

| 4 weeks after | 0.649*** | 0.655*** | 0.638*** |

| (14.09) | (14.20) | (13.19) | |

| 5 weeks after | 0.607*** | 0.614*** | 0.594*** |

| (11.97) | (12.09) | (11.35) | |

| 6 weeks after | 0.497*** | 0.506*** | 0.484*** |

| (9.79) | (9.96) | (9.32) | |

| 7 weeks after | 0.434*** | 0.445*** | 0.421*** |

| (9.96) | (10.20) | (9.44) | |

| 8 weeks after | 0.358*** | 0.370*** | 0.344*** |

| (10.64) | (11.02) | (9.78) | |

| 9 weeks after | 0.233*** | 0.245*** | 0.216*** |

| (8.74) | (9.44) | (7.57) | |

| 10 weeks after | 0.070** | 0.081*** | 0.050* |

| (2.64) | (3.23) | (1.82) | |

| 11 weeks after | 0.042 | 0.053* | 0.021 |

| (1.54) | (1.96) | (0.74) | |

| 12 weeks after | 0.138*** | 0.150*** | 0.113*** |

| (4.34) | (4.78) | (3.41) | |

| 13 weeks after | 0.210*** | 0.222*** | 0.183*** |

| (6.36) | (7.02) | (5.37) | |

| 14 weeks after | 0.172*** | 0.185*** | 0.144*** |

| (4.92) | (5.47) | (4.06) | |

| 15 weeks after | −0.032 | −0.025 | −0.071 |

| (−0.85) | (−0.67) | (−1.70) | |

| Treat | 0.253*** | 0.246*** | 0.263*** |

| (6.92) | (6.59) | (6.92) | |

| Constant | −0.216*** | −0.241*** | −0.249*** |

| (−5.95) | (−11.75) | (−11.97) | |

| Market FEs | Yes | Yes | Yes |

| Week FEs | Yes | Yes | Yes |

| Province×Treat | No | Yes | Yes |

| Market×Time | No | No | Yes |

| Observations | 8,370 | 8,370 | 8,370 |

| R‐squared | 0.593 | 0.617 | 0.665 |

| Control group | 2017Dec.‐2018Mar. & | 2017Dec.‐2018Mar. & | 2017Dec.‐2018Mar. & |

| 2018Dec.‐2019Mar. | 2018Dec.‐2019Mar. | 2018Dec.‐2019Mar. |

Notes: This table presents the week‐by‐week DID impact of the nationwide lockdown on Chinese cabbage price. Dummy I(Week i = 0) is excluded as the baseline group, which refers to the week from January 16 to January 22. The coefficients for week = −1 to week = −7 were not reported for the brevity of the table. Standard errors are clustered at province level and t statistics are in parentheses.

= p < 0.1.

= p < 0.05.

= p < 0.01.

As regards the magnitude of effects, the price increase immediately after the lockdown was enforced is large (from 46% points increase in week 1 to 65% points increase in week 4) and statistically significant at 1% throughout, which is highly consistent with the T‐RD results. The price increase started to level off in week 5 and gradually came down week by week until week 11 when the price dropped to the level for the same period in a normal year. The price rose again from week 11 to week 13, the period when the number of confirmed cases resurged in a few provinces. Compared to the price surge in week 1, the price increase in the second episode of price surge is much smaller in magnitude (11%–15% point increase in week 12) and also much shorter lived. The price resurgence peaked in week 13 (18%–22% higher than the same period for a normal year) and then leveled off in week 14. By week 15, the price came down to the level of that in a normal year.

Mechanism Analysis

As discussed earlier, we posit that the main channel through which the lockdown measures affect vegetable prices is the disruption of the agricultural supply chain. In response to the lockdown and shelter‐in‐place orders, strict transportation control and delay of work have brought great challenges to the vegetable industry. The necessary seeds, seedlings, and other means of production for vegetable planting could not be met (Wang 2020; Zhou 2020). Restrictions on the movement of people led to misallocation of labor force. Owing to the implementation of traffic restrictions between markets, the products in the main vegetable‐producing areas cannot be exported in time, which leads to the problem of slow sales and wastage of vegetables, whereas the demand in the main vegetable‐selling areas could not be fulfilled, leading to higher prices. We investigate the disruption of supply chain caused by the lockdown measures in the following aspects.

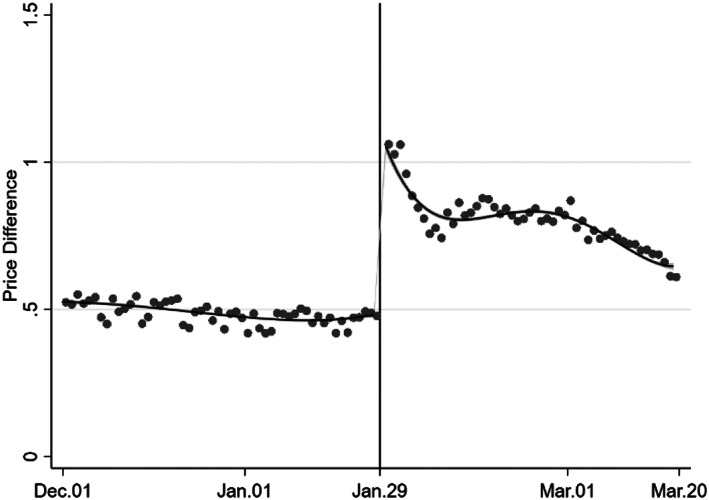

Price Disparity

If lockdown measures reduce the movement of goods across and within cities, then price dispersion between any two wholesale markets would arise as expected, when compared with normal time characterized by restriction‐free movement of people and goods. We apply the similar T‐RD design for price difference of market pairs to observe if there is a discontinuity at the cutoff. The T‐RD model can be specified as below:

