Significance

Women and men expect systematically different levels of future inflation. This gender expectations gap can be detrimental for women’s economic choices and long-term wealth, because it might reduce the effectiveness of economic policies, induce stress, and affect women’s well being. Using data for a representative US population, we document that traditional gender roles, rather than innate characteristics, shape the gender expectations gap. By doing most of the grocery shopping for their households, women observe different price signals than men. Because grocery prices are volatile and positive price changes are especially memorable, women end up expecting systematically higher inflation than men. The gender expectations gap disappears if grocery chores are distributed equally within households.

Keywords: gender roles, expectations, perceptions, experiences, social conditioning

Abstract

Expectations about economic variables vary systematically across genders. In the domain of inflation, women have persistently higher expectations than men. We argue that traditional gender roles are a significant factor in generating this gender expectations gap as they expose women and men to different economic signals in their daily lives. Using unique data on the participation of men and women in household grocery chores, their resulting exposure to price signals, and their inflation expectations, we document a tight link between the gender expectations gap and the distribution of grocery shopping duties. Because grocery prices are highly volatile, and consumers focus disproportionally on positive price changes, frequent exposure to grocery prices increases perceptions of current inflation and expectations of future inflation. The gender expectations gap is largest in households whose female heads are solely responsible for grocery shopping, whereas no gap arises in households that split grocery chores equally between men and women. Our results indicate that gender differences in inflation expectations arise due to social conditioning rather than through differences in innate abilities, skills, or preferences.

Beliefs about the future shape important lifetime decisions, such as retirement savings and housing choices, and they often differ systematically across genders (1–4). For the case of beliefs about consumer prices, women have systematically higher inflation expectations than men. We label this phenomenon the “gender expectations gap.”

The gender expectations gap can have detrimental consequences for women’s economic choices and long-term wealth. Economic theory suggests that high inflation expectations cause individuals to save less than needed to finance retirement and to consume too much during their working lives. In addition, expecting high prices in the future can induce stress and affect women’s happiness and wellbeing (5). The gender expectations gap might also hamper the effectiveness of economic policies in times of crisis (6). Yet, despite its relevance, the roots of the stark gender expectations gap are still unknown.

In this paper, we establish the role of traditional gender roles as a determinant of the gender expectations gap. Gender roles induce women and men to engage in different activities and to experience different environments in their daily lives. As a result, women and men are exposed to different signals about the economy that then lead to differences in perceptions and expectations (7).

Our analysis focuses on the role of grocery shopping and exposure to grocery prices. We argue, and show empirically, that exposure to grocery prices induces a divergence in beliefs between grocery shoppers and nongrocery shoppers, which—paired with traditional gender roles—can explain the gender expectations gap. The underlying mechanism consists of three steps. First, prior literature has shown that consumers are overly reliant on personally experienced price realizations when forming beliefs about future realizations (8). Second, research in social psychology, marketing, and economics has documented that price increases rather than decreases are more memorable to individuals (4, 9–14). Because grocery prices are highly volatile—so much so that they are excluded from the Core Consumer Price Index (Core CPI) that the Federal Reserve uses to identify persistent inflation trends (15)—grocery shoppers are exposed to larger price increases than nongrocery shoppers, on average. As a result, grocery shoppers perceive inflation to be higher than nongrocery shoppers. This divergence in beliefs translates into gender differences because, complying with traditional gender roles, women still undertake the majority of grocery shopping for their households. Their perception of current inflation and hence their expectations of future inflation are higher than men’s, giving rise to the gender expectations gap.

To assess the relationship between gender-specific exposure to economic signals and expectations, we construct a dataset that combines detailed information about a representative US sample’s participation in their household’s grocery chores (Kilts–Nielsen Consumer Panel) with individual-level elicitation of economic beliefs (Chicago Booth Expectations and Attitudes Survey [CBEAS]). Our dataset consists of deidentified survey data that have been determined to fall under exempt status for Institutional Review Board (IRB) review by the National Bureau of Economic Research (NBER) IRB (FAW 00003692; IRB Protocol 19_278).*

Our data establish the gender expectations gap within households. That is, unlike prior research, our identification is robust to any systematic unobserved differences between households, such as different family structure, financial, or career choices. As shown in Fig. 1, Left, the raw data indicate that within married couples, women have significantly higher inflation expectations than men. Although both women’s and men’s average inflation expectations (5.1 and 4.6%, respectively) exceed average realized inflation for the survey periods, which was 1.36%, the difference between expected and realized inflation is significantly larger among women.

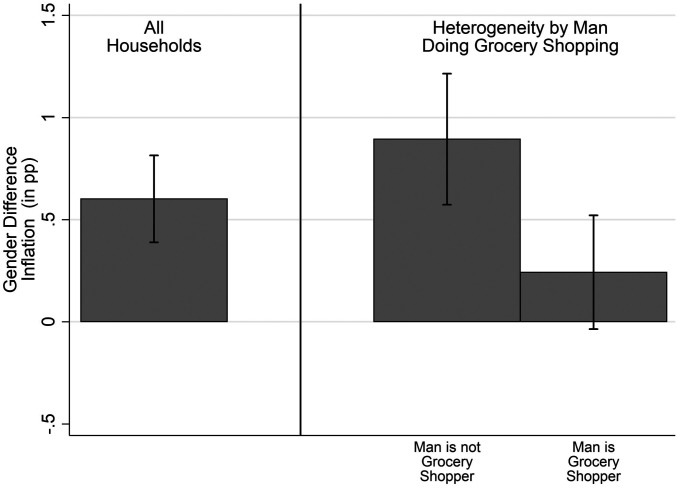

Fig. 1.

Gender expectations gap within households: raw data. Left bar plots the average differences in the inflation expectations of women and men within all households in the customized Chicago Booth Expectations and Attitudes Survey, which we fielded in June of 2015 and 2016. Center and Right bars split the sample based on whether men in the household take part in grocery shopping. Error bars indicate 95% confidence intervals obtained from standard errors clustered at the household level.

The economic magnitude of the gap, around 0.5 percentage points (pp), is large, amounting to 25% of the US Federal Reserve’s inflation target of 2%. Based on the Fisher equation—the equality between the nominal interest rate and the sum of the real interest rate and expected inflation—the divergent beliefs across genders also imply women will perceive real interest rates to be lower than men perceive them, because nominal interest rates are the same for everybody. Because nominal rates in the US economy were below 1.5% over recent years, the magnitudes we estimate imply that women’s perceived real rates were up to 33% lower than men’s. Lower perceived real interest rates, in turn, increase consumers’ willingness to spend, which might lead women to consume more and save less than men, thus resulting in lower lifetime wealth.†

The raw data also reveal a second fact, which is the focus of our analysis: The gender expectations gap varies substantially based on which spouse does the grocery shopping. In households in which men do not grocery shop, the gender gap in inflation expectations almost doubles in size (Fig. 1, Center bar). In households in which spouses share grocery shopping chores more equally, we fail to detect any economically or statistically significant gender gap in inflation expectations (Fig. 1, Right bar).

