Abstract

Policy Points.

We compared the structure of health care systems and the financial effects of the COVID‐19 pandemic on health care providers in the United States, England, Germany, and Israel: systems incorporating both public and private insurers and providers.

The negative financial effects on health care providers have been more severe in the United States than elsewhere, owing to the prevalence of activity‐based payment systems, limited direct governmental control over available provider capacity, and the structure of governmental financial relief.

In a pandemic, activity‐based payment reverses the conventional financial positions of payers and providers and may prevent providers from prioritizing public health because of the desire to avoid revenue loss caused by declines in patient visits.

Financial distress in the health care sector is a nonintuitive consequence of a pandemic. Yet, in the United States, the budgets of health care providers are under considerable strain as the COVID‐19 pandemic continues.

Analysts anticipate that these continuing financial challenges will generate a wave of consolidation among hospitals and physician practices through 2021. 1 Critical access hospitals, hospitals serving vulnerable populations, and independent primary care practices are particularly threatened. 2 , 3 These dire financial outcomes arose through the interaction of the public health measures taken in response to the COVID‐19 epidemic, particularly the shutdown of elective procedures, along with the underlying structure of US health care financing and the US government's emergency response.

But COVID‐19 is a global epidemic. The twin effects of COVID‐19 treatment and reduced non‐COVID treatment have dramatically changed the number and case mix of patients treated in similar ways across high‐income countries. In all countries, the number of acutely ill patients with COVID rose while the number of patients with other conditions fell. The effects of these changes on health care providers’ finances have varied, however, depending on how health care systems are ordinarily structured and financed and to what extent government actions protected health care providers. By comparing the financial effects of the COVID‐19 pandemic in the United States and three other health care systems (England, Germany, and Israel) that incorporate both public and private insurers and providers, we can identify the governmental and policy factors that contributed to the severity and distribution of the effects of COVID‐19 on US providers.

In all four countries, the impacts of COVID on the utilization of health care were similar. During infection surges, the number of COVID patients stressed hospitals, and as a result, nonurgent services for non‐COVID patients were postponed or forgone. The governments of all four countries directly supported health care providers with funding for increased COVID‐related expenditures (such as for personal protective equipment). The governments of all four countries also protected and compensated health care providers for their financial losses, but they did so in different ways, reflecting the structure of their health systems. In Israel, which uses relatively little activity‐based financing, the government saw less need for dedicated financial assistance. The governments of Germany and England shifted the form of payment away from activity‐based financing toward budgets to provide financial protection to health care providers, particularly in hospitals. Finally, in the United States, where activity‐based payment is prevalent and the health care–financing system is far too fragmented to permit a rapid switch in the method of payment, the government directly compensated providers for lost revenue.

The COVID‐19 Pandemic and the Public Health and Economic Responses

The COVID‐19 pandemic has had devastating effects. It has caused 1.19 million deaths worldwide in just the ten months ending in October 2020. 4 The pandemic and the response to it have also put enormous strains on all health care systems, in two distinct ways. First, health care systems have had to treat surges of very seriously ill patients, sometimes in numbers that overwhelmed capacity. Second, efforts to control the pandemic through lockdowns and other precautions have substantially reduced the number of non‐COVID cases treated and particularly the number of elective procedures performed in all countries. 5

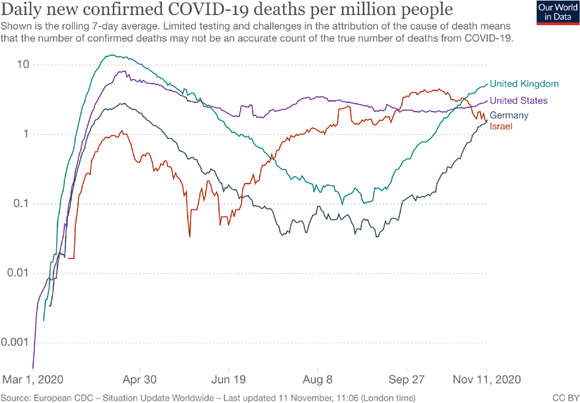

All four of the countries discussed in this article experienced the first widespread outbreaks of COVID‐19 in late February and early March 2020. Figure 1 describes the evolution of the pandemic over time in each of the four countries.

Figure 1.

Covid‐19 Deaths per Million People, 20204 [Color figure can be viewed at wileyonlinelibrary.com]

The public health response of all four countries was much the same. In early March 2020, they imposed significant restrictions on movement, closed most retail stores, closed in‐person education, and suspended elective procedures. These provisions remained in effect through at least May 2020, easing somewhat through the summer and resuming in the fall as the pandemic resurged. 6

The Structure and Financing of Health Care Before COVID‐19

Even though the pandemic and the public health response were similar in the four countries, the health system context in which these events occurred was not. The four countries’ systems vary substantially in how providers are paid and in the roles played by public and private insurance (a brief summary can be found in Table 1).

Table 1.

