Abstract

It is widely feared that the shock of the COVID‐19 pandemic will lead to a significant worsening of the food security situation in low and middle‐income countries. One reason for this is the disruption of food marketing systems and subsequent changes in farm and consumer prices. Based on primary data in Ethiopia collected just before the start and a few months into the pandemic, we assess changes in farm and consumer prices of four major vegetables and the contribution of different segments of the rural‐urban value chain in urban retail price formation. We find large, but heterogeneous, price changes for different vegetables with relatively larger changes seen at the farm level, compared to the consumer level, leading to winners and losers among local vegetable farmers due to pandemic‐related trade disruptions. We further note that despite substantial hurdles in domestic trade reported by most value chain agents, increases in marketing—and especially transportation—costs have not been the major contributor to overall changes in retail prices. Marketing margins even declined for half of the vegetables studied. The relatively small changes in marketing margins overall indicate the resilience of these domestic value chains during the pandemic in Ethiopia.

Keywords: Africa, COVID‐19, Ethiopia, food systems, value chain analysis

1. INTRODUCTION

It is feared that the COVID‐19 pandemic will lead to widespread increases in global poverty and food insecurity and that these negative impacts will concentrate on the most vulnerable segments of the population in low‐ and middle‐income countries (Barrett, 2020). Laborde et al. (2020), Swinnen and McDermott (2020), and Torero (2020) estimate that due to the COVID‐19 pandemic over 140 million people—a large number of them in sub‐Saharan Africa—will fall into extreme poverty and suffer from food insecurity and hunger. A major contributor to the increased food insecurity is the reduction of income among vulnerable populations. In addition, disruptions to food systems and changes in farm and consumer prices could also turn out to be major drivers of food insecurity. Changes in food and agricultural prices are an obvious concern to policy makers in low and middle‐income countries during this pandemic, given the importance of agricultural prices for the income of farmers and food prices for the purchasing power of consumers as well as their link to social unrest (Barrett, 2020; Bellemare, 2015).

There are various factors that may cause food and agricultural prices to change during this pandemic. Because of reduced demand due to the global recession, some researchers predict that commodity prices will decrease globally (Laborde et al., 2020). Meanwhile, others predict price increases, at least in the short run, due to hoarding and changes in purchase and storage patterns (e.g., Lusk, 2020; Reardon et al., 2020). Increased marketing costs—due to complications in logistics linked to the pandemic (such as seen in meat packing plants in the US; Hahn, 2020)—may further widen the wedge between farm and consumer prices (Narayan & Saha, 2020; Reardon et al., 2020). While significant food price movements have been seen in some cases, they seem highly context specific (Akter, 2020; de Paulo Farias & de Araújo, 2020; Yu et al., 2020), with price rises noted in some cases—most often for perishables such as meat, fish, and vegetables (e.g., Akter, 2020; Lele et al., 2020; Mogues, 2020)—and declines in others (e.g., Harris et al., 2020; Narayan & Saha, 2020). However, few authors have looked at what factors in the food systems of poorer economies have contributed to local food price changes and which farmers have been affected by these changes during the COVID‐19 pandemic. This is an important topic as these food prices matter enormously for the livelihoods of people in low‐income countries. Thus, insights on price movements provide valuable inputs into the design of effective policies to mitigate negative effects of the crisis.

In this paper, we provide a careful study of farm and consumer prices and marketing margins during the COVID‐19 pandemic in Ethiopia, the second most populous country in Africa. After the first COVID‐19 case was confirmed in Ethiopia in mid‐March 2020, the government closed schools, banned all public gatherings, and recommended social distancing. Other measures to contain the spread of the virus soon followed. Travelers from abroad were initially put into a 14‐day mandatory quarantine and travel through land borders was prohibited. Several regional governments banned all public transportation and imposed restrictions on other vehicle movements between cities and rural areas. In Addis Ababa, public and private transportation, such as minibus taxis, were ordered to work at half capacity (with half the load of people) and charge double the price. Private cars could only be driven every other day (a restriction that was lifted after a few weeks). Moreover, the wholesale market for fruits and vegetables was relocated from crowded quarters (Atikilit Tera) to an open space (Jan Meda) to facilitate social distancing between customers and traders. While these actions were expected to slow the spread of the virus, they may have had substantial unintended effects on the functioning of food value chains.

We study rural‐urban vegetable value chains from the country's most important commercial horticultural cluster in the East Shewa zone in the Central Rift Valley, which supplies approximately 200 million USD worth of vegetables annually (Minten et al., 2020) to Addis Ababa, the largest city of the country. To assess the changes in the vegetable marketing system, we rely on unique large‐scale price data (more than 10,000 observations) at different levels of the value chain, including rural farmers, wholesale markets, wet markets, and urban retailers, that were collected for major vegetables just before the onset of the pandemic (February 2020) and 3 months into the pandemic (May 2020). We also collected data from value chain participants—farmers, wholesalers, and retailers—on adjustments and disruptions in their marketing activities linked to the pandemic.

Value chain agents indicated that their businesses were seriously affected by the COVID‐19 pandemic. Most agents reported a decrease in demand, turnover, and clients; increased losses; less competition; higher transport costs; and changes in procurement areas. We further find that producer prices changed significantly over this period, with increases over a 3‐month period up to 64% (tomato) and decreases as high as 67% (green pepper). Changes at the retail level were, however, relatively much smaller, between 19% increases (tomato) and 29% decreases (green pepper). We find that despite significant hurdles in domestic trade, changes in marketing costs have not been the major contributor to increases in retail prices. Marketing margins even declined in the case of two of the four vegetables studied.1 Moreover, increases in transportation costs, which were seen in Ethiopia as well as in other countries during the pandemic (Narayan & Saha, 2020), might have been less of a driving factor of overall price changes in these value chains of perishable products. Such products are typically traded over relatively short distances, so transportation costs are relatively less important as a component of their retail prices, in contrast with other crops (Dillon & Barrett, 2016).

These findings suggest that a number of other factors outside the studied domestic value chains have contributed to a larger extent to farm and consumer price changes. First, the ban on international trade and disruptions to inter‐regional trade led to a more localized marketing system. It seems that this wider market access before the pandemic played a price‐stabilizing role for some vegetables, leading to large price swings during the pandemic. These effects have then created winners and losers among farmers, as has been seen during previous trade policy shocks (Aksoy & Beghin, 2004; Headey, 2011). Second, urban demand fell due to income losses and the widespread fear that eating raw vegetables would increase the likelihood of contracting the virus (Hirvonen, Abate et al., 2020). Changes in production costs and local supply changes likely also played a role for some products.