Our multivariate analysis further reveals that the difference between households with and without male participation in grocery chores cannot be explained by men’s and women’s innate characteristics, which are the typical focus of studies about gender differences in economics: The gender gap is unaffected when we control for risk preferences, numeracy, or financial literacy at the individual level (19, 20). The results are also similar when we partial out income, education levels, and other demographics, such as unemployment status or ethnicity, which influence uncertainty in individual inflation expectations. Instead, as we saw in the raw data, no gender difference exists once we restrict the analysis to households in which both men and women do the grocery shopping. This result emphasizes the importance of studying gender roles above and beyond innate characteristics or preferences to understand expectations and choice.

To further corroborate our interpretation that exposure to different price signals due to gender roles drives the gender expectations gap, rather than innate cognitive differences across genders, we analyze the channel through which price signals translate into expectations. Earlier research has shown that observed price signals shape individuals’ perceptions of current inflation, which in turn determine expectations about future inflation (21). We document that the mapping process from perceptions of current inflation to expectations of future inflation is virtually identical for men and women, regardless of whether they participate in grocery chores. This result excludes different cognitive processes across genders as an explanation. Instead, the perceived level of current inflation is what differs across genders. It is higher for women who are the sole grocery shoppers in their households.

To better understand the sources of different inflation perceptions across genders, in the second wave of our survey, we asked respondents what information sources they used when forming inflation expectations as well as the goods or services, if any, that came to mind during the expectations-formation process. First, we find that two-thirds of our respondents mention their own shopping experiences as one of the three main sources of information for inflation. Moreover, we find that the gender gap does not arise when we compare men and women who mainly think about other information sources when forming expectations.

To corroborate the survey answers to the two questions, we show that both men and women who report thinking of shopping experiences as the primary source of information for forming inflation expectations most frequently mention grocery goods such as milk, bread, and eggs as specific goods whose prices they recall. Unconditionally, however, women are systematically more likely to report thinking about each of these goods. On the other hand, men are substantially more likely than women to refer to the price of gasoline. If the gender expectations gap were really driven by exposure to different price signals while shopping, rather than other unobservables correlated with gender, we should find that the gap is largest when comparing women who thought about grocery prices and men who thought about gas prices within their shopping bundles. And, indeed, we find this case to be true.

In the last part of this paper, we corroborate the external validity of our results in the New York Fed Survey of Consumer Expectations (SCE), a dataset that is commonly used in economics research and in whose construction we were not involved. We first replicate our baseline results on the gender expectations gap over both a short-term and a long-term horizon. The second step—linking the gender expectations gap to grocery price exposure—is harder to replicate directly, because the SCE lacks data on individuals’ contribution to grocery chores. As an indirect approach, we consider two subsamples. The first subsample includes respondents from areas where a high share of men participates in their households’ grocery shopping according to the CBEAS data. The second subsample includes respondents below 25 y of age, among whom the perception of traditional gender norms tends to be less stark (22, 23). In these two subsamples, the gender expectations gap is indeed lower for all measures of inflation.

Finally, the longer time series of the SCE data allows us to compute individual-level measures of volatility and uncertainty of inflation expectations. We find both are higher among women, which is consistent with our proposed mechanism: Women are more exposed to volatile signals about inflation through grocery prices, which change frequently, and hence have not only higher but also more volatile expectations.

Overall, our results support the conjecture that differences in women’s and men’s daily environments can have significant consequences for beliefs about economic variables. That is, traditional gender roles can shape beliefs beyond contexts that have been singled out as “gendered,” such as beliefs about women’s abilities in Science, Technology, Engineering, and Math (STEM) disciplines or in leadership roles. Even in realms that have no gender connotation, such as expectations about economic variables, for example, inflation, differential exposure to signals in daily life due to gender roles leaves an imprint on women’s outlook.

Our findings on the gender expectations gap, as well as the underlying signal-exposure mechanism, have significant implications at both the aggregate and the individual level. At the aggregate level, inflation expectations are central to the effectiveness of economic policy (6), especially as low interest rates are becoming the norm in most industrialized countries, including the United States since the 2008 financial crisis and again during the COVID-19 crisis (24). In such times, policies that aim to stabilize business cycles and to avoid prolonged economic crises need to manage consumers’ inflation expectations. However, our findings suggest that inflation expectations cannot be managed using the same policies for men and women, because of the gender expectations gap.

At the microlevel, inflation expectations that systematically differ from ex post realizations can be detrimental to individual economic outcomes. Consumers who expect higher prices might make suboptimal consumption choices, not accumulate enough savings for retirement, and make nonoptimal real-estate investments. Thus, the gender expectations gap can adversely affect women’s financial decisions and wealth accumulation, which in turn increases gender inequality in wealth.

Earlier research has documented that gender roles affect women’s preferences, beliefs, and outcomes in several domains (25–27), including their choices of fields of education and skills (28–30), occupations (31), career paths (32, 33), and investment decisions (23). In those areas, gender roles influence both women’s own actions, as they conform to a prescribed gender role (34, 35), and the actions of others based on gender stereotyping (36–39). In all these cases, gender roles affect beliefs about women’s ability to conduct male-connotated tasks and outcomes that possess a gender-specific connotation. Our findings suggest that, even beyond decisions that are stereotypically gendered, seemingly innocuous differences in women’s daily exposures to prices can have significant consequences for perceptions and expectations. The evidence in our paper highlights a relationship between gender roles and nongendered beliefs and outcomes, which is subtle and hard to reduce through traditional policy interventions.

Data

Chicago Booth Expectations and Attitudes Survey.

We utilize a different source of data, the CBEAS. We designed this customized survey in March 2015 and fielded it online in two waves in June 2015 and June 2016. We invited all members of the Kilts–Nielsen Consumer Panel (KNCP) to participate, approximately 40,000 to 60,000 households per wave. The KNCP reports both static demographics, such as household size, income, ZIP code of residence, and marital status, and dynamic features of participants’ grocery purchases, such as categorizations of the products purchased, information on the shopping outlets, and the per-unit price paid for each item. The prices are collected electronically through scanning by participating households. To ensure the accuracy of the data, Nielsen organizes monthly prize drawings, provides points for its gift catalog after each scanner-data submission, and is in ongoing communication with panel households. Not surprisingly given these incentives, the KNCP annual retention rate is above 80%.

Nielsen also administers smaller surveys of a subset of panelists on a regular basis and customized survey solutions on an ad hoc basis, typically to pretest new products and target group-specific marketing campaigns for producers of fast-moving consumer goods. The CBEAS follows the same protocol of these customized solutions: Surveys are administered online, and Nielsen sends an email to an address provided by the panelist household. After a household member consents to participate, the survey starts and the participant sees each question on a separate screen without the possibility to return to previous questions. At the end of the survey, the online platform asks the respondent whether any other household member age 18 y or above exists that has not yet participated in the survey, in which case the initial survey link remains valid and additional household members can participate in the survey. Our survey elicits several demographic characteristics that allow us to match each response to the unique panelist profile of Nielsen.