The Structure and Financing of Health Care in Israel, the United States, Germany, and England

| Provider Type | Country | Structure | Payment |

|---|---|---|---|

| General Practitioners | United States |

|

|

| England |

|

|

|

| Germany b |

|

|

|

| Israel |

|

|

|

| Outpatient Specialists | United States |

|

|

| England |

|

|

|

| Germany b |

|

|

|

| Israel |

|

|

|

| Inpatient Specialists | United States |

|

|

| England |

|

|

|

| Germany |

|

|

|

| Israel |

|

|

|

| Hospitals | United States |

|

|

| England |

|

|

|

| Germany |

|

|

|

| Israel |

|

|

American Medical Association. Employed physicians outnumber self‐employed. Press release. May 6, 2020. https://www.ama‐assn.org/press‐center/press‐releases/employed‐physicians‐outnumber‐self‐employed. Accessed November 11, 2020.

Federal Medical Register. Statistical information. Berlin, Germany: National Association of Statutory Health Insurance Physicians; December 31, 2019. https://www.kbv.de/media/sp/2019‐12‐31_BAR_Statistik.pdf. Accessed October 30, 2020.

American Hospital Association. Fast facts on U.S. hospitals. Chicago, IL: American Hospital Association; March 2020. https://www.aha.org/statistics/fast‐facts‐us‐hospitals. Accessed November 11, 2020.

United States

In 2019, a little more than one‐third of Americans obtained their primary insurance coverage through several public programs; more than half were covered by a highly fragmented private insurance system; and 9.2% of the population was uninsured. In general, public insurance programs pay regulated, activity‐based rates (fee‐for‐service for physicians; diagnosis‐related groups [DRGs] for hospitals) that are typically substantially lower than the negotiated rates paid by private insurers, which themselves vary among insurers. Although many physicians are paid salaries, these are often tied to underlying activity levels. Almost all hospitals and most physicians accept both publicly insured and privately insured patients, but the mix of publicly insured and privately insured patients varies considerably among providers. Providers that serve low‐income and disadvantaged populations receive more of their payments from public plans, while those that serve higher‐income populations rely more heavily on private insurance payments.

England

England operates a national health care system, the National Health Service (NHS), available to all residents. The NHS directly funds clinical commissioning groups (CCGs, led by general practitioners, GPs) and specific health care services. CCGs contract with public hospitals and most reimbursement follows nationally determined DRG rates; specialists are salaried employees of the NHS.

About 10.5% of the population purchases private insurance, which is often provided as an employee benefit. 7 Patients purchase private insurance to obtain faster access to nonacute specialist care or to finance services not provided by the NHS. Nearly all physicians working in the private sector also work for the NHS, but receive higher reimbursement for private‐sector patients, although some purely private health care providers serve only patients with private supplementary insurance.

Germany

Germany has a multipayer health system. Social health insurance (SHI), administered through competing plans, covers about 88% of the population, and private health insurance (PHI) covers 10% of the population (the rest are covered by special schemes). There is a mix of public and private hospitals. Only about 30% of hospitals are public, but they contain more than half of all beds. Even though almost 40% are private for‐profit hospitals, they have fewer than 20% of beds. The rest are nonprofit hospitals. 8 Most ambulatory physicians are self‐employed and work in solo or group practices. Publicly and privately insured patients use the same providers, but the providers are reimbursed at higher rates by private health insurance, particularly for ambulatory care. Social health insurance–affiliated physicians receive fee‐for‐service payments within a negotiated regional global budget. Hospitals are paid for the care of both private and public patients using the same DRG‐based payment system within global target budgets.

Israel

The Israeli National Health Insurance system operates through four competing, nonprofit health plans. The prices of publicly funded services and salaries of inpatient physicians in public nonprofit hospitals are regulated by the government. Payments to health providers in the public sector are usually based on budgets or salaries, and payments to those in the private sector are based on activity (fee‐for‐service). First, health plans receive their budgets through a risk‐adjusted capitation payment. Second, public nonprofit hospitals are reimbursed using per diems in medical wards and a combination of per diems and case‐based payment mechanisms for surgical care. Hospitals operate under a global budget cap that has both a floor (“lower cap” bound), set at 93% of the previous year's payments by each health plan to each hospital, and a ceiling (“upper cap” bound). Third, the salaries for employed physicians are established through sectorwide negotiation. Most GPs are salaried or paid based on capitation, and most specialists contract with the health plans and are paid based mainly on contact capitation (a capitation payment paid for a quarter if a doctor sees a patient in that quarter) and some fee‐for‐service. Those who choose to treat privately funded patients charge fee‐for‐service. 9 Almost all Israeli adults also purchase voluntary health insurance, which funds services provided by self‐employed specialists and private for‐profit hospitals; these are not subject to regulated prices. Private for‐profit hospitals account for about 30% of all elective surgery, as well as diagnostic imaging; they do not provide general medical care. 10

Government Responses

In response to the economic toll of the COVID lockdown, as well as the added costs associated with treating COVID patients, the four governments implemented specific programs aimed at preserving the financial stability of health care providers.

