Abstract

Background:

Universal Health Coverage refers to health care system that provides health care and financial protection to all the citizen. Rashtriya Swasthya Bima Yojna as National Health Insurance Scheme initiated in Chhattisgarh State in 2009 for below poverty line families. Second scheme is Mukhyamantri Swasthya Bima Yojna initiated in 2012, which covers non below poverty line families.

Objectives:

To assess socio demographic factors among women residing in slum of Rajnandgaon, to find their universal health insurance coverage under RSBY/ MSBY and to assess the extent of concerned treatment under RSBY/MSBY.

Methods:

It was a community based cross sectional study, conducted in the urban slum area of Rajnandgaon amongst 188 women above 18 years of age who were hospitalized 6 months prior to the study using snow ball technique as a sampling method. They were interviewed using semi structured questionnaires by the investigator with the help of anganwadi worker.

Result:

77.65% respondents/study subjects were enrolled under the universal health insurance (RSBY card/ MSBY card). Subjects belonging to Lower socio-economic status and having BPL card were enrolled under scheme more than upper socio-economic group. Out of 146 smart card holders, a mere 1.36% subjects incurred catastrophic OOPE. Out of 42 respondents not having smart card, 40.47% subjects incurred catastrophic OOPE

Conclusion:

The RSBY card reduced the inpatient OOPE. RSBY card prevented catastrophic OOP in most of the respondent. RSBY has made health services accessible to all sections of community at minimal cost.

Keywords: Community based health insurance, out of pocket expenditure, universal health coverage, universal health insurance

Introduction

There is a global consensus on the goals of Universal Health Coverage (UHC) which has been defined as all people receiving quality health services that meet there needs without exposing them financial hardships in paying for them.[1] It refers to health care system that provides health care and financial protection to the entire citizen. The World Health Organization defined universal health coverage as ensuring all people access to promotive, preventive, curative and rehabilitative health services of sufficiently good quality.[2] It also ensures people do not suffer financial hardship paying for health care services. The target is to provide all people with access to high quality integrated health services as well as safe effective quality and affordable essential medicines and vaccine. UHC global monitoring report confirms half of World's population still does not have access to quality essential services to promote and protect health and also states that 800 million people spends 10% of their household budget on health care expenses.[3] Investments to reduce health risk among poor and provision of insurance against catastrophic health care cost are important elements in a strategy for reducing poverty.[4] Financial protection in health means that everyone can obtain the health care services they need without experiencing financial hardship. It is a key health system objective and an important dimension of universal health coverage, a target (3.8) of Sustainable Development Goal (SDG).[5] Twelfth Five Year Plan 2012-2017 proposed to reduce poor households out of pocket expenditure as one of its goal.[6] A National Health Mission goal also proposes the same.[7] Rashtriya Swasthya Bima Yojna (RSBY) as National Health Insurance Scheme initiated in Chhattisgarh State in 2009 to protect poor households from financial risks associated with hospitalization expenses. Second scheme is Mukhyamantri Swasthya BimaYojna which was initiated in 2012. It is expanded form of RSBY which covers non below poverty line families. Families need to pay 30 Rs for getting insurance card and the members would get free health care up to Rs 30000 to Rs 50000.[8] The direction of RSBY's effect on utilization of outpatient services and OOP spending on outpatient care is, however, ambiguous. The impact on outpatient care will depend on whether it complements or substitutes inpatient care. Any health scheme favoring hospitalization alone over comprehensive outpatient care and coverage may not be an appropriate product for health needs of the society. RSBY helped improve accessibility and gave some degree of financial protection to patients. It also actively engaged with existing resources in the Indian health care and insurance markets. Benefit packages of RSBY scheme should include wage loss compensation along with hospitalization expenses.[9] Ayushman Bharat Mission (ABM) has started insurance coverage for selected package of medical and surgical procedures for hospitalized patients belonging to socioeconomically vulnerable families on the lines of Rashtriya Swasthya Bima Yojna though the insurance amount is larger. The development of subcenters into health and wellness centers continues to be under the NHM. These two missions, i.e., NHM and ABM, deal with primary and secondary care, respectively. In the absence of a linkage between these two missions, it may not be possible to maintain a balance. The primary health-care providers should be empowered to decide which patient to refer, to which hospital (public or private), and at what cost to pay, so that ultimately health services are cashless for the patient.[10] Government's capacity for monitoring and regulation of these schemes should be improved. Better monitoring mechanisms should be put in place to prevent private sector empanelled hospitals from overprescription and overcharging.[11]