The raw CBEAS sample includes 92,511 respondents, with 49,383 respondents from 39,809 unique households in the first wave (43% response rate) and 43,036 respondents from 36,758 unique households in the second wave (45% response rate). Of those, 15,104 participated only in the first wave, 7,269 only in the second wave, and 18,373 in both waves.‡ We limit the sample to couples for which we observe responses of both the male and the female head of household.§ This sample restriction is necessary to estimate the gender expectations gap within households, which requires expectations data from two individuals of different genders who both make relevant decisions in the same household. In these households, we can compare men and women, keeping constant all household-level characteristics. This sample includes 20,866 observations of male and female household heads across both survey waves, which belong to 7,846 unique households.

The survey design builds on the Michigan Survey of Consumers (MSC) and the New York Fed SCE, as well as the pioneering work of refs. 3, 8, and 40. The full survey is shown in SI Appendix, section B. Here, we briefly discuss some of the key questions for our analysis.

We first elicit demographic information the KNCP does not provide: narrow college major, employment status, occupation, income expectations, rent, mortgage, and medical expenses. We also ask respondents whether they are the primary grocery shopper for their household, sometimes shop, or never do the shopping, and we record whether the female household head is a nonretired and nonunemployed homemaker (“stay-home mum”). Consistent with the notion that women are more likely to do the grocery shopping for the household, female heads declare that they are the main grocery shopper in 5,135 households (65%), whereas male heads do so only in 908 households (12%), and other household members do so in the remaining 1,803 households (22%).¶ Other household members who report being the main grocery shopper are typically female individuals whose age is higher than the age of both male and female heads and who do not enter our analysis.

Finally, we elicit numerical values of perceived inflation (over the prior 12 mo) and expected inflation (over the next 12 mo), in terms of both point estimates and the full probability distribution. For expected inflation, we use the same question as in the SCE. Before we elicit responses for inflation-related questions, we have an introductory text introducing the concept of inflation: “We would like to ask you some questions about the overall economy and in particular about the rate of inflation/deflation (Note: inflation is the percentage rise in overall prices in the economy, most commonly measured by the Consumer Price Index and deflation corresponds to when prices are falling).” This text ensures survey respondents report expectations about a common target rather than their expectations about the inflation rate in their personal consumption bundle. We decided to elicit expectations about overall consumer price inflation for several reasons. First, we can directly observe the ex post realization and therefore compare expectations with outcomes. Second, CPI inflation is a key rate the Federal Reserve targets and attempts to influence via policy decisions. Third, we did not want to deviate from the benchmark-question wording in the SCE, which was developed through extensive pretesting and cognitive interviews headed by an interdisciplinary team of economists, psychologists, and marketing academics.

New York Fed Survey of Consumer Expectations.

In our complementary analysis, we use SCE data from June 2013 to April 2018 to study the gender expectations gap for a longer period than available through the CBEAS waves. The SCE has become a key survey tool to study the effectiveness of monetary policy in the United States.# It collects a broad set of economic expectations for a representative population, alongside demographic characteristics, as well as elicited mathematical and financial skills. The survey is a rotating panel in which the same respondent is interviewed every month for up to 12 mo. We restrict the sample to respondents for whom we observe both expectations and financial skills (40,568 individual-month observations). The number of unique individuals in this sample is 6,052, of which 49.66% are women.

We define all of the variables we use in this paper in SI Appendix, Table A.1.

Inflation Data.

Before moving to the results, we briefly discuss the macroeconomic environment in terms of realized core and food inflation during our sample period. SI Appendix, Fig. A.1 plots the time series of core inflation and food and beverage inflation over the last 20 y. We define the inflation rate as the annual percentage of change in these price indexes as published by the US Bureau of Labor Statistics. We retrieve the data from the Federal Reserve Economic Data (FRED) database of the Federal Reserve Bank of St. Louis.

The two time series show considerable variation over time. But the volatility of food inflation is substantially larger than the volatility of core inflation that excludes food and energy. We also see that core inflation was below 3% during the last two decades, starting in January 2000, whereas food and beverage inflation was as high as 6% during this period but also displays substantially larger swings and volatility.

Results

We first assess the conjecture that differences in men’s and women’s daily exposures to price signals help predict the extent of the gender expectations gap. As women undertake the majority of grocery shopping duties for their households, they are exposed to the volatile and large price changes of grocery goods more frequently than men. To the best of our knowledge, no earlier work, including other research by the authors of this paper, has studied how the differences in exposure to price signals within households shape differences in economic expectations across the members of the same household. This analysis is made possible by the unique within-household focus of the CBEAS, and the questions we consider in the rest of this paper have not been used in any other work.

As previewed in Fig. 1 in the Introduction, the raw data of the CBEAS reveal women’s inflation expectations are, on average, 0.40 pp higher than those of men (). The average difference, however, masks substantial heterogeneity: Households in which men do not grocery shop exhibit a 0.64 pp () gender difference in inflation expectations, compared to a small and insignificant difference of 0.10 pp () in other households. A two-sided -test for equality of gender differences between the two samples rejects the null at .∥

The economic magnitude of the gender difference is sizable: The average inflation target of the Federal Reserve is 2%/y, and realized inflation was less than 2% during our survey months. Hence, the gender expectations gap amounts to more than a quarter of both targeted and realized inflation in terms of economic magnitude.

We test whether these patterns from the raw data continue to hold in a multivariate setting in which we account for demographic variables and preferences that might affect gender differences in inflation expectations. We estimate a linear model regressing inflation expectations on gender and our proxy for gender roles, controlling for all demographics and individual characteristics available in our data, including age, square of age, employment status, 16 income dummies, home ownership, marital status, college dummy, four race dummies, reported risk tolerance, and the individual-level variance of the elicited probability distribution of inflation expectations as a proxy for uncertainty. Additionally, we control for a set of expectations about other economic variables that might predict inflation expectations, including expectations about individual income, individual financial soundness, and aggregate US growth. In the most restrictive specification, we include household fixed effects to ensure time-invariant systematic heterogeneity across households cannot drive our results.

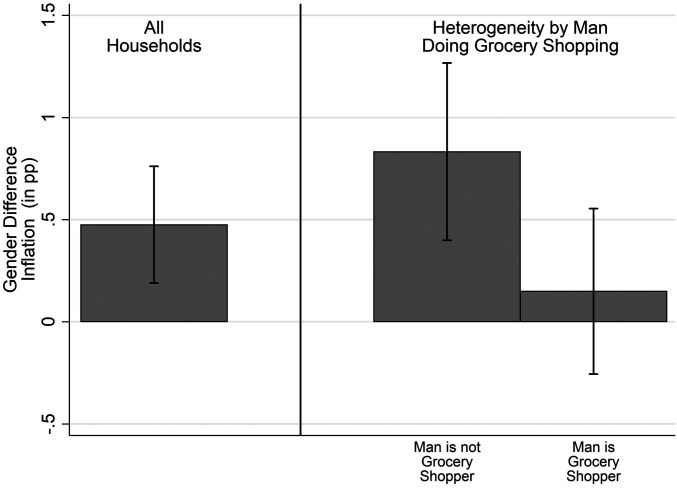

Fig. 2 displays the same gender differences as Fig. 1, but based on the estimates from the multivariate analysis. The pattern is similar to the raw data. Within households, women’s inflation expectations are, on average, 0.33 pp (P 0.01) higher than men’s (Fig. 2, Left). However, in households in which men do not participate in grocery shopping, the difference amounts to 0.65 pp (P 0.01), versus pp (P 0.94) in other households (Fig. 2, Right).