United States

In the United States, initial assistance to providers (mainly hospitals) took the form of advance payments (effectively loans that would be subsequently repaid) from the Medicare program. The CARES Act (enacted on March 27, 2020) included the Paycheck Protection Program, which provided loans (that could be forgiven) to small businesses including physician and dental practices. 11 The Act's Provider Relief Fund was authorized to distribute funds equivalent to about 5% of national health expenditures (NHEs) to hospitals and health care providers, including independent practitioners such as doctors and dentists. 12 Hospitals and other Medicare and Medicaid providers received initial disbursements of the Provider Relief Fund based on the prior year's revenue. 13 Later disbursements focused on hospitals severely affected by COVID‐19 admissions, such as rural hospitals and clinics, skilled nursing facilities, the Indian Health Service and tribal hospitals, and safety‐net hospitals, and also included providers who did not participate in the Medicare program. The Provider Relief Fund's allocation formulas, however, did not assess existing access to capital, financial need, or revenue shares affected by COVID‐19 restrictions. 2 , 14 Instead, funding flowed to wealthier hospitals serving greater numbers of privately insured patients (whose treatment commands nearly twice the average rate of reimbursement for Medicare patients), as these hospitals saw the greatest absolute reduction in revenues due to the suspension of elective procedures. 15 , 16

England

Between April and July 2020, England discontinued its normal payment system for health care. Instead, all NHS hospitals and GP practices received payment at rates based on the previous year's average monthly expenditures plus an increase to account for inflation. 17 Between April 3 and May 19, 2020, NHS trusts could also claim additional COVID‐19–related capital expenditures up to £250,000 (about $324,000) without prior approval. 18 In addition, the UK government decided to write off £13.4 billion (about $17.8 billion) of past debt of NHS trusts in England, affecting more than 100 hospitals, in order to give hospitals a “clean slate” to make investments in maintaining essential services and responding to the COVID‐19 emergency effectively. 18

Pay‐for‐quality payments coordinated by the Commissioning for Quality and Innovation have been suspended until April 2021. 19 The private sector, which generally provides nonacute specialist care, was highly affected by the cancellation or postponement of services in the first months of the pandemic, but the NHS quickly took over the extra capacity. At the end of March, England passed a health services’ exclusion order to the Competition Act 1998. 20 This enabled the NHS to write block contracts with the vast majority of private hospitals, including their outpatient capacity, to make the capacity available for NHS patients. The NHS reimbursed private providers for services based on an estimate of the full operating costs of care, a level intended to avoid insolvency without generating profits. The block capacity agreements were intended to support the NHS with the provision of elective and planned services and, starting in November 2020, will be replaced by a £10 billion contract for private providers lasting until November 2024. 21

Germany

Toward the end of March 2020, the German government passed the Hospital Relief Act to provide financial support for hospitals. 22 The act sought both to compensate revenue shortfalls due to decreased admissions and to provide incentives and capacity to treat COVID‐19 patients. Hospitals received a per diem payment for empty beds, determined by calculating the difference between the number of patients currently being treated each day and the average number of patients treated in the previous year. Hospitals also received funding to expand their ICU capacity and to compensate for the extra costs of nursing care and personal protective equipment. Ambulatory care physicians received compensation from the Association of Sickness Fund physicians if the revenue of their practice decreased by more than 10% in a quarter when compared with the previous year's quarter. Furthermore, health insurers had to offer additional reimbursement to physicians for the costs of COVID‐19–related services and measures.

Israel

The Israeli government approved a program for COVID‐19 relief to support hospitals (of New Israeli Shekels [NIS] 1.8 billion, about USD $550 million), which enabled them to hire more personnel to treat COVID‐19 patients, assemble COVID‐19 wards, and buy pharmaceuticals and protective gear. 23 , 24 On April 15, 2020, a new (special) per‐diem payment code was established for COVID‐19 patients. 25

The Impacts on Providers

While it is still early to assess the overall financial impacts of COVID‐19 on health providers, in this section we use available data to describe how providers have fared. These effects combine the direct effects of the pandemic and those of the government interventions that have addressed these effects. Our data are necessarily provisional, as assessments of the pandemic's financial impact are still under way in all four countries.

United States

Spending on health care services, not including pharmaceuticals, dropped sharply in the early months of the pandemic. 26 Hospitals and independent physicians have been particularly affected by patients postponing or forgoing elective and ambulatory care. A series of Commonwealth Fund reports on outpatient care during the pandemic found that ambulatory care visits declined by nearly 60% in April 2020, began to recover by mid‐May 2020, and returned to pre‐pandemic levels starting in early September 2020. 27 Some hospitals and independent physicians were able to use telehealth services to stem a portion of their patient and revenue loss. The percentage of overall visits conducted through telehealth services peaked at nearly 14% in mid‐April 2020 and has slowly declined since then. 27

As the revenue from health care services fell, the sector lost more than 1.5 million jobs from February through April 2020, a 9.5% decrease compared to the same period in 2019. Job losses in early 2020 were concentrated in ambulatory office–based settings (−1.04 million jobs total; −523,000 jobs, not including dental care jobs), while hospitals suffered relatively fewer losses (−122,000 jobs). 28