| (3) |

where ln(Price_d ij,t ) is the logarithm of the absolute value of price difference between wholesale market i and wholesale market j (i ≠ j) at time t; η ij is market‐pair FEs; and all other variables are defined the same way as in equation (1). We use the absolute value of price difference between any two wholesale markets as our measure of price disparity, which is motivated by other influential studies in the literature (Jensen 2007; Aker 2010; Fuje 2019). 15 The total number of market‐paired price dispersions is 817,789.

Prior to reporting the T‐RD regression results, we first present the graphical analysis of the T‐RD results. Fourth‐order polynomial is again chosen based on the AIC and BIC criteria. The graphical analysis in figure 6 shows that the price dispersion between markets surged up immediately after the implement of nationwide lockdown policy and trended down afterward. This pattern of change reflects that governmental policies to ensure the supply of food to customers are effective to narrow the difference of price between markets. To check whether the significant jump in price dispersion after lockdowns were imposed was not caused by seasonality or traditional ceremonial events, we conduct a falsification analysis by applying T‐RD to the 2018 and 2019 data for the same time periods as in 2020. The results are shown in the Online Supplementary Appendix, figure A1. The fact that the price dispersion in the normal years (either 2018 or 2019) is flat at a relatively low level over the entire period and similar to the level in 2020 prior to the lockdown suggests that (a) the vegetable markets in China in normal time is highly efficient, and (b) the drastic jump in price dispersion is indeed caused by the supply chain disruption in response to the nationwide lockdown policy. 16

Figure 6.

Discontinuity in difference of Chinese cabbage price between markets. Notes: The solid line shows the fit of fourth‐order polynomial RD estimation based on equation (3) and the shaded areas are the 95 percent confidence intervals.

The T‐RD regression results presented in table 5 mimic the graphical results. More specifically, the lockdown policy caused price dispersion between a given pair of markets to almost double (82.9%–87.8%). The effects are statistically significant at 1% level throughout. The results are also robust to the choice of different bandwidths or standard errors methods (Online Supplementary Appendix, table A3). The statistically significant and large surge in price dispersion is convincing evidence that lockdowns caused serious disruption to the vegetable supply chain, resulting in the price surge of vegetable.

TABLE 5.

Impacts of nationwide lockdown on price dispersion (RD estimates) dependent variable: ln|Pi‐Pj|

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| After | 0.829 *** | 0.878 *** | 0.856 *** | 0.842 *** |

| (8.07) | (10.10) | (9.44) | (8.08) | |

| Time | −0.00614 | 0.00520 | 0.0233 | 0.0128 |

| (−0.42) | (0.35) | (1.54) | (0.53) | |

| After×Time | −0.0556 | −0.126 *** | −0.148 *** | −0.110 * |

| (−1.19) | (−3.54) | (−3.67) | (−1.81) | |

| Time 2 | −0.00158 | 0.000342 | −0.00274 | |

| (−1.00) | (0.15) | (−0.54) | ||

| After×Time 2 | 0.00879 ** | 0.00870 | 0.00556 | |

| (2.18) | (1.38) | (0.40) | ||

| Time 3 | −0.0000667 | −0.000414 | ||

| (−0.70) | (−1.01) | |||

| After×Time 3 | −0.0000937 | 0.000836 | ||

| (−0.41) | (0.92) | |||

| Time 4 | −0.0000132 | |||

| (−1.21) | ||||

| After×Time 4 | −0.00000565 | |||

| (−0.21) | ||||

| Constant | −1.216 *** | −1.254 *** | −1.218 *** | −1.204 *** |

| (−33.27) | (−37.45) | (−34.11) | (−29.53) | |

| Market‐pair FEs | Yes | Yes | Yes | Yes |

| Month FEs | Yes | Yes | Yes | Yes |

| Market×Month FEs | Yes | Yes | Yes | Yes |

| AIC | 63705.33 | 1.810e+05 | 3.279e+05 | 4.367e+05 |

| BIC | 63729.89 | 1.810e+05 | 3.280e+05 | 4.368e+05 |

| Best bandwidth | 7.55 | 16.29 | 29.72 | 36.21 |

| N | 26513 | 75288 | 136673 | 182763 |

| adj. R 2 | 0.259 | 0.246 | 0.237 | 0.241 |

Notes: The best bandwidth is calculated using MSE‐optimal bandwidth selector for the T‐RD treatment effect estimator (MSERD). Standard errors are clustered at the market level and t statistics are in parentheses.

