Abstract

Humira® (adalimumab) by AbbVie has been the top-selling biologic drug product for the last few years – reaching nearly $20 billion in annual sales in 2018. Upon the October 2018 release of four adalimumab biosimilars into the European market, those sales began to shrink. By the end of 2019, the annual sales of Humira®, albeit still high, dipped closer to $19 billion as nearly 35% of European patients had been switched from Humira® to a biosimilar. Diminishing sales are expected to continue as the adoption of adalimumab biosimilars increases in Europe and Humira®’s patent protection is lost in the United States come 2023. In this review we discuss how impactful the availability of biosimilars has been to the European adalimumab market approximately two years after their release. We further analyze the marketed biosimilars with regards to differences in their formulation, delivery devices, biological activity, physicochemical properties, clinical trials data, and current financial foothold. More importantly, though, we highlight how “similar” these biosimilars are to Humira®. In doing so, we seek to educate the public on what they may be able to expect once adalimumab biosimilars enter the United States market in 2023.

Introduction:

Humira® (adalimumab), AbbVie’s blockbuster monoclonal antibody product indicated for a number of inflammatory disease states, reached its pinnacle in 2018 with nearly $20 billion in worldwide sales. In 2019, the sales only slightly decreased down to approximately $19.2 billion1,2. These sales, along with the large, ever-growing patient population, gave Humira® the title of top-selling drug product in 2018 and 20192. Originally approved by the FDA in 2002 and EMA in 2003 as the first fully-humanized monoclonal antibody to treat rheumatoid arthritis, Humira® has maintained a strong presence in the biologics market over the last 17+ years.

Humira® is a tumor necrosis factor-alpha (TNF-α) inhibitor that binds to soluble and transmembrane TNF-α. By binding TNF-α, Humira® prevents it from interacting with p55 and p75 TNF receptors found on cell surfaces. Repression of TNF-receptor binding decreases the cellular signaling responsible for inducing innate inflammatory and immune responses. Patients with arthritic diseases have elevated levels of TNF-α in their synovial fluids. Thus, Humira® is an effective treatment for these patient populations as it lowers the frequency of TNF-α -receptor binding in synovial fluids, resulting in the reduction of inflammatory responses including swelling and joint pain3. In more recent years, the indications for Humira® have expanded beyond arthritis into skin diseases – psoriasis and hidradentitis suppurativa – and gastrointestinal diseases – irritable bowel syndrome, Crohn’s disease, and ulcerative colitis. While AbbVie states that Humira® is effective in all indicated disease types in part due to the neutralization of TNF-α, a secondary mechanism of action, Fc-mediated apoptosis, has also been proposed in the gastrointestinal diseases4,5. Fc-mediated apoptosis can be elicited through the activation of antibody-dependent cellular cytotoxicity (ADCC) or complement-dependent cytotoxicity (CDC). During ADCC transmembrane TNF-α-positive inflammatory-inducing cells are targeted for cell death. This process is enhanced in the presence of Humira® due to Humira®- Fc receptor binding, which enables the subsequent recruitment of natural killer cells to induce inflammatory cell death. Similarly, the initiation of CDC through the binding of Humira®’s Fc region with C1q proteins results in a signaling cascade that culminates in cell lysis. These mechanisms of action reduce the number of inflammatory-inducing cells in the gut and alleviates the patients’ symptoms.

Given the wide range of indications currently approved for Humira®, ten in total3, it is not surprising to see how one drug could be so profitable. It is also not surprising to learn that such a valuable drug is now a lead candidate for competition. Due to the unsurpassed success of Humira®, many pharmaceutical companies have tried to follow suit and create a biosimilar “copycat” adalimumab to outcompete the novel drug. To this day, there are a number of biosimilar adalimumabs vying for a chance to thrive in the lucrative market established by Humira®. These include six distinct biosimilars authorized by the EMA for use6; of which five are on the European market and one has since been withdrawn by the sponsoring company. Six biosimilars have also been FDA approved7 but are unable to enter the United States market due to patent protection.

While Humira® was an unmatched powerhouse for over 15 years, 2018 tested the ability of Humira® to maintain its foothold in the autoimmune disease market. Already Humira® has taken a hit from the biosimilar competition in Europe. Internationally net revenues decreased by 31.1% on a reported basis (down 27.8% operationally) over the course of 2019. This large decrease in international revenues was largely attributed to biosimilar competition8. Nevertheless, it still has strong sales and maintains a large patient base in Europe.

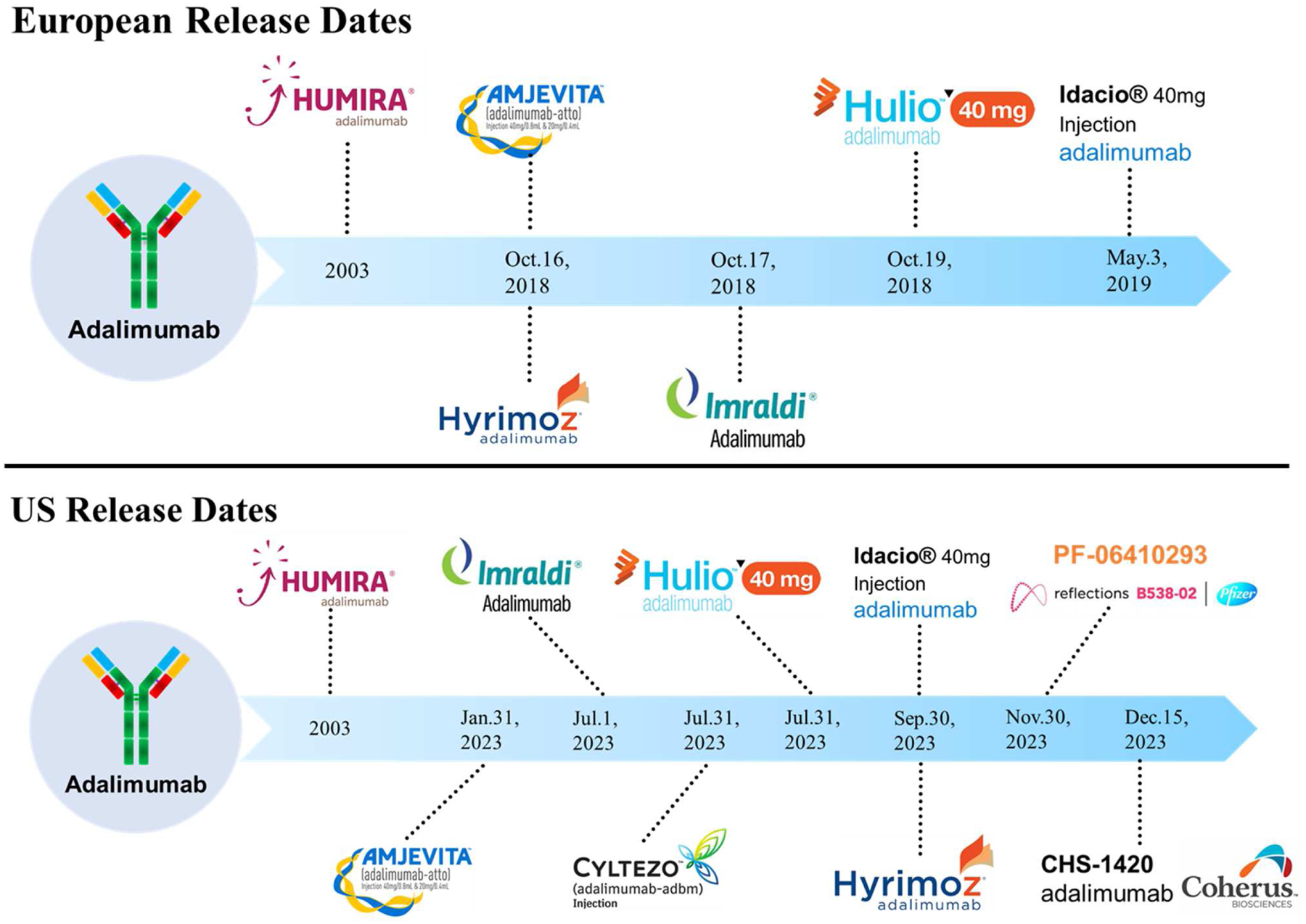

As depicted in Figure 1, in October of 2018 four biosimilars were released on the European market: Amgevita™, Hyrimoz™, Imraldi™ and Hulio™9. Seven months later, in May of 2019, Idacio® was approved and marketed in Europe10,11.The first half of 2019 saw the withdrawal of Cyltezo® prior to its entrance on the European market. According to Boehringer Ingelheim, this withdrawal decision was made in order to focus the company’s commercial efforts on Cyltezo®’s United States market entrance. In general, Boehringer Ingelheim has decided to halt biosimilar development activities outside of the United States12,13. Although not explicitly stated, Cyltezo® is the only adalimumab biosimilar currently undergoing interchangeability clinical studies, which may be another reason why Boehringer Ingelheim chose to withdraw the product in Europe. If the interchangeability designation is accepted by the FDA, then Cyltezo® would be the first and only adalimumab biosimilar with this status. This would mean that Cyltezo® could be substituted for Humira® by a pharmacist without them needing to consult the prescriber14. Similarly, in late 2019 the EMA authorized Amsparity™ by Pfizer for market release, but Pfizer decided not to market the product in Europe citing “unfavorable market conditions” as their reason for witholding15,16. As will be discussed in further depth later in this article, the United States has yet to see biosimilar competition on its market, and will continue to lack competition, until 2023 when AbbVie’s licensing agreements allow for the marketing of adalimumab biosimilars17–24.

Figure 1.

European release dates and United States release dates of adalimumab biosimilars.

Previous reviews on the topic of adalimumab biosimilars, including those by Zhao et al. and Azevedo et al., gave insights into the early adalimumab biosimilar landscape, especially with regards to clinical data and pharmacokinetics25,26. However, these articles are outdated given how rapidly the field has progressed since the European approval and marketing of adalimumab biosimilars. This review aims to further the knowledge presented in these early articles by addressing the Humira® biosimilar competition approximately two years after the first four biosimilars were released on the European market. We discuss here the variations in formulations, delivery devices, biological activity, physicochemical properties, pharmacokinetics, clinical trial data, and pricing schemes between each biosimilar and a reference Humira®. By completing this analysis, we were able to compile publicly available data and information on the approved adalimumab biosimilars into one comprehensive paper. We envision this paper to be useful to researchers, industry partners, healthcare providers, payers and patients looking to gain more awareness of the competitive space as we approach Humira®’s loss of exclusivity in the United States.