2. CONCEPTUAL FRAMEWORK

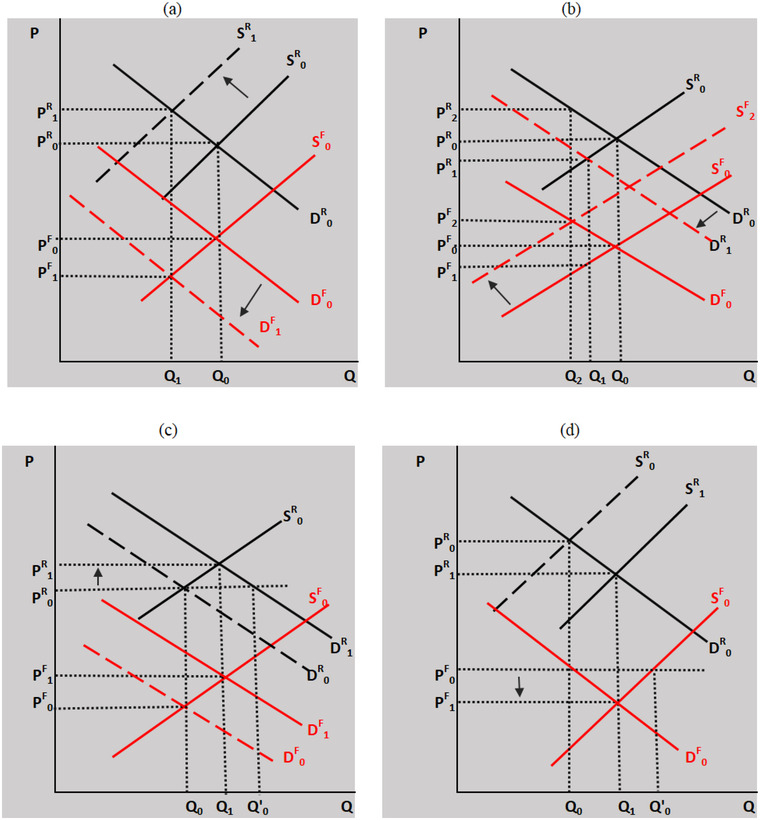

To understand the impact of COVID‐19 on the farm and retail sector, we rely on simple supply, derived supply, demand, and derived demand frameworks as outlined by Gardner (1975) and Tomek and Robinson (1990). We consider four scenarios. The first two scenarios assess impacts of COVID‐19 in the case of autarky; in the next two, international trade options are brought in. The results of the four scenarios are presented in Figure 1. In all four scenarios, the S0 (supply), D0 (demand), P0 (prices), and Q0 (quantity) are referring to the case before the COVID‐19 pandemic. Superscripts F and R refer to the situation at the farm and retail level, respectively.

FIGURE 1.

COVID19 impacts on marketing margins (a), supply and demand shifts (b), elimination of international trade in case of food importer (c), and food exporter (d) [Color figure can be viewed at wileyonlinelibrary.com]

Scenario (a) looks at the case of increased marketing margins which are caused by higher transport costs due to restrictions on mobility (e.g., more paperwork required and more checkpoints at regional borders), less willingness for trucks to travel because of the increased health risk and therefore less competition, and lower availability of backhaul because of an economic downturn. In this case, we see a shift downward of the derived demand curve at the farm level and an upward shift for the derived supply at the retail level. This leads to a higher retail price (P1 R) and a lower farm price (P1 F) than in the situation before the pandemic (P0 R, P0 F). Less produce will be produced and consumed.

In scenario (b), we consider cases of retail demand and farm supply shifts because of COVID‐19 related disruptions. In the first case, there is a downward shift in demand (from D0 R to D1 R) caused by a decline in purchasing power of consumers.2 In such a case, retail prices would decline to P1 R and farm prices would consequently decline as well (to P1 F). In a second case of a farm supply shift upward linked with increasing production costs (due to higher costs of agricultural inputs such as agro‐chemicals as well as labor (as documented by Minten et al. (2020)), farm prices would increase to P2 F and retail prices would increase as well (P2 R). In both cases, less produce would be produced and consumed. In the case of demand as well as supply shifts combined, price and quantity effects would be even bigger.

In scenario (c) and (d), we assess the impact of the blockage of international borders for net importers and net exporters of agricultural produce, respectively. In the first scenario of a net importer and if no imports are allowed in (imports are reduced by Q0’ – Q0), we subsequently see an increase in retail prices from the world market price (P0 R) to the autarky price P1 R and an increase in farm prices from P0 F to P1 F. While local supply of the produce will increase from Q0 to Q1, overall consumption in the country will decline from Q0’ to Q1. In the case of a net exporter and when exports are stopped, prices at the farm level will be reduced and quantities produced will be lowered from Q0’ to Q1. In retail markets, prices will decline to P1 R and consumption would go up from Q0 to Q1 (Figure 1d).

These frameworks indicate the likely different forces at play during the COVID‐19 pandemic. They also illustrate the heterogeneous effects on prices that can be found at retail and farm level, depending on the type of prevalent shift, the magnitude of the shifts, and on the trade situation. In most cases, it seems that there will be a combination of effects and empirical assessments need to show what effects prevail in practice. Obviously, these models are simplified frameworks of what goes on in reality and in more complete models time lags in supply and demand, risk, price expectations, changing market power, and quality and spatial factors (see e.g., Gardner & Rausser, 2001; McCorriston, 2002; Wohlgenant, 2001) should be taken into consideration. Developing such more complete models are beyond the scope of the analysis in this paper.

3. DATA

3.1. In‐person survey in January and February 2020

This study builds on a large‐scale vegetable value chain survey conducted in January and February 2020 in Ethiopia. Focusing on the main value chain supplying vegetables to Addis Ababa, we fielded primary surveys at different levels of the value chain, going from rural producers to urban retailers.3

The sampling strategy varied depending on the respondent type. First, four major vegetable producing woredas (districts) in East Shewa zone in the Oromia region (Adami Tulu, Bora, Dugda, and Lume) were purposely selected for this study. From these woredas, we selected kebeles (sub‐districts) that had at least 100 ha of irrigated land. A total of 37 kebeles were identified (Dugda: 12 kebeles; Adami Tulu: 12; Bora: 7; Lume: 6). Then within each kebele, we categorized all farmers as either ‘‘investor’’ or smallholders depending on the amount of land they were renting in. Farmers that rented in less than .5 ha of land were considered to be smallholders, while those renting in more than .5 ha were considered to be investors (see Minten et al., 2020). One‐quarter of the farmers interviewed were randomly selected from the investor farmers list; three‐quarters from the smallholder list. In each kebele, a community questionnaire was fielded as well. A total of 810 vegetable farmers were interviewed in January and February 2020, of which 634 were smallholders and 176 were medium‐scale investors.4 Second, 56 urban wholesalers operating in Addis Ababa were interviewed. These wholesalers were randomly selected from the group of wholesalers that dealt with one of the five major vegetable crops focused on in the study: onion, tomato, green pepper, cabbage, and Ethiopian kale.

Third, prices of vegetables were followed daily over the period of the survey in the wholesale market and in four large wet markets in Addis Ababa.

Fourth, the value chain survey also covered 446 urban retail outlets in five sub‐cities (out of 10) in Addis Ababa. In these sub‐cities, we visited all supermarkets and minimarkets, as well as all the Ethiopian Fruit and Vegetable Marketing Share Company (ET‐FRUIT) outlets. We then randomly selected four kebeles and visited 10 randomly selected local fruit and vegetable shops in each kebele. Within each kebele, two ketenas (neighborhoods) were randomly selected and all micro‐sellers of the five vegetables were listed. From this list, three micro‐sellers were randomly selected.

The five vegetables examined are the most important vegetables grown in this area, with 33% and 31% of the irrigated land allocated to tomatoes and onions, respectively, while cabbage, green pepper, and Ethiopian kale are estimated to be grown on 8%, 8%, and 9% of the land, respectively. Other crops make up the remaining 12%.