Fig. 2.

Gender expectations gap within households: residuals. Left bar plots the average differences in the inflation expectations of women and men within all households headed by heterosexual couples in our sample based on the customized Chicago Booth Expectations and Attitudes Survey, which we fielded in June of 2015 and 2016, conditional on controls. Control variables include age, square of age, employment status, 16 income dummies, home ownership, marital status, college dummy, four race dummies, reported risk tolerance, household fixed effects, individual income expectations, expectations for aggregate US growth, and individual expectations about financial soundness. Center and Right bars propose a sample split based on whether men in the household take part in grocery shopping. Error bars indicate 95% confidence intervals obtained from standard errors clustered at the household level.

The pooled-sample analysis in Table 1 provides the same insight, including the disappearance of gender differences after controlling for grocery-price exposure. Columns 1 to 3 display the estimation results from three specifications: using an indicator for female as the independent variable (in column 1), using an indicator for being the main grocery shopper as the independent variable (in column 2), and including both variables (in column 3). Columns 4 to 6 show parallel estimations but within household.

Table 1.

Inflation expectations: gender and grocery shopping

| Across households | Within households | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | |

| Female | 0.134 | 0.162 | ||||

| (0.092) | (0.119) | |||||

| Main grocery shopper | 0.413*** | 0.415*** | ||||

| (0.118) | (0.149) | |||||

| Demographics | X | X | X | X | X | X |

| Expectations | X | X | X | X | X | X |

| Household FE | X | X | X | |||

| 0.107 | 0.108 | 0.108 | 0.616 | 0.616 | 0.611 | |

| Observations | 20,866 | 20,866 | 20,866 | 20,866 | 20,866 | 20,866 |

Shown are ordinary-least-squares coefficients and standard errors clustered at the household level (in parentheses). Observations are the responses of male and female heads of household in the customized Chicago Booth Expectations and Attitudes Survey, which we fielded in June 2015 and 2016. In all columns, the outcome variable is respondents’ 12-mo-ahead numerical inflation expectations. Female is an indicator for female heads; Main grocery shopper is an indicator equal to 1 for the respondents who declare they are the main grocery shopper for the household; Demographics include age, square of age, employment status, 16 income dummies, home ownership, marital status, college dummy, four race dummies, reported risk tolerance, and confidence in inflation-expectations accuracy. Expectations include dummies for respondents’ 12-mo-ahead qualitative income expectations, 12-mo-ahead individual financial soundness, and 12-mo-ahead aggregate US growth. Household fixed effects (FE) are included in columns 4–6. ***.

Across households, women exhibit 0.29 pp (P 0.01) higher inflation expectations than men (Table 1, column 1), and respondents who are the main grocery shopper for the household exhibit 0.47 pp (P 0.01) higher inflation expectations than other respondents (Table 1, column 2). Most importantly, however, the specification in Table 1, column 3 reveals that after controlling for participation in grocery shopping, no significant gender difference in inflation expectations is detectable, either economically or statistically (0.13 pp, P = 0.14), whereas the coefficient on grocery shopping remains largely unchanged (0.41 pp, P 0.01). All findings continue to hold, and the coefficient estimates remain quantitatively similar when we restrict the estimation to variation within households (Table 1, columns 4–6). Furthermore, the within-household estimates do not depend on whether we focus on households that appear only once in the sample or those for which we have two observations, one for each survey wave. When we restrict the analysis to the subset of households whose male and female heads participate only once in our survey, and hence appear only once in the sample, we continue to estimate significantly positive coefficient estimates for the effect of main grocery shopper of similar magnitudes: 0.474 in the specification without household fixed effects, mirroring Table 1, column 3, and 0.868 in the specification with household fixed effects, mirroring Table 1, column 6. The coefficient of the female indicator in these specifications remains small and insignificant.

These estimates reveal that innate (or otherwise induced) gender-specific variation does not generate the gender difference in beliefs, because the indicator for gender is not a significant predictor after controlling for grocery-price exposure. Instead, exposure to different price signals predicts the gender differences in beliefs.

We complement these results with estimations based on sample splits and on the alternative stay-home proxy. First, we split the full sample into the subsample of households whose female heads do not participate in grocery shopping at all and the complementary subsample in which the female head does at least some grocery shopping. As shown in Table 2, column 1, the sign of the coefficient estimate for female heads becomes negative, although insignificant, when we restrict the sample to females who do not participate in grocery shopping. Note this subsample is small—it constitutes only 8.7% of the full representative sample. By contrast, the gender expectations gap between female and male heads is positive and significant in the remainder of the sample (Table 2, column 2).** The pooled-sample specification in Table 2, column 3 confirms the difference is significant: When we include a dummy for observations in the complementary sample (in which women do at least some shopping) that interacted with the indicator for a female respondent, the female dummy is insignificant and the interaction effect is significantly positive.†† Hence, intrinsic characteristics related to gender are unlikely to drive the gender expectations gap; instead, participation in grocery shopping predicts inflation expectations independent of gender.

Table 2.

Inflation expectations: subsamples and stay-home mums

| 1 | 2 | 3 | 4 | 5 | 6 | |

| Female no | Female some | Full | Female | Female | Full | |

| Sample | groceries | groceries | sample | worker | home | sample |

| Female | −0.486 | 0.241** | ||||

| (0.336) | (0.111) | |||||

| Female | 0.716** | 0.506* | ||||

| Female some groceries | (0.321) | (0.287) | ||||

| Female stays home | ||||||

| Demographics | X | X | X | X | X | X |

| Expectations | X | X | X | X | X | X |

| Household FE | X | X | X | X | X | X |

| 0.657 | 0.615 | 0.616 | 0.624 | 0.614 | 0.616 | |

| Observations | 1,806 | 19,060 | 20,866 | 17,289 | 3,577 | 20,866 |

Shown are ordinary-least-squares coefficients and standard errors clustered at the household level (in parentheses). Observations are the responses of male and female heads of household in the customized Chicago Booth Expectations and Attitudes Survey, which we fielded in June 2015 and 2016. In all columns, the outcome variable is respondents’ 12-mo-ahead numerical inflation expectations. Column 1 restricts the sample to households whose female head does not do any grocery shopping. Column 2 uses the complementary sample of households whose female head does at least some grocery shopping; that is, she is the main grocery shopper or does some grocery shopping. Column 4 restricts the sample to households whose female head is employed in the formal labor market. Column 5 uses the complementary sample of households whose female head is a homemaker. In columns 2 and 5, the indicators Female some groceries and Female home equal 1 for both male and female heads of households whose female head does some grocery shopping or is a homemaker, respectively. (The levels of these household-level indicators are fully absorbed by the household fixed effect.) Female is a dummy variable that equals 1 for female heads and 0 otherwise. Demographics include age, square of age, employment status, 16 income dummies, home ownership, marital status, college dummy, four race dummies, reported risk tolerance, and confidence in inflation expectations. Expectations include dummies for respondents’ 12-mo-ahead qualitative income expectations, 12-mo-ahead individual financial soundness, and 12-mo-ahead aggregate US growth. *, **, ***.