Formulation and delivery device differences:

The formulation of a drug product is critical for a multitude of reasons; it can dictate the route of administration, aggregation/degradation impurity formation, pH, solubility, shelf-life stability, and a number of other parameters critical to maintaining the integrity of a drug product’s manufacturing, storage and delivery. AbbVie is no stranger to the importance of optimizing a drug’s formulation. When it was first approved, Humira® was formulated with a citrate buffer and dosed at 50 mg/mL in a latex-containing device with a 27 gauge needle. Pain-on-injection complaints from patients resulted in a modification of the formulation buffer to eliminate many of the excipients including citrate and citric acid, which are speculated to be pain-inducing27,28. AbbVie took a step further to address the pain complaints and also decreased the needle size (higher gauge number) and eliminated latex, a potential allergen and irritant, from their pre-filled pens and syringes29. Furthermore, as larger volumes may be connected to injection site pain, they reduced the volume per injection from 0.8 mL to 0.4 mL while still delivering 40 mg per injection. As was demonstrated in AbbVie’s clinical trials published in 2016, these formulation and device alterations have been effective in addressing pain-on-injection issues. Patients in the trials reported lower visual activity scores upon receiving a citrate-free Humira® injection when compared with their scores reported after receiving an original Humira® injection. 42.6% of patients receiving the citrate-free version reported mild pain after injection compared with 86.9% who reported pain after injection upon receiving the original version30. The promising outcomes that were met during this study exemplify why the citrate-free Humira® is an attractive, arguably superior alternative to the original version. The appeal of prescribing citrate-free Humira® is apparent in Europe as most patients there are receiving the improved version31.

Clearly formulation, as well as delivery device specifications, have been deemed vital to Humira’s® success. Interestingly, some of the more noticeable differences between all of the approved adalimumab biosimilars stem from their formulations and delivery device parameters. Table 2 outlines excipient and device information pertinent to each biosimilar3,29,30,32–42.

Table 2.

Formulation and delivery device information for each adalimumab biosimilar approved by the EMA.

| Product | Humira® | Humira® (Citrate free) | Amgevita™ | Imraldi™ | Hyrimoz™ | Hulio™ | Idacio® | Cyltezo® | Amsparity™ |

|---|---|---|---|---|---|---|---|---|---|

| Excipients | Citric acid monohydrate; Dibasic sodium phosphate dihydrate; Monobasic sodium phosphate dihydrate; NaCI; Sodium citrate; Mannitol; Tween 80 | Mannitol; Tween 80 | Glacial acetic acid; Sucrose; Tween 80 | Sodium citrate dihydrate; Citric acid monohydrate; L-Histidine; L-Histidine hydrochloride monohydrate; Sorbitol; Tween 20 | Adipic acid; Citric acid monohydrate; NaCI; Mannitol; Tween 80; | Monosodium glutamate; Sorbitol; Methionine; Tween 80 | Sodium dihydrogen phosphate dihydrate; Disodium phosphate dihydrate; Mannitol; NaCI; Citric acid monohydrate; Sodium citrate; Tween 80 | Glacial acetic acid; Sodium acetate trihydrate; Trehalose dihydrate; Tween 80 | Edetate disodium dihydrate; L-Histidine; L-Histidine hydrochloride monohydrate; L-methionine; Sucrose; Tween 80 |

| Formulation PH | 5.2 | N/A | 5.2 | 5.2 | 5.2 | 5.2 | 5.2 | 5.2 | 5.5 |

| Concentrati on | 50 mg (40 mg/0.8 mL)* | 100 mg/mL (40 mg/0.4 mL) | 50 mg/mL (20 mg/0.4 mL; 40 mg/0.8 mL) | 50 mg/mL (40 mg/0.8 mL) | 50 mg/mL (40 mg/0.8 mL) | 50 mg/mL (20 mg/0.4 mL; 40 mg/0.8 mL) | 50 mg/mL (40 mg/0.8 mL) | 50 mg/mL (40 mg/0.8 mL) | 50 mg/mL (20 mg/0.4 mL; 40 mg/0.8 mL) |

| Citrate free version | No | Yes | Yes | No | No | Yes | No | Yes | Yes |

| Shelf life | 2 years | 2 years | 2 years | 3 years | 2.5 years | 2 years | 2 years | 2 years | 3 years |

| Needle size | Syringe: 27G Pen: 27G | Syringe: 29G Pen: 29G | Syringe: 29G Pen: 27G | Syringe: 29G Pen: 29G | Syringe: 27G Pen: 27G | Syringe: 29G Pen: 29G | Syringe: 29G Pen: 29G | Syringe: 27G Pen: N/A | Syringe: N/A Pen: N/A |

| Latex in device | Yes | No | Yes | No | Yes | No | No | Yes | No |

| Other devices | N/A | N/A | Sure-click Autoinjector | Hadlima PushTouch Autoinjector | N/A | N/A | N/A | N/A | N/A |

There multiple concentrations/dosages available for Humira® not included here for sake of brevity. 50 mg delivered as 40 mg/0.8 mL is most common dosage available in the pen3.

Given the adoption of citrate-free Humira® on the European market, we want to highlight the biosimilars that align with this reference product in regards to citrate absence, latex absence, smaller needle size and lower volume dosages. Amgevita™, Hulio™, Cyltezo® and Amsparity™ have all eliminated citrate buffers from their formulations. Imraldi™, Hulio™, Idacio®, and Amsparity™ have all removed latex in their delivery devices. Imraldi™, Hulio™, Idacio®, and the syringe version of Amgevita™ all have smaller, 29 gauge needles. Amgevita™, Hulio™ and Amsparity™ offer lower volume options to deliver less adalimumab per injection. While these lower volume options do not exactly match the dosage decisions made by AbbVie, they may have merit in certain patient populations. In conclusion, from the information publicly available, the only biosimilar that nearly matches citrate-free Humira® in all four attributes hypothesized to decrease pain-on-injection – lack of citrate excipients, lack of latex, smaller needles, and availability of a lower volume option - is Hulio™. However, it remains to be seen whether one of those attributes supersedes the others with regards to reducing pain-on-injection30. Thus, we are unable to fully elucidate whether the formulation, volume, or device parameters make one adalimumab “superior” to the others with regards to patient-friendliness.

Part of the reason why no biosimilar can exactly mimic Humira®’s formulation is because it is strongly protected by patents. With over 130 patents related to formulation and manufacturing methods, most of which were issued in 2014 or later to seemingly prevent biosimilar competition from entering the United States market, AbbVie was able to create a patent fortress43. The large number of patents drove multiple biosimilar manufacturers to face AbbVie in court. AbbVie argued that the biosimilar companies infringed upon their patents. In turn, these biosimilar companies claimed that AbbVie’s “patent thicket” had many overlapping, non-inventive patents. Two famous litigations were AbbVie v. Amgen and AbbVie v. Boehringer Ingelheim. Amgen, as the first company to submit a biologics license application for Amgevita™, was the first to enter into litigation against AbbVie and was also the first to settle back in 2017. Boehringer Ingelheim entered into litigation in 2017 but was the last company to settle in 2019.The outcome of both cases was a win for AbbVie. The two biosimilar companies agreed on an undisclosed settlement and future licensing of their respective adalimumab biosimilar (Amgevita™ for Amgen and Cyltezo® for Boehringer Ingelheim) in the United States come 202344–46. In the first half of 2020, AbbVie was still litigating a case regarding Humira®. A class action lawsuit was filed by United States purchasers of Humira® claiming that the prevention of biosimilars on the market was a violation of federal and state antitrust laws. AbbVie was victorious again in this legal battle when the plaintiffs dismissed the charges finding that AbbVie’s “patent thicket” did not fall within the antitrust scope and their alleged “pay-for-delay” scheme was not anticompetitive43. Taking this all into account, it is understandable why there remain differences in formulation, device specifications and dosage forms across the biosimilars.

Physicochemical properties:

Biosimilars have had a more challenging time gaining FDA and EMA approval compared to small molecule generics. This is in large part due to the complexity of proteins compared to small molecules and their reliance on living cells, rather than chemical synthesis, for manufacture. Previous studies have shown that biosimilars can differ from their innovator counterpart in protein modifications such as glycosylation profiles47,48. While lot-to-lot variability in post-translational modifications can exist even across innovator lots, generally this variability is limited. In a product quality analysis of 544 batches of Humira® manufactured over 13 years, molecular charge and glycosylation patterns were monitored. High levels of consistency were shown between the batches made in different bioreactors. This consistency of charged species and glycosylation profiles also resulted in unchanging TNF-α binding data49. Consistency is key to having a successful product because changes to the physicochemical properties could result in varied solubility, stability, efficacy or immunogenicity.

Knowing that post translational modifications can lead to varying responses in biological activity, pharmacokinetics and immunogenicity, it is important to understand each modification’s potential impact on protein function, as well as its likelihood of occurrence50–59. Numerous publications have described how higher levels of afucosylated glycans can enhance the effector function of proteins by increasing FcγRIIIa binding and antibody-dependent cellular cytotoxicity (ADCC)52–55. Similarly, others have correlated the presence of high mannose IgG glycoforms with shorter drug half-lives and faster drug clearance59. Biosimilars and innovators can also differ in their charge variant profiles, often due to the presence or absence of C-terminal lysine60–62. Along with lysine, terminal sialic acid can influence charge variant profiles. Biosimilars showing higher levels of acidic variants, due to the presence of terminal sialic acids63, have the potential for decreased proteolytic resistance and effector functionality57,58,64.

To determine that the post translational modifications of a biosimilar should not preclude it from gaining approval, analytical techniques were implemented during development and reported in FDA product quality reviews. In the FDA product quality reviews for Amgevita™60, Imraldi™61 and Hyrimoz™62, there generally was commonality in the types of physicochemical characterization tests conducted. For each biosimilar, hydrophilic interaction chromatography and/or mass spectrometry methods were utilized to determine relative percentages of charge variants and glycan moieties60–62 (Table 3). For the most part, all three biosimilars have similar glycoform and charge variant trends when compared head-to-head with their respective reference product Humira®.

Table 3.