Even though health care providers have been able to qualify for federal financial relief, the distribution of funds has been inequitable. Small, rural, or safety‐net hospitals that typically operate with lower financial liquidity and narrower margins and are at a higher risk for closure received less funding than did larger, wealthier hospitals. 29 , 30 Although small, independent providers were able to benefit from paycheck protection program (PPP) disbursements, certain specialties, such as pediatric practices, have also struggled to obtain federal relief owing to the eligibility requirements of Medicare payments. 31

Most studies of COVID‐19's effects in the United States focus on the first wave of the pandemic and the concurrent lockdowns. Estimates in the peer‐reviewed literature suggest a drop of $22.3 billion in hospitals’ income from elective surgery that was canceled between March and May 2020. 32 From early March to late April, health spending overall fell by 46%, ranging from 26.9% in inpatient care to 86.2% for ambulatory surgical centers. 33 Industry reports suggest that hospital margins took a severe hit in the first wave and that margins would fall by 5% to 7%, 34 which represents a decline relative to last year by 4.9% excluding CARES Act funds and by 1.2% including these funds. 35 Net losses to primary care practices, assuming (as subsequently occurred) a partial shutdown in winter, were estimated to exceed $15 billion. 3

England

In England, NHS providers were funded through a revised payment system adopted during the COVID‐19 pandemic. Due to the early financial response and payment adaptation in England, NHS providers did not face substantially lower revenues. Private practice providers were unable to perform expensive procedures that would account for higher revenues, but they also received funding from the NHS to cover costs.

Record‐level waiting lists resulting from postponements have prompted more patients to pay for their treatment themselves or to take out private health insurance. 36 At the end of November 2020, only 68.2% of patients in England started their treatments within 18 weeks, where the target is 92%. 37 Moreover, 192,169 patients have been waiting more than 52 weeks for treatment, dramatically up from 3,097 patients in March 2020. 38 Since the NHS had block‐booked capacity from private providers, privately insured patients still faced waiting times for treatment, and some consumers have demanded refunds from private insurance companies because of the difficulty in accessing services. 39 Teleconsultation services have provided some relief in both sectors, but particularly in NHS‐provided primary care. In August 2020, 43% of appointments were conducted over the telephone, and of these, 70% were appointments with general practitioners. 40

Germany

As elsewhere, German hospitals and physician practices saw a sharp decline in elective procedures and ambulatory consultations in the early part of the pandemic. Overall, hospital admissions dropped by almost 30% between March and May 2020, which led to a sharp decrease in revenues from DRG‐based payment. Hospitals’ revenues dropped by an average of €2.5 Million from March through May 2020 as a result of less inpatient surgery. 41 The same report also states that almost half of all hospitals expected to end 2020 with a deficit, and only 29% would end with a surplus. Expected deficits were most prevalent (70%) in larger hospitals (> 600 beds). These figures should be interpreted with caution, however, as they are based on a survey conducted by the German Hospital Institute, owned by the German Hospital Federation.

The protection mechanisms put in place by the government ensured that this income loss would not threaten the hospitals’ financial viability. In fact, the per‐diem payment for empty beds was €8.76 billion to hospitals between March and September 2020. Initially, all hospitals received the same amount of €560 per empty bed. This meant that small hospitals with low case‐mix indices, that is, those usually treating rather uncomplicated cases, received more money than they would have received under normal conditions. The compensation for empty beds did not, however, cover the costs for large teaching and other specialized hospitals. Therefore, a revision of the compensation scheme specified that hospitals receive different amounts for empty beds, ranging from €190 to €760 per day, depending on the case‐mix index. While this compensation ended on October 1, the Hospital Future Law specifies that hospitals are expected to negotiate with social health insurance funds regarding further compensation for COVID‐19 related costs and revenue shortfalls. This means that overall, hospitals’ financial viability will be safe. Interestingly, while the effects of COVID‐19 were different for small and large hospitals, they did not differ by ownership (public, private, nonprofit) because all hospitals are governed by the same financing principles and treat mostly publicly insured patients.

Israel

Since payments to providers in the public sector are based mainly on budgets, salaries, and capitations, these providers were somewhat protected from financial impacts of the pandemic. Israeli physicians faced relatively limited decreases in outpatient care and limited loss of income during the first wave of COVID‐19. Salaried general practitioners or those paid on capitation were not affected at all. Telemedicine allowed most specialists to meet their contact capitation targets either based on earlier visits or through virtual visits. 42 , 43 The minority of self‐employed physicians without contracts with health plans (i.e., those who treat privately funded patients and charge unregulated fee‐for‐service) usually did not have alternative virtual visits and lost income.