In Table 2, columns 4–6 confirm these findings qualitatively using the stay-home mum proxy for traditional gender norms and exposure to different price signals in daily life. We find that the gender expectations gap is larger for the subsample of households in which the female head is a homemaker (column 5) than for households in which the female head is employed in the formal labor market (column 4). The difference remains statistically (marginally) significant in the pooled-sample specification where we interact the female and subsample indicators (column 6).

Mechanisms

Our research hypothesis posits that the large and volatile price changes of groceries generate divergent beliefs between the grocery shoppers and the nongrocery shoppers in a household, which in turn leads to the gender differences in beliefs when women do most of the grocery shopping. The underlying mechanism can be broken down into three parts: First, because women are exposed to grocery prices more often than men, they are more likely than men to think about grocery prices when forming beliefs about aggregate inflation. Second, because grocery prices are more volatile than other prices and positive price changes are more memorable to consumers than negative price changes (4, 8–14),‡‡ the differential exposure to grocery prices generates higher inflation perceptions among women.§§ Third, the gender differences in perceptions of (current) inflation map into differences in expectations about (future) inflation independent of gender.

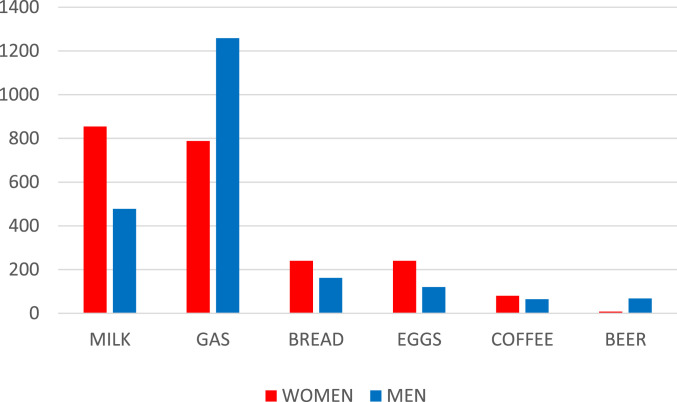

To assess the first part of the mechanism in the raw data, we exploit the fact that in the second wave of our survey, after eliciting aggregate inflation expectations, we asked respondents to indicate the information sources they used when forming inflation expectations out of a list of nine prespecified sources whose order was randomized, including traditional media, social media, own shopping, family and friends, or other sources (SI Appendix, section B, question 19). In a separate question (SI Appendix, section B, question 20), we also elicited the goods or services that came to respondents’ minds, if any, when we asked about their expectations. For the goods and services, we provided no prespecified options, and respondents needed to type the name of the good and service. In Fig. 3, we report the number of respondents for the five most common answers of men and, separately calculated, for women, which amount to six items overall: milk, gas, bread, eggs, coffee, and beer. (Because respondents could type freely, we created homogeneous broad categories for each good. For instance, answers such as “milk,” “one gallon milk,” and “one gallon low fat vitamin D milk” are all coded as “milk.”)

Fig. 3.

Goods women and men think of when forming expectations. Shown is the absolute frequency (number of respondents, y axis) with which the men and women surveyed in the customized Chicago Booth Attitudes and Expectations Survey, which we fielded in June of 2015 and 2016, report specific goods as the first item whose price changes come to their mind when asked to provide their inflation expectations. We report the five most frequently reported goods for men and the five most frequently reported goods for women. The two quintuplets overlap except for one good.

Two facts emerge. First, the most common type of response is a grocery good, and women tend to report each of them more frequently than men (with the notable exception of beer). Second, men are disproportionally more likely than women to think about gasoline prices. Therefore, even when thinking about own shopping experience, most men and women consider price signals coming from different types of goods.

We leverage these two survey responses to assess the first part of the mechanism more formally. If our mechanism is correct, we should observe that the gender expectations gap does not arise when comparing men and women who do not think primarily about their own shopping experiences when forming expectations. If it did arise, unobservables correlated with gender, grocery shopping, and expectations would be a plausible alternative explanation for our results. Moreover, within the subset of men and women who think about their shopping experiences—and hence keep constant the exposure to prices as a source of information to form inflation expectations—the men and women who think about different goods’ prices, such as groceries versus gas, are the ones who should drive the gender expectations gap. Instead, the men and women who think about the same goods’ prices should form similar inflation expectations.

In Table 3, we provide empirical evidence consistent with both conjectures. Indeed, the gender expectations gap is fully driven by men and women who think primarily about shopping (columns 1–3) and disappears for men and women who also think about sources of information unrelated to shopping (columns 4–6). (The subsample in columns 1–3 includes only respondents who reported thinking about own shopping as the first of the three options they could choose for information sources. Columns 4–6 include those whose first option was not shopping and who might have not mentioned shopping at all or mentioned shopping as the second or third option. Overall, as discussed above, about two-thirds of the sample chose shopping as the first, second, or third option. The finding that own shopping experiences are the most common source of information is direct evidence for the channel we propose and explains why variation in grocery shopping impacts average inflation expectations in the data.) In particular, the gap is largest for men and women who think about different goods, namely, groceries for women, whose prices are highly volatile, and gas for men (column 3).

Table 3.

Inflation expectations: own shopping vs. other information sources

| Own shopping | Other information sources | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | |

| M, gas; F, | Nobody gas | |||||

| Source of information: | All | All | groceries | All | All | or groceries |

| Main grocery shopper | ||||||

| Female | 1.705*** | −0.166 | ||||

| (0.548) | (0.202) | |||||

| Demographics | X | X | X | X | X | X |

| Expectations | X | X | X | X | X | X |

| 0.123 | 0.126 | 0.200 | 0.079 | 0.080 | 0.090 | |

| Observations | 2,325 | 2,325 | 499 | 5,774 | 5,774 | 3,384 |

Shown are ordinary-least-squares coefficients and standard errors clustered at the household level (in parentheses). Observations are the responses of male and female heads of household in the customized Chicago Booth Expectations and Attitudes Survey, which we fielded in June 2016. In columns 1–3, we consider only the subsample of respondents who argue that their main source of information to form inflation expectations is their own shopping (which we observe only in the 2016 wave), whereas in columns 4–6 we consider the respondents who report other sources of information. In column 3, we further restrict the sample to households whose male head reports that he thought about gas prices when forming expectations, whereas the female head reported thinking about grocery prices. In column 6, we instead restrict the sample to male and female household heads who report explicitly the goods/services they thought about, which do not include either gas or groceries. In all columns, the outcome variable is respondents’ 12-mo-ahead numerical inflation expectations. Main grocery shopper is an indicator for the respondents who are the main grocery shoppers for their households; Female is an indicator for female heads; Demographics include age, square of age, employment status, 16 income dummies, home ownership, marital status, college dummy, four race dummies, reported risk tolerance, and confidence in inflation-expectations accuracy. Expectations include dummies for respondents’ 12-mo-ahead qualitative income expectations, 12-mo-ahead individual financial soundness, and 12-mo-ahead aggregate US growth. ***.