= p < 0.1.

= p < 0.05.

= p < 0.01.

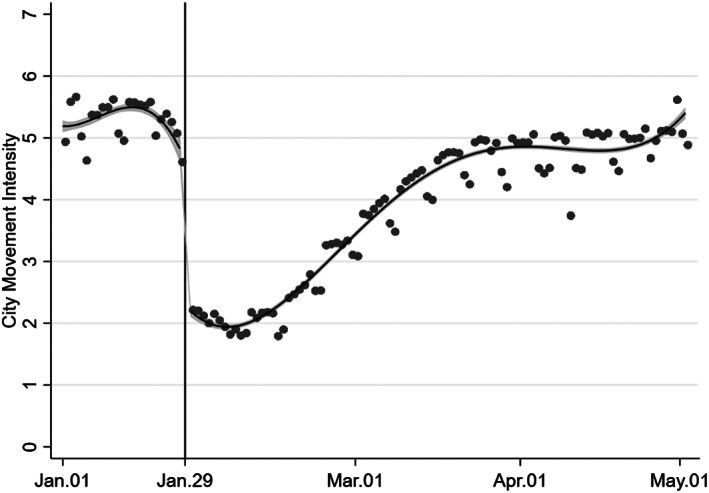

Disruption in Traffic Flow

The surge in price dispersion across markets caused by the lockdown measures is a clear indicator of supply chain disruption caused by the shutdown of roads and transportation. High dispersion indicates that the markets are more fragmented due to the disrupted flow of commodities across markets. To more directly examine the degree to which the traffic flow was affected by the lockdown measures, we use data on labor mobility intensity from Harvard and freight volume from Ministry of Transport of the People's Republic of China. 17

First, the graphical presentation of the T‐RD results on labor mobility intensity shows a drastic decline in labor mobility intensity immediately after the national lockdown measures were enforced (figure 7). This finding is consistent with our expectation that lockdown measures caused major traffic disruption and trade flow. Interestingly, the trend of labor mobility intensity is almost the reverse trend of the vegetable price. For example, the labor mobility intensity experienced a drastic fall immediately after the lockdown measures were enforced and reached the lowest level in a few weeks, around the same period when the vegetable price peaked. Also, the labor mobility intensity declined slightly again in early‐mid April in response to the resurgence of COVID‐19 in a few provinces, while the vegetable price resurged during the same period. In May, both the vegetable price and the human mobility intensity recovered to normal levels. This evidence is consistent with the disruption of traffic and trade flows.

Figure 7.

Discontinuity in labor mobility intensity between cities. Notes: The solid line shows the fit of fourth‐order polynomial T‐RD estimation and the shaded areas are the 95 percent confidence intervals.

A regression analysis was further conducted to help understand the relationship between the change in labor mobility intensity and the change in vegetable prices between 2020 and the previous years. The results are shown in table 6. The coefficient of interest is the coefficient of the interaction term between treat (=1 for 2020, 0 previous years) and labor mobility intensity. The negative and significant coefficients for the interaction term across columns (row 1) confirm that the labor mobility intensity and the vegetable price moved in the opposite direction from January 29 to May 1. This finding further confirms that the traffic disruption associated with the lockdown measures is the primary reason for the low labor mobility and high vegetable prices and price disparity.

TABLE 6.

Association between labor mobility intensity and Chinese cabbage price

| (1) | (2) | (3) | |

|---|---|---|---|

| Treat×Labor Mobility Intensity | −0.120*** | −0.139*** | −0.138*** |

| (−11.62) | (−14.66) | (−14.18) | |

| Treat | 1.067*** | 1.301*** | 1.277*** |

| (19.72) | (13.54) | (12.59) | |

| Labor Mobility Intensity | 0.032** | 0.041*** | 0.038*** |

| (2.29) | (2.90) | (3.66) | |

| Constant | 0.016 | −0.033 | 0.023 |

| (0.29) | (−0.70) | (0.51) | |

| Market FEs | Yes | Yes | Yes |

| Day FEs | Yes | Yes | Yes |

| Province×Treat | No | Yes | Yes |

| Market×Time | No | No | Yes |

| Observations | 27,927 | 27,927 | 27,927 |

| R‐squared | 0.553 | 0.607 | 0.661 |

| Control Group | 2018 Jan. ‐2018 May & | 2018 Jan. ‐2018 May & | 2018 Jan. ‐2018 May & |

| 2019 Jan. ‐2019 May | 2019 Jan. ‐2019 May | 2019 Jan. ‐2019 May |

Notes: The time window of observations is from January 29 to May 1. Standard errors are clustered at the market level and t statistics are in parentheses.

* = p < 0.01.

= p < 0.05.

= p < 0.01.