Public hospitals were also sheltered from the financial effects of COVID‐19 through the global budget cap floor that guarantees hospitals 93% of the previous year's revenue. In addition, a new per diem tariff was created for designated COVID wards and was excluded from the upper cap in order to reimburse hospitals for all COVID‐related extra expenses. These protections did not apply to private hospitals, which not only saw sharp declines in (elective) activity but also did not treat COVID patients. Even after elective surgeries were resumed, patients refrained from visiting hospitals. 44

The Israeli Ministry of Finance has a policy of underfunding hospitals and health plans, constantly expecting them to become more efficient, 45 and as a consequence, they are constantly in deficit. 46 , 47 During the first half of 2020, the health plans’ deficit increased by only 5.5% compared to 2019, most of it due to increased activity in hospitals owned by the biggest health plan (30% of the acute‐care beds), particularly for treating COVID‐19 patients. 48

Conclusions

The financial impacts of the COVID‐19 pandemic on health care providers have been more severe and have prompted more direct government assistance in the United States than in England, Germany, and Israel. One important reason is that in the United States, except for Maryland, 49 almost all funding is activity based, so that declines in activity levels directly and immediately affect providers’ bottom line. In the other three countries, although activity‐based funding is still common, a somewhat larger share of providers are paid through salary, capitation, or budget mechanisms that provide both upside protection to the public payers and downside protection to providers. In Israel, for example, the combination of the use of telemedicine before the pandemic and the contact‐based capitation system protected specialists, whereas the floor in the capping mechanism functions as a global budget that protected hospitals. 50

The nature and dimension of the effects generated through differences in structure were amplified by the variegated scope of governmental control. In the three other countries studied, public payers control, directly or indirectly, substantially more of the available provider capacity. The NHS was able to change payment formulas and reroute the flow of funds for nearly the entire system. In Germany, the Association of Sickness Fund physicians were able to step in and provide rescue funding to physicians who saw declines in visits. But in the highly fragmented US health system, coordinated changes in payment systems in response to COVID‐19 were not feasible.

The governments of all four countries saw it as important to protect providers from the financial consequences of sharp fluctuations in the utilization of services. To some extent, this additional financial compensation was part of a public health response: fiscally strained hospitals would not be able to provide adequate care to patients with COVID or the remaining non‐COVID patients. This motive is clearest in England and Israel, where supplemental compensation consisted primarily of extra funding for COVID‐related needs (ICU infrastructure, more workers, and personal protective equipment).

The decision to compensate health care providers directly for declines in case‐based payments also reflected the political salience of health care providers. The political dimensions of the compensation decisions are evident in debates over how funding should be allocated, including whether private providers should be compensated in systems, like those in England and Israel, that rely mainly on public providers, and how funds should be distributed among hospitals.

These decisions played out differently across the four countries. Government actions to change payment systems or compensate providers most naturally offered protection to providers who relied on public payments. Providers who relied more on privately insured patients benefited less from public structural and compensatory mechanisms. In Germany, where privately paid patients are not heavily concentrated in the caseloads of a small number of providers, the public compensation mechanism sufficed, and no further actions were taken to protect providers who relied on private payments. In Israel, private for‐profit facilities catering to privately insured patients suffered substantial losses, but the government did not step in to compensate them. In England, the NHS effectively took over the private hospitals’ capacity altogether. In the United States’ hospital sector, by contrast, the government explicitly directed additional government funds to facilities that had negotiated higher private prices. These politically driven decisions have implications for the future structure of the health system. It is unclear how the private/public mix in the post‐pandemic health system will look in Israel, given the sector's substantial financial losses, and in England, where the NHS has taken over. In the United States, by contrast, concerns have been mainly about the post‐COVID viability of rural and safety‐net hospitals.

On the one hand, in ordinary times, payments based on activity or volume put payers at risk because the provider has an incentive to do more and future expenditures are uncertain. On the other hand, providers are protected because they are promised reimbursement for costs incurred. In a pandemic, the risks are reversed. Budgets offer more protection to providers, and those providers who rely most on activity‐based payments are at greatest risk. Beyond the threats to the providers’ financial viability, the use of activity‐based payment in a pandemic also sets up new incentives in the context of the public health emergency. Activity‐based financing gives providers strong incentives to develop new ways to deliver services, for example, by rapidly expanding telemedicine services. In contrast, rather than advocating for shutdowns that might reduce the virus's spread, providers who rely on activity‐based payment may seek to minimize public health threats so as to avoid the losses in income implied by restrictions on elective procedures.

Funding/Support: Sherry Glied reports grants from Commonwealth Fund during the conduct of the study.

Acknowledgments: We thank Hannah Tsuchiya for her valuable help with this research. The paper builds partially on the content compiled in the COVID‐19 Health System Response Monitor (HSRM), a joint initiative by the European Observatory on Health Systems and Policies, the WHO Regional Office for Europe and the European Commission (see www.covid19healthsystem.org). We thank Juliane Winkelmann, Christoph Reichebner and Nathan Shuftan for compiling data about Germany, Selina Rajan, Natasha Curry and Gemma Williams for the data about the United Kingdom, and Amit Meshulam, Nadav Penn, Gideon Leibner and Shuli Brammli‐Greenberg for helping compiling the data about Israel.