Percentage of charge variants/ glycans for each biosimilar relative to Humira® given as a range (average). Each biosimilar is compared to a reference Humira® (left of biosimilar column) that was tested simultaneously during analysis.

| Charge variants/glycans | Humira® | Amgevita™ | Humira® | Imraldi™ | Humira® | Hyrimoz™ |

|---|---|---|---|---|---|---|

| % basic | 19.7–29.3 (24.5) | 10.8–16.5 (13.7) | 17.5–30.2 (23.9) | 8.6–10.9 (9.8) | >20.3 | 12.9–17.7 (15.3) |

| % acidic | 13.1–18.2 (15.7) | 17.6–21.7 (19.7) | 11.9–18.7 (15.3) | 22.6–25.6 (24.1) | 9.2–13.9 (11.6) | 6.8–10.7 (8.8) |

| % afucosylated | 7.5–13.3 (10.4) | 6.7–10.8 (8.8) | 1.6–2.3 (2.0) | 2.0–3.6 (2.8) | 0.5–0.9 (0.7) | 2.4–3.2 (2.8) |

| % sialylated | 0.1–0.3 (0.2) | 0.5–1.2 (0.9) | 0.0–0.6 (0.3) | 2.1–3.5 (2.8) | <LOQ | 0.3–0.5 (0.4) |

| % galactosylated | 16.5–23.0 (19.8) | 19.9–39.2 (29.6) | 18.3–21.4 (19.9) | 19.3–28.3 (23.8) | 14.7–23.1 (37.8) | 23.7–37.4 (30.6) |

| % high mannose | 5.6–10.6 (8.1) | 5.0–8.5 (6.8) | 4.4–9.3 (6.9) | 5.3–9.9 (7.6) | 3.9–6.6 (5.3) | 0.9–1.3 (1.1) |

| % C terminal lysine | n/a | n/a | 5.7–9.6 (7.7) | 1.3–3.1 (2.2) | 13.3–18.7 (16.0) | 3.1–6.0 (4.6) |

All three biosimilars were determined to have lower percent basic variants compared with their respective Humira® control lots. The lower percentage of basic variants was attributed to the decrease in C terminal lysine abundance. The removal of C terminal lysine has previously been shown to not impact effector function in vitro, so the lower basic variant levels in the biosimilars were thought to have no meaningful effect on the biosimilars’ efficacy60–62. All three biosimilars also had higher levels of afucosylated, sialylated and galactosylated species compared with Humira®. It is considered desirable to have higher levels of afucosylation and galactosylation because these glycoforms can increase Fc receptor binding, subsequently enhancing effector functions55. Sialylation, on the other hand, is considered undesirable because its presence has been linked to the closing of Fc binding sites on a therapeutic, thus decreasing the Fc receptor binding and overall effector functionality of a therapeutic57,58,64.

For Amgevita™ and Imraldi™ there was an increase in the percentage of acidic variants relative to Humira®. The higher levels of acidic variants were likely caused by the relative increase in sialylated species. Hyrimoz™ also reported an increase in % sialylated species, yet it was determined have fewer acidic variants than Humira®. The reason for this discrepancy was not explicitly described in the FDA product quality review, but perhaps there were fewer deamidated or fragmented species in Hyrimoz™ compared to Humira®, attributing to its overall lower % acidic variants62.

While we describe such trends based on the average values for a biosimilar compared with Humira®, we should touch on the fact that table 3 also depicts ranges of % charge variants and glycans. As alluded to earlier, since the production of biological products yields heterogeneity, the trends we describe here may not hold true for every batch of biosimilar and comparative reference Humira®. Some may fall at the more extreme ends of a range for a specific glycan/charge variant profile, while other batches may tend more towards average values. Also, while some ranges for Humira® and biosimilar glycan/ charge variant profiles overlap, some do not. The overlapping, narrower ranges may perhaps increase the chance for deviation from the aforementioned expectations. Nevertheless, these general trends are useful in demonstrating that 1) in general adalimumab biosimilars have similar trends with respect to relative levels of certain glycoforms and charge variants; and 2) biosimilars can still be approved even with some inherent physicochemical variability between the reference product and biosimilar.

In vitro biological activity:

As adalimumab is not immune from the manifestation of protein modifications, it is critical to understand not just the presence and abundance of certain modifications, but also whether they elicit an expected biological response. Examples of the tests conducted for biosimilar comparison of in vitro biological activity are listed in Table 4. What is important to note is that there is a no published universal set of methods conducted for all biosimilars to assess “similarity”. As table 4 exemplifies, there are a number of tests commonly completed during adalimumab biosimilar development including TNF binding, TNF neutralization and ADCC induction. However, there is variability in some of the assays conducted to measure drug functionalities. For example, the primary soluble TNF (s-TNF) binding assays tested differed between the biosimilars - ELISA for Amgevita™60, FRET for Imraldi™61, and SPR for Hyrimoz™62.

Table 4.

Examples of bioactivity assays conducted by the sponsoring company comparing Humira® vs biosimilars.

| Humira® vs Amgevita™ | |||

|---|---|---|---|

| Attribute tested for biosimilarity | Method of analysis | Average (relative activity, %) | |

| Humira®(US) | Amgevita™ | ||

| sTNF-α binding | ELISA | 110 | 108 |

| mTNF-α binding* | Cell-based competition assay: mTNFα expressed on CHO cells, quantified by image cytometer measuring AlexaFluor | 105 | 103 |

| TNF-α neutralization | Apoptosis inhibition: U-937 cells used to measure NF κβ pathway (methods for NF κβ-dependent and independent apoptosis) | 107 | 104 |

| C1q binding | ELISA | n/a | n/a |

| CDC | Cell-based: TNF expressing CHO cells (target) labeled with calcein, quantified by fluorescence | 96 | 102 |

| ADCC | Cell-based: Fluorescence labeled CHO cells expressing mTNFα (target) with NK92-M1 cells (effector), quantified by fluorescence | 85 | 87 |

| Apoptosis induction | Apoptosis potency assay using genetically modified Jurkat T cells expressing mTNFa, quantified by Caspase-Glo assay and plate reader | n/a | n/a |

| Humira® vs lmraldi™ | |||

| Attribute tested for biosimilarity | Method of analysis | Average (relative activity, %) | |

| Humira® (US) | Imraldi™ | ||

| sTNF-α binding | FRET | 101 | 99 |

| mTNF-α binding | Cell-based flow cytometry | 91 | 93 |

| TNF-αneutralization | Cell-based: HEK293 cells transfected with NF κβ luciferase reporter gene | 104 | 100 |

| C1q binding | ELISA | 96 | 91 |

| CDC | Cell-based CDC assay | 99 | 94 |

| ADCC | Cell-based: NK cell ADCC assay | 108 | 98 |

| Apoptosis induction | Apoptosis potency assay: stimulation of mTNFα induced apoptosis | 102 | 105 |

| Humira® vs Hyrimoz™ | |||

| Attribute tested for biosimilarity | Method of analysis | Average (relative activity, %) | |

| Humira®(US) | Hyrimoz™ | ||

| sTNF-α binding | SPR | 102 | 105 |

| mTNF-α binding | Cell-based competition assay: mTNFα expressed on HEK293 T-cells, quantified by flow cytometry | 97 | 100 |

| TNF-α neutralization | Cell-based: HEK293 cells transfected with NF κβ luciferase reporter gene | 96 | 98 |

| C1q binding | ELISA | 92 | 98 |

| CDC | Cell-based: Jurkat T cells expressing mTNFα | 103 | 93 |

| ADCC | Cell-based: Fluorescence labeled HEK293 expressing mTNFα (target) with NK3.3 cells (effector), quantified by fluorescence | 103 | 99 |

| Apoptosis induction | Apoptosis potency assay using genetically modified Jurkat T cells expressing mTNFα, quantified by flow cytometry | 94 | 93 |

Approximated values from a graph. Note: Imraldi™ data shown here is the average of a data range given for each assay in the product quality review summary table.

There is also variability among the biosimilars in the amount of publicly available biological activity data. For Hulio™ and Idacio® we were unable to find any meaningful published data on biological activity. For the data discussed here we looked at the biologics license application for Amgevita™60 and the FDA product quality reviews for Imraldi™61 and Hyrimoz™62 as we found that these documents reported data collected by the sponsoring companies.

Due to the inconsistency in data reporting methods across the biosimilars, it is unfair to compare them head-to-head. To address this, we have included the data for each biosimilar and the reference Humira® product that it was concomitantly tested with it. By comparing these products tested under the same conditions, conclusions about “similarity” can be drawn.

Pharmacokinetic data:

The current treatment regimen for Humira® is to administer 40 mg of the drug every other week in order to maintain therapeutic levels in a patient. In rheumatoid arthritis patients this leads to a maximum serum concentration (Cmax) of 4.7±1.6 μg/mL, of which 31–95% of the serum concentration is retained in the synovial fluid. The time to reach Cmax is 131±56 hours. The average terminal half-life is 2 weeks, hence the every other week dosing schedule. The bioavailability is 64% and the volume of distribution is 4.7–6 L. The elimination of Humira® is dependent on age, decreasing in older populations, and anti-drug antibody (ADA) formation, increasing as ADAs are formed. The pharmacokinetics can also vary depending on the disease state. For example, the mean steady state trough levels reported for rheumatoid arthritis and ankylosing spondylitis patients treated without methotrexate is approximately 5 μg/mL, which differs from psoriatic arthritis patients who had mean steady state trough levels of 6–10 μg/mL. Patients with gastrointestinal diseases, such as Crohn’s and ulcerative colitis, achieve different steady-state trough levels of 7 and 8 μg/mL, respectively. Likewise, patients with hidradenitis suppurativa report steady-state trough levels of 7–11 μg/mL3.

The FDA approved drug labels for all biosimilars (INN for Idacio®) listed identical pharmacokinetic properties to Humira®33,35,39,65–68. Looking further into some of the approval report documentation, we can see some small differences in pharmacokinetics between the biosimilars and Humira® across healthy and disease states. For example, in an initial healthy subject study Amsparity™ reportedly had a Cmax of 4.53±1.27 ug/mL and a half-life of 351.5 ± 188.78 hours. Concomitantly tested US Humira® had a Cmax of 4.04 ± 1.18 ug/mL and a half-life of 346.2 ± 204.61 hours while EU Humira® had a Cmax of 4.09 ± 1.17 ug/mL and a half-life of 362.4 ± 200.83 hours34. Nevertheless, these differences are not significant enough to raise red flags, which is why Amsparity™, as well as other approved adalimumab biosimilars, can be considered “similar” to Humira®.

In sum, although the pharmacokinetics can be influenced by glycosylation and other factors, all of the biosimilars meet the acceptable pharmacokinetic ranges established by Humira®. While there are some small pharmacokinetic differences reported in clinical studies, these differences are not large enough to warrant great concern.

Degradation pathways:

The degradation pathways of adalimumab need to be well understood in order to determine the product’s shelf-life and storage conditions. Adalimumab products often require stringent handling and storage conditions in order to maintain the integrity of the protein throughout its journey from production to distribution and patient handling. In order to simulate what would happen if a patient left Humira® at room temperature, exposed to light for an extended period of time or if Humira® was bouncing around during shipping, forced degradation studies have been conducted. During these studies adalimumab is exposed to a variety of stress conditions including agitation, high or low pH, light exposure, oxidation, high temperature, etc. After exposure, the adalimumab is analyzed to determine how the stressor impacted the protein structure and function. Often times the analysis is conducted using chromatography and mass spectrometry techniques69, in tandem with other bioassays. Understanding the impact of stressors helps in determining the product’s shelf-life and storage conditions. After all, we want to ensure that patients receiving adalimumab are only receiving a safe and effective version.