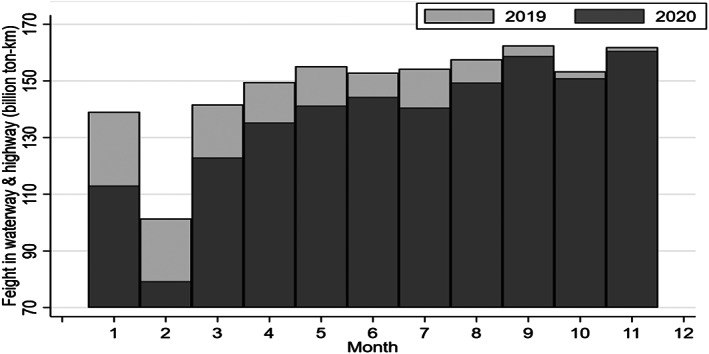

The freight volume is a direct indicator of the traffic flow of goods. The data on freight volume include the goods transported through road networks and that through the water networks. Unfortunately, we only have monthly data by province, making more nuanced changes within each month difficult to determine. Figure 8 demonstrates two important facts. First, in a normal year (2019), the freight volume is the least in the month of February because of the Spring Festival Holiday, then it moves up all the way until November/December. The shipment of goods slows down in January as the biggest holiday of the year approaches. Second, we find a substantial decline in the freight volume since January 2020 (18.7%, 21.8%, 13.4% in January, February, and March, respectively), which suggests a severe disruption of supply chains. Although we do not have separate data on the volume of perishable vegetable shipment, we expect the disruption of fresh vegetable supply chain to be aggravated, as suggested by the average figure.

Figure 8.

Monthly freight volume in 2020 and 2019 by province. Notes: The value of the vertical axis starts from 70 instead of zero.

A simple DID regression was run to explore the relationship between the shock in freight volume (measured by the difference in freight volume between 2020 and 2019) and the price in 2020 relative to the prices in normal years. The DID results are shown in table 7. The negative and significant coefficient on the interaction terms between the freight volume and the treat (=1 for 2020, 0 previous years) across the columns suggests that the change in freight volume and vegetable price is negatively correlated. Put differently, a drastic drop in freight volume caused by the lockdown measures is expected to cause the price to go up.

TABLE 7.

Effect of transport and traffic on Chinese cabbage price: DID estimates

| (1) | (2) | |

|---|---|---|

| Treat×ΔFreight Volume | −0.261*** | −0.275*** |

| (−3.12) | (−3.25) | |

| Treat | 0.508*** | 0.496*** |

| (12.90) | (12.46) | |

| Constant | 0.208*** | 0.255*** |

| (5.37) | (6.71) | |

| Market FEs | Yes | Yes |

| Day FEs | Yes | Yes |

| Market×Time | No | Yes |

| Observations | 28,219 | 28,219 |

| R‐squared | 0.522 | 0.581 |

| Control group | 2018 Jan. ‐2018 May & | 2018 Jan. ‐2018 May & |

| 2019 Jan. ‐2019 May | 2019 Jan. ‐2019 May |

Notes: Treat equal to 1 for 2020, equal to 0 otherwise; ΔFreight Volume is the first difference of freight volume between 2020 and 2019. The time window of observations is from January 29 to May 7, the fifteenth week after lockdown. Standard errors are clustered at the market level and t statistics are in parentheses.

* = p < 0.1.

** = p < 0.05.

= p < 0.01.

Vegetable Area and Vegetable Price

Another way to test the mechanism of supply chain disruption is to utilize the fact that vegetable production capacity is unevenly distributed across provinces. If the disruption of supply chain causes shortage of vegetable supply in the market, then those provinces that are relatively more

self‐sufficient in vegetable supply are less likely to be affected by the lockdown policy. To test this hypothesis, we augmented the base DID model by including per capital vegetable sown area in each province as well as its interactions with treatment and time variables. The first row of table 8 shows that a 10% increase in per capita vegetable sown area would lead to a reduction of the price hike in response to the lockdown policy by 1.3% to 2.0%. The results are robust to different controls (columns 1–3). The results here also support the interruption of supply chain channel.

TABLE 8.

Effect of vegetable planting area on Chinese cabbage price: DID estimates

| (1) | (2) | (3) | |

|---|---|---|---|

| Treat×lnArea | −0.127*** | −0.201*** | −0.188*** |

| (−3.92) | (−3.62) | (−3.17) | |

| Treat | 0.298*** | 0.051 | 0.074 |

| (3.60) | (0.34) | (0.47) | |

| Constant | 0.214*** | 0.207*** | 0.252*** |

| (5.51) | (5.49) | (6.86) | |

| Market FEs | Yes | Yes | Yes |

| Day FEs | Yes | Yes | Yes |

| Province×Treat | No | Yes | Yes |

| Market×Time | No | No | Yes |

| Observations | 28,219 | 28,219 | 28,219 |

| R‐squared | 0.523 | 0.562 | 0.620 |

| Control group | 2018 Jan. ‐2018 May & | 2018 Jan. ‐2018 May & | 2018 Jan. ‐2018 May & |

| 2019 Jan. ‐2019 May | 2019 Jan. ‐2019 May | 2019 Jan. ‐2019 May |

Notes. The time window of observation is from January 29 to May 7, the fifteenth week after lockdown. Standard error is clustered at market level and t statistics are in parentheses.

* = p < 0.1.

** = p < 0.05.

= p < 0.01.