Conflict of Interest Disclosure: All authors have completed the ICMJE Form for Disclosure or Potential Conflicts of Interest. Erin Webb reports personal fees from the World Health Organization outside of the submitted work. Sherry Glied reports that she is a member of the boards of Directors of NeuroRx and Geisinger and reported personal fees from NIHCM, outside of the submitted work. Ruth Waitzberg reports personal fees from Resource International LLC and the World Health Organization, outside the submitted work.

References

- 1. Cutler DM, Nikpay S, Huckman RS. The business of medicine in the era of COVID‐19. JAMA. 2020;323(20):2003‐2004. 10.1001/jama.2020.7242 [DOI] [PubMed] [Google Scholar]

- 2. Khullar D, Bond AM, Schpero WL. COVID‐19 and the financial health of US hospitals. JAMA. 2020;323(21):2127‐2128. 10.1001/jama.2020.6269. [DOI] [PubMed] [Google Scholar]

- 3. Basu S, Phillips RS, Phillips R, Peterson LE, Landon BE. Primary care practice finances in the United States amid the COVID‐19 pandemic. Health Aff. (Millwood). 2020;39(9):1605‐1614. 10.1377/hlthaff.2020.00794. [DOI] [PubMed] [Google Scholar]

- 4. Roser M, Ritchie H, Ortiz‐Ospina E, Hasell J. Coronavirus pandemic (COVID‐19). Oxford, England: Our World in Data. https://ourworldindata.org/coronavirus. Accessed November 11, 2020. [Google Scholar]

- 5. Birkmeyer JD, Barnato A, Birkmeyer N, Bessler R, Skinner J. The impact of the COVID‐19 pandemic on hospital admissions in the United States. Health Aff. (Millwood). 2020;39(11):2010‐2017. 10.1377/hlthaff.2020.00980. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6. The Health System Response Monitor (HSRM) . 2020. https://www.COVID19healthsystem.org/mainpage.aspx. Accessed November 11, 2020.

- 7. Thorlby R. The English health care system. In: Tikkanen R, Osborn R, eds. International profiles of health care systems. The Commonwealth Fund. https://www.commonwealthfund.org/international‐health‐policy‐center/countries/england. Accessed May 11, 2021. [Google Scholar]

- 8. Federal Statistical Office (Destatis), Wiesbaden, Germany. Basic data on hospitals. 2020. https://www.destatis.de/DE/Themen/Gesellschaft‐Umwelt/Gesundheit/Krankenhaeuser/Publikationen/Downloads‐Krankenhaeuser/grunddaten‐krankenhaeuser‐2120611187004.pdf?__blob=publicationFile. Accessed October 30, 2020.

- 9. Rosen B, Waitzberg R, Merkur S. Israel: Health system review. Health Syst Transition. 2015;17(6):1‐212. https://www.euro.who.int/__data/assets/pdf_file/0009/302967/Israel‐HiT.pdf?ua=1. Accessed May 11, 2021. [PubMed] [Google Scholar]

- 10. Brammli‐Greenberg S, Yaari I, Avni E. Public opinion on the level of service and functioning of the health system. 2018. Jerusalem, Israel: Myers‐JDC‐Brookdale Institute; May 2020. https://brookdale.jdc.org.il/publication/national‐consumer‐health‐survey‐2018/. Accessed November 11, 2020. [Google Scholar]

- 11. Schwartz K, Neumann T. Funding for health care providers during the pandemic: an update. KFF. March 24, 2021. https://www.kff.org/policy‐watch/funding‐for‐health‐care‐providers‐during‐the‐pandemic‐an‐update/. Accessed May 11, 2021.

- 12. Cooper Z, Mahoney N. Economic principles to guide the allocation of COVID‐19 provider relief funds. Health Affairs Blog, July 9, 2020. 10.1377/hblog20200706.961297. [DOI]

- 13. CARES Act Provider Relief Fund . General information. Washington, DC: US Department of Health and Human Services; 2020. https://www.hhs.gov/coronavirus/cares‐act‐provider‐relief‐fund/general‐information/index.html. Accessed November 14, 2020. [Google Scholar]

- 14. Jiang JX, Bai G, Gustafsson L, Anderson G. Canary in a coal mine? A look at initial data on COVID‐19's impact on U.S. hospitals. New York, NY: Commonwealth Fund; June 25, 2020. https://www.commonwealthfund.org/publications/issue‐briefs/2020/jun/canary‐in‐a‐coal‐mine‐initial‐data‐COVID‐19‐impact‐hospitals. Accessed November 14, 2020. [Google Scholar]

- 15. Drucker J, Silver‐Greenberg J, Kliff S. Wealthiest hospitals got billions in bailout for struggling health providers. New York Times. May 25, 2020. https://www.nytimes.com/2020/05/25/business/coronavirus‐hospitals‐bailout.html. Accessed November 14, 2020.