In FDA report documents, we can see that biosimilar companies do complete forced degradation studies on both their product and reference Humira® lots. For example, studies using peracetic acid to force oxidation showed that Amsparity™ followed the same oxidation-induced degradation pathway as Humira®. Interestingly though there were some apparent differences in degradation rates between Humira® and Amsparity™ that were attributed to differences in formulation. The thermal, light and deamidation forced degradation experiments showed that Amsparity™ was slightly favored over Humira® with regards to maintaining stability. Nevertheless, the FDA reviewers concluded that Amsparity™ and Humira® were highly similar70.

Aside from FDA filings, other 3rd party articles have been published also comparing the degradation patterns of Humira® with its biosimilars. In an article comparing Amgevita™ with Humira® thermal stability and degradation studies were completed as part of the similarity assessment. The biosimilar adalimumab was exposed to heat at 25, 40, and 50°C over the course of 2 weeks. It was formulated in both the Amgevita™ formulation and Humira® formulation. In the Humira® formulation there were more aggregates forming at 50°C than in the Amgevita™ formulation. The aggregates were characterized using SEC and it was determined that the identified oligomer formation and overall degradation pattern matched that of Humira® at 50°C. Under non-stressed conditions, aggregation levels were also analyzed via SEC with light scattering and analytical ultracentrifugation sedimentation. These results showed that Amgevita™ and Humira® have similar types and amounts of aggregates, as well as overall particle levels71. Similarly, in another study comparing Amgevita™ with Humira®, the samples were age-adjusted using a linear regression model to determine if the two fell within the acceptable quality range at the end of the drug’s 2 year shelf-life. The authors reported that >90% of the Amgevita™ lots were within the quality range72.

In a study comparing Imraldi™ with Humira®, oxidation and deamidation products, which influence a protein’s conformation, stability, activity and safety, were analyzed and the two were found to be similar. Oxidation levels at Met256 as measured by LC-ESI-MS/MS were nearly identical, as were relative deamidation levels of asparagine residues. This study also demonstrated that high molecular weight aggregate levels were low, ≤ 0.5%, in both Imraldi™ and Humira®. The levels were confirmed by SEC, CE-SDS, sedimentation velocity analytical ultracentrifugation, and SEC coupled multi-angle laser light scattering63. In conclusion, the biosimilar adalimumabs have proven to follow similar degradation pathways as Humira®, thus bolstering their similarity claims and eliminating potential safety and efficacy concerns.

Clinical trial data:

Many patients in Europe have been switched from Humira® to an adalimumab biosimilar36,73,74. The success in convincing patients and physicians to switch over may be partially attributed to the similarity shown during clinical trials. Each biosimilar was compared head-to-head with a reference Humira® to prove similarity in response rates and anti-drug antibody (ADA) formation in patient populations. While biosimilars are indicated for most if not all of the same disease states as Humira®, including rheumatoid arthritis, plaque psoriasis and Crohn’s disease, often only one indication was tested for each biosimilar during the primary clinical trial studies. Amgevita™ was the only biosimilar tested in two patient populations – rheumatoid arthritis and plaque psoriasis – for primary studies. All other biosimilars were tested in either rheumatoid arthritis or plaque psoriasis populations.

Tables 5 and 6 list the current EMA approved biosimilars with their pertinent clinical trial information and results34,75–83. In Table 5 all of the biosimilar trials measured their primary efficacy endpoint using a common rheumatoid arthritis metric, the American College of Rheumatology score at which there is at least a 20% improvement in patients’ joint pain/inflammation (ACR20 score)84. Along with ACR20 scores, ADA levels and neutralizing ADA levels (data not shown) were also reported after 24 weeks of treatment. These levels were reported because they are linked to immunogenicity, which can be detrimental in patients as it can reduce a therapeutic’s overall efficacy and/or enhance its safety implications in vivo85. All of the studies also reported results for secondary efficacy endpoints, including American College of Rheumatology scores with 50% and 70% improvement in pain/inflammation – ACR50 and ACR70, respectively – and Disease Activity Scores reported for 28 joints monitored during treatment – DAS28 scores (results not shown)84.

Table 5.

Comparison of clinical trials results in rheumatoid arthritis patients based on full-analysis set (FAS) results, except for Imraldi™ where per protocol set (PPS) data was reported for the primary outcomes.

| Product | Study Name | Study Population | Treatment Duration | ACR20 Response Rate (Week 24) | ADA Positive (Week 24) |

|---|---|---|---|---|---|

| Amgevita™ | 20120262 | ABP501:N=264 Humira®: N=262 |

Main phase: 24 w Total: 28 w |

ABP 501: 74.6% Humira®:72.4% |

ABP 501: 38.3% Humira®: 38.2% |

| Imraldi™ | SB5-G31-RA | SB5: N=239 Humira®: N=237 |

Main phase: 24 w Total: 52 w |

SB5: 72.4% Humira®: 72.2% |

SB5:33.1% Humira®: 32.0% |

| Hulio™ | FKB327–002 | FKB327: N=367 Humira®: N=363 |

Main phase: 24–26 w Total: 76 w |

FKB327: 74.4% Humira®: 75.7% |

FKB327: 57.9% Humira®: 55.5% |

| Cyltezo® | 1297.2 |

BI695501: N=324 Humira®: N=321 |

Main phase: 24 w Total: 48 w |

BI695501:69% Humira®: 64.6% |

BI695501: 39.6% Humira®: 45.3% |

| *Amsparity™ | B538–02 | PF-06410293: N= 297 Humira®: N= 299 |

Main phase: 12 w Total: 78 w |

PF-06410293: 68.5% Humira®: 72.7% |

PF-06410293: 37.7% Humira®: 43.5% |

Note: Amsparity data for ACR20 response rate was taken from the 12-week main phase. ADA positive data was taken from week 26 samples to give a closer comparison to other biosimilars with ADA measured at week 24.

Table 6.

Comparison of clinical trials data in plaque psoriasis patients based on full-analysis (FAS) results, except for Idacio® where per protocol set (PPS) data was reported for primary outcomes.

| Product | Study Name | Study Population | Treatment Duration | PASI 75 Response Rate (Week 16) | ADA Positive (Week 16) |

|---|---|---|---|---|---|

| Amgevita™ | 20120263 | ABP501: N=175 Humira®: N=175 |

Main phase: 16 w Total: 52 w |

ABP 501: 74.4% Humira®: 82.7% |

ABP 501: 55.2% Humira®: 63.6% |

| Hyrimoz™ | GP2017–301 | GP2017: N=231 Humira®: N=234 |

Main phase: 16 w Total: 51 w |

GP2017:58.1% Humira®: 55.9% |

GP2017:25.7% Humira®: 23.6% |

| Idacio® | EMR200588–002 | MSB11022: N=202 Humira®:N=189 |

Main phase: 16 w Total: 54 w |

MSB11022: 90.0% Humira®: 92.0% |

MSB11022: 89.1% Humira®: 90.9% |

For the five biosimilars tested in arthritic patients, response rates were within a few percentage points of Humira®, corroborating similarity. There were some differences in ACR20 scores, with Amgevita™ and Hulio™ coming in closer to 75% and Cyltezo® and Amsparity™ reporting scores closer to 69%. However, despite efforts to enhance the uniformity of ACR score reporting and measuring, these differences can likely be explained by variations in the reporting/measuring of scores at individual trial sites86,87. What is more important to and supportive of similarity claims is that the ACR20 values for each biosimilar are close to the respective Humira® values tested in the same trial.

For the reported ADA values, we see good comparability between a biosimilar and its concomitantly tested Humira® reference product. There are differences across biosimilars; for example, Amgevita™ reported only 38% ADA formation for both Amgevita™ and Humira® whereas Hulio™ reported nearly 60% ADA formation for both Hulio™ and Humira®. But, much like for the ACR20 scores, there are a number of possible reasons for these discrepancies including the use of assays with different sensitivities at different trial sites. The assessment reports for each biosimilar include clinical trial results but do not clarify exactly which assays were used to quantify the antibody levels. Therefore, if assays with different sensitivities were utilized to report these results, then the wide variability may be explained.

Another factor that could result in these disparities could be related to how the data is reported. Taking a deeper dive into Table 5, we see that the data reported here is taken from the full-analysis set (FAS) of results for most biosimilars. For Imraldi™, however, the most complete data we could find was for the per protocol set (PPS). Using different groupings of subjects for analysis may impact the final results presented. Also, Amsparity™ had the primary efficacy endpoint, ACR20, measured after 12 weeks rather than after 24 weeks. Therefore, the ACR20 responses shown in Table 5, reported after 12 weeks of treatment, may be lower than what would be expected after 24 weeks of treatment. We were able to find ADA data for Amsparity™ after 26 weeks. Since this is two weeks after the data reported for the other biosimilars, allowing more time for ADAs to form, it may give rise to a higher number of ADA positive patients than would be expected if measured after 24 weeks. In conclusion, it is these unknowns in data collection and reporting that make head-to-head comparison of adalimumab biosimilars tested across multiple trial sites improper.

Table 6 contains information about the biosimilars that were tested in plaque psoriasis patients. Similar to rheumatoid arthritis, there are guidelines for evaluating efficacy in plaque psoriasis patients. The response rate was measured using a Psoriasis Area and Severity Index score (PASI 75) at which there was a 75% improvement from the baseline score 16 weeks post initial treatment88. For all three biosimilars tested in plaque psoriasis patients, the clinical trials were carried out beyond the 16 week primary endpoint to 51–54 weeks. The PASI 75 scores were relatively similar between the biosimilar and concurrently tested Humira® but there was variability across the biosimilars. Hyrimoz™ had ~57% positive PASI 75 response rates whereas Idacio® had over 90%. There was also variability in the ADA formation levels. Hyrimoz™ reported the lowest ADA formation in ~25% of patients, but of the ADAs, most were concluded to be neutralizing ADAs. Neutralizing ADAs are undesirable as they completely block the adalimumab from binding with TNF-α. Idacio® had the highest ADA formation at ~90%, but in looking at clinical data not included in Table 6, it appears as if only half of those are neutralizing ADAs.

As described earlier for the biosimilars tested in rheumatoid arthritis patients, a limited congruity in the assays used to measure ADAs could account for differences in the levels quantified. Likewise, different methods of reporting ADAs, such as breaking down ADAs into neutralizing and non-neutralizing or not,may also play a role. The wide range for PASI 75 response rates, though, is more difficult to resolve. Given that PASI 75 is a common metric measured during psoriasis trials, one would expect that the scores should be similar across all biosimilars. The “similarity” among all biosimilars should result in the same efficacy for a 50 mg/mL adalimumab dose. However, just because we are seeing deviations in response rates from 57% to 92% responders does not mean that one biosimilar is more efficacious than another. As long as there are similar response rates between a biosimilar and its reference Humira®, then a biosimilar is proving its efficacy and similarity. The PASI metric is considered to be the gold standard for psoriasis monitoring, but like with any inherently subjective metric, it does have its limitations89. These limitations, especially given the fact that these trials were conducted with different patients, and likely handled by different clinicians, could explain why such variability exists between biosimilars.