Women have a greater chance to fall a prey to critical ailments such as arthritis, irregular BP, diabetes, pregnancy and lack of financial back up in case a medical contingency arise. Health insurance schemes are specially designed with an intention to cover illness that a woman is more prone to get during her lifetime. The study assessed the health care modalities utilized by women covered under RSBY/MSBY, thereby evaluating effectiveness of the insurance scheme.

Aim and Objectives of the Study

The aim of this study is to understand the extent of Universal Health Insurance coverage and utilization among women in urban slum of Rajnandgaon, Chhattisgarh for health care in public and private facilities. It includes the following objectives.

To assess socio demographic factors among the study participant.

To find universal health insurance coverage under Rashtriya Swasthya BimaYojana (RSBY)/Mukhyamantri Swasthya BimaYojna (MSBY) in study subjects.

To assess the extent of concerned treatment under RSBY/MSBY

Material and Methods

It was a community based cross sectional study design.

Study settings

The study was conducted in the urban slum area of Rajnandgaon amongst the women above 18 years of age who were hospitalized 6 months prior to the study {C. G.}.

Study period

Study was undertaken from the month of July 2018 to January 2019 for a period of six months.

Sample size and Sampling technique

According to Chhattisgarh Slum Census 2011, slum population of Rajnandgaon Municipal Corporation was 92112 which were 56.47% of total population i.e.,1,63,114. 68% of women in urban slum of Raipur {C. G.} covered under RSBY and MSBY.[12] Sample size was calculated as 188 with an estimated relative precision of 10%. Nonprobability sampling technique was adopted.

Inclusion criteria and exclusion criteria

The inclusion criteria was women above 18 years of age who were hospitalized 6 months prior to the study for at least 3 days while the exclusion criteria was that those not giving consent to participate in the study.

Study tool

A semi structured questionnaire was used to collect information on socio-demographic details, healthcare services utilized, insurance covered or not and expenses incurred. Recall period of six month was fixed for Health Insurance coverage and utilization services. Validity of the questionnaire were judged by the senior faculty members and the consistency of findings has been undertaken by a team of researchers rather than single researcher (inter-observer reliability).

Data collection and procedure

The data collection was carried out by using non-probability sampling—snowball technique as a sampling method. In snowball technique, the subjects were asked to nominate another person with the same trait as the subject and was continued till sample size was obtained. It was followed to identify study subjects in the urban slum of Rajnandgaon. The relevant data is collected through face-to-face interviews, using an interview schedule, on insurance coverage, utilization of health care services, and household expenditure on health care. After obtaining consent from the study participants, they were interviewed using semi structured questionnaires by supervisors and were cross-verified by field investigators daily. We collected data by face-to-face interviews with women at their homes. Home visit along with mitanin (anganwadi worker) was carried out to identify the study participants. The information regarding insurance covered, not covered, utilization of card in government and private hospital, reasons for admission, expenditure in Indian rupees (INR) towards medicine, laboratory investigation, diagnostic, blood transfusion, transportation of patient, lodging, daily wage loss, food, procedure, that is direct and indirect out of pocket expenditure and catastrophic out of pocket expenditure besides basic socio-demographic data was collected. Catastrophic OOP is any medical expense above 10% of the individual's annual income, as per case definition. The study was approved by Institute Ethics Committee. The privacy of respondents was respected and confidentiality was maintained up to full extent.

Variables

Explanatory variables included socio-demographic structure, utilization modalities of health specific services and dependent variables included RSBY coverage's, MSBY coverage's, RSBY utilizations, Out of pocket expenditures (OOPE) and catastrophic out of pocket expenditures (COOPE). Association between insurance coverage, utilization, catastrophic OOPE with socio-demographic factors and other characteristic was assessed.