An important caveat is that the extent of exposure of men to gas prices may correlate with unobservables such as commuting times, and one might worry that these differences contribute directly to the formation of inflation expectations. Although we cannot fully partial out those influences, the proxy does capture households in which price exposures of men and women are more or less different. The fact that the gender expectations gap is higher for couples whose price exposure differs most helps pin down the mechanism.

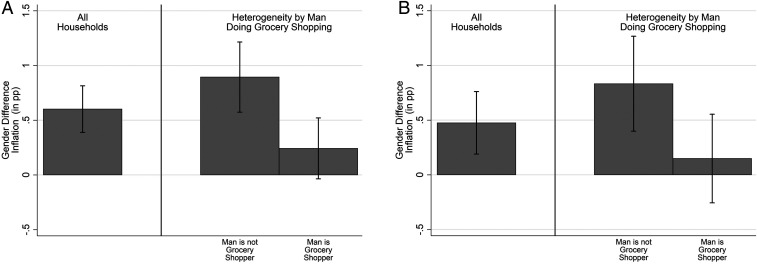

Moving to the second part of the mechanism, Fig. 4 provides direct evidence consistent with it. Fig. 4A displays the gender gap in the perception of current inflation (the percentage change in consumer prices over the last 12 mo) in the raw data. In line with the results for inflation expectations, women perceive current inflation to be higher than do men (Fig. 4 A, Left bar), and this gender difference occurs only in households in which men do not participate in grocery shopping (Fig. 4 A, Center and Right bars). As with inflation expectations, these results also hold conditional on all observables we discussed before (Fig. 4B).

Fig. 4.

Gender gap in inflation perceptions within households. A, Left bar plots the average differences in the inflation perceptions of women and men for all households in our sample based on the customized Chicago Booth Expectations and Attitudes Survey, which we fielded in June of 2015 and 2016. A, Center and Right bars right propose a sample split based on whether men in the household take part in grocery shopping. Error bars indicate 95% confidence intervals obtained from standard errors clustered at the household level. B presents gender differences defined as above conditional on controls. Control variables include age, square of age, employment status, 16 income dummies, home ownership, marital status, household size, college dummy, four race dummies, reported risk tolerance, household fixed effects, individual income expectations, expectations for aggregate US growth, and individual expectations about financial soundness.

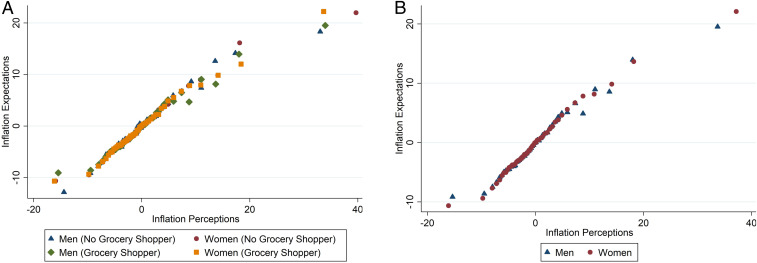

We assess the third part of the proposed mechanism in Fig. 5. The binscatter plot maps expectations of future inflation against perceptions of current inflation, with men’s observations shown as triangles and women’s as circles. Fig. 5A documents a strong correlation between perceptions and expectations. Moreover, this correlation does not vary systematically across genders as the plots for males and females overlap tightly.

Fig. 5.

Mapping of perceptions into expectations by gender and grocery shopping. A is a binscatter plot mapping inflation perceptions into inflation expectations by gender and B also conditions on grocery-shopping behavior. Inflation perceptions and expectations are based on the customized Chicago Booth Expectations and Attitudes Survey, which we fielded in June of 2015 and 2016.

Fig. 5B shows that the tight mapping holds independent of men’s and women’s participation in grocery shopping: The mapping between inflation perceptions and expectations is very similar whether we focus on men or women who do or do not go grocery shopping. The latter findings rule out that selection distorts the mapping between perceptions and expectations.

The uniform mapping between perceived and expected inflation also holds up when estimated in a multivariate linear regression using inflation expectations as the dependent variable and inflation perceptions, the indicator for being female, and their interaction as independent variables, conditional on the same controls discussed above. Inflation perceptions are a strong predictor of inflation expectations, whereas both the coefficient on the interaction of inflation perceptions with the gender dummy (, P = 0.527) and the gender coefficient (, P = 0.321) are insignificant.

In summary, women do not have a different mapping function of inflation perceptions into expectations than men, and hence innate cognitive gender-specific characteristics are unlikely to play a role in the process of mapping inflation perceptions into expectations. Instead, higher exposure to grocery-price inflation predicts higher perceptions, which in turn map into higher expectations.

External Validity and Replication

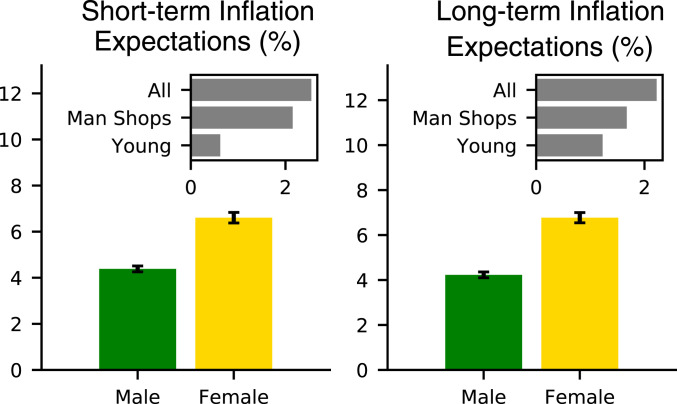

In the last step, we corroborate the external validity of our results using a different dataset, the New York Fed SCE, which is commonly used in economics research and in whose construction we had no role. We cannot construct the same gender-role proxy in the SCE as in the CBEAS, because the CBEAS data are unique in containing both expectations data and participation in grocery chores, even within households. To provide indirect evidence for the SCE, we study specific subsamples that are likely to differ in their compliance with traditional gender roles. The first subsample approximates involvement in grocery chores based on geography, using our CBEAS sample. We consider respondents from states where a high share of men do at least some grocery shopping for their households (the top 25% US states), which we label “man shops.” The second subsample consists of respondents below 25 y of age (“young”), among whom the perception of traditional gender norms has become less stark than among older cohorts (22, 23).

The horizontal gray bars in Fig. 6 indicate the corresponding gender differences. The top bar plots the difference in expectations for the full sample (all). The middle and bottom bars in each graph, labeled man shops and young, show the corresponding gender differences for the first and the second subsample. Consistently, the gender gap in inflation expectations is lower in the subsample with male involvement in grocery chores and the subsample of young couples, where traditional gender roles are likely less stark. This result holds for both short-term and long-term inflation expectations.

Fig. 6.