A review of the current adalimumab biosimilars demonstrates the similarities and differences in formulation, physicochemical properties, bioactivity, pharmacokinetics, degradation pathways, clinical response rates, and ADA formation among the adalimumab biosimilars. Due to limitations that preclude an accurate comparison of data across biosimilars, it is challenging to determine whether the variations in data are reflective of the product or of the assay. What can be said though is that, as we would expect given their approval status, the analyzed adalimumab biosimilars have shown significant levels of similarity to Humira®.

The science behind the products, while interesting and insightful, does not tell the entire story of the approved and marketed adalimumab biosimilars. Now that most have been on the European market for nearly two years, it is important to dive into the business side of each biosimilar currently available in Europe.

Financial impact:

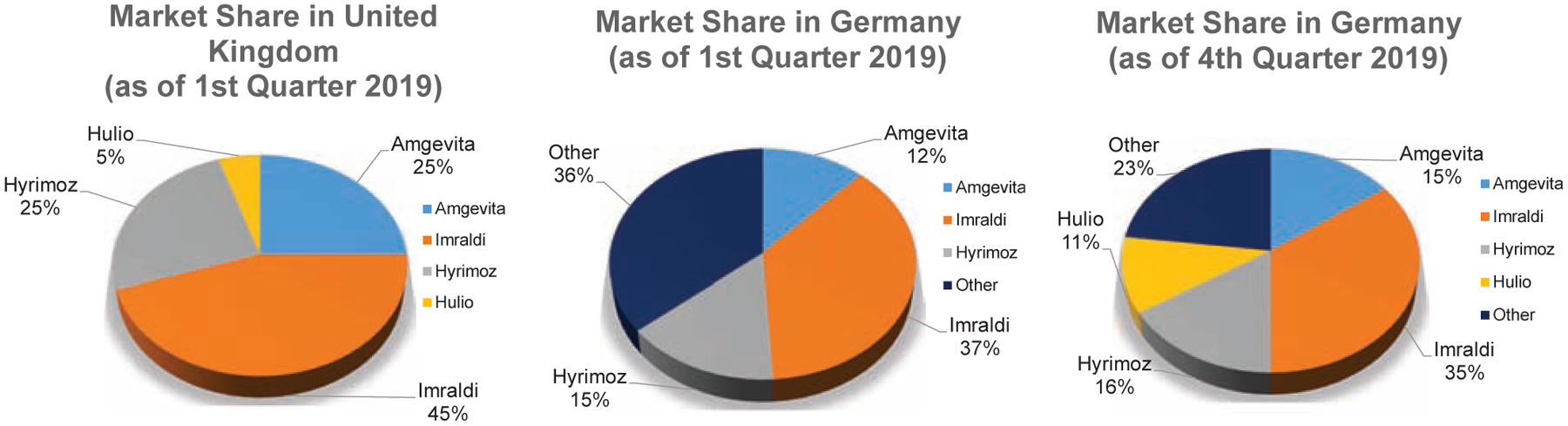

Since their market release in October 2018, or May 2019 for Idacio®, the adalimumab biosimilars have chipped away at Humira® sales. Collectively, the availability of all adalimumab biosimilars in Europe have resulted in AbbVie reporting a 31.1% decrease in net revenue in 20198. In Germany, Imraldi™, Amgevita™ and Hulio™ respectively held 15.6%, 13.4% and 11% of the total adalimumab market as of October 2019. Of the market’s remaining 60%, Humira® only maintained ~50%73,90A similar situation played out in the United Kingdom where ~63% of patients had been switched over to biosimilars after 6 months91. Again, Imraldi™ was the best-selling drug maintaining 45% of the adalimumab biosimilar market there92.

Beyond Germany and the United Kingdom adalimumab biosimilars as a whole captured about 35% of the adalimumab European market within a year of release. Imraldi™ appears to have dominated the entire European market. After the first quarter of 2019 Imraldi™ held 6.6% of the global adalimumab market, which includes Humira®. By the end of June 2019, Imraldi™ claimed 46% of the adalimumab biosimilar market share across Europe74.

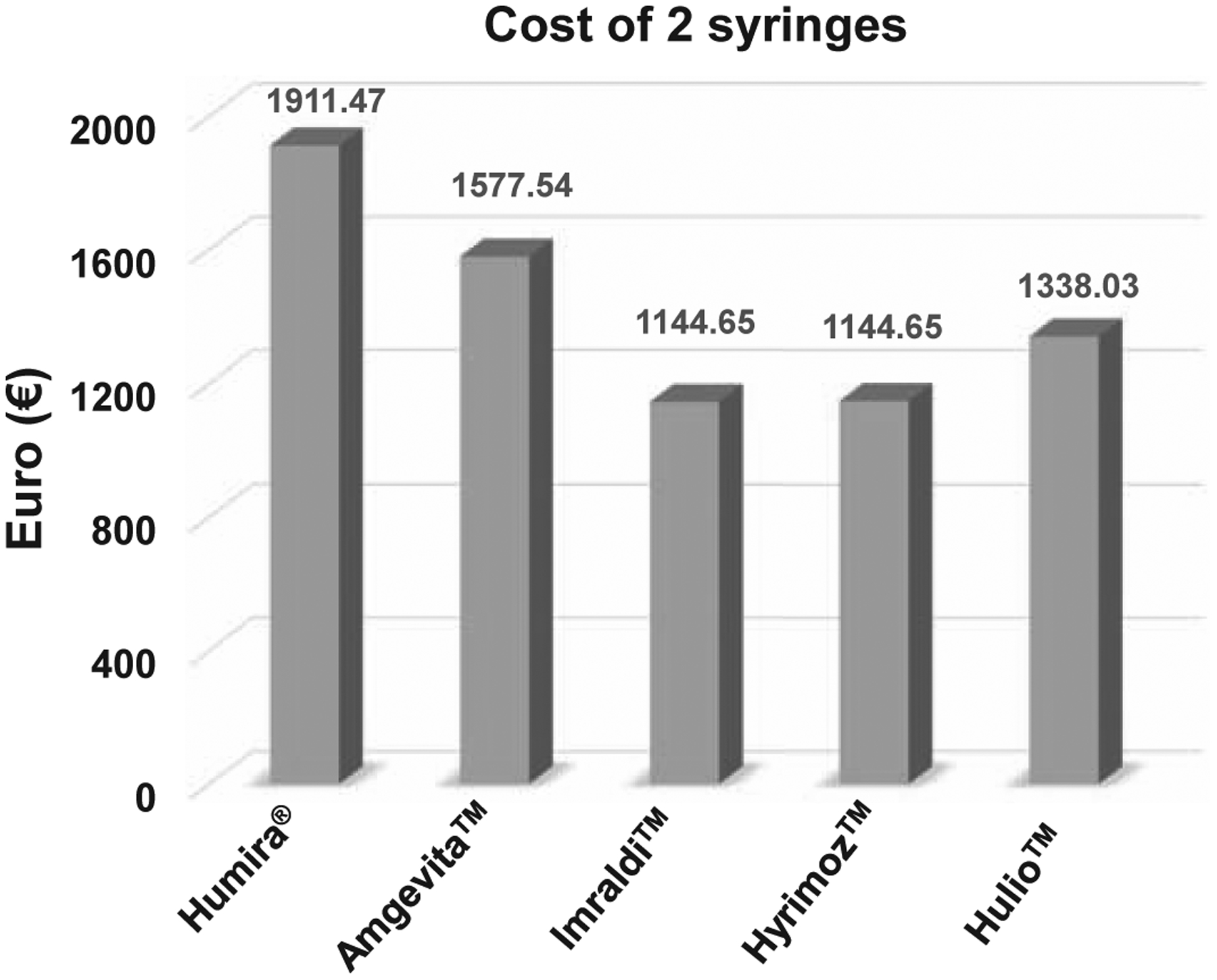

As Figure 3 exemplifies, Imraldi™ and Hyrimoz™ were the cheapest adalimumab biosimilar options upon the 2018 market release with the cost of two syringes in Germanybeing 1145€. This represented a 40% decrease in the cost compared to Humira®73. Amgevita™ only had an 18% discount93 for the same time period in Germany. No information about Hulio™ pricing schemes in Germany could be found, but it was reported that Hulio™ offered a 30% discount94 compared to Humira® in Ireland.

Figure 3.

Cost in euros of one month’s worth of adalimumab biosimilar treatment upon market release in Germany.

Note: Hulio is estimated based on pricing reports from Ireland.

In a more recent report released by IQVIA after the first quarter of 2020, some of these biosimilar prices have seen further reductions. When compared with the list price of Humira® one year before biosimilar market entry, countries such as Denmark, Germany, Hungary, Italy, Poland and Sweden now report ≥ 50% reduction of net price. The United Kingdom and France allegedly have 30–49% and 15–29% net price reductions, respectively95. While this document does not disclose list price of the drugs, it gives an idea as to the financial impact and trends biosimilars can have on the biologics market.

While discussing pricing schemes and the overall financial implications of adalimumab biosimilars, it needs to be noted that different countries have varying healthcare systemsand government policies. In Germany, much like in the United States, the healthcare system is decentralized. Due to this, German doctors can prescribe whichever brand they deem most appropriate, provided they observe cost efficiency96. In the United Kingdom there is a tendering process that awards lots – regions for marketing – to each biosimilar and the size of each lot depends on the strength of the offers made. Details of the offer are not public, but Imraldi™ must have made a strong offer to the United Kingdom health system because it was granted the largest total number of regions for sales. Not only was it granted the largest total number of regions, but it was also given some of the most populous areas including the South East and East of England91.

France requires that all biosimilars are the same cost, at least a 15% discount from Humira®, eliminating the cost advantage of one biosimilar over the next97. Some Nordic countries have a winner-takes-all policy where the cheapest treatment option is the only one available. AbbVie bestowed a nearly 80% discount for Humira® prescriptions in the region, allowing it to maintain its monopoly in these countries97,98. Ireland was slow to the uptake of biosimilars, but is now beginning to treat naïve patients with biosimilars instead of Humira® and has established financial incentives for physicians/hospitals who prescribe biosimilars over Humira®99.

On top of all of this, we also need to further consider factors such as pharmacy substitution ability, reimbursement, incentivization, and naïve vs. current patient switchability. For example, in the Netherlands physician interchangeability of different adalimumab products is permitted for naïve patients. Pharmacy substitution of these products without needing written consent from a physician is allowed throughout the course of treatment. This contrasts with Hungary where switching from originator to biosimilar or biosimilar to originator is permitted at the physician’s discretion but pharmacy substitutions are banned. In Romania there are no incentives and limited financial reimbursements for physicians and payers to make them heavily consider biosimilars. Conversely, in Poland hospitals have financial limits to government reimbursements, driving the desire to purchase and prescribe biosimilars. In Polish retail there is also a flat reimbursement rate which financially incentivizes the use of biosimilars95.