3.2. Phone survey in May 2020

To understand how the COVID‐19 pandemic affected the vegetable value chain, we conducted a phone survey with the farmers as well as the wholesale and retail outlets that took part in the in‐person survey in early 2020. In the phone survey, we planned to re‐contact half of the vegetable farmers as well as half of the wholesale and retail outlets. If the respondent could not be reached, refused to take part in the survey, or was no longer active in the vegetable sector, he or she was replaced with another respondent from the in‐person survey sample. All phone survey respondents were randomly selected from the pool of previous survey respondents. The final phone survey sample included 433 farmers,5 30 wholesale outlets, and 235 retail outlets.

An average phone interview took approximately 30 min. The farmer survey instruments focused on access to inputs, marketing and income, behavioral responses to COVID‐19, and their plans for the next cropping season. The wholesale instrument asked about the trading activities and changes in operations in the past 3 months. The retail instrument asked questions about procurement and sales and changes in operations in the past 3 months. All three instruments asked about vegetable prices (for different qualities) at the time of the survey, permitting us to compare prices at different levels of the value chain in the same period. We also used that same price instrument to daily follow prices at the wholesale market and four major wet markets in Addis Ababa, as we did in the first survey round in early 2020.

In Table 1, we use the data collected in February to compare the farmer, wholesale, and retail outlet characteristics between those who took part in the phone survey and those who did not. We see that the two sub‐samples are generally well balanced. The differences in means are largely not statistically different from zero. The exception is that farmers that took part in the phone survey were, on average, somewhat more educated and more likely to originate from male‐headed households. In addition, among the retail outlets, fruit and vegetable shops were less represented in the phone survey compared to the in‐person survey conducted before the pandemic.

TABLE 1.

Comparing respondent characteristics in the February 2020 survey sample between respondents that were and were not included in the May 2020 phone survey

| Observations and variables | Included in phone survey | Not included in phone survey | Difference | p‐value |

|---|---|---|---|---|

| Farmers | ||||

| Male headed households (%) | 96.1 | 92.9 | 3.2 | .04 |

| Level of education of respondent (years) | 6.6 | 5.1 | 1.5 | .00 |

| Vegetable business experience of respondent (years) | 10.1 | 9.6 | .5 | .25 |

| Observations: | 433 | 546 | ||

| Urban wholesalers | ||||

| Male respondent (%) | 93.3 | 100.0 | ‐6.7 | .18 |

| Level of education of respondent (years) | 9.2 | 9.5 | ‐.3 | .68 |

| Vegetable business experience of respondent (years) | 11.3 | 10.4 | .9 | .63 |

| Observations: | 30 | 26 | ||

| Urban retailers | ||||

| Supermarket (%) | 19.2 | 12.8 | 6.4 | .49 |

| Fruit & vegetable grocery shops (%) | 46.4 | 57.8 | ‐11.4 | .08 |

| Fruit & vegetable micro‐sellers (%) | 28.5 | 23.7 | 4.8 | .56 |

| ET‐FRUIT shops (%) | 6.0 | 5.7 | .3 | .98 |

| Male respondent (%) | 45.1 | 49.5 | ‐4.4 | .53 |

| Level of education of respondent (years) | 7.5 | 7.0 | .5 | .25 |

| Vegetable business experience of respondent (years) | 7.8 | 7.9 | ‐.1 | 1.00 |

| Observations: | 235 | 211 |

Note: Difference in means between the groups tested with a t‐test (null‐hypothesis: difference in means = 0).

Source: February 2020 and May 2020 survey rounds.

This article is being made freely available through PubMed Central as part of the COVID-19 public health emergency response. It can be used for unrestricted research re-use and analysis in any form or by any means with acknowledgement of the original source, for the duration of the public health emergency.

4. RESULTS

4.1. Value chain agents' views about changes due to the pandemic

In the phone survey, we asked our respondents how their operations had changed during the pandemic. Nearly 60% of the smallholder farmers and more than 60% of the investors reported that they received less income than usual in the past 30 days (Table 2). Others indicated, however, same or even higher incomes. Despite the larger share reporting lower incomes, the majority of smallholders and investors reported to plan to continue growing vegetables in the next season—most signaled that they would be expanding their operations by renting in more land in the near future (Table 2).

TABLE 2.

Stated income losses in the past month, and future plans among farmers

| Smallholders (%) | Investors (%) | |

|---|---|---|

| Income changes: | ||

| “In the past 30 days would you say that your household received more or less income compared to the income you usually receive at this time of the year?” | ||

| Much less | 8.7 | 10.5 |

| Less | 50.8 | 53.0 |

| Same | 28.1 | 26.1 |

| More | 11.0 | 9.7 |

| Much more | 1.3 | .8 |

| Future plans: | ||

| Plan to grow vegetables in next rainy season | 77.5 | 88.8 |

| Plan to grow vegetables in next irrigation season | 94.6 | 88.1 |

| Intention of farmers on land rental in next irrigation season: | ||

| No change | 42.6 | 20.9 |

| Rent in more | 43.0 | 59.0 |

| Rent in less | 2.4 | 3.0 |

| Rent out more | 1.0 | 1.5 |

| Rent out less | .3 | .0 |

| Do not know yet | 10.7 | 15.7 |

Source: May 2020 survey round. Observations: 433 farmers.

This article is being made freely available through PubMed Central as part of the COVID-19 public health emergency response. It can be used for unrestricted research re-use and analysis in any form or by any means with acknowledgement of the original source, for the duration of the public health emergency.

We asked wholesale and retail traders to compare the situation at the time of the survey to the situation 3 months earlier, that is, before the pandemic began. Most wholesalers and retailers reported that there was less choice when it comes to transportation and that related costs had substantially increased (Table 3).6 Moreover, both the demand and the quantity of vegetables sold had decreased and the share of vegetables that could not be sold had increased (Table 3).

TABLE 3.

Stated changes in traders' businesses compared to 3 months prior

| Decreased | Remained same | Increased | |

|---|---|---|---|

| Wholesalers (%) who believe that… | |||

| … the choice in transporters going to rural areas … | 63.3 | 36.7 | .0 |

| … the cost of transport from rural areas to Addis Ababa … | .0 | 6.7 | 93.3 |

| … the number of clients that they sell to … | 83.3 | .0 | 16.7 |

| … turnover (quantity of vegetables sold) … | 86.7 | .0 | 13.3 |

| … losses … | 3.3 | 20.0 | 76.7 |

| Retailers (%) who believe that… | |||

| … the choice in transporters from wholesale markets … | 55.7 | 37.5 | 6.8 |

| … the cost of transport from Addis wholesale markets to retail shops … | 1.3 | 24.7 | 74.0 |

| … the number of clients that they sell to … | 82.1 | 9.4 | 8.5 |

| … turnover (quantity of vegetables sold) … | 80.4 | 10.2 | 9.4 |

| … losses … | 11.5 | 26.4 | 62.1 |

Source: May 2020 survey round. Observations: 30 wholesalers; 235 retailers.

This article is being made freely available through PubMed Central as part of the COVID-19 public health emergency response. It can be used for unrestricted research re-use and analysis in any form or by any means with acknowledgement of the original source, for the duration of the public health emergency.