- 16. Schwartz K, Damico A. Distribution of CARES Act funding among hospitals. Washington, DC: KFF; May 13, 2020. https://www.kff.org/coronavirus‐COVID‐19/issue‐brief/distribution‐of‐cares‐act‐funding‐among‐hospitals/. Accessed November 14, 2020. [Google Scholar]

- 17. National Health Service (NHS) . Changes to COVID‐19 finance reporting and approval processes as we move into the second phase of the NHS response. London, England: NHS; May 19, 2020. https://www.england.nhs.uk/coronavirus/wp‐content/uploads/sites/52/2020/05/C0518‐changes‐to‐finance‐reporting‐and‐approval‐processes.pdf. Accessed November 11, 2020. [Google Scholar]

- 18. UK Department of Health & Social Care . NHS to benefit from £13.4 billion debt write‐off. April 2, 2020. https://www.gov.uk/government/news/nhs‐to‐benefit‐from‐13‐4‐billion‐debt‐write‐off. Accessed November 11, 2020.

- 19. National Health Service (NHS) . Commissioning for Quality and Innovation (CQUIN) guidance, 2020/21. London, England: NHS; 2020. https://www.england.nhs.uk/nhs‐standard‐contract/cquin/cquin‐20‐21/. Accessed November 11, 2020. [Google Scholar]

- 20. The Competition Act 1998. (Health services for patients in England) (Coronavirus) (Public policy exclusion) Order 2020 (UK). https://www.legislation.gov.uk/uksi/2020/368/made. Accessed May 11, 2021.

- 21. National Health Service (NHS) . NHS increasing capacity framework. Press release. October 14, 2020. https://www.contractsfinder.service.gov.uk/Notice/e1aa1a78‐c54a‐40cb‐9174‐61b972700f98?origin=SearchResults&p=1. Accessed November 11, 2020.

- 22. COVID‐19 Hospital Relief Act 2020. (Germany). http://www.bgbl.de/xaver/bgbl/start.xav?startbk=Bundesanzeiger_BGBl&jumpTo=bgbl120s0580.pdf. Accessed May 11, 2021.

- 23. The Knesset . Finance committee protocol from the 17 of August, 2020. https://m.knesset.gov.il/news/pressreleases/pages/press17.08.20v.aspx. Accessed May 11, 2021.

- 24. Filut A. An emergency budget will be distributed to the health system. Calcalist. March 12, 2020. https://www.calcalist.co.il/local/articles/0,7340,L‐3800371,00.html. Accessed November 11, 2020.

- 25. Israel Ministry of Health . Update on the Ministry of Health's services price list from April, 13th 2020. Jerusalem, Israel: Israel Ministry of Health; April 13, 2020. https://www.health.gov.il/Subjects/Finance/Taarifon/Pages/PriceList.aspx. Accessed November 11, 2020. [Google Scholar]

- 26. Cox C, Kamal R, McDermott D. How have healthcare utilization and spending changed so far during the coronavirus pandemic?. Washington, DC: Peterson‐KFF Health System Tracker; August 6, 2020. https://www.healthsystemtracker.org/chart‐collection/how‐have‐healthcare‐utilization‐and‐spending‐changed‐so‐far‐during‐the‐coronavirus‐pandemic/. Accessed November 14, 2020. [Google Scholar]

- 27. Mehrotra A, Chernew M, Linetsky D, Hatch H, Cutler D, Schneider EC. The impact of the COVID‐19 pandemic on outpatient care: visits return to prepandemic levels, but not for all providers and patients. New York, NY: Commonwealth Fund; October 15, 2020. https://www.commonwealthfund.org/publications/2020/oct/impact‐COVID‐19‐pandemic‐outpatient‐care‐visits‐return‐prepandemic‐levels. Accessed November 14, 2020. [Google Scholar]

- 28. McDermott D, Cox C. What impact has the coronavirus pandemic had on healthcare employment?. Washington, DC: Peterson‐KFF Health System Tracker; June 16, 2020. https://www.healthsystemtracker.org/chart‐collection/what‐impact‐has‐the‐coronavirus‐pandemic‐had‐on‐healthcare‐employment/#item‐start. Accessed November 14, 2020. [Google Scholar]

- 29. Diaz A, Chhabra KR, Scott JW. The COVID‐19 pandemic and rural hospitals—adding insult to injury. Health Affairs Blog, May 3, 2020. 10.1377/hblog20200429.583513. [DOI]

- 30. Reese PP, Lin E, Harhay MN. Preparing for the next COVID‐19 crisis: a strategy to save safety‐net hospitals. Health Affairs Blog, June 22, 2020. 10.1377/hblog20200617.787349. [DOI]

- 31. Rubin R. COVID‐19's Crushing effects on medical practices, some of which might not survive. JAMA. 2020;324(4):321‐323. 10.1001/jama.2020.11254. [DOI] [PubMed] [Google Scholar]

- 32. Bose SK, Dasani S, Sanford ER, et al. The cost of quarantine: projecting the financial impact of canceled elective surgery on the nation's hospitals. Ann Surg. 2021;273(5):844‐849. [DOI] [PubMed] [Google Scholar]

- 33. McWilliams JM, Russo A, Mehrotra A. Implications of early health care spending reductions for expected spending as the COVID‐19 pandemic evolves. JAMA Intern Med. 2021;181(1):118‐120. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34. American Hospital Association . The effect of COVID‐19 on hospital financial health. July 2020. https://www.aha.org/guidesreports/2020‐07‐20‐effect‐COVID‐19‐hospital‐financial‐health. Accessed May 11, 2021.