We also want to bear in mind that there could be other unaccounted for influences that may drive the pricing, financial impact and uptake of one particular biosimilar over another. Deals similar to the Johnson & Johnson deal negotiated for Remicade® could be struck between pharmaceutical companies and pharmacies to promote the prescription of one specific biosimilar100. Patient assistance programs informing patients of the safety, efficacy and financial benefits of taking a specific biosimilar may convince hesitant patients to convert101,102. Clearly, numerous factors influence and drive the business behind adalimumab biosimilars.

Undoubtedly the availability of adalimumab biosimilars has changed the financial landscape for healthcare systems, patients and payers across most European countries. Why some countries have been more receptive to the use of biosimilars than others, thus leading to larger cost savings per prescription, stems from a number of reasons including but not limited to variability in healthcare systems, reimbursement processes, incentivizations, government regulations and markets. Whether the biosimilar prices set by each country are adequate cannot be definitively answered here. Further understanding of each country’s healthcare economics, government policies, and even biosimilar education levels are needed.

Conclusion:

Our deep dive into the status of each adalimumab biosimilar approved and/or marketed in Europe and the United States has allowed us to gain a better understanding of what differences, or, more frequently, what similarities lie between biosimilars and the reference product Humira®. Sure, some data across biosimilars is not aligned, but these disparities can be explained once assay types, reporting methods, and subjectivity between trial sites are accounted for. Plus, as we have continued to reiterate throughout this paper, what is critical for the approval and marketability of these biosimilars is not how well they compare to each other, but rather how well they compare to their reference product Humira®. Based on what we have shown above, aside from some incongruities in formulation and delivery device specifications, it appears as if the biosimilars are indeed similar to Humira®. This comes as no shock as one would expect that an approved biosimilar would meet all of the stringent requirements established by the FDA and EMA to prove “similarity”.

In summary, this review has compiled considerable amounts of data and information surrounding the approved and/ or marketed biosimilars available in Europe and the United States. The compilation of this information is meant to educate researchers, industry partners, healthcare providers, payers and patients alike who seek to understand what will be arriving onto the United States market come 2023. As was discussed in the financial impact section of this paper, the biosimilar market for adalimumab continues to be a growing, ever-changing one. We expect it to gain more complexity as we enter into 2023 and beyond. However, complexity should not necessarily be viewed as a bad thing because having more, cheaper adalimumab options will lead to better awareness and patient access to these life-changing therapeutics.

Figure 2.

Adalimumab biosimilar market share breakdown in 2019 for the United Kingdom and Germany.

Table 1.

List of adalimumab biosimilar products.

| Biosimilar Product | Company | US Product Names | Other Affiliated Names |

|---|---|---|---|

| Amgevita™ | Amgen | Amjevita | Solymbic |

| Hyrimoz™ | Sandoz (Novartis) | Hyrimoz | Halimatoz, Hefiya |

| Imraldi™ | Samsung Bioepis | Hadlima | n/a |

| Idacio® | Fresenius Kabi | n/a | Kromeya |

| Hulio™ | Mylan/ Fujifilm | Hulio | n/a |

| Cyltezo® | Boehringer Ingelheim | Cyltezo | n/a |

| Amsparity™ | Pfizer | Abrilada | n/a |

Note: Cyltezo has been withdrawn from European market but will be released in the United States come 2023.

Acknowledgement:

Jill Coghlan was supported by the Cellular Biotechnology Training Program (NIH T32 GM008353).

Footnotes

Publisher's Disclaimer: This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final form. Please note that during the production process errors may be discovered which could affect the content, and all legal disclaimers that apply to the journal pertain.

References:

- 1.Mikulic M Revenue of AbbVie’s Humira 2011–2019. Statista. Published February 28, 2020. Accessed May 5, 2020. https://www.statista.com/statistics/318206/revenue-of-humira/ [Google Scholar]

- 2.Urquhart L Top companies and drugs by sales in 2019. Nat Rev Drug Discov. 2020;19(4):228. doi: 10.1038/d41573-020-00047-7 [DOI] [PubMed] [Google Scholar]

- 3.FDA CDER. HIGHLIGHTS OF PRESCRIBING INFORMATION-HUMIRA.; 2002. Accessed June 4, 2019. www.fda.gov/medwatch

- 4.Billmeier U, Dieterich W, Neurath MF, Atreya R. Molecular mechanism of action of anti-tumor necrosis factor antibodies in inflammatory bowel diseases. World J Gastroenterol. 2016;22(42):9300–9313. doi: 10.3748/wjg.v22.i42.9300 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Kang J, Pisupati K, Benet A, Ruotolo BT, Schwendeman SP, Schwendeman A. Infliximab Biosimilars in the Age of Personalized Medicine. Trends Biotechnol. 2018;36(10):987–992. doi: 10.1016/j.tibtech.2018.05.002 [DOI] [PubMed] [Google Scholar]

- 6.European Medicines Agency. Medicines . Published 2020. Accessed May 5, 2020. https://www.ema.europa.eu/en/medicines/field_ema_web_categories%253Aname_field/Humn/ema_medicine_types/field_ema_med_biosimilar?search_api_views_fulltext=adalimumab

- 7.Biosimilar Product Information | FDA. Accessed November 10, 2020. https://www.fda.gov/drugs/biosimilars/biosimilar-product-information

- 8.AbbVie Reports Full-Year and Fourth-Quarter 2019 Financial Results . AbbVie News Center. Published February 7, 2020. Accessed May 5, 2020. https://news.abbvie.com/news/press-releases/abbvie-reports-full-year-and-fourth-quarter-2019-financial-results.htm [Google Scholar]

- 9.Amgen Siedor A., Sandoz Samsung, and Mylan Launch Biosimilars in Europe (UPDATED) - Big Molecule Watch. Big Molecule Watch. Published November 2, 2018. Accessed May 5, 2020. https://www.bigmoleculewatch.com/2018/11/02/amgen-sandoz-samsung-and-mylan-launch-biosimilars-in-europe-updated/ [Google Scholar]

- 10.Adalimumab biosimilar Idacio launched in Germany. GaBI - Generics and Biosimilars Initiative. Published May 17, 2019. Accessed May 5, 2020. http://www.gabionline.net/Biosimilars/News/Adalimumab-biosimilar-Idacio-launched-in-Germany [Google Scholar]

- 11.Biosimilars approved in Europe . GaBI-Generics and Biosimilars Initiative. Published February 24, 2020. Accessed May 5, 2020. http://www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-Europe [Google Scholar]

- 12.Stanton D Biogen reports steep European adoption of Humira biosimilar - BioProcess InternationalBioProcess International. Published April 26, 2019. Accessed May 5, 2020. https://bioprocessintl.com/bioprocess-insider/global-markets/biogen-reports-steep-european-adoption-of-humira-biosimilar/

- 13.DiGrande S Boehringer Ingelheim to Pull Out of EU Biosimilars Market, Focus on US | Center for Biosimilars®. The Center for Biosimilars. Published November 29, 2018. Accessed October 22, 2020. https://www.centerforbiosimilars.com/view/boehringer-ingelheim-to-pull-out-of-eu-biosimilars-market-focus-on-us [Google Scholar]

- 14.Biosimilar and Interchangeable Products. U.S. Food & Drug Administration. Published 2017. Accessed May 30, 2019. https://www.fda.gov/drugs/biosimilars/biosimilar-and-interchangeable-products [Google Scholar]

- 15.PFIZER REPORTS FOURTH-QUARTER AND FULL-YEAR 2019 RESULTS | Business Wire. Business Wire. Published January 28, 2020. Accessed October 22, 2020. https://www.businesswire.com/news/home/20200128005272/en/PFIZER-REPORTS-FOURTH-QUARTER-AND-FULL-YEAR-2019-RESULTS [Google Scholar]

- 16.Pfizer launching biosimilars in US and Japan but not in EU . GaBI - Generics and Biosimilars Initiative. Published February 14, 2020. Accessed May 5, 2020. http://www.gabionline.net/Biosimilars/News/Pfizer-launching-biosimilars-in-US-and-Japan-but-not-in-EU [Google Scholar]

- 17.Dunn Andrew. AbbVie staves off 6th Humira biosimilar in US. BioPharma Dive. Published 2018. Accessed May 30, 2019. https://www.biopharmadive.com/news/abbvie-staves-off-6th-humira-biosimilar-in-us/541665/

- 18.Momenta Press Release. Momenta Pharmaceuticals Announces Global Settlement with AbbVie to Enable Commercialization of M923, a Proposed Biosimilar to HUMIRA® (adalimumab) | Momenta Pharmaceuticals. 2018. Accessed June 4, 2019. http://ir.momentapharma.com/news-releases/news-release-details/momenta-pharmaceuticals-announces-global-settlement-abbvie [Google Scholar]

- 19.AbbVie and Boehringer Ingelheim Settle Over Biosimilar Adalimumab. The Center for Biosimilars. Published 2018. Accessed May 30, 2019. https://www.centerforbiosimilars.com/news/abbvie-and-boehringer-ingelheim-settle-over-biosimilar-adalimumab [Google Scholar]

- 20.Pfizer Is Latest to Settle With AbbVie Over Humira. The Center for Biosimilars. Published 2018. Accessed May 30, 2019. https://www.centerforbiosimilars.com/news/pfizer-becomes-latest-to-settle-with-abbvie-over-humira [Google Scholar]

- 21.Amgen Press Release. Amgen And AbbVie Agree To Settlement Allowing Commercialization Of AMGEVITA. Published 2017. Accessed June 4, 2019. https://www.amgen.com/media/news-releases/2017/09/amgen-and-abbvie-agree-to-settlement-allowing-commercialization-of-amgevita/ [Google Scholar]

- 22.Sandoz Press Release. Sandoz announces global resolution of biosimilar adalimumab patent disputes, securing patient access | Sandoz. 2018. Accessed June 4, 2019. https://www.sandoz.com/news/media-releases/sandoz-announces-global-resolution-biosimilar-adalimumab-patent-disputes [Google Scholar]

- 23.Biogen Press Release. Biogen and Samsung Bioepis Agree to Settlement with AbbVie Allowing Commercialization of IMRALDI™ (Adalimumab Biosimilar) in Europe | Biogen. Published 2018. Accessed June 4, 2019. http://investors.biogen.com/news-releases/news-release-details/biogen-and-samsung-bioepis-agree-settlement-abbvie-allowing [Google Scholar]

- 24.Coherus Biosciences Press Release. Coherus BioSciences Announces Global Settlement with AbbVie Securing Rights to Commercialize its Adalimumab Biosimilar Candidate, CHS-1420 | Coherus Biosciences Inc. Published 2019. Accessed June 4, 2019. https://investors.coherus.com/news-releases/news-release-details/coherus-biosciences-announces-global-settlement-abbvie-securing [Google Scholar]