At the time of the phone interview in May, the wholesale traders further reported that, compared to the period before the pandemic, more of the vegetables they sold originated from the East Shewa zone—where the interviewed farmers were located (Table 4). The share of that zone increased by 15 percentage points, from 45% to 60% of total supply. If we assess changes of origins by vegetable (combining the East Shewa zone with sub‐urban zones (the Akaki area)), we see little change for tomato and cabbage, where nearby supplies were already at very high levels before the COVID‐19 pandemic, but we note significant shifts for onions and green pepper. For the latter two vegetables, the share of these nearby areas increased by 16% and 33%, respectively. For onions, the share of onions imported internationally (from Sudan) decreased from 14% to 0% and from a further away region (Somalia) from 5% to 0%. In the case of green pepper, the share of the Amhara and Tigray regions combined, located to the North of Addis Ababa and often a day or longer drive away by truck, decreased from 40% to 2%. Overall, the pandemic seems to have led to a much stronger reliance on localized marketing.

TABLE 4.

Procurement locations and sales patterns of urban wholesalers before and after onset of COVID‐19 pandemic

| 3 months before (%) | Now (%) | Difference | |

|---|---|---|---|

| (%‐point) | |||

| Origin of vegetables: | |||

| Overall | |||

| East Shewa | 44.7 | 60.0 | 15.3 |

| Other areas | 55.3 | 40.0 | ‐15.3 |

| By vegetable (share East Shewa + suburban): | |||

| Tomato | 85.8 | 84.5 | ‐1.3 |

| Onion | 29.5 | 44.6 | 15.1 |

| Green pepper | 48.7 | 82.5 | 33.8 |

| Cabbage | 100.0 | 98.5 | ‐1.5 |

| Clients sold to: | |||

| Other wholesalers | 19.4 | 16.7 | ‐2.7 |

| Consumers | 2.3 | .0 | ‐2.3 |

| Institutions (schools, universities, jails, army, hospitals, etc.) | 6.4 | 1.2 | ‐5.2 |

| Restaurants | 6.5 | 11.3 | 4.8 |

| Supermarkets | 8.7 | 12.8 | 4.1 |

| Micro fruit and vegetable sellers | 40.5 | 24.8 | ‐15.7 |

| Fruit and vegetable grocery shops | 17.4 | 33.2 | 15.8 |

| Other clients | .8 | .0 | ‐.8 |

Source: May 2020 survey round. Observations: 30 wholesalers.

This article is being made freely available through PubMed Central as part of the COVID-19 public health emergency response. It can be used for unrestricted research re-use and analysis in any form or by any means with acknowledgement of the original source, for the duration of the public health emergency.

We also observe important shifts in the clientele of the wholesale traders. The role of public institutions declined as schools and universities were closed, while a larger share of the produce was sold to supermarkets, grocery stores, and restaurants that remained open. As there was significantly less mobility on the roads and walkways, where some of the micro‐sellers were operating, a number of them seemingly reduced quantities traded or stopped operations all together. Micro‐sellers also complained about higher overall costs because of higher transportation costs, relatively higher transaction costs as turnover was overall smaller, and higher carrying costs they faced because of the longer distances between the bus stations and the new wholesale market. These changes may have reduced their profitability and might have led some to stop operations.

4.2. Price formation in the vegetable value chain before and during the pandemic

The survey instruments fielded in both survey rounds were carefully designed to collect price data at different levels of the value chain. We asked farmers to estimate the price of the vegetables with different quality characteristics in their kebele at the time of the survey. We asked wholesalers and retailers to quote the prices for all qualities of vegetables that they were selling the day of the interview. We have a total of 11,665 price observations for tomatoes, onions, green pepper, and cabbage.7 Table A1 in the Appendix provides the summary statistics of these price data. As all surveys were conducted at the same time, we can analyze vegetable price formation along the value chain.

A concern with the price data collected from the traders is that they may be subject to reporting bias. To explore this issue, in the February survey round we also asked price quotes from customers visiting the same wholesale and retail outlets.8 A comparison of the prices quoted by the traders and the buyers shows negligible and not statistically significant differences, indicating that the traders were reporting prices truthfully and accurately (Table A2 in Appendix).

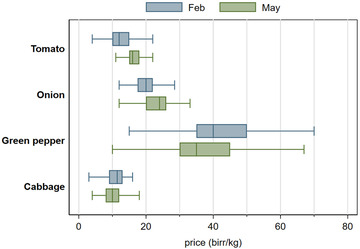

Figure 2 shows a box and whiskers diagram of the retail (consumer) price changes and variations across the four vegetable types. The size of the box marks the difference between the 25th percentile (the left‐hand side of the box) and the 75th percentile (the right‐hand side of the box) of the retail price distribution for a given vegetable and survey round. The bottom and top rule indicate the bottom 5th and top 5th percentiles of the full distribution. Focusing on the vertical bar rule inside the box that marks the median, we see that retail price trends were quite heterogeneous during the pandemic. Median tomato and onion prices increased by 33% and 20%, respectively, while the median prices of green pepper and cabbage went down by 13 and 12%, respectively. Moreover, the sizes of the boxes in the diagram reveal considerable variation in retail prices, particularly for green pepper.

FIGURE 2.

Retail prices by vegetable type and survey round [Color figure can be viewed at wileyonlinelibrary.com]

Source: February 2020 and May 2020 survey rounds.

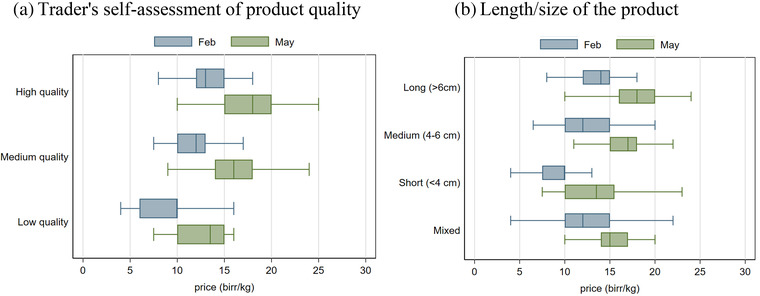

These within‐product price variations are to a large extent driven by quality differences. This is illustrated in Figure 3, which shows how the tomato prices vary across different quality indicators, such as the trader's self‐assessment of the overall quality and the length/size of the product.

FIGURE 3.

Retail tomato prices by quality and survey round. (a) Trader's self‐assessment of product quality. (b) Length/size of the product [Color figure can be viewed at wileyonlinelibrary.com]

Source: February 2020 and May 2020 survey rounds.

We then analyze price formation before and during the pandemic using a regression approach. Specifically, we regress the price of the vegetable (pit) on a set of binary variables for each level of the value chain and then interact these with a binary variable capturing the survey round:

| (1) |

Setting the farm gate level as the base category, variables and equal 1 if the vegetable price i in survey round t was observed at the wholesale and retail outlet (and zero otherwise), respectively. Variable captures the survey round, equaling 1 if the price i was observed in May (i.e., during the pandemic) and zero if in February. We also control for differences in vegetable quality and origin (place of production) through a series of variables captured by vector 9 and is the error term. The computed standard errors are adjusted for heteroskedasticity (White, 1980). Finally, we estimate Equation (1) separately for the four vegetable types.

Table 5 reports the regression results separately for each vegetable type. The bottom row shows the farm gate price measured in birr/kg for each vegetable in February 2020. The coefficient on the ‘‘May survey’’ variable ( in Equation 1) shows the change in the farm gate price in May 2020. We see that the farm gate prices for tomatoes and onions increased considerably over the 3‐month period, while the opposite was true for green pepper and cabbage. While price decreases for green pepper partly reflect seasonal patterns, large price increases for tomato and onions are atypical for this period of the year and might therefore reflect impacts of the COVID‐19 pandemic.