Conclusion

In order to effectively contain the spread of the COVID‐ virus, lockdown measures and shelter‐in‐place orders have been widely adopted around the world. Although these lockdown measures are necessary and effective in many countries, the economic cost of such measures could be exorbitant. Many governments and communities have been struggling to determine virus control measures that could strike a balance between public health benefits and economic consequences of such measures. For the purpose of designing more pragmatic virus control policies to fight against the current and future pandemics, it is important to understand different aspects of economics costs of these stringent measures that helps in guiding governments and communities.

This study aims to contribute to this important debate by focusing on evaluating the effects of lockdown measures adopted by the Chinese government on the level and dispersion of vegetable prices. Although this topic has attracted much attention of policy makers and academic scholars alike, studies using rigorous methods and large and representative data are rare. In this study, we employ the combination of T‐RD method and DID to identify and quantify the causal effects of the strict lockdown policy on vegetable prices using daily price data from 151 wholesale markets of Chinese cabbage.

The T‐RD and DID results show that the lockdown policy has a large and significant effect on the vegetable prices. The daily price of Chinese cabbage sharply increased by 46% initially and the price increase peaked by week 4 (65%) before it started to decline week by week. It is not until week 10 that the price came down to the level that is expected in a normal year. The price rose again from week 11 to week 13 (from the initial 11%–15% to 18%–22% in week 13) and then leveled off in week 14. By week 15, the price finally came down to the level in a normal year.

The study further confirms that the disruption of the supply chain mechanism is the driving force triggering the price surge. Three pieces of evidence are consistent with this hypothesis. First, we find that the lockdown policy led to a significant and substantial increase in price dispersion, implying that the vegetable markets across and within cities are more disintegrated because of the disruption of traffic flow. Second, data on labor mobility intensity and freight volume showed a considerable decline in labor mobility and the shipment of goods after the lockdown measures were implemented, which is a more direct indication of supply chain disruption. Third, we also find that the price surge is more pronounced in vegetable‐importing provinces than in vegetable‐producing areas and in provinces that grow more vegetables than those growing less vegetables.

Our findings allow us to draw several policy implications. First, our results highlight the importance of designing more flexible policies that prioritize the smooth flow of perishable produces that are essential to people's diet and health (e.g., vegetables) from producing provinces to importing provinces during the lockdown times. Second, the findings also reinforce the importance of capacity and quality of warehouse infrastructure. A larger storage capacity as well as improved preservation and cold‐storage facilities would help in reducing the price shock caused by the lockdown measures. Third, when governments design pandemic relief programs to help their citizens, earmarking a certain amount of funds to help the poor cover additional financial burden resulting from the price increases of food items, such as fresh vegetables, is preferred. Fourth, promoting local field and greenhouse production of vegetables as a means to generate income would also help minimize the impacts of lockdown measures on vegetable prices.

Although we are thankful for the availability of price data at the wholesale markets level, the wholesale market data do not allow us to answer some other interesting questions. For example, how do the lockdown measures affect the vegetable prices at the farm gate? How do price increases influence farmers' consumption behaviors toward vegetables in comparison with other non‐perishable food items? Finally, how are these effects translated into household's welfare? Future research using farm‐level and/or the household‐level data will help in answering some of these important questions.

Supporting information

Figure A1. Falsification test: price difference of 2018 and 2019

Note: The solid line shows the fit of fourth‐order polynomial RD estimation and the shaded areas are the 95 percent confidence intervals.

Table A1. Impacts (ATEs) of nationwide lockdown on Chinese cabbage price: RD estimates with lagged dependent variable

Table A2: Alternative falsification tests: Moving the policy timing by three weeks earlier or later

Table A3. Impacts (ATEs) of nationwide lockdown on price difference: RD estimates with different bandwidth

Table A4. Impacts of nationwide lockdown on price dispersion (RD estimates)

Note: Dependent variable: Pi/Pj

Table A5: Time of the first‐level lockdown in different provinces

This article was published via expedited review through the AJAE call for “COVID‐19, Food, Environment, and Development” manuscripts.

Jianqing Ruan is a professor in China Academy for Rural Development (CARD), School of Public Affairs, Zhejiang University (ZJU), Hangzhou, China. Qingwen Cai is a graduate student in CARD. Songqing Jin is an associate professor in the Department of Agricultural, Food and Resource Economics, Michigan State University, East Lansing, MI 48824. We thank Editor Terry Hurley and anonymous reviewers for their constructive comments and suggestions. Jianqing Ruan acknowledges the financial support from the Natural Science Foundation of China (Grant numbers 71873121). Songqing Jin acknowledges the financial support from Michigan State University's AgBioResearch Project (MICL02608).

All authors contributed equally to this work.

Endnotes

Data are from the Ministry of Agriculture and Rural Affairs of the People's Republic of China: http://www.moa.gov.cn/

Detailed information on dates for different provinces to adopt measures to control the virus is presented in the Online Supplementary Appendix, table A5.

News from official website: http://www.nhc.gov.cn/xcs/fkdt/202004/9c234e08268f4937b496eab547910f37.shtml

After the nationwide lockdown policy was announced on January 29, no province can be treated as a clean control province. For this reason, we use January 29 as the cutoff point for the lockdown policy. However, we find the results are not sensitive to the dates by a couple of days.