- 25.Zhao S, Chadwick L, Mysler E, Moots RJ. Review of Biosimilar Trials and Data on Adalimumab in Rheumatoid Arthritis. Curr Rheumatol Rep. 2018;20(10). doi: 10.1007/s11926-018-0769-6 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Azevedo V, Dela Coletta Troiano Araujo L, Bassalobre Galli natalia, kleinfelder alais, marostica Catolino nathan, martins Urbano paulo cesar. Adalimumab: a review of the reference product and biosimilars. Biosimilars. 2016;Volume 6:29–44. doi: 10.2147/BS.S98177 [DOI] [Google Scholar]

- 27.Nash P, Vanhoof J, Hall S, et al. Randomized Crossover Comparison of Injection Site Pain with 40 mg/0.4 or 0.8 mL Formulations of Adalimumab in Patients with Rheumatoid Arthritis. Rheumatol Ther. 2016;3(2):257–270. doi: 10.1007/s40744-016-0041-3 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.Gely C, Marín L, Gordillo J, et al. Impact of pain associated with the subcutaneous administration of adalimumab. Gastroenterol Hepatol. 2020;43(1):9–13. doi: 10.1016/j.gastrohep.2019.06.008 [DOI] [PubMed] [Google Scholar]

- 29.AbbVie. HUMIRA® (adalimumab) Citrate-free Injection. Humira Patient Information. Published 2019. Accessed June 6, 2019. https://www.humira.com/citrate-free [Google Scholar]

- 30.Nash P, Vanhoof J, Hall S, et al. Randomized Crossover Comparison of Injection Site Pain with 40 mg/0.4 or 0.8 mL Formulations of Adalimumab in Patients with Rheumatoid Arthritis. Rheumatol Ther. 2016;3(2):257–270. doi: 10.1007/s40744-016-0041-3 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.Troein P, Newton M, Patel J, Scott K. The Impact of Biosimilar Competition in Europe.; 2019.

- 32.CHMP. ANNEX I SUMMARY OF PRODUCT CHARACTERISTICS-HULIO.; 2018. Accessed June 4, 2019. https://www.ema.europa.eu/en/documents/product-information/hulio-epar-product-information_en.pdf [Google Scholar]

- 33.FDA CDER. HIGHLIGHTS OF PRESCRIBING INFORMATION-ABRILIDA.; 2019. Accessed May 11, 2020. www.fda.gov/medwatch.

- 34.CHMP. ANNEX I SUMMARY OF PRODUCT CHARACTERISTICS- AMSPARITY. Accessed May 11, 2020. https://www.ema.europa.eu/en/documents/product-information/amsparity-epar-product-information_en.pdf [Google Scholar]

- 35.Fda Cder. HIGHLIGHTS OF PRESCRIBING INFORMATION. Accessed November 10, 2020. www.fda.gov/medwatch

- 36.Engl and NHS and NHS Improvement Regional Medicines Optimisation Committee Briefing Best Value Biologicals: Adalimumab Update 6.; 2019. Accessed November 6, 2019. https://www.england.nhs.uk/publication/what-is-a-

- 37.Erskine David and Minshull John. Update on Development of Biosimilar Versions of Adalimumab with Particular Focus on Excipients and Injection Site Reactions David Erskine and John Minshull-London Medicine Information Service Building on Previous Work Undertaken by PMSG (Version 2) The First Stop for Professional Medicines Advice.; 2018. Accessed May 24, 2019. http://www.ema.europa.eu/e

- 38.CHMP. ANNEX I SUMMARY OF PRODUCT CHARACTERISTICS-HYRIMOZ.; 2018. Accessed June 4, 2019. https://www.ema.europa.eu/en/documents/product-information/hyrimoz-epar-product-information_en.pdf [Google Scholar]

- 39.CHMP. ANNEX I SUMMARY OF PRODUCT CHARACTERISTICS-IDACIO.; 2019. Accessed June 4, 2019. https://www.ema.europa.eu/en/documents/product-information/idacio-epar-product-information_en.pdf [Google Scholar]

- 40.CHMP. ANNEX I SUMMARY OF PRODUCT CHARACTERISTICS-CYLTEZO.; 2017. Accessed June 4, 2019. https://www.ema.europa.eu/en/documents/product-information/cyltezo-epar-product-information_en.pdf [Google Scholar]

- 41.CHMP. ANNEX I SUMMARY OF PRODUCT CHARACTERISTICS-AMGEVITA.; 2018. Accessed June 4, 2019. https://www.ema.europa.eu/en/documents/product-information/amgevita-epar-product-information_en.pdf [Google Scholar]

- 42.CHMP. ANNEX I SUMMARY OF PRODUCT CHARACTERISTICS-IMRALDI.; 2018. Accessed June 4, 2019. https://www.ema.europa.eu/en/documents/product-information/imraldi-epar-product-information_en.pdf [Google Scholar]

- 43.Gervase R, Miller J, Laidlaw H. AbbVie Humira Patent Thicket Not Providing Cognizable Basis for Antitrust Violation. The National Law Review. Published June 18, 2020. Accessed November 10, 2020. https://www.natlawreview.com/article/abbvie-s-enforcement-its-patent-thicket-humira-under-bpcia-does-not-provide [Google Scholar]

- 44.Sagonowsky E Boehringer buckles in AbbVie patent fight, saving Humira from biosims until 2023 | FiercePharma. Fierce Pharma. Published May 14, 2019. Accessed November 10, 2020. https://www.fiercepharma.com/pharma/boehringer-deal-abbvie-s-megablockbuster-u-s-market-for-humira-looks-safe-until-2023 [Google Scholar]

- 45.Williams A Patent Docs: HUMIRA® Biosimilar Update -- Settlement in AbbVie v. Amgen Case Announced and AbbVie v. Boehringer Ingelheim Litigation Begins. Patent Docs. Published September 28, 2017. Accessed November 10, 2020. https://www.patentdocs.org/2017/09/humira-biosimilar-update-settlement-in-abbvie-v-amgen-case-announced-and-abbvie-v-boehringer-ingelhe.html [Google Scholar]

- 46.Mitrokostas N, Blais E, Procter G. End Of A Humira Battle Observations From The AbbVie-Amgen Armistice. Biosimilar Development. Published October 31, 2017. Accessed November 10, 2020. https://www.biosimilardevelopment.com/doc/end-of-a-humira-battle-observations-from-the-abbvie-amgen-armistice-0001 [Google Scholar]

- 47.Kang J, Kim SY, Vallejo D, et al. Multifaceted assessment of rituximab biosimilarity: The impact of glycan microheterogeneity on Fc function. Eur J Pharm Biopharm. 2020;146:111–124. doi: 10.1016/j.ejpb.2019.12.003 [DOI] [PubMed] [Google Scholar]

- 48.Pisupati K, Tian Y, Okbazghi S, et al. A Multidimensional Analytical Comparison of Remicade and the Biosimilar Remsima. Anal Chem. 2017;89(9):4838–4846. doi: 10.1021/acs.analchem.6b04436 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 49.Tebbey PW, Declerck P. Importance of manufacturing consistency of the glycosylated monoclonal antibody adalimumab (Humira®) and potential impact on the clinical use of biosimilars. GaBI J. 2016;5(2):70–73. doi: 10.5639/gabij.2016.0502.018 [DOI] [Google Scholar]

- 50.Liu L Antibody Glycosylation and Its Impact on the Pharmacokinetics and Pharmacodynamics of Monoclonal Antibodies and Fc-Fusion Proteins. J Pharm Sci. 2015;104:1866–1884. doi: 10.1002/jps.24444 [DOI] [PubMed] [Google Scholar]

- 51.Pierri CL, Bossis F, Punzi G, et al. Molecular modeling of antibodies for the treatment of TNFα-related immunological diseases. Pharmacol Res Perspect. 2016;4(1):e00197–e00197. doi: 10.1002/prp2.197 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 52.Shields RL, Lai J, Keck R, et al. Lack of fucose on human IgG1 N-linked oligosaccharide improves binding to human FcγRIII and antibody-dependent cellular toxicity. J Biol Chem. 2002;277(30):26733–26740. doi: 10.1074/jbc.M202069200 [DOI] [PubMed] [Google Scholar]

- 53.Shinkawa T, Nakamura K, Yamane N, et al. The absence of fucose but not the presence of galactose or bisecting N-acetylglucosamine of human IgG1 complex-type oligosaccharides shows the critical role of enhancing antibody-dependent cellular cytotoxicity. J Biol Chem. 2003;278(5):3466–3473. doi: 10.1074/jbc.M210665200 [DOI] [PubMed] [Google Scholar]

- 54.Chung S, Quarmby V, Gao X, et al. Quantitative evaluation of fucose reducing effects in a humanized antibody on Fcγ receptor binding and antibody-dependent cell-mediated cytotoxicity activities. MAbs. 2012;4(3):326–340. doi: 10.4161/mabs.19941 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 55.Houde D, Peng Y, Berkowitz SA, Engen JR. Post-translational Modifications Differentially Affect IgG1 Conformation and Receptor Binding. Mol Cell Proteomics. 2010;9(8):1716–1728. doi: 10.1074/mcp.M900540-MCP200 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 56.Goetze AM, Liu YD, Zhang Z, et al. High-mannose glycans on the Fc region of therapeutic IgG antibodies increase serum clearance in humans. Glycobiology. 2011;21(7):949–959. doi: 10.1093/glycob/cwr027 [DOI] [PubMed] [Google Scholar]

- 57.Kuhne Bonnington, Malik, et al. The Impact of Immunoglobulin G1 Fc Sialylation on Backbone Amide H/D Exchange. Antibodies. 2019;8(4):49. doi: 10.3390/antib8040049 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 58.Scallon BJ, Tam SH, Mccarthy SG, Cai AN, Raju TS. Higher levels of sialylated Fc glycans in immunoglobulin G molecules can adversely impact functionality. Mol Immunol. 2007;44:1524–1534. doi: 10.1016/j.molimm.2006.09.005 [DOI] [PubMed] [Google Scholar]

- 59.Higel F, Seidl A, Sörgel F, Friess W. N-glycosylation heterogeneity and the influence on structure, function and pharmacokinetics of monoclonal antibodies and Fc fusion proteins. Eur J Pharm Biopharm. 2016;100:94–100. doi: 10.1016/j.ejpb.2016.01.005 [DOI] [PubMed] [Google Scholar]

- 60.Biologics License Application for ABP-501.; 2019.