Statistical analyses

Relevant data was collected, compiled using Microsoft Excel. Data were checked for correctness and completeness and analysed using SPSS Software version 16. Statistical tools applied were mean, percentages. Chi- square test was applied as statistical test of significance. Categorical variables were expressed as proportions and the continuous variables as mean (standard deviation) or median [inter quartile range (IQR)].

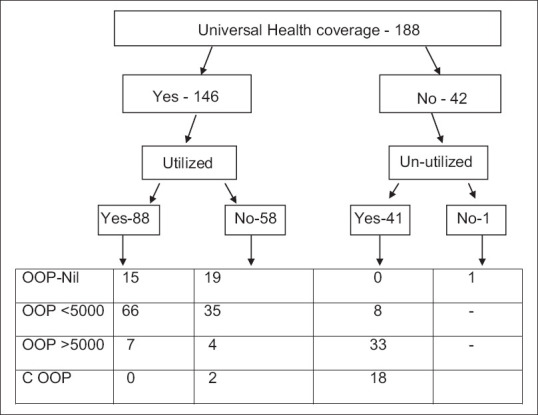

Conceptual framework

The conceptual framework for the study with result is illustrated in Figure 1. It represents the relationships between universal health coverage enrolment (yes/no), its utilization (yes/no) and financial risk protection (out of pocket and catastrophic household expenditures).

Figure 1.

Conceptual Framework with result

Result

In this study, 77.65% respondents/study subjects were enrolled under the universal health insurance (RSBY card/MSBY card/smart card). 22.35% study subjects were not enrolled under universal health insurance (RSBY card/MSBY card/smart card). Most of the respondents was below Poverty Line 89.89%. Majority of respondents were of the age group 26–40 years (40.42%) followed by the age group of 18–25 years (35.63%). 77.12% subjects belonged to upper lower class of socioeconomic status followed by 8.51% subjects belonged to lower middle class as per modified Kuppuswamy scale). 65.42% subjects were admitted in Government hospital (Medical College Hospital and UHTC, Shankarpur) and 34.57% in private hospital. 94.14% respondents belonged to Hindu religion followed by 5.31% Muslim. Caste wise 72.34% subjects belonged to other backward classes (OBC) and 10.63% subject's belonged to general category. Subjects belonging to lower socio-economic status and having BPL card were enrolled under scheme than upper socio-economic group. [Tables 1 and 2].

Table 1.

Association of UHI coverage with socio-demographic factors

| Characteristic | Characteristic`s subgroup | UHI Covered | Total | Pearson Chi-square test Value | DF | P | |

|---|---|---|---|---|---|---|---|

| Yes | No | ||||||

| Age in years | 18-25 | 55 | 12 | 67 | 4.368 | 3 | 0.224 |

| 26-40 | 59 | 17 | 76 | ||||

| 41-60 | 20 | 11 | 31 | ||||

| >60 | 12 | 2 | 14 | ||||

| BPL/APL card Available | BPL | 140 | 29 | 169 | 25.869 | 1 | 0.000 |

| APL | 06 | 13 | 19 | ||||

| Religion | Hindu | 138 | 39 | 177 | 0.635 | 2 | 0.728 |

| Muslim | 7 | 03 | 10 | ||||

| Christian | 1 | 0 | 1 | ||||

| Caste | OBC | 106 | 30 | 136 | 2.866 | 3 | 0.413 |

| OPEN | 13 | 7 | 20 | ||||

| SC | 14 | 2 | 16 | ||||

| ST | 13 | 3 | 16 | ||||

| Family Type | Joint | 65 | 21 | 86 | 0.395 | 1 | 0.530 |

| Nuclear | 81 | 21 | 102 | ||||

| Education of Respondent | Illiterate | 13 | 1 | 14 | 8.549 | 5 | 0.128 |

| Primary | 36 | 5 | 41 | ||||

| Secondary | 62 | 23 | 85 | ||||

| Higher secondary | 21 | 5 | 26 | ||||

| Graduate | 12 | 6 | 18 | ||||

| Post Graduate | 2 | 2 | 4 | ||||

| Socio-economic status | Upper | 3 | 9 | 12 | 21.035 | 4 | 0.0000 |

| Upper middle | 10 | 3 | 13 | ||||

| Lower middle | 13 | 3 | 16 | ||||

| Upper low | 118 | 27 | 145 | ||||

| Lower | 2 | 0 | 2 | ||||

| Total | 146 | 42 | 188 | ||||

Table 2.