Gender gap in inflation expectations: replication in the New York Fed Survey of Consumer Expectations. The vertical bars report the estimated mean for men (green, left bar) and women (yellow, right bar) of short-run and long-run inflation expectations elicited by the New York Fed Survey of Consumer Expectations (41). Black segments are 95% confidence intervals. Gray horizontal bars indicate the difference between the expectations of women and men for three groups: “All” includes the full sample; “man shops” includes only respondents in the top 25% of US states based on the share of men who are the main grocery shopper in the household, which we compute in the Chicago Booth Expectations and Attitudes Survey; “young” includes only respondents below 25 y of age; the two latter subsamples capture groups in which gender norms might be less stark than in the full sample.

We also use the SCE to assess the robustness of our results when controlling for individual characteristics we do not observe in the CBEAS, such as numeracy and financial skills. We confirm our results when partialling out these characteristics in the full sample as well as when restricting the analysis only to respondents who answer correctly all of the questions about numeracy, probability literacy, and financial literacy in the SCE (see SI Appendix, Table A.3, which reports coefficients from standardized regressions to ensure comparability across columns). Based on these results, potential systematic differences in numeracy, probability literacy, or financial literacy across genders cannot explain the gender expectations gap.

Finally, because the SCE has a panel component in which we observe several inflation-expectations elicitations within respondent, we can compute measures of uncertainty and volatility of expectations within individual, which is impossible in the CBEAS that includes only two waves. We find that women’s inflation expectations are more uncertain and volatile than men’s (SI Appendix, Table A.4), which is consistent with the mechanism we propose for the effect of gender roles in the gender expectations gap.

Discussion

Traditional gender roles expose women to different signals about prices than men. This differential exposure generates divergent beliefs about future inflation and contributes to explaining the gender expectations gap. One implication of our findings is that gender roles shape beliefs not only in contexts that have been singled out as “gendered,” such as beliefs about the ability to perform in STEM disciplines or in leadership roles, but also in realms that have no gender connotation, such as inflation expectations.

These subtle effects of gender roles are hard to tackle with targeted policy interventions. Policies that have been implemented around the world include support for women in STEM disciplines (42) or gender quotas on the boards of large companies (43). However, to reduce the gap in economic expectations, and hence improve women’s economic and financial choices relative to men’s, women’s exposure to a wider range of economic signals and environments would need to be fostered, which seems difficult to enforce through legislation or regulation.

Another relevant angle is the recent tendency of shopping outlets to move to online retail, a phenomenon that has been accelerated during the COVID-19 crisis. This development is interesting both because it individualizes shopping experiences, which might become even easier to trace, and because it might affect the ways in which men and women are differentially exposed to price changes, inflation perceptions, and expectations. Our findings imply that such technologically induced changes in norms about shopping will affect the gender expectations gap going forward.

Supplementary Material

Acknowledgments

We thank Shannon Hazlett and Victoria Stevens at Nielsen for assistance with the collection of the PanelViews Survey. We gratefully acknowledge financial support from the University of Chicago Booth School of Business and the Fama–Miller Center for Research in Finance to run the surveys. This paper also benefited significantly from a visit of M.W. at the Center for Advanced Studies Foundations of Law and Finance funded by the German Research Foundation (Deutsche Forschungsgemeinschaft), project FOR 2774. We also thank Klaus Adam, Sumit Agarwal, Andreas Fuster, Ricardo Perez-Truglia, Chris Roth, Giorgio Topa, Johannes Wohlfart, and conference and seminar participants at the NBER Behavioral Finance, the NBER Corporate Finance, the 2019 Stanford Institute for Theoretical Economics (SITE) workshop, the Cleveland Fed Conference on Inflation, Boston College, and the University of Chicago for valuable comments.

Footnotes

The authors declare no competing interest.

This article is a PNAS Direct Submission. R.A. is a guest editor invited by the Editorial Board.

*Following our paper, other researchers have started to elicit individual inflation expectations and labor-force participation in the Kilts–Nielsen Consumer Panel through customized surveys (e.g., refs. 16–18).

†This result is known as the consumer Euler equation and relates real consumption growth to real interest rates: Lower perceived real rates reduce the propensity to save and increase the propensity to spend.

The average response time was 14 min and 49 s in the first wave and 18 min and 35 s in the second wave, which included a few more questions.

§Nielsen allows households to designate up to two heads of household, one labeled as the “male head” and one as the “female head.”

¶A two-sided t test for whether the shares of grocery shoppers are equal across genders rejects the null hypothesis at standard levels of significance (P 0.01).

#Ref. 41 provides a detailed overview of the survey design, the sample construction, and summary statistics of the SCE.

The pattern is qualitatively similar in households with a “stay-home mum,” in which the gender difference amounts to 0.58 pp, whereas it is 0.36 pp in other households, albeit with both differences being statistically significant ().

**This subsample also reveals that our main results hold irrespective of whether the main grocery shopper is the female head, the male head, or a third household member.

††Note the noninteracted subsample indicator is absorbed by the household fixed effect, because it has the same value for both female head and male head within the household.

‡‡Auxiliary analyses on our individual-level survey data confirm that higher perceived volatility of price changes is strongly correlated with higher inflation expectations, even in the subsample of nongrocery shoppers, for whom any confounds associated with the act of grocery shopping are muted. SI Appendix, Fig. A.2 reports this result graphically.

§§In an auxiliary analysis of shoppers who appear to actively hunt for bargains and discounts, we show that the resulting gap in expectations is diminished (SI Appendix, Table A.2). We thank the anonymous editor for this excellent suggestion.

This article contains supporting information online at https://www.pnas.org/lookup/suppl/doi:10.1073/pnas.2008534118/-/DCSupplemental.

Data Availability

Anonymized survey and code data have been deposited in Nielsen Datasets at the Kilts Center for Marketing at the University of Chicago Booth School of Business; Github (Nielsen data are at https://doi.org/10.3886/E140001V2) (44).

References

- 1.Bjuggren C. M., Elert N., Gender differences in optimism. Appl. Econ. 0, 1–14 (2019). [Google Scholar]

- 2.Jacobsen B., Lee J. B., Marquering W., Zhang C. Y., Gender differences in optimism and asset allocation. J. Econ. Behav. Organ. 107, 630–651 (2014). [Google Scholar]

- 3.Armantier O., et al. , Measuring inflation expectations. Annu. Rev. Econ. 5, 273–301 (2013). [Google Scholar]

- 4.Bruine de Bruin W., et al. , Expectations of inflation: The role of demographic variables, expectation formation, and financial literacy. J. Consum. Aff. 44, 381–402 (2010). [Google Scholar]

- 5.Di Tella R., MacCulloch R. J., Oswald A. J., Preferences over inflation and unemployment: Evidence from surveys of happiness. Am. Econ. Rev. 91, 335–341 (2001). [Google Scholar]

- 6.Bernanke B. S., “Monetary policy objectives and tools in a low-inflation environment” in Speech at a Conference on Revisiting Monetary Policy in a Low-Inflation Environment (Federal Reserve Bank of Boston, 2010). [Google Scholar]

- 7.Lucas R. E., Expectations and the neutrality of money. J. Econ. Theor. 4, 103–124 (1972). [Google Scholar]

- 8.Cavallo A., Cruces G., Perez-Truglia R., Inflation expectations, learning, and supermarket prices: Evidence from survey experiments. Am. Econ. J. Macroecon. 9, 1–35 (2017). [Google Scholar]

- 9.Vlasenko P., Cunningham S. R.. Capturing the inflation that people experience: The everyday price index vs. the consumer price index. American Institute for Economic Research Working Paper, (004). https://www.aier.org/wp-content/uploads/2015/07/WP004-EPI-Polina-Vlasenko-PV.pdf. Accessed 10 May 2021.