- 35. Kaufmalhall . National hospital flash report. January 2021. https://www.kaufmanhall.com/ideas‐resources/research‐report/national‐hospital‐flash‐report‐january‐2021. Accessed May 11, 2021.

- 36. Davies M. More people considering private healthcare in the wake of COVID‐19. LaingBuisson. July 9, 2020. https://www.laingbuissonnews.com/healthcare‐markets‐content/news‐healthcare‐markets‐content/more‐people‐considering‐private‐healthcare‐in‐the‐wake‐of‐COVID‐19/. Accessed May 11, 2021.

- 37. National Health Service . Statistical press notice: NHS referral to treatment (RTT) waiting times data November 2020. Press release. January 14, 2021. https://www.england.nhs.uk/statistics/wp‐content/uploads/sites/2/2021/01/Nov20‐RTT‐SPN‐publication‐v0.pdf. Accessed February 3, 2021.

- 38. National Health Service (NHS) . Statistical press notice: NHS referral to treatment (RTT) waiting times data March 2020. Press release. May 14, 2020. https://www.england.nhs.uk/statistics/wp‐content/uploads/sites/2/2020/05/Mar20‐RTT‐SPN‐publication‐version.pdf. Accessed November 17, 2020.

- 39. Plimmer G. UK private medical insurers under pressure to refund payments: customers are still paying premiums averaging around £600 a year despite restricted access. Financial Times . June 23, 2020. https://www.ft.com/content/7c48ef55‐ab09‐4433‐b222‐320031bb76e8. Accessed November 11, 2020.

- 40. National Health Service . Appointments in general practice August 2020. London, England: NHS; September 24, 2020. https://digital.nhs.uk/data‐and‐information/publications/statistical/appointments‐in‐general‐practice/august‐2020. Accessed November 11, 2020. [Google Scholar]

- 41. DKI . Hospital barometer survey 2020 (Krankenhaus barometer Umfrage 2020). https://www.dki.de/sites/default/files/2020‐12/Krankenhaus%20Barometer%202020%20‐%20final.pdf. Accessed May 11, 2021.

- 42. Waitzberg R, Aissat D, Habicht T, et al. Compensating healthcare professionals for income losses and extra expenses during COVID‐19. Eurohealth. 2020;26(2):83‐87. https://www.euro.who.int/en/about‐us/partners/observatory/publications/eurohealth/health‐system‐responses‐to‐COVID‐19/17.‐compensating‐healthcare‐professionals‐for‐income‐losses‐and‐extra‐expenses‐during‐COVID‐19. Accessed May 11, 2021. [Google Scholar]

- 43. Safadi K, Kruger JM, Chowers I, et al. Ophthalmology practice during the COVID‐19 pandemic. BMJ Open Ophthalmol. 2020;5:e000487. 10.1136/bmjophth-2020-000487. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 44. Linder R. Private medicine collapses: “The whole chain of treatment has stopped with a squeak of the brakes, people will pay with their lives.” The Marker. April 21, 2020. https://www.themarker.com/coronavirus/.premium‐1.8784088. Accessed November 11, 2020.

- 45. Zwanziger J, Brammli‐Greenberg S. Strong government influence over the Israeli health care system has led to low rates of spending growth. Health Aff. 2011;30(9):1779‐1785. [DOI] [PubMed] [Google Scholar]

- 46. MoH . Financial report 2016–2017. The medical centers of the General Government. https://www.health.gov.il/publicationsfiles/financial‐analysis‐2016‐2017.pdf. Accessed May 11, 2021.

- 47. MoH . A summary report on the HPs’ activities for 2019. https://www.health.gov.il/UnitsOffice/regulation_computing_digital_health/shaban/Pages/reports.aspx?a. Accessed May 11, 2021.

- 48. Filut A. The corona raised the HMO deficit by only 5.5%. https://www.calcalist.co.il/local/articles/0,7340,L‐3877699,00.html. Accessed May 11, 2021.

- 49. Peterson CL, Schumacher DN. How Maryland's total cost of care model has helped hospitals manage the COVID‐19 stress test. Health Affairs Blog. October 7, 2020. 10.1377/hblog20201005.677034. [DOI]

- 50. Waitzberg R, Penn N, Leibner G, Brammli‐Greenberg S. Israel country page, section 4.1: health financing. Health System Response Monitor (HSRM). November 1, 2020. https://www.COVID19healthsystem.org/countries/israel/livinghit.aspx?Section=4.1%20Health%20financing&Type=Section. Accessed November 16, 2020.