TABLE 5.

Price regressions by vegetable type

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Tomato | Onion | Green pepper | Cabbage | |

| Urban wholesale | 1.74*** | 4.02*** | ‐.26 | .41* |

| (.25) | (.58) | (.89) | (.22) | |

| Urban retail | 7.80*** | 9.01*** | 23.06*** | 5.64*** |

| (.20) | (.46) | (.69) | (.18) | |

| Urban wholesale x May survey | .72*** | ‐.80 | .97 | 1.11*** |

| (.28) | (.52) | (.96) | (.18) | |

| Urban retail x May survey | ‐1.13*** | ‐2.02*** | 2.17** | 1.18*** |

| (.23) | (.55) | (.85) | (.21) | |

| May survey | 4.77*** | 5.34*** | ‐11.08*** | ‐2.11*** |

| (.12) | (.22) | (.53) | (.11) | |

| Quality and origin controls? | Yes | Yes | Yes | Yes |

| Observations | 3230 | 3491 | 2646 | 2266 |

| R2 | .697 | .398 | .623 | .647 |

| Farm gate price in February (birr/kg) | 5.73 | 13.67 | 22.05 | 5.44 |

Note: Heteroskedasticity robust standard errors in parentheses.

p < .10.

p < .05.

p < .01. Quality controls for tomato are: overall quality, ripeness, size, form, and origin; for onion: overall quality, size, and origin; for green pepper: overall quality, length, thickness, color, and origin; and for cabbage: overall quality, size, and origin.

Source: February 2020 and May 2020 survey rounds.

This article is being made freely available through PubMed Central as part of the COVID-19 public health emergency response. It can be used for unrestricted research re-use and analysis in any form or by any means with acknowledgement of the original source, for the duration of the public health emergency.

The coefficients on the non‐interacted value chain level variables (i.e., and in Equation 1) quantify the gross marketing margins before the pandemic in February 2020. The gross margins at wholesale level are generally small relative to farm gate prices and to the gross margins in the urban retail sector. In the case of green pepper, the gross margin estimate is not statistically different from zero in both rounds. The margins were highest for onions in February (18%). While brokers and traders in wholesale markets are often seen as exploitative and overly powerful (Gebreamlak, 2020), these results suggest that even if there is market power and one could address it, it seemingly will not reduce urban retail prices nor increase producer prices very much given the relatively small contribution of these margins to final prices.10

The coefficients on the interacted terms (i.e., and in Equation 1) inform us how the marketing margins changed during the pandemic. In the case of onion, the difference in the wholesale margin between the two rounds is negligible and not statistically different from zero. For tomatoes and cabbage, the wholesale margin on average increased .7 and 1.1 birr/kg, respectively. Meanwhile, urban retail margins declined significantly in the case of tomatoes and onions and increased for green pepper and cabbage, the two products that saw price decreases between February and May (see Figure 2).

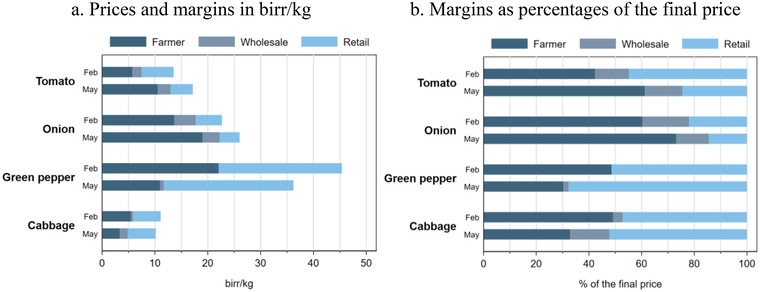

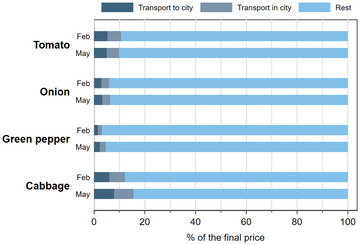

We use these regression results to show the average price composition along the value chain, that is, from farmer to consumer, in both periods.11 Figure 4 shows the predicted gross margins in birr terms as well as percentages of the final retail price. Strikingly, the observed changes in retail (consumer) prices during the pandemic are largely driven by increases or decreases in farm gate prices and not by wholesale or retail cost margins. It seems then that the various disruptions associated with the pandemic have not led to substantial increases in marketing margins.

FIGURE 4.

Vegetable price structure before and during the pandemic, by vegetable type. (a) Prices and margins in birr/kg. (b) Margins as percentages of the final price [Color figure can be viewed at wileyonlinelibrary.com]

Note: These graphs are based on the estimated coefficients reported in Table 5.

As indicated earlier, the reductions in both international trade and domestic trade between sub‐national regions (e.g., between the Oromia region, which Addis Ababa is surrounded by, and the Amhara region) seem to have increased the reliance of Addis Ababa on vegetables produced in the East Shewa zone. This reduced trade may have contributed to the unusually large changes in prices12—confirming earlier findings that regional and international trade can play an important role in stabilizing food price volatility (e.g., Minot, 2014). This reduction in trade over longer distances has also led to winners and losers, as is typically seen after trade policy reforms or trade‐related shocks (Aksoy & Beghin, 2004; Headey, 2011).13

In Ethiopia, the pandemic disrupted trade between neighboring countries and sub‐national regions. Therefore, those farmers in the East Shewa zone that faced international and regional competition in marketing their produce before the pandemic seemingly benefited as the trade disruptions reduced supply, leading to price increases.14 Onions provide a good example of a crop that was widely imported before the pandemic.15 In contrast, those farmers in the East Shewa zone that were producing crops that were exported to other sub‐national regions (e.g., to Amhara) lost out due to decrease in demand, which subsequently led to an oversupply and declining prices. In our case, such dynamics are observed for green peppers. Moreover, it seems that especially farmers—more than consumers—were exposed to large price volatility because of these domestic and international trade disruptions.

Finally, transportation costs are often a major determinant of food prices (Dillon & Barrett, 2016; Minten et al., 2016; World Bank, 2009). However, their importance depends on trade distances and the final value of produce. It seems that changes in transportation costs might be less of an issue in the case of value chains with perishable products that are typically traded over relatively short distances. Most traders that we interviewed reported that transportation costs increased considerably between the two periods. The median increase in transportation costs reported by wholesalers who transported vegetables was about 25%, while transportation costs in the city changed similarly. Interestingly, transport costs in the city over relatively small distances are as high as transport costs from rural areas to the capital. The relatively high costs in the city are due to the small quantities that are bought daily by retailers and that often need to be transported on small mini‐bus taxis, while transport from rural areas is done on large and more cost‐efficient trucks that specialize in the transport of vegetables.16

It is important to note that transportation costs form a negligible part of the total retail prices of the vegetables studied here and stayed so even with the inflated transport costs during the pandemic. Using the data collected in the February survey, we estimate that transportation costs from rural areas to Addis Ababa as well as transport within the city were each about .66 birr/kg, amounting to a total transport cost of 1.3 birr/kg, a relatively small share of the final retail price (Figure 5). Figure 5 further indicates that the increase in these transportation costs in May—by .3 birr/kg—has not been a major contributor to changes in the final retail price of these vegetables.