The website of National Agricultural Products Price Database is http://nc.mofcom.gov.cn/

The website of Harvard is https://dataverse.harvard.edu/dataverse/covid19

The website of Ministry of Transport of the People's Republic of China is http://www.mot.gov.cn/tongjishuju/

T‐RD has been increasingly used in evaluations of policies, the implementation of which occur at a fixed time point (Chen and Whalley 2012; Bento et al. 2014; Ito 2015; Yang et al. 2018; Fuje 2019). For example, in the framework of T‐RD, Fuje (2019) investigates the impact of fuel subsidy reforms on food price using monthly grain price data. Yang et al. (2018) examines the effect of subway openings on short‐run traffic congestion using daily transport data.

As noted earlier, we exclude January 23–28 from the analysis because the lockdown policy was already implemented in some provinces. However, we also tried the same regression with the data for these days, and the results are largely consistent. The magnitude of price surge, however, is slightly smaller. This is expected because the vegetable prices in these few provinces adopting the lockdown policy during January 23–28 already experienced price increase, causing the effects (i.e., price difference after and before Jan. 29) to be underestimated. Although there may still some anticipation effects prior to January 23, we would expect that the existence of such anticipation effects (higher price right before the implementation of measures) would cause an underestimation of the lockdown effects on price increase.

Adding further lags continues to reduce the magnitude of the coefficient somewhat, but the coefficients of the additional lag variables are not statistically significant, indicating that the higher order autocorrelation is not present.

We thank an anonymous reviewer for this excellent suggestion.

The coefficients for the pre‐policy periods are excluded from table 5 to avoid the table to be too long. Consistent with figure 5, except for week −1, the coefficients for week −2, …, week −7 are all statistically insignificant.

It is worth pointing out that the resurgence of pandemic in April mainly occurred in a few key vegetable‐producing provinces (e.g., Heilongjiang, Shanxi, Shanghai). We ran separate regressions for the few provinces with virus resurgence and for the rest of the country (not reported) and found that although the cabbage prices were not significantly affected in the provinces, the resurgence of virus caused cabbage price to rise in the rest of the country. These findings suggest that the resurgence and the associated control measures affected the movement of vegetables from vegetable‐producing provinces to other provinces. As a result, the vegetable prices in other provinces increased due to the reduction of vegetable supply.

As a robustness check, we also use the ratio of prices between two markets (Pi/Pj) as an alternative measure of price disparity, where we arrange Pi and Pj to ensure Pi > Pj in the pre‐policy period. The results (reported in the Online Supplementary Appendix, table A4) are consistent with those based on the absolute distance of price difference between two markets. The lockdown measures led to a significant and large increase in the price ratio of two markets. We thank an anonymous reviewer for this suggestion.

Similar to the case of price change, we also conducted an alternative falsification test by moving the policy date three weeks before or after the announcement of the nationwide lockdown policy. The results reported in Panel B of the Online Supplementary Appendix, table A2 show that the “fake cutoff date” has no effect on price dispersion, further verifying the validity of the T‐RD strategy.

REFERENCES

- Abdul, Ibrahim Muhammad . 2020. Covid‐19, Lockdown and Transitory Food Insecurity in Nigeria. Food & Agribusiness Management (FABM) 1(1): 26–30. https://fabm.org.my/archive/1fabm2020/1fabm2020‐26‐30.pdf. [Google Scholar]

- Aker, Jenny C . 2010. Information from Markets Near and Far: Mobile Phones and Agricultural Markets in Niger. American Economic Journal Applied Economics 2(3): 46–59.23946866 [Google Scholar]

- Akter, Sonia . 2020. The Impact of COVID‐19 Related “Stay‐at‐Home” Restrictions on Food Prices in Europe: Findings from a Preliminary Analysis. Food Security 12(4): 719–25. 10.1007/s12571-020-01082-3. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Andersen, Asger , Hansen Emil Toft, Johannesen Niels, and Sheridan Adam. 2020. Consumer Responses to the COVID‐19 Crisis: Evidence from Bank Account Transaction Data. CEPR Discussion Papers . https://voxeu.org/article/consumer-responses-covid-19-crisis [DOI] [PMC free article] [PubMed]

- Arndt, Channing , Davies Rob, Gabriel Sherwin, Harris Laurence, and Anderson Lillian. 2020. Covid‐19 Lockdowns, Income Distribution, and Food Security: An Analysis for South Africa. Global Food Security 26: 100410. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Baek, Chae Won , Mccrory Peter B, Messer Todd, and Mui Preston. 2020. Unemployment Effects of Stay‐at‐Home Orders: Evidence from High Frequency Claims Data. Review of Economics & Statistics: 1–72. 10.1162/rest_a_00996. [DOI] [Google Scholar]

- Bellemare, Marc F . 2015. Rising Food Prices, Food Price Volatility, and Social Unrest. American Journal of Agricultural Economics 97(1): 1–21. [Google Scholar]

- Bento, Antonio M , Kaffine Daniel, Roth Kevin, and Zaragoza Matthew. 2014. The Effects of Regulation in the Presence of Multiple Unpriced Externalities: Evidence from the Transportation Sector. American Economic Journal: Economic Policy 6(3): 1–29. [Google Scholar]