Association of UHI coverage with other Characteristic

| Characteristic | Characteristic`s subgroup | UHI Covered | Total | Pearson Chi-square test Value | DF | P | |

|---|---|---|---|---|---|---|---|

| Yes | No | ||||||

| Admission | Government Hospital | 113 | 10 | 123 | 41.407 | 1 | 0.000 |

| Private Hospital | 33 | 32 | 65 | ||||

| Utilized Card | Yes | 88 | 0 | 88 | 47.592 | 1 | 0.000 |

| No | 58 | 42 | 100 | ||||

| Family size | =or<5 | 76 | 21 | 97 | 0.055 | 1 | 0.814 |

| >5 | 70 | 21 | 91 | ||||

Majority of respondents (46) were admitted for normal delivery, while 30 were admitted for medical condition, 29 for LSCS, 21 for surgical condition and 8 for gynecological conditions followed by 6 for orthopedic condition and 3 for cataract. [Table 3]. Out of 146 respondents covered under the urban Health insurance 60.27% (88) subjects utilized the insurance and 20.45% (18) subjects incurred out of pocket expenditure. Out of 123 respondents who were admitted in government hospital, 5.69% subjects incurred out of pocket expenditure while out of 65 respondents who were admitted in private hospital, 75.38% subjects incurred out of pocket expenditure. Out of 169 respondents holding BPL card, 41 (24.25%) subjects incurred out of pocket expenditure while out of 19 respondents holding APL card 15 (78.94%) subjects incurred out of pocket expenditure. [Table 4] In this study median OOPE was 1500 Rs with IQR (Q3-Q1) [3950 Rs – 625 Rs]. Out of the total OOPE, median OOPE for medicine and investigation was 30% each. According to the study findings age, caste, religion, family type, education of respondent, subjects having a BPL card/APL card and admission in government hospital/private hospital, socioeconomic status, and all these factors were found to be statistically not significant for utilization of the card. Out of 146 smart card holders, a mere 1.36% subjects incurred catastrophic OOPE while remaining 98.6% did not incur catastrophic OOPE. Out of 42 respondents not having smart card 40.47% subjects incurred catastrophic OOPE while 59.52% did not incur catastrophic OOPE which was found to be statistically significant. [Table 5].

Table 3.

Admission Reasons of study subjects

| Characteristic | Characteristic`s subgroup | UHI Covered | Utilized | Total | ||

|---|---|---|---|---|---|---|

| Yes | No | Yes | No | |||

| Admission Reason | Normal Delivery | 46 | 4 | 20 | 30 | 50 |

| LSCS | 29 | 15 | 15 | 29 | 44 | |

| Hysterectomy | 3 | 7 | 3 | 7 | 10 | |

| Other Gynaecology c | 8 | 0 | 8 | 0 | 8 | |

| Surgical condition | 21 | 7 | 14 | 14 | 28 | |

| Medical condition | 30 | 9 | 19 | 20 | 39 | |

| Ophthalmic problem | 3 | 0 | 3 | 0 | 3 | |

| Orthopedic condition | 6 | 0 | 6 | 0 | 6 | |

| Total | 146 | 42 | 88 | 100 | 188 | |

Table 4.