FIGURE 5.

Share of transportation costs in final retail price, by vegetable and survey round [Color figure can be viewed at wileyonlinelibrary.com]

Source: February 2020 and May 2020 survey rounds.

The upshot of this analysis—and linking it back to the conceptual framework in Section 2—is that despite the fear of COVID‐19 infections, shifts in supply areas, difficulties in mobility, and the relocation of wholesale markets, marketing margins changed little in absolute terms and these market systems have therefore shown surprising resilience during the COVID‐19 pandemic. This finding also implies that the changes in marketing margins—as shown in scenario (a)—have not been a major diver for the change in producer and consumer prices seen since the onset of the pandemic.

In the documented price effects, we have seen heterogeneous effects by vegetable. Some vegetables were strongly affected by international trade effects. In the case of sizable reductions of imports of vegetables, as shown for onions, we find significant prices increases, as predicted in scenario (c). There is suggestive evidence for green pepper—which was more exported from the East Shewa area than other vegetables before the pandemic hit (36% was sold by farmers to traders from other regions, compared to only 29% for tomatoes) and which saw the biggest increase in East Shewa's share in Addis markets between May and February—that this drop of export market opportunities might have contributed to the drop in its prices, as shown in scenario (d).

In the case of local trade only where we have seen large price changes as well, we might have seen upwards pressure on production costs (and possibly leading to a shift in the supply curve) for some crops, especially for tomato that is heavily grown by medium‐scale farmers that rely substantially on hired labor (Minten et al., 2020) and that is most labor intensive of all vegetables17 as wages increased by 36% over the period considered, leading to price increases as modeled in scenario (b). Using a representative household phone survey carried out in May in Addis Ababa, Hirvonen, Abate et al. (2020) find that 22% of consumers were avoiding consuming raw vegetables as they were perceived to create risks for COVID‐19 infections. A later survey conducted with the same households showed that the average household per capita vegetable consumption fell by 19% in birr terms between September 2019 and August 2020 (Hirvonen, de Brauw et al., 2020), indicating that demand shifts may have explained some of the noted price changes—though it is also possible that the causality runs the other way; the price increases reduced household vegetable demand. However, the aggregate statistics do not permit us to assess the demand effects—shown in scenario (b)—more carefully by vegetable.

5. CONCLUSIONS

Based on unique large‐scale price data from different segments in rural‐urban vegetable value chains in Ethiopia, we study the evolution of farm and retail prices and marketing margins during the first 3 months of the COVID‐19 pandemic. To slow the spread of the virus, the Government of Ethiopia banned travel through land borders while some regional states imposed restrictions on border crossings. The evidence provided here suggests that this led to substantial changes in vegetable prices at the farm as well the consumer level. In particular, we see large price changes for farmers, but the effects are heterogenous: farmers who faced less competition from other areas (locally or internationally) benefited through higher output prices from the imposed pandemic trade restrictions, while those that could no longer export to other areas in the country lost out. We also show that increasing local factor costs might have contributed to price increases for some crops. Overall changes in wholesale and retail marketing margins have been relatively less important, despite the reduced turnover, higher losses, and higher transportation costs reported by agricultural traders and retailers. We take this as evidence of notable resilience in the local marketing systems.

Our findings have important implications. First, close monitoring of price movements and the factors contributing to those movements is paramount, especially during shocks and especially this crisis period. Changes in consumer prices are often claimed to be linked to predatory behavior among traders, motivating government intervention to curb trading activity, as has already been witnessed during the COVID‐19 pandemic (Gebreamlak, 2020; Resnick, 2020; Wegerif, 2020). However, the earlier evidence on such predatory behavior is limited (Minten et al., 2017; Sitko & Jayne, 2014) and the findings reported here indicate that the price changes during this pandemic have not been driven by large increases in marketing margins. Second, quantitative assessments on the relative importance of different segments in the value chains are useful for setting priorities to reduce farm‐retail spreads in order to achieve higher prices for producers and lower prices for consumers. Our data in particular illustrate the lower importance of transportation costs and the relatively large contribution of urban distribution costs in the final retail prices of vegetables. More focus on addressing potential inefficiencies in these urban distribution systems is therefore called for. Improving those inefficiencies in marketing systems would help in keeping margins low, producer prices high, and consumer prices low, to the potential benefit of nutritional outcomes in the country. Third, further empirical and conceptual work on better understanding this surprising resilience of these marketing systems for other crops and in other settings would be useful.

Supporting information

Supplement Material

ACKNOWLEDGMENTS

We would like to thank Todd Benson, Gerrit Holtland, Fantu Bachewe, Rob Vos, Johan Swinnen, the editor, and two reviewers for useful comments, edits and support. We would also like to acknowledge the contributions of the survey team and the respondents to the survey. The research was done under the Ethiopia Strategy Support Program (ESSP) and was financially supported by the United States Agency for International Development (USAID), the Department for International Development (DFID) of the government of the United Kingdom, and the European Union (EU). The research presented here was also co‐financed and conducted as part of the CGIAR Research Program on Policies, Institutions, and Markets (PIM), which is led by IFPRI.

1.

TABLE A1.

Means and standard deviations of vegetable prices (birr/kg) by survey round

| February 2020 | May 2020 | |||||

|---|---|---|---|---|---|---|

| N | Mean | SD | N | Mean | SD | |

| Farm gate | ||||||

| Tomato | 1123 | 5.7 | 2.3 | 610 | 10.5 | 2.8 |

| Onion | 1266 | 13.7 | 3.0 | 602 | 18.9 | 4.7 |

| Green pepper | 807 | 22.0 | 10.0 | 337 | 12.0 | 7.0 |

| Cabbage | 823 | 5.4 | 2.2 | 348 | 3.3 | 1.4 |

| Urban wholesale | ||||||

| Tomato | 176 | 5.9 | 2.0 | 97 | 12.1 | 2.8 |

| Onion | 191 | 16.0 | 2.8 | 74 | 22.1 | 2.9 |

| Green pepper | 189 | 21.2 | 6.4 | 81 | 11.0 | 4.5 |

| Cabbage | 80 | 6.9 | .8 | 65 | 5.6 | 1.0 |

| Urban retail | ||||||

| Tomato | 783 | 12.4 | 3.8 | 460 | 16.5 | 3.4 |

| Onion | 838 | 22.6 | 11.6 | 524 | 25.5 | 9.5 |

| Green pepper | 801 | 42.9 | 12.8 | 436 | 36.1 | 12.2 |

| Cabbage | 594 | 10.9 | 3.3 | 360 | 10.5 | 2.7 |

Note: N = number of observations; SD = standard deviation.

Source: February 2020 and May 2020 survey rounds.

This article is being made freely available through PubMed Central as part of the COVID-19 public health emergency response. It can be used for unrestricted research re-use and analysis in any form or by any means with acknowledgement of the original source, for the duration of the public health emergency.

TABLE A2.