- Calonico, Sebastian , Cattaneo Matias D, and Titiunik Rocio. 2014. Robust Data‐Driven Inference in the Regression‐Discontinuity Design. Stata Journal 14(4): 909–6. [Google Scholar]

- Chen, Kevin Z. , Zhang Yumei, Zhan Yue, Fan Shenggen, and Si Wei. 2020. How China Can Address Threats to Food and Nutrition Security from the COVID‐19 Outbreak. IFPRI Book Chapters . https://www.ifpri.org/blog/how-china-can-address-threats-food-and-nutrition-security-coronavirus-outbreak

- Chen, Yihsu , and Whalley Alexander. 2012. Green Infrastructure: The Effects of Urban Rail Transit on Air Quality. American Economic Journal: Economic Policy 4(1): 58–97. [Google Scholar]

- Coibion, Olivier , Gorodnichenko Yuriy, and Weber Michael. 2020a. “Labor Markets During the COVID‐19 Crisis: A Preliminary View.” NBER Working Paper No. 27017.

- Coibion, Olivier , Gorodnichenko Yuriy, and Weber Michael. 2020b. “The Cost of the COVID‐19 Crisis: Lockdowns, Macroeconomic Expectations, and Consumer Spending.” Becker, Friedman Institute Working Paper No. 2020‐60.

- Cullen, Maximo Torero . 2020. COVID‐19 and the Risk to Food Supply Chains: How to Respond? Available at: http://www.fao.org/2019-ncov/analysis/en/

- Devereux, Stephen , Béné Christophe, and Hoddinott John. 2020. Conceptualising COVID‐19's Impacts on Household Food Security. Food Security the Science Sociology & Economics of Food Production & Access to Food 12: 769–72. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Easterly, William , and Fischer Stanley. 2001. Inflation and the Poor. Journal of Money, Credit and Banking 33(2): 160–78. [Google Scholar]

- Fan, Shenggen , Si Wei, and Zhang Yumei. 2020. How to Prevent a Global Food and Nutrition Security Crisis under COVID‐19? China Agricultural Economic Review 12(3): 471–480. https://www.emerald.com/insight/content/doi/10.1108/CAER-04-2020-0065/full/html. [Google Scholar]

- Fang, Hanming , Wang Long, and Yang Yang. 2020. Human Mobility Restrictions and the Spread of the Novel Coronavirus (2019‐NCoV) in China. Journal of Public Economics 191: 104272. 10.1016/j.jpubeco.2020.104272. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ferreira, Francisco HG , Fruttero Anna, Leite Phillippe G, and Lucchetti Leonardo R. 2013. Rising Food Prices and Household Welfare: Evidence from Brazil in 2008. Journal of Agricultural Economics 64(1): 151–76. [Google Scholar]

- Fuje, Habtamu . 2019. Fossil Fuel Subsidy Reforms, Spatial Market Integration, and Welfare: Evidence from a Natural Experiment in Ethiopia. American Journal of Agricultural Economics 101(1): 270–90. [Google Scholar]

- Goddard, Ellen . 2020. The Impact of COVID‐19 on Food Retail and Food Service in Canada: Preliminary Assessment. Canadian Journal of Agricultural Economics 68(2): 157–61. 10.1111/cjag.12243. [DOI] [Google Scholar]

- Hadley, Craig , Stevenson Edward Geoffrey Jedediah, Tadesse Yemesrach, and Belachew Tefera. 2012. Rapidly Rising Food Prices and the Experience of Food Insecurity in Urban Ethiopia: Impacts on Health and Well‐Being. Social Science & Medicine 75(12): 2412–9. [DOI] [PubMed] [Google Scholar]

- Hahn, Jinyong , Todd Petra, and Van Der Wilbert Klaauw. 2001. Identification and Estimation of Treatment Effects with a Regression‐Discontinuity Design. Econometrica 69(1): 201–9. [Google Scholar]

- Hailu, Getu . 2020. Economic Thoughts on COVID‐19 for Canadian Food Processors. Canadian Journal of Agricultural Economics/Revue Canadienne d'agroeconomie 68: 163–169. 10.1111/cjag.12241. [DOI] [Google Scholar]

- Harris, Jody , Depenbusch Lutz, Pal Arshad Ahmad, Nair Ramakrishnan Madhavan, and Ramasamy Srinivasan. 2020. Food System Disruption: Initial Livelihood and Dietary Effects of COVID‐19 on Vegetable Producers in India. Food Security 12: 841–851. 10.1007/s12571-020-01064-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hausman, Catherine , and Rapson David S.. 2017. “Regression Discontinuity in Time: Considerations for Empirical Applications.” NBER Working Paper 23602.