- 61.CENTER FOR DRUG EVALUATION AND RESEARCH. APPLICATION NUMBER: 761059Orig1s000 PRODUCT QUALITY REVIEW(S).; 2019. [Google Scholar]

- 62.CENTER FOR DRUG EVALUATION AND RESEARCH. APPLICATION NUMBER: 761071Orig1s000 PRODUCT QUALITY REVIEW(S).; 2018. [Google Scholar]

- 63.Lee N, Lee JJ, Yang H, et al. Evaluation of similar quality attribute characteristics in SB5 and reference product of adalimumab. MAbs. 2019;11(1):129–144. doi: 10.1080/19420862.2018.1530920 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 64.Vidarsson G, Dekkers G, Rispens T. IgG subclasses and allotypes: From structure to effector functions. Front Immunol. 2014;5(OCT). doi: 10.3389/fimmu.2014.00520 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 65.fda, cder. HADLIMA HIGHLIGHTS OF PRESCRIBING INFORMATION.; 2019. Accessed November 10, 2020. www.fda.gov/medwatch. [Google Scholar]

- 66.FDA. HIGHLIGHTS OF PRESCRIBING INFORMATION-HYRIMOZ.; 2018. Accessed June 4, 2019. www.fda.gov/medwatch [Google Scholar]

- 67.fda. CYLTEZO HIGHLIGHTS OF PRESCRIBING INFORMATION.; 2017. Accessed November 10, 2020. www.fda.gov/medwatch [Google Scholar]

- 68.Fda. AMJEVITA (Adalimumab-Atto) Injection for Subcutaneous Use Label.; 2016. Accessed November 10, 2020. www.fda.gov/medwatch [Google Scholar]

- 69.Füssl F, Carillo S, Bones J, et al. Degradation Pathways Analysis of Adalimumab Drug Product Performed Using Native Intact CVA-MS.; 2019.

- 70.Fda. CENTER FOR DRUG EVALUATION AND RESEARCH APPLICATION NUMBER: 761118Orig1s000 PRODUCT QUALITY REVIEW(S).; 2019. [Google Scholar]

- 71.Liu J, Eris Tamer, Li C, Cao S, Kuhns Scott. Assessing Analytical Similarity of Proposed Amgen Biosimilar ABP 501 to Adalimumab. BioDrugs. 2016;30:321–338. doi: 10.1007/s40259-016-0184-3 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 72.Sivendran R, Ramírez J, Ramchandani M, Liu J. Scientific and statistical considerations in evaluating the analytical similarity of ABP 501 to adalimumab. Immunotherapy. 2018;10(11):1011–1021. doi: 10.2217/imt-2018-0040 [DOI] [PubMed] [Google Scholar]

- 73.Humira biosimilars won almost 50% market share over 12 months in Germany. Published online 2019. https://www.apmhealtheurope.com/freestory/0/65736/humira-biosimilars-won-almost-50--market-share-over-12-months-in-germany

- 74.Byung-ho K, Ha-yeon L. Samsung Bioepis claims No.1 in European adalimumab biosimilar mkt . Pulse News. Published June 4, 2019. Accessed May 5, 2020. https://pulsenews.co.kr/view.php?year=2019&no=382569 [Google Scholar]

- 75.Committee for Medicinal Products for Human Use (CHMP). Cyltezo Assessment Report.; 2017. Accessed May 7, 2020. www.ema.europa.eu/contact

- 76.Committee for Medicinal Products for Human Use (CHMP). Amgevita Assessment Report.; 2017. Accessed May 8, 2020. www.ema.europa.eu/contact

- 77.Committee for Medicinal Products for Human Use (CHMP). Imraldi Assessment Report.; 2017. Accessed May 8, 2020. www.ema.europa.eu/contact

- 78.Committee for Medicinal Products for Human Use (CHMP). Idacio Assessment Report.; 2019. Accessed May 8, 2020. www.ema.europa.eu/contact

- 79.Committee for Medicinal Products for Human Use (CHMP). Halimatoz Assessment Report.; 2018. Accessed May 8, 2020. www.ema.europa.eu/contact

- 80.Fleischmann RM, Alten R, Pileckyte M, et al. A comparative clinical study of PF-06410293, a candidate adalimumab biosimilar, and adalimumab reference product (Humira®) in the treatment of active rheumatoid arthritis. Arthritis Res Ther. 2018;20(1). doi: 10.1186/s13075-018-1676-y [DOI] [PMC free article] [PubMed] [Google Scholar]

- 81.Genovese MC, Glover J, Greenwald M, et al. FKB327, an adalimumab biosimilar, versus the reference product: results of a randomized, Phase III, double-blind study, and its open-label extension. Arthritis Res Ther. 2019;21(1):281. doi: 10.1186/s13075-019-2046-0 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 82.Weinblatt ME, Baranauskaite A, Niebrzydowski J, et al. Phase III Randomized Study of SB5, an Adalimumab Biosimilar, Versus Reference Adalimumab in Patients With Moderate-to-Severe Rheumatoid Arthritis. Arthritis Rheumatol. 2018;70(1):40–48. doi: 10.1002/art.40336 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 83.Cohen S, Genovese MC, Choy E, et al. Efficacy and safety of the biosimilar ABP 501 compared with adalimumab in patients with moderate to severe rheumatoid arthritis: A randomised, double-blind, phase III equivalence study. Ann Rheum Dis. 2017;76(10):1679–1687. doi: 10.1136/annrheumdis-2016-210459 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 84.At a glance: Common scores used in rheumatology | rheumatology.medicinematters.com. Medicine Matters-rheumatology. Published July 9, 2018. Accessed May 11, 2020. https://rheumatology.medicinematters.com/treatment/patient-reported-outcomes-/at-a-glance-rheumatology-scores/16077860 [Google Scholar]

- 85.FDA CDER. Guidance for Industry Immunogenicity Assessment for Therapeutic Protein Products.; 2014. Accessed March 26, 2020. http://www.fda.gov/Drugs/GuidanceComplianceRegulatoryInformation/Guidances/default.htmand/orhttp://www.fda.gov/BiologicsBloodVaccines/GuidanceComplianceRegulatoryInformation/Guidances/default.htm [Google Scholar]

- 86.Goldman JA, Xia HA, White B, Paulus H. Evaluation of a modified ACR20 scoring system in patients with rheumatoid arthritis receiving treatment with etanercept. Ann Rheum Dis. 2006;65(12):1649–1652. doi: 10.1136/ard.2005.047266 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 87.Felson DT, LaValley MP. The ACR20 and defining a threshold for response in rheumatic diseases: Too much of a good thing. Arthritis Res Ther. 2014;16(1). doi: 10.1186/ar4428 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 88.Abrouk M, Nakamura M, Zhu TH, Farahnik B, Koo J, Bhutani T. The impact of PASI 75 and PASI 90 on quality of life in moderate to severe psoriasis patients. J Dermatolog Treat. 2017;28(6):488–491. doi: 10.1080/09546634.2016.1278198 [DOI] [PubMed] [Google Scholar]

- 89.Validity of Outcome Measures. Canadian Agency for Drugs and Technologies in Health; 2017. Accessed July 10, 2020. https://www.ncbi.nlm.nih.gov/books/NBK533695/ [Google Scholar]

- 90.Arias Aurelio. One Hundred Days of Humira Biosimilars. IQVIA. Published online March 2019. https://www.iqvia.com/blogs/2019/03/one-hundred-days-of-humira-biosimilars [Google Scholar]

- 91.NHS England and NHS Improvement Regional Medicines Optimisation Committee Briefing Best Value Biologicals: Adalimumab Update 6.; 2019. https://www.england.nhs.uk/publication/what-is-a-

- 92.Inserro A Multicenter European Study to Look at Real-World Experience of Patients Switched to Imraldi. The Center for Biosimilars. Published July 17, 2019. Accessed May 5, 2020. https://www.centerforbiosimilars.com/news/multicenter-european-study-to-look-at-realworld-experience-of-patients-switched-to-imraldi [Google Scholar]

- 93.Mauduit Helene. Sandoz aligns price of Humira biosimilar Hyrimoz with Germany’s cheapest, Biogen’s Imraldi. APM Heal Eur. Published online October 2018:26. https://www.apmhealtheurope.com/freestory/0/61001/sandoz-aligns-price-of-humira-biosimilar-hyrimoz-with-germany-s-cheapest--biogen-s-imraldi [Google Scholar]

- 94.Hamilton P Mylan claims HSE could save €42m with use of biosimilar drug for arthritis. The Irish Times. https://www.irishtimes.com/business/health-pharma/mylan-claims-hse-could-save-42m-with-use-of-biosimilar-drug-for-arthritis-1.3636172. Published September 20, 2018. [Google Scholar]

- 95.Country Scorecards for Biosimilar Sustainability.; 2020.

- 96.Hirschler B, Erman M. Europe ready to cash in on cheap copies of AbbVie biotech drug - Reuters. Reuters. https://www.reuters.com/article/us-abbvie-biosimilars/europe-ready-to-cash-in-on-cheap-copies-of-abbvie-biotech-drug-idUSKCN1LE1JO. Published August 29, 2018. Accessed May 11, 2020. [Google Scholar]

- 97.“Who wants the biggest slice of the biosimilar pie?”: The Humira biosimilar wave in Europe. Eversana- Global Pricing Published 2019. Accessed June 6, 2019. https://www.eversana.com/insights/who-wants-the-biggest-slice-of-the-biosimilar-pie-the-humira-biosimilar-wave-in-europe/ [Google Scholar]

- 98.Sagonowsky Eric. AbbVie’s massive Humira discounts are stifling Netherlands biosimilars: report | FiercePharma. FiercePharma. Published online March 2019. Accessed June 6, 2019. https://www.fiercepharma.com/pharma/abbvie-stifling-humira-biosim-competition-massive-discounting-dutch-report [Google Scholar]

- 99.Paying hospitals to cut the drugs budget. The Irish Times. https://www.irishtimes.com/business/health-pharma/paying-hospitals-to-cut-the-drugs-budget-1.3911275. Published June 1, 2019. Accessed June 10, 2019. [Google Scholar]

- 100.Reinke Thomas. Show Us (the U.S.) the Savings. Managed Care Magazine. Published 2019. Accessed May 24, 2019. https://www.managedcaremag.com/archives/2019/1/show-us-us-savings [PubMed] [Google Scholar]

- 101.Brixner D, Rubin DT, Mease P, et al. Patient Support Program Increased Medication Adherence with Lower Total Health Care Costs Despite Increased Drug Spending. J Manag Care Spec Pharm. Published online May 11, 2019:1–11. doi: 10.18553/jmcp.2019.18443 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 102.Rubin DT, Mittal M, Davis M, Johnson S, Chao J, Skup M. Impact of a Patient Support Program on Patient Adherence to Adalimumab and Direct Medical Costs in Crohn’s Disease, Ulcerative Colitis, Rheumatoid Arthritis, Psoriasis, Psoriatic Arthritis, and Ankylosing Spondylitis. J Manag Care Spec Pharm. 2017;23(8):859–867. doi: 10.18553/jmcp.2017.16272 [DOI] [PMC free article] [PubMed] [Google Scholar]