Association of OOP with other Characteristic

| Characteristic | Characteristic`s subgroup | Out of pocket expenditure | Total | Chi-square test Value | DF | P | ||

|---|---|---|---|---|---|---|---|---|

| Nil | <5000 | >5000 | ||||||

| Card Utilized | No | 20 | 43 | 37 | 100 | 25.359 | 2 | 0.000 |

| Yes | 15 | 66 | 7 | 88 | ||||

| Admission | Government Hospital | 35 | 82 | 6 | 123 | 75.298 | 2 | 0.000 |

| Private Hospital | 0 | 27 | 38 | 65 | ||||

| Card holder | BPL | 35 | 105 | 29 | 169 | 31.597 | 2 | 0.000 |

| APL | 0 | 4 | 15 | 19 | ||||

| Total | 35 | 109 | 44 | 188 | ||||

Table 5.

Association of Catastrophic OOP with socio-demographic factors and other characteristic

| Characteristic | Characteristic`s subgroup | Catastrophic OOP | Total | Chi-square test Value | DF | P | |

|---|---|---|---|---|---|---|---|

| Yes | No | ||||||

| Age in years | 18-40 | 11 | 132 | 143 | 5.454 | 1 | 0.02 |

| >40 | 09 | 36 | 45 | ||||

| BPL/APL card Available | BPL | 16 | 153 | 169 | 2.411 | 1 | 0.120 |

| APL | 04 | 15 | 19 | ||||

| Religion | Hindu | 19 | 158 | 177 | 0.029 | 1 | 0.864 |

| Muslim and Christian 1 | 1 | 10 | 111 | ||||

| Caste | OBC and | 19 | 137 | 156 | 2.29 | 1 | 0.130 |

| SC and ST | 1 | 31 | 32 | ||||

| Education of Respondent | Illiterate | 1 | 13 | 14 | 0.194 | 1 | 0.659 |

| Literate | 19 | 155 | 174 | ||||

| Socio-economic status | Upper and middle | 4 | 37 | 41 | 0.043 | 1 | 0.836 |

| Lower | 16 | 131 | 147 | ||||

| Admitted at | Government Hospital | 0 | 123 | 123 | 42.352 | 1 | 0.000 |

| Private Hospital | 20 | 45 | 65 | ||||

| Smart card available | Yes | 2 | 144 | 146 | 59.054 | 1 | 0.000 |

| No | 18 | 24 | 42 | ||||

| Smartcard utilized | Yes | 0 | 88 | 88 | 19.695 | 1 | 0.000 |

| No | 20 | 80 | 100 | ||||

Discussion

This study explored coverage of health insurance schemes, utilisation of hospitalisation and out of pocket expenditure (OOPE) for the insured and uninsured women residing in urban slums of Rajnandgaon. In the present study, 188 women residing in urban slums of Rajnandgaon, were interviewed. A total of 77.6% respondents were enrolled under universal health coverage. In a similar study by Nandi et al. found that 68% women residing in slum of Raipur were insured under UHI.[12] About45.5% (273 out of 600 families) were covered by some form of the health insurance in which all the members of the household may or may not have insurance and the rest 55.5% (327 out of 600 families) do not have any form health insurance i.e., none of the family members have health insurance in the rural area of central Karnataka.[13] The majority of the population in the study area were Hindus, and the likelihood of them taking up the CBHI schemes was higher.[14] Current study did not find any association of religion with enrolment. Occupation and level of education did not find any association with enrolment.[14] Similar finding also evident from current study. Some studies reported that occupation and level of education were the determinant.[13,15] The subscription of health insurance was found to be 3.7 times more among the class I families (OR = 3.7, CI = 0.28949.503) when compared to families belonging to class V but it is not statistically significant.[13] In the present study, it was found that study subjects belonging to Lower socio-economic status were enrolled for RSBY more than Upper group and it was found to be statistically significant. The rates of hospitalisation in public sector who were covered with insurance was much higher than those who were not covered with insurance and was found consistent with study of S. Nandi et al.[12] In the present study, it was observed that 60% study participants were admitted for obstetrics and gynaecological conditions more in public sector. Nandi et al.[12] also observed that insurance coverage was mostly used for gynecological and obstetrics conditions when compared with other medical conditions. In the present study, out of 146 respondents covered under the urban Health insurance 60.27% (88) subjects utilized the insurance. A study by Karan et al. found that the inpatient care utilization rate under the scheme remained low. Of the 35.5 million families (approximately 130 million persons) enrolled in RSBY over the period from 2008 to 2013, the scheme funded only about 5.8 million hospitalizations.[16] In this study median OOPE was 1500 Rs with IQR (Q3-Q1) [3950 Rs – 625 Rs]. Similarly, the overall average median (IQR) OOPE per event of hospitalization was INR 104 (INR 7–INR 1,760). In rural areas, it was INR 450 (INR 25–INR 4,612), and in urban areas, INR 100 (INR 4–INR 200).[17]