Accuracy of prices reported by traders

| Price quoted by traders (birr/kg) | Price quoted by buyers (birr/kg) | t‐test | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Vegetable type | N | Mean | Median | SD | Mean | Median | SD | t‐value | p‐value |

| Wholesale price | |||||||||

| Tomato | 24 | 5.98 | 6 | 1.49 | 5.94 | 6 | 1.55 | .09 | .925 |

| Onion | 37 | 16.00 | 16 | 1.45 | 15.97 | 16 | 1.48 | .08 | .937 |

| Green pepper | 27 | 21.15 | 18 | 6.61 | 21.26 | 18 | 6.46 | ‐.06 | .950 |

| Head cabbage | 22 | 6.77 | 7 | .86 | 6.75 | 6.75 | .86 | .09 | .930 |

| Retail price | |||||||||

| Tomato | 363 | 11.63 | 12 | 3.03 | 11.41 | 12 | 3.22 | .96 | .337 |

| Onion | 400 | 23.62 | 18 | 14.46 | 23.62 | 18 | 14.39 | .00 | .997 |

| Green pepper | 453 | 40.13 | 40 | 12.68 | 38.98 | 40 | 13.41 | 1.32 | .186 |

| Head cabbage | 263 | 12.25 | 13 | 2.66 | 11.95 | 12 | 2.52 | 1.34 | .182 |

Note: N = number of observations; SD = standard deviation. Difference in means between the groups tested with a t‐test (null‐hypothesis: difference in means = 0).

Source: February 2020 survey round.

This article is being made freely available through PubMed Central as part of the COVID-19 public health emergency response. It can be used for unrestricted research re-use and analysis in any form or by any means with acknowledgement of the original source, for the duration of the public health emergency.

Hirvonen K, Minten B, Mohammed B, Tamru S. Food prices and marketing margins during the COVID‐19 pandemic: Evidence from vegetable value chains in Ethiopia. Agricultural Economics. 2021;52:407–421. 10.1111/agec.12626

Footnotes

Changes in marketing margins between the two periods reduced the change in absolute terms of vegetable retail prices compared to farm prices, that is, in the case of increases of farm gate prices, smaller marketing costs reduced that increase at the retail level and vice‐versa.

Hirvonen, de Brauw et al., 2020 use a representative sample of households to study food security dynamics in Addis Ababa during the pandemic. They find that more than half of the households in Addis Ababa report that their incomes were lower than usual in May–July but this did not translate into widespread declines in total food consumption levels in August 2020 when compared to September 2019. However, over the same period, household vegetable consumption fell by 19% in birr terms.

This type of detailed value chain data, collected in a cascading manner, is vital for developing a complete picture of the value chain. Other approaches come with a number of methodological weaknesses. For example, the common practice in food value chain analysis is that it often only uses anecdotal or qualitative evidence and it does not rely on reliable and representative surveys (e.g., Webber and Labaste 2009; World Bank 2009; Nang'ole, Mithöfer, and Franzel 2011). Moreover, household surveys based on random sampling have the disadvantage that the selected farmers might be of relatively less importance in major food supply areas and thus might not present a representative picture of the farmers who effectively participate in value chains of specific food crops (World Bank 2009).

We also interviewed 169 beneficiaries of SNV's Horti‐Life project but did not attempt to re‐contact these farmers in the phone survey.

The survey team attempted to call a total of 570 farmers. Out of these, 433 were successfully interviewed, 51 experienced phone problems (no network or wrong number), 14 farmers refused to take part in the phone survey, and 72 farmers did not sell or grow one of the five studied vegetables in the previous month. Out of the 433 farmers in the final phone survey sample, 299 were smallholder farmers and 134 investor farmers. However, we do not disaggregate our findings along this dimension in this paper.

It should be noted that most transport is not done with cooled trucks but with trucks where bags, baskets and wooden boxes (in the case of tomato) are loaded in the back of an open truck. A typical truck making the journey between rural and urban areas would carry between 4.5 and 6 tons of vegetables.

We dropped the analysis of price formation for Ethiopian kale given the use of units in markets that were difficult to convert to kilograms, such as small bunches, large bunches, and bags.

Enumerators were told to stay around for a few minutes after completing their interview, to wait for a buyer at that particular wholesale or retail outlet. If a buyer appeared, they asked the price directly from the buyer, if not, they moved to the next interview. This explains the lower number of observations in Table A1.

The quality indicators vary across vegetable types. A subjective quality indicator (best; medium; low) is used for all vegetables, ripeness for tomato (green; ripe; overripe; semi‐rotten; rotten), size (in cm) for tomato, onion, green pepper, form (circle; oval; mixed) for tomato, thickness and color for green pepper and size for cabbage (large > 1.5 kg; medium 1–1.5 kg; small < 1 kg).

The price difference between farm and urban wholesale also accounts for the transportation costs to bring vegetables from rural production areas to the city.

In the case of green pepper, the estimate on the wholesale margin in February is negative, though not statistically different from zero. We set this margin to zero in Figure 4.

Seasonal price indices based on vegetable retail prices of the Central Statistical Agency were calculated over the January 2005–March 2019 period using the percentage moving average method. In this method, the index is calculated as an average ratio of the real price over a twelve‐month moving average value of the item. Over the period studied, retail prices show typically relatively small changes between February and May in the case of tomato and cabbage, but the difference is larger for onions and green pepper. The difference in percentage points of the seasonal index from May compared to February was +1% for tomato, ‐7% for onions, ‐7% for green pepper, and ‐1% for cabbage. A cereal price index for Addis Ababa shows that prices went up by 14% between those two periods, part of the regular seasonal movement for cereals during this period of the year but also reflecting the relatively high inflation in the country in 2020 (19.8% in May 2020, compared to twelve months earlier (CSA, 2020)).

54% of the farmers only grew one vegetable, 28% two, and 18% more than two. Minten et al. (2020) show that it is especially the medium‐scale tenant farmers that cultivated those vegetables (83% of their cultivated area in the 12 months before the survey compared to 47% for the smallholders) that saw significant price increases, indicating that they were likely bigger winners from these price increases than the smallholders. However, factor prices were up significantly for all.

Minten et al. (2020) show, however, that input costs, such as wages, went up as well for a number of these farmers, but that these changes were less than output price changes.

The increase of onion prices is seemingly linked to the closure of the land borders with Sudan due to the COVID‐19 pandemic. In a typical year, Ethiopia imports a significant tonnage of onions from Sudan—for example, 16.1 million USD in 2018 (data downloaded from https://comtrade.un.org/data/). But, as borders have been closed, onion imports from Sudan dried up.

Reardon et al. (2012) show the relatively high prices of transport by food retailers in the case of potatoes in Asia, more in particular in Bangladesh (54% of their operating costs), China (14%), and India (28%).

For example, our farm data show that medium‐scale farmers employ 35% more labor per unit land for tomatoes compared to onions.