- 10.Brachinger H. W., A new index of perceived inflation: Assumptions, method, and application to Germany. J. Econ. Psychol. 29, 433–457 (2008). [Google Scholar]

- 11.Ranyard R., Del Missier F., Bonini N., Duxbury D., Summers B., Perceptions and expectations of price changes and inflation: A review and conceptual framework. J. Econ. Psychol. 29, 378–400 (2008). [Google Scholar]

- 12.Fluch M., et al. Perceived inflation in Austria–extent, explanations, effects. Monetary Pol. Econ., 22–47, 2005. [Google Scholar]

- 13.Bates J. M., Gabor A., Price perception in creeping inflation: Report on an enquiry. J. Econ. Psychol. 7, 291–314 (1986). [Google Scholar]

- 14.D’Acunto F., Malmendier U., Ospina J., Weber M.. Exposure to grocery prices and inflation expectations. J. Pol. Econ., 10.1086/713192 (2021). [DOI]

- 15.Evans C. L., Fisher J. D. M., What are the implications of rising commodity prices for inflation and monetary policy? Chicago Fed. Lett. 286, 1 (2011). [Google Scholar]

- 16.Coibion O., Gorodnichenko Y., Weber M., Monetary policy communications and their effects on household inflation expectations. https://www.nber.org/papers/w25482. Accessed 10 May 2021.

- 17.Coibion O., Georgarakos D., Gorodnichenko Y., Weber M., Forward guidance and household expectations. https://www.nber.org/papers/w26778. Accessed 10 May 2021.

- 18.Coibion O., Gorodnichenko Y., Weber M., Labor markets during the covid-19 crisis: A preliminary view. https://www.nber.org/papers/w27017. Accessed 10 May 2021.

- 19.Lusardi A., Mitchell O. S., Planning and financial literacy: How do women fare? Am. Econ. Rev. 98, 413–417 (2008). [Google Scholar]

- 20.Niederle M., “Gender” in Handbook of Experimental Economics, Kagel J. H., Roth A. E., Eds. (Princeton University Press, Princeton, NJ, 2015). [Google Scholar]

- 21.D’Acunto F., Hoang D., Weber M., Managing households’ expectations with unconventional policies. Rev. Financ. Stud., in press.

- 22.Glaeser E. L., Ma Y., The supply of gender stereotypes and discriminatory beliefs. https://www.nber.org/papers/w19109. Accessed 10 May 2021.

- 23.D’Acunto F., Identity and choice under risk. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3263787. Accessed 10 May 2021.

- 24.Summers L., The threat of secular stagnation has not gone away. http://larrysummers.com/2018/05/06/the-threat-of-secular-stagnation-has-not-gone-away/. Accessed 12 January 2021.

- 25.Croson R., Gneezy U., Gender differences in preferences. J. Econ. Lit. 47, 448–474 (2009). [Google Scholar]

- 26.Bertrand M., New perspectives on gender. Handb. Labor Econ. 4, 1543–1590 (2011). [Google Scholar]

- 27.Adams R. B., Funk P., Beyond the glass ceiling: Does gender matter? Manag. Sci. 58, 219–235 (2012). [Google Scholar]

- 28.MossRacusin C., Dovidio J., Brescoll V., Graham M., Handelsman J., Science faculty’s subtle gender biases favor male students. Proc. Natl. Acad. Sci. U.S.A. 109, 16474–16479 (2012). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.Guiso L., Monte F., Sapienza P., Zingales L., Culture, gender, and math. Science 320, 1164–1165 (2008). [DOI] [PubMed] [Google Scholar]

- 30.Dossi G., Figlio D. N., Giuliano P., Sapienza P., Born in the family: Preferences for boys and the gender gap in math. https://www.nber.org/papers/w25535. Accessed 10 May 2021.

- 31.Eagly A., Steffen V., Gender stereotypes stem from the distribution of women and men into social roles. J. Personality Social Psychol. 46, 735–754 (1984). [Google Scholar]

- 32.Adams R. B., Kirchmaier T., Women on boards in finance and stem industries. Am. Econ. Rev. 106, 277–281 (2016). [Google Scholar]

- 33.Goldin C., Mitchell J., The new lifecycle of women’s employment: Disappearing humps, sagging middles, expanding tops. J. Econ. Perspect. 31, 161–182 (2017). [Google Scholar]

- 34.Steele C., A threat in the air: How stereotypes shape intellectual identity and performance. Am. Psychol. 52, 613–629 (1997). [DOI] [PubMed] [Google Scholar]

- 35.Correll S., Constraints into preferences: Gender, status, and emerging career aspirations. Am. Sociol. Rev. 69, 93–113 (2004). [Google Scholar]

- 36.Fernández R., Fogli A., Olivetti C., Mothers and sons: Preference formation and female labor force dynamics. Q. J. Econ. 119, 1249–1299 (2004). [Google Scholar]

- 37.Skewes L., Fine C., Haslam N., Beyond Mars and Venus: The role of gender essentialism in support for gender inequality and backlash. PloS One 13, e0200921 (2018). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 38.Eagly A., Sex Differences in Social Behavior: A Social-Role Interpretation (Erlbaum, Hillsdale, NJ, 1987). [Google Scholar]

- 39.Carli L., Alawa L., Lee Y. A.., Stereotypes about gender and science. Psychol. Women Q. 56, 565–576 (2016). [Google Scholar]

- 40.Bruine de Bruin W., Van der Klaauw W., Topa G., Expectations of inflation: The biasing effect of specific prices. J. Econ. Psychol. 32, 834–845 (2011). [Google Scholar]

- 41.Armantier O., Topa G., Van der Klaauw W., Zafar B., An overview of the survey of consumer expectations. Econ. Pol. Rev. 23-2, 51–72 (2017). [Google Scholar]

- 42.House of Representatives, United States Congress , Promoting women in entrepreneurship act. Public Law No. 115-6 (02/28/2017) (2017) .

- 43.Armstrong J., Walby S., EU Gender Quotas in Management Boards (EU Notes, 2012). [Google Scholar]

- 44.D’Acunto F., Malmendier U., Weber M., Gender roles produce divergent economic expectations: Replication files. Inter-university Consortium for Political and Social Research. 10.3886/E140001V2. Deposited 7 May 2021. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Data Availability Statement

Anonymized survey and code data have been deposited in Nielsen Datasets at the Kilts Center for Marketing at the University of Chicago Booth School of Business; Github (Nielsen data are at https://doi.org/10.3886/E140001V2) (44).