In the absence of health insurance coverage, 43% study subjects had to do Catastrophic OOPE compared to that reported by Lalit Ku. Chandrawanshi et al.[18] in which 69.02% subjects had to do catastrophic OOPE. In relation to catastrophic OOPE, our study reported religion, level of education, socio-economic status were found not to have an association. There was a significant association in the proportion of people who had incurred catastrophic expenditure with lower socioeconomic strata. About 71.4% of upper lower class had catastrophic expenditure compared to 37.8% in lower-middle class and 1% in upper-middle class.[19] Women reporting OOPE higher than the median were more likely to have delivered by caesarean section (OR 56.8, 95% CI 13.6–237).[20] In the present study also, OOPE as well as catastrophic expenditure was more with the women who delivered by caesarean section at private hospital and those who were not covered with any insurance. At Government hospitals, pregnant women were financially protected because of JSSK. As per case definition catastrophic OOP is any medical expense above 10 percent of the individual's annual income. In our study it was observed that only 1.36% respondents had to do catastrophic OOP, enrolled with universal health coverage, but 43% respondents had to do catastrophic OOP being not enrolled under universal health coverage, further helping to prove the fact that RSBY card prevented catastrophic OOP in most of the respondents. 20% respondents experienced catastrophic OOP expenditure when smart card was not utilized including both enrolled and not enrolled participants. Similar finding were seen by Nandi et al.,[12] where 35 percent of respondents experienced catastrophic OOP expenditure when smart card was not utilized. An impact evaluation of the RSBY scheme suggested that RSBY scheme neither affected the likelihood of inpatient OOP spending nor affected the probability of outpatient OOP expenditure. On the contrary, likelihood of incurring OOP spending (both inpatient and outpatient) increased by 30%.[16]

Conclusion

Totally, 77.65% respondents/study subjects were enrolled under the universal health insurance (RSBY card/MSBY card/smart card). The RSBY card reduced the inpatient OOPE. RSBY card prevented catastrophic OOP in most of the respondent. RSBY has made health services available to all sections of community at minimal costs, helping them to access better health care that could not be afforded by them. By knowing the packages for common procedures under RSBY/MSBY/National Health Protection scheme, primary health care professionals can guide referring patients at their level so that overcharging at tertiary level can be prevented. The information regarding utilization of insurance card should be disseminated at the primary level so that the needy patients will get maximum benefit thereby reducing OOP expenditure.

Limitation of the study

The present study had some limitations, including cross-sectional nature of the study, nonprobability sampling, and lack of a complete list of sampling frame that affect the use of services and recall bias. In addition, some factors related to the use of health services, such as household's culture and traditional health seeking behavior, have not been addressed in this study.

Declaration of patient consent

The authors certify that they have obtained all appropriate patient consent forms. In the form the patient(s) has/have given his/her/their consent for his/her/their images and other clinical information to be reported in the journal. The patients understand that their names and initials will not be published and due efforts will be made to conceal their identity, but anonymity cannot be guaranteed.

Financial support and sponsorship

The study was funded by the National Urban Health Mission (NUHM), Government of Chhattisgarh. The funders had no role in study design, data collection and analysis or preparation of the manuscript.

Conflicts of interest

There are no conflicts of interest.