- Headey, Derek , and Fan Shenggen. 2008. Anatomy of a Crisis: The Causes and Consequences of Surging Food Prices. Agricultural Economics 39(1): 375–1. [Google Scholar]

- Hobbs, Jill E . 2020. Food Supply Chains during the COVID‐19 Pandemic. Canadian Journal of Agricultural Economics/Revue Canadienne Dagroeconomie 68(2): 171–6. [Google Scholar]

- IMF . 2020. World Economic Outlook. World Economic Outlook, October 2020: A Long and Difficult Ascent. Available at: https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook-october-2020

- Ito, Koichiro . 2015. Asymmetric Incentives in Subsidies: Evidence from a Large‐Scale Electricity Rebate Program. American Economic Journal Economic Policy 7(3): 209–37. [Google Scholar]

- Jensen, Robert . 2007. The Digital Provide: Information (Technology), Market Performance, and Welfare in the South Indian Fisheries Sector. Quarterly Journal of Economics 122(3): 879–924. [Google Scholar]

- Kraemer, Moritz UG , Yang Chia Hung, Gutierrez Bernardo, Wu Chieh Hsi, and Scarpino Samuel V. 2020. The Effect of Human Mobility and Control Measures on the COVID‐19 Epidemic in China. Science 368: 493–7. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kuwonu, Franck . 2014. Ebola Disruption Could Spark New Food Crisis. Africa Renewal 28(3): 15. [Google Scholar]

- Laborde, David , Martin Will, Swinnen Johan, and Vos Rob. 2020. COVID‐19 Risks to Global Food Security. Science 369(6503): 500–2. [DOI] [PubMed] [Google Scholar]

- Lang, Corey , and Siler Matthew. 2013. Engineering Estimates versus Impact Evaluation of Energy Efficiency Projects: Regression Discontinuity Evidence from a Case Study. Energy Policy 61(7): 360–70. [Google Scholar]

- Lee, David S , and Lemieux Thomas. 2010. Regression Discontinuity Designs in Economics. Journal of Economic Literature 48(2): 281–355. [Google Scholar]

- Li, Deqiang , Liu Qinghe, Liu Zhicheng, Gao Zefei, Zhu Junkai, Yang Junyan, and Wang Qiao. 2020. Estimating the Efficacy of Traffic Blockage and Quarantine for the Epidemic Caused by 2019‐NCoV (COVID‐19). 10.1101/2020.02.14.20022913. [DOI]

- Matsungo, Tonderayi M , and Chopera Prosper. 2020. The Effect of the COVID‐19 Induced Lockdown on Nutrition, Health and Lifestyle Patterns among Adults in Zimbabwe. BMJ Nutrition Prevention & Health 3(2): 205–212. 10.1101/2020.06.16.20130278. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Mohammad, Nafees , and Khan Farukh. 2020. Pakistan's Response to COVID‐19 Pandemic and Efficacy of Quarantine and Partial Lockdown: A Review. European Journal of General Medicine 17(2): 1–4. 10.13140/RG.2.2.14258.96966. [DOI] [Google Scholar]

- Narayanan, Sudha , and Saha Shree. 2020. “Urban Food Markets and the Lockdown in India.” Social Science Electronic Publishing. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3599102

- Reardon, Thomas , Mishra Ashok, Nuthalapati Chandra Sekhara Rao, Bellemare Marc F, and Zilberman David. 2020. COVID‐19's Disruption of India's Transformed Food Supply Chains. Economic & Political Weekly 55(18): 18–22. [Google Scholar]

- Richards, Timothy J , and Rickard Bradley. 2020. COVID‐19 Impact on Fruit and Vegetable Markets. Canadian Journal of Agricultural Economics 68(2): 189–94. 10.1111/cjag.12231. [DOI] [Google Scholar]

- Rude, James . 2020. COVID‐19 and the Canadian Cattle/Beef Sector: Some Preliminary Analysis. Canadian Journal of Agricultural Economics 68(2): 207–13. 10.1111/cjag.12228. [DOI] [Google Scholar]

- Siche, Raúl . 2020. What Is the Impact of COVID‐19 Disease on Agriculture? Scientia Agropecuaria 11(1): 3–6. [Google Scholar]

- Tse, Wai Pui , Che Chun Tao, Liu Ken, and Lin Zhi Xiu. 2006. Evaluation of the Anti‐Proliferative Properties of Selected Psoriasis‐Treating Chinese Medicines on Cultured HaCaT Cells. Journal of Ethnopharmacology 108(1): 133–41. [DOI] [PubMed] [Google Scholar]

- Vercammen, James . 2020. Information‐Rich Wheat Markets in the Early Days of COVID‐19. Canadian Journal of Agricultural Economics/Revue Canadienne Dagroeconomie 68(2): 177–84. [Google Scholar]

- Wang, Fuzeng . 2020. Challenges and Opportunities Brought by the Epidemic to China's Vegetable Industry. Vegetable 3: 4–10. [Google Scholar]

- Wang, Yubin , Wang Jingjing, Wang Xiaoyang, and Xin Xian. 2020. COVID‐19, Supply Chain Disruption and China's Hog Market: A Dynamic Analysis. China Agricultural Economic 12(3): 427–43 10.1108/CAER-04-2020-0053. [DOI] [Google Scholar]

- Weinberg, Joe , and Bakker Ryan. 2014. Let Them Eat Cake: Food Prices, Domestic Policy and Social Unrest. Conflict Management & Peace Science 32(3): 309–26. [Google Scholar]