REFERENCES

- Aksoy, M. A. , & Beghin, J. C. (2004). Global agricultural trade and developing countries. Washington, DC: World Bank. [Google Scholar]

- Akter, S. (2020). The impact of COVID‐19 related ‘stay‐at‐home’ restrictions on food prices in Europe: Findings from a preliminary analysis. 12, 4(719–725). Food Security, forthcoming. ( 10.1007/s12571-020-01082-3). [DOI] [PMC free article] [PubMed] [Google Scholar]

- Barrett, C. B. (2020). Actions now can curb food systems fallout from COVID‐19. Nature Food, May, 1–2. [DOI] [PubMed] [Google Scholar]

- Bellemare, M. F. (2015). Rising food prices, food price volatility, and social unrest. American Journal of Agricultural Economics, 97(1), 1–21. [Google Scholar]

- CSA (Central Statistical Agency) . (2020). Country and regional level consumer price indices. Addis Ababa: Federal Democratic Republic of Ethiopia. [Google Scholar]

- de Paulo Farias, D. , & de Araújo, F. F. (2020). Will COVID‐19 affect food supply in distribution centers of Brazilian regions affected by the pandemic? Trends in Food Science & Technology, 103, 361–366. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Dillon, B. M. , & Barrett, C. B. (2016). Global oil prices and local food prices: Evidence from East Africa. American Journal of Agricultural Economics, 98(1), 154–171. [Google Scholar]

- Gardner, B. L. , & Rausser, G. C. (2001). Handbook of agricultural economics: Marketing, distribution and consumers (Vol. 1B). North Holland. [Google Scholar]

- Gardner, B. L. (1975). The farm‐retail price spread in a competitive food industry. American Journal of Agricultural Economics, 57(3), 399–409. [Google Scholar]

- Gebreamlak, H. (2020). Onion tears. Addis Fortune, June, 20 (21), 1051. Retrieved from https://addisfortune.news/onion‐tears/ [Google Scholar]

- Hahn, W. (2020). Livestock, dairy, and poultry outlook, LDP‐M‐312. U.S. Department of Agriculture, Economic Research Service. [Google Scholar]

- Harris, J. , Depenbusch, L. , Pal, A. A. , Nair, R. M. , & Ramasamy S. (2020). Food system disruption: Initial livelihood and dietary effects of COVID‐19 on vegetable producers in India. Food Security, 12(4), 841–851. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Headey, D. (2011). Rethinking the global food crisis: The role of trade shocks. Food Policy, 36(2), 136–146. [Google Scholar]

- Hirvonen, K. , de Brauw, A. , & Abate, G. (2020). Food consumption and food security during the COVID‐19 pandemic in Addis Ababa. IFPRI Discussion Paper 01964. Washington, DC: International Food Policy Research Institute (IFPRI). [Google Scholar]

- Hirvonen, K. , Abate, G. , & de Brauw, A. (2020). Food and nutrition security in Addis Ababa during COVID‐19 pandemic: May 2020 report. ESSP Working Paper 143. Washington, DC and Addis Ababa, Ethiopia: International Food Policy Research Institute (IFPRI) and Policy Studies Institute (PSI). [Google Scholar]

- Laborde, D. , Martin, W. , Swinnen, J. , & Vos, R. (2020). Covid‐19 risks to global food security. Science, 369(6503), 500–502. [DOI] [PubMed] [Google Scholar]

- Lele, U. , Bansal, S. , & Meenakshi J. V. (2020). Health and nutrition of India's labour force and COVID‐19 challenges. Economic & Political Weekly, 55(21), 13. [Google Scholar]

- Lusk, J. (2020). Meat and egg prices following the COVID‐19 outbreak. Blogpost. Retrieved from http://jaysonlusk.com/blog/2020/4/5/food‐sales‐and‐prices‐following‐covid‐19‐outbreak

- McCorriston, S. (2002). Why should imperfect competition matter to agricultural economists?. European Review of Agricultural Economics, 29(3), 349–371. [Google Scholar]

- Minot, N. (2014). Food price volatility in sub‐Saharan Africa: Has it really increased? Food Policy, 45, 45–56. [Google Scholar]

- Minten, B. , Tamru, S. , Engida, E. , & Tadesse, K. (2016). Feeding Africa's cities: The case of the supply chain of teff to Addis Ababa. Economic Development and Cultural Change, 64(2), 265–297. [Google Scholar]

- Minten, B. , Mohammed, B. , & Tamru, S. (2020). Emerging medium‐scale tenant farming, gig economies, and the COVID‐19 disruption: The case of commercial vegetable clusters in Ethiopia. European Journal of Development Research, 32(5), 1402–1429. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Minten, B. , Assefa, T. , & Hirvonen, K. (2017). Can agricultural traders be trusted? Evidence from coffee in Ethiopia. World Development, 90, 77–88. [Google Scholar]

- Mogues, T. (2020). Food markets during COVID‐19. Special series on Covid‐19. Washington DC: International Monetary Fund. Retrieved from https://www.imf.org/~/media/Files/Publications/covid19‐special‐notes/en‐special‐series‐on‐covid‐19‐food‐markets‐during‐covid‐19.ashx [Google Scholar]

- Nang'ole, E. M. , Mithöfer, D. , & Franzel, S. (2011). Review of guidelines and manuals for value chain analysis for agricultural and forest products. ICRAF Occasional Paper 17. Nairobi: World Agroforestry Centre (ICRAF). [Google Scholar]

- Narayan, S. , & Saha, S. (2020). One step behind: The government of Indian and agricultural policy during the COVID‐19 lockdown. Review of Agrarian Studies, forthcoming. 10(1), 111–127. [Google Scholar]

- Reardon, T. , Bellemare, M. F. , & Zilberman, D. (2020). How COVID‐19 may disrupt food supply chains in developing countries. In: Swinnen J., and McDermott J. (Eds.) COVID‐19 and global food security (pp. 78—80). Washington DC: IFPRI. [Google Scholar]

- Reardon, T. , Chen, K. Z. , Minten, B. , & Adriano, L. (2012). The quiet revolution in staple food value chains in Asia: Enter the dragon, the elephant, and the tiger. Asian Development Bank and IFPRI, December. [Google Scholar]

- Resnick, D. (2020). COVID‐19 lockdowns threaten Africa's vital informal urban food trade. In: Swinnen J., and McDermott J. (Eds.) COVID‐19 and global food security (pp. 73—74). Washington DC: IFPRI. [Google Scholar]

- Sitko, N. J. , & Jayne, T. S. (2014). Exploitative briefcase businessmen, parasites, and other myths and legends: Assembly traders and the performance of maize markets in eastern and southern Africa. World Development, 54, 56–67. [Google Scholar]

- Swinnen, J. , & McDermott, J. (2020). COVID‐19 and global food security. Washington DC: IFPRI; [Google Scholar]

- Tomek, W. G. , & Robinson, K. L. (1990). Agricultural product prices. Ithaca and London: Cornell University Press. [Google Scholar]

- Torero, M. (2020). Without food, there can be no exit from the pandemic. Nature, 580, 588–589. [DOI] [PubMed] [Google Scholar]

- Webber, M. , & Labaste, P. (2009). Building competitiveness in Africa's agriculture: A guide to value chain concepts and applications. Washington, DC: World Bank. [Google Scholar]

- Wegerif, M. (2020). Informal food traders and food security: experiences from the Covid‐19 response in South Africa. Food Security, 12(4), 797–800. [DOI] [PMC free article] [PubMed] [Google Scholar]

- White, H. (1980). A heteroskedasticity‐consistent covariance‐matrix estimator and a direct test for heteroskedasticity. Econometrica, 48(4), 817–838. [Google Scholar]

- Wohlgenant, M. K. (2001). Marketing margins: Empirical analysis. Handbook of agricultural economics, 1, 933–970. [Google Scholar]

- WorldBank . (2009). Eastern Africa: A study of the regional maize market and marketing costs. Report no. 49831‐ET, Washington, DC: World Bank. [Google Scholar]

- Yu, X. , Liu, C. , Wang, H. , & Feil, J. H. (2020). The impact of COVID‐19 on food prices in China: Evidence of four major food products from Beijing, Shandong and Hubei Provinces. China Agricultural Economic Review, 12(3), 445–458. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Supplement Material