References

- 1.Making fair choices on the path to universal health coverage. Final report of the WHO Consultative Group on Equity and Universal Health Coverage [Internet] Geneva: World Health Organization; 2014. Available from: http://www.who.int/choice/documents/making_fair_choices/en/ cited 2019 Oct 24. [Google Scholar]

- 2.World Health Organization (2010) Health systems financing: The path to universal coverage. Geneva: WHO; Available from: http://whqlibdoc.who.int/whr/2010/9789241564021_eng.pdf . [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.URL site. [Last accessed on 2020 Jan 22]. Available from: http://www.who.int/universalhealth-coverage/en/

- 4.Park K. Park's Textbook of Preventive and Social Medicine. 22nd ed. Jabalpur: Bhanot Publishers; 2013. p. 651. [Google Scholar]

- 5.United Nations. [Last accessed on 2016 Jan 18]. Available from: https://sustainabledevelopment.un.org/

- 6.XIIth five year plan document, GOI. Available from: http/www clearias.com/12th-five-year-plan-2012-2017 targets/

- 7.National Health Policy; 2017. [Last accessed on 2020 Mar 18]. Available from: http://www.cdsco.nic.in/writereaddata/National-Health-Policy.pdf .

- 8.RSBY – Ministry of health and family welfare India. [Last accessed on 2020 Jan 18]. Available from: http://www.rsby.gov.in/about_rsby.aspx .

- 9.Zodpey S, Farooqui H. Universal Health Coverage in India: Progress achieved & the way forward. Indian J Med Res. 2018;147:327–9. doi: 10.4103/ijmr.IJMR_616_18. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Kumar R. Achieving universal health coverage in India: The need for multisectoral public health action. Indian J Community Med. 2020;45:1–2. doi: 10.4103/ijcm.IJCM_61_19. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Sharma A, Prinja S. Universal health coverage: Current status and future roadmap for India. Int J Noncommun Dis. 2018;3:78–84. [Google Scholar]

- 12.Nandi S, Dasgupta R, Garg S, Sinha D, Sahu S, Mahobe R. Effectiveness of universal health insurance for women in urban slums of Raipur Chhattisgarh. BMJ Glob Health. 2016;1(Suppl l):A12–3. [Google Scholar]

- 13.Netra G, Rao BAV. A study on awareness, coverage and willingness to avail health insurance among the residents of a rural area in Central Karnataka. Natl J Community Med. 2019;10:190–6. [Google Scholar]

- 14.Reshmi B, Unnikrishnan B, Nair NS, Guddattu V. Factors determining the enrolment in community-based health insurance schemes: A cross-sectional study from coastal South India. Indian J Community Med. 2018;43:312–5. doi: 10.4103/ijcm.IJCM_118_18. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Baloul I, Dahlui M. Determinants of health insurance enrolment in Sudan: Evidence from Health Utilisation and Expenditure Household Survey 2009? BMC Health Serv Res. 2014;14(Suppl 2):O17. doi: 10.1186/1472-6963-14-S2-O17. [Google Scholar]

- 16.Karan A, Yip W, Mahal A. Extending health insurance to the poor in India: An impact evaluation of Rashtriya Swasthya Bima Yojana on out of pocket spending for healthcare. Soc Sci Med. 2017;181:83–92. doi: 10.1016/j.socscimed.2017.03.053. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Vasudevan U, Akkilagunta S, Kar SS. Household out-of-pocket expenditure on health care-A cross-sectional study among urban and rural households, Puducherry. J Family Med Prim Care. 2019;8:2278–82. doi: 10.4103/jfmpc.jfmpc_302_19. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Chandrawanshi LK, Kapoor R. Ways of health financing during illness events at household level; and its determinants among rural community of Delhi, India. Int J Curr Res. 2017;9:5. [Google Scholar]

- 19.Hadaye RS, Thampi JG. Catastrophic health-care expenditure and willingness to pay for health insurance in a metropolitan city: A cross-sectional study. Indian J Community Med. 2018;43:307–11. doi: 10.4103/ijcm.IJCM_252_18. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Das S, Sundaramoorthy L, Bhatnagar T. Out-of-pocket expenditure for delivery at home and public health facilities in the context of conditional cash transfer and free delivery care programs: An analytical cross-sectional study in South 24 Parganas district, West Bengal, India, 2017. Clin Epidemiol Glob Health. 2020;8:1395–1401. [Google